This chapter examines the composition and trends of Fiji’s ocean economy prior to the COVID-19 crisis in the context of its overall economic development, including the importance of tourism, inshore and offshore fisheries, and maritime transport and ports. The chapter identifies key challenges from climate change and other increasing pressures on ocean and coastal resources, which threaten the benefits that can be drawn by ocean economy sectors.

Towards a Blue Recovery in Fiji

2. The ocean economy of Fiji before COVID-19: Economic trends and sustainability stressors

Abstract

2.1. Fiji stands to benefit from fulfilling its ambitions regarding a sustainable ocean economy

Fiji is a small island developing state (SIDS) located in the heart of the Pacific Ocean. Its total land area, composed of 332 islands, totals 18 274 km². This land area compares to over 1 290 000 km² of national waters, which represent Exclusive Economic Zones (EEZs). The country’s population of approximately 884 887 resides primarily on the 2 largest of the 110 inhabited islands, Viti Levu and Vanua Levu. The country also has a significant diaspora, largely to Australia, New Zealand, Canada and the United States (IOM, 2020[1]).

As an island nation surrounded by the ocean, Fiji’s culture, traditions, values and customs are intimately linked to marine ecosystems, which have sustained life since time immemorial (Republic of Fiji, 2021[2]). In 2020, the country launched a National Ocean Policy to enhance management of its ocean resources and sustain the livelihoods and aspirations of current and future generations of Fijians. The policy states that “Fiji will not pursue a short-sighted exploitation of ocean ecosystems at the expense of bigger, bluer opportunities of a sustainable ocean economy.” (Republic of Fiji, 2021[2]). It commits the country to sustainably manage 100% of its ocean and designate 30% of its waters as marine protected areas (MPAs) by 2030.

On the international stage, too, Fiji has demonstrated leadership regarding the conservation and sustainable use of the ocean. Fiji was the first country to sign and ratify the United Nations Convention on the Law of the Sea, the Kyoto Protocol and the Paris Agreement. Fiji co-chaired with Sweden the first ever United Nations Ocean Conference to Support the Implementation of Sustainable Development Goal 14, the “Ocean” goal. It also held the presidency of the 23rd Conference of Parties under the United Nations Framework Convention on Climate Change (UNFCCC) in 2017. In this context, Fiji has championed inclusion of the ocean agenda within the UNFCCC process through initiatives such as the Ocean Pathway Partnership. Fiji is also one of the 16 members of the High Level Panel for a Sustainable Ocean Economy, an initiative building momentum for a sustainable ocean economy in which effective protection, sustainable production and equitable prosperity go hand in hand.

Transitioning to a sustainable ocean economy holds the potential to generate sustainable economic opportunities, employment and innovation, and to fuel the recovery in Fiji. Transitioning to a sustainable ocean economy means pursuing a coherent unified vision of ocean management. In such a vision, the complexity of inter-sectoral relations is understood; environmental, social and economic values are integrated; and adequate resources are mobilised across sectors. Focusing only on economic growth, and “greening” later, would be more costly than taking immediate steps towards a bluer, more resilient and inclusive economy. Delaying the “blue path” would entail sharper subsequent corrective measures and higher risk of irreversible environmental damage, high-carbon lock-in and stranded assets. These, in turn, would be exacerbated by adverse distributional impacts. A sustainable ocean economy provides an opportunity to focus on all three dimensions of sustainability – environmental, social and economic. It will mean correcting unsustainable trends in existing sectors. Finally, it will entail developing new sectors and industries by assessing and balancing risks and rewards and integrating community interests and environmental concerns into decision making from the outset. Whether it is offshore wind energy, growing aquaculture or marine biotechnologies, the ocean offers new opportunities to create more diversified, sustainable and resilient economies. This is particularly important for Fiji. Its economy has recorded remarkable growth in the last two decades, but it has remained most reliant on the tourism sector. Consequently, it has remained particularly exposed to shocks in this sector, as well as to increasing environmental degradation and climate change impacts.

2.2. Fiji’s ocean economy in the context of its overall economic development

Fiji is an upper middle-income country and the second largest economy among Pacific small island developing states (Pacific SIDS) after Papua New Guinea. In 2020, Fiji’s national income per capita stood at USD 5 057.6 (World Bank, 2020[3]).Compared to other Pacific SIDS, Fiji is less remote and has long operated as a regional hub for maritime transportation, which has allowed for relatively more economic development. According to the Human Development Index, Fiji ranks 98 among 188 countries, slightly above most other Pacific SIDS (with a value of 0.74 vs. an average of 0.67 for the others).

Despite comparing relatively well to other Pacific SIDS, Fiji still faces large development challenges. Fiji is a developing economy with large pockets of poverty and a large subsistence agriculture sector. Its development trajectory has suffered from both natural and political shocks. Poverty remains significant, with a national incidence of 30% in 2019 (ADB, 2019[4]). Although the incidence of poverty has declined over time, reductions were mainly concentrated in urban areas, declining from 28% in 2002-2003 to 19%; in 2008-2009, rural areas recorded increased incidence of poverty from 40% in 2002-2003 to 43% in 2008-2009 (ADB, 2018[5]). In addition, agriculture remains the main source of livelihood for almost half of Fijians in rural areas, although its contribution to gross domestic product (GDP) only reached 8% prior to COVID-19 (World Bank Group, 2020[6]).

Challenges remain for Fiji to meet the Sustainable Development Goals (SDGs). Fiji ranks 62 in the overall SDG achievement of the 193 UN state members (Sachs et al., 2021[7]). It has met only 1 of the 17 SDGs, namely SDG 4 on the quality of education. Significant progress has been made towards SDG 3 (Good Health and Well-being) and two targets have been achieved: reducing global maternal mortality and ending preventable deaths of newborns and children under five (3.1 and 3.2). In addition, by 2020, Fiji had successfully integrated climate change measures into national policies, strategies and planning (13.2). Despite this progress, Fiji faces challenges, significant challenges or major challenges to meet 15 of the 17 SDGs (Figure 2.1 ).

Figure 2.1. SDG achievement in Fiji

Source: Sachs et al., (2021[7]), Sustainable Development Report 2021, https://www.sdgindex.org/reports/sustainable-development-report-2021/.

In the past two decades, Fiji has experienced sustained economic growth, but its small and undiversified economy remains highly exposed to shocks. Driven mainly by tourism, the Fijian economy has grown at an average of 3.3% a year between 2010 and 2014 and by 3.8% in 2018 alone. However, volatility marks Fiji’s economic trajectory owing to low diversification. This makes the country susceptible to external shocks. It also depends strongly on imports, which in 2018 represented 55% of GDP, with fuel imports weighting heavily on Fiji’s import bill.

Fiji's economy was driven for many years by sugar and textile exports, but its economy has more recently been fuelled by the tourism sector. The decline in preferential market access and the phasing out of a preferential price agreement with the European Union undermined earnings and competitiveness of the sugar and textile industries. Tourism has expanded since the early 1980s and had become the leading economic activity in Fiji before the COVID‑19 crisis. Prior to the pandemic, the tourism sector contributed to nearly 40% of GDP and represented a major source of foreign exchange (World Bank Group, 2020[6]).

While global restrictions on international travel strongly hit Fiji’s economy, the COVID-19 crisis also represents a chance to re-think the tourism sector, diversify the economy and seize new opportunities from the sustainable use and conservation of the ocean. The pandemic had a major impact on Fiji’s economy (as discussed in detail in Chapter 3). However, it also brought to the fore vulnerabilities stemming from over-reliance on a single sector, and the need to diversify the economy to enhance resilience and opportunities to transform sectors so they become cleaner and more inclusive. While systemic changes are needed, encouraging examples are already arising. These examples are discussed in Chapter 6.

2.3. Fiji’s ocean economy: Composition and trends

As an island economy, Fiji has few sectors that do not rely on the ocean. Most imported and exported goods rely on marine shipment using ports and other coastal infrastructure. Inter-island travel and movement of goods depends heavily on domestic maritime infrastructure and logistics. Tourism, one of the largest contributors to Fiji’s economy, is largely centred on ocean activities and coastal infrastructure. Fisheries and aquaculture are important for both economic development and subsistence livelihoods. The fisheries sector contributes to the economy through exports, employment and revenue, and provides important recreational and social benefits (Kitolelei, Torii and Bideshi, 2009[8]).

Measuring the exact contribution of ocean-related industries to the economy remains a challenging task for countries around the world, including Fiji. Managing sustainably ocean and coastal resources requires reliable measures of the ocean’s contributions to society and the effects of human activities on the marine environment the ocean economy depends on. However, standard national statistics, including as derived from the System of National Accounts, do not allow granular information on economic activities disaggregated by terrestrial and marine components. Therefore, it is often complex to derive solid estimates of the overall contribution of ocean-based activities. This is why several countries have started to compile “satellite accounts” to improve ocean economy statistics and their contribution to sound policy making in this area (Jolliffe, Jolly and Stevens, 2021[9]).

Table 2.1 compares ocean economy activities identified by the OECD (OECD, 2021[10]) and economic activities as aggregated in Fiji’s national economic accounts. It thus suggests how ocean industries are reflected in Fiji’s national accounts. In addition, detailed data sources relating to the ocean economy industries identified by OECD (2021[10]) are scattered across a number of different ministries. An initial mapping of main data sources for each of the ocean economy industries identified in OECD (2021[10]) is provided in Table 2.2.

Table 2.1. An initial mapping of ocean economy industries in Fiji’s national accounts

|

Ocean economy sectors (OECD 2021) |

Possible FBS allocated sector for economic reporting |

|---|---|

|

Marine fishing |

Agriculture, hunting, Forestry and Fishing |

|

Marine aquaculture |

|

|

Processing and preserving of marine fish, crustaceans and molluscs |

|

|

Maritime passenger transport |

Water transport |

|

Maritime freight transport |

|

|

Maritime ports & support activities for maritime transport |

|

|

Maritime ship, boat and floating structure building |

Transport equipment, Basic metals and Fabricated metals |

|

Offshore extraction of crude petroleum & natural gas |

Other non-metallic minerals, Mining and quarrying |

|

Maritime manufacturing, repair & installation |

Manufacturing, recycling, Basic metals and fabricated metal |

|

Marine & coastal tourism |

Food, beverages and tobacco, Hotels and restaurants, Retail trade (except of motor vehicles and motorcycles), Repair of household goods, Inland transport, Water transport, Air transport, Other supporting and auxiliary transport activities, Travel agencies |

|

Offshore industry support activities |

Renting of machinery & equipment and other business activities |

|

Ocean scientific research & development |

Education, Other community, social and personal services |

|

Marine and seabed mining |

Construction, Mining and quarrying |

Source: Authors representation based on (OECD, 2021[10])and Fiji’s National Bureau of Statistics.

Table 2.2. Initial mapping of primary data sources concerning ocean economy industries

|

Ocean economy sectors (OECD 2021) |

Main data source in Fiji |

|---|---|

|

Marine fishing |

Ministry of Fisheries |

|

Marine aquaculture |

|

|

Processing and preserving of marine fish, crustaceans and molluscs |

|

|

Maritime passenger transport |

Maritime Safety Authority of Fiji |

|

Maritime freight transport |

|

|

Maritime ports & support activities for maritime transport |

Maritime Safety Authority of Fiji |

|

Maritime ship, boat and floating structure building |

|

|

Maritime manufacturing, repair & installation |

|

|

Marine and seabed mining |

Ministry of Fisheries/Department of Waterways |

Source: Authors representation based on discussions with and information from Fiji’s National Bureau of Statistics.

Most available studies focus on sub-sectors of the ocean economy, failing to provide a holistic assessment of its value in Fiji and other Pacific islands. The vast majority of studies focus on individual sectors of the ocean economy, or use microeconomic methods, such as estimates of consumer and producer surplus, to estimate the economic value of marine assets and services (Brander et al., 2020[11]). Most of these studies do not produce estimates on value added, or other national account statistics, in relation to the whole of the ocean economy. However, one study does attempt to estimate “gross marine product” of Melanesian countries, a measure of the contribution of the ocean economy of Melanesian countries to GDP (Hoegh-Guldberg and Ridgway, 2016[12]).

The only available estimate of Fiji’s ocean economy as a whole places its direct and indirect contribution at one-third of Fiji’s GDP (Natuva, 2021[13]). This study uses data from 2014, identifying fisheries and aquaculture, maritime transport and trade, coastal and maritime tourism, and maritime security as key sectors of Fiji’s ocean economy. In addition, the ecosystem services1 of the ocean are estimated at between USD 1.2 billion and USD 1.8 billion per year in Fiji (Gonzalez et al., 2015[14]). Initial estimates from a recent exercise suggest mangrove ecosystems contribute about 1.8% Fiji’s GDP (GOAP, forthcoming[15]).

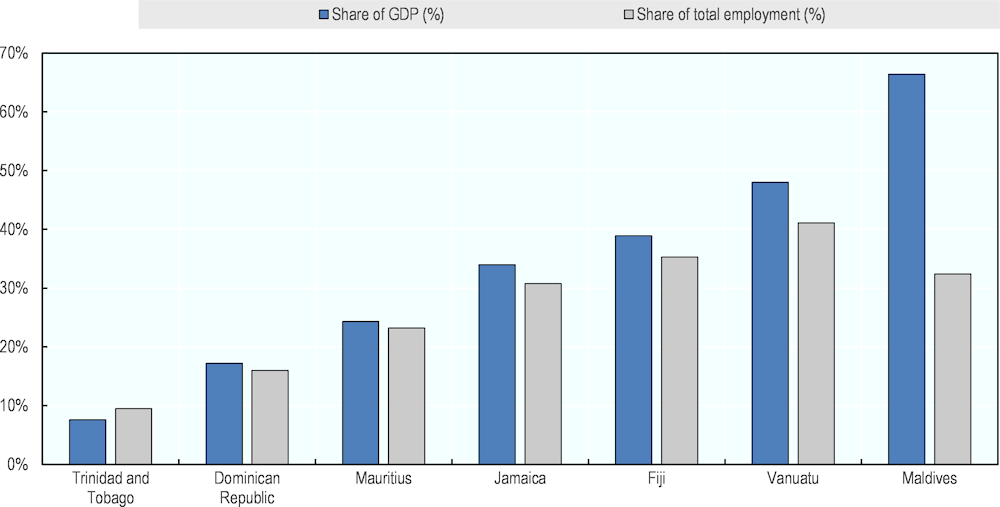

The tourism sector in Fiji contributed 38.9% to GDP and 35.5% to employment prior to COVID-19 (Figure 2.2). In Fiji, tourism has expanded since the early 1980s and, with the decline of the sugar and textile industries, it became the leading economic activity in the islands before the COVID-19 crisis. At 38.9% of GDP, the tourism sector is larger in Fiji than in several other individual SIDS (Figure 2.2), and well above the average in OECD countries estimated at 2.5% pre-COVID-19. Between 2014 and 2019, the value added of the sector grew by 28% – from FJD 956 408 (USD 442 052) to FJD 1 222 245 (USD 564 922) (Table 2.3). The contribution of Fiji’s tourism value added in the economy’s total value added hovered around 13% in 2014-19 (Table 2.3). Fiji’s tourism satellite accounts indicate that tourism directly supported 28 771 jobs in 2018. The sector has also surpassed sugar as Fiji’s main export earner. Over 90% of tourism attractions in Fiji are maritime- or coastal-based.

Figure 2.2. High contribution of the tourism sector to Fiji’s economy and employment (2018 data)

Note: Share of employment (%) is relative to the total employment in the economy and includes both direct and indirect employment in tourism.

Source: Authors representation based on data in (Hampton and Jeyacheya, 2020[16]).

Table 2.3. Economic information for industries making up Fiji’s tourism sector

Evolution of tourism value added between 2014 and 2019

|

Tourism value added |

2014 |

2015 |

2016 |

2017 |

2018 |

2019[p] |

|---|---|---|---|---|---|---|

|

Tourism-characteristics industries |

||||||

|

Accommodation |

369 946 |

403 770 |

381 286 |

516 473 |

543 081 |

590 099 |

|

Food and beverage serving industry |

32 467 |

35 016 |

33 017 |

35 369 |

40 041 |

41 754 |

|

Road passenger transport |

21 242 |

25 921 |

26 757 |

27 701 |

27704 |

28 124 |

|

Water passenger transport |

10 644 |

11 411 |

12 188 |

12 553 |

12 656 |

12 754 |

|

Air passenger transport |

251 588 |

294 835 |

305 548 |

298 281 |

229 575 |

209 034 |

|

Transport equipment rental |

14 461 |

14 810 |

14 918 |

15 773 |

16 605 |

16 680 |

|

Travel agency and tour operator activities |

45 105 |

52 142 |

51 039 |

51 739 |

52 945 |

54 578 |

|

Recreational and cultural industry |

12 528 |

12 696 |

14 935 |

14 695 |

14 768 |

15 502 |

|

Tourism-related industries |

|

|

|

|

|

|

|

Retail trade |

161 755 |

164 224 |

176 199 |

184 422 |

195 259 |

204 127 |

|

Financial activities |

55 |

55 |

55 |

56 |

56 |

57 |

|

Education |

2 728 |

2 911 |

2 945 |

3 379 |

3 402 |

3 426 |

|

All non-tourism related industries |

33 889 |

36 127 |

40 140 |

42 100 |

44 678 |

46 110 |

|

Total |

956 408 |

1 053 916 |

1 059 027 |

1 202 541 |

1 180 770 |

1 222 245 |

|

Total gross value added (GVA) |

7 210 327 |

7 708 405 |

8 406 666 |

8 930 771 |

9 363 403 |

9 667 899 |

|

Total tourism gross value added (TGVA) |

956 408 |

1 053 916 |

1 059 027 |

1 202 541 |

1 180 770 |

1 222 245 |

|

Growth rate of TGVA |

23.1 |

10.2 |

0.5 |

13.6 |

-1.8 |

3.5 |

|

|

|

|

|

|

|

|

|

TGVA contribution to GVA |

13.30% |

13.70% |

12.60% |

13.50% |

12.60% |

12.60% |

Source: Fiji Bureau of Statistics (2020[17]), Fiji’s Direct Tourism Contribution, https://www.statsfiji.gov.fj/images/documents/Economics_Statistics/Annual_Reports/Satellite-Accounts/Fijis_Direct_Tourism_Contribution_Release_2014-2019.pdf

The tourism sector also has a multiplier effect on other sectors of Fiji’s economy, although linkages could be strengthened. The tourism sector supports numerous other industries in Fiji’s economy, such as transport and agriculture. For instance, the transportation industry is involved in moving tourists between the main arrival hubs and various tourist destinations throughout Fiji. Agriculture is essential for the provision of food to hotels and restaurants. With increasing tourist numbers, the need for food supply also increases. However, Fiji has struggled to meet such demand, resulting in high food imports to sustain the growing tourist numbers (Natuva, 2021[13]). A recent study by the International Finance Corporation (IFC) (2018[18]) estimates that hotels and resorts in Fiji’s main tourist areas imported more than half of their fresh produce in 2017 (52% or USD 18.8 million). The study also points to the potential of increasing local production to supply the tourism sector in Fiji. It suggests that, with the right policies and motivation, Fiji could grow nationally 63% of the value of current imported food. This would represent USD 11.8 million worth of fresh produce that could be deducted from its import bill.

Cruise ship tourism has grown significantly in Fiji. Recent years have witnessed an exponential rise of the cruise industry globally. Indeed, the industry set a record in terms of new builds, new cruise brands, expedition ships and capacity growth in 2019. In this context, several countries have begun to enlarge their ports to accommodate the industry’s increasingly larger cruise ships. In Fiji, too, cruise tourism was an expanding market pre-COVID-19. IFC (2019[19]) estimated “cruise companies, their passengers and crew spent at FJD 44.2 million (USD 21.4 million) in Fiji in 2018”. This represents a direct contribution of 0.66% of GDP to Fiji in 2018 (IFC, 2019[19]). An estimated 158 000 tourists visited Fiji by cruise liner in 2015. However, cruise passengers usually have short stays in countries and are found to spend on average 94% less than long-stay tourists (Brida and Zapata, 2010[20]). This seems to be the case in Fiji, where the average stay of cruise tourists was only 1 day in 2015 compared to an average of 14.9 days for other tourist categories, as shown in Table 2.4 (Fiji Bureau of Statistics, 2018[21]). Moreover, the global cruise companies often capture spending by cruise tourists.

Table 2.4. Comparison of cruise ship passengers with other tourist types: Length of stay and expenditure

|

2011 |

2012 |

2013[p] |

2014[p] |

2015[p] |

|

|---|---|---|---|---|---|

|

Average length of stay (days) |

9.4 |

9.6 |

9.5 |

9.5 |

9.5 |

|

Business |

8.4 |

9.3 |

8.8 |

8.8 |

8.9 |

|

Personal |

|||||

|

Visiting friends & relatives |

20.1 |

21.5 |

20.5 |

21.0 |

20.9 |

|

Others |

13.7 |

15.4 |

15.0 |

14.7 |

15.1 |

|

Cruise ship passengers |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

|

Total visitor days |

6 292 985 |

6 266 998 |

6 142 939 |

6 483 783 |

6 984 831 |

|

Business |

353 811 |

288 594 |

319 180 |

330 860 |

352 227 |

|

Personal |

5 939 174 |

5 978 404 |

5 823 759 |

6 152 923 |

6 631 604 |

|

Visiting friends & relatives |

1 209 920 |

1 199 270 |

1 119 382 |

1 231 220 |

1 287 188 |

|

Others |

4 729 254 |

4 779 134 |

4 704 377 |

4 921 703 |

5 345 416 |

|

Cruise ship passengers |

44 042 |

60 002 |

111 931 |

65 732 |

85 322 |

|

Per diem expenditure [FJD] |

|||||

|

Business |

223.67 |

227.54 |

233.39 |

237.73 |

244.16 |

|

Personal |

|||||

|

Visiting friends & relatives |

64.21 |

65.41 |

66.82 |

68.14 |

69.98 |

|

Others |

170.69 |

172.35 |

175.80 |

181.80 |

184.96 |

|

Cruise ship passengers |

61.30 |

63.05 |

64.33 |

64.64 |

67.69 |

|

Tourism earnings [FJD M] |

1 286.5 |

1 300.0 |

1 318.2 |

1 404.6 |

1 506.2 |

|

Business |

77.8 |

65 |

73.6 |

77.3 |

84.6 |

|

Personal |

1 208.7 |

1 235.0 |

1 244.6 |

1 327.3 |

1 475.6 |

|

Visiting friends & relatives |

77.8 |

78.4 |

74.8 |

83.7 |

89.8 |

|

Others |

1 128.1 |

1 152.8 |

1 162.6 |

1 239.3 |

1 380.0 |

|

Cruise ship passengers |

2.8 |

3.8 |

7.2 |

4.3 |

5.8 |

Note: P stands for projected.

Source: Fiji Bureau of Statistics (Fiji Bureau of Statistics, 2016[22]), Fiji's earnings from tourism - December & Annual 2015, https://www.statsfiji.gov.fj/latest-releases/tourism-and-migration/earnings-from-tourism/595-fiji-s-earnings-from-tourism-december-annual-2015.html.

The fisheries sector is Fiji’s third largest export earner and is responsible for the livelihoods of a significant share of Fiji’s population. It is composed of three main segments: offshore fisheries, inshore fisheries and aquaculture.

The offshore fishery relates to commercial tuna species, including bigeye and yellowfin. These high-value commodities are largely destined for the Japanese and US markets as fresh and chilled tuna (sashimi market) and loin fillets. Frozen albacore is generally sold to local canneries or exported to American Samoa (Ministry of Fisheries, 2018[23]). With its offshore fishery, Fiji seeks to create more value by becoming a regional hub for fish processing. However, both changes in tuna migratory patterns due to rising ocean temperatures (Bell, Johnson and Hobday, 2011[24]) and the current proposal for off-shore Marine Protected Areas to achieve Fiji’s commitment of conserving 30% of its ocean by 2030 Fiji’s (as discussed in Chapter 4) are expected to affect the sector and will require mitigation measures.

Offshore fisheries are known as the main source of revenue for the fishery industry; it is the only segment reflected in national statistics on fisheries. It represents the third largest share of Fiji’s exports, accounting for an average of 12% of agriculture GVA (1% of GDP) (Fiji Bureau of Statistics, 2022[25]).

Fiji’s inshore fisheries involves small-scale commercial reef fisheries targeting domestic markets and the export of inshore resources such as aquarium products. It contributes significantly to the local Fijian economy for both domestic food supplies and income generation. Subsistence fisheries account for over 30% of fisheries sector output (Ministry of Fisheries, 2018[23]). The inshore fishery is estimated to produce more than 16 times the food for local consumption than the offshore fishery (Gillett, Lewis and Cartwright, 2014[26]). It also employs about four times the labour force of the offshore segment (Kitolelei, Torii and Bideshi, 2009[8]). However, the inshore fishery is barely reflected in official statistics on fisheries.

The tuna cannery in Levuka is the largest employer in Ovalau Island and many ancillary businesses depend on its existence. Pacific Fishing Company Limited, mainly owned by the Fijian government (99.6%), is operated by the Minister for Public Enterprises. The company has its main processing plant in the Island of Levuka and employs more than 1 000 people of whom more than half are women (Parliament of the Republic of Fiji, 2019[27]).2 In 2014, the tuna industry provided direct employment for 20.8% of the total number of people employed across the Pacific (Gillett and Tauati, 2018[28]). Strong demand for local canned products has fostered economic growth, but climate change is projected to affect migratory patterns of the albacore tuna and may result in shortages of raw tuna supply. Further challenges to the processing business include ageing equipment, the remote location of Levuka and high operational costs related to fuel, ports and labour.

Aquaculture is still small in Fiji. Aquaculture is considered to be one of the sectors with the largest potential for growth globally (OECD, 2020[29]). In recent years, it has expanded substantially, driving up total fish production against a more stagnating trend for wild fish catch. In 2016, global aquaculture production, including both inland and marine production, was 110.2 million tonnes and worth approximately USD 243.5 billion (OECD, 2020[29]). Through the years, aquaculture in Fiji has developed with many species cultured in marine, brackish water and freshwater. The cultured species include tilapia, carps, freshwater prawns, saltwater shrimp, seaweed, clams, giant clams, pearl oysters, mud crabs, corals and turtles (Kitolelei, Torii and Bideshi, 2009[8]). The Strategic Plan for 2019-2029 for the fishery sector includes a rapid expansion of aquaculture as one of its key priorities (Ministry of Fisheries, 2019[30]), with specific targets for tilapia and shrimp production. The expansion of small-scale aquaculture is seen as a means to diversify the fisheries sector, increase food security and generate income. Despite these priorities, data suggest that Fiji’s aquaculture sector is still small, with the total value of aquaculture harvests standing at USD 1.45 million (Gillett and Tauati, 2018[28]) (Table 2.5).

Table 2.5. Fiji’s aquaculture production volumes and values

|

Commodity |

2014 production volume (kg, or pieces if noted) |

2014 production values (FJD) |

2014 production values (USD) |

|---|---|---|---|

|

Tilapia |

150 500 |

56 750 |

266 035 |

|

Freshwater shrimp |

11 462 |

183 392 |

92 622 |

|

Penaeid shrimp |

5 617 |

140 425 |

70 922 |

|

Pearls |

103.2 |

157 800 |

796 970 |

|

Pearl oyster spat |

45 000 pieces |

90 000 |

45 455 |

|

Seaweed |

30 000 |

27 000 |

13 636 |

|

Cultured coral |

2 706 pieces |

||

|

Cultured rock |

37 530 pieces |

150 000 |

75 758 |

|

Mud crab |

7 000 |

180 000 |

90 909 |

|

Total |

204 682.2 kg plus 85 236 pieces |

FJD 2 875 567 |

USD 1 452 307 |

Source: Gillet and Tauati, (2018[28]), Fisheries of the Pacific Islands: Regional and national information, https://www.fao.org/publications/card/en/c/7688c916-f1f2-5fe4-b306-2f7a0528e829/.

Maritime transport and ports in Fiji are of strategic importance for the country. Fiji relies heavily on maritime transport for trade. For the past two decades, Fiji’s maritime transport sector has continued to grow. Port services and the shipbuilding industry directly contributed up to 2.3% of Fiji’s GDP in 2016, although shipbuilding has declined significantly since the 1970s and 1980s. Approximately 90% of Fiji's import and export trade occurs through the two ports of Suva and Lautoka (ADB, 2013[31]). Suva is the country's busiest international entry port. Despite recent investments to expand these two main ports, congestion in and around the ports is still significant. The Asian Development Bank (ADB) supported the Fiji Ports Development Project through a loan facility. This project upgraded both wharves; enabled government investment in mobile cranes to facilitate mechanised loading and unloading of shipping containers; and raised productivity. A recent study assessed the ability of the maritime infrastructure to meet increasing demand. It deemed the international port at Suva is not expected to be a constraint for large, established logistics players (IFC, forthcoming[32]). However, it noted that new entrants struggle to enter the market due to congestion in and around the port. ADB is continuing to assist the Fiji government to assess the viability of relocation of elements of the King’s Wharf, Suva (e.g. passenger vessels, fishing vessels, cruise ships). Suva Port may reach capacity between 2026 and 2030 (IFC, forthcoming[32]).

Fiji is also considered to be a strategic hub for the South Pacific. Neighbouring countries such as Tuvalu and Kiribati rely heavily on Fiji ports as a transhipment point for goods with the rest of the world. Fiji’s high reliance on maritime transport makes it highly dependent on market developments in global maritime transport. Increased consolidation of container shipping that transports most consumer goods and manufactured goods has resulted in a growing tendency of hub and spoke-port networks. As a consequence, smaller ports and ports in the periphery have less direct connections than they had before. This is also the case for Fiji and a tendency that has played out during the pandemic, even if it is part of a longer trend. In the face of these trends, Fiji could team up with counterparts in the region to develop a co-ordinated strategy.

Domestic inter-island shipping is considered a major constraint to the development of outer islands beyond Viti Levu. However, inter-island shipping remains heavily reliant on imported fuels. It operates with vessels that are on average 20 years old, which are highly inefficient and polluting.

The high consumption of diesel by old vessels combined with Fiji’s high reliance on imported fuels translates into high costs of the shipping sector. The absence of sustainable sea transport options for outer islands is a major limiting factor for their sustainable development (Bola, 2017[33]).

The government subsidises inter-island shipping. However, Fiji has endorsed the Agreement on Climate Change, Trade and Sustainability (ACCTS). This could lead to phasing out fossil fuel subsidies for the shipping sector; Fiji’s Ministry of Trade is studying the socio-economic implications of this move.

Overall, many concerns remain for Fiji’s shipping sector. In 2020, a parliamentary petition to the government of Fiji highlighted concerns regarding the shipping sector over reliability, safety, affordability, environmental impacts, etc.

2.4. Sustainability trends of Fiji’s ocean economy

Fiji’s exposure to natural disasters poses significant challenges to its socio-economic development. Many SIDS, including Fiji, are located in regions that are most prone to natural disaster. Tropical storms and cyclones perennially afflict SIDS. Furthermore, their dispersed and remote geographies, and small economies, make them poorly equipped to respond to these extreme events. Given the small size of SIDS economies, a single natural disaster can translate into losses several times the country’s GDP. As such, it can wipe out entire economic sectors and erode the development gains accumulated over decades. Globally, SIDS make up two- thirds of the countries that suffer the highest relative losses – between 1% and 9% of their GDP each year – from natural disasters (OECD/The World Bank, 2016[34]).

Fiji is located in the tropical cyclone belt, which makes it especially exposed to tropical storms, rising sea levels, floods and landslides. Every year, cyclones and floods cause substantial property damages destroying plantations, roads, mangrove forests, coral reefs, etc. In 2016, Fiji experienced unprecedented economic losses following Tropical Cyclone (TC) Winston with estimated damages reaching 20% of GDP. Estimates suggest that Fiji’s annual losses due to such extreme weather events could reach 6.5% of GDP by 2050 (World Bank, 2017[35]).

A growing host of interlinked and mutually reinforcing impacts of climate change affects Fiji’s ocean sectors and overall economy. The key climate change impacts on Fiji’s coastal and marine ecosystems concern: (i) changing weather patterns, including more heavy rains translating into frequent floods; (ii) coral bleaching; and (iii) sea-level rise (Mangubhai et al., 2019[36]). Fiji experienced its largest coral bleaching event in the 2000 La Niña. Sea surface temperatures rose above the summer maximum for five months. This resulted in extensive coral bleaching with coral community losses of 40-80% across Fiji (Mangubhai et al., 2019[36]). Coral bleaching happens when the water temperature exceeds 29.2°C. In 2019, the seawater temperatures in Fiji between January and May ranged from 27‑31°C (marine ecology consulting, 2019[37]). Coral reefs, Fiji’s main touristic attraction, are globally projected to decline by a further 70-90% at 1.5°C warming (Masson-Delmotte et al., 2019[38]). Modelling work on the island of Viti Levu identified Fiji’s capital Suva (the major tourist centre and arrival port of Nadi) and Fiji’s second largest city Lautoka at high risk of sea-level rise (Gravelle and Mimura, 2008[39]). The increasing pressure on ocean makes it urgent to properly assess risks and implement mitigation plans that can ensure its preservation.

Growing impacts of climate change could result in food insecurity. Loss of coastal resources and reduced productivity of fisheries are among the expected impacts of climate change. Globally, annual catches from marine fisheries are projected to decline by 3 million tonnes if warming reaches 2°C. Overfishing poses an additional threat to corals by removing key species like herbivorous fishes that eat algae that compete with corals for space and help keep the ecosystem in balance. Under projected emissions scenarios, sea surface temperature, sea-level rise and ocean acidification are likely to increase (Bell, Johnson and Hobday, 2011[24]). These in turn are likely to affect food webs in the ocean, including the migratory patterns of pelagic species, such as tuna. By 2050, under a high global greenhouse gas (GHG) emissions scenario without effective climate change mitigation policies, the total biomass of three tuna species in the waters of ten Pacific SIDS could decline by an average of 13% due to a greater proportion of fish occurring in the high seas (Bell, Senina and Adams, 2021[40]). The potential implications for Pacific Island economies in 2050 include an average decline in purse-seine catch of 20%, an average annual loss in regional tuna-fishing access fees of USD 90 million and reductions in government revenue of up to 13% (Bell, Senina and Adams, 2021[40]). Although no studies focus on Fiji, growing evidence suggests that climate change will affect reef fisheries. This could manifest in the performance of individual species, trophic linkages and alternations to recruitment dynamics, population connectivity and other ecosystem processes (Munday et al., 2008[41]). Water quality is also at risk as flooding and strong winds increase the risk of saltwater intrusion (Masson-Delmotte et al., 2019[38]). Disrupted supply of water and food can force communities to migrate to safer ground.

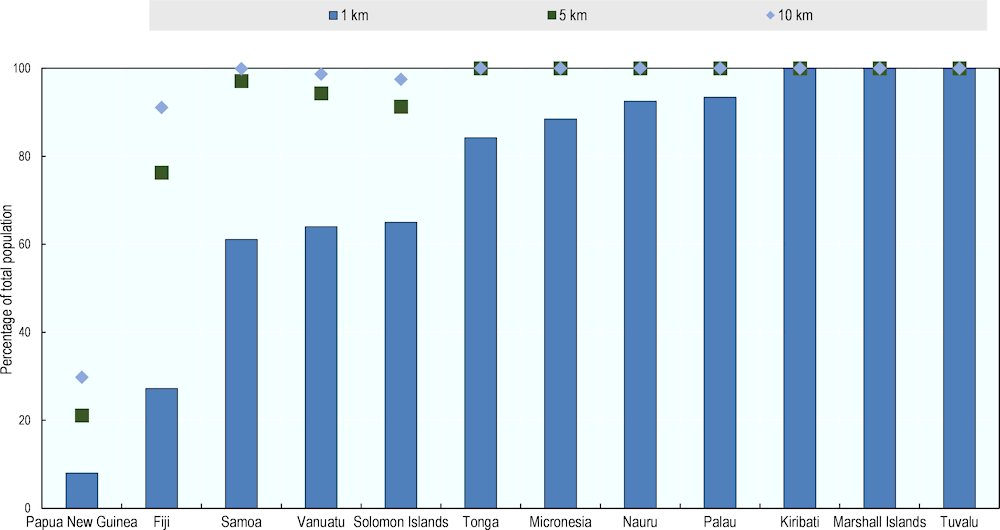

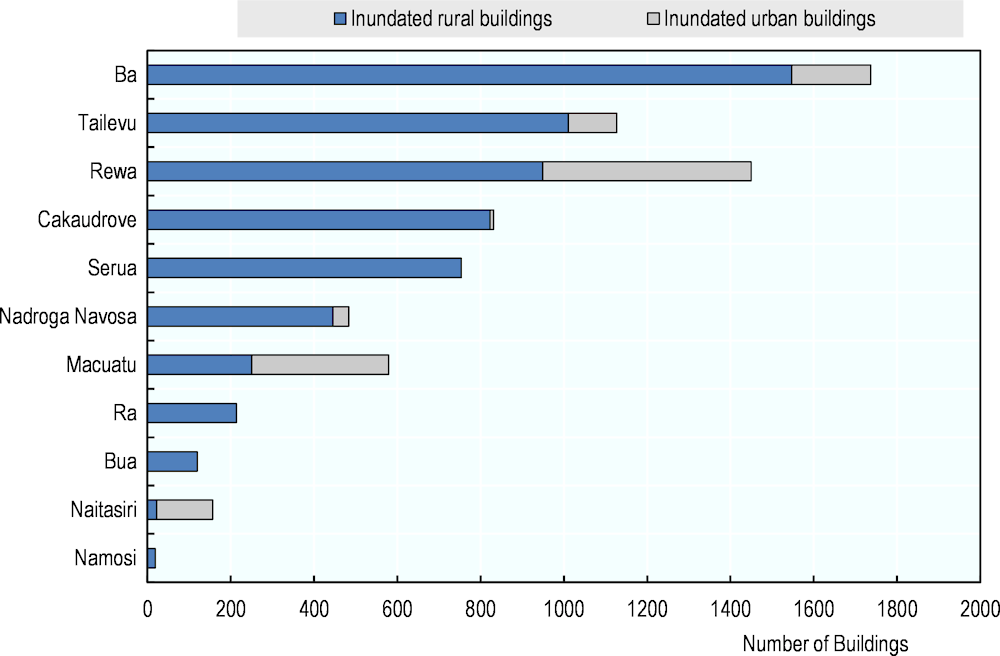

Coastal erosion and sea-level rise due to climate change are leading to permanent community relocations. Pacific SIDS populations are especially vulnerable to erosion, inundation or regular flooding, as on average 91% of people live within 5 km of the coast (Figure 2.3). Relocation of people and assets away from sites at risk is one consequence of climate change. In 2014, the village of Vunidogoloa was the first to be relocated due to coastal erosion and storm surges caused by climate change-induced sea-level rise (Merschroth et al., 2020[42]). The total relocation cost for Vunidogoloa was estimated at USD 978 229 (Ministry of Finance, 2015[43]). Since 2014, six other communities have been fully or partially relocated in Fiij due to climate change events. Coastal erosion impacts are exacerbated by inundation events, which are expected to increase with sea-level rise and changed weather patterns and more intense rainfalls. Further, the loss of coral reefs will result in greater wave energy reaching shorelines and reduced sediment production, while higher sea levels increase the risk of wave processes causing erosion (Feresi et al., 2000[44]; Jolliffe, 2016[45]). Future projections incorporating Antarctic’s contribution on sea level show a rise of between approximately 0.09-0.18 m by 2030 and between 0.66-1.21 m by 2100 (Table 2.6). Merschroth et al. (2020[42]) estimate that 7 472 buildings will be inundated by 2050 and 10 304 by 2100. According to these estimates, by 2050, 241 buildings will be inundated on average per year. The province of Ba (which hosts one of the most visited towns of the country) and Nadi (the touristic hub) could be the most severely affected (Figure 2.4). Moreover, sea-level rise is projected to have major impacts on the primary urban areas of Suva, Lautoka, Lami, Labasa and Nasinu.

Figure 2.3. Pacific SIDS are particularly prone to sea-level rise and coastal erosion

Source: Source: Authors’ representation based on Pacific Data Hub, https://pacificdata.org/data/dataset/percentage-of-population-within-1-5-10km-coastal-buffers.

Figure 2.4. Rural areas are expected to suffer the most from sea-level rise

Note: Estimates are based on the assumption of sea level rising of 0.22 m for the year 2050.

Source: Authors’ representation based on data in (Merschroth et al., 2020[42]), www.mdpi.com/2071-1050/12/3/834.

Table 2.6. Median sea level projections for Fiji

|

Year |

Low emissions scenario |

High emissions scenario |

|---|---|---|

|

2030 |

0.13 [0.09-0.17] |

0.14 [0.10-0.18] |

|

2040 |

0.18 [0.13-0.23] |

0.20 [0.15-0.27] |

|

2050 |

0.23 [0.17-0.30] |

0.28 [0.21-0.37] |

|

2060 |

0.27 [0.20-0.36] |

0.37 [0.28-0.49] |

|

2070 |

0.32 [0.23-0.42] |

0.47 [0.36-0.63] |

|

2080 |

0.36 [0.26-0.49] |

0.60 [0.45-0.80] |

|

2090 |

0.41 [0.30-0.56] |

0.73 [0.55-0.99] |

|

2100 |

0.46 [0.33-0.63] |

0.89 [0.66-1.21] |

Note: Units are metres and the 5-95% range is relative to 1986-2005. Representative Concentration Pathways, or RCP 2.6 corresponds to the “Low emissions scenario” and the RCP 8.5 corresponds to the “High emissions scenario”.

Source: CSIRO and SPREP, (2021[46]), Current and future climate for Fiji: enhanced 'NextGen' projections Technical report, https://publications.csiro.au/publications/publication/PIcsiro:EP2021-2149.

Overfishing and changes in fish migratory patterns affect the fisheries sector. The overexploitation of fish stocks was identified as one of the major constraints affecting the Fijian fisheries sector (Gillett and Tauati, 2018[28]). Many coastal resources, especially those close to the urban markets, are fully exploited. Giant humphead wrasse and bumphead parrotfish have been overexploited to the point of local extinction and some medium- to larger-size grouper species have undergone marked declines over the past decades, resulting in seasonal bans during breeding periods (Prince et al., 2021[47]). Sea cucumber densities are reported to be critically low for some species, and stock numbers of pearl oysters – in particular of Pinctada margaritifera – are considered too low to support expansion of pearl farming. Further, high exploitation of tuna resources outside the Fiji zone by foreign fishing vessels has translated in a reduction in catch rates in Fiji’s coastal areas. Lack of awareness on the part of coastal communities of the limitations for fisheries development and the consequences of overexploitation are also critical issues affecting sustainability (Gillett and Tauati, 2018[28]). Overall, at the current rate of exploitation of fish and inadequate coastal fisheries management systems in place, Fiji will not be able to meet the recommended the 34–37 kg per year per capita fish consumption needed for good nutrition or to maintain current consumption by 2030 (Bell et al., 2009[48]).

Rising ocean temperatures are projected to affect offshore fisheries. Catches from the Western and Central Pacific represent over half of all tuna produced globally. However, this could change drastically as ocean temperatures rise.

Fiji’s tourism sector faces growing risks from environmental degradation and climate change. Globally, the tourism sector has a high climate and environmental footprint. Mass tourism can produce large environmental impacts due to increased use of local resources, and it can generate waste that puts under pressure the already fragile waste management system in SIDS. These sources of pollution are projected to increase as populations, coastal cities and tourism continue to grow. The tourism sector also requires heavy energy and fuel consumption. Its growth over recent years has put marine and land ecosystems under increasing stress and challenged the achievement of the Paris Agreement targets. Studies over the past decade have estimated that tourism has contributed between 5-8% to global GHG emissions (OECD, 2021[49]). However, tourism can have positive or negative impacts depending on how it is planned, developed and managed (UNWTO, 2012[50]). For instance, the tourism sector also contributes to the conservation efforts and the livelihoods of local communities of many countries. The United Nations World Tourism Organization (UNWTO) (2012[50]) estimates that 14 African countries generate about US 142 million in protected-area entrance fees.

Fiji’s tourism sector depends highly on the attractiveness of the natural environment. In Fiji, the sector has been associated with mangrove clearance and coastal degradation, both of which aggravate problems such as coastline erosion, vulnerability to natural disasters, fish stock declines, poor water quality, pollution and biodiversity loss (Garcés-Ordóñez et al., 2020[51]; Singh, Jamal and Ahmad, 2021[52]). Tourist activity and urbanisation concentred along coastlines have major impacts on coral reefs, one of Fiji’s major tourist attractions. Concentration of reef-harming nutrients was found to be higher near hotels and populated cities (Levett and McNally, 2003[53]).

Recent research highlighted that tourism stakeholders in Savusavu on Vanua Levu in Fiji are concerned about the environmental impacts of tourism (Graci and Van Vliet, 2020[54]). Specific areas relate to waste management and wastewater due to lack of adequate waste management infrastructure; destruction of marine and coastal natural assets, such as mangrove destruction; and growing impacts from climate change. There is no centralised wastewater treatment system in Savusavu. If individuals want to recycle their waste, they have to pay for their recycling to be shipped to the main island, which many cannot afford.

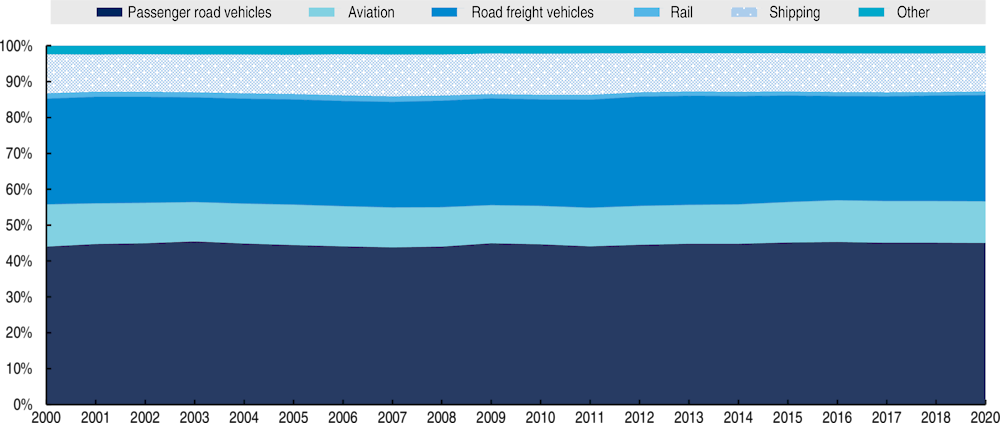

Lagging behind in decarbonisation of the shipping industry can result in future penalties. The shipping industry accounts for 2.6% of total GHG emissions globally and 15% of transport emissions in 2018 (Figure 2.5) (IMO, 2020[55]). In the absence of effective mitigation measures, shipping emissions are expected to increase from 90% to 130% by 2050 (IMO, 2020[55]). The use of low-carbon fuels in international shipping is virtually zero and biofuels account for only 0.1% of final energy consumption (IEA, 2021[56]). The shipping industry across Pacific nations is particularly dependent on imported and polluting fossil fuels. Fiji’s domestic industry must be prepared to face the carbon penalties likely to emerge globally in the next five to ten years. Although Fiji’s contribution to greenhouse gas (GHG) emissions is negligible, Fiji is strongly committed to reducing carbon emissions from its shipping sector. To that end, it has embraced a target of net zero carbon emissions by 2050 as part of a coalition of six Pacific countries (i.e. the Pacific Blue Shipping partnership, led by the Marshall Islands).

Figure 2.5. Transport sector global CO2 emissions by mode

Note: "Other" includes pipeline and non-specified transport.

Source: Authors’ representation based on data from IEA (2022[57]).

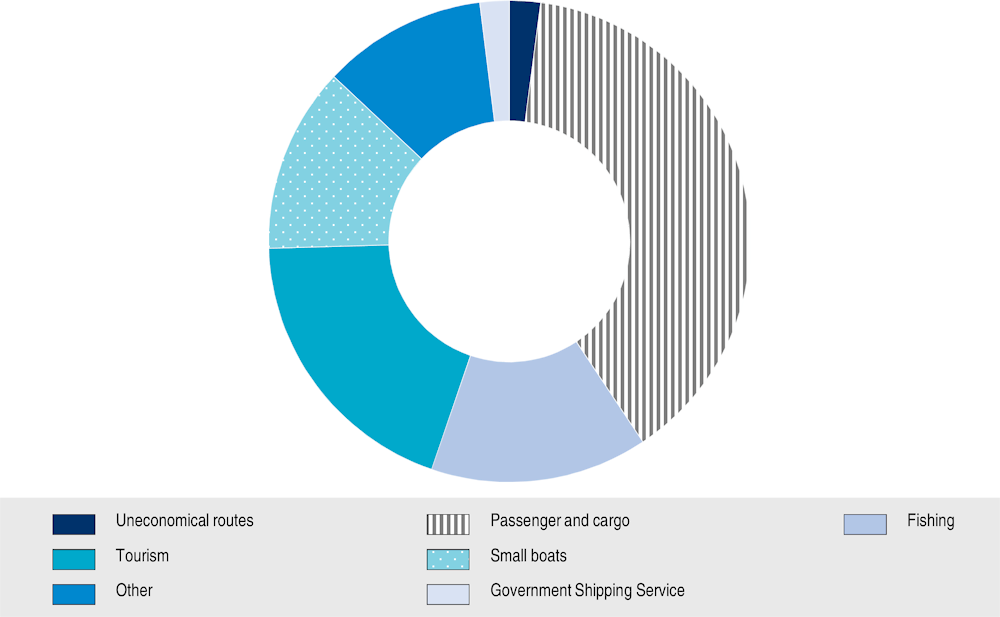

Fiji Low Emission Development Strategy (2018) notes estimated emissions of the domestic maritime sector in 2016 at 174 kilotons of CO2 with an estimated increase to 198.5 kilotons in 2020 (Ministry of Economy, 2018[58]).Passengers and cargo transportation account for the largest share of Fiji’s maritime transport emissions (Figure 2.6). At the same time, seaports are highly exposed to climate change impacts, including sea-level rise and increased intensity of storms. In 2018, the International Maritime Organization adopted its initial strategy on the reduction of GHG emissions from ships. This aimed to least halve sector-wide emissions (vs. 2008) by 2050 and achieve zero GHG emissions as soon as possible this century.

Investment in green and decarbonisation technologies represents an up-front expense and a new type of investment, which may not be readily supported by traditional maritime financing instruments. Financial support is needed to accelerate pathways for zero-carbon bunker fuels. This would enable the industry to make long-term investments, and enable developing countries to adapt port infrastructure to climate change.

Increased maritime traffic in Fiji’s ports has also generated pollution. The increased maritime traffic in Fiji’s ports has also generated pollution, particularly oil pollution from ships. Fiji is cognisant of the environmental risks associated with maritime transport. It has taken positive actions to mitigate the threat to the health of the ocean and its ecosystems. In 1983, for example, Fiji acceded to the International Convention for the Prevention of Pollution from Ships (MARPOL). It is also taking steps to decarbonise its domestic shipping industry. However, there often seems to be a disconnect between domestic policies that target expansion of economic development opportunities and policies to tackle climate change, green growth and ocean health. Development promotion efforts include measures to increase the domestic fleets, expand franchise servicing areas, increase subsidies through fuel rebates and tax concessions, and build infrastructure.

Figure 2.6. Breakdown of Fiji’s emissions from maritime sector, 2016

Note: Fishing includes domestic flagged vessels only. Fiji has ten uneconomical routes that are part of the Government Shipping Franchise Scheme. Fiji Low Emission Development Strategy estimates the total emissions for the maritime sector in 2016 at 174 kilotonnes of CO2. The shares refer to this total.

Source: Authors’ based on Fiji Low Emission Development Strategy, (Ministry of Economy, 2018[58]).

Risks from deep seabed mining. Globally, commercial deep seabed mining activities have not yet started, but the area in which exploration contracts have been granted within national jurisdictions amounts to 900,000 km2. Outside of national jurisdictions, deep sea mining activities are regulated by the International Seabed Authority (ISA), which has so far granted 31 concessions for exploration in an area exceeding 1.3 million of kilometres - roughly more than four times the size of Italy. The Clarion – Clipperton area off the Pacific Ocean is estimated to be a particularly rich area, containing more manganese, nickel, cobalt, titanium and yttrium than the entire terrestrial reserves. The industrial exploitation of these resources, however, could cause irreversible damage to underwater ecosystems and the life-giving functions they provide. Following the appeal of 570 scientists from 44 different countries, in 2021 members of the International Union for Conservation of Nature (IUCN), which has 1 400 members from over 170 countries, passed a motion to establish a moratorium on deep seabed mining until more empirical evidence on potential environmental impacts is available. Currently, 95% of the ocean remains unexplored and uncharacterised. The huge gaps in knowledge of deep sea ecosystems, the lack of technologies able to minimize damage and the vulnerable nature of ecosystems in the deep sea, point that the deep seabed mining industry is not in a position to guarantee the preservation of life and life-giving functions where it would operate.

Fiji’s potential for deep seabed mining is understood to be limited to one of the three main kinds: seafloor massive sulphides. A Korean deep-sea mineral exploration company was awarded an exploration licence in 2011, which was renewed in 2017 for four years. Commercial mining is not anticipated to be possible until the 2030s. In the Pacific Possible report (World Bank, 2017[59]), deep seabed mining is identified as one of five potential sources of transformative growth in the Pacific. However, given limited understanding of the environmental impacts of deep seabed mining and weak regulations, it recommends a cautious approach. So far, the Precautionary Principle has been applied to deep seabed mining. However, as more countries and companies become interested in commercial deep seabed mining, pressures to move from exploration to exploitation may grow. The Fiji prime minister has publicly banned deep-sea mining, and a ten-year moratorium is included in drafts of the Climate Change Bill. However, the Climate Change Act 2021 did not include these clauses, nor did the National Ocean Policy make any specific commitments. Exploratory licences were always excluded from the proposed moratorium.

The current picture and future prospects for deep-sea mineral mining within Fiji territorial waters and the wider Pacific is unclear. Despite the prime minister’s appeal to other Pacific Island leaders for a wider moratorium, there has been no regional agreement. Nauru, in particular, has championed the potential benefits. Fiji’s public stance on a moratorium does not appear to have been officially implemented within Fiji. The Ministry of Lands and Mineral Resources, for example, is understood to be relatively unrestricted in projects it can support.

References

[4] ADB (2019), Poverty Data: Fiji, webpage, http://www.adb.org/countries/fiji/poverty (accessed on 24 February 2022).

[5] ADB (2018), Poverty Analysis Summary, webpage, https://www.adb.org/sites/default/files/linked-documents/cps-fij-2014-2018-pa.pdf#:~:text=2.%20Poverty%20indicators.%20Poverty%20remains%20a%20significant%20concern,poor%20people%20is%20in%20urban%20and%20peri-urban%20areas. (accessed on 24 April 2022).

[31] ADB, A. (2013), Fiji Maritime Transport: Suva and Lautoka Ports, https://www.adb.org/features/fijis-ports-open-wider-world-report-card (accessed on 28 January 2022).

[24] Bell, J., J. Johnson and A. Hobday (2011), Vulnerability of Tropical Pacific Fisheries and Aquaculture to Climate Change, Secretariat of the Pacific Community, Noumea (New Caledonia).

[48] Bell, J. et al. (2009), “Planning the use of fish for food security in the Pacific”, Marine Policy, Vol. 33/1, pp. 64-76, https://doi.org/10.1016/J.MARPOL.2008.04.002.

[40] Bell, J., I. Senina and T. Adams (2021), “Pathways to sustaining tuna-dependent Pacific Island economies during climate change”, Nature Sustainability, Vol. 4, pp. 900–910.

[33] Bola, A. (2017), “Potential for sustainable sea transport: A case study of the Southern Lomaiviti, Fiji islands”, Marine Policy, Vol. 75, pp. 260-270, https://doi.org/10.1016/J.MARPOL.2016.02.002.

[11] Brander, L. et al. (2020), “Cook Islands marine ecosystem service valuation”, report commissioned by the Cook Islands National Environmental Service, https://www.maraemoana.gov.ck/wp-content/uploads/2021/06/25.-Cook-Islands-MESV-Report-2021.pdf (accessed on 14 February 2022).

[20] Brida, J. and S. Zapata (2010), “Economic impacts of cruise tourism: The case of Costa Rica”, Anatolia, Vol. 21/2, pp. 322-338, https://doi.org/10.1080/13032917.2010.9687106.

[46] CSIRO and SPREP (2021), Current and future climate for Fiji: enhanced ’NextGen’ projections Technical report, https://publications.csiro.au/publications/publication/PIcsiro:EP2021-2149.

[44] Feresi, J. et al. (2000), Climate Change Vulnerability and Adaptation Assessment for Fiji. International Global, prepared for The World Bank Group, International Global Change Institute (IGCI), University of Waikato, in partnership with South Pacific Regional Environment Programme(SPREP) and Pacific Islands Climate Change Assistance Programme (PICCAP), Fiji.

[25] Fiji Bureau of Statistics (2022), Fiji National Accounts, (database), https://www.statsfiji.gov.fj/index.php/statistics/economic-statistics/national-accounts-gdp (accessed on 15 April 2022).

[17] Fiji Bureau of Statistics (2020), Fiji’s Direct Tourism Contribution, https://www.statsfiji.gov.fj/images/documents/Economics_Statistics/Annual_Reports/Satellite-Accounts/Fijis_Direct_Tourism_Contribution_Release_2014-2019.pdf (accessed on 18 May 2022).

[21] Fiji Bureau of Statistics (2018), Economic Surveys – Accommodation and Food Service Activities, (database), https://www.statsfiji.gov.fj/statistics/economic-statistics/business-activity-building-construction.html (accessed on 20 March 2022).

[22] Fiji Bureau of Statistics (2016), Fiji’s earnings from tourism - December & Annual 2015, https://www.statsfiji.gov.fj/latest-releases/tourism-and-migration/earnings-from-tourism/595-fiji-s-earnings-from-tourism-december-annual-2015.html (accessed on 18 May 2022).

[51] Garcés-Ordóñez, O. et al. (2020), “The impact of tourism on marine litter pollution on Santa Marta beaches, Colombian Caribbean”, Marine Pollution Bulletin, Vol. 160, p. 111558, https://doi.org/10.1016/J.MARPOLBUL.2020.111558.

[26] Gillett, R., A. Lewis and I. Cartwright (2014), “Coastal fisheries in Fiji: Resources, issues and enhancing the role of the Fisheries Department”, Gillet Preston Associates.

[28] Gillett, R. and M. Tauati (2018), “Fisheries of the Pacific Islands regional and national information”, FAO Fisheries and Aquaculture Technical Paper, Vol. 625, pp. 1-400, https://www.fao.org/publications/card/en/c/7688c916-f1f2-5fe4-b306-2f7a0528e829/.

[15] GOAP (forthcoming), , Global Ocean Accounts Partnership.

[14] Gonzalez, R. et al. (2015), “Marine ecosystem service valuation”, MACBIO (GIZ/IUCN/SPREP), Suva, Fiji, http://www.macbio.pacific.info (accessed on 14 February 2022).

[54] Graci, S. and L. Van Vliet (2020), “Examining stakeholder perceptions towards sustainable tourism in an island destination. The case of Savusavu, Fiji”, Tourism Planning and Development, Vol. 17/1, pp. 62-81, https://doi.org/10.1080/21568316.2019.1657933/FORMAT/EPUB.

[39] Gravelle, G. and N. Mimura (2008), “Vulnerability assessment of sea-level rise in Viti Levu, Fiji Islands”, Sustainability Science, Vol. 3, pp. 171-180, https://doi.org/10.1007/s11625-008-0052-2.

[16] Hampton, M. and J. Jeyacheya (2020), “Tourism-Dependent Small Islands, Inclusive Growth, and the Blue Economy”, One Earth, Vol. 2/1, pp. 8-10, https://doi.org/10.1016/J.ONEEAR.2019.12.017.

[12] Hoegh-Guldberg, O. and T. Ridgway (2016), Reviving Melanesia’s Ocean Economy: The Case for Action, WWF-Pacific.

[57] IEA (2022), Transport sector CO2 emissions by mode in the Sustainable Development Scenario, 2000-2030, http://www.iea.org/data-and-statistics/charts/transport-sector-co2-emissions-by-mode-in-the-sustainable-development-scenario-2000-2030 (accessed on 18 May 2022).

[56] IEA (2021), International Shipping, Tracking Report November 2021, webpage, https://www.iea.org/reports/international-shipping (accessed on 23 March 2022).

[19] IFC (2019), Assessment of the Economic Impact of Cruise Tourism in Fiji, International Finance Corporation, Washington, DC, http://www.mitt.gov.fj (accessed on 28 January 2022).

[18] IFC (2018), From the Farm to the Tourist’s Table: A Study of Fresh Produce Demand from Fiji’s Hotels and Resorts, International Finance Corporation, Washington, DC, https://www.ifc.org/.

[32] IFC (forthcoming), Agri-logistics deep dive: Expanding the private sector role in delivering agri-logistics solutions in Fiji.

[55] IMO (2020), Fourth IMO GHG Study 2020, International Maritime Organization, London, https://wwwcdn.imo.org/localresources/en/OurWork/Environment/Documents/Fourth%20IMO%20GHG%20Study%202020%20Executive-Summary.pdf.

[1] IOM (2020), Migration in the Republic of Fiji: A Country Profile 2020, International Organization for Migration, Geneva, http://www.iom.int.

[45] Jolliffe, J. (2016), Economic dimensions of relocation as an adaptation strategy to climate change: A case study of the Narikoso Relocation Project, Fiji, Pacific Community, Suva.

[9] Jolliffe, J., C. Jolly and B. Stevens (2021), “Blueprint for improved measurement of the international ocean economy: An exploration of satellite accounting for ocean economic activity”, OECD Science, Technology and Industry Working Papers, No. 2021/04, OECD Publishing, Paris, https://doi.org/10.1787/aff5375b-en.

[8] Kitolelei, J., T. Torii and V. Bideshi (2009), “An overview of Fiji’s fisheries”, https://www.researchgate.net/publication/279861585_An_Overview_of_Fiji_Fisheries.

[53] Levett, R. and R. McNally (2003), A Strategic Environmental Assessment of Fiji’s Tourism Development Plan, WWF, Gland, Switzerland.

[36] Mangubhai, S. et al. (2019), “Fiji: Coastal and marine ecosystems”, World Seas: An Environmental Evaluation Volume II: The Indian Ocean to the Pacific, pp. 765-792, https://doi.org/10.1016/B978-0-08-100853-9.00044-0.

[37] marine ecology consulting (2019), “Intensity and scale of coral bleaching on Fiji’s reefs”, marine ecology consulting, Suva, https://www.marineecologyfiji.com/snapshot-of-the-2019-coral-bleaching-in-fiji/.

[38] Masson-Delmotte, V. et al. (2019), Global warming of 1.5°C, Intergovernmental Panel on Climate Change, Geneva, http://www.environmentalgraphiti.org (accessed on 28 January 2022).

[42] Merschroth, S. et al. (2020), “Lost material stock in buildings due to sea level rise from global warming: The case of Fiji Islands”, Sustainability, Vol. 12/3, p. 834, https://doi.org/10.3390/SU12030834.

[58] Ministry of Economy (2018), Fiji Low Emission Development Strategy 2018-2050, Ministry of Economy, Republic of Fiji, Suva, https://unfccc.int/sites/default/files/resource/Fiji_Low%20Emission%20Development%20%20Strategy%202018%20-%202050.pdf.

[43] Ministry of Finance (2015), Climate Public Expenditure and Institutional Review FIJI, Ministry of Finance, Republic of Fiji, Suva, https://www.forumsec.org/wp-content/uploads/2018/10/Fiji-CPEIR-Report-comp.pdf (accessed on 7 March 2022).

[30] Ministry of Fisheries (2019), The Strategic Plan for 2019-2029, Ministry of Fisheries, Suva.

[23] Ministry of Fisheries (2018), Fiji’s Fisheries Sector Investment Guide, Ministry of Fisheries, Suva.

[41] Munday, P. et al. (2008), “Climate change and the future for coral reef fishes”, Fish and Fisheries, Vol. 9/3, pp. 261-285, https://doi.org/10.1111/J.1467-2979.2008.00281.X.

[13] Natuva, T. (2021), “Fiji`s Blue Economy: The importance of maritime security”, Policy Papers on Maritime Strategy and Defence Issues, No. 23, Visiting Navy Fellows, https://www.navy.gov.au/sites/default/files/documents/VNF_Edition_One.pdf#page=127.

[10] OECD (2021), Blueprint for improved measurement of the international ocean economy : An exploration of satellite accounting for ocean economic activity, OECD Publishing, Paris, https://doi.org/10.1787/aff5375b-en (accessed on 25 April 2022).

[49] OECD (2021), “Managing tourism development for sustainable and inclusive recovery”, OECD Tourism Papers, No. 2021/01, OECD Publishing, Paris, https://doi.org/10.1787/23071672.

[29] OECD (2020), Sustainable Ocean for All: Harnessing the Benefits for Developing Countries, The Development Dimension, OECD Publishing, Paris, https://doi.org/10.1787/bede6513-en.

[34] OECD/The World Bank (2016), Climate and Disaster Resilience Financing in Small Island Developing States, OECD Publishing, Paris, https://doi.org/10.1787/9789264266919-en.

[27] Parliament of the Republic of Fiji (2019), “Pacific Fishing Company LTD 2017 Annual Report”, Parlamentary Paper, Vol. 33, http://www.parliament.gov.fj/wp-content/uploads/2019/05/Committee-Review-Report-PAFCO-2017-Annual-Report.pdf (accessed on 14 February 2022).

[47] Prince, J. et al. (2021), “Spawning potential surveys in Fiji: A new song of change for small-scale fisheries in the Pacific”, Conservation Science and Practice, Vol. 3/2, p. e273, https://doi.org/10.1111/CSP2.273.

[2] Republic of Fiji (2021), National Ocean Policy 2020-2030, Republic of Fiji, https://library.sprep.org/content/republic-fiji-national-ocean-policy-2020-2030.

[7] Sachs, J. et al. (2021), Sustainable Development Report 2021, Cambridge, Padstow, https://doi.org/10.1017/9781108992411.

[52] Singh, A., S. Jamal and W. Ahmad (2021), “Impact assessment of lockdown amid COVID-19 pandemic on tourism industry of Kashmir Valley, India”, Research in Globalization, Vol. 3, p. 100053, https://doi.org/10.1016/J.RESGLO.2021.100053.

[50] UNWTO (2012), Challenges and Opportunities for Tourism Development in Small Island Developing States, World Tourism Organization, Geneva, https://www.e-unwto.org/doi/book/10.18111/9789284414550.

[3] World Bank (2020), GDP per capita (current US $) - Fiji, (database), https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=FJ (accessed on 24 April 2022).

[35] World Bank (2017), New report projects $4.5 billion cost to reduce Fiji’s vulnerability to climate change, 10 November, Press Release, World Bank, Washington, DC, https://www.worldbank.org/en/news/press-release/2017/11/10/new-report-projects-us45-billion-cost-to-reduce-fijis-vulnerability-to-climate-change.

[59] World Bank (2017), Pacific Possible: Long-term Economic Opportunities and Challenges for Pacific Island Countries, World Bank, Washington, DC, https://documents1.worldbank.org/curated/en/168951503668157320/pdf/ACS22308-PUBLIC-P154324-ADD-SERIES-PPFullReportFINALscreen.pdf (accessed on 14 April 2022).

[6] World Bank Group (2020), Country Partnership Framework for the Republic of Fiji FY2021-FY2024, World Bank Group, Washington, DC.

1 f

Notes

← 1. Ecosystem services analysed included subsistence food provision, commercial food harvesting, research and education, mineral and aggregate mining, tourism, coastal protection and carbon sequestration.

← 2. The company declares that, out of 1 036 employees, 664 are women, including for production and back-office activities, www.parliament.gov.fj/wp-content/uploads/2019/05/Committee-Review-Report-PAFCO-2017-Annual-Report.pdf.