This chapter focuses on the pay-out options of the private pension system. The main objective of a pension system, to provide a regular income in retirement, is currently undermined by the fact that people are allowed to take their assets as a lump-sum at retirement. In addition, the incentives for them to take an income option are not sufficient. Reforms need to address these poor incentives and ensure that all pension members receive at least a minimum level of income in retirement, and encourage them to take an income option while being confident that those benefits will be secure. 1*

OECD Reviews of Pension Systems: Peru

Chapter 7. Optimising the design of the private pension system for the pay-out phase

Abstract

The current pay-out structure of the SPP has significantly undermined the role of the SPP to provide an income in retirement. Prior to 2016, individuals retiring in the SPP had to take their accumulated assets as a stream of income in retirement, either by purchasing a life annuity from an insurance company, taking regular withdrawals from their individual account, or some combination of the two. Mixed currency options are also available but have not proven very popular. Since 2016, Law No. 30425 allows individuals to take 95.5% of their accumulated assets as a lump-sum without penalty. This has driven a huge increase in the number of people retiring, who largely exit before the legal retirement age through the REJA regime given the ease of qualifying for early retirement under this regime. Nearly all retirees now take the lump-sum at retirement.

In parallel, recent initiatives have increased the security of annuity benefits, including improvements in the reserving and capital requirements for these products and the longevity assumptions used.

Nevertheless, changes need to be made to the pension system to make sure that the pension system’s objective of providing a lifetime income in retirement is fulfilled. International best practices for the structure of the pay-out phase, reflected in the OECD Roadmap for the good design of defined contribution pension plans, promote the use of life annuities as a way to protect individuals from the risk of outliving their savings in retirement.2 One way to offer this protection while striking a balance between flexibility and liquidity, and longevity protection is to combine the option of a programmed withdrawal with a deferred annuity beginning payments at an advanced age. While the OECD recommends that in an ideal world the option of taking the lump sum should be removed, this option is likely not feasible to implement in Peru.

Therefore, given that the main objective of a pension system is to provide a retirement income, measures should be implemented that would make individuals better off taking a pension rather than a lump-sum. Ideally, and in line with the OECD Roadmap for the Good Design of Defined Contribution Pension Plans, people should only be allowed to take their savings accumulated to finance retirement as a lump-sum when they already have pension benefits that provide them with a regular stream of income in retirement, or when they (partially) use their savings to buy a product that provides a regular stream of income during retirement. Therefore, first, measures should be put in place to provide incentives to take a pension rather than a lump-sum. Second, the options for pay-out in the SPP should be simplified. Finally, measures should be in place to ensure the security of benefit payments during retirement.

7.1. Options for pay-out at retirement

At retirement, individuals can choose to receive their pension in one of three ways, or in some combination:

Leave their assets invested with the AFP and take a programmed withdrawal, calculated taking into account their balance, age, gender and family

Transfer their assets to an insurance company to purchase a life annuity

Take 95.5% of their assets as a lump-sum, with the remaining 4.5% transferred to EsSalud to finance their health coverage (since April 2016)

The AFPs are required to explain the options that affiliates reaching retirement have to withdraw their accumulated assets, how pension income could be expected to change over time for each option, and the offers from the different insurance companies that are providing annuities. In their communication, the AFPs must follow seven principles that intend to make the communication easy to understand and act upon (simplicity, opportunity, objectivity, security, traceability, accessibility, and service orientation).

For the programmed withdrawal option, the level of income is determined using an age-specific annuity factor each year. The SBS derives a range for the discount rate on which the programmed withdrawal calculation is based from a projection based on utility maximisation, and the range is updated every two years. AFPs have discretion to set the discount rate used for the calculation of programmed withdrawals for their members within the range set by the SBS. Table 7.1 shows the technical rates offered by each AFP for the calculation of programmed withdrawals, and shows that the range between the lowest and the highest rate is quite large, at nearly a percentage point.

Table 7.1. Technical rate used by AFPs for the calculation of programmed withdrawals

December 2018.

|

AFP |

Rate |

|---|---|

|

Habitat |

3.85% |

|

Integra |

4.06% |

|

Prima |

3.19% |

|

Profuturo |

4.10% |

Source: SBS.

For options involving annuities, insurance companies provide quotations through the electronic platform MELER (Mercado Electrónico de Rentas y Retiros del SPP). This system is an online tool developed by the SBS through which the insurance companies can sell their pension products. AFPs can provide affiliates with the quotations once they begin the retirement process to decide how to withdraw their pension.

At a minimum, the AFPs must provide the affiliate with quotes from all insurance companies of how much pension income could be received from a family life annuity and temporary programmed withdrawal with a deferred annuity. Within these basic options, individuals can choose the currency (PEN or USD), the level of payment adjustments and the period of deferral. The affiliate can request quotes for up to two additional retirement pension products with the characteristics of their preference, which will be requested from all insurance companies that have registered such products in the Superintendence Registry.

The various combinations of pay-out options involving life annuities from insurance companies are as follows:

Renta mixta - programmed withdrawal taken in soles and a life annuity taken in USD

Renta temporal con renta vitalicia diferida - half of the fund is taken by programmed withdrawals and half used to purchase a life annuity deferring payments 1-3 years in either currency, with payments indexed at 2%

Renta combinada - programmed withdrawal and a life annuity paying in soles at the same time

Renta bimoneda - two annuities paying in soles and USD, with payments indexed by 2%

Renta escalonada - after 20 years the annuity income is reduced by 50-75%, and payments are indexed by 2%

Retirement annuities indexing payments to inflation are not commonly offered due to a lack of instruments with which to hedge inflation.

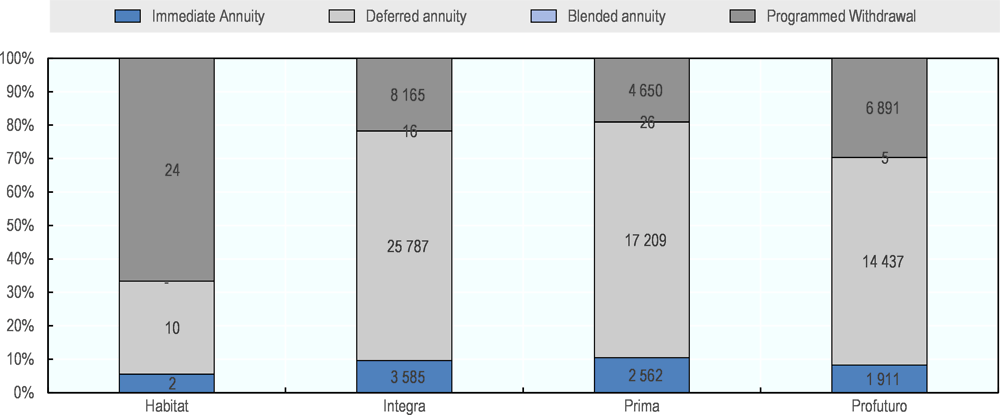

The SBS must approve all new types of annuity products offered by insurance companies. Once the authorization process is completed for a certain type of product, any insurer may offer it. Pay-out options that combine a programmed withdrawal with a deferred life annuity are the most prevalent pay-out option, and three-quarters of pensions in pay-out are either this option or an immediate life annuity. Nearly a quarter of individuals are receiving programmed withdrawals only (Figure 7.1). Besides Habitat, who being new to the market has very few pensioners in pay-out, Profuturo has the largest proportion of its pensioners (30%) taking a programmed withdrawal, and is also the AFP offering the highest discount rate for this option. The number of people choosing non-standard blended annuity options is negligible.

Figure 7.1. Old age pensions in pay-out

Note: Blended annuity includes mixed annuities, combined annuities, and multi-currency options.

Source: SBS.

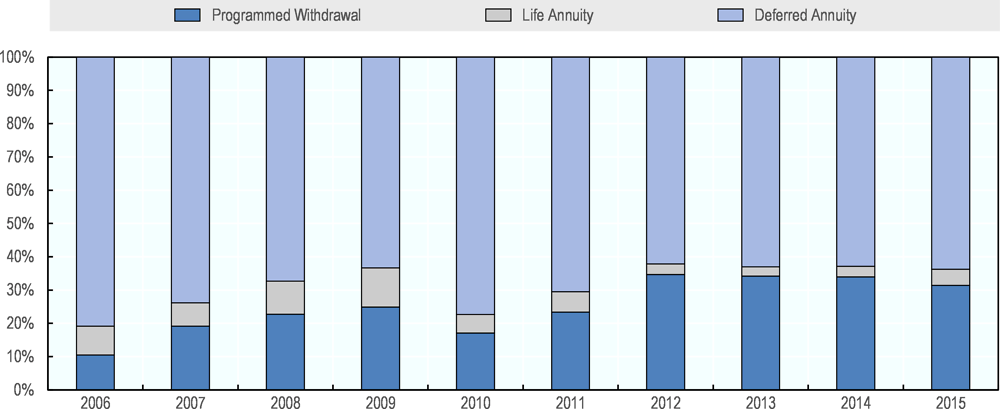

Up until 2016, the majority of individuals each year preferred taking a combination of a programmed withdrawal and deferred annuity at retirement. Preferences between deferred annuities, programmed withdrawals and life annuities remained relatively stable from 2012 to 2015, with around a third of retirees choosing a programmed withdrawal, and under 5% selecting a life annuity (Figure 7.2). In terms of preferences by gender, a larger proportion of women have preferred to take programmed withdrawals, while a higher proportion of men have preferred the deferred annuity. There has been little difference, however, in gender preference for life annuities.

Figure 7.2. Pay-out option selected by retiring affiliates before lump-sum option

Source: SBS.

Since 2016 nearly everyone retiring in the SPP chooses a lump-sum. The Law No 30425 enacted April 2016 allowed members to fully withdraw the assets accumulated in their individual account at retirement as a lump-sum. Individuals who choose this option receive 95.5% of their assets in cash, and must pay 4.5% to EsSalud to secure their health benefits in retirement. As a result of this law, nearly everyone now retiring in the SPP elects to receive their benefits as a lump-sum. Table 7.2 shows that 95% of individuals retiring elected to receive a lump-sum in 2016, increasing to nearly 99% in 2018. Among the few individuals who choose to receive their benefits as income, the majority prefer to have some type of annuity in retirement.

Table 7.2. Proportion of retiring pensioners selecting each type of pay-out option since lump-sums have been available

|

|

Programmed Withdrawal |

Life Annuity |

Deferred Annuity |

De-escalating Annuity |

Lump-Sum |

|---|---|---|---|---|---|

|

2016 |

1.43% |

0.54% |

2.42% |

0.32% |

95.29% |

|

2017 |

0.40% |

0.35% |

0.68% |

0.27% |

98.31% |

|

2018 |

0.45% |

0.20% |

0.38% |

0.05% |

98.91% |

Source: SBS.

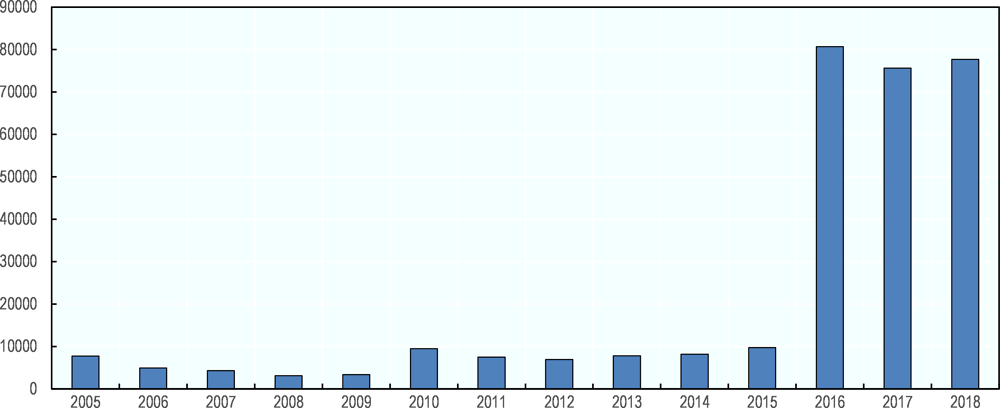

The ability for individuals to take their pension savings as a lump sum at retirement also triggered a massive increase in the number of individuals retiring. Figure 7.3 shows that there was an eight-fold increase in the number of people retiring in 2016 compared to 2015, with the number of people retiring jumping from around 10 thousand to over 80 thousand in 2016. The high number of retirees has been sustained in 2017 and 2018 at just under 80 thousand.

Figure 7.3. Number of SPP affiliates retiring

Source: SBS

This increase is largely driven by the ability for individuals to retire early under the REJA regime. 60% of retirees in 2016 and 74% in 2017 and 2018 retired early under the REJA regime. A slightly higher proportion of women than men have selected the lump sum option.

While most people now take a lump-sum at retirement and the majority of these people do not keep the funds invested, 40% of the funds taken out as of December 2017 stayed invested. A small proportion (3.6%) was invested with insurance companies, typically in ten year term annuities. A larger proportion (13.3%) was surprisingly reinvested with the AFPs, but in a regular investment account rather than the pension account. Individuals are therefore not making the optimal financial decisions with the lump-sum, and even when they want to keep it invested, they do not want it within the pension system.

7.2. Annuity market

Insurance companies provide life annuities to pensioners in the SPP. There are currently seven life insurance companies operating in the Peruvian market that offer life annuities for the SPP: Interseguro, La Positiva Vida, Mapfre Peru Vida, Pacifico Vida, Protecta, Rimac and Sura.

Since 2012, the annuity prices have been going down in tandem with the increase in the 10-year bond rate. Nevertheless, since individuals have been allowed to take a lump sum at retirement, annuity sales have plummeted.

The SBS has taken several measures in recent years to increase the security of annuity benefits for pensioners. Reserve requirements now better reflect the mismatch of cash flows between assets and liabilities, and capital requirements are moving towards risk-based requirements. New mortality tables have been implemented that are based on the actual mortality of the pensioners in the SPP and account for future expected improvements in life expectancy following international best practices. Finally, options to protect annuity payments in case of insurer insolvency are being considered.

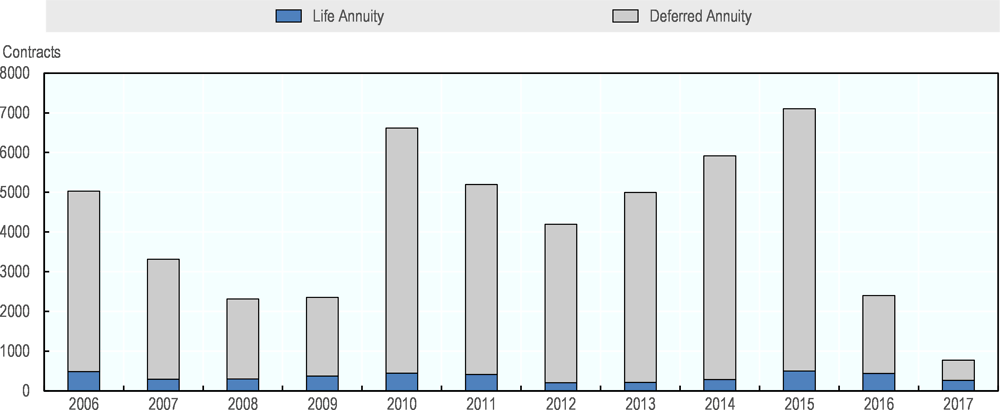

7.2.1. Annuity sales and pricing

The number of annuities sold each year has varied, and sales dropped off significantly in 2016 following the allowance of the lump-sum pay-out (Figure 7.4). The majority of individuals prefer a combination of programmed withdrawals with a deferred life annuity rather than an immediate annuity.

Figure 7.4. Annuities sold

Source: SBS, OECD Global Insurance Statistics

Over 60% of pensioners in pay-out as of December 2018 that had chosen options involving annuities (either immediate or deferred) had fixed nominal pension payments. Individuals seem to be reluctant to take a lower pension income initially in exchange for protection against inflation risk to maintain a stable standard of living, in line with what has been observed internationally.

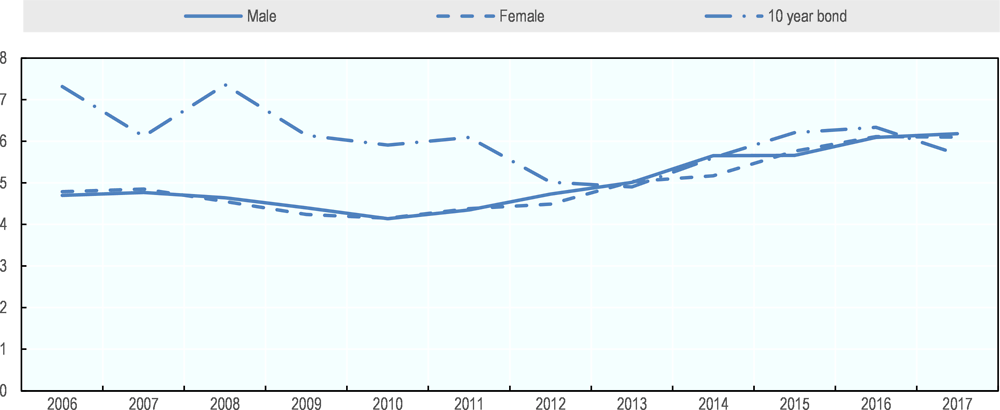

The discount rates used to price annuities have more recently aligned more with long-term bonds. Up until 2012, annuity providers seemed to be charging a significant margin on the annuities being sold to individuals aged 65, with the implicit discount rate used for pricing one to two percentage points below the ten-year government bond rate (Figure 7.5). Since 2012, however, the discount rates have converged more with bond rates. One potential explanation of this observation could be the introduction of new regulatory mortality tables in 2011, which were more conservative than the previous regulatory tables and were likely closer to the assumptions that insurance companies were actually using. The use of the new tables to calculate the implicit discount rate would result in a higher implicit discount rate, and one that would be closer to the discount rate actually being used for pricing.

Figure 7.5. Implicit discount rates for annuity at age 65

Notes: 10 year bond rate in PEN is the 12 month average. Discount rate is calculated assuming pricing with the regulatory mortality tables, and the average price of all annuities sold.

Source: SBS, Banco Central de Reserva del Perú.

7.2.2. Reserving and capital requirements

New reserve requirements for insurers that improve the method for discounting the expected future cash flows became effective in 2019. The new reserving methodology is more in line with the approach taken by Chile. It calculates the mismatch of asset and liability cash flows on a monthly basis, and assumes that any excess is invested to cover the following period. At the end of the asset cash flows, the rolled forward difference is discounted to the beginning of the period and required as an additional positive or negative reserve. The new methodology derives the discount rate through a comparison of the sales rate, the risk-free rate and the average sales rate of the SPP combined with a methodology to measure the adequacy of assets, both in terms of duration and currency, for the coverage of the obligations. This methodology will apply to new policies, existing policies and the SCTR regime.

The solvency margin for individual life and income insurance operations is equal to the amount obtained from the application of the following formula and on the basis of the information contained in the financial statement: 5%*(Mathematical Reserve)*Max(Retention Ratio, 0.85) where the Retention Ratio is the proportion of the mathematical reserves retained on the provider’s balance sheet. However, the SBS is planning to transition to risk-based capital requirements.

7.2.3. Managing longevity risk

Having appropriate mortality tables that account for future improvements in life expectancy is important to ensure the security of people’s pensions. The SBS is responsible for the approval of the mortality tables used for the calculation of annuity reserves and programmed withdrawal calculations (SBS, 2018[1]). The development of appropriate mortality tables and accurate mortality assumptions is necessary to ensure that annuity providers will have sufficient reserves to back and guarantee the future annuity payments.

The SBS developed mortality tables following international best practices in 2017, which were approved in 2018.3 For the first time, the tables used for the SPP are based on the mortality experience of members in the SPP and take into account expected future improvements in mortality. A primary goal of the development of the new mortality tables was to reflect the mortality experience of Peruvian SPP members, both in terms of the current level of mortality and the future expected improvements in mortality that lead to increases in life expectancy. Up until then, the mortality tables used for the private pension system in Peru had been based primarily on the experience of Chile, and did not incorporate future expected increases in life expectancy.

The new tables use the Peruvian SPP population to determine the current level of mortality, which is important not only because life expectancy can differ widely across different countries, but also within countries for different population sub-groups. The Peruvian SPP population represents a specific subset of the general Peruvian population, and tends to have better access to education and health care. International evidence makes clear that life expectancy can differ significantly across socioeconomic groups, and those having higher incomes and education can expect to spend several years longer in retirement compared to those with low educational attainment and lower incomes.

In addition to ensuring that base assumptions are accurate for the specific population in question, accounting for future expected improvements in mortality is imperative to reflect the fact that life expectancy is increasing. Incorporating mortality improvement assumptions typically increases the estimated life expectancy at age 65 by one to two years.

The development of mortality tables based on Peruvian SPP data and the adoption of dynamic tables that account for expected future improvements was a major step to ensure the sustainability of the private pension system to provide pension income to retired Peruvians. The use of accurate tables improves the soundness of annuity reserves and preserves the solvency of the insurance companies, ensuring that annuity payments to pensioners can be met. Indeed, establishing appropriate mortality tables is essential to mitigating the expected longevity risk that annuity providers are exposed to (OECD, 2014[2]).

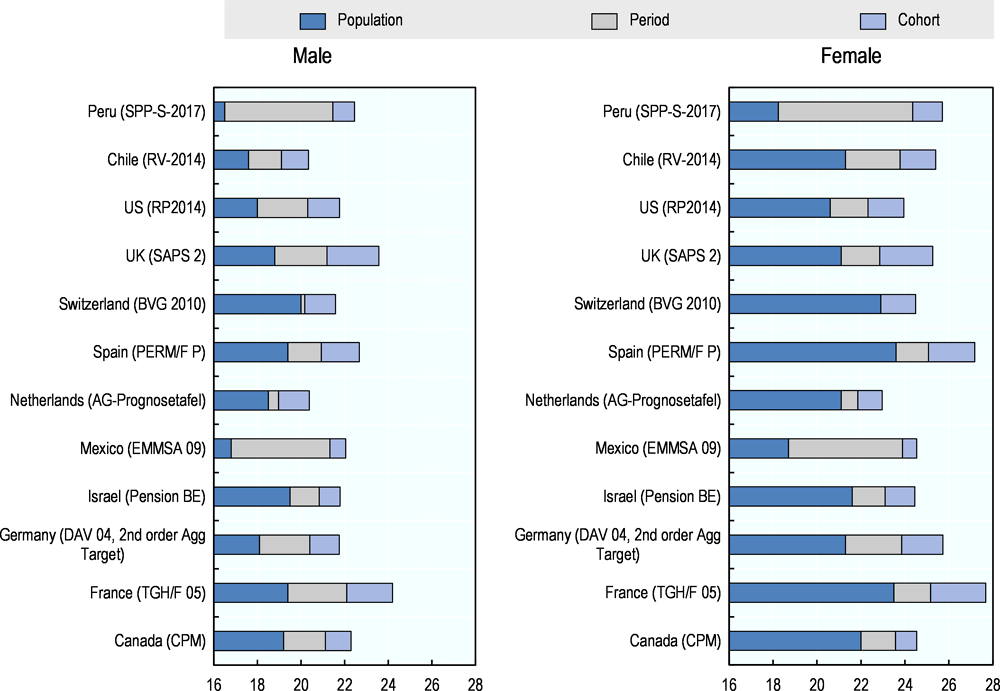

The life expectancy given by the tables for the pension population is higher than the life expectancy for the general population of Peru. However, comparing the life expectancy from the new mortality tables for healthy lives in the SPP with those calculated from other tables largely reflects differences that would be expected given the differences in the underlying populations in question. Figure 7.6 compares the 2016 life expectancies in several countries, and shows the period life expectancy of the population, the period life expectancy of the mortality table developed for pensioners or annuitants in that country and the cohort life expectancy from that same table taking into account future improvements in mortality. For the countries shown, the life expectancy of the pensioner/annuitant population is over 2 years higher than the general population on average. Future expected improvements in mortality add around an additional 1.5 years to life expectancy. The difference in life expectancies between the Peruvian population and the Peruvian pensioner population, however, is much higher than this average, with the gap amounting to five to six years. This result is driven by the very low coverage of the pension system in Peru, and the fact that the affiliates of the SPP tend to have higher incomes on average than the general population. The additional life expectancy from future improvements in mortality, however, is more or less in line with other countries, with one additional year in life expectancy for males, and 1.35 for females.

Figure 7.6. Life expectancy at age 65 in 2016

Note: Population figures are 2016 from OECD statistics, except for Canada, Chile, France (2015) and Peru (2016, CEPAL).

Source: OECD, CEPAL, own calculations.

7.2.4. Protecting members in insolvency

Currently there is no mechanism to transfer the insurance portfolio of a company in insolvency, but there is a priority order established for companies in the insolvency process. A recent proposal establishes that the liabilities related to the credits of the insured or their beneficiaries are excluded from the balance sheet during this process in order to facilitate the transfer of the portfolio. If the transfer is not successful, the liabilities are integrated into the liquidation total and the order of priority of payments applies. It also proposes the exclusion of the total liquidation of assets and liabilities related to the insurance under the SPP in order to safeguard these obligations even during liquidation. While the proposal had the backing of the various institutions involved in addition to the Ministry of Economy and Finance and the Central Reserve Bank of Peru, the proposal was discarded. The SBS is now analysing the possibility of implementing an Insurance Policy Coverage Fund that includes annuities.

7.3. Policy options

Changes need to be made to the pension system that will allow it to achieve its objective of providing individuals with an income in retirement. First, and most importantly, incentives should be put in place to encourage people to take a pension rather than a lump-sum to ensure that they will receive at least a minimum income in retirement. Second, the pay-out options to provide a pension income need to continue to be simplified and standardised so individuals are sure to understand the differences in the options and are able to make a well-informed decision. Finally, the continued security of benefits should be ensured by having a procedure in place to protect annuitants in the case of insolvency of the insurer.

7.3.1. Address poor incentives created by the lump-sum pay-out option

The introduction of the option to take assets accumulated in the SPP as a lump-sum at retirement has undermined the main objective of a pension system to provide a regular stream of income to people in retirement. Over 95% of people retiring now take the assets they have accumulated in the SPP as a lump sum. This means that the Peruvian pension system is no longer functioning in a way that will ensure that the assets accumulated will be used to finance individuals’ retirement in old age. Furthermore, it provides incentives for individuals to take financial decisions for their retirement that are not in their best interest, and allows individuals to arbitrage the rules of the system in ways that are costly to both individuals and to the SPP.

First, people have an incentive to retire as early as they possibly can. This combined with the REJA regime has resulted in a huge increase in the number of people retiring since 2015. Over three-quarters of the people who have retired since 2005 have retired in 2016 through 2018 alone, and 69% of these have done so through the REJA regime. Often, these individuals have been able to continue working after they remove their pension assets from the system, but no longer save and accumulate assets to finance their old age.

Second, people may make financial decisions that are not in their best interest even at a normal retirement age. If people take all of their money up front, they are not taking steps that will protect them from the longevity risk of outliving their assets in retirement. Furthermore, even if they take their money out and invest it elsewhere, they will be losing out on the tax advantage offered on investment income.

Finally, people have an incentive to contribute only briefly to the system in order to be eligible for health coverage by EsSalud in retirement. The premium paid to EsSalud is 4.5% of the accumulated balance, regardless of the duration of contributions made and the level of assets accumulated. With a very small contribution to the SPP as they near retirement age, they can benefit from health benefits for life. This will be an unsustainable situation for the government to finance going forward, because the contributions going to pay for coverage by EsSalud will not be sufficient to finance the benefits that will need to be paid out.

Ideally, following the OECD Roadmap for the Good Design of Defined Contribution Pensions Plans, there should not be an option to take accumulated assets as a lump-sum at retirement. Nevertheless, this option was approved by the Peruvian parliament and remains popular. Therefore, as a second best, measures to provide incentives to individuals to choose a pension over a lump-sum need to be put in place.

Require a minimum pension to be paid

In order to ensure that individuals have a minimum protection from the longevity risk of outliving their assets in retirement, they should be required to take a minimum level of pension income from the system before being allowed to withdraw a lump-sum. This level could be set at the level of the minimum pension established for the system.

Under the proposed system, combining a public and private pension component, this requirement could be met with the public pension benefit alone if the individual has contributed a sufficient number of years. However, where the public component does not provide a pension of at least the minimum wage, a portion of the individual account savings would need to be used to top it up. This could be done by taking a life annuity or a programmed withdrawal, perhaps subject to certain amount thresholds to limit unjustified administrative expenses for very small accounts.

Introduce financial incentives to encourage individuals to take a pension instead of a lump-sum

To limit taking a lump-sum for the amount of assets exceeding the minimum required pension, financial incentives could be used to encourage individuals to take a regular income rather than a lump-sum. Financial incentives to not take a lump-sum already exist in the form of the exclusion from tax on investment income if the assets remain invested within the pension system. These incentives are prospective and only impact future investment income. However, people are likely not even aware of these incentives, and they do not seem to be effective as people return to insurance companies to invest after they have taken a lump-sum rather than purchase an annuity straight away within the system.

The purpose of financial incentives is to encourage people to save to finance a lifetime income in retirement. Taking a lump-sum does not fulfil this purpose. Therefore, it seems justifiable that incentives put in place to save for retirement be removed for lump-sums, making this option more costly to the individual. Moreover, removing the tax advantage already accumulated retrospectively could be more effective because the individual would immediately feel the impact of the reduction in the assets they are able to take. From a behavioural perspective, taking away what the individual feels is already theirs (in this case, accumulated non-taxed investment income) is more painful than taking away something that they do not yet have (future tax-free investment income).4 Taking back this tax advantage would represent an additional tax withheld on their accumulated assets of 5.8% for the average earner with a full contribution history that would be felt immediately. If matching contributions or subsidies were also to be implemented, as suggested in this report, the assets accumulated as a result of these matching contributions should also be taken back. This will strengthen the financial incentive not to take a lump sum.

In addition to financial incentives targeting the members, financial incentives should also be in place to encourage the AFPs to promote the option of programmed withdrawals over the lump-sum option. The AFPs currently do not receive any management fee from pensioners taking programmed withdrawals, so have no incentive to talk individuals out of taking all of their assets out of the system. To better align incentives, the same fee structure should apply in the pay-out phase as applies to accumulation. Given that pensioners are expected to have a conservative investment strategy, the fee that is charged would not be expected to be very high.

Introduce incentives to limit gaming of the pension system

There should also be an incentive linked to health coverage. Individuals who have only contributed for a brief amount of time should not be entitled to receive full health coverage from EsSalud if they take a lump-sum. The eligibility for coverage should therefore be based on having achieved a minimum number and/or density of contributions.

Furthermore, the amount paid for coverage should not necessarily be independent of the age at which coverage begins. For individuals retiring early, excluding those who do so because of disability or illness, the percentage of assets withheld could be increased. This increase would intend to compensate for the lost contributions and investment returns that would have been included if the individual had worked until the statutory retirement age, as well as to account for the fact that they would expect to be receiving this health coverage for a longer period.

7.3.2. Simplify the options available

The options that individuals have for pay-out of their pension are extremely complex, particularly for the various types of annuities that they can choose. The main features that individuals have to decide upon are whether they want the annuity payments to be adjusted annually, whether they want the annuity payments to begin immediately or be deferred, and in which currency they would like payments to be made. However, virtually any combination of these features is possible, and depending on how this choice is presented to the individual, the choice could easily overwhelm them.

Individuals do not opt to take the more complex annuities offering multi-currency options and options that layer programmed withdrawals on top of the annuity. Given the lack of interest and risk of confusion, such complex products should not be part of the main pay-out choices presented to individuals. In addition, multi-currency options in particular present additional currency risks to individuals that they may not understand. The complexity of the choice may provide additional impetus for them to leave the system with their money, even if they intend to go back to an insurance company to purchase a simpler fixed-term annuity.

Significant progress has already been made to simplify the product offering. In 2010, the options available to cover retirement and survivor and disability risks reduced to 131 from 520. In 2018 this reduced further to only 28 products on average. The SBS’s goal is to reach a level of only 18 product options. Of these 18 options, insurance companies will be obliged to provide quotes for three specific products as well as two additional products of their choice.

Optionality around product features should be limited to basic and simple components. Multi-currency options, in particular, are too complex and should not be offered within a system that should aim to limit risks to pensioners.

While a reduction in options is necessary, one additional option that could better meet the needs of the population may be considered. Individuals have been showing a strong preference for guaranteed term annuities. As such, a lifetime annuity with a guaranteed period could be a valuable option to include, as it would provide a guaranteed payment to beneficiaries in case of death while protecting the pensioner from longevity risk. This is also an option that limits risk to the pensioners and should be relatively easy to understand.

7.3.3. Ensure the security of pension benefits

The ability of the pension system to deliver on its intentions and for people to trust that they will continue to get the income that they expect to receive in retirement is important for the legitimacy of the system. This is not only true for those taking annuity payments but also for those with programmed withdrawals. Therefore, it is essential that the assumptions used to calculate benefits are appropriate and in line with the macroeconomic and demographic realities, and that there are mechanisms in place to safeguard pensioners’ benefits, in particular in the case of insolvency of insurance companies.

Ensure the appropriateness of assumptions used to calculate benefits

One important aspect to ensure the security of benefits is making sure that the assumptions on which these payments are based are appropriate. Going forward, it will be important for the SBS to regularly review and update, if necessary, the mortality tables used for the calculation of annuity reserves and programmed withdrawal amounts. The Peruvian SPP is likely facing significant changes in the demographic composition of its retired population, as the majority of individuals retiring are now withdrawing their pension as a lump-sum. Those who choose to stay in the system and draw down their pension as income in retirement may represent a specific subset of the pensioner population whose mortality experience may be different from that of the current pensioner population. The impact of future changes to the retired population will therefore need to be accounted for in future revisions of the tables.

Product design should also aim to limit risks to pensioners. For example, the allowable deferral period for the option that combines a temporary programmed withdrawal with a deferred annuity needs to be extended in order to provide a higher and more stable income to pensioners throughout retirement. Currently, the accumulated assets are equally split between the temporary withdrawal phase and the purchase of a deferred annuity, and the annuity is only deferred from one to five years. This essentially functions as a mechanism to allow people to take half of their assets as a lump-sum while significantly reducing the income that the deferred annuity can provide. The OECD Roadmap for the Good Design of Defined Contribution Pension Plans suggests that an appropriate design for the pay-out phase could be a deferred annuity combined with a temporary programmed withdrawal, but the design referred to here is one with an annuity deferred to begin payments at an advanced age. The advantage of a longer deferral period is that a much higher level of income can be purchased with a given amount of assets. To purchase the same level of income beginning at age 80 that a nominal immediate annuity could provide at age 65, less than 25% of the assets are needed, and only 12% are needed to have the same level of income beginning at age 85.5 An annuity deferred only five years with 50% of the assets, however, will pay nearly 25% less than an immediate annuity beginning payments at 65.

Ensure that appropriate mechanisms are in place to safeguard pensioners’ benefits

A mechanism to protect the benefits that pensioners are entitled to should be in place. Two proposals have been considered, one within the wind-up procedure and one outside of it.

The first proposal to safeguard the assets backing the annuity books of insurance companies in the case of insolvency could be revisited. This would help to avoid any reductions in the benefits that pensioners are receiving if the insurance company providing them becomes insolvent.

Another option could be implementing an Insurance Policy Coverage Fund to insure a minimum level of benefits in the case of insolvency. Such schemes are relatively common in OECD jurisdictions. They can provide confidence in the pension system in a worst-case scenario of insurer insolvency, and they can help to promote competitive markets by providing a smooth procedure for unprofitable businesses to exit the market. One drawback of such arrangements, however, is the potential moral hazard for the company to take on more risks because they are insured and the insurance fund would pick up the resulting losses. In addition they present an added cost to the system, and an implicit subsidisation by well-managed companies to poorly managed companies (OECD, 2001[3]). The design of such schemes therefore needs to be carefully considered to limit these disadvantages.

References

[2] OECD (2014), Mortality Assumptions and Longevity Risk: Implications for pension funds and annuity providers, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264222748-en.

[3] OECD (2001), Policyholder Protection Funds: Rationale and Structure, http://www.oecd.org/finance/insurance/1813504.pdf

[1] SBS (2018), Desarrollo de Tablas de Mortalidad Aplicables al Sistema Privado de Pensiones del Peru, http://www.sbs.gob.pe/tmortalidad/documento_metodologico.pdf.

Notes

← 1. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

← 2. The OECD Roadmap was approved and endorsed by all OECD countries in June 2012.

← 3. The OECD provided technical assistance to develop the mortality tables.

← 4. This phenomenon is commonly referred to as the endowment effect.

← 5. This calculation is for a male aged 65 and assumes nominal payments and a discount rate of 6% (consistent with prevailing discount rates) and the Peruvian mortality tables developed for the SPP.