This chapter assesses the merits of inducing private finance in water supply and inland water transport. It discusses infrastructure investment needs in the region, with particular focus on private participation. It introduces the concept of spillover tax revenues, which are also known as indirect or secondary revenues, or externality effects. The chapter also shows the importance of the spillover effect of water supply and inland water transport on the economy. It then examines financing for water supply through bank loans, insurance funds, pension funds, revenue bonds and equity investment. Finally, it proposes alternatives for financing water supply and inland water transport. This includes returning fractional spillover tax revenues to investors in water projects and offering financing for start-up businesses and small and medium-sized enterprises near the water supply.

Innovation for Water Infrastructure Development in the Mekong Region

3. Inducing private finance to water supply and inland water transport using spillover tax revenues

Abstract

Introduction

Water is a necessary public good. While water supply is mostly the domain of the public sector, private investors could help expand the water networks and thus increase the usable water supply. Many countries in the Mekong region lack proper water supply, sanitation and inland water transport. Water supply improvements may create new economic opportunities through spillover effects. Businesses and housing may be attracted to areas that were previously ignored because of the inherent water access difficulties.

Insurance corporations and pension funds are gradually expanding and looking to enlarge their long-term investment portfolios in each country. Public sector funding alone cannot cover the huge demand for infrastructure construction. The engagement of institutional investors such as insurance corporations and pension funds could develop much more infrastructure. Furthermore, private investors could also finance inland water transport, provided that the risk-adjusted rates of return are attractive enough. Nevertheless, high costs and limited returns may be discouraging private sector involvement.

This chapter assesses the merits of inducing private finance in water supply and inland water transport. It discusses infrastructure investment needs in the region, with particular focus on private participation.

Huge needs for infrastructure investment in Asia

Asian countries need different types of infrastructure. Table 3.1 shows the infrastructure investment needed in Asia and the Pacific, as estimated by the Asian Development Bank (2017[1]). The electricity sector has the highest need for infrastructure investment, representing 51.8% of the total, followed by transport, telecommunications, and water and sanitation.

Table 3.1. Infrastructure investment needed in Asia and the Pacific, 2016-30

(USD billion in 2015 prices)

|

Sector |

Baseline estimates |

||

|---|---|---|---|

|

Investment |

Annual average |

Share (%) |

|

|

Electricity |

11 689 |

779 |

51.8 |

|

Transport (including inland water transport) |

7 796 |

520 |

34.6 |

|

Telecommunications |

2 279 |

152 |

10.1 |

|

Water and sanitation |

787 |

52 |

3.5 |

|

Total |

22 551 |

1 503 |

100 |

Source: (Asian Development Bank, 2017[1]).

Spillover effects from water infrastructure investment

Infrastructure investment can boost economic growth

Infrastructure investments increase productivity, in addition to creating massive spillover effects for the economy. Yoshino and Nakahigashi (2004[2]) and Nakahigashi and Yoshino (2016[3]) used macroeconomic data of Japan to estimate the impact of infrastructure investment on the economy. Infrastructure construction, for example, has direct effects by increasing production in key sectors that support construction, among others. Indirect effects, also known as spillover or externality effects, arise from increased production and employment induced by infrastructure investment (Yoshino and Nakahigashi, 2004[2]). As an example of an indirect effect, infrastructure such as water supply will rely on various materials and equipment as inputs. This will in turn lead to job creation in subsectors involved in the manufacturing of these inputs and construction of the project. Infrastructure could also generate a variety of spillover effects. It has the potential to attract private businesses to the region. New retail outlets and factories could be constructed, resulting in higher regional output. This, in turn, will bring employment to the region, increasing consumption and demand for new housing. Improved water supply could prompt the construction of new office buildings and new housing units, which will increase the efficient use of land along the water supply. Water transport could also facilitate tourist and goods flows from neighbouring countries. For instance, the construction of a shopping centre in the port is typically followed by restaurant openings and more hotels could be built in the vicinity of ports, taking advantage of tourists’ preference for proximity. All these economic activities could create new jobs in the region.

Table 3.2 provides estimates of the direct effect of infrastructure investment and its spillover effects based on Japanese macro-level data. In 1966‑70, the direct effect of infrastructure investment in increasing output was 0.638 (first row). The spillover effect of increasing output induced by growth in private capital was 0.493 (second row), and the spillover effect of increasing output by growth in employment was 0.814 (third row). The biggest spillover effect was increased employment, which contributed to an increase in output (third row). The last row of Table 3.2 presents the share of the total effect of infrastructure investment in Japan from spillover effects. These proportions are quite high at about 66‑68%.

Table 3.2. Estimates of spillover effects on increased output in Japan

|

1956‑60 |

1961‑65 |

1966‑70 |

1971‑75 |

1976‑80 |

1981‑85 |

|

|---|---|---|---|---|---|---|

|

Direct effect of infrastructure investment |

0.696 |

0.737 |

0.638 |

0.508 |

0.359 |

0.275 |

|

Spillover effect through private capital (Kp) |

0.452 |

0.557 |

0.493 |

0.389 |

0.270 |

0.203 |

|

Spillover effect through employment (L) |

1.071 |

0.973 |

0.814 |

0.639 |

0.448 |

0.350 |

|

Spillover effects of infrastructure investment (percentage) |

68.644 |

67.481 |

67.210 |

66.907 |

66.691 |

66.777 |

|

1986‑90 |

1991‑95 |

1996‑2000 |

2001‑05 |

2006‑10 |

||

|

Direct effect of infrastructure investment |

0.215 |

0.181 |

0.135 |

0.114 |

0.108 |

|

|

Spillover effect through private capital (Kp) |

0.174 |

0.146 |

0.110 |

0.091 |

0.085 |

|

|

Spillover effect through employment (L) |

0.247 |

0.208 |

0.154 |

0.132 |

0.125 |

|

|

Spillover effects of infrastructure investment (percentage) |

66.222 |

66.200 |

66.094 |

66.122 |

66.139 |

Source: (Nakahigashi and Yoshino, 2016[3]).

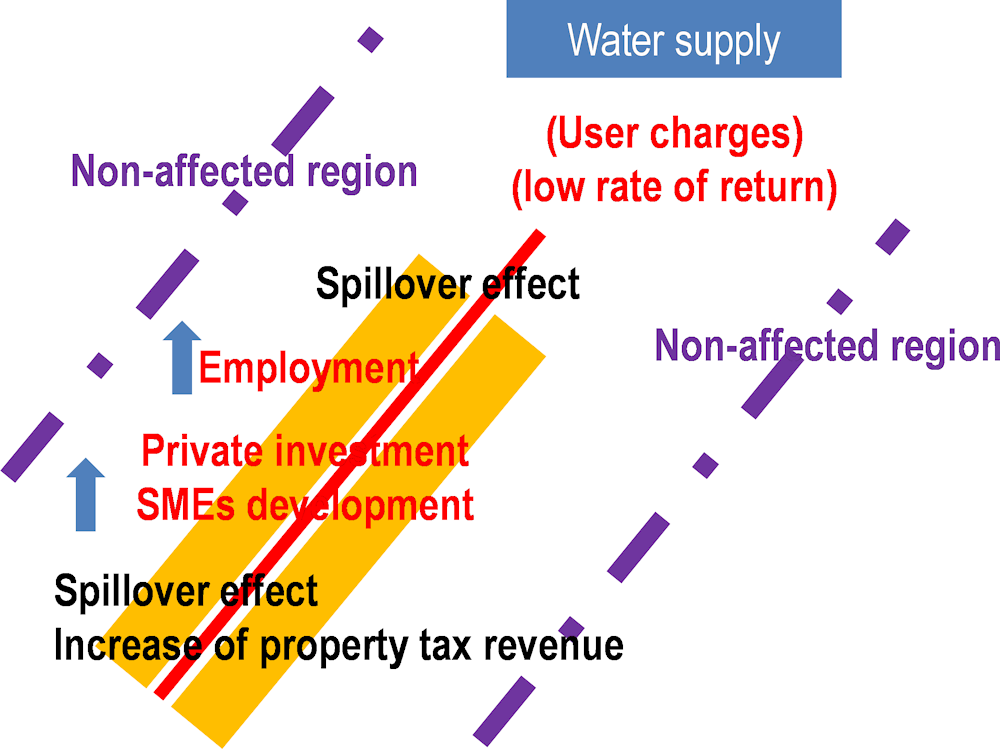

Figure 3.1 illustrates the spillover effects of the water supply. The red diagonal line represents the water supply and new water supply to be constructed. Along these water supply corridors, new industries and companies could come into the region to set up manufacturing activities. Apartments for housing are likely to be constructed along the new water supply routes, followed by restaurants and other service sector establishments. Hence, the yellow part of Figure 3.1 depicts the spillover effects created by the new water supply.

This economic development will have positive effects on regional output. This, in turn, will lead to an increase in both local and central government tax revenues. Past experience has shown, however, that all these incremental tax revenues mainly benefitted local and central governments rather than being returned to water supply companies that relied solely on user charges as source of returns. This state of things has been deterring many private investors from investing in water supply projects. Water supply thus relied on public money, which restricted expansion in many parts of developing Asia. The rate of return from the water supply would increase if spillover tax revenues were partly returned to private investors. This, in turn, would encourage private investors such as insurance corporations and pension funds together with banks to invest in water supply, which could expand the water supply network.

Figure 3.1. Spillover effects of water supply

Note: SMEs = small and medium-sized enterprises.

Source: Authors.

Estimates of spillover effects of infrastructure investment on connectivity

This section estimates spillover effects of three cases of infrastructure investment in Asian countries: the railway in Uzbekistan, the high-speed railway on Kyushu Island in Japan and the expressway in Manila (Yoshino and Pontines, 2018[4]). It defines a dummy variable for before and after the construction periods by taking the difference in the tax revenues between two regions. Specifically, it takes a value of 1 for the region along the infrastructure and 0 for other regions where there was no impact from the infrastructure investment.

As shown in Table 3.3, the economy along the railway in Uzbekistan grew by 2 percentage points more than in other regions. This difference was due to the spillover effects after the railway connected the production region to the market, which generated additional tax revenues for the government (Yoshino and Abidhadjaev, 2017[5]).

Table 3.3. Estimated difference in gross domestic product before and after railway construction in Uzbekistan

|

Region group |

Outcome |

Pre-railway period 2005‑08 |

Post-railway period 2009‑12 |

Difference (percentage points) |

|---|---|---|---|---|

|

Non-affected group |

Average GDP growth rate (percentage) |

8.3 |

8.5 |

0.2 |

|

Affected group |

Average GDP growth rate (percentage) |

7.2 |

9.4 |

2.2 |

|

Difference |

2.0 |

Note: GDP = gross domestic product. Affected group includes the regions of Samarkand, Surkandharya, Tashkent and the Republic of Karakalpakstan.

Source: (Yoshino and Abidhadjaev, 2017[5]).

This difference-in-difference approach represents the effect of the treatment, which in this case is the railway project in Uzbekistan.

Table 3.4 shows the case of the Star Highway in Manila (Yoshino and Pontines, 2018[4]). The periods and indicate periods under construction. At the end of , the highway had been completed and started operation. For Batangas City (last row), tax revenues increased from nearly PHP 491 billion without construction () to over PHP 622 billion (Philippine peso) and PHP 652 billion after construction had started ( and ).

During the highway construction, construction workers and related construction projects came to the region, which increased regional GDP. At the end of , the Star Highway had been completed. Then, at , tax revenues diminished compared with the construction period until after the fourth year when tax revenues increased drastically. At , tax revenues reached PHP 1 208 billion, about twice as much as before the construction. These are the spillover tax increases coming from infrastructure investment, in this case the Star Highway.

These tax revenues are the increases, not the existing tax revenue. Due to the highway construction and increased economic activities, Batangas City had gained tax revenues of PHP 1 208 billion by because of the highway construction and increased economic activities. If part of these incremental tax revenues (PHP 1 209 billionPHP 490 billion) were to be returned to private investors, it is highly likely that they would be willing to invest in the construction of the highway. The same effects apply to the construction of new water supply infrastructure.

Table 3.4. Calculated increase in business tax revenues for the beneficiary group relative to non-beneficiary group

(PHP million)

|

Region |

t-2 |

t-1 |

t |

t+1 |

t+2 |

t+3 |

t+4 |

|---|---|---|---|---|---|---|---|

|

Lipa City |

134.36 |

173.50 |

249.70 |

184.47 |

191.81 |

257.35 |

371.93 |

|

Ibaan City |

5.84 |

7.04 |

7.97 |

6.80 |

5.46 |

10.05 |

12.94 |

|

Batangas City |

490.90 |

622.65 |

652.83 |

637.83 |

599.49 |

742.28 |

1 209.61 |

Source: (Yoshino and Pontines, 2018[4]).

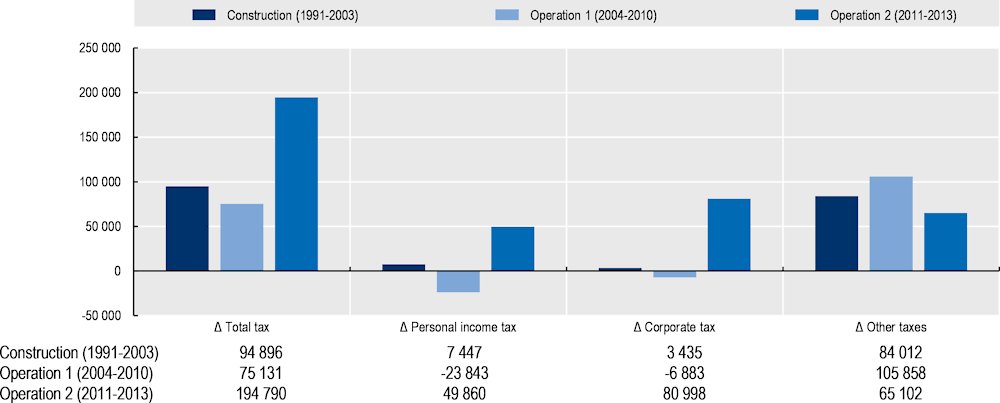

In the case of the high-speed railway of Kyushu Railway Company (JR Kyushu) in Japan (Yoshino and Abidhadjaev, 2017[6]), the study compared tax revenues in three periods: (i) the construction period; (ii) the operational period without good connectivity; and (iii) the operational period with good connectivity to large cities such as Osaka and Tokyo. It also compared total tax revenues, as well as revenues from personal income tax, corporate tax and other taxes (including property tax), for the three different periods (Figure 3.2). When construction started, speculators who anticipated a significant rise of property values started buying land along the high-speed railway. This caused property tax revenues to increase significantly (denoted in Figure 3.2 as “other taxes”). The project involved hiring many workers and construction companies in the region, which increased revenue from both personal and corporate taxes. Due to the operational period when there was no connectivity with large cities such as Osaka and Tokyo, revenues from personal income tax and corporate tax decreased in the short term compared to the construction period. Eventually, connectivity with Osaka and Tokyo brought businesses and passengers into the region, which created a dramatic increase in corporate and individual income taxes associated with local economic expansion. Furthermore, the expectation of continued increases in the value of property proximal to the railway increased property tax revenue, as is shown in “other taxes” revenues in Figure 3.2.

Figure 3.2. Changes in tax revenues by connectivity in high-speed railway

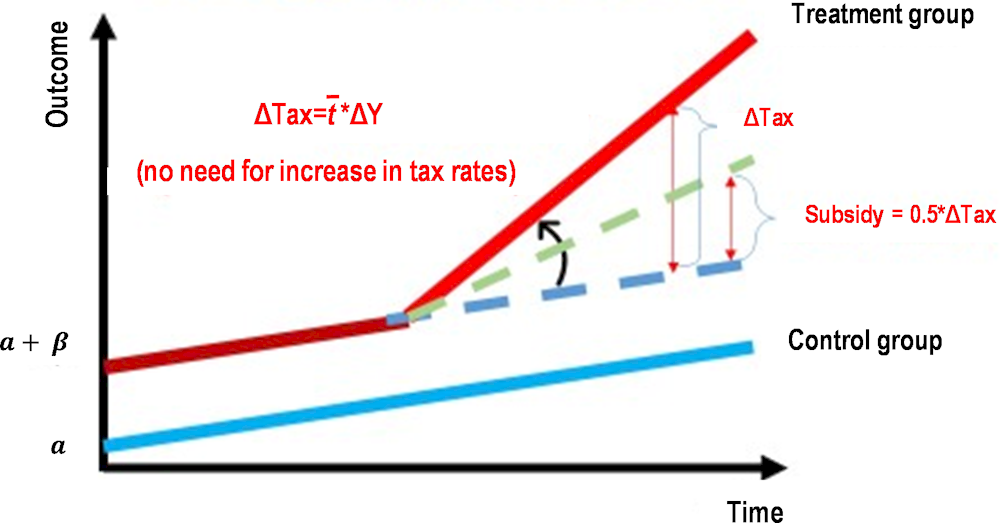

The spillover effects can be ascertained through the following procedure, presented diagrammatically in Figure 3.3:

1. Compute the national average growth rate of tax revenues in each tax category, such as corporate tax, personal income tax, property tax, sales tax, etc.

2. Compute the growth rate of all tax revenues along the newly constructed infrastructure, such as roads, highways, railways, water supply, etc.

3. Take the difference between (1) and (2) by defining the difference as spillover effects.

Figure 3.3. Spillover tax revenues of affected region vs. national average tax revenues

Source: Authors.

Without investment in infrastructure, the government would not obtain the increased tax revenues. Part of the tax revenues could be distributed to private investors who financed the infrastructure without decreasing existing tax revenues of local and central governments. The proposed method of returning spillover tax revenues to investors would encourage the development of rural regions. In the Philippines, the central government finances much of the infrastructure development. However, local governments collect most of the spillover tax revenues, which increases their tax revenues. If local governments return a part of their increased spillover tax revenues to the central government, the central government can invest those returned tax revenues into other projects to help mitigate poverty in rural regions. These projects would generate additional tax revenues from spillovers and so on. The proposed return of the spillover tax revenues to private investors also applies to central governments as appropriate.

Economic impact of inland water transport

Inland water transport is a high priority in the Mekong region, but the development of ports and other facilities has not advanced well. Ministries that manage inland water transport receive most of their revenue from user charges paid by owners of boats and ships. Governments have not given enough consideration to the regional development of inland water transport; yet ports can become tourist attractions to create employment in the region and greatly expand markets for farmers to sell their produce. Spillover tax revenues will be created when the inland water transport brings businesses into the region and local and central governments can earn much higher tax revenues from property tax, corporate tax, income tax and sales tax than from user charges collected from boats and ships.

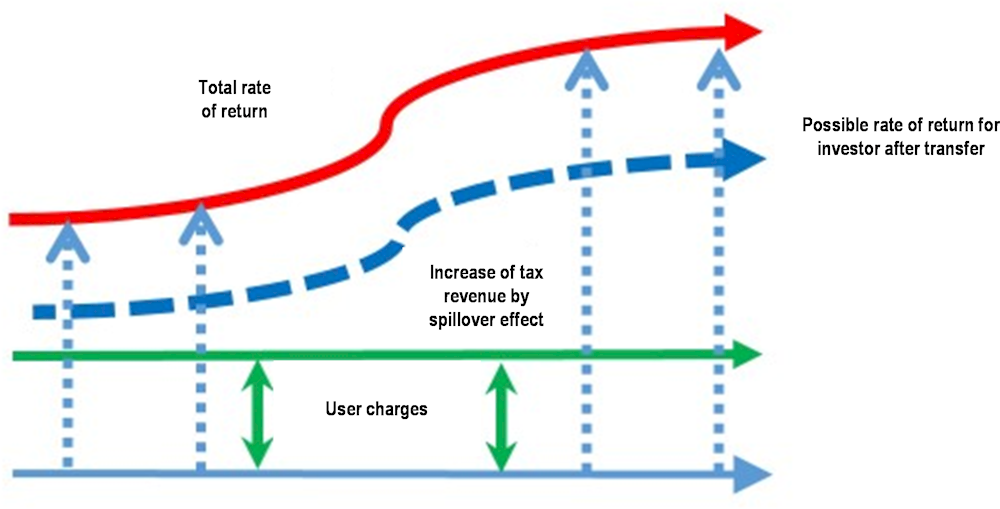

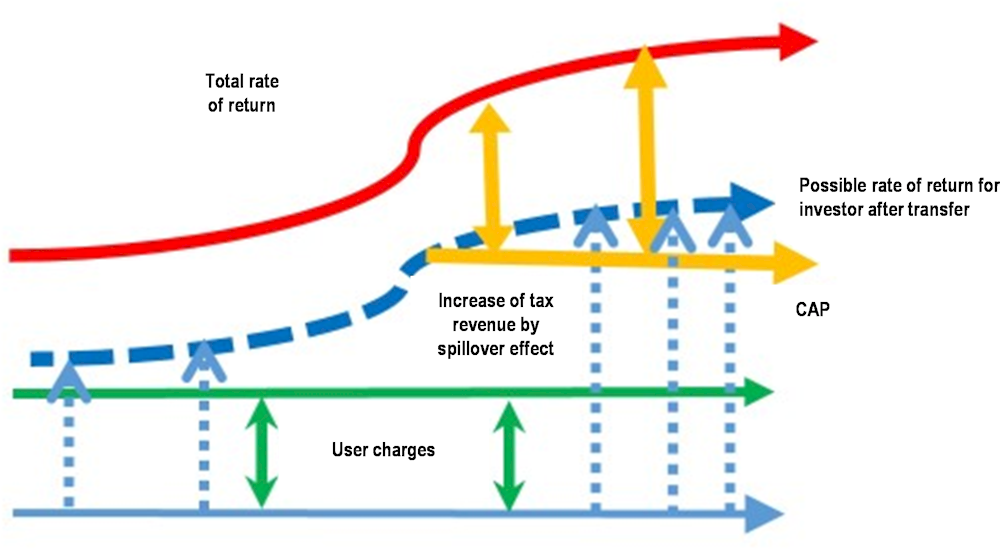

Figure 3.4 graphically illustrates the mechanisms through which spillover effects reduce user charges and increase the rate of return from inland water transport. The red curve represents the total hypothetical gains in terms of tax revenues. If a portion of the additional tax revenues were returned to private investors, the investors’ rate of return from inland water transport would shift from the green line (user charges only) to the blue dotted curve. The difference between the green line and the blue line therefore illustrates the additional returns for private investors after transfer. Increased inland waterway transport could have significant business and employment effects, while the incremental tax revenues would expand even more as a result of more economic dynamism. In other words, government revenues would benefit from additional revenue sources.

Figure 3.4. Injection of increased tax revenues to increase rate of return

Source: Authors.

Water supply and inland water transport will be able to create a bigger economic impact in regions with larger population densities. However, rural regions may not be able to create such sizeable spillover effects and the incremental tax revenues might not be large. The government can set up a cap for private investors. A cap of 15%, for example, means that if the total rate of return (part of spillover tax revenues and user charges) surpasses 15%, the government would take the yellow portion of increased tax revenues (Figure 3.5). It would then use the extra tax revenues to supply water to less densely populated rural regions. This would mitigate urban and rural mismatches of water supply.

Figure 3.5. Injection of increased tax revenues to increase rate of return with government cap

Source: Authors.

Financing for water supply and inland water transport

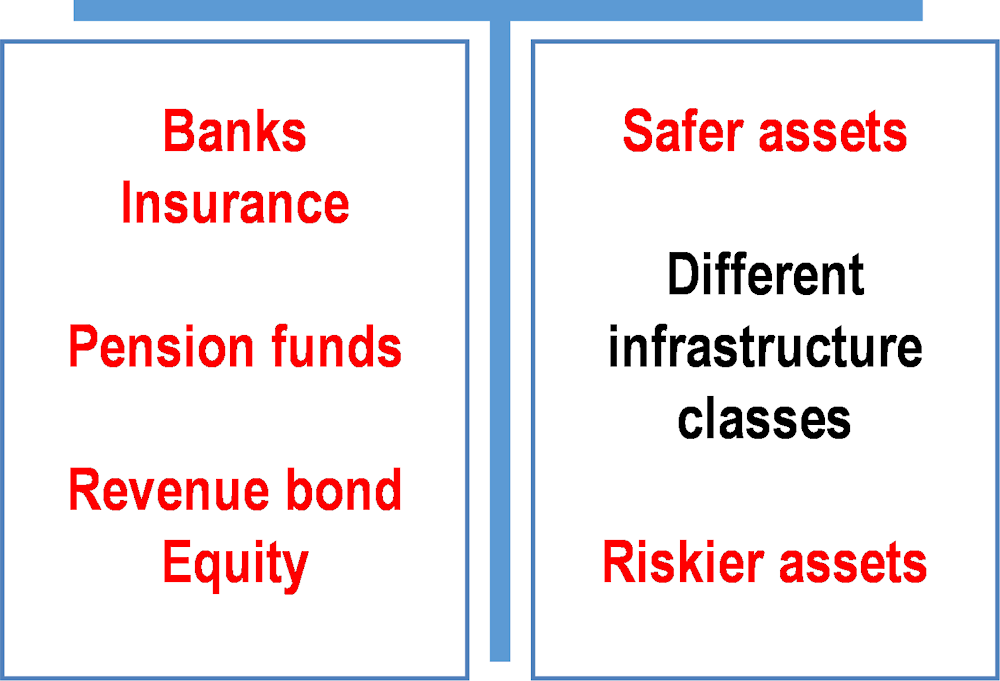

There are five different methods of private finance for water supply and inland water transport (Figure 3.6): (i) bank loans; (ii) insurance corporations; (iii) pension funds; (iv) revenue bonds; and (v) equity investment. Bank loans have relatively short tenors (one to five years), insurance corporations typically have a medium tenor (10 to 20 years), while pension funds have much longer investment horizons. The next three subsections provide an overview of these three financing methods.

Pension funds

In the coming years, many Asian countries will be faced with ageing populations. Public pension funds must be well-established, and private insurance systems must be ready to cope with this change in demographics. Once collection begins for insurance and pension funds, these long-term assets must be matched by long-term investment opportunities. For instance, insurance is growing in Thailand as a source of finance for this purpose. Water supply and inland water transport needs in the Asian region are large in scale and cost, requiring enormous funding for infrastructure construction.

Figure 3.6. Different classes of infrastructure assets and types of finance

Source: Authors.

The right-hand side of Figure 3.6 shows safer infrastructure assets at the top and riskier infrastructure assets at the bottom. There are many different kinds of asset classes in water supply investment. Safe assets may be represented by water supply in large cities and densely populated urban regions. The private sector can expect continuous revenues from existing water supply operations. If the rate of return from the existing water supply is high, private investors can invest in brownfield infrastructure, which represents a relatively safe asset. At the bottom are risky infrastructure assets, such as water supply in new towns and rural regions; it is unclear how much revenue these assets could create. If spillover tax revenues from water supply are returned to investors, as proposed, the rate of return for private investors would increase significantly. Even risky infrastructure assets can be deemed worthwhile investments if the extra spillover tax revenues created in large cities are injected. Thus, the rate of return for all kinds of water supply investment can be increased. Similarly, the safe assets in infrastructure investment could be increased, thereby providing insurance corporations and pension funds with an incentive to invest in domestic water supply.

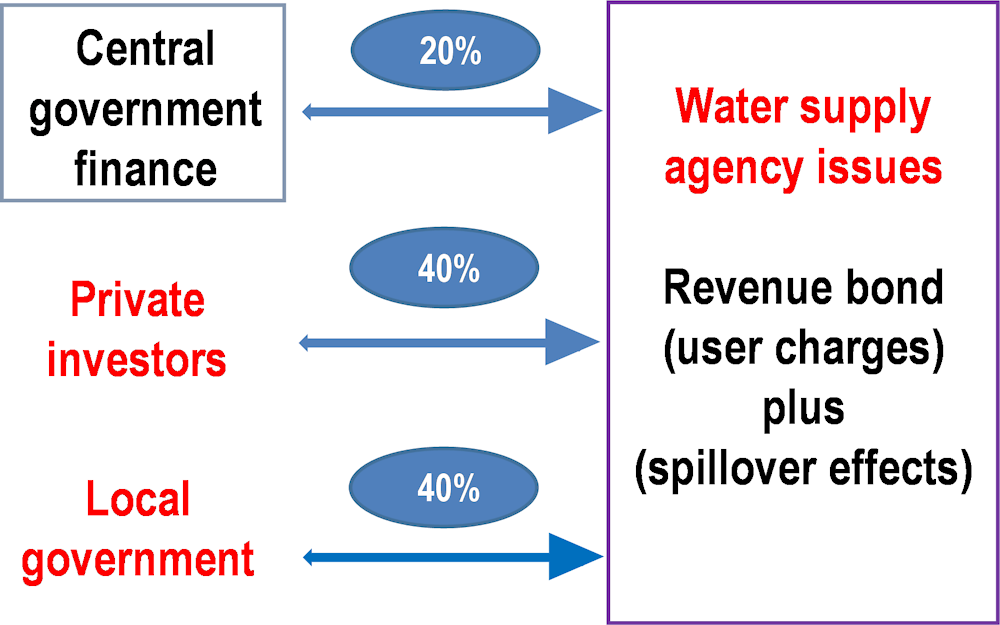

Revenue bonds

If the water supply agency, which captures not only the user charges but also part of the spillover tax revenues, earns sufficient annual revenue (Figure 3.7), it can issue revenue bonds. The interest rate on revenue bonds changes based on the revenues created by the user charges and spillover tax revenues. If business is strong, the spillover tax revenues will rise, and the revenue bond will achieve a higher rate of return, reflected in a higher interest rate. Revenue bonds can be purchased by a mix of entities. As an example, these could comprise the central government (20%), private investors (40%) and local government (40%). The entities share all the risks but also the benefits, each in proportion to their investment. The exact proportions would need to be negotiated for each project, the distribution suggested previously above being for illustrative purposes only.

Figure 3.7. Revenue bond for water supply

Source: Authors.

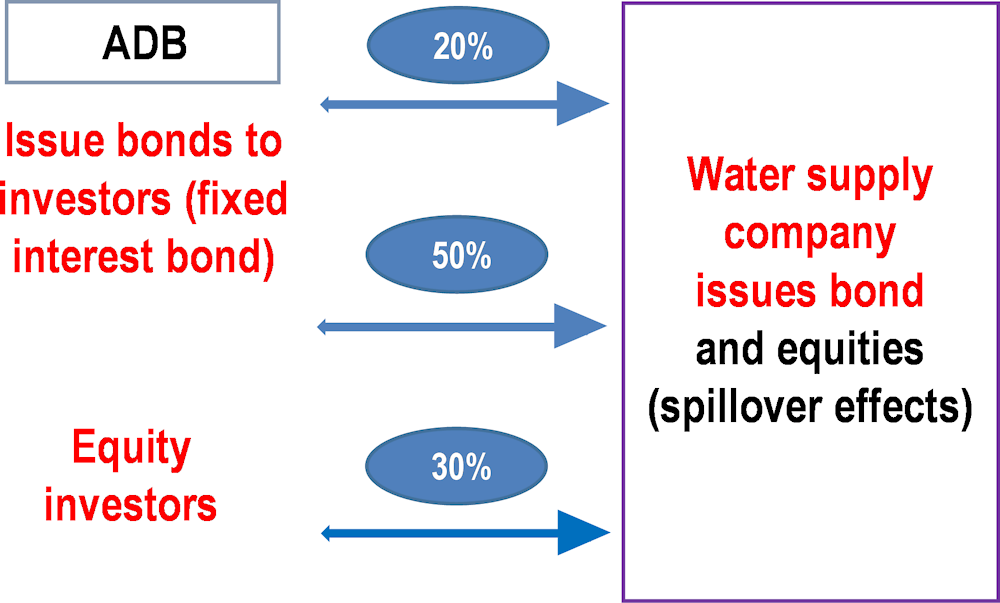

Bond and equity investment

Figure 3.8 illustrates equity and bond investment in water supply. The right-hand side shows that the water supply company raises funds by issuing bonds and equity. User charges and spillover effects are both returned to equity and bondholders. Such a mix, for example, might include 20% from the Asian Development Bank, 50% from fixed interest rate bonds and 30% from the stock market. If spillover tax revenues are returned to water supply investment investors, the rate of return of this fixed bond would be significantly higher. If the rate of return from user charges and spillover tax revenues were much higher than expected, then equity investors in the bottom 30% would also enjoy excess benefits.

Figure 3.8. Equity and bond investment for water supply

Note: ADB = Asian Development Bank.

Source: Authors.

However, various risks are also associated with water supply investment, including but not limited to:

Political risk

Construction risk

Operation and maintenance risk

Exchange rate risk, if the investors are from overseas

Environmental risk (often associated with infrastructure investment).

Addressing the mechanisms for dealing with each of these risks lies beyond the scope of this publication.

Models for returning fractional spillover tax revenues to investors in water projects

It is especially difficult to induce private-sector financing in water supply. User charges are kept low, and the rate of return from these charges is not expected to cover the construction and other costs. Spillover tax revenues must be returned to investors in this case or water shortages are likely to continue. If the rate of return is increased, as explained earlier, private investors may be willing to invest in construction and other up-front costs.

Spillover tax revenues created by the water supply could be used. The United States, for example, has used property tax revenues to increase the rate of return to infrastructure investors. This study suggests using not only property tax revenues, but also revenue from a variety of other taxes. These revenues would be returned to water supply investors. Increased spillover tax revenues should be shared with the local government and private investors in infrastructure investment.

The development of territories proximal to water supplies and inland water transport would not create service monopolies. Issuance of infrastructure bonds and their wide dissemination in the market will distribute ownership. At the same time, the water supply infrastructure firm will diversify its revenue streams by promoting secondary activities such as real estate. The revenue streams from these secondary activities may be more or less volatile than those from the main project. Subsequently, water tariffs and fares will decline, making households better off. This will have an impact on the local economy and raise the marginal productivity of capital. This, in turn, will increase tax revenues, assuming the tax rates are held constant. Returning part of this net increase in tax revenue to the water supply firm will push utility fees further down and make households better off still. This will increase the viability of a water supply project and contribute to the sustainable development of the region.

Return of spillover tax revenues

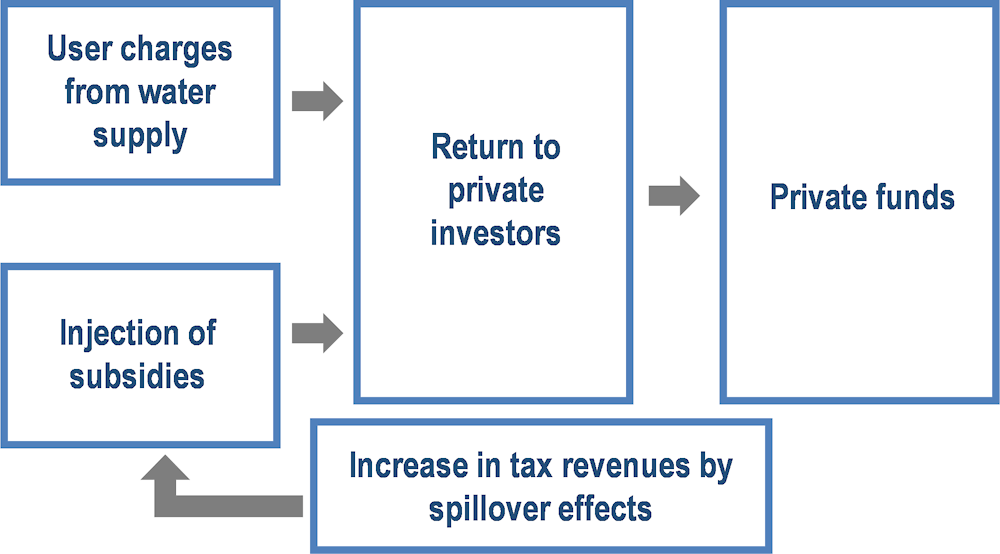

Figure 3.9 shows a model for the return of spillover tax revenues to private investors. The bottom rectangle illustrates the increased tax revenues created by spillover effects of the water supply. The government could subsequently inject a portion of these spillover revenues as subsidies to private investors.

Figure 3.9. Injection of fraction of tax revenues as subsidy

Source: Authors.

Financing for start-up businesses and small and medium-sized enterprises along water supply

Financing could also be available for start-up businesses together with the new water supply. If clean water is supplied in a new region, many entrepreneurs will be interested in starting a business because new residents will be available as customers. However, start-up businesses often find it difficult to raise initial capital, and banks’ tight lending standards often deprive them of bank loans. About 20 years ago, Japan created hometown investment trust funds, a concept that expanded to Cambodia, Viet Nam and Peru. In such instances of hometown crowdfunding, money is collected from individuals in the region. When the water supply becomes operational, many people in the region contribute small amounts of money to local business entrepreneurs that would otherwise be unavailable through the bank lending channel.

While water supply is important to regional development, financing for small businesses along with a new water supply will mitigate income inequality and create business opportunities for start-ups. The approach will increase spillover effects from water supply by allowing new businesses to start in the region. Hometown crowdfunding can thus finance both the water supply and new business development within the water supply region in turn. This will increase the spillover effects and the number of interested investors, the average size of investment, or both.

However, tax collection in many developing countries is difficult. Small and medium-sized enterprises do not pay tax, and even large businesses hide their revenue. To counter this practice, the Philippine Finance Minister and Asian Development Bank Dean have suggested using satellite data for proper tax collection. These data could help identify how many people come to shopping malls or restaurants every day, how long the opening hours are, how many trucks deliver to each factory, how much greenery a farmland contains and so on. Satellite data can provide tax authorities with rough figures of business activities and even estimates of farm crops. Such satellite data could capture spillover tax revenues properly and thus increase the rate of return to investors in water supply. However, incentivising both households and businesses to shift from cash to digital payments may be an easier path. In either case; improved digital infrastructure, digital literacy and cyber security will be essential precursors of implementation.

Various infrastructure projects and the allocation of spillover tax revenues

In many cases, various infrastructure investments, such as electricity, water supply, roads, etc., are constructed simultaneously. Estimates in previous sections focused on the use of one infrastructure project such as high-speed rail; none referred to infrastructure investments of, for example, electricity, water supply and port re-development occurring simultaneously.

Inland water transport will bring tourists and commodities from various regions to the port. A large distribution of goods and visitors from various parts of the river will make the port a focal point for business and tourism. Inland water services, as well as electricity and water supply, must be provided to develop the river basin region. If various infrastructure investment comes together, spillover tax revenues must be allocated among parties.

There will be two ways to identify the impact on spillover tax revenues created by each infrastructure investment.

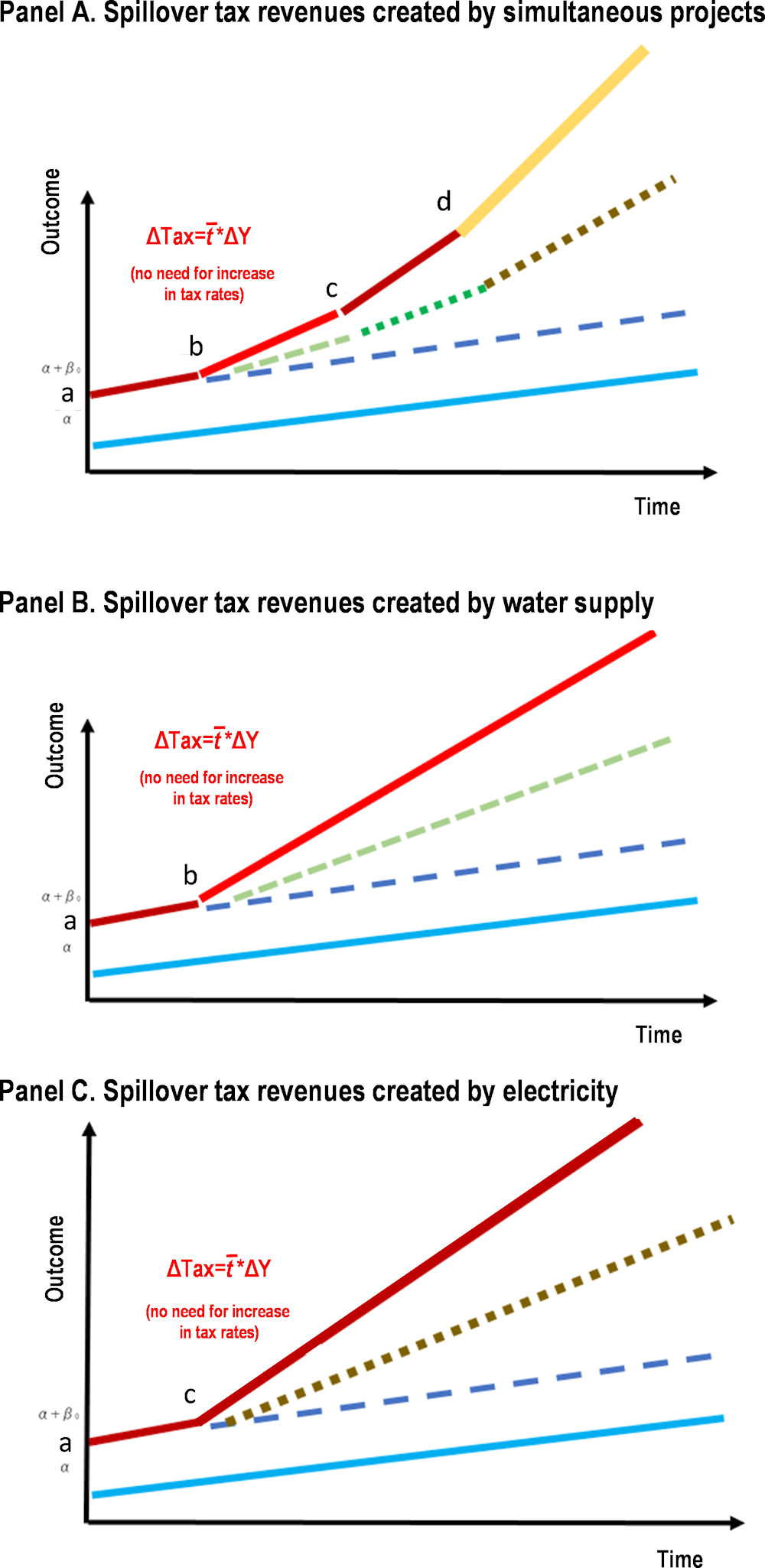

Staggered infrastructure projects. In this scenario, the use of annual dummy variables can identify spillover effects for each type of investment project (Figure 3.10, Panel A.). First, for example, electricity is supplied at point b. An increase in tax revenues follows. A few months later, in period c, the water supply is completed. An additional increase in various tax revenues will arise. Then the inland water facility at the port will be renewed. Point d observes a further increase in tax revenues. Spillover tax revenues will be different in each period (b, c, d). This will allow for the identification of different economic impacts in the region. This, in turn, will allow for spillover tax revenues to be allocated to different kinds of infrastructure investments.

Simultaneous infrastructure projects. In this scenario, it is difficult to measure the impact of tax revenues created by each infrastructure project separately as shown in Figure 3.10, Panel A. Many different kinds of spillover effects can be computed one by one. They derive from different kinds of infrastructure investments such as electricity, water supply, inland water, road, etc. Each individual impact on spillover tax revenues may not be easily distinguishable from the spillover impact of past infrastructure investments. Panel B and Panel C in Figure 3.10 provide a comparison of spillover tax revenues for water supply and electricity.

Figure 3.10. Subsidy based on additional flow of tax revenue due to various infrastructure investments

Source: Authors.

Conclusion

Water supplies are essential public goods and there are huge infrastructure needs in the Mekong region, in particular. This chapter discusses the importance of the spillover effect of water supply and inland water transport on the economy by using the concept of spillover tax revenues, which are also known as indirect or secondary revenues. The engagement of private investors needs to be further strengthened and appropriate setting of the risk-adjusted rates of return is critical to encourage private sector participation.

References

[1] Asian Development Bank (2017), Meeting Asia’s Infrastructure Needs, Asian Development Bank, Manila, Philippines, http://dx.doi.org/10.22617/fls168388-2.

[3] Nakahigashi, M. and N. Yoshino (2016), “Changes in economic effect of infrastructure and method”, Public Policy Review, Vol. 12/1, Policy Research Institute, Tokyo, pp. 47-68.

[5] Yoshino, N. and U. Abidhadjaev (2017), “An impact evaluation of investment in infrastructure: The case of a railway connection in Uzbekistan”, Journal of Asian Economics, Vol. 49/April, Elsevier, Amsterdam, pp. 1-11, https://www.adb.org/sites/default/files/publication/175724/adbi-wp548.pdf.

[6] Yoshino, N. and U. Abidhadjaev (2017), “Impact of infrastructure on tax revenue: Case study of high-speed train in Japan”, Journal of Infrastructure, Policy and Development, Vol. 1/2, Enpress Publisher LLC, Tustin, US, pp. 129-48.

[2] Yoshino, N. and M. Nakahigashi (2004), “The role of infrastructure in economic development”, The ICFAI Journal of Managerial Economics, Vol. 2, Hyderabad E.N. Murthy, pp. 7-24.

[4] Yoshino, N. and V. Pontines (2018), “The highway effect on public finance: Case of the STAR highway in the Philippines”, Financing Infrastructure in Asia and the Pacific: Capturing Impacts and New Sources, Asian Development Bank Institute, Tokyo, https://www.adb.org/publications/highway-effect-public-finance-case-star-highway-philippines.