This chapter assesses the socio-economic characteristics of the regions most vulnerable to the transformations needed for the transition of key manufacturing sectors to climate neutrality. The chapter considers regional, worker and firm characteristics. These point to the specific vulnerabilities of each region and lay the basis for regional policy action for a just transition. The most vulnerable regions tend to underperform on key regional socio‑economic indicators, including gross domestic product (GDP) per capita, wages and net migration. Workers employed in the key manufacturing sectors in the most vulnerable regions often have low educational attainment, work in low-skilled occupations and tend to have temporary contracts. Some firms in these regions underperform on productivity, reinforcing challenges to incorporate new technologies and finance needed investment.

Regional Industrial Transitions to Climate Neutrality

4. Regional industrial transitions to climate neutrality: Identifying potential socio-economic vulnerabilities

Abstract

Regions with high emissions per capita and high employment shares in at least one of the key manufacturing sectors are particularly vulnerable in the transition to climate neutrality in manufacturing by 2050. The key manufacturing sectors were identified in Chapter 1 and are the manufacturing sectors that will have to undergo particularly large transformations in the transition to climate neutrality. The sectors are oil refining, chemicals, steel and aluminium, cement, paper and pulp, and vehicles. The vulnerable regions were identified in Chapter 2. In the following analysis, these will be referred to as “most vulnerable regions”. The transformations key industries need to undertake will have implications for infrastructure to provide access to energy, raw materials and transport under climate-neutral conditions. These were analysed in Chapter 3.

Among the most vulnerable regions, some will in addition be particularly vulnerable to socio-economic impacts, notably with respect to job loss and job transformations. This chapter, therefore, assesses the socio-economic characteristics of the regions themselves as well as the characteristics of workers and firms in the key sectors.

The first section of this chapter discusses socio-economic characteristics of the most vulnerable regions. Using various indicators, vulnerabilities are identified. Regions underperforming on socio-economic characteristics, compared to the national and EU averages, potentially need policy attention to ensure a just transition. The section identifies whether the socio-economic characteristics of regions make them more vulnerable to the transformations to climate neutrality.

The second section takes a closer look at the characteristics of workers employed in the key manufacturing sectors in the most vulnerable regions. It identifies individual characteristics which may make workers particularly vulnerable to changes in skill needs, risks of job loss and other forms of employment restructuring the sectoral transformations may bring. This section identifies vulnerable workers who may need support to ensure a just transition.

The third section considers the productivity performance of firms in the most affected regions. As shown in the first chapter, integrating new zero-emission technologies is important for moving key manufacturing sectors to climate neutrality by 2050. The most productive firms are likely to be best able to integrate these new technologies. Regions with more productive firms in key manufacturing sectors may therefore face fewer challenges and may be better placed to grasp opportunities in the transition to climate neutrality.

Socio-economic characteristics of the most vulnerable regions

This section discusses the socio-economic indicators that point to further vulnerabilities to impacts of the transition to climate neutrality in regions already identified as vulnerable. It considers the following indicators to assess potential socio-economic impacts and vulnerabilities:

Regions with lower GDP per capita will have fewer resources, in the public and private sectors, to provide services, infrastructure and other forms of support to firms and individuals involved in the transformations. They may also be less able to offer attractive alternatives for economic activity or employment.

Similar to GDP per capita, the regional wage indicates workers’ resources available to absorb economic shocks and take advantage of opportunities during the transition.

A higher relative poverty risk increases the vulnerability of regions, as a greater number of already vulnerable people will be affected by the transformations.

Lower unemployment in each region indicates a larger number of alternative job opportunities. Increases in unemployment and poverty would most likely result in lower demand for services in a region.

High educational attainment may reflect the skillsets of workers and their ability to adapt to transitional changes. Regions with lower levels of education may find it more difficult to smoothly transition their workers to the new employment opportunities that may arise from the transition.

Regions with faster Internet download speed may have a better-developed capacity to take advantage of economic opportunities resulting from digitalisation. As discussed in the first chapter, circular economy practices require good data connectivity, for example to take advantage of asset-sharing business models. Moreover, Internet connectivity can offer opportunities for the diversification of economic activity. Hence, technical proficiency would likely help regions to mitigate negative effects during the transition to climate neutrality.

Net migration reflects the attractiveness of a region and its ability to attract workers and retain its inhabitants. A positive net migration increases the flow of ideas and skills into a region, increasing the ability to capture the opportunities created by the transition. Net outmigration often leaves regions with an ageing population who may have more difficulty in facing challenges and seizing opportunities. Net outmigration may also increase per capita costs in providing infrastructure services, including the infrastructure needed for climate neutrality. Outmigration can however also help workers adapt by moving towards regions with transition opportunities.

The difference between the average wage in the key manufacturing sectors and the average regional wage illustrates the contribution of key sector jobs to regional wealth. This is the only sector-specific regional indicator. Regions, where these wage differences are large, may be more vulnerable to any local job losses or restructuring of employment in key manufacturing sectors, especially if regional employment in these key manufacturing sectors is large. Regional employment shares in key manufacturing sectors were identified in the second chapter.

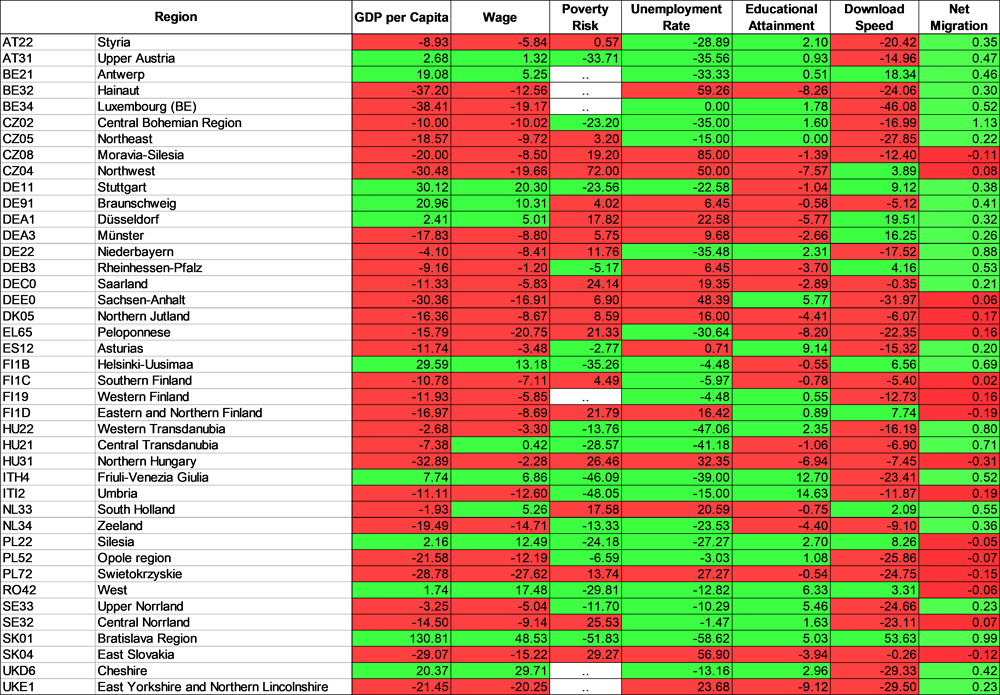

The most vulnerable regions underperform in most socio-economic indicators

In the majority of regions most vulnerable to the transformations of the key manufacturing sectors for climate neutrality, regional GDP per capita is below the national average (Table 4.1) and, in some, below the European Union (EU) average (Fuentes Hutfilter et al., 2023[1]). Capital city regions are typically among the exceptions, as they often host headquarter activities in which workers may be less vulnerable. Some of the most vulnerable regions with lower GDP per capita account for a large part of the national population, notably in Eastern Slovakia and Eastern and Northern Finland. While GDP per capita is above the EU average across more than half of vulnerable regions, just transition challenges remain. Many of these regions are in richer countries with stronger industrial activity and they often compare less favourably with other regions in the same country. The most vulnerable regions are particularly vulnerable in EU comparison and may require the most policy attention.

Moreover, the average wage in over two-thirds of the most vulnerable regions is below the national average (Table 4.1) and some are also below the EU average (Fuentes Hutfilter et al., 2023[1]). For example, the most vulnerable regions in the Czech Republic, Greece and Poland often have between 10% to 30% lower wages compared to the national average.

Many of the most vulnerable regions with lower GDP per capita and wages are also exposed to higher relative poverty risk. More than half of the most vulnerable regions face higher poverty risk than their national average.

Table 4.1. Socio-economic indicators in the most vulnerable regions

Relative difference between the regional and national indicator values, percentage of the national average,1 large (NUTS 2) regions

Note: The wage is the total remuneration paid including employer-paid social security contributions. Educational attainment is the share of the population with an upper secondary degree or more. Poverty risk is the share of the population at risk of poverty, severely materially deprived or that live in households with extremely low work intensity. Data for this indicator is not available for some regions of interest, this is represented by ‘..’. Download speed refers to how quickly data can be pulled from the server on the Internet to the device. Net migration is the population change not attributable to births and deaths.

1. All indicators are compared to the national average except for net migration. Net migration is the regional net immigration rate, as a percentage of the regional population. Red-coloured cells contain values below the national average, except for net migration. Red-coloured cells for net migration contain values below 0.2%. Most of these regions have net immigration rates below the respective national average and so appear little attractive.

Source: Own calculations using Eurostat and (Ookla, 2020[2]).

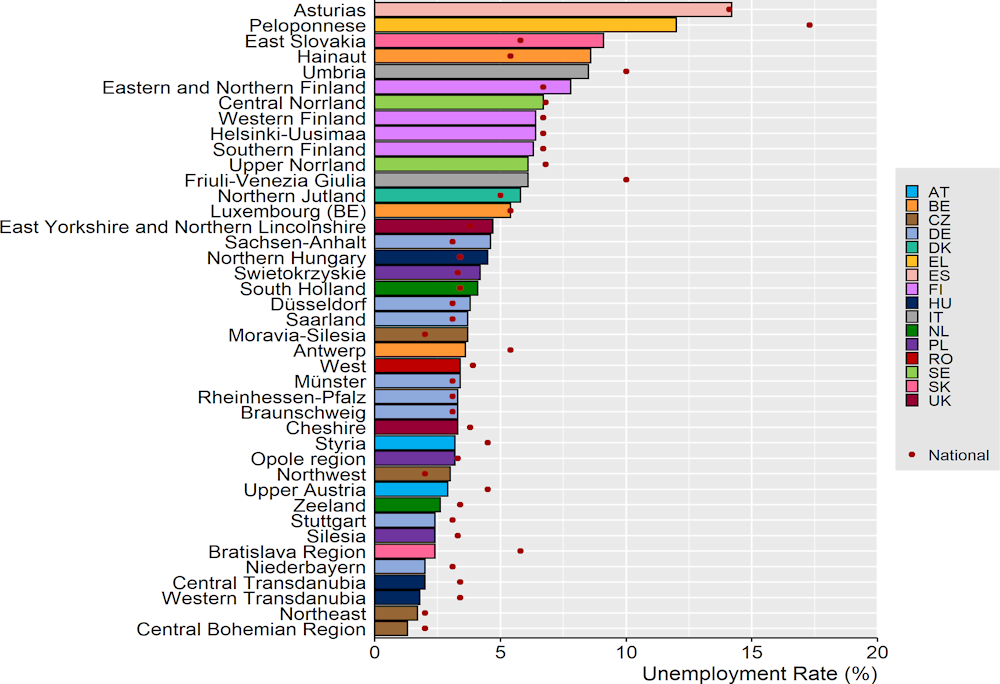

Unemployment rates are below the national rate in many of the most vulnerable regions. This may in part be because activity in the key manufacturing sectors provides job opportunities in these regions. For example, all vulnerable regions with high employment in vehicle manufacturing have lower unemployment rates than the national rate. Even so, unemployment rates are high in all the vulnerable regions of Finland, Greece, Italy, Spain and Sweden (Figure 4.1).

About half of the most vulnerable regions have a larger share of the population with at least an upper secondary degree (equivalent to a high school diploma or an upper secondary vocational qualification) than the national average and most have a bigger share than the EU (Fuentes Hutfilter et al., 2023[1]). However, in many of the most vulnerable regions where wages in key sector jobs are high, educational attainment in the region is relatively low. The low educational attainment level in these regions may weaken the capacity of regional economies and their workers to respond to any restructuring in the key manufacturing sectors.

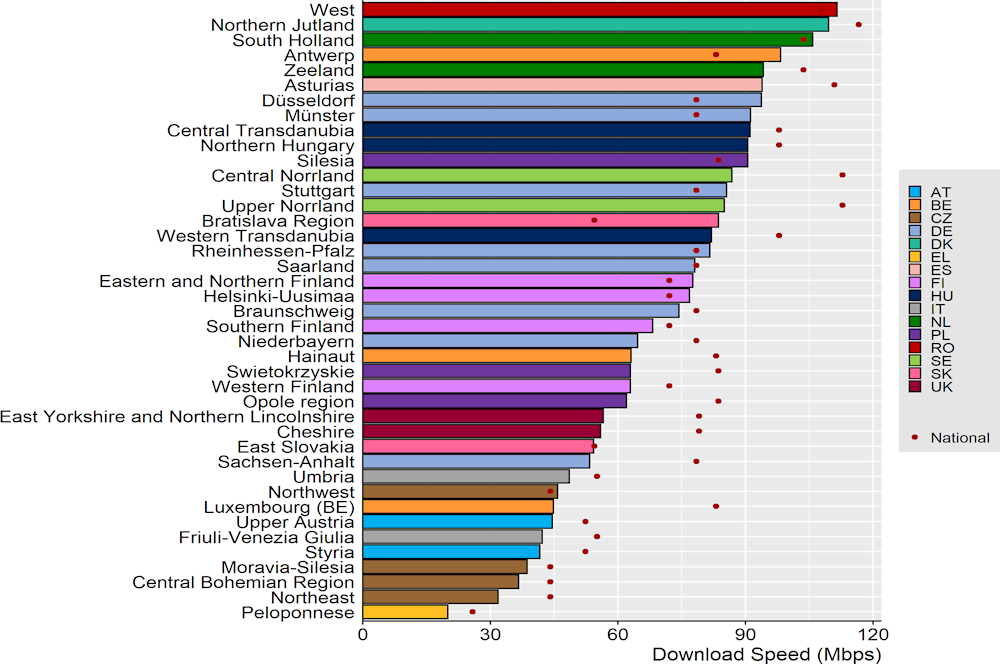

Even though the most vulnerable regions tend to have high broadband access rates, the fixed Internet download speeds, measured in megabits per second (Mbps), are lower than the national averages. Only in a third of the most vulnerable regions is download speed above the national averages. Additionally, download speeds in all vulnerable regions in Austria, the Czech Republic, Italy and the United Kingdom (UK) are below 60 Mbps, i.e. particularly low (Figure 4.2).

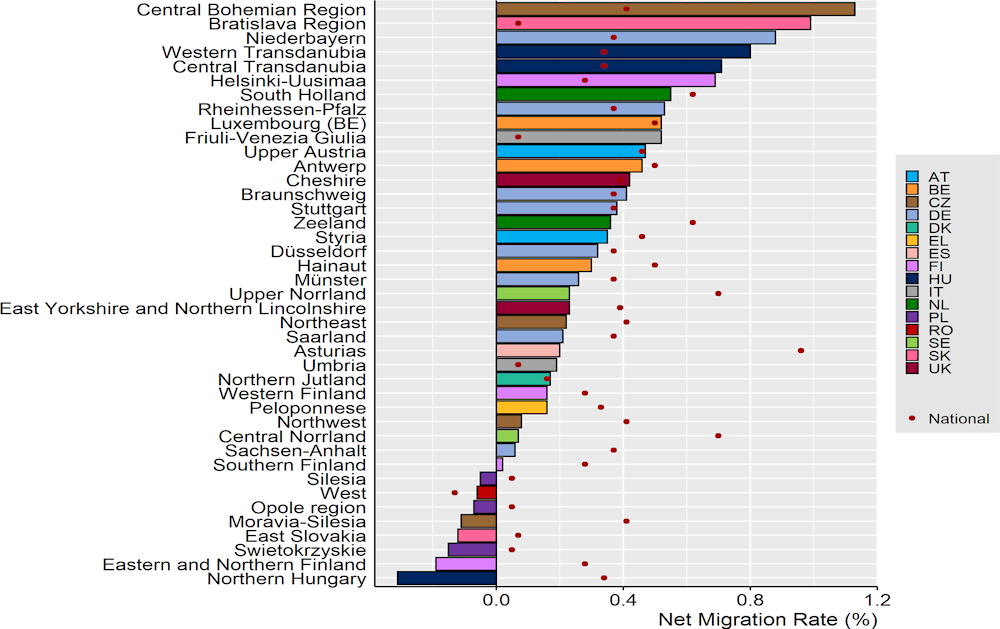

Some of the most vulnerable regions appear to be little attractive overall. Indeed, several regions appear vulnerable on most of the indicators discussed (Box 4.1). Most of these also experience net outmigration or at least net immigration rates well below the national level, and so may be particularly unattractive to young workers (Figure 4.3).

Figure 4.1. Unemployment rate

Figure 4.2. Fixed Internet download speed

Note: Fixed internet download speed refers to how quickly data can be pulled from the server on the internet to the device using a non-cellular connection type (WiFi, ethernet).

Source: (Ookla, 2020[2])

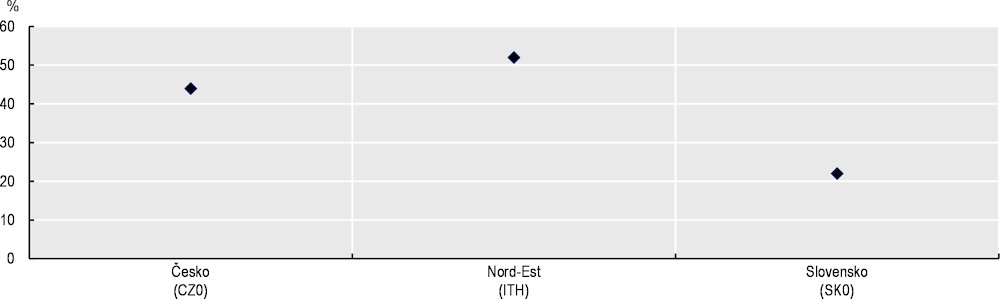

Figure 4.3. Net migration rate

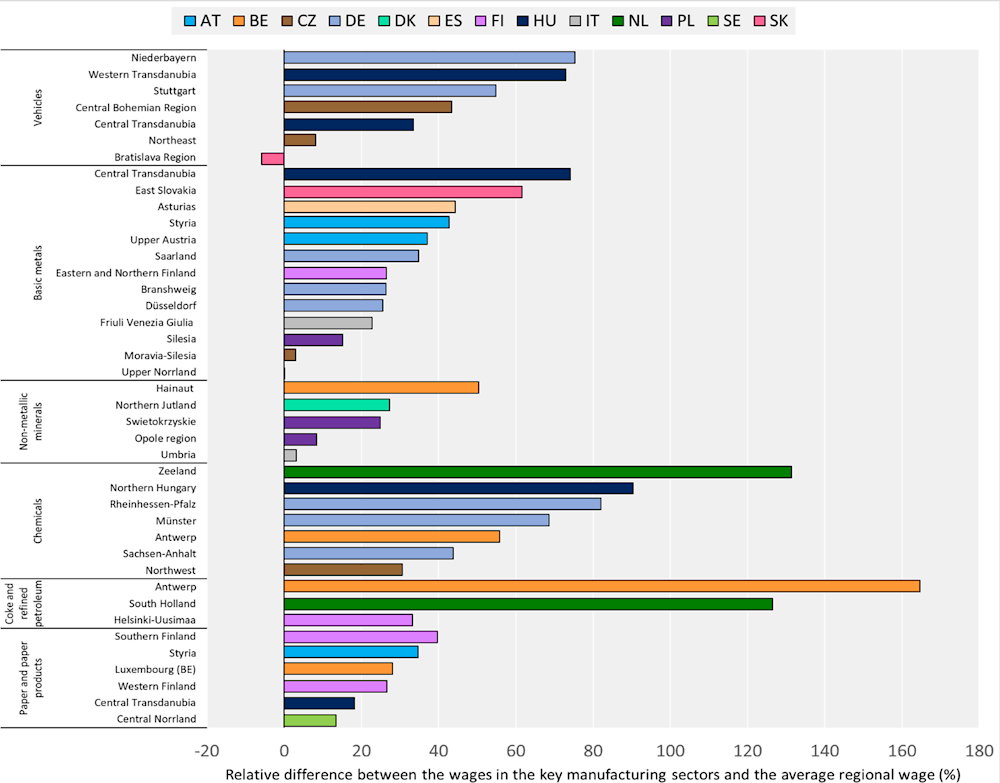

Wages in the key manufacturing sectors tend to be higher than the respective regional wage (Figure 4.4). In most vulnerable regions the average wage in key manufacturing sectors is more than 20% higher. In the manufacture of coke and refined petroleum products, the average sectoral wage is even more than double the regional average wage. For instance, in Hungary’s most vulnerable regions, it can be 30% to 80% higher. Loss of such well-paid jobs would likely have regional development implications, especially if these regions are socio-economically weak. If workers lose these jobs, they may, in the absence of policy measures such as retraining, not be able to find alternative equally well-paid jobs. This could contribute to opposition to the transition to climate neutrality.

Figure 4.4. Sectoral wages tend to be much higher than regional wages

Note: The key manufacturing sectors identified in the first chapter are: paper and paper products (17), coke and refined petroleum products (19), chemicals and chemical products (20), other non-metallic mineral products (23), basic metals (24), and motor vehicles, trailers and semi-trailers (29). The regions of the Peloponnese in Greece, West in Romania and Cheshire and East Yorkshire and Northern Lincolnshire in the UK are not shown as there are no sectoral wage data in their respective sectors.

Source: Authors’ calculations using Eurostat.

In the majority of the most vulnerable regions where GDP per capita is below the national average, wages in the key manufacturing sectors are above regional average wages, as described above. In these regions, the regional development implications of job losses would be particularly stark, as such job losses would further dampen GDP.

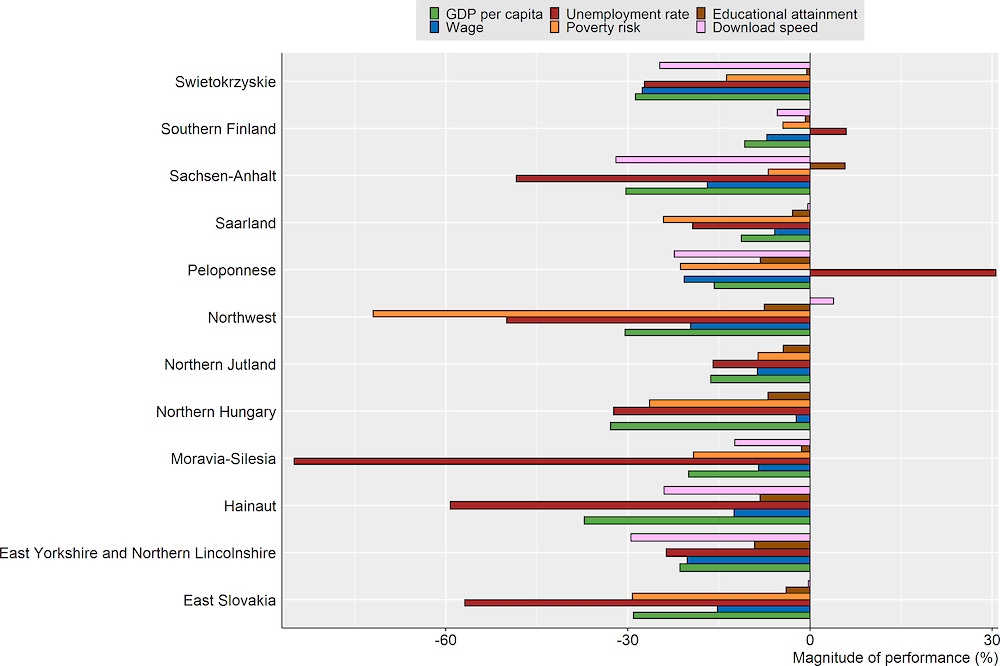

Box 4.1. Some regions are vulnerable on account of most socio-economic indicators

Ten of the most vulnerable regions stand out for underperforming in at least six of the seven indicators considered in Table 4.1. In these regions, lower GDP per capita overlaps with higher poverty risk, higher unemployment and lower average wage and significantly lower migration rates compared to national averages. Moravia-Silesia in the Czech Republic, Swietokryskie in Poland and Eastern Slovakia in the Slovak Republic underperform in every indicator for which data are available. Hainaut in Belgium, Southern Finland, Saarland and Sachsen-Anhalt in Germany, the Peloponnese in Greece and East Yorkshire and Northern Lincolnshire in the UK underperform in every indicator but have positive migration rates (Figure 4.5).

Figure 4.5. Magnitude of indicator performance in underperforming regions

Note: Indicators in which regions perform worse than the national average are portrayed as negative. Indicators in which regions perform better than the national average are portrayed as positive.

Source: Own calculations using Eurostat and (Ookla, 2020[2]).

The magnitude of underperformance in these indicators is also particularly large in the regions which appear vulnerable on multiple indicators. With respect to unemployment and poverty risk, the regions are always in the top ten underperformers relative to national averages. The underperforming regions also have particularly low GDP per capita and wages.

These regions are mostly affected by transformations in basic metals and non-metallic minerals manufacturing, as shown in the second chapter of this series. In addition, Eastern Slovakia, Moravia-Silesia, Northwest and Saarland have significant employment in vehicle manufacturing, a sector that may experience significant employment loss. The big performance gaps between the key transition regions and their countries decrease the ability of the regions to mitigate the challenges and capture the opportunities of the transition.

Socio-economic characteristics of workers in the most vulnerable regions

This section assesses the socio-economic characteristics of workers who are employed in vulnerable regions and key manufacturing sectors. The following individual worker characteristics chosen for analyses reflect the needs of workers in key manufacturing sectors in coping with transformations:

Low earnings limit the private resources of workers to deal with transformations, such as training or finding a new job, especially relocating is required.

Gender differences exist in adapting to transformation. Women may face greater transformation challenges, as they receive on average 17% fewer hours of employer-sponsored training and earnings are often lower (Bassanini and Ok, 2004[3]).

The level of education and skill requirements of workers’ occupations reflect the ability of workers to acquire transferable skills in the transition. Workers with little education and in jobs with limited skill requirements will face greater challenges adapting to the transformations required.

Participation rates in job-related training are low for individuals with low educational attainment and skills. More educated workers are more than three times as likely to participate in training compared to less educated workers (Cedefop, 2015[4]), while higher-skilled occupations are more than twice as likely to participate in training compared to lower-skilled occupations.

Workers in temporary employment contracts face a larger risk of job loss without compensation and have limited access to employer-sponsored training programmes.

Young employees are more likely to be in temporary employment, which tends to pay less, offer fewer unemployment benefits and reduce access to training compared to permanent jobs (OECD, 2002[5]). These young workers, however, will need to adapt to post-transformation societies and changing employment landscapes by acquiring new skills and education. Older workers are less flexible and more likely to become unemployed for prolonged periods and retire early as societies transform. This reinforces poverty risks for poorly paid older workers that do not enjoy adequate pension and unemployment benefits.

Collective wage bargaining and trade unions benefit workers by aiming to improve employment conditions, provide job security and ensure access to long-life training (OECD, 2017[6]). Workers’ access to collective representation may reduce workers’ vulnerabilities during the transition.

The analyses are conducted using the EU Structure of Earnings Survey (Box 4.2). Due to data limitations, the analyses of worker characteristics are conducted at the NUTS 1 level. NUTS 1 regions are identified according to Table 4.1, where a NUTS 1 region is considered vulnerable if it contains at least one vulnerable NUTS 2 region.

Box 4.2. The Structure of Earnings Survey

The Structure of Earnings Survey (SES) is a large sample survey of enterprises on the characteristics of employees and their employers. It has been conducted in its current form every four years since 2002. The analysis uses the 2018 vintage, which includes data for 25 countries within the EU as well as EU candidate countries and European Free Trade Association (EFTA) countries. The SES provides regional breakdowns at the NUTS 1 level and industry breakdowns at the two-digit Nomenclature of Economic Activities (NACE) level.

The SES collects data for workers employed in enterprises with at least ten employees, in all areas of economic activity excluding public administration. The employees included in the sample are those who actually received remuneration during the reference month of October, thus excluding non-remunerated employees such as family or unpaid voluntary workers.

The sampling procedure for the SES usually contains two stages, where in the first stage a random sample of local units of enterprises (the primary sampling unit) is drawn using stratification criteria including the NACE industry and NUTS 1 region. The second stage consists of a simple random sample of employees within each selected local unit, where stratification may or may not be carried out.

The analyses that follow account for the two-stage sampling structure of the data as well as stratification. It is assumed that the first stage is stratified by NUTS 1 region and two-digit NACE industry. No stratification is assumed for the second stage. Thus, the estimated standard errors and confidence intervals may be overestimated and the statistical significance of results underestimated. The analysis produces point estimates for the population using grossing-up factors. These are sample weights, which correspond to how many employees in the population each sample observation represents.

Source: EC (2018[7]), Structure of Earnings Survey 2018: Eurostat’s arrangements for implementing the Council Regulation 530/1999, the Commission Regulations 1916/2000 and 1738/2005, (accessed on 29 November 2021).

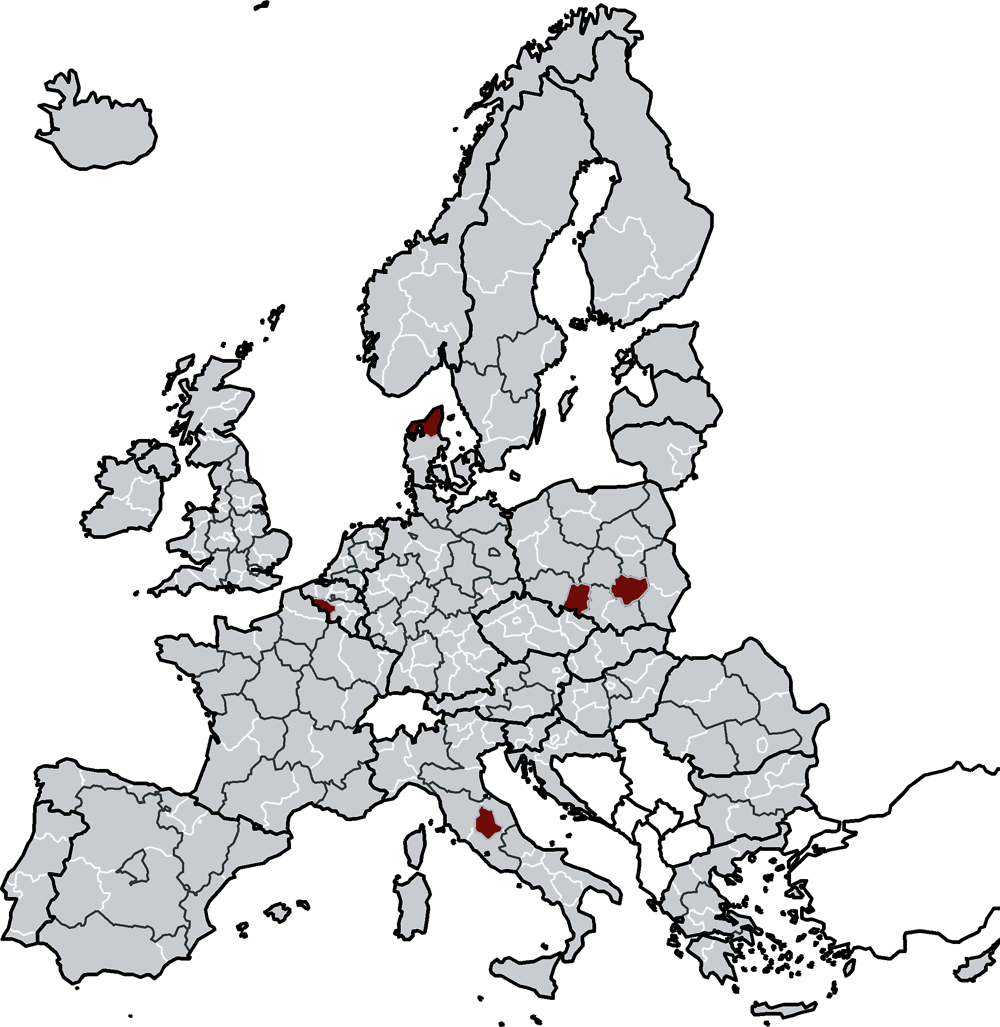

Worker vulnerability in the most vulnerable regions in the manufacture of non-metallic mineral products is high

The NUTS 2 regions of Hainaut in Belgium, Northern Jutland in Denmark, Umbria in Italy and the Opole region and Swietokrzyskie in Poland are vulnerable in the manufacture of non-metallic minerals. Figure 4.6 depicts these NUTS 2 regions as well as the NUTS 1 regions that contain these NUTS 2 regions.

Figure 4.6. Regions with high employment and high emissions in non-metallic mineral production (NACE 23)

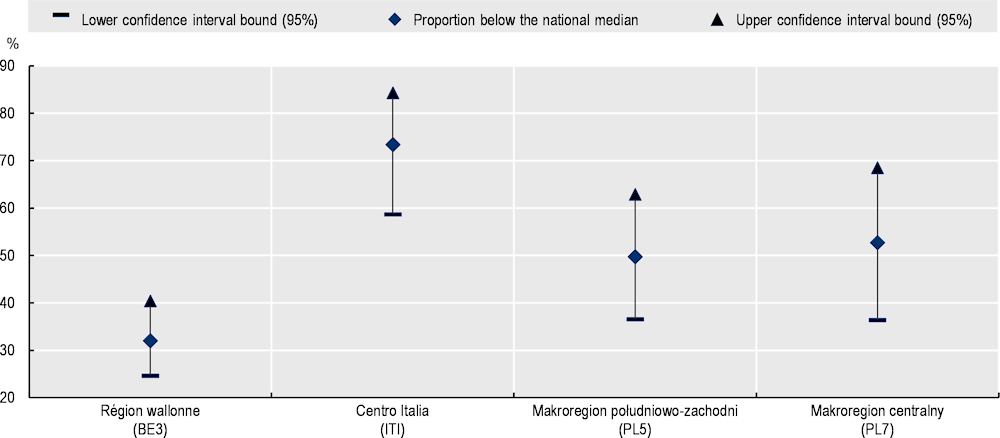

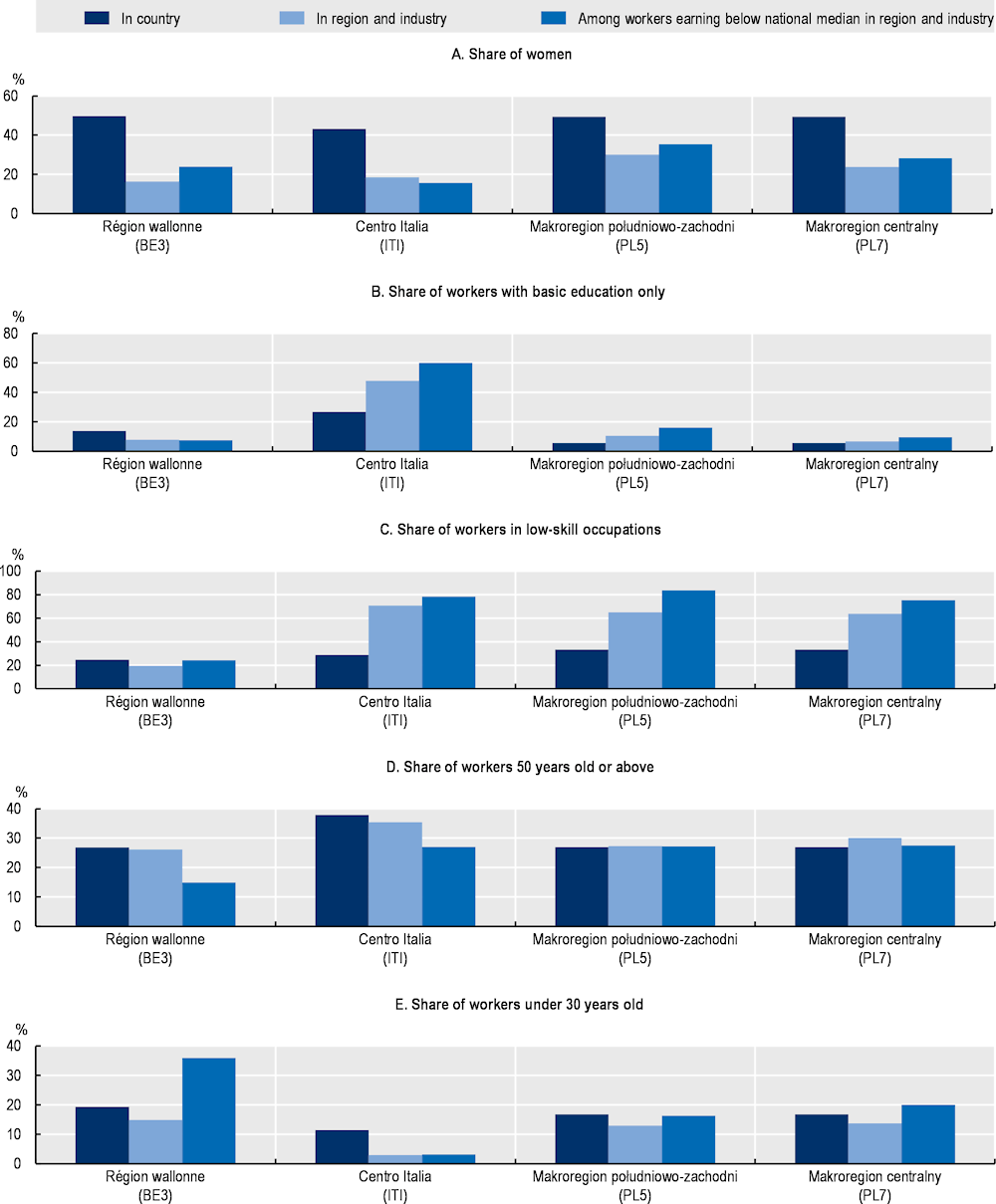

The share of low-earning workers differs substantially across regions (Figure 4.7). Workers in Wallonia are generally better paid than workers across all economic sectors in Belgium, with only 32% of workers employed in the sector in this region earning less than the median Belgian worker. The opposite is true for Central Italy, where 73% of workers earn below the national median. Wages are on par with the national level for the Polish regions of interest.

Low educational attainment and low skills increase low earnings vulnerability substantially (Fuentes Hutfilter et al., 2023[1]), except in Wallonia, where lower-skilled and lower-educated workers still earn more than the national median. In Central Italy, almost all workers with basic education or in low-skill occupations earn less than the national median. Similar patterns arise in the Polish regions.

Figure 4.7. Share of low-earning workers employed in non-metallic mineral production (NACE 23)

Notes: National medians calculated using the SES sample data.

Source: Authors’ calculations based on SES microdata.

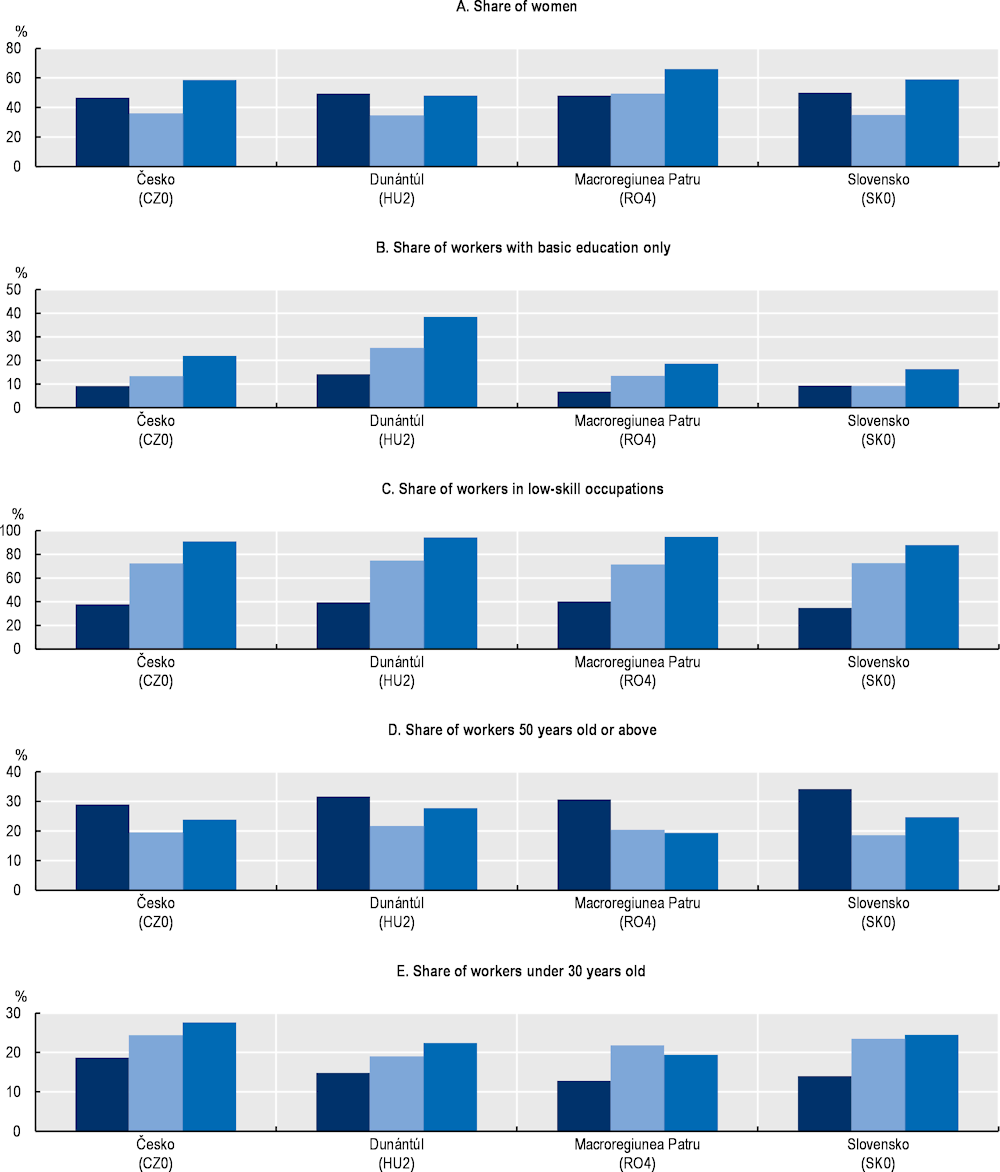

Far more men work in the non-metallic mineral production sector than women (Figure 4.8, Panel A). While men working in this sector will generally be more affected by the transition, women are over-represented among low earners, who are less likely to receive retraining.

Workers employed in the sector tend to be less educated and lower-skilled (Panels B and C) than the median worker in the country, except in Wallonia. Fifty percent of workers in Central Italy possess only basic education and 70% are employed in low-skill occupations. The share of workers in low-skill occupations in the Polish regions is twice the share in the country. These workers also tend to earn less in the case of the Italian and Polish regions.

Many of these workers likely do not possess transferable skills and are less likely to acquire new skills in the changing employment environment. According to the OECD Survey of Adult Skills (PIAAC), less than one in four adults with low skills participate in professional training compared to 58% of adults with high skills. Low-educated workers are significantly less willing to develop their skills further through training than high-educated workers (Fouarge, Schils and de Grip, 2012[8]).

The share of young workers is relatively small, especially in Central Italy where only 3% of workers are under 30 (Panel E). Difficulty in attracting young workers may make it harder to achieve the profound transformations some activities in this sector require.

Older workers tend to earn more than the national median in Wallonia, while in the Polish regions, most older workers are on low earnings. Limited education and low-skill occupations reinforce poverty risks among older workers. Around two-thirds of workers in the industry with only basic education in Wallonia are more than 50 years old compared to 37% in Belgium as a whole. Similarly, older workers account for 56% of the workforce in low-skill occupations in this region, a proportion considerably higher than the national average of 31%.

Figure 4.8. Worker characteristics in non-metallic mineral production (NACE 23) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

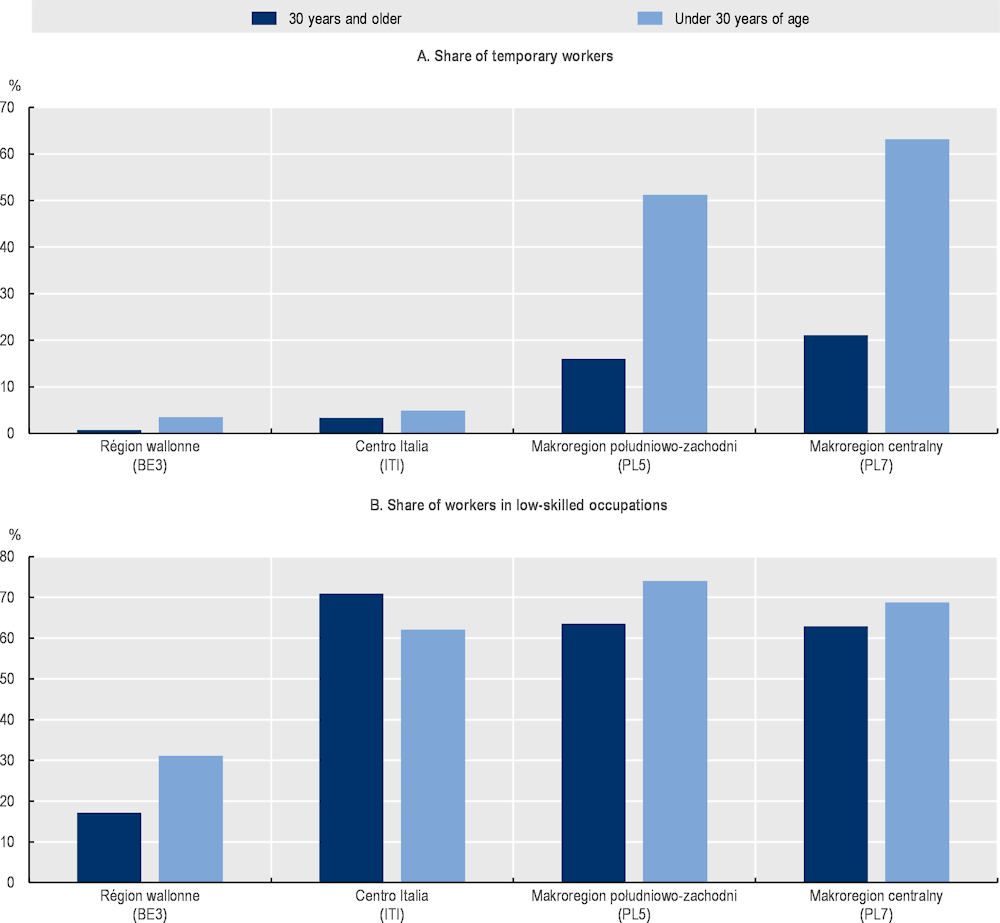

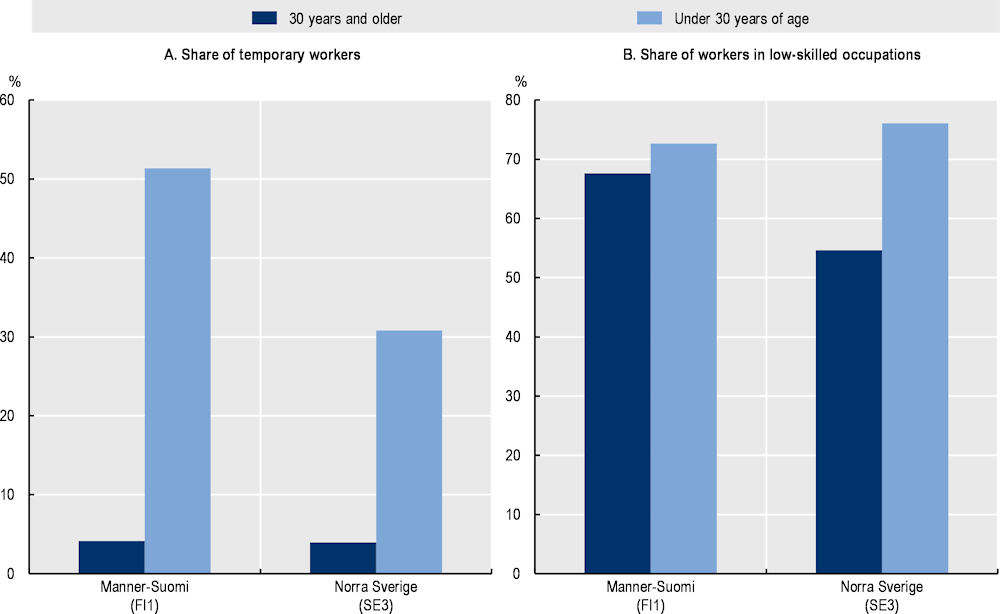

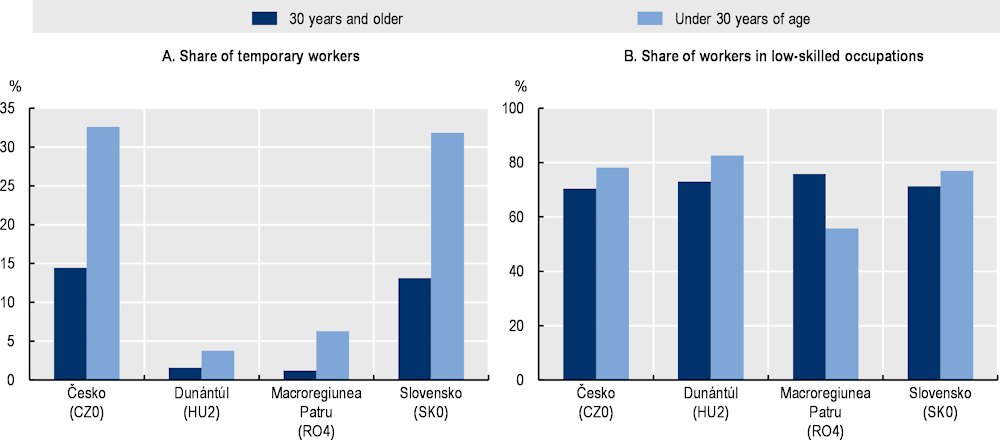

Young workers are more likely to be in temporary work across all regions (Figure 4.9). They are also more likely to work in low-skilled occupations in all regions except Central Italy. In the Polish Southwestern Macro region, young workers are on average 3 times more likely to be in temporary employment than workers who are 30 years old and above. Furthermore, three-quarters of young workers are employed in low-skill occupations.

Figure 4.9. Vulnerability of young workers employed in non-metallic mineral production (NACE 23)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. See notes for Figure 4.8 for the definition of low-skilled occupations.

Source: Authors’ calculations based on SES microdata.

In Central Italia and Wallonia, all workers in the industry enjoy the benefits associated with collective bargaining. However, the majority of workers employed in the industry in the Polish regions are not covered by collective agreements. Moreover, hardly any collective agreements in Central and Eastern Europe provide provisions for training (OECD, 2019[9]).

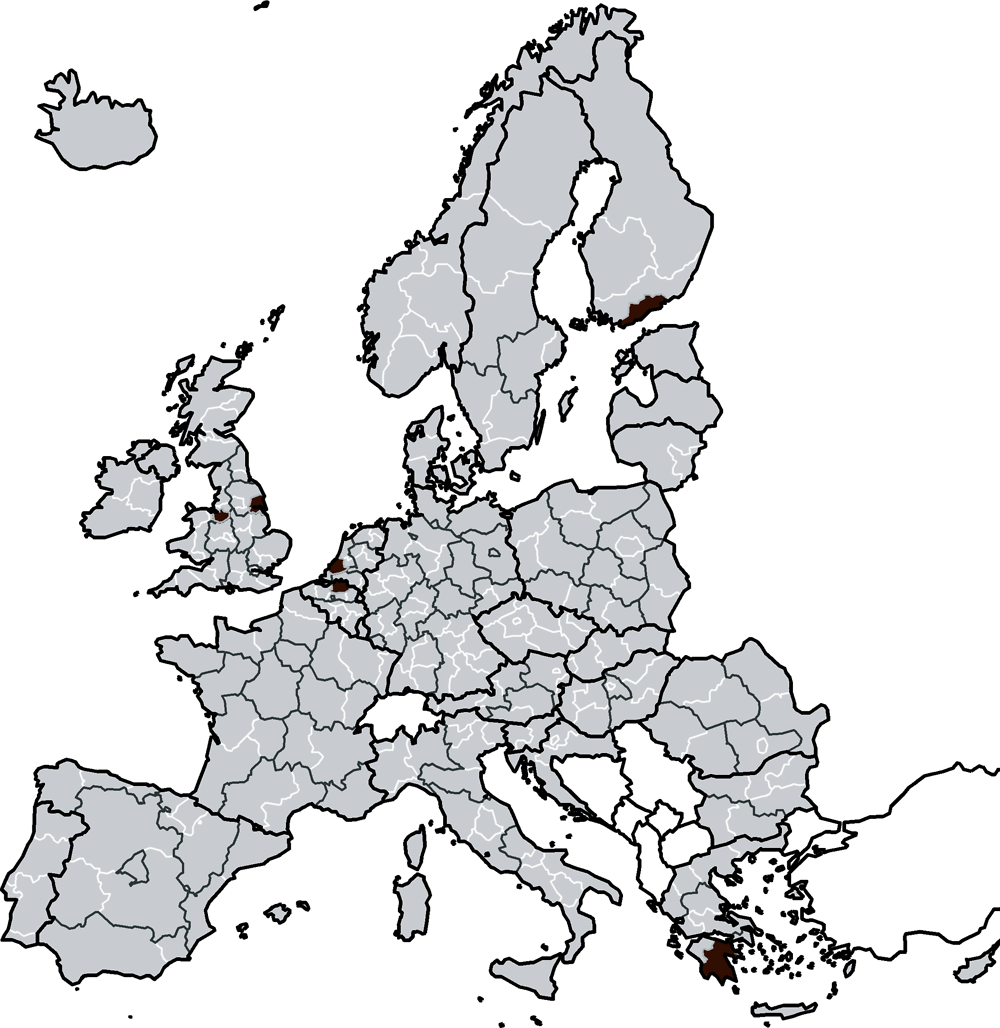

Worker vulnerability in regions vulnerable to transformations in the manufacture of paper and paper products (NACE 17)

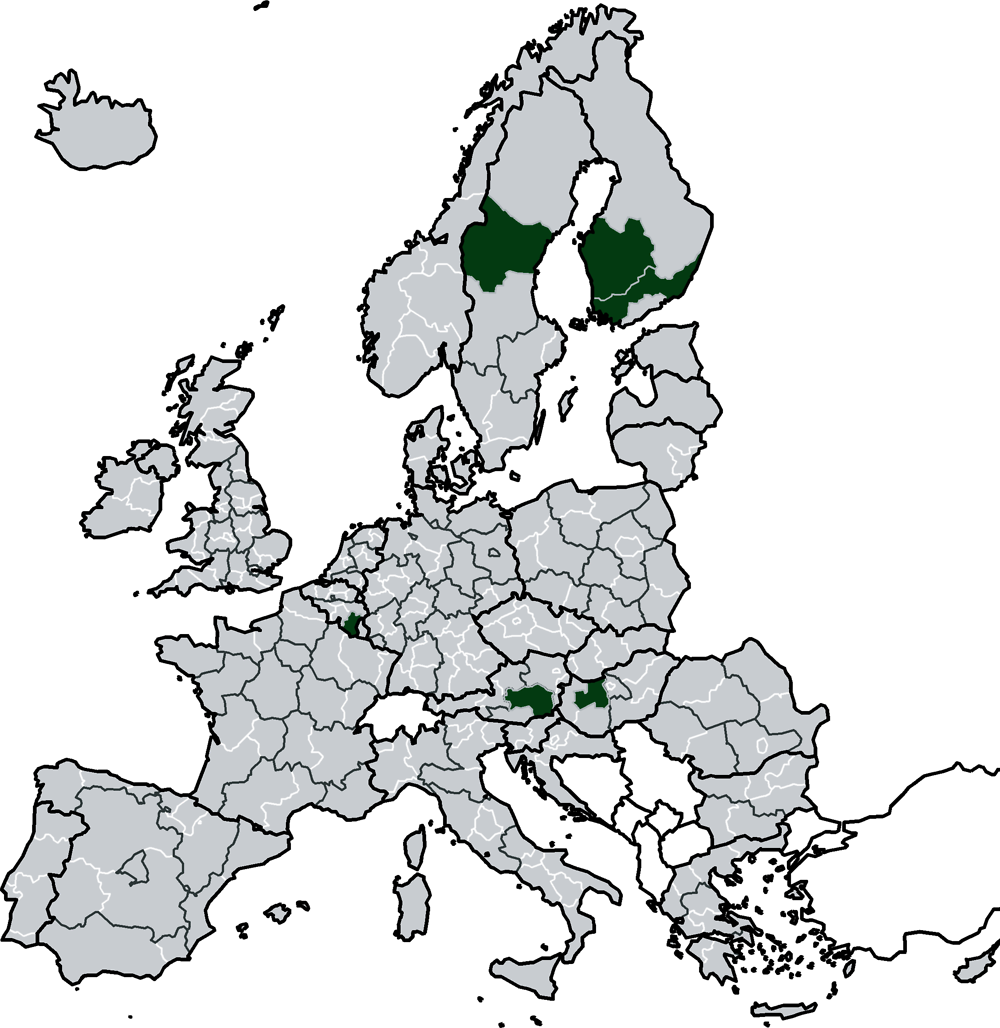

Figure 4.10. NUTS 2 regions with high employment and high emissions in the manufacture of paper and paper products (NACE 17)

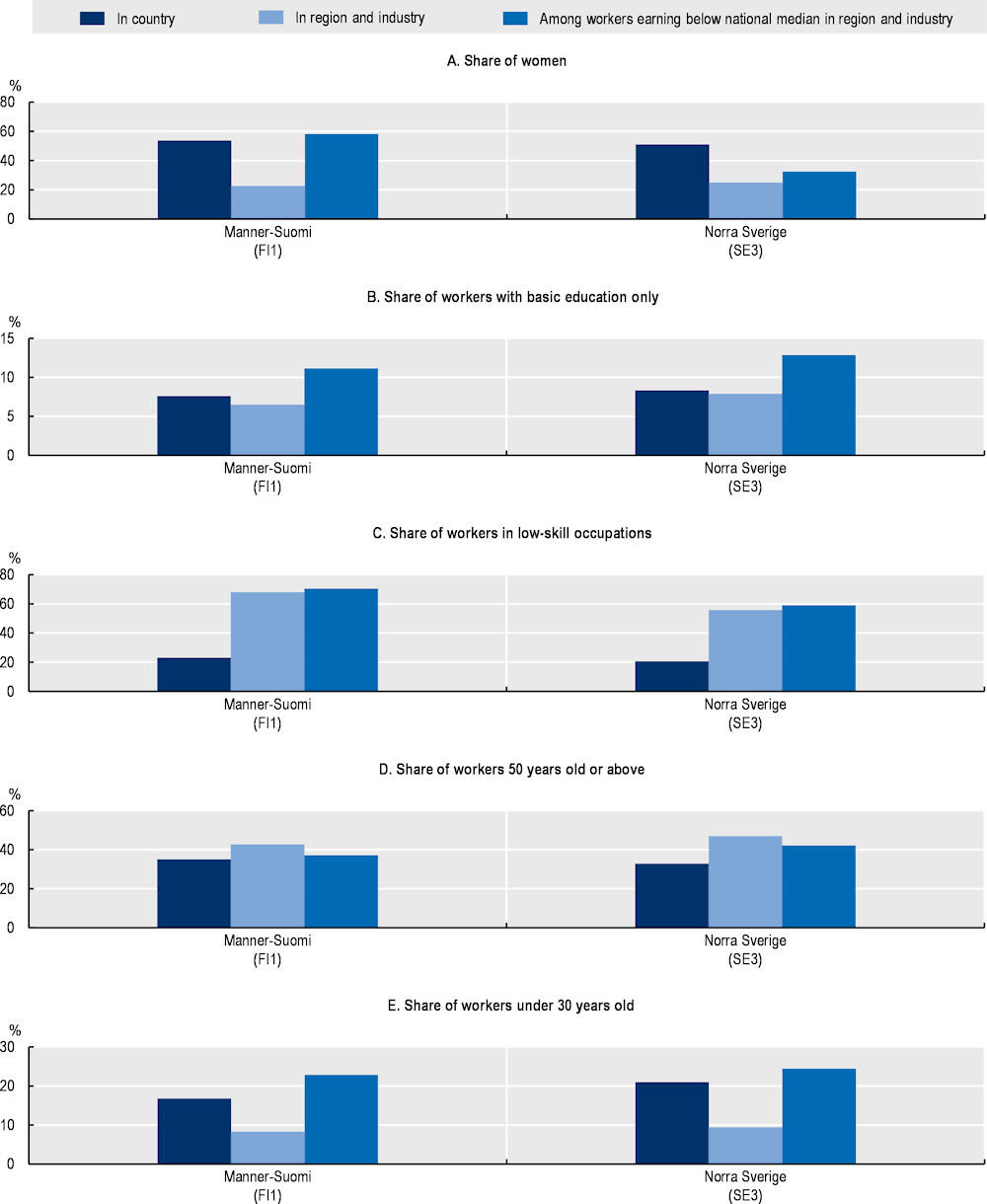

The vulnerable regions in paper and paper product manufacturing are located in Austria, Belgium, Finland and Sweden (Table 4.1). Nevertheless, due to data limitations related to insufficient observation units for Styria (Austria) and Luxembourg (BE) (Belgium), the analysis is limited to the Finnish and Swedish.

Figure 4.11. Worker characteristics in the manufacture of paper and paper products (NACE 17) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

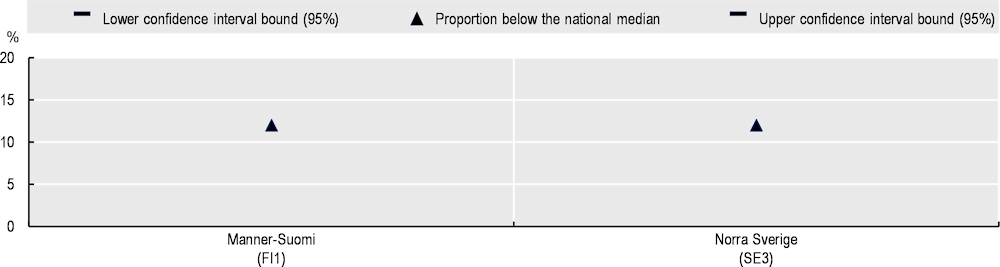

Workers employed in the industry in these regions tend to work more in low-skill occupations compared to workers across the respective country: 68% of the paper manufacturing workforce in Mainland Finland are in low-skill occupations, compared to 23% for all workers in Finland. A similar pattern, although less pronounced, emerges for North Sweden with respect to Sweden.

Young workers tend to be underrepresented in this industry, which may hamper industrywide transformation efforts. They account for less than 10% of the workforce in the most vulnerable regions, compared to 17% and 21% in Finland and Sweden as a whole respectively. Older workers may also be more vulnerable if production locations move. Such moves may occur as paper and pulp production continues to shift to recycled material inputs as biomass will become increasingly scarce, as argued in the first chapter of the series.

Figure 4.12. Vulnerability of young workers employed in the manufacture of paper and paper products (NACE 17)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Workers in the industry in the most vulnerable regions are well-paid (Figure 4.13), with 88% of workers in the industry in Mainland Finland and North Sweden earning more than the median country wage.

Figure 4.13. Share of low-earning workers employed in the manufacture of paper and paper products (NACE 17)

Note: National medians calculated using the SES sample data.

Source: Authors’ calculations based on SES microdata.

Worker vulnerability in most vulnerable regions in the manufacture of coke and refined petroleum products (NACE 19)

Figure 4.14. NUTS 2 regions with high employment and high emissions in the manufacture of coke and refined petroleum products (NACE 19)

Figure 4.15. Worker characteristics in the manufacture of coke and refined petroleum products (NACE 19) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

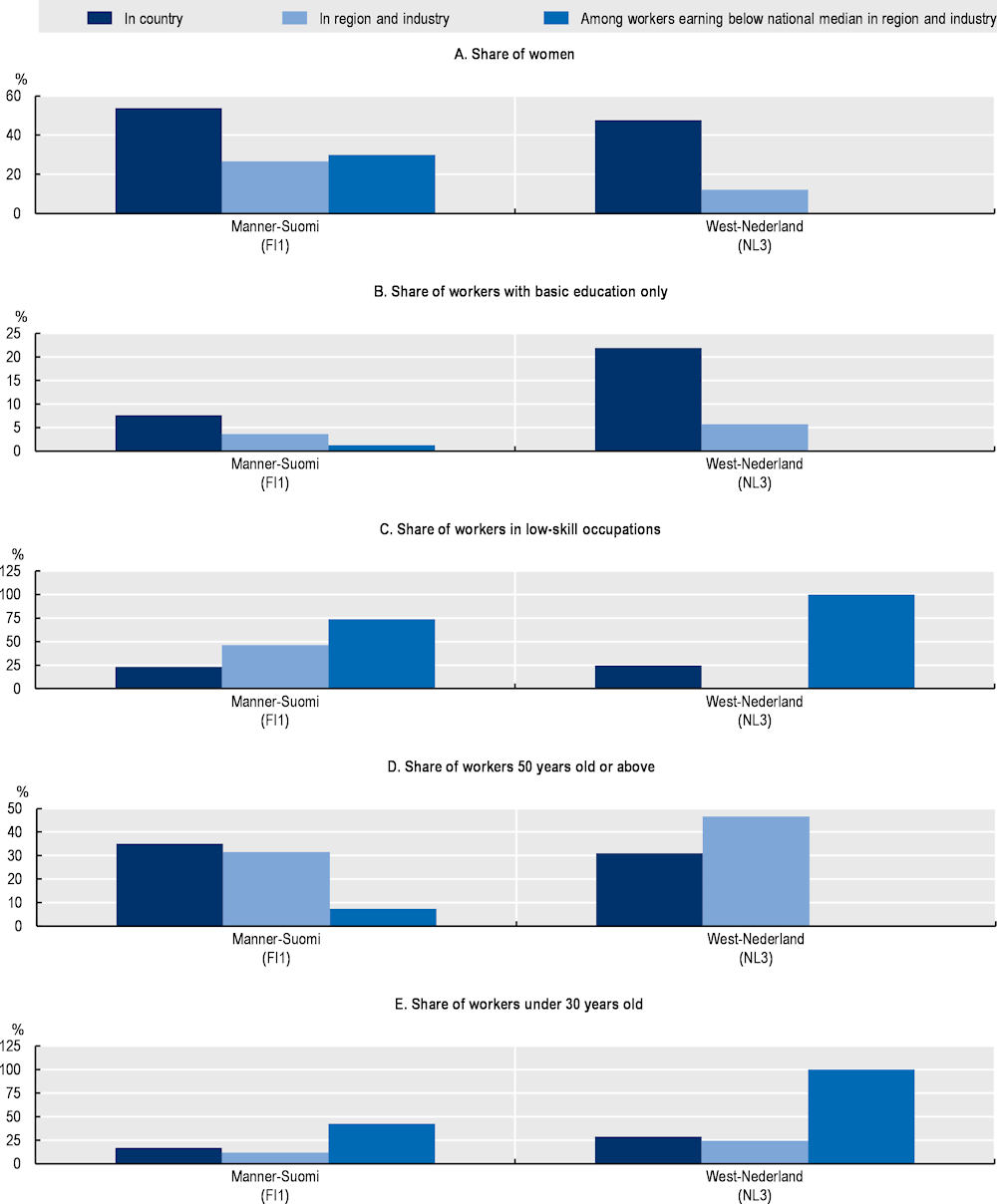

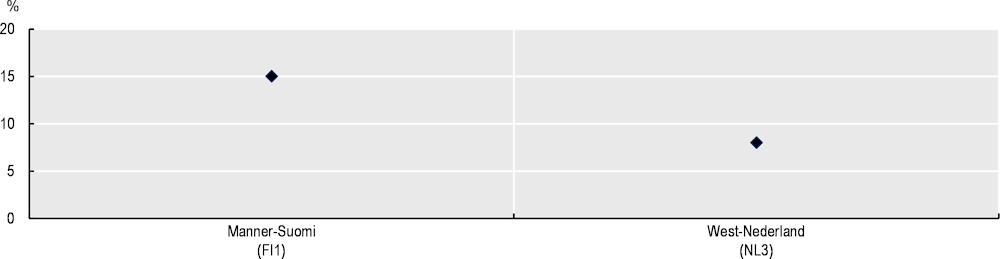

Among key sectors, the manufacture of coke and refined petroleum products stands out for facing substantial job losses. In the most vulnerable regions, workers’ educational attainment is relatively high compared to the national averages, which could facilitate their employment transition to other sectors. The difference is largest for West Netherlands, where only 6% of workers have only basic education. Even so, these workers are likely to be employed in low-skill occupations.

As one of the most male-dominated manufacturing sectors, the industry employs between three to seven times more men than women in the most vulnerable regions (Figure 4.15, Panel A). When job displacement rates for men are high and men still provide the main source of household income, just transition impacts may be bigger.

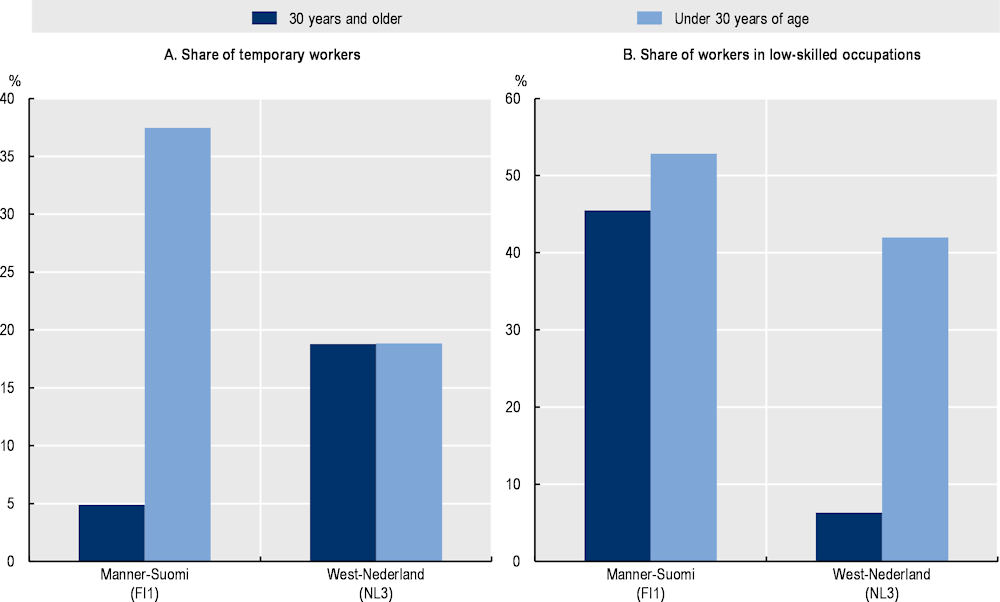

Young workers in Mainland Finland are particularly vulnerable to reduced employment protection and income losses as they are approximately seven times more likely to hold temporary jobs than workers aged 30 and above (Figure 4.16, Panel A). In contrast, while young workers in West Netherlands are as likely as older workers to be in temporary employment, they have a greater tendency to be employed in low-skill occupations (Figure 4.16, Panel B).

Figure 4.16. Vulnerability of young workers employed in the manufacture of coke and refined petroleum products (NACE 19)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

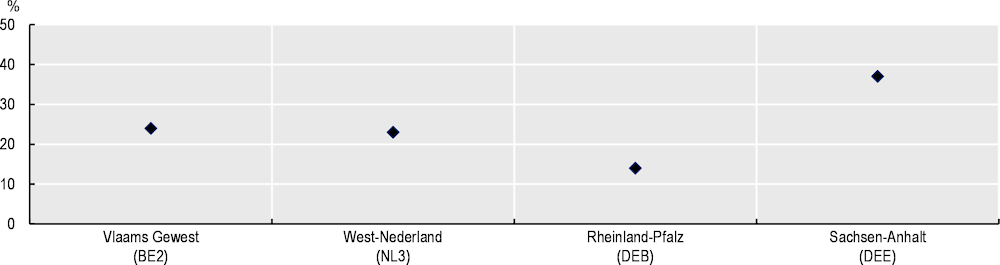

Figure 4.17. Share of low-earning workers employed in the manufacture of coke and refined petroleum products (NACE 19)

Note: National medians calculated using the SES sample data.

Source: Authors’ calculations based on SES microdata.

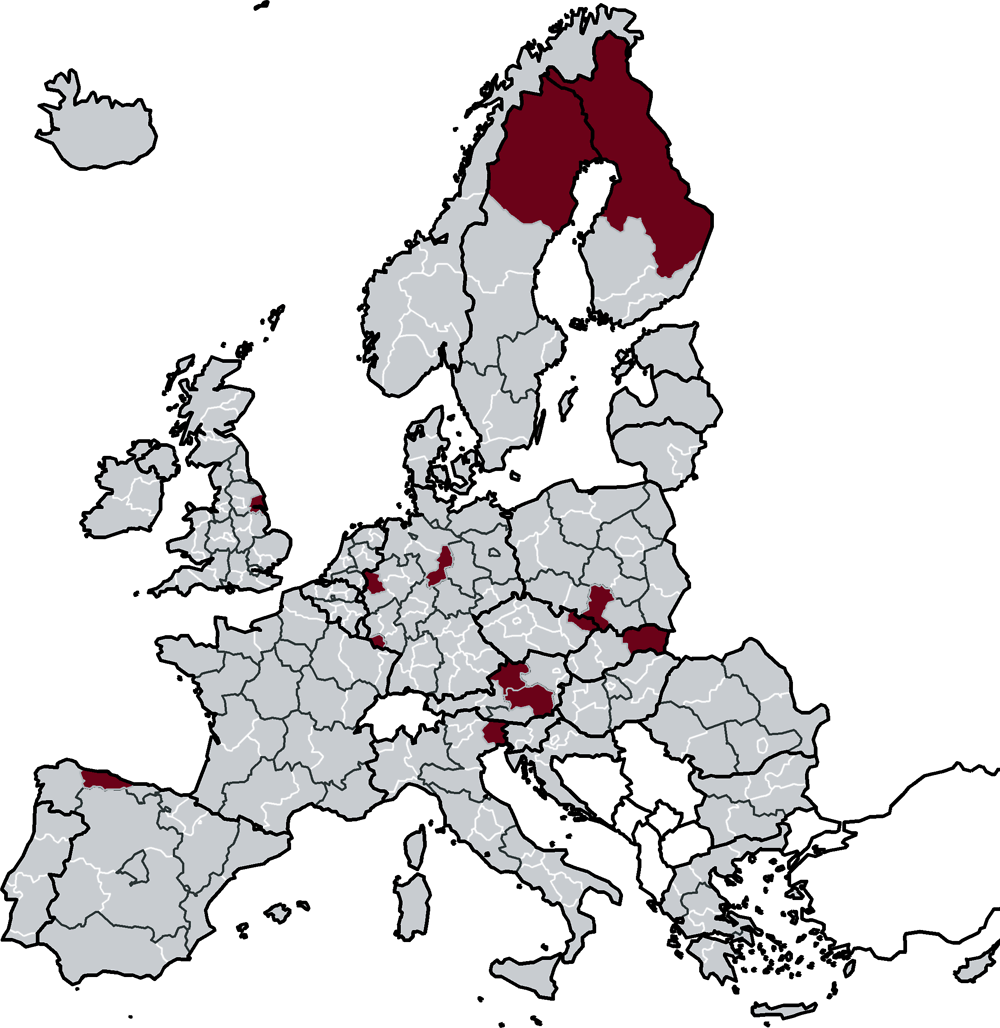

Worker vulnerability in the most vulnerable regions in the manufacture of chemicals and chemical products (NACE 20)

Figure 4.18. NUTS 2 regions with high employment and high emissions in the manufacture of chemicals and chemical products (NACE 20)

Figure 4.19. Worker characteristics in the manufacture of chemicals and chemical products (NACE 20) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

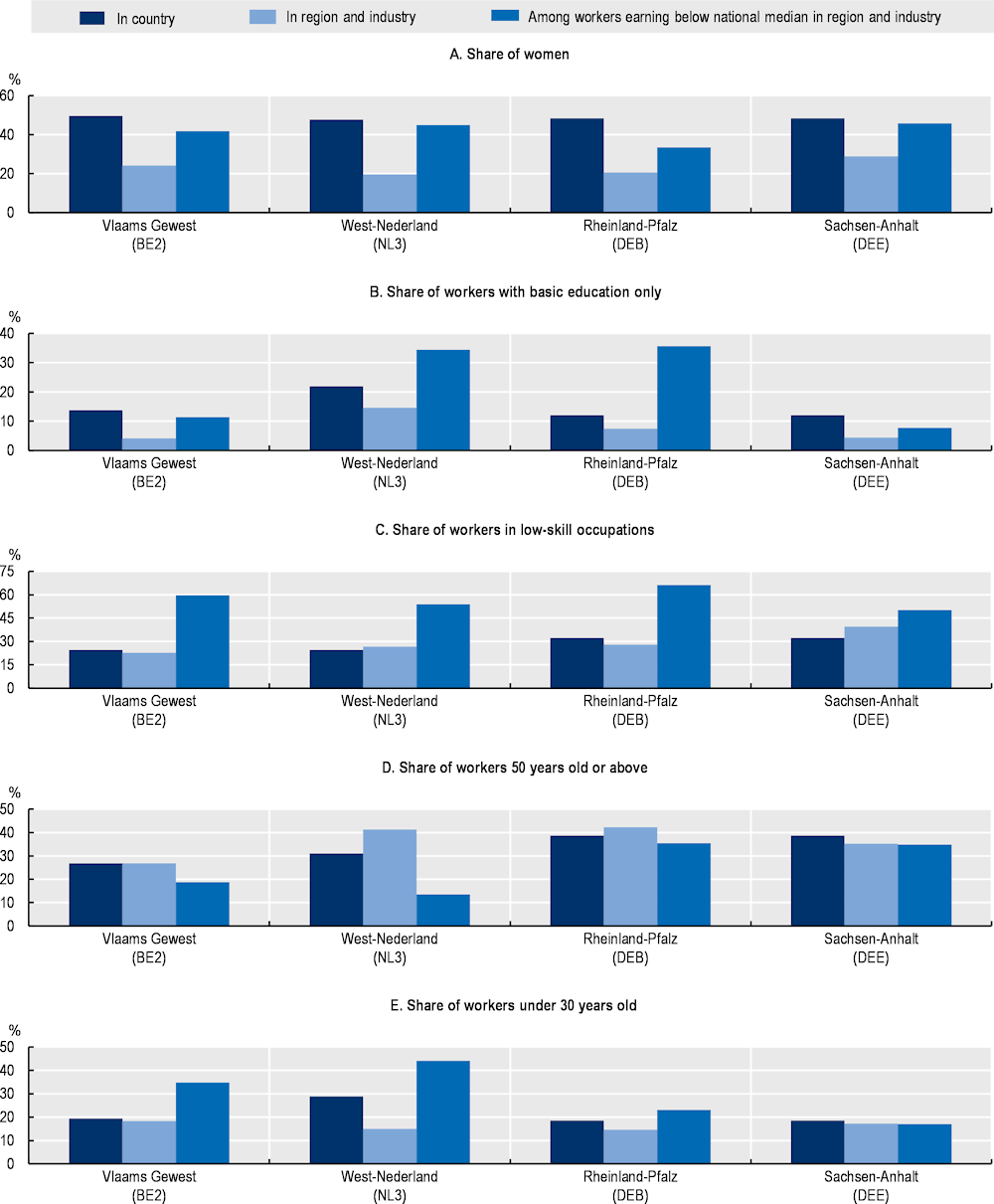

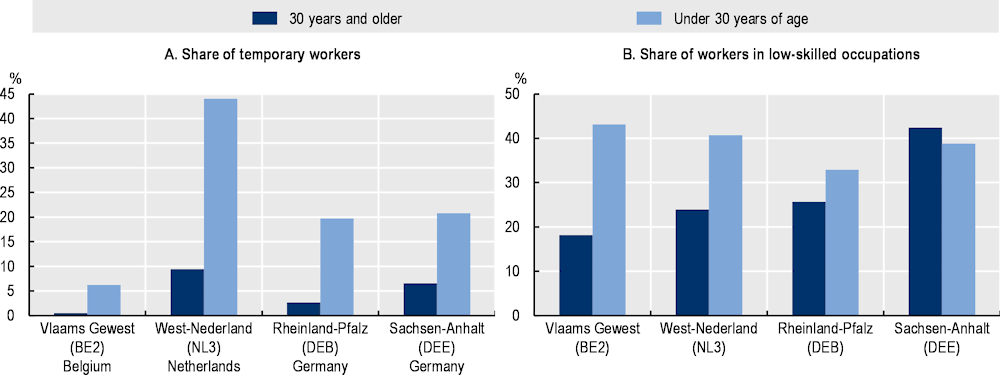

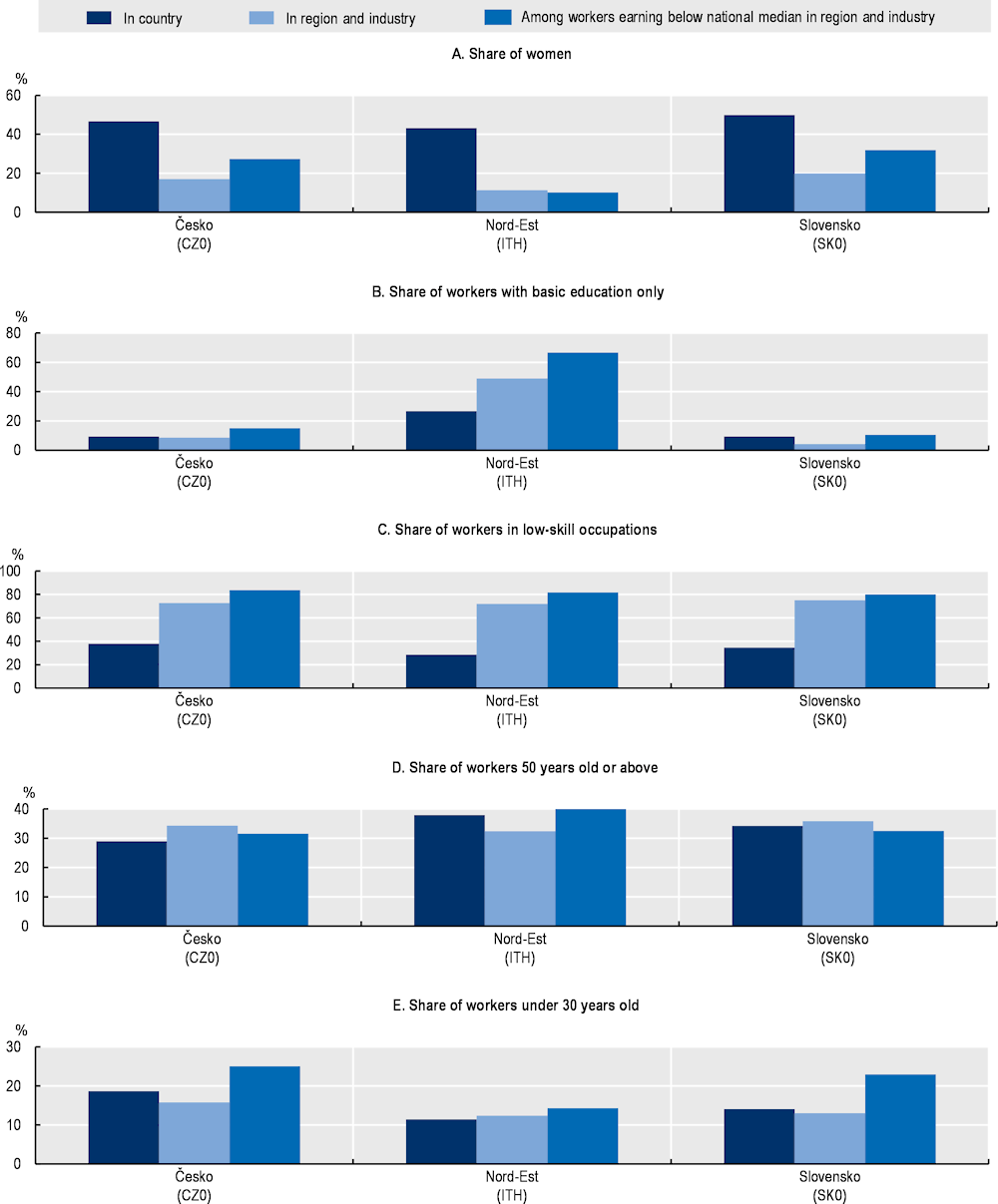

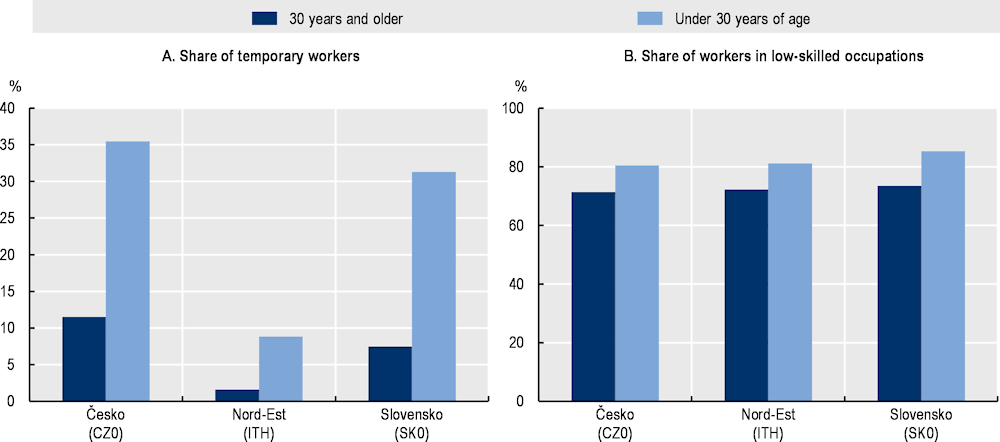

Acquisition and adjustment of skills may be particularly important in the chemicals sector, given the breadth and complexity of required production processes and their transformations, often covering raw materials, and energy use with the high importance of reducing energy consumption. Circular economy challenges may also be particularly complex, as discussed in the first chapter. The transition is likely to be particularly challenging for older workers who display on average a 22 percentage points lower participation rate in adult learning than their prime-age colleagues (OECD, 2019[10]). Except for Flanders, workers aged 50 and above account for more than a third of workers in the manufacture of chemicals and chemical products industry and are over-represented in two of the most vulnerable regions (Figure 4.19). The vulnerability of young workers to the transition stems from their tendency to be in temporary employment and in low-skill occupations (Figure 4.20), which in turn limits workers’ access to employer-sponsor training programmes.

Figure 4.20. Vulnerability of young workers employed in the manufacture of chemicals and chemical products (NACE 20)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Figure 4.21. Share of low-earning workers employed in the manufacture of chemicals and chemical products (NACE 20)

Note: National medians calculated using the SES sample data.

Source: Authors’ calculations based on SES microdata.

Wages in vulnerable regions in the manufacture of chemicals and chemical products industry tend to be relatively high. Nonetheless, differences across vulnerable regions are substantial. In Sachsen-Anhalt, Germany, 40% of workers in the industry earn less than the national median.

Worker vulnerability in the most vulnerable regions in the manufacture of basic metals (NACE 24)

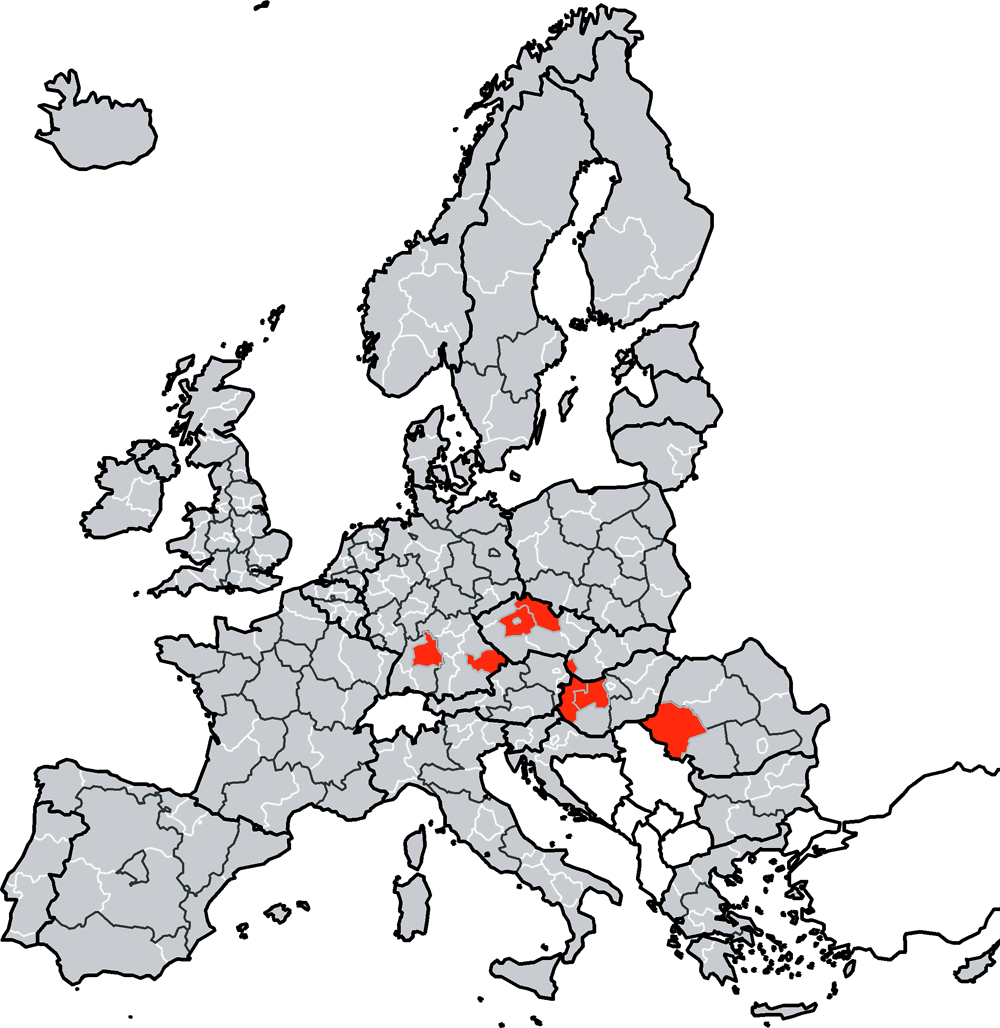

Figure 4.22. NUTS 2 regions with high employment and high emissions in the manufacture of basic metals (NACE 24)

Figure 4.23. Worker characteristics in the manufacture of basic metals (NACE 24) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Regions with high employment shares and high emissions per capita in basic metals manufacturing are mainly in Northern and Central Europe. Workers in Northeast Italy will be particularly vulnerable in the transition as they tend to be low educated. Workers in low-skill occupations, such as manual workers and those in elementary occupations, account for three-quarters of the industry workforce in vulnerable regions. This exacerbates vulnerabilities since, as noted, lower-skilled and lower-educated workers tend to lack training opportunities.

Figure 4.24. Vulnerability of young workers employed in the manufacture of basic metals (NACE 24)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Figure 4.25. Share of low-earning workers employed in basic metals production (NACE 24)

Note: National medians calculated using the SES sample data.

Source: Authors’ calculations based on SES microdata.

Despite the high incidence of low-skill occupations, wages in Northeast Italy for workers employed in the industry are on par with the national median wage. The proportion of workers earning above the national median is highest in Slovak Republic, at 78%.

Worker vulnerability in the most vulnerable regions in the manufacture of motor vehicles, trailers, and semi-trailers (NACE 29)

Figure 4.26. NUTS 2 regions with high employment in the manufacture of motor vehicles, trailers and semi-trailers (NACE 29)

The vulnerable regions for the automotive manufacturing industry are spread across Europe, with a particular concentration in Central Europe. The incidence of low educational attainment is particularly high in Transdanubia in Hungary, where one in four workers have only basic education. Although most workers in the other vulnerable regions have at least upper secondary education, these workers tend to be employed in occupations with low skill requirements. Workers with lower educational attainment not only are less likely to participate in professional education and training but also experience difficulties in finding new jobs. This may be particularly relevant to the motor vehicles industry, which is likely subject to significant employment losses as well as increased outsourcing risks.

Figure 4.27. Worker characteristics in the manufacture of motor vehicles, trailers and semi-trailers (NACE 29) in selected regions

Note: Country values are calculated using the SES sample data. Basic education refers to the G1 level (below upper secondary educational attainment) according to the International Standard Classification of Education, 2011 version. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Figure 4.28. Vulnerability of young workers employed in the manufacture of motor vehicles, trailers and semi-trailers (NACE 29)

Note: Temporary refers to temporary or fixed duration contracts, except for apprenticeships, traineeships or students receiving remuneration. Low-skill occupations refer to craft and related trades workers, plant and machine operators and assemblers, and elementary occupations according to the International Standard Classification of Occupations (ISCO-08).

Source: Authors’ calculations based on SES microdata.

Within-sector differences in firm productivity across the most vulnerable regions

Differences in firm productivity have implications for the just transition to climate neutrality. This section argues that regions with less productive firms in key manufacturing sectors may also be more vulnerable. It presents an analysis of the productivity performance of firms in the most vulnerable regions.

Manufacturing firms closer to the productivity frontier may find it easier to engage the needed transformations (Gal, 2013[11]). Moreover, high productivity sets the base for high profitability and profits are a key finance source. This is particularly relevant in the key manufacturing sectors, since the integration of new technologies, many of which are not yet deployed at scale, is essential for these transformations and will require substantial investment.

There is a risk that laggard firms exit the market, for example because of rising carbon prices. Hence, regions with more laggard firms are at a higher risk of losing firms and employment. Laggard firms within the key manufacturing sectors may need to follow different transition pathways with stronger policy support.

In what follows, firm-level labour productivity is calculated using a matched Emissions Trading System (ETS)-Orbis dataset, where data are available (Box 4.3). Indicators of firm productivity are analysed for companies in the key manufacturing sectors, for each relevant two-, three- or four-digit sector (NACE). The productivity frontier is defined as the top 5% of companies under EU ETS with the highest labour productivity. The figures below show companies’ labour productivity performance and their relative distance to the labour productivity frontier. In addition, they show the percentile where the companies are positioned in the productivity ranking of all companies in the EU ETS, from least to most productive.

Box 4.3. Productivity data

Measuring firm productivity

Productivity data is from the ETS-ORBIS matched data provided by the European Commission (2021[12]) and the OECD-Orbis database (Gal, 2013[11]), the latter including several productivity measures (Andrews, Criscuolo and Gal, 2015[13]). This chapter draws on labour productivity defined as value-added relative to the number of workers in the company owning at least one installation in a region that is vulnerable to the transition of key manufacturing sectors to climate neutrality.

Source: European Commission (2021[12]) (Gal, 2013[11]). (Andrews, Criscuolo and Gal, 2015[13]).

Some of the most vulnerable regions host low-productivity firms, adding to the vulnerability

The productivity distribution of firms with available value-added-based labour productivity data and installations differs by sector. Some regions most affected by the transformations mainly have firms close to the productivity frontier in key manufacturing sectors, while other regions have mainly laggards.

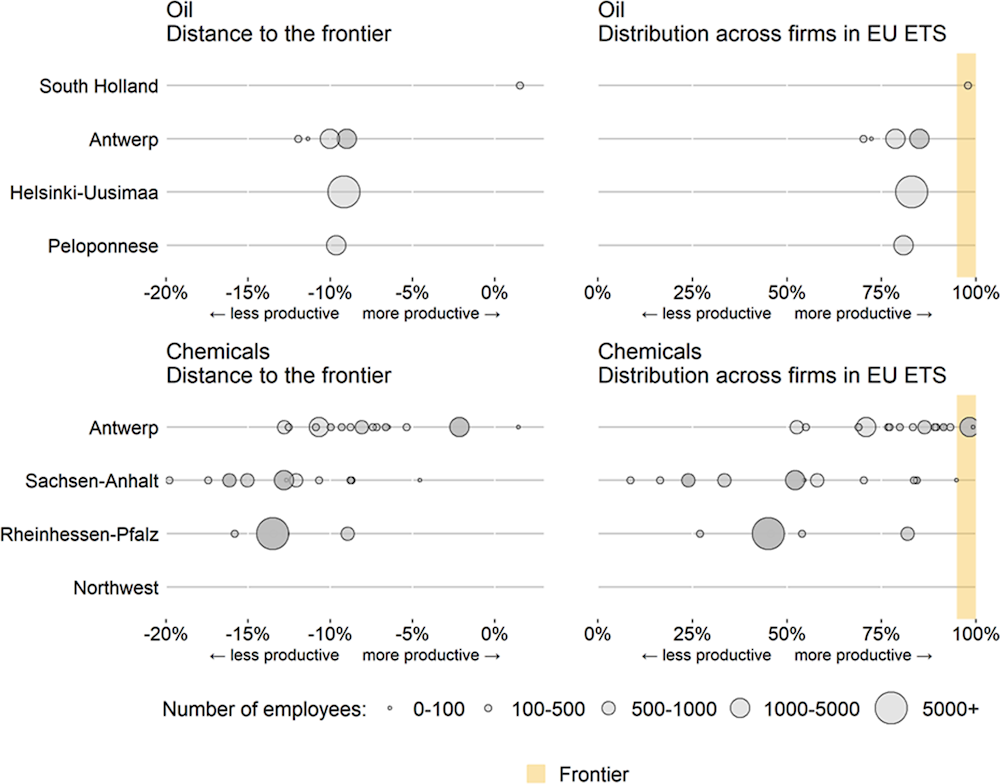

The most vulnerable regions that are particularly affected by transformations in oil refining tend to have relatively productive companies (Figure 4.29). These regions tend to host a few companies with installations in the sector. Most firms are only 10% less productive than the frontier and they are in the top 25% of most productive firms. Oil refining is the key manufacturing sector where the most activity will disappear. The least productive installations are most likely to disappear or may be among the first to do so; still, some opportunities in biofuel refining could be captured, perhaps by the most innovative firms.

In the chemical sector, the most vulnerable regions have at least one installation from a company relatively close to the productivity frontier (Figure 4.29). In some regions, such as in Sachsen-Anhalt, Germany, the bulk of companies lag substantially, with labour productivity 10% to 20% lower than the frontier, and accounting for most of the employment.

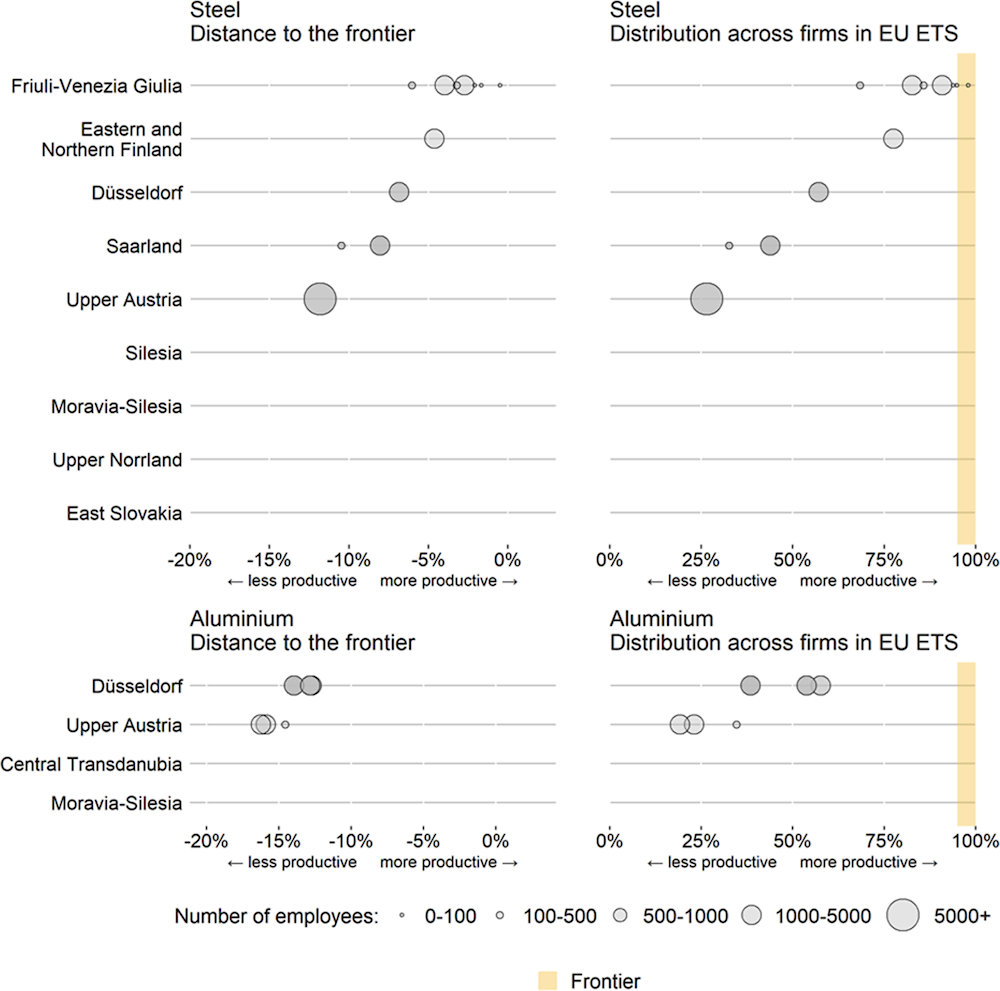

Companies in basic metals will also need to integrate new carbon-neutral technologies to produce steel and aluminium, especially so in steel production if carbon capture and storage is avoided. They will also need to invest substantially in these technologies. Only a few of the most vulnerable regions in steel have firms close to the productivity frontier, while the most vulnerable regions in aluminium have mainly laggard firms (Figure 4.30).

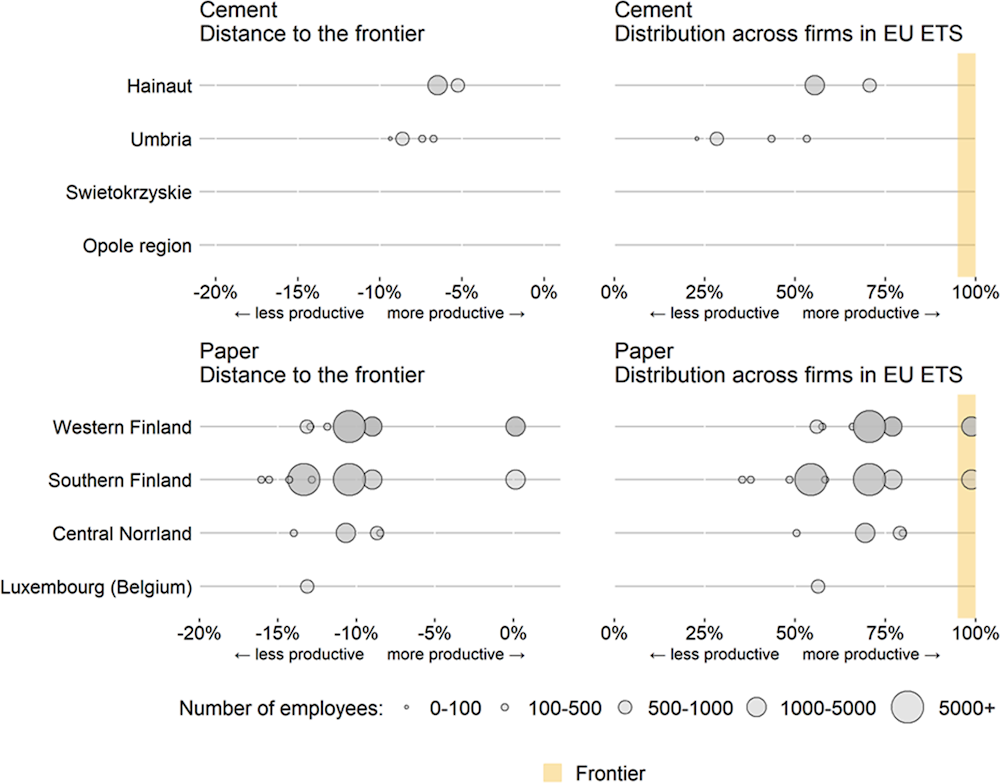

The most vulnerable regions in cement tend to have firms with average value-added-based labour productivity (Figure 4.31). In paper, the least productive firms tend to be smaller in terms of employment.

Among the key manufacturing sectors, only chemicals have a large enough number of companies with available data to establish correlations between firm productivity, the emissions intensity of value-added and capital intensity of employment (Fuentes Hutfilter et al., 2023[1]). Labour productivity is positively correlated with capital intensity and profitability, as expected. Less productive firms tend to be more emission-intensive after excluding outliers. This may suggest that some companies with high emissions, and therefore strong transformation needs in the most vulnerable regions, also face low productivity and therefore relatively large transition challenges. There is no correlation between the capital intensity of labour and emissions intensity of value-added, suggesting that stranded asset risks are not particularly strong in high-emission companies.

Figure 4.29. Firm productivity and size in the most vulnerable regions for oil and chemicals

Note: The productivity frontier is defined as the average of the 5% most productive companies across all companies by sector under the EU ETS with available data. The most vulnerable regions are identified in Chapter 2. For some of the most vulnerable regions, no individual firm productivity data are available, sometimes because there are no value-added data. The sectors are NACE 19: manufacture of coke and refined petroleum products, and NACE 20: manufacture of chemicals and chemical products. Data for 2018.

Source: OECD-ETS-Orbis matched data.

Figure 4.30. Firm productivity and size in the most vulnerable regions for steel and aluminium

Note: The productivity frontier is defined as the 5% most productive companies across all companies by sector under the EU ETS with available data. The most vulnerable regions are identified in Chapter 2. The sectors are NACE 241: manufacture of basic iron and steel and ferroalloys, and NACE 2442: aluminium production. Data for 2018.

Source: OECD-ETS-Orbis matched data.

Figure 4.31. Firm productivity and size in the most vulnerable regions for cement and paper

Note: The productivity frontier is defined as the 5% most productive companies across all companies by sector under the EU ETS with available data. The most vulnerable regions are identified in working paper 2. The sectors are NACE 235: manufacture of cement, lime and plaster, and NACE 171: manufacture of pulp, paper and paperboard. Data for 2018.

Source: OECD-ETS-Orbis matched data.

References

[13] Andrews, D., C. Criscuolo and P. Gal (2015), “Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries”, OECD Productivity Working Papers, No. 2, OECD Publishing, Paris, https://doi.org/10.1787/5jrql2q2jj7b-en.

[3] Bassanini, A. and W. Ok (2004), “How do firms’ and individuals incentive to invest in human capital vary across groups?”, OECD, Paris, https://www.oecd.org/els/emp/34932892.pdf (accessed on 9 March 2022).

[4] Cedefop (2015), Unequal access to job-related learning: Evidence from the adult education survey, European Centre for the Development of Vocational Training, Luxembourg, https://doi.org/10.2801/219228.

[12] EC (2021), European Emissions Trading System (ETS) – Calculations on the Regional Employment Impact of ETS Installations, European Commission, https://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/reg_impact_ets_installations_en.pdf.

[7] EC (2018), Structure of Earnings Survey 2018: Eurostat’s Arrangements for Implementing the Council Regulation 530/1999, the Commission Regulations 1916/2000 and 1738/2005, European Commission, https://ec.europa.eu/eurostat/cache/metadata/Annexes/earn_ses_main_esms_an1.pdf (accessed on 29 November 2021).

[8] Fouarge, D., T. Schils and A. de Grip (2012), “Why do low-educated workers invest less in further training?”, Applied Economics, Vol. 45/18, pp. 2587-2601, https://doi.org/10.1080/00036846.2012.671926.

[1] Fuentes Hutfilter, A. et al. (2023), “Regional Industrial Transitions to Climate Neutrality: Identifying potential socio-economic impacts”, OECD Regional Development Policy Papers, OECD, Paris.

[11] Gal, P. (2013), “Measuring Total Factor Productivity at the Firm Level using OECD-ORBIS”, OECD Economics Department Working Papers, No. 1049, OECD Publishing, Paris, https://doi.org/10.1787/5k46dsb25ls6-en.

[10] OECD (2019), Getting Skills Right: Future-Ready Adult Learning Systems, Getting Skills Right, OECD Publishing, Paris, https://doi.org/10.1787/9789264311756-en.

[9] OECD (2019), Negotiating Our Way Up: Collective Bargaining in a Changing World of Work, OECD Publishing, Paris, https://doi.org/10.1787/1fd2da34-en.

[6] OECD (2017), OECD Employment Outlook 2017, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2017-en.

[5] OECD (2002), OECD Employment Outlook 2002, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2002-en (accessed on 25 July 2022).

[2] Ookla (2020), Speedtest by Ookla Global Fixed Network Performance Map Tiles.