Trade finance serves as the lifeblood of the day-to-day international trade in goods and services. Due to the significant impact of the Coronavirus pandemic (COVID-19) on the world economy, concerns are growing with respect to the cost and availability of trade finance. In response to these concerns, governments are turning to their export credit agencies (ECAs) to step-in and attempt to fill the financing gaps, as they did in response to the 2008-2009 financial crisis.

Trade Finance in Times of Crisis - Responses from Export Credit Agencies

Abstract

Trade finance serves as the lifeblood of the day-to-day international trade in goods and services by enabling transactions between buyers and sellers around the globe. More specifically, trade finance provides the fluidity and security needed to allow for the movement of goods and services (Auboin and Meier-Ewert, 2008[1]). Although precise figures on the magnitude of trade finance are unavailable, it is assumed to be significant: in 2009, it was estimated to have contributed to between 80% to 90% of all world trade (WTO, 2009[2]).

Trade finance (especially short-term) also tends to be highly vulnerable in times of economic crises (Chauffour and Farole, 2009[3]), leading to increased prices and reduced overall availability. During the 2008‑2009 economic crisis, in an attempt to avoid the potentially serious impacts of a shrinkage of trade finance on the real economy (IMF, 2003[4]), the G20 agreed to ensure the availability of support for USD 250 billion of trade finance in 2009 and 2010. Now, with the significant impact of the Coronavirus pandemic (COVID-19) on the world economy, similar concerns with respect to the cost and availability of trade finance are again leading governments, multilateral groupings, and public institutions to reflect on possible responses.

What is trade finance?

Payment for the exchange of goods and services can take place in several ways. In the simplest scenario, the seller is paid by cash in advance or payment is made at delivery. However, deferred payments are often necessary, and more often than not, some form of financing is put in place to enable the buyer to pay the seller over time according to a fixed schedule. Such financing of trade can take many different forms, and may or may not involve financial institutions.

Trade finance products typically include intra-firm financing, inter-firm financing, or more dedicated tools such as letters of credit, advance payment guarantees, performance bonds, and export credits insurance or guarantees (Box 1).

Box 1. Examples of trade finance instruments

Advance payment guarantees/ Bonds: A guarantee that advance payments will be returned to the buyer if the seller does not perform its obligations under the contract.

Cash-in-advance: Payment is received before ownership of the goods is transferred. The most commonly used cash-in-advance options are wire transfers and credit cards. This form of payment is the most secure for the seller and least attractive for the buyer, as it ties up the buyer’s capital.

Documentary collections (D/C): A process under which an exporter’s bank (remitting bank) collects funds from the importer’s bank (collecting bank) in exchange for documents relating to the exported goods

Export Credit Insurance: Insurance that provides conditional assurance to an exporter of a product or service that payment will be made if the foreign buyer is unable to pay.

Letters of credit (LC): A commitment by a bank on behalf of the buyer that payment will be made to the seller, provided that the terms and conditions stated in the LC have been met. LCs are one of the most secure instruments available to international traders.

Open account: A transaction where the goods are shipped and delivered before payment is due. This option is the most advantageous for the buyer in terms of cash flow and cost, but it is consequently the highest risk option for the seller.

Performance Bonds (or contract bonds): Bonds issued to one party of a contract (usually by a bank or insurance company) as a guarantee against the failure of the other party to meet obligations specified in the contract.

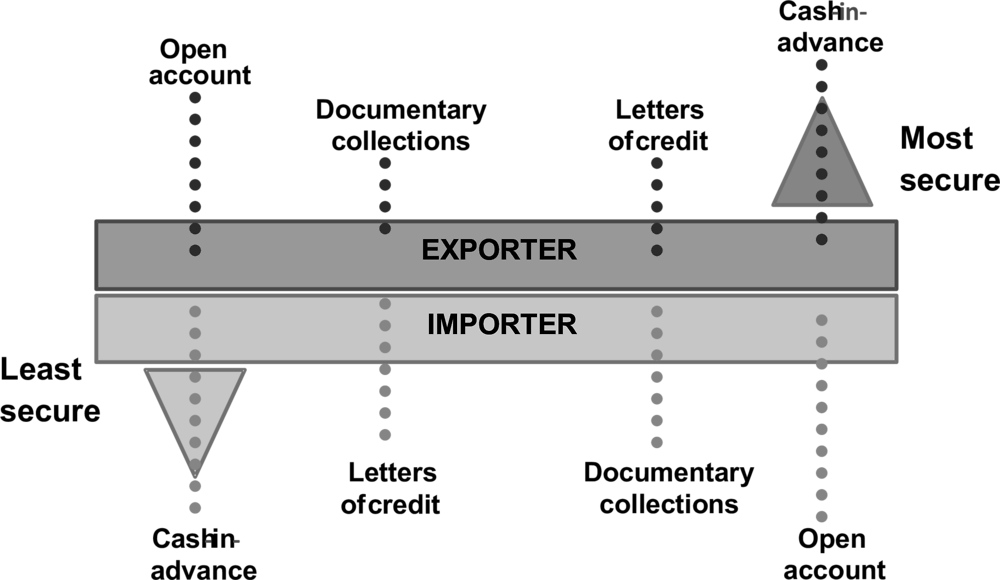

Figure 1. Payment risk diagram

As seen in Figure 1, these trade finance instruments provide for a spectrum of possible risk allocation between the seller (exporter) and buyer (importer) in an international trade transaction.

Among these products, a traditional distinction is made between short-term (ST) trade finance products, which provide for deferred payment over a period of less than one year (usually less than 180 days), and medium- and long-term (MLT) export financing/guarantees, which can be extended with repayment terms reaching, or even exceeding, ten years. While the ST financing facilities are typically used for trade in commodities, intermediate or consumer goods, MLT financing techniques are preferred in the case of exports of capital goods or goods with a longer useful life, and are sometimes part of projects which generate their own revenues and can then be used to service the debt incurred by the importer (project finance). ST trade finance is supplied primarily by private banks (bank-intermediated trade financing) and by firms (firm-to-firm or intra-firm credit) (Chauffour and Farole, 2009[3]).

Although comprehensive and reliable data on international trade finance are not available, studies estimate that bank-intermediated trade finance accounts for 10% to 30% of world trade, with the remainder being organised by inter-firm trade credits through open account trading (Lotte van Wersch, 2019[5]). Commercial lenders such as multinational banks, local commercial banks, non-bank lenders, credit insurers and official export credit agencies (ECAs) backed by their governments are active in this market.

Is there currently a trade finance problem?

One common indicator of the cost of ST financing in general (i.e. not just for trade finance) is the TED spread (short for Treasury-Eurodollar). The TED spread is the difference between the interest rates on interbank loans and short term US government debt. The TED spread is calculated as the difference between the three-month LIBOR and the three-month T-bill interest rate. Although the TED spread fluctuates over time, a rising TED spread indicates that liquidity is being withdrawn from the market. Historically, the TED spread varied between 10 basis points (bps) and 50 bps (0.1% to 0.5%). During the 2008-2009 financial crisis, the TED spread fluctuated between 1% and 2%, but rose at one point to just over 4%. Between January 2000 and February 2020, the TED spread averaged 0.43% with a median rate of 0.30%.

As of the most recent report (15 May 2020), the TED spread had decreased to 0.26% after having spiked as high as 1.42% on 26 March 2020, the highest level since December 2008. Over the March-April 2020 period the TED spread averaged 88 bps. While the recent downward trend might be attributed to the efforts of central banks that are injecting liquidity into the markets, the sudden spike in spreads over the March-April period indicates that the inter-bank market severely tightened due to the market uncertainty caused by the crisis. With the return of inter-bank rates to pre-crisis levels, the question now being asked is whether lack of demand is keeping the rates low or if commercial banks are reserving their lending for only the best rated borrowers. In either case, the recent spike would tend to suggest that the cost of ST financing and thus ST trade finance has moved into uncertain territory.

As commercial lenders perceive increased risk and/or higher liquidity costs they typically start to limit their overall exposure, thereby affecting the availability of trade finance. Therefore, it is also likely that gaps in trade financing, especially for the ST, are beginning to emerge.

Moreover, a particular concern expressed by some business groups (ICC, 2020[6]) is that a shortage of trade finance could constrain the economic recovery by hindering the efforts of companies to re-engage in exports. This is particularly important as countries recover at different paces, and access to global demand could be important in helping firms and countries to reignite economic activity.

What has the policy response been?

In a tightening lending environment, the private sector is increasingly looking to governments to maintain open financing channels and ensure that supply chains remain intact. Actors in the trade industry are looking for alternative (non-private) sources of ST trade financing and official export credits for MLT projects. In response to these concerns, governments are turning to their ECAs to fill the financing gaps, as they did in response to the 2008-2009 crisis.

A survey conducted by the OECD1 shows OECD countries and their ECAs have reacted quickly and taken a number of measures aimed at bridging financing gaps, such as increasing the capacity for support of ECAs, expanding working capital programmes, introducing new facilities to support exports and exporters, and introducing more flexibility to the terms and conditions of official support (Box 2). This is consistent with the measures reported to the Berne Union in its survey conducted in April 2020 (Berne Union, 2020[7]).

According to the OECD survey, measures aimed at introducing more flexibility to the terms and conditions of official support have been the most widespread across OECD countries. Although many of the measures appear to be focused on existing transactions (such as deadline deferrals, flexibilities relating to claim policies, and repayments), some are also directed towards new potential transactions (increased cover, down payment flexibilities). In addition, measures meant to increase the availability of working capital financing (implementation of new programmes, expansion of existing programmes) as a response to the observed shock on supply seem very popular among ECAs.

Box 2. Measures taken by OECD countries and their ECAs in response to the Coronavirus pandemic (COVID-19)

|

Broad category |

Sub-category |

Detailed measure |

|---|---|---|

|

Modification of the terms and conditions of official support |

Repayment flexibilities |

- Deferring loan repayments / Moratorium of loan payments - Extending loan terms - Extending restructurings |

|

Interest rate and fee flexibilities |

- Waiving all fees associated with extensions, including legal and documentation fees - Waiving late interest and late fees - Reduction of fees for exporters in case of new demand for insurance cover |

|

|

Changes in premium |

- Discounts on premiums (SMEs) |

|

|

Cover changes |

- Expansion of the ST facilities to marketable risks (EU) - Willingness to take on greater risk than in the past when assessing new buyer coverage requests - Increase of the maximum percentage of cover |

|

|

Claim flexibilities |

- Shortening of claims waiting period - Speeding-up of claims payment (SMEs) |

|

|

Deferment of deadlines |

- Extension of the term of export pre-financing guarantee agreements |

|

|

National content changes |

- Flexibilities to national content rules |

|

|

Flexibilities for cancellations |

||

|

Working capital |

Increasing facilities |

|

|

Cover changes |

- Increased maximum cover |

|

|

Repayment flexibilities |

- Extension of the repayment period of loans, extension of duration to fulfil export commitments for loans |

|

|

Increased capacity |

- Increasing ECAs’ statutory limits, Special government-back programmes, etc. |

|

|

New facilities |

Insurance/ Guarantee facilities |

|

|

Direct lending programs |

||

|

Other |

Application flexibilities |

- Faster processing of applications - Discounted services (credit research service) |

|

Documentation flexibilities |

- Moratorium on deadlines for submitting documentation and financial reports |

|

|

Reinsurance schemes with private insurers |

This table has been prepared based on the survey submitted to OECD countries and their ECAs, and reflects the answers received up to 20 May 2020.

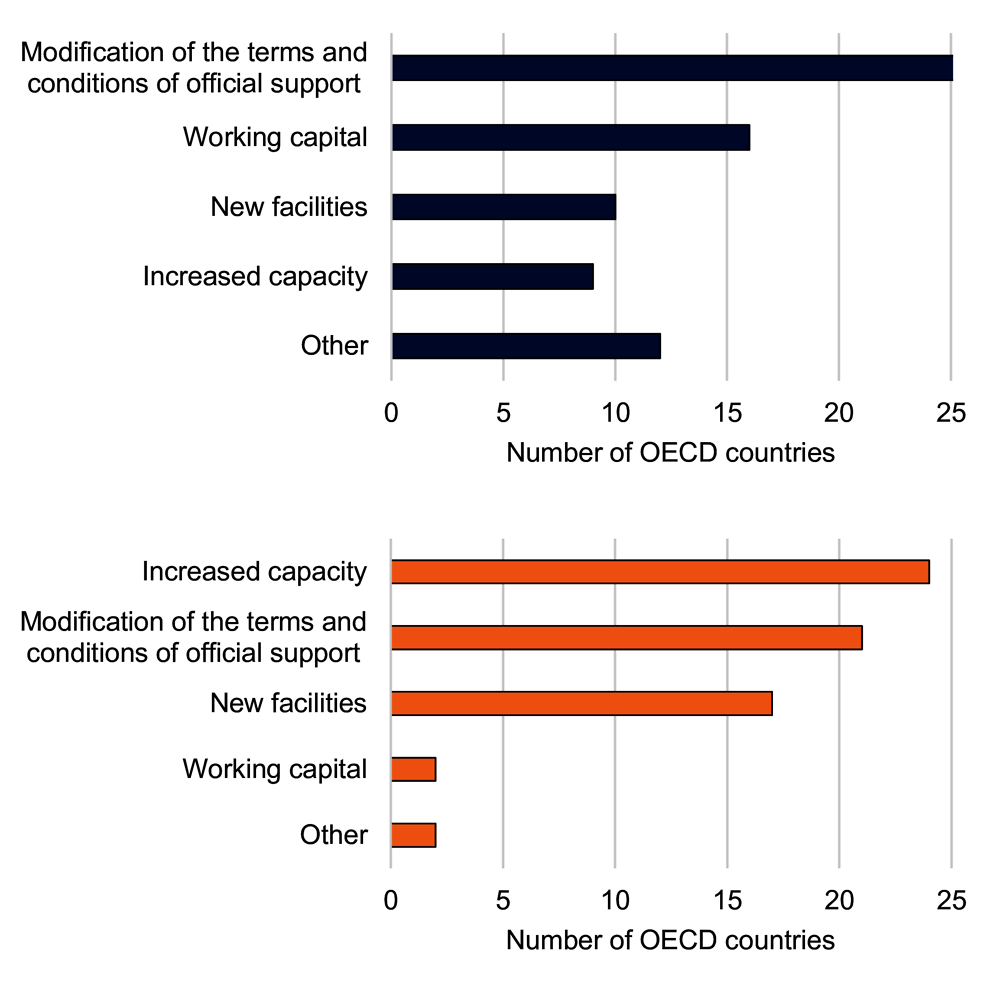

On the basis of the information provided so far, the nature of the measures taken seems to be geared in a slightly different direction in comparison to those taken in response to the 2008-2009 global economic crisis, where measures linked to an increase in capacity were the most prevalent (Figure 2). However, since the effects of the Coronavirus pandemic (COVID-19) on the economy are still unclear, measures taken by ECAs and governments are likely to evolve as more light is shed on the possible financing gaps.

Figure 2. Nature of measures taken by OECD countries in response to Coronavirus pandemic (COVID-19) (top) compared to the 2008-2009 financial crisis (bottom)

Note: OECD survey (with responses as of 20 May 2020) and OECD country ECA websites.

The survey responses also indicate that ECAs and governments seem to be focusing their efforts on SME exporters that are particularly vulnerable in a crisis. This includes measures to address the availability of domestic finance (working capital) to allow exporters to cover the costs of inputs to the products they manufacture for export, as well as through trade finance to support their exports to foreign buyers.

Finally, although most reported measures have not been directed towards a specific sector, several OECD countries and ECAs have indicated that they are considering targeted measures to help those sectors which have been hit the hardest, such as the aircraft and the cruise ship sectors (where many ECAs have been working with borrowers to restructure repayments in ongoing transactions).

The OECD is supporting governments during the crisis by providing a forum for them to exchange information and practices relating to export credit programmes and products, and will continue to monitor the evolution of measures taken.

Export credits work at the OECD

The OECD is the key multilateral negotiating forum where international disciplines on officially supported export credits are agreed, implemented and monitored. These disciplines enable governments, which are both partners and competitors, to co-operate in establishing a level playing field for exporters while at the same time minimising financial subsidies. They also facilitate transparency and the sharing of information on export credits policies and practices among ECAs and governments.

OECD export credits work is structured in two Committees: the Working Party on Export Credits and Credit Guarantees (also known as the Export Credit Group, or ECG), created in 1963, and the Participants to the Arrangement on Officially Supported Export Credits (the “Participants), created in 1978 with the adoption of the first “Consensus”.

The Participants manage and maintain the Arrangement financing rules which are to be observed when providing official support for export credits.

The ECG works on non-financial (called “good governance”) issues relating to export credits, emphasising the need for coherence between national export credits policies and policies on environmental and social due diligence processes, anti-bribery measures, and sustainable lending policies, as well as on statistical issues relating to transaction reporting.

References

[1] Auboin, M. and M. Meier-Ewert (2008), Improving the availability of trade finance during financial crises, World Trade Organisation, https://www.wto.org/english/res_e/booksp_e/dis02_e.pdf.

[7] Berne Union (2020), Export credit insurance industry response to COVID-19, https://www.berneunion.org/DataReports.

[3] Chauffour, J. and T. Farole (2009), Trade finance in crisis : Market adjustment or market failure?, World Bank, http://documents.worldbank.org/curated/en/673931468336294560/Trade-finance-in-crisis-market-adjustment-or-market-failure.

[6] ICC (2020), Trade financing and Covid-19: Priming the market to drive a rapid economic recovery, https://iccwbo.org/content/uploads/sites/3/2020/05/icc-trade-financing-covid19.pdf.

[4] IMF (2003), Trade finance in financial crises: Assessment of key issues, https://www.imf.org/external/np/pdr/cr/2003/eng/120903.htm.

[5] Lotte van Wersch, C. (2019), Statistical coverage of trade finance – Fintechs and supply chain financing, http://file:///C:/Users/schleich_j/Downloads/wpiea2019165-print-pdf.pdf.

[2] WTO (2009), Trade finance, https://www.wto.org/english/thewto_e/coher_e/tr_finance_e.htm.

Note

← 1. OECD countries have been responding to this survey on an ongoing basis. The results presented here reflect the responses provided as of 20 May 2020.