Colombia needs to speed up digitalisation to transform its firms and industries. The country has advanced in digital connectivity. It has taken steps to update its training in digital skills and has a buoyant start-up scene. Now it needs to complement the current focus on technology adoption by identifying potential areas in which it can be an innovator and creator of knowledge-based solutions. This chapter reviews the progress Colombia has made in its digital transformation. It focuses on start-ups and existing firms, and concludes with a call to integrate the digital dimension in future policies for production development.

Production Transformation Policy Review of Colombia

Chapter 3. Transforming industries: Unleashing the potential of Industry 4.0 in Colombia

Abstract

Introduction

Digital technologies are reshaping business dynamics. All countries, regardless of their level of development, now face the challenge of updating their policies and tools to benefit from new technologies. They are redefining how and where businesses operate and how consumers interact with them. The rapid convergence of multiple digital technologies is not just reshaping production and consumption; it is redefining the competitive landscape.

An understanding of new technologies and how they are transforming economies is paramount. It will help enhance industrial competitiveness and help businesses contribute to more inclusive and sustainable societies. It may also lead to ways to deal with the growing divide between pockets of industrial excellence and the territories and people left behind. The PTPR process of the Production Development Policy 2016-2025, presented in Chapter 2 of this report, highlighted as a major policy weakness the absence of any analysis of how digital technologies could help Colombia transform its economy.

This chapter focuses on digitalisation, Industry 4.0 and its potential transformative impact on Colombia’s production and innovation system (Box 3.1). It reviews the progress Colombia has made in digital connectivity and skills. It discusses the advances in start-up development enabled by the digital economy and by targeted policies, and it analyses how existing firms could benefit more from digital technologies. It concludes by calling for a digitalisation dimension to be included in the future agenda for production development.

Box 3.1. What is Industry 4.0?

The term Industry 4.0 originates from the 2011 German high-tech strategy Industrie 4.0 which promotes the computerisation of manufacturing. It refers to the use of advanced digital technologies in industrial production and service delivery processes to enable new and more efficient processes for the production of goods and services combining traditional and digital technologies. Industry 4.0 encompasses several technologies, including 3D printing, the Internet of Things (IoT) robotics, artificial intelligence and big data.

Source: (BMBF, 2016[1]; Forbes, 2018[2]; OECD, 2017[3]).

Colombia has taken steps to close the digital gap

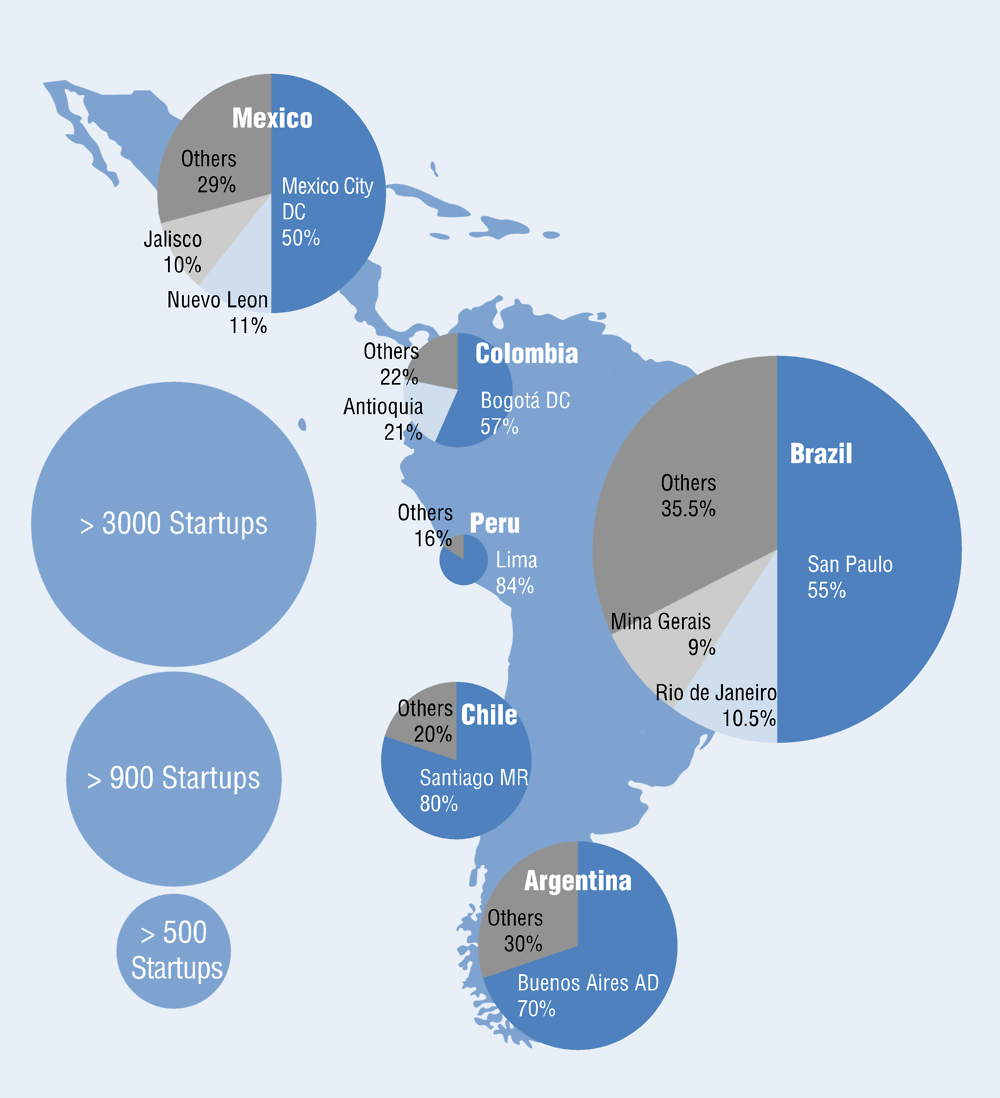

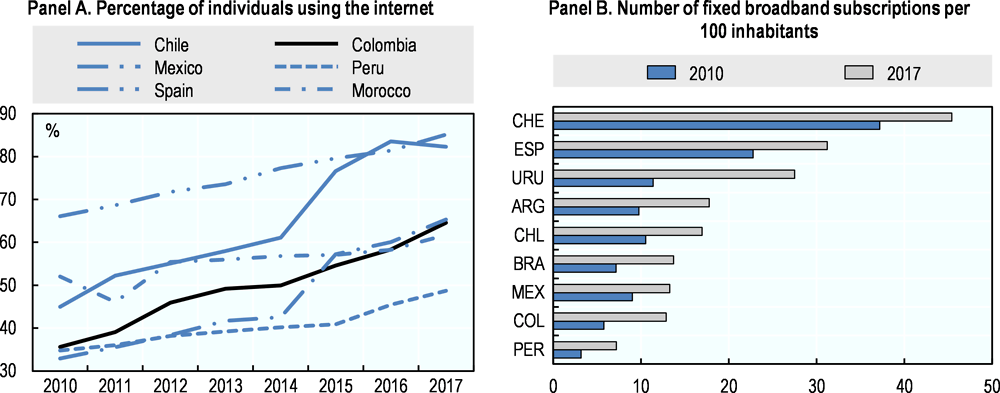

Colombia has improved digital connectivity. The Live Digital Plan (Plan Vive Digital) boosted investments in digital infrastructure. As of 2017, 98% of municipalities were connected to the internet (MINTIC, 2018[4]). However, the gap between urban and rural areas remains large. Only 10% of households in rural areas have an internet connection (OECD, 2019[5]). Estimates from the United Nations suggest that 3G coverage covers 100% of the population, higher than the world average of 85% (ITU, 2017[6]). The share of individuals using the internet nearly doubled from 35.6% in 2010 to 64.6% in 2017, reaching a share similar to that of Mexico (65.3%), but still below Chile’s share of 82.3%. In 2010-17, the number of broadband subscriptions per 100 inhabitants doubled from 6 to 12, bringing Colombia on a par with Mexico. However, this is still among the lowest levels in OECD countries (Figure 3.1).

Figure 3.1. The share of individuals using the internet has doubled since 2010

Source: Authors’ elaboration based on OECD ICT Access and Usage by Households and Individuals database, http://www.oecd.org/sti/broadband/broadband-statistics and ITU (2018) Country ICT data, https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx.

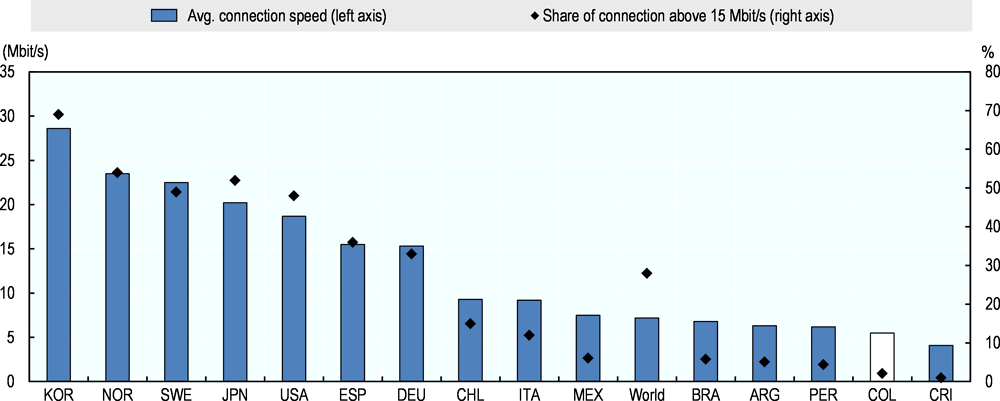

Much progress is still required to address the last-mile connectivity challenge, and to put the country on a par with regional peers and frontier economies. For example, Switzerland, the top OECD country in 2017, had three times the amount of broadband subscriptions per 100 inhabitants compared to Colombia. And while Colombia’s density of fixed broadband subscriptions was similar to that of Mexico and Brazil, it was almost 2.4 times lower than that of Spain (Figure 3.2). The average internet connection speed in Colombia is 5.5 Mbit per second, lower than the world average of 7.2. The share of high-speed connections (connections with a speed higher than 15 Mbit per second) is also extremely low, 2.2% in 2017, compared to 69% in Korea, 36% in Spain and 15% in Chile in the same year (Akamai, 2017[7]). Resolution 5161 (2017) of the Commission for Regulation and Communication (CRC) of the MINCIT, stipulates that, as of January 2019, internet providers will be allowed to commercialise only broadband connections equal to or greater than 25 Mbit per second (MINTIC, 2017[8]). This connection quality gap is a major barrier for businesses, as many of their digital-related functions need a high quality, high-speed connection. This is especially true if firms aspire to operate in globally interconnected digital supply chains (OECD, 2017[9]; OECD, 2017[3]).

Figure 3.2. Average Internet connection speed and share of connections above 15 Mbit/s, 2017

Note: Mbit/s: megabytes per second.

Source: Authors’ elaboration based on Akamai (2017), “State of the Internet report, 2017”, www.akamai.com/us/en/about/our-thinking/state-of-the-internet-report.

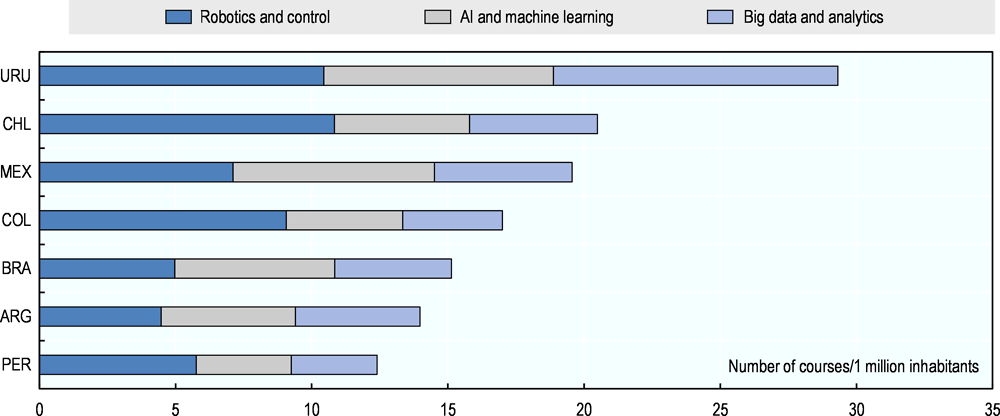

The country is investing in closing the skills gap. While Colombia faces a gap in education coverage and quality (OECD, 2016[10]) it has made progress in offering training in digital skills. In the last decade, Colombia’s universities have updated their curricula to offer training in digital technologies. According to estimates from the Economic Commission for Latin America and the Caribbean (ECLAC) (2018), Colombia has the fourth highest number (among the seven countries for which data is available) of training programmes in digital technologies per million inhabitants in Latin America, after Uruguay, Chile and Mexico (Figure 3.3). The training focuses on robotics and control (53%), artificial intelligence and machine learning (25%), and big data and analytics (22%), a pattern similar to that of Chile. Colombia has also introduced technical diplomas and certificates that offer short-term training more in line with the fast-changing demands of employers. Colombia, with 119 short-term courses, is second among the seven countries analysed, behind Brazil with 711. Once normalised for the entire population, Colombia ranks fourth, behind Uruguay, Chile and Brazil. However, Colombia offers a lower number of postgraduate courses (masters and PhDs) compared to other countries in the region that focus on digital technologies. The country has 1.66 postgraduate courses per million inhabitants; about 2.5 times lower than the top economy, Uruguay. This gap is more pronounced in doctoral programmes; Colombia offered 13 doctoral programmes, or 0.27 per million inhabitants, the lowest in the region.

The availability of human capital ready to work on the digital revolution is increasing. The number of engineering and science graduates grew at an annual rate of 8.25%, increasing from 37 949 in 2004 to 105 506 in 2016. Additionally, with 22% of graduates among enrolled students, Colombia is the second country in the region in graduation rates in engineering and technology courses after Mexico, with 24%. Chile and Argentina have a graduation rate of 16% and 9% respectively. Further development of the digital ecosystem will require a larger number of graduates in digital disciplines. This will mean improving teaching capacities at secondary level to provide an adequate base for more advanced digital courses. Computer science needs to be embedded in educational systems for organisational, pedagogical and innovation reasons (ECLAC, 2018[11]).

Figure 3.3. Number of training courses in digital technologies per millions of people, Colombia, 2017

Source: ECLAC (2018), Data, algorithms and policies: redefining the digital world, https://repositorio.cepal.org/bitstream/handle/11362/43515/7/S1800052_en.pdf.

Digital technologies are contributing to start-up development in Colombia

Start-ups are flourishing in the country

Only a decade ago start-ups were far from being a reality in Latin America. Since then the countries of the region have increased opportunities for new businesses to flourish (OECD, 2016[12]; OECD, 2013[13]). Since 2010, with the introduction of the programme Start-Up Chile, the region has witnessed fast progress in the creation and expansion of start-ups (OECD, 2016[12]; OECD, 2013[13]). Even though, the start-up reality in Latin America is still far from what happens in main global start-up hubs, the advancements on the digital agendas in the region coupled with targeted programmes for start-up development and legal reforms made it easier to expand and wind up businesses (ECLAC, 2018[11]; ECLAC, 2018[14]).

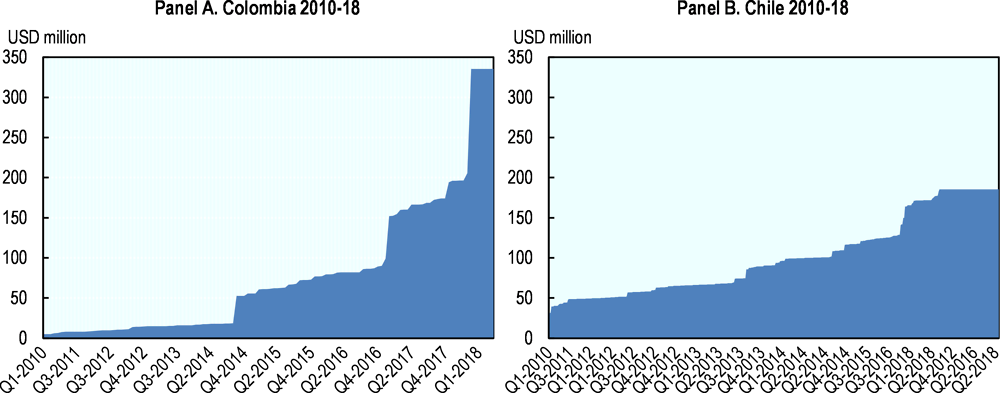

The progress on broadband infrastructure, coupled with growing middle classes, has allowed Colombia to reap the benefit of the rising start-up scene in Latin America (OECD, 2016[12]). Colombia is now the fifth largest hub by number of start-ups in Latin America after Brazil, Mexico, Argentina and Chile, and the fourth largest by venture capital (VC) (LAVCA, 2017[15]). Start-ups in Colombia cluster in the traditional industrial hubs of Bogota and Antioquia, making Colombia’s start-up ecosystem one of the most territorially diversified in the region, along with Mexico and Brazil. While Bogota accounts for 57% of all start-ups in the country, other countries in the region show higher concentration rates. For example in Chile, the metropolitan region of Santiago concentrates 80% of all start-ups (Figure 3.4). Start-up development in recent years has also contributed to improve the image of Colombia and of certain cities in particular. After decades of conflict, they are now known for their vibrant innovative ecosystem. Medellín is a case in point. The city has developed an effective public-private partnership through Ruta N that fosters start-up development in the city. After years of headlines as a city of crime, Medellin was named “Innovative City of the Year” by the Wall Street Journal and the Citi Group in 2016. These changes would have not been possible without the advancements on digital infrastructure (ECLAC, 2018[11]; ECLAC, 2018[14]).

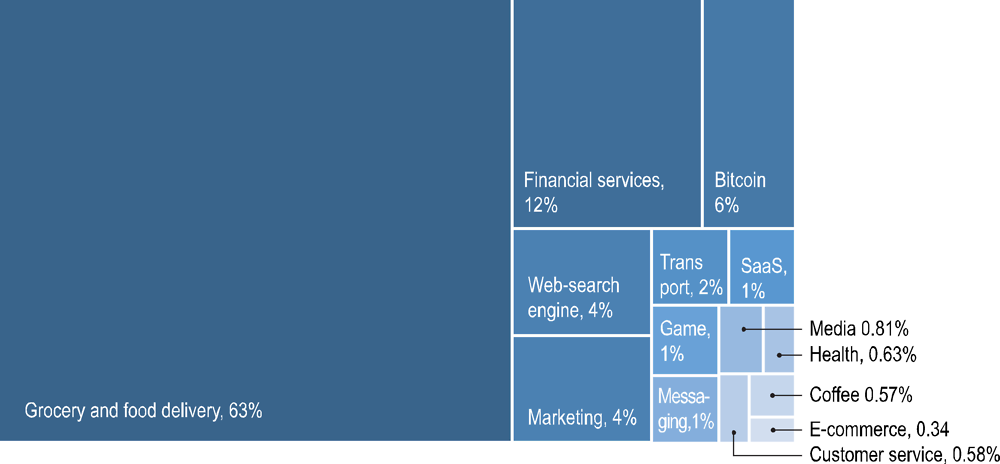

Figure 3.4. Start-ups in Latin America and their distribution by region and departments, 2006-18

Venture Capital (VC) has increased in Colombia. In 2010-18, VC investment reached approximately USD 340 million, almost double that of Chile (USD 185 million) (Figure 3.5). Colombia’s venture capital is mainly concentrated in the expansion stage (71% of total funding), while early stage and seed deals absorbed 6% VC investments. The Chilean ecosystem is different, also due to public policies that actively support the development of a domestic VC industry. In Chile, VC offer comparably more financing in the seed and early stage (21% of VC) (Table 3.1). VC in Colombia depends largely on the United States, which accounts for almost 50% of total VC investments (in Chile the share is 36%), local investors account for 25%, and the rest is dispersed among different investors. Spain, the United Kingdom, Mexico, Brazil and Argentina are among the top ten VC funds in Colombia (Crunchbase, 2018[16]). In 2006-18, ten industrial activities absorbed 95% of VC. Food and grocery delivery services alone absorbed 63%, followed by financial services (12%), and enterprises that exploit and develop new digital technologies such as bitcoin (6%) (Figure 3.6). In Colombia, VC invests in a few start-ups with considerable resources. In 2010-2018, one start-up, Rappi, the last-mile logistics start-up founded in 2015 offering delivery services from food to cash withdrawal and known as the Amazon of Colombia, absorbed 57% of total VC investments. The top ten start-ups accounted for almost 90% of all VC, whereas, in Chile, ten start-ups accounted for 73% of total VC funds in the same period.

Figure 3.5. VC investments (USD million), Colombia and Chile, 2010-2018

Table 3.1. Venture capital by stage, Chile, Colombia, 2010-2018

|

|

Colombia |

Chile |

||||

|---|---|---|---|---|---|---|

|

|

Number of investments |

Total investment USD |

Average investment USD |

Number of investments |

Total investment USD |

Average investment USD |

|

Seed |

64 (51%) |

3 631 673 (1%) |

56 744 |

371 (82%) |

17 721 494 (10%) |

47 766 |

|

Early stage (Start-up) |

35 (28%) |

14 75 575 (4%) |

425 016 |

48 (11%) |

21 098 138 (11%) |

439 544 |

|

Later stage (Growth) |

23 (18%) |

80 500 000 (24%) |

3 500 000 |

28 (6%) |

94 514 176 (51%) |

3 375 506 |

|

Expansion |

4 (3%) |

236 765 000 (71%) |

59 191 361 |

4 (1%) |

52 000 000 (28%) |

13 000 000 |

|

Total |

126 |

335 772 |

451 |

185 333 |

||

Note: Seed refers to an investment below or equal to USD 150 000, Early stage investment refers to financing greater than USD 150 000 and below or equal to USD 1 million, Later stage investment refers to financing greater than USD 1 million and below or equal to USD 10 million, Expansion refers to an investment above USD 10 million.

Source: Authors’ elaboration of Crunchbase (2018) database, https://www.crunchbase.com/.

Figure 3.6. Top ten start-ups account for 90% of total VC investments

Note: a) Only sectors that absorbed at least USD 1 million are displayed, b) SaaS refers to Software as a Service, which are software distribution models in which a third-party provider hosts applications and makes them available to customers over the Internet. These includes among others business applications, CAD software, HRM software, and service desk management.

Source: Authors’ elaboration of Crunchbase (2018) database, https://www.crunchbase.com/.

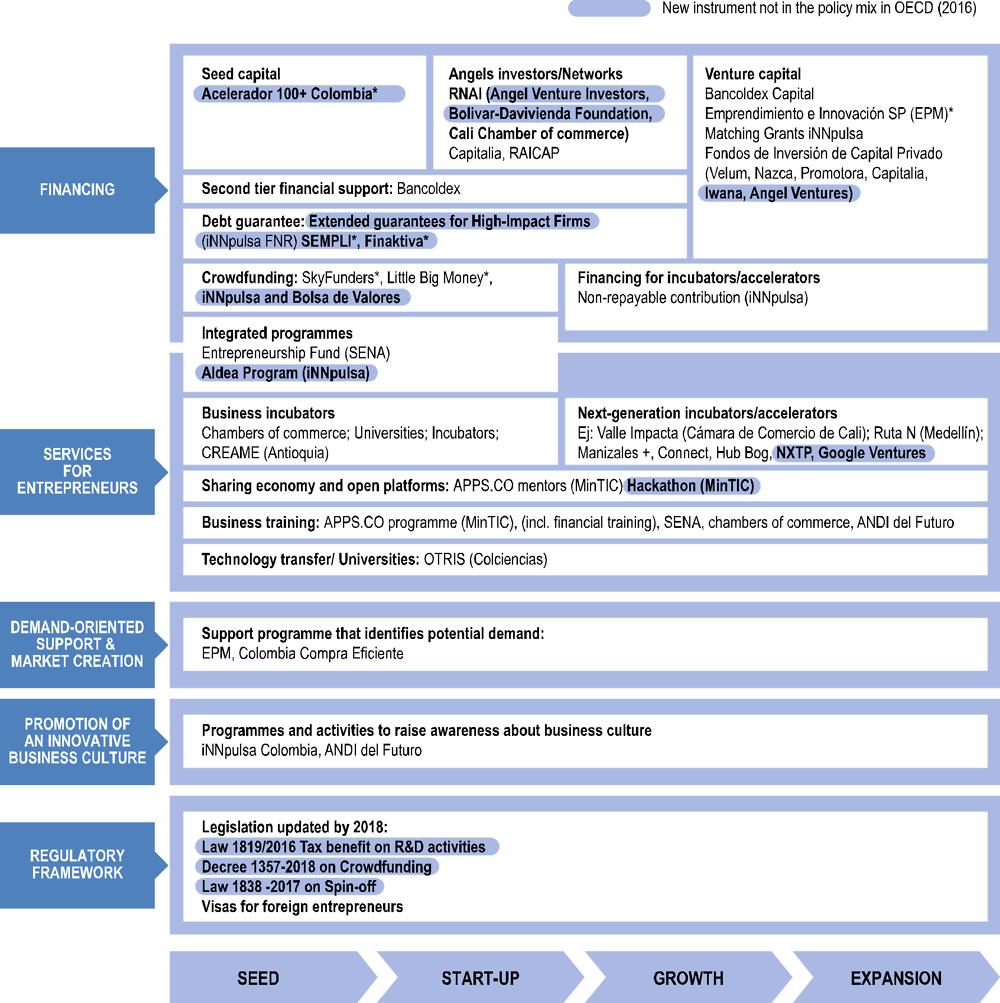

Policies played an important role in enabling start-up development in Colombia

Chile pioneered start-up promotion in Latin America with the introduction of Start-Up Chile in 2010. Colombia followed shortly afterwards with iNNpulsa in 2012 as a specialised agency of MinCIT in charge of channelling funds to innovative firms (OECD, 2013[13]). Since then, the country has experimented with different policy approaches and has advanced in consolidating the institutionality for start-up promotion. iNNpulsa has been reformed into an implementing agency in charge of start-up promotion, always responding to the Ministry of Commerce, Trade and Tourism (MinCIT), but not linked to Bancoldex anymore. However, Colombia has not yet consolidated the institutional set-up for start-ups and it does not have a unique agency in charge. For example, the national training institute (SENA) offers seed capital and technical assistance to entrepreneurs through the Entrepreneurship Fund. Since 2016, that fund also supports start-ups in less developed regions such as Guajira and Chocó. Bancoldex, a state owned business development bank, also provides financing for start-ups at the expansion phase.

Start-up promotion has been a relatively dynamic area of public policy in Latin America; institutions and instruments for start-up promotion have been monitored, assessed and reformed in relatively short periods. This shows a capacity to adopt results-based polices lacking in other areas of industrial and innovation policies (OECD, 2016[12]). Colombia has updated its policy mix since 2016. Based on the results of monitoring and evaluation, it has strengthened financing, services for entrepreneurs and the regulatory framework (Figure 3.7).

In line with global trends, iNNpulsa has reformed and streamlined its policy mix. The ALDEA programme, since 2016, offered an integrated approach. The programme is similar to that in Chile, with a multi-phase platform. The aim is to ensure a better selection of beneficiaries and to ease the transition from the start-up to the growth and expansion phases. The firms are selected by experts. They assess potential growth and impact, and whether a firm can raise seed capital ranging between USD 15 000 and USD 40 000 for one-year projects. Beneficiaries are start-ups in existence for less than four years with a turnover of at least USD 95 000. Beyond financial support, the programme offers technical assistance from mentors, advisers, investors and credit institutions, to help overcome financial and managerial barriers. In 2016-18, 108 companies were supported by the ALDEA programme. Among the successful start-ups are Soft Cafeteria, a company that connects school canteens and parents and provides information on the quality of children’s diets, and Ubits, a digital technology company that helps large companies to conduct online corporate training. Large firms are starting to look at Colombia as a potential innovation hub. Google set up a Venture Accelerator programme in 2018 that offers selected start-uppers three-month intensive support. This includes mentorship and access to networks and contacts to enable start-ups to grow internationally.

Colombia has improved the legal framework for start-ups. As part of the e-government agenda (Decree 1078/2015 and Decree 1008/2018) the MinCIT introduced the programme “fewer, easier procedures” (menos trámites más fácil), covering 114 revised procedures (5 eliminated, 56 simplified and 43 completely digitalised) (CPC, 2018[17]). Additionally, in 2017, the government passed a law (no.1838) that regulates university spin-offs to facilitate technology transfer. The Decree 1357, in 2018, regulates crowdfunding and enables banks and firms to create crowdfunding platforms. This makes access to finance easier but it limits the development of more sophisticated instruments such as crowd factoring and requires pre-conditions, such as the prior authorisation by the Superintendencia Financiera (Ministry of Finance and Public Credit, 2018[18]). Colombia issues a business visa, but this only targets large investors. They need to contribute equity investment in a domestic company of at least 100 times the national minimum wage. Chile makes it much easier. It offers a one-year working visa, with minimal requirements for investors setting up businesses in the country (OECD, 2016[12]).

Figure 3.7. Policy mix to support start-ups in Colombia, 2016 and 2018

Note: Items marked with an asterisk (*) are private initiatives.

Source: Authors’ elaboration based on official information from DNP, iNNpulsa and Bancoldex, 2018; OECD (2016), Start-up Latin America Latina: Building an Innovative Future, and OECD (2013), Start-up Latin America: Promoting Innovation in the Region.

Identifying mechanisms connecting start-ups to the different production and innovation ecosystems is key to reaping benefits from new technologies that will speed up economic transformation in Colombia. This would allow to increasingly rely on digital technologies, not only as platforms that enable the development of application, but also as business areas where start-ups could provide targeted solutions and services for existing firms. Some private entities are already advancing in this respect. New digital providers are facilitating innovation in Colombia. For example, in Medellin, Ruta N, the innovation and business platform of the city, and Bancolombia, are relying on SUNN (Startups Neural Network) a private company that provides an open platform to increase dynamism and connections in their business ecosystem. The platform is based on artificial intelligence, and aims to connect upstream (innovative start-ups) and downstream (traditional business) actors. It uses artificial intelligence to map and discover projects that start-ups, experts and other firms could collaborate on in a specific ecosystem. The system provides a dashboard to monitor the ecosystem’s activity.

Fast-tracking digitalisation in firms could increase productivity

Identifying opportunities to foster start-up development using digital technology is only part of the picture. The technology is also a key competitive and transformative factor for existing businesses. A coherent and cohesive whole-of-government approach to better respond to digital transformation is paramount in a fast changing technology world (Box 3.2). This section provides a short overview of how firms in Colombia are using digital technologies. It also provides examples of what policies could do to enable existing firms and production clusters to benefit from the potential of Industry 4.0.

Box 3.2. OECD reviews of digital transformation: Going digital in Colombia

The OECD is undertaking the Reviews of Digital Transformation: Going Digital in Colombia. The aim of the Review is to help policy makers in Colombia ensure a coherent and cohesive whole-of-government approach to better respond to digital transformation and make it work for growth and well-being.

The Review enables benchmarking of digital technology and policy-related developments in Colombia vis-à-vis other OECD countries, building on the integrated policy framework and body of good practices developed by the OECD. It examines the economic performance of Colombia and its key policies and regulations related to the digital transformation. It considers developments in the communication infrastructure for the digital economy, telecom markets and related regulations and policies. It analyses trends in the use of digital technologies by individuals, businesses and the government, and examines policies to foster diffusion. The Review also considers other policy areas of the OECD’s integrated policy framework, such as innovation, productivity, trade and jobs.

Building on an analysis of the inter-relations between key policy domains and different levels of government, the Review assesses the coherence of policies across these domains and of the synergies across government ministries, levels and institutions in Colombia.

Source: See www.oecd.org/going-digital/ for more information about the integrated policy framework and Going Digital project.

Firms in Colombia are starting to use digital technologies for businesses

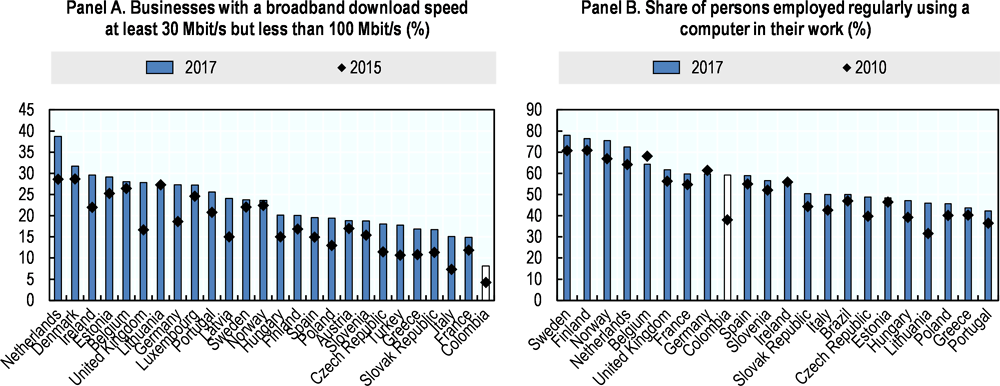

More firms in Colombia are using the internet for business (ECLAC, 2016[19]). The share of businesses with high-speed broadband internet connections doubled in 2015-17. Nevertheless, this share is still low compared to other countries. It is roughly 8% in Colombia, while the same figure is 15% in Italy and 39% in the Netherlands (Figure 3.8).

Figure 3.8. The connection speed and use of computers for businesses have increased

Note: Business enterprises refer to firms with ten or more employees.

Source: Authors’ elaboration based on OECD Broadband Statistics, 2018,http://www.oecd.org/sti/broadband/broadband-statistics.

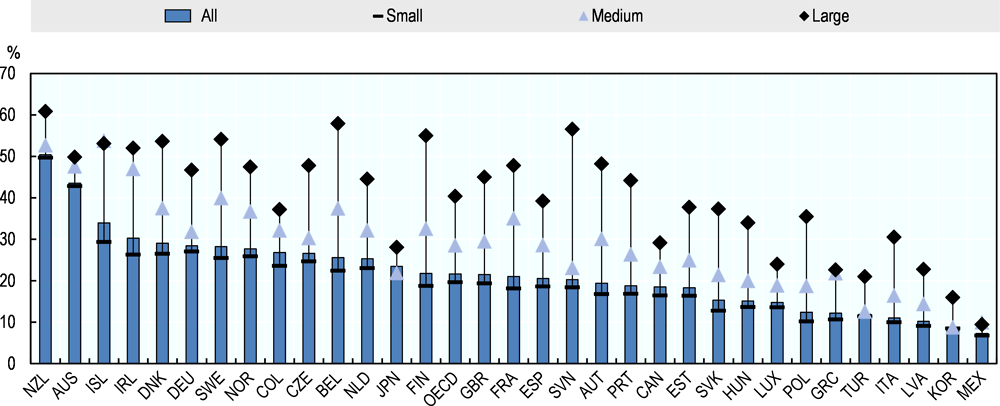

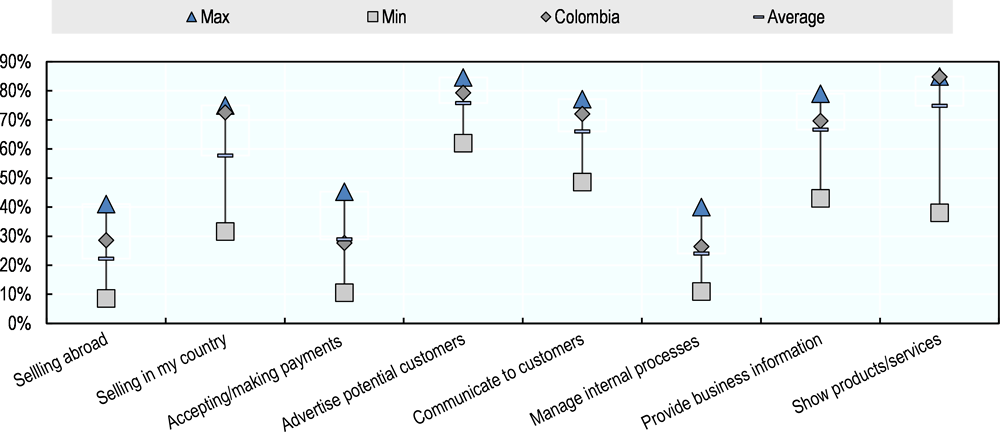

E-commerce is widespread in Colombia. Firms are adopting digital technologies to transform B2B (business to business) and B2C (business to consumers) interactions. In 2015, 23% of small firms, 32% of medium and 38% of large enterprises were engaged in e-commerce activities. These figures are above the OECD average of 22% and above that of other countries in the region, such as Mexico, where only 7% of SMEs carry out e‑commerce (Figure 3.9). Additionally, according to the OECD, World Bank and Facebook survey on the future of digital technology in business, in Colombia 29% of digitally active firms report that they use digital platforms to export. According to the survey, 73% of respondent firms are using digital platforms to sell, primarily to national customers, and 85% are using them in advertising. Digital technologies transform production, organisation and decision-making processes and contribute to increased productivity. There are several implications, covering different sectors and activities (OECD, 2017[3]). In Colombia, digital technologies are primarily used to increase market access, and their impact on new forms of business organisation is yet to be explored; only 26% of firms report that digital tools are used to manage internal business processes and only 29% accept digital payment (Figure 3.10).

Figure 3.9. Colombia firms are engaging in e-commerce activities, 2017

Note: Only enterprises with ten or more employees are considered. Small firms have 10-49 employees, medium-sized firms have 50-249 employees and large firms have 250 or more employees.

Source: Authors’ elaboration based on OECD ICT Access and Usage by Businesses (database), http://oe.cd/bus Database, 2018.

Figure 3.10. What are firms in Colombia using the internet for?

Note: Max, Min and Average are calculated from developed and emerging economies in 42 countries, where the reference population are SMEs with a Facebook account.

Source: Authors’ elaboration based on OECD, World Bank and Facebook – The Future of Business Survey, 2018.

More and better measurement is essential to develop policies and to increase firms’ awareness of the potential benefits and risks of Industry 4.0 and the use of digital technologies for business. Some countries are already modifying their official industrial statistics to better capture the readiness of their production systems to embrace digital transformation. In the United States, the Annual Capital Expenditures Survey (ACES), launched for the first time in 1996, has gradually incorporated specific questions related to digitalisation in business. ACES covers all domestic non-farm businesses and details investments by type and industry. The Census Bureau eliminated the use of paper forms with the 2016 ACES (US Census Bureau, 2019[20]). In the absence of fully comparable official statistical information, pilot firm-level surveys can also be useful to kick-start awareness and to spot new trends. These pilot surveys, if well structured, can then be scaled up to better inform official industrial statistics. In Brazil, for example, the National Confederation of Industry (CNI) has carried out a major research project to understand Industry 4.0 and to map its current and potential use in Brazilian industry (Box 3.3).

In 2017, the National Business Association of Colombia (ANDI) carried out a survey of its members on digital transformation to better understand the reality of digital technologies in national businesses. This opinion survey revealed that the main barriers firms face in the adoption of digital strategies are related to the lack of managerial digital culture (74%), the lack of awareness of potential benefits (62%), and budget constraints (56%) (ANDI, 2017[24]). In 2017, the MinTIC carried out for the first “Great ICT Survey” (Gran Encuesta TIC). The survey aimed at companies and individuals and its objective is to articulate historically dispersed statistical efforts in diverse surveys.

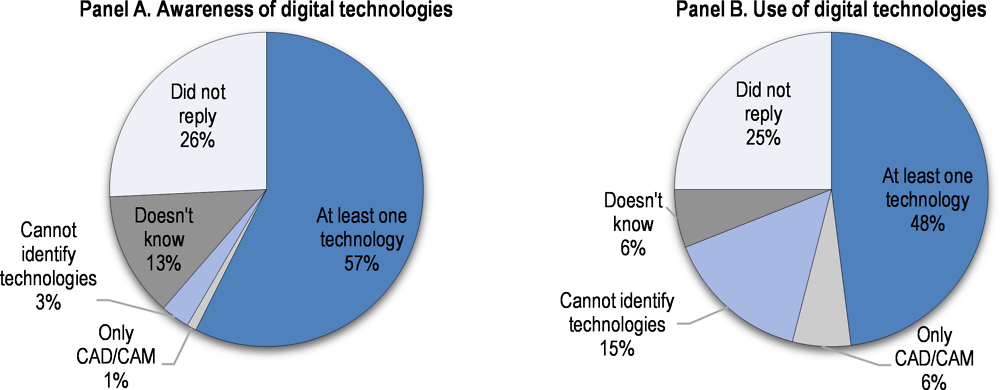

Box 3.3. Measuring the use of digital technologies in firms: The experience of Brazil

The Brazilian National Confederation of Industry (CNI) was founded in 1938.

In 2016, the CNI embarked in an ambitious project to map digital technologies and to understand their use and development by Brazilian firms. This was a business opinion survey to identify not only the investment intentions of Brazilian industry, but also the main drivers and obstacles faced by companies in carrying out their investment plans. Data was collected in the period 24 January-19 March 2018. It covered national companies whose main economic activity was classified as manufacturing or mining and quarrying industry, according to IBGE's National Classification of Economic Activities (CNAE 2.0). The final sample contained 632 randomised and representative firms. Digital technologies were classified according their potential disruptive impact and business functions. Five business functions in which digital technologies have an impact were defined: supplier relations, product development, production management, customer relations, and business management. The potential impact was classified according to four generational types of digital technologies: first generation (rigid production); second generation (lean production); third generation (integrated production); and fourth generation (integrated, connected, and smart production).

Almost 60% of all respondents said they were aware of the importance of these technologies for industrial competitiveness. Awareness was higher among large enterprises (68%) than in SMEs (43%). The survey also revealed that fewer than 50% of manufacturing firms were using digital technologies in their production processes (Figure 3.12). Within manufacturing, the highest share of firms using these technologies was in electronics and electrical equipment (61%), while there was less use in textile and apparel (29%).

Figure 3.11. Less than half of Brazilian manufacturing firms are adopting digital technologies

Source: Joao Emilio Goncalves, Executive Manager, Industrial policy unit, CNI, Brazil. “Industry 4.0 in Brazil. Opportunities and Challenges”. Presentation during the 10th plenary meeting of the OECD Initiative on GVC and Production Transformation, Paris, 27 June 2018 (CNI, 2018[21]; CNI, DIRET and IEL, 2018[22]; CNI, 2016[23]).

In addition, in 2017, the MinTIC, in co-operation with the Bogotá Chamber of Commerce (CCB), carried out the first survey on the adoption of digital technologies in the country. The survey covered 17 sectors and all 33 administrative departments (MINTIC, 2017[25]). This new initiative monitors the state of digitalisation of productive processes of Colombian companies taking into account the size of companies, the economic sector and the region. The survey indicates a limited adoption of all digital technologies in SMEs and micro-enterprises (Table 3.2). Among large firms, 49% were using Cloud computing in their business activities, in line with the OECD average (OECD, 2017[26]). They are followed by 23% of SMEs and only 13.6% of micro-enterprises. In other advanced technologies, SMEs and micro-enterprises have not yet reaped the benefits of the technological transition. For example, only 2.4 % and 1.2% of SMEs and 0.6% and 0.7% of micro-enterprises have adopted Artificial Intelligence (AI) and Robotics. The lag of SMEs in Colombia, as in other OECD countries, is linked to a lack of investment in complementary assets, such as R&D, human resources, organisational changes and process innovation (see Chapter 1 and OECD, 2017[15]). Furthermore, in Colombia, large regional disparities slow the adoption of these technologies. For example, most firms using digital technologies are located in the most industrialised regions of Bogotá, Antioquia and Atlántico (MINTIC, 2017[25]).

Table 3.2. Share of firms adopting digital technologies, by size class, Colombia, 2017

|

All firms |

Large |

SMEs |

Micro |

|

|---|---|---|---|---|

|

Cloud computing |

19.1 |

48.8 |

22.9 |

13.6 |

|

Internet of the things |

9 |

14.8 |

9.3 |

8.2 |

|

Robotics |

1.5 |

11.1 |

1.2 |

0.6 |

|

3D printing |

2.2 |

4.8 |

2.1 |

2.1 |

|

Big data analytics |

3.2 |

16.8 |

4 |

1.3 |

|

Artificial Intelligence |

1.8 |

9.7 |

2.4 |

0.7 |

|

Blockchain |

1.6 |

5.9 |

1.6 |

1.1 |

Note; Size class classifications in Colombia are defined according to the parameters contained in Law 905 of 2004. This involves three different indicators with three different thresholds: the monthly salaries in force (SMMLV), the total assets and the number of employees.

Source: Digital survey Ministry of Information and Communication Technologies (MINTIC) and Bogotá Chamber of Commerce (CCB), 2017, https://www.mintic.gov.co/portal/604/articles-61929_recurso_4.pdf.

Policies for production development in Colombia need to take into account Industry 4.0

Colombia has advanced in digital connectivity, although much needs to be done to raise the country to the level of more advanced economies. Some policies have led to Industry 4.0 giving more impetus to business development and competitiveness. Some of these targeted policies have fostered access to the use of digital technologies by firms, particularly small and medium enterprises. The programme Micro and SMEs Live Digital (MiPyme Vive Digital), managed by MinTIC and Findeter, mobilised USD 25 million in 2014-18 to increase access and use of digital infrastructure by micro-enterprises and SMEs (OECD, 2018[27]).

The Production Development Policy (PDP) (see Chapter 2 of this report), has objectives to 2025, but it does not include a focus on Industry 4.0 and the use of digital technologies to transform existing businesses and create new ones. This contrasts with several economies in Latin America and other regions of the world. In these countries and regions, governments and businesses are collaborating to define production transformation strategies that take advantage of the potential of digital technologies. All have different approaches but they all identify targeted and substantial resources to help existing firms in the transition to Industry 4.0. They also finance research and start-up development to enhance competitiveness.

The governance of these emerging initiatives to benefit from Industry 4.0 is specific to each country and region. Two key features are present in all approaches. There are cross-ministerial committees in which the agencies in charge of digitalisation or the ministries for ICT participate. As well, there are specific public-private committees where the government, the business community (both existing industries and large firms, and small firms and entrepreneurs) and academia and research institutions meet to define priorities and funding needs and responsibilities (Table 3.3).

Table 3.3. Several countries are taking steps to reap the benefits of Industry 4.0

|

|

National level |

Regional level |

||||||

|---|---|---|---|---|---|---|---|---|

|

|

China |

Germany |

Sweden |

Thailand |

Emilia Romagna, Italy |

Basque Country, Spain |

Shenzhen, China |

|

|

Strategy |

Made in China 2025 |

Industrie 4.0 |

Produktion 2030 |

Thailand 4.0 |

Industria 4.0 |

Industrialisation Plan 2020 |

Shenzhen Action Plan 2025 |

|

|

Time horizon |

2015-25 |

2010-20 |

2013-30 |

2016-21 |

2014-20 |

2014-20 |

2015-25 |

|

|

Public budget |

USD 10 billion |

USD 250 million |

USD 50 million (2013-17) |

USD 286 million |

USD 2 billion |

USD 1.5 billion |

N/A |

|

|

Governance |

Cross-ministerial, multi-level |

Cross-ministerial, multi-level & participatory |

Cross-ministerial, multi-level & participatory |

Cross-ministerial, multi-level & participatory |

Cross-ministerial, multi-level & participatory |

Cross-ministerial, cluster of companies and STI actors |

Cross-departmental |

|

|

Prioritisation |

Technologies |

Automation & robotics, new materials, renewable energies |

IoT, automation & robotics |

Nine enabling technologies |

Infrastructure, enterprise development, robotics, biotech |

Digitalisation, automation, energy efficiency, green technologies |

Biosciences, Advanced manufacturing, energy production and efficiency |

Digital equipment, robotics and new materials, green manufacturing, biotech |

|

Industries |

Aerospace transport equipment, biopharma and advanced medical products |

Machinery, electronic, mechanical engineering |

Agro-food, construction mechatronics, health industry, creative industry |

Automotive electronics, health, tourism, food and agriculture, aviation, chemistry, |

Agro-food, construction, creative industries, health, motor vehicles |

Agro-food, creative industries, health |

Electronics, motor vehicles, aerospace, engineering equipment, |

|

Note: IoT: Internet of things; n/a: not applicable.

Source: Updates and expands (OECD/UN, 2018[28]), Production Transformation Policy Review of Chile: Reaping the Benefits of New Frontiers, http://dx.doi.org/10.1787/9789264288379-en.

In Colombia, the PDP has a Technical Committee to co-ordinate strategy. However, the Ministry of ICT has not been part of it, and this has limited the capacity to embrace fully digitalisation. Expanding governance to include key public and private actors in charge of digitalisation could help to identify priority gaps and lines of actions. It could also mobilise joint financing and define appropriate tools to speed the transition to Industry 4.0. This would help broaden the current focus of the PDP. It now focuses on existing firms and their adoption of new technology. It could concentrate on more innovative aspects, to unlock some of the potential benefits of digitalisation. There are unprecedented opportunities to transform businesses and therefore cities, communication and ultimately societies.

To bring about a major transformation through Industry 4.0 in Colombia, the emphasis needs to be both on adopting new technology and on research and development agenda. This will require the participation of key stakeholders from the public and the private sector such as in the case of the Basque Countries in Spain or in the Industrie 4.0 in Germany where the governments lead the agendas and gather all the relevant stakeholders, such as companies, business and worker associations. In this way, existing businesses will be strengthened and new businesses, products and services will be created (Table 3.4).

Table 3.4. A key challenge for Colombia is to shift from technology adoption to creation

|

|

Short term: Adopting digital technologies |

Medium and long term: Innovating through digital technologies |

|---|---|---|

|

Objectives |

Improving quality of and access to internet infrastructure Fast-tracking technology adoption in businesses (processes, products, services and organisation) Favouring start-up development and enabling experimentation |

Developing new products and services based on digital technologies |

|

Lines of action |

Public-private partnerships for infrastructure development. Financing and fiscal incentives for firms to facilitate digital transformation Services to raise awareness and transform mind-sets to facilitate technology adoption Updates in public procedures and training for public officials to manage digital programmes for firms Targeted short-term training for entrepreneurs and workers to facilitate technology adoption |

Public-private partnerships for strengthening the science and technology infrastructure Public financing for digital research and development through a mission-oriented research fund Public-private financing for disruptive innovation Public investment in innovative training of high skilled scientists, engineers and innovators |

|

Beneficiaries |

Start-ups, existing firms, employees |

Start-ups, existing firms, research and technology centres, networks of innovators |

Source: Authors’ elaboration based on the High Level Consensus Building Event co-organised by the OECD Development Centre, DNP, ANDI and CPC in Bogotá, Colombia in October 2018.

Conclusions

Colombia has advanced in digital connectivity, but the country is still not at the level of OECD countries. Colombia needs to make its industries and services more competitive and productive. A smarter use of digital technologies would help in this push. Cities can be active players in this field. Medellín, has announced in 2019 the creation of an Industry 4.0 technology centre with an initial investment of USD 6 million up to 2022.

More needs to be done to improve the coverage and quality of digital connectivity. Low broadband connection speed can hamper firms working in digitally connected and global platforms and chains. This, in turn, slows productivity and the competitiveness of Colombia’s businesses. The country can also improve start-up development by providing incentives in business areas connected to digital technologies. A reform of regulations on university-to-business spin-offs would make it easier to pass on to business the research developed by universities. Despite infrastructure limitations, digital technologies have opened up unprecedented opportunities for Colombia. In the realm of start-up creation, the country has transformed its image in less than a decade. Medellin, once globally renowned for crime, now attracts global investors and is among the world’s most dynamic start-up hubs.

Fast-tracking digitalisation in firms and creating new opportunities for digital innovation is necessary to unlock the potential of Industry 4.0. This means that national and regional governance and financing polices for production development need to be reformed. The Ministry of ICT and agencies in charge of digitalisation should sit on the committees in charge of defining strategies, policies and financing for production development. Public-private consultation bodies should include not only established and big businesses but also small firms and entrepreneurs. The latter need an early opportunity to explain their views and needs.

In addition, Colombia should try to identify potential areas in which the country could be an innovator and creator of knowledge-based solutions, as well as a user. Achieving this transformation requires time, but also public and private investments at levels that match needs. Micro and SMEs Live Digital (Mi Pyme Digital) is one of the main programmes to help adopt digital technologies in businesses in Colombia, particularly in micro and small firms. It spent USD 25 million of public funds in 2014-18. By contrast, in Spain, the 5G Digital Agenda will invest USD 300 million in 2018-20. The objective is to harness all the opportunities offered by 5G connection by 2020. This means supporting the adoption of standards, identifying practical-use cases, experimenting with technology and developing the relevant ecosystems (EU, 2018[29]). In Colombia, what is needed is an increase in investment to enable current and future firms to operate and compete in an Industry 4.0 landscape. This also requires broadening the production development agenda and including a pillar linked to science, research and innovation. This has been a missing link in the previous efforts to sustain production development in the country.

References

[42] Ahmad, N. and P. Schreyer (2016), “Measuring GDP in a Digitalised Economy”, OECD Statistics Working Papers, No. No. 2016/07, OECD Publishing, Paris, https://doi.org/10.1787/5jlwqd81d09r-en..

[7] Akamai (2017), State of the Internet Report, https://www.akamai.com/uk/en/about/our-thinking/state-of-the-internet-report/.

[24] ANDI (2017), Encuesta de transformación digital 2017, ANDI, Bogotá, http://www.andi.com.co/Uploads/Encuesta%20Transformaci%C3%B3n%20Digital%20ANDI.pdf (accessed on 29 November 2018).

[35] ANDI (2017), Estrategia para una nuoeva industrialización: Colombia un país de oportunidades, ANDI, Bogotá, https://www.google.fr/_/chrome/newtab?espv=2&ie=UTF-8 (accessed on 06 June 2018).

[1] BMBF (2016), Industrie 4.0, https://www.bmbf.de/de/zukunftsprojekt-industrie-4-0-848.html (accessed on 10 January 2019).

[41] CAF (2017), Observatorio del Ecosistema Digital en América Latina y el Caribe 2017, Development Bank of Latin America CAF, https://www.caf.com/app_tic/. (accessed on 12 October 2018).

[21] CNI (2018), Investimentos em industria 4.0, Brazilian National Confederation of Industry , Brasilia, https://bucket-gw-cni-static-cms-si.s3.amazonaws.com/media/filer_public/8b/0f/8b0f5599-9794-4b66-ac83-e84a4d118af9/investimentos_em_industria_40_junho2018.pdf (accessed on 03 December 2018).

[30] CNI (2017), Industry 4.0: a new challenge for Brazilian industry, CNI , Brazil, 2317-7330.

[23] CNI (2016), Industry 4.0, CNI Indicators, 2317-7330.

[22] CNI, DIRET and IEL (2018), Building the future of Brazilian industry, Volume I, IEL - Euvaldo Lodi Institute, Brasilia, https://bucket-gw-cni-static-cms-si.s3.amazonaws.com/media/filer_public/8f/26/8f267223-f41b-4b8a-8247-939df15b8de5/sintese_miolo_ing.pdf (accessed on 03 December 2018).

[44] CONPES 3866 (2016), Política nacional de desarrollo productivo, Departamento Nacional de Planeación, Bogotá, http://www.colombiacompetitiva.gov.co/prensa/informes/Conpes-3866-de-2016-Politica-desarrollo-productivo.pdf (accessed on 06 June 2018).

[17] CPC (2018), Informe Nacional de Competitividad 2018-2019, Consejo Privado de Competitividad, Bogotá, https://compite.com.co/wp-content/uploads/2018/10/CPC_INC_2018-2019_Web.pdf.

[36] Consejo Privado de Competitividad (ed.) (2017), Informe Nacional de Competitividad 2017-2018 -, https://compite.com.co/informe/informe-nacional-de-competitividad-2017-2018/ (accessed on 06 June 2018).

[16] Crunchbase (2018), crunchbase database, https://www.crunchbase.com/.

[34] Doner, R. and B. Schneider (2000), “Business Associations and Economic Development: Why Some Associations Contribute More Than Others”, Business and Politics, Vol. 2/03, pp. 261-288, http://dx.doi.org/10.2202/1469-3569.1011.

[11] ECLAC (2018), Data, algorithms and policies. Redefining the digital world, United Nations publication, Santiago, https://repositorio.cepal.org/bitstream/handle/11362/43515/7/S1800052_en.pdf (accessed on 18 October 2018).

[14] ECLAC (2018), Estado de la banda ancha en América Latina y el Caribe 2017, https://www.cepal.org/es/publicaciones/43365-estado-la-banda-ancha-america-latina-caribe-2017.

[19] ECLAC (2016), La nueva revolución digital: de la Internet del consumo a la Internet de la producción, ECLAC, Santiago, Chile, https://repositorio.cepal.org/handle/11362/38604.

[32] ECLAC (2008), La transformación productiva 20 años después: viejos problemas, nuevas oportunidades | Publicación | Comisión Económica para América Latina y el Caribe, https://www.cepal.org/es/publicaciones/2889-la-transformacion-productiva-20-anos-despues-viejos-problemas-nuevas (accessed on 03 September 2018).

[29] EU (2018), Spain Digital Single Market., https://ec.europa.eu/digital-single-market/en/country-information-spain (accessed on 14 January 2019).

[2] Forbes (2018), “What is Industry 4.0?”, https://www.forbes.com/sites/bernardmarr/2018/09/02/what-is-industry-4-0-heres-a-super-easy-explanation-for-anyone/.

[6] ITU (2017), Measuring the Information Society Report, Volume 2: ICT Country profiles, nternational Telecommunication Union, Geneva, Switzerland, https://www.itu.int/en/ITUD/Statistics/Documents/publications/misr2017/MISR2017_Volume2.pdf.

[33] Kotler, P. and D. Gertner (2002), “Country as brand, product, and beyond: A place marketing and brand management perspective”, Journal of Brand Management, Vol. 9/4, pp. 249-261, http://dx.doi.org/10.1057/palgrave.bm.2540076.

[15] LAVCA (2017), 2017 Trend Watch: Latin American Venture Capital | LAVCA, https://lavca.org/industry-data/trend-watch-2016-latin-american-venture-capital/ (accessed on 09 November 2018).

[37] Meléndez, M. and G. Perry (2010), “Industrial Policies in Colombia”, SSRN Electronic Journal, http://dx.doi.org/10.2139/ssrn.1817239.

[18] Ministry of Finance and Public Credit (2018), Decreto 1357-2018, https://actualicese.com/normatividad/2018/07/31/decreto-1357-de-31-07-2018/.

[4] MINTIC (2018), MinTIC le cumple a Colombia: 98% de municipios conectados a Internet y 28 millones de conexiones, https://www.mintic.gov.co/portal/604/w3-article-61094.html (accessed on 12 October 2018).

[8] MINTIC (2017), “Mínimo de banda ancha en Colombia será de 25 Mbps para el 2019”, https://www.mintic.gov.co/portal/604/w3-article-57179.html (accessed on 04 January 2019).

[25] MINTIC (2017), MinTIC revela los primeros resultados del Observatorio de Economía Digital, https://www.mintic.gov.co/portal/604/w3-article-61929.html (accessed on 07 January 2019).

[31] OCYT (2018), Informe Anual de Indicadores de Ciencia y Tecnología 2017 – OCyT, http://ocyt.org.co/proyectos-y-productos/informe-anual-de-indicadores-de-ciencia-y-tecnologia-2017/ (accessed on 09 September 2018).

[5] OECD (2019), Broadband Portal Statistics, http://www.oecd.org/sti/broadband/broadband-statistics/ (accessed on 04 January 2019).

[27] OECD (2018), Digital Government Review of Colombia: Towards a Citizen-Driven Public Sector, OECD Digital Government Studies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264291867-en.

[43] OECD (2018), Education at glance. Database, https://stats.oecd.org/?_ga=2.205184912.1097140435.1547027115-672064607.1528363303.

[9] OECD (2017), Going Digital: Making the Transformation Work for Growth and Well-Being, OECD Publishing , Paris, https://www.oecd.org/mcm/documents/C-MIN-2017-4%20EN.pdf (accessed on 19 October 2018).

[39] OECD (2017), OECD Science, Technology and Industry Scoreboard 2017: The digital transformation, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264268821-en.

[26] OECD (2017), Strengthening SMEs and entrepreneurship for productivity and inclusive growth, https://www.oecd.org/cfe/smes/ministerial/documents/2018-SME-Ministerial-Conference-Key-Issues.pdf (accessed on 07 January 2019).

[3] OECD (2017), The Next Production Revolution: Implications for Governments and Business, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264271036-en.

[10] OECD (2016), PISA 2015 Results (Volume II): Policies and Practices for Successful Schools, PISA, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264267510-en.

[12] OECD (2016), Start-up Latin America 2016: Building an Innovative Future, Development Centre Studies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264265660-en.

[38] OECD (2014), OECD Reviews of Innovation Policy: Colombia 2014, OECD Reviews of Innovation Policy, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264204638-en.

[13] OECD (2013), Start-up Latin America : promoting innovation in the region., OECD.

[28] OECD/UN (2018), Production Transformation Policy Review of Chile: Reaping the Benefits of New Frontiers, OECD Development Pathways, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264288379-en.

[40] OOIJEN Charlotte, V. and U. Barbara((n.d.)), “OECD Digital Government Studies Assessing the Impact of Digital Government in Colombia: TOwArDS A nEw mEThODOlOGy”.

[20] US Census Bureau (2019), Annual Capital Expenditures Survey (ACES), https://www.census.gov/programs-surveys/aces/about.html.