Chapter 1 examines how trade impacts women in three of their economic roles ‒ as workers, entrepreneurs and business leaders, and consumers. It draws on new data sets, and combines data in new ways to shed light on how women engage in trade, how they are most affected by changes in consumer prices due to trade, and gender gaps in wages and entrepreneurship in export sectors. Barriers to women’s participation in employment and trade, such as the distribution of unpaid work and differences in access to finance, are outlined. To the extent possible, analysis is extended to examine trade’s impact on women of different ethnicities.

Trade and Gender Review of New Zealand

1. Women workers, business leaders and consumers in New Zealand

Abstract

Women workers

Methodology and data

This chapter focusses on women’s participation in trade as employees, with a focus on employment and wages. The analysis in this section uses two main approaches. The first approach is a top-down methodology that utilises the export propensity by industry from New Zealand’s input-output tables to estimate export and tradables sector employment (Baily and Ford, 2018[1]). This methodology has been extended to provide gender-differentiated estimates. While straightforward to calculate and timely, this approach requires some key simplifying assumptions, the most notable of which is that the export propensity applies evenly across an industry.

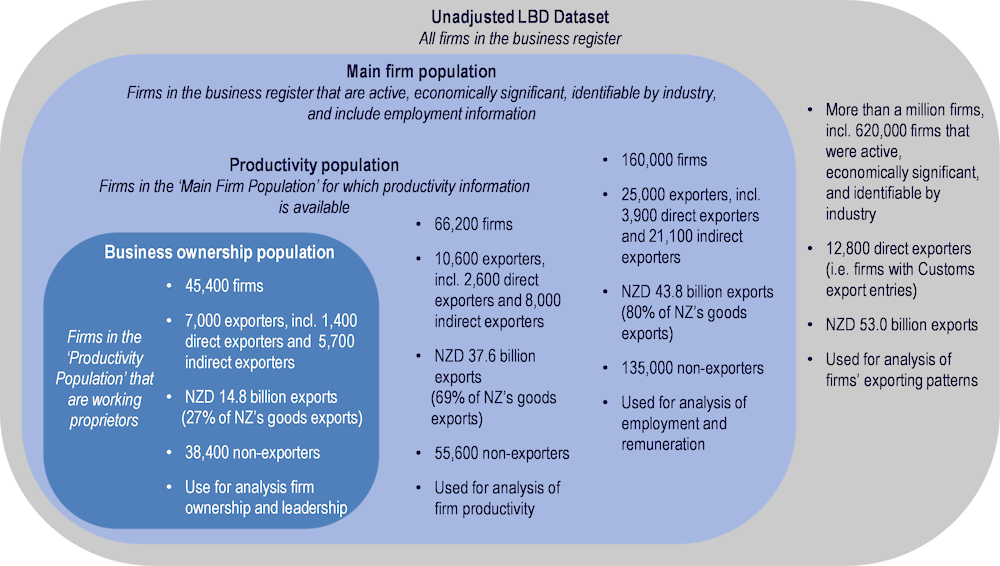

The second approach is a bottom-up methodology utilising New Zealand’s administrative data sets, the Longitudinal Business Database (LBD) and the Integrated Data Infrastructure (IDI). The LBD and IDI collate administrative and other data from a wide range of sources.1,2 The LBD captures data about individual firms. Critically, customs data on goods exports and imports can be linked to individual firms. The IDI captures information about individuals (which are carefully anonymised to preserve privacy). Finally, firm data in the LBD can be linked to each firm’s employee data in the IDI via monthly payroll tax filings.

Linking all this data provides a fairly comprehensive picture on whether firms participate in goods exporting activities, the characteristics of their business owners and leaders (including their gender), and their employees (the number of them, and their gender and pay characteristics). The notable gap in the data set are firms that export and import services. At present, there is no administrative data source that comprehensively measures services exports and imports. All firm-level data presented relate to the year ending March 2018 (Figure 1.1).

Figure 1.1. New Zealand administrative data subsets used for firm-level analysis

Employment of women in New Zealand’s export and tradable sectors

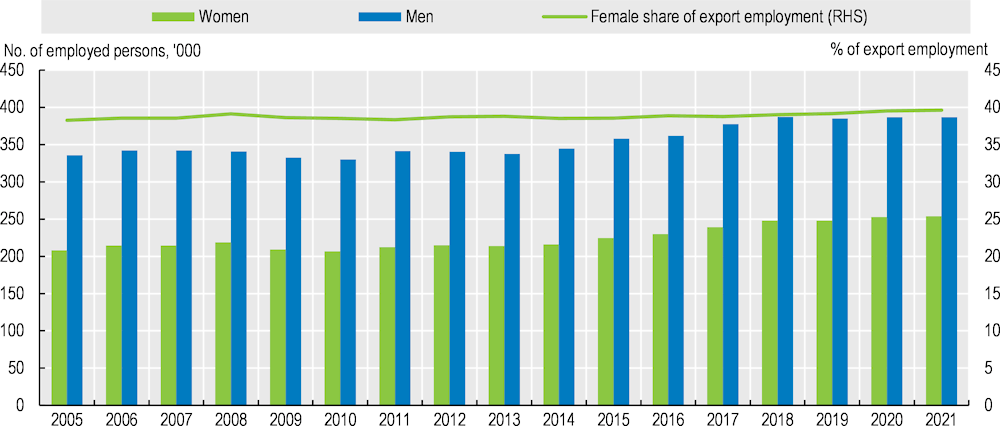

The number of women in New Zealand who produce goods and services for export has increased steadily over the past two decades. Since 2005, women’s export employment has grown by 22% to 254 000 (Figure 1.2). This outpaced growth in the number of men in export-related employment, which grew 15% to 387 000.

Over the same period, the number of women in the wider tradable sector has also increased. Women’s tradable employment increased by 22% to over 510 000, compared with growth in men’s tradable employment of 16%. The wider tradable sector includes employees producing goods and services for export (directly and indirectly), as well as those in industries where international competition is material enough to affect market conditions regardless of whether any individual firm has a solely domestic focus.

This has seen the proportion of jobs held by women in the export and tradable sectors lift slightly over the past two decades. The share of women’s employment in the export sector increased from 38.3% to 39.6% between 2005 and 2021. The results from the firm level (goods-only export) data show a similar employment share of 40.1% in 2018. While at its highest level since data began, women remain underrepresented in export employment compared to their share of the total workforce, where they make up 47.1% of persons employed, and the working age population, where they make up 50.7%.

Figure 1.2. Export employment by gender

Note: Years to June quarter.

Source: Stats NZ, MFAT calculations (2021).

Representation of women in New Zealand’s key exporting industries

A key factor behind women’s low representation in export employment is the nature of the occupations that tend to be held by women in New Zealand. Studies of New Zealand’s occupational gender segregation have found persistent over-representation of women in ‘caring professions’ (such as nursing, teaching and social work), administrative and sales roles, and lower-skilled service jobs (such as personal care and hospitality).3 There is long-standing under-representation of women in farming, lower-skilled manual jobs (such as labouring and machine operating), and technical professions (such as engineering and information technology).

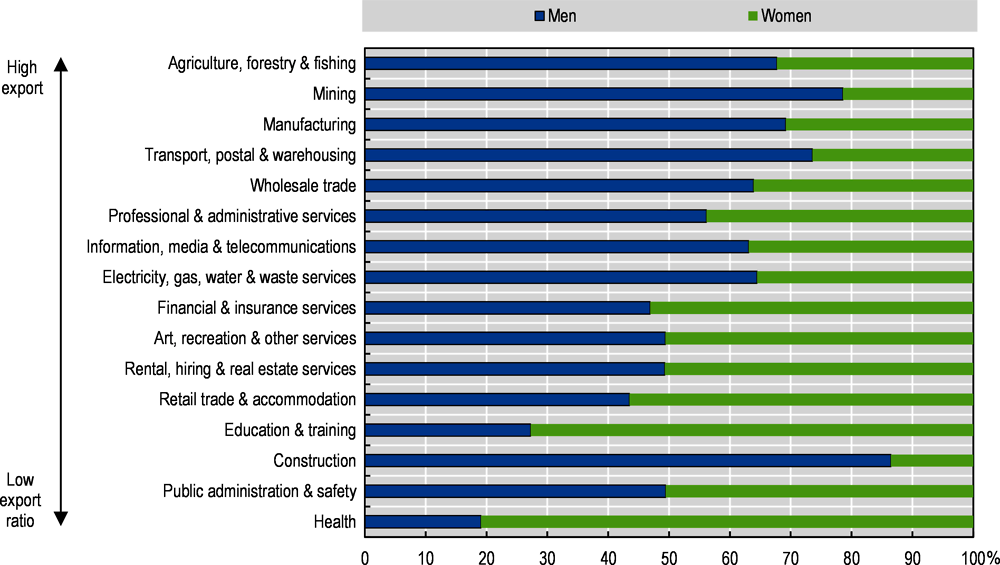

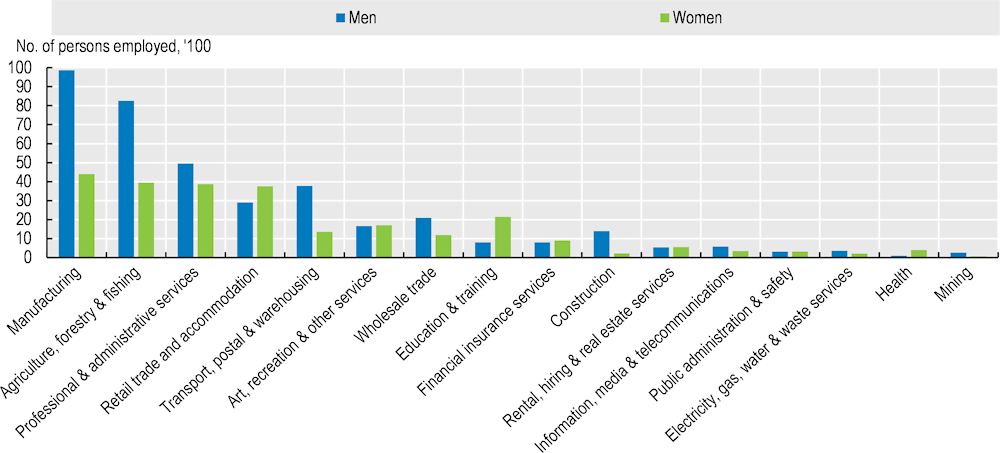

Given New Zealand’s exports are heavily concentrated in the primary industries and related manufacturing, these occupational differences contribute to significantly lower representation of women in New Zealand’s key exporting industries (Figure 1.3 and Figure 1.4). In 2020, the manufacturing, mining, and agriculture, forestry and fishing industries accounted for roughly three-quarters of New Zealand’s total exports, but only a third of all export-related employment of women (compared with half of export employment of men).

Figure 1.3. Gender shares of total industry employment, 2021

Note: Employment data refer to shares that are based on total employment, i.e. export and non-export employment, for each industry. The ranking from high to low export intensity is based on the export ratio from input-output tables, and includes services exports.

Source: Stats NZ, MFAT calculations (2021).

Figure 1.4. Export employment by gender and industry, 2021

Source: Stats NZ, MFAT calculations (2021).

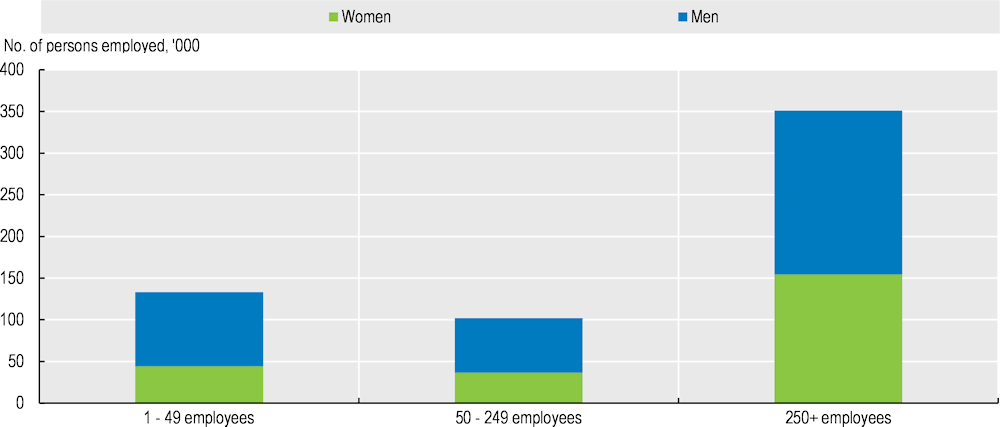

Firm level data for goods-only exporting paints a similar story. The firm level data also suggests that women employees are better represented in exporting sectors in larger firms (i.e. those with more than 250 staff) than they are in small firms (Figure 1.5).

Figure 1.5. Employees of exporting firms by firm size, 2018

Source: Stats NZ, MFAT calculations (2021).

Conversely, there is a high representation of women in domestically focused services sectors. In low-export industries such as healthcare and education, women make up over 70% of the workforce, while other industries with limited exports such as public administration and retail and accommodation also have relatively high rates of employment of women. Construction is the only domestic-focused industry with a strong male employment bias.

The underrepresentation of women in high-export industries is an enduring feature that has changed little in recent years. For example, while the proportion of women’s employment in manufacturing and mining has grown slightly since 2005 (up two and four percentage points respectively to 31% and 24%), employment of women in agriculture, forestry and fishing is unchanged (at 32%) and in transport, postal and warehousing has declined two percentage points (to 26%).

It is unclear whether there are specific barriers constraining women’s participation in export industry occupations ‒ such as skills/qualifications mismatches or biases against hiring women for these jobs ‒ or whether it reflects different employment preferences of men and women.

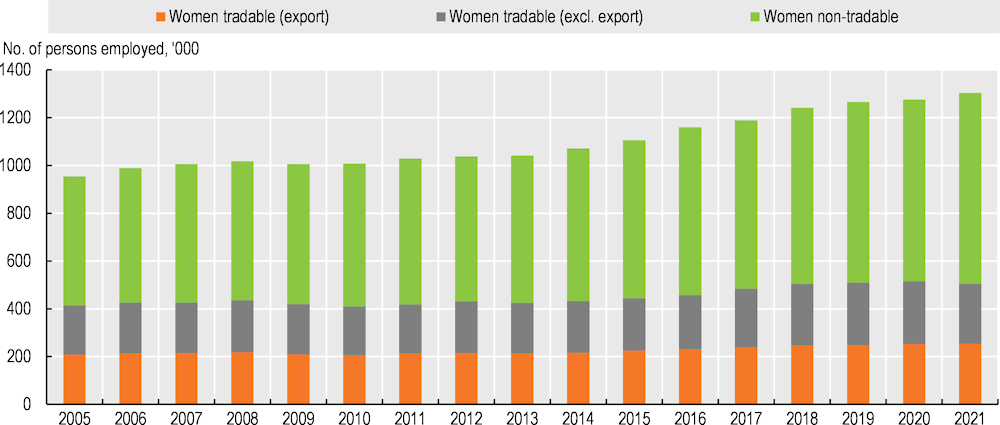

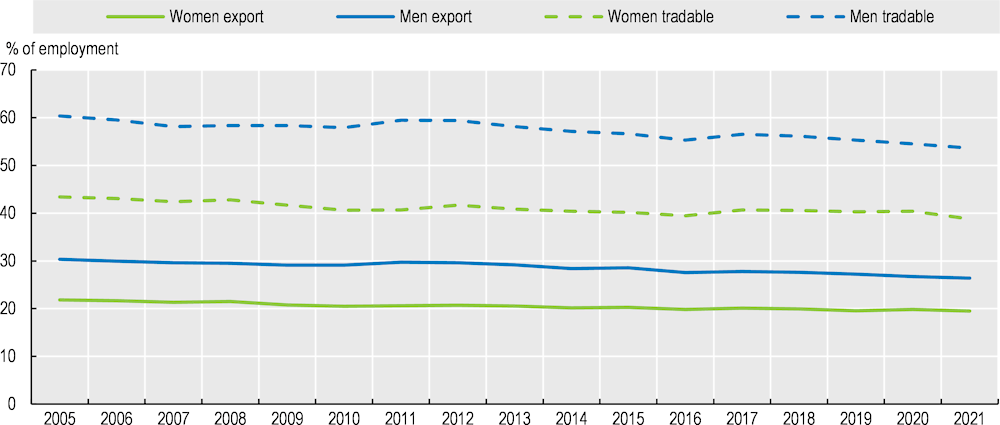

Proportion of women working in export and tradable employment

Despite growth in the number of women in tradable employment, the proportion of women working in the export and tradable sectors as a share of total women’s employment has actually fallen. This is due to the number of women in non-export-related jobs growing rapidly. Since 2005, women’s employment in the tradable sector has grown by 91 000, including 46 000 more women in export-related jobs. However, this was more than offset by an increase of 259,000 in non-tradable employment (Figure 1.6). As a result, the proportion of women in export employment declined from 21.8% to 19.5% in 2021, and in tradable industries from 43.4% to 38.8% (Figure 1.7).

Figure 1.6. Women's export, tradable and non-tradable employment

Note: Years to June quarter.

Source: Stats NZ, MFAT calculations (2021).

Figure 1.7. Employment in export and tradable sectors as share of total

Note: Years to June quarter.

Source: Stats NZ, MFAT calculations (2021).

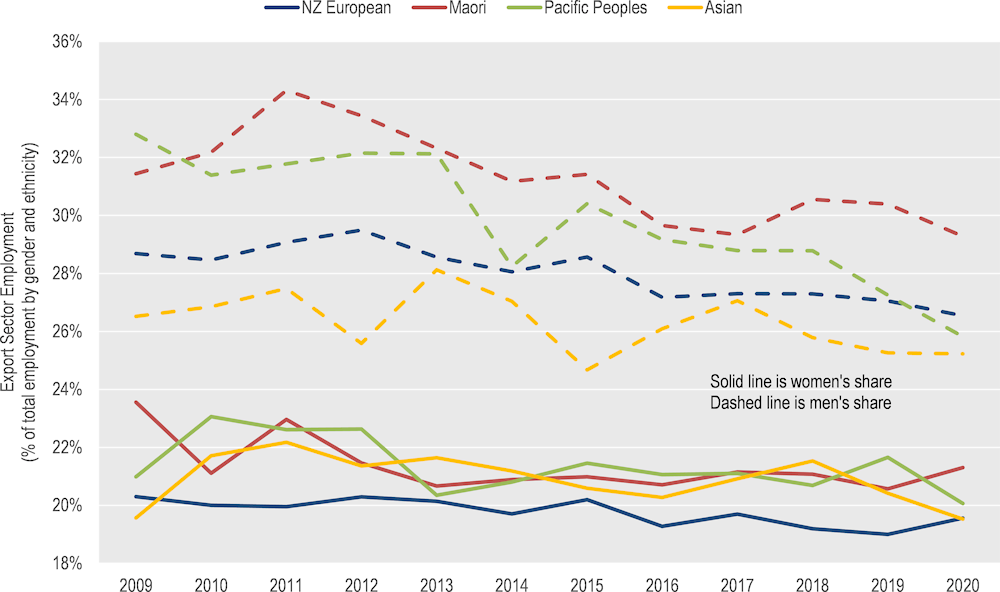

Proportion of women working in export employment by ethnicity

The top down methodology can be further extended to look at the intersection between gender and ethnicity.4 Women, regardless of ethnicity, remain markedly less likely to be in export employment than men (Figure 1.8). Māori and Pasifika women are more likely to be in export employment than New Zealand European women. This in large part stems from relatively high employment of Māori women in export-oriented agriculture and related manufacturing sectors, while Pasifika women have relatively high employment in manufacturing and transport and warehousing. Similar industry composition figures drive the relatively higher proportion of Māori and Pasifika men in export employment.

Figure 1.8. Export employment by gender and ethnicity

Note: Years to June quarter.

Source: Stats NZ, MFAT calculations (2021).

Economy-wide share of export employment

The declining share of export and tradable employment reflects a broader trend across the New Zealand economy. Since 2005, the proportion of New Zealand’s workforce in export-related employment has steadily declined from 26.4% to 23.1% and tradable employment from 52.5% to 46.6%. This has matched similar declines in the export orientation of New Zealand’s GDP.

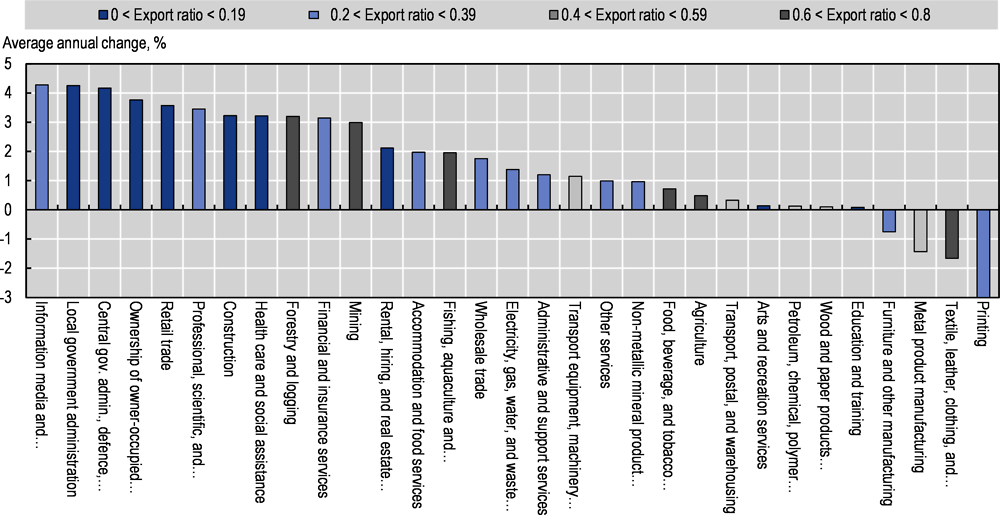

This trend has been driven by the rapid growth of low-export industries over the past two decades. Industries such as government administration, construction, retail trade, and health and social care have led New Zealand’s GDP and employment growth since 2005 (Figure 1.9). Of New Zealand’s 15 fastest growing industries, only three have had a notable export focus: forestry and logging, mining, and support services for primary industries. Conversely, in agriculture ‒ the industry with the highest export propensity ‒ output in 2020 was broadly similar to 2005 levels in real terms, while real output in some sections of the manufacturing industry declined.

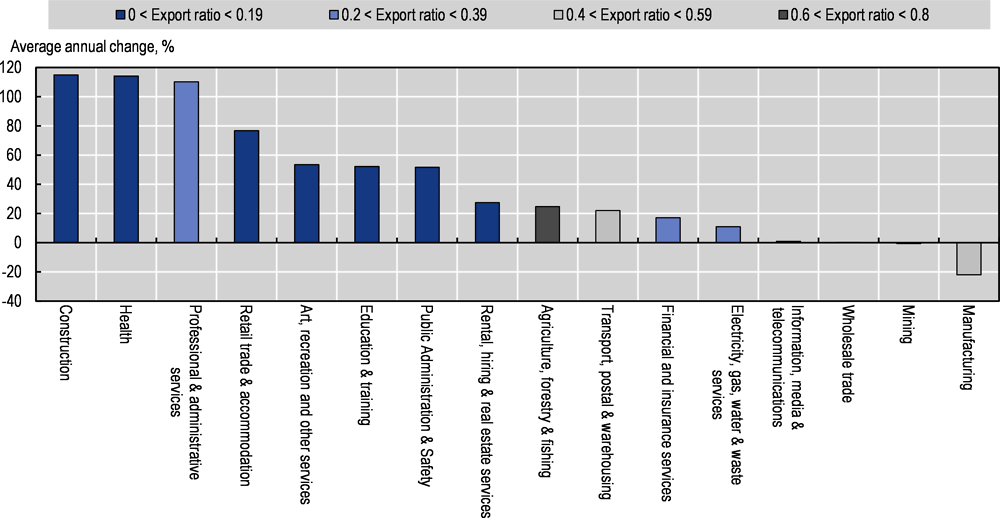

Employment growth has broadly followed these trends in output. Almost 80% of new employment since 2005 has been in services industries with low export propensities5 (Figure 1.10). Meanwhile, in export-focused industries, there were 47 000 more people employed across the agriculture, forestry and fishing and transport, postal and warehousing industries in 2021 than in 2005. This was partially offset by 22 000 fewer jobs in manufacturing and negligible growth in mining employment, despite mining being the second-fastest growing export industry since 2005 in terms of output.

Figure 1.9. Real GDP growth since 2005 by industry and export ratios

Source: Stats NZ, MFAT calculations (2021).

Figure 1.10. Employment growth since 2005 by broad industry

Source: Stats NZ, MFAT calculations (2021).

As a result, it appears from aggregate employment data that the declining share of women’s export employment has been driven mainly by a structural decline in the share of export employment across New Zealand’s economy, rather than a growing gender bias. It also appears there has been limited progress in increasing women’s participation in export and trade-focused industries in recent years.

Gender wage gap

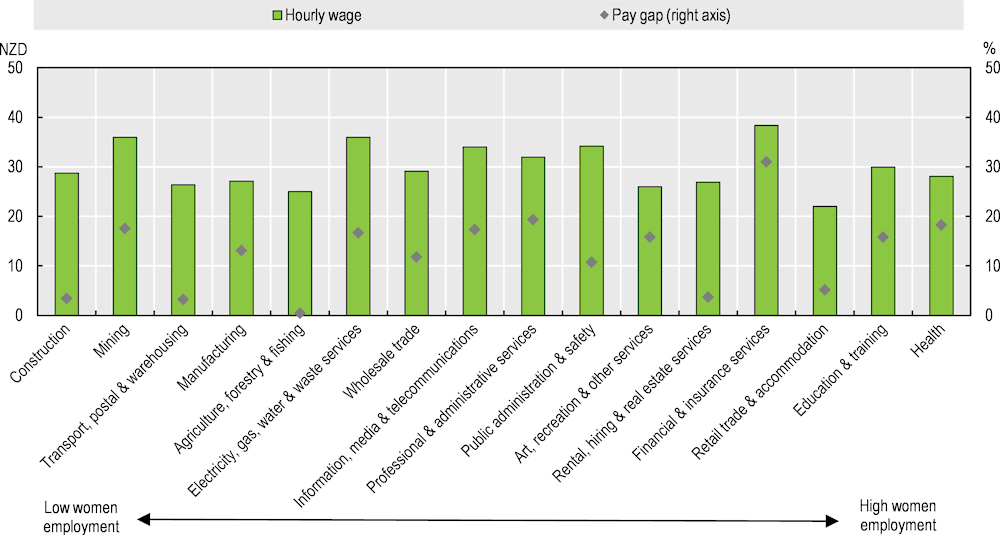

New Zealand women continue to earn less than men on average across all industries. The official gender pay gap, as measured by the difference in median hourly earnings, was 9.1% in 2021.6 After trending down from over 15% in the late 1990s, the gender pay gap has been essentially flat at around 10% over the past decade. The pay gap also varies significantly across industries, from only 0.4% in agriculture, forestry and fishing to 31.0% in financial and insurance services.

While some studies have found that wages tend to be significantly lower in industries dominated by women, in New Zealand there appears little correlation at an aggregate level between the level of the median wage in an industry and the proportion of employment of women (Figure 1.11). For example, the median wage is higher in the health and education industries where women comprise over 70% of the workforce than in the male-dominated construction, transport, postal and warehousing, and agriculture, forestry and fishing industries.7

Similarly, gender wage gaps across industries do not appear to relate to the share of employment of women in those industries. For example, the gender wage gaps in the health and education industries where women are prevalent are 18.3% and 15.8% respectively; whereas in the construction, transport, postal and warehousing, and agriculture, forestry and fishing industries, where fewer women work, the gaps range from only 0.4% to 3.4%.

Figure 1.11. Gender pay gap and median wage by share of women’s employment, 2021

Source: Stats NZ, MFAT calculations (2021).

When considering gender wage gaps across occupation rather than industry, there is some evidence that gender pay disparities are larger in higher income occupations. The median hourly wage for women in high-earning professional roles is 15.0% less than for men, whereas for women in labourer, sales, or clerical and administration roles the gender wage gap ranges from 4.4% to 8.7%. A notable exception to this trend is in managerial roles, where the pay gap is 6.9%.

Other measures such as weekly and average earnings reveal wider pay gaps. For example, the gender pay gap as measured by average hourly wages was 10.6% in 2021, as the long upper tail for wages has a greater impact on the mean than the median and men are disproportionately represented in high-earning roles. Further, when measured as median weekly earnings, the gender pay gap was 23% in 2021. The firm-level analysis uses a similar median monthly earnings measure. The significant difference between hourly and weekly/monthly earnings reflects that women are almost twice as likely as men to work part-time and are less likely to work overtime, due to women shouldering more family responsibilities and unpaid work in the household.

Gender pay gap in export sectors

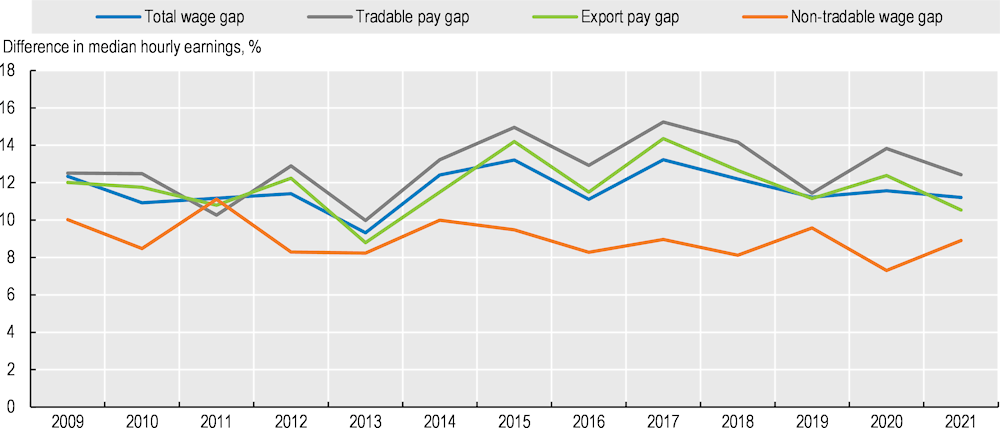

Estimates of the wage gaps between men and women in export and tradable employment also remain broadly similar to what they were a decade ago. They also remain consistently higher than the gender wage gap in non-tradable employment (Figure 1.12). The industry-weighted median wage for women in export employment in 2021 was 10.5% lower than for men, while in tradable employment it was 12.4% lower. This compares with an 8.9% wage gap in non-tradable employment.

Figure 1.12. Estimates of export, tradable and non-tradable gender wage gaps

Note: These are industry-weighted estimates of the median wage gaps between males and females. For consistency, the 'Total wage gap' depicted here therefore differs from the official measure discussed elsewhere.

Source: Stats NZ, MFAT calculations (2021).

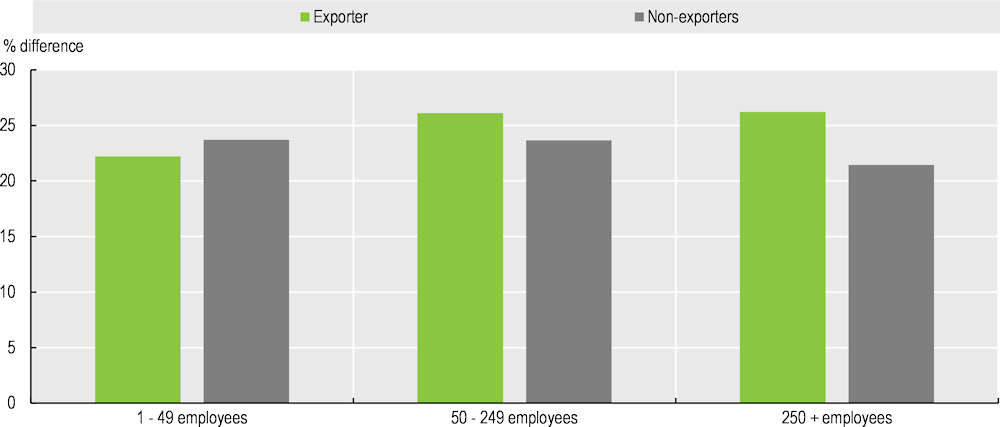

Larger gender pay gaps in export employment also emerge in the firm-level data using a median monthly earnings measure, with gender pay gaps of 23.6% for goods exporting firms and 21.6% for non-goods exporting firms. For direct goods exporters only the difference is even more marked at 26.4%. Furthermore, the differences appear larger for larger exporting firms, while interestingly the reverse is true of non-exporting firms (Figure 1.13).

Figure 1.13. Gender pay gap in average monthly earnings by firm size, 2018

Source: Stats NZ, MFAT calculations (2021).

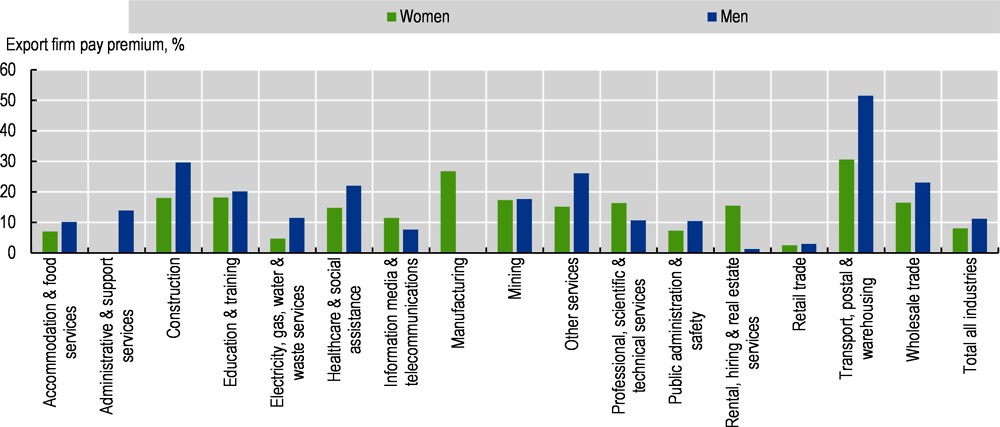

Women employees also appear to be benefiting less from participating in export activities than men when comparing export and non-export related wages for each gender, i.e. their “export pay premium”. Men employed in goods exporting firms earn, on average, 11.2% more than men employed in non-exporting firms. By contrast, the export pay premium for women employees is only 8.1% on average. This higher export firm pay premium for men is replicated across most sectors (Figure 1.14). Similar findings emerge in the aggregate, top-down analysis. Furthermore, this gender difference between tradable and non-tradable wages has grown over the past decade, with men enjoying a particularly high wage premium since 2015.

Figure 1.14. Export firm pay premium by sector and gender, 2018

Note: Figure does not include pay premium data for the following sectors: Agriculture, fisheries and forestry (as all firms in this sector are considered exporters); Financial and insurance services (given that we would not expect these firms to export goods); Manufacturing, for male employees (due to Statistics NZ suppression requirements); and Arts and Recreation Services (the magnitude of the export pay premium is artificially high for this sector – due to the small number of exporting firms from this sector in our sample).

Source: Stats NZ, MFAT calculations (2021).

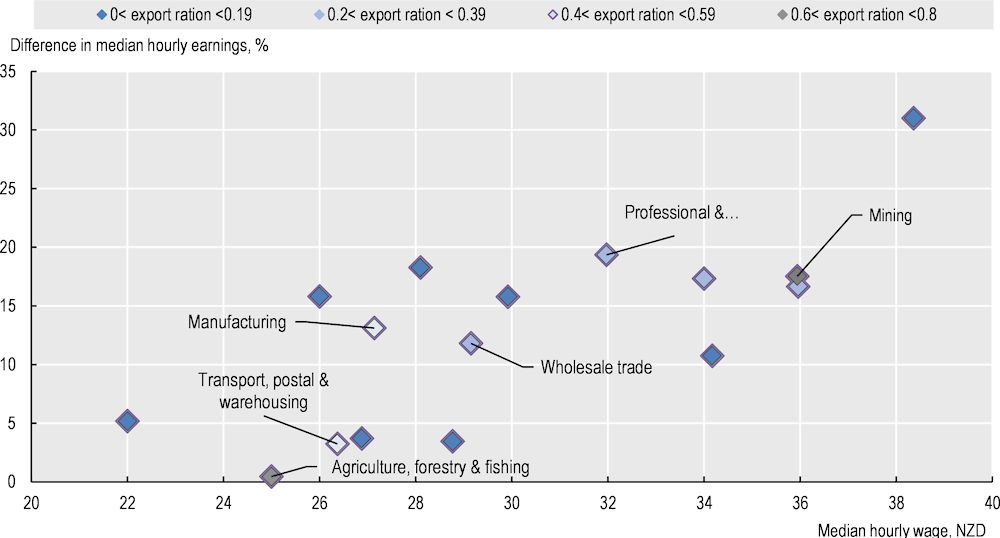

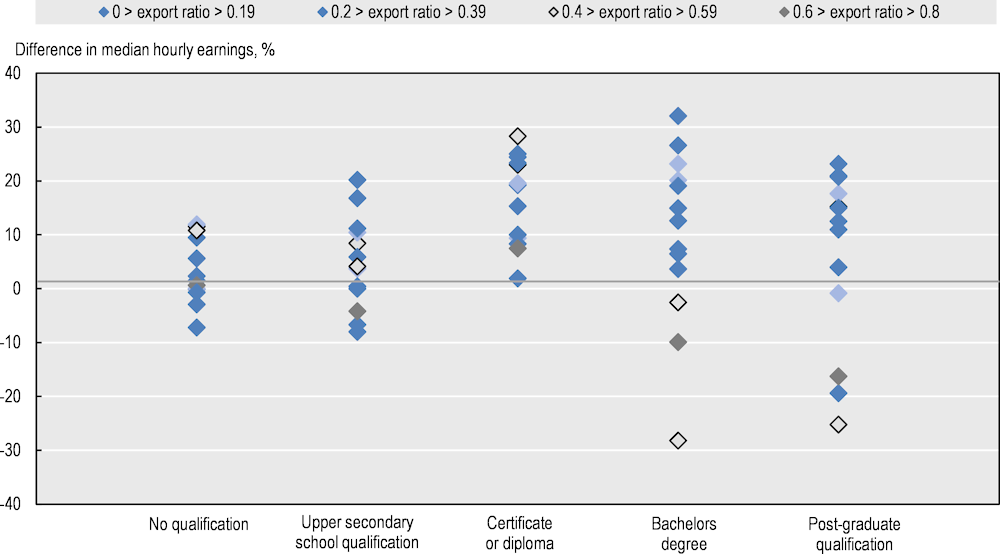

However, it is difficult from aggregate data to identify the drivers of the larger tradable gender disparities – in particular, to identify whether they relate to factors intrinsic to trade or other sources of gender discrimination. As seen in some other OECD countries, gender wage gaps in New Zealand tend to be larger in higher wage industries (Figure 1.15). Moreover, this trend is consistent across both higher exporting and lower exporting industries. It is also not clear that exporting industries have exceptionally large gender wage gaps across different levels of educational qualification. While industry pay disparities generally are larger and more varied for individuals with higher qualification levels, it is broadly consistent across exporting and domestically focused industries (Figure 1.16). In fact, women with bachelor’s degrees or higher in the transport, postal and warehousing, and agriculture, forestry and fishing industries earn higher hourly median wages than men, although the sample sizes for these groups are relatively small.

Figure 1.15. Industry gender wage gaps and wage levels, 2021

Source: Stats NZ, MFAT calculations (2021).

Figure 1.16. Industry gender wage gaps by educational qualification, 2021

Note: Due to data unavailability, the Mining, Information, media & telecommunications, and Electricity, gas, water & waste services industries are not included

Source: Stats NZ, MFAT calculations (2021).

Women entrepreneurs, business owners and leaders

Methodology and data

This section focusses on women’s participation in trade as business owners and leaders, with a focus on better understanding the characteristics of their businesses and the challenges they face to trading. An overview of the business characteristics of women-owned and women-led businesses, their situation vis-à-vis trade, and the challenges they face will make use of the OECD-World Bank-Facebook Future of Business survey of firms with an online presence on Facebook. The bi-annual survey includes questions about perceptions of current and future economic activity, including trade, as well challenges and business characteristics, including the gender of the owner/manager. The survey aims to give a snapshot of businesses, mostly small and medium-sized, with an online presence. Over 700 000 Facebook page owners have taken the survey, out of an estimated population of 80 million businesses that have created a Facebook business page.8 The survey was weighted in accordance with the Facebook page administrator population rather than the total business population. Therefore the survey should be regarded as representative of firms with an online Facebook presence rather than the entire business population. Most of the data used here refer to the July 2019 survey which included specific trade-related questions. The 2020 survey focused on questions focused on the Covid-19 pandemic and government support measures.

The survey results used here were for New Zealand firms. In order to increase the quality of responses, the analysis of responses in this chapter is restricted to self-identified owners and managers. The management structure of 868 New Zealand firms could be identified. Of those firms, 283 (33%) are led by women, 331 (38%) are led by men and 254 (29%) are led equally by men and women. Similarly, the ownership structure in 512 of New Zealand respondents was identified, 273 (53%) of which were women. Results are weighted to reflect as closely as possible the population of businesses with a Facebook page as Facebook is “in a unique position of knowing a considerable amount of information about both respondents and non-respondents” (Schneider, 2020[2]).

It will be seen that the vast majority of the firms surveyed in this way are in services sectors. This analysis complements the analysis focussing on New Zealand women’s participation in goods exporting as entrepreneurs, business owners and leaders. That analysis primarily utilises the firm-level data set described at the beginning of the “Women workers” section. The analysis mostly focuses on the slightly wider definition of women as business leaders, largely because this has a much larger sample size to work with in the firm-level dataset.

From the firm-level data, it is possible to determine whether the 10 500 goods exporting firms are led mostly by men or mostly by women. For this analysis, the 5% highest paid employees in each firm are assumed to constitute the firm’s managers and leaders. Where there were equal numbers of men and women, they are regarded as “split led firms”. For small firms (<20 employees), the top 5% will be a single person, which in many cases will also be the owner (although we are unable to verify this at this stage). For the largest firms, the top 5% is likely to consist of the senior leadership team and perhaps the next tier of managers.

A comparison of the population of firms covered in the LBD-IDI firm level data combined with customs import and export data with the New Zealand survey respondents to the Future of Business Survey suggests that the two datasets are complementary and suggests the survey data are broadly significant (Table 1.1). The firm-level data includes many more firms, and is administrative data so gives a comprehensive picture of the types of firms it includes ‒ largely those that are goods exporters or firms that sell to goods exporters. The survey data includes many fewer firms ‒ it includes less than 1 000 firms whereas the comprehensive LBD-IDI dataset covers 160 000 firms. FOBS includes more services firms, but covers agriculture and construction firms less well than the administrative data. Its bias is toward those firms that are digitally active, since the survey is online. It surveys many fewer firms than are included in the administrative data but includes services firms that do not export indirectly through goods exporting firms, and includes some additional qualitative information such as the challenges faced by entrepreneurs. Interestingly, the FOBS includes a slightly smaller share of micro-firms and a slightly larger representation of medium-sized and larger firms, than the administrative dataset. Both datasets suggest that around 15% of New Zealand firms export.

The quantitative analysis was complemented by a qualitative process of engaging women entrepreneurs and business leaders. The qualitative analysis consisted of structured discussions with New Zealand women entrepreneurs focused on the challenges they face growing their businesses internationally, the discrimination they have faced as business leaders, and the support they have received. These discussions were facilitated by New Zealand’s trade promotion agency, New Zealand Trade and Enterprise (NZTE).

Table 1.1. Firm coverage in the LPD-IDI administrative data and the Future of Business Survey

Number of firms and share in the total number of firms covered in each dataset

|

|

Firm-level data (1) |

Future of Business Survey |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

Goods exporter (direct or indirect) |

Share |

Non-exporter |

Share (%) |

Exporter |

Share (%) |

Non-exporter |

Share (%) |

|

|

Agriculture, Forestry and Fishing |

21264 |

13.37 |

0 (2) |

0.00 |

17 |

2.79 |

27 |

4.56 |

|

|

Construction |

81 |

0.05 |

22,620 |

14.22 |

4 |

0.65 |

41 |

6.86 |

|

|

Manufacturing |

1419 |

0.89 |

9,117 |

5.73 |

16 |

2.67 |

26 |

4.28 |

|

|

Services |

2253 |

1.42 |

102,315 |

64.32 |

49 |

8.22 |

417 |

69.97 |

|

|

Total |

25017 |

15.73 |

134,052 |

84.27 |

85 |

14.33 |

511 |

85.67 |

|

Note: 1. Combining New Zealand’s administrative data sets, the Longitudinal Business Database (LBD) and the Integrated Data Infrastructure (IDI). All agricultural firms were assumed to be exporters.

Business characteristics9

One factor in the success and survival of a firm is the motivation for starting the business. Most entrepreneurs in New Zealand start their businesses by choice. The main reason for both women and men to found their own business is to achieve a better work life balance: this reason is given by about 50% of both women and men. Other main reasons for going into entrepreneurship are to pursue a passion or interest, greater independence, and to make more money. A minority of entrepreneurs (about 14% of both women and men) are opportunity entrepreneurs, i.e. they have gone into business to commercialise a specific product or develop an idea (Box 1.1). Slightly fewer women entrepreneurs (9%) than men (10%) in New Zealand are necessity entrepreneurs, i.e. they have founded or joined their businesses because they have no other employment opportunities. Contrary to the situation in OECD countries more generally, more New Zealand women (11%) have taken over family businesses than men (8%). A substantial share of both women and men business owners ‒ close to 30% ‒ are sidepreneurs, i.e. they also have another activity, usually paid employment in another firm.

New Zealand businesses owned by women tend to be younger than those owned by men. Over one-third of business led by men have been in operation for ten years or longer whereas less than one in five of businesses led by women have been operating for ten years or more.

Box 1.1. Types of entrepreneurship

Entrepreneurs found their businesses for a complex set of reasons, and many of them depend on the other economic opportunities available to them. Necessity entrepreneurs are unemployed or cannot find quality employment. Their only viable employment option is to found a business. In times of high economic growth, necessity entrepreneurship declines. Flexibility entrepreneurs found their businesses because workforce policies do not accommodate their caregiving responsibilities or they desire more control over when and where they work. While some necessity and flexibility entrepreneurs grow successful businesses, for the most part they return to the labour force when they can. Opportunity entrepreneurs see possibilities in the market that they want to exploit. They are more likely to enter the market in good economic times than in bad. These businesses tend to have a higher rate of survival and better growth prospects. Part-time entrepreneurship is often called sidepreneurship. The rate of growth in the number of sidepreneurs is often greater than for all ventures

Source: American Express (2019[3]).

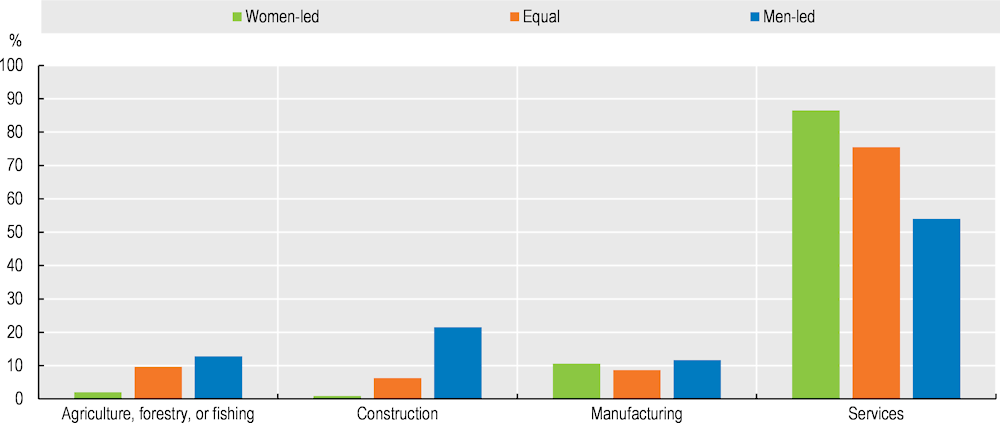

The vast majority of women-owned and women-led businesses are in services sectors (Figure 1.17). Close to 90% of women-led firms with a Facebook business page are in services, compared with 54% of men-led firms. Men-led firms far outnumber women-led firms in construction and agriculture, and are more prevalent in the manufacturing sector.

Services subsectors where most women own and lead businesses are personal services,10 hospitality, education services, retail and wholesale trade, and professional and scientific services.11 Men tend to own and lead businesses in professional and scientific services and retail and wholesale trade, followed by the media, information and communications sector,12 and the hospitality sector.

Figure 1.17. The vast majority of women-owned and women-led firms are in services

Note: Firms based in New Zealand with a Facebook presence.

Source: Facebook-OECD-World Bank Future of Business survey, June 2019.

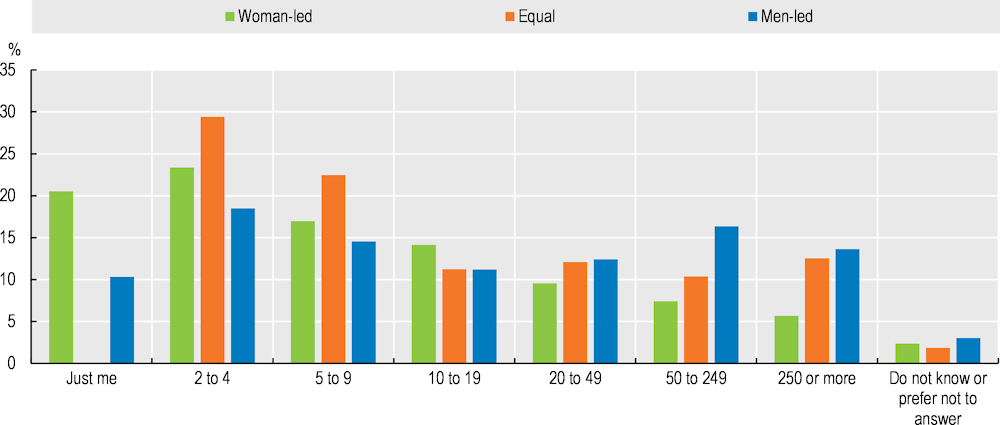

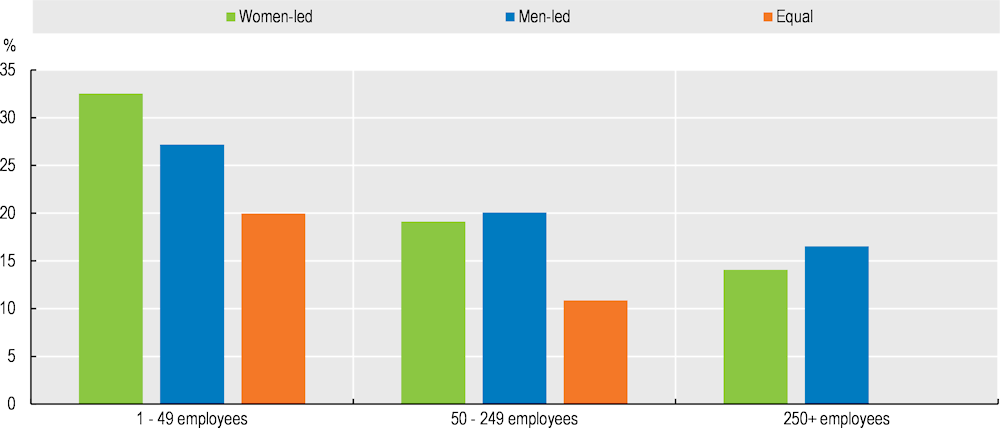

As in other OECD countries, women-owned and women-led businesses are smaller than those owned and led by men. Women entrepreneurs in New Zealand are much less likely than men to have employees (Figure 1.18). They are more likely than men to lead micro- or small enterprises (less than 20 employees). In larger businesses, the gulf between women and men in ownership and management is substantial. It is particularly wide in medium-sized (50-250 employees) and large firms (more than 250 employees) which represent 16% and 14% of men-led firms respectively, compared with 7% and 6% of women-led firms.

Even in services sub-sectors where women dominate, their businesses are smaller. In personal services, retail trade, hospitality, healthcare and professional services, women-owned and women-led businesses tend to be smaller than those owned and led by men.

Figure 1.18. Women led firms are smaller than those led by men

Note: Firms based in New Zealand with a Facebook presence.

Source: Facebook-OECD-World Bank Future of Business survey, June 2019.

Women entrepreneurs in trade13

Overall, as in many other OECD countries, women entrepreneurs in New Zealand trade less than their male counterparts (Figure 1.19) This finding is driven mostly by smaller enterprises. Since smaller enterprises tend to trade less, and women-led businesses tend to be smaller, they trade less overall than men-led businesses. However, although the vast majority of micro and small firms do not trade, women-led sole proprietor firms (with no employees) in New Zealand actually trade more than men-led firms of the same size. Women-led medium- and large-sized enterprises tend to trade less than their men-led equivalents. However, women-led firms that trade tend to export to more countries than their male counterparts, regardless of firm size. Moreover, there is a small subset of women business leaders of medium and large enterprises who export very extensively ‒ to more than 11 countries ‒ and on average they export to more countries than their male counterparts. In services sectors, women-led firms trade almost as much as men-led ones which is notable given that some services where women work (personal services, childcare, etc.) are less traded across borders.

As is the case in many OECD countries, women-owned and women-led businesses tend to export more to individual consumers and export less to other businesses, than men-led firms. This indicates that in order to expand exports, they will need to increase their extensive margins, i.e. increase the number of customers, rather than the intensive margin, i.e. the size of each order.

Figure 1.19. Women-led firms trade less than men-led firms

Note: Firms based in New Zealand with a Facebook presence.

Source: Facebook-OECD-World Bank Future of Business survey, June 2019.

Women-owned and women-led businesses engage with their clients online

The Covid-19 pandemic has shown the potential and importance of e-commerce. Even before the pandemic, women-owned and women-led businesses in OECD countries, and even more so in New Zealand, engaged online more extensively than their male counterparts. Women-owned and women-led businesses are more likely than those owned and led by men to receive more than half of their orders online. They are substantially less likely than their male counterparts to receive less than a quarter of their business from online sales.

Challenges to business expansion and trade

When asked specifically about challenges to trade, both women and men business leaders indicate the biggest challenge is ‘distance to foreign markets’. Perhaps unsurprisingly this challenge was cited more often in New Zealand than in any other OECD country. Moreover, this challenge is cited equally by leaders of small and larger firms. Although there is no way that trade policies can bring markets closer, distance can become somewhat less challenging to exporters in situations of high levels of air transport connectivity and digital services and connectivity (for more information on this, see section on New Zealand’s regulatory environment for services trade and Benz and Jaax (2022, forthcoming[4]). It should be noted that ‘poor internet connection to sell online’ was not a concern for any of the New Zealand business leaders in the Facebook survey.

The second largest challenge to exporting expressed by women business leaders is navigating foreign regulations. Navigating customs regulations was cited among the top five challenges by both women and men exporters and was cited as a common concern both by leaders of small and larger firms.14 Just over one-fifth of women business owners who expressed difficulties exporting indicated that compliance with customs regulations was a major challenge for their business. There may be a role for export promotion services in main export markets in informing New Zealand women exporters of regulations abroad, and aiding them to manage those constraints.

About one-fifth of women business owners that expressed difficulties exporting indicated that e-payment systems represent a challenge, and women seem to indicate this more frequently than men. The sectors most impacted by poor online payment alternatives are the retail trade and textiles and clothing sectors. This could also be an area of exploration for New Zealand’s export promotion experts, either in terms of information or technical assistance in navigating existing e-payment solutions, or tailoring needs to different export markets.

Interestingly, few women entrepreneurs indicate that they experience challenges finding overseas partners, which is one of the main challenges experienced by men entrepreneurs. This may be due to women exporting more to individuals, preferring to sell their products and services through distributors or online platforms, or to the smaller size of their businesses.

Contrary to many OECD countries, women business leaders surveyed through Facebook in New Zealand overall do not rank financing as one of the main challenges to business expansion. This finding may be driven by smaller firms; in medium-sized enterprises, financing is a more frequently cited challenge. This may point to the small amount of capital that women usually have to start their businesses. In OECD countries in general, women request less credit, and obtain less than they request, and so start their businesses with less capital. As businesses grow, access to capital becomes more of an issue and is a problem more often cited by women leaders of firms with 20 or more employees than by men. Similarly, few women cited ‘export financing’ among their main challenges, which may reflect the nature of the services they are selling, much of it online, and therefore with more limited capital needs. In fact, only among entrepreneurs in the textiles and clothing sector was obtaining export financing considered a challenge.

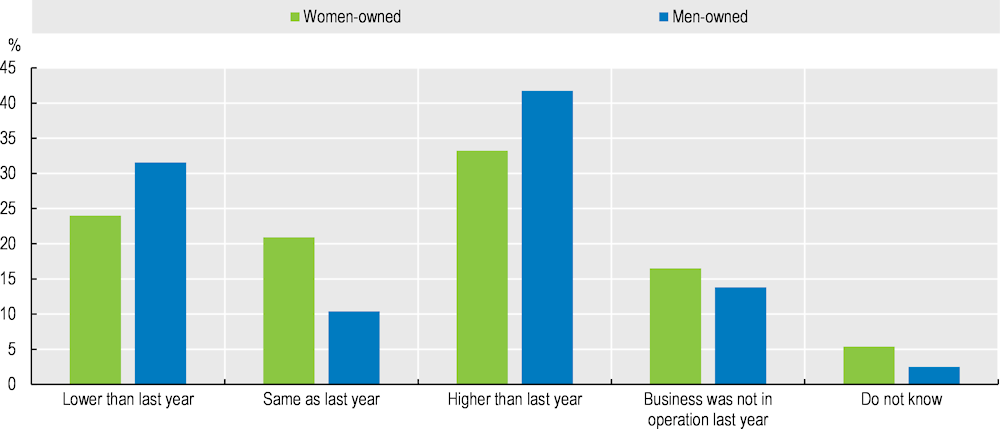

Impact of the COVID-19 pandemic on women and men entrepreneurs15

The year 2020 represented a challenging environment for entrepreneurs, both women and men. The restrictions of movement due to the pandemic, coupled with drops in demand for many goods and services and disruptions to supply chains, meant that many small businesses were strongly impacted. Despite these challenges, women-owned businesses in New Zealand have shown great resilience. Fewer women business owners declared that their levels of activity in 2020 were lower than before the pandemic, compared with men business owners (Figure 1.20). Moreover, slightly more women owners indicated that their activity was the same or higher than before the pandemic, as compared with men.16

The results regarding impacts of the pandemic will need to be confirmed with the 2021 survey data. This is particularly true as New Zealand’s most restrictive measures came somewhat later in the pandemic compared to many other OECD countries. One positive aspect that may explain women entrepreneurs’ resilience during 2020 is their large online presence that may have allowed them to navigate the changes in delivery of goods and services.17 Globally, businesses that reported higher shares of digital sales were also more likely to have reported more robust sales during the pandemic period (Facebook, 2021[5]).

Figure 1.20. Women-owned firms are highly resilient

Note: Firms based in New Zealand with a Facebook presence.

Source: Facebook-OECD-World Bank Future of Business survey, 2020. Monthly surveys were conducted from the end of May until the end of October 2020, with an additional wave fielded at the end of December 2020.

Some survey responses related to the state of businesses during the pandemic suggests some of the underlying challenges faced by women entrepreneurs. A larger percentage of women business owners (5.4%) than men (2.5%) did not report knowing whether their business is doing better or worse than in the previous year. More women than men also indicated they had founded their business in the last year, which mirrors the finding that women-owned and women-led businesses are younger and that a minority of entrepreneurs are opportunity entrepreneurs, i.e. they form their businesses to pursue a market opportunity or innovation, a category of businesses that tends to open when economies are performing well.

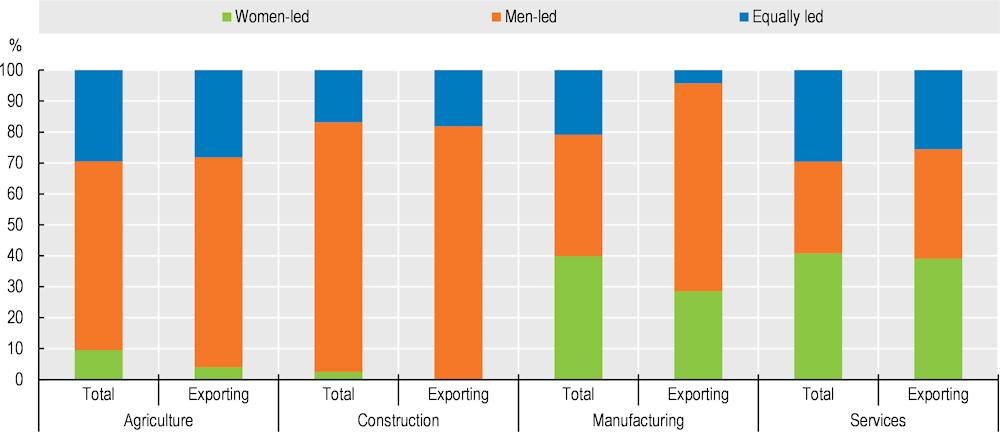

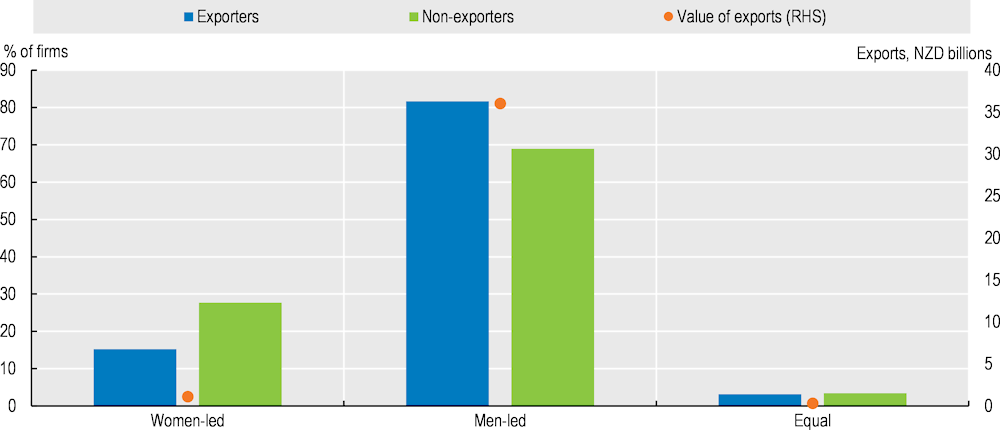

Women as leaders of goods exporting firms18

Using New Zealand’s firm-level data for goods exporters, 82% of goods exporting firms are majority-men led, compared with 15% that are majority women-led. By comparison, firms producing goods led by men made up 69% of non-exporting firms and 28% were led by women. Exporting firms led by men accounted for over 96% of exports sold by these firms, with women-led firms accounting for just 3% of export values (Figure 1.21).19 This is stark evidence of unequal participation at the senior leadership level across firms in general and exporting firms in particular. It is also a likely contributor to the gender pay gaps examined in earlier sections.

Women-led firms have a marginally higher export propensity than men- or split-owned firms. So while women appear to be significantly less likely to lead a firm (including an export firm), those firms they do lead are marginally more willing to sell overseas (31%) than men- or split-owned firms (25% and 19%, respectively). A key factor behind this is the higher export propensity of small (<50 employees) businesses led by women. For medium and large firms the differences in export propensity between women and men led firms are small.

Figure 1.21. Exporting firms by gender of firm leadership, 2021

Source: Stats NZ, MFAT calculations (2021).

Figure 1.22. Export propensity by gender of leader and firm size, 2021

Source: Stats NZ, MFAT calculations (2021).

Women as owners of goods exporting firms

While firm-level data on ownership is limited, it is possible to investigate export characteristics of firms denoted as working proprietors in New Zealand’s administrative data. Working proprietors accounted for NZD 14.8 billion of goods exports in 2018 and 7 000 exporting firms. Two-thirds of exporting working proprietors were men, while 14% were women and 20% were jointly owned. The high share of the latter reflects the inclusion of “indirect exporters” from the agricultural sector, of which a large number are family-run farms and orchards.

The insights from this subset of working proprietors largely mirror those of the leadership analysis. Men working proprietor exporters are currently more productive and pay higher average salaries than women working proprietors, though the differences are less stark than for firms led by men or women. Similar to the analysis of business leaders, women working proprietors have a marginally higher propensity to export. This result is driven by the higher export propensity of small women-owned businesses.

Barriers to women’s participation in trade and labour markets

Evidence shows that many women face substantial barriers to growing their businesses, including internationally, and to participating in the labour force. These include accessing finance to a similar degree to men, engaging in unpaid work in the home that leaves them less time to engage in paid work and to devote to their businesses, and making use of professional and business networks that seem to be less than fully inclusive of women (Korinek, Moïsé and Tange, 2021[6]).

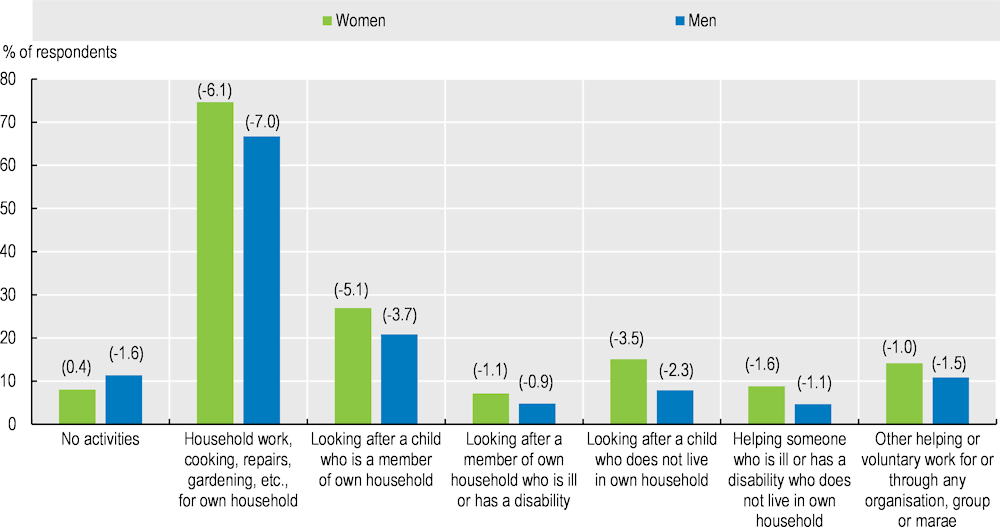

Distribution of unpaid work

Responses from the 2018 New Zealand Census showed that women participate in unpaid activities at a higher rate than men for all categories of unpaid activity. Nearly three-quarters of women participate in household work, while only two-thirds of men undertake similar activities. Similarly, 27% of women were engaged in childcare in 2018 compared to 21% of men, and nearly twice as many women were involved in caring for an ill or disabled family member as men. This mirrors findings from the Stats NZ 2009 time use survey, which found that, on average, women engage in nearly twice the amount of unpaid work as men (4.4 hours per day for women versus 2.4 per day for men).

Although recent data are less precise, the gap in engagement in unpaid activities may have reduced somewhat in recent years. The 2018 Census indicated that the proportion of the population that participates in all categories of unpaid activity has decreased since 2006. One of the areas where women’s participation in unpaid work fell by more than men was in childcare. It appears that families have, in recent years, more readily opted to use formal childcare arrangements rather than relying on a family member or friend to provide that care. This is consistent with the following findings of the 2017 Statistics NZ “Childcare in New Zealand survey”:

A 10 percentage point increase ‒ from 54% to 64% ‒ in the proportion of preschool children attending formal childcare (kindergartens, playschools, etc.) between 2009 and 2017.

A 6 percentage point increase in the number of primary school-age children in formal childcare (from 9% to 15%) over that period.

A more recent survey indicated that lockdowns during the COVID-19 pandemic had an equalising effect on the participation of New Zealand men and women in unpaid activities (Westpac New Zealand, Deloitte, 2021[7]). The survey found that during New Zealand’s pre-Delta lockdowns, women did 5% more paid work than in a typical week, and 7% less housework and had 6% less care responsibilities. Conversely, men did 4% more housework and 4% more care responsibilities, with no change to their paid work.

This sits in contrast to the experience in much of the rest of the world, where the COVID-19 pandemic, and associated lockdowns, appear to have had a disproportionately negative effect on women’s participation in paid work (McKinsey Global Institute, 2020[8]). This is perhaps because of New Zealand’s relatively short lockdowns relative to other economies. It remains to be seen whether changing attitudes towards working-from-home precipitated by these lockdowns will mean that these positive changes become permanent.

Figure 1.23. Percentage of 2018 NZ Census respondents participating in selected unpaid activities and change in participation rate since 2006

Source: Stats NZ, MFAT calculations (2021).

Access to finance

The Future of Business survey data suggested that access to finance was less of a challenge for women-led exporters in New Zealand than elsewhere in OECD countries. However, this challenge was raised by women exporters and business leaders during the consultative process. Problems accessing finance seem to be even more acute for Māori women business owners and leaders (BERL, 2022[9]). It is possible to link firm responses to the New Zealand Business Operations Survey (BOS), which asks questions about access to debt and equity finance, to their administrative data in the LBD. Because the BOS is a survey rather than administrative data, the number of firms for which leadership by gender can be determined falls to around 5 300, of which 1 365 are exporters. Just over 100 of those export firms were women-led. Whilst the number of firms is relatively small, the way the BOS sample is constructed, with a skew to larger firms, means export coverage is relatively high (NZD 32 billion, 58% of goods exports).

Within this relatively narrow sample, 8% of women-led goods exporting firms had sought access to equity finance, and 24% to debt finance, within the latest financial year. In both cases, this was lower than for men-led firms at 10% and 35% respectively. The rates were similar for non-goods exporting firms, with again women-led firms much less likely to have sought finance. For both women- and men-led firms, the reason finance was not sought was usually because it was not needed (about 75% for equity finance and about 85-90% for debt finance). A possible contributing factor to lower rates of women-led firms seeking financing is advice. About 20% of women-led export firms sought advice on debt or equity finance, while about 30% of men-led firms did so.

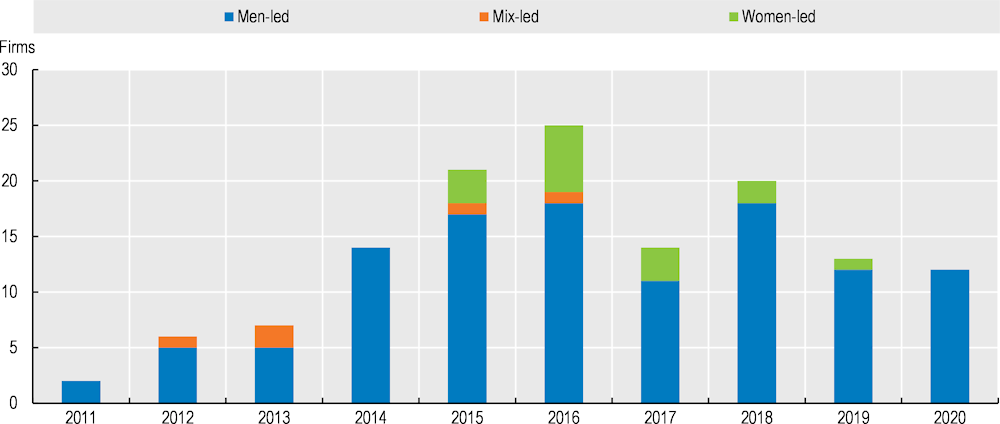

Equity raised by women-led and men-led firms in New Zealand

From a sample of firms that raised investor equity,20 on average over the last ten years 11% of those firms were led by women, compared with 85% of equity-raising firms that were led by men, and 4% of firms were led by both women and men (Figure 1.24). The sector of activity where most firms raised capital was the information technology sector, with 48 men-led firms and four firms led by women receiving funding in New Zealand since 2011. Other leading sectors of activity where men-led firms raised equity were the media (17 firms) and financial sectors (16 firms). Women-led firms raised equity in financial sector (four firms) and the wellness sector (three firms).

The amount of funding raised by women-led firms compared with those led by men varies considerably by year, but is always substantially less per firm. Over the last ten years, men-led firms received 97% of the total equity raised, with women-led firms raising only 3% of equity in New Zealand. In the period of 2015 to 2019, on average, women-led firms raised 17% of the amount of funding raised by men-led firms, which means women-led firms raised six times less funding compared with their male counterparts. This compares unfavourably to women-led firms in mainland Europe: in Germany, women-led start-ups raise three times less funds than male-led start-ups; in France they raise 2.5 times less; but compares more favourably with the United Kingdom, where women-led firms raise 13 times less (Boston Consulting Group, 2019[10]).

Figure 1.24. Few women-led firms raise equity in New Zealand

Source: Crunchbase and Dealroom databases.

Women consumers

Unlike women’s economic roles as workers and business leaders, in their role as consumers trade impacts cannot be measured directly. Consumption patterns are generally collected at the household level, with no breakdown within households by gender. Instead of measuring the impacts of trade and trade policies on women directly, it is possible to measure price changes due to trade and trade policies and their effects on different types of households, such as couples, single dwellers, two-parent families and single-parent families, and on households at different income levels. Although this analysis does not apply specifically to women within households, they are disproportionately represented in certain household categories, such as single-parent households and elderly single dwellers. This analysis may be considered to go beyond the scope of the impact of trade on women and encompass more vulnerable populations.

The distributional implications of trade impacts on consumer prices

Following the framework described in Luu et al (2020[11]) the OECD’s CGE model METRO (OECD, 2020[12]) is used to examine the extent to which different households are exposed to trade-driven changes in consumer prices resulting from trade policy changes.21 A stylised hypothetical tariff simulation is conducted where New Zealand increases its tariffs to 25% on all imports from all trade partners22 excluding Australia, which produces changes in consumer prices on the 65 commodities in the model. The results on commodity price changes are then linked to information from New Zealand’s 2019 Household Economic Survey23 describing expenditure patterns of different socio economic groups. Linking the model results and the household survey allows for comparing the exposure, measured by changes in purchasing power, across different household characteristics ‒ for this analysis, household structure.

A household’s exposure to trade-driven policy changes will depend on the price changes of the commodities they consume and the extent to which the household consumes that commodity. If price changes are concentrated in the goods and services consumed by lower-income or single parent households, for example, then trade-driven changes in prices may increase inequality.

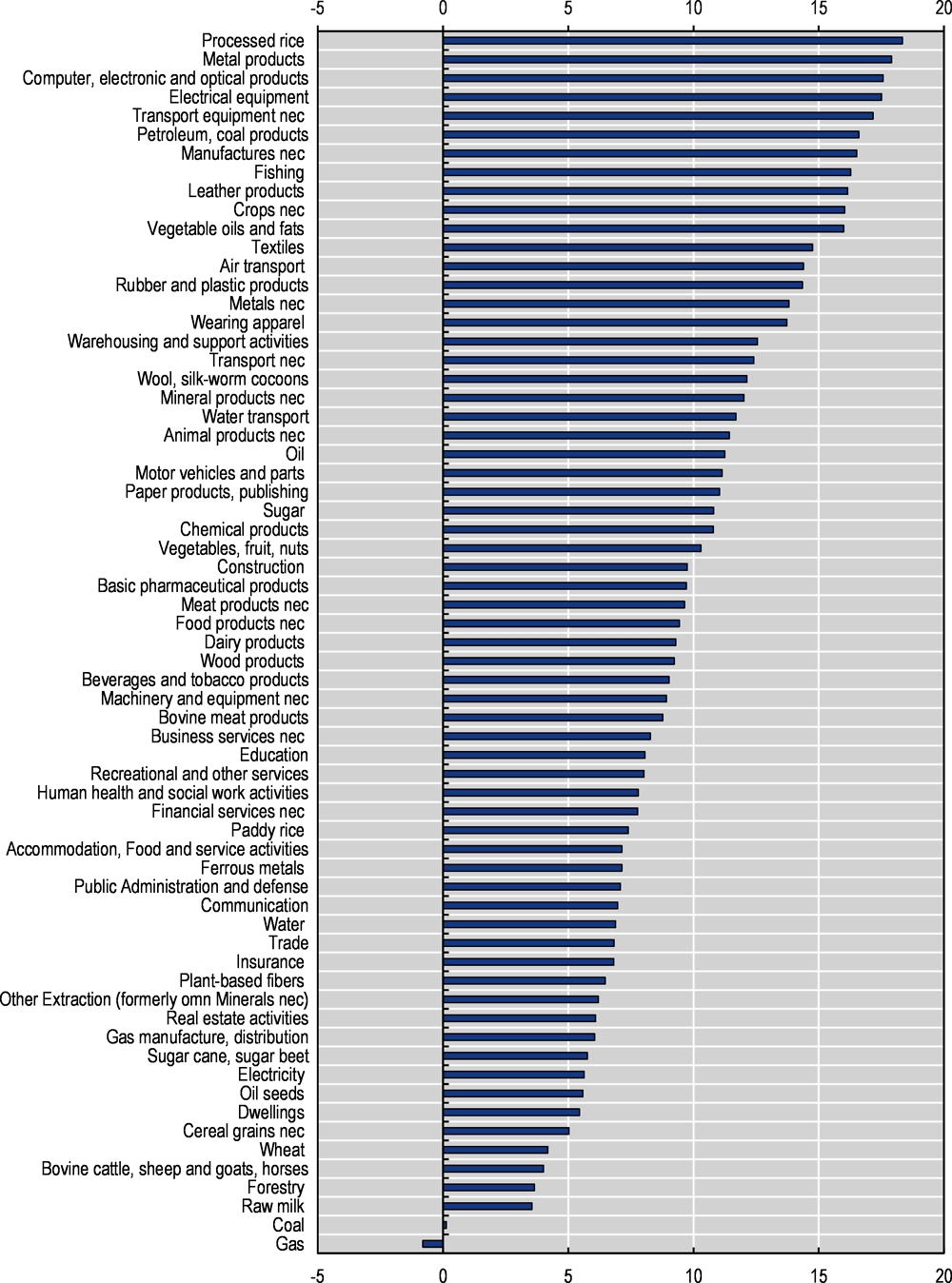

Tariffs rates in New Zealand are generally low. Imports of primary or manufactured products face an average tariff of 2.3%. The stylised simulation increases the tariff rate significantly. An increase in tariff rates to 25% in the model results in a rise in consumer prices on almost all commodities in New Zealand (Figure 1.25). On average, consumer prices of goods and services increase by 8.2% in the simulation. Prices on manufactured goods increase by 13.7%, with computers and electronics increasing the most in this category (17.6%). Consumer prices on food products increase on average by 9.6%, with a broad range within the category. Bovine meat products increase by 8.8% while the price of processed rice rises by 18.3%. The price of transport services by air, water, and other modes rise on average by 13.2%.

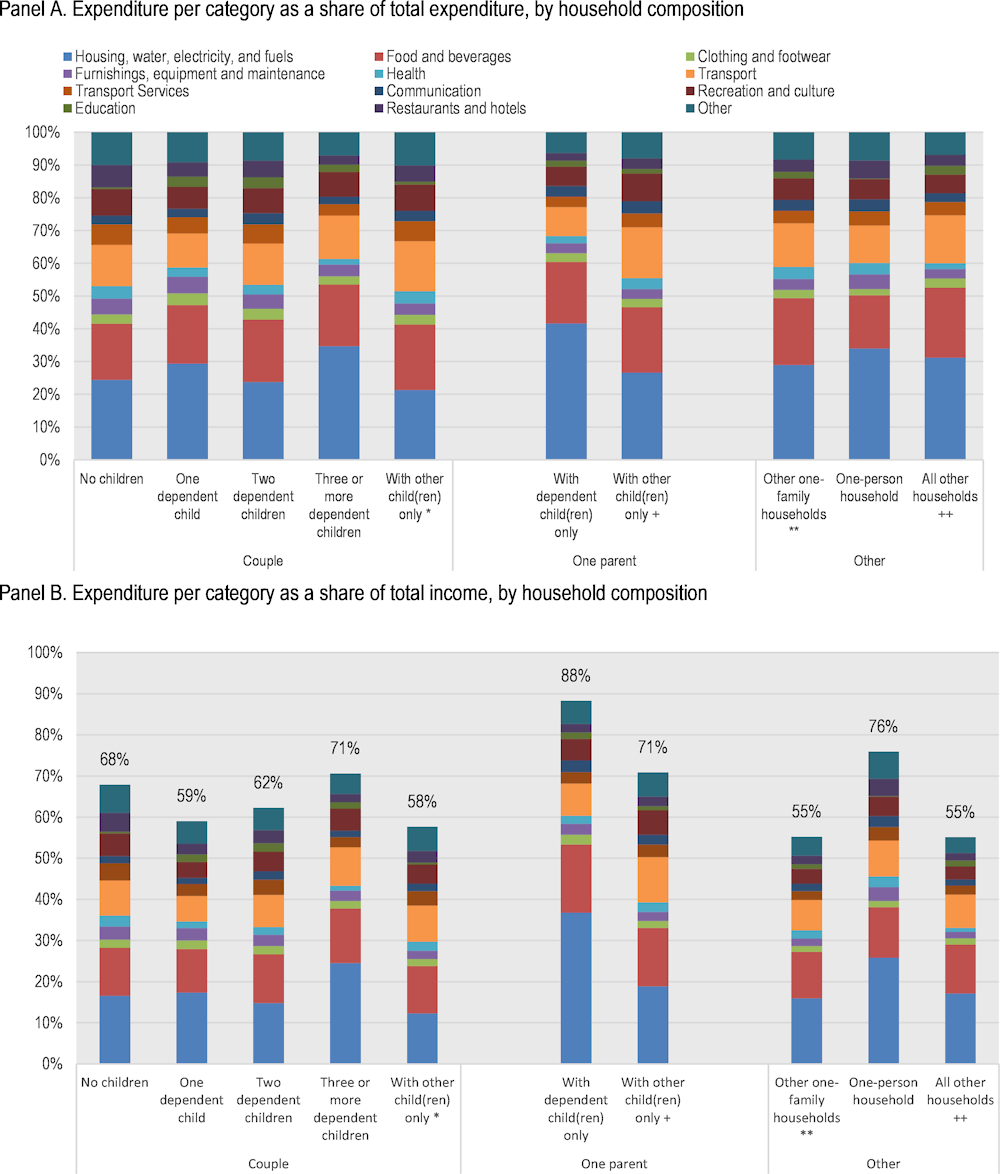

The degree to which households are exposed to a tariff increase will depend on how much they consume of each commodity.24 For all households, a large part of household expenditure is allocated to non-tradable items, in particular housing, which represents almost 30% of total expenditure. The same is true when examining expenditure share by household composition (Figure 1.26, Panel A). Housing expenses account for 21.3% (Couple with other child(ren) only) to 41.7% (One parent with dependent child(ren) only) of total spending. Second to housing expenses, food and beverages also account for large share of total household expenditure (18.6% across all household types and ranging from 16.2% for a one person household to 21.4% for multi-family households). Households with multiple-adults spend a large share of their total expenditure on transport purchases, e.g. cars and fuel (around 15% of total expenditure), whereas transport accounts for only 8% total expenditures of a one-parent household. Beyond basic living expenses, couples without children spend the most on restaurants and hotels and transportation services (6.8% and 6.2% of total expenditure respectively), while single-parent households with dependent children spend the least on these items (2.4% and 3.2% respectively). Distributional differences are even more prominent when expenditure is expressed relative to income (Figure 1.26, Panel B), since lower income groups, in particular those households where only one member earns a wage, spend a larger share of their income and have a lower propensity to save. In New Zealand, a one-parent household with one or more dependent children spends 88.3% of their income. A one-person household spends about three-quarters of their earnings, while a couple with no children spends only 67.9% of their income. Given the role of household savings for expenditure patterns, income and expenditure-based approaches are likely to deliver different distributional effects of changes in consumer prices.

Figure 1.25. Change in consumer prices in New Zealand

Note: This figure shows the percentage change in consumer prices in New Zealand associated with an increase in tariffs on all imports to 25% by New Zealand on all trade partners excluding Australia. The relative price changes produced by the METRO model were converted to absolute price using the exchange rate appreciation. As with most CGE models, METRO produces price changes relative to each country’s numeraire, the consumer price index (CPI). With CPI fixed and normalised to one in each region, the exchange rate in the model captures the price adjustment needed in domestic relative prices to balance the external accounts. The conversion preserves the price ratios of the domestic system and maps it into international purchasing power.

Source: OECD METRO Model.

Figure 1.26. Expenditure shares by household composition

Note: OECD calculations based on New Zealand 2019 Household Economic Survey. Average weekly household expenditure as a share of total expenditure (Panel A) or share of average household weekly income (Panel B). * Includes couple with adult children only, as well as couple with adult and dependent children.

+ Includes one parent with adult children only, as well as one parent with dependent and adult children.

** Contains all one-family households where 'other people' are present, who may be related or unrelated to the family nucleus.

++ This category is an aggregation of two-family household, three-or-more-family households, or any other multi-person households.

Source: 2019 Household Economic Survey (HES) of New Zealand.

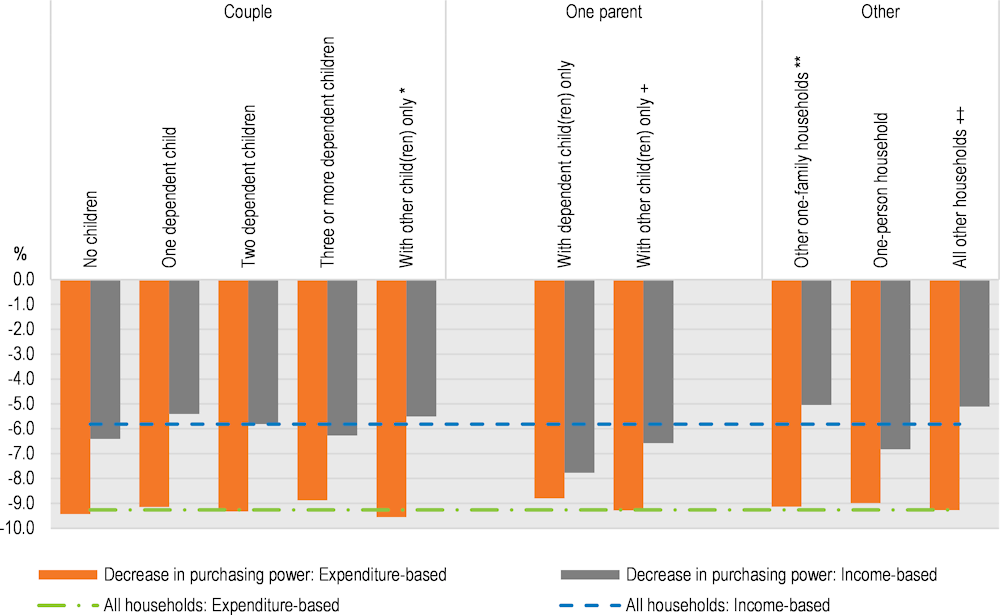

The change in household purchasing power,25 following the imposition of the tariff is computed both on an expenditure and on an income-based approach and presented in Figure 1.27. A unilateral increase in tariff rates on all imports of goods and services to 25% would generate a loss of 9.3% in household purchasing power on average in all households on an expenditure basis. Because New Zealand households save around 37% of their income, the purchasing power loss on an income-basis is not as pronounced but still negative nonetheless (-5.8%). On an expenditure basis, differences in the extent to which different types of households are exposed to trade-driven prices changes are small. All types of households lose about 9% of purchasing power on an expenditure basis. However, because some household types have higher propensities to consume, those that save less of their income experience larger losses from the trade-driven price increases. The most exposed household type is the one-parent household with dependent children, which are in their vast majority headed by women. The tariff increase would generate a loss of 7.8% for those households, measured on an income basis. The type of household that is the second most affected is single person households (who lose 6.8 of purchasing power on an income basis). Although these households comprise people of all ages and genders, women predominate in older single households and generally have lower pensions as compared with older men. Couples-only households spend a lower share of their income, so they are less affected by the tariff increase and experience a purchasing power loss of 6.4%. These findings are consistent with other studies looking at the distribution effects of taxes. Luu et al. (2020[11]) and OECD/KIPF (2014[13]) both found neutral effects on an expenditure basis and regressive effects on an income basis in OECD countries.

Figure 1.27. Change in purchasing power by household composition

Notes

* Includes couple with adult children only, as well as couple with adult and dependent children.

+ Includes one parent with adult children only, as well as one parent with dependent and adult children.

** Contains all one-family households where 'other people' are present who may be related or unrelated to the family nucleus.

++ This category is an aggregation of two-family households, three-or-more-family households, or any other multi-person households.

Source: OECD METRO Model and New Zealand 2019 Household Economic Survey.

The simulation implemented in this study increases import tariffs to ascertain their price impact on household expenditures, and allows conclusions to be drawn on the reverse effect. This analysis suggests that lower prices due to trade positively impact households that are made up of a single parent with dependent children even more than households with two or more adults. Since women head the vast majority of those households, they particularly benefit from the lower prices that trade brings. Another household type that benefits particularly from lower prices is one-person households. Although this study does not differentiate households by age, women commonly predominate among older single person households. These findings suggest therefore that more vulnerable household types benefit more, measured on an income basis, from lower prices. Prices of some staple foods, such as processed rice and vegetable oils, are particularly strongly affected by potential trade barriers in New Zealand.

The policy conclusion that can be reached from this analysis corroborates New Zealand’s policy choices of low tariff rates and willingness to engage in trade agreements and multilateral trade negotiations. It suggests that lower tariffs can benefit more vulnerable households, where women are predominantly found. From a consumption perspective therefore, trade can serve to decrease inequality between households. It should be kept in mind, however, that a large share of household expenditure is in non-tradables, such as housing, which are not directly affected by lower prices through trade. Housing in particular accounts for a large share of expenditure, especially by single-parent households with dependent children (41%) so trade can be only one part of a suite of policies to support vulnerable households’ purchasing power.

Consumption of specific products destined for women

Compared with some other countries, New Zealand maintains few tariffs on imported goods and there is limited evidence of a gender bias within those tariffs. One of the product categories where tariffs are applied is clothing. A 10% tariff is applied to both men’s and women’s clothing, suggesting equal trade barriers to these products. However, the absolute impact is uneven, with the value of women’s clothing imports (and subsequent share of tariff revenue on these products) 47% higher than men’s clothing imports. This is due to women spending more on clothing and consuming a larger share of imported clothing than men. The second area where gender-specific tariffs can be identified is on some female sanitary products. The weighted average MFN tariff on these imported products is 0.38%. In 2019, New Zealand women paid just under NZD 100 000 in tariffs for these products. While a tariff is in place for these goods, they are typically granted zero duty concession if this is requested by the importing firm.

Annex 1.A. Analysis of distributional implications of trade impacts on consumer prices

Annex Table 1.A.1. Product groups used in METRO analysis of distributional implications of trade impacts on consumer prices

|

Product group |

Detailed products included in aggregate |

|---|---|

|

Food and beverages |

Bread and cereals |

|

Food and beverages |

Meat |

|

Food and beverages |

Fruit |

|

Food and beverages |

Vegetables |

|

Food and beverages |

Food products n.e.c. |

|

Food and beverages |

Coffee, tea and cocoa |

|

Food and beverages |

Mineral waters, soft drinks, fruit and vegetable juices |

|

Food and beverages |

Spirits |

|

Food and beverages |

Wine |

|

Food and beverages |

Beer |

|

Food and beverages |

Tobacco |

|

Clothing and footwear |

Clothing materials |

|

Clothing and footwear |

Garments |

|

Clothing and footwear |

Cleaning, repair and hire of clothing |

|

Clothing and footwear |

Shoes and other footwear |

|

Clothing and footwear |

Repair and hire of footwear |

|

Housing, water, electricity, and fuels |

Actual rentals paid by tenants |

|

Housing, water, electricity, and fuels |

Other actual rentals |

|

Housing, water, electricity, and fuels |

Imputed rentals of owner-occupiers |

|

Housing, water, electricity, and fuels |

Materials for the maintenance and repair of the dwelling |

|

Housing, water, electricity, and fuels |

Services for the maintenance and repair of the dwelling |

|

Housing, water, electricity, and fuels |

Water supply |

|

Housing, water, electricity, and fuels |

Refuse collection |

|

Housing, water, electricity, and fuels |

Other services relating to the dwelling n.e.c. |

|

Housing, water, electricity, and fuels |

Electricity |

|

Housing, water, electricity, and fuels |

Gas |

|

Housing, water, electricity, and fuels |

Liquid fuels |

|

Housing, water, electricity, and fuels |

Solid fuels |

|

Housing, water, electricity, and fuels |

Heat energy |

|

Furnishings, equipment and maintenance |

Furniture and furnishings |

|

Furnishings, equipment and maintenance |

Carpets and other floor coverings |

|

Furnishings, equipment and maintenance |

Repair of furniture, furnishings and floor coverings |

|

Furnishings, equipment and maintenance |

Household textiles |

|

Furnishings, equipment and maintenance |

Major household appliances whether electric or not |

|

Furnishings, equipment and maintenance |

Small electric household appliances |

|

Furnishings, equipment and maintenance |

Repair of household appliances |

|

Furnishings, equipment and maintenance |

Glassware, tableware and household utensils |

|

Furnishings, equipment and maintenance |

Major tools and equipment |

|

Furnishings, equipment and maintenance |

Small tools and miscellaneous accessories |

|

Furnishings, equipment and maintenance |

Non-durable household goods |

|

Furnishings, equipment and maintenance |

Domestic services and household services |

|

Health |

Pharmaceutical products |

|

Health |

Other medical products |

|

Health |

Therapeutic appliances and equipment |

|

Health |

Medical services |

|

Health |

Dental services |

|

Health |

Paramedical services |

|

Health |

Hospital services |

|

Transport |

Motor cars |

|

Transport |

Motor cycles |

|

Transport |

Bicycles |

|

Transport |

Spare parts and accessories for personal transport equipment |

|

Transport |

Fuels and lubricants for personal transport equipment |

|

Transport |

Other services in respect of personal transport equipment |

|

Transport services |

Passenger transport by railway |

|

Transport services |

Passenger transport by road |

|

Transport services |

Passenger transport by air |

|

Transport services |

Passenger transport by sea and inland waterway |

|

Transport services |

Combined passenger transport |

|

Transport services |

Other purchased transport services |

|

Transport services |

Postal services |

|

Communication |

Telephone and telefax equipment |

|

Communication |

Telephone and telefax services |

|

Recreation & culture |

Equipment for the reception, recording and reproduction of sound and pictures |

|

Recreation & culture |

Information processing equipment |

|

Recreation & culture |

Recording media |

|

Recreation & culture |

Repair of audio-visual, photographic and information processing equipment |

|

Recreation & culture |

Major durables for outdoor recreation |

|

Recreation & culture |

Games, toys and hobbies |

|

Recreation & culture |

Equipment for sport, camping and open-air recreation |

|

Recreation & culture |

Gardens, plants and flowers |

|

Recreation & culture |

Pets and related products |

|

Recreation & culture |

Veterinary and other services for pets |

|

Recreation & culture |

Recreational and sporting services |

|

Recreation & culture |

Cultural services |

|

Recreation & culture |

Games of chance |

|

Recreation & culture |

Books |

|

Recreation & culture |

Newspapers and periodicals |

|

Recreation & culture |

Miscellaneous printed matter |

|

Recreation & culture |

Stationery and drawing materials |

|

Education |

Pre-primary and primary education |

|

Education |

Secondary education |

|

Education |

Tertiary education |

|

Education |

Education not definable by level |

|

Restaurants & hotels |

Restaurants, cafs and the like |

|

Restaurants & hotels |

Accommodation services |

|

Other |

Hairdressing salons and personal grooming establishments |

|

Other |

Electric appliances for personal care |

|

Other |

Other appliances, articles and products for personal care |

|

Other |

Prostitution |

|

Other |

Jewellery, clocks and watches |

|

Other |

Other personal effects |

|

Other |

Life insurance |

|

Other |

Insurance connected with the dwelling |

|

Other |

Insurance connected with health |

|

Other |

Insurance connected with transport |

|

Other |

Other insurance |

|

Other |

Other financial services n.e.c. |

|

Other |

Other services n.e.c. |

References

[3] American Express (2019), The 2019 State of Women-Owned Businesses Report, https://about.americanexpress.com/sites/americanexpress.newshq.businesswire.com/files/doc_library/file/2019-state-of-women-owned-businesses-report.pdf.

[1] Baily, P. and D. Ford (2018), “Estimating New Zealand’s tradable and non-tradable sectors using Input-Output Tables”, New Zealand Ministry for Foreign Affairs and Trade Working Paper, Vol. December, https://www.mfat.govt.nz/assets/Trade-General/Trade-stats-and-economic-research/MFAT-Working-Paper-Estimating-New-Zealands-tradable-and-non-tradable-sectors-using-Input-Output-Tables.pdf.

[4] Benz, S. and A. Jaax (2022, forthcoming), Shedding light on drivers of services tradability over two decades, OECD Publications, Paris.

[9] BERL (2022), New Zealand Women in Export Trade: Understanding the barriers, Schulze, H.; Yadav, U.; Riley, H.; Dixon, H. (Draft mimeo).

[10] Boston Consulting Group (2019), Les inégalités d’accès au financement pénalisent les créatrices de startup: 1er barometre SISTA x BCG sur les conditions d’accès au financement des femmes dirigeant.e.s de startup, https://static1.squarespace.com/static/5cb5f6b651f4d41671cfdd25/t/5d77bf6b1c0c795f4311284b/1568128879711/Barometre-SistaxBCG-France10sept.pdf.

[14] Deaton, A. and J. Muellbauer (1980), “An almost ideal demand system”,,”, The American Economic Review, Vol. 70/3, https://www.jstor.org/stable/1805222.

[5] Facebook (2021), Global State of Small Business Report, https://scontent-cdt1-1.xx.fbcdn.net/v/t39.8562-6/10000000_2773117226319503_1319481196229331970_n.pdf?_nc_cat=101&ccb=1-5&_nc_sid=ae5e01&_nc_ohc=KV41mjYRYGEAX-zGlGE&_nc_ht=scontent-cdt1-1.xx&oh=00_AT93bcp2G845hl4NRfehCFWyUmCA1Zs4cjNT3q3HXo3nWw&oe=61C044F5.

[6] Korinek, J., E. Moïsé and J. Tange (2021), “Trade and gender: A Framework of analysis”, OECD Trade Policy Papers, No. 246, OECD Publishing, Paris, https://doi.org/10.1787/6db59d80-en.

[11] Luu, N. et al. (2020), “Mapping trade to household budget survey: A conversion framework for assessing the distributional impact of trade policies”, OECD Trade Policy Papers, No. 244, OECD Publishing, Paris, https://doi.org/10.1787/5fc6181b-en.

[8] McKinsey Global Institute (2020), COVID-19 and Gender Equality: Countering the Regressive Effects, https://www.mckinsey.com/featured-insights/future-of-work/covid-19-and-gender-equality-countering-the-regressive-effects.

[15] MFAT (2022), “Inclusive and productive characteristics of New Zealand goods exporting firms”, MFAT working paper, Ministry of Foreign Affairs and Trade of New Zealand, https://www.mfat.govt.nz/assets/Trade-General/Trade-stats-and-economic-research/Inclusive-and-productive-characteristics-of-New-Zealand-goods-exporting-firms-MFAT-Working-Paper.pdf.

[12] OECD (2020), “METRO Version 3 Model Documentation”, [TAD/TC/WP/RD(2020)1/FINAL], https://one.oecd.org/document/TAD/TC/WP/RD(2020)1/FINAL/en/pdf.

[13] OECD/KIPF (2014), The Distributional Effects of Consumption Taxes in OECD Countries, OECD Tax Policy Studies, No. 22, OECD Publishing, Paris, https://doi.org/10.1787/9789264224520-en.

[2] Schneider, J. (2020), Future of Business Survey Methodology Note, https://scontent-cdt1-1.xx.fbcdn.net/v/t39.8562-6/238554568_111626007787616_5411963469147558965_n.pdf?_nc_cat=103&ccb=1-5&_nc_sid=ae5e01&_nc_ohc=J4wY1mDW3GIAX-Atyb7&_nc_ht=scont.

[7] Westpac New Zealand, Deloitte (2021), Sharing the Load, https://www.westpac.co.nz/assets/About-us/sustainability-community/documents/Sharing-the-Load-Report-2021-Westpac-NZ.pdf.

Notes

← 2. Disclaimer: Access to the data used in this study was provided by Stats NZ under conditions designed to give effect to the security and confidentiality provisions of the Statistics Act 1975. The results presented in this study are the work of the author, not Stats NZ or individual data suppliers. As such, they are not official statistics. They have been created for research purposes from the IDI and LBD, which are carefully managed by Stats NZ. For more information, see (MFAT, 2022[15]).

The results are based in part on tax data supplied by Inland Revenue to Stats NZ under the Tax Administration Act 1994 for statistical purposes. Any discussion of data limitations or weaknesses is in the context of using the IDI for statistical purposes, and is not related to the data’s ability to support Inland Revenue’s core operational requirements.

← 3. For example, see Women at Work: 1991-2013 by StatsNZ (2015) for a discussion of trends in gender-based occupational segregation from 20 years of New Zealand’s census data.

← 4. Drilling to this level of detail entails further loss of data quality. For example, some combinations of gender, ethnicity and industry employment are suppressed by Stats NZ due to small sample size. Some interpolation of data is therefore required. However, this is not expected to materially influence the overall results. The key simplifying assumption that the export propensity by industry applies evenly still applies.

← 5. This comprises: construction; health; public administration and safety; retail trade and accommodation; art, recreation and other services; education and training; financial and insurance services; rental, hiring and real estate services.

← 7. There are pockets within the health and education industries, such as aged care support, where women are paid significantly less than the average. These inequities are being addressed via the NZD 2 billion Care and Support Workers (Pay Equity) settlement.

← 8. Additional information on this survey can be found at: https://datacatalog.worldbank.org/dataset/future-business-survey-aggregated-data and in Schneider (2020[2]).

← 9. The analysis in the section uses the Future of Business survey data and should be considered as relevant to businesses with an online presence.

← 10. Personal services include services such as hairdressing, wellness and other beauty treatments, laundry services, pet care and training, wedding planning, repair of computer and household goods, bicycle repair.

← 11. Professional and scientific services include legal and accounting, architectural services, marketing services, design activities, photographic services and animal health care.

← 12. Media, information and communication services include computer programming and consultancy, publishing activities, sound recording and music publishing, broadcasting and telecoms.

← 13. The analysis in the section uses the Future of Business survey data and should be considered as relevant to businesses with an online presence.

← 14. The survey does not specify whether customs regulations refer to the origin or destination country of the goods and services traded. Since the question refers to exports, it can be inferred that the customs regulations at issue are most likely in the destination country, i.e. in New Zealand’s trading partners.

← 15. The analysis in the section uses the Future of Business survey data and should be considered as relevant to businesses with an online presence.

← 16. As a point of comparison, before the pandemic, both women and men were equally positive about their firms’ prospects in June 2019 with over 60% of both women and men indicating a positive outlook for their firms. Those who had a negative view of their business’s prospects were in the single digits for both women- and men-led firms in 2019.

← 17. This finding was confirmed in a study of women entrepreneurs in New Zealand (BERL, 2022[9]) where women entrepreneurs that were engaged in online sales and in the technology sectors indicated that their sales and revenue had not dropped during the pandemic.

← 18. This section and the following draw on information from New Zealand’s firm level data sets as outlined in the Methodology and data section of the Women workers chapter above.

← 19. These figures are somewhat sensitive to the leadership proxy chosen – e.g. setting the threshold at the top 10% of paid employees provides a slightly more even distribution.

← 20. Refers to equity raised by start-up firms by gender of founder(s) in Crunchbase and Dealroom databases. Firms included in the analysis were those that declared residence in New Zealand, and for which information was available on the gender of the leader/founder. In the case of multiple founders those with majority men (women) were classified as men (women) led, and those that had equal number of men and women were classified as mix lead. These data refer to firms that were established after year 2000. Analysis focused on funding opportunity, hence only included venture capital (seed, pre-seed, angel, series A-Z, growth funding, late stage funding) and grants which had the amount of equity raised. Values were converted into USD and normalised to 2005 levels. This amounts to 134 firms from 2011-2020.

← 21. Standard closure assumptions apply in the simulation: governments adjust spending to maintain their pre-simulation fiscal position. The trade balance is fixed, while exchange rates are flexible. Investments are savings driven.

← 22. The model database is aggregated to ten regions (New Zealand, Australia, People’s Republic of China (hereafter “China”), Other Asia, ASEAN, United States, other Americas, European Union (27), the United Kingdom, and rest of the world) and 65 sectors. For the description of the sectors, see https://www.gtap.agecon.purdue.edu/databases/v10/v10_sectors.aspx#Sector65.

← 23. The New Zealand Household Survey uses the New Zealand Household Expenditure Classification (NZHEC). To follow the framework described in Luu et al (2020[11]), a correspondence table between NZHEC and the Classification of Individual Consumption According to Purpose (COICOP) was produced. The correspondence table links the 65 sectors in the METRO model to 157 NZHEC product codes.

← 24. See Annex Table 2.A.1 for a list of product groups covered.

← 25. This book follows the approach in Luu et al (2020[11]), which computed the change in purchasing power based on the compensating variation approach (Deaton and Muellbauer, 1980[14]).