This Chapter provides background information on macroeconomic conditions up until the end of 2022. Tax policy developments are closely connected with economic trends: tax revenues are affected by changes in macroeconomic conditions and economic developments are important factors behind tax reforms. This Chapter covers recent trends in growth, inflation, productivity, investment, the labour market, and public finances.

Tax Policy Reforms 2023

1. Macroeconomic background

Abstract

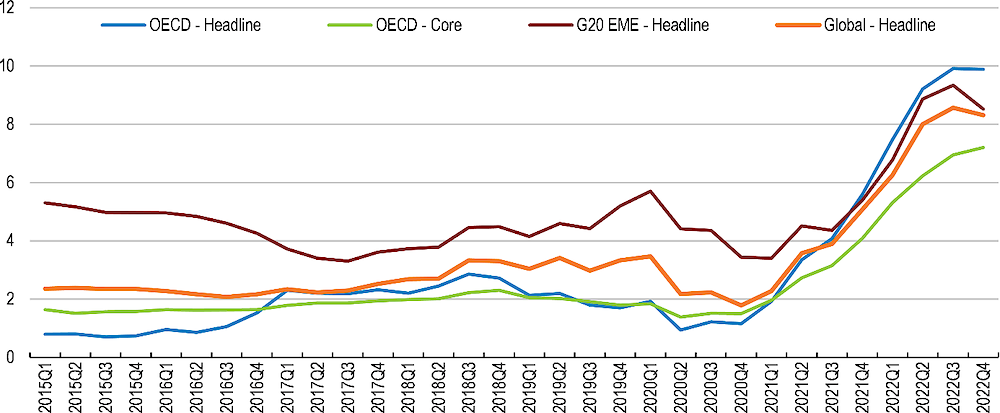

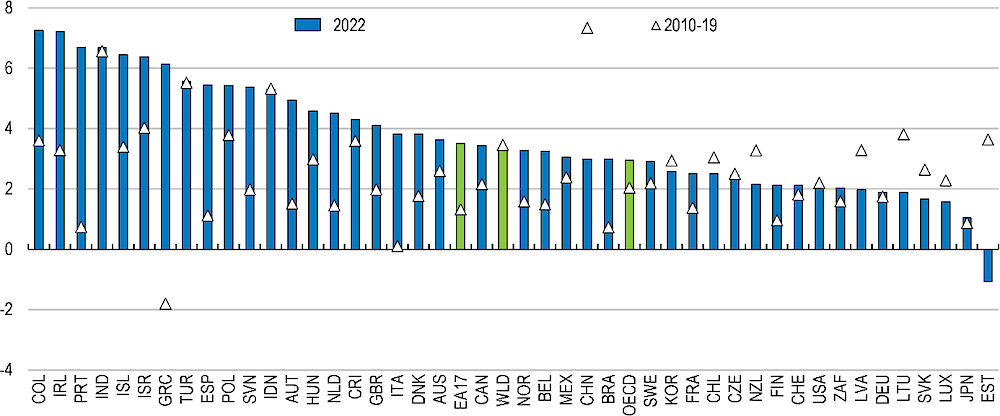

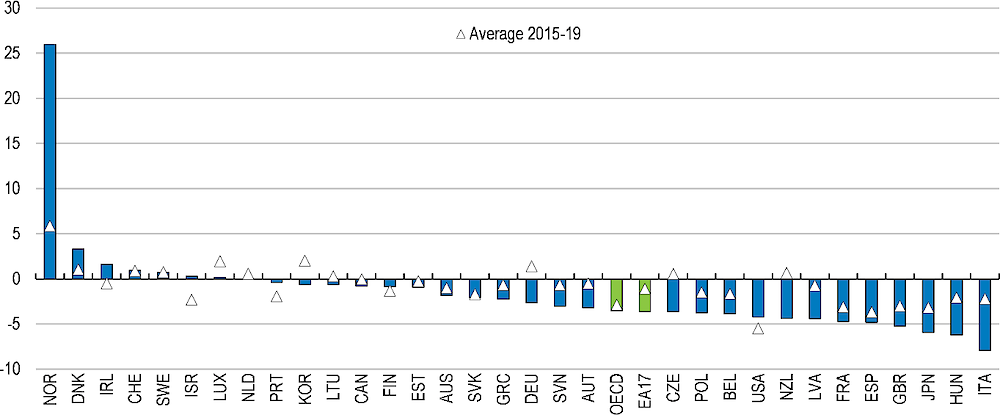

Global GDP growth reached 3.2% in 2022, a year marked by the Russia’s large-scale aggression against Ukraine (Figure 1.1). This was marginally below the average growth rate in the decade after the global financial crisis, but a sharp slowdown from 2021. Global growth for 2022 was also 1.3 percentage points (p.p.) weaker than projected at the end of 2021, reflecting the effects of the war in Ukraine, the drag on household incomes from high inflation, rising interest rates and slower growth in China (OECD, 2023[1]).

The war in Ukraine directly impacted commodities markets (especially energy and food) and added to the supply chain disruptions that had emerged when economies reopened after COVID-19 lockdowns. Weak real income growth resulting from the surge of inflation, together with a collapse of confidence indicators and concerns about potential energy and food shortages, held back consumers’ expenditures and increasingly weighed on activity during 2022. Energy expenditure in OECD economies is estimated to have increased by nearly 8 p.p. of GDP in 2022, similar to the evolution in 1974, a year of energy-related recession (OECD, 2022[2]).

Some economies performed relatively well in 2022, experiencing a rebound as they recovered from the effects of the pandemic, notably in services (Figure 1.1). These economies included Colombia, Greece, Hungary, Iceland, Ireland, Italy, the Netherlands, Portugal, Slovenia, and Spain, as well as the euro area as a whole. However, many countries in Central and Eastern Europe, including the Baltic States, were clearly more affected by the war.

Global growth slowed through the course of 2022, from 4.3% in the first quarter of 2022 (year-on-year) to 2.3% in the fourth quarter. This slowing was evident in macroeconomic outcomes in the fourth quarter of 2022 – output stagnated in Japan, activity in China moderated, and in Europe, there were strong adverse effects from extremely high energy prices. The United States was an exception, with continued labour market resilience outweighing the impact of higher interest rates on investment (OECD, 2023[1]).

Figure 1.1. Real GDP growth

Note: Aggregates are using weights in purchasing power parities except the euro area (EA17) using weights in local currency. Growth in Ireland was computed using gross value added at constant prices excluding foreign-owned multinational enterprise dominated sectors.

Source: OECD Economic Outlook 113 database; and OECD calculations.

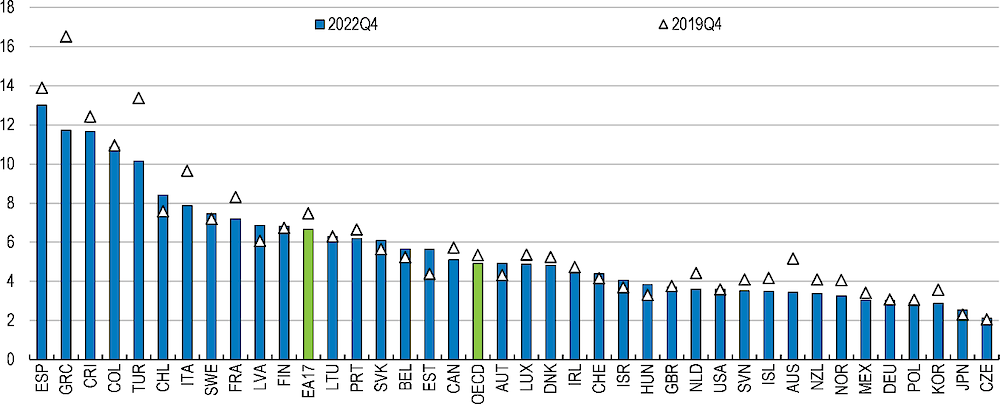

Headline and core inflation continued to increase sharply in 2022, reaching 9.9% and 7.2% respectively for the OECD as a whole in the fourth quarter of 2022 (Figure 1.2). Inflation for the emerging-market economies in the G20 also strengthened to 8.5% in Q4 of 2022.

Inflation pressures had already begun to rise before Russia’s large-scale aggression against Ukraine, with contributions from both demand- and supply-side factors resulting mostly from the reopening of economies after pandemic-related lockdowns (OECD, 2022[2]). Some of the factors pushing up inflation subsequently subsided during 2022, including shipping costs and a surge in durable goods demand, but the economic consequences of the war in Ukraine, notably the rise of key commodity prices, especially energy, had a significant impact on inflation levels. This affected most countries, but particularly those in Central and Eastern Europe. Natural gas prices in European wholesale markets were about seven times higher in 2022 compared to the 2015-19 average.

While energy and food products drove the initial increase in headline inflation, core inflation, which excludes those products, also rose to a level not seen for several decades (Figure 1.2). Inflation became much more broad-based in 2022 – services inflation trended up while goods inflation started to recede from very high levels (OECD, 2023[1]). By the end of 2022, 60% per cent or more of the items in consumer price baskets had annual inflation rates above 4% in the United States, the euro area and the United Kingdom.

Figure 1.2. Inflation rates

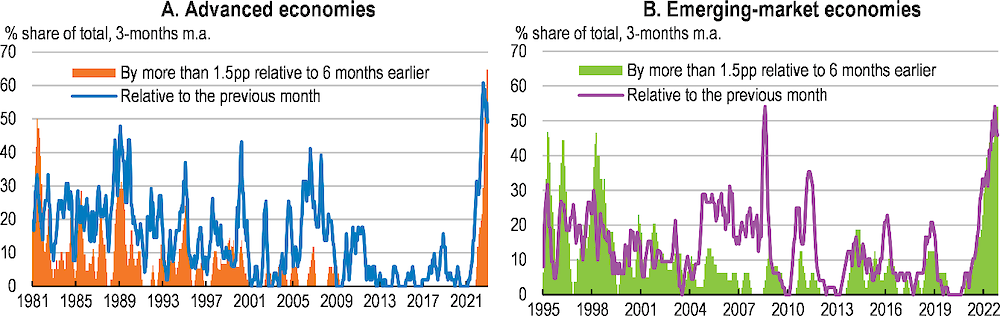

The surge in inflation provoked quick and synchronised monetary policy tightening from early 2022 (Figure 1.3). This monetary policy tightening was aimed at ensuring inflation expectations remained well anchored and headline inflation returns to target. By the end of 2022 there were early signs that tighter policy was beginning to take effect, with housing investment and prices declining in some countries, bank lending rates rising, and bank credit standards being tightened in the largest economies.

Figure 1.3. Monetary policy tightening was fast and highly synchronised

Note: The sample consists of 35 advanced economies and 16 emerging-market economies. All members of the OECD except Costa Rica are

included in the sample. The sample composition changes over time according to data availability.

Source: Bank for International Settlements; and OECD calculations.

Despite an uptick in the final quarter of 2022, the OECD unemployment rate remained low at the end of the year. At slightly below 4.9% of the labour force, this is the lowest rate (except for Q3 of 2022) since the 1980s (Figure 1.4). The fall in the unemployment rate compared to before the pandemic was especially strong in Australia, Greece, Italy, and Türkiye. Exceptions to this decline were notable in many Central and Eastern European countries more directly affected by the war, as well as Austria, Belgium, Chile, and Israel.

Low unemployment, high vacancy rates and high inflation put upward pressure on nominal wage growth. However, nominal wage growth did not keep pace with inflation, resulting in a sharp erosion of wages and household incomes in real terms in many OECD economies in 2022 (OECD, 2023[3]). For the OECD as a whole, real gross household disposable income per capita fell by 2.3% in 2022. Despite this, household consumption held up through 2022, rising by 4.3% in the OECD as a whole, with households lowering saving rates to offset the weakness in income growth (OECD, 2023[1]).

Government expenditures soared during the pandemic, reflecting a strong and swift fiscal response. With revenues declining, borrowing and public debt rose sharply. Deficits shrunk during 2022, helped in part by the impact of higher inflation on revenue growth, and by the end of the year were close to the pre-crisis average for the OECD as a whole, down from 10.2% of GDP in 2020, 7.5% of GDP in 2021, and 3.6% of GDP in 2022 (Figure 1.5). The deficit remained relatively large in Japan and several European economies, however. During 2022, many countries introduced new policy measures, or extended the duration and generosity of existing policies, such as subsidies, to cushion the impact of higher food and energy prices on households and businesses. Support to energy consumers was about 0.8% of GDP in the median OECD economy in 2022 but above 2% of GDP in several countries, especially in Europe (OECD, 2023[1]). Policy support has been predominantly untargeted, raising its cost and limiting incentives to lower energy consumption.

Figure 1.4. Unemployment rates in OECD countries

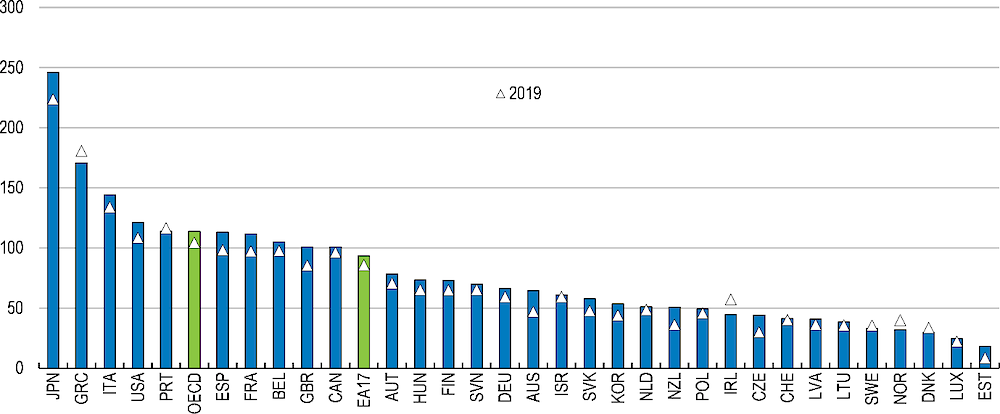

Government debt increased in many countries relative to pre-pandemic levels, reaching 113.8% of GDP on average across the OECD in 2022 (Figure 1.6). Ensuring the sustainability of the public finances has become more challenging due to the multiple impacts of the pandemic, the war and energy shocks. Interest rate increases implemented in 2022 may have caused government debt service burdens in some countries to rise as existing low-cost debt matures, adding to fiscal pressures.

Figure 1.5. Budget balance

Note: 2022 data for Israel, Japan, Korea, New Zealand, and Switzerland are estimates.

Source: OECD Economic Outlook 113 database.

Figure 1.6. General government gross debt

Note: Maastricht definition for EU member countries. 2022 data for Israel, Japan, and Korea are estimates.

Source: OECD Economic Outlook 113 database.

References

[1] OECD (2023), OECD Economic Outlook, Interim Report March 2023: A Fragile Recovery, OECD Publishing, Paris, https://doi.org/10.1787/d14d49eb-en.

[3] OECD (2023), Statistics News Release - OECD GDP Growth, https://www.oecd.org/sdd/na/GDP-Growth-Q422.pdf.

[2] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/f6da2159-en.