The International VAT/GST Guidelines present a set of internationally agreed standards, rules and mechanisms to address the challenges that the uncoordinated application of national VAT systems presents in the context of international trade. With a key focus on cross-border trade in services and intangibles, the Guidelines also include the recommended approaches to address challenges for the collection of VAT on cross-border sales of digital services and products. They were developed in an inclusive manner, notably through the OECD Global Forum on VAT, and reflect consensus among more than 100 jurisdictions worldwide. They were delivered as part of the OECD/G20 Base Erosion and Profit Shifting (BEPS) package and have been further complemented with detailed implementation guidance.

VAT policy and administration

VAT is a major revenue source for governments worldwide, with over 170 countries operating a VAT now. The OECD plays an essential leadership role in fostering inclusive global dialogue on VAT policy and administration matters, assisting countries to secure appropriate taxation outcomes through the development of internationally agreed standards and effective mechanisms for their implementation.

Key messages

The OECD Global Forum on VAT is a unique platform that promotes a truly global dialogue on the design and operation of Value Added Taxes/Goods and Services Taxes. It brings together officials and practitioners from around the world to share policy analysis and experience, to identify best practices and strengthen international co-operation, and to develop consensus around common solutions to common problems. To date, five Global Forums have convened, bringing together tax administrations from over 100 jurisdictions alongside international and regional organisations, as well as representatives from the business community and academia.

The OECD has published a series of detailed implementation guidance to further support tax administrations in building robust VAT frameworks for the taxation of digital trade. The development of the implementation guidance resulted from consensus-based discussions on the following high-priority matters: developing effective collection mechanisms for non-resident suppliers (2017); the role of digital platforms in VAT collection on online sales (2019); the impact of the growth of the sharing and gig economy on VAT policy and administration (2021). The OECD is dedicated to supporting tax administrations in addressing emerging challenges from the evolving digital economy, ensuring ongoing assistance and collaboration.

Recognising the necessity of tailored guidance and support for tax administrations, notably in developing economies, to implement the recommended approaches for collecting VAT on international digital trade, the OECD has developed three VAT Digital Toolkits in close collaboration with the World Bank Group and regional multilateral organisations. They provide step-by-step guidance for the design and the implementation of the recommended framework for the collection of VAT on digital trade, taking into account the specific opportunities, challenges and circumstances of developing economies in, respectively, Latin America and the Caribbean, Asia-Pacific and Africa. The toolkits serve as a firm foundation for the OECD’s continued capacity-building assistance to interested tax administrations.

Context

Countries around the world are implementing reforms for VAT on e-commerce based on OECD standards and guidance

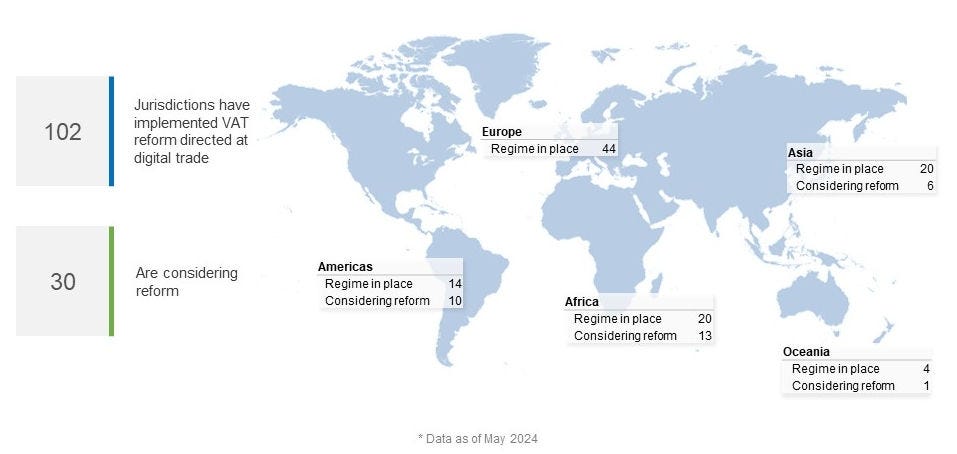

To date, over 100 jurisdictions (more than half of which are developing countries) have implemented reforms based on the OECD VAT standards and guidance, and over 30 jurisdictions are considering implementation. Their implementation allows economies to secure crucial VAT revenues and to ensure a level playing field between traditional businesses and e-commerce firms, without stifling innovation and economic growth. While most of these reforms have been aimed at the collection of VAT on online sales of services and digital products, countries are now increasingly considering further reforms to ensure that VAT is also collected effectively on online sales of low-value imported goods.

Latest insights

-

Announcement15 February 2023

Announcement15 February 2023 -

10 March 2022

10 March 2022 -

Announcement23 June 2021

Announcement23 June 2021 -

Announcement19 April 2021

Announcement19 April 2021

Related publications

-

Working paper6 September 2018

Working paper6 September 2018 -

5 October 2015

5 October 2015