The Dialogue recommends the utilisation of Land Value Capture (LVC) as an additional source of financing water in Indonesia. Land value capture is the recovery and public utilisation of land value gains that result from public planning and infrastructure investments. This Chapter discusses several LVC instruments that can be used to finance water infrastructure in Indonesia. It emphasises that, while the legislative framework is mature, Indonesia still needs to strengthen the enabling framework for LVC. Local government capacity to implement LVC and the maintenance of land registries require particular attention.

Water Financing and Disaster Risk Reduction in Indonesia

4. Land value capture as an innovative funding source for water infrastructure

Abstract

4.1. Land Value Capture as an infrastructure financing tool

Governments increasingly struggle with financing key infrastructure and services. In Jakarta for example, the lack of adequate piped water is the root cause of persistent groundwater extraction, which is causing parts of the city to sink by up to 12 centimetres per year. Often overlooked however is the fact that public investments in infrastructure lead to higher land prices. Left untouched, this newfound wealth is in fact a direct transfer of public funds in the form of windfall gains to private landowners.

This unearned wealth is an untapped resource that, when recovered for public use, has the potential to be reinvested in much needed infrastructure and services. Land is one of the most valuable forms of capital. In the OECD, land makes up approximately 40% of the total capital stock, amounting to USD $152 trillion (OECD, 2017[1]). Utilising even a portion of this value towards infrastructure provision can help in improving our built environments and transitioning societies towards a climate-friendly future.

4.1.1. Conceptualisation of Land Value Capture

The premise of Land Value Capture (LVC) is simple: public action should generate public benefits. LVC refers to policies that enable governments to recover windfall gains arising from government actions for public benefit. These actions include tangible developments such as the provision of water, energy, and housing, and intangible developments such as rural to urban land conversion, flexible land-use regulations, and more generous building density permits. Increases in land value stemming from such interventions can be large. For example, Smolka (2013[2]) finds that an investment in piped water provision of USD $1.02 per square meter of land increased land prices by USD $11.10 per square meter in locations within 10 kilometres of city centres in Latin America. Land values can increase by up to 600% when converting rural land to urban uses, depending on local market conditions (Borrero, 2016[3]).

Beyond its substantial revenue potential, LVC is a valuable funding tool for the following reasons:

It can be an economically efficient revenue source. Land value gains which result from public infrastructure are windfall profits for private landowners rather than a return from their economic activity, such as own investment. When governments tap windfall gains, they do not generate efficiency losses that typically result from taxing economic activity. They may not discourage investment, for example.

The time profile of LVC revenues is also beneficial. Land value gains typically materialise upfront, when a public investment project is announced or carried out, reducing borrowing needs. This is particularly attractive for countries that pay a high price for access to international capital markets.

LVC can be an inclusive instrument, as it can redistribute land value gains accrued by affluent landowners to be shared with the community. As the landowners who benefit most tend to be the wealthiest, LVC can be progressive in nature. Furthermore, revenues from LVC instruments can serve to finance infrastructure that benefits the poor (Wolf-Powers, 2012[4]).

LVC can also promote environmental sustainability. Reaching biodiversity protection and greenhouse gas emission reduction targets as well as climate adaptation objectives requires upfront investment, including for water infrastructure. Land-use planning is central to reaching these objectives and is also central to LVC. LVC can contribute to green infrastructure (such as to harness the carbon sink and biodiversity potential in wetlands) and more sustainable land-use practices (for example densification around existing water supply infrastructure). LVC can also encourage policymakers and developers to use land in more efficient ways, avoiding wasteful land-use practices.

4.1.2. Limitations and barriers to Land Value Capture adoption

LVC needs to be used well to encourage equitable and sustainable land development. LVC can lead to overdevelopment and unnecessary increases in built-up area, especially when local governments rely too heavily on LVC revenues as a source of income and develop land purely for fiscal gains. LVC can therefore also result in unstable and cyclical fiscal revenues during macroeconomic boom-bust cycles, as revenues are highly dependent on changes in land values and overall demand for land (Kim and Dougherty, 2020[5]). Equity benefits from LVC depend heavily on how the resources mobilised by LVC are used, and whether they are sufficiently targeted towards marginalised groups. Earmarking LVC gains towards specific geographic areas needs to be either avoided or compensated with other public funding to provide infrastructure for poorer areas. LVC is attractive where the potential for land value gains is large, which risks biasing infrastructure provision towards wealthy areas.

Effective LVC implementation is dependent on several underlying factors. Among others, public support is key, as LVC fundamentally entails a compromise between private property rights and the public good, resulting in an increase in taxes and fees on land. Second, administrative capacity is required to carry out underlying tasks including land valuation, maintenance of cadastres, and the regulation of land and its use. Opposition by landowners and lacking administrative capacity are the most important barriers countries face to implement LVC (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). The implementation of LVC is thus challenging as it depends on institutional, legislative, and spatial planning frameworks, along with the enforcement of land-use regulations. The following sections discuss key issues.

4.1.3. The case for Land Value Capture in Indonesia

The need for sustainable land use and management

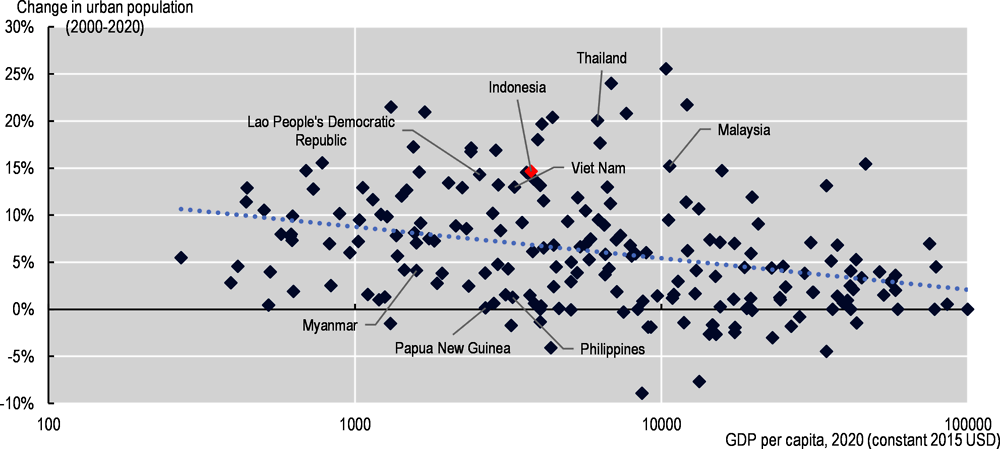

Indonesia is urbanising rapidly. Figure 4.1 plots the 2000-2020 change in urban population against 2020 GDP per capita. During this period, Indonesia’s urban population share increased by 15 percentage points, well above the estimated trendline. This suggests that Indonesia’s urbanisation exceeds other countries with similar income. Indonesia’s current urbanisation rate of 57% is also still significantly lower than in higher income countries. More people will move to cities as economic growth continues. The new population living in cities will need adequate infrastructure and services, as well as land to live in. Land-based tools such as LVC will thus be needed to not only finance public investments, but also to properly manage newly built-up land so that development occurs in a sustainable and equitable manner.

Figure 4.1. Urbanisation trends, 2000-2020

Notes: Change in urban population is measured as the percentage point change in urban population relative to the total population between 2000 and 2020. The dotted blue line indicates the estimated trendline for the datapoints.

Source: OECD national accounts; United Nations, Department of Economic and Social Affairs, Population Division (2019[7]), World Urbanization Prospects: The 2018 Revision (ST/ESA/SER.A/420), New York: United Nations; World Bank national accounts

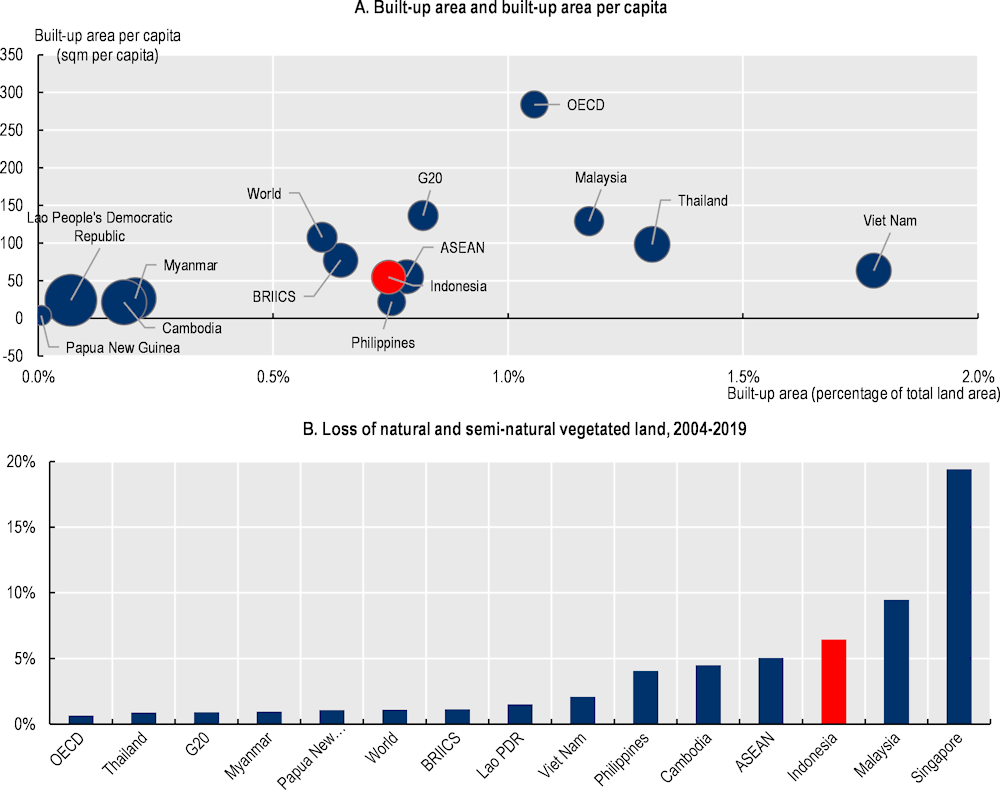

However, current trends in Indonesia’s are inconsistent with sustainable land use practices. Built-up area in Indonesia is already greater than most of its peers with similar income levels, measured both as a percentage of total land area and in per capita terms ( Figure 4.2 Panel A). In addition, built-up area continues to increase at a steady rate, suggesting that urbanisation is occurring mainly by ‘building out’ instead of ‘building up’. This has many negative consequences including longer travel distances that lead to car dependency, greater greenhouse gas emissions and an increased carbon footprint. These patterns have also contributed to a significant loss of vegetated land (Figure 4.2 Panel B), which is key to maintaining biodiversity and preventing land degradation. As Indonesia further develops and continues to urbanise, LVC can play a key role in promoting sustainable development and environmentally friendly land use. However, the selection of investment and land use projects that are consistent with environmental sustainability remains critical, as environmentally unsustainable projects, which need to be avoided, can also raise land prices.

Figure 4.2. Sustainable land-use indicators

Notes: The bubble size in panel A indicates the magnitude of change in built-up area between 2000 and 2014. Loss of natural and semi-natural vegetated land is defined as the percentage of tree cover, grassland, wetland, shrubland and sparse vegetation converted to any other land cover type.

Source: Florczyk, A. et al. (2019[8]), GHSL Data Package 2019, EUR 29788 EN, Publications Office of the European Union, http://dx.doi.org/10.2760/290498; OECD (2022[9]), OECD. Stat (database), https://stats.oecd.org/ (accessed 1 December 2022).

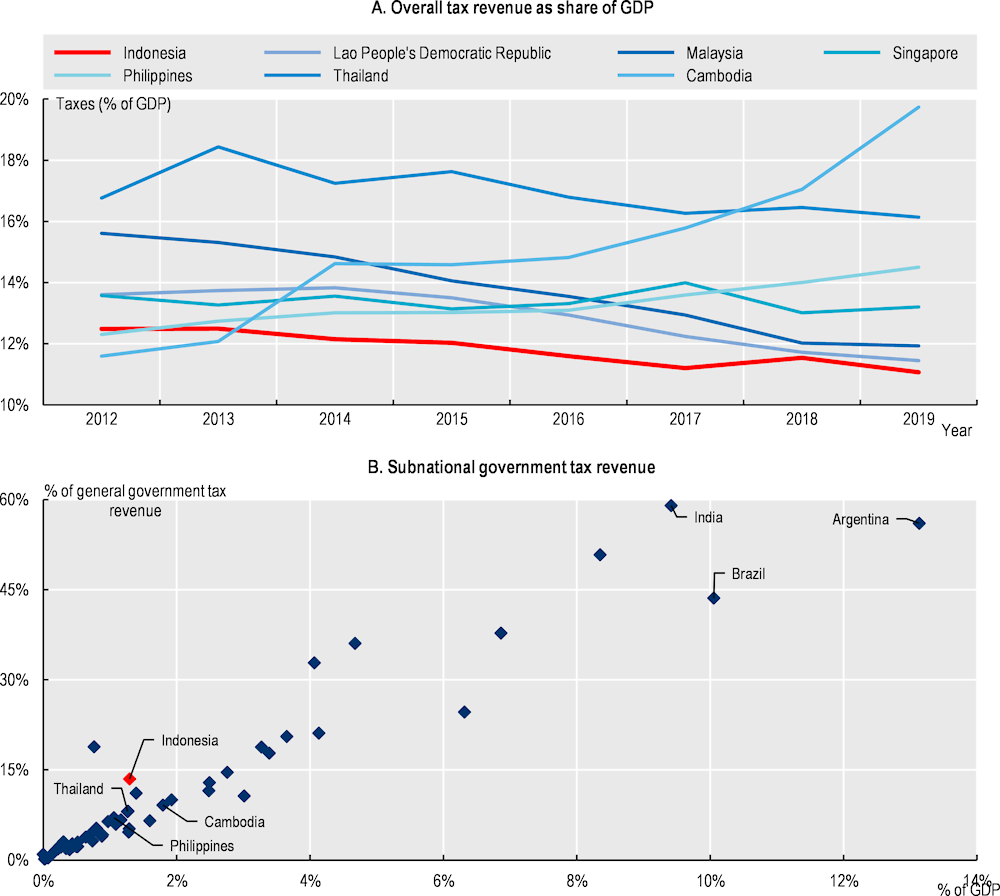

Weak tax revenues and subnational government fiscal autonomy

Indonesia’s tax burden, at 11.1% of GDP in 2019, is among the lowest of Southeast Asian countries, and this share has been steadily declining since 2012 (Panel A of Figure 4.3). Subnational government revenues are also low when compared to other upper- and lower-middle income countries, both as a share of GDP and as a share of general government tax revenue (Panel B of Figure 4.3). LVC policy tools are therefore an attractive option to increase revenues for much needed public investment. LVC could be a viable tool to increase subnational fiscal autonomy and diversify revenue streams, as LVC revenues are primarily the jurisdiction of local governments.

Figure 4.3. Government tax revenue

Notes: Only upper-middle income and lower-middle income countries are shown in panel B.

Source: Asian Development Bank (2018[10]), “Key Indicators for Asia and the Pacific 2019”, Key Indicators for Asia and the Pacific, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/fls190428-3; OECD/UCLG (2022[11]), OECD/UCLG World Observatory on Subnational Government Finance and Investment database (SNG-WOFI), https://www.sng-wofi.org/ (accessed on 1 December 2022).

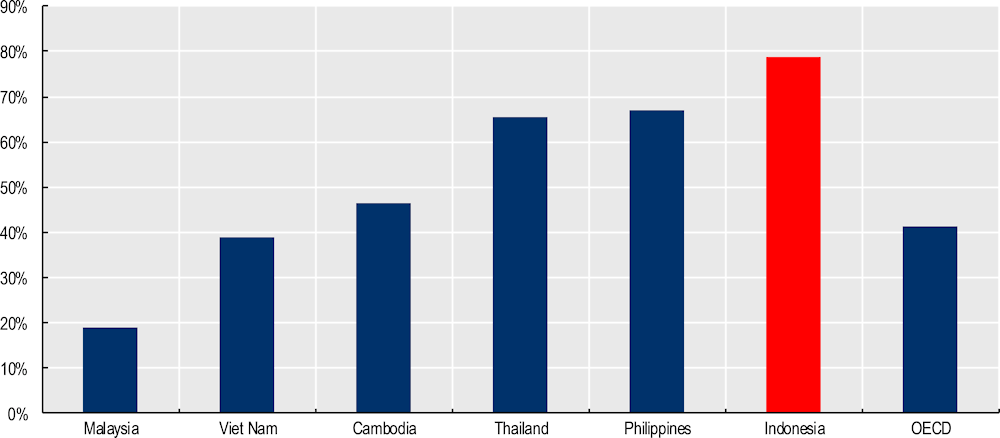

The lack of subnational government tax revenues leads to an over-reliance on central government grants and subsidies (Figure 4.4). Central government transfers make up close to 80% of total subnational government revenues, which is close to twice the OECD average and significantly higher than other Southeast Asian economies.

From an economic view, the efficiency and accountability of local provision of services and infrastructure is best secured when subnational governments finance most of their own expenditures (Bahl and Bird, 2018[12]), given that these investments primarily benefit the local population. Together with user charges, local taxes are the most efficient local financing instruments, as they match the beneficiaries with those that bear the burden of the taxes and fees (Oates, 2008[13]). The utilisation of LVC could thus not only increase subnational revenues but also improve the efficiency of local government spending.

Figure 4.4. Central government grants and subsidies as share of subnational government revenues

Source: OECD/UCLG (2022[11]), OECD/UCLG World Observatory on Subnational Government Finance and Investment database (SNG-WOFI), https://www.sng-wofi.org/ (accessed on 1 December 2022).

4.2. The enabling framework for Land Value Capture in Indonesia

4.2.1. Legislative framework

Chapter VI of the Indonesian constitution specifies that provinces, regencies and municipalities shall have ‘wide-ranging autonomy’ over all matters except those that are specified by law to reside with the central government (foreign policy, defence, security, judicial policy, national monetary and fiscal policy, and religious affairs). The ‘big bang decentralisation’ reform of 1998 paved the way towards regional autonomy and decentralisation (Asian Development Bank, 2022[14]). Amendments to the constitution in 2000 further anchored regional governance in Indonesia, Today, legislation continues to favour increased devolution of central powers (Table 4.1). In addition, proposed amendments provides a summary of relevant legislation and proposed amendments.

The Indonesian constitution also stipulates the social function of land and property, which lays the basis for implementing LVC. Within this framework, the proper implementation of LVC can be considered to uphold constitutional values while also providing a way for local governments to meet their duties set by law. Overall, Indonesia’s legal framework provides a solid basis for LVC implementation, contrary to other countries across the world (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]).

Table 4.1. Recent trends in key local government legislation

|

Legislation |

Amendments |

Principal effect |

|---|---|---|

|

Law No. 22 of 1999 on regional government |

Original legislation |

Deconcentrated central powers and increased devolution to districts and cities |

|

Law No. 32 of 2004 on local governance |

Stipulated areas under the control of the central government and those under the control of subnational governments; sets out obligatory and optional tasks for local governments |

|

|

Law No. 23 of 2014 on local government |

Repealed Law 32/2004 Strengthened central authority over local governments; mining, forestry, maritime affairs, and fisheries transferred to provinces |

|

|

Law No. 25 of 1999 on revenue sharing between central and regional government |

Original legislation |

Set allocations of oil and gas revenues |

|

Law No. 33 of 2004 on fiscal balance between central and regional government |

Set the framework for sources of local government funding based on the allocation of responsibilities among the various levels of government |

|

|

Proposed replacement for Law 33/2004 |

Rectifies inequalities in central funding allocations; incentivizes local governments to pursue more local-source revenue generation |

|

|

Law 34/2000 |

Original legislation |

Districts and cities given authority to impose new taxes, subject to specified criteria |

|

Law No. 28 of 2009 on local taxes and charges |

Original legislation |

Transferred certain taxes from provinces to districts and cities Prohibited taxes (but not charges and fees) other than those specified in Law 28/2009 |

|

Proposed replacement for Law 28/2009 |

Expands local government tax base, increases certain maximum tax rates, and improves the implementation of local taxes and charges |

Source: Adapted from Asian Development Bank (2022[14]), Modernizing Local Government Taxation in Indonesia, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/tcs220138-2.

Despite constitutional provisions and efforts to reinforce legislative frameworks for LVC, local government adoption of LVC practices has been limited to specific use cases in select areas. Jakarta in particular has implemented a provision for impact fees and developer obligations on a case-by-case basis through the Governor of Jakarta Regulation No. 210 of 2016. It has also experimented with charging for rights to develop buildings above the standard development density allowed by local ordinances. Land readjustment has been used in the urban expansion of Yogyakarta and the regularisation of agricultural land in Cirebon, West Java. Strategic land management has been carried out in limited fashion by the National State Asset Management (LMAN) under the Ministry of Finance.

Greater LVC uptake has been hampered in part due to a lack of specific guidelines from higher level governments, as well as a lack of local ordinances outlining specific rules and regulations outside major urban centres such as Jakarta or Yogyakarta. Local governments have also obtained relative autonomy only recently, which results in a lack of expertise.

Since 2020, the government of Indonesia has been crafting a Presidential Decree for LVC implementation, with a draft being brought to public consultation in the end of 2022 (Box 4.1). The presidential decree proposes to allow earmarking land value capture revenues to infrastructure projects that generate the land value gains. There can be advantages and disadvantages to such earmarking. A public finance principle is to avoid earmarking as it encourages inefficient public spending. For example, the revenues may be larger than the efficient amount of spending in the project concerned, resulting in overspending. LVC revenue potential may exceed the cost of projects giving rise to the land value gains. It may be in the public interest to recover the full LVC potential.

Earmarking also gives rise to the risk that infrastructure projects are more likely to be developed where LVC potential is large. These areas may be economically dynamic and relatively wealthy, leaving poor neighbourhoods underserved. While earmarking may in some cases make it politically easier to introduce LVC instruments, over- and underspending may also give rise to political problems with earmarking. As the OECD Compendium on LVC policies reveals, many countries allocate at least some of the revenues to the general budget, such as in Finland, or to a specific fund that serves to fund infrastructure projects more generally, such as in Hong Kong. This can help make sure that revenues are used equitably, giving priority to infrastructure poorer areas often need more badly. Another possibility for making sure LVC policy tools are deployed equitably is to use the revenues, or in-kind contribution requirements, for example in Developer Obligations, for social housing. This practice is also widespread and is for example done in Germany.

Box 4.1. Draft presidential decree for LVC

The government of Indonesia has been preparing a Presidential Decree to regulate the use of LVC. A draft has been recently issued for public discussion. This new legislation will address several important issues, including:

Strengthening the authority of local governments at the municipal and regency level to implement LVC . The local government will be mandated to form a special agency or to appoint an existing agency to govern LVC implementation.

Regulating the implementation of several LVC instruments. Several types of LVC Instruments that could be utilised in Indonesia are mentioned in the legislation, including the Infrastructure Levy (Pembayaran Sukarela Pengganti Pajak), FAR Compensation (Kompensasi Pelampauan KLB) with either in cash or in-kind contribution, Transfer of Development Rights (Pengalihan Hak Membangun), Developer Obligation, and Land Consolidation (Konsolidasi Lahan).

Creating the option to earmark revenue obtained from LVC instruments for financing infrastructure development.

Source: Republik Indonesia (2022[15]), Peraturan Presiden Republik Indonesia (draf): Pendanaan Penyediaan Infrastruktur Melalui Pengelolaan Perolehan Peningkatan Nilai Kawasan.

4.2.2. Land registration and valuation

Land registration and valuation are central to LVC. Land registration is central to identifying land owners who may be asked to pay LVC contributions. Valuation allows governments to identify LVC potential and set charges in an economically efficient and equitable way.

Indonesia has slowly been transitioning from the dualistic land legislation regime originating from the Dutch colonial era to the land regulation enacted through National Law 5/1960. The Dutch colonial had different laws regarding land ownership for native and non-native citizens. The Dutch colonial government limited efforts to formally register land to urban areas predominantly occupied by Dutch citizens (Monkkonen, 2013[16]). It concentrated infrastructure developments in these limited areas.

After the enactment of the National Law number 5/1960, the government of Indonesia began acknowledging property rights from the customary use of land. The law stipulated that every individual may register their land ownership and obtain a legal title up to 20 years after the enactment of the law. However, the registration of land parcels in Indonesia has yet to be completed. Approximately 60% of land in Indonesia has not been registered by the government. This has led to issues concerning informal settlements and dual claims on land (Box 4.2). The Ministry of Agrarian Affairs and Spatial Planning launched a programme to accelerate the land registration process in 2017 (Percepatan Pendaftaran Tanah Sistematis Lengkap, PTSL), which aims to complete all land registration by 2025.

Land valuation in Indonesia is conducted mainly to either update the tax base for land and property taxes, or to calculate compensation for government land acquisition. The responsibility for updating land values for tax bases is the responsibility of municipalities and regencies. Due to issues concerning land registration and a general lack of administrative capacity, local governments still often struggle with proper land valuation based on fair market values.

Land valuation for calculating compensation for acquisition is the responsibility of central government ministries and public agencies that propose land acquisition for public infrastructure development. Valuations are usually conducted by a certified land valuator appointed by the government through a public procurement mechanism. This land valuator is usually a private valuator who must own a professional valuator certificate issued by the Ministry of Finance.

Land valuation for compensation is likely the better instrument to use in the context of LVC. Up-to-date land valuation for tax purposes is difficult and costly to achieve in many countries, in part because all real estate subject to tax must be evaluated. These difficulties are reinforced in Indonesia. By contrast valuation for compensation can be applied in a targeted fashion to real estate benefitting from land value gains as a result of public action. To identify land value gains due to public action (infrastructure provision; land use regulation change), such assessments can be combined with hedonic price estimation methods, which assess the share of land value gain that can be attributed to these public actions.

Box 4.2. Informal settlements in Indonesia

Indonesia has many informal settlements, in particular in urban areas. These settlements, called “urban kampung”, are mostly in precarious areas, such as along flood-prone riversides or disaster-prone coastal areas.

Informal urbanisation is often attributed to the dualistic land registration system originating from the Dutch colonial era (Monkkonen, 2013[16]). Informal settlements are predominantly located in unregistered land plots. Within these plots, land is subdivided and developed without any legal permit from the government. In addition, procedures to register land and obtain development permits are long and costly, which further encourages informal settlement growth in Indonesian cities.

Informal settlements mostly lack even the most basic infrastructure and services, and struggle to provide water and sanitation. The Government of Indonesia and the Ministry of Public Works and Housing have attempted to address these issues, including through programs such as Program Pengentasan Kemiskinan Perkotaan (P2KP) in 1996-2006, Program Nasional Pemberdayaan Masyarakat (PNPM) Mandiri Perkotaan in 2007-2014, Program Peningkatan Kualitas Kawasan Permukiman (P2KKP) in 2015, and the recent Kota Tanpa Kumuh (Kotaku) Program.

4.2.3. Land acquisition

Governments may want to use land acquisition directly for LVC (“strategic land management”). To do so it is important they can acquire land at prices that does not incorporate the valuation gains from rezoning or building infrastructure the government undertakes. Moreover simple land acquisition rules are an important fall-back mechanism that can improve the willingness of private landowners to collaborate in LVC, for example, in the context of land readjustment (see below).

National Law number 5/1960 stipulates that the state can acquire individual property rights for public use if fair compensation is paid. The public agency or ministry planning to acquire land must make a proposal to the Ministry of Finance, which outlines the location, size, function, and land value estimation. Only recently through Law number 2/2012 on Land Procurement in the Public Interest has Indonesia introduced formal rules for land acquisition. The law allows land acquisition for water projects such as embankments, reservoirs, irrigation systems, drinking water channels, water disposal channels, and sanitation, among others. While the law allows legal recourse for landowners when the compensation is perceived to be unfair, there is no clear procedure outlined for how land values should be determined to compensate owners, other than it be determined in a “fair and reasonable” manner. Likewise, there is also no stipulation for the government to be allowed to fix land values at a specific point in time, unlike many other countries.

Land acquisition for public infrastructure development is typically a long process in Indonesia. Government Regulation number 19/2021 outlines this process, which consists of: (1) preparation of the land acquisition proposal, (2) public announcement of development plan, (3) identification of the affected area, (4) public consultation of the development plan, (5) authorisation of the land acquisition and development proposal, (6) identification of the affected land plots, (7) appointment of land valuator, (8) general meeting for agreeing the form of compensation, (9) payment of compensation, and (10) execution of land acquisition.

Landowners can appeal both the development plan and the amount of compensation to be paid. If a landowner disagrees with the development plan, the committee appointed to manage land acquisition processes must report to the provincial government, which establishes a team to review the development plan and decide whether the development should continue. Landowners are allowed to sue governments in local courts when they do not agree with compensation terms, and cases can also be escalated to the Supreme Court in certain instances. In such cases, local governments make compensation payments according to the terms decided upon by the Supreme Court.

4.2.4. Land use and spatial planning

Land use and spatial planning are fundamental to LVC. They allow to identify and anticipate the public actions that generate value gains in private property and which can be the basis of land value capture, as changes in allowed land use and infrastructure provision are key public actions driving land value increases.

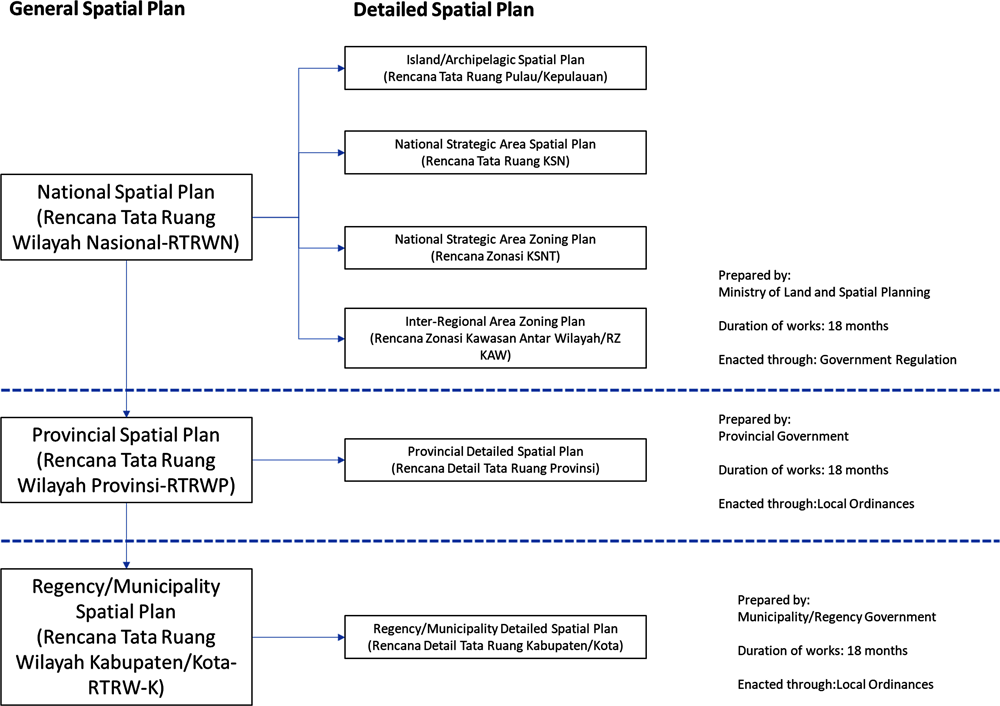

The spatial planning system of Indonesia is hierarchical and rigid, with lower-level spatial plans always mandated to follow guidelines set by upper-level spatial plans (Figure 4.5). The legal basis for the spatial planning system is established by National Law number 26/2007, with some parts having been amended by National Law number 11/2020.

Figure 4.5. Hierarchy of the spatial planning system in Indonesia

Traditionally, the process of preparing spatial plans at the municipal level is long and arduous. Upper-level spatial plans are often absent, which precludes the preparation of local-level detailed spatial plans under the hierarchical spatial planning system. Moreover, local-level plans must be approved by the Ministry of Agrarian Affairs and Spatial Planning before being brought to the local parliament, which ultimately passes the plan as a local ordinance. The enactment of National Law number 11/2020 required development permits to be issued based on detailed spatial plans. Consequently, the Ministry of Agrarian Affairs and Spatial Planning introduced a program to accelerate the preparation of detailed spatial plans in all Indonesian municipalities. However, detailed spatial plans at the municipal and regency level are still rare in Indonesia, with only 243 out of 2119 detailed spatial plan regulations having been enacted by municipalities across Indonesia.

Lack of land-use and spatial planning regulation enforcement is also a challenge. This is because local governments generally lack the capacity to enforce regulations, and because of the difficulty in regulating informal settlements that are prevalent across Indonesia. Dubbed the “blueprint syndrome”, detailed spatial plans, if they exist, are often idealistic visions rather than acting planning documentation. As a result, there is often a lack of synchronisation between local agencies responsible for tasks including issuing development permits and regulating land use, increasing hidden costs related to development permits and infrastructure development (Monkkonen, 2013[16]).

The predominance of the informal land and property market is another issue that hampers LVC adoption. Stemming from land ownership rules under customary law, land is not registered with governments in many areas and is subdivided into smaller plots and developed without obtaining development permits. Moreover, the unclear and arduous process for obtaining permits has further encouraged informal development (Zhu and Simarmata, 2015[17]). Even today, informal settlements continue to grow rapidly in many areas across Indonesia.

4.3. Recommendations for implementing LVC for water infrastructure provision

Many different LVC instruments can be used to finance water infrastructure. Which one suits best depends on the characteristics of the infrastructure and the local development context. Policy makers should deploy a broad range of instruments depending on the circumstances. The following sections draw on the ‘OECD-Lincoln taxonomy’ of instruments (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). It provides consistent definitions for the most used LVC instruments around the world (Box 4.3).

Box 4.3. The ‘OECD-Lincoln taxonomy’ of LVC instruments

Infrastructure levy

An infrastructure levy is a tax or fee levied on landowners possessing land that has gained in value due to infrastructure investment initiated by the government.

Landowners pay a fee for public infrastructure from which they benefit. The decision to build infrastructure is generally initiated by the government, and the government identifies the catchment area in which landowners are to pay the levy. The amount of the levy should be based on the amount of land value benefit obtained and can be either a one-time payment or payable over a longer period.

Developer obligations

A developer obligation is a cash or in-kind payment designed to defray the costs of new or additional public infrastructure and services private development requires.

Developer obligations apply when developers seek development approval or special permissions. The obligations can consist of cash or in-kind contributions. Unlike the infrastructure levy, developer obligations are triggered by the initiative of private developers and landowners. The obligations can be either negotiated between the government and developers or calculated using a fixed formula.

Charges for development rights

Charges for development rights are cash or in-kind contributions payable in exchange for development rights or additional development potential above a set baseline.

Charges for development rights are levied to build at a higher density beyond a baseline defined by an ordinance or regulation. Developers may also be charged for development rights when governments alter zoning or density regulations. Limited development rights, for example in protected environmental areas, can also be transferred to a different plot better suited to higher density development.

Land readjustment

Land readjustment is the practice of pooling fragmented land parcels for joint development, with owners transferring a portion of their land for public use to capture value increments and cover development costs.

Land readjustment is where contiguous plots of land are pooled and developed jointly. It is often accompanied by zoning changes so that newly developed land is more valuable. Landowners provide a share of their plots for public infrastructure and services. Landowners are returned a smaller plot of land that is nonetheless more valuable due to the upzoning and improvements made.

Strategic land management

Strategic land management is the practice of governments actively taking part in buying, developing, selling and leasing land to advance public needs and recoup value increments borne through public action.

With strategic land management, governments buy land or use existing land holdings to extract values from them. If land is acquired at predevelopment prices, increases in land value that are due to public interventions are captured. Governments can recover land value gains with the sale or lease of rezoned and developed plots, or by leasing usage rights which capture value increments through rents.

Source: Adapted from OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center (2022[6]), Global Compendium of Land Value Capture Policies, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/4f9559ee-en.

4.3.1. Developer obligations and charges for development rights

With developer obligations, public authorities, in most cases local governments, require developers to contribute to public infrastructure and service provision in exchange for development approval. They therefore typically involve in-kind contributions, whereby developers provide public infrastructure in development areas themselves but can also involve cash contributions. They are often used to pay for the costs of increased public service demand resulting from the development. Limiting the charges to such costs may make it easier get political support for the charges, including from the developers themselves, as the provision of these public services increases land value. However, the charges can exploit the full valuation gains resulting from the development approval. Developer obligations can cover capital and operating costs. Developer obligations are also one of the least contentious LVC instruments, as the provided amenities tend to raise the value of properties. Relatedly, charges for development rights work in a similar manner to developer obligations and can be employed in similar ways to finance infrastructure in areas where development potential is high.

Developer obligations, often termed impact fees, negotiated exactions, and developer charges, are the most commonly used LVC instrument (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). Many countries use them to fund urban water infrastructure, including Canada, Costa Rica, the Czech Republic, Germany, Korea, South Africa, and Sweden. They often cover costs for public infrastructure within the development area, such as water pipe and sewerage connections, but can also go beyond, depending on the value gains from the permission to develop. In Korea and Japan for example, the authorities agree the provision of water infrastructure of greater scale with developers, such as bulk water supply and treatment infrastructure. In Portugal, the ‘urbanisation tax’ is charged to offset the impact on infrastructure external to the project. Similarly, charges for development rights, sometimes referred to as air rights sale or transfer of development rights, have been used extensively in countries such as Brazil to fund urban infrastructure, including for water (Box 4.4).

There is much untapped potential to provide for water infrastructure through developer obligations and charges for development rights in Indonesia, especially as Indonesia’s population and economy continues to grow and demand for new developments remains strong. They require, a legal framework for implementation. There is no official national legal provision to charge developers for certain infrastructure obligations in Indonesia (Asian Development Bank, 2021[18]). At the subnational level the Governor Jakarta Regulation No. 210 of 2016 implements impact fees and developer contributions through ordinances. However, they are not mandatory and are only applied to a limited number of developments. In many other countries developer obligations are mandatory to obtain development approval. Other regions of Indonesia lack similar ordinances. An assessment of the land value gains generated by development permits as well as of the cost of in-kind developer obligations would allow policy makers to make full use of the potential to exploit land value uplifts.

Developer obligations and charges for development rights also require strong planning and analytical capacity at the local level for setting fees and negotiating with developers. Another prerequisite is the proper enforcement of land-use regulations. Transparency on development permits and associated developer obligations could help prevent corruption and encourage peer learning across local governments. Central government support in developing the local administrative capacity to carry out related tasks is critical in ensuring the proper application of developer obligations, especially for regions outside of Jakarta. For example, the Development Bank of Ecuador provides a subsidised line of credit and technical support for municipalities in Ecuador to use in implementing LVC.

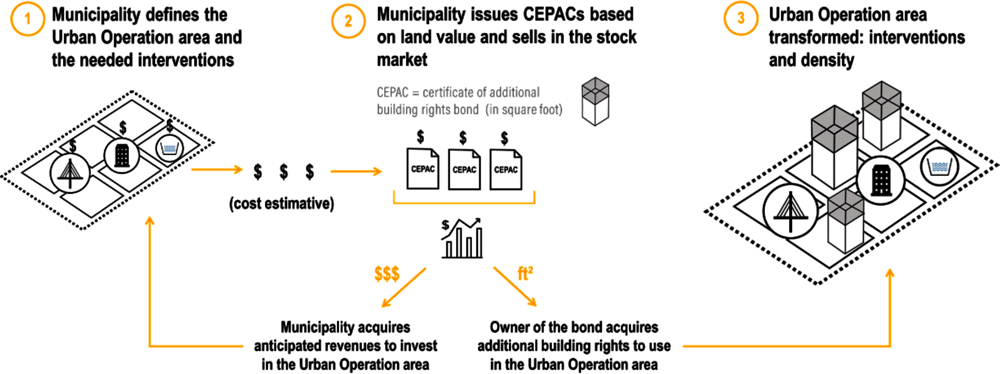

Box 4.4. Certificates of Additional Building Potential (CEPACs) in São Paulo, Brazil

CEPACs (Certificados de Potencial Adicional de Construção, or Certificates for Potential Additional Construction) are a financial instrument created by the city of São Paulo, Brazil, to finance urban infrastructure projects and promote sustainable urban development. CEPACs are essentially certificates that represent the right to build additional floor area in a particular area of the city, beyond what is currently allowed by existing zoning regulations. These certificates are sold at public auctions to real estate developers, who can then use them to build taller and denser buildings in the designated areas. The idea behind CEPACs is that by allowing developers to build taller and denser buildings in designated areas, the city can raise funds for infrastructure projects, while also promoting more compact and sustainable urban development patterns.

OODCs (Outorga Onerosa do Direito de Construir, or Charges for Additional Building Rights) regulate charges for additional building rights in Brazil and provide the basis for CEPACs. It is based on the notion that the landowners’ property rights are limited to a basic floor area ratio (FAR) that differs from the maximum FAR the area could support. The right to build at a density up to the basic FAR is free, but developers wanting to build at a higher density than the FAR established by zoning law for a particular area must pay compensation to the city. The OODC is defined by the City Statute (Brazilian Land Development Act), the national law approved in 2001, that sets the guidelines for urban policy.

In addition to the City Statute, the use of CEPACs in São Paulo is supported by a range of local regulations and guidelines. These include the Municipal Urban Development Plan, which sets out the overall strategy for urban development in the city, and the Municipal Public Transport Plan, which identifies the infrastructure projects that are eligible for funding from CEPAC proceeds. The city also has a set of guidelines for the sale and use of CEPACs, which govern the process by which they are sold at auction and the conditions under which they can be used by developers.

CEPACs are used in urban operations (UO), which are delimited urban areas subjected to zoning redefinition for land use and density and supported by improved urban infrastructure. UOs involve large-scale areas (typically over 500 hectares) and have building rights over and above the restrictions imposed by the master plan or zoning ordinances. These areas are chosen by the municipal government, and thus reflect both public and private interests. The owner of a CEPAC can either convert the charge into additional building rights in the UO or can resell it in the stock market as a security.

Figure 4.6. Workflow for CEPACs

Source: Mahendra, A. et al. (2020[19]), “Urban Land Value Capture in São Paulo, Addis Ababa, and Hyderabad: Differing Interpretations, Equity Impacts, and Enabling Conditions”, Lincoln Institute Working Paper WP20AM1.

The use of these funds is governed by specific guidelines established by the city, which set out the conditions under which they can be used and the types of projects that are eligible for funding. In many cases, a fixed share (typically 10 to 30 percent) of these funds are used to develop affordable housing and finance slum urbanisation efforts, with a portion of land plots inside the UO being dedicated to affordable housing, known as Special Zones of Social Interest (ZEIS). More broadly, funds collected through OODCs are deposited in the Urban Development Fund (Fundo de Desenvolvimento Urbano), which finances public urban investments within the city boundary.

Since their introduction in 2004, CEPACs have become an important source of funding for urban infrastructure projects in São Paulo. As of 2016, it had been estimated that a total of BRL 2.7 billion (approximately USD 820 million) had been raised through the sale of CEPACS since their introduction in 2004. This funding has been used to support a range of projects, including the expansion of the city's metro system, the creation of new public parks and green spaces, and the provision of affordable housing.

Source: Ingram, G. and Y. Hong (eds.) (2010[20]), Municipal Revenues and Land Policies, Lincoln Institute of Land Policy; Mahendra, A. et al. (2020[19]), “Urban Land Value Capture in São Paulo, Addis Ababa, and Hyderabad: Differing Interpretations, Equity Impacts, and Enabling Conditions”, Lincoln Institute Working Paper WP20AM1; Smolka, M. (2013[2]), Implementing Value Capture in Latin America, Lincoln Institute of Land Policy, Cambridge, MA, https://www.lincolninst.edu/publications/policy-focus-reports/implementing-value-capture-latin-america (accessed on 2 September 2020); Smolka, M. and C. Maleronka (2018[21]), “Assessing the monetary relevance of land value capture: the case for charges for additional building rights in Sao Paulo, Brazil”, International Journal of Real Estate and Land Planning; Suzuki, H. et al. (2015[22]), Financing Transit-Oriented Development with Land Values: Adapting Land Value Capture in Developing Countries, The World Bank, https://doi.org/10.1596/978-1-4648-0149-5.

4.3.2. Land readjustment

Land readjustment is a process in which land is pooled for development and landowners contribute a portion of their plots for infrastructure and services. Even with the smaller land plots, land readjustment tends to be beneficial for landowners because development makes land much more valuable. As a result, land readjustment is often less costly in terms of judicial procedures compared to expropriation.

The amount of land value increment that is captured through land readjustment is directly proportional to the amount of land that landowners contribute for public use. The contributed land in turn can be used to not only provide for infrastructure, but also to generate revenues through sale or lease. Land readjustment is typically used within the context of urbanisation and urban expansion, which is important in countries catching up with high income countries, such as Indonesia. The conversion of rural land for urban uses results in significant land value uplifts. 60% of urban expansion in the Seoul metropolitan area of Korea, for example, was accomplished through land readjustment in the 1980s, while land readjustment was carried out in 30% of all urban areas in Japan since the early 20th century (Asian Development Bank, 2021[18]; OECD, 2022[23]). Both countries have been remarkable for quickly catching up with high income countries in the 20th century (Box 4.5).

Indonesia’s continued urbanisation, coupled with economic growth, has resulted in high demand for developed urban land. As a result, the demand for water infrastructure and other services has steadily increased, yet without the accompanying tax revenues needed to fund such public works (Figure 4.3). Therefore, there is strong potential to implement land readjustment in Indonesia, which would not only provide much needed funding for water infrastructure but also diversify local government revenue streams and reduce their dependence on central government transfers. Without such value capture mechanisms, urban developments risk not being provided basic water infrastructure such as piped water and sewerage systems, and can result in slumification.

Land readjustment is a versatile instrument that can be suitable for developing any water infrastructure that requires the reallocation of land plots. As land readjustment is typically implemented for large-scale projects, this includes larger water infrastructure facilities including water intake facilities, wastewater treatment plants, and raw water infrastructure such as dams and irrigation infrastructure. Furthermore, governments can retain a portion of land for sale or lease, which can provide funding for the operation and maintenance of water infrastructure in the area.

A challenge to the successful application of land readjustment is in obtaining landowner consensus. Many countries require a supermajority of up to two-thirds of landowners by law, which can sometimes be difficult to obtain. However, these issues can be overcome when land readjustment is utilised together with expropriation in a hybrid fashion, as is the case in Korea where landowners are given the choice between retaining a portion of their land after development or selling their land outright to the government (OECD, 2022[23]). Solid expropriation mechanisms can also be a valuable fall-back option which can encourage landowners to reach a consensus and go through with land readjustment projects.

Box 4.5. Land readjustment in Japan and Korea

Japan and Korea have a long history of land readjustment, dating back to the early- and mid-twentieth century when the countries were beginning to urbanise. In Japan, land readjustment is by far the most popular LVC instrument, and its scope has been expanded since the 1990s to also include disaster prevention and urban regeneration. In Korea, land readjustment has been used extensively since the 1970s following rapid urbanisation and economic growth, and its use has increased in recent years due to its perceived advantages over expropriation. In both countries, there are national frameworks and legislation that provide the general guidelines for implementing land readjustment projects, while the local governments oversee actual implementation.

In Japan, two-thirds of involved landowners and leaseholders must consent to land readjustment projects, while in Korea, the consent of landowners representing half of the total number of owners and two-thirds of the total land area is required. In Korea in particular, land readjustment can also be conducted without landowner consent for certain projects, such as when private efforts are unsuccessful, when projects concern the provision of key public facilities, or for rebuilding after natural disasters. In both countries, the participation of resisting landowners may be enforced through expropriations.

In both countries, typically a share of 30-40% of the area of readjusted plots is reserved for public improvements. This includes public utilities, public spaces, and transportation projects. Land readjustment projects can require the provision of basic water infrastructure including piped water and sewerage facilities, and for large-scale projects, more substantial water infrastructure may also be provided, such as treatment facilities and the revitalisation of riverbeds and their surrounding areas. Moreover, land readjustment projects also typically reserve a certain portion of the land for public sale and lease. This is an important feature of the system since these revenues may cover a significant portion of the development costs and the operating costs for infrastructure. In Japan, they are also used to compensate non-landowning stakeholders with various claims, such as informal residents and leaseholders.

The implementation of land readjustment faces resistance from landowners in some cases, especially when the share of land given up for public use is perceived to be too large. There are legal measures to enforce participation through expropriation, but in both countries, this rarely occurs as the remaining land is still much more valuable even after a portion of the original plot has been ceded for public use. Tenants and informal residents without ownership rights also resist in some cases, fearing that they may not receive adequate compensation. However, both Japan and Korea have fiscal and legal mechanisms to facilitate compensation for these stakeholders and provide temporary housing and relocation assistance.

Source: OECD (2022[23]), “Financing transportation infrastructure through Land Value Capture: Concepts, tools, and case studies”, OECD Regional Development Papers, No. 27, OECD Publishing, Paris, https://doi.org/10.1787/8015065d-en; OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center (2022[6]), Global Compendium of Land Value Capture Policies, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/4f9559ee-en.

4.3.3. Infrastructure levies

An infrastructure levy can pay for the costs of public infrastructure investment and upkeep by charging the landowners that have benefited from increases in land prices due to the public investment. Infrastructure levies are typically applied to already developed land, especially in urban areas, which benefit from new infrastructure. Infrastructure levies are therefore typically cash contributions. However, they may also be applied to rural water infrastructure projects, such as irrigation infrastructure raising the value of agricultural land. They are charged based on the catchment area of real estate benefiting from the infrastructure. Infrastructure levies require government initiative and are less subject to negotiation. Due to these characteristics, infrastructure levies are typically applied to larger-scale public infrastructure projects that generate wide-ranging value uplifts in well-defined geographic areas, such as public transit systems and big-ticket public utilities.

Argentina, Austria, Ecuador, Hungary, Poland, and Turkey, among other countries, charge infrastructure levies when they provide water infrastructure, including wastewater management facilities and water treatment systems (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). Typically, infrastructure levies are charged at around 30% to 60% of the gain in land value (Peterson, 2008[24]).

Infrastructure levies may be particularly attractive for flood protection infrastructure because it does not generate revenues from user charges. Using LVC for flood protection can therefore also help make sure development in flood-prone areas is avoided, unless a contribution towards flood protection is made. It can include flood management systems, river diversions, embankments, and green infrastructure, such as natural flood retention areas. Infrastructure levies are also particularly attractive when valuable assets benefit from the infrastructure service. Value uplifts and revenue potential may then be highest and can serve to finance expensive infrastructure to protect such assets. For example, Jakarta is currently implementing a large-scale river diversion project, funded fully through tax revenue. It aims to reduce flood risk, mostly in the wealthy Jakarta business district. Applying LVC policy tools are particularly useful in this context because the principal beneficiaries - wealthy landowners - can afford to pay LVC charges. The cost of the intervention, reported at USD 50 million, could be financed with an infrastructure levy on major real estate owners in the business district, with the cost of the project distributed to them based on a recent certified assessment of their property values. Setting up such an infrastructure charge early in the project development process could also mobilise resources and partnerships with the beneficiaries that support the cost-effective design, planning and implementation of the project. In this case, financing the project through LVC instruments could have promoted a progressive use of public funds, where tax revenues are used for other purposes than to the benefit of a defined group of wealthy beneficiaries.

Box 4.6. Nature-based solutions for water infrastructure

Nature-based solutions (NBS) are policy approaches to leverage nature and ecosystems to protect people and optimize infrastructure to do so, for example to protect against flood risk, while safeguarding the natural environment. NBS can be innovative solutions to manage water-related disaster risks (Gómez Martín et al., 2020[25]).

NBS have strong potential to make urban development sustainable in the face of global environmental challenges, including climate change, while providing local wellbeing benefits and disaster prevention, keeping highly urbanised areas liveable. They can contribute to CO2 emission reduction and biodiversity protection. They can reduce the impacts of climate change, limiting the impact of heatwaves, as well as the exposure and vulnerability to floods. They provide green recreational space, particularly in low-income neighbourhoods, where disaster risk exposure and vulnerability may be particularly strong and recreational space scarce. The large-scale delivery of urban NBS is therefore urgent for high-level government commitments such as the Sustainable Development Goals (Croeser et al., 2022[26]; Gómez Martín et al., 2020[25]; Schmidt, Guerrero and Albert, 2022[27]).

Green corridors for flood management, restoration of natural floodplains, and multifunctional public space for recreation and stormwater management, in particular, combine risk reduction with many of these sustainability and wellbeing benefits. NBS thus provides benefits beyond those of “grey” flood protection infrastructure. These also include the replenishment of aquifers, reduced energy consumption, pollutants filtration with improved water and air quality, improved aesthetics, promotion of communal activities and crime reduction (Grafakos et al., 2019[28]). NBS’ costs may also be substantially lower, as the example of Buenos Aires, Argentina suggests (Kozak et al., 2020[29]). They can therefore be considerably more cost-effective. Adding NBS to grey infrastructure in a hybrid approach can add benefits and land value gains without generating higher cost.

Policy makers face two major barriers to harness NBS:

Governments must scale up the delivery of public space, which is contested, especially in cities.

NBS do not generate revenues, unlike other infrastructure, such as irrigation or urban water supply, and prevents some land to be used for economic activity which generates revenue.

LVC can help overcome both barriers. LVC instruments can make land available, for example, through developer obligations or land readjustment, or deliver revenues, for example through infrastructure charges. Owing to the wide range of local wellbeing benefits, NBS can raise real estate prices considerably more than flood protection alone (Grafakos et al., 2019[28]), making the combined use of LVC for NBS potentially attractive to developers and real estate owners.

As the following examples illustrate, applying a broad range of LVC instruments may make the most of cost effective NBS. Political economy arguments may also play a role for instrument selection.

In the Indian city of Kalkota, recent research proposes the use of LVC instruments to improve water retention; to restore or create rainwater catchments; and to expand large surface green corridors serving as parks as well as flood retention areas. These measures can be undertaken with charges for development rights, whereby real estate owners give up parcels of land in exchange for the permit to raise building heights; the infrastructure charges, whereby real estate owners benefiting from the green corridor make monetary payments; and developer obligations where developers are required to provide NBS in exchange for building permits. The amount of LVC charges and obligations can be assessed on the basis of a hedonic pricing model estimating the impact of past NBS investment on real estate values (Nath, Chakraborty and Banerjee, forthcoming[30]).

In the Colombian city of Cali, dams, dikes, canals, and pumping plants have exacerbated flood hazards, shifting them to lower-income populations, due to lack of maintenance and degradation of natural ecosystems, while climate change is aggravating flood risk. The Cañaveralejo river project aims to build urban resilience by strengthening natural river flows, minimizing flood risk and improving public space. Consulted stakeholders argued that LVC instruments relating to investment, notably charges for development rights, are likely to be the best accepted. Infrastructure charges based on an assessment of real-time land value impacts of the project were seen as a promising revenue source, but complex, while simpler infrastructure charges without such assessment met with mistrust, owing incomplete municipal projects in the past and corruption. However, administrative and institutional barriers need to be overcome in any case, including for the consultation of all stakeholders (Grafakos et al., 2019[28]).

There is no legal mechanism to charge infrastructure levies in Indonesia. Infrastructure levies can be challenging to implement as they may be considered as charges for infrastructure imposed by the government for a service some landowners may not demand. Indeed, among the LVC instruments, infrastructure levies are the most susceptible to legal appeals (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). Nonetheless, examples in countries such as the United Kingdom and Japan highlight how infrastructure levies can be successfully implemented by i) opening and maintaining robust channels for dialogue with the public that effectively communicate the benefits of the proposed infrastructure, and ii) clearly defining and communicating the rules for assessing how much landowners are to pay so that they perceive the charges to be fair (OECD, 2022[23]). Like developer obligations, infrastructure levies also require strong central government support in developing local government capacity to estimate land value increments that arise due to the new infrastructure.

Infrastructure levies are best charged based on actual or estimated real estate value gains. In Ecuador for example, for urban water infrastructure such as sewerage, landowners whose plots directly gain access are charged, while for larger projects such as tram lines, all landowners in a neighbourhood are charged. How much benefiting landowners are charged is based on a formula that accounts for size, value and distance to the infrastructure, with the idea being those properties closer to the infrastructure benefit more and thus pay more in LVC fees. In this way, the real estate owners’ contribution is clearly linked to the value benefit they receive from the public infrastructure project, reducing risks of resistance, while also increasing revenue potential and making levies fairer.

Infrastructure levies require established procedures to assess valuation gains, such as from professional assessments. Moreover, levies need to be credibly announced when the project starts, so that they accrue to owners that realise the value gain. Landowners below a certain income or wealth threshold are often excluded from paying charges altogether to avoid hardship (OECD, 2022[23]).

4.3.4. LVC through expropriations and the strategic management of public land

In many countries, governments actively participate in the development and management of land assets. This can be done by expropriating land for public use, generating value uplifts in government landholdings and through public private partnerships. The acquired land can be used to directly provide for water infrastructure. It can also be sold or leased to generate revenues. Countries such as Australia, Finland, Israel, and the Netherlands have adopted public land leasehold systems. For example, the Netherlands is well-known for its ‘Active Municipal Land Policy’, where municipalities acquire vacant, abandoned or unproductive land through debt financing, develop and service this land, and sell or lease this land to the private market. The profits generated during this process are used to finance the development of the land and infrastructure as well as provide for future operation and maintenance costs. In France, land for public infrastructure is often provided for by expropriation. As in many countries, the French government can purchase land at a price which prevailed before the announcement of the public improvements or development projects (OECD, 2022[23]).

The State Asset Management Agency (LMAN) manages the government’s property in Indonesia. While expropriation and the strategic management of land is occasionally used as an LVC instrument, there are barriers to implementation that limit their more effective use. There is no legal basis for the government to purchase land at prices which prevailed before the announcement of the government intervention, which makes land acquisition costly. Administrative capacity and coordination among public entities to implement strategic land management practices are also lacking (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[6]). The effective utilisation of these instruments for LVC purposes will depend on reforming the legal basis for the government’s role in the land market, and in balancing public interests with private property rights.

4.4. Recommendations to strengthen the enabling framework for LVC

The provision of water in Indonesia is predominantly funded either by tariffs or direct government transfers. However, the high cost of building water infrastructures and operating and maintaining them cannot be provided for by charges and transfers alone. This has resulted in inadequate and insufficient water infrastructure and a lack of access to basic water services such as piped water, as well as insufficient flood protection capacity. LVC instruments can provide tools to government at all levels (national, regional, local) to bridge this financing gap. Indonesia is implementing legislative reforms for LVC to this purpose. Nonetheless some key actions still need to be addressed.

4.4.1. Developing local government capacity to implement LVC

Implementation of LVC involves the responsibility of all government levels, but in particular local governments. Their responsibilities include ensuring fundamental framework conditions are met. LVC requires the development and monitoring of spatial planning outcomes and land-use regulations, as LVC relies on governments having unique power to determine and alter land uses. It also requires defining landowners affected by LVC instruments, as well as setting the rates for fees and contributions, negotiating with landowners and developers, and managing land assets. Where the central government is in charge of such a project, it will need powers to set such charges in local areas benefitting from such infrastructure. This is the case, for example, for an ongoing river-diversion project providing flood protection to the business district of Jakarta. Nonetheless, even in such cases, local governments play a key role in the actual implementation of LVC.

Local governments need to improve administrative capacity to carry out these tasks. However, the history of decentralisation and regional autonomy is still relatively short in Indonesia, resulting in municipalities in Indonesia generally lacking the capacity to set LVC fees or negotiate with developers, among other tasks. Municipalities also lack the capacity to effectively collect taxes and fees, making them reliant on central government transfers. Most localities also lack formally enacted land-use regulations. This has hampered the issuance of development permits, which makes implementing LVC instruments such as developer obligations, charges for development rights, and land readjustment costly and time-consuming. This has contributed in part to the prominence of the informal land and property market, which further makes regulating land-use and public land acquisition difficult. The example of Ecuador in providing credit and technical support through the national development bank suggests a possible solution to aid local government capacity building efforts.

Developing local government capacity to implement LVC will require targeted central government financial and administrative support for municipal governments. A viable approach could be to maintain a pool of planning and administrative experts certified by the central government that are called upon as needed to aid local government planning efforts (OECD, 2022[31]). Equally important is simplifying the rigid spatial planning legislation which requires Detailed Spatial Plans to be approved by both the Ministry of Agrarian Affairs and Spatial Planning and the local parliament. Continued legislative reforms to expand local government autonomy in implementing and collecting taxes and fees should be carried out, and these reforms should be well integrated with the newly proposed presidential decree on LVC implementation.

4.4.2. Maintaining accurate land registries

Maintaining accurate and detailed land registries is essential for the effective implementation of LVC. A robust system of land administration and management allows clarity and certainty regarding land ownership. Land registries are also essential in developing and enforcing land use plans and land-based regulations, and are the basis for calculating land values and land value increases due to government interventions. More generally, accurate and detailed land registries allow the land market to function effectively and efficiently while discouraging informal and possibly illegal land uses and settlements.

Outside of Jakarta, land registries across Indonesia are largely incomplete and not sufficiently updated. This often results in complex landownership issues, for example double claims of ownership, and lengthy legal disputes hampering LVC implementation and public land acquisition. There are still many landowners that have not converted their old certificates issued by the colonial government to those issued by the National Land Agency.

In addition, land registries do not have accurate information on the values of land plots, and even if this information exists, the values are not updated regularly. Currently, land valuations are only updated for specific plots when the land needs to be acquired to develop infrastructure. This prevents calculating land value increments and holds back applying LVC. It also results in forgone land and property tax revenues. Legal provisions and administrative support should be provided to assess land values for projects of interest for LVC.

The maintenance of accurate land registries requires both sufficient financial resources and administrative capacity of local governments. Sufficient support provided by central government ministries and agencies in charge of maintaining land registries is needed for local governments to carry out on-the-ground assessments. Importantly, an adequate workforce of certified appraisers needs to be available at the municipal level. This could be achieved in part by allowing private professionals certified by the government to carry out land valuation and appraisal.

4.4.3. Reforming land acquisition legislation

Conducted in a fair and transparent manner, land acquisition can facilitate the provision of land for water infrastructure, especially in cases where the infrastructure requires a significant amount of land and landownership rights are complex. Furthermore, land acquisition can act to speed up LVC implementation in some cases by giving landowners a choice between sale and making LVC contributions. In Korea for example, projects often utilise a hybrid approach in which expropriations are carried out in cheaper areas and land readjustment is used for more expensive plots, which speeds up implementation and reduces overall project costs (OECD, 2022[23]). Land acquisition rules on terms that will allow the government to retain land value gains from its infrastructure development also serves as a fall-back mechanism when landowners fail to reach a supermajority for LVC projects to commence. It will provide stronger incentives for landowners to cooperate in with the government LVC, for example in the case of land readjustment, and avoid costly legal expropriation procedures. In many countries such as France and Singapore, governments have the right to acquire land for infrastructure development at prices that prevailed before the announcement of the infrastructure project, which effectively returns all or most of the windfall land value gains back to the public (Box 4.7).

To facilitate land acquisition for LVC purposes, legislation must be clear on how landowner compensation is determined. This can include stipulating whether estimated or market values are used, explicitly listing the specific criteria and land characteristics used to calculate fair values, as well as outlining when these valuations take place and who oversees them. A clearer land acquisition framework can help in expediting water infrastructure developments by reducing legal disputes. In order to prevent land acquisition from becoming prohibitively costly and to utilise acquisition as an LVC instrument, legislation could include clauses for freezing land prices at specific points in time predating government interventions, which can vary depending on the type of project and infrastructure.

Box 4.7. Land acquisition in Singapore

Singapore’s rapid transformation from a colonial port city into a global financial centre was due at least in part to a sound land administration and management system. Many of Singapore’s urban development efforts relied on a land acquisition framework that allowed government to acquire privately owned land to facilitate development of public infrastructure and services.

Landownership in the 1960s was concentrated among a small group of private enterprises and individuals, which initially made land acquisition difficult. Various pieces of legislation since then allowed the government to expropriate private land for any public purpose, and for residential, commercial, and industrial developments without excessive financial cost.

Singapore’s legislation does not allow dispute over expropriation, but allows landowners to contest the amount of compensation paid. Singapore’s legislation also allows the government to disregard land value increases for up to 2 years prior to the acquisition for improvements made by the owner to their own property, and for up to 7 years for increases due to infrastructure works in the surrounding area. Such legislation has paved the way for the construction of large-scale public housing and infrastructure and has facilitated large-scale development projects such as the reclamation of Marina Bay.

Singapore’s system of land acquisition acts as an effective LVC instrument by allowing the government to expropriate land at a cost that does not include any windfall gains. Even with such legislation, landowner appeals are limited. This is because the acquired land was used for projects that had clear public benefits, such as the large-scale public housing programme that provided vast amounts of low-cost housing to citizens.

Source: Asian Development Bank (2021[18]), Innovative Infrastructure Financing through Value Capture in Indonesia, Asian Development Bank, https://doi.org/10.22617/spr200093-2.

References

[14] Asian Development Bank (2022), Modernizing Local Government Taxation in Indonesia, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/tcs220138-2.

[18] Asian Development Bank (2021), Innovative Infrastructure Financing through Value Capture in Indonesia, Asian Development Bank, https://doi.org/10.22617/spr200093-2.

[10] Asian Development Bank (2018), “Key Indicators for Asia and the Pacific 2019”, Key Indicators for Asia and the Pacific, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/fls190428-3.

[12] Bahl, R. and R. Bird (2018), Fiscal Decentralization and Local Finance in Developing Countries: Development from Below, Edward Elgar.

[3] Borrero, O. (2016), Urban Multiplier (presentation), Lincoln Institute of Land Policy.

[26] Croeser, T. et al. (2022), “Finding space for nature in cities: the considerable potential of redundant car parking”, npj Urban Sustainability, Vol. 2/1, https://doi.org/10.1038/s42949-022-00073-x.

[8] Florczyk, A. et al. (2019), GHSL Data Package 2019, EUR 29788 EN, Publications Office of the European Union, https://doi.org/10.2760/290498.

[25] Gómez Martín, E. et al. (2020), “Using a system thinking approach to assess the contribution of nature based solutions to sustainable development goals”, Science of The Total Environment, Vol. 738, p. 139693, https://doi.org/10.1016/j.scitotenv.2020.139693.

[33] Government of Indonesia (2022), PROTARU, https://tataruang.atrbpn.go.id/protaru.

[28] Grafakos, S. et al. (2019), “Exploring the Use of Land Value Capture Instruments for Green Resilient Infrastructure Benefits: A Framework Applied in Cali, Colombia Working Paper WP19SG1”.

[20] Ingram, G. and Y. Hong (eds.) (2010), Municipal Revenues and Land Policies, Lincoln Institute of Land Policy.

[5] Kim, J. and S. Dougherty (eds.) (2020), Local Public Finance and Capacity Building in Asia: Issues and Challenges, OECD Fiscal Federalism Studies, OECD Publishing, Paris, https://doi.org/10.1787/a944b17e-en.

[29] Kozak, D. et al. (2020), “Blue-Green Infrastructure (BGI) in Dense Urban Watersheds. The Case of the Medrano Stream Basin (MSB) in Buenos Aires”, Sustainability, Vol. 12/6, p. 2163, https://doi.org/10.3390/su12062163.

[19] Mahendra, A. et al. (2020), “Urban Land Value Capture in São Paulo, Addis Ababa, and Hyderabad: Differing Interpretations, Equity Impacts, and Enabling Conditions”, Lincoln Institute Working Paper WP20AM1.

[32] Ministry of Agrarian Affairs and Spatial Planning (2022), Program PTSL Pastikan Penyelesaian Sertifikasi Lahan Akan Sesuai Target, https://www.kominfo.go.id/content/detail/12924/program-ptsl-pastikan-penyelesaian-sertifikasi-lahan-akan-sesuai-target/0/artikel_gpr.

[16] Monkkonen, P. (2013), “Urban land-use regulations and housing markets in developing countries: Evidence from Indonesia on the importance of enforcement”, Land Use Policy, Vol. 34, pp. 255-264, https://doi.org/10.1016/j.landusepol.2013.03.015.

[30] Nath, S., I. Chakraborty and S. Banerjee (forthcoming), Land value capture for flood protection using nature-based solutions in Kolkata.

[13] Oates, W. (2008), “On the Evolution of Fiscal Federalism: Theory and Institutions”, National Tax Journal, Vol. LXI/2.

[23] OECD (2022), “Financing transportation infrastructure through Land Value Capture: Concepts, tools, and case studies”, OECD Regional Development Papers, No. 27, OECD Publishing, Paris, https://doi.org/10.1787/8015065d-en.

[9] OECD (2022), OECD.Stat (database), https://stats.oecd.org/ (accessed on 2022 December 1).

[31] OECD (2022), Shrinking Smartly in Estonia: Preparing Regions for Demographic Change, OECD Rural Studies, OECD Publishing, Paris, https://doi.org/10.1787/77cfe25e-en.

[1] OECD (2017), The Governance of Land Use in OECD Countries, OECD Publishing, Paris, https://doi.org/10.1787/9789264268609-en.

[6] OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center (2022), Global Compendium of Land Value Capture Policies, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/4f9559ee-en.

[11] OECD/UCLG (2022), OECD/UCLG World Observatory on Subnational Government Finance and Investment database (SNG-WOFI), https://www.sng-wofi.org/ (accessed on 1 December 2022).

[24] Peterson, G. (2008), Unlocking Land Values to Finance Urban Infrastructure, The World Bank, https://doi.org/10.1596/978-0-8213-7709-3.

[15] Republik Indonesia (2022), Peraturan Presiden Republik Indonesia (draf): Pendanaan Penyediaan Infrastruktur Melalui Pengelolaan Perolehan Peningkatan Nilai Kawasan.

[27] Schmidt, S., P. Guerrero and C. Albert (2022), “Advancing Sustainable Development Goals with localised nature-based solutions: Opportunity spaces in the Lahn river landscape, Germany”, Journal of Environmental Management, Vol. 309, p. 114696, https://doi.org/10.1016/j.jenvman.2022.114696.

[2] Smolka, M. (2013), Implementing Value Capture in Latin America, Lincoln Institute of Land Policy, Cambridge, MA, https://www.lincolninst.edu/publications/policy-focus-reports/implementing-value-capture-latin-america (accessed on 2 September 2020).

[21] Smolka, M. and C. Maleronka (2018), “Assessing the monetary relevance of land value capture: the case for charges for additional building rights in Sao Paulo, Brazil”, International Journal of Real Estate and Land Planning.