This chapter provides an overview of the significant growth of capital markets in selected Asian jurisdictions. It summarises key aspects and trends on how these markets function and highlights key sustainability issues for Asian capital markets.

Sustainability Policies and Practices for Corporate Governance in Asia

1. Capital markets and key sustainability issues in Asia

Abstract

Capital markets play an important role in driving economic growth. Access to capital markets, in particular equity markets, not only provides companies access to the much-needed funding which is essential for innovation, but also benefits households by providing them with opportunities to participate in corporate value creation and save for their retirement. In the context of sustainability, a well-functioning capital allocation mechanism will play a key role in the decarbonisation process, as economies will require an enormous mobilisation of private capital to invest in uncertain and innovative ventures. Market-based financing is well-suited to finance such ventures by providing risk-willing long‑term capital. Regulatory frameworks for companies accessing capital in public markets can also be used to encourage companies to disclose more information about their sustainability practices and policies, and provide investors with the opportunity to influence and support the necessary business transformation of companies.

1.1. Public equity markets overview

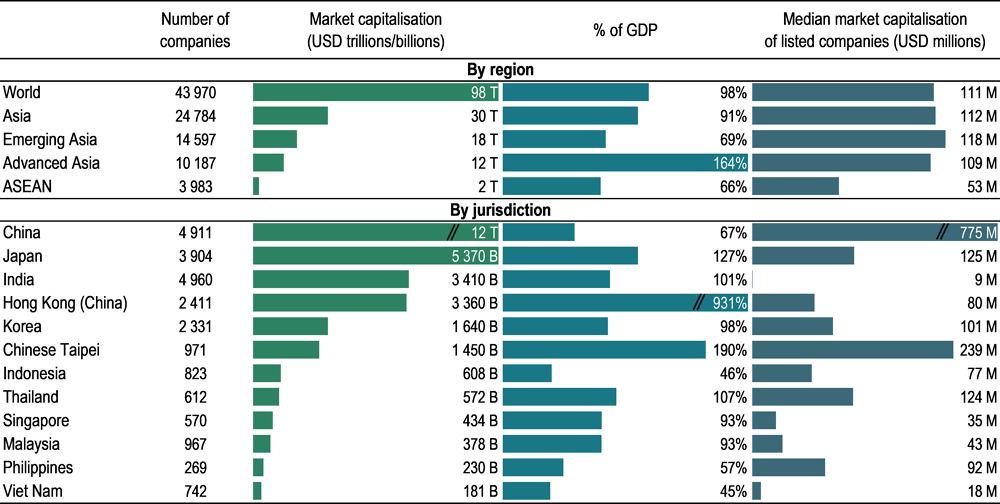

Over the past two decades, equity markets in Asia have grown significantly and now Asia is home to almost 25 000 companies with a total market capitalisation of USD 30 trillion, equivalent to 91% of its total GDP (Figure 1.1). This is to a large extent driven by the IPO activity undertaken by Asian companies. Indeed, there has been a marked increase in the participation of Asian companies in global equity markets, with their portion of global IPO proceeds rising from 22% in the 1990s to 44% during the period from 2012 to 2022. In particular, China and India rank among the top three jurisdictions globally by number of non‑financial company IPOs during the last decade, driving a significant increase in the number of listed companies in Asia.

By the end of 2022, the aggregate market capitalisation of emerging Asian equity markets stood at USD 18 trillion, made up of nearly 15 000 listed companies. Equity markets in advanced Asia hosted over 10 000 listed companies, with a total market capitalisation of USD 12 trillion. However, there are still significant differences in the relative size of equity markets in the broader economy between advanced and emerging Asia. In advanced Asia, the aggregate ratio between market capitalisation and GDP is a considerable 164%, which is particularly driven by financial hubs, such as Hong Kong (China), where the ratio is over 900%. In comparison, emerging Asia has a much lower value of market capitalisation to GDP (69%), indicating that there is still considerable untapped potential in these equity markets. The ASEAN region, despite representing a relatively small share of Asia’s market capitalisation, is home to 16% of the total number of listed companies in Asia.

At the jurisdiction level, as more companies enter the public markets, many Asian jurisdictions have seen their equity market capitalisation surpassing GDP levels. These include Japan, India, Hong Kong (China), Chinese Taipei and Thailand. In China, despite being the largest equity market in Asia (USD 12 trillion), its market capitalisation only represents 67% of GDP. This reveals considerable potential for its listed companies to contribute more to the nation’s economy. Japan ranks second after China, with almost 4 000 listed companies and a total market capitalisation of USD 5.4 trillion, representing 127% of its GDP. India is the largest market by the number of listed companies (4 960), representing 20% of the region’s total, closely followed by China with 4 911 listed companies.

Figure 1.1. Equity markets overview, end-2022

Notes: Companies listed on stock exchanges identified as over-the-counter (OTC) and multilateral trading facility (MTF) are excluded from the analysis. The sample comprises exclusively primary listings, with secondary listings being excluded. In the case of Hong Kong (China), the numbers reported by the stock exchange are higher than those reported here owing to the fact that the OECD methodology excludes secondary listings. In China, the Beijing Stock Exchange is excluded from the statistics as this exchange mainly serves innovative small and medium-sized enterprises and all identifiable growth markets are excluded from the statistics. Therefore, the number displayed here could differ from the stock exchange’s official statistics.

Source: OECD Capital Market Series dataset, LSEG Datastream, see Annex for details.

One important observation shown in Figure 1.1 relates to the size of listed companies. Listed companies in Asia have a median size of USD 112 million, corresponding in scale to their global counterparts. The only exception is the ASEAN region, where the median size of listed companies is only around half of their counterparts in Asia (USD 53 million).

At the jurisdiction level, this difference is even more pronounced. Notably, in China, listed companies have a median size of USD 775 million, over six times larger than in Japan, which has the second-highest median company size. Indeed, the median company listed in China is even larger than the median company listed in the United States.1 This has been largely driven by the strict listing requirements imposed by the Chinese Securities Regulatory Commission and stock exchanges.2 Moreover, a significant number of listed companies in China are state-owned enterprises (SOEs), which are often large companies. On the contrary, in India, the median size of listed companies is only USD 9 million, suggesting that even smaller growth companies have been able to tap into public equity markets. Within ASEAN economies, while listed companies in Thailand and the Philippines are relatively large (with a median size of USD 124 million and USD 92 million respectively), in Singapore, Malaysia and Viet Nam, the median size of listed companies falls between USD 18-43 million, a figure considerably lower than in other parts of Asia.

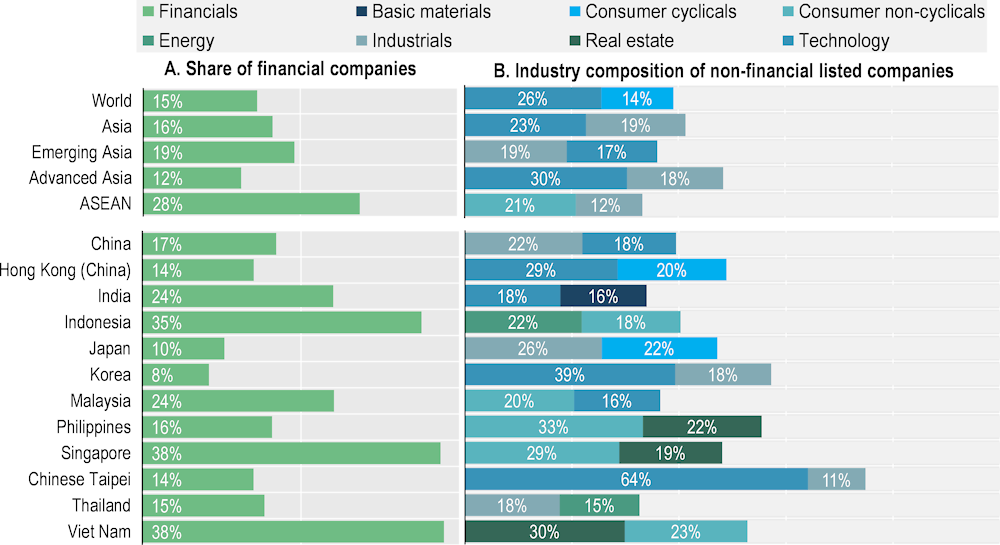

With respect to industry composition, shown in Figure 1.2, financial companies account for a significant share of market capitalisation in Asia, particularly in emerging Asia and in ASEAN economies. This is primarily driven by a strong banking sector. A detailed examination shows that in emerging Asia the banking sector makes up 67% of the financial industry, and this number is even higher in ASEAN economies (87%). In comparison, in developed Asian economies such as Japan and Korea, the banking sector accounts for a much lower share of the financial industry (55% and 48% respectively). This dominant position of the banking sector in the emerging Asia and ASEAN regions implies that banks still play a prominent role in providing financing. Indeed, in ASEAN economies such as Indonesia, the Philippines and Viet Nam, between 80% to 100% of corporate funding corresponds to bank loans (Zurich Insurance Group, 2021[1]).

When examining the industry composition excluding the financial sector, technology and industrial companies are dominant in Asia. Indeed, in advanced Asia, technology companies represent almost one‑third of total market capitalisation, followed by industrial companies (18%). In emerging Asia, the industrial sector makes up 19% of the market capitalisation, while the technology sector represents 17%. In Chinese Taipei and Korea, the technology sector accounts for as much as 64% and 39% of the market capitalisation, respectively. This is largely because both Chinese Taipei and Korea have strategically positioned themselves in the global technology supply chain as key semiconductor hubs (Financial Times, 2023[3]). For China and Japan, industrial companies make up the lion’s share, representing 22% and 26% of the domestic market capitalisation. This dominance of industrial companies in public equity markets of China and Japan is a reflection of their strong industrial sectors worldwide.

Across most ASEAN markets, the consumer non-cyclical sector stands out as the largest sector, well beyond the levels seen in other parts of Asia and globally. Specifically, in Singapore and the Philippines, companies in the consumer non-cyclical sector represent around one-third of the market capitalisation. In Indonesia, Malaysia and Thailand, the consumer non-cyclical sector also accounts for around 20% of the market capitalisation. The real estate sector also plays a major role, representing 30% of the market capitalisation in Viet Nam, and around 20% in both Singapore and the Philippines.

Figure 1.2. Industry composition of listed companies, end-2022

Note: Panel B of the figure shows for each region/jurisdiction the top two industries by market capitalisation.

Source: OECD Capital Market Series dataset, LSEG Datastream, see Annex for details.

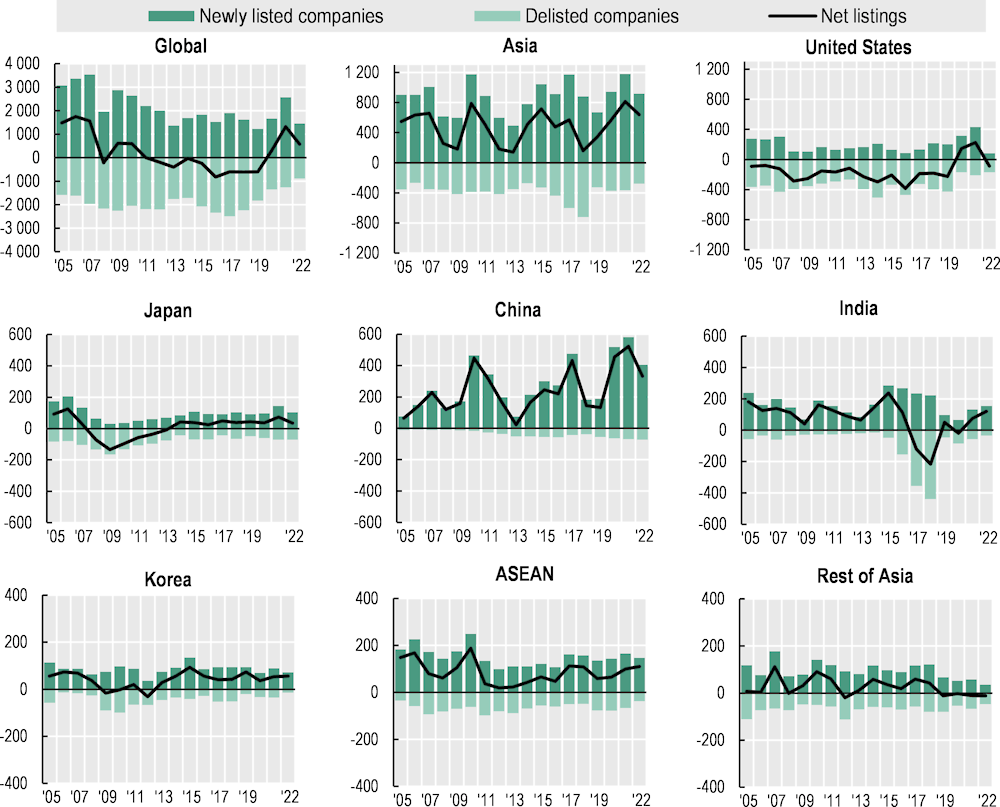

In addition to the strong IPO activity in Asian equity markets, very few companies have delisted from regional stock exchanges, leading to positive net listings for most Asian markets. Indeed, with an average of almost 900 new listings and 400 delistings per year, Asia has seen a sustained increase in the total number of listed companies each year since 2005 (Figure 1.3). This is counter to a broader global trend of net delistings, particularly in many advanced markets. In the United States, the number of delistings was larger than that of new listings in every single year between 2005 and 2019.

The listing and delisting trends also vary across Asian economies. In China, with an average of 38 delistings and nearly 277 new listings per year, there has been a pronounced growth in the number of listed companies. ASEAN economies, as well as India have shown a similar trend. The only exception for India has been during 2017 and 2018, when Indian authorities clamped down on shell companies, both listed and unlisted, for being used as conduits for illicit fund flows (The Times of India, 2018[4]). Japan, despite a period of negative net listings between 2008 and 2013, has seen a rebound in the last ten years.

Figure 1.3. Listing and delisting trends in Asia

Source: OECD Capital Market Series dataset, LSEG Datastream, see Annex for details.

1.2. Key sustainability issues in Asia

The management of sustainability-related risks and opportunities has become an increasingly important issue for economies, corporations, investors and societies at large. Several jurisdictions have made commitments to transition to a net‑zero/low‑carbon economy (see Section 4.2) and have incorporated sustainability-related requirements in their regulatory frameworks, as this report shows. Investors are also increasingly considering disclosures about how companies assess and identify material sustainability risks, notably climate change (see Section 1.3).

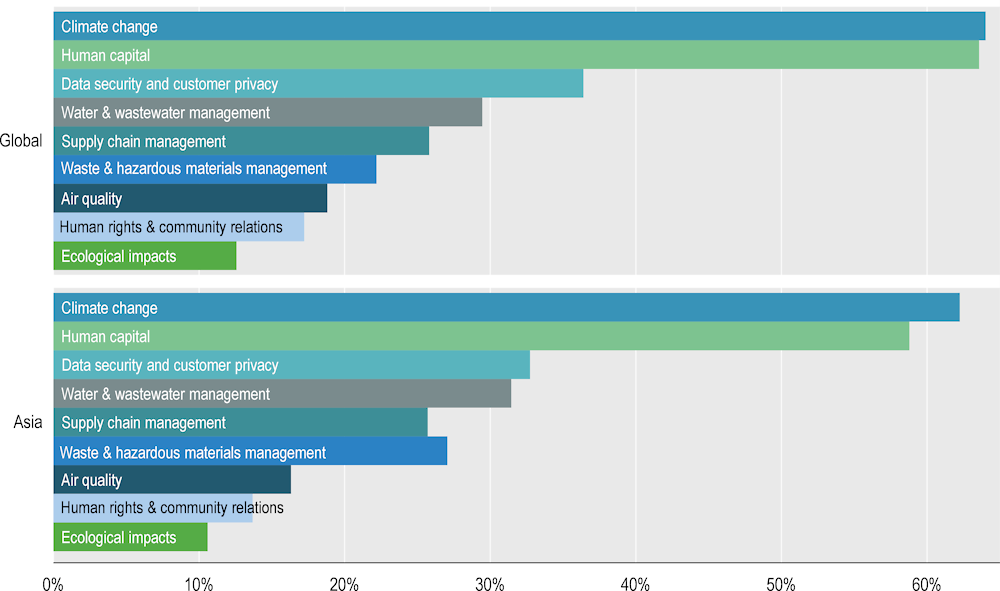

The spectrum of sustainability‑related issues is wide, ranging from climate change and greenhouse gas (GHG) emissions to human rights and community relations. The Sustainability Accounting Standards Board (SASB) sets out 26 general sustainability issues in its Materiality Map3 that are most likely to materially impact the financial condition or operating performance of companies across 77 industries. Using this Materiality Map, the SASB Sustainable Industry Classification System (SICS) Taxonomy4 (“SASB mapping”) creates a company-level dataset classifying companies according to financially material sustainability issues that they are facing. The market capitalisation of these companies provides insights with respect to the prevalence of each sustainability issue globally and in Asia. In this respect, climate change is found to be one of the most prevalent sustainability issues. Globally, by the end of 2022, companies that accounted for 64% of total market capitalisation were facing financially material climate change‑related risks (Figure 1.5). The share at risk in Asia is similar, corresponding to 62% of the region’s total market capitalisation. If unmitigated, climate change could lead to large economic losses. According to an analysis covering 48 jurisdictions representing 90% of the global economy, the cost of not taking any action to tackle the impacts of climate change could be around 18%5 of world’s GDP by 2050 (Gray and Varbanor, 2021[5]). While there are some regional and country-specific differences, Asian and ASEAN economies are expected to be impacted to a greater extent. The report finds that the GDP of Asian and ASEAN economies will contract by 26.5% and 37.4%, respectively, by 2050 due to the lack of mitigation and adaptation to the risks that climate change poses. It is important to note that the effects of climate change will differ across countries, and emerging market economies are expected to be impacted more than advanced economies. Given the importance of this issue, climate change‑related provisions in corporate governance frameworks have already been adopted by most jurisdictions globally, including in Asia (see Section 2.1).

Human capital is the second most prevalent issue both globally and in Asia. This category of sustainability risk includes employee health and safety, labour practices including compliance with labour laws and internationally accepted norms and standards, and employee diversity, inclusion and engagement. While the sustainability risk relating to human capital is a financially material risk for companies representing 63.6% of the global market capitalisation, in Asia this number is comparatively lower at 59% of the region’s market capitalisation.

Enhancing disclosure related to human capital in public company filings has already been included as a potential proposal in the US Securities Exchange Commission’s (SEC) bi-annual rule-making agenda (US SEC, 2022[6]). In 2020, the US SEC required companies to describe their human capital resources in their public filings, including if there were any relevant human capital measures or objectives that the management was considering in conducting business, to the extent that such disclosures would be material (US SEC, 2020[7]). The European Union published its Corporate Sustainability Reporting Standards Directive in 2022 (2022/2464/EU[8]). This aimed to modernise and strengthen the rules concerning the social and environmental information that was previously set out by the Directive on Non‑Financial Reporting (2014/95/EU[9]). The latest standards require large companies, as well as listed SMEs, to report on sustainability issues, including social matters and the treatment of employees (EC, 2023[10]). In Japan, the Corporate Governance Code, which was revised in 2021, requires companies to disclose details of their policies and goals to ensure management diversity (Tokyo Stock Exchange Inc., 2021[11]).

Asian companies’ exposure to sustainability risks are in line with global trends for the most part. Water and wastewater management, and Waste and hazardous materials management are notable exceptions. Asian companies that are facing financially material risks of these two issues represent 31% and 27%, respectively, of the region’s market capitalisation, while globally the figures are lower at 29% and 22%, respectively (Figure 1.4).

Figure 1.4. The share of market capitalisation exposed to selected sustainability issues by region, end-2022

Note: The figure merges some sustainability issues from the SASB mapping: “Climate Change” aggregates “Energy management”, “GHG emissions” and “Physical impacts of climate change”; “Human Capital” merges all three sustainability issues within this dimension in the SASB mapping: “Employee Health & Safety”, “Employee Engagement, Diversity & Inclusion” and “Labour Practices”; “Data Security and Customer Privacy” is the combination of “Data Security” and “Customer Privacy”. The information provided in the figure is as of end 2022.

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, SASB mapping (© 2023 IFRS Foundation. All Rights Reserved), OECD calculations. See Annex for details.

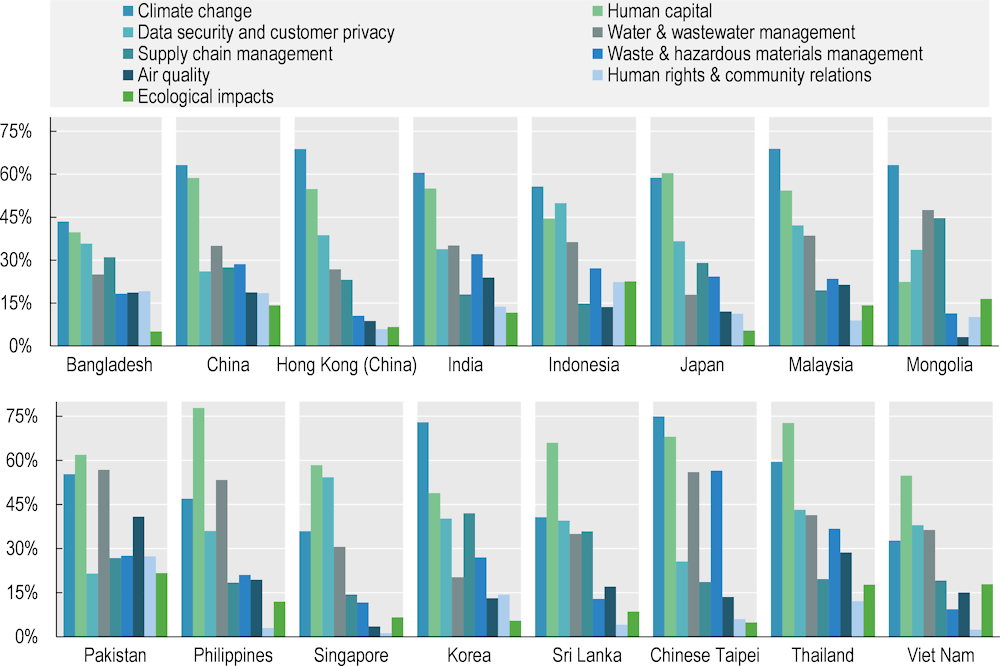

In most Asian jurisdictions, Climate change and Human capital are the two most prevalent sustainability issues facing companies by the end of 2022 (Figure 1.5). The Philippines, Thailand and Malaysia are the three jurisdictions most exposed to financially material risks related to Climate change with companies representing 78%, 73% and 69% of the total market capitalisation in each jurisdiction facing this risk. In Korea, Japan and Chinese Taipei, Human capital is the most prevalent sustainability issue faced by companies representing 75%, 73% and 60% of the total market capitalisation in each jurisdiction. In these jurisdictions, Climate change is still the second most common sustainability issue faced by companies.

The second most prevalent sustainability issue following Climate Change varies across Asian jurisdictions. For instance, in Indonesia, Singapore and Viet Nam, Data security and customer privacy is the second most common issue, whereas in Mongolia, Pakistan and the Philippines it is Water & wastewater management.

Figure 1.5. The share of market capitalisation exposed to selected sustainability issues by jurisdiction, end-2022

Note: The figure merges some sustainability issues from the SASB mapping: “Climate Change” aggregates “Energy management”, “GHG emissions” and “Physical impacts of climate change”; “Human Capital” merges all three sustainability issues within this dimension in the SASB mapping: “Employee Health & Safety”, “Employee Engagement, Diversity & Inclusion” and “Labour Practices”; “Data Security and Customer Privacy” is the combination of “Data Security” and “Customer Privacy”. The information provided in the figure is as of end 2022.

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, SASB mapping (© 2023 IFRS Foundation. All Rights Reserved), OECD calculations. See Annex for details.

Table 1.1 summarises the most exposed Asian jurisdictions to sustainability issues, ranking them by exposure by market capitalisation. Pakistan has the highest exposure by market capitalisation to three sustainability issues: Water & wastewater management; Air quality; and Human rights & community relations. For Human capital and Waste & hazardous materials management, Chinese Taipei is the most exposed Asian jurisdiction. Other sustainability risks that are the most prevalent in terms of the share of domestic market capitalisation are: Data security and customer privacy for Singapore; Supply chain management for Mongolia; and Ecological Impacts for Indonesia.

Table 1.2 provides further detail with respect to all the sustainability issues defined by the SASB Sustainable Industry Classification System Taxonomy (“SASB mapping”) and shows the relevant share of companies facing financially material risks relating to each of the sub-issues. In 9 of the 26 sub-issues, in terms of market capitalisation, the share of Asian companies facing relevant risks are higher than the share of companies globally. Overall, the sustainability risks provided in these figures and tables do not correspond to the exact market value at risk, which would require an individual assessment of each company’s financial exposure to these risks. However, the share of market capitalisation can serve as a helpful reference point for Asian policy makers when supervising and regulating their capital markets.

Table 1.1. The most exposed Asian jurisdictions to selected sustainability issues, end-2022

|

Sustainability issues |

Jurisdiction |

Share of market capitalisation – by jurisdiction |

Share of market capitalisation – Asia as a region |

|---|---|---|---|

|

Climate change |

The Philippines |

78% |

62% |

|

Human capital |

Chinese Taipei |

73% |

59% |

|

Data security and customer privacy |

Singapore |

54% |

33% |

|

Water & wastewater management |

Pakistan |

57% |

31% |

|

Waste & hazardous materials management |

Chinese Taipei |

57% |

27% |

|

Supply chain management |

Mongolia |

45% |

26% |

|

Air quality |

Pakistan |

51% |

16% |

|

Human rights & community relations |

Pakistan |

27% |

14% |

|

Ecological impacts |

Indonesia |

23% |

11% |

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, SASB mapping (© 2023 IFRS Foundation. All Rights Reserved), OECD calculations. See Annex for details.

Table 1.2. The share of market capitalisation exposed to sustainability issues, end-2022

|

Dimension |

Sustainability issues |

Share of the market capitalisation where each sustainability issue is material |

|

|---|---|---|---|

|

Global |

Asia |

||

|

Environment |

Energy management |

46% |

50% |

|

Water & wastewater management |

29% |

31% |

|

|

Waste & hazardous materials management |

22% |

27% |

|

|

GHG emissions |

26% |

26% |

|

|

Air quality |

19% |

16% |

|

|

Ecological impacts |

13% |

11% |

|

|

Social capital |

Data security |

36% |

33% |

|

Product quality & safety |

28% |

28% |

|

|

Access & affordability |

21% |

20% |

|

|

Selling practices & product labelling |

21% |

18% |

|

|

Human rights & community relations |

17% |

14% |

|

|

Customer welfare |

15% |

12% |

|

|

Customer privacy |

16% |

11% |

|

|

Human capital |

Employee health & safety |

28% |

31% |

|

Employee engagement, diversity & inclusion |

35% |

27% |

|

|

Labour practices |

11% |

11% |

|

|

Business model & innovation |

Product design & lifecycle management |

54% |

64% |

|

Materials sourcing & efficiency |

27% |

35% |

|

|

Supply chain management |

26% |

26% |

|

|

Physical impacts of climate change |

7% |

8% |

|

|

Business model resilience |

10% |

6% |

|

|

Leadership & governance |

Business ethics |

31% |

27% |

|

Systemic risk management |

20% |

21% |

|

|

Competitive behaviour |

8% |

11% |

|

|

Critical incident risk management |

13% |

10% |

|

|

Management of the legal & regulatory environment |

9% |

7% |

|

Note: Industry classification according to SASB mapping.

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, SASB mapping (© 2023 IFRS Foundation. All Rights Reserved), OECD calculations. See Annex for details.

1.3. Ownership landscape in Asia

The last few decades have seen drastic changes in the ownership landscape of equity markets around the world. There are several factors shaping the ownership structure of listed companies. The first is the rise of institutional investors. Indeed, with retail investors switching from direct investing to investing via pooled investment vehicles, there has been a re-concentration of ownership in the hands of institutional investors, in particular those following passive index strategies. The second factor is that an increasing number of state-owned enterprises have been listing on public equity markets as part of privatisation processes. However, even after listing, states often still hold significant stakes in these companies. As a result, the public sector has also become an important owner of listed companies.

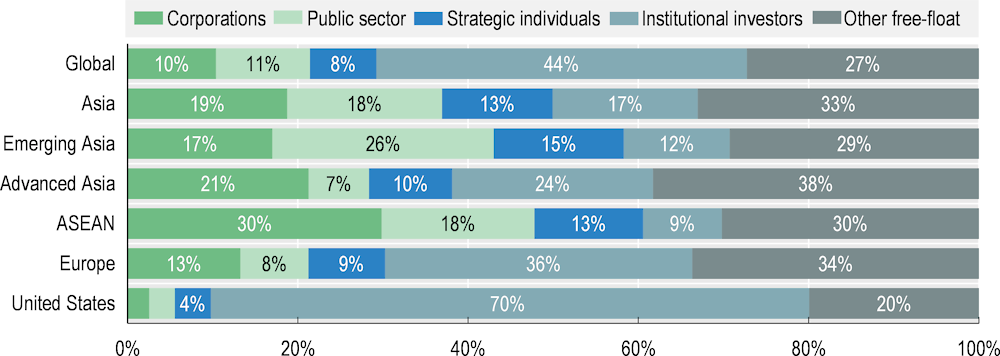

There are significant differences in ownership structures across regions and jurisdictions. Investors have been classified into five categories following previous OECD research: private corporations and holding companies (“corporations”); public sector; strategic individuals and families (“strategic individuals”); institutional investors; and other free-float including retail investors (“other free‑float”) (De La Cruz, Medina and Tang, 2019[12]). Figure 1.6 shows the ownership distribution based on this ownership classification across different regions. Globally, institutional investors are the largest investor category, holding 44% of the listed equity, followed by the public sector with 11%, private corporations with 10% and strategic individuals with 8%. The remaining 27% free-float belongs to shareholders who fall below the threshold for mandatory disclosure of ownership records, along with retail investors exempt from disclosure requirements.

In Asia, contrary to the global picture, institutional investors are not the largest investor category, holding only 17% of the listed equity. Instead, the ownership of listed Asian companies is relatively evenly distributed between corporations, the public sector and strategic individuals, with their respective holdings amounting to 19%, 18% and 13%. In advanced Asian markets, the listed equity is predominantly held by corporations and institutional investors, whereas in emerging Asian markets, the public sector and strategic individuals have a higher ownership stake in listed companies. In ASEAN economies, the dominance of company group structures is also reflected in the ownership landscape, with 30% of the total market capitalisation held by other corporations.

Figure 1.6. Investor holdings, as of end-2022

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, see Annex for details.

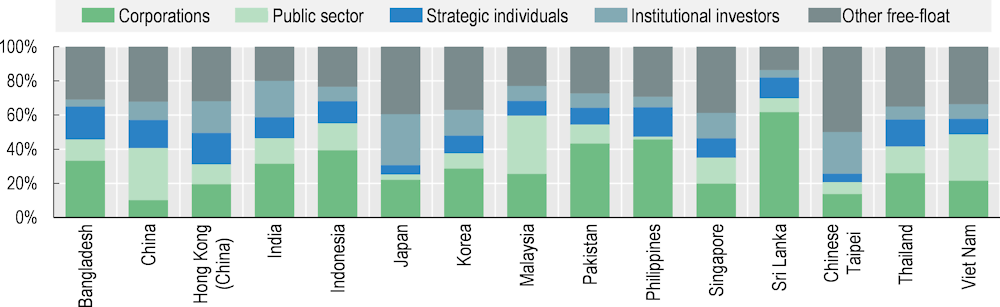

The relative importance of different categories of investors differs significantly across jurisdictions. In Japan and Chinese Taipei, institutional investors are the largest category of owners, holding 30% and 24% of the listed equity, respectively (Figure 1.7). Corporations are prominent owners in Bangladesh, India, Indonesia, Pakistan, the Philippines and Sri Lanka, where they own over one-third of the listed equity. In Korea and Malaysia, corporations are also important owners, holding 29% and 26% of the market capitalisation, respectively. In Malaysia, China and Viet Nam, over one-quarter of the listed equity is owned by the public sector.

Figure 1.7. Investor holdings in Asia, end-2022

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, see Annex for details.

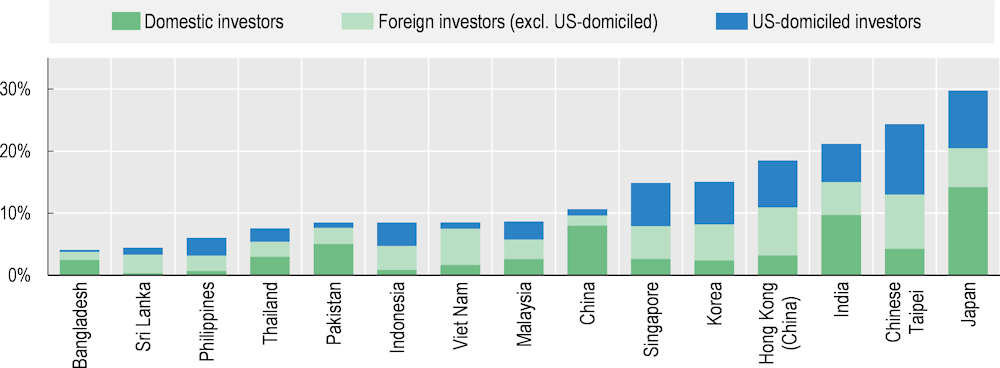

In most Asian markets, institutional investors do not play a significant role as owners as they do in the United States or Europe. However, as an increasing number of Asian listed companies are being included in major investable indices (see Section 1.4.1), it is anticipated that the ownership of institutional investors will grow further. Across most Asian jurisdictions, non-domestic institutional investors hold a larger share of the listed equity compared to domestic institutional investors (Figure 1.8). The only exceptions are Bangladesh, Pakistan and China. Importantly, US-domiciled institutional investors represent a significant share in most jurisdictions, notably in Japan and Chinese Taipei. On average, US‑domiciled institutional investors account for almost half of foreign investor holdings across Asian jurisdictions.

Figure 1.8. Domestic and non-domestic institutional investors holding, end-2022

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, see Annex for details.

The public sector owns a significant share of market capitalisation in Asia, particularly in emerging Asia. As mentioned, this is mainly a result of partial privatisation of SOEs. In many emerging Asian markets, the state has retained controlling shares even post-listing, leading to an increased number of listed companies under state control. Table 1.3 provides an overview of listed companies controlled by the public sector. Companies are classified as state-controlled when the combined public sector ownership stakes add up to 25% or higher. By the end of 2022, the global number of listed companies with states as a controlling shareholder was 1 904. Among these, 1 446 companies were listed on stock exchanges in Asia, with a total market capitalisation of USD 7.6 trillion. Importantly, these state-controlled companies are often among the largest in their respective market. In Malaysia and China, companies controlled by the public sector represent 53% and 47% of the total market capitalisation, respectively. In advanced Asian markets such as Japan and Korea, they represent a much smaller share.

Table 1.3. Listed companies in Asia under state control, as of end-2022

|

Market cap. of state‑controlled companies (USD millions) |

Number of listed companies under state control |

Average state holdings |

State-controlled listed companies (share of total market capitalisation) |

State-controlled listed companies (share of total number of companies) |

|

|---|---|---|---|---|---|

|

China |

5 588 101 |

916 |

52% |

47% |

21% |

|

Hong Kong (China) |

572 989 |

181 |

56% |

17% |

11% |

|

India |

469 945 |

106 |

67% |

14% |

7% |

|

Malaysia |

195 065 |

58 |

56% |

53% |

10% |

|

Japan |

176 072 |

10 |

39% |

3% |

0% |

|

Singapore |

156 633 |

16 |

49% |

37% |

6% |

|

Indonesia |

145 619 |

46 |

67% |

25% |

8% |

|

Thailand |

128 430 |

18 |

49% |

23% |

4% |

|

Chinese Taipei |

75 720 |

15 |

34% |

5% |

2% |

|

Viet Nam |

61 545 |

40 |

61% |

38% |

15% |

|

Korea |

49 080 |

14 |

60% |

3% |

1% |

|

Bangladesh |

5 389 |

10 |

65% |

17% |

10% |

|

Pakistan |

4 283 |

13 |

59% |

16% |

5% |

|

Sri Lanka |

302 |

2 |

65% |

5% |

5% |

|

Philippines |

254 |

1 |

38% |

0% |

1% |

Note: A company is considered state-controlled if the public sector’s combined ownership amount to 25% or greater. Note that this definition may differ from the one used in individual jurisdictions.

Source: OECD Capital Market Series dataset, FactSet, LSEG, Bloomberg, see Annex for details.

1.4. Sustainability indices and sustainable investing trends in Asia

Recent years have seen the widespread adoption of index investment strategies by institutional investors. At the same time, the volume of assets following sustainability criteria has increased significantly. These two trends have major implications for how institutional investors allocate their assets and drive sustainable investments globally.

1.4.1. Indices inclusion of companies from Asia

Index investing offers substantial benefits such as portfolio diversification and decreased management fees. However, there are also drawbacks. For instance, index investing strategies tend to direct fund flows into a restricted pool of companies, and possibly lead to diminished engagement incentives with investee companies. In recent years, an increasing number of Asian companies have been included in major investable indices, which could have an impact on their corporate governance practices, including sustainability issues.

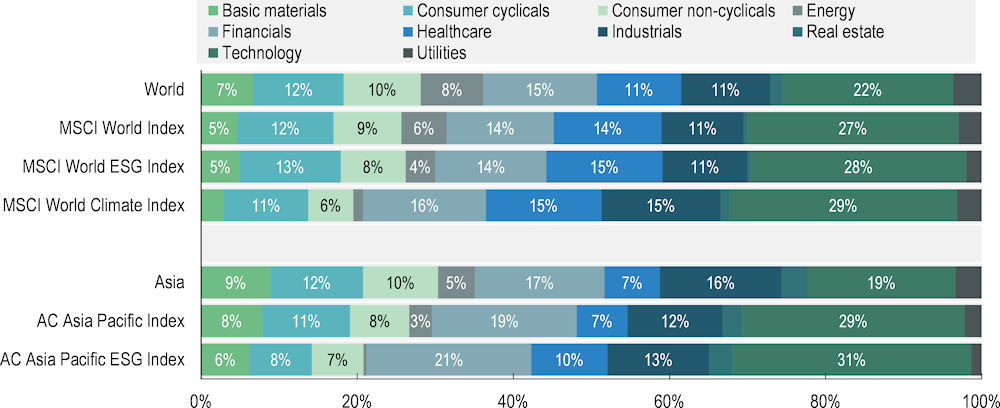

Importantly, the environmental, social and governance (ESG) indices are often heavily weighted towards certain industries, influencing the allocation of capital. Figure 1.9 illustrates that the MSCI World Index is heavily weighted towards companies operating in the healthcare and technology sectors, at the same time, it allocates a comparatively smaller portion of investments to the basic materials and energy sectors. Regarding the MSCI World ESG Index and MSCI World Climate Index, it is evident that these two indices allocate an even greater share to healthcare and technology sectors, and at the same time a reduced allocation towards the basic materials and energy sectors. Indeed, the allocation of the MSCI World Climate Index reveals that the energy sector constitutes less than 1% of its portfolio and the basic materials sector constitutes 3%, indicating a substantial deviation from its share in the parent MSCI World Index (6% and 5% respectively). Importantly, the MSCI World Climate Index also assigns a relatively higher proportion to the industrials sector compared to their representation in the parent MSCI World Index. Notably, healthcare and technology sectors have a similar representation in the MSCI World Climate Index and in the MSCI World Index.

The industry composition of major Asian indices exhibits a similar scenario. For the AC Asia Pacific ESG Index, the basic materials and energy sectors constitute a lower weight compared to their share in the parent AC Asia Pacific Index. Apart from these two industries, the consumer cyclicals and non-cyclicals sectors also appear in significantly smaller proportions within the AC Asia Pacific ESG Index. At the same time, the financial and technology sectors are assigned a considerably higher weight in the AC Asia Pacific ESG Index compared to the parent AC Asia Pacific Index and to their share in the regional market capitalisation.

Figure 1.9. Industry composition of major global and Asian indices, end-2022

Note: The information on MSCI constituents is as of March 2023, REITS and investment funds are excluded from the indices. Apart from the industry composition of major indices, the figure also shows the actual industry composition for the listed companies in the world and Asia.

Source: OECD Capital Market Series dataset, FactSet, LSEG, MSCI (2023[13]), Bloomberg, see Annex for details.

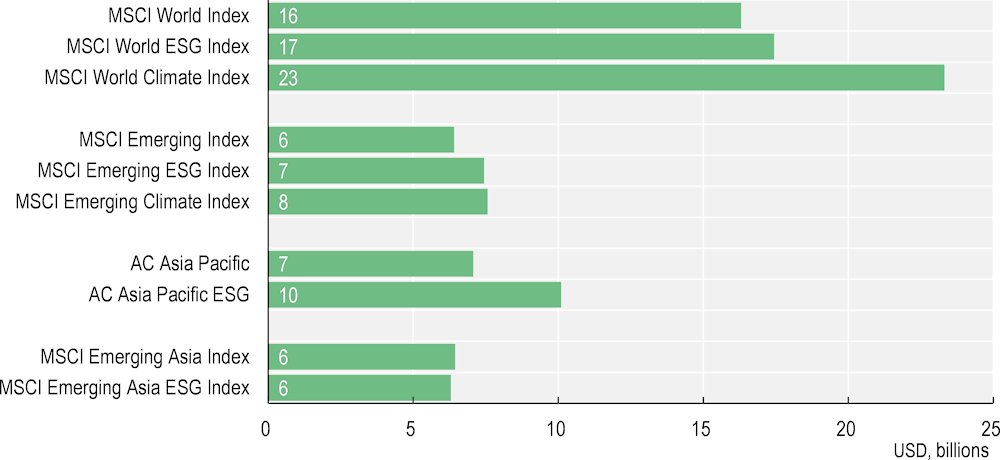

Since most indices adopt a market capitalisation-weighted approach, they have an inherent bias towards larger companies. Consequently, investors’ portfolios mirroring these indices are often heavily concentrated in fewer and larger corporations. This preference is reflected in the holdings of institutional investors. Indeed, across jurisdictions, the average holdings of institutional investors tend to be higher in large companies than in smaller ones (Medina, de la Cruz and Tang, 2022[14]). The difference in size between companies included in indices and those that are not is significant. For instance, the median market capitalisation of Asian listed companies is USD 112 million (Figure 1.1), compared to USD 7 billion for companies included in the AC Asia Pacific Index (Figure 1.10). This bias embedded in the index investing leaves smaller and growth companies off the radar of institutional investors.

Importantly, ESG and climate indices, which are constructed based on major indices with additional criteria, have an even stronger preference for larger companies. These indices often narrow down the selection to a smaller group of companies from major indices, which are already predominantly composed of larger listed firms. Figure 1.10 shows that listed companies included in MSCI World ESG and Climate indices have a median size of USD 17 billion and USD 23 billion respectively, significantly larger than median size (USD 16 billion) of companies included in the parent index (MSCI World Index). A similar pattern is observed in indices from other regions.

Figure 1.10. Median size of listed companies included in the MSCI indices, end-2022

Note: The size is calculated as the median market capitalisation of all companies in the index. The information on MSCI constituents is as of March 2023, REITS and investment funds are excluded from the indices.

Source: OECD Capital Market Series dataset, FactSet, LSEG, MSCI (2023[13]), Bloomberg, see Annex for details.

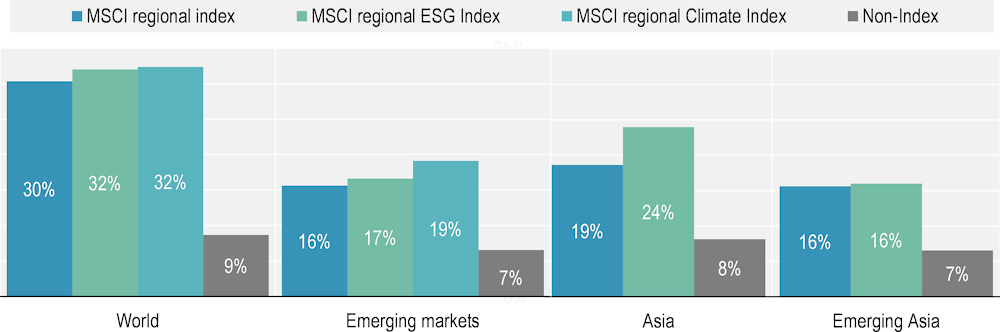

To further analyse how index strategies influence institutional investor holdings in Asian equity markets, the universe of Asian listed companies is divided into index and non-index companies. As institutional investors increasingly use indices in their investment process, it is expected that companies included in indices will have higher institutional ownership. Indeed, as shown in Figure 1.11, institutional investors own an average of 7-9% of the listed equity in non-index companies, which is much lower than that of indexed companies. For instance, Asian companies included in the MSCI World Index have an average institutional ownership of 30%, and those included in the MSCI Emerging Market Index have an average institutional ownership of 16%. Importantly, companies included in MSCI’s regional ESG and Climate indices appear to have an even higher concentration of institutional investors. Given the substantial inflow of funds into ESG- and climate-related investments in recent years, it comes as no surprise that companies included in these indices have garnered increased interest from institutional investors, leading to a rise in institutional ownership.

Figure 1.11. Institutional investor holdings in index and non-index Asian companies, end-2022

Note: The information on MSCI constituents is as of March 2023, REITS and investment funds are excluded from the indices.

Source: OECD Capital Market Series dataset, FactSet, LSEG, MSCI (2023[13]) , Bloomberg, see Annex for details.

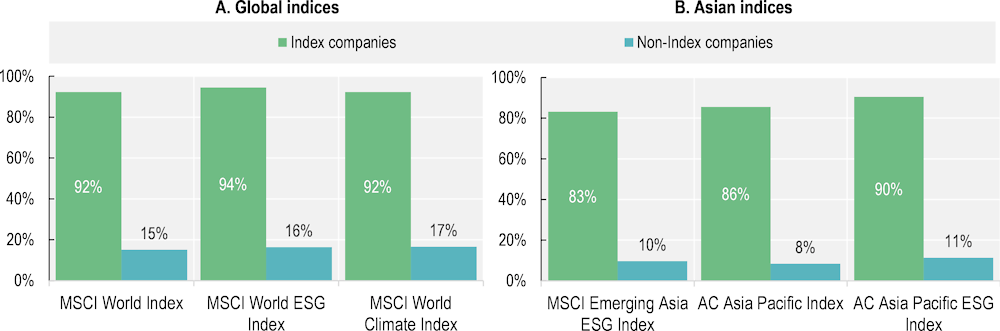

Figure 1.12 presents the share of Asian listed companies that disclose sustainability-related information, broken down by whether or not they are included in the MSCI indices. The figure shows that companies included in the major indices are more likely to disclose sustainability-related information than companies not included in the indices. For instance, among companies included in the MSCI World ESG Index, 94% of them disclose sustainability information, which is significantly higher than the share of companies disclosing sustainability-related information not included in the index. The same trend is also observed for Asian indices.

Figure 1.12. Share of listed companies disclosing sustainability information, end-2022

Note: The disclosure of sustainability-related information relates to either separate sustainability reports or integrated in annual reports. Further details are provided in Section 2.4. The information on MSCI constituents is as of March 2023. REITS and investment funds are excluded. In Panel B, companies from Australia and New Zealand are excluded from the AC Asia Pacific Indices.

Source: OECD Capital Market Series dataset, FactSet, LSEG, MSCI (2023[13]), Bloomberg, see Annex for details.

1.4.2. Sustainable investing trends

As shown in Section 1.3, in most advanced markets including advanced Asia, institutional investors have become the most important investor category. Given this importance, the asset allocation of institutional investors, including investments in sustainable assets, has implications for the economy more broadly. Institutional investors have recently been giving increased consideration to ESG risk factors through either direct engagement or several portfolio selection strategies. According to the results of a sustainable investing survey of investors conducted in 2020, globally there has been a significant increase in the size of assets under management invested under sustainable criteria (GSIA, 2020[15]). Investors from Australia, Canada, Europe, Japan, the United States and New Zealand allocated around USD 35 trillion of their assets to investment vehicles that claimed to be sustainable. At the start of 2020, these assets represented 35.9% of total assets under management, up from 33.4% in 2018.

However, survey-based approaches, commonly used to estimate sustainable investing data, carry the risk of overstating the amount of environmental, social and governance investment. This could be either due to investors being misled by labels on financial products (including so-called “greenwashing” or “sustainability-washing”) or the selected portfolios of investors not being aligned with scientific evidence.

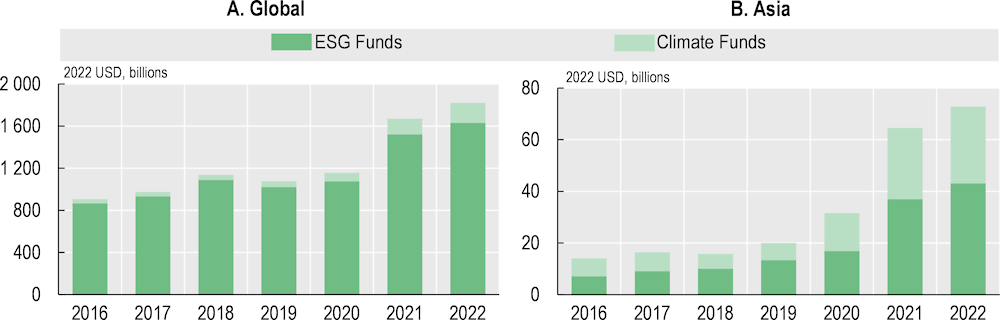

Assets under management of ESG funds that follow a sustainable investing strategy, in particular funds that label themselves as ESG or sustainable funds – for instance by including “ESG” or “sustainable investing” terms in their names globally reached USD 1.8 trillion in 2022 (Figure 1.13, Panel A). In Asia, the assets under management of such funds amounted to USD 73 billion representing 4% of the global total in 2022 (Figure 1.13, Panel B). The share of climate funds accounted for 41% of total Asian sustainability‑labelled funds in 2022, which is much higher than the share of such funds globally, at 10%.

Figure 1.13. Assets under management of funds labelled as or focusing on ESG and climate

Note: The information was retrieved from LSEG Funds Screener. Funds classified as Climate Funds or ESG Funds are those containing in their names, respectively, climate or ESG relevant acronyms and words such as ESG, sustainable, responsible, ethical, green and climate (and their translation in other languages). Funds without any asset value are excluded.

Source: OECD Corporate Sustainability dataset, LSEG, See Annex for details.

1.5. Trends in sustainable bonds financing

Green, social, sustainability and sustainability-linked bonds is an umbrella term for debt instruments that include environmental and/or social aspects (hereafter “sustainable bonds”). They can be classified into four main categories. Green bonds are instruments for which the proceeds are earmarked for environmental projects or activities, such as climate change mitigation and adaptation. Similarly, proceeds from social bonds are allocated to projects with the purpose of achieving positive social outcomes, such as food security or affordable housing. Sustainability bonds are used to finance a combination of environmental and social projects. Finally, sustainability-linked bonds are instruments for which a sustainability indicator of some sort is structurally embedded in the contract, linking the coupon payment to the issuer’s progress (or lack thereof) with respect to that indicator. Contrary to the first three categories, sustainability-linked bonds are not “use of proceeds bonds”, meaning the proceeds are not necessarily earmarked for a social or environmental purpose. Rather, they serve to tie an issuer’s broader sustainability commitments to its financing costs (OECD, 2023[16]).

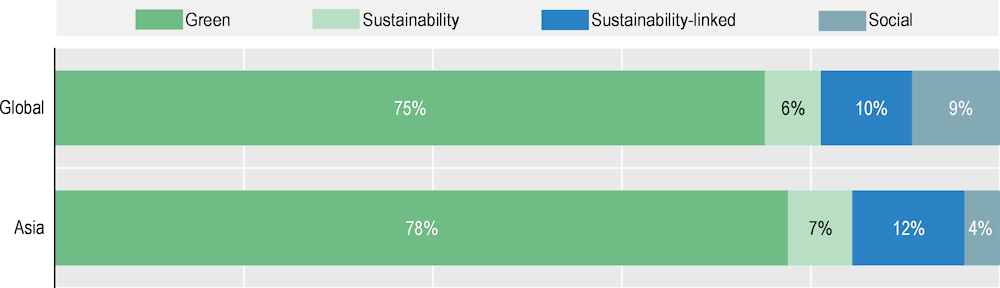

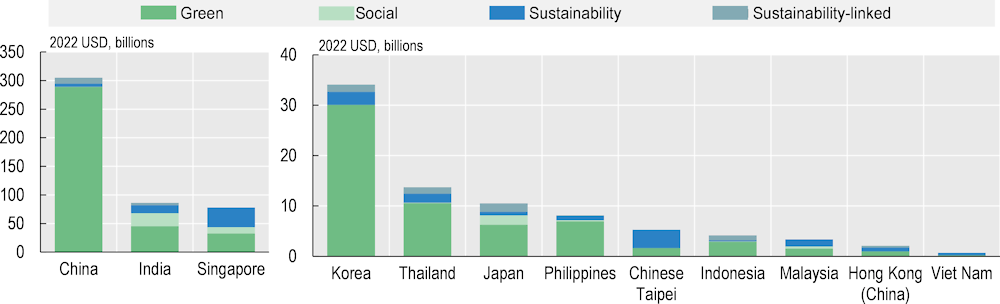

Green bonds are by far the dominant category of sustainable bonds, both globally and in Asia, representing roughly three quarters of total proceeds. Social bonds are less common in Asia, representing 4% of total proceeds compared to 9% globally. Contrarily, sustainability-linked bonds are somewhat more prevalent in the region, making up 12% of total proceeds compared to 10% globally (Figure 1.14).

Figure 1.14. Distribution of sustainable corporate bonds by category, 2013-2022

Note: Sustainable corporate bonds by both financial and non-financial companies are included in the figure.

Source: OECD Corporate Sustainability dataset, LSEG, Bloomberg. See Annex for details.

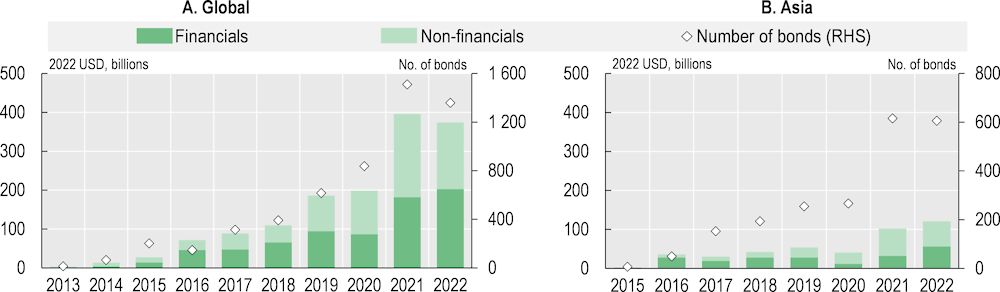

Figure 1.15 illustrates the substantial growth in green bond issuance over the past decade. Since 2013, green bond issuance has grown at a compound annual rate of 68%, far outpacing the growth in general corporate bond issuance. Global green bond issuance reached USD 374 billion in 2022, roughly a third (USD 121 billion) of which was issued by Asian companies. The split between financial and non-financial companies is roughly equal in both regions. While still small relative to the broader corporate bond market, the extraordinary growth rate means sustainable bonds now represent a non-negligible share of total global corporate bond issuance, 8% globally and 6% in Asia (up from 0.6% and 0.2%, respectively, in 2015). Notably, green bond issuance fell much less (5%) in 2022 than total corporate bond issuance (25%).

Figure 1.15. Green corporate bond issuance

Source: OECD Corporate Sustainability dataset, LSEG, Bloomberg. See Annex for details.

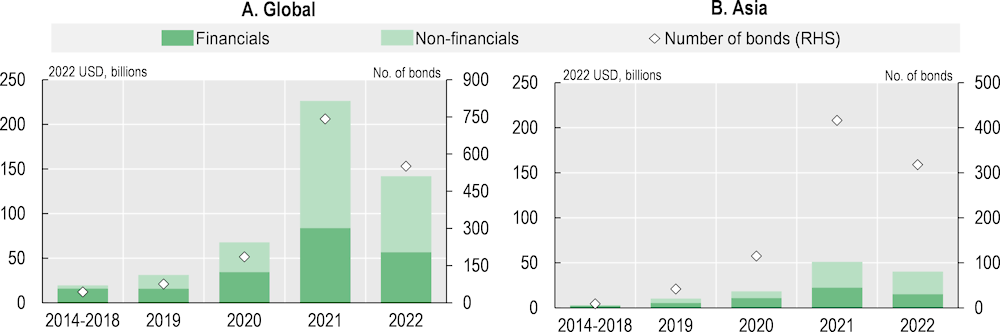

The issuance of social, sustainability and sustainability-linked (SSS) bonds has also grown significantly, reaching USD 141 billion globally in 2022, USD 40 billion of which was issued by Asian companies (a slightly smaller share than for green bonds). Unlike green bond issuance, which remained strong despite tightening financial conditions in 2022, SSS bond issuance globally fell by 37% between 2021 and 2022. The decrease was smaller in Asia at 21%. When it comes to SSS bonds, non-financial companies represent a slightly larger share than financial companies, both in Asia and globally (Figure 1.16).

Figure 1.16. Social, sustainability and sustainability-linked corporate bond issuance

Source: OECD Corporate Sustainability dataset, LSEG, Bloomberg. See Annex for details.

As shown in Figure 1.17, the Asian sustainable corporate bond market is dominated by three jurisdictions: China, India and Singapore. China is by far the largest, with total issuance of USD 305 billion between 2013 and 2022, representing 55% of the total in Asia. This is lower than the Chinese share in Asian corporate bond markets more broadly, which was 65% during the same period. Green bonds were 95% of Chinese sustainable bond issuance. In India, where total issuance amounted to USD 86 billion, SSS bonds are relatively more prevalent, together representing almost half of sustainable bond issuance. Notably, social bonds are common in India, accounting for over a quarter (27%) of total sustainable bond issuance, by far the highest share in Asia, where the average is 6%. India represents 16% of total sustainable bond issuance in Asia over the past decade, which is significantly higher than its share in all corporate bond issuance (4%). The same is true for Singapore, which represents 14% of Asian sustainable bond issuance, but only 2% of general corporate bond issuance. In Singapore, sustainability bonds are the most common category, representing 44% of total issuance. This category is also dominant in Chinese Taipei (69%), Viet Nam (68%), Malaysia (42%) and Hong Kong (China) (35%).

Figure 1.17. Sustainable corporate bonds issuance by jurisdiction, 2013-2022

Note: Sustainable corporate bonds by both financial and non-financial companies are included in the figure. Sustainable bond data does not include relevant information for Bangladesh, Cambodia, Lao PDR, Mongolia, Pakistan and Sri Lanka.

Source: OECD Corporate Sustainability dataset, LSEG, Bloomberg. See Annex for details.

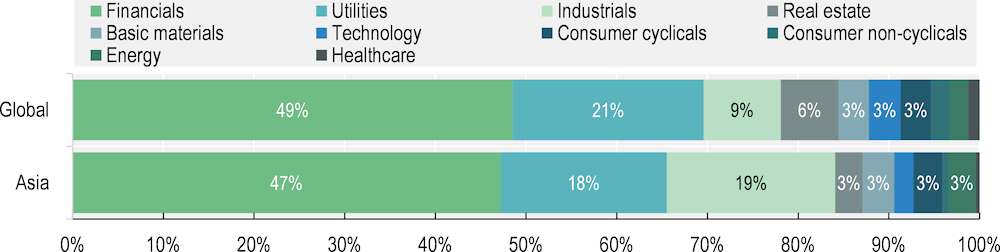

Figure 1.18 breaks down issuance by industry, globally and in Asia. For both, the financial sector represents just below half of total issuance. This is slightly lower, but similar, to the sector’s share in all corporate bond issuance. The financial, utilities and industrials sectors together represent over three‑quarters of sustainable issuance globally and as much as 84% in Asia in the past decade. The industry distribution of sustainable bond issuance is similar globally and in Asia, with two notable exceptions: the industrials sector’s share is twice as large in Asia compared to globally (19% and 9%, respectively), whereas the reverse is true for the real estate sector (3% and 6%, respectively).

Figure 1.18. Sustainable bonds issuance by industry, 2013-2022

Note: Sustainable corporate bonds by both financial and non-financial companies are included in the figure.

Source: OECD Corporate Sustainability dataset, LSEG, Bloomberg. See Annex for details.

References

[8] 2014/95/EU (2014), Disclosure of Non-financial and Diversity Information by Certain Large Undertakings and Groups Directive, European Parliament and Council, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014L0095.

[7] 2022/2464/EU (2022), Corporate Sustainability Reporting Directive, European Parliament and Council, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464.

[11] De La Cruz, A., A. Medina and Y. Tang (2019), “Owners of the World’s Listed Companies”, OECD Capital Market Series, Paris, http://www.oecd.org/corporate/Owners-of-the-Worlds-.

[9] EC (2023), Corporate sustainability reporting, https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en (accessed on June 2023).

[2] Financial Times (2023), Taiwan and South Korea to remain key chip hubs, says MKS chief, https://www.ft.com/content/33702630-41ea-4c60-b186-aa4212729638.

[4] Gray, C. and L. Varbanor (2021), The Economics of Climate Change: Impacts for Asia, https://www.swissre.com/risk-knowledge/mitigating-climate-risk/economics-of-climate-change-impacts-for-asia.html (accessed on June 2023).

[14] GSIA (2020), Global Sustainable Investment Review 2020, https://www.gsi-alliance.org/.

[13] Medina, A., A. de la Cruz and Y. Tang (2022), “Corporate ownership and concentration”, OECD Corporate Governance Working Papers, No. 27, OECD Publishing, Paris, https://doi.org/10.1787/bc3adca3-en.

[12] MSCI (2023), Equity Index Constituents, https://www.msci.com/constituents (accessed on May 2023).

[15] OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en.

[3] The Times of India (2018), Over 1 lakh shell companies deregistered this fiscal: Govern .., https://timesofindia.indiatimes.com/business/india-business/over-1-lakh-shell-companies-deregistered-this-fiscal-government/articleshow/67285309.cms.

[10] Tokyo Stock Exchange Inc. (2021), Japan’s Corporate Governance Code, https://www.jpx.co.jp/english/news/1020/b5b4pj0000046kxj-att/b5b4pj0000046l07.pdf.

[5] US SEC (2022), SEC Announces Spring 2022 Regulatory Agenda, https://www.sec.gov/news/press-release/2022-112 (accessed on June 2023).

[6] US SEC (2020), SEC Adopts Rule Amendments to Modernize Disclosures of Business, Legal Proceedings, and Risk Factors Under Regulation S-K, https://www.sec.gov/news/press-release/2020-192 (accessed on June 2023).

[1] Zurich Insurance Group (2021), ASEAN: The resilience of banks, https://www.zurich.com/-/media/project/zurich/dotcom/economics-and-markets/docs/2021/topical-thoughts/asean-the-resilience-of-banks.pdf?rev=25c750cf3d5e4db3a8ca156091dea45a&hash=3E7E588659AF2862075BAF77D2ACC209.

Notes

← 1. However, the average market capitalisation of US listed companies is higher than the average market capitalisation of listed companies in China.

← 2. For instance, companies need to meet one of the following requirements to be listed on the Shenzhen Stock Exchange, http://docs.static.szse.cn/www/index/listing/rule/W020230217557163411686.pdf.

(i) Net profit for the last three years is positive. The accumulated net profit for the last three years is no less than RMB 150 million (c. USD 21 million) and the net profit for the last year is not less than RMB 60 million (c. USD 8 million). Net cash flows from operating activities for the last three years are no less than RMB 100 million (c. USD 14 million) or operating income is not less than RMB 1 billion (c. USD 140 million).

(ii) Estimated market capitalisation is not less than RMB 5 billion (c. USD 700 million). Positive previous year’s net profits, the operating income of the latest year is not less than RMB 600 million (c. USD 84 million), and the cumulative cash flows from operating activities of the last three years are not less than RMB 100 million (c. USD 14 million).

(iii) Estimated market capitalisation is not less than RMB 8 billion (c. USD 1.1 billion), with positive net profits for the most recent year and operating income of not less than RMB 800 million (c. USD 111 million) for the most recent year.

← 3. © 2023 IFRS Foundation. All Rights Reserved.

← 4. Ibid 3.

← 5. According to the scenario where global temperature increases are 3.2°C above the pre-industrial average by 2050, compared to the Paris Agreement target of 1.5°C.