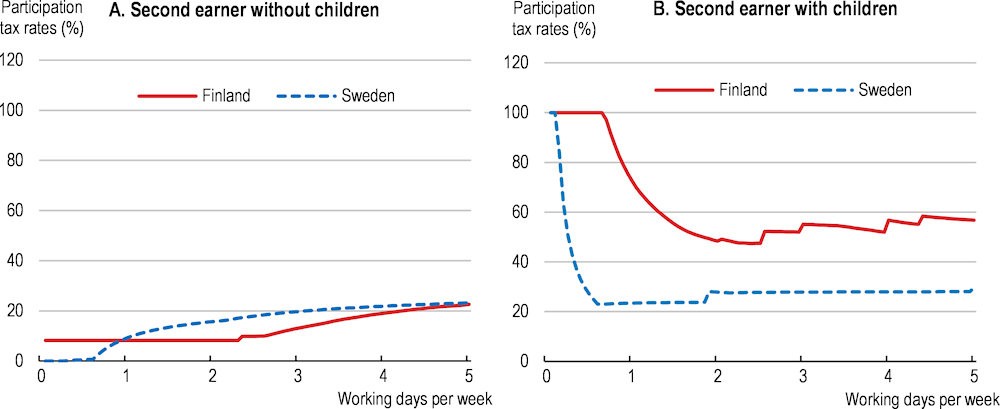

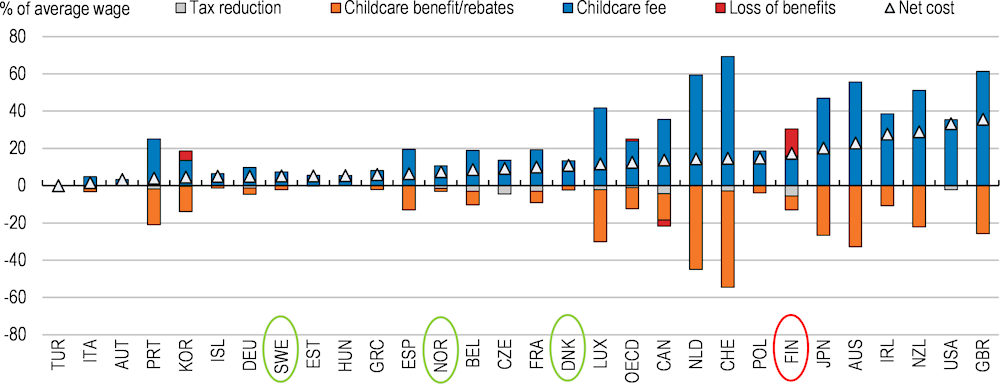

In the context of the COVID-19 pandemic and resulting economic contraction and government debt build-up, the government is formulating reforms to raise employment by 80 thousand workers by 2029. Finland’s employment rate has been lagging behind the Scandinavian Nordics, with most of the gap attributable to older workers, who have more favourable access to early retirement schemes than their Scandinavian counterparts. To restrict their use, extended unemployment benefit, which is paid to unemployed persons aged 61 or more after normal unemployment benefit expires until they retire or reach 65, should be phased out and non-medical conditions should no longer be taken into account for disability benefit applications of persons aged 60 or more. Activity rates for mothers of young children are also lower in Finland than in the Scandinavian Nordics mainly owing to Finland’s generous homecare allowance. It should be reduced and access to convenient early childhood education and care services expanded to improve mothers’ work incentives. By increasing mothers’ work experience at critical points in their careers, such a reform would also help to narrow Finland’s large gender wage gap. As part of its 2021 budget, the government is setting out labour market reforms to increase employment by 31 to 36 thousand workers. Such reforms should focus on promoting employment of older workers.

OECD Economic Surveys: Finland 2020

2. Realising the government’s objective to increase employment

Abstract

As described in the new OECD Jobs Strategy, Finland performs well in terms of job quality and inclusiveness of the labour market but not so well in some dimensions of job quantity (Box 2.1). In particular, the employment rate is lower than in the Scandinavian Nordics (Denmark, Norway and Sweden), which also have high levels of social cohesion and redistribution and are considered by Finns to be the most comparable countries, and the unemployment rate is higher than the OECD average. Prior to the COVID-19 crisis, the government had committed to implementing reforms to increase the employment rate from 73.4% of the working-age population (15-64 years) in 2023 on unchanged policies to 75%, slightly below the Scandinavian average. This increase, which corresponds to an increase of 60 000 in the number of people employed, was intended to help pay for the increases in social spending in the government’s programme. In the aftermath of the COVID-19 crisis, this employment rate target is unattainable. Instead, the government has committed to implementing reforms before the end of its term in office in 2023 to increase the number of people employed by 80 000 by 2029. If realised, this increase in employment would raise the employment rate from an estimated 70.8% in 2020 to 73.7% in 2029, reversing the labour market damage caused by COVID-19 and reducing, but not eliminating the structural budget deficit. The government is formulating reforms as part of the 2021 budget that it estimates would achieve a little less than a half of this employment objective (Box 2.2).

This chapter reviews essential policy measures for Finland to achieve its employment objective. The next section sets the scene by analysing the origins of the sizable gap in the employment rate between Finland and the Scandinavian Nordics and identifies the key target groups: older workers and mothers with young children. The following section reviews major reforms since the turn of the century to extend the working lives of older workers, including the government’s latest policy package to increase the employment rate. Section 3 provides policy recommendations to boost employment of older workers. It describes notable features of the unemployment and disability benefits system in Finland, in particular easier access to these benefits granted to older workers, which creates strong incentives for early retirement. Section 4 discusses measures to strengthen work incentives for mothers with young children.

Box 2.1. Finland’s labour market performance in the new OECD Jobs Strategy

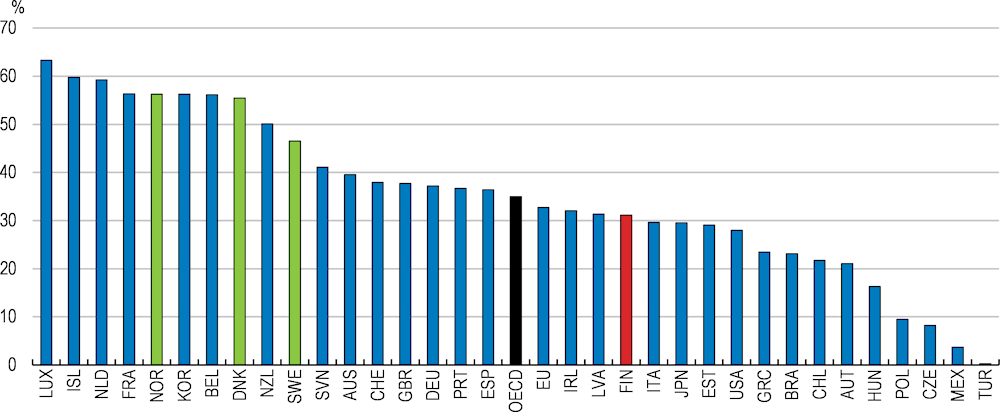

Finland performs well in term of job quality and labour market inclusiveness, but lags behind the Scandinavian Nordics and, in some dimensions, the OECD average for job quantity (Figure 2.1). While the employment rate improved markedly over the past few years and is now higher than the OECD average, it remains lower than in the Scandinavian Nordics (see below). Finland’s high unemployment rate reflects high long-term unemployment that is rooted in weak work incentives and labour market mismatches (OECD, 2016[1]). Earnings quality is in the top third of OECD countries, while labour market insecurity and job strain are among the lowest in the OECD. Due to a compressed wage distribution and extensive redistribution, the share of working-age persons with less than 50% of the median household income is only 7%, a share that is smaller only in the Czech Republic, Switzerland and Iceland. Furthermore, the employment gap between disadvantaged groups and prime-age men is also significantly lower than the OECD average, albeit higher than in the Scandinavian Nordics. The gender labour income gap is among the lowest in the OECD, but this is driven by the small gender gaps in working hours and employment rates, while the gender pay gap among full-time employees is large (see below).

Figure 2.1. Dashboard of labour market performance for Finland

Note: Employment rate: Share of working age population (20-64 years) in employment (%). Broad labour underutilisation: Share of inactive, unemployed or involuntary part-timers (15-64) in population (%), excluding youth (15-29) in education and not in employment (%). Earnings quality: Gross hourly earnings in PPP-adjusted USD adjusted for inequality. Labour market insecurity: Expected monetary loss associated with the risk of becoming unemployed as a share of previous earnings. Job strain: Percentage of workers in jobs with a combination of high job demands and few job resources to meet those demands. Low income rate: Share of working-age persons living with less than 50% of median equivalised household disposable income. Gender labour income gap: Difference between per capita annual earnings of men and women (% of per capita earnings of men). Employment gap for disadvantaged groups: Average difference in the prime-age men's employment rate and the rates for five disadvantaged groups (mothers with children, youth who are not in full-time education or training, workers aged 55-64, non-natives, and persons with disabilities; % of the prime-age men's rate).

Source: OECD (2018), Good Jobs for All in a Changing World of Work: The OECD Jobs Strategy.

Box 2.2. The employment package for the 2021 budget negotiation

In the context of the 2021 budget negotiations, the government is formulating a comprehensive employment package that it estimates would generate 31,000–36,000 jobs by 2029, somewhat less than half the 80 000 objective. Additional measures will be decided during the government’s mid-term policy review session, to be held in Spring 2021. The employment package covers a wide range of measures, some of which were already included in the 2019 employment package (see below). The most important areas for reform include:

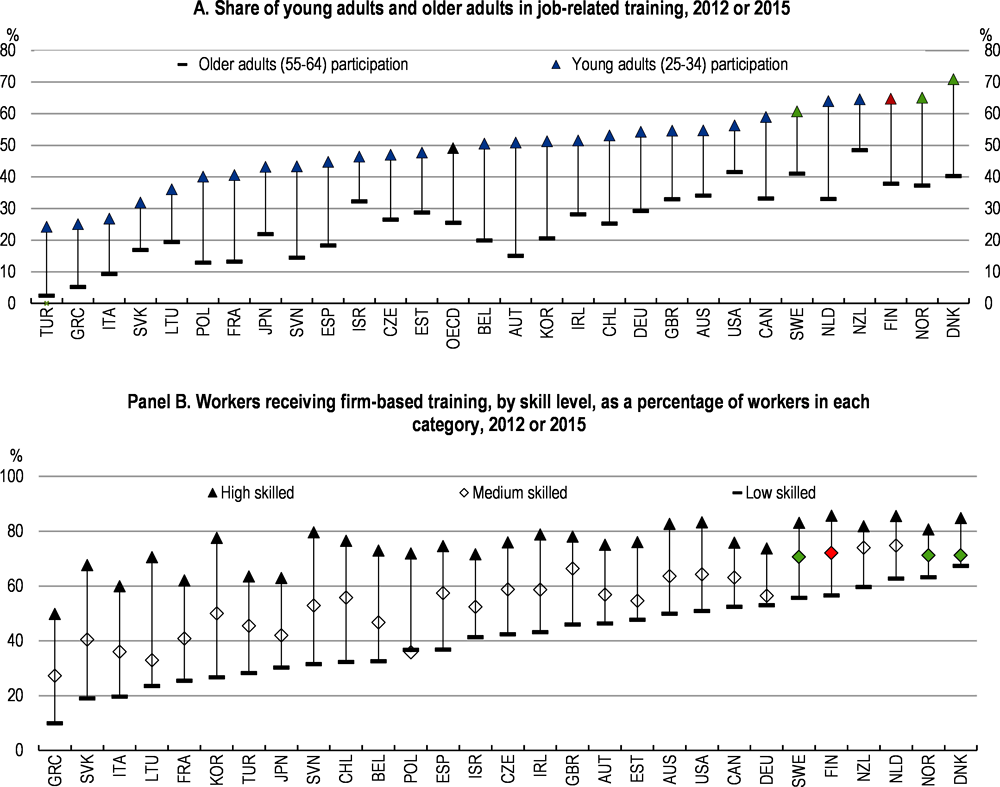

Increasing the employment rate of older workers. The social partners were tasked to propose measures to reduce the early retirement of workers aged 55 and over and increase their employment by between 10 000-12 000 by 2029 in a way that strengthens public finances, for instance by maintaining ability to work, skills and well-being throughout workers’ careers and avoiding disability. A new centre promoting lifelong learning in working life, which will help to maintain workers’ skills as they age, will be established in 2021. These measures would complement the increase in the minimum age when an unemployed person becomes entitled to an extension of the unemployment benefit from 61 currently to 62 from 2023. This reform, which was decided by the previous government and enacted in January 2020, is estimated to increase employment by up to 7 000 (see below).

Strengthening job search by unemployment benefit recipients. The government will introduce an obligation for unemployment benefit recipients to apply for up to four job opportunities every month. Failure to fulfil this obligation would result in the loss of five days’ worth of unemployment benefits. If repeated, the loss of unemployment benefits will increase gradually. In order to support more intensive job search, resources for the Public Employment Offices will be increased by EUR 70 million to strengthen job counselling services. These additional resources will allow the PES to contact unemployed job seekers every fortnight at an early stage of the unemployment period. The government expects these measures to increase employment by up to 10 000.

Reducing the fee for early childhood education services. The government will reduce client fees for early childhood education and care (ECEC) by EUR 70 million, which it estimates would increase employment by up to 3 600.

Other measures include facilitating the use of the wage subsidy scheme, adopting a linear model for partial disability pension that preserves work incentives for those on disability pension, overhauling apprenticeship training, establishing a new centre promoting lifelong learning in working life and improving educational attainment of the low-skilled population.

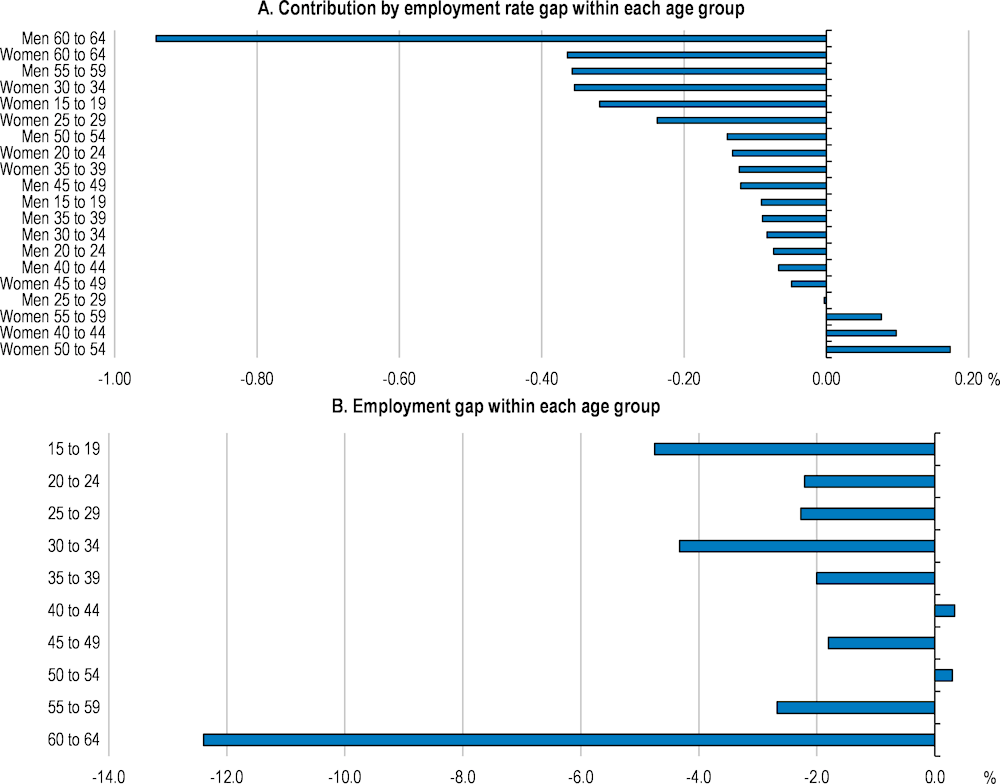

The employment rate gap between Finland and the Scandinavian Nordics

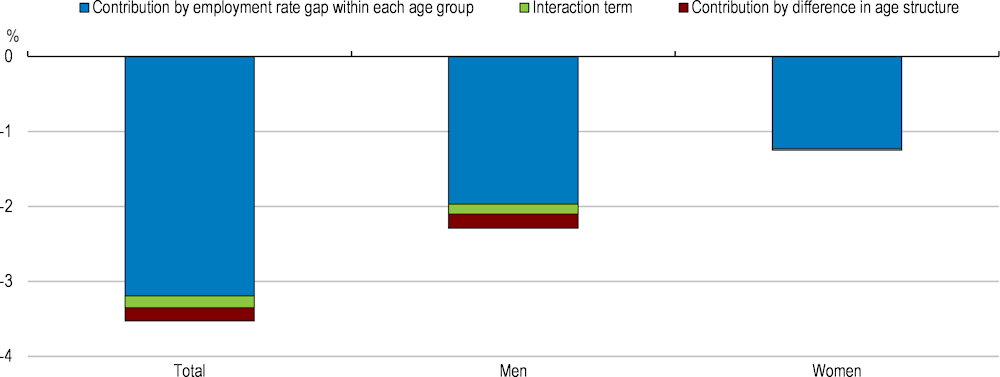

The employment rate of persons aged 15-64 in Finland was 73% in 2019, below the 76% average rate in the Scandinavian Nordics. Considering that they have much higher shares of immigrants, who have lower employment rates than the native-born (Box 2.3), Finland’s relative performance is even poorer than suggested by the headline figures and the potential for improvement correspondingly greater. By far the largest contribution to the employment rate gap is made by the 60-64 year-old age group, followed by young women (up to 35 years of age, although this gap mainly reflects differences in statistical classifications – see below) and youth (15-19 years old) (Figure 2.2, Panel A). The employment rate gap for 60-64 year olds is enormous, at 13 percentage points (Panel B) and reflects lower full-time employment rates in Finland when the split between full-time and part-time employment is made on a common definition (excluding Denmark from the Scandinavian Nordic average owing to a lack of data). Closing this gap would entail increasing employment by 48 000, which would go a long way to achieving the target 80 000 headcount employment increase. The employment rate of 65-69 year-olds (15%), who are outside the working-age population definition (15-64) used for the government’s employment objective, also lags far behind the Scandinavian Nordic average (25%).

Box 2.3. The native-born employment rate gap

The gap between employment rates in Finland and the Scandinavian Nordics is flattered by the lower share of immigrants in Finland’s population (6%) than the average for the other countries (14%). Employment rates for immigrants in all four countries are considerably lower than for the native-born (Table 2.1). For the native-born population, the employment rate gap is considerably larger than for the total population. Closing the native-born employment rate gap with the Scandinavian Nordic average would entail increasing this employment rate by 7.3 percentage points, corresponding to 185 000 jobs.

Table 2.1. The employment rate gap is much greater for the native-born- than the total population

|

Native-born |

Foreign-born |

Total |

|

|---|---|---|---|

|

Finland |

72.8 |

62.2 |

72.2 |

|

Denmark |

77.0 |

66.4 |

74.3 |

|

Norway |

76.5 |

69.7 |

74.8 |

|

Sweden |

80.8 |

66.7 |

77.4 |

|

Average for the Scandinavian Nordics other than Finland |

78.1 |

67.6 |

75.5 |

Note: Share of persons aged 15-64. The data refer to 2018.

Source: OECD International Migration Statistics; and OECD Labour Force Statistics.

Figure 2.2. The gap in employment rates between Finland and the Scandinavian Nordics is mostly attributable to older workers

Population aged 15-64, 2018

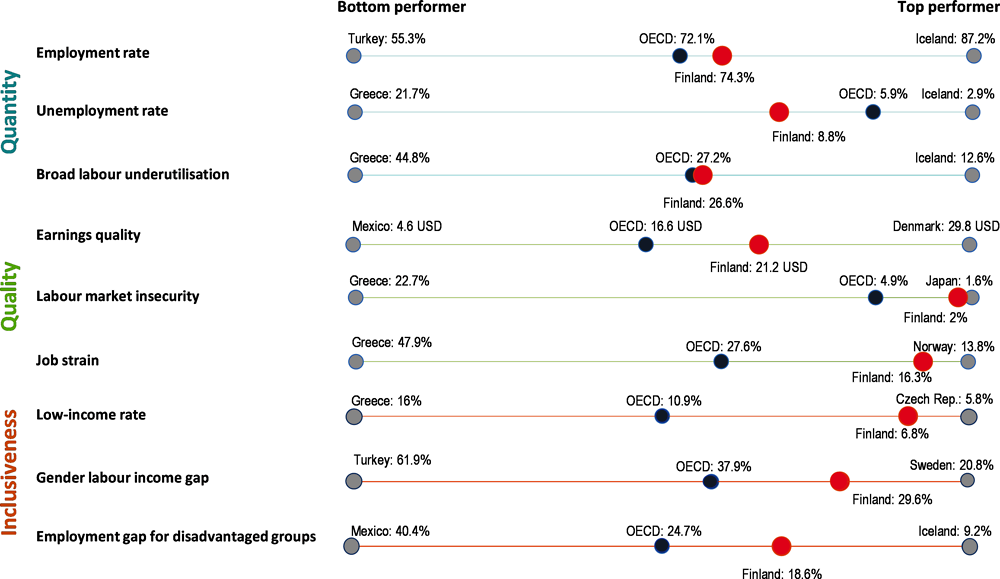

The shortfall in Finland’s employment rate relative to the Scandinavian Nordic average almost entirely reflects differences in age-group employment rates and only marginally differences in population age structure (Figure 2.3). Differences in age structure make almost no contribution to the female employment rate gap and only a small contribution to the male gap, reflecting the slightly larger share of older men in the working-age population in Finland than in the other countries.

Figure 2.3. Differences in age structure contribute little to the employment rate gap

Note: The gap in employment rates between Finland and the average for the Scandinavian Nordics (i.e., Denmark, Norway and Sweden) is decomposed into difference in age structure (i.e. shares of each age group in the working age population) and employment rate gap within each age group.

Source: OECD staff calculations based on OECD Labour Force Statistics database.

The employment rate gap for older workers

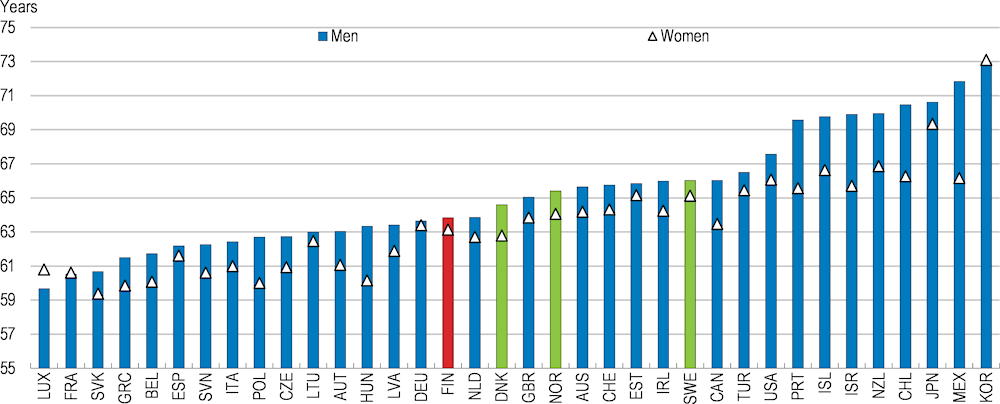

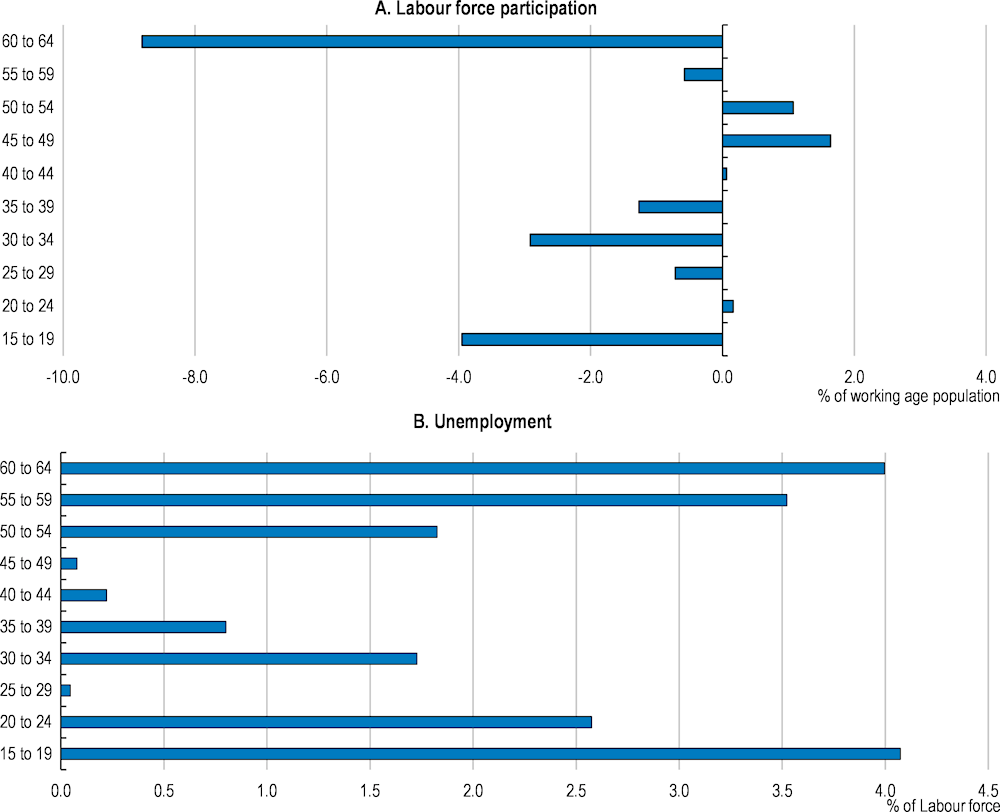

The employment rate gap for 60-64 year olds reflects both a much lower labour force participation rate (Figure 2.4, Panel A), which is weighed down by labour market exit through early retirement pathways (see below), and a higher unemployment rate (Panel B). The participation- and unemployment rate gaps are considerably higher for men than for women. The effective retirement age, based on the average age of exit from the labour force of each five-year cohort aged over 40 during a five-year period, is lower (63.5) than in the Scandinavian Nordic countries (64.7) and the OECD average (64.4; Figure 2.5). The Finnish Centre for Pensions’ (FCP) estimate of the effective retirement age, which is based on the expected age at which people currently aged 25 will draw an earnings-related pension (old-age or disability), is somewhat lower, at 61.3 (61.6 for males and 60.9 for females). However, older workers drawing extended unemployment benefit (see below) are not considered to be retired according to this definition even though they effectively are.

Figure 2.4. Labour force participation of seniors is lower and unemployment higher than in the Scandinavian Nordics

Population aged 15-64, 2019

Note: Difference between Finland and the average for the Scandinavian Nordics (i.e., Denmark, Norway and Sweden).

Source: OECD, Labour Force Statistics database.

Figure 2.5. The effective retirement age is lower than in the Scandinavian Nordics

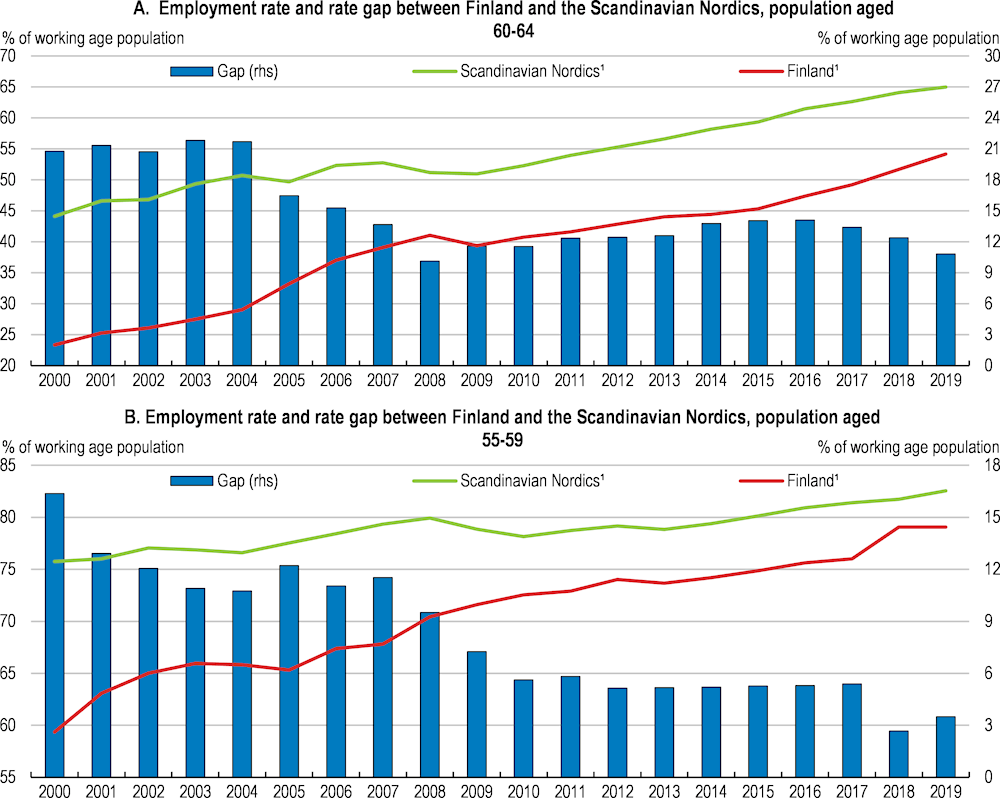

The employment rate gap for 60-64 year olds declined sharply between 2004 and 2008, reflecting a faster increase in the employment rate in Finland than in the Scandinavian Nordics but has since been stable as the increase in the employment rate in Finland was matched in the other countries (Figure 2.6, Panel A). By contrast, the gap for 55-59 year olds has continued to narrow over the past decade, reflecting a much larger increase in the employment rate than in the Scandinavian Nordics (Panel B).

Figure 2.6. Over the past decade, the employment rate gap has fallen for 55-59 year olds, but not for 60-64 year olds

The employment rate gap for young women

The employment rate for young women (30 to 34) in Finland is 74%, 5.9 percentage points lower than the Scandinavian Nordic average, and 7.8 percentage points lower than in Sweden. However, this gap is overstated owing to differences in the statistical treatment of maternity leave beyond three months – women on such maternity leave are deemed to be out of the labour force in Finland but still employed in Sweden. A way to avoid this problem is to compare employment rates excluding women on maternity leave. This can be done by focusing on work attendance rates, which measure the share of persons who were at work during the survey week (Kambur and Pärnänen, 2017[2]). Measured by work attendance rates, the percentage of young women going to work in Finland is about the same as in Sweden, suggesting that the employment rate difference is an artefact.

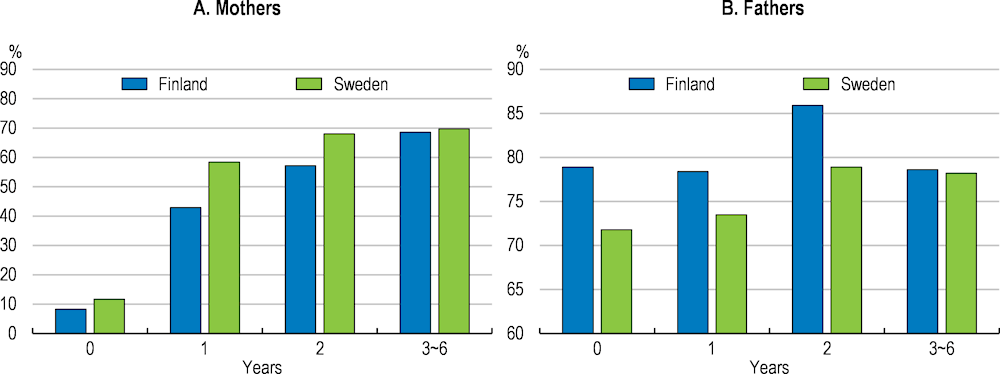

Nevertheless, work attendance rates for young mothers are considerably lower in Finland than Sweden for mothers of children aged up to three years old (Figure 2.7, Panel A). This pattern is especially noticeable when the youngest child is over one year old - the difference is only 3.5 percentage points when the youngest child is aged less than one but increases to 15 percentage points when the youngest child is between one and three years old. It is thus more common for mothers to return to work when their child is one year old in Sweden than in Finland. The opposite holds for fathers, who are more likely to continue working when their children are younger than three years old in Finland than in Sweden (Panel B) – Finnish fathers take less parental leave than their Swedish counterparts. The share of mothers of young children working part-time is also much lower in Finland than Sweden, narrowing the gap in terms of hours worked. Whereas around half of mothers work part-time in Sweden when the child is aged one or two years old, this share is only one quarter in Finland.

Figure 2.7. Work attendance rates are lower in Finland for mothers of young children

Work attendance rates¹ by age of youngest child, 2015

Note: 1. The work attendance rate refers to the share of persons who were at work during the survey week, thus excluding those who have a job but have been temporarily absent from work.

Source: Kambur, O. and A. Pärnänen (2017), ‘Finland/Sweden comparison: No great differences in working among mothers of small children’, Tieto&Trendit, Statistics Finland.

The employment rate gap for youth

The youth (aged 15-19 years) employment rate in Finland is 28%, 7 percentage points lower than the Scandinavian Nordic average. However this gap is driven by Denmark, where much vocational education at the upper secondary level occurs through apprenticeships, in contrast to arrangements in Finland, Norway and Sweden. As a result, a higher share of people in vocational education are employed in Denmark than in the other countries. Excluding Denmark, the Scandinavian Nordic average youth employment rate is the same as in Finland. As the youth employment rate gap reflects differences in the way that vocational education is delivered in Denmark rather than poor labour market performance and the small numbers of youth in the labour force, this gap is not discussed further in this chapter.

Reforms since the turn of the century to increase employment

Tightening access to disability pension and increasing the share of employers subject to experience-rated contributions

Disability benefit has acted as a pathway to early retirement in Finland (see below). In 2004, the government tightened eligibility conditions by abolishing the Individual Early Retirement (IER) scheme, which applied lenient medical criteria for employees aged 60 and over with a long working career; the IER did not define the minimum degree of working incapacity or consider working possibilities other than the current job or occupation. As a result of this reform, the share of claim rejections rose and the share of new retirees being granted a disability pension declined by nearly 10 percentage points (de la Maisonneuve et al., 2014[3]). The share of disability benefits in total pension expenditure fell from more than 18% in 2003 to about 13% in 2011. The reform is also estimated to have lengthened the working lives of older workers by 3.4 months (Kyyrä, 2015[4]). Furthermore, it may have contributed to the decline after 2004 in the employment gap of 60-64 year olds between Finland and other Scandinavian Nordics (Figure 2.6, Panel A). At the same time, the reform introduced some non-medical eligibility criteria for disability benefit for those aged 60 and over, which still facilitate early retirement.

Until 1995, firms with more than 300 employees were required to pay a lump-sum payment to the insurance provider that amounts to a given share of a new disability benefit claim by their former employees, while those below the size threshold paid a uniform fixed tariff for each employee. A reform in 1995 lowered the size threshold, making mid-sized firms with 50 to 300 employees liable to this lump-sum payment. This reform reduced transitions to sickness benefits and further transitions from sickness benefits to disability benefits (Korkeamäki and Kyyrä, 2012[5]), suggesting that that higher disability benefit costs encouraged employers to invest in sickness prevention measures and to accommodate employees with health problems in the workplace. Since 2006, the lump-sum payments have been replaced by partially experience-rated disability insurance premiums. The effect of this scheme in reducing the inflow into disability benefits is ambiguous (Kyyrä and Paukkeri, 2018[6]). The survey of employers conducted by the Finnish Centre for Pensions indicates that employers find the current experience-rating system complex (Liukko et al., 2017[7]), implying that they may not be well aware of the extent to which they could reduce their contributions by making greater efforts to prevent worker disability.

Increasing the age of entitlement to extended unemployment benefit

Finland offers generous unemployment benefit entitlements to older workers that are longer than those for younger workers and can also be extended up to the statutory retirement age (Box 2.4). This extension, often dubbed as the unemployment tunnel, provides an attractive pathway to early retirement. The unemployment rate rises sharply in Finland for workers near the age at which they are entitled to the unemployment tunnel. The eligibility age has been raised gradually over time, from 55 before 1997 for all workers to the current 61 for those born in or after 1957. The age threshold is to increase to 62 for those born in 1961 or after. These reforms have pushed back the timing of the sharp rise in unemployment, effectively lengthening the working lives of older workers (see below).

Box 2.4. Unemployment benefits in Finland

Unemployment benefits in Finland consist of earnings-related Unemployment Insurance benefits (ansiosidonnainen päiväraha), a flat-rate basic unemployment allowance (peruspäiväraha) and a flat-rate means-tested labour market subsidy (työmarkkinatuki).

Earnings-related benefits, which comprise a flat-rate basic part (EUR 33.66 per day in 2020) and an earnings-related component, are paid to unemployment insurance fund members satisfying the employment condition (those having worked and paid contributions for at least 26 weeks within the last 28 months); the funds pay 6% of the costs of earnings-related benefits with the rest coming from social security contributions and general taxation. Although membership is not compulsory, 84% of employees were enrolled in unemployment funds in 2012 (Shin and Böckerman, 2020[8]). Non-members of unemployment funds can receive the flat-rate basic unemployment allowance (EUR 33.66 per day in 2020) from the Social Security Institution (Kela) if they satisfy the same employment condition. Those eligible to neither earnings-related benefits nor basic unemployment allowance, because they do not satisfy the employment condition or used up the maximum payment period of basic or earnings-related unemployment benefits (see below), can receive a labour market subsidy (EUR 33.66 per day in 2020) from Kela.

The earnings-related component of earnings-related unemployment benefit is 45% of the difference between the past daily wage and the base part of the benefit for the unemployed previously receiving monthly wages of EUR 3 198 or lower. For those receiving higher monthly wages, the replacement rate of 45% is applied up to the income threshold and then a lower replacement ratio of 20% is applied to the exceeding amount. Slightly higher replacement rates are applied to the unemployed with a child and those participating in activation programmes. In practice, overall replacement rates of around 60% have been most common (Kyyrä, Pesola and Rissanen, 2017[9]).

The earnings-related and basic unemployment benefits are paid for a maximum of 400 days (300 days for those who have worked less than three years). However, workers aged 58 years or more who worked at least five years in the past 20 years are entitled to a maximum of 500 weekdays of benefits. Furthermore, those aged 61 years (62 years from 2023) or older when reaching their 500-days benefit limit qualify for an extension until the retirement age of 65.

Unemployment benefits can be combined with work. The unemployed taking up full-time work for less than two weeks or part-time work can qualify for partial benefits. The days on which partial benefits are paid are only counted partially toward the maximum benefit duration, but the working days are counted into the employment condition if the weekly working time is at least 18 hours.

Note: Daily wage is computed by dividing the monthly wage by 21.5.

Source: The Social Security Institution (Kela), (Kyyrä, Pesola and Rissanen, 2017[9]).

Employers share part of the benefit costs (the liability component) when their former employee receives extended unemployment benefit (Box 2.5). Before 2000, firms with more than 300 employees were liable for 50% of the present value of the unemployment pension benefits (the equivalent of extended unemployment benefit at the time) while firms with 50 to 300 workers paid 0% to 50% of the expected benefits depending on their size. A reform implemented in 2000 strengthened this liability component by raising the maximum liability share to 80%, which was applied to firms with more than 800 employees. The linear schedule of liability components for firms with 50 to 800 employees was also adjusted accordingly. As a result, the costs of the unemployment tunnel increased substantially for large firms with more than 500 employees, while smaller firms enjoyed somewhat lower liabilities (Hakola and Uusitalo, 2005[10]). The reform is estimated to have reduced the risk of unemployment among older workers by 16% (Hakola and Uusitalo, 2005[10]), most likely by restraining large employers from targeting older workers in collective dismissals (see below).

Box 2.5. Employers’ costs for former employees in the unemployment tunnel or on disability benefit

The liability component in the unemployment tunnel

Employers have to pay at least part of the benefit costs (the liability component) when their former employee receives extended unemployment benefits (unemployment tunnel). This concerns employers with a payroll of over € 2 086 500 in 2019. The share of the liability component in total benefit costs rises progressively with the size of payroll and reaches 90% of costs for payrolls above € 33 384 000 (80% in case the unemployed was born between 1950 and 1956). The employer is not obliged to pay the liability component if employment was terminated before the employee reached the age of 56, or the employee resigned on their own initiative. However the latter does not apply to the cases where employees agreed to leave voluntarily with a compensation package from their employer.

Employers may also be obliged to pay part of unemployment benefits if: (1) their former employees have become entitled to the unemployment benefits due to the termination of their employment after reaching the age of 60; (2) they are still receiving unemployment benefits after the reaching the minimum eligibility age for old-age pension; or (3) they started to receive unemployment benefit after reaching 62 and continued to receive an unemployment allowance until retirement on an old-age pension.

Experience-rating in disability benefits

Finland finances a major part of disability benefit through partially experience-rated premia, which are a weighted sum of the base premium rate and experience-rated premia. Experience-rating applies to firms with payroll exceeding the threshold of about EUR 2 million. Firms are classified into 11 contribution categories according to the number of disability pension incidences in the company over the past two years. Depending on these categories, a firm can earn a 90% discount on the base premium or be obliged to pay a 450% surcharge on top of the base premium (Kyyrä and Paukkeri, 2018[6]).

The age distribution of the employees in a firm does not affect its classification in contribution categories, since its past disability pension incidences are compared separately with the average disability rate for each age cohort, which creates an incentive for cream skimming in recruitment.

Source: Employment Fund homepage, Finnish Centre for Pensions homepage, (Kyyrä and Paukkeri, 2018[6]).

The 2005 and 2017 old-age pension reforms

The 2005 old-age pension reform introduced the life expectancy coefficient, which was applied for the first time in 2010. It reduces pensions for each cohort born after 1947 such that growing life expectancy does not increase the present value of pensions at age 62 from the level in 2009. The reform also changed the income base for calculating pensions from the last 10 years of each employment contract prior to retirement to incomes over the entire work history. This reform also introduced a flexible retirement age from 63 to 68 years, which turned out to have the opposite effect on extending working lives to the other measures. Before the implementation of a flexible retirement age in 2005, the full retirement age was 65 years. There was also an early retirement regime for retirees aged 60 to 64 years. Gruber et al. (2019[11]) find that the introduction of a flexible retirement age was effectively treated as lowering the full retirement age to 63 years. They find that retirement probabilities in the age range that was suddenly eligible for flexible retirement increased by 40% or more in 2005 from levels in 2004 despite only a modest increase in incentives to retire before age 65.

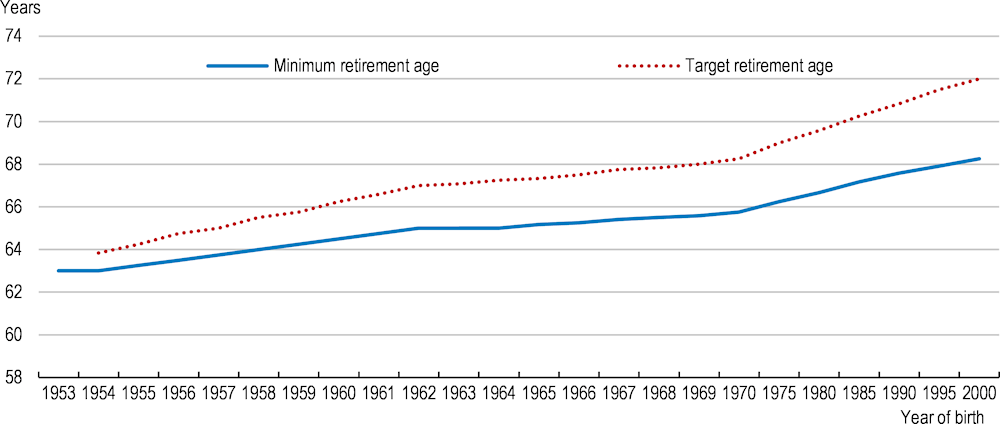

The 2017 pension reform raises the minimum retirement age gradually from 63 to 65 by 2025 and will link the minimum retirement age to life expectancy from 2030 onwards in such a way that the share of adult life spent in retirement remains constant. The reform also increases incentives to defer taking the pension (or part thereof) beyond the minimum age (by up to five years) by increasing pensions by 0.4% per month of deferral, which together with the 1.5% pension accrual rate results in a greater increase in pensions from working beyond the minimum eligibility age than before (when there was simply a 4.5% accrual rate). The 0.4% per month increment is actuarially neutral – on average, the present value of acquired pension rights is not affected by the timing of retirement.

To help people make more informed decisions about the timing of their retirement, a target retirement age for each cohort is calculated that corresponds to the age at which the pension increment from delaying retirement offsets the reduction from the life expectancy coefficient (Figure 2.8). For example, the minimum retirement age for those born in 1957 is 63 years and 9 months. For the increment for retirement beyond the minimum age to equal or surpass the reducing effect of the life expectancy coefficient for this cohort, they need to postpone their retirement by 12 months. It follows that the target retirement age for those born in 1957 is 64 years and 9 months.

Figure 2.8. Target retirement ages are rising faster than minimum retirement ages

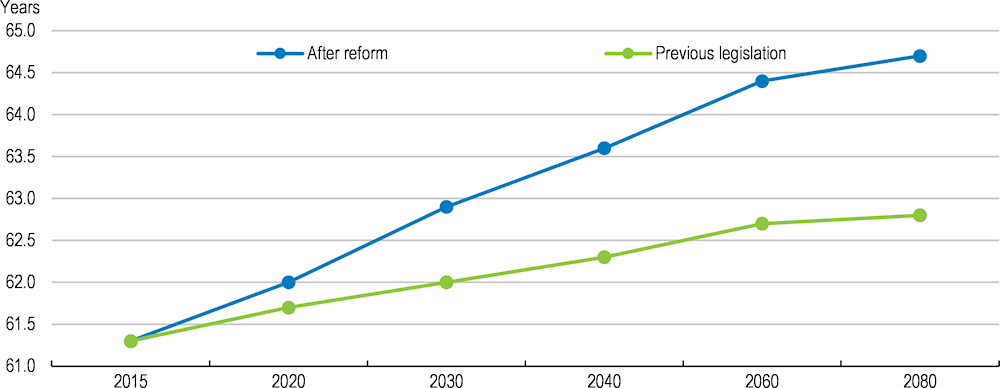

The 2017 reform is estimated to increase the expected effective retirement age (Finnish Centre for Pensions measure, described above) in 2030 from 62.0 years under the previous legislation to 62.9 (Figure 2.9) (Reipas and Sankala, 2015[12]). By 2080, the expected effective retirement age is 64.7 years in the reform projection, compared with 62.8 years in the projection based on the previous legislation. Reipas and Sankala estimate that the reform (including the effect of raising the minimum age for extended unemployment benefit) will increase employment by around 53 000 by 2040, rising to 91 000 by 2080. The reduction in the number of retirees will also partly be channelled into unemployment, which is expected to rise by 14 000 by 2040 and 49 000 by 2080. The authors estimate that in the long run, the reform will raise the employment rate of 15-74 year olds by around two percentage points.

Figure 2.9. The 2017 old-age pension reform is projected to increase the expected effective retirement age

Source: Reipas, K. and M. Sankala (2015), Effects of the 2017 earnings-related pension reform, Finnish Centre for Pensions.

Pension expenditure relative to wages insured (i.e., the pension expenditure ratio) is estimated to be lower for decades to come under the current legislation than under the previous legislation (Reipas and Sankala, 2015[12]). Over 2030-50, this difference is estimated to be about 2% of GDP per year. Both the reduction in pension expenditure and growth in the wage sum are mainly attributable to later retirement. The reduction in the pension expenditure ratio means that the contribution rates needed to finance pensions are lower over coming decades than under the previous legislation. The reform sets the contribution rate at 24.4%, a relatively high level compared with many OECD countries, including Scandinavian Nordics, until the end of the 2060s. Assets under the Employee Pensions Act (to help pay for future pensions) are set to rise markedly, from 240% of the wage bill currently to 290% in 2080 whereas under the previous legislation they were projected to decline to 220% in 2080 (Reipas and Sankala, 2015[12]). The outlook will be less favourable, however, when Statistics Finland’s updated long-term demographic projections that take into account the large recent decline in the fertility rate are integrated (Box 2.6).

Box 2.6. Financing old-age pensions

Finland’s pension system is financed from both assets accumulated in pension funds (i.e., pre-funding) and pay-as-you-go (PAYG) pension contributions, with the latter source being the largest – only about one-fifth of private sector pension expenditure is financed by pension funds. The national pension and the guarantee pension, which are not earnings related, are solely funded by PAYG.

The Finnish Centre for Pensions projects an increase in total statutory pension expenditure from 13.4% of GDP in 2017 to 15% by 2085, with all of the increase occurring in the second half of the century owing to a shrinking working-age population (Tikanmäki et al., 2019[13]). The contribution rate under the Employees Pensions Act (TyEL contribution) is projected to rise from 24.3% in 2017 to 25% by the end of the 2020s and begin to increase rapidly in the 2050s owing to the decline in working-age population, reaching 30% in 2085. At this time, the contribution rate will be at a sustainable level. A constant TyEL contribution rate of 26.7% would be sufficient to finance expenditures in the long term. Contribution rates for municipal pensions in 2017 (28.5%) were slightly greater than the constant contribution rate sufficient to finance these pensions in the long term. Taking all earnings-related pension schemes together, the contribution rate in 2017 (29.2%) was sufficient to finance pension expenditure in the long term.

The projections are highly sensitive to assumptions about the birth rate and investment returns. A fertility rate of 1.20 instead of the 1.45 assumed in the projection would require the contribution rate in 2085 to be 4 percentage points higher than the baseline (the fertility rate was 1.41 in 2018). Should the annual real investment return be one percentage point lower than assumed (2.5% during 2019-28 and 3.5% thereafter), pension contributions would need to be raised to 33.3% by 2085 (3.2 percentage points higher than in the baseline scenario).

Source: (Tikanmäki et al., 2019[13])

Boosting activation

The requirement to look for jobs or to participate in training programmes attached to unemployment benefits is lenient, especially for old recipients (see below), resulting in long unemployment spells. The previous government tightened such conditions for benefit eligibility by requiring the newly unemployed to spend 18 hours in paid employment, earn at least EUR 241 in self-employment, or participate in five days of employment programmes at the employment office in their first three months of unemployment. Failure to meet any of these conditions resulted in a 4.65% reduction in the benefit level for 65 days. This activation model was repealed in January 2020, despite preliminary evidence that it could increase employment by 8 000, because some people were unable to fulfil the activation requirements owing to a shortage of training places. The government has proposed alternative measures to strengthen activation in the Employment Package for the 2021 Budget negotiation, including a new obligation for unemployed jobseekers to apply for up to four job opportunities every month and increased resources for the PES (Box 2.2). On the other hand, the Package reduces the strictness of unemployment benefit sanctions, including by giving a warning before imposing sanctions.

Reducing effective tax rates on labour income

As discussed in the 2018 OECD Economic Survey of Finland, work incentives in Finland are hampered by high average- and marginal effective tax rates on labour income. Part of the problem is tapering rules for unemployment benefits that include losing the benefit when working more than 80% of full-time. Furthermore, complex administrative procedures associated with various benefits discourage second earners from working more out of fear that they may end up losing some of them (Bureaucracy trap). While work incentives improved somewhat during the previous government’s term owing to a freeze on the indexation of social security benefits, this improvement has been reversed to some degree by the current government. The previous government commissioned a pilot study replacing means-tested benefits with a universal basic income that guarantees a given level of income regardless of employment status as an option to simplify the benefits system and to boost work incentives (Box 2.7). The study found that the basic income scheme did not lead to a significant increase in the employment rate but improved subjective well-being (Kangas et al., 2020[14]). There were, however, serious limitations to the experiment because some participants still had to claim means-tested benefits, there was a lack of diversity in types of labour market status, no account was taken of the increase in taxes that would be needed to finance such a scheme and forward-looking participants’ behaviour was affected by the knowledge that the scheme was only for a fixed term. Moreover, the findings may have been impacted by the introduction of the activation model in early-2018.

Box 2.7. The basic income experiment

The basic income experiment was designed and administered by the Ministry of Social Affairs and Health and the Social Insurance Institution (Kela). It provided an opportunity for long-term unemployed persons receiving the basic unemployment benefit to opt out of the existing benefit system and instead receive a basic non-means-tested income not subject to activation conditions, significantly lowering the tax wedge on labour income and administrative burdens. The experiment targeted individuals aged 25-58 who were receiving basic unemployment benefit from Kela in November 2016. Among them, 2 000 randomly selected individuals were paid € 560 per month regardless of whether they found a job or participated in activation measures.

These 2 000 individuals were compared with other individuals in the target group on their employment status, namely their working hours and earnings, as well as well-being, for the period from November 2017 to October 2018. It was found that the employment rate for basic income recipients improved slightly more during this period than for the control group. The basic income recipients were employed for 78 days on average, as opposed to 73 days for the control group. Overall, the recipients of basic income only marginally outperformed the control group in terms of the average number of working days, but did enjoy higher levels of subjective well-being. The experiment was, however, subject to serious shortcomings. For instance, individuals with an entitlement to unemployment benefit greater than the universal income, mainly because they had children, did not benefit from less bureaucracy and non-compulsory participation in active labour market programmes. Moreover, the long-term unemployed are unlikely to be skilled in job search and therefore may respond less to a lower labour tax wedge; the experiment should have been run with different types of labour market status. In addition, the impact of the basic income could have been larger had the activation model not been introduced in early-2018 (see above) as it may have boosted job search efforts of unemployment benefit recipients (the control group) more than of recipients of the basic income. On the other hand, the scheme was not revenue neutral. Allowing for the effect of higher taxes to pay for it would reduce any favourable effect that the scheme may have had on labour supply.

Source: (Kangas et al., 2020[14]).

The employment package announced in 2019 and revised in the proposed 2021 budget

To help attain the employment goal, the government announced an employment package in 2019, which featured an increase in resources for the public employment service (PES), more intense job counselling, reform and increased use of wage subsidies, and a plan to increase the activity rate and ultimately employment among the disabled and an increase in work-related immigration. These measures were subsequently incorporated in the employment package prepared for the 2021 Budget (Box 2.2).

The planned increase in resources for the PES is a positive step, given that Finland has relatively low PES staffing per unemployed person compared with other Nordic countries. Indeed, the number of unemployed per caseworker has more than doubled since 2008, putting the employment service under strain (OECD, 2018[15]). Against this background, the government plans to make job counselling more intense by recruiting more PES staff. Empirical studies point to the positive employment effect of more intense job counselling. For example, a pilot project in Germany found that a lower caseload per caseworker led to more re-employment and shorter unemployment durations (Hainmueller et al., 2016[16]). Similarly, a working-class area in the Helsinki region that implemented more intense counselling experienced a greater reduction in unemployment than other parts of Helsinki. However, only € 70 million over a four-year period has been budgeted for this reform, which is unlikely to be enough to implement it fully given that follow-up will require additional resources.

The government also intends to increase the use of wage subsidies for companies and public employers and a recruitment subsidy for micro-enterprises. An employer hiring an unemployed jobseeker can receive financial assistance in the form of a pay subsidy that covers up to 30, 40, 50 or 100% of wage costs. Total wage subsidies will cost EUR 10-15k on average per year per person-employee. The government estimates that this wage subsidy reform will give work to 500-1 000 jobless people in the long run by increasing incentives for firms to hire them. To encourage take-up of wage subsidies by employers, the government also plans to reduce bureaucracy, given that it has been administratively complex to hire someone with the current scheme. The effects of the wage subsidy scheme on employment may be severely reduced by deadweight losses – many beneficiaries might have found jobs without subsidisation. Empirical results suggest that the effectiveness of wage subsidies in Finland has been rather weak – wage subsidies applied in the private sector generate small positive effects, whereas those applied in the public sector do not (Asplund et al., 2018[17]). The absence of positive effects of wage subsidies in the public sector, which comprise around 30% of total wage subsidies, is not surprising as their aim is to reduce the burden of labour market subsidy (i.e., social assistance for the unemployed who do not qualify for unemployment allowance) on municipal finances and to push the older unemployed to the unemployment tunnel. Finding ways to reduce deadweight effects and to increase permanent employability is important if these programmes are to be retained.

The government has also planned further reforms to promote employment among those in need of special support, including the disabled. A programme for work and welfare and a working capacity programme for people with partial work capacity is in the pipeline. As part of the programme, a condition will be added to public procurement contracts that will incentivise the employment of persons with partial working capacity and others with a vulnerable labour market status. The careers of 18 800 persons were cut short by entry into disability pension in 2016, and 600 000 Finns estimate that disability or disease affects their work and opportunities for finding employment. To lengthen careers and to prevent further losses in labour input, the employer, staff and occupational health care will collaborate in taking measures that promote workability and return to work.

Overall, the net effect of the original 2019 employment package would have fallen short of the government’s employment objective as it did not focus on increasing employment of older workers, even though this group has the greatest untapped potential. It is therefore welcome that the employment package for the 2021 budget negotiation emphasises boosting employment of older workers (Box 2.2). To increase their employment rate, it is essential that the package include measures to tighten further pathways to early retirement.

Increasing the employment of older workers

Early retirement pathways reduce employment of seniors

The main reason that the employment rate of older workers is lower in Finland than in the Scandinavian Nordics is that Finns have better access to early retirement pathways, notably through unemployment or disability benefits. In 2017, about 12% and 14% of new pensioners aged 63 were previously receiving unemployment or disability benefits, respectively, for several years, according to the Finance Ministry.

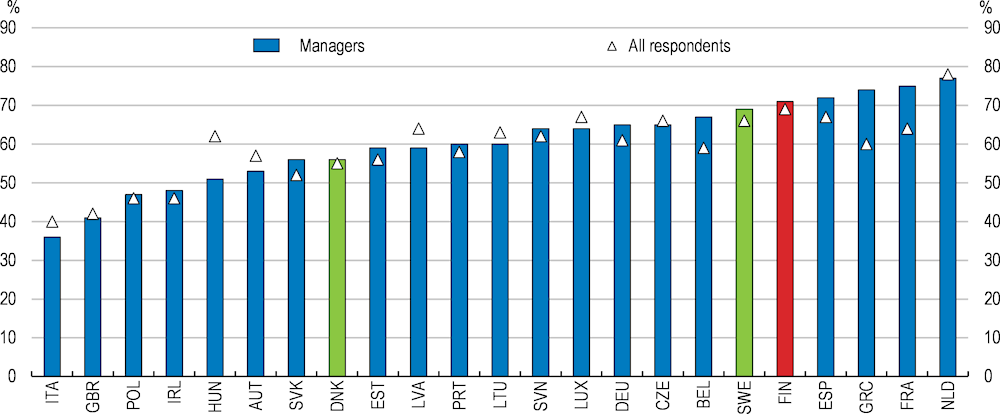

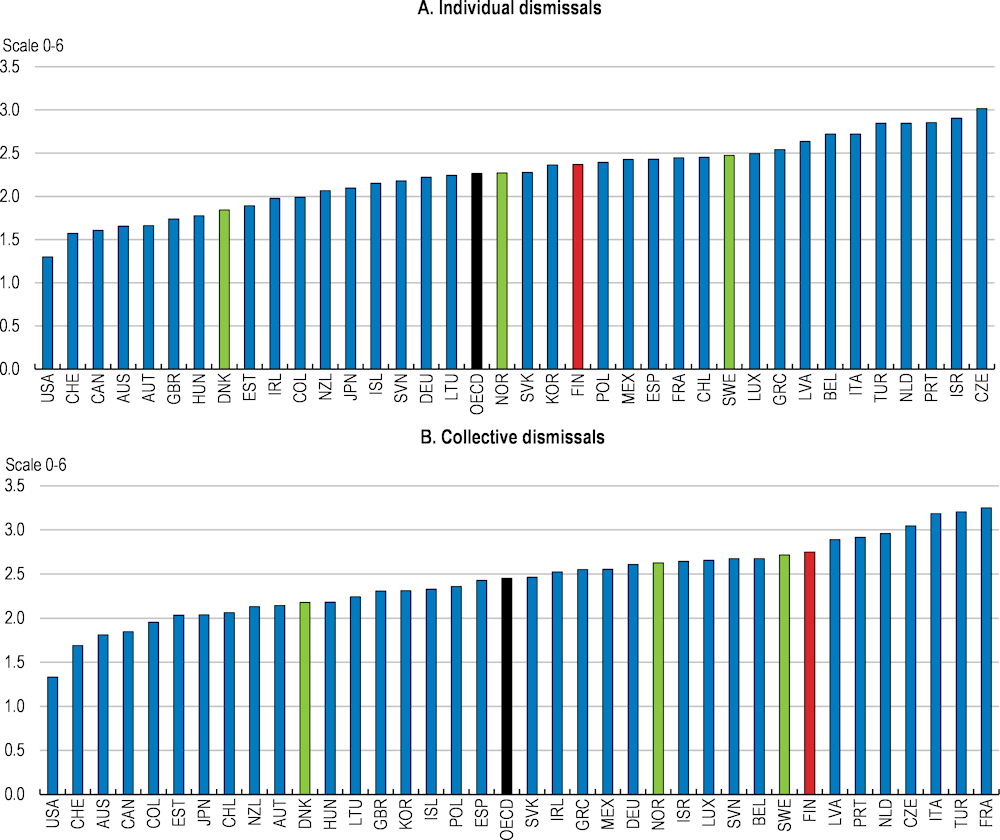

These institutional arrangements are motivated by a concern that older workers who lose their job may have greater difficulty than others in finding another suitable job, exposing them to the risk of a sharp drop in income before retirement. However, such arrangements may also increase the risk of older workers being targeted in lay-offs because they have replacement incomes for the rest of their lives and are less harmed by worse income prospects (‘scarring’) following a period of unemployment than other workers. Laying-off workers is relatively easy in Finland despite relatively strict employment protection legislation (EPL) for individual and collective dismissals(Figure 2.10), because it tends not to be binding in practice as employers and employees often negotiate voluntary departures with compensation packages (OECD, 2016[18]). The conditions for making temporary lay-offs under the short-term work scheme are particularly lenient relative to those in other OECD countries (OECD, 2016[18]): worker consent is not required, laid-off workers receive regular unemployment benefits and employers do not bear any financial costs except when the laid-off workers enter the unemployment tunnel. Older workers laid-off under this scheme are less likely to be hired back than other workers. The conditions for using this scheme should be reviewed to ensure that it is not providing a low-cost route for employers to make permanent lay-offs of older workers.

Figure 2.10. Employment protection is stronger in Finland than in the Scandinavian Nordics

OECD’s indicator of employment protection legislation by type of dismissal, 2019

Note: The figure presents the contribution of different sub-components to the indicators for employment protection. The height of the bar represents the value of the indicator. OECD stands for the unweighted average of 37 countries.

Source: OECD Employment Protection Database, 2019 update version four.

Phase out the unemployment benefit route to early retirement

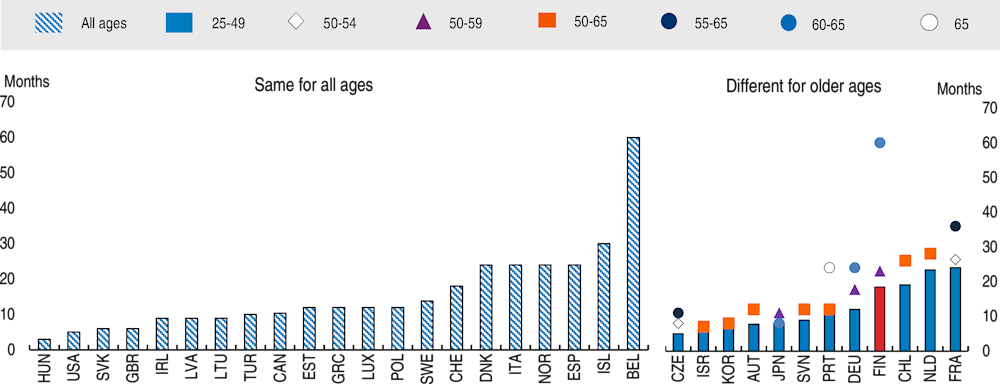

The unemployment early retirement pathway starts with a spell on unemployment benefit, which may be up to 500 weekdays for a person aged 58 or more when they became unemployed (see Box 2.4). If they are still receiving unemployment benefit when they turn 61 (62 for people born in 1961 or later) and have worked for at least five of the past 20 years, they are entitled to extended unemployment benefit (unemployment tunnel) until they reach 65. Thus, it is possible to draw unemployment benefits continuously from age 59 (60 from 2023) until 65 without re-charging benefit rights. The unemployment pathway to retirement can be entered even younger by re-charging unemployment benefit rights close to expiry before reaching the qualifying age for extended unemployment benefit. For the unemployed whose benefits are due to expire after 57 years of age, this can be done by taking up their entitlement to participate in activation measures or to a job with the local municipality. For persons already aged 60, the maximum duration of earnings-related unemployment benefits (until 65) is only matched in Belgium among OECD countries (Figure 2.11). This duration is much longer than in the Scandinavian Nordics, where the extension of unemployment benefits for older workers was abolished years ago (OECD, 2018[19]), thereby curbing the use of unemployment benefits as a pathway to early retirement (OECD, 2013[20]).

Figure 2.11. The maximum duration of unemployed benefit for older workers is long in Finland

Maximum duration¹ of unemployment insurance² payment for a single unemployed aged 25-64 without children and with a full contribution record for all ages, 2018

1. The maximum duration is capped at 60 months for Belgium and Finland. The actual maximum duration might be longer or even unlimited (e.g. in Belgium). In the Netherlands, persons over 41 are capped at 28 months with the maximum duration gradually reducing by 1 month per quarter to 24 months in April 2019.

2. The chart only shows insurance benefits. Assistance benefits can be available as follow-up support in some countries. Australia and New Zealand operate only unemployment assistance benefits which are means-tested but not limited in duration. In some cases, particular rules exist for older unemployed (65 or under) that are not fully taken into account in the database. This is the case for Finland, France, Lithuania, Luxembourg, Portugal and Spain where it is possible under some conditions to extend benefits to the full-rate pension age. See the source for more details.

Source: OECD Tax and Benefits Systems: OECD Indicators, www.oecd.org/social/benefits-and-wages.

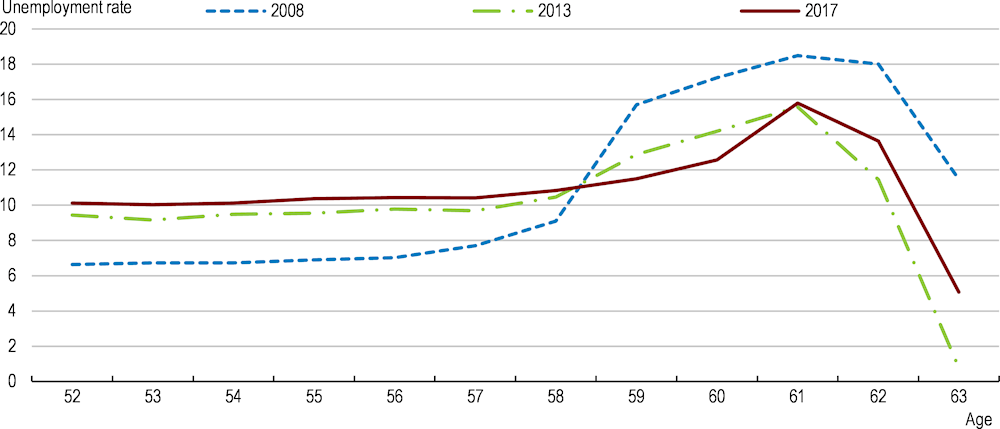

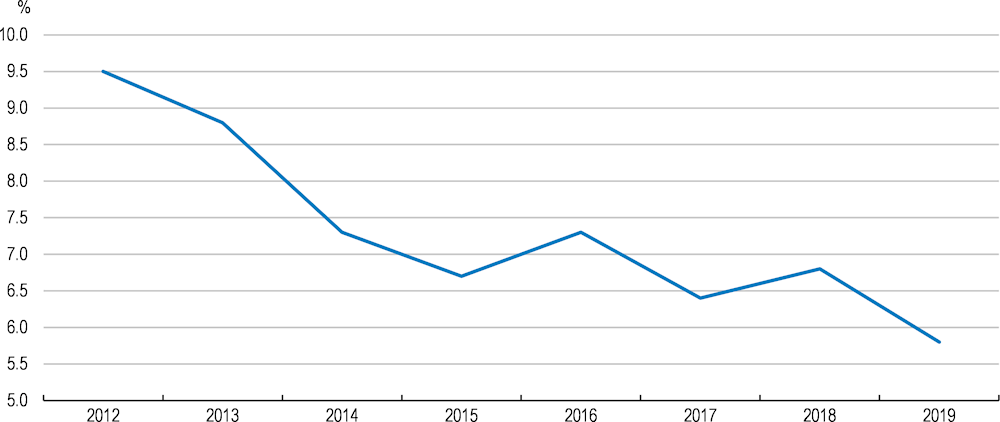

The effect of these arrangements on unemployment rates for older workers can be seen in the sharp increase in rates in the run-up to the age threshold for extended unemployment benefit (Figure 2.12). Prior to the age at which the unemployment pathway to retirement begins (currently, 59), unemployment rates for the over 50s are similar across ages, albeit at higher levels after the Global Financial Crisis than immediately before. In 2017, for example, the unemployment rate was around 10% from age 52 to 57. At age 58, when people becoming unemployed are entitled to an extra 100 days of benefit, the unemployment rate starts to rise and increases sharply to a peak of 16% at age 61, when unemployed people become entitled to extended unemployment benefit. The unemployment rate stays high at age 62 but falls sharply at age 63, which was the minimum eligibility age for old-age pension in 2017. Increases in the eligibility age for extended unemployment benefit in successive reforms (from 57 to 59 years in 2005 (taking effect in 2009), to 60 years in 2012 (taking effect in 2015) and to 61 years in 2015 (taking effect in 2018)) have shifted the increase in unemployment to older ages. The eligibility age for extended unemployment is to rise further to 62 years, with effect from 2023.

Figure 2.12. Increasing the minimum age for extended unemployment benefit pushes back the sharp rise in unemployment rates for older workers in the run-up to benefit eligibility

Source: Ministry of Finance, Ministry of Economic Affairs and Employment and Ministry of Social Affairs and Health (2019), Selvitys eläkeuudistuksessa sovittujen lisäpäiväoikeuteen ja ikääntyneiden aktivointiin tehtyjen muutosten vaikutuksista.

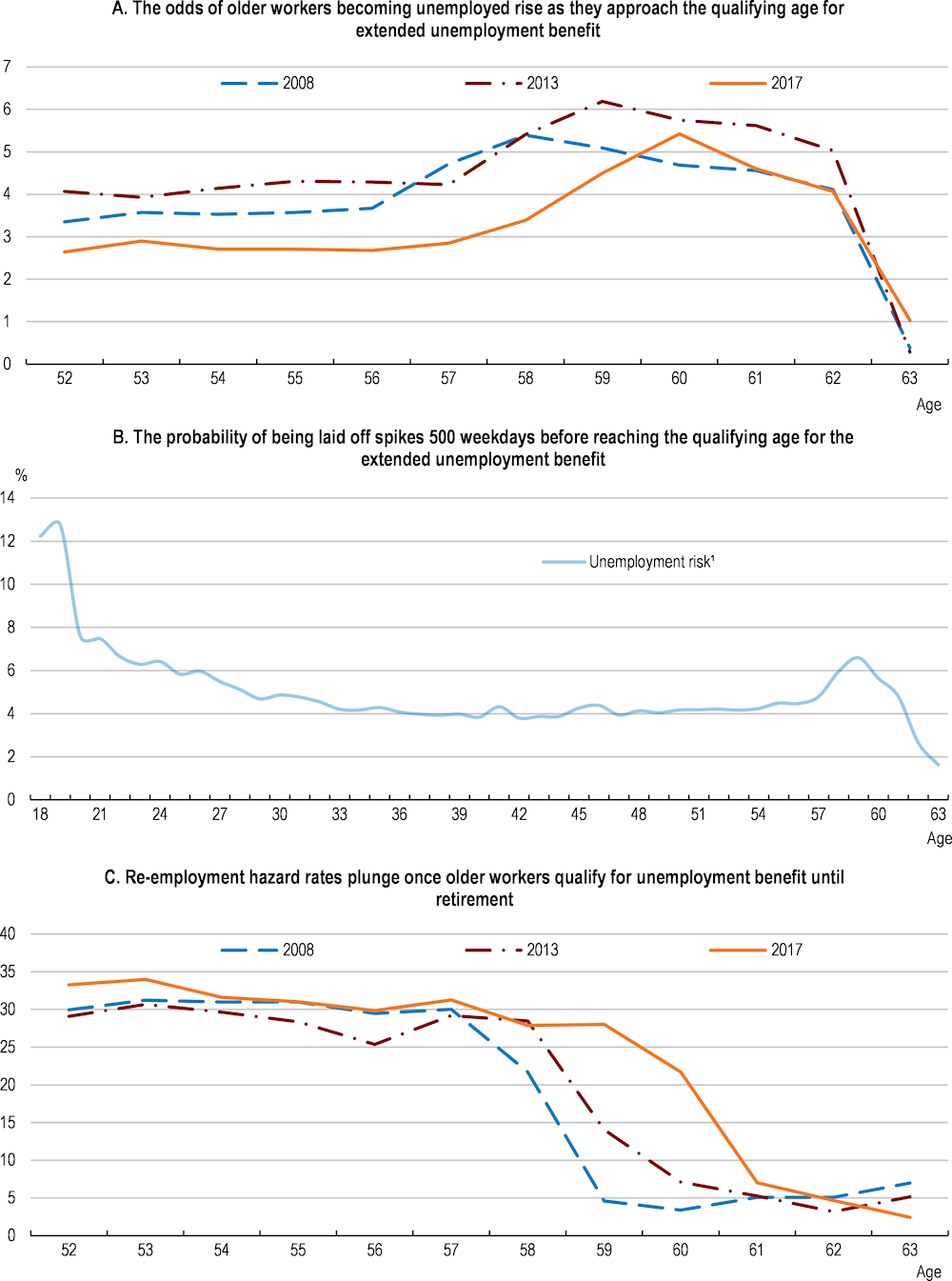

Extended unemployment benefit substantially increases the odds of older workers becoming unemployed and reduces the odds of them becoming employed again. Exit from paid employment to unemployment begins prior to the qualifying age for extended unemployment benefit and increases sharply at ages within 500 weekdays of the qualifying age (Figure 2.13, Panel A). The spike in layoffs at the age when unemployment benefits can last until retirement (i.e., 500 working days before the qualifying age for extended unemployment benefit) (Panel B) points to the mutual interest of employers and employees in using the unemployment route to retirement – employers are able to reduce staffing in a socially acceptable way and, at the same time, reduce employment of workers who are often less profitable than others and employees get to retire early. Re-employment hazard rates plunge once the older unemployed reach the age at which they qualify for unemployment benefits until retirement, highlighting the lack of incentives for the older unemployed to find work again (Panel C).

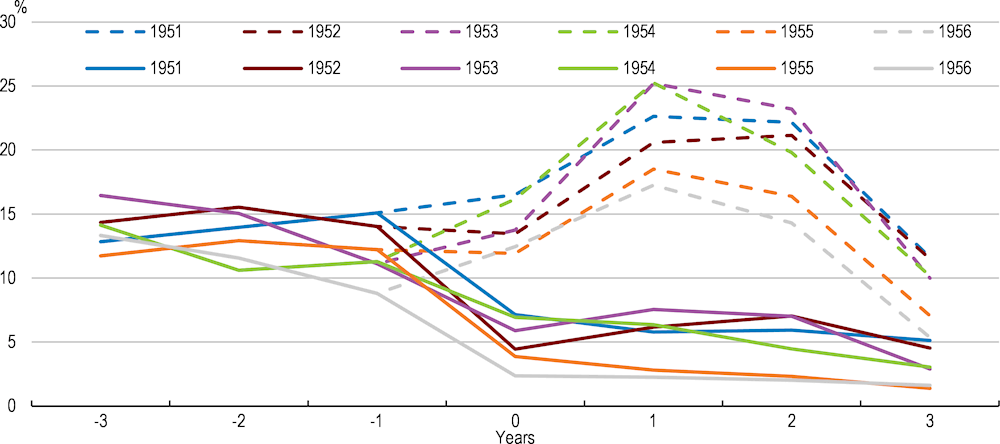

In order to get the unemployed back into employment, unemployment benefits need to be combined with effective active labour market policies. However, in Finland activation measures push the older unemployed towards the unemployment tunnel rather than towards re-employment, as noted above. Indeed, the participation in activation measures by individuals not eligible for extended unemployment benefit surges a year before the eligibility age, while it drops considerably for those eligible for the tunnel (Figure 2.14).

The activation of individuals who entered the unemployment tunnel is very lenient. The PES offices usually do not devote as much attention to these individuals as to other groups (Ministry of Finance, Ministry of Economic Affairs and Employment, and Ministry of Social Affairs and Health, 2019[21]), as they are regarded as retired rather than unemployed. Should the PES enforce job search and work requirements more strictly, these older unemployed could switch from unemployment- to disability benefits rather easily (see below).

A major step to restrict access to early retirement routes would be to phase out the extension of unemployment benefits by gradually raising the eligibility age to the maximum age of entitlement (65) by 2029 and then abolish it at this point . Such a reform would remove the strong disincentive to work longer, as seen in the past each time the eligibility age for extended unemployment benefit was increased; for instance, the 2005 reform that raised the eligibility age from 57 to 59 years increased the average age of the employed aged between 54 and 63 years by 7 months (Kyyrä and Pesola, 2020[22]). Older workers would be less willing to accept redundancy arrangements with their employers and, should they become unemployed, would have stronger incentives to search for a job and accept one; for instance, the 1997 reform that increased the eligibility age by two years doubled the probability of re-employment for the affected unemployed (Kyyrä and Wilke, 2007[23]). The PES would no longer be justified in not offering active labour market programmes to the older unemployed on the grounds that their financial security is assured without working. Moreover, increased employment hazard rates for older unemployed persons would boost the return on PES activation investments for unemployed seniors.

Figure 2.13. The extended unemployment benefit reduces labour supply

Note: 1. The probability of unemployment conditional on employment in the previous year, 2015.

Source: Ministry of Finance, Ministry of Economic Affairs and Employment and Ministry of Social Affairs and Health (2019), Selvitys eläkeuudistuksessa sovittujen lisäpäiväoikeuteen ja ikääntyneiden aktivointiin tehtyjen muutosten vaikutuksista.

Figure 2.14. Activation policies push older workers towards the unemployment tunnel rather than re-employment

Participation of the unemployed in activation measures around the qualification age for extended unemployment benefit

Note: The broken lines show participation rates for the unemployed who do not qualify for extended unemployment benefit and solid lines rates for those who do qualify. The years are birth cohorts. Zero on the horizontal axis is the minimum age for qualifying for extended unemployment benefits.

Source: Ministry of Finance, Ministry of Economic Affairs and Employment and Ministry of Social Affairs and Health (2019), Selvitys eläkeuudistuksessa sovittujen lisäpäiväoikeuteen ja ikääntyneiden aktivointiin tehtyjen muutosten vaikutuksista.

Eliminating the unemployment tunnel would encourage employers to hire and train older workers, as longer working lives would increase the period over which the fixed costs associated with hiring and training could be amortised (Saint-Paul, 2009[24]). Indeed, the past reforms that raised the eligibility age for extended unemployment benefit boosted hiring of workers who were slightly younger than the cohort directly affected by the reforms, reflecting employers’ expectation that these workers would remain in work longer (Ilmakunnas and Ilmakunnas, 2015[25]).

Such a move would also reduce the costs of hiring older workers. Employers above a certain payroll size are responsible for a share of extended unemployment benefit costs of former employees who enter the unemployment tunnel after being laid off (see Box 2.5). While the liability component is intended to curb abuse of the unemployment tunnel by employers, it also creates strong disincentives for employers subject to this liability to hire workers in their late fifties. Abolishing the extended unemployment benefit would remove such disincentives.

If the unemployment tunnel is not eventually eliminated, reforms to restrict its use are needed. The recently legislated increase in the eligibility age for extended unemployment benefit from 61 to 62 years from 2023 is a step in the right direction. Nevertheless, this age would also need to be linked to life expectancy beyond 2030 to prevent the maximum duration of extended unemployment benefit from rising.

Another reform to increase the employment rate of seniors would be to subject the older unemployed to the same activation and job search requirements in practice as other unemployed. Similarly, the unemployed should no longer be allowed to recharge their unemployment entitlements by participating in activation measures. Since participation in activation measures is a requirement for receiving unemployment benefits, rewarding such entitlement sends an undesirable signal that it is optional (OECD, 2016[18]). This entitlement also allows the unemployed, particularly the old unemployed, to chain unemployment benefits by participating in activation measures whenever current entitlement runs out.

In Finland, earnings-related pension entitlements accrue for individuals receiving earnings-related unemployment benefits, except when individuals are receiving extended unemployment benefit beyond the minimum retirement age. To increase incentives to work, the government should extend the non-accrual of pension rights to the whole period of extended unemployment benefit receipt. This would act as a tax on pensions from remaining unemployed, which is effective in motivating workers close to retirement to return to employment while maintaining an adequate level of unemployment benefits (Hairault et al., 2012[26]).

In order to discourage the dismissal of older workers through the unemployment tunnel, the government could consider extending the coverage of the liability component to a wider range of employers. The current payroll threshold for the liability component is about EUR 2.1 million (Box 2.5). As median annual earnings in the private sector were about EUR 38 000 in 2018, this level implies that most firms with less than 50 employees are exempt from the liability component. These firms have been exempted from the liability component and experience-rating out of concern that such costs could imperil their survival. However, such firms comprise 98% of firms in Finland and employ 46% of employees (European Commission, 2019[27]). As discussed above, past reforms that enlarged the coverage of experience-rating reduced risks of unemployment and inflows into disability benefit. The government should thus consider extending the liability component to small firms, if not micro firms. Lowering the threshold would also remove the disincentive for firms just below the threshold (i.e. firms with 49 employees) to grow into medium- to large-sized firms.

Align conditions for obtaining disability benefit for older workers with those for other workers

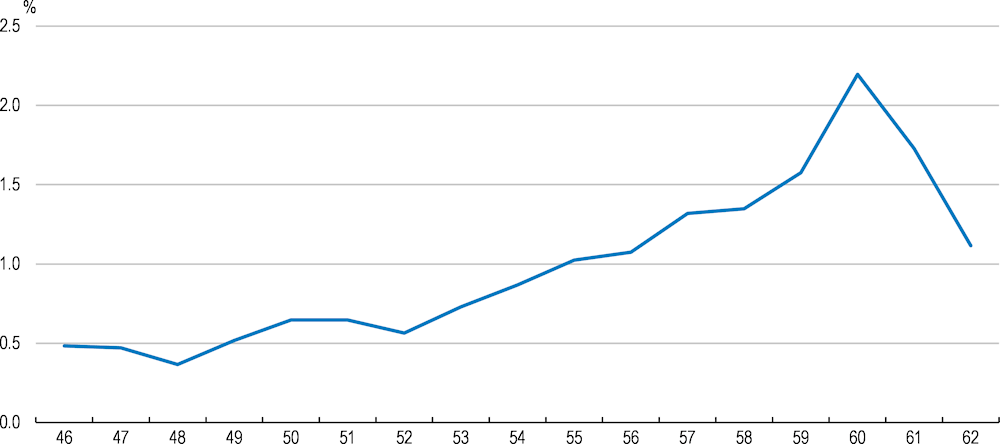

Disability benefits have been widely used as a pathway to early retirement in Finland. In 2017, about 20% of new pensioners aged 63 were previously receiving disability benefits, while 14% were receiving them since the age of 56. The probability of inflow into disability benefits soars when individuals turn 60 (Figure 2.15), the age when more lenient eligibility criteria for disability benefits, including non-medical factors, start to apply (Box 2.8). Disability benefit applicants aged 60 and over are rarely rejected (Figure 2.16). Furthermore, disability benefit recipients aged 60 and over are also much less likely to be rehabilitated, and therefore receive disability pension until retirement (Ministry of Finance, 2019[28]). This is both because older workers can refuse rehabilitation measures and because existing rehabilitation measures are not effective in restoring older workers’ work capacity (Aho et al., 2018[29]).

Inflow into disability benefits often surges when access to other early retirement pathways is tightened by policy changes. For instance, applications for a disability pension soared in 2018, when the activation model came into force, because unemployed jobseekers were not subject to benefit sanctions for not fulfilling activation requirements if they had a pending disability benefit application (Laaksonen, Rantala and Salonen, 2019[30]). Disability benefits may also be used by employers as an alternative measure to let go of older workers when collective dismissal is harder to justify. Indeed, employees working for firms with high worker turnover are more likely to flow into sickness and disability benefits (Korkeamäki and Kyyrä, 2012[5]).

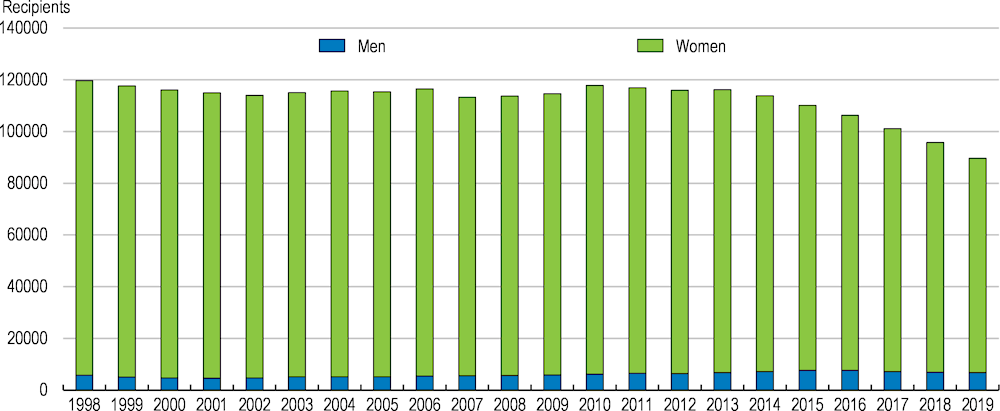

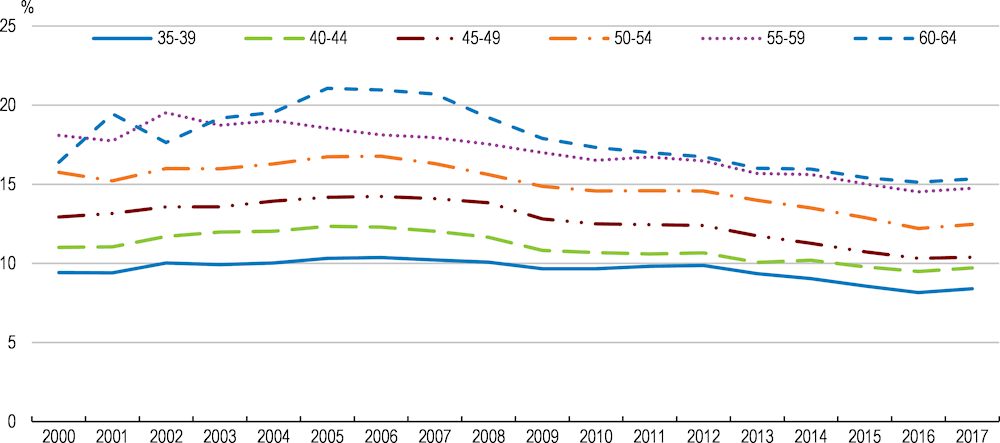

Disability benefits are claimed after workers have been on sickness leave for a year, during which they claim sickness benefits from the Social Security Institution, Kela (Box 2.8). Overall, the health status of older workers has improved markedly in recent years owing to more healthy lifestyles (less smoking and alcohol consumption), reducing the number sickness benefit claimants (Figures 2.17 and 2.18).

Figure 2.15. The probability of inflow into disability benefits soars at age 60

Source: Ministry of Social Affairs and Health and Ministry of Finance (2019), Ikääntyneiden työllisyyden edistämiskeinoja valmistelevan työryhmän loppuraportti.

Figure 2.16. The rejection rate for disability benefits applicants aged 60 or over is very low

Source: Ministry of Social Affairs and Health and Ministry of Finance (2019), Ikääntyneiden työllisyyden edistämiskeinoja valmistelevan työryhmän loppuraportti.

Figure 2.17. The share of 55-64 years olds in poor health declined sharply

The share of people who perceive their health to be bad or very bad

Note: The question about self-perceived health has five possible answers categories very good, good, fair, bad, and very bad. The chart refers to the share of people that perceive to be in bad or very bad health.

Source: Eurostat.

Figure 2.18. The number of sickness allowance recipients has declined

Recipients of sickness allowance relative to the previous year's non-retired population

Source: Ministry of Social Affairs and Health and Ministry of Finance (2019), Ikääntyneiden työllisyyden edistämiskeinoja valmistelevan työryhmän loppuraportti.

By reducing the incidence of disability benefit awards to older workers and hence employers’ experience-rated disability benefit contributions, excluding non-medical criteria from disability benefit assessments would also reduce the cost of hiring older workers. Finland is one of few countries that use experience-rating in disability insurance contributions to incentivise employers to take preventive workplace measures against disability. Employers with payroll exceeding EUR 2 million must pay higher contributions when their employees claim disability benefits (see Box 2.5). Such employers consider the risk of having to pay higher contributions as a barrier to hiring older workers (Liukko et al., 2017[7]).

Box 2.8. Sickness and disability benefits in Finland

Sickness benefit

Workers aged between 17 and 67 years can claim sickness allowance when they become ill and are unable to work. The sickness allowance is disbursed by the Social Security Institution (Kela) for a maximum of 300 working days and is earnings-related – the amount of benefit is calculated based on confirmed taxable earnings. Also, employers typically pay the full salary during the first one to three months of illness, depending on the collective agreement.

Disability benefits

After having received the sickness benefit for a period of about one year, workers assessed to be in further need of rehabilitation can apply for earnings-related disability benefits. Those assessed to have lost over 60% of working capacity are eligible to the full rehabilitation- or disability benefit, while those having lost 40% to 60% of working capacity are entitled to partial rehabilitation- or disability benefit. The amount of the rehabilitation benefit is the same as that of the disability benefit, and the partial benefit amounts to half of the full benefit.

Rehabilitation benefits are intended for recipients who are likely have their work capacity restored through rehabilitation and can be drawn during the fixed period specified in their rehabilitation plans. Those unlikely to return to work or whose capacity to work is not restored after rehabilitation receive disability benefit, which can be drawn until they reach the minimum retirement age for an earnings-related pension.

Disability benefit eligibility is assessed primarily on the basis of medical examinations that consider the claimant’s capacity to perform his/her original job or a different job. However, claimants over 60 are subject to more lenient eligibility criteria that include various non-medical factors like the length of employment history or working conditions. This special provision is a legacy of the Individual Early Retirement scheme that was abolished in 2002, which applied lenient medical criteria to disability benefit applicants aged 60 and over.

Earnings-related disability benefits are part of the earnings-related pension system. Those not eligible to an earnings-related benefit can claim a disability benefit in the national pension system until the age of 65 (the retirement age for the national pension).

Source: Finnish Centre for Pensions website, (European Commission, 2019[31]), (Kyyrä and Paukkeri, 2018[6]).

More needs to be done to curb the inflow from long-term unemployment into disability pension. In 2018, almost half of all new disability pension recipients were previously unemployed. While (long-term) unemployment is often due to reduced work capacity, unemployed people with a disability do not receive a rehabilitation assessment, in contrast to sickness benefit recipients, and therefore have little chance of restoring their work capacity. Furthermore, since healthcare services in Finland are often occupation linked, the unemployed receive less attention from the health care system, which results in health deterioration that reduces employability (von Werder and Thum, 2013[32]). Some municipalities provide free medical screening for anyone over 45 as well as rehabilitation plans for long-term unemployed but such services are not universal.

The rehabilitation system also need to be overhauled so that it works better to return people to employment. Some 80% of people who receive a positive rehabilitation assessment never begin a rehabilitation programme. There are several reasons for this outcome, including the lack of suitable rehabilitation programmes and/or support to find them and a strengthened ‘pension orientation’, whereby a person not yet receiving disability benefit refuses rehabilitation because she considers herself already to be a pensioner and, as such, sees no point in participating in rehabilitation programmes.

Non-medical criteria for assessing the work capacity of disability benefit applicants aged 60 or more should no longer be taken into account to limit the use of disability benefit as an alternative pathway to early retirement. Past experience in Finland and other Nordic countries suggests that such reform lengthens working lives significantly. For instance, Finland’s 2002 reforms that abolished the Individual Early Retirement scheme that allowed workers aged 60 years or more to access disability benefit under lenient medical criteria (see Box 2.8) reduced the probability of a worker retiring through disability benefit by age 63 by 25% and extended working lives by as much as 3.4 months (Kyyrä, 2015[4]). Likewise, Sweden experienced a significant drop in the disability hazard rate and an increase in the employment rate of individuals aged 60 to 64 following the 1997 reform that excluded non-medical criteria from assessments of disability benefit eligibility (Jönsson, Palme and Svensson, 2012[33]). As noted above, longer working lives would also encourage employers to hire and train older workers.

Enhancing current and future older workers’ skills

Reforms to close early retirement pathways need to be coupled with policies that enhance the employability of older workers and make the work environment more conducive to longer working lives. Steps need to be taken to increase the capability of workers to keep up with technological change, such as digitalisation, and to facilitate the smooth transition to new jobs by displaced older workers. Potential discrimination against older workers at work or with respect to job applications must also be tackled and more flexible working time arrangements should be promoted.

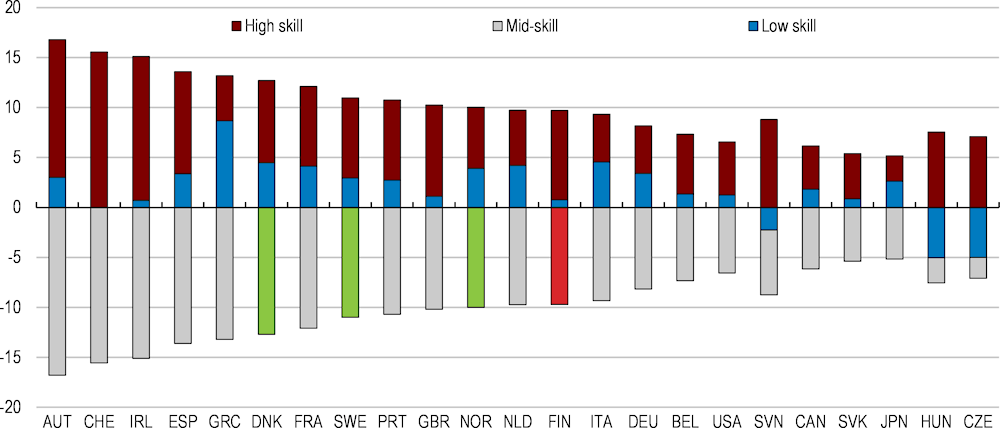

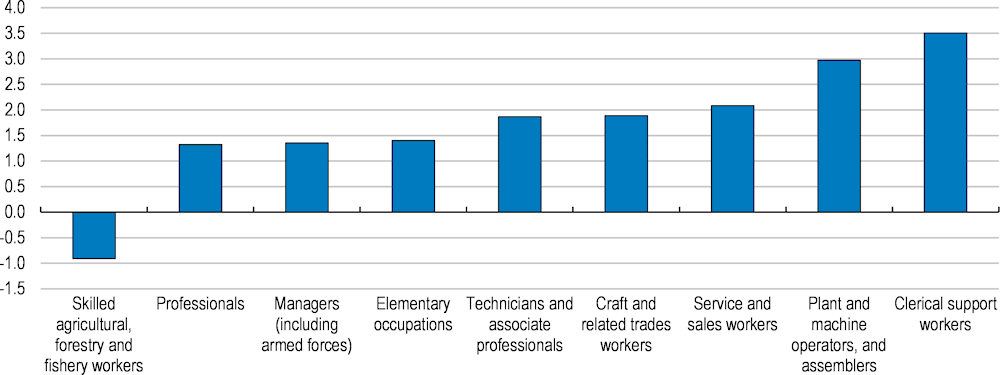

Figure 2.19. The labour market has become more polarised, with high-skill replacing mid-skill jobs

Percentage point change in share of total employment, 1995 to 2015

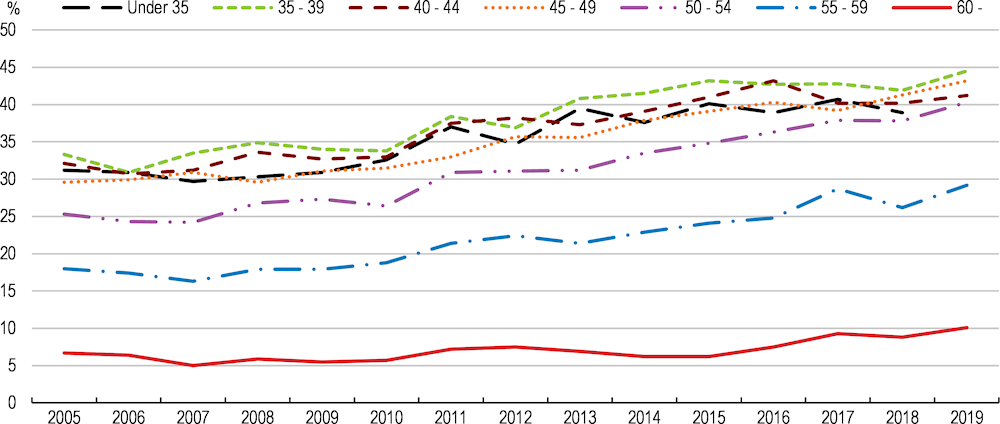

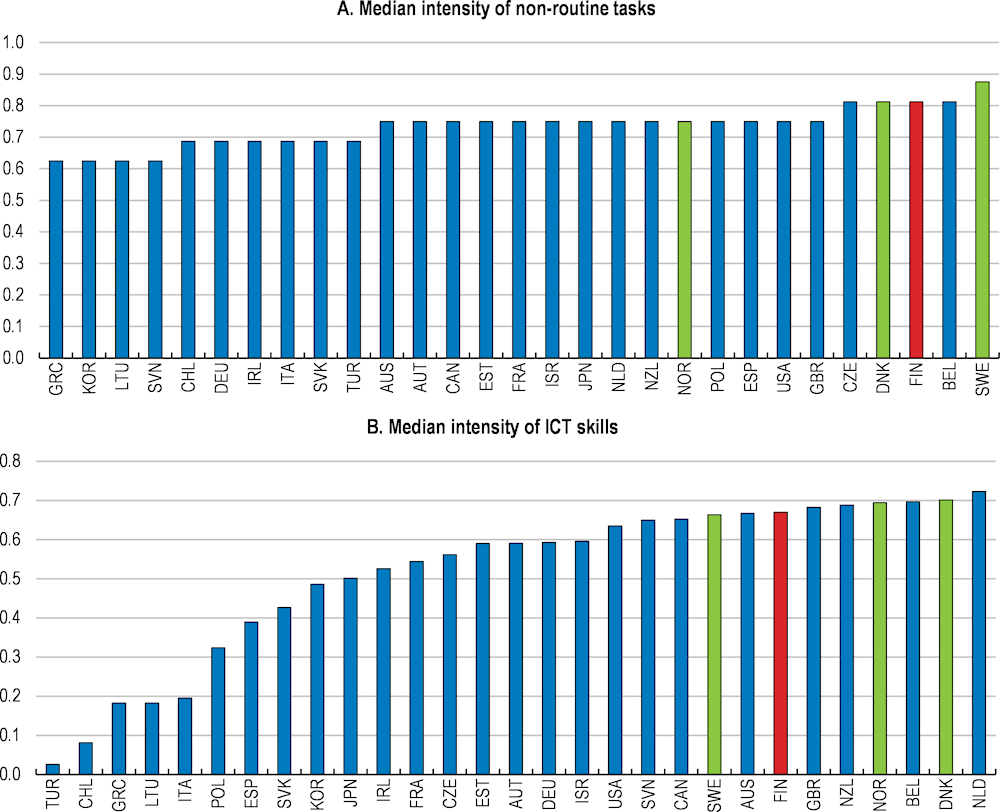

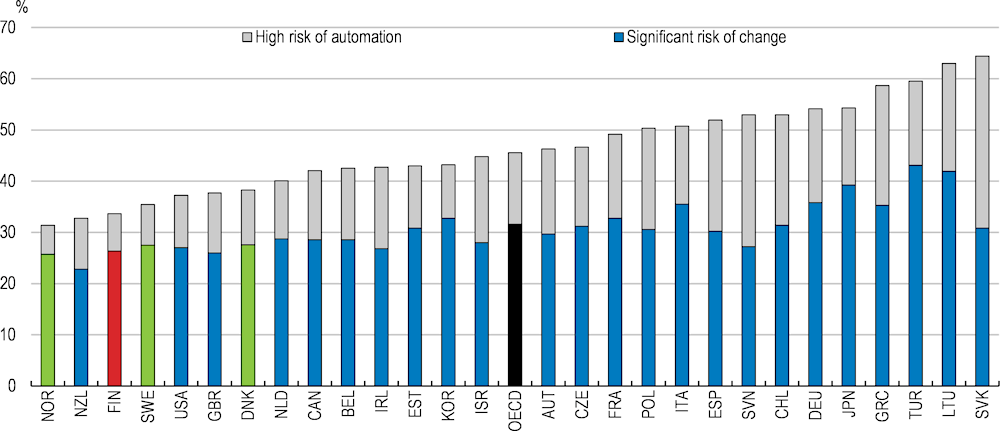

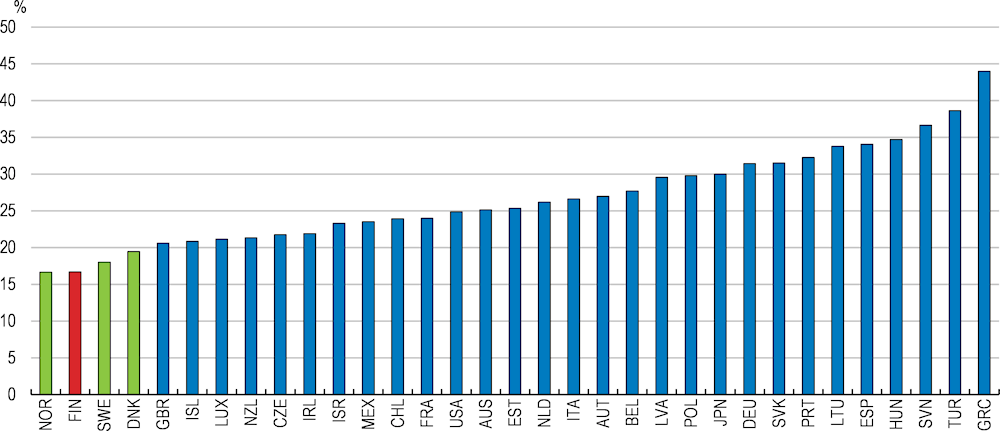

Labour market demand in Finland has been driven in recent decades by the fastest adoption of digital technologies among EU economies (European Commission, 2019[34]). Jobs have become more polarised, as the share of medium-skill production and clerical jobs has decreased while low-skill service occupations and high-skill specialist occupations have gained share (Pekkala Kerr, Maczuskij and Maliranta, 2016[35]). While the polarisation of labour markets is commonly observed across OECD countries, the decrease in the share of mid-skill jobs in employment in Finland has been mostly offset by the increase in the share of high-skill jobs (Figure 2.19). The strong demand for high-skilled workers reflects the fact that jobs in Finland are more intensive in non-routine tasks and ICT skills than those in other OECD countries (Figure 2.20). This job structure underlies the smaller share of jobs at high risk of automation than in most other OECD countries. Nevertheless, about one quarter of jobs are likely to undergo significant change, a share that is closer to the OECD average (Figure 2.21).

Figure 2.20. The intensity of non-routine tasks and ICT skills at work is high

Note: The intensity of non-routine tasks and the intensity of ICT skills are captured by the indicators constructed from The Survey of Adult Skills (PIAAC), which includes information on tasks workers perform at the workplace, including reading, writing, numeracy, ICT and problem solving and on the frequency with which workers perform these tasks. Indicators are normalised between 1 and 0, with a higher value corresponding to a higher frequency of performing tasks that are of a non-routine nature or require ICT skills. See the source for more details.

Source: OECD (2019), OECD Skills Outlook 2019.

Figure 2.21. Automation risk is low but one quarter of jobs would undergo changes

Share of jobs which are at a high risk of automation or a risk of significant change

Note: Jobs are at high risk of automation if the likelihood of them being automated is at least 70%. Jobs at risk of significant change are those with the likelihood of being automated estimated at between 50 and 70%. Data for Belgium correspond to Flanders and data for the United Kingdom to England and Northern Ireland.

Source: OECD (2019), OECD Employment Outlook 2019.

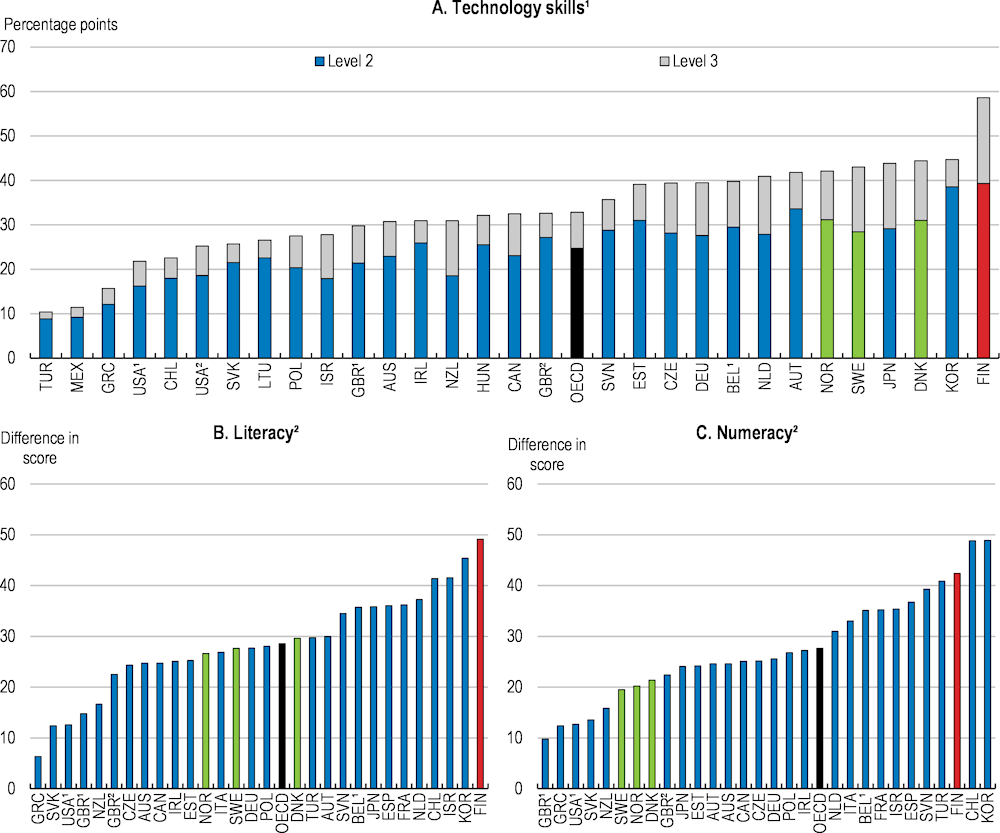

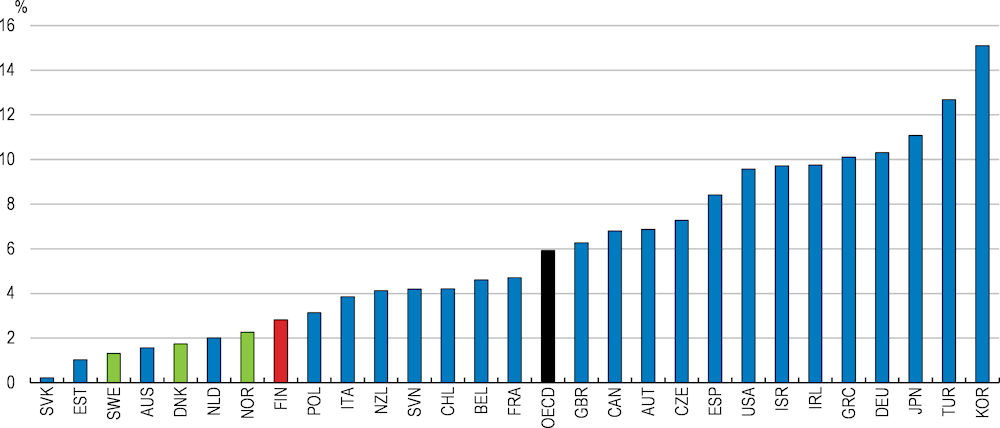

Given the particularly high demand for skills in Finland, older workers face severe challenges in the labour market as they have lower information processing skills, including literacy and numeracy skills, than the rest of the working-age population, particularly than the younger generation (Figure 2.22). This reflects both their lower education levels than younger cohorts and a deterioration of skills with age. The older age group surveyed in the 2012 PISA study did not benefit from the comprehensive school system implemented from 1972, which provided a nine-year basic education to everyone. Furthermore, Finland belongs to a group of countries where literacy skills erode somewhat with age (Barrett and Riddell, 2016[36]). The large inter-generational skill gaps combined with fast diffusion of digital technologies reduces the chance of older workers remaining employed, especially those facing higher risks of being replaced by computers or robots. Fortunately, the seniority wage premium is low in Finland, limiting the loss of cost competitiveness of older workers, making it easier for them to remain in continuous work (OECD, 2019[37]) (Figure 2.23).

Figure 2.22. Information processing skills are lower for older than for younger workers

Difference between the youngest (25-34 year-olds) and oldest (55-65 year-olds) adults

Note: 1. Difference in shares of the youngest (25-34 year-olds) and oldest (55-65 year-olds) adults scoring at Level 2 or 3 in problem solving in technology-rich environment. 2. Difference between the youngest (25-34 year-olds) and oldest (55-65 year-olds) adults. In all panels, data for Belgium¹ correspond to Flanders, data for United Kingdom¹ correspond to England, data for United Kingdom² correspond to Northern Ireland, data for United States¹ correspond to data from 2012/2014 survey and data for United States² correspond to 2017.

Source: OECD Survey of Adult Skills (PIAAC) (2012, 2015, 2018).

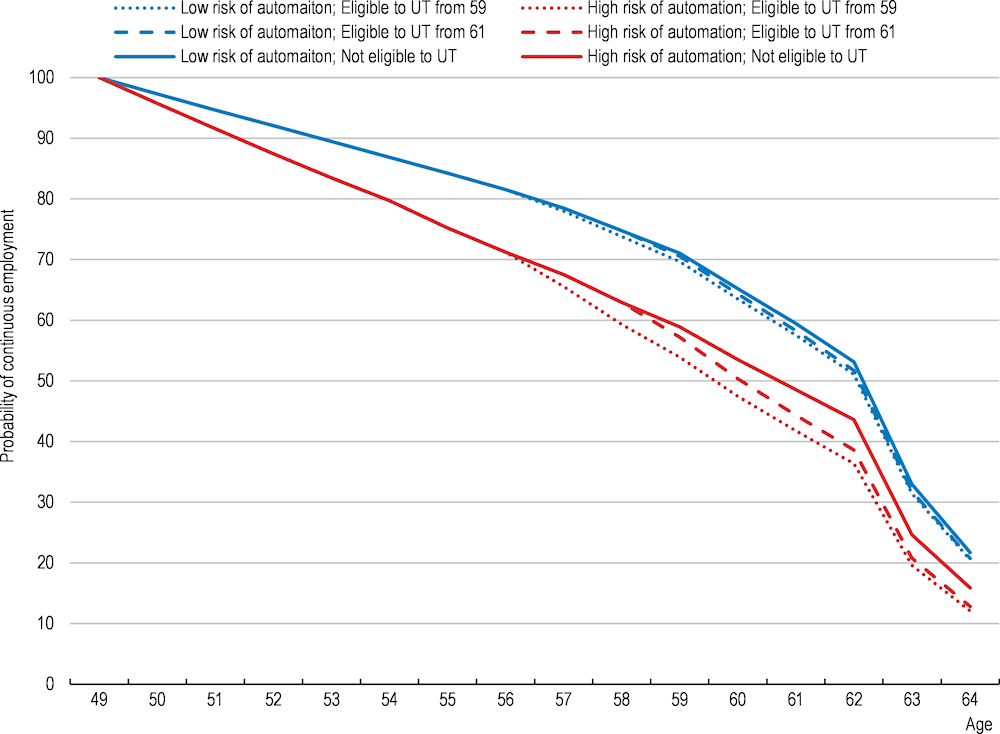

The unemployment tunnel increases the probability of early retirement of older workers more in occupations that are highly exposed to digital technologies and automation risks than in other occupations (Box 2.9). Indeed, the surge in unemployment risks starting 500 days before the eligibility age for extended unemployment benefit (documented in Figure 2.13, Panel A) is significantly larger for office clerks or production workers (Figure 2.24), occupations often characterised by high shares of codifiable routine tasks that are more likely to be automated (Nedelkoska and Quintini, 2018[38]). The interaction between the unemployment tunnel and digital technologies in driving older workers out of employment documented in Box 2.9 underscores the importance of closing pathways to early retirement, in addition to boosting skills, for ensuring the inclusion of older workers in the future of work.

Figure 2.23. The seniority premium in wages is relatively small

Predicted wage growth moving from 10 to 20 years of job tenure for individuals aged 50-60, 2011/12 or 2014/15

Note: Estimates were obtained from a cross-sectional regression of wages on tenure, squared tenure and controls for: gender, experience, years of education, literacy and numeracy skills, occupation, skill use at work, and educational status of the parents. The OECD is a weighted average and excludes Hungary, Iceland, Latvia, Lithuania, Luxembourg, Mexico, Portugal and Switzerland. Data for the United Kingdom refer to England and Northern Ireland and Belgium to Flanders.

Source: OECD (2018), Working Better with Age: Japan.

Figure 2.24. The effect of the unemployment tunnel is larger in automatable occupations

Change in unemployment risks from age 58 to 60, percentage points, 2015-17

Source: Yashiro, N. et al. (2020), “Technological changes, labour market institutions and early retirement-Evidence from Finland”, OECD Economics Department Working Paper, Forthcoming.

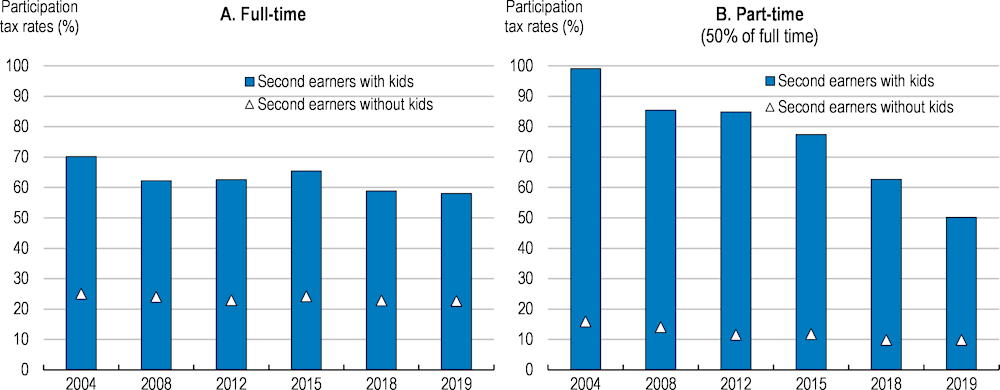

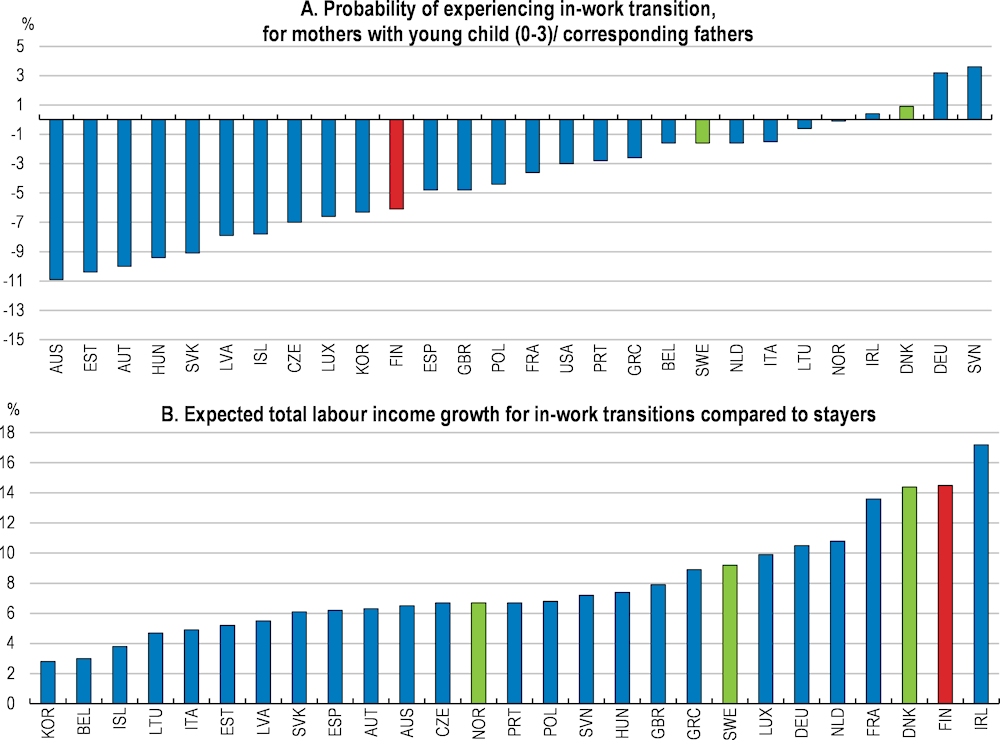

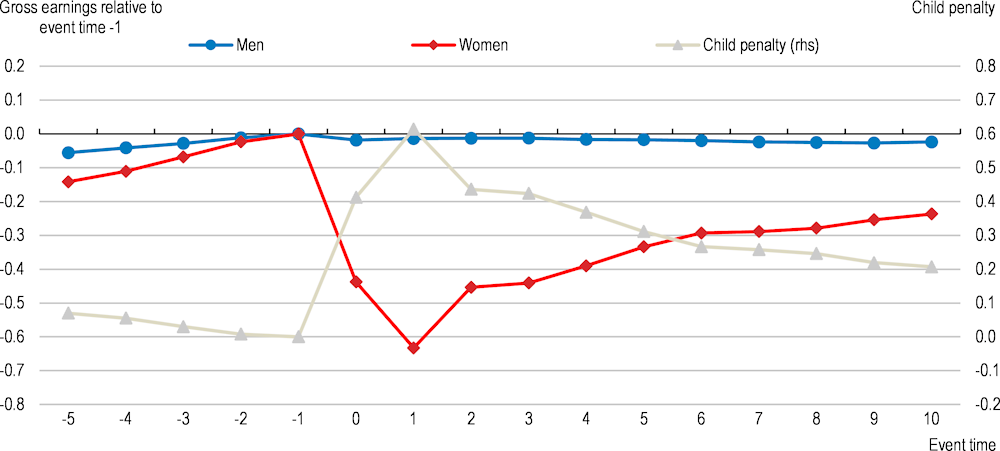

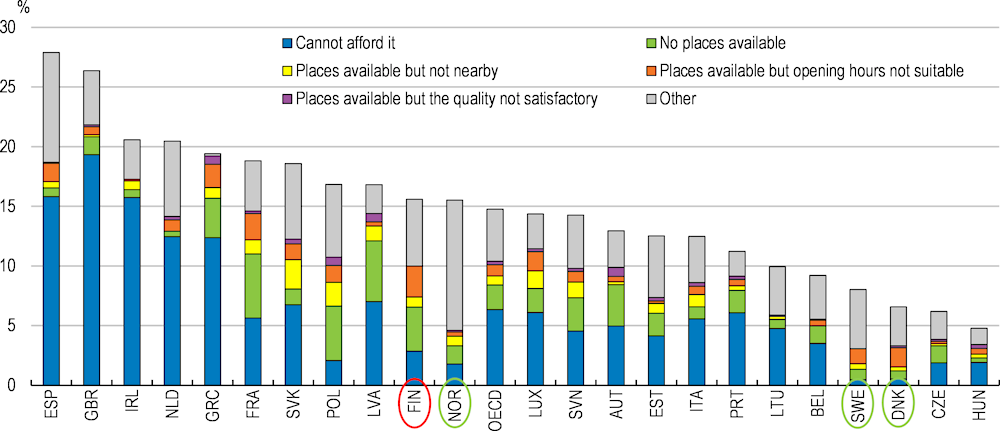

Box 2.9. The unemployment tunnel promotes the early retirement of workers more exposed to digital technologies