This chapter analyses the provision of green finance to small and medium-sized enterprises (SMEs) in Georgia. It discusses the experience of three banks most active in the Georgian market – Bank of Georgia, ProCredit Bank Georgia and TBC Bank. On this basis, the chapter discusses the sustainable energy challenges in Georgia, and the emerging policy context for green investment. These are analysed in terms of supply-side and demand-side policy measures. The chapter finishes by identifying possible policy responses to scale up green finance for SMEs in the country.

Access to Green Finance for SMEs in Georgia

Chapter 4. Climate finance for SMEs in Georgia

Abstract

4.1. Overview

There are a number of estimates at the national level of financing requirements for Georgia to meet its sustainable development and climate change targets. However, these do not specifically refer to small and medium-sized enterprises (SMEs). Estimates include the following:

USD 8.3 billion for 2017-30 for energy efficiency (National Energy Efficiency Action Plan) (NEEAP Expert Team, 2017[1])

USD 10.6 billion between 2017-30 for energy efficiency, non-energy greenhouse gas (GHG) and land use, land-use change, and forestry emission reduction (Low Emission Development Strategy) (Winrock and Remissia, 2017[2])

USD 2.4 billion for hydropower 2017-30 (Third National Communication of Georgia to the United Nations Framework Convention on Climate Change) (Government of Georgia, 2015[3])

USD 1.5‑2.0 billion for climate change adaptation over 2021‑30 (Intended Nationally Determined Contribution) (Government of Georgia, 2015[4])

A significant proportion of these financial flows is not directly relevant to SMEs. However, sufficient funds should be accessible to, and affordable for, Georgian SMEs. This would allow them to invest in green projects (e.g. energy efficiency, renewable energy sources). It would also help them develop the market for provision of green goods and services (e.g. energy-efficient building products). Green technologies are expensive and, in Georgia, about 90% of these technologies are imported1. Much can be done by both the government (e.g. making energy-efficiency standards mandatory, introducing tax relief on certain technologies) and the international community (e.g. international financial institutions can offer more diversified financial mechanisms rather than just loans) to make green technologies more affordable. Improving the availability and affordability of green investment will also reduce waste and transition SMEs towards more efficient and modern technologies. This, in turn, would help improve wider productivity and innovation in the Georgian economy.

The scope of “green finance” in this report refers to those investments that provide environmental benefits in the broader context of environmentally sustainable development such as investments in clean / renewable sources of energy, energy efficiency, reductions in air, water and land pollution, recycling and waste management, and clean transport. The European Union (EU) is currently developing EU Taxonomy of Sustainable Activities2, a classification of agreed definitions and terms of sustainable development types of projects which can qualify as green investments. This Taxonomy is expected to clarify many issues that bankers and investors have with regard to green investments and finance.

4.2. Georgian credit market

Retail lending has been one of the main drivers behind credit growth but due to recent regulatory changes the share of lending to SMEs and corporates has significantly increased. Corporate lending is constrained by existing indebtedness among corporate clients and the ability of larger firms to access cheaper international funding. Bank lending appears to work well, although capital market instruments remain underdeveloped.

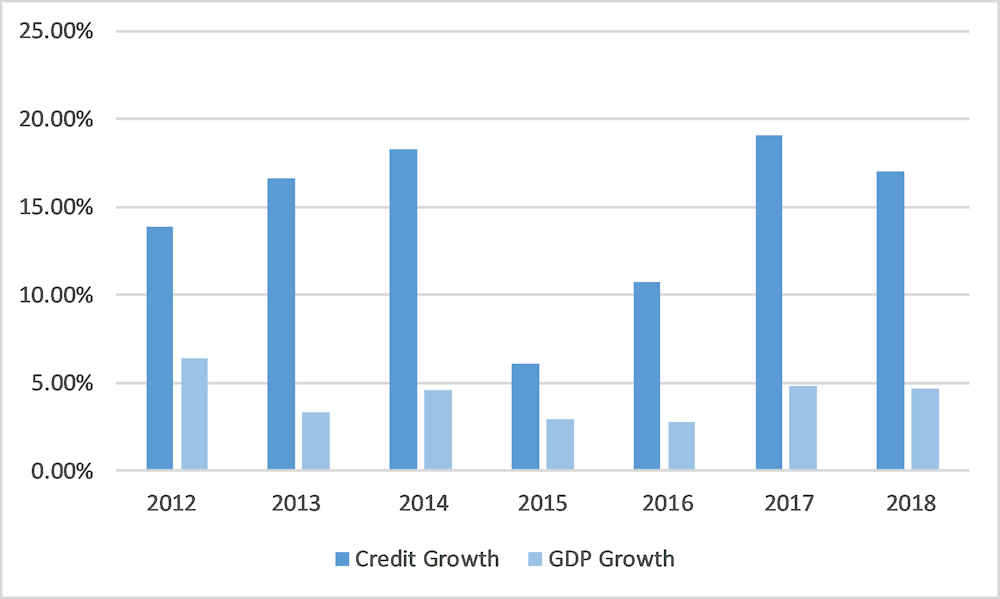

In terms of access to credit, the credit ratio to gross domestic product (GDP) is relatively high compared to other countries in the region. Growth in credit is higher than GDP growth and has increased over recent years.

Figure 4.1. Growth in credit vs GDP growth in Georgian banks, share per annum, 2012-18

Loan growth (both real and adjusted for the exchange rate) is generally higher than economic growth. There is an ongoing availability and volume of credit relative to GDP. Aggregate demand is the driving force for credit expansion with no evidence of a credit crunch (sharp reduction in credit availability).

Retail credit is one of the main drivers of loan growth (with a 20% year-on-year increase). The National Bank of Georgia (NBG) is addressing emerging risks to complement its dedollarisation strategy (e.g. limits on loan-to-value ratios). Retail credit penetration (32% of GDP) is relatively high. While concerns exist around rapid growth, safeguards appear to be in place. Retail loans represent 55% of credit in 2017, compared to 49% in 2014.

SME lending and access to finance has been flagged as the third most important obstacle to business (EBRD/World Bank Group, 2015[6]). However, the share of SMEs identifying this barrier is similar to other countries. SME credit as a share of overall corporate credit has been increasing over the last two years. Retail access to credit is also in line with other countries. The main issues relating to access to finance appear to be low levels of SME wealth/assets and existing indebtedness rather than bank lending policies per se.

There have been significant declines in interest rates on loans denominated in both GEL and foreign currencies, as well as in the loan-deposit spreads for both. Despite high levels of return on equity, banks do appear to be passing through economic gains into more competitive loan pricing. At present, GEL-USD interest rate spreads are the main driver of dollarisation. In the meantime, many SMEs have been happy to access foreign currency loans at lower interest rates, despite the currency exposure this can bring.

4.3. Green credit

To some extent, green finance is already available to support investment in energy, resource efficiency and green supply chains among Georgian SMEs. Credit lines, extended by international financial institutions (IFIs) and disbursed through local banks, are the main source of long-term financing for green investments for SMEs in Georgia and across the wider EU’s Eastern Partnership (EaP) countries (OECD, 2016[7]). At least eight banks and microfinance institutions have benefited from such IFI credit lines in Georgia.

Local banks on-lend to private sector clients (households, SMEs, larger industrial companies and renewable energy project developers). The end user and the local bank can often benefit from consultancy services and training to develop feasible projects.3

The tenor of the credit lines offered by IFIs is also often longer than that available to banks on the local market. Being able to match maturities and benefit from cheaper cost of capital provides some comfort to local banks, making them more willing to lend. Such credit lines facilitate access to longer-term finance that might otherwise be unavailable to SMEs. They also make it more feasible for these companies to borrow over timescales that match the payback periods for energy-efficiency investments.

In terms of interest rates, the cost of loans offered to SMEs does not directly reflect the cost of IFI credit lines. Loans are generally priced dynamically based on a borrower credit assessment and competition in the wider lending market. High cost of capital can make investments with potentially negative marginal abatement costs4 more expensive, thereby reducing the attractiveness of such investments to borrowers.

Most IFIs active in the region have opened environmental credit lines with local financing institutions (FIs). In Georgia, the primary IFIs involved have included the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), KfW (Germany), the Development Bank of Austria (OeEB). Two multilateral facilities (Green for Growth Fund (GGF) and the Global Climate Partnership Fund (GCPF) have also played important roles. The Green Climate Fund (GCF) has provided funds to EBRD for on-lending through the Sustainable Lending Financing Facility.

Box 4.1. IFIs involved in green financing in Georgia

More detail on the IFIs that have set up environmental credit lines in Georgia is provided below:

EBRD has operated a series of credit lines to six Georgian banks. Most recently under the EnergoCredit brand, EBRD provided a USD 125 million credit line programme to banks in the Caucasus region between 2007‑17. Partner banks included Bank of Georgia (BoG), Bank Republic (later acquired by TBC Bank), BasisBank, Credo Bank, TBC Bank and VTB Bank. In 2016, the Green Climate Fund agreed to a large energy-efficiency financing facility with EBRD of USD 375 million. It will support lending through financial intermediaries in ten countries alongside USD 1 billion of EBRD co-financing. In addition, in 2017, EBRD provided credit lines to BoG and TBC Bank through the Deep and Comprehensive Free Trade Area (DCFTA) facility, targeting SMEs and supporting investments in energy efficiency.

The European Investment Bank (EIB) has supported a number of banks through integrated SME and environment loans. EIB has provided EUR 165 million for SMEs through three Georgian banks (BoG, TBC Bank, ProCredit Bank). The EIB Group also provides partial portfolio credit guarantees under the EU Finance for Innovators (InnovFin)5 and DCFTA programmes, so far to TBC Bank and ProCredit Bank. EIB has also supported the microfinance sector that provides microlending to small and micro businesses in Georgia (Credo Bank).

KfW provided a EUR 25 million loan to BoG. It was supported by a EUR 0.75 million technical assistance package, with a risk-sharing facility supported by OeEB in 2012. The facility, with a maturity of ten years, is mainly used to provide long-term loan finance for the construction or rehabilitation of small-sized hydropower plants up to 20 megawatts.

OeEB provided ProCredit Bank with a USD 15 million credit line for SME energy efficiency in 2012. OeEB also supports a range of relevant technical advisory and risk-sharing facilities in the Caucasus. These include financing the National Cleaner Production Center in Georgia, set up by the United Nations Industrial Development Organization and the United Nations Environment Programme. They also include a risk facility supporting a KfW loan supporting small hydropower development through BoG.

Green for Growth Fund provided a USD 15 million credit line to BoG for energy-efficient housing in 2014. It provided a USD 15 million credit line to TBC Bank in 2015 for renewable energy (RE)/EE lending activities. Finally, it provided a USD 5 million credit line to Bank Republic (TBC Bank since 2016) for green lending to households.

GCPF provided a USD 25 million debt facility to TBC Bank to support renewable energy development in Georgia in 2017.

Source: Various fund websites and personal communication with staff of the banks.

Table 4.1 sets out Georgian banks that have received IFI-supported credit lines since 2008.

Table 4.1. Overview of Georgia’s financial institutions receiving IFI support

|

EBRD |

EIB |

FMO |

GCPF |

GGF |

KfW |

OeEB |

|

|---|---|---|---|---|---|---|---|

|

Bank of Georgia |

X |

X |

X |

X |

Xa |

||

|

Bank Republic |

X |

X |

X |

||||

|

Basis Bank |

X |

||||||

|

Credo Bank |

X |

X |

|||||

|

Crystal Microfinance |

X |

||||||

|

ProCredit Bank |

X |

||||||

|

TBC Bank |

X |

X |

X |

X |

X |

X |

X |

|

VTB Bank |

X |

Notes: FMO = Dutch Entrepreneurial Development Bank; GCPF = Global Climate Partnership Fund; GGF = Green for Growth Fund; KfW = Kreditanstalt für Wiederaufbau; OeEB = Development Bank of Austria. Xa - Unfunded risk-sharing facility alongside a KfW loan.

Source: Authors’ review of IFI/fund reports.

Microfinance institutions, institutional investors and non-financial sector corporations play a limited role in financial flows for climate action in Georgia. Some microfinance organisations, such as MFO Crystal, are making progress in designing and providing loans to energy-efficiency activities and smaller-scale, often decentralised, renewable energy facilities. The same is true for commercial banks that primarily target SMEs, such as JSC ProCredit Bank. The Dutch Entrepreneurial Development Bank (FMO) started to work with MFO Crystal on a green microfinance programme in 2017.

There have also been examples of domestic equity investments. For example, the government-owned JSC Partnership Fund made equity investments in the production of green construction materials in 2016. However, these investments tend to be oriented towards medium and large companies or platforms. Georgia also participates in the Global Energy Efficiency and Renewable Energy Fund programme, which finances private equity investors making green investments.

4.4. Local banks that provide green finance in Georgia

This subsection sets out the experience of the three most active banks in providing green finance in Georgia – BoG, ProCredit Bank Georgia and TBC Bank (in alphabetical order). All three offer a mixture of SME and corporate lending products depending on the size of client. All three have also participated in IFI green credit lines. However, each has taken a different approach to SME green finance.

BoG, one of the two leading banks in Georgia, operates a broad spectrum of services. The bank services 2.5 million clients through a network of 271 retail branches and has approximately a 35% market share in terms of total assets, loans and customer deposits. It operates a multi-brand strategy in retail banking, which consists of emerging and mass retail (Express and flagship branches, express pay-terminals, mobile and internet banking), Solo (banking products and services for more affluent segments), and micro/SME segment. It also provides banking services to its corporate clients. BoG is the leading corporate lender in Georgia, servicing more than 2 500 businesses across a range of sectors, including trade, energy industry and tourism. It also serves as the country’s leading trade finance business and provides leasing services through its wholly-owned subsidiary, Georgian Leasing Company. The bank is the core entity of Bank of Georgia Group PLC (the Group), listed company on the premium segment of the London Stock Exchange’s main market for listed securities, which is a constituent of the Financial Times and Stock Exchange (FTSE) 250 Index. The Group also provides a range of services through corporate advisory, debt and equity capital, market research and brokerage practices under its wholly-owned subsidiary Galt and Taggart. BoG has been a leading proponent of green lending in the Georgian market. It has taken multiple credit lines with IFIs to promote energy efficiency and renewable energy lending (EBRD, EIB, KfW and GGF).

TBC Bank is a universal bank operating in Georgia that serves retail, SME and corporate clients. In 2016, TBC Bank purchased Bank Republic from Societe Generale, making it the largest Georgian bank in terms of loans and deposits. Its share of total loans reached nearly 38% and its share of non-banking deposits reached nearly 39% at the beginning of 2018, according to the National Bank of Georgia. It has more than 2 million clients and 170 branches across Georgia. TBC Bank is listed on the London Stock Exchange and is a constituent of the FTSE 250 index. It has received a number of credit lines from five IFIs to promote energy efficiency and renewable energy investments, as well as to support green growth for corporates and SMEs.

ProCredit Bank Georgia has been operating in the Georgian banking sector since 1999. Its core aim is to finance SMEs alongside retail clients. ProCredit Bank Georgia is part of the international ProCredit group of banks operating mainly in Eastern and South East Europe, as well as in Germany. ProCredit Holding, the parent company, serves the SME business sector, offering comprehensive banking services based on the German “Hausbank” principle. The ProCredit group is listed on the Frankfurt Stock Exchange’s Prime Standard. The Co-finance Programme between ProCredit Bank Georgia and ProCredit Bank Germany allows Georgian SMEs with larger financing requirements (EUR 750 000–5 million) to be financed at preferential interest rates. ProCredit has a strong social and environmental policy, with an environmental management system. It was the first bank in Georgia to obtain ISO 14001 certification. ProCredit Bank offers Eco Loans to support investments in energy-efficient materials and equipment supporting both SMEs and households to improve productivity and efficiency. Retail loans are offered for housing upgrade and electric transport transition, but are not branded explicitly as eco-loans. The Bank’s green lending constitutes 16% of its total loan portfolio.

All three banks benefit from access to international capital markets and well-developed governance models (either through their main shareholder or as a result of listing on established stock exchanges).

4.5. Key success factors

All three banks share several differentiating features that have enabled them to successfully participate in providing green credit to the SME sector. Senior management and staff identified the following common key reasons for their success:

Senior management buy-in and support: All the banks demonstrate strategic support at senior management level for engagement in the environmental finance market with a clear view of the benefits this can bring for market share and profitability. They also engaged early with IFI lending programmes to support energy efficiency and renewable energy on-lending. Together with strong commitment to international governance standards and environmental and social mandate, this early engagement allowed all three banks to build strong reputations and skills in the marketplace.

Standard bank product development: All three banks have sought to align support from international IFIs and donors into standard products aligned with their core client base. Where each IFI has different lending and reporting criteria, these tend to be blended from a front-end perspective – with the concessionality and tenor blended and packaged for clients. This has allowed the banks to take full product ownership, rather than just act as an intermediary for individual IFI lending operations.

Dedicated in-house capacity: All three banks have dedicated significant internal resources to developing and promoting energy efficiency and renewable energy lending products on the Georgian market. This has included building capacity in loan appraisal (e.g. the incorporation of energy savings into cash-flow and payback analysis). It has also included renewable energy product finance; marketing; training for branch staff in promoting products; and environmental reporting (e.g. energy savings, GHG emission calculations).

Economies of scale: All three banks, as the leading financial institutions in Georgia, have a well-established client base. This has provided them with a strong and diversified pipeline of customers for energy efficiency and renewable energy finance products. The client profile is highly diversified from a sector profile. The banks have been able to achieve economies of scale in product development and distribution. All three have strong marketing capacity to promote the product using client success stories. All three also have international share capital that has allowed them to maintain a level of financial robustness during periods of political and economic stability.

Ability to work with international donors: All three banks enjoy strong corporate governance regimes and international shareholder base. This has facilitated co‑operation with IFIs, which often struggle to engage with banks that present reputational risk.

4.6. Key challenges

There is a lack of affordable long-term capital for smaller-scale SMEs in Georgia. This can severely impact their ability to make investments in clean energy, energy efficiency and other sustainability improvements. Discussions with representatives of the three banks identified several challenges that prevent the scale up of green finance to the SME market in Georgia. These are outlined below.

Supply side

Definition of SMEs and large average loan size: Georgian banks co‑operating with IFIs to disburse green credit lines use international standards for defining and reporting on the eligibility of borrowers (see earlier discussions on SME definitions). As a result, funds have tended to flow to larger companies, often classified as corporates in the Georgian context (although classified as SMEs under EU standards). For this reason, the average SME loan size for energy efficiency has been relatively large (often in excess of USD 1 million) for BoG and TBC Bank. Further, much of the loan business has originated through their corporate banking departments rather than through their SME departments. The same is true for ProCredit Bank. The size of its SME loan under the Eco-Loan programme at EUR 750 000–5 million is significantly larger than what smaller businesses might require. It is attractive for banks to issue smaller numbers of larger loans as this reduces transaction costs. This, in turn, allows the banks to target more creditworthy customers and increases their potential return on capital.

A tendency to direct green finance towards hydropower development: Some of the early green credit lines negotiated with IFIs (e.g. EBRD’s Energocredit facility) were structured to be interchangeable across renewable energy and energy efficiency. This reflected concerns over the lack of demand for energy-efficiency borrowing at sufficient scale to allow for credit-line disbursement according to envisaged timescales. As a result, significant funds were used for hydropower projects rather than SME lending. Hydropower in Georgia has attracted significant private investor interest (both domestic and international). Moreover, local banks in Georgia have developed strong capacity in evaluating and investing in such projects. These projects became attractive due to the availability of power purchase agreements and other policy support.

Opportunity costs for banks: Banks are often faced with opportunity costs when deciding whether to actively promote green lending products to the SME sector. When lending to SMEs, banks often have a range of more “straightforward” and shorter-term products (e.g. standard SME finance) that can provide good returns and for which there is a growing market. Banks can also choose instead to target other larger and more profitable segments through their branch networks (e.g. mortgage finance, retail banking). There are opportunity costs for investing in what are perceived to be green lending products with a potentially smaller customer base and higher transaction costs. This is especially the case where there are more stringent eligibility and reporting requirements. Often, particularly when co‑operating with IFI credit lines, significant transaction costs are associated with SME green lending. These could include more complex loan applications, energy audits, feasibility studies, monitoring and reporting of results. These can make such loans less profitable or require higher pricing. It remains to be seen how many of the banks that have co‑operated with IFIs will continue to offer green lending products once their credit lines are disbursed.

Insufficient capacity for appraising green projects in banks: Banks have been relatively slow to understand the green lending market. The use of minimum energy-saving criteria can mean that cash-flow and project-finance analysis should be used alongside more mainstream standard credit assessment procedures. The use of project finance is still relatively rare in the SME space in Georgia (and elsewhere). Lending decisions are usually based on standard credit decision criteria. Banks are also initially risk averse as they lack familiarity with the green technologies and processes being financed. They may also be unaware of what types of projects within their wider lending portfolio may be suitable for green finance. Banks may also prefer to fund projects that increase capacity and productivity (where potential returns are clear) rather than those that simply reduce costs. Energy-efficiency projects often have rapid payback periods [see (OeEB, 2015[8])]. However, the short tenor and high cost of finance in Georgia make the prospect of resource efficiency less attractive than it might otherwise be.

Constraints around equity investment: Public and private sector investors have provided equity investments, particularly to larger-scale renewable energy and hydropower projects. However, equity is much less available for smaller-scale, non-hydro renewables and energy-efficiency projects. Capital markets are underdeveloped in Georgia. As a result, SMEs looking to scale their operations into sustainable development sectors lack access to angel investors, venture capital or private equity investors.

Demand side

Lack of awareness among borrowers: There is a lack of awareness among potential borrowers (particularly smaller SMEs) of the potential benefits accruing from investments in energy-efficiency projects. This is combined with exaggerated perceptions of risk associated with technology and financing. Borrowers do not view their capital investment programmes specifically in terms of energy efficiency or climate change benefits. Often, those making investment decisions are unaware of the real payback periods associated with such investments. They may have a poor understanding of the co-benefits in terms of improved quality and productivity. Investment in green technologies or energy efficiency for SMEs may often be regarded as an opportunity cost at the expense of increasing production or developing new products. SMEs may not know about the full range of best practices that can be integrated alongside capital investment and how they can also improve financial returns on projects.

Incomplete strategic and regulatory frameworks continue to limit demand for sustainable energy finance. The incremental development, adoption and implementation of national energy-efficiency policies and associated sub-regulations serve to constrain the potential market for sustainable energy finance. Ongoing energy subsidies for fossil fuels also distort investment decisions, although recent pricing reform is now beginning to drive demand. An OECD study on energy subsidies in the EU Eastern Partnership countries shows that in the natural gas sector in Georgia, consumption is significantly subsidised, for the needs of both electricity generation and distribution for heating and cooking. Natural gas subsidies come in the form of regulated tariffs, value-added tax exemption and direct budget transfers (OECD, 2018[9]).

Box 4.2. Examples of criteria for ProCredit Bank eco loans

ProCredit Bank offers eco loans for SMEs to address a range of efficiency upgrades and renewable investments. Examples of qualifying investments include the following:

Production processes – replacing old machines or equipment or purchasing additional machines or equipment

Building envelope – applying thermal insulation to external walls/ceilings/floors and installing double-/triple-glazed windows or doors

Electrical equipment – purchasing high-efficiency electric motors, new lighting systems, appliances rated A+ and above, etc.

Heating or cooling – installing new central heating/cooling systems, boilers, air conditioners, etc.

Waste management – separation of waste, recycling (paper, plastic, glass) prevention of waste, etc.

Renewable energy sources – installing solar water heating systems (flat collectors, vacuum tube collectors), ground heat pumps or biomass boilers (wood, pellet, etc.).

Source: ProCredit Bank.

4.7. Policy response

Providing smaller-scale SMEs with improved access to finance for green investment has been difficult. The government has been exploring this challenge during the development of recent climate-related development frameworks.

Both the Low Emission Development Strategy (LEDS) and the draft National Energy Efficiency Action Plan (NEEAP) stress the need for funding mechanisms to support the scale up of green finance. These would be supported by a broader national focus on investment promotion and facilitation and financial market development (although not necessarily focused on SMEs).

NEEAP has proposed a dedicated agency6 that would seek to scale green investment. It would target such areas as green infrastructure, energy efficiency and potentially renewable energy (OECD, 2018[10]). Such an agency would have the following qualities:

be managed as an independent agency outside of the ministry structure

have a longer-term financing period (e.g. two-three years) for more strategic planning

support donor co‑ordination

facilitate blended finance to support other public and private sector investment

be capitalised from budgetary resources

be supported over time through other revenue streams (e.g. energy bills; taxes on inefficient goods and services such as vehicles; and environmental fines).

LEDS has also explored a range of options for mobilising green finance, including the following:

developing a climate finance strategy roadmap

establishing a national green investment bank

creating a climate finance task force to improve budgeting, planning and analysis

improving the use of blended finance

exploring bond finance for climate-related projects.

Any funds (whether a national investment bank or other financing platform) must clearly be able to work alongside platforms to achieve the reach and distribution to address SME financing challenges. One option would be to partner with Enterprise Georgia and the commercial banking sector (see Annex A). Such an approach could incorporate green criteria into their existing concessional support for SMEs in the “Produce in Georgia” Programme.

References

[6] EBRD/World Bank Group (2015), The Business Environment in the Transition Region (based on the Business Environment and Enterprise Performance Survey), European Bank for Reconstruction and Development, London; World Bank Group, Washington, DC, https://ebrd-beeps.com/wp-content/uploads/2015/07/BEEPSV-complete.pdf.

[4] Government of Georgia (2015), Georgia’s Intended Nationally Determined Contribution, United Nations Framework Convention on Climate Change, Bonn, http://www4.unfccc.int/submissions/INDC/Published%20Documents/Georgia/1/INDC_of_Georgia.pdf.

[3] Government of Georgia (2015), Third National Communication of Georgia to the UN Framework Convention on Climate Change, United Nations Development Programme, Tbilisi, https://www.ge.undp.org/content/georgia/en/home/library/environment_energy/third-national-communication-of-georgia-to-the-un-framework-conv0/.

[5] NBG (2019), Key Macroeconomic Indicators and International Ratings, National Bank of Georgia (database) (accessed 23 October 2019), https://www.nbg.gov.ge/index.php?m=494&lng=eng.

[1] NEEAP Expert Team (2017), Draft National Energy Efficiency Action Plan, Report Commissioned by EBRD, National Energy Efficiency Action Plan, Tbilisi.

[9] OECD (2018), Inventory of Energy Subsidies in the EU’s Eastern Partnership Countries, Green Finance and Investment, OECD Publishing, Paris, http://www.oecd.org/env/inventory-of-energy-subsidies-in-the-eu-s-eastern-partnership-countries-9789264284319-en.htm.

[10] OECD (2018), Mobilising Finance for Climate Action in Georgia, Green Finance and Investment, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264289727-en.

[7] OECD (2016), Environmental Lending in EU Eastern Partnership Countries, Green Finance and Investment, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264252189-en.

[8] OeEB (2015), Energy Efficiency Potential. Final Country Report: Georgia, Energy Efficiency Finance II TASK 1, Development Bank of Austria, Vienna, https://www.oe-eb.at/dam/jcr:c480882f-df26-4d62-9901-d6e25e2a4ec1/OeEB-Study-Energy-Efficiency-Finance-Georgia.pdf.

[2] Winrock and Remissia (2017), Georgia Low Emission Development Strategy Draft Report, commissioned by the USAID-funded EC-LEDS Clean Energy Program, Winrock International and Sustainable Development Center, Little Rock, US.

Notes

← 1. Information provided by EBRD during the Policy Dialogue meeting in Tbilisi in July 2019.

← 2. The EU taxonomy is a tool to help investors understand whether an economic activity is environmentally sustainable. The EU taxonomy contains (i) technical screening criteria for 67 activities across 8 sectors that can make a substantial contribution to climate change mitigation; (ii) a methodology and worked examples for evaluating substantial contribution to climate change adaptation; (iii) guidance and case studies for investors preparing to use the taxonomy.

← 3. Discussions with Georgian commercial banks indicate that green loans are normally priced in a way similar to other types of SME lending.

← 4. Marginal abatement costs can be negative when the low-carbon option is cheaper than the business-as-usual option. However, marginal abatement costs can often rise steeply as more pollution is reduced.

← 5. The InnovFin SME Guarantee scheme aims to facilitate and accelerate access to loan finance for innovative SME businesses and provides guarantees on debt financing between EUR 25 000 and EUR 7.5 million.

← 6. This agency is envisaged to function more like a supervisory board that will be tasked to oversee energy efficiency issues in the country. The government of Georgia is reconsidering establishment of such an agency but final solution is still pending.