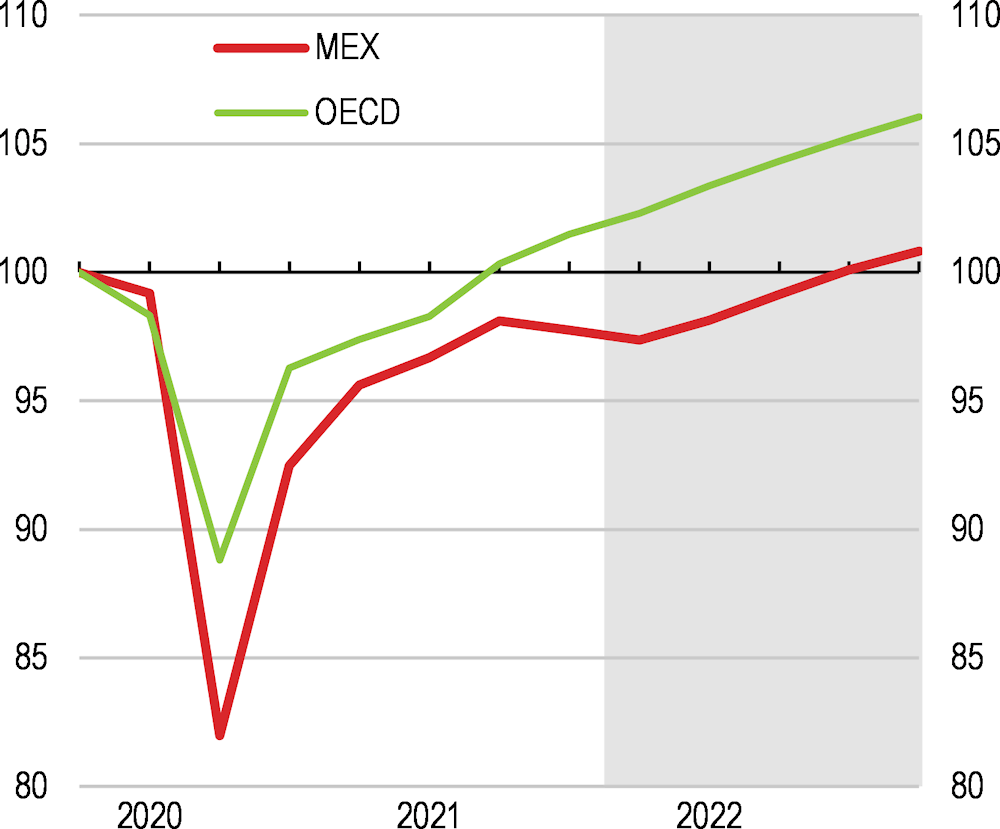

The COVID-19 pandemic was particularly deep (Figure 1). Mexico’s solid macroeconomic policy framework, underpinned by an innovative debt management, sound monetary policy and a flexible exchange rate, safeguarded macroeconomic stability and comfortable access to international capital markets. The manufacturing sector, deeply integrated in global value chains, led the recovery with the services sectors taking over recently as main growth driver. Labour market participation, which fell markedly, is recovering, but remains below pre-pandemic levels. Informal workers, women and youth were particularly hit, exacerbating long-standing inequalities.

OECD Economic Surveys: Mexico 2022

Executive summary

The economy is rebounding

Figure 1. The recession was deep

Real GDP, Index 2019Q4 = 100

The last infectious wave peaked in January 2022 and vaccination is progressing. Looking ahead, the recovery will continue (Table 1). Exports will continue to benefit from strong growth in the United States. With a larger share of the population vaccinated and the gradual improvement in the labour market, consumption will also be a key growth driver. Investment will also pick up, driven by planned infrastructure projects. Inflation will edge down, after the significant increase in 2021. The latest fiscal plan foresees that the deficit will remain broadly unchanged in 2022 and gradually decrease thereafter. As such, the fiscal stance, while remaining cautious, has become less restrictive and provides mild support to the recovery.

Table 1. The economy is recovering

|

|

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|

|

Gross domestic product |

-8.2 |

5.3 |

2.3 |

2.6 |

|

Private consumption |

-10.5 |

7.3 |

2.0 |

2.3 |

|

Gross fixed capital formation |

-17.8 |

10.4 |

4.4 |

4.5 |

|

Exports |

-7.3 |

5.9 |

6.5 |

5.3 |

|

Imports |

-13.7 |

14.6 |

6.0 |

5.8 |

|

Unemployment rate |

4.4 |

4.1 |

4.0 |

3.9 |

|

Consumer price index |

3.4 |

5.7 |

5.4 |

3.4 |

|

Public balance (% of GDP) |

-2.9 |

-2.9 |

-3.2 |

-3.0 |

|

Public debt (net, % of GDP) |

51.5 |

49.9 |

50.0 |

49.7 |

|

Current account (% of GDP) |

2.3 |

-0.7 |

-0.8 |

-0.9 |

Source: OECD Economic Outlook database.

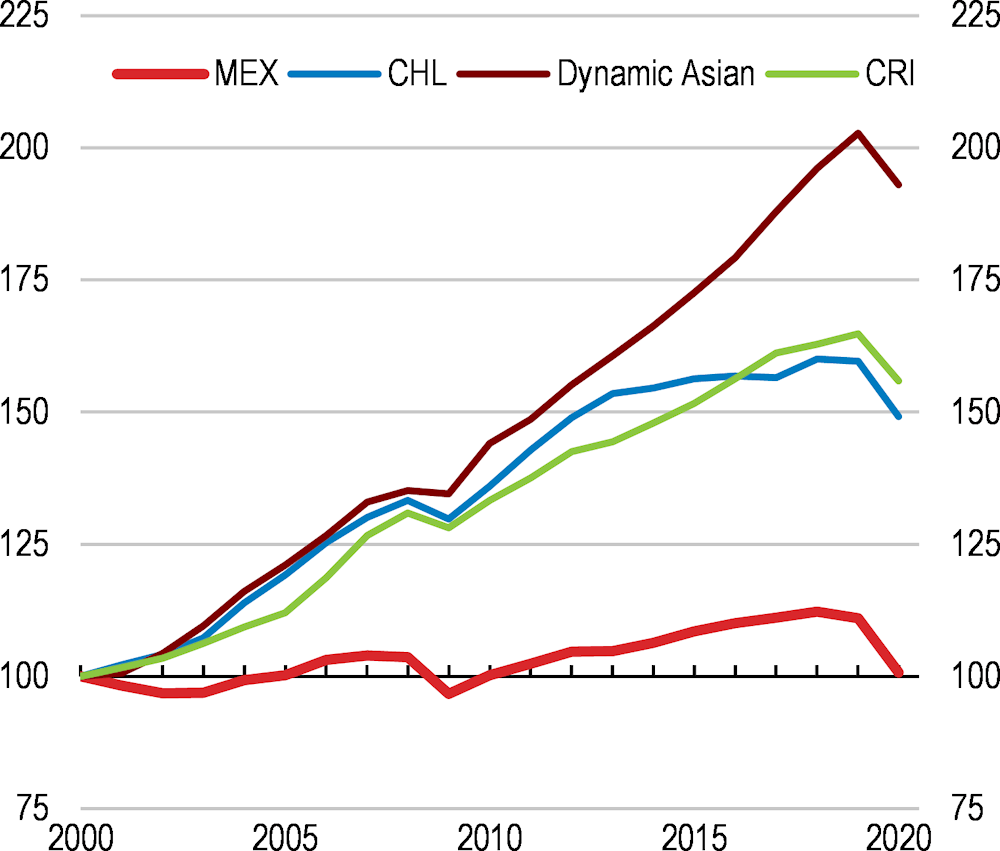

Mexico’s potential to be a high-growth economy is large. It has transitioned from being an oil-dependent economy in the early 1990s towards a manufacturing hub, highly integrated in global value chains, today. The proximity to the United States export market is a fundamental competitive advantage. However, such potential remains unrealised and growth over the last decades has been low (Figure 2).

Figure 2. Growth has been low

Index of real PPP-adjusted GDP per capita, 2000 = 100

Note: Dynamic Asia includes India, Indonesia, Malaysia, Philippines, Thailand, and Viet Nam.

Source: World Bank World Development Indicators.

Medium-term growth prospects have weakened. Informality, low competition, financial exclusion and corruption are some of the factors hindering productivity growth. Weak investment and low female participation rates deteriorate growth prospects further. The updated trade agreement in North America can give fresh impetus to growth. However, a comprehensive reform agenda is needed to reboot investment and turn around productivity.

Tax revenues remain low

Mexico has been fiscally prudent over the years, broadly meeting its fiscal targets and ensuring fiscal sustainability despite having the lowest tax-to-GDP ratio in the OECD. Revenues have been resilient during the pandemic and the fiscal deficit widened only slightly.

Social spending and public investment have recently increased, but the pandemic has created additional needs, as poverty has risen, health and education systems are strained, and infrastructure gaps remain. Accompanying spending increases in these essential areas with a gradual increase in tax revenues would help to respond to these spending needs while maintaining and reinforcing Mexico’s commitment to debt sustainability.

Broadening tax bases, by eliminating inefficient and regressive exemptions, holds the promise of increasing revenues without increasing tax rates. There is also significant room to strengthen subnational taxes, namely property and vehicle taxes.

Restarting investment and boosting productivity are key priorities

Investment, muted since 2015 and falling since 2019 (Figure 3), is hindered by uncertainty about domestic policy settings. Uncertainty particularly increased following proposals to reform the electricity market. With the appropriate policy settings, the potential for investment to restart is high. Mexico could reap further benefits from the strong recovery in the United States and the on-going reorganisation of global supply chains closer to consumer markets. Of particular importance are reforms to provide certainty about existing contracts and regulatory stability.

Figure 3. Investment has been weak

Gross fixed capital formation, index, 2015Q1 = 100

At around 55%, informality remains high and is both a cause and a consequence of low productivity. A comprehensive strategy is needed to reduce informality, with actions needed in several policy areas. Improving business regulations at state and municipal, which in some instances remain costly and complex, should be a key building block of that strategy.

Reforming trade regulations would also bring benefits to consumers and strengthen productivity. Mexico is well integrated into manufacturing value chains, but there is room for further integration in services. Continuing to reinforce the anticorruption framework and strengthening implementation of already enacted legislation is also fundamental to boost productivity and improve governance.

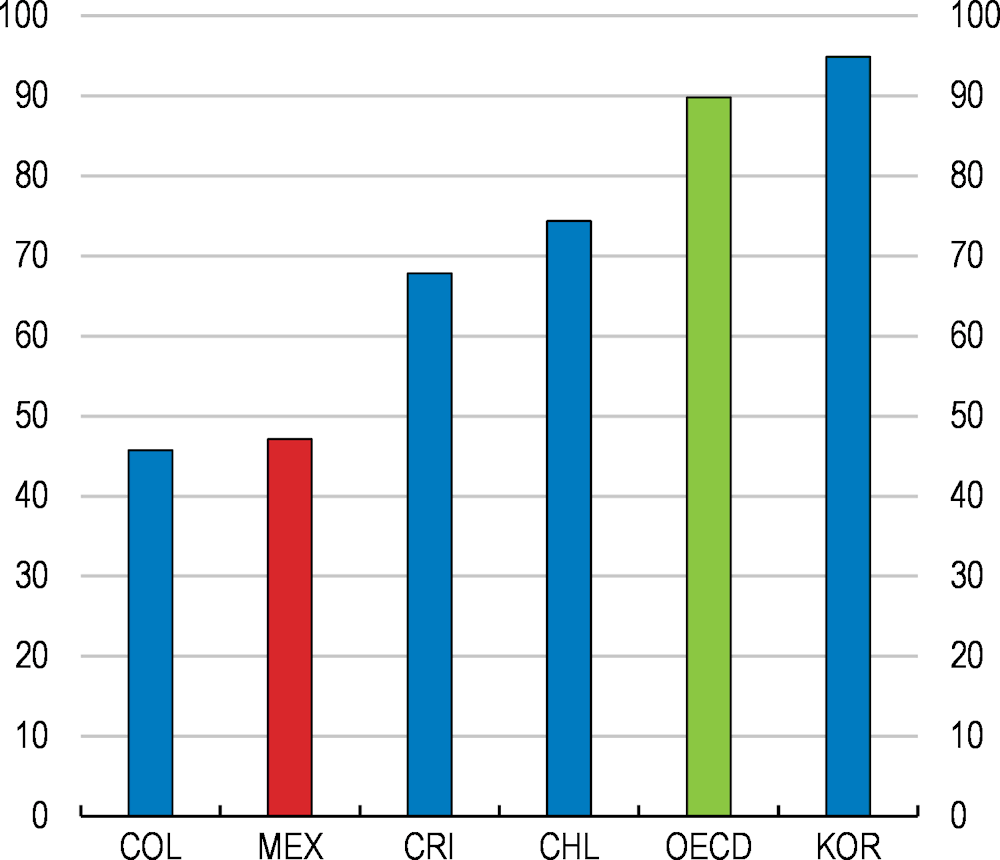

There is significant room to improve access to finance by firms and households (Figure 4), which would boost growth and inclusion. Fostering competition in the banking sector would contribute to reduce interest rate margins, supporting SMEs access to credit. Fintech’s potential to strengthen financial inclusion could be realised by upgrading digital payment regulations.

Figure 4. Access to finance is low

% aged 15+ with bank account, 2017

Note: Data for Mexico refer to 2018 and to adult population between 18 and 79 years of age.

Source: Global Findex Database.

Mexico was a pioneer among emerging economies in taking action on climate change mitigation and adaptation. However, additional policy action is needed to meet emission targets. Mexico’s potential in the renewables sector is high but remains untapped. The electricity market reform under discussion proposes to establish a guaranteed market share of at least 54% for the public electricity company and to eliminate regulatory bodies overseeing competition and granting permits. Mexico is also increasing investment in fossil fuel exploration and extraction and building a new refinery. Transport is the second largest emitter sector. Experiences of several Mexican states attest the benefits of transitioning towards cleaner transportation means.

Efforts to improve the equality of opportunities should be redoubled

Mexico has one of the highest levels of poverty and income inequality in the OECD, which calls for continuing efforts to strengthen social protection, reduce gender gaps and improve education.

The pandemic and the associated increase in social vulnerability signal the need to continue strengthening the social protection system and making it more efficient and responsive to economic cycles. The number of recipients of social programmes has recently increased. Reducing fragmentation and improving targeting would offer the possibility of extending coverage further, particularly among low-income households.

Important reforms to labour market regulations and pensions are underway. Reforms to enhance conflict resolution, workers representation and collective bargaining hold the promise of facilitating labour disputes resolution and compliance with workers’ rights. The reform of the pension system, agreed with the private sector, addresses some of its weakness, such as low benefits and limited coverage.

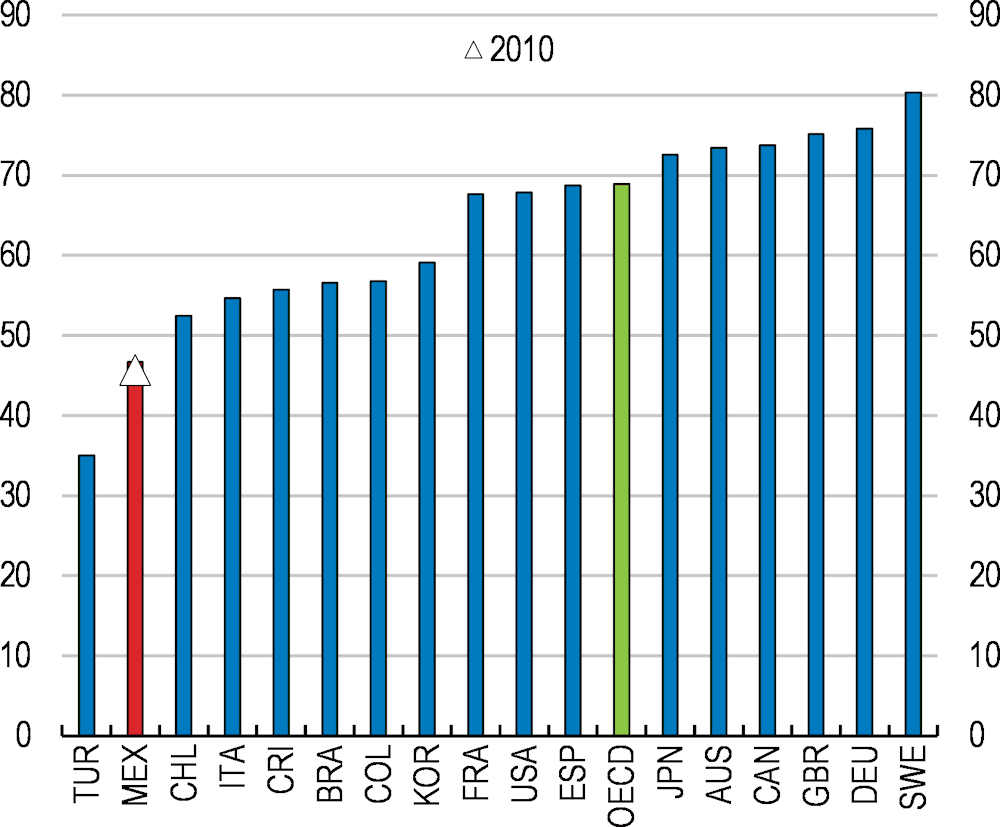

Mexico has made good progress in improving female political representation but labour force participation lags the OECD average and other Latin American countries (Figure 5). Care responsibilities fall disproportionally on women, hampering their prospects to complete education or be in the labour force. Reducing gender inequalities would boost growth and well-being significantly. Women have been particularly hit by the pandemic, as they were particularly affected by long schools closures and were more predominantly employed in sectors requiring in-person work.

Figure 5. Female labour market participation is low

% of female population aged 15-64, 2020

The education system was highly impacted by the pandemic. After one of the longest schools closure in the OECD, pre-existing inequalities are likely to widen further. Before the pandemic hit, best performing students had a similar level of performance as the OECD average. However, the gap between top and bottom students in Mexico was large and equivalent to four years of schooling.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Safeguarding the on-going recovery |

|

|

The share of the vaccinated population is rising but remains below the one observed in OECD and regional peers. Additional infection waves would hamper the recovery. |

Accelerate vaccination. |

|

Activity has rebounded. The recovery of the labour market is still ongoing. The fiscal stance for the near-term provides mild support to the recovery. |

Stand ready to provide further targeted fiscal support if the recovery falters or the pandemic resurges. |

|

Further improving macroeconomic policies |

|

|

Public spending is low in international perspective. Spending on social protection and public investment have recently increased, but the pandemic has strained health and education systems, poverty has increased and infrastructure gaps remain significant. Responding to increasing spending needs while maintaining commitment with debt sustainability requires increasing tax revenues. The tax-to-GDP ratio is the lowest in the OECD and lower than in regional peers. |

Increase public investment, based on sound and transparent cost-benefit analysis, and spending on social programs, education and health, with a special focus on low-income households, over the medium-term. Broaden tax bases by phasing out inefficient and regressive exemptions and by reducing informality, and foster property tax collection by updating the cadastre using digital technologies. |

|

The budgetary process has improved. The ability to run countercyclical fiscal policies and support the economy during downturns is limited. The existing current spending rule covers only around 36% of public sector expenditure. |

Introduce a long-term debt anchor and widen the share of public spending covered by the spending rule. Establish an independent and adequately resourced fiscal council. |

|

Inflation picked up well above 3%. The increase was triggered by supply chain disruptions and additional domestic pressures on some merchandise items. There are risks that price formation mechanisms may be affected in a generalised way. |

Gradually increase the interest rate if inflation does not return to the 3% target. Tighten at a faster pace if long-term inflation expectations start to rise. |

|

Support to PEMEX has increased to 1% of GDP. Despite new business plans, PEMEX remains a significant risk for the sovereign. |

Strengthen PEMEX and other SOEs governance by aligning it to the OECD Guidelines on Corporate Governance of State-owned Enterprises. |

|

Restarting investment and boosting productivity |

|

|

Investment has been weak since 2015. Reform reversals and planned regulatory changes in electricity and oil markets increase uncertainty and hamper investors’ confidence. |

Provide investors with certainty about existing contracts and regulatory stability. |

|

Access to finance by firms and households is low. SMEs access to credit is hampered by high interest rate margins and information asymmetries. Digitalisation and Fintech can widen access to finance but their impact is hampered by barriers in digital payment markets and low digital skills. |

Strengthen the credit registry system by ensuring that all lenders are able to access all credit history information. Upgrade digital payment regulations to facilitate entry in payment card market. Modify the school curricula to strengthen digital literacy from a young age and upskill teachers’ digital capacity. |

|

Corruption perceptions have fallen but remain higher than in peers. The toolkit to fight corruption has been strengthened but implementation efforts lag. |

Continue to strengthen the fight against corruption, including by boosting technical expertise in anticorruption agencies. |

|

At about 55% of workers, informality is high. Informality is both a cause and a consequence of low productivity. |

Establish a comprehensive strategy to reduce the cost of formalization, including reducing firms’ registration costs at the state and municipal level. |

|

Competition has been weak in key sectors of the economy and a few companies tend to dominate markets. |

Strengthen competition, including by ensuring that the competition authority remains independent and adequately resourced and by reducing regulatory burden. |

|

Improving equality of opportunities |

|

|

Unemployment insurance schemes provide income protection for individuals losing employment and act as valuable counter-cyclical tools. |

Establish a federal unemployment insurance scheme. |

|

Education inequalities are large. Pandemic-related schools closures are likely to have long-term negative effects on skills and growth. |

Put in place programmes aimed at reintegrating back to schools those who dropped during the pandemic and provide targeted support and tutoring to those with learning difficulties. |

|

Female labour force participation at 45% is low. Family care responsibilities hamper women prospects to complete education or be in the labour force. |

Establish a network of childcare facilities, giving priority to low income households. |

|

Strengthening green growth |

|

|

Under currently implemented policies, Mexico’s commitments to curb emissions, as in many countries, will be challenging to achieve. |

Broaden the carbon tax base, gradually increase the rate, and use part of the revenues to offset the effects of higher energy prices on low-income households. |

|

Mexico has huge untapped potential in renewables. A reform of the electricity market under discussion establishes a maximum private participation of 46% in the electricity market and eliminates regulatory bodies overseeing competition and granting permits. |

Maintain regulations that promote renewables generation and private sector participation. Upgrade the electricity grid by implementing smart grid technologies and integrating storage devices into the network. |