Understanding the context in which firms operate is essential for collecting and interpreting data on business innovation. The systems view of innovation stresses the importance of external factors that can influence a firm’s incentives to innovate, the types of innovation activities that it undertakes, and its innovation capabilities and outcomes. External factors can also be the object of a business strategy, public policy or concerted social action by public interest groups. This chapter discusses the characteristics of the firm’s external environment that can influence innovation and the associated challenges and opportunities that managers need to consider when making strategic choices, including for innovation. These factors include the activities of customers, competitors and suppliers; labour market, legal, regulatory, competitive and economic conditions; and the supply of technological and other types of knowledge of value to innovation.

Oslo Manual 2018

Chapter 7. Measuring external factors influencing innovation in firms

Abstract

7.1. Introduction

7.1. The systems view of innovation stresses the importance of the external environment by conceptualising the innovation activities of firms as embedded in political, social, organisational and economic systems (Lundvall [ed.], 1992; Nelson [ed.], 1993; Edquist, 2005; Granstrand, Patel and Pavitt, 1997). These external factors can influence a firm’s incentives to innovate and its innovation activities, capabilities and outcomes. External factors can also be the object of a business strategy, public policy or concerted social action by public interest groups.

7.2. Building on the innovation literature and previous measurement experiences, this chapter identifies the main elements of interest in the external environment and priorities for data collection. These include external environmental or contextual factors that are often closely intertwined with the firm’s internal drivers, strategies and behaviours. A firm’s environmental context is partly the outcome of management choices, such as a decision to enter a given market. Consequently, research on outcomes, such as business performance, requires data on a firm’s internal capabilities and strategies (see Chapter 5) as well as on external factors.

7.3. External influences on the innovation activities of firms can be measured directly or indirectly. Indirect measurement obtains information on the influence of external factors on the firm without referring specifically to innovation. In this case, the effects of external factors on innovation are identified after data collection, for example through econometric analysis. The advantage of indirect measurement is that data can be collected for all types of firms, regardless of their innovation status. In contrast, direct measurement methods ask respondents to self-assess the relevance and impact of an external factor on a specific dimension of innovation. These questions require limited additional analysis. However, direct questions can introduce cognitive biases, or insufficient time could have passed to allow the respondent to evaluate the effects of an external factor on the firm’s innovation activities or outcomes.

7.4. As highlighted in Chapter 2, contextual information on the framework conditions for business innovation can be collected from multiple sources. In some instances, reliable quantitative and qualitative information can be obtained from experts or from administrative sources such as budgetary and legislative records. The number of external factors of potential relevance to innovation is large enough to warrant dedicated data collection on the business environment. This chapter contains proposals for obtaining data (either by linking existing information or collecting new information) on the external environment of firms that can help explain the incidence of innovation and its outcomes.

7.2. Main elements of the external environment for business innovation

7.5. A firm’s external environment includes factors that are beyond the immediate control of management. These factors create challenges and opportunities that managers need to consider when making strategic choices. Such factors include the activities of customers, competitors and suppliers; the labour market; legal, regulatory, competitive and economic conditions; and the supply of technological and other types of knowledge of value to innovation. The internal environment of a firm is ostensibly under the control of management and refers to the firm’s business model, production and innovation capabilities, as well as financial and human resources (see Chapter 5).

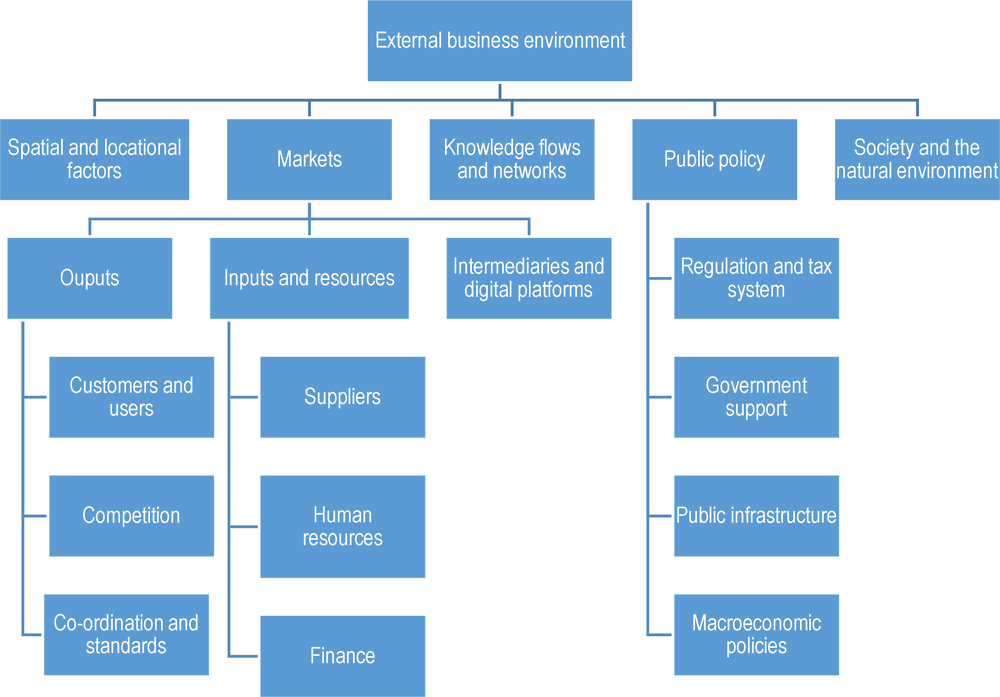

Figure 7.1. Main elements of the external environment for business innovation

7.6. Figure 7.1 provides an overview of the external factors that can influence business innovation. There are five main elements: spatial and locational factors, markets, knowledge flows and networks, public policy, and society and the natural environment. Four of these elements are discussed below, while knowledge flows and networks are covered in Chapter 6.

7.7. Spatial and locational factors define the firm’s jurisdictional location and its proximity to product and labour markets (see section 7.4). These factors can influence costs and awareness of consumer demand (Krugman, 1991). When detailed data on policy, taxation, public infrastructure, society and other factors that vary by location are unavailable, a firm’s location at the regional or national level can act as a proxy for these factors.

7.8. Markets are leading contextual factors (see Chapter 2) that are also shaped by the firm’s own decisions. Relevant information for data collection (see section 7.4) includes the characteristics of suppliers that provide inputs of goods and services to the firm, the structure of demand in the firm’s current and potential markets, the markets for finance and labour, as well as data on the extent of competition in product markets and standards. Information on intermediaries and platforms is of growing importance because of the reorganisation of several markets around online platforms (see subsection 7.4.4).

7.9. Public policy can influence business activities in direct and indirect ways. The regulatory and enforcement framework influences how firms can appropriate the outcomes of their innovation efforts (see Chapter 5) and the multiple relationships and transactions that firms engage in, while the tax system affects the cost of business activities. Governments can also use the tax system and other policies to target support to firms, including support for innovation. Other aspects of the public sector that can influence firms include the delivery of infrastructure services and the management of macroeconomic policy, which can affect the ability of firms to launch and successfully exploit innovations. The collection of data on public policy is examined in section 7.5.

7.10. Society and the natural environment can directly and indirectly affect business activities. Societal aspects can influence the public acceptance of innovations as well as firm policies on corporate social responsibility. Larger societal changes can drive system-wide innovations, such as a move to a low-carbon economy. The impact of business activities and products on the natural environment can also drive business innovation, for instance when firms seek to reduce these impacts through “green” innovations. Firms can also engage in innovation activities in response to predicted changes in the natural environment, as in the case of adaptation to climate change. The collection of data on this dimension is examined in section 7.6.

7.11. These various elements exhibit a great deal of overlap and interaction with each other. For example, public policy can influence the evolution of a firm’s business environment through markets by regulating monopolies or by using market mechanisms to mitigate the negative environmental effects of business activities. Markets, governmental and social institutions and norms can underpin the availability of useful knowledge that firms draw upon for innovation and shape the knowledge flows and networks discussed in Chapter 6.

7.3. Location of business activities

7.12. A firm’s position in the market is also influenced by decisions on where specific business activities are conducted. A firm can conduct an activity itself (within the firm) or a firm can purchase business activities as a service from a supplier (outside the firm). The decision to perform an activity within or outside the firm will influence the types of innovations undertaken by the firm. In addition, data on whether a specific business activity is conducted domestically or in the “Rest of the world” can be used to position the firm within global value chains. This information can be collected by asking respondents to indicate which business activities (aligned to the types of business process innovations in Chapter 3) are conducted within or outside the firm’s enterprise group and the location of activities (domestic or in the rest of the world) (see Table 7.1). Collecting this information is particularly important for documenting the outsourcing and offshoring activities of affiliates of multinational enterprises (MNEs) and the domestic parents of their affiliates abroad (see Chapter 5).

Table 7.1. Business activities by location

|

Within the firm or the firm’s group |

Outside the firm and firm’s group |

||||

|---|---|---|---|---|---|

|

|

Business activities |

Domestic |

Rest of the world |

Domestic |

Rest of the world |

|

a) |

Production of goods and services |

|

|

|

|

|

b) |

Distribution and logistics |

|

|

|

|

|

c) |

Marketing and sales |

|

|

|

|

|

d) |

Information and communication |

|

|

|

|

|

e) |

Administration and management |

||||

|

f) |

Product and business process development |

|

|

|

|

Source: Based on the business process taxonomy used in Chapter 3 and surveys on the location and outsourcing of business functions.

7.13. A firm’s location also affects many other external and internal factors that influence innovation. Where relevant, these locational aspects are discussed below.

7.4. Markets and the environment for business innovation

7.14. Markets provide the medium in which firms exchange goods and services to fulfil their objectives. This section identifies market-mediated influences on innovation and describes options for measurement.

7.4.1. Markets for the firm’s products

Industry and products

7.15. Competition and technological opportunities vary by product market and can directly influence decisions on innovation activities and investments. The firm’s product market can be identified using the United Nations’ Central Product Classification (CPC) system, which is the main global reference for all goods and services and provides a framework for the international comparison of statistics on goods and services. The CPC classifies products by their physical properties, other intrinsic characteristics, and industrial origin into one CPC class. Alternatively, firms can be classified by their main economic activity or industry, based on the types of products produced and the methods of production in use (see Chapter 9).

Main product market

7.16. Data on the classification of a firm’s products or industry are rarely sufficient for identifying the effects of market conditions on the activities of firms, hence the need for supplementary data, for example on a firm’s main market.

7.17. A firm’s main market (by product or industry) can influence its market power, the level of competition that it faces, and potential barriers to entry. Relevant questions on the main market include the amount of sales, the number of competitors, and the presence or absence of MNEs in a firm’s main market. Further discussion of competition is provided below.

Geographical markets

7.18. Data on the geographical coverage of a firm’s markets are useful for interpreting information on whether the firm has “new-to-market” innovations (see Chapter 3) and the location of competitors and the variety of user demand (see Chapter 5). In addition, users of innovation data may be interested in data on firms that were “born global” by serving foreign or digital markets from their inception.

Types of customers

7.19. Firms can sell products to three main types of customers: governments (business-to-government [B2G]), other businesses (business-to-business [B2B]), and individual consumers (business-to-consumer [B2C]). A firm can sell products to more than one type of customer at a given time.

7.20. Identifying B2G-active firms is relevant for research on the role of government in innovation. It is of interest to collect data on whether firms entered into new agreements to sell products to governments and to identify agreements by the level of government (national, regional or local). For B2B-active firms, data collection should differentiate between sales to independent firms and sales to firms that are affiliated through ownership.

Main customer

7.21. Due to survey response burden, it is not possible to collect data on the characteristics of all of a firm’s customers. One option is to focus on the firm’s main customer, which could be a business, a government or private non-profit organisation, or an individual consumer. Data on the identities of main customers that are businesses or government organisations are of value to research on competition and networks. However, respondents might be reluctant to provide this information due to concerns over confidentiality. Some of this information could be available from other sources such as annual reports. Of note, the collection and processing of data on named sources requires careful governance, resources and data handling capabilities on the part of agencies or organisations running innovation surveys. If the name and other details for a firm’s main customer cannot be obtained, an alternative is to ask if a firm has a dominant customer (e.g. accounting for 10% or more of total sales), the sales share of its three largest customers, and the industry of the firm’s dominant or three largest customers.

Influence of customers on innovation

7.22. Customer and user demand for products from businesses, governments and individuals are major drivers of all types of innovation, not only product. Firms can use several methods or channels to identify customer demand for new or improved products (or business processes), including:

Surveys or focus groups of customers, including surveys or discussions with those who attended product demonstrations.

Development or co-creation with customers of concepts and ideas for new or improved products or business processes (see subsection 5.5.2).

User innovation, whereby consumers or end-users modify a firm’s products, with or without the firm’s consent (von Hippel, 2005, 1988), or when users develop entirely new products. These modifications or new products can then be adopted and sold by firms.

Computer or sensor data generated through the use of products.

7.23. Firms can use these channels to collect the following types of information from their customers or users:

detailed specification requirements, for instance when a business customer provides technical and other specifications for new business processes, software, services, etc.

information about the price that customers are willing to pay for new or improved product characteristics

evaluations of the quality or reliability of the firm’s business processes, such as service delivery

other data that may be used to improve the firm’s products or business processes, such as behavioural and performance data on the interaction between users and products.

7.24. These questions are relevant for all firms, regardless of their innovation status (see Chapter 3). Interpretation can be improved by collecting data on the firm’s main type of customer (business/government/consumers), or by collecting data on customer engagement for each of the three main customer types. The methods used to obtain valuable information from customers, and the intensity with which these methods are used, are likely to vary by type of customer.

7.25. An evaluation of the role of customers in innovation can also benefit from information on how (or if) the firm used data from customers in its innovation activities. Data collection can ask respondents about the use of specific actions to meet customer requirements, such as cost reductions, improvements in product quality, reduced lead times, enhanced after-sales functions, greater risk-sharing (i.e. consignment-based payments), extended business hours, etc.

7.26. Evidence on the influence of government demand on innovation activities can be obtained through questions that distinguish between participation in government procurement agreements that:

formally required an innovation to meet the procurement specifications

did not formally require innovation, but where innovation was needed to meet the specifications

neither required nor needed innovation to fulfil the contract specifications.

7.27. Although most research on procurement and innovation focuses on contractual agreements with governments, the same structure can be used to collect data about procurement requirements from businesses or other entities to which the firm provides goods or services (Appelt and Galindo-Rueda, 2016).

7.4.2. Competition and collaboration in markets

Competition

7.28. Competition is a defining characteristic of markets and can have a substantial influence on innovation. Information on market competition can be obtained indirectly from data on the geographical location of the firm’s markets, from the types of customers served by a firm (see above), or directly from questions on the extent or type of competition faced by firms.

7.29. Key indicators of competition in product markets include the number of competitors, the relative size of competitors (larger or smaller than the respondent firm), or qualitative measures of the intensity of competition in the firm’s market. Surveys can include questions on the characteristics or identity of a firm’s main competitor, for example whether it is an MNE.

7.30. Innovation surveys can capture information on the entry of new competitors into the firm’s market and expectations about future sources of competitive pressures, including new entrants with disruptive business models or firms with competing innovations. Competitive pressure from the unregulated or informal sector can be an important driver of innovation activities in some industries, countries and regions. Firms can also be asked to rate the current or expected competitive pressure from different types of firms or organisations.

7.31. Innovation surveys can query whether any of a firm’s products or business processes has been rendered fully or partially obsolete as a result of a competitor’s innovations. Information on obsolescence would provide evidence on the process of creative destruction, a major tenet of the innovation and growth literature.

7.32. The response of firms to competitive pressures and the role of innovation in this response are of interest to innovation research. Possible responses include the innovation objectives discussed in Chapter 8, and other actions such as changes to prices, adjustments to personnel, disinvestment, mergers and acquisitions, etc.

7.33. Situations of monopsony (a market situation in which there is a single buyer) can affect a firm’s operations, profitability and ability to enter new markets or redesign its business processes. From a firm’s perspective, this can apply to both the demand for its products (number of potential buyers) and its suppliers (if the firm is the sole buyer for a certain type of input).

7.34. Data collection can capture features of the market for business inputs by querying the extent of competition in the firm’s main markets for inputs, the existence of alternative sources of essential goods or services, the adoption of strategies to reduce supplier dependence, and the establishment of strategic partnerships or risk-sharing agreements with suppliers.

7.35. Intense competition, along with a high rate of technological change and high demand for innovation in a firm’s market, can result in short product life cycles. Under these conditions, firms must update their products frequently, resulting in a high rate of product innovation and consequently a high share of total sales from product innovations (see subsection 8.3.1).

7.36. Data collection can identify the importance of competition and product market conditions in driving innovation. A list of relevant factors is provided in Table 7.2. Respondents can be asked about the importance of each factor or the respondent’s level of agreement with each item.

Table 7.2. Competition and product market characteristics that can influence innovation

Proposed items for inclusion in questions on competition

|

Basic measures |

|

Number of competitors1 |

|

Characteristics of main competitor – e.g. whether an MNE, a digital platform2 |

|

Qualitative measures of potential competition intensity |

|

Your firm’s goods/services need to be quickly upgraded to remain relevant. |

|

Technological developments in your firm’s main markets are difficult to predict. |

|

Your firm’s goods/services are easily substituted by your competitors’ offerings. |

|

The entry of new competitors is a major threat to your firm’s market position. |

|

The actions of your competitors are difficult to predict. |

|

Your firm faces strong competition in its markets. |

|

Price increases in your markets tend to lead to an immediate loss of clients. |

|

Customers in your markets find it difficult to assess the quality of products before purchasing them. |

1. In the case of firms operating in more than one product market, it may be necessary to focus on the most important market.

2. Competitors with digital business models are also relevant (see subsection 7.4.4).

Source: Based on questions on competition used in various innovation surveys.

Co-ordination and standards in markets

7.37. In market environments, co-ordination through collaboration or standards plays an important role as an enabler and instrument of business strategy and activity.

7.38. Section 6.3 describes how to collect data on collaboration practices for innovation. This information can be complemented by data on collaborative arrangements that do not necessarily involve innovation, such as alliances, joint ventures, public-private partnerships, supplier-customer networks, consortia and other collaborative initiatives with other businesses and trade associations.

7.39. Standards play an important co-ordination role in many markets and can influence the characteristics of product and business process innovations. Standards are often defined by consensus and approved by a recognised body that provides, for common and repeated use, rules or guidelines for the characteristics of products, processes and organisations (Blind, 2004). A firm that has accreditation for specific standards can offer potential customers a guarantee that its products and processes are fully compliant (Frenz and Lambert, 2014).

7.40. Surveys can evaluate the role of standards in a firm’s markets and for its innovation activities through questions on the importance to the firm of the following actions involving:

accreditation for important industry or market standards (a priority list of standards can be provided to firms active in specific industries)

ability to demonstrate that product or business process innovations meet relevant industry or market standards

active engagement in the formulation of relevant industry standards

ownership of – or access to – intellectual property (IP) rights that are essential for the use of industry standards, i.e. when an unlicensed party cannot comply with a standard without infringing IP rights.

7.41. Standards can be important sources of knowledge and therefore can be included in the list of information sources for innovation (see Table 6.6) or innovation objectives. Compliance with standards can also be an innovation objective (see Table 8.1).

7.42. Widespread policy and research interest in the transformation of innovation systems (see subsection 2.2.1) could also warrant the inclusion of questions on the importance of complementary innovations introduced by other actors in the system. For instance, the widespread adoption of an innovation can depend on complementary innovations occurring in other industries or in supporting infrastructure.

7.4.3. The market for inputs

7.43. In addition to customers as a source of ideas for innovation, firms can obtain other inputs for their innovation activities from their suppliers, the labour market, and financial markets.

Suppliers

7.44. Firms can obtain inputs from firms or organisations that supply goods (equipment, materials, software, components etc.), services (consulting, business services, etc.) or IP rights.

7.45. Data collection is unlikely to be able to identify all of a firm’s suppliers of goods, services or IP rights. One option is to collect data for specific types of suppliers, such as suppliers of equipment or business services, or for the most important supplier of goods or services. Relevant information on a firm’s most important supplier includes its main economic activity, location, multinational status, and if it is linked by ownership to the respondent’s firm. The identity of the supplier can also be requested to support data linking and network analysis, but this approach faces the same challenges of confidentiality and response burden as for questions on the firm’s main customer. An alternative is to collect data on the share of materials, equipment, etc. obtained from the firm’s three most important suppliers. Further details can be requested on the nature of supplier-based relationships, for instance if they involve collaboration, co-investment and risk-sharing, or franchising agreements. This may also include a question on criteria used to select suppliers (technical capabilities, prestige, prices, accreditation, geographic proximity, etc.).

7.46. Surveys consistently identify suppliers as important sources of information and collaboration partners for innovation (see Chapter 6). Further insight on the role played by suppliers in innovation can be acquired through questions on the engagement of suppliers in each of the activities listed in Table 7.1, with some adaptation for the context of different supplier relationships. The influence of suppliers on innovation can also be assessed through questions on whether procurement contracts with suppliers required innovation to meet contract specifications.

Human resources and the labour market

7.47. Guidance on the measurement of human resources used by the firm and contributing to its internal capabilities is provided in Chapter 5. Such internal capability is closely related to the labour market in which the firm operates. Firms search for individuals and hire their services on the labour market. Some of these individuals are responsible for building and maintaining the internal competencies of the firm, including the competencies required for innovation. The market for skilled and highly qualified labour warrants attention because of the close links between human capital and innovation capabilities (Cohen and Levinthal, 1990; Jones and Grimshaw, 2012). The efficiency and characteristics of the labour market can have a wide range of implications for the firm’s strategy and performance. Labour market transactions between firms and individuals are also subject to regulatory oversight (see section 7.5 below) and social norms that can be difficult to disentangle from other market characteristics.

7.48. Two labour market characteristics that are relevant to skilled workers, or workers involved in innovation, are the geographical scope of the labour market and the employment history of new hires. The geographical scope concerns where a firm sources its employees from: locally, regionally, nationally, or internationally. Data collection on this topic can identify the need to attract workers from increasingly distant locations and is relevant to research on domestic and international migration. The employment history concerns the primary source of a firm’s new hires, which is relevant to research on knowledge flows. Individuals can be hired directly as they leave the education system, for instance new graduates with a master’s or doctoral degree, from a period of inactivity or unemployment, or from previous employment. The latter can be disaggregated into hiring primarily from competitors, from other firms (such as suppliers), or from government.

7.49. Data on labour market conditions can be collected for the entire workforce and for highly skilled or qualified personnel involved in innovation. It is important to specify if a question refers to all employees, or only to employees involved in innovation activities.

Markets for finance

7.50. Financial markets play a central role in allocating resources to innovation and other activities (Kerr, Nanda and Rhodes-Kropf, 2014). They shape the innovation investment efforts of firms and their actual sources of funds (see Chapter 4).

7.51. A basic distinction when considering markets for finance is between equity (provided in exchange for a share in ownership of the firm) and debt (generating an obligation to repay the amount borrowed). Table 7.3 provides a summary list with different types of internal and external sources of finance. Respondents may find it difficult to map sources of finance to specific activities that may or may not involve innovation, such as business investment, mergers and acquisitions, payment of liabilities, or shareholder buyouts. An alternative is to collect information on the overall financing of the firm. Questions can be framed in terms of past behaviour during the observation period or in terms of future plans. In addition, respondents may be asked about the availability and affordability of different sources of finance. Evidence on the use of intangible assets as collateral can be of high relevance to research on the financing of innovation.

Table 7.3. Types of finance for general and specific innovation activities

|

Source |

Type of finance |

Examples |

|---|---|---|

|

Internal |

|

Through retained profits or asset disposal Transfers and loans from affiliated firms or owners |

|

External |

Equity |

Ordinary/common stock Venture capital or private equity Business angel |

|

|

Debt |

Bonds and obligations, convertible debt Bank loans, overdraft facilities Trade credit, factoring, leasing, advance orders Credit cards Loans from family and friends Loans from government or government-backed credit institutions |

|

Mixed |

Subordinated loans/bonds, mezzanine finance, convertible bonds, preferred stock |

|

|

Financial transfers |

Grants and subsidies Private donations and philanthropy |

7.4.4. Intermediaries and digital platforms

7.52. Markets can include intermediaries that encourage and support transactions between different types of customers, creating supplier-customer relationships. Network effects can create interchangeable roles for suppliers and customers that alter market dynamics and relations. An example is when networks allow media firms, content providers, and advertisers to act as both suppliers and users of content. Intermediaries such as knowledge brokers or knowledge transfer offices at universities and research institutes connect potential users of knowledge with knowledge producers. Data can be collected on the use of knowledge brokers and IP rights to mediate knowledge transfer (see subsection 6.3.5).

7.53. Digitalisation has contributed to the emergence of technology-based virtual market platforms that capture, transmit and monetise data over the Internet through competitive and collaborative transactions between different users, buyers, or suppliers (see subsection 5.5.3). These virtual market platforms provide a space for established and new firms to develop and sell complementary technologies, products or services (Evans and Gawer, 2016). Consequently, these platforms provide fertile ground for the development and diffusion of innovations.

7.54. Data collection on digital platforms is primarily conducted in information and communication technology surveys. However, innovation surveys could include basic questions on whether or not the firm provides, uses or competes on digital platforms, and if goods or services are digitally ordered or delivered. Data collection can ask respondents whether their firm:

provides digital platform services, or has a digital platform business model

uses the services of digital platform providers

competes with (or is exposed to competition from) providers of digital platform services (see Table 7.2)

competes with (or is exposed to competition from) users of digital platform services.

7.5. The public policy environment for business innovation

7.5.1. Regulations

7.55. Regulation refers to the implementation of rules by public authorities and governmental bodies to influence market activity and the behaviour of private actors in the economy (OECD, 1997). A wide variety of regulations can affect the innovation activities of firms, industries and economies (Blind, 2013), including regulations on product markets, trade and tariffs, financial affairs, corporate governance, accounting and bankruptcy, IP rights, health and safety, employment and the labour market, immigration, environment, and energy. In order to be of use for research, data on regulations must be obtained for specific markets or purposes. For example, product market regulations can be disaggregated into regulations to ensure the health or safety of users, energy efficiency, recycling after use, etc. Data collection can determine if each regulatory area acted as a barrier to change, required innovation for compliance, or was not relevant to the firm. If a firm made changes in response to a regulation, the firm can be asked if the changes required investment in innovation to comply with the regulation.

7.56. Alternatively, surveys can collect information on the types of regulations that create the highest compliance costs and which regulations have the largest effect on decisions to develop product or business process innovations or enter new markets. The jurisdiction of regulations (local, regional, national, supranational) is also of research interest.

7.5.2. Government support programmes

7.57. Government support programmes represent direct or indirect transfers of resources to firms. Support can be of a financial nature or may be provided in kind. This support may come directly from government authorities or indirectly, for example when consumers are subsidised to purchase specific products. Firms can benefit from public support that targets business activities (for instance expenditures on research and experimental development [R&D] or the acquisition of new machinery) or the outcomes of business activities (for instance revenue streams arising from past innovation activities or reduced pollutant emission levels). Innovation-related activities and outcomes are common targets of government support. National and international regulations oversee the conditions under which support can be provided to firms, thus generating specific demand for evidence on the extent and impact of different forms and levels of government support for innovation.

7.58. Data collection can obtain information on whether a firm received direct financial support from public authorities and, if possible, the level of government that provided the support. Research into the effect of government financial support for innovation requires data on the nature and amount of government support by innovative, innovation-active and non-innovative firms. This includes identifying the component of government support that is specifically aimed at promoting innovation. Chapter 4 guidance on the sources of finance for innovation is helpful in this respect.

7.59. Both survey and administrative data sources on government support can be usefully combined to analyse the effects of public support policies. Administrative data on participation in government support programmes can be linked to innovation survey respondents, preferably using common business identification numbers if available in both databases. In addition to reducing response burden, this can provide more granular and accurate quantitative information for research on the individual and combined impacts of government programmes to support innovation. However, when administrative data are used, it is important to achieve full coverage for all substantive innovation support programmes. Data requirements for the evaluation of government policy are also discussed in section 11.5.

7.60. Survey respondents can be asked whether they were aware of government support for innovation, whether they considered applying, if they applied, whether they received support and, if so, the amount (value) of support received. Policy research can also benefit from data on the firm’s experience with specific local, regional or national support programmes.

International comparisons

7.61. For international comparisons, data on the experience with or use of government support programmes should be mapped into categories that fit into a common policy instrument taxonomy. Table 7.4 suggests potential approaches for classifying such instruments. Ideally, information should also be collected by type of instrument, since this will affect the interpretation of questions on the amount of support received. For example, the net value to a firm from a secured loan at near commercial rates could be lower than a significantly smaller grant that does not need to be paid back.

Table 7.4. Possible approaches for classifying government policy instruments in innovation surveys

|

Characteristics |

Examples and comments for measurement |

|---|---|

|

By intention to support innovation capability or activity |

Use the list of innovation activities in Chapter 4. plus a list of capabilities that are related to innovation, such as personnel development and network integration Could also include subsidies for the production of goods or services |

|

By policy objective |

Can use the classification of socio-economic objectives, but this has not been comprehensively tested and could be difficult for firms to answer |

|

By type of instrument |

Grants and subsidies, vouchers, tax subsidies, loans, loan guarantees, equity injections; inducement prizes; services and other in kind support |

|

By level of government agency responsible |

Local, regional, national, supranational and international rules |

|

By conditions on the support |

Policies can provide unconditional transfers, or support can be provided on a discretionary (e.g. competitive) or non-discretionary, on-demand basis |

|

Financial value of support |

Different instruments require different valuation methods (OECD, 1995) and consequently respondents may be unable to provide reliable estimates of the financial value of support, other than for basic transfers such as direct grants |

Source: Adapted from OECD (2015), Frascati Manual 2015: Guidelines for Collecting and Reporting Data on Research and Experimental Development, http://oe.cd/frascati and the taxonomy adopted by the OECD’s STIP COMPASS database of innovation policy initiatives and instruments (https://stip.oecd.org/).

7.62. The Frascati Manual 2015 (OECD, 2015: § 12.20-12.38) provides a classification system for different types of instruments to support R&D. This classification can be adapted to cover instruments to support innovation (see Table 7.5).

7.63. In addition to the transfer or subsidy content of these support instruments, firms may also value other elements, such as the experience acquired in the application and granting process, or the signal conveyed to other actors in the innovation system by a successful application.

Table 7.5. Main types of policy instruments to support innovation

|

Grants |

Government grants or other transfers for innovation activities. These are often related to specific innovation projects and help meet part of their related costs. |

|

Equity finance |

Government investment in business equity |

|

Debt finance |

Government loans for innovation |

|

Guarantees for debt financing |

Government guarantees to facilitate third-party financial investment in the firm’s innovation activities |

|

Payment for goods and services |

Buying goods or services from firms, implicitly or explicitly requiring firms to innovate as part of the agreement |

|

Tax incentives |

Tax relief for innovation activities and related outcomes, such as incentives for R&D expenditures or favourable IP regimes |

|

Use of infrastructure and services |

Direct or indirect provision of infrastructure and services for business innovation activities, such as subsidised access to R&D, testing or prototyping facilities, or allowing access to relevant data, networking or advisory resources This may include allocating vouchers to firms to allow them to acquire certain types of specialised services from approved providers, such as universities, research centres or design consultants. |

Source: Adapted from OECD (2015), Frascati Manual 2015: Guidelines for Collecting and Reporting Data on Research and Experimental Development, http://oe.cd/frascati.

7.5.3. Innovation and public infrastructure

7.64. Public infrastructure can be defined by government ownership or by government control through direct regulation. Consequently regulated infrastructure that is partly or fully financed, delivered, and managed by firms can still be considered public. Such infrastructure, including systems and facilities, can serve multiple, interdependent uses. The specific technical and economic characteristics of public infrastructure strongly influence the functional capabilities, development and performance of an economy. This warrants the inclusion of public infrastructure as an external factor that can influence innovation. Table 7.6 provides a general typology of public infrastructure for data collection on the relevance and quality of infrastructure to firms, such as accessibility, affordability for users, resilience and adaptability.

Table 7.6. Types of public infrastructure of potential relevance to innovation in firms

|

General type |

Examples |

Level of assessment of relevance/quality |

|---|---|---|

|

Transport |

Airports, rail, roads, bridges, waterways and marine facilities (e.g. ports) |

|

|

Energy |

Generation, storage, transmission/distribution |

|

|

Information and communication |

Telecommunication networks, postal services, broadcasting, etc. |

|

|

Waste management |

Solid waste management, hazardous waste, wastewater |

|

|

Water supply |

Collection and purification, storage, distribution |

|

|

Knowledge infrastructure |

Educational institutions, libraries, repositories, databases, etc. |

|

|

Health |

Hospitals, clinics, outreach services, etc. |

|

7.65. Public policy for infrastructure can have different incentive effects on innovation for firms that provide or use infrastructure. The types of infrastructure included in Table 7.6 are implicitly defined by specific industry codes (International Standard Industrial Classification of All Economic Activities [ISIC]), which can be used to identify those firms that provide infrastructural services. If ISIC data are insufficiently detailed or unreliable, data collection can ask if a respondent is a provider or user of each type of infrastructure.

7.5.4. Macroeconomic policy environment

7.66. It may be relevant to assess business views on the macroeconomic policies implemented by governments, including monetary, public expenditures and taxation policies. In addition, respondents can be asked which macroeconomic variables have the greatest influence on their firm’s plans for its innovation activities (e.g. inflation, exchange rates, consumer demand).

7.6. The social and natural environment for innovation

7.6.1. The social context for innovation

7.67. Surveys of innovation in the Business sector are unsuitable for the collection of information on the general social environment for innovation, such as citizen attitudes to IP, entrepreneurship or new technologies. This information should be collected through social surveys. However, innovation surveys can obtain data from business managers about the role of social factors on their firms’ decisions, as shown in Table 7.7. The proposed items distil several factors captured in a variety of surveys conducted by national statistical organisations and academic researchers. They mainly focus on the roles of individuals as consumers or as potential employees. The response options can vary from “strongly disagree” to “strongly agree”. The results can be aggregated by firm size or industry and related to actual innovation performance data.

Table 7.7. Collecting information on characteristics of the firm’s social environment

|

Level of agreement/ disagreement |

|

|---|---|

|

Consumers like to receive detailed information about your firm’s goods and services. |

|

|

Consumers are willing to provide personal data to your firm in return for (better) goods and services. |

|

|

Consumer preferences for your firm’s goods and services change very quickly. |

|

|

Consumers are willing to pay more for goods or services that incorporate new technology or design. |

|

|

Intellectual property is respected by consumers and firms in your market. |

|

|

Corrupt behaviours are encountered by your firm on a regular basis. |

|

|

Public interest groups have influenced your firm’s business investment decisions. |

|

|

Environmental organisations have influenced your firm’s business investment decisions. |

|

|

University graduates are prepared to undertake creative and innovative work within your firm. |

|

|

University graduates are attracted to work for your firm. |

|

|

Your firm’s employees are interested in establishing spin-off firms to exploit opportunities. |

7.6.2. The natural environment

7.68. The natural environment can be an important external factor that influences the decisions of firms. In addition to firms whose economic activity partly depends on the natural environment (tourism, agriculture, fishing, mining, etc.), firms in all industries can find it necessary to develop strategies to manage their relationship with the natural environment.

7.69. Possible environmental factors that can affect all businesses include changes in environmental amenities, flooding and other natural disasters, pandemics and epidemics, climate change, and water, soil and air pollution. Relevant information on these conditions can be obtained from other sources, including insurance data and national data on pollutant levels.

7.70. In industries or geographic locations particularly affected by the natural environment, it may be of interest to collect data on whether firms respond to environmental factors through innovation, or if environmental factors create a barrier to innovation.

7.7. External factors as drivers and obstacles to business innovation

7.71. Depending on the context, an external factor can act as a driver of innovation or a barrier to innovation. An example is product quality regulations for pharmaceuticals. These regulations can create barriers to new entrants while motivating specific types of innovation activities for firms active in the market. External factors can also provide opportunities and incentives to develop a competitive advantage and thereby create new value for the firm. External factors and innovation objectives (covered in section 8.1) are therefore closely interrelated.

7.7.1. External factors as drivers of innovation

7.72. The external factors that can drive innovation can be grouped into three main categories: (i) the firm’s market environment; (ii) public policies including regulations; and (iii) the social environment. Table 7.8 provides a list of potential drivers in each category. Depending on policy interests, data on more detailed drivers can be collected. For example, the category covering regulations can be disaggregated into specific types, or the category on the availability/cost of finance can focus on specific sources of finance.

Table 7.8. Proposal for integrated collection of data on external drivers of innovation

|

General area |

Specific area |

Importance as a driver of innovation (low, medium, high, not relevant) |

|---|---|---|

|

Markets |

Domestic customers |

|

|

Access to international markets |

||

|

Suppliers and value chains |

||

|

Availability/cost of skills |

||

|

Availability/cost of finance |

||

|

Competitors |

||

|

Standards |

||

|

Markets for knowledge |

||

|

Digital platforms |

||

|

Public policy |

Regulations |

|

|

Functioning of courts and rules enforcement |

||

|

Taxation |

||

|

Public spending (level and priorities) |

||

|

Government support for innovation |

||

|

Government demand for innovations |

||

|

Public infrastructure |

||

|

General policy stability |

||

|

Society |

Consumer responsiveness to innovation |

|

|

Favourable public opinion towards innovation |

||

|

Level of trust among economic actors |

7.7.2. External factors as barriers or obstacles to innovation

7.73. An innovation barrier prevents a non-innovative firm from engaging in innovation activities or an innovation-active firm from introducing specific types of innovation. Innovation obstacles increase costs or create technical problems, but are often solvable. Data collection on innovation barriers or obstacles should ensure that all questions are applicable to both innovation-active and non-innovative firms and can capture differences in the awareness of barriers between both types of firms (D’Este et al., 2012). Asymmetries in awareness can hamper the analysis of the factors that influence business innovation. Furthermore, responses to questions on barriers can represent ex post “justifications” that fail to capture actual barriers or the role of some barriers as drivers of innovation.

7.74. Data collection on barriers or obstacles can follow the list of factors provided in Table 7.8 above, with some modifications. For example, the “availability/cost of skills” can be changed to a “lack of/high cost of skills”, “public infrastructure” can be changed to “inadequate public infrastructure”, etc.

7.75. Questions on barriers or obstacles can also include internal factors within the firm, such as a lack of internal finance for innovation, a lack of skilled employees within the firm, or a lack of resources to discourage high-skilled employees from leaving the firm to work for competitors.

7.76. An alternative to asking separate questions for drivers and barriers is to use a single list of items, as in Table 7.8, and ask respondents the extent to which each item contributed to or deterred innovation.

7.8. Summary of recommendations

7.77. This chapter identifies a range of external factors in the firm’s environment that can influence innovation activities. For the measurement of these factors, it is recommended to:

Adopt neutral and balanced language for measuring potential external drivers of innovation, taking into account the dual barrier/incentive effect of environmental or contextual factors.

Use, whenever possible, questions that are relevant to all firms, regardless of their innovation status.

Use questions on the behaviour of firms in response to external factors, instead of questions that require respondents to apply heuristics to estimate impacts.

7.78. The generic recommendation in this manual to prioritise items taking into account policy user needs for the study of framework conditions for innovation is most relevant in the context of this chapter, as it is not possible to include all dimensions in one survey.

7.79. Recommendations for general data collection are given below. Other types of data covered in this chapter are suitable for specialised data collection exercises.

7.80. Key questions for data collection should cover:

the firm’s industry and main market (see also Chapter 5)

competition and product market characteristics (Table 7.2)

7.81. government policy and support for innovation (Table 7.4 and the use of different types of instruments in Table 7.5)

drivers or barriers to innovation (Table 7.8).

7.82. Supplementary questions for data collection, depending on national priorities, space or resources include:

additional characteristics of customers, including user requirements, the main customer’s share of sales and the industry of the main customer (subsection 7.4.1)

location of business activities and value chains (Table 7.1)

effect of regulations on innovation (subsection 7.5.1).

7.83. Other topics presented in this chapter are suggested for occasional or experimental use in surveys.

References

Appelt, S. and F. Galindo-Rueda (2016), “Measuring the link between public procurement and innovation”, OECD Science, Technology and Industry Working Papers, No. 2016/03, OECD Publishing, Paris, https://doi.org/10.1787/5jlvc7sl1w7h-en.

Blind, K. (2013), “The impact of standardization and standards on innovation”, Nesta Working Papers, No. 13/15, Nesta, London, www.nesta.org.uk/report/the-impact-of-standardization-and-standards-on-innovation/.

Blind, K. (2004), The Economics of Standards: Theory, Evidence, Policy, Edward Elgar Publishing, Cheltenham.

Cohen, W.M. and D.A. Levinthal, (1990), “Absorptive capacity: A new perspective on learning and innovation”, Administrative Science Quarterly, Vol. 35/1, pp. 128‑152.

D’Este, P. et al. (2012), “What hampers innovation? Revealed barriers versus deterring barriers”, Research Policy, Vol. 41/2, pp. 482-488.

Edquist, C. (2005), “Systems of innovation: Perspectives and challenges”, in The Oxford Handbook of Innovation, Oxford University Press, Oxford, pp. 181-208.

Evans, P.C. and A. Gawer (2016), “The rise of the platform enterprise: A global survey”, The Emerging Platform Economy Series, No. 1, The Center of Global Enterprise.

Frenz, M. and R. Lambert (2014), “The economics of accreditation”, NCSLI Measure, Vol. 9/2, pp. 42-50, https://doi.org/10.1080/19315775.2014.11721682.

Granstrand, O., P. Patel and K. Pavitt (1997), “Multi-technology corporations: why they have ‘distributed’ rather than ‘distinctive core’ competences”, California Management Review, Vol. 39/4, pp. 8-25.

Jones, B. and D. Grimshaw (2012), “The effects of policies for training and skills on improving innovation capabilities in firms”, Nesta Working Papers, No. 12/08, Nesta, London.

Kerr, W.R., R. Nanda and M. Rhodes-Kropf (2014), “Entrepreneurship as experimentation”, Journal of Economic Perspectives, Vol. 28/3, pp. 25-48.

Krugman, P. (1991), Geography and Trade, MIT Press, Cambridge, MA.

Lundvall, B.-Å. (ed.) (1992), National Innovation Systems: Towards a Theory of Innovation and Interactive Learning, Pinter, London.

Nelson, R. (ed.) (1993), National Innovation Systems. A Comparative Analysis, Oxford University Press, New York/Oxford.

OECD (2015), Frascati Manual 2015: Guidelines for Collecting and Reporting Data on Research and Experimental Development, The Measurement of Scientific, Technological and Innovation Activities, OECD Publishing, Paris, http://oe.cd/frascati.

OECD (1997), The OECD Report on Regulatory Reform: Synthesis Report, OECD Publishing, Paris, https://doi.org/10.1787/9789264189751-en.

OECD (1995), Industrial Subsidies: A Reporting Manual, OECD Publishing, Paris.

von Hippel, E. (2005), Democratizing Innovation, MIT Press, Cambridge, MA.

von Hippel, E. (1988), The Sources of Innovation, Oxford University Press, New York.