The general government budget deficit is projected to increase by 6.5% of GDP in 2020 and the European Central Bank (ECB) has supplied vast amounts of liquidity and supported increased bank lending. However, some of these measures risk reducing banks’ risk-bearing capacity. Activity will gradually return to its pre-COVID-19 level by 2022.

Three quarters of the 3.5% of GDP in discretionary measures that increase the 2020 budget deficit were in response to COVID-19. As the measures unwind and the economy recovers, the budget deficit is projected to fall to 3.5% of GDP by 2022, with 40% of the decline reflecting automatic stabilisers. General government debt will increase sharply in 2020 and slowly thereafter.

To complement expansionary monetary policy measures, the ECB has lowered bank capital requirements, introduced flexibility in the treatment of non-performing loans, and reduced solvency and collateral requirements, enabling banks to accept lower quality collateral. While these measures have increased domestic lending capacity, they risk reducing banks’ risk-bearing capacity.

Measures are being taken to slow the growth in household debt, 70% of which is housing loans (including rapidly growing housing company loans, which are ultimately a household liability). However, the recent reduction in loan-to-value ratios for housing loans was reversed this year to support recovery from the COVID-19 crisis.

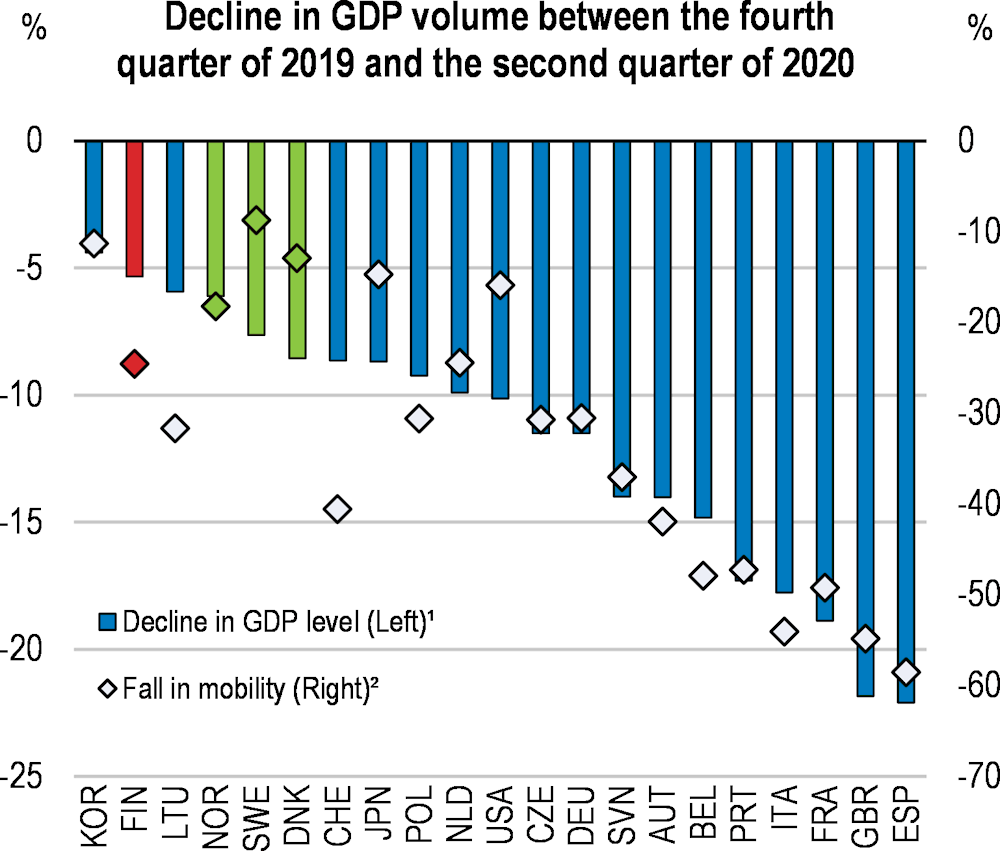

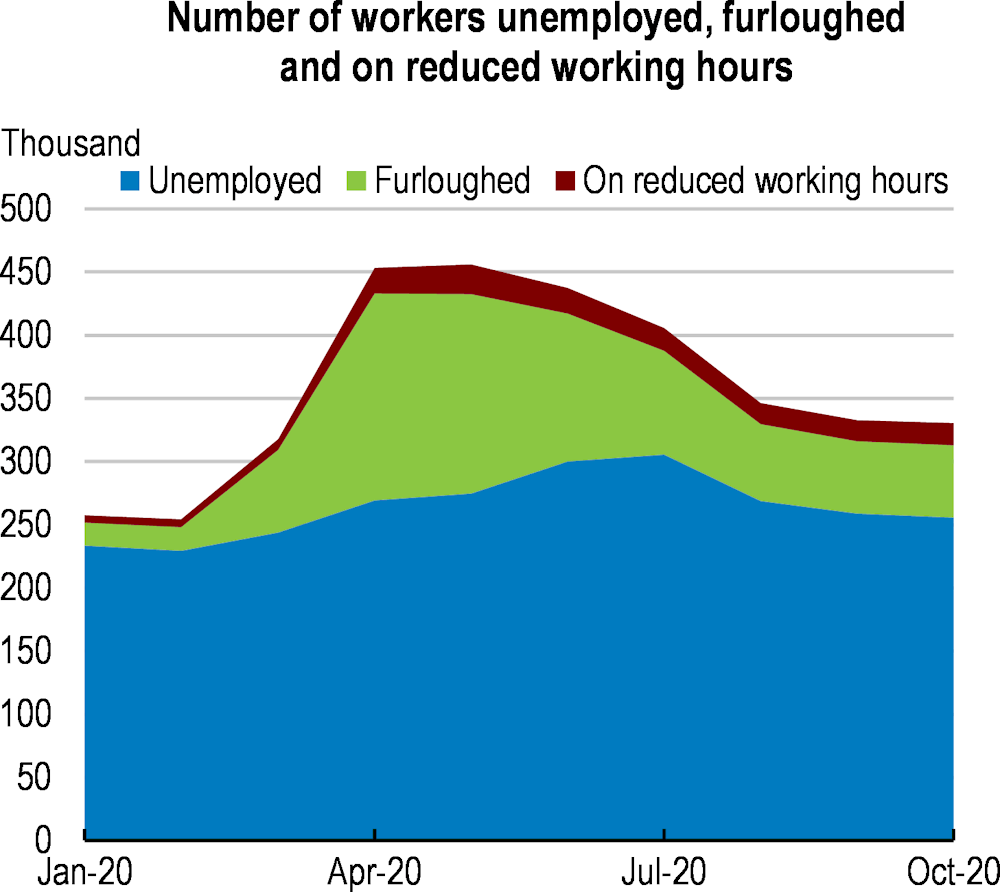

Real GDP is projected to drop by around 3% in 2020 and to recover slowly, especially in light of the second coronavirus wave (Table 1). The recovery will be led by private consumption and exports. Unemployment and bankruptcies are likely to rise in the short run, as relief measures run out towards the end of 2020. Inflation pressure will be weak, reflecting the sizable output gap and labour market slack.