This chapter evaluates the effectiveness of the largest components of the social protection system according to their coverage rates, adequacy, equity and efficiency, using administrative and household survey data. It examines the Monthly Benefit for Poor Families with children (MBPF), the Monthly Social Benefit (MSB) and contributory pensions paid by the Social Fund, as well as the overall effectiveness of the pension and the health-care systems in responding to the population’s needs. It also analyses the impact of possible reforms to the state benefits for children.

Social Protection System Review of Kyrgyzstan

Chapter 3. The effectiveness of social protection

Abstract

Chapter 2 identifies the wide range of social protection instruments protecting different groups of people in Kyrgyzstan. However, these programmes are not always well aligned with the needs of the population identified in Chapter 1, and they vary considerably in size. The next step in the SPSR is to understand the effectiveness of the different programmes in order to determine which represent best value for money and which might require reform.

This chapter analyses the impact of Kyrgyzstan’s major social protection programmes in greater detail. It considers their effectiveness across three dimensions: coverage, equity and the efficiency with which they reduce poverty. This analysis includes preliminary analysis of a proposed new system of state benefits for children that combines categorical and poverty-targeted components.

The MBPF’s impact is hampered by low coverage, low benefits and targeting errors

The MBPF is intended to mitigate the effects of extreme poverty among households with children. This programme is of utmost importance given 48.5% of the poor population is aged under 18. However, its low coverage rates and low benefit levels constrain its effectiveness.

Coverage

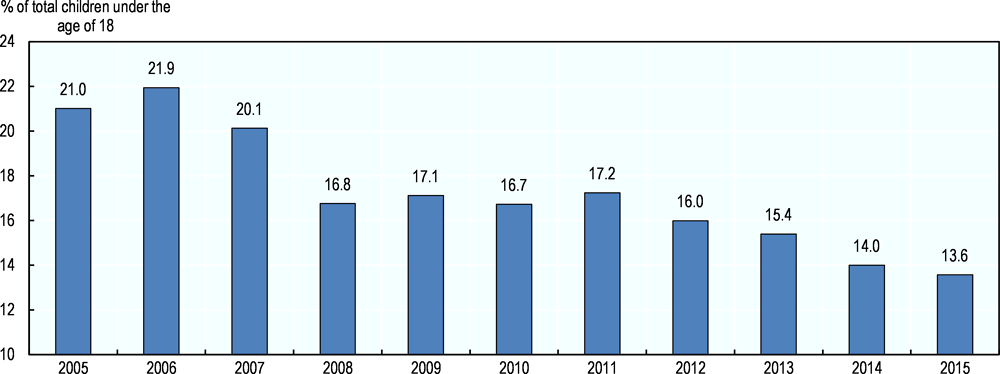

Coverage of the MBPF is low and declining. According to the GoK, coverage rates of children under age 18 declined from 21% in 2005 to 13.6% in 2015 (Figure 3.1). Survey data suggest coverage at a household level is much lower. According to the 2015 Kyrgyz Integrated Household Survey (KIHS), 8.5% of all households received a benefit through the programme, while only 4.9% of the population lived in MBPF-eligible households.

Figure 3.1. Official figures show a decline in coverage

Coverage rate of children under 18 through the MBPF

Source: MoLSD, NSC (2015).

This level of coverage is far below the proportion of households with children that are classified as poor. However, it is higher than the proportion of households who are (de jure) eligible for the programme, which is targeted at the extreme poor by using the guaranteed monthly income (GMI) as a threshold even though extreme poverty has almost been eradicated (Box 3.1).

The MBPF’s impact is undermined by significant exclusion errors. Data from the 2015 KIHS show an overall take-up rate among eligible households of 22.7%, meaning some 77.3% of people living in MBPF-eligible households did not receive any benefits. Only 24.8% living in eligible households in the first decile did receive the benefit. This is consistent with other analysis indicating that the MBPF excludes over 80% of extremely poor children (Gassmann and Trindade, 2016[1]).

It is apparent that the GMI is not an appropriate means test threshold (Box 3.1). Assuming the GoK retains a poverty-targeting component to the child benefits, it might need to establish an eligibility threshold that is both measurable and affordable. A cost-neutral option would be to allow coverage of the MBPF to increase while reducing benefit levels (thereby reversing the tendency of the last decade). As is discussed below, however, the value of the MBPF already falls below critical welfare measures.

Box 3.1. The link to the GMI limits both the cost and effectiveness of the MBPF

The GMI plays a critical role in determining eligibility for the MBPF as well as the value of the benefit. As such, it serves to ration coverage and limit adequacy. In both cases, the low level of the GMI; it thus serves as a major impediment to the effectiveness of Kyrgyzstan’s only poverty-targeted programme.

When the GMI was established in 1998, it was set at 50% of the EPL, with the intention of gradually raising it to 100% of the EPL. Instead, the GMI fell as a proportion of the EPL to as low as 21% in 2008 before recovering to breach 50% for the first time in 2015. The result is that the value of the MBPF, which is connected to the value of the GMI, is very low.

It also means that the eligibility threshold for the MBPF is not meaningful; only a very small proportion of the households have a per capita income below the GMI. The only way to retain the GMI is to artificially deflate the imputed income of rural households so that it falls below the level of the GMI. This option doesn’t exist for urban households, whose income is much less likely to be in-kind; this contributes to the overwhelming bias of the MBPF towards rural households.

Adequacy

At the end of 2015, the value of the MBPF benefit was KGS 705 per month. 1 This benefit value was not high enough to guarantee households with children an income above the EPL even though it was three times higher in real terms than it had been previously.

As is the case with the low coverage of the MBPF, the fact that the value MBPF is not adequate is also a function of its link to the GMI. Until 2014, the benefit a household received was intended to fill the gap between their current income and the level of the GMI. In 2015, this system was simplified such that the value of the benefit was set at the level of the GMI. It should be remembered that benefit values vary according to the altitude coefficient discussed in Chapter 2.

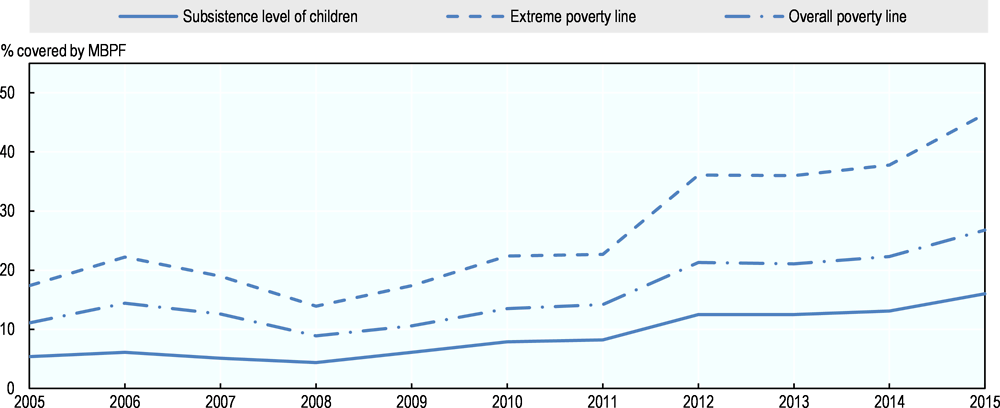

The MBPF is too low to cover beneficiaries’ basic needs. Its average level in 2015 was 16.0% of the required subsistence minimum for children,2 46.4% of the EPL and 26.8% of the overall poverty line (OPL) (Figure 3.2). A significant increase in benefit levels (either by increasing the value of the GMI or cutting the link with this threshold) would therefore be required to make the MBPF more adequate according to these thresholds. However, the cost of the programme would rise commensurately with such an increase.

Figure 3.2. The MBPF falls short of key poverty benchmarks

The value of MBPF relative to key poverty thresholds (2005-15)

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Equity

In addition to its coverage and adequacy, a social protection programme’s effectiveness is determined by the distribution of benefits. A programme is considered pro-poor if the distribution of benefits and beneficiaries displays higher incidence in the lower deciles of the population.

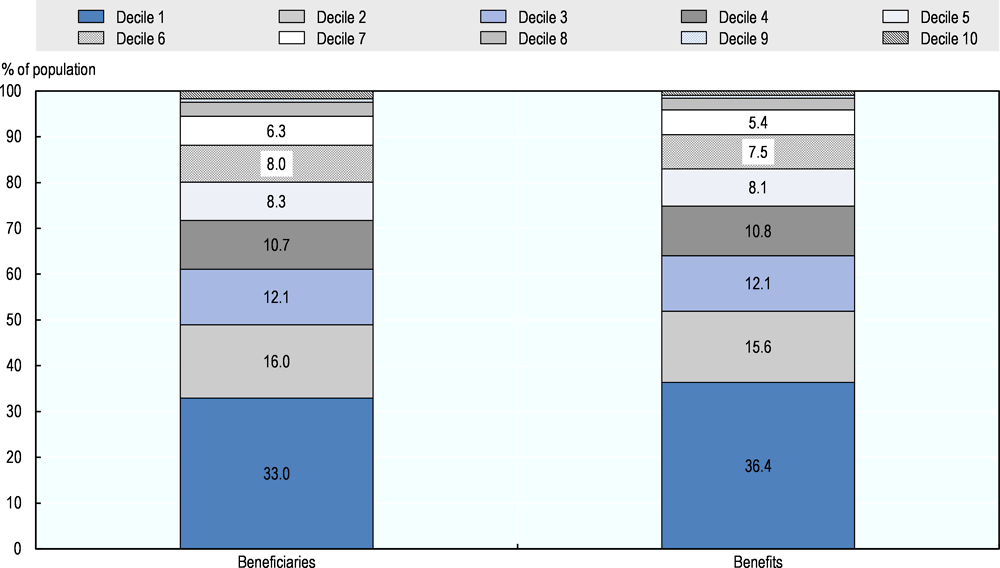

The MBPF is pro-poor. A World Bank expenditure review of social assistance (2014[3]) found that over 70% of MBPF recipients who received over 80% of the total MBPF benefits belonged to the poorest 40% of the population in 2011. In 2015, 36.4% of benefits distributed through the programme were transferred to households in the first decile of the income distribution, and 61.9% of MBPF recipients who received over 71.7% of the total MBPF benefits, belonged to the poorest 40% of the population.

In contrast, the combined benefits to the top three deciles accounted for less than 4% of total benefits in 2015 (Figure 3.3, right-hand column). The trend is similar, although less pronounced, in the incidence of beneficiaries (Figure 3.3, left-hand column), which show one-fifth of all beneficiaries were in the first decile of the population. In 2015, 62% of MBPF recipients who received over 72% of the total MBPF benefits belonged to the poorest 40% of the population.

Figure 3.3. The MBPF is pro-poor but there is leakage to higher income groups

Incidence of MBPF beneficiaries and benefits (2015 KIHS)

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Efficiency

Measured against the extreme and overall poverty lines, the MBPF has relatively low effects on poverty alleviation. However, the exact effect depends on a key assumption in the simulations: the marginal propensity to consume (MPC). Previous analysis of social assistance in Kyrgyzstan (Gassmann and Trindade, 2015[4]) has assumed a very low MPC, of around 33%. This implies that the income boost associated with receiving a benefit is lower than the value of the benefit itself, perhaps because some other source of income is reduced as a consequence (such as transfers from another household).

The impact of transfers on poverty at the household level can be sensitive to the size and composition of the household. Children might have lower consumption requirements than adults, and there might be economies of scale in larger households. Equivalence scales can be applied to poverty analysis results to capture these factors. Although mindful of the analysis of equivalence scales by the World Bank (2013[5]), this report will not apply an equivalence scale as the GoK does not do so when calculating the official poverty rate.

Analysis of the 2015 KIHS based on these assumptions shows that MBPF benefits achieve a 4% reduction in the poverty headcount, displaying a poverty gap reduction efficiency of 60% (a cost of KGS 1.66 led to a poverty gap reduction of KGS 1).3 The extreme poverty gap reduction efficiency of 8.25% is considerably lower (a cost of KGS 12.12 led to an extreme poverty gap reduction of KGS 1).4

Table 3.1. Poverty-reducing efficiency of the MBPF

|

Cost (KGS, million) |

Poverty headcount reduction (%) |

Extreme poverty headcount reduction (%) |

Poverty gap reduction (KGS, million) |

Extreme poverty gap reduction (KGS, million) |

Poverty reduction efficiency (%) |

Extreme poverty reduction efficiency (%) |

|---|---|---|---|---|---|---|

|

2 180 |

-3.91 |

-37.5 |

-1 309.8 |

-179.76 |

60.08 |

8.25 |

Source: Authors’ calculations based on (2015[2]), Kyrgyz Integrated Household Survey (database).

Reforming the MBPF to balance impact and cost is a major challenge

In 2017, the GoK published a Draft Law on State Benefits proposing that the MBPF be replaced by three categorical benefits:

A once-off payment at the birth of every child equivalent to KGS 4 000

A monthly benefit for all children under the age of three, with a value of KGS 700 per child per month.

A monthly grant for any household with three or more children between the ages of three and sixteen, paying a monthly benefit of KGS 500 per child per month, starting from the third child.

This proposed design encountered strong resistance from different groups. Objections focused on two issues in particular:

The adverse impact on existing beneficiaries: The requirement that only households with three or more children would receive the benefit for children aged over 3 years old, and that only the third child onwards would be eligible, meant that current recipients of the MBPF would invariably be worse-off.

Cost: Categorical benefits would cost significantly more than the MBPF.

In response to these concerns, a hybrid model has been discussed that retains three components but envisages a continued role for the MBPF. The components are:

A once-off payment at the birth of every child, equivalent to KGS 4 000

A monthly benefit for infants up to 2 years old, with a value of KGS 700 per child per month (with an altitude coefficient applied)

The MBPF for children aged between 2 years old and 16 years old whose per capita household income falls below the GMI, payable at a rate of KGS 810 per child per month (altitude coefficient applied)

This section of the SPSR compares the distributional implications, impact on poverty and cost of each component. It also analyses a lower MBPF value set at the average level of benefit paid in 2015 (KGS 653) to show how differences in the value of the MBPF affect its impact. Poverty impact is calculated based on the poverty rate in 2015; in that year, the national poverty rate would have been 33.1% if MBPF payments were excluded from household consumption.

Poverty-reducing impact of the new and old schemes

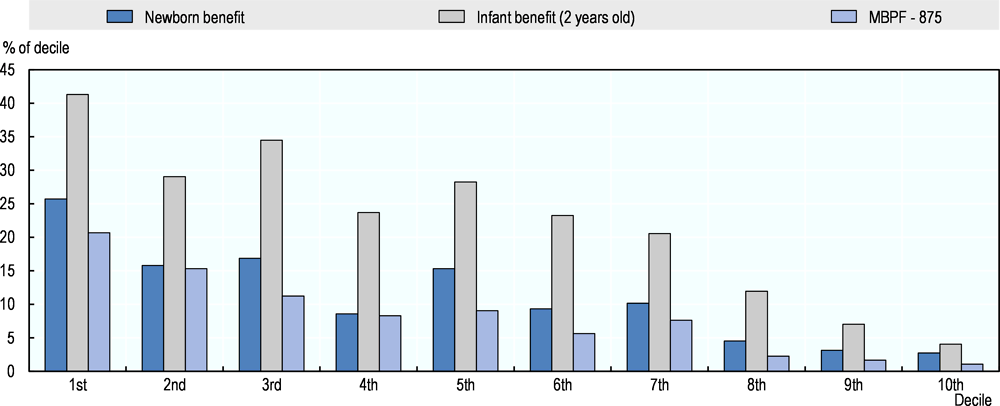

The three components of the proposed benefits benefit the poorer deciles more than those with higher incomes (Figure 3.4). The MBPF is the most progressive in the sense that coverage falls most steeply across income deciles: from 20.7% in the first decile to 11.2% in the third. However, the universal infant benefit achieves the highest level of coverage in the first and second deciles, at 41.3% and 29.0% respectively. Coverage of the infant benefit declines after the fifth decile but exceeds 20% up to and including the eighth decile. While receipt of the infant benefit declines with income, there is significant leakage to higher deciles, as is to be expected for a universal benefit.

Figure 3.4. The MBPF is more progressive than categorical benefits

Beneficiary incidence of three possible components of a hybrid scheme

Note: Deciles are calculated based on pre-MBPF consumption.

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

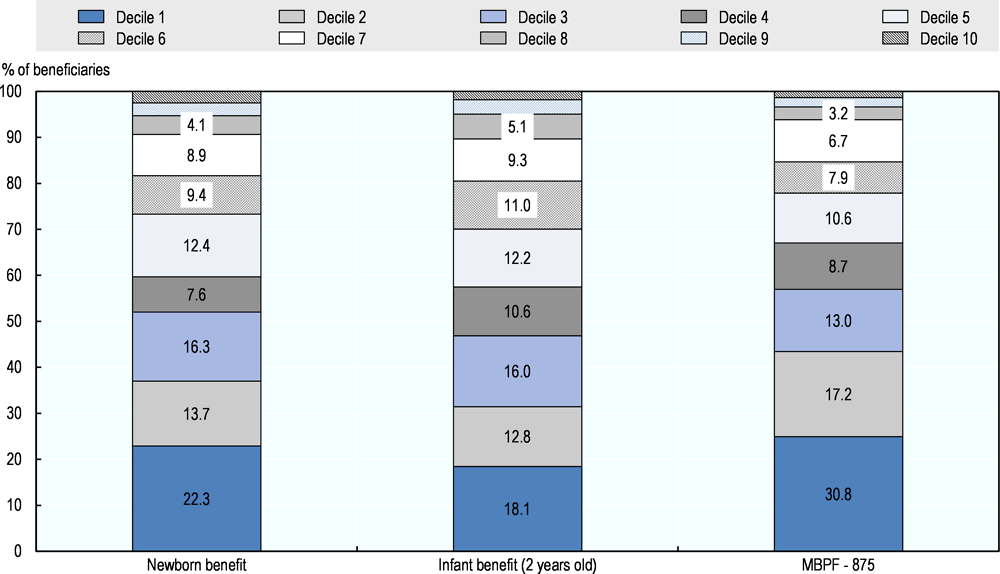

Figure 3.5 shows how the beneficiary population is distributed across the income distribution. This is a more accurate reflection of the distributional implications of the different components, since it strips out the discrepancies in absolute coverage of the MBPF and universal benefits respectively. There is less disparity between the universal benefits and the MBPF in terms the proportion of beneficiaries in each decile.

Figure 3.5. A majority of categorical beneficiaries are in the lowest income deciles

Distribution of beneficiaries for the three components by decile

Note: Deciles are calculated based on pre-MBPF consumption.

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

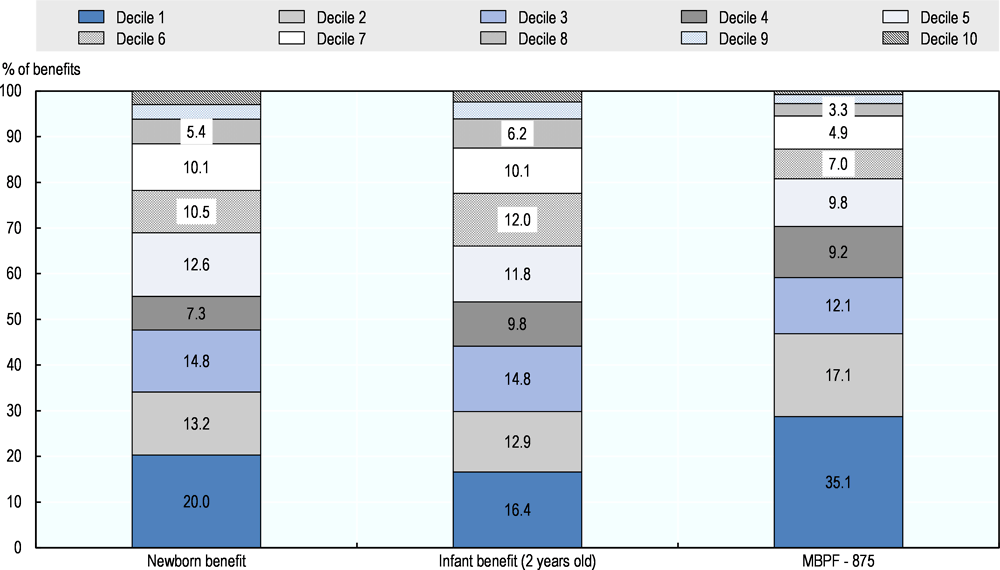

Benefit incidence shows similar trends to the beneficiary incidence. However, in this case, there is an even steeper decline for the MBPF: 30.8% of total MBPF benefits are transferred to the first decile, versus 13.0% in the third decile (Figure 3.6). Leakage of the MBPF to non-poor households is again evident: 39.0% of benefit expenditure goes to income deciles four and above. However, this is much lower than the equivalent figure of 53.1% for the infant benefit and 47.2% for the newborn benefit.

Figure 3.6. Over half of MBPF benefits would go to the first two income deciles

Benefit incidence of the three components by decile

Note: Deciles are calculated based on pre-MBPF consumption.

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Table 3.2. Estimated coverage, cost and poverty impact of hybrid state benefits

|

Benefit |

Value |

Total number of beneficiaries |

Total disbursement (KGS million) |

Total disbursement (% of GDP) |

Reduction in the poor population (%) |

Reduction in poverty rates (percentage points) |

|---|---|---|---|---|---|---|

|

Newborn benefit |

KGS 4 000, without coefficient |

119 184 |

462.6 |

0.11 |

0.24 |

0.08 |

|

Infant benefit (up to second birthday) |

KGS 700 per month, with coefficient |

254 718 |

2 311.5 |

0.53 |

4.10 |

1.35 |

|

Low MBPF (up to 2 years old) |

KGS 653 per month, without coefficient |

232 219 |

1 819.8 |

0.42 |

4.13 |

1.37 |

|

High MBPF (2-16 years old) |

KGS 810 per month per capita, with coefficient |

232 219 |

2 438.7 |

0.56 |

4.80 |

1.59 |

Source: Authors’ calculations based on NSC (2015[6]), Kyrgyz Integrated Household Survey (database).

The overall impact on poverty of the three components is shown in Table 3.2. This includes the “low benefit” for the MBPF by way of comparison. With a higher level of the MBPF benefit, the new hybrid programme has the effect of reducing poverty from 33.1% to 30.1%. Coverage levels of the universal and the poverty-targeted components are striking: the infant benefit reaches more children than the MBPF (eligible to children aged 2 to 16 years old) despite the disparity in overall cohort size.

The lower-value MBPF is 21.3% less expensive than the universal infant benefit while the higher-value MBPF is 5.5% more expensive. The infant benefit is less efficient at reducing poverty than either the high value MBPF or the low value MBPF. The low value MBPF is more efficient at reducing poverty than the high value, which is a function of the poverty gap: increasing the MBPF’s value above a certain level has less impact on the overall poverty rate because the benefit is more than sufficient to exit recipients from poverty.

The overall cost of the proposed hybrid programme is estimated at 1.2% of GDP. The cost drops to 0.96% of GDP using the lower value MBPF. Although this would be less costly than the proposal for a complete shift towards categorical benefits, both options are considerably more costly than the MBPF in its current form, which received an allocation equivalent to 0.6% of GDP in 2015. As discussed in Chapter 4, such an increase in spending on state benefits will be difficult to finance; reducing the value of the infant benefit or eliminating the altitude coefficient from this component might be necessary.

Future demand for a categorical benefit

Demand for categorical programmes, as well as their cost and impact, are driven by demographic factors. Assuming benefit levels remain constant in real terms, the cost of the categorical components of the proposed hybrid option would be determined by changes in the age structure of the population. Depending on whether more or fewer children are covered, the impact on national poverty would also vary.

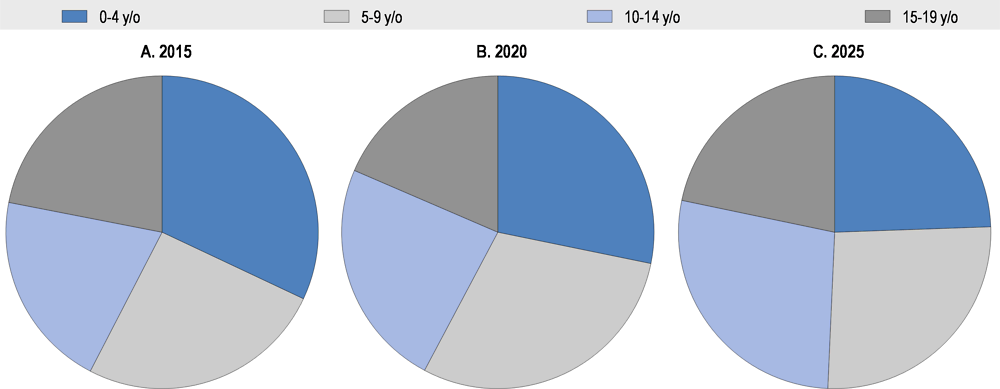

Kyrgyzstan’s relatively high fertility rate means the number of children aged under 20 is expected to grow from 2.3 million to 2.7 million between 2015 and 2025. However, the fertility rate is declining: the number of individuals under age five is projected to fall over this period, from 747 691 to 656 180 (Figure 3.7). This has the potential to reduce the cost of state benefits, and in particular categorical benefits aimed at newborns and infants.

Figure 3.7. The proportion of infants in the population is declining

Children under age 20, by five-year cohort (2015, 2020, 2025)

The analysis of the proposed hybrid programme lacks a counterfactual of the MBPF’s impact under different conditions. For example, to gauge their respective impact on poverty, it might be interesting to allocate the same budget to the MBPF as to the new programmes and simulate the results. However, this disregards the structural problems with the MBPF that might limit its capacity to scale up, not least its rural bias.

Moreover, such an exercise might also require a revision of the eligibility criteria so that coverage of the MBPF is expanded at the same time; otherwise the impact of a higher allocation to this programme would merely be to (significantly) increase the benefits paid to households that are already receiving the benefit. Interestingly, anecdotal evidence has indicated that increases in the value of the MBPF (that have coincided with significant declines in coverage) have been associated with considerably higher leakage.

By combining categorical and poverty-targeted benefits, the hybrid programme modelled here addresses the two main shortcomings of the proposed shift to universal benefits: exclusion of existing recipients and excessive cost. As such, it represents a practical way forward that will enhance the poverty-reducing impact of state benefits at a lower cost than the initial proposal.

This analysis shows there is a weak rationale for continuing the recent trend of reducing coverage of the MBPF while simultaneously increasing benefit values, even though these remain far below important welfare measures. Assuming that the programme’s budget is fixed in real terms, a greater impact on poverty would be achieved by widening access (by increasing the income threshold) while keeping benefit levels unchanged in real terms.

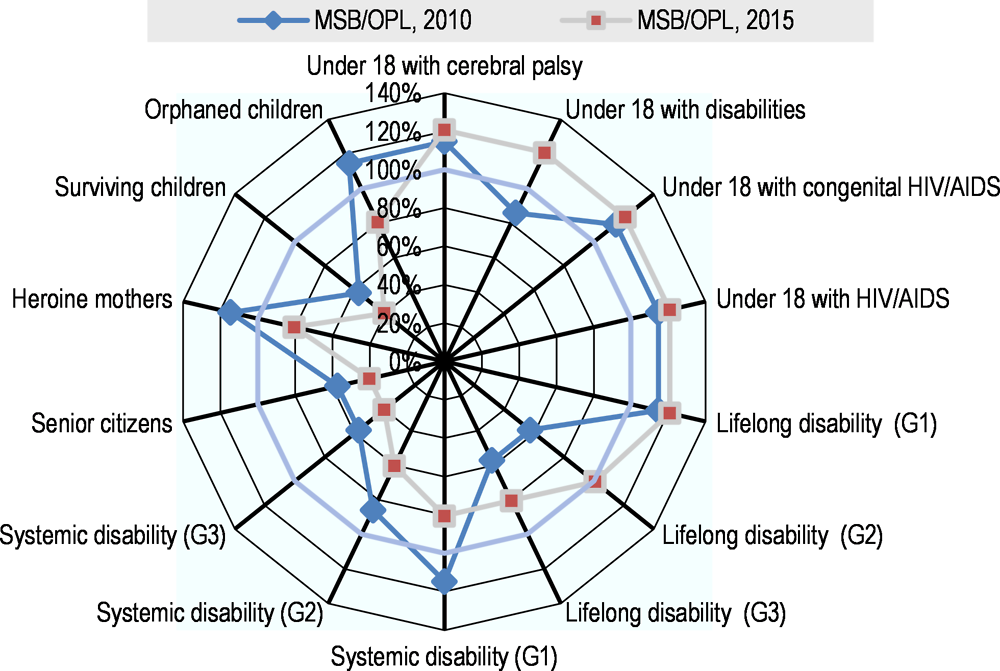

Coverage of the MSB is growing but it has challenges with transparency

The MSB is a categorical rather than means-tested benefit. In recent years, there have been different dynamics at play for different groups, reflecting both demographic factors and political priorities. As a result, the MSB has evolved into an umbrella programme comprising benefits for various vulnerable groups, some of which have benefited from parametric adjustments while others have been left worse off. In general, benefits that have analogues in the social insurance system have been reduced while those that do not have increased.

Coverage

Coverage of the MSB has steadily increased, from 53 900 beneficiaries in 2005 to 80 500 in 2015, growing at a much faster rate (a 50% increase) than Kyrgyzstan’s population as a whole, which increased by 15% over this period. Nonetheless, the coverage rate in 2015 was just 1.3% of the total population in 2015 (up from 1.0% in 2010).

While overall coverage has increased, there are disparities in growth among categories. Strongest growth appears among children under age 18 with HIV/AIDS, orphaned children and persons with Group III systemic disabilities5 (Table 3.3). However, while the relative increase was highest among children with HIV/AIDS, there were 445 beneficiaries of this category in 2015, up from 100 beneficiaries in 2010.

Among the adult disability categories, it is notable that strongest growth has occurred among adults with systemic disabilities and that the increases in lifelong and systemic disabilities have been highest among Group III beneficiaries – the group still able to work. The high growth among Group III claimants coincides with a proportionally higher increase in the benefit level relative to other categories and previous years (World Bank, 2014).

The Disability-Adjusted Life Years findings of Chapter 1 do not explain the increase in claimants for other categories, suggesting the possibility of latent demand for disability benefits: the increase in the size of the benefit has motivated eligible individuals to invest time and money to enrol. The increase in claimants might also be linked to employment patterns. There is evidence in other countries that workers vulnerable to difficult labour market conditions enrol for disability benefits, a trend likely pronounced when there is disparity between the value of unemployment benefits and disability benefits, as is the case in Kyrgyzstan.

The decrease in the number of MSB beneficiaries among older persons is a temporary phenomenon associated with an upwards adjustment in MSB entitlement ages, from 63 to 65 years for men and from 58 to 60 years for women. The purpose of this reform was to restrict access to the benefit so that workers would be incentivised to belong to the contributory pension system rather than rely on the social pension.

There was a significant increase in the number of MSB beneficiaries among orphaned children and children without an income-generating adult in the household, which likely reflects two factors: diminishing coverage of the contributory pension system among today’s workforce and the impact of labour migration on childcare. The increased coverage of children with disabilities masks significant exclusion errors: the number of children with disabilities receiving MSB increased by 6 700 between 2011 and 2015, while the number of children with disabilities increased by 17 500.

Table 3.3. The number of children eligible for the MSB is growing

Level and growth in MSB beneficiaries, by category

|

Category |

Category composition |

Increment in the number of beneficiaries in 2015 vs. 2010, (%) |

2010 |

2015 |

|---|---|---|---|---|

|

Children under 18 with disabilities |

Cerebral palsy |

26.2 |

3 435 |

4 335 |

|

Other disabilities |

33.7 |

17 211 |

23 011 |

|

|

HIV and AIDS |

481.4 |

62 |

362 |

|

|

Congenital HIV/AIDS in children |

256.5 |

23 |

83 |

|

|

Persons with lifelong disabilities |

Group I |

22.2 |

3 604 |

4 404 |

|

Group II |

13.8 |

14 493 |

16 493 |

|

|

Group III |

47.6 |

4 832 |

7 132 |

|

|

Persons with systemic disabilities |

Group I |

89.3 |

336 |

636 |

|

Group II |

86.7 |

1 961 |

3 661 |

|

|

Group III |

167.4 |

597 |

1 597 |

|

|

Senior citizens, including highland inhabitants |

-16.6 |

1 807 |

1 507 |

|

|

Heroine mothers |

8.3 |

120 |

130 |

|

|

Surviving children |

25.6 |

11 719 |

14 719 |

|

|

Orphaned children |

166.6 |

300 |

800 |

|

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

As discussed in Chapter 2, coverage of MSB-eligible populations is characterised by exclusion and inclusion errors, which are attributable to unequal access to medical certification and non-transparent practices in the certification process.

Almost 49 000 individuals over the age of 18 were classified as disabled in 2015 according to the KIHS, while administrative data show that 34 000 individuals received a disability transfer through the MSB (Table 3.3). The MSB does not provide targeted support for the examination, diagnosis, treatment and rehabilitation of persons with disabilities in low-income households, which is particularly hurtful for children with higher chances of full rehabilitation contingent on timely medical treatment.

Main exclusion errors in the MSB relate to poor diagnosis of individuals in need of disability assessment by primary health care institutions and financial barriers to inclusion among low-income families. Increasing employment in the informal sector, where occupational safety requirements are not observed, is also believed to have driven increases in systemic disabilities.

Inefficiencies in the board of medical-social experts (Disability Board of Review) – especially inaccuracies in awarding benefits to disability Group III, often due to favouritism – is a major source of inclusion errors in the MSB. These beneficiaries have privileged admission to hospitals (entitled to free treatment) and maintain the right to work while receiving benefits (IVEST, 2016[8]).

Adequacy

The benefits under the MSB are generous relative to the MBPF, with six out of the 14 beneficiary categories receiving benefits matching or exceeding the OPL in 2015 (Figure 3.8). These six categories all correspond to the group of disabled children or adults, although persons with systemic disabilities receive benefits below the OPL.

Until 2005, the value of the MSB was the same across all categories of beneficiary and set at the same level as the GMI.6 Benefits were uniformly raised above the GMI in 2006, and in 2007, the GoK varied the MSB by category, disrupting the consistency across different components of the programme. The value of the MSB was officially delinked from the GMI from 2010, when the benefit value was also increased by around 50% to compensate for the electricity tariff increases.

On average, the value of the MSB almost doubled between 2005 and 2015. However, benefit levels have increased unevenly across categories since 2010; the benefit for children and adults with disabilities has increased, while it has not done so for other categories.

Benefits are smallest for surviving children, elderly without pensions, Heroine mothers and orphan children, ranging from 30% to 80% of the OPL. Benefits for these categories declined as a proportion of the OPL between 2010 and 2015.

The decline in real benefit levels for elderly individuals reliant on social assistance is in stark contrast to the treatment of Social Fund pensions, which are typically indexed on an annual basis with reference to wage inflation (consistently been higher than price inflation in Kyrgyzstan).

Figure 3.8. The adequacy of the MSB differs by component

Adequacy of MSB benefits, by category

Note: G1, G2, and G3 refer to Group 1, Group 2, and Group 3, respectively.

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Equity

Since it is not poverty-targeted, the MSB is not pro-poor by design, except insofar as the prevalence of beneficiary categories declines with income. The relatively small number of beneficiaries makes it difficult to capture the incidence of benefits and beneficiaries through household survey data. However, eligible low-income individuals are at a higher risk of exclusion from the MSB due to high financial and access burdens associated with the examination and certification of disability.

The equity principle also relates to how vulnerable groups are treated by different social protection programmes. By providing more favourable eligibility conditions and benefit adjustments for contributory pensions than for the MSB, the GoK is undermining this principle. Given the structural challenges facing the contributory system it might be necessary to find other means of maintaining contributions to the Social Fund.

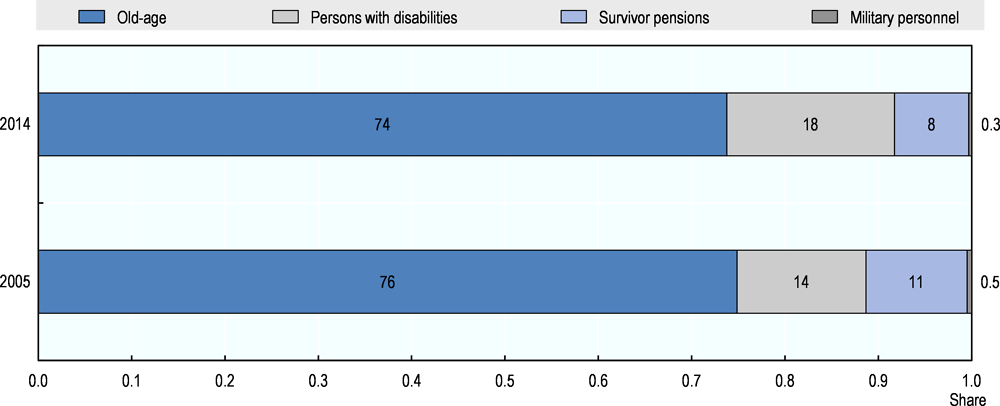

High pension coverage will be difficult to sustain

The State Pension Social Insurance programme is the largest social protection programme in Kyrgyzstan. Contributors to the Social Fund, which is responsible for its management, are eligible for old-age, disability and survivor pensions, while military personnel receive pensions on a non-contributory basis.

Coverage

Pension coverage among the elderly was nearly universal in 2015, and 45.2% of the population lived in pension beneficiary households. In that year, pensions covered nearly 647 000 individuals through the contributory components, up from 536 000 in 2005, versus 2 000 who received the MSB.7 The increase in beneficiaries reflects demographic trends: coverage as a share of the population remained stable at around 10.5% between 2005 and 2015 (NSC, 2015).

The composition of pension beneficiaries changed between 2005 and 2014. While the share of old-age pensioners (76% and 74%, respectively), survivor pensioners (11% and 8%) and military pensioners (0.5% and 0.3%) decreased, the share of disability pensioners increased from 14% to 18% (Figure 3.9).

Figure 3.9. The proportion of disability pensioners is growing

Composition of Social Fund beneficiaries (2005 and 2014)

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

In 2011, the ratio of old-age pensioners to the population over age 65 exceeded 100% due to a combination of 91% coverage of the population over age 65 and significant early retirement (World Bank, 2014). Over 17% of old-age pension recipients in 2013 had taken early retirement, reflecting special dispensations for groups such as Heroine mothers and individuals living in high-altitude areas, who are able to retire 5 years and 10‑13 years before the statutory retirement age, respectively.

However, the proportion of the current labour force contributing to the Social Fund is much lower than the proportion of the retired workforce receiving benefits. Just over half the labour force contributed to the Social Fund in 2013, which not only suggests pension coverage among the elderly will decline over time but also threatens the solvency of the pay-as-you-go component of the Social Fund.

Low coverage among the current workforce is partly a function of the high contribution rate. However, evidence suggests strong public desire to be covered by the Social Fund, albeit at a lower cost (discussed in Chapter 2).

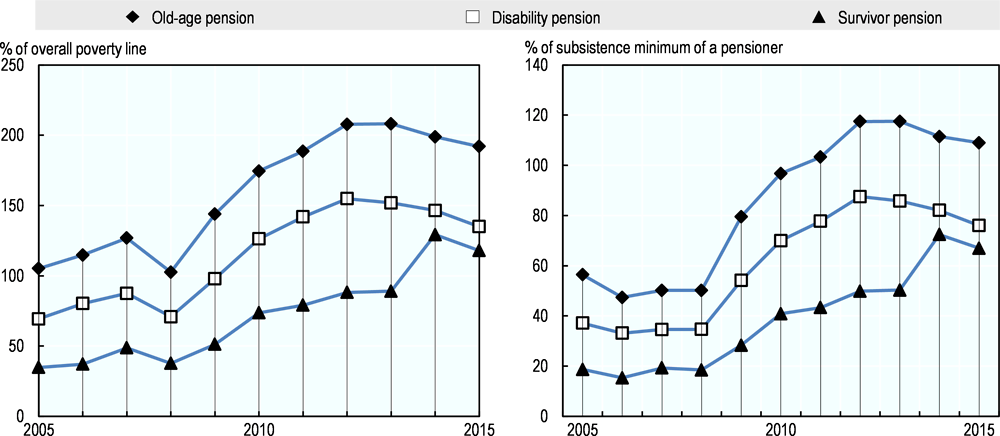

Adequacy

The average benefit from all forms of contributory pensions exceeds the OPL, meaning the programme plays a critical role in reducing poverty. However, there are variations in the level and trajectories of the different components.

The average value of the old-age pension rose from 105.2% of the OPL in 2005 to 208.1% in 2013 but fell to 192.0% thereafter (Figure 3.10, left-hand panel). The average disability pension has exceeded the OPL since 2010 and, in 2015, stood at 135.0% of the threshold. The average survivor pension benefit exceeded the value of the OPL for the first time in 2014 but showed the strongest growth over the preceding decade: in 2015, it was almost 3.5 times its 2005 level as a proportion of the OPL.

However, pension payments are much lower when indexed against the SM for pensioners (Figure 3.10, right-hand panel). The average value of the old-age pension has exceeded the SM for pensioners since 2011 and was at 111% of this threshold in 2015, up from 56% in 2005.The disability pension was at 82% of the threshold in 2015, up from 37% in 2005, and the survivor pension benefit was at 72%, up from 19% in 2005.

Figure 3.10. Average pension levels exceed the overall poverty line

Adequacy of pensions relative to the overall poverty line

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

In the case of contributory social protection arrangements, adequacy also relates to the return workers receive on their lifetime contributions. A widely used indicator of a pension system’s adequacy is the replacement rate. From an individual’s perspective, this measures the value of the pension benefit as a proportion of salary (either career average or at career end). From the perspective of the system, it is calculated as the ratio of the average pension to the average wage.

The ILO (1967[9]) recommends replacement rates exceed 45% of a worker’s income in retirement, a rate especially problematic given the high contribution rate: 25% of a worker’s salary, divided between employee and employer. If workers consider the value of the pension benefit to be low relative to the contribution rate they might opt out of the system.

Despite the increased value of old-age pensions against the OPL, the replacement rate declined from 40.1% in 2010 to 37.9% in 2014. The aggregate decline in replacement rates likely reflects the changing composition of contributors; smaller contributions translate into lower replacement rates. However, the decline also masks adequacy dynamics among different groups of individuals, both in absolute terms and with respect to their contributions.

The maximum value of the basic pension component (which accounts for the majority of pension income for voluntary contributors) was set at 12% of the average wage or KGS 1 500 in 2015. For workers not contributing for the full period (20 years for women and 25 years for men), the value of the basic pension is pro-rated, meaning some recipients might receive a basic pension far below the OPL and even equivalent to the MSB. Mandatory contributors, especially those at higher-income levels, will receive a low return on their contributions due to cross-subsidisation of other contributors and design features of the insured components (discussed in Chapter 2).

According to the World Bank (2014[10]), replacement rates will fall to 25% of the average contributor wage in 2035 if the second pillar component of the pension system is not reformed (the first pillar is being phased out). This implies the basic pension will comprise an ever-larger part of pension payments, increasing to 50% of the benefit paid to formal-sector workers and 95% of the benefit paid to farmers.

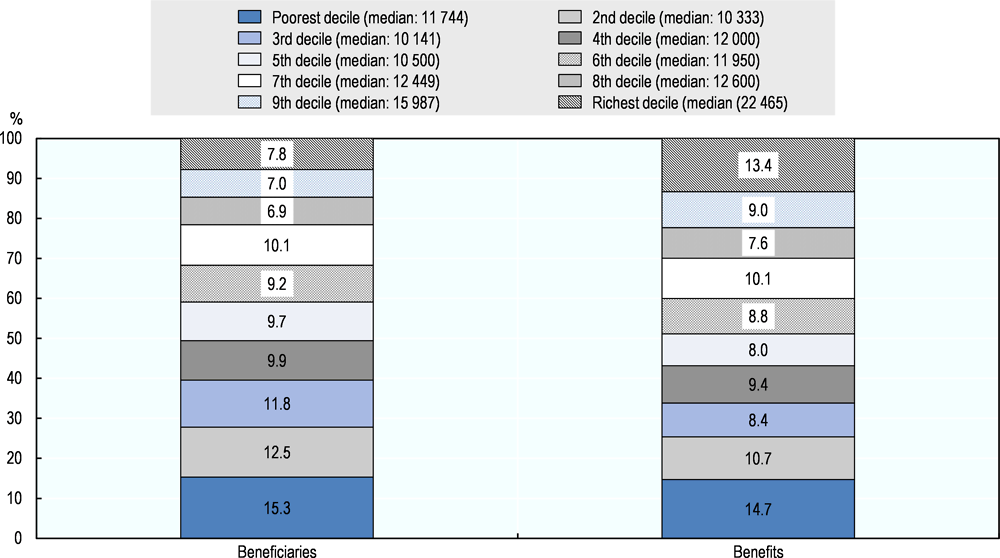

Equity

The incidence of pension beneficiaries and benefits tends to be pro-poor, with the first two deciles accounting for more than one-quarter of benefits and beneficiaries (Figure 3.11). The distribution of benefits does not vary greatly between the third and the ninth decile but is notably higher among the first two deciles and the top decile.

Figure 3.11. The pension system is pro-poor

Incidence of pension beneficiaries and benefits across income distribution

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

The distribution of benefits does not vary greatly between the third and ninth deciles but is notably higher among the first two deciles and in the top decile. This reflects the weak link between pension contributions and benefits received. In a typical pension arrangement (whether defined benefit or defined contribution), upper income deciles would receive a larger proportion of overall benefits paid annually because they contributed more in absolute terms, even though the rate of contributions might be the same for all income levels.

This is not the case in Kyrgyzstan due to the system’s design. The basic pension component is quasi-contributory: the value of a contributor’s benefit is determined by the duration not size of contributions, so the replacement rate declines with income. As workers’ contributions to the second pillar component lose their value and the weight of the basic pension increases, the system will become more redistributive from the better-off to the worse-off, especially given the basic pension is financed almost entirely from the Republican Budget.

However, workers may respond by withdrawing from the Social Fund or under-reporting their earnings, which will exacerbate the financial strain caused by the imbalance between contributors and beneficiaries and could harm public finances more broadly, if it causes a decline in tax revenues (thus also affecting the GoK’s ability to finance the basic pension component).

Equity analysis must also consider workers not covered by the contributory system. Providing an MSB benefit that is significantly lower than the minimum pension payment is perceived as a means of promoting compliance with the contributory system. However, trends discussed in Chapter 1 indicate the number of MSB beneficiaries will increase substantially in the coming years, driven by workers who worked informally or abroad their whole careers. Maintaining a tax-financed non-contributory scheme (the MSB) and a tax-financed quasi-contributory scheme (the basic pension) might not be politically sustainable or administratively efficient over the long term.

Health coverage has increased but poses equity challenges

The level of health care coverage in Kyrgyzstan reflects a combination of the State Guaranteed Benefits Package (SGBP), Mandatory Health Insurance (MHI), other demand-side mechanisms under the Mandatory Health Insurance Fund (MHIF) umbrella and supply-side initiatives.

Coverage

The SGBP forms a non-contributory universal entitlement for a basic package of health services. Under the SGBP, all primary and emergency health services are free at the point of use. However, enrolment requires at least a temporary residence permit and basic identification documents, a potential barrier to access for migrants who might lack them (Giuffrida, Jakab and Dale, 2013[11]). Some 22% of those without resident permits at their current living location had been unable to use health services when they needed assistance, versus only 12% of those who had the permit.

SGBP does not cover co-payments for inpatient care and specialised outpatient care. There are two additional levels of co-payment coverage: they are waived entirely or partly for vulnerable groups and certain medical conditions, while a lower co-payment schedule applies for those covered by the MHI. Those not covered by the exemption schemes or MHI have to pay the maximum co-payment (Table 3.4).

Co-payment exemption categories are heterogeneous, from World War II veterans to children under age 5 and the disabled. They cover 48% of the population: in 2012, around 640 000 patients benefited, with more than half of the exemptions covering care for children under age 5 and pregnant women (Giuffrida, Jakab and Dale, 2013[11]). The exemption mechanism has been found to be effective in lowering the health payment burden in exempted categories (Jamal and Jakab, 2013[12]).

According to the 2012 Demographic Health Survey (DHS), around 12% of the population does not have MHI coverage (NSC/MoH/ICF International, 2013[13]). Those not covered seem to be wealthier and younger. Age is a clear factor for women, with 81% of those aged 15‑30 covered by MHI, versus 92% for those aged 30‑49. For men, the difference is around five percentage points between the two age groups. Wealth is a more important determinant for men, with 96% of men in the poorest two quintiles covered by MHI, versus 86% in the richest three quintiles. This pattern of coverage points to an important factor of adverse selection whereby the younger and wealthier (thus likely healthier) opt out. Opting out is made possible for informal workers by the de facto voluntary nature of their enrolment in MHI (see also Giuffrida, Jakab and Dale, 2013).

Those enrolled in MHI, either through payroll contributions or a flat rate enrolment contribution of KGS 550 by informal workers and the self-employed, pay a reduced co-payment rate, while those not covered by MHI and not part of the exemption scheme pay the full co-payment rate.

Table 3.4. Co-payment rates under the SGBP

|

Forms of co-payment |

In-patient facilities, other than national hospitals, KGS |

National hospitals, KGS |

||

|---|---|---|---|---|

|

Co-payment for the general practice |

With a referral for hospitalisation |

Minimum rate |

330 |

330 |

|

|

|

Average rate |

840 |

1 160 |

|

Maximum rate |

2 650 |

2 980 |

||

|

Co-payment for surgery |

With a referral for hospitalisation |

Minimum rate |

430 |

430 |

|

|

|

Average rate |

1 090 |

1 510 |

|

Maximum rate |

3 440 |

3 870 |

||

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Co-payments data show the average co-payment rate for surgery in non-national hospitals closely matches the minimum wage (KGS 1 060 per month), while the maximum rate is three times the minimum wage. Even the minimum rate of KGS 430 represents 41% of the minimum wage, with levels even higher in national hospitals. The overall level of co-payments can thus be rather high and points to the limits of the financial coverage provided by the health care system, especially for catastrophic events and, in theory, for those not covered by MHI or the exemption system.

The level of health coverage is also determined by the Additional Drug Package (ADP) scheme. ADP coverage is linked to MHI enrolment, so those not covered by MHI are disadvantaged by both higher co-payments for consultations and no reimbursements for medicines. Even for those covered by ADP, coverage is limited, as the reimbursement has a ceiling of 50% of a baseline price for a generic drug, which is often exceeded by the actual price because of prescription of brand names (WHO, 2016[14]).

Adequacy

The adequacy of health coverage in Kyrgyzstan can be evaluated by using the global Universal Health Coverage Outcome Monitoring Framework, which looks at service coverage and financial protection (WHO/World Bank, 2017[15]). Beside the outcome-focused indicators, the availability and quality of health services are key elements in judging how the health care system ensures de facto coverage.

Access to care

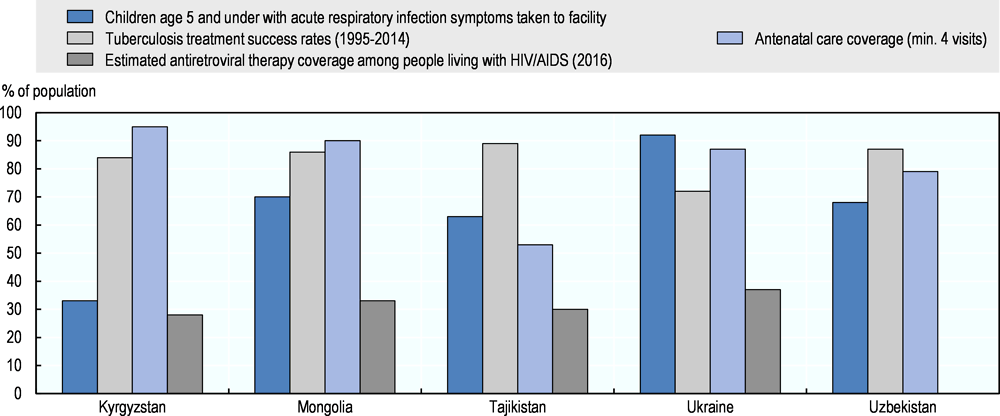

SGBP entitlement does not fully translate into access to health services. Kyrgyzstan compares unfavourably to a set of regional countries for antiretroviral (ART) coverage8 and care for children with respiratory symptoms but favourably for antenatal care and tuberculosis (TB) treatment (Figure 3.12).

Figure 3.12. Access to care is variable

Low ART coverage partly owes to the vertical nature of the HIV/AIDS programme, limiting SGBP’s reach to cover the disease (Ancker S. and Rechel, 2015[16]). Good TB coverage is due to its integration into the SGBP (Ibraimova A., Akkazieva and Ibraimov, 2011[17]), expressly including outpatient TB drugs (van den Boom, Mkrtchyan and Nasidze, 2014[18]).

According to the 2015 KIHS, 31.8% of individuals who declared a medical need did not access any health services. The majority (88.5%) instead opted for self-treatment. Other reasons cited were the high cost of health visits (2.3%), the high cost of drugs (5.8%) or a decision to let the disease/illness run its course (2.7%). Similarly, 61.9% of those referred to a hospital (or who required inpatient treatment) but did not stay at a hospital also opted for self-treatment, 18.0% cited the expense and 6.4% let the disease run its course.

Financial protection

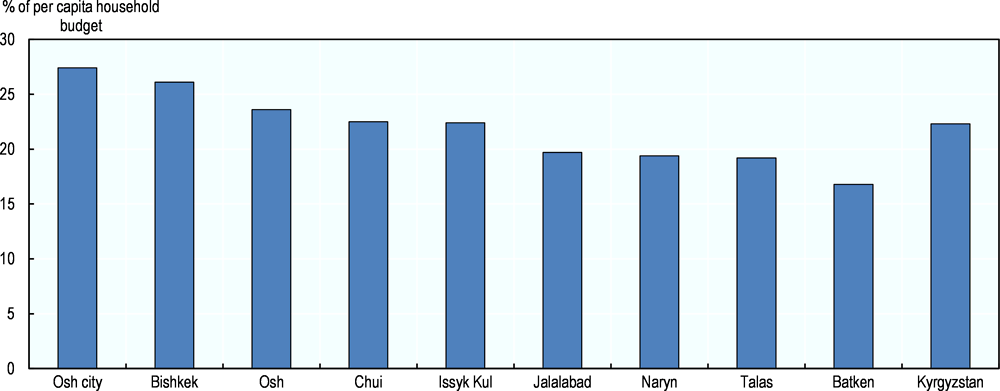

According to a recent WHO study, out-of-pocket (OOP) health expenditure initially decreased after major health care system reforms starting in the 1990s (discussed in Chapter 2) but has since been on the rise. OOP health spending in per capita household budgets decreased from 5.3% in 2006 to 3.5% in 2009 (WHO, 2017[19]). Between 2009 and 2014, OOP spending rose, reaching 5.2% in 2014. However, if considering only those who used health services (at least one medical contact in a year), household OOP expenditure was 22%. There is wide regional distribution, with Osh City and Bishkek having higher OOP spending and Batken having the lowest (Figure 3.13).

Figure 3.13. Out-of-pocket health spending varies by region

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

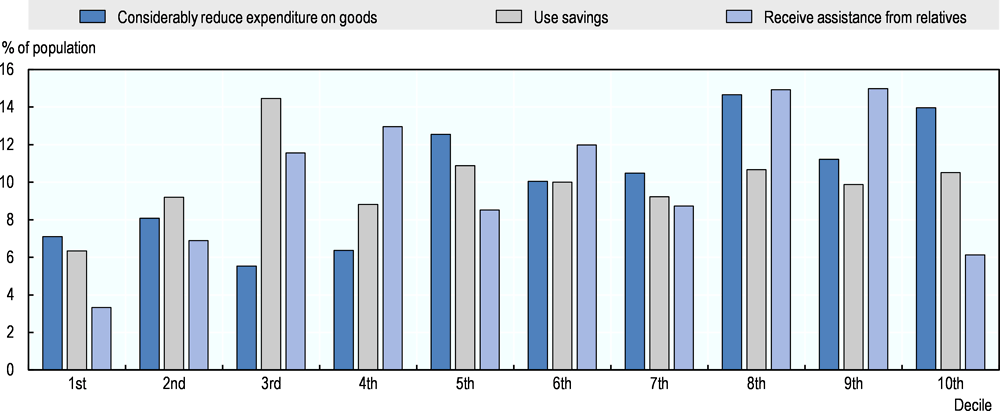

Individuals needing health care and having to pay OOP often resort to alternative coping mechanisms to afford treatment. The 2015 KIHS showed that 845 146 individuals used their savings to pay for health care costs, 401 665 reduced expenditure considerably as the second most common mechanism, and 151 310 relied on assistance from relatives (NSC, 2015[2]).

Health care expense coping strategies are more prevalent among upper deciles (Figure 3.14). This is expected, as those in higher deciles are also more likely to seek treatment in the first place and to use expensive private providers or seek care abroad. Lower MHI coverage among the richest could also explain their higher need for OOP and coping strategies for catastrophic health events.

Figure 3.14. Main coping mechanisms for financing health treatment, by decile

Source: Authors’ calculations based on NSC (2015[2]), Kyrgyz Integrated Household Survey (database).

Availability and quality

While there has been important focus on developing coverage mechanisms on the demand side, there is some question how well service delivery has matched this evolution. Important gaps in service largely relate to lack of health workers, especially in primary health care, and to their uneven regional distribution. In 2015, 60 family group practices had no doctors, and 198 had only one (Abdraimova, Abdurakhmanova and Ybykeeva, 2015[20]). Staff shortages, even in hospitals, owe partly to large numbers of doctors leaving public hospitals to join the private sector or find work abroad (Ibraimova A., Akkazieva and Ibraimov, 2011[17]). The GoK has implemented many stick and carrot policies, including mandatory posting of medical graduates and bonuses for working in rural areas, with limited effect.

Service delivery is further constrained by gaps in equipment and infrastructure. This is especially true for rayon (district) hospitals, some of which lack basic utilities, such as running water or electricity (Ibraimova A., Akkazieva and Ibraimov, 2011[17]). Moreover, medical practices, which are rarely in line with clinical guidelines, are a system-wide issue affecting quality of care.

The impacts of low health service quality on effective coverage and health outcomes can be seen through several indicators. For example, men with high blood pressure cited low quality of care as the main reason they did not seek services (Abdraimova A., Iliasova and Zurdinova, 2016[21]). Knowing maternal mortality is linked to quality of hospital obstetric care for normal and emergency delivery, the relatively high maternal mortality, coupled with the high levels of access to skilled personnel at birth, points to quality gaps in service delivery.

The Den Solook programme, aimed explicitly at increasing quality of care, has made important strides. Under the programme, the GoK has introduced improvements to facilities, purchased new equipment, and established new methods of quality assurance and of developing and implementing a new set of clinical guidelines (Ibraimova A., Akkazieva and Ibraimov, 2011[17]).

Equity

Several equity challenges in health coverage relate to the design and implementation of the health care system, regarding both health insurance mechanisms and health services availability and quality.

Equity in service coverage

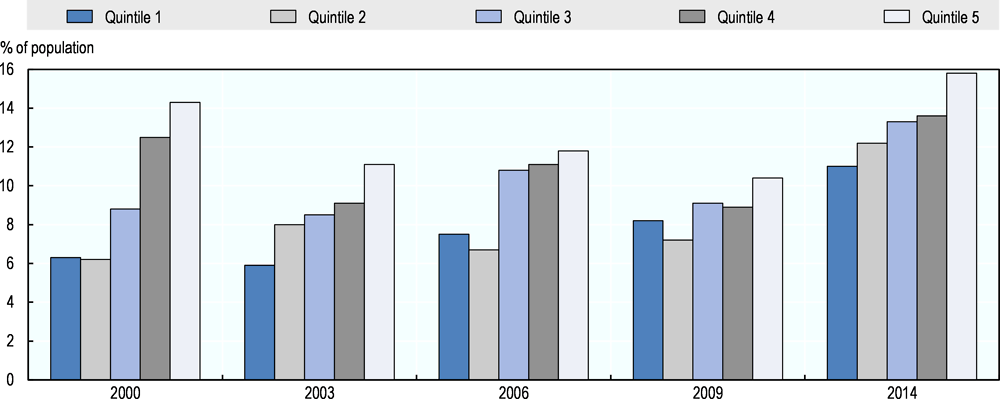

Outpatient utilisation patterns reveal inequities in service coverage. In Kyrgyzstan, outpatient utilisation is skewed towards richer population groups, although the equity gap in utilisation has narrowed in recent years (Figure 3.15).

Figure 3.15. Utilisation of outpatient services in the past 30 days by income quintile (2000-14)

Source: Akkazieva, Jakab, and Temirov (2016[22]), “Long-term trends in the financial burden of health care seeking in Kyrgyzstan, 2000–2014”.

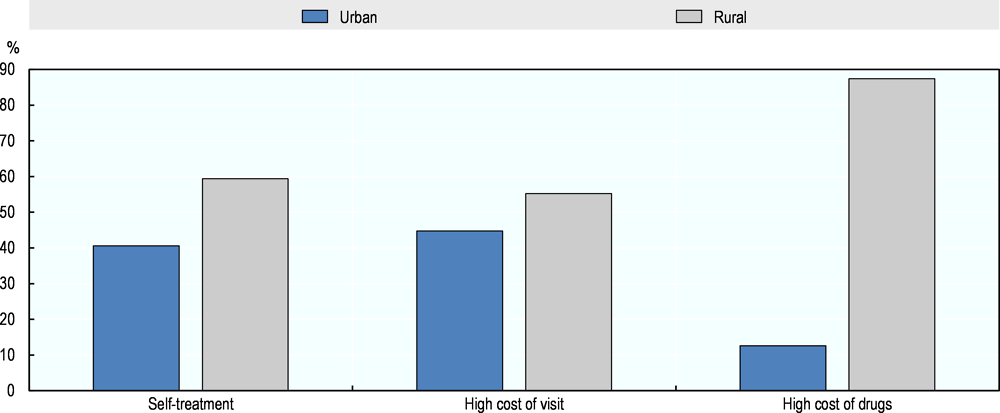

Access to services inequities are also geographical. Rural residents more often face self-treatment and high visit and drug costs (Figure 3.16). Among those who reported self-treatment, 56.0% lived in rural areas. Among those who cited high drug costs as a reason to avoid services, 86.9% lived in rural areas.

Figure 3.16. Financial barriers to health services are higher for rural residents

Reasons for not accessing health services (2014)

Source: Authors’ calculations based on NSC (2014[23]), Kyrgyz Integrated Household Survey (database).

Equity in financial protection

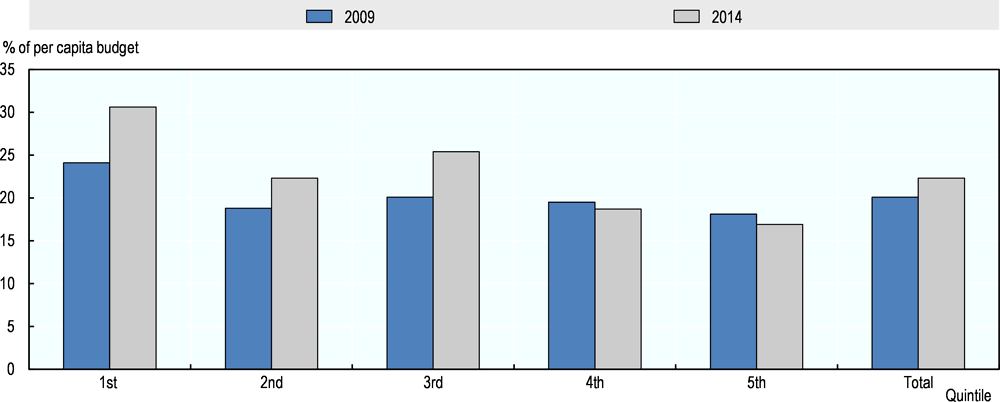

The poorest individuals tend to bear the heaviest financial burden from health payments. The poorest 20% of households spends about 30% of total expenditure on OOP health expenses, versus 22% spent by the richest quintile (WHO, 2016[24]) (Figure 3.17).9 While the rate of growth in OOP spending varied across quintiles between 2009 and 2014, the financial burden increased most for the poorest quintile.

Figure 3.17. Out-of-pocket health spending is a larger burden on the poor

Source: Akkazieva, Jakab, and Temirov (2016[22]), “Long-term trends in the financial burden of health care seeking in Kyrgyzstan, 2000–2014”.

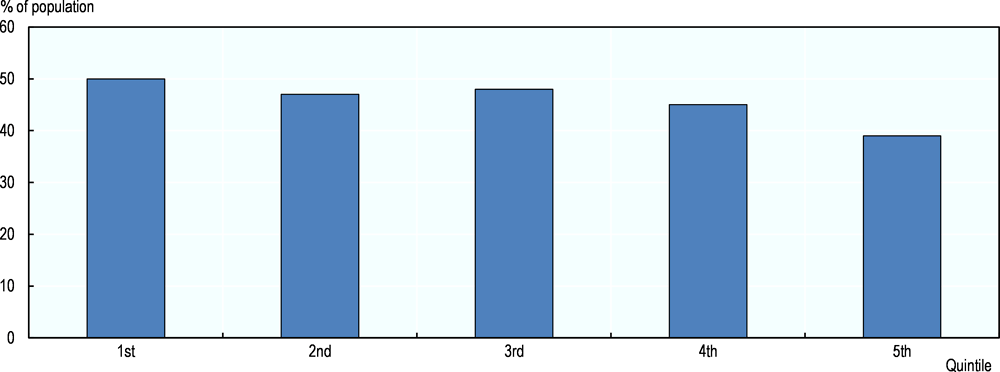

Co-payment exemptions tend not to be pro-poor, targeting the poor ineffectively and benefiting the non-poor substantially. The exemptions cover less than 50% of the poorest two income quintiles and 39% of the richest quintile (Figure 3.18). Although the GoK provisions the right to further co-payment exemption for those in low-income households, this is inaccurately and inadequately implemented.10

Figure 3.18. Health-care user fee exemptions are poorly targeted

Coverage of user-fee exemptions by decile (2010)

Source: Jamal and Jakab (2013[25]), “Targeting performance of co-payment exemptions in the State Guaranteed Benefit Package”, http://hdl.handle.net/10986/13311.

References

[21] Abdraimova A., A. Iliasova and A. Zurdinova (2016), Reasons for low health care seeking among men with hypertension in Kyrgyzstan, Health Policy Analysis Center, Bishkek.

[20] Abdraimova, A., A. Abdurakhmanova and E. Ybykeeva (2015), Addressing underutilized capacity for NCD care: New role for family doctors/general practitioners and nurses?, Health Policy Analysis Center, Bishkek.

[22] Akkazieva B., Jakab M. and A. Temirov (2016), Long-term trends in the financial burden of health care seeking in Kyrgyzstan, 2000–2014, World Health Organization Regional Office for Europe, Copenhagen.

[16] Ancker S. and B. Rechel (2015), “HIV/AIDS policy-making in Kyrgyzstan: a stakeholder analysis”, Health Policy and Planning, Vol. 30/1, pp. 8-18, https://dx.doi.org/10.1093/heapol/czt092.

[28] Gassmann, F. (2012), Kyrgyz Republic: Evaluation of the Draft Strategy on Social Protection Development 2012-2014.

[1] Gassmann, F. and L. Trindade (2016), “The effect of means-tested social transfers on labour supply: heads versus spouses-An empirical analysis of work disincentives in the Kyrgyz Republic”, UNU-MERIT Working Paper Series, No. 2016-030, Maastricht Economic and social Research institute on Innovation and Technology (UNU‐MERIT), Maastricht.

[26] Gassmann, F. and L. Trindade (2016), “The effect of means-tested social transfers on labour supply: heads versus spouses-An empirical analysis of work disincentives in the Kyrgyz Republic”, UNU-MERIT Working Paper Series, No. 2016-030, Maastricht Economic and social Research institute on Innovation and Technology (UNU‐MERIT), Maastricht.

[4] Gassmann, F. and L. Trindade (2015), Kyrgyz Republic Analysis of Potential Work Disincentive Effects of the Monthly Benefit for Poor Families in the Kyrgyz Republic, World Bank, Washington DC.

[11] Giuffrida, A., M. Jakab and E. Dale (2013), “The Case of the State Guaranteed Benefit Package of the Kyrgyz Republic”, UNICO Studies Series, No. 17, World Bank, Washington DC, http://openknowledge.worldbank.org/handle/10986/13311.

[17] Ibraimova A., B. Akkazieva and A. Ibraimov (2011), Kyrgyzstan: Health System Review, European Observatory on Health Systems and Policies, Brussels.

[9] ILO (1967), Convention concerning Invalidity, Old-Age and Survivors' Benefits (Entry into force: 01 Nov 1969).

[8] IVEST (2016), “In Kyrgyzstan, for 10 years the number of disabled persons increased by 50 thousand”, Информ-Вест [Inform-West], http://news.ivest.kz/70601156-v-kyrgyzstane-za-10-let-kolichestvo-invalidov-uvelichilos-na-50-tys.

[12] Jamal, S. and M. Jakab (2013), Targeting performance of co-payment exemptions in the State Guaranteed Benefit Package, World Health Organization Regional Office for Europe, Barcelona.

[25] Jamal, S. and M. Jakab (2013), Targeting performance of co-payment exemptions in the State Guaranteed Benefit Package, World Health Organization Regional Office for Europe, Barcelona.

[2] NSC (2015), Kyrgyz Integrated Household Survey, National Statistics Committee of the Kyrgyz Republic, Bishkek.

[6] NSC (2015), Kyrgyz Integrated Household Survey, National Statistics Committee of the Kyrgyz Republic, Bishkek.

[23] NSC (2014), Kyrgyz Integrated Household Survey, National Statistics Committee of the Kyrgyz Republic, Bishkek.

[29] NSC (2014), Kyrgyz Integrated Household Survey, National Statistics Committee of the Kyrgyz Republic, Bishkek.

[30] NSC (2004), Kyrgyz Integrated Household Survey, National Statistics Committee of the Kyrgyz Republic, Bishkek.

[13] NSC/MoH/ICF International (2013), Kyrgyz Republic Demographic and Health Survey 2012, National Statistical Committee of the Kyrgyz Republic, Ministry of Health of the Kyrgyz Republic, and ICF International, http://dhsprogram.com/publications/publication-FR283-DHS-Final-Reports.cfm.

[7] UN DESA (2017), World Population Prospects: The 2017 Revision, United Nations Department of Economic and Social Affairs, New York, http://un.org/en/development/desa/population/publications.

[27] UNICEF (2014), Analysis of the Situation of Children in Mongolia, United Nations Children’s Fund Mongolia, Ulaanbaatar.

[18] van den Boom, M., Z. Mkrtchyan and N. Nasidze (2014), Review of tuberculosis prevention and care services in Kyrgyzstan, 30 June – 5 July 2014, World Health Organization Regional Office for Europe, Copenhagen.

[19] WHO (2017), Universal Health Coverage Data Portal, World Health Organization, Geneva, http://apps.who.int/gho/cabinet/uhc.jsp.

[14] WHO (2016), Pharmaceutical pricing and reimbursement reform in Kyrgyzstan, World Health Organization Regional Office for Europe, Copenhagen.

[24] WHO (2016), Pharmaceutical pricing and reimbursement reform in Kyrgyzstan, World Health Organization Regional Office for Europe, Copenhagen.

[15] WHO/World Bank (2017), Tracking Universal Health Coverage: 2017 Global Monitoring Report, World Health Organization, Geneva.

[10] World Bank (2014), “Kyrgyz Republic Public Expenditure Review Policy Notes: Pensions”, in Public Expenditure Review Report No. 89007, World Bank, Washington DC.

[3] World Bank (2014), “Kyrgyz Republic Public Expenditure Review Policy Notes: Social Assistance”, in Public Expenditure Review Report No. 89022, World Bank, Washington DC.

[5] World Bank (2013), Kyrgyz Republic - Poverty update, 2011, World Bank, Washington DC, http://openknowledge.worldbank.org/handle/10986/16075.

Notes

← 1. Consultation with Ministry of Labour and Social Development, 2017.

← 2. The government of Kyrgyzstan calculates the minimum subsistence levels for children, adults and pensioners and uses those as national benchmarks. These calculations include costing the subsistence needs of each of the groups – the cost of tailored baskets of goods and services most suitable to each of the groups.

← 3. For every KGS 100 of transfers, the poverty gap reduces by KGS 60.08.

← 4. For every KGS 100 of transfers, extreme poverty gap reduces by KGS 8.25.

← 5. Disability is categorised Group I (total disability and requiring constant attendance), Group II (total disability with an 80% loss of mobility) or Group III (partial disability with some loss in working capacity).

← 6. Previously, the guaranteed minimum consumption level (GMCL).

← 7. Based on consultations with the Social Fund on 22 June 2016.

← 8. There is no data for ART coverage for Uzbekistan.

← 9. Including only those households with a member who has come into contact with the health care system.

← 10. Article 4, paragraph 23, Government Decree No. 350 of 1‑July 2011 on the SGBP.