Why governments should target support amidst high energy prices

Governments across the OECD and in key non-member economies have rolled out significant support to shield households and firms from the impacts of high energy prices that followed the strong recovery in demand in the aftermath of the COVID-19 slump and the fallout of the war in Ukraine.

While relatively simple to introduce and communicate in general, measures that act to lower the price of energy are not targeted and weaken incentives to reduce energy use when supply is tight.

If prices remain elevated, governments should shift to more targeted measures, including through the increased use of income support, noting that such a shift may require improvements to existing transfer and social welfare systems to ensure effective targeting.

Targeting of support should use criteria beyond income to include other factors that determine the degree of a household’s financial vulnerability, e.g. housing location and quality, and household composition.

Pursuing the transition to carbon neutrality helps reduce dependence on fossil fuels, but can succeed only if policies ensure affordable access to low and zero carbon options.

Interventions that blunt price signals and dampen incentives to reduce fossil-based energy use should be phased out while building capacity to better address household vulnerabilities to price shocks and accelerating the development of alternative sources of energy.

Introduction

Energy prices have been soaring since early 2021 due to a combination of supply and demand factors. These include long-term trends such as underinvestment in natural gas and clean energy supply, and short-term developments like reductions in natural gas spot delivery by Russia and a strong recovery in demand in the aftermath of the COVID-19 slump (IEA, 2021[1]). The war in Ukraine has put further strain on already tight energy markets and increased uncertainty over the near term development of supply. Russia has cut off energy supply to several countries, and others have introduced embargoes on Russian energy imports.

The International Energy Agency (IEA) predicts that high prices of petroleum and gas products are here to stay. This is despite the fact that steadily rising oil supply volumes from the Middle East and the United States, along with slower economic growth, are expected to mitigate oil and gas supply constraints due to the Russian supply disruption.1 Volatility of energy prices has also been extremely high. As a result, the energy crisis is now contributing to rising inflation pressures across the world (OECD, 2022[3]) (Figure 1).

Energy users have few options to cut demand drastically in the very short run, meaning that concerns over energy affordability and the cost of living loom large.2 Price shocks have had significant adverse effects on households and businesses, which has prompted governments to respond (Boone and Elgouacem, 2021[4]). This policy brief takes stock of the responses and considers their respective merits and drawbacks. It also highlights the challenges of providing well-designed income support, including for the transition to carbon neutrality.

Support measures can be classified in several ways but a key distinction is between income support – i.e. transfers to households and businesses – and price support measures, which seek to reduce energy prices paid by consumers. Income support can be delivered through transfers or vouchers to households and firms. In times of crisis, income support measures already in place can be extended to a wider population or the amount of existing transfers can be increased.

Price support measures can take the form of, for instance, price controls, reduced electricity excise taxes and network fees, value added tax (VAT) and fuel excise tax reductions or exemptions, and rebates at the pump. Both income support and price control measures can be targeted, either through means-testing or by restricting the benefit of the measures to certain specific categories of energy consumers based on some criteria, such as energy consumption, income or residence.

Source: Eurostat and OECD Statistics.

The key message emerging from this policy brief is that governments will need to shift from policies that directly seek to limit price increases to those that cushion their impact through targeted income support. This approach will ensure that the support provided is fair and effective, while limiting its effects on government budgets and maintaining price signals to encourage the transition to carbon neutrality. However, even the most sophisticated fiscal systems may not be fully geared to the task, calling for action to improve their capacity to target specific groups. In addition, broad access to alternative energy sources is a prerequisite for an effective and publicly acceptable longer-term strategy for the transition to carbon neutrality.

2. Support is significant

This note draws on data collected by the OECD on government support measures implemented in 42 OECD and key partner economies since the onset of the energy crisis in the third quarter of 2021. As of 30 May 2022, the information collected covers 284 measures designed to cushion the impact of rising energy prices in the short run. Governments have also estimated the fiscal costs of the key measures, in terms of either resources spent or revenue foregone.3

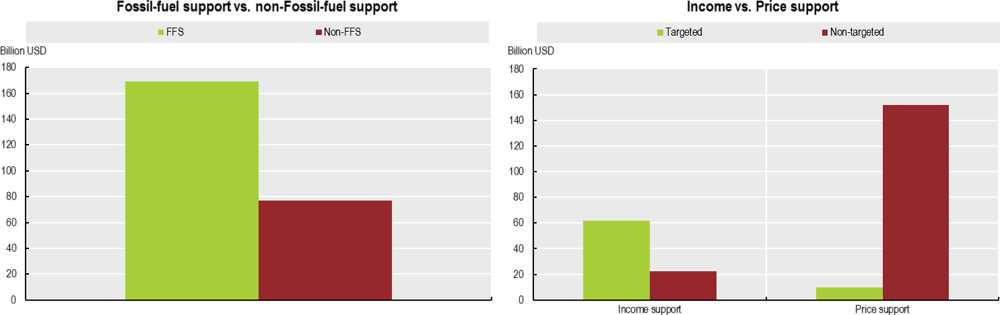

Data show that the cost of support delivered so far is significant. The aggregate fiscal cost of measures provided since October 2021 and ending by December 20224 – i.e. summing the fiscal cost of measures for which an estimate is available – amounts to a total of USD 246 billion of which USD 169 billion comes in the form of support for fossil fuels (left-hand side of Figure 2).5 This means that in a period of over 15 months, governments will have rolled out additional support in the order of magnitude of the regular annual support measures for fossil fuels being provided prior to the energy price hikes (USD 201 billion in 2019 and USD 182 billion in 2020).6

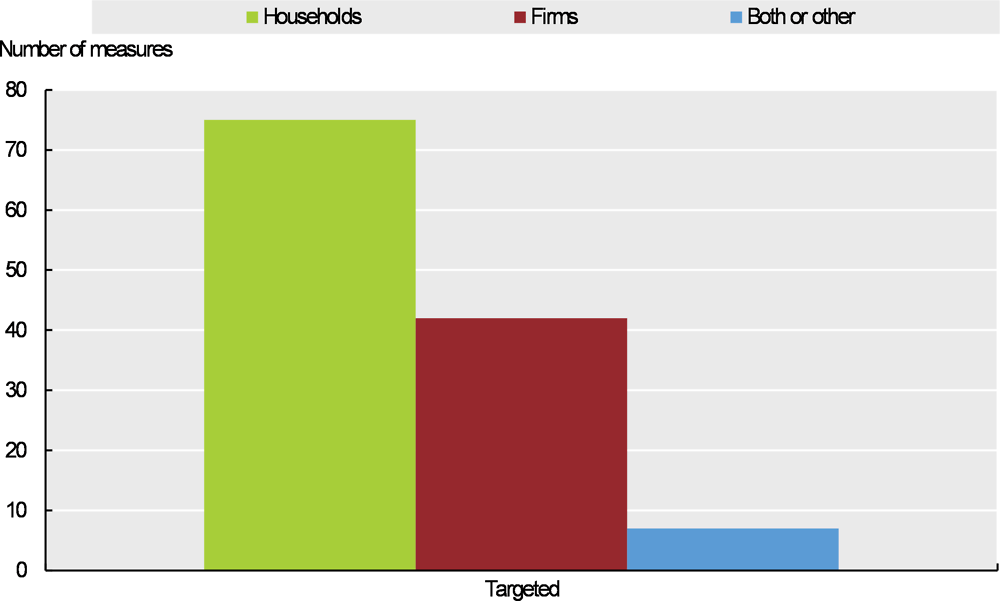

Governments’ responses have focused largely on price control – which tends to support rather than curb demand. Income support measures account for 34% of the total value of support provided through policies covered by the database (right-hand side of Figure 2). Most of these, 73%, have been targeted. By contrast, price support – 66% of the amount of total support provided – is in large part non-targeted (94%).7 In terms of counts of individual measures, most support has been directed towards households and to a lesser extent firms (Figure 3).

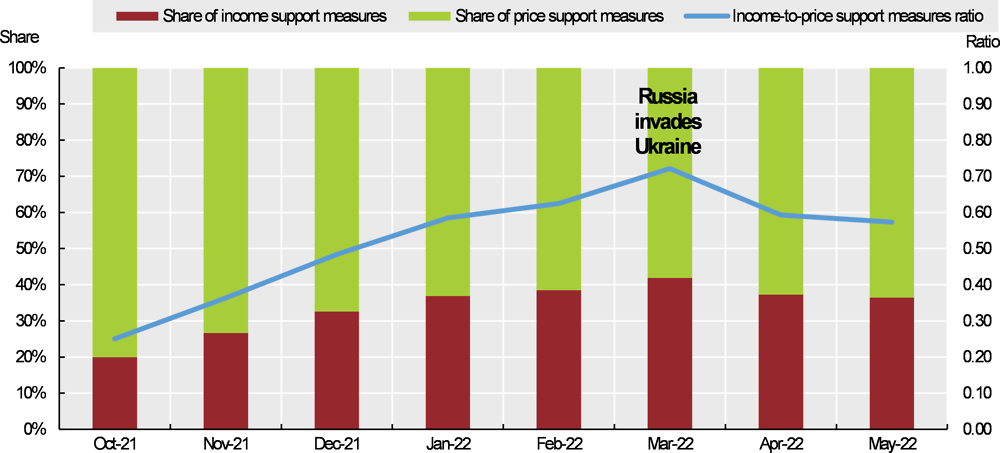

Initially, governments rolled out mainly price support measures, then gradually shifting to income support measures. The war in Ukraine provoked further increases in energy prices, which caused governments to again turn to price-based polices, reversing the trend of a rising share of income-based policies (Figure 4). Such a pattern might reflect the relative ease with which price support measures can be administered when urgent action is needed – e.g. tax cuts can be implemented rapidly.

More than two-thirds of countries have combined price and income support policies. These patterns generally hold in both OECD and non-OECD countries covered by the database, although non-OECD countries tend to rely more on price support measures. This may reflect a lack of capacity to administer sophisticated targeted income support programmes, particularly in emerging economies where informality is high and alternative energy sources are less developed (Section 3).8

Note: 1) Measures classified as income support are those that provide lump-sum transfers to households or businesses to help alleviate energy cost increases. Price support includes all measures that reduce the post-tax energy price for all energy sources. These include price controls, reduced electricity charges and network fees, VAT and excise tax reductions, and compensation to distributors for selling energy products at reduced prices. Targeted measures are ones provided to specific groups, such as vulnerable households or businesses. Non-targeted measures apply to all consumers with no eligibility conditions.

2) Information on 284 measures was collected for 42 OECD and key partner economies, with 137 measures providing an estimated fiscal cost for a total of USD 246 billion between October 2021 and December 2022.

3) Fossil-fuel support measures imply a change in relative prices of energy sources that encourage the use of fossil fuels.

Source: Authors’ elaboration based on OECD research

Source: Authors’ elaboration based on OECD research.

Note: Share of the cumulative number of measures introduced until the date provided on the x-axis.

Source: Authors’ elaboration based on OECD research.

3. Target more to contain fiscal costs

Approaches to delivering support differ in their administrative ease, effectiveness and alignment with other policy objectives. To the extent that energy prices continue to remain high, support should strike a balance between effectiveness, budgetary and implementation costs, focusing on the strongest needs, and ensuring synergies with longer-term climate change and energy security objectives.

To this end, there are several reasons why countries should move away from price support measures, which for the most part contribute to raising fossil fuel subsidies:

Price controls fix or cap the price of energy below market prices. While they are relatively simple to implement, they tend to be untargeted and benefits can accrue disproportionately to large energy consumers, who often have higher incomes.

Price controls may also dampen price signals, limiting the incentive for energy savings or switching away from fossil fuels.

When end-user energy (e.g. electricity, natural gas, and gasoline) prices are capped at below cost recovery, they can cause large losses further upstream in the energy supply chain thereby discouraging new infrastructure investments and ultimately exacerbating supply shortages (Guenette, 2020[5]). Even if governments compensate energy suppliers for their losses to ensure the continuation of their operations, implicit government guarantees typically weaken incentives for operational improvements. They can hence jeopardise the medium-term goals of ensuring energy security and the transition to carbon neutrality. In spite of their limitations, one advantage of price controls is that they also benefit individuals that fall outside of formal government welfare systems.

Price support measures can temporarily relieve inflationary pressures as they help lower inflationary expectations (Agénor and Knight, 1992[8]; Aparicio and Cavallo, 2021[9]). However, they do not allow for demand to adjust to supply constraints, which could exacerbate commodity shortages and sustain future inflation (Vaitilingam, 2022[10]; Neely, 2022[11]).

Energy tax reductions, whether targeted at excise duties or value-added taxes, also seek to reduce the effective price that consumers pay. Like price controls, these policies are relatively quick and simple to implement and communicate, and reach individuals in the informal sector. But they also weaken price signals and hence the incentives to reduce consumption levels. Unlike price controls, energy tax cuts do not affect energy suppliers who still sell their products at market prices and avoid revenue losses. However, fiscal revenues immediately decrease, and the budgetary cost can be high over time.

In addition, caution is warranted regarding the extent to which energy tax reductions translate into lower consumer prices. For instance, a VAT rate cut does not guarantee a consumer price cut of the same extent (Benzarti, Carlonie and Kosonen, 2020[6]). In addition, the pass-through of tax cuts into consumer prices may be lower in times of constrained supply, as is the case today (Marion and Muehlegger, 2011[7]). Apart from reducing the effectiveness of government support, there may also be fairness concerns when tax cuts directly translate into larger profits for fossil fuels producers.

Countries should therefore aim to support vulnerable populations through targeted income support, while developing alternative energy sources and transportation modes. In contrast to price support, income support measures bt– e.g. temporary means-tested transfers – do not mute price signals, thereby encouraging energy savings and fuel switching, resulting in less GHG emissions while providing a financial lifeline to consumers (Pototschnig et al., 2022[12]; Bethuyne et al., 2022[13]).

While income support still has a fiscal cost, better targeting of support measures can allow for a more sustainable policy response if high prices persist. However, given that targeted interventions rely on government social databases to identify beneficiaries, some countries may face challenges in administering or implementing them in practice. First, in countries where social benefit systems are not very well developed or have a hard time reaching many of those potentially in need, e.g. due to high informality or lack of institutional capacity, targeting may be challenging. But even in countries where social benefits systems are more sophisticated, effective targeting would still require more than simply increasing existing transfers. Innovations in transfer mechanisms may be needed to ensure that groups that are most vulnerable to the energy price shock are reached.

Evidence for Germany shows that existing social and fiscal systems are not entirely capable of addressing the additional burden of higher energy prices in a finely targeted way, and additional fine-tuned measures may be needed to avoid social hardship while limiting budgetary costs (Kalkuhl et al., 2022[14]). The reason for such limited effectiveness is that existing systems do not account for the highly heterogeneous impact of price increases across households, which is driven by many factors. Income is one factor among others: the additional cost of higher energy prices is estimated to reach 6% of the overall consumption expenditure for the poorest decile compared with 2.8% for the richest groups (Kalkuhl et al., 2022[14]). Other factors, however, including housing location and quality, and household composition and access to energy and public transport all determine the degree of a household’s financial vulnerability to energy price shocks (Flues and Thomas, 2015[15]; Blake and Bulman, 2022[16]). Therefore, as the case of Germany shows, support based on income alone may not be adequate.

Targeting is also important when providing support to firms. Governments should focus on companies that were previously solvent but are suffering from liquidity and solvency problems deriving directly from the crisis (OECD, 2021[17]). Such approach will mitigate the risk of keeping inefficient firms alive, which could restrict competition, dampen domestic productivity growth, and even distort international markets (OECD, 2020[18]). However, support should be time-limited even as energy costs remain high, as firms will need to adapt over time. More generally, government support to firms should also be transparent, proportionate, and non-discriminatory (i.e applying objective and transparent criteria for determining firms’ eligibility) (OECD, 2020[18]).

The unfolding energy crisis highlights social and political challenges of coping with energy price increases, similar to those anticipated as part of the transition to carbon neutrality (ECB, 2022[19]; IEA, 2021[20]). In addition, persistently high energy prices resulting from the consequences of the war in Ukraine highlight that fossil fuels have become a less reliable source of energy, prompting concerns over energy security, particularly in Europe. In this new geopolitical context, synergies between climate policy and energy security policy should be exploited over the medium term, as pursuing the transition to carbon neutrality can help reduce dependence on fossil fuels. For this reason, interventions that blunt price signals and dampen incentives to reduce fossil-based energy use should be phased out while building capacity to better address household vulnerabilities to price shocks and accelerating the development of alternative sources of energy. This can be done, for instance, by supporting energy efficiency improvements and ensuring that networks and infrastructures are adapted to zero carbon technologies. Over time, investing in capacities for energy users to adapt their energy consumption and shift to alternative fuels should be a common priority for climate, energy, and social policies.

References

[8] Agénor, P. and M. Knight (1992), “Credibility Effects of Price Controls in Disinflation Programs”, IMF Working Papers, 1992(083), A001, https://www.elibrary.imf.org/view/journals/001/1992/083/article-A001-en.xml.

[9] Aparicio, D. and A. Cavallo (2021), “Targeted Price Controls on Supermarket Products”, The Review of Economics and Statistics 103(1), pp. 60-71, https://doi.org/10.1162/rest_a_00880.

[6] Benzarti, Y., J. Carlonie and T. Kosonen (2020), “What goes up may not come down”, Journal of Political Economy 128, pp. 4438-4474.

[13] Bethuyne, G. et al. (2022), Targeted income support is the most social and climate-friendly measure for mitigating the impact of high energy prices, https://voxeu.org/article/targeted-income-support-mitigate-impact-high-energy-prices.

[16] Blake, H. and T. Bulman (2022), “Surging energy prices are hitting everyone but which households are-more-exposed?”, Ecoscope, https://oecdecoscope.blog/2022/05/10/surging-energy-prices-are-hitting-everyone-but-which-households-are-more-exposed/.

[4] Boone, L. and A. Elgouacem (2021), At the cross-roads of a low-carbon transition: what can we learn from the current energy crisis?, https://oecdecoscope.blog/2021/10/22/at-the-cross-roads-of-a-low-carbon-transition-what-can-we-learn-from-the-current-energy-crisis/.

[19] ECB (2022), Looking through higher energy prices? Monetary policy and the green transition, https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220108~0425a24eb7.en.html.

[2] European Commission (2021), Tackling rising energy prices: a toolbox for action and support, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2021%3A660%3AFIN&qid=1634215984101.

[15] Flues, F. and A. Thomas (2015), The distributional effects of energy taxes, OECD Publishing, https://doi.org/10.1787/5js1qwkqqrbv-en.

[5] Guenette, J. (2020), Price Controls: Good Intensions, Bad Outcomes, World Bank, https://openknowledge.worldbank.org/handle/10986/33606.

[20] IEA (2021), Net Zero by 2050, https://www.iea.org/reports/net-zero-by-2050.

[1] IEA (2021), What is behind soaring energy prices and what happens next?, https://www.iea.org/commentaries/what-is-behind-soaring-energy-prices-and-what-happens-next.

[14] Kalkuhl, M. et al. (2022), Effects of the energy price crisis on households in Germany - Socio-political challenges and policy options, Mercator Research Institute on Global Commons and Climate Change.

[7] Marion, J. and E. Muehlegger (2011), “Fuel tax incidence and supply conditions”, Journal of Public Economics 95, pp. 1202-1212.

[11] Neely, C. (2022), Why Price Controls Should Stay in the History Books, https://www.stlouisfed.org/publications/regional-economist/2022/mar/why-price-controls-should-stay-history-books.

[3] OECD (2022), OECD Economic Outlook, Interim Report March 2022: Economic and Social Impacts and Policy Implications of the War in Ukraine, OECD Publishing, https://doi.org/10.1787/4181d61b-en.

[17] OECD (2021), COVID-19 emergency government support and ensuring a level playing field on the road to recovery, https://www.oecd.org/coronavirus/policy-responses/covid-19-emergency-government-support-and-ensuring-a-level-playing-field-on-the-road-to-recovery-1e5a04de/.

[18] OECD (2020), Government support and the COVID-19 pandemic, https://www.oecd.org/coronavirus/policy-responses/government-support-and-the-covid-19-pandemic-cb8ca170/.

[12] Pototschnig, A. et al. (2022), Consumer protection mechanism during the current and future periods of high and volatile energy price, https://fsr.eui.eu/publications/?handle=1814/74376.

[10] Vaitilingam, R. (2022), “Inflation, market power, and price controls: Views of leading economists”, VoxEu, https://voxeu.org/article/inflation-market-power-and-price-controls-igm-forum-survey.

Authors

Kurt Van Dender (✉ kurt.vandender@oecd.org)

Assia Elgouacem (✉ assia.elgouacem@oecd.org)

Grégoire Garsous (✉ gregoire.garsous@oecd.org)

Hamza Belgroun (✉ hamza.belgroun@oecd.org)

Mark Mateo (✉ mark.mateo@oecd.org)

Amy Cano Prentice (✉ amy.canoprentice@oecd.org)

Notes

The reason is that global refinery maintenance and capacity constraints are exacerbating dislocations caused by the war in Ukraine, thereby leading to tightened markets of petroleum products. See https://www.iea.org/reports/oil-market-report-may-2022 for further discussion.

This is not to say that nothing can be done. For instance, the IEA has designed a 10-point plan to decrease oil use by 6.2% within a four-month time window. See https://www.iea.org/reports/a-10-point-plan-to-cut-oil-use.

As of today, estimates provided by governments are available for only a subset of 137 measures included in the database.

The fiscal cost of measures covering several years has been annualized.

The total cost estimate is the aggregate of country-level estimations that can employ different methodological approaches, i.e. accrual vs. cash accounting. Additionally price-based measures can have off-budget and below-the-line implications that are difficult to assess in the short run.

This amount is extracted from the OECD Inventory of Support Measure for Fossil Fuels, which is a database that identifies, documents, and estimates more than 1 300 individual policy measures supporting the production or consumption of fossil fuels. It covers approximately the same countries as the database discussed in this policy brief. See https://www.oecd.org/fossil-fuels/ for more information.

Patterns are the same when considering the number of measures included in the database instead of their fiscal cost. Income support measures account for 38% of all policies covered by the database, with 78% being targeted. Price support measures account for 62% of all measures and are largely non-targeted (77%).

The amount provided through price support measures in OECD countries accounts for 65% of the total against 100% in non-OECD countries. Non-OECD countries covered by the database include Argentina, Bulgaria, Brazil, China, Indonesia, India, Romania, and South Africa.