This chapter reviews Viet Nam’s investment and competition framework in the context of clean energy. It examines the country’s efforts to level the playing field between the national power utility and independent power producers, as well as to create a fair, efficient and transparent procurement process for renewables. It assesses Viet Nam’s foreign direct investment regime and other areas to improve the framework for clean energy investment, including how to facilitate land access.

Clean Energy Finance and Investment Policy Review of Viet Nam

4. Investment and competition policy

Abstract

The substantial deployment of renewable energy in Viet Nam has been driven by a wave of private investment under independent power producer (IPP) terms, consequently increasing the share of private ownership of installed capacity from 20 to 30% since 2018. As the renewable energy market matures, Viet Nam will need to continue to support fair competition and equal access between private developers and state owned enterprises, and particularly with the state utility Viet Nam Electricity (EVN), who holds a dominant position across the electricity sector. The upcoming framework for competitive procurement of renewable projects, the full launch of the wholesale market, the continued equitisation of EVN generation companies and the strengthened independence of the National Load Dispatch Centre (NLDC) will be important milestones for creating a level playing field between EVN and renewable IPPs. Viet Nam has been particularly successful in attracting foreign direct investment (FDI) over the last decade and the country’s clean energy transition will play an important role in continuing this trend to achieve the government’s ambitions to become a leading manufacturing hub in the region.

Assessment and recommendations

Progress is being made towards developing a competitive power market

Viet Nam should be commended on implementing several stages of its electricity market reforms. Since the 1990’s the government has worked towards reforming the power sector in order to ensure efficient and affordable power and long-term security of supply. The 2004 Electricity Law was a key milestone and under the reform process, EVN has undergone restructuring into separate entities to enhance operational independence and divestment from non-strategic generation activities. At the end of 2020, EVN accounted for 48% of total installed capacity, down from 58% in 2018 (VIET, 2021[1]). However, the continued participation of SOEs in the generation subsector and EVN’s dominant role across all stages of the electricity market remain problematic for the achievement of the ambitious electricity market development agenda prioritised under the 2004 Electricity Law and Resolution 55 orienting the National Energy Development Strategy to 2050. While a majority of renewable projects have been developed by the private sector, it remains important to develop a fair and transparent procurement process in order create a level playing field. The establishment of the wholesale market will be the next milestone, and as more variable renewable capacity is introduced, this market can play a key role in increasing efficiency and driving cost reductions through competition if price signals are effectively harnessed.

Significant transmission upgrades are needed to integrate variable renewable capacity

By 2045, variable renewable electricity could make up more than 44% of Viet Nam’s installed capacity (Institute of Energy, 2021[2]). Meeting long-term demand growth and deployment targets for new generating capacity, especially variable renewable generation, will require significant amounts of investment in transmission infrastructure. According to the draft PDP VIII, between 2021 and 2045 Viet Nam requires USD 85 billion in grid investment, or between USD 3.3 and USD 3.4 billion per year, on average. It is essential that this transmission infrastructure be built in a timely manner whilst also keeping costs within a reasonable limit. EVN’s role in planning and developing transmission will remain critically important, but Viet Nam should consider the potential role private investors can play in supporting new transmission investments. Under Article 4 of the Electricity Law, the state holds monopoly rights in transmission activities, which includes investment, management and operation. The lack of framework for private participation in the transmission subsector makes it unclear how such investments could be made possible in the future. A review of the Electricity Law is under discussion within the current Socio-Economic Development Strategy (SEDS) cycle. In order to upgrade the transmission system to keep up with current needs, priority should be given to enabling private participation and developing a framework that allows for bankable concession agreements.

Contracting under Public Private Partnership (PPP) laws are underused for clean energy projects

Although power grids and power plants are amongst the five permitted sectors under the new law on Public-Private Partnership (Law No. 64/2020/QH14) (the "PPP Law"), procurement under the PPP law has not been widely used for recent clean energy projects. The recent surge in renewable deployment has been driven by feed-in-tariffs (FIT) established by a separate regulatory framework which introduced standardised power purchase agreements (PPAs) governed under the Law on Investment. As Viet Nam transitions away from the FIT, the PPP law may provide an effective legal framework for larger-scale renewable projects, as more flexibility is permitted to negotiate contract terms.

However, the PPP law does remain unclear on the availability of government guarantee undertakings (GGUs) which are often critical to securing non-recourse project finance debt. The reduction in protection for currency convertibility risk and a requirement for Vietnamese law as the governing law will also prove problematic for many sponsors and lenders. This should be seen as a source of implementation risk for the ambitious deployment plans under the PDP VIII draft, particularly for highly complex and capital intensive integrated liquefied natural gas (LNG) to power projects which have been accelerated under current plans. With respect to energy efficiency, the stipulated minimum project value of VND 200 billion (USD 8.5 million) may create barriers for PPP arrangements, given the typically smaller and fragmented nature of energy efficiency projects (often under USD 1 million). Models for significant project aggregation will be required to achieve the necessary scale to meet these thresholds.

Commitment to clean energy will strengthen its status as an attractive FDI market

Viet Nam is already an attractive location for foreign direct investment, and thanks to its effective management of COVID-19, the country is positioned to benefit from the disruption to established global supply chains caused by the pandemic as well as ongoing trade disputes. This is in line with Viet Nam’s ambitions to become a leading industrial hub amongst ASEAN economies, accounting for 40% of GDP by 2030, with 30% attributed to manufacturing and processing industries (Resolution No. 23-NQ/TW). As the pressure increases for multinationals to reduce their overall carbon footprint, and supply chains come under increasing scrutiny, the availability of affordable, secure and clean power for supply chain activities will take increasing importance. Viet Nam’s commitment to energy efficiency and low carbon energy will strengthen its attractiveness to foreign investors. Corporate sourcing of renewable electricity is a route for Viet Nam’s manufacturing base to rapidly and cost-effectively decarbonise. This is also attractive to multinationals as it provides the opportunity to demonstrate additionality to their stakeholders, in the sense that additional renewable capacity is being developed in Viet Nam by virtue of their PPA. Moreover, with the right pricing structure, a long term corporate PPA can hedge against rising electricity costs. The government must be commended for its willingness to innovate in this area with a much-anticipated pilot direct PPA programme planned to commence this year.

Dispute Resolution should be strengthened in order to boost investor confidence

Under standardised power purchase agreements dispute resolution takes place through mediation before the Electricity and Renewable Energy Authority (EREA), and if unresolved can be escalated to the Electricity Regulatory Authority of Viet Nam (ERAV), with results appealable in Vietnamese courts. In practice, some PPA disputes have gone through local arbitration, notably the Viet Nam International Arbitration Centre, subject to agreement by both parties. As Viet Nam’s power system continues to evolve, including, for example, the move away from the feed-in tariff support to competitive auctioning coupled with the increasing share of IPPs, ERAV’s dispute resolution role is likely to grow in importance. It is therefore important that ERAV’s independence be strengthened, so that the decisions it makes are perceived by market participants as fair, objective and free of political interference. Under the new competitive bidding framework, Viet Nam should provide recourse to arbitration as a standard practice, departing from the current framework which requires EVN’s consent on a case-by-case basis.

Coordination around land-use rights remains a challenge for project development

Land access is an important topic for both transmission infrastructure and renewable electricity projects. Land remains in the hands of the state, and individuals and entities are able to purchase the right to use the land through Land Use Right Certificates (LURCs). Foreigners are able to secure LURCs for renewable projects, however the process for obtaining them remains challenging, particularly for developers unfamiliar with the context. There is a need to improve the transparency and co-ordination of various approval processes, as well as co-ordination between governmental and provincial stakeholders, to achieve cost-effective and expedient renewable project development and limit the possibilities for opacity. Future renewable auction mechanisms provide an opportunity for simplified land acquisition and clearance processes. In particular, the People’s Provincial Committee can play a larger role in identifying the location for renewable projects, and in taking responsibility for land acquisition and clearance. Moreover, to facilitate better planning, the national and provincial land use master plan should take into consideration land needs for development of renewable projects and transmission infrastructure.

Box 4.1. Main policy recommendations on investment and competition policy

Ensure that the wholesale market incentivises system-friendly operations by providing accurate and high-resolution (in terms of time and geography) price signals to all appropriate market participants. Exposure to correct price signals can incentivise greater efficiency in operation and capital allocation.

Strengthen ERAV’s independence, so that all market participants view the decisions it makes as fair, objective and free of political interference. Consider providing recourse to arbitration as a standard practice for renewable electricity PPAs.

Enhance the independence of the NLDC in the near term and consider a timeline for the independence of the transmission company, Viet Nam Electricity National Power Transmission Corporation (EVNNPT), and the separation of distribution and competitive activities such as generation and retail in EVN power corporations.

Consider revising the legal framework to enable private investment in transmission infrastructure, in order to realise planned upgrades in a timely and cost effective manner. Priority should also be given to developing a framework for competitive bidding and bankable concession agreements, for instance through the new PPP law.

Establish guidelines for competitive and transparent procurement of renewable projects in order to support a level playing field between private sector and state-owned enterprises (SOEs), both domestic and regional. Ensure that development risks regarding allocation of LURCs are taken into consideration in the design of the bidding framework.

Creating a level playing field between public and private investors in clean energy infrastructure

In the face of constrained public finance and growing energy demand, private investment has been recognised as a key component to ensure long-term security of a power supply, which is accessible and affordable to consumers. Viet Nam has sought to move away from a centrally-planned monopoly towards a power sector with multiple participants and at this time, the market can be labelled as partially competitive, with EVN holding a dominant position. A regulatory authority has been established, and the upcoming auction mechanism will pave the way for competitive bidding and greater transparency. Viet Nam is implementing plans to increase efficiency and competition by privatising shares of SOEs, and in particular the state utility’s (EVN) ownership of generation assets through a process known as equitisation, as well as by increasing corporate governance.

More efforts are needed to level the playing field between IPPs and EVN

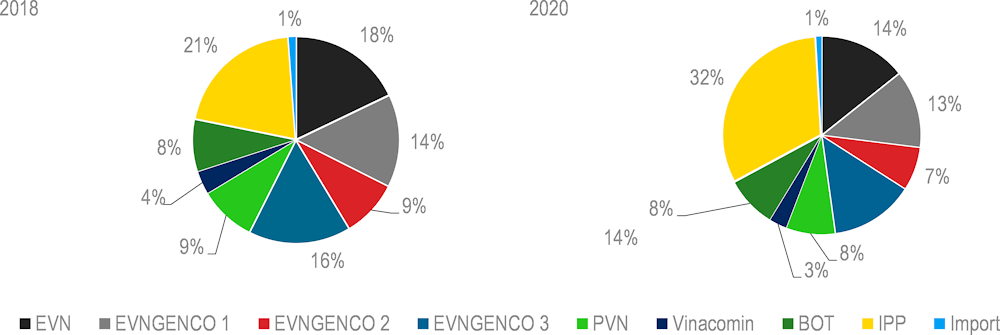

The electricity market in Viet Nam remains heavily government owned by state utility EVN and its subsidiaries who maintain a monopoly over electricity transmission distribution, wholesale and retail (see chapter 2). Until 2018, 58% of generation remained in the hands of EVN, with a further 13% owned by PetroVietnam and Vinacomin (VIET, 2021[1]). The landscape has been changing with a surge of new private investment since 2019, through renewable projects (Figure 4.1). This has primarily taken the form of greenfield investment in wind and large amounts of solar under independent power producers (IPPs) arrangements. From 2018 to 2020, the share of capacity owned by IPPs jumped from 21% to 31% of total installed capacity (VIET, 2021[1]). By virtue of the integrated structure of the market, renewable project development and operation remains heavily dependent on EVN. For solar, wind, biomass, waste to energy and small hydro projects, IPPs depend on non-negotiable power purchase agreements (PPA) from EVN, the sole offtaker of electricity in Viet Nam (discussed in Chapter 3). Under current legislation there is no framework for industrial and commercial users to directly source renewable electricity from IPPs.

Figure 4.1. Ownership of installed capacity in Viet Nam 2018 and 2020

Although a majority of renewable projects have been developed by the private sector, renewable electricity does feature in SOE strategies, albeit modestly. This reinforces the need for a fair and transparent procurement process. The current system could be perceived to favour SOEs from the energy sector who, by virtue of their structural ties with the Ministry of Industry and Trade (MOIT), would be better placed to navigate the project development process, combined with competitive advantages of SOEs in Viet Nam, such as facilitated access to land, and their ability to borrow from state-owned commercial banks on more preferential terms.

To date SOE renewable targets remain modest. For instance, PetroVietnam, Viet Nam’s state owned oil firm, only aims to develop 100 MW of renewables capacity by 2025 and 900 MW by 2035 (Renewables Now, 2020[3]). EVN’s generation companies (GENCOS) already have 215 MW of solar capacity, with plans to increase capacity in forward looking strategies (VIET, 2021[1]) (EVN, 2019[4]). In an investor conference in January 2021, ahead of its initial public offering (IPO), GENCOS 2 announced that it recently completed 50 megawatt power (MWp) of solar power projects, and had 55 MW of wind power under construction, with plans for eight new power projects of a total capacity of 2 593 MW comprising six solar power plants and two thermal plants (Viet Nam News, 2021[5]). As EVN continues to partially privatise its generation companies, investment in renewable electricity may feature in its strategy to attract investors. However, significant participation in the renewable electricity sector would be problematic for competition. At this stage of the electricity market reforms, EVN’s GENCOS have a clear advantage over competitors, through structural ties with EVN subsidiaries across the electricity sector but also through its relationship with MOIT.

Equally, as the wholesale market develops, a level playing field is important to ensure that prices reflect actual system conditions and are free from price distortion. An effective wholesale market can help unlock greater efficiency and system flexibility as exposure to price signals provides incentives for efficient capital allocation and responsive asset operation with view of system needs. Market participation of SOE owned assets that benefit from direct or indirect state aid can harm private participants’ ability to compete, at a cost to consumers and public finances. Barriers to efficient market operation can also occur where competition policy and SOE governance regulations allow opportunities for anti-competitive practices such as predatory pricing or other abuses of market power.

Viet Nam has made significant progress with the unbundling EVN and SOE reforms. However, the continued participation of SOEs (albeit reducing over time) in the power market and EVN’s dominant role across all stages of the market remain problematic for the achievement of the ambitious electricity market development agenda prioritised under the electricity law and as set out in other sector strategies such as resolution 55.

Currently renewable generators benefiting from FITs have no exposure to market prices as they do not participate in the electricity market. This is common globally as revenue stability and preferential tariffs are needed to stimulate technological progress. However, as renewable generators are integrated into the market at the end of the 20 year FIT period, the market design will need to be adapted to ensure price signals remain conducive to continued asset operation and can incentivise investments. Forward planning for this eventuality will be required as Viet Nam’s market development reforms progress, for instance through a gradual exposure to market prices in new assets. Evidence from European markets have shown that high levels of variable renewable generation can lead to declining revenue prospects particularly during times of peak generation (Rövekamp et al., 2021[6]).

There is a need to create a more transparent, clear and predictable procurement process

The main instrument for project procurement is the Power Development Plan (PDP), which lists a pipeline of projects to be developed over the period. A key milestone in the project development process for renewable projects is the project’s inclusion in provincial power development plans. For projects under 30 MW, the evaluation is handled by the Provincial People’s Committee (PPC), which is the executive arm of government at provincial level, and by MOIT’s regional office, the Department of Industry and Trade, which sits under the PPC. Final approval for projects under 30 MW, and both the evaluation and approval for projects over 30 MW, takes place at central level. This procurement framework and particularly project approval has been noted to lack clear guidance, with different procedures applied across provinces.

The current process leave the door open for speculative practices whereby investors without strong technical expertise or financial resources seek to acquire numerous projects, both onshore and offshore, with the view of selling their stakes in project companies to better suited renewable developers. Establishing a transparent procedure will be a key step to ensuring fair competition and selection of the most appropriate investors, as well as streamlining some of the project development processes. This in turn can reduce the perceived risk of project development, helping reduce risk premiums expected in equity returns and cost of debt (VIR, 2020[7]).

Viet Nam has committed to introducing a structured competitive procurement program for renewable projects in the near future, however, additional legal guidance for how this works under the overall legal mechanisms will need to be developed. Unlike PPP contracts, which have a procedural requirement for bidding under the new PPP law, current regulations do not provide an explicit framework for competitive selection of IPPs for new generation, which includes renewable power but also liquefied natural gas (LNG) projects. Competitive procurement across technologies is important in order to provide transparency and predictability to investors and to drive down costs. Guidance would need to clarify whether investor approval falls under the 2021 Investment Law and current bidding regulations. The development of the competitive bidding mechanism for solar power, is supported by the World Bank, with inputs from line ministries, the private sector and development partners (World Bank Group, 2019[8]). The strategy and framework put forward by the World Bank proposes a competitive selection of investors based on a pre-selected project location, either in terms of a substation or a solar park. Bidding would be conducted at the local level by the PPC, who would evaluate the IPP’s financial strength and capacity to raise debt, and its experience in construction and operation of utility scale solar photovoltaic (PV), onshore wind or offshore wind installations, as well as some form of pre-feasibility study of the project (see chapter 5 for further discussion).

Strengthening competition should be a priority in the equitisation process

Under the electricity market reform, EVN has undergone restructuring into separate entities to enhance operational independence with the long-term goal of divestment from generation activities, with the exception of strategic multipurpose hydropower. In parallel to other aspects of the market reform, plans to privatise generation assets, known in Viet Nam as the process of “equitisation”, have progressed slower than expected. EVN restructured its generation with the view of fully privatising power plant companies, outside of strategic hydropower, by 2014. This was deferred after EVN suffered a financial crisis from 2009‑2010, and significant equity injections were required from government (Lee and Gerner, 2020[9]). A new plan to partially “equitise” EVN’s generation assets starting from 2018 was approved by the Prime Minister (Decision No. 852/QD-TTg), with EVN retaining at least 51% shareholdings of GENCOS in the first phase. This process has proven to be challenging, and the first IPO of GENCO 3 was far from reaching its target. Only 0.36% of GENCO 3’s shares sold, well below the targeted 12.8%, and raising around USD 8 million rather the desired USD 290 million (OECD, 2018[10]). After a second round, in total 2.8% of the company shares sold. EVN is continuing to implement the equitisation of GENCO 2 and GenCo 1, however, a similar lacklustre response from investors was seen for the IPO of GENCO 2 in 2021 (VIR, 2021[11]).

While EVN’s current strategy for partially privatising its generation companies creates new opportunities to finance the energy sector, it does not necessarily increase competition in the market. By keeping a majority share, EVN retains control over operation and investment, in effect maintaining or possibly strengthening its position in the market and leaving their private shareholders with limited influence. The weak turnout at IPO’s can be in part linked to high valuation of shares and volatility in Viet Nam’s stock market, but also because of concerns over highly indebted generation plants and weak corporate governance (Viet Nam News, 2018[12]). Investors must take on shares in a significant amount generation capacity which has varying risk profiles, as all of EVN’s generation activities, outside of strategic assets, are organised under these three GENCOS. The division of generation into a few large companies is useful for EVN to group plants in areas with transmission constraints, when there is insufficient competition in the market, and package less efficient plants together with better performing plants. However, this can represent a disadvantage for external investors, as these plants will increase the risk of the overall portfolio. In the context of an evolving electricity market, in terms of progress on market reforms and in particular the upcoming wholesale market, it may be possible to give bidders more flexibility over power plant grouping, for instance targeting subsidiaries of GenCos, or selling plants individually, which would help investors manage risk (Asian Development Bank, 2000[13]).

In the IPO, concerns were also raised around corporate governance. Minority shareholder rights, have in some areas been weak. However, Viet Nam has seen important developments over the last few years. This includes the Law on Enterprises that came into effect in 2021, which lowers the threshold to 5% shareholders down from 10% for minority shareholders to have access to important corporate information, and waivers the former six-month delay before ordinary shareholders could exercise rights. It also allows for shareholders holding preferred dividends, which are non-voting under Vietnamese law, to attend and vote in shareholder meetings where proposed resolutions adversely affect their rights and obligations (OECD, 2018[14])

Increasing the independence of electricity market actors will ensure effective competition and market confidence

A World Bank analysis of privatisation in developing countries notes that the effectiveness of moving from state to private ownership is closely tied to the strength of the regulatory framework and competition in the market, in order to yield economic gains and improve company performance. In the electricity sector, only when privatisation is coupled with the establishment of an independent regulator is it linked to more generating capacity and higher output. Conversely, in situations of weak competition, attempts to improve performance of state-owned enterprises is ineffective without privatisation (Estrin and Pelletier, 2018[15]).

A key step in the reform process has been the establishment of the Electricity Regulatory Authority of Vietnam (ERAV), who handles inspections and dispute resolution in electricity activities. However, as discussed in chapter 2, ERAV remains structurally dependent on MOIT, and as the market develops ERAV’s oversight role will need to be strengthened and potentially expanded. ERAV has authority for dispute resolution under model PPAs. This can create concerns amongst private investors that they may not receive fair treatment if situations of conflict were to arise with EVN, due to limitations to ERAV’s authority and independence.

The National Load Dispatch Centre (NLDC), which is also the System Operator, holds an essential role for ensuring effective competition which in turn helps attract private sector investment. The NLDC determines short-term operations of generating plants and is the interface with the transmission system. The NLDC is planned to be unbundled between 2025 and 2030, but until that time it remains structurally dependent on EVN, who also owns a significant share of generation capacity. This lack of independence between generation and system operation creates concerns over the objectiveness of dispatch prioritisation. This is particularly the case given oversupply and congestion in transmission networks, which, alongside a lack of take or pay commitment, represents a significant risk to renewable developers. The independence of NLDC, as well as a clear and transparent mechanism for addressing dispatch congestion, will be important steps to provide generators with more confidence and should be prioritised in the near term.

At this time, the ownership, operation and maintenance of the transmission grid remains with EVN under the National Power Transmission Corporation (EVN NPT). EVN NPT’s role in granting grid connection agreements could open the door to perceived or real conflicts of interest that affect the ability for competing IPPs and SOEs to access the transmission system on equal terms. There is also little transparency in the way that grid connection is managed, this could be improved through, for example, an enforceable first‑come first-served connection queue overseen by ERAV. Further reforms of EVN’s organisational structure will also be required in preparation for retail market liberalisation expected under the market reform roadmap in 2021-2023. Currently EVN’s Power Corporations (PCs) carry out retailing, distribution and meter data management functions. Effective retail market reforms may require these functions to be separated, initially via ring-fencing and potentially with full legal separation at a later stage. This is important for ensuring equitable treatment of competing retailers and generators and protection of confidential data that would give a competitive advantage (Ricardo Energy & Environment, 2019[16]).

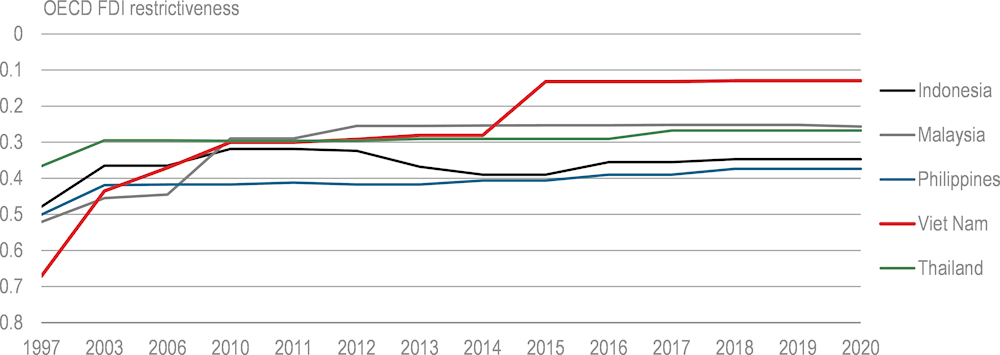

Promoting equal treatment of foreign and domestic investors in clean energy

The regime for foreign investment is generally quite permissive, and Viet Nam has a very low foreign direct investment (FDI) restrictiveness index of 0.01, with 0 being the most open, and sits ahead of its regional peers in this respect (Figure 4.2). The ratification of the EU-Viet Nam Free Trade Agreement (EVFTA) in 2020 and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in 2019 further demonstrates the government’s commitment to facilitate opportunities for foreign investors. Clean energy represents an opportunity to support Viet Nam’s industrial ambitions through attracting FDI from increasingly environmentally conscious multinationals. For clean energy, certain administrative hurdles remain in place, particularly around project development processes, perceptions of risk allocation and dispute resolution mechanisms.

Figure 4.2. Viet Nam's FDI liberalisation compared to regional peers

Viet Nam boasts an attractive and open environment for FDI

Foreign investors, which are companies where 50% or more of charter capital contribution is foreign owned, are provided with almost equal treatment except those in sectors explicitly named on the “negative list” or “conditional list”. Foreign and domestic investment in clean energy is governed by the Law on Investment (No. 67/2014/QH13), which regulates business investment activities in the country, and the Law on Enterprises (No. 59/2020/QH14) which regulates the types of business enterprises permitted in the country and how they operate. The energy sector is amongst permitted sectors and the only additional step that foreign renewable developers must officially take is to apply for an investment registration certificate (IRC), either at central or provincial level (Apricum, 2020[17]). Depending on the size of the project, either the Ministry of Planning and Investment (MPI) or its regional office, the Department of Industry and Trade (DPI), oversees this process. All new enterprises, both domestic and foreign, must also obtain an enterprise registration certificate.

Investors are not compelled to source locally under the investment law. Treaties, such as the WTO Trade Related Investment Measures (TRIMs), and the 2020 EU-Viet Nam Trade and Investment Agreement reinforce this. Other areas of law impose certain local requirements for subcontracting under renewable electricity or energy efficiency investments, which may require capacity building in Viet Nam to ensure local resources are technically able. These include the Law on Bidding and Decree No. 59/2015/ND-CP guiding the Construction Law, which states that a foreign contractor must employ Vietnamese sub-contractors to do construction work in Viet Nam. Current regulations do not expressly require foreign investors to hire local staff, but for certain positions Vietnamese workers are given preference under the 2012 Labour Code. Under the new PPP Law, investors committing to use domestic contractors, goods and materials are eligible for preferential treatment during the bid evaluation process.

Clean energy will be essential to fulfil ambitions of becoming a leading industrial hub

The industrial sector is an engine of growth for Viet Nam’s economy and a core part of the country’s economic strategy is to attract FDI particularly in manufacturing, with ambitions to become a leading industrial hub amongst ASEAN economies. According to the National Industrial Policy (Resolution No. 23-NQ/TW) government intends for industry to account for 40% of GDP by 2030, with 30% attributed to manufacturing and processing industries. At a time of the disruption to established global supply chains caused by COVID-19 and ongoing trade disputes, and thanks to its effective management of the pandemic, Viet Nam’s manufacturing base is well positioned to welcome more FDI. However, industrial environmental performance must continue to improve to ensure the country can capitalise on these trends. Environmental policies of multinationals continue to tighten worldwide and there will be increasing scrutiny on the environmental impact of international supply chains. Energy efficient manufacturing practices and access to renewable electricity should be made a priority in order for Viet Nam to remain an attractive location for FDI. Growing interest amongst domestic and international business has already been highlighted through the medium of Renewable Energy Buyers Alliance (REBA) Viet Nam Working Group (USAID, 2019[18]).

Viet Nam is already aware of this as can be seen by the Pilot Direct Power Purchase Agreement (DPPA) between renewable electricity developers or power generation companies and commercial and industrial consumers (Draft DPPA Decision), submitted to MOIT in 2020. With Draft Decision No. 544, MOIT is proposing a synthetic DPPA mechanisms for off-site renewable electricity projects to be implemented between 2020 and June 2022. The DPPA pilot is proposed to be limited to power consumers for industrial manufacturing and generation would come from grid connected solar and wind generators over 30 MW, already approved under PDP VII-revised.

Complex procedures and unclear risk allocation may limit FDI in renewable projects

Despite low FDI restrictiveness, the first phase of renewable deployment has primarily been developed and financed by leading Vietnamese conglomerates such as BIM Group, Trung Nam Group and Xuan Cau Group as well as major ASEAN developers such as AC Energy from the Philippines and, Super Energy and B Grimm from Thailand. FDI from OECD countries has been low, linked to complicated project development processes, perceptions of risk, and lack of confidence in mechanisms for dispute resolution.

The permitting and licensing process for renewable projects is extensive, requiring a number of administrative procedures and legal documentation relating to investment and enterprise certifications, inclusion in national and provincial planning, grid connection agreements with EVN, land clearance and environmental impact assessment. This has been a relatively complicated process, requiring a number of stakeholders at both central and provincial level. While international investors should appreciate that each market in Asia is different, an additional complexity in Viet Nam is that administrative procedures may vary across provinces. This often requires legal and technical support with expertise in the particular province to prepare documents, as well to navigate the process with relevant provincial authorities, which increases costs. High investment in time and resources in the development process for renewable projects can be a deterrent, as investors will carefully weigh up the risk-return-ratio. Given that there is currently no competitive bidding process in place, this also leaves open the opportunity for inefficient practices, such as local investors unqualified in renewable development but better able to navigate the system, developing projects with the intention of selling shares to foreign investors at a profit.

As discussed in chapter 3, PPA terms leave investors open to certain risk. Model PPA for renewables do not offer take-or-pay obligation or minimum purchase guarantee. This creates contractual uncertainties, given high curtailment risks associated with limitations on transmission capacity that developers are facing. Foreign investors are also exposed to currency inconvertibility risk as the FIT rate is fixed to US dollar value but denominated and paid for in Vietnamese dong. Finally, the terms for compensation upon early termination of the PPA, without fault of the developer, are unclear. Lack of compensation predictability creates uncertainty over future cash flows and debt service capacity, particularly given the current developing status of the renewables market.

Mechanisms for dispute resolution may not be sufficient to reassure foreign investors

Dispute resolution under the model PPA is governed by Vietnamese law with mediation through MOIT’s Electricity Renewable Energy Authority (EREA) and, if unresolved, escalation to the Electricity Regulatory Authority of Vietnam. Results are appealable in Vietnamese courts. This could be problematic for investors, as EVN and its subsidiaries are closely tied to MOIT through both legal structure and corporate governance. The government has authority over EVN’s investments, appointing the members of its board of directors and its senior management (Lee and Gerner, 2020[9]). Combined with the structural dependence of both EREA and ERAV on MOIT this creates uncertainty over fair treatment if a dispute were to arise.

The model PPA allows the possibility of using another dispute resolution body, if both parties consent to arbitration, which allows EVN the right to refuse. In practice, EVN has agreed to local arbitration for some projects, notably through the Viet Nam International Arbitration Centre, however this decision is made on a case by case basis. In general, international investors in Viet Nam tend to prefer international arbitration for dispute resolution as an alternative to domestic courts and before private arbitration centres such as the Viet Nam International Arbitration Centre. Under the New York Convention on Recognition and Enforcement of Foreign Arbitral Awards 1958, foreign investors are able to negotiate provisions for international arbitration deemed more neutral, such as the Singapore International Arbitration Centre. However, it appears that for renewables projects under PPA terms, EVN may be unwilling to agree to arbitration outside of Viet Nam. Under the framework and strategy put forward for the upcoming competitive bidding mechanism for solar energy, the World Bank also advises that international arbitration is available in the event of early termination of PPA (World Bank Group, 2019[8]).

While Vietnamese law specifically governs renewable electricity projects under the model PPA, FDI in other areas often falls under investment treaties, which have been an important policy tool for creating an attractive investment climate. These treaties protect investors post-establishment, giving covered access to investor state dispute settlement (ISDS) mechanisms (inspired by commercial arbitration systems), which enforces fair and equitable treatment and includes provisions against expropriation without compensation and against discrimination. Between the Vietnamese legal framework and international treaties, different levels of protection are provided to domestic and foreign investors, but also different levels of protection are provided to foreign investors depending on the treaty provisions under which they are covered. Under the PPA terms, these practices do not apply to renewable electricity development but may apply to FDI in other clean energy activities, for instance under PPP arrangements, whereby international treaties can be used as a means to resolve disputes.

Facilitating land access for renewable electricity development

Land access is an important topic for both transmission infrastructure and renewable electricity projects. In Viet Nam, land remains the property of the Vietnamese people and is administered by the government on its behalf. Only the rights to use land known as Land Use Rights Certificates (LURCs) can be bought or sold. Vietnamese nationals can purchase these rights indefinitely, whereas for foreigners and foreign businesses these can only be bought for a 50-year period, which is renewable once. This process is much akin to the land system in other countries such as the UK and is not in itself a constraint to investment. The process of co-ordination for LURC acquisition is relatively complex, requiring a number of stakeholders, which may lead to significant delays for infrastructure development.

Issues around securing land rights play a central role in project development

Land is an important risk in the renewable project development in Viet Nam. Level land covers no more than 20% of the country’s geography, which has much more tropical lowlands, hills, and densely forested highlands. Land for renewable project development, and particularly solar, competes with other uses, such as agriculture. Under the former planning cycle, the land use master plan and the power development were not synchronised, which led to challenges around availability and planning of flat land. As discussed in chapter 2, this may pose a risk under the current planning cycle, as the PDP VIII draft has been submitted before the National Master Land Use plan has been finalised. To add to this, are risks around delayed connection to grid and grid congestion leading to curtailment. This means that not only is flat land in high demand, but also suitably situated land is even more sought after.

In order to secure land rights, developers must undertake negotiations for LURC through the People’s Provincial Committee, who have decentralised administrative authority over provincial lands, under the 2013 Land Law. An appraisal board headed by the provincial governor decides on land planning and sets the land use fees. Steps include appraisal of land and clearance plans by relevant provincial authorities such as the regional office of MONRE, the Department of Natural Resources and Environment (DONRE), negotiations between multiple parties owning LURCs, agreement of land lease fees, and clearance and compensation of current owners. Before completing the agreement with the PPC, the developer must obtain the environmental impact assessment, the investment registration certificate and an enterprise registration certificate for the project. For renewable project developers this creates a multi‑layered process, which can vary across provinces and which is generally a long, costly and complex procedure for IPPs. Until a competitive investor and project evaluation process is in place, this process does not exclude speculative practices, whereby prime locations are secured by investors without the capabilities to develop renewables, with a view to selling licences or shares in the company to experienced renewable developers. In addition to the development of the renewable project, the IPP is responsible for investing, installing and operating power lines and transformers from the renewable plant to the nearest connection point, which depending on the location of the plant relative to the substation, may pass through land with multiples LURC owners. This has the effect of significantly increasing project development risk.

Another essential function of land rights is to secure long-term investment and financing. The renewable plant is considered the main asset which can be used as security for lenders, and the ownership of the plant relies on the IPP having legal rights over the land. Land rights enable project companies or a special purpose vehicle (SPV) to hold the plant over the course of the PPA and financing agreement (World Bank Group, 2019[8]). Under the Law on Land, project developers may take security over land and assets attached to the land, but only with credit institutions operating in Viet Nam (World Bank Group, 2016[19]). This restricts the flows of international debt capital for renewable project development, due to an inability to take security over land for foreign credit institutions. Some transactions have bypassed this by using a local bank as security agent. However, this arrangement is a grey area in the legal sense and has not been tested in the courts. Under the incentives for renewable energy, projects can be exempt or benefit from reduced land-use rental payment, but if they take advantage of this incentive, developers lose the right to take security over land, although they may still mortgage the assets attached to the land, with credit institutions operating in Viet Nam (Hogan Lovells, 2018[20]).

As discussed earlier in the chapter, significant investments are needed to update transmission infrastructure. Within the current legal framework, this falls under the responsibility of EVN given that transmission is a state monopoly activity. Land issues, however, are not exclusively a concern for the private sector. Land clearance is a key issue faced by EVN in the construction of new transmission lines, which often cross long distances. A similar negotiation process is required with LURC owners for those territories. Transmission lines require comprehensive environmental impact assessments and appraisal by relevant ministries, in particular MONRE, due to their passage lines through protected areas, such as forest lands. If Viet Nam is to consider private investment in transmission infrastructure, this will be an important consideration for potential investors and lenders.

Competitive bidding guidelines, floating solar and cities provide new opportunities

Suitable land resources for renewable projects are in limited supply, particularly for those well situated for grid connections and where variable renewable energy (vRE) capacity will not contribute to congestion in the grid. Moreover, under the former master planning, projects often competed against land for agricultural purposes, as provincial land use plans and the PDP VII-revised were synchronised. With these risks in mind, the solar bidding strategy and framework proposed by the World Bank puts forward a competitive selection of investors based on a pre-determined project locations. The two models proposed, substation-based and solar park model, aim to address concerns around transmission grid stability and project development risk (World Bank Group, 2019[8]).

The substation-linked model helps optimise the use of existing transmission capacity and reduces both the potential cost of integrating vRE and the risk of curtailment. EVN NPT would have responsibility for identifying substations across provinces which have available interconnection capacity limits and invite bidding for a specific MW capacity at each substation. In the long term this could also proactively drive grid investments needed for new vRE generation, by planning grid and vRE capacity together. Government would undertake a screening of environmental and social constraints for land around the substation in co-ordination with the provinces, but under this model IPPs are responsible for identifying land for their bid, and will be responsible for land clearance procedures. This means that although curtailment risks are reduced, the land development risks remain with the developer.

Under the solar park model, land identification and clearance is managed by the PPC and EVN, in line with provincial land use plans. They would also undertake investments for the solar park infrastructure. This means that all administrative prerequisites around the land rights steps are obtained before the competitive bidding procedure begins and the winning IPPs gains full ownership of the land without undertaking lengthy negotiations with the PPC. The IPP will be responsible for arranging the financing, construction, and operation of the solar project. The solar park model significantly lowers development risks and can shorten the development timeline for IPPs. Costs savings particularly linked to acquiring land rights, should therefore be reflected by lower PPA tariffs. While lower risks can attract larger more risk adverse investors, this approach is more demanding on the government, who manages the process and who must have sufficient institutional capacity and budget to undertake the selection, clearance and infrastructure work.

In the face of land constraints, floating solar PV facilities are an interesting opportunity, particularly given Viet Nam’s existing hydro infrastructure. Viet Nam already boasts the largest installation in South East Asia, Ho Tam Bo and Ho Gia Hoet 1 floating PV facilities, both located on irrigation lakes in the Chau Duc district, connected in 2020 with a generation capacity of 35 MWp each. This is following an Asian Development Bank financed, 47.5 MWp floating solar PV facility on the existing 175 MW Da Mi hydropower plant owned by Da Mi Hydropower Joint Stock Co.

The potential of rooftop solar PV in urban areas has also been recognised as a potential to meet electricity needs. A 2017 study commissioned by the World Bank found a potential of 18 000 GWh in Hô Chi Minh and 2 300 GWh in Na Dang (Effigis Geo-Solutions, 2018[21]) and under Decision No. 2023/QD-BCT, Viet Nam’s Rooftop Solar Promotion Program 2019-2025 targets 1 GW of rooftop solar capacity by 2025. By the end of 2020 101 996 projects with total capacity of 8.274 GW had already been achieved.

Harnessing public procurement and public-private partnerships for clean energy

Public procurement and public-private partnerships are powerful instruments for driving private investment in energy efficiency and renewable electricity. By setting energy related technical standards and output specifications within public procurement and public-private-partnership practices, government can harness private sector efficiency and incentivise innovation and investment in clean energy technologies.

Technical standards in public procurement drive investment in energy efficiency

Central and regional governments could play a key role in driving energy efficiency market development as large energy consumers. This pertains, notably, to improving energy performance of public sector buildings and in public sector utilities such as telecoms and water supply and sanitation. To enable this energy efficiency, performance criteria should be mainstreamed into public procurement practices whether under public private partnerships or under more conventional public procurement limited to design and construction contracting or procurement of products and appliances.

Energy efficiency is not yet systematically integrated into public procurement in Viet Nam. With respect to public sector procurement mandates, current regulation encourages the public sector to prefer arrangements for the supply of specific products, or the provision of services with a defined cost, defined activities and specified equipment. Countries typically encounter issues around budgeting, which make it difficult for public entities to finance energy efficiency investments from savings in energy costs. For example, energy efficiency investments may be financed from investment budget whereas the resulting savings are credited to the operational budget (Gynther, 2016[22]). Prioritising energy in public procurement helps raise awareness and create incentives for the industry to innovate and create business models around energy service provision. Mandatory technical standards have an important role in incentivising these investments, such as the National Energy Efficiency Building Code QCVN 09:2013/ BXD (VEEBC), which sets mandatory technical standards for the design, construction or retrofitting of civil buildings. However, as discussed in Chapter 3, enforcement remains an issue. Viet Nam has already had a few examples of public lighting programmes. For instance, in 2018 a private company won a bid to replace all inefficient lamps with LED in Hoa Binh Authority under an ESCO investment business model, whereby the company operates the city lighting systems with an annual provincial payment, to be transferred back to the authority after nine years. Similar projects for city lighting are being applied in Dac Nong, Can Tho, and Long Xuyen.

PPP can be an effective tool for supporting greater clean energy investment

The new Law on Public-Private Partnership (PPP) (Law No. 64/2020/QH14) codifies provisions relating to PPP projects, reducing previous uncertainties over which legal framework is applicable to PPP projects. But at the same time this law also determines precise projects that can fall into the definition of PPPs which are: transportation; power grids and power plants (except for hydropower plants and state monopolies as prescribed by the Electricity Law); irrigation, clean water supply, water drainage, sewerage and waste treatment; health care and education; and IT infrastructure.

For energy efficiency in particular, the stipulated minimum project value of VND 200 billion (USD 8.5 million) may create certain barriers for PPP arrangements for EE, given the typically smaller and fragmented nature of energy efficiency projects (often under USD 1 million). Models for significant project aggregation will be required to achieve the necessary scale to meet these thresholds. However, another approach is to integrate energy efficiency into PPP contracts as a general practice, by setting technical specifications that define energy performance requirements over the lifetime of the project. The advantage of performance requirement is that it is measurable in the outcomes of the project, and does not set requirements on specific solutions, allowing for innovation and incentivising the private partner to develop an integrated approach to energy efficiency from early in the project design phase (GI Hub, 2019[23]).

Although power grids and power plants are amongst the five permitted sectors under new law, PPPs have not been widely used in renewable projects. Given that the recent surge in renewable electricity has been driven by feed-in tariffs (FIT), projects have generally been implemented through independent power producer investment with terms determined by the power purchase agreements. As Viet Nam transitions away from the FIT, PPP arrangements may prove to be useful instruments for larger or riskier renewable projects, where government incentives and negotiable contract terms can provide additional reassurance to investors. Moreover, EVN and other energy SOEs have noted their interest in developing a long term renewable strategy and PPPs can leverage public funding to have wider impact.

Private participation can play a key role in updating the transmission system

According to PDP VIII, between 2021 and 2045 Viet Nam will need to invest around USD 85 billion in grid infrastructure, or between USD 3.3 and USD 3.4 billion per year, on average. Transmission infrastructure has been an issue for developers, both in terms of delayed connection of plants to the grid and transmission system congestion leading to curtailment. To accommodate current generation needs, between the 2021 to 2025 period alone, 651 substations, 120 projects on 500 kV lines, and 531 projects on 220 kV lines are planned. Given that the PDP VIII does not clearly identify generation sources, EVN is not yet actively planning transmission investment for new generation. Given the urgency of updates, it is critically important that this transmission infrastructure be built in a timely manner, and with a view of the scale of investment required, it will be important to keep costs within a reasonable limit. In other countries, transmission projects have notoriously been delayed and gone over budget, especially when they are built in densely populated or environmentally sensitive areas.

There are various models for private participation in transmission infrastructure, such as long-term concessions, Build, Own, Operate, Transfer (BOOT), Merchant line and financial ownership. While there is no perfect model for private participation, long-term concessions and BOOT models have been the most effective in attracting high levels of private capital to countries across the world (IEA, 2020[24]). Independent Power Transmission (IPT) models with BOOT contracts gives the concessionary responsibilities for building and operating a single transmission line or a package of a few lines in exchange for an annual payment. IPTs are widely used around the world, including Brazil, Chile, Colombia, India, Mexico and Peru (Box 4.2) (ESMAP, 2015[25]) In order to be implemented in Viet Nam, these models would require policy and regulatory changes and will depend on the effective design of bankable contracts and a competitive tender process. Under Article 4 of the Electricity Law, the state holds monopoly rights over activities of transmission, which includes investment, management and operation. While there is no framework for private sector investment, there has already been one exceptional case of a private investor for a large solar power project investing in a 500/220 kV substation and transmission line to EVN’s grid (Pham, 2020[26]). The draft PDP VIII proposes an amendment of the Electricity Law towards greater flexibility for private investment in the power sectors including in transmission infrastructure, ensuring that all resources can be mobilised. The review of the Electricity Law is still under discussion, but combined with the new PPP law, effective since 2021, which provides for investments in power plants and power grids, this could serve as a potential avenue for private investment.

Box 4.2. Private investment in transmission – the experience of Brazil

Brazil stands out among other emerging economies for having mobilised over USD 38 billion in private capital for transmission expansion projects since 1999, primarily in the form of long-term concessions. Between 1999 and 2020 alone, Brazil organised 50 tenders of multiple lots resulting in the award of 334 concessions and 96 000 km of transmission lines designed, built and operated by the private sector. With scarce investment capital Brazil favoured the Independent Power Transmission (IPT) model offering 30-year BOOT contracts with annual payments. The contract incentivises the IPT to commission the transmission line on time, to keep costs over the duration of the contract to a minimum and to ensure high availability for the transmission line over the contract term. Although Eletrobras, the government-owned transmission company, continues to own the majority of the transmission grid, new concessionaires have entered the sector. Between 1999 and 2010, nearly 70% of investments in transmission came from private investment, with foreign companies accounting for 30 %, local private companies 39%, and SOEs 31%.

Competitive bidding for companies is based on lowest annual revenue, which is the annual fee the IPT will be paid if successful in the tender. While the outcome of the tender sets the price, the regulator can review during five-year price determinations. Agência Nacional de Energia Elétrica (ANEEL), the Energy Regulatory Agency, runs the tendering process and sets a cap on maximum annual revenue. To be eligible for the tender, a number of technical and financial conditions are required for bidders to participate in tenders, such as proof of contracts with relevant subcontractors, minimum levels of liquidity, equity and capital, and tax compliance, and ANEEL holds the company’s bid guarantee of 1% of investment. Winners are selected based on a reverse bidding, which establishes construction deadlines and rules for the regular energy transmission service provision.

To ensure timely delivery, the process provides incentives to meet deadlines and imposes penalties on delays to commissioning. Transmission companies that have previously had delays are banned from the tender for a given period. The ITP contract also mandates access to the transmission network on a consistent and nondiscriminatory basis. A rate of 97% availability of the transmission line is require under which the IPT may be penalised. ITP companies sign contracts with all network users and third parties who may want to access the line, including generation companies, distribution companies and large customers dependent on these lines.

The process of competitive tendering has also reduced transmission costs, with winning bids between 1999 and 2020, on average 25.8 percent lower than annual revenue estimated by ANEEL, and reductions on estimated individual line costs of up to 70.3 percent.

Opening the transmission sector to competition for new projects can help Viet Nam meet its transmission upgrades planned in the PDP VIII draft. The Brazil example highlights that the independent power transmission models can successfully mobilise large amounts of capital for grid upgrades and that having multiple owners to transmission infrastructure does not necessarily compromise transmissions system efficiency or security. This is largely due to the central government transmission planning by the Ministry of Mines and Energy (MME) and the Energy Research Office (EPE) with the National System Operator (ONS), which has effectively co-ordinated transmission projects from design through to system operations, combined with a strong regulatory agency (ANEEL) governing concessionaires. This highlights the importance of strengthening the independence and powers of the electricity regulator, as well as the independence of the power system planning and operation.

Source: ANEEL (2021) Results of auctions website ESMAP (2015) Private Sector Participation in Electricity Transmission and Distribution-Experiences from Brazil, Peru, The Philippines, and Turkey, World Bank (2021) Private Participation in Infrastructure (PPI) (database), IBRD (2017) Linking Up: Public-Private Partnerships in Power Transmission in Africa

References

[17] Apricum (2020), Vietnam’s solar success story and why its solar M&A landscape is about to heat up, https://www.apricum-group.com/vietnams-solar-success-story-and-why-its-solar-ma-landscape-is-about-to-heat-up/?cn-reloaded=1.

[13] Asian Development Bank (2000), Developing best practices for promoting private sector investment in infrastructure power, http://www.adb.org.

[28] Duong, V. (2020), Patent Landscape on Green Technology in Viet Nam., https://www.researchgate.net/publication/342436180_Patent_Landscape_on_Green_Technology_in_Viet_Nam/citation/download.

[21] Effigis Geo-Solutions (2018), Assessment of rooftop photovoltaic solar energy potential in Vietnam.

[25] ESMAP (2015), Private Sector Participation in Electricity Transmission and Distribution-Experiences from Brazil, Peru, The Philippines, and Turkey, The International Bank for Reconstruction And Development / THE WORLD BANK GROUP, Washington, https://documents1.worldbank.org/curated/en/786091468189572248/pdf/99009-ESMAP-P146042-PUBLIC-Box393185B.pdf (accessed on 2 June 2021).

[15] Estrin, S. and A. Pelletier (2018), Privatization in Developing Countries: What Are the Lessons of Recent Experience?, Oxford University Press, https://academic.oup.com/wbro/article/33/1/65/4951686.

[4] EVN (2019), EVN to focus investment on 5 solar power projects, https://en.evn.com.vn/d6/news/EVN-to-focus-investment-on-5-solar-power-projects-66-163-1533.aspx.

[23] GI Hub (2019), Chapter 5. Output specifications | Reference Guide on Output Specifications for Quality Infrastructure.

[22] Gynther, L. (2016), Energy Efficiency & Public Sector Policy brief, https://www.odyssee-mure.eu/publications/policy-brief/public-sector-building-energy-efficiency.html.

[20] Hogan Lovells (2018), Renewable Energy in Vietnam, https://www.hoganlovells.com/en/publications/client-briefing-renewable-energy-in-vietnam.

[30] IBRD (2017), Linking Up: Public-Private Partnerships in Power Transmission in Africa, World Bank Group, Washington, https://openknowledge.worldbank.org/bitstream/handle/10986/26842/LinkingUp.pdf?sequence=3&isAllowed=y (accessed on 1 June 2021).

[24] IEA (2020), Attracting private investment to the electricity transmission sector in Southeast Asia.

[2] Institute of Energy (2021), Draft Power Development Plan 2021-2030 with a vision to 2045.

[9] Lee, A. and F. Gerner (2020), Learning from Power Sector Reform Experiences The Case of Vietnam, World Bank, http://www.worldbank.org/prwp.

[14] OECD (2018), OECD Investment Policy Reviews: Viet Nam 2018, OECD Investment Policy Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264282957-en.

[10] OECD (2018), OECD Investment Policy Reviews: Viet Nam 2018, OECD Investment Policy Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264282957-en.

[26] Pham, L. (2020), First private-invested 500/220kV transmission line in Vietnam connected, http://hanoitimes.vn/first-private-invested-500220kv-transmission-line-in-vietnam-connected-314366.html.

[3] Renewables Now (2020), PetroVietnam to foray into renewables, eyes 900 MW by 2035 - report, https://renewablesnow.com/news/petrovietnam-to-foray-into-renewables-eyes-900-mw-by-2035-report-706109/.

[16] Ricardo Energy & Environment (2019), Establishing the Vietnam Wholesale Electricity Market (VWEM), https://www.adb.org/sites/default/files/project-documents/48328/48328-001-tacr-en_0.pdf.

[6] Rövekamp, P. et al. (2021), Renewable electricity business models in a post feed-in tariff era, Elsevier Ltd.

[18] USAID (2019), Vietnam Releases Direct Power Purchase Agreement Policy Proposal for Public, https://www.usaid.gov/vietnam/press-releases/jun-12-2019-vietnam-releases-direct-power-purchase-agreement-policy.

[1] VIET (2021), State management role in power sector, Vietnam Initiative for Energy Transition, Hanoi, Vietnam.

[5] Viet Nam News (2021), EVNGENCO 2 to sell over 581 million shares through IPO, https://vietnamnews.vn/economy/859677/evngenco-2-to-sell-over-581-million-shares-through-ipo.html.

[12] Viet Nam News (2018), Doubts remain over the EVN’s sub-unit IPOs, https://vietnamnews.vn/economy/463725/doubts-remain-over-the-evns-sub-unit-ipos.html.

[11] VIR (2021), Investors give EVN Genco 2 cold shoulder at IPO, https://www.vir.com.vn/investors-give-evn-genco-2-cold-shoulder-at-ipo-82519.html.

[7] VIR (2020), FiT revamp vulnerable to speculation, https://www.vir.com.vn/fit-revamp-vulnerable-to-speculation-76532.html.

[27] World Bank (2019), Investment Policy and Regulatory Review: Viet Nam, http://documents1.worldbank.org/curated/en/400351586323809041/pdf/Vietnam-2019-Investment-Policy-and-Regulatory-Review.pdf.

[29] World Bank Group (2021), Data on Private Participation in Infrastructure (PPI), Infrastructure Finance, PPPs & Guarantees, https://ppi.worldbank.org/en/ppidata (accessed on 17 June 2021).

[8] World Bank Group (2019), Viet Nam Solar Competitive Bidding Strategy and Framework, http://www.worldbank.org.

[19] World Bank Group (2016), Project appraisal document on a proposed credit in the amount of sdr 107.00 million (us$150 million equivalent) to the socialist republic of vietnam for the viet Nam improved land governance and database project.