The chapter reviews the state of play in two pilot regions – one with a strong urban centre and one more rural – and reports on engagement with regional stakeholders to figure out practical modes of consolidation of water utilities. The consultations provided valuable feedback to inform recommendations at national level.

Reform of Water Supply and Wastewater Treatment in Lithuania

6. An Action Plan for the consolidation of water utilities in the pilot regions

Abstract

6.1. Introduction

6.1.1. The context: background and objectives of the OECD collaboration with Lithuania

In Lithuania, the Law on Drinking Water Supply and Wastewater Treatment Services (2006, amended in 2014) introduced the reform of the Water Supply and Sanitation (WSS) sector and the concept of consolidation of water utilities on a voluntary basis A new version of the law is currently being discussed in the parliament. It is expected that the new (improved) version of the law will be adopted by the end of the year.

By 2019, it resulted in the creation of a regional water operator for the Klaipėda region and a reduced number of operating water companies (one company per municipality). Reluctance of municipalities to consolidate their water companies remains one of the main obstacles for implementation of this reform.

The Government of the Republic of Lithuania is working towards the enhanced sustainability of WSS services in the country. The Implementation Plan of the Government Programme includes activities for the consolidation of the drinking water supply and wastewater treatment sector, to ensure higher operational efficiency and to reduce the disparity in prices for WSS services. A roadmap for consolidation of water companies was recently elaborated by the Government (2019). Modalities of the reform implementation, including options for consolidation of the water utility sector, have to be further considered and included into the proposal to the Government.

The OECD supports the Ministry of Environment of the Republic of Lithuania in operationalising the national strategy to enhance the sustainability of the WSS sector and compliance with the EU acquis in this area. The collaboration entails a focus on two pilot regions and derives lessons for the reform implementation. Lithuania selected Kaunas and Marijampole as pilot regions.

This Project supports the development of detailed recommendations for implementation of the roadmap for the consolidation of water utilities of Lithuania, including recommendations on financial and governance incentives to facilitate a broader water sector reform in the country. The expected impact of the Project will be a sustained capacity of consolidated utilities to finance needed investments to comply with EU acquis and deliver better services to the population, including segments who currently do not have access.

The main outcome will be enhanced self-financing capacity of water utilities and increased social equity in access to and prices for WSS services in Lithuania, through consolidation of service providers, robust tariff policy and adequate accompanying measures.

Output 6 is an important step of the OECD collaboration with the Ministry of Environment of the Republic of Lithuania. It builds on previous project outputs, and namely:

Chapter 1 - Background report characterising the state of play;

Kick-off meeting , where the Government officially launched and announced the project and main stakeholders voiced their support and priorities;

Chapter 3 – Issues paper, where the need for reform and current issues for consolidation are investigated. Following this report, two pilot regions – Kaunas and Marijampole – were identified for investigating scenarios for consolidation and the development of a roadmap for implementation. The OECD Secretariat convened one workshop in each region in October 2021, focusing on the main issues related to WSS in each region and preliminary reactions to the Ministry’s intention to accelerate agglomeration of water services as a means to enhance operational efficiency and financial sustainability of the sector; and

Marijampoles and Kaunas County Analysis, two reports providing detailed data and information on the water sector in the two pilot regions.

Chapter 6 also informs other chapters, on pricing, performance monitoring, and accompanying amendments of the legal framework.

6.1.2. Chapter 6: objectives and main steps

The objectives of Chapter 6 report are to:

Develop scenarios for the consolidation of water utilities in the Kaunas and Marijampole regions; and

Provide practical recommendations for implementing consolidation of water utilities in the two regions.

After reviewing previous project outputs, additional case studies were reviewed to inspire potential consolidation arrangements in Lithuania; similarly, the most inspiring examples among the case studies identified in Chapter 3 report were identified. This allowed for a preliminary identification of preliminary scenarios, and practical steps towards consolidation, to be discussed and evaluated with representatives of water utilities and municipalities in the two regions.

To this end, in June 2022 the OECD Secretariat convened a second workshop in each of the two regions to discuss, refine and evaluate the proposed scenarios and practical steps towards consolidation.

The outcomes of the two workshops were presented and discussed with Irmantas Valunas and Monika Sakalauskaitė of the Ministry of Environment of the Republic of Lithuania.

6.1.3. This report

Chapter 6 presents the results of the process illustrated above, and includes:

Why is reform needed? A synthesis of the previous phases of the OECD project;

Options for consolidation: possible practical arrangements and sharing of functions;

Preferred options for consolidation in the two pilot regions; and

The way forward: practical steps towards consolidation in the two pilot regions and beyond.

6.2. Why is consolidation needed?

6.2.1. Country overview

Lithuania is characterized by abundant freshwater supply, mainly from groundwater sources. The country has undertaken significant investments, in the last two decades, to reach the EU water acquis on WSS. The massive investments focused on building new infrastructures to connect most of the population to WSS. However, the goal of 95% of the population having access to drinking water supply and sanitation services is not yet achieved. Only 9 municipalities (2018) were able to achieve the goal.

A part of the population is not yet connected to the water supply nor to the wastewater treatment networks. For that, the country needs further investments to reach the objective. Originally, the infrastructure development was financed through EU funding – more than 1 billion euros came through EU Cohesion policy or other grants. 3.5 billion euros of investments are still needed to reach full compliance with the EU and national water supply and wastewater treatment regulation. However, water utilities are not able to attract new investors due to low financial viability and long payback period of the projects. The new financing capacities are needed to operate and maintain water assets, adapt services to changing needs, driven by more stringent environment and health regulations, or a changing climate.

Furthermore, there is a need to properly operate and maintain the recently constructed infrastructure to ensure lasting service provision and performance and avoid cost related to premature decay of existing infrastructure. To do so, the water companies should ensure sustainable financing for the operation and maintenance of the water utilities. Nevertheless, companies operating the water utilities are already facing financial difficulties to maintain the proper investment levels to operate the water utilities. This means that the current infrastructure might be at risk.

In Lithuania, the water utilities are owned by the municipalities and local governments (62 water utilities in 2020). They bear most of the cost of providing water supply and sanitation services and operating and maintaining existing systems. They face severe challenges, be it on the financial level such as a) lack of professional staff to run the water utility that could further increase operational cost and b) low population density – which makes it difficult for the water utility to connect all population; or on technical level such as losses in drinking water supply – on average 26% (2020).

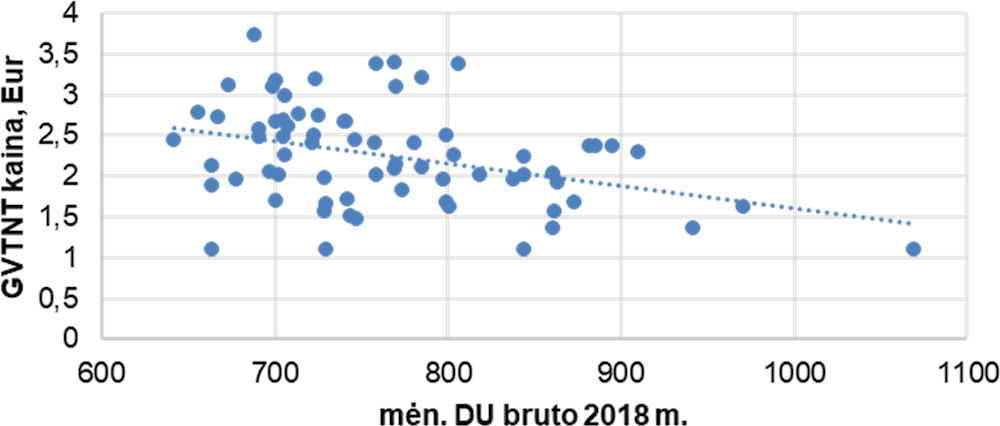

In addition, there are significant disparities in water prices and quality service across the country. It is unclear how revenues from tariffs for WSS can cover the projected costs. Water utilities, operating in small municipalities and rural areas are not able to provide adequate service and proper access to WSS services. Water tariffs are usually higher in small municipalities where investment needs are higher. Higher-income urban population pays less for WSS services than the population of small municipalities, where incomes are significantly lower, thus contributing to social inequality (see Figure 6.1 below).

Figure 6.1. Cost of WSS services and the ratio of the average wage in municipalities

Translation: Y axis: cost of drinking water supply and wastewater treatment; eur/month; X axis: Gross monthly salary in 2018

Source: Ministry of Environment of Lithuania

Furthermore, a proper maintenance and operation of the WSS system would require a further increase of WSS tariffs, going beyond an affordability threshold and reaching 4% for low-income households. This situation is not financially sustainable. It puts sector reforms at risk as Lithuania lacks a sustainable funding strategy for the long-term operation and maintenance of WSS services.

This project focuses on two pilot regions in Lithuania, the Kaunas and Marijampole regions. For what concerns water management challenges and practices, these two regions present similarities among them and to the national context. At the same time, they also present some differences, and in particular:

In the Kaunas region, 65% of the population is concentrated in the Kaunas city, the second largest city in Lithuania. Overall, population density is higher than in Lithuania as a whole, although still significantly lower than the EU average. These two aspects make it easier for water companies to connect the population to the network, as shown by the higher connection rate to WSS services – and, to some extent, also to carry out operation and maintenance. Another effect is that population is projected to decrease less dramatically (-9%) than in the Marijampole region;

The Marijampole region is mostly rural. Marijampole city is in fact only the seventh largest city in Lithuania, and it hosts 46% of total population in the region. As a result, population density is significantly lower than the national average. This exacerbates the challenges faced by WSS operators in connecting the population to the network, as shown by a lower-than-average connection rate, and also in operating and maintaining the system. Being mostly rural, the region is projected to experience a massive population decrease (-50%) by 2050, and this can represent a major challenge when it comes to investment in new WSS infrastructures or the maintenance of the existing ones: it means that the customer base of water utilities are also projected to decrease by 50%, resulting in half of the revenues from WSS tariffs – a vital funding source for the sector.

The table below illustrates the key figures with respect to water management in Lithuania and the two pilot regions.

Table 6.1. Key figures on water management in the Kaunas and Marijampole regions

|

Key figures in relation to water management |

Lithuania – national level |

Kaunas region |

Marijampole region |

|---|---|---|---|

|

Population (inhabitants) |

2.8 million |

445 185 |

127 002 |

|

Of which: living in urban areas |

65% (19% in Vilnius) |

65% (Kaunas city) |

46% (Marijampole city) |

|

Living in rural areas |

35% |

35% |

54% |

|

Expected population growth by 2050 |

Not available |

-9% |

-50% |

|

Population density (inhabitants/km2) EU average: 109 |

44.6 |

55 |

28.4 |

|

Connection rate to WSS services |

82% drinking water, 74% sanitation |

86.6% |

80% |

|

Average losses in drinking water supply |

26% |

24% |

29% |

The differences highlighted above also emerged in the discussions with water operators and municipalities in the two regions, as shown in chapter 3. The following sections provide more detailed data on WSS in the two pilot regions, highlighting the challenges currently faced by the water sector.

6.3. Challenges faced by the WSS sector in the Kaunas region

6.3.1. Key challenge 1. Disparities in connection rates across municipalities

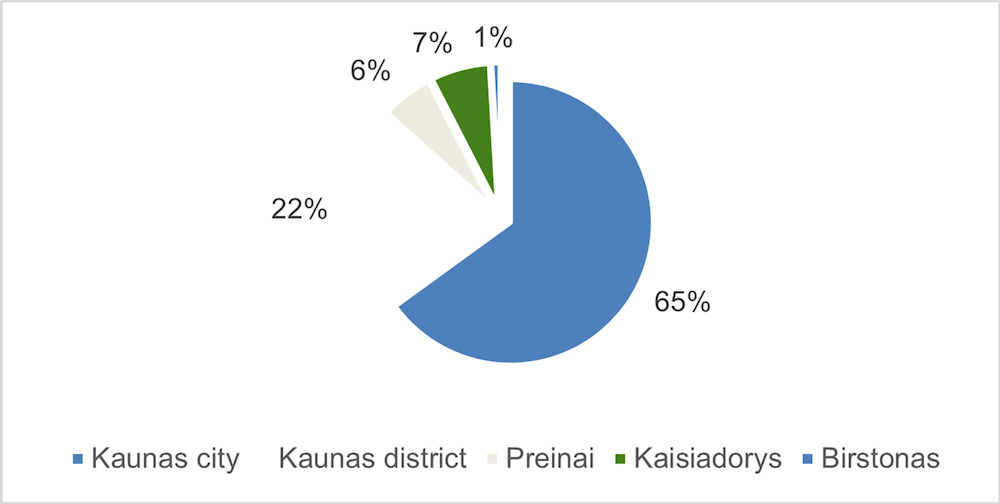

Kaunas region is the second largest region in Lithuania, and it includes five municipalities. The distribution of the population across municipalities is shown in the figure below.

Figure 6.2. Distribution of population in the different municipalities of Kaunas region

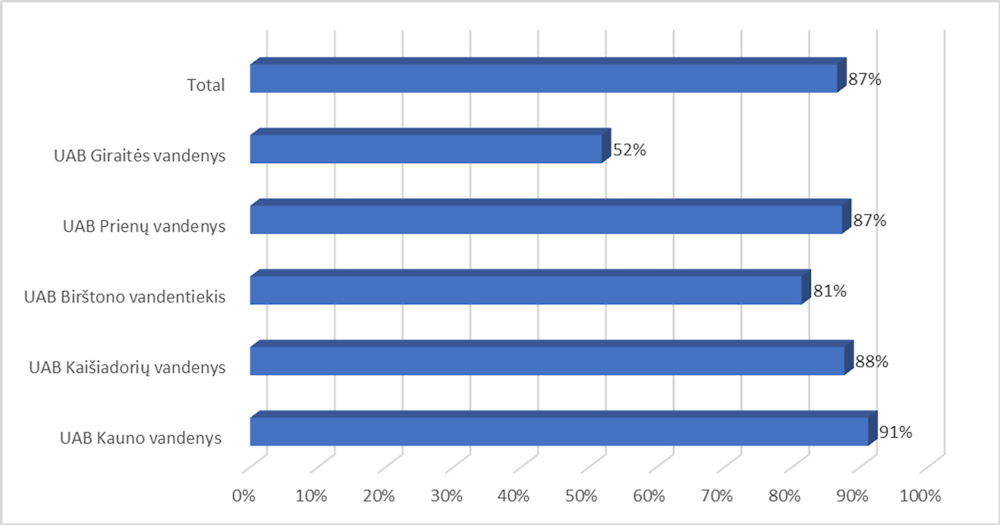

Most of the population is connected to drinking water and sanitation services (86.63% of the overall population – 2020) (Figure 6.3). The connection to water services differs from one municipality to the other, with disparity in connection rates being related to the importance of population living in (less-populated) rural areas.

Figure 6.3. Part of the population connected to the water services - Kaunas region

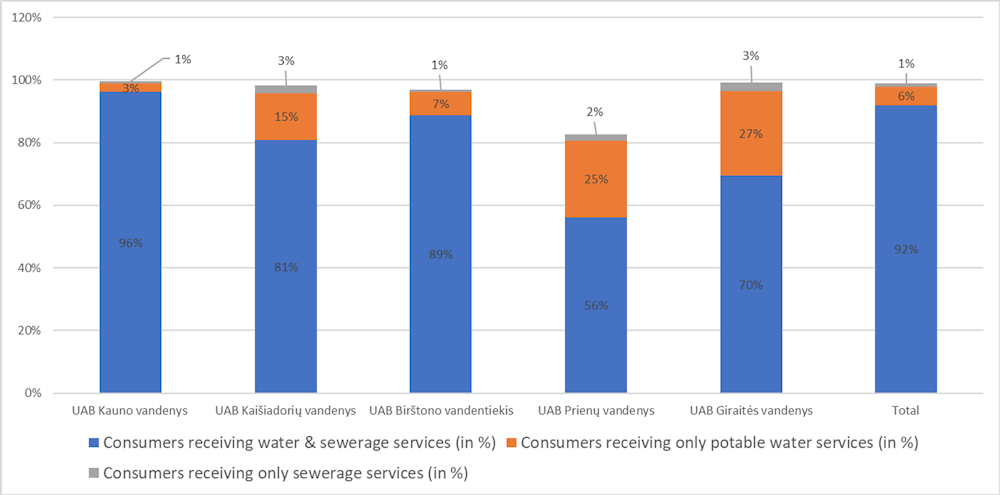

The majority of the population is connected to both drinking water supply and sanitation services (91% of the population) (see Figure 6.4), with the remaining receiving either sewage treatment service or drinking water services.

Figure 6.4. Different services provided for consumers - Kaunas region

Key challenge 2. Losses in water supply service

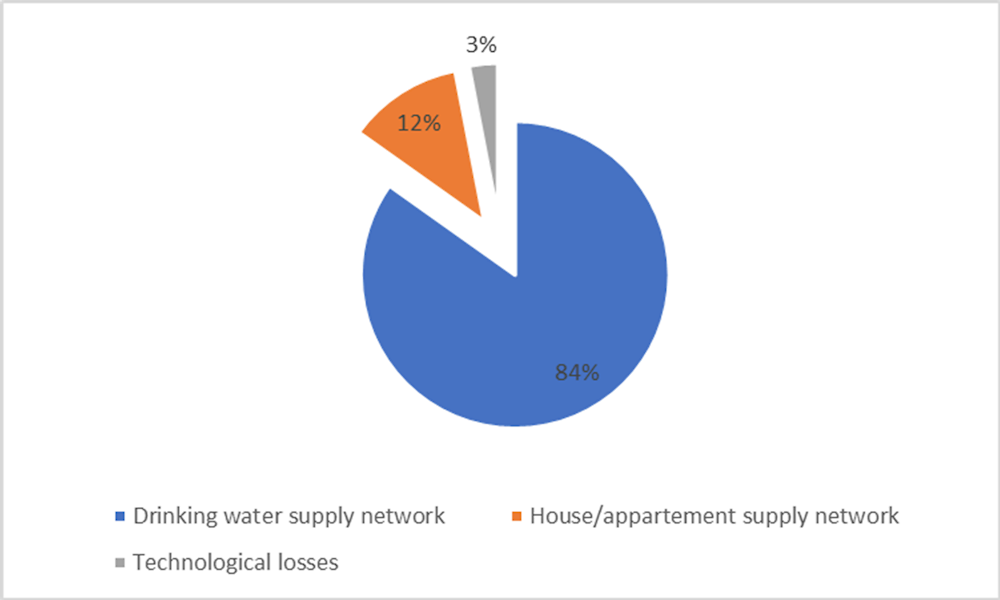

In 2020, the volume of water extracted and distributed by the five companies was 27 858 thousand cubic meters. However, the companies managed to sell only 20 905 cubic meters (76% of the overall volume). This indicates a loss of (approximately) 24% in the distribution networks, with the majority of these losses (84%) being attributed to the drinking water supply network, 12% to losses in house/apartment pipe system and the remaining 3% being technological losses (see Figure 6.5).

Figure 6.5. Losses in water supply service - Kaunas region

Key challenge 3. Unknown level of wastewater treatment in the region

In relation to sewage treatment, data that have been collected in the frame of the present study only shows the total volume of wastewater collected from households, (approximately) 30 751 thousand cubic meters (2020). However, there is no evidence found on the current level of treatment as well as on the number of treatment plants per municipality. Such data would help better understand whether the environmental norms set by the different European directives (e.g. Water Framework Directive, Urban Wastewater Directive) are currently complied with or not.

The discussions with water operators and municipalities revealed the presence of three WWTPs in the Kaisadory district. One of the three WWTPs has been renovated and is working efficiently and respecting the environmental norms. The other two plants are old and need to be renovated, with steps currently taken for the renovation of a second plant. The operator and municipalities are currently identifying sources of (European) funding that could be mobilised for carrying out the renovation of the plants

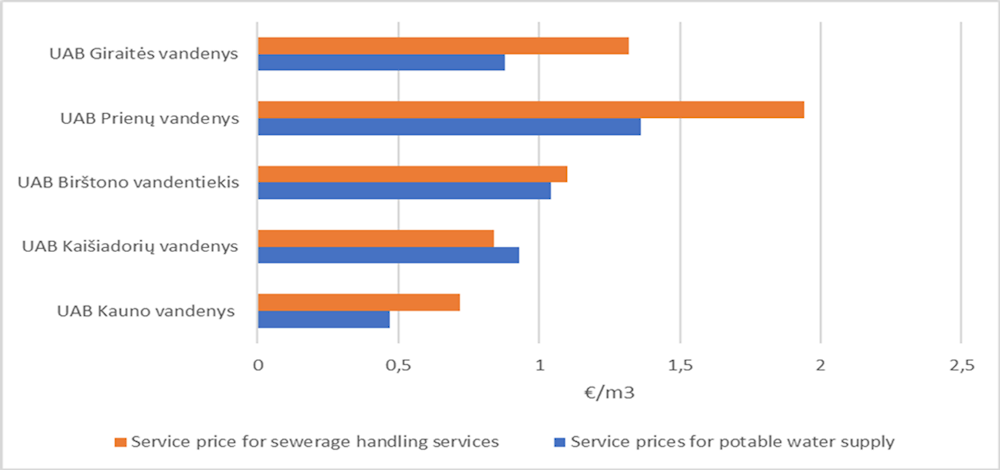

Key challenge 4. Price disparities across urban and rural municipalities

Large water tariff disparities exist across municipalities (see Figure 6.6), in line with the general situation at the national level. The lowest water tariffs are recorded in Kaunas, the largest municipality (in terms of population), an urban area with higher income levels, whereas the highest water tariffs are recorded in the smallest municipality, a rural area with lower income levels that might face more significant affordability challenges.

Figure 6.6. Water prices - Kaunas region

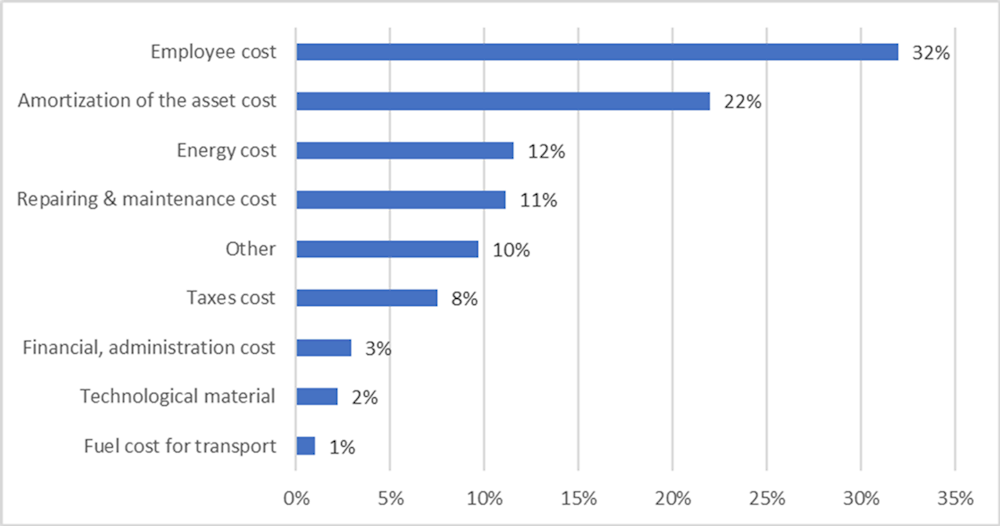

Key challenge 5. Importance of different cost categories and impact of rising energy prices

The five companies of the Kaunas region spent 29 million euros in 2020. The analysis of the different cost components (see Figure 6.7) stresses the importance of labour costs (32% of the total costs) and of asset amortization (22% of the total costs). Energy costs represented 12% of total costs; these costs experiencing currently a significant increase as a result of the worldwide energy crisis.

The discussions with water operators highlighted that current increase in energy prices is making it difficult for water operators to distribute water without increasing WSS prices. Two solutions are being adopted in Kaunas to overcome the continuous increase in energy prices. The first one is regulatory solution. The water operators will be allowed to apply for compensation from the government when energy prices increase by 30%. The water companies in Kaunas are currently preparing to apply for this compensation. It is noteworthy that this process creates a backlog as the delay in tariff adjustment urges utilities to postpone needed maintenance. The second one is the installation of solar power panels that allow to decrease the electricity bill for the operator.

Figure 6.7. Cost categories for water operators - Kaunas region

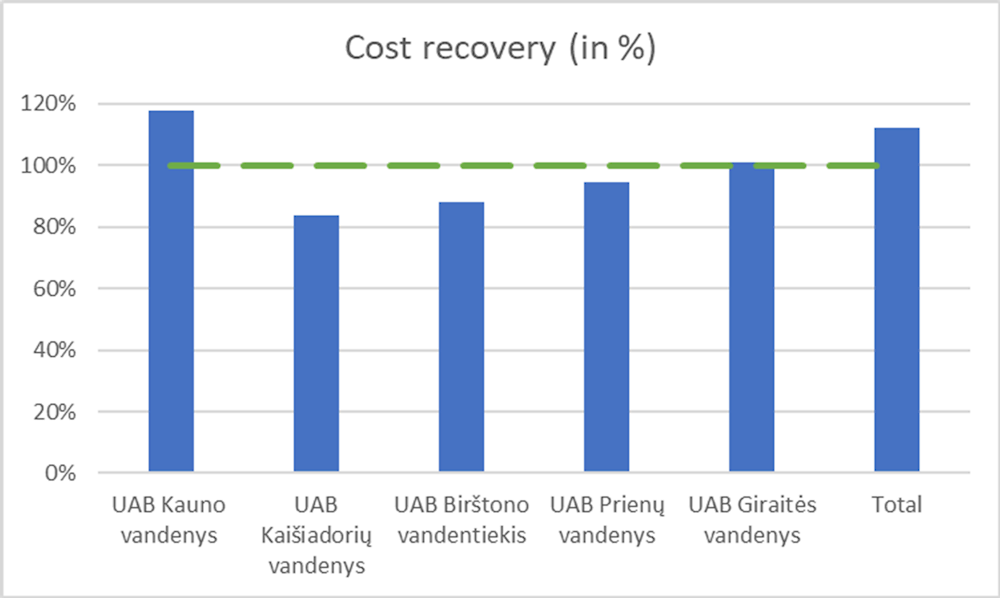

Key challenge 5. Diverse cost-recovery levels across municipalities

Only two out of five companies are managing to recover all their costs with revenues from water tariffs (see Figure 6.8). However, when the costs and revenues for all companies are aggregated, the total cost-recovery ratio is above 100%.

Figure 6.8. Financial performance of water companies in Kaunas region

6.4. Challenges faced by the WSS sector in the Marijampole region

6.4.1. Key challenge 1. Disparities in connection rates across municipalities

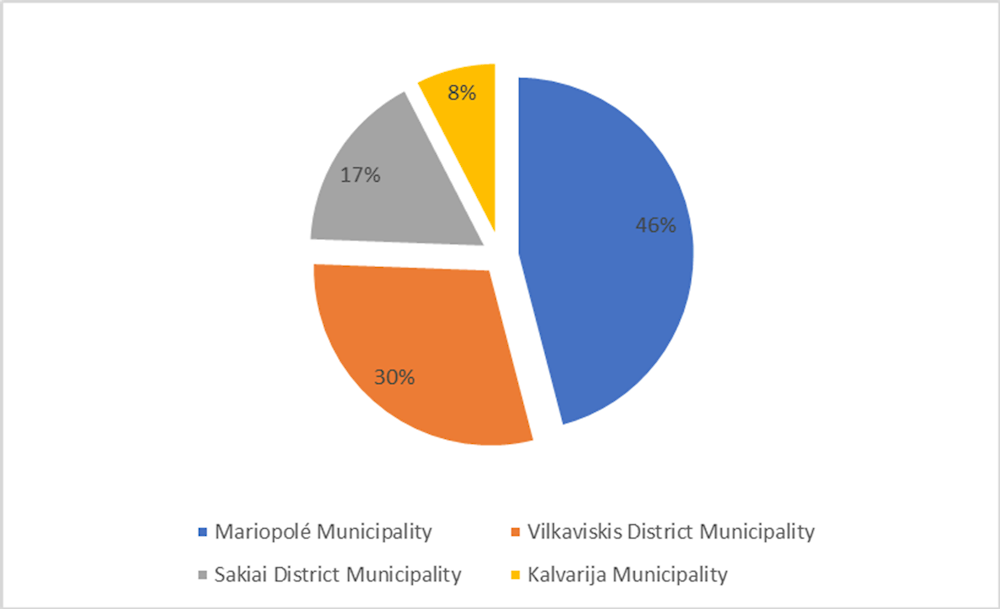

The Marijampole region covers 6.8% of the area of Lithuania and is composed of four municipalities. Except for Marijampole city, it is a mostly rural region. The distribution of the population across municipalities is shown in the figure below.

Figure 6.9. Distribution of population in the different municipalities of Marijampole region

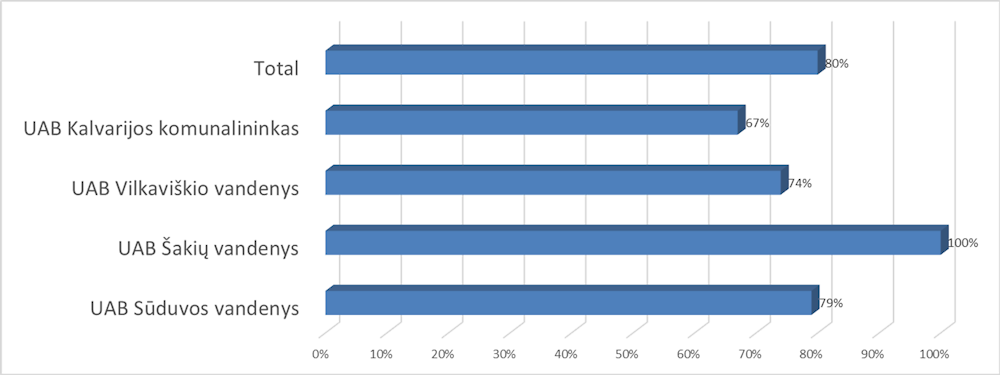

Most of the population is connected to both drinking water and sanitation services (80% of the overall population – 2020), with significant differences among municipalities translating the relative importance of rural areas (see Figure 6.10) with scattered population.

Figure 6.10. Part of the population connected to the water services – Marijampole region

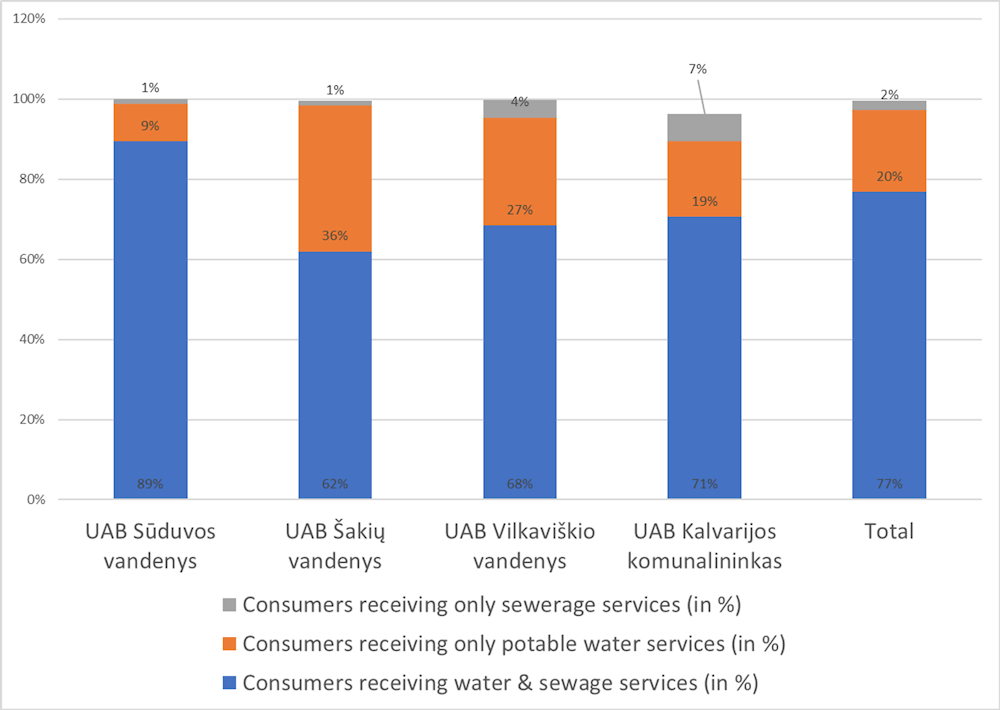

The majority of consumers receive drinking water and wastewater treatment services (76%); with the remaining being connected to either sewage treatment services or drinking water services (see Figure 6.11).

Figure 6.11. Different services provided for consumers – Marijampole region

6.4.2. Key challenge 2. Losses in water supply service

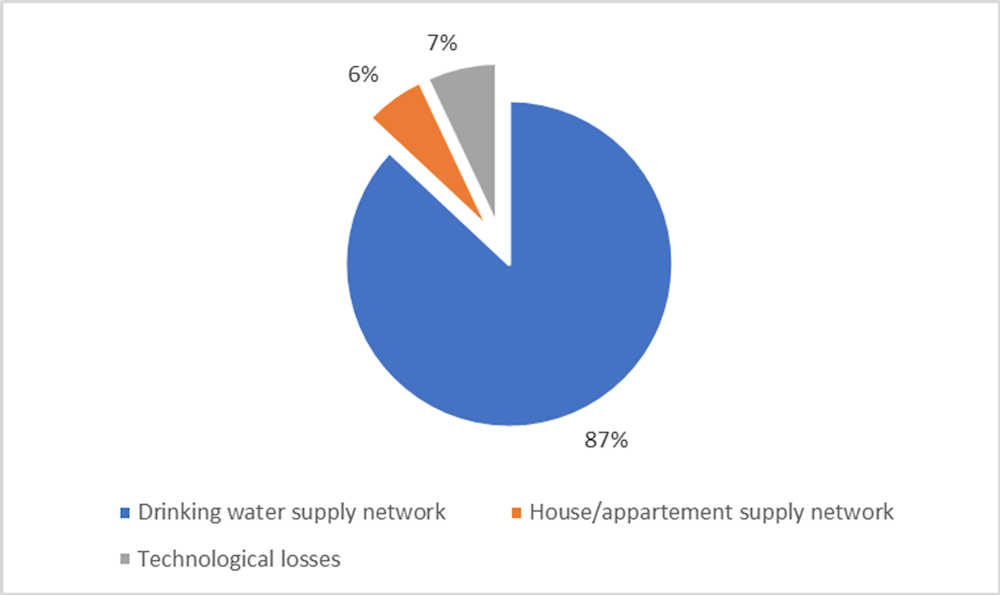

In 2020, the volume of water extracted and distributed by the four companies was 4 067 thousand cubic meters. However, losses of Marijampole region water management companies accounted for an average of 29%, with the largest share of losses taking place in the water supply networks (see Figure 6.12).

Figure 6.12. Losses in water supply service - Marijampole region

One of the biggest challenges faced by water operators in the Marijampole region is the old water supply network. The companies do not have any plans of the network and they rely on leakage reporting so they can fix the leak. According to the water operators, three fails in the water supply system are reported each day in the region.

6.4.3. Key challenge 3. Unknown level of wastewater treatment in the region

Data obtained in the context of this study relates to the volume of wastewater collected from households, (approximately) 6 902 thousand cubic meters (2020). However, no evidence has been found on the level of treatment and the number of treatment plants per municipality. It is not clear then how current treatment complies with existing environmental norms set by European directives.

According to the water operators of the Marijampole region, the WWTPs were constructed in the 80s and 90s of last century. However, due to the population decrease, renovation was done to downsize some of the plants so they could work efficiently and at lower costs. Furthermore, the wastewater is well treated, and the discharged water is tested quarterly or monthly, depending on the company.

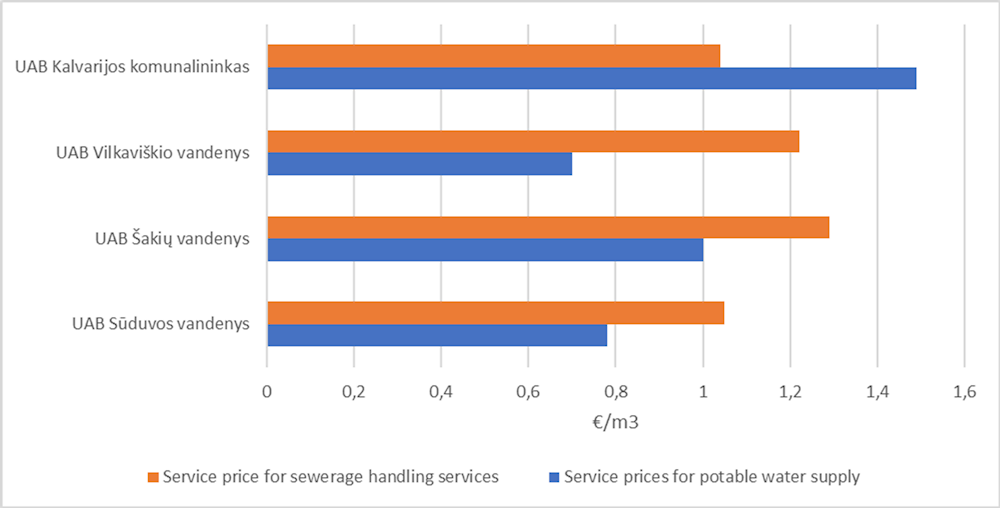

6.4.4. Key challenge 4. Price disparities across urban and rural municipalities

Large water tariff disparities exist across municipalities (see Figure 6.13), in line with what happens at the national level: the lowest water prices are recorded in Marijampole, the largest municipality (in terms of population), an urban area with higher income levels, whereas the highest prices are recorded in the smallest municipality, a rural area with lower income levels. This can pose affordability challenges in the lower-income municipalities.

Figure 6.13. Water prices - Marijampole county

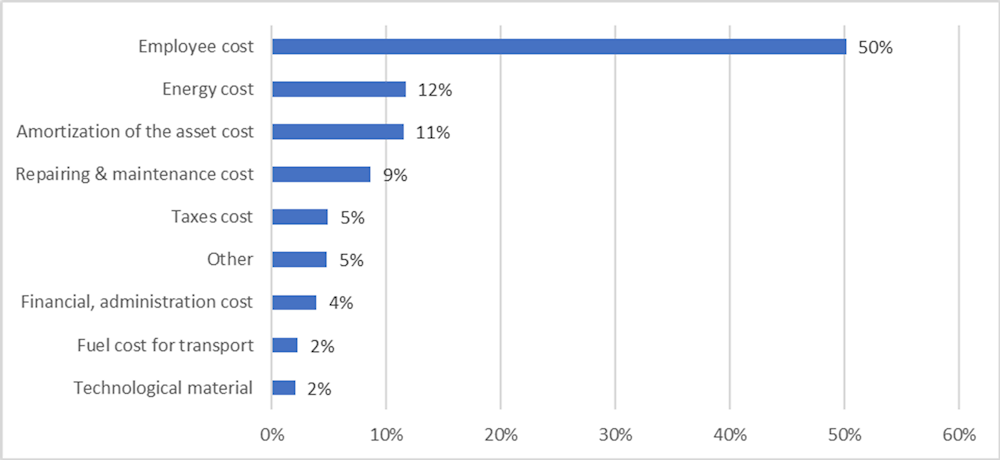

6.4.5. Key challenge 5. Importance of different cost categories and impact of rising energy prices

The four companies in the Marijampole region spent 8 million euros in 2020 (Figure 6.14). Employee costs alone represent half of the total costs, with energy costs representing 12% of these costs – a ratio that is likely to experience significant increase as a result of the current energy crisis.

As for the Kaunas region, water operators highlighted that the energy prices tripled in the last year, which made operation (including extraction, treatment, and distribution) of water challenging with the low prices. They also stressed that energy price increases are likely to limit (or postpone) maintenance as compared to what was originally planned with the set water tariff.

Figure 6.14. Cost categories for water operators - Marijampole county

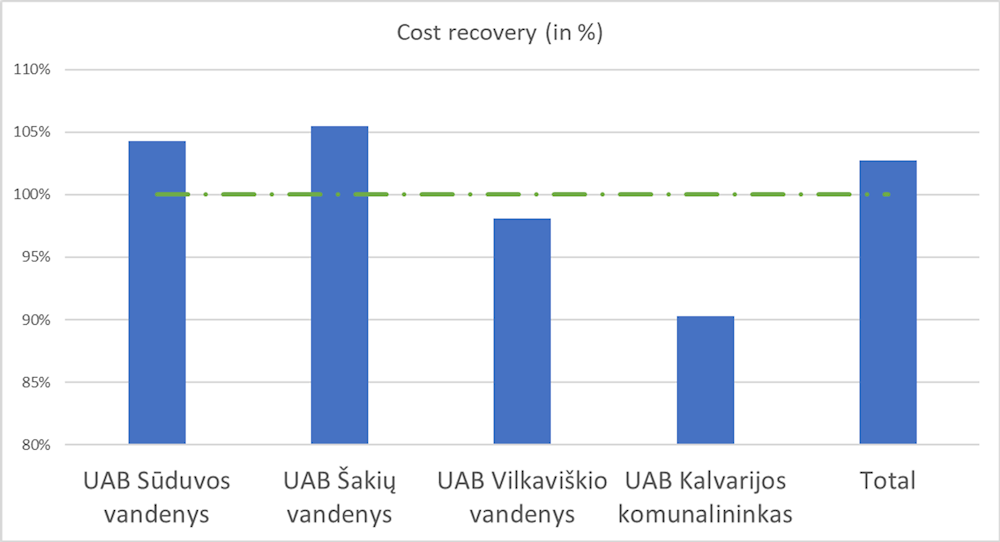

6.4.6. Key challenge 6. Diverse cost-recovery levels across municipalities

Only two out of four companies are managing to recover all their costs with revenues from water tariffs (see Figure 6.15). When all companies are combined, total revenues cover all costs.

Figure 6.15. Financial performance of water companies in Marijampole county

6.4.7. How consolidation can help address WSS sector issues in the two pilot regions

The above sections presented the main challenges/issues facing the different water companies in Lithuania, in particular for the Kaunas and Marijampole regions. Consolidation of the WSS sector in the two regions can contribute to addressing such challenges, and it can help in:

Increasing the number of inhabitants connected to the water supply and wastewater treatment networks. In fact, the consolidation of different companies will lead to more cooperation between the different municipalities and thereafter to a better coordination in the infrastructure investments.

Better (efficient) investment decisions which leads to economies of scale. The consolidated companies will be eligible to apply for collective funding and thereafter make better investment decisions – in relation to the water supply networks and/or to the wastewater treatment plants.

Decrease in operation cost: although some cost components are exogenous, and utilities can do nothing to reduce them (e.g. energy prices), in other cases pooling some functions and activities can result in a cost reduction (e.g. through energy efficiency) – and this holds, for example, in reducing an important cost category such as personnel costs, as expertise might be shared among utilities. As shown in the next chapter, sharing functions is the focal point of consolidation.

Improvement in water supply efficiency and decrease in leakage. This is due to a better organization of the work and sharing of functions.

6.5. Options for consolidation of the WSS sector in the pilot regions

6.5.1. Practical arrangements for consolidating the WSS sector: an overview

As mentioned in the previous chapter, in Lithuania the perspective of merging municipal companies into a regional company is encountering the resistance of municipal utilities – smaller municipalities fear their voice will not be heard after consolidation – and some utilities – larger ones are concerned they will need to increase tariffs to finance upgrade of least performing assets, affecting their original customer base. This poses a strong obstacle to the consolidation of the sector.

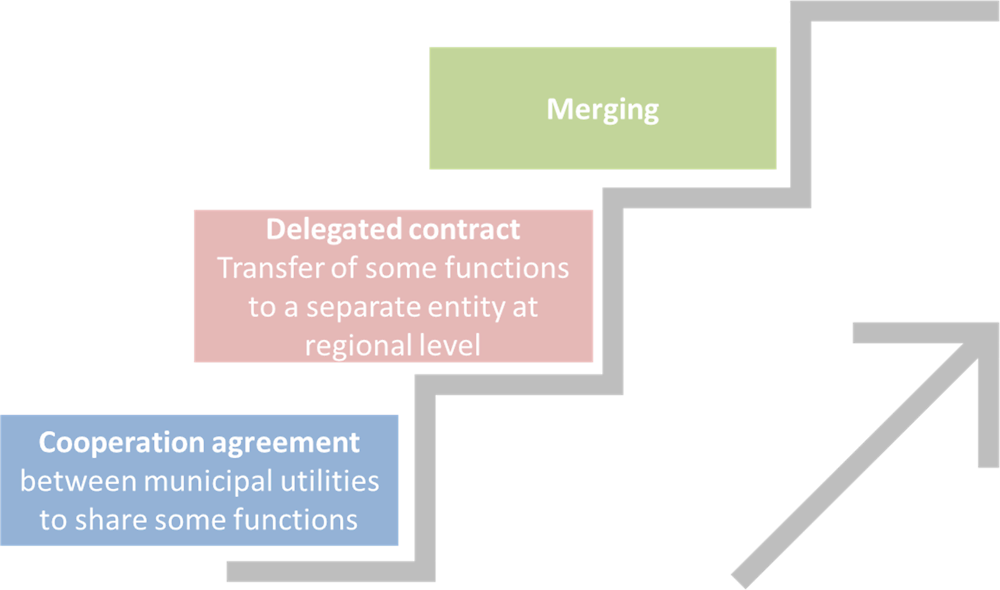

Finding the right practical arrangement for consolidating the WSS sector can be key in addressing such resistance. In fact, consolidation does not necessarily imply a full merger of all municipal utilities operating in a region, as different levels of cooperation can be realized through different organizational arrangements, and namely:

A special-purpose vehicle—that is, a specific cooperation agreement between service providers who remain separate entities, with a well-defined scope such as managing a specific facility or sharing some functions. An example of this agreement is the SDEA, a public establishment of cooperation in the WSS sector operating in Eastern France (see Box 1 below);

A delegated contract signed between the jurisdiction level in charge of service delivery and an operator, transferring all or most of operational responsibilities, but maintaining the original entities. Examples of this arrangement already exist in OECD countries, as summarized in Box 2 below.

A merger, by which original service providers consolidate into a single entity and disappear.

These organizational arrangements can be seen as progressive, as they imply an increasing level of aggregation with municipal utilities having the largest independency in the case of cooperation agreement and reduced levels of responsibility in the case of delegated contract, as opposed to their full merging into one company in the upper level of consolidation – as also shown in the figure below.

These different practical arrangements were presented to workshop participants, stressing that merging is not the only solution, nor the unavoidable point of arrival of the consolidation process.

Figure 6.16. Practical arrangements for consolidation of the WSS sector

Box 6.1. Cooperation agreement between service providers: the SDEA in France

In France, Syndicat des Eaux et de l’Assainissement Alsace-Moselle (SDEA) is an aggregation of water utilities following a mandate (top-down) approach. The NOTRe Act mandated the progressive transfer of water and sanitation services competence from municipalities to integrated intercommunalities, with the purpose to achieve economic efficiency (through economies of scale), and solidarity (through economies of scope).

The SDEA is a public establishment of cooperation specialized in the water field and federates different municipalities/group of municipalities/Strasbourg EuroMetropol and the Bas-Rhin department. The idea from this federation is to have one establishment that manages drinking water production, river streams, reservoirs, and wastewater collection and treatment for all members of the federation. It comprises 737 municipalities and is administrated by local elected officials from different municipalities. The SDEA comprise three levels of governance, and namely:

Global scale: bodies at the local scale include a General Assembly, a Board of Directors, a Permanent Commission, Thematic Commissions and Tender Commissions. This level is in charge of overall policy and economies of scale, adaptation of the common tool to the challenges, grouped purchases and pooling of financing capacities;

Territorial scale: bodies at the territorial scale include Territorial councils and Contracts Commissions. This level is in charge of synergies, common projects, inter-perimetral consultations, pooling of local investments and sharing of best practices;

Local scale: this level is administered by Local Commissions. It is in charge of proximity management, analytical financial management, definition of tariffs and financing, investment programs, awarding of work contracts and follow-up of local affairs.

Source: Series of ppt presentations provided by SDEA

Box 6.2. Delegated contracts: some examples from OECD countries

Several countries have separated water or treated wastewater production and the delivery of the service to customers:

In Boston, a metropolitan authority consolidates water production and sewage treatment, leaving member municipalities in charge of system management.

In Portugal, the government created a national water company in 1994. Municipalities in the same area were offered the opportunity to manage treatment plants jointly, while communes kept responsibility for operating water and sewer mains.

In Australia, the 1994 reform planned by the Council of Australian Governments mandated the unbundling of former urban water monopolies, with bulk water production and sewage treatment organised at the regional level (by one public company) and retail water services at a more local level (by several water distribution companies). This choice paved the way for alternative water supply technologies (e.g. recycling and desalination).

Source: OECD project in Lithuania – Chapter 3 Issues paper

At the heart of the consolidation process: sharing of functions

No matter which organizational arrangement is chosen, the sharing of functions lies at the heart of the consolidation process for the WSS sector, in a view of reducing/ mutualizing costs and increase efficiency of operations. For example, employees training that can achieve a reduction in training costs per employee if trainings are jointly organized by utilities at the regional level; similarly, better unitary prices can be obtained if the procurement of goods and services (e.g. laboratory products) is done by all utilities together – and thus larger quantities are purchased at one time.

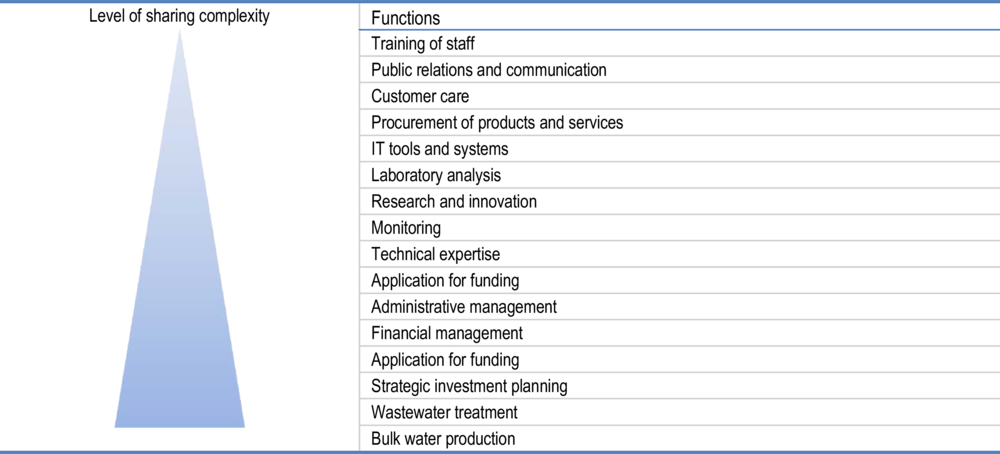

The number and types of functions that are shared among utilities can vary, from a “lighter” consolidation level to a “stronger” level, as some functions can be more easily shared than others in terms of transaction costs, administrative and organizational changes, and financial resources required. This also means that some functions could be easily shared in the short term, whereas other functions might need more time to be accepted and implemented – and, bringing this reasoning to the extreme, some functions might not eventually be shared even in the longer term. Functions that could be shared are listed in the table below, following an increasing level of complexity (from the easiest ones to the more challenging ones to be shared).

Table 6.2. Sharing functions among WSS utilities, from the least to the most complex one

Participants to the workshops were presented with the full list of functions that could be shared, and they were asked to identify those functions that could be more easily shared – or, in other words, which functions could be shared in the short term, and which ones could be feasible but would require more time for implementing them.

Discussions with water operators highlighted that there is already a track record in mutualising functions of services in Lithuania, at municipal level or in other sectors, and in particular:

At municipal level, across sectors (WSS is not included): consolidation of public services (including customer services) in Kaunas city (see the Kaunas City service center);

In other sectors: solid waste management in the Kaunas District.

In the water sector: collection and treatment of sewerage sludge at the regional level in the Kaunas region; wastewater treatment in Kaunas, serving also small municipalities.

Training of staff: it is carried out for all utilities at the national level by the National Association of Water Suppliers, which brings together all Lithuanian operators.

However, size matters: larger cities (typically Kaunas city) have a higher capacity to mutualise multiple services at municipal level, or to lead mutualisation of some functions at district or regional levels, than smaller or rural districts such as Marijampole.

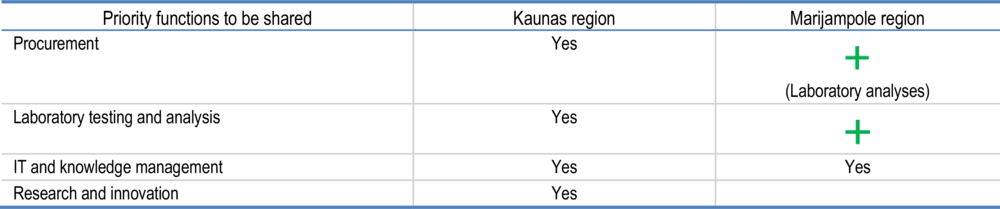

The tables below summarize the functions that could be shared as a priority in the Kaunas and Marijampole regions respectively.

Table 6.3. Sharing functions in the Kaunas region: outcomes of the discussion

|

Sharing functions in the Kaunas region |

|

|---|---|

|

Functions |

Advantages, opportunities, needs and challenges |

|

Laboratory analysis |

These are areas where cooperation could work very well. More discussions are required to learn from current practices in that domain, identify topics and innovation of common interest, and then identify financial resources to support (common) research and innovation projects. |

|

Research and innovation |

|

|

IT and knowledge management |

Sharing IT systems would deliver common information and knowledge, facilitating cross-comparison. At present, several suppliers are serving municipal utilities with different products – and this also translates in higher costs born by the single operators. However, this would require upfront costs (purchasing software, training…) that would benefit from some sort of financial support. |

|

Procurement |

While demands can differ across utilities, there are opportunities to join forces and seek economies of scale for some substances and services (such as maintenance of solar panels). At present, joint procurement in Kaunas municipality (for municipal services) is working very well, and the same could be for joint procurement among water utilities. |

Table 6.4. Sharing functions in the Marijampole region: outcomes of the discussion

|

Sharing functions in the Marijampoles region |

|

|---|---|

|

Functions |

Advantages, opportunities, needs and challenges |

|

Laboratory analysis |

The facilities needed to carry out this type of analyses is costly, and often these are already in place in larger municipalities – thus, smaller utilities could make use of such facilities. They are discussing the possibility for having joint procurement of laboratory services, which are very expensive. However, the current procurement law would make this procedure burdensome (see also box below). |

|

IT and knowledge management |

Overall, the digitalization process started only recently, and it is still ongoing. At present, several suppliers are serving municipal utilities with different products – and this also translates in higher costs borne by the single operators. The possibility to share/mutualise experts with engineering and IT expertise was mentioned as a positive development that could support the management of the (smaller) water utilities of the region. However, this would require upfront costs (purchasing software, training…) that would benefit from some sort of financial support. Common databases might also allow for mutualizing customer service: at the moment, this function could not be mutualized as water utilities do not have access to other utilities’ databases. |

|

Procurement |

While demands can differ across utilities, there are opportunities to join forces and seek economies of scale for some substances and services. |

The ongoing revision of the Procurement Law is a common challenge and an opportunity at the same time. The procurement law is currently going through changes, so it could be an occasion to explore mechanisms to be put in place to make joint procurement possible. According to the current law on procurement, joint procurement, as well as the mutualisation of laboratory analysis and monitoring, could be put in place through a somewhat burdensome procurement procedure: it was suggested that this aspect of the law is amended to make mutualisation possible through a simple agreement between water utilities.

6.6. Making it happen: Practical steps towards implementation

6.6.1. Obstacles to consolidation and practical solutions

During the June workshops with municipalities and water utilities in the Kaunas and Marijampole regions, the reasons for resistance were explored, and some key concerns emerged. To make consolidation possible, these concerns need to be addressed. Main concerns and possible solutions (when available) are listed below.

Table 6.5. Selected barriers to consolidation and practical responses

|

Barriers to consolidation |

Practical response |

|---|---|

|

Utilities acknowledge consolidation is the forthcoming option for efficiency gains and financial sustainability. They claim they are fine and can manage consolidation. They point at municipalities as the institutions, which may oppose or delay the process. |

This can be addressed through tailored governance arrangements, as illustrated by the SDEA. |

|

For smaller municipalities, concerns about having their voices heard are a major political bottleneck. |

It can potentially be addressed through tailored governance arrangements. |

|

Overall, a lack of financial capacity was highlighted in both regions – and this is true in particular for utilities in smaller municipalities. Often, financial capacity of utilities can barely cover operation and maintenance of infrastructures – and in some cases not even maintenance. Sharing functions would require an initial investment (e.g. IT systems above) and, although this would be compensated by cost reduction in the medium term, utilities cannot sustain the upfront costs of setting up mutualization. |

The discussions stressed the need to identify and clarify the scale (regional, national) at which mutualisation/the sharing of functions can best be carried out/supported. |

|

The assumption that consolidation necessarily implies making water tariffs homogenous in the larger entity is a deterrent for action. It derives from the perception that homogenous tariffs result from an increase for selected customers, who will lose from the reform. |

The case could be made that this assumption however is misleading:

|

Of note: adding to the tariff setting formula selected indices and the possibility to reflect inflation or increases in selected costs (energy, labour, or construction) would facilitate utilities’ responses to external shocks (as for the heating sector), without triggering a delayed and cumbersome tariff review, a point discussed in more depth in Chapters 4, 7 and 8.

6.6.2. Practical steps towards consolidation in the Kaunas region

Mutualise functions with other local services in Kaunas municipality

Develop a roadmap for the consolidation of selected functions (replicating the Kaunas City service center, but at sector level)

Challenge applications for tariff revision as a response to the energy crisis. Use the opportunity to urge exploration of other responses benefitting from economies of scale.

Question renovation and development plans, building on the benchmarking of business plans method proposed in Chapters 7 and 8.

6.6.3. Practical steps towards consolidation in the Marijampole region

Mutualise functions, starting with procurement of laboratory equipment, testing and analytical capacities. The IT system could be mutualized in the longer term.

Utilities in the region are not used to cooperate. Setting up a regional coordination body could be a first step for them to start working together towards sharing some functions. This would allow for discussing issues and possible solutions in a collective and potentially coordinated way.

A uniform work organisation procedure would be useful as a basis for consolidation and sharing of (some) functions (e.g. information technology, procurement).

Revive discussions between Marijampole and a neighbouring municipality about merging.

Support discussion about sludge management at regional level. A decision is required as for the site that will receive the sewerage sludge.

Revive exploration of sharing billing with a district heating utility.

6.7. In conclusion

The discussions in both regional workshops confirmed that merger is at best a distant option, if consolidation of WSS services should be based on voluntary initiatives. A more practical trajectory was considered, which aims at promoting some forms of consolidation by sharing, mutualising or coordinating functions. This can be a gradual endeavour, from functions that are comparatively easy to share or coordinate (e.g. training, procurement of some appliances or substances) towards coordination efforts which are more demanding (typically the development and investment plans).

Not all municipalities and utilities will advance at the same pace. The capacity to build on a large municipality, and a track record in sharing functions in other sectors, are assets. This confirms that the government (Ministry and economic regulator) have a role, ahead of setting up the appropriate incentives: supporting the emergence of some administrative hub or capacity at regional level can advance consolidation of WSS services in regions where such capacity does not exist.

Chapter 6 summarizes some relevant findings from previous outputs of this project, and it brings the reflection forward by providing recommendations on the way forward for consolidation of the water sector in the Kaunas and Marijampole regions in Lithuania.

Proposed options for consolidation and recommended practical steps are the result of targeted discussions with municipalities and water operators in the region: two workshops were in fact organized in June 2022 – one in the Kaunas region and one in the Marijampole region.

Chapter 6 findings do not mean to be exhaustive, nor representative for the entire country – and, in particular:

The work for Chapter 6 has been carried out in a relatively short time, building on the evidence that was available. It is likely that more evidence (on the performance, on the state of the infrastructure, etc.) is available with the water supply companies (although not in a digital format which might make access and use challenging);

The diversity of the two pilots in terms of the balance between urban and rural is an issue that is key to consolidation in large part of Lithuania. However, we acknowledge the limitation of the work with only two pilots that are very different but that might not cover all the diversity of Lithuania. Thus, the main conclusions of this report should not be extrapolated as such the main conclusions to any municipality like this.

The key messages included in this report are summarized below.

Key message 1. While the perspective of a full merger is encountering strong resistance, other “lighter” organizational arrangements could indeed be welcome by municipal water utilities and provide a pathway towards more efficient WSS services.

“Lighter” organizational arrangements would allow for the consolidation of the sector while maintaining existing water companies, although with different levels of responsibility and independence. These arrangements include: (i) cooperation agreements between providers with a well-defined scope; and (ii) delegated contracts signed between the jurisdiction level in charge of service delivery and an operator, transferring all or most of operational responsibilities.

Key message 2. No matter which organizational arrangement is chosen, the sharing of functions lies at the heart of the consolidation process for the WSS sector, in a view of reducing/ mutualizing costs and increase efficiency of operations.

The number and types of functions that are shared among utilities can vary, and some functions can be more easily shared than others in terms of transaction costs, administrative and organizational changes, and financial resources required. This also means that some functions could be easily shared in the short term, whereas others might need more time to be accepted and implemented.

The table below summarizes the functions that could be shared as a priority (i.e. in the shorter term) in the two pilot regions. In the Marijampole region, water utilities and municipalities also indicated a possible timeline for sharing functions, i.e. two functions can be shared in the shorter term (highlighted in the table with a green plus symbol), while another function can be shared in the longer term. In contrast, these time preferences were not provided by water operators and municipalities in the Kaunas region.

Table 6.6. Priority functions that could be shared in the two pilot regions

Key message 3. Size matters! Larger cities – typically Kaunas city – have a higher capacity to mutualize multiple services at municipal level, or to lead mutualization of some functions at district or regional level, than smaller or rural districts such as Marijampole.

There is already a track record in mutualising functions of services in the Kaunas city, at municipal level or in other sectors; in the Marijampole region, water utilities and municipalities highlighted that they do not have the same capacity as a large city.

In addition, a lack of financial capacity to share functions was highlighted in both regions and this is true in particular for utilities in smaller municipalities. Often, financial capacity of utilities can barely cover operation and maintenance of infrastructures.

Key message 4. The assumption that consolidation necessarily implies making water tariffs homogenous in the larger entity is a deterrent for action.

However, homogenous tariffs are not a requirement for consolidation, and this needs to be made very clear when discussing with water utilities and municipalities.

Key message 5. The mutualization of functions and the practical steps recommended in this report will require facilitation support.

Chapter 6 outlines a “wish list” of actions that will not take place over night and on its own: rather, some facilitation will be needed so that representatives from water utilities can collectively agree on the way forward for mutualising specific functions. This facilitation support is essential for territories/regions with small (rural) water utilities such as Marijampole that are fully occupied with responding to, and solving problems, with limited capacity and resources for anticipating and setting the right conditions for efficient management.