OECD Economic Surveys: Chile 2018

Executive summary

Abstract

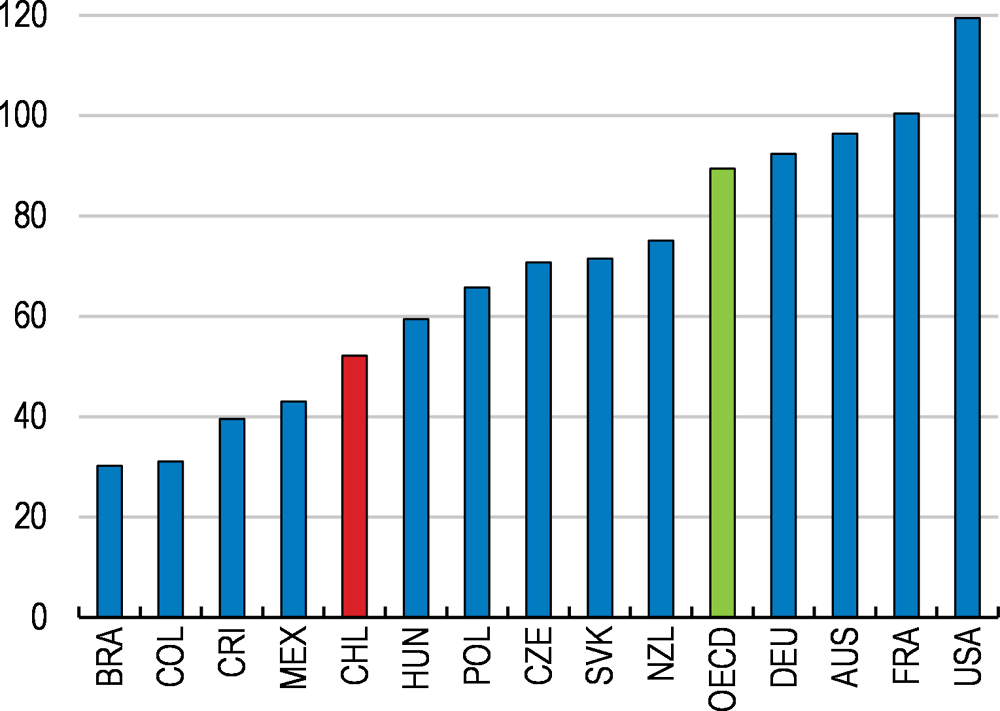

Growth is bottoming out after a long adjustment to lower copper prices

Growth is bottoming out

Y-o-y, % changes

Note: LAC is the unweighted average of Argentina, Brazil, Colombia, Costa Rica and Mexico.

Source: OECD, Economic Outlook 102 Database.

Over the past decades Chile has substantially improved the quality of life of its citizens. However, growth stalled at the end of the commodity boom. In the short term, solid fundamentals, a better global outlook for commodity exports and trade, monetary policy easing and a supportive fiscal stance are helping a gradual recovery. Additional social and education expenditure, notably through the ongoing education reform, will support inclusive growth overtime. However, boosting productivity would raise incomes for all Chileans and help financing high-quality public services, education and health. Too many adults have weak basic skills, while the excessive reliance on self-employment and short-term contracts and an inefficient training system hinder productivity growth and well-being.

Reinvigorating productivity and exports to support inclusive growth

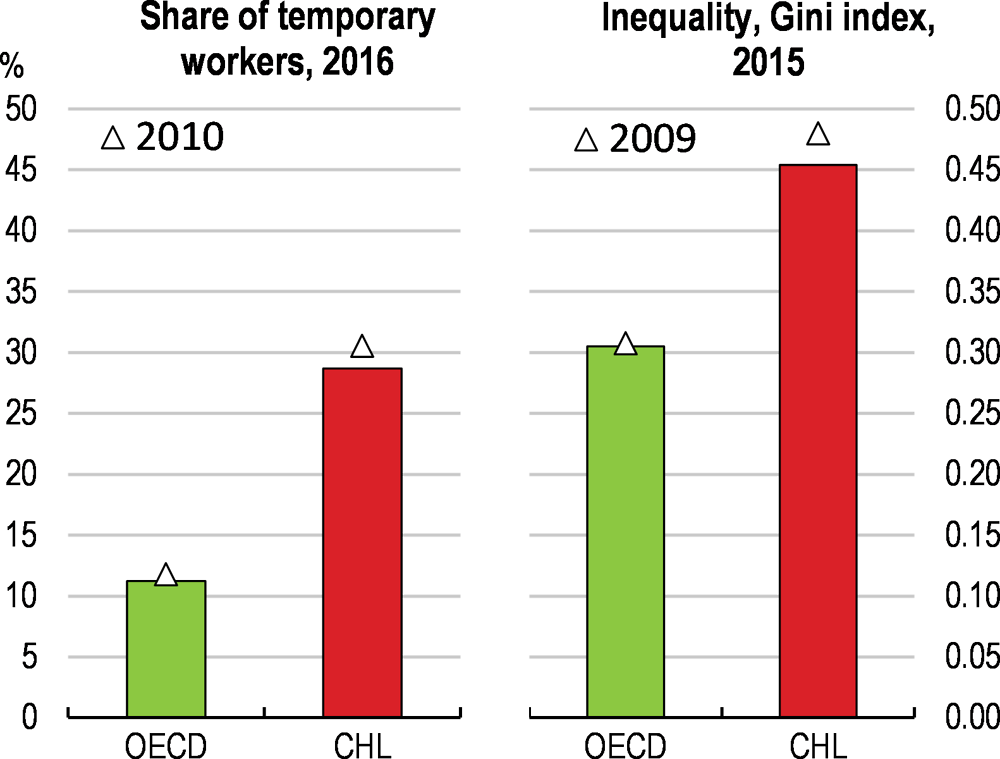

The productivity gap remains significant

Productivity level, 1,000 USD PPP per employee

The commodity boom hid weak non-commodity exports and low productivity. The reliance on natural resource intensive sectors limited diversification of exports in terms of goods, firms and destinations. This implies a high vulnerability to external shocks notably to copper developments, and environmental costs. Recent reforms eased firm registration, launched an integrated digital portal for business procedures, improved electricity supply and raised investment in renewables. However, productivity and export performance would be aided by lowering high entry barriers and regulatory complexity in some sectors. Addressing skill shortages, improving international connections and domestic infrastructure would also help create better-quality employment.

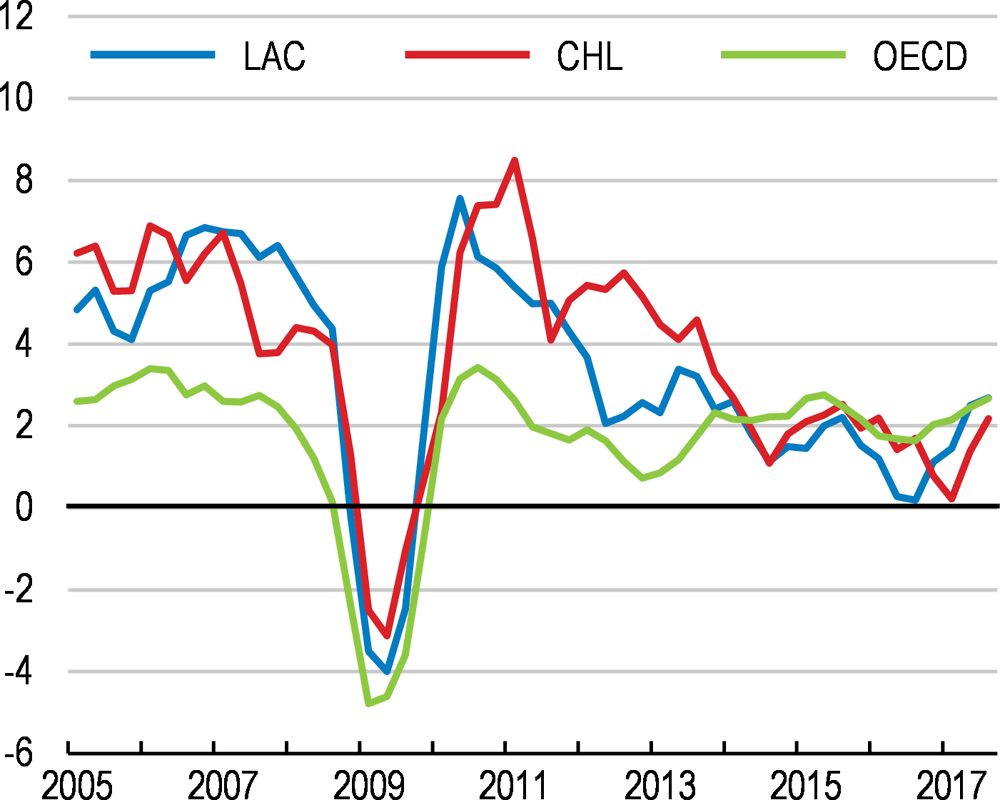

Making growth more inclusive with labour market and social measures

Inequality is still high

Labour market and social reforms, focusing especially on women and the low-skilled, are win-win for inclusive growth. Relative poverty, the share of low-skilled workers, gender participation and wage gaps and youth unemployment remain high by OECD standards. Wide-ranging efforts are under way to raise equity and quality of education. Broader access to childcare and healthcare, higher effectiveness of training policies, additional reforms to the tax system and an expansion of transfers would share prosperity more widely. Reducing severance payments of permanent contracts while increasing the coverage of unemployment benefits would curb the large share of short-term and informal contracts, and improve productivity and well-being for all Chileans.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

||

|---|---|---|---|

|

Making growth more sustainable |

|||

|

The macroeconomic policy framework is sound, but financial supervision remains perfectible. |

Implement the banking law which incorporates Basel III capital adequacy requirements and strengthens supervision. |

||

|

The fiscal stance is broadly appropriate. However, public debt has increased from a low level and fiscal revenues are dependent on copper prices. |

Increase further public revenues from environmental, property and personal income taxes to increase equity and stimulate growth over time. Secure the mandate, resources and independence of the Fiscal Advisory Council in Law and strengthen its role in medium-term budgetary planning. |

||

|

Weak and slowing trend productivity growth. |

Strengthen existing national e-procedures for firm registration and authorisation, and focus on ex-post controls for businesses that have low associated sanitary and environmental risks. Involve stakeholders further in the design of regulations through early consultation procedures. Conduct systematic ex-ante and ex-post evaluations of regulations, notably through the existing productivity assessments. Improve further technical assistance and mentoring to small firms, building on the new local business centres. |

||

|

Social and education spending have increased but inequality remains high. |

Further increase social spending to reduce inequalities. |

||

|

The private pension system does not do enough to reduce inequalities, while population aging will put pressure on public spending. |

Raise contributions to increase savings for retirement. Continue to increase the solidarity pillar funded with general taxation. Progressively increase and align the retirement age of women and men. |

||

|

Improving productivity and export performance |

|||

|

The competition framework has significantly improved. However, the survival of less productive firms points to weak competition. |

Systematically review competitive pressures in key sectors, such as telecommunications and maritime services, by conducting market studies and applying the guidelines of the OECD’s Competition Assessment Toolkit. Ensure that public entities have to comply with the Competition Agency recommendations or to publicly explain their decisions. Streamline permits and their process to encourage investment and simplify regulations that depend on firm size, such as childcare provision, to limit their impact on firm growth. |

||

|

Expenditure on R&D is low as a share of GDP, especially in the business sector. |

Strengthen policy evaluation by beefing-up data collection, systematic reviews and independent studies. Expand R&D support programmes that are proven to work, and close down or adjust inefficient ones. |

||

|

Export performance has weakened. Intra-regional trade is low compared to other regions of the world. Non-tariff barriers are pervasive. |

Continue efforts to fully integrate the single window mechanism with the domestic logistic infrastructure and with regional partners. Reduce further non-tariff barriers on intra-regional trade by simplifying regulations of preferential trade agreements. |

||

|

Port connections to railways are weak. Lagging intermodal transport infrastructure and metropolitan coordination increase congestion and environmental damages. |

Develop national, regional and metropolitan long-term infrastructure strategies. Integrate the regulation of public and private ports. Fully integrate the environmental and health damages of transport modes in taxes and road pricing to ensure fair competition. Reduce barriers to entry in maritime services and railways. |

||

|

Enhancing inclusiveness and job quality |

|||

|

Cash transfers are small. |

Strengthen cash benefits, notably employment subsidies and unemployment- and health-insurance support. |

||

|

Women and youth employment rates are low relative to the OECD. Ongoing efforts will increase equity in access and quality at all levels of education. A high share of adults lacks basic skills. Higher education does not adequately prepare students for the labour market. |

Further increase affordable, good-quality child care for the poorest children and in rural areas, and expand opening hours for childcare institutions. Continue ongoing efforts to improve quality at all levels of education. Develop apprenticeships, integrating work and school-based learning, across all levels of education. |

||

|

A high share of the population holds temporary or informal jobs. |

Reduce dismissal costs for permanent contracts and increase coverage of unemployment benefits by reducing the minimum contribution periods. |

||

|

The share of low-skilled workers is high and they have restricted access to training programmes. |

Better target firm-provided training programmes to the most vulnerable workers. Continuously evaluate active labour market policies, public and firm-provided training, to focus funding on those that are performing well. |

||