This report quantifies the magnitude, value, scope and trends of global trade in counterfeit and pirated goods, also known as fakes. Using a unique enforcement dataset and tailored methodology, it estimates the overall scale of this threat and outlines which industries are particularly at risk. It also gauges the main economies of origin of fakes in global trade, and the key directions of trade flows. Finally, it analyses recent trends in terms of modes of shipment and the evolution of trade routes.

Global Trade in Fakes

Abstract

Executive Summary

This study presents an updated quantitative analysis of the value, scope and magnitude of world trade in counterfeit and pirated products. Based on data for 2019, it estimates that the volume of international trade in counterfeit and pirated products amounted to as much as USD 464 billion in that year, or 2.5% of world trade.

In previous OECD-EUIPO studies, which relied on the same methodology, trade in counterfeit and pirated goods was estimated at up to 2.5 % of world trade in 2013, equivalent to up to USD 461 billion, and 3.3% of world trade in 2016, or USD 509 billion. Thus, in nominal terms, in absolute terms and in terms of its share in total trade, the volume of trade in fakes has remained significant, representing amounts close to the GDPs of advanced OECD economies such as Austria or Belgium.

Drawing on detailed EU data, this study also provides an in-depth assessment of the situation in the European Union. The results show that in 2019, imports of counterfeit and pirated products into the EU amounted to as much as EUR 119 billion (USD 134 billion), which represents up to 5.8 % of EU imports. It should be noted that these results rely on customs seizure observations and do not include domestically produced and consumed counterfeit and pirated products; nor do they include pirated digital content on the Internet.

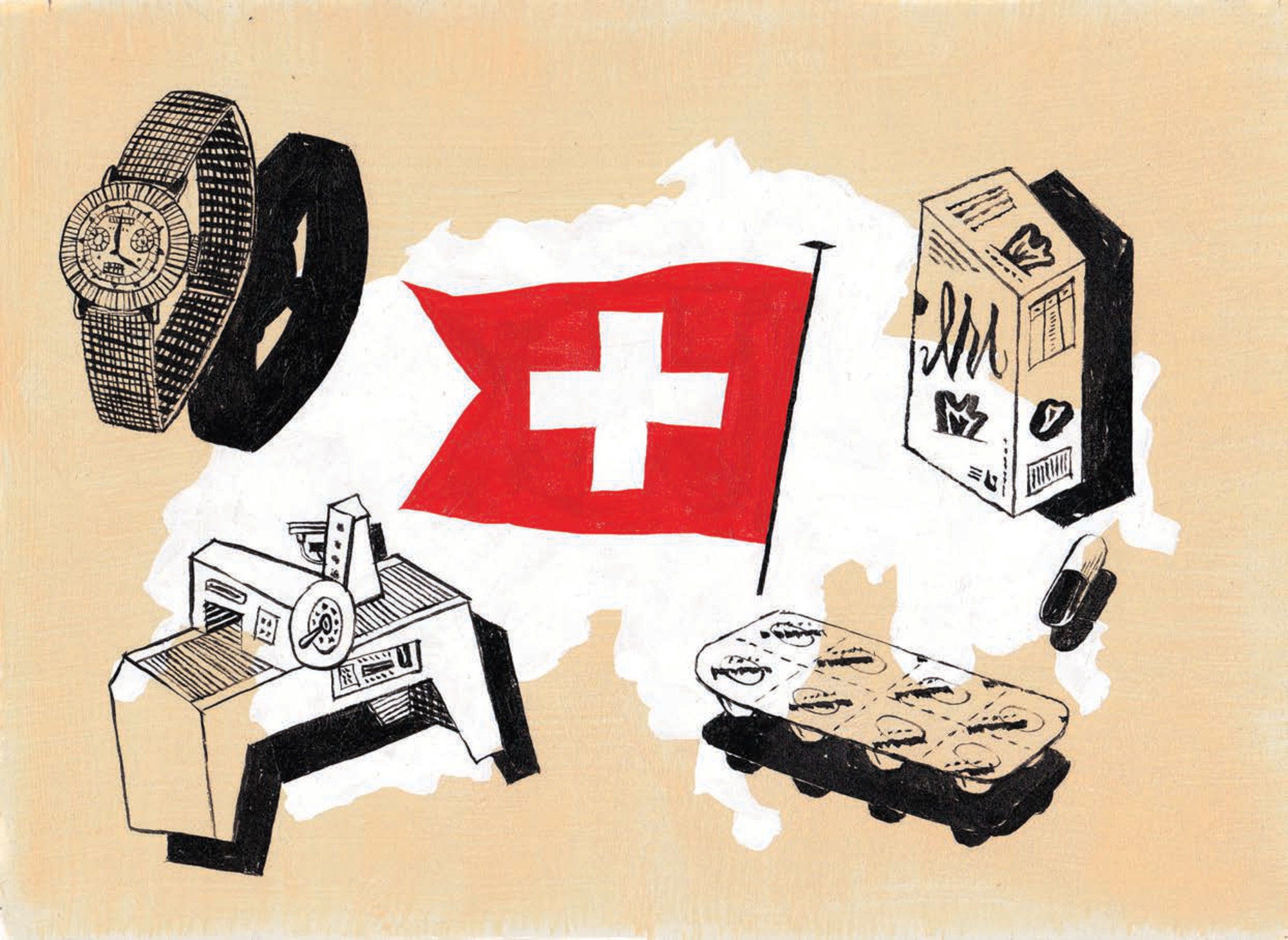

Counterfeiting and piracy threaten a large number of industries. Fakes can be found among many types of goods, including common consumer products (clothing, footwear), business-to-business products (spare parts, pesticides), and luxury items (fashion apparel, deluxe watches). Importantly, many fake goods can pose serious health, safety and environmental risks. These include fake pharmaceuticals in particular, but also food, cosmetics, toys, medical equipment and chemicals.

While counterfeit and pirated goods originate from virtually all economies in all continents, China remains the primary economy of origin.

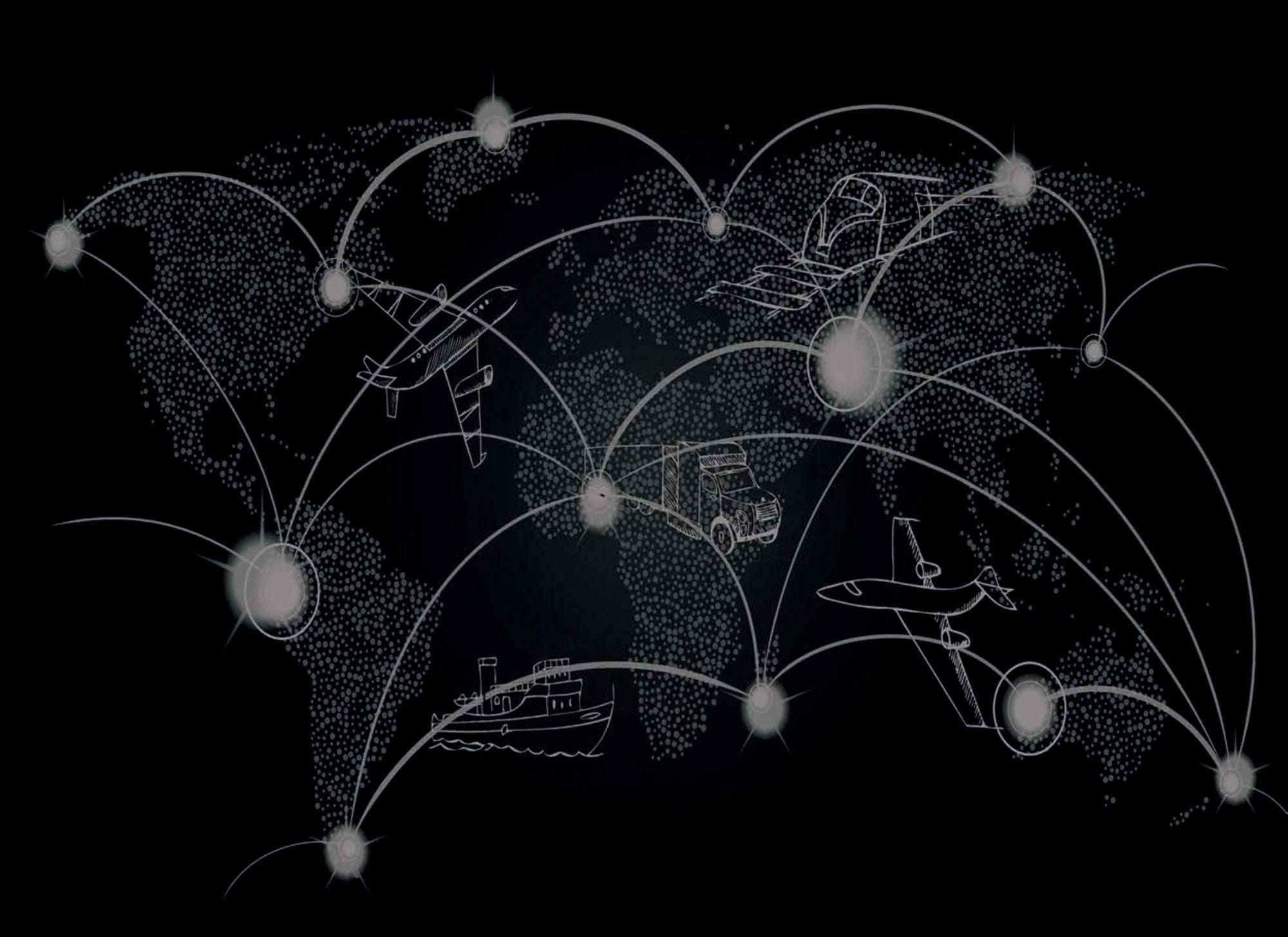

Counterfeit and pirated products continue to follow complex trading routes, misusing a set of intermediary transit points. Many of these transit economies, for example Hong-Kong (China), Singapore or United Arab Emirates, are well developed, high-income economies and important hubs of international trade.

Fake goods tend to be shipped by every means of transport. In terms of the number of seizures, small parcels -- in particular via postal services -- is the most common, posing a significant challenge in terms of enforcement. In terms of value, counterfeits transported by container ship clearly dominate, accounting for more than a half of the global value of counterfeit seizures in 2019.

The COVID-19 pandemic has affected trade in fake goods, although, in terms of volume, the impact was smaller than initially expected. In most cases, the crisis has aggravated existing trends. The main trend was the intense misuse of the online environment. Under confinement, consumers turn to online markets to fulfil their needs, driving significant growth in the online supply of a wide range of counterfeits. The sharp increase in fakes concerned not only medicines and personal protective equipment (PPE), but many other goods, including watches, consumer goods, and products in the mechanical and electrical engineering and metalworking industry (e.g., kitchen appliances).

The analysis presented in this report is based primarily on a quantitative assessment using the tailored statistical methodologies developed by the OECD, drawing on data from a large dataset on customs seizures of intellectual property-infringing goods. The data refer to the pre-COVID period; the crisis has introduced a great deal of dynamism, and no final, robust conclusions as to the effects of the pandemic can be drawn at this stage.

To understand and combat the risk of counterfeit and pirated trade of trade in fakes, governments need up-to-date information on its magnitude, scope and trends. This study is part of a continuous monitoring effort to support policy and enforcement solutions.