The economic recovery that started in 2021 in Emerging Asia – ASEAN, China and India, is anticipated to continue in 2022. The chapter presents recent macroeconomic developments and provides the near-term outlook for key sectors. Financial markets were calm in 2021, but rising interest rates in advanced economies and geopolitical tensions such as the escalation of the ongoing war in Ukraine could pose a challenge in upcoming months. The pandemic had an impact on the banking sector, as evidenced by declining profitability and bank lending in a number of countries. In parallel, international trade continued to provide key support, but response to the Omicron variant could disrupt supply chains and weigh on growth. Headline inflation increased in a sustained way, in particular in the second quarter of 2021, amid rising energy prices. Monetary policy remains accommodative in most countries in response to subdued or fragile recoveries. Fiscal stimulus continued, but the impact on public finances is anticipated to be more moderate than in 2020.

Economic Outlook for Southeast Asia, China and India 2022

Chapter 1. Macroeconomic assessment and economic outlook in Emerging Asia

Abstract

Introduction

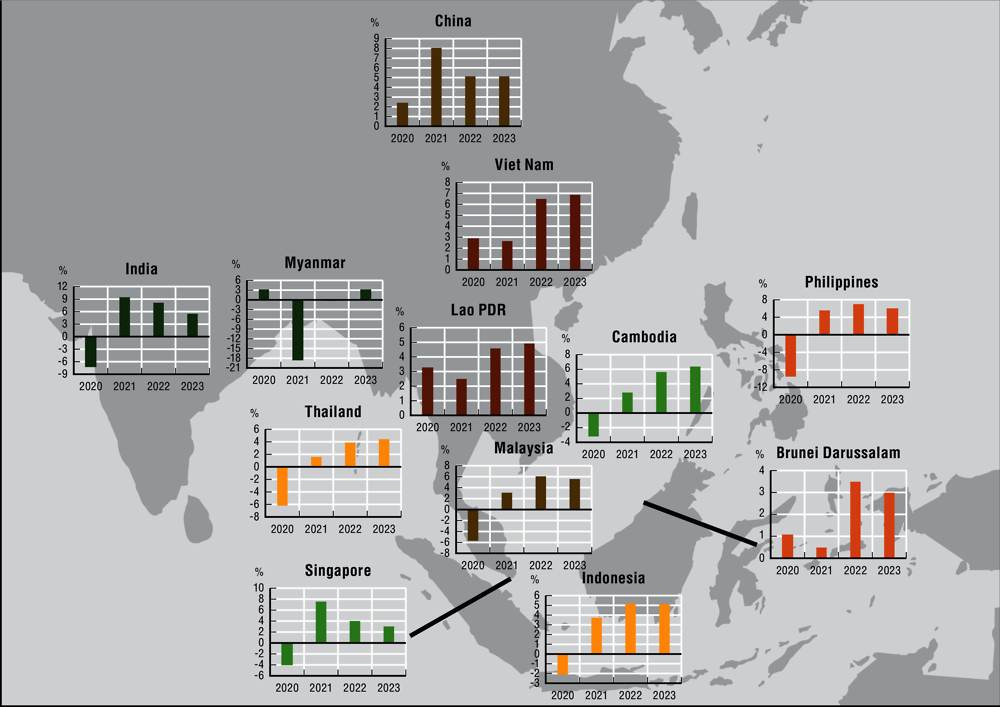

Following the historic decline in economic activity recorded in the first half of 2020, and the subsequent rebound that occurred in the second half of 2020, the countries of Emerging Asia faced another setback in the second and third quarters of 2021, as another wave of the COVID-19 pandemic prompted a new round of containment measures. Still, the recovery that started in 2021 is anticipated to continue in 2022, though great uncertainty remains (Figure 1.1).

Figure 1.1. Growth in real GDP in Southeast Asia, China and India: Comparison between growth rates for 2021, 2022 and 2023 (%)

Note: Data are as of 7 March 2022. Data for India and Myanmar relate to fiscal years. The 2021 actual figures for China, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Viet Nam are based on national sources. The 2022 and 2023 projections for China, Indonesia, and India, as well as the 2021 projections for India, are based on the OECD Economic Outlook No. 110.

Source: OECD Development Centre and OECD (2021a).

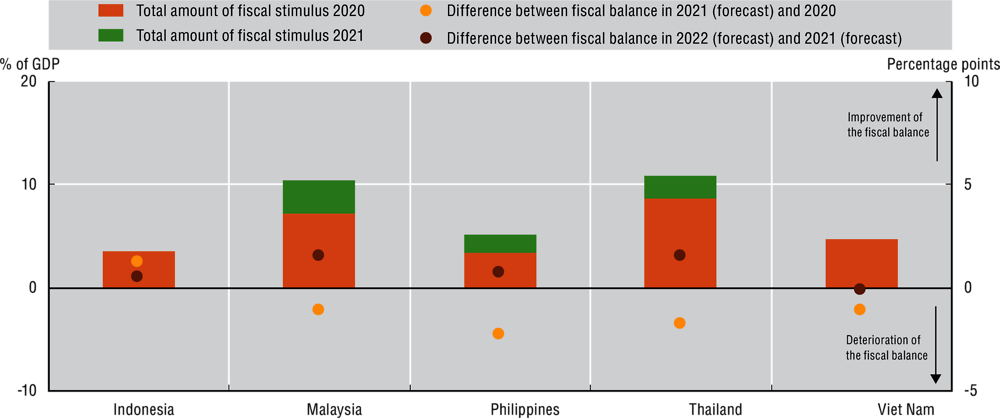

Financial markets were generally calm in 2021. Looking ahead, however, rising policy rates in advanced economies and the war in Ukraine could both pose challenges in the upcoming months. It is worthy of note, meanwhile, that the pandemic has had a negative impact on the banking sector, as evidenced by declining level of profitability and bank lending in a number of countries in the region. In parallel, international trade continued to provide vital support for Emerging Asian economies, although supply-chain disruptions affecting key sectors such as raw materials and semiconductors could restrict economic growth in some countries. Moreover, the pandemic inflicted lasting damage to labour markets. In addition, there was a sustained increase in headline inflation, particularly in the second quarter of 2021. This reflects not just rising commodity prices, but also the comparison with a low base a year earlier. Meanwhile, monetary policy remains accommodative in most countries in Emerging Asia. Fiscal stimulus continued in 2021, with Malaysia, the Philippines, Singapore and Thailand unveiling new support packages. However, the impact on public finances is anticipated to be more moderate than it was in 2020. Looking ahead, growth prospects in the near term will largely be determined by the way countries respond to the various risks.

Overview and main findings

Countries in Emerging Asia faced persistent waves of cases from the Delta variant of COVID-19, whose duration and severity was even worse than in 2020. However, the restrictions were less disruptive in 2021 thanks to their being more targeted. Differences in economic outlooks among Emerging Asian countries have become even more relevant, with the management of the pandemic differing starkly among countries. While a number of countries have embarked on mass vaccination programmes using a variety of vaccines, attaining herd immunity is likely to be a very slow process in some countries due to constraints in the supply of vaccines, logistical issues, and vaccine hesitancy. Looking ahead, Emerging Asian economies are projected to increase by 5.8% on average in 2022, and to expand by 5.2% in 2023. Furthermore, ASEAN’s average real GDP growth is forecast to be 5.2% in 2022, and 5.2% in 2023. Output growth in 2022 in ASEAN will range from -0.3% in Myanmar to 7.0% in the Philippines (Table 1.1).

Table 1.1. Real GDP growth in ASEAN, China and India, 2020-23

Percentage

|

|

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|

|

ASEAN-5 |

||||

|

Indonesia |

-2.1 |

3.7 |

5.2 |

5.1 |

|

Malaysia |

-5.7 |

3.1 |

6.0 |

5.5 |

|

Philippines |

-9.6 |

5.6 |

7.0 |

6.1 |

|

Thailand |

-6.2 |

1.6 |

3.8 |

4.4 |

|

Viet Nam |

2.9 |

2.6 |

6.5 |

6.9 |

|

Brunei Darussalam and Singapore |

||||

|

Brunei Darussalam |

1.1 |

0.5 |

3.5 |

3.0 |

|

Singapore |

-4.1 |

7.6 |

4.0 |

3.0 |

|

CLM countries |

||||

|

Cambodia |

-3.2 |

2.8 |

5.6 |

6.3 |

|

Lao PDR |

3.3 |

2.5 |

4.6 |

4.9 |

|

Myanmar |

3.2 |

-18.6 |

-0.3 |

3.3 |

|

China and India |

||||

|

China |

2.4 |

8.1 |

5.1 |

5.1 |

|

India |

-7.3 |

9.4 |

8.1 |

5.5 |

|

Average of ASEAN-10 |

-3.2 |

3.0 |

5.2 |

5.2 |

|

Average of Emerging Asia |

-0.8 |

7.4 |

5.8 |

5.2 |

Note: Data are as of 7 March 2022. Data for India and Myanmar relate to fiscal years. The 2021 actual figures for China, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Viet Nam are based on national sources. The 2022 and 2023 projections for China, Indonesia, and India, as well as the 2021 projections for India, are based on the OECD Economic Outlook No. 110.

Source: OECD Development Centre and OECD (2021a).

ASEAN-5

Indonesia is experiencing steady economic recovery, supported mainly by international trade. Real GDP growth is expected to reach 5.2% in 2022, before expanding by another 5.1% in 2023. In terms of supporting Indonesia’s suppressed domestic demand, fiscal stimulus is expected to do the heavy lifting, with the 2022 budget aiming to improve welfare for the lower-income fringes of the population. In addition, it is anticipated that the gradual easing of travel restrictions will lead to a recovery in the tourism sector, which is an important part of the country’s economy. On the downside, however, the economic recovery remains subject to a very high degree of uncertainty due to the continued spread of the Omicron variant.

Malaysia was confronted with a sharp rise in COVID-19 cases in 2021, with repeated outbreaks between February and October, and a peak in August. Real output is projected to expand at an annual rate of 6% in 2022, and 5.5% in 2023. The outlook is exposed to downside risks, with the fast-spreading Omicron variant and an intensifying degree of disruption to supply chains expected to slow the recovery in the near term. On the other hand, the negative effects of containment measures on growth should be tempered by sustained fiscal support and recovering global demand. In addition, Malaysia’s 2022 budget, which includes a record spending package, is expected to improve consumer sentiment, and to support domestic demand. Services exports are expected to benefit from the gradual recovery in tourist flows, after the launch of a vaccinated travel lane with a number of countries.

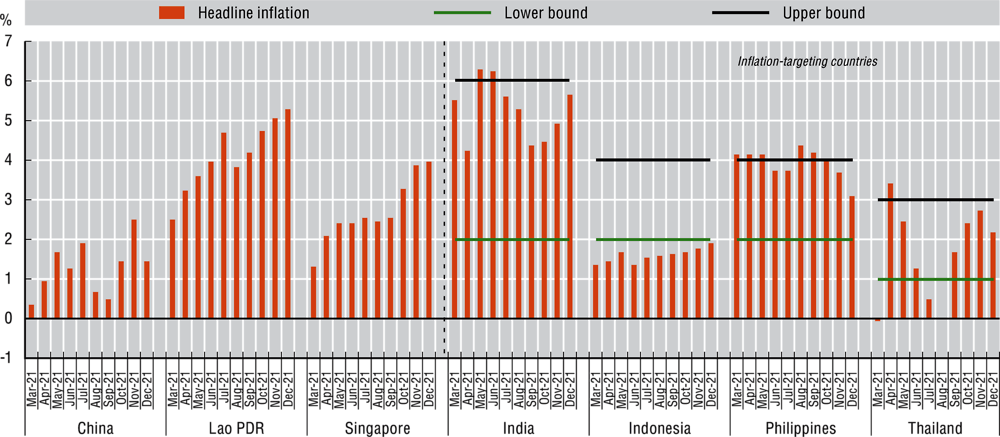

In the Philippines, renewed outbreaks of COVID-19 in the autumn of 2021, followed by record-high case counts due to the Omicron variant in early 2022, have prompted new rounds of restrictions, albeit more localised in nature. The outlook is for robust growth in 2022 (+7%), while output growth is likely to remain strong in 2023 (+6.1%). A faster implementation of investment projects in infrastructure, and the recovery in cash remittances by overseas Filipino workers constitute upside risks to the forecast, although pandemic-related uncertainties amid relatively low vaccination rates and still-elevated infections due to the Omicron variant continue to tilt the risk balance to the downside. Inflation has also picked up, and even exceeded the upper limit of the tolerance band during the second half of 2021. This reflects a combination of a low comparison base from a year earlier, as well as rising energy prices.

Thailand was also affected by a new wave of COVID-19 cases in the second half of 2021, with Omicron-fuelled cases surging in early 2022. Real GDP is forecast to grow by 3.8% in 2022, before accelerating to 4.4% in 2023. The continued fiscal support that the Thai government provided in 2021 will likely ease pandemic-related pressures on domestic demand. In addition, a quarantine-free reopening of borders to visitors from certain countries will support efforts to restart Thailand’s key tourism sector. On the other hand, risks to the outlook include persistent bottlenecks in supply chains. Exports are also likely to be less dynamic due to supply-chain disruptions.

In Viet Nam, surging COVID-19 cases with a record-high number recorded in February 2022 constitute a headwind to economic growth, in addition to lingering supply-chain disruptions. Real GDP is expected to expand by 6.5% in 2022, and then to edge 6.9% higher in 2023. Still, the balance of risks remains tilted mainly to the downside. The Vietnamese labour market is likely to require more time before it will be able to leave the pandemic-induced crisis fully behind it. A marked deterioration in employment in the third quarter of 2021, when Viet Nam’s unemployment rate surged to multi-year highs (3.6% in September), is expected to weaken household demand in the short term.

Brunei Darussalam and Singapore

Brunei Darussalam recorded weak growth for most of 2021, amid the continued spread of COVID-19 and the re-imposition of containment measures, which dragged on private consumption and investment. Net exports also contributed negatively to growth in the first three quarters of 2021, as buoyant import growth outpaced a rise in exports. Real GDP is set to grow by 3.5% in 2022, and further increase by 3% in 2023. Still, volatile commodity prices and the uncertain medium- to long-term outlook for fossil fuels continue to cloud the outlook for exports. On the upside, the economy should continue to benefit from government policies aimed at intensifying activities outside of the oil and gas sector.

In Singapore, a sharp rise in COVID-19 cases in the second half of 2021, followed by another significant surge due to Omicron, has prompted the authorities to unwind the country’s remaining restrictions at a slower pace than had initially been foreseen. Since the most recent restrictions have tended to be more targeted, however, economic growth in Singapore is set to reach 4% in 2022, after a historic plunge in 2020 and a strong recovery in 2021. Subsequently, output growth is expected to settle at 3% in 2023. The risks to the outlook are broadly balanced. On the downside, persistent supply bottlenecks could hamper exports. On the upside, the reopening of international borders to travellers from certain countries under the “Vaccinated Travel Lane” framework should buttress services exports. In addition, Singapore’s high vaccination rate reduces its domestic pandemic-related risks to a certain extent.

Cambodia, Lao PDR and Myanmar

In Cambodia, a severe resurgence of the COVID-19 pandemic began in the second quarter of 2021, with repeated localised spikes occurring until November. Moreover, case counts have also been on the rise in recent weeks, fuelled by the Omicron variant. Output growth is anticipated to come in at 5.6% in 2022 and 6.3% in 2023. Yet the balance of risks to this outlook appears to be slightly tilted to the downside due to the importance of foreign tourism, a sector in which uncertainty remains high despite the easing of restrictions on people arriving from certain international destinations. Furthermore, the rapid rise in credit to the non-financial corporate sector, and the concentration of domestic credit in the construction and real-estate sectors, risk undermining financial stability. On the upside, Cambodia’s high vaccination rate should alleviate the burden on the healthcare system. Moreover, the agricultural sector is expected to remain resilient, while exports of garments should benefit from the ongoing economic recovery of trading partners.

In Lao PDR, rising COVID-19 cases prompted a tightening of containment measures throughout 2021 and early 2022. Moreover, the risks to the economic forecast for the country are mostly tilted to the downside. Although the Omicron wave appears to be on a declining path, a comparatively lower rate of vaccination coverage in Lao PDR than in other countries in the region means that domestic risks related to the pandemic remain relatively high. On the upside, exports of goods are expected to be a bright spot in the economy, supported by increasing demand in neighbouring countries, and the launch of a high-speed railway between China and Lao PDR. Overall, real GDP growth for 2022 is forecast at 4.6%. In 2023, growth is anticipated to accelerate to 4.9%.

In Myanmar, political unrest that began in February 2021, and which coincided with the sharp rise in COVID-19 cases, has derailed the recovery. Output growth is forecast to reach -0.3% in 2022 and 3.3% in 2023, after moving deeply into negative territory in 2021 (–18.6%). This outlook is subject to downside risks related to the impact of the political turmoil on consumption and investment, and also to the relatively low vaccination rate in Myanmar compared to neighbouring countries. Another factor tilting the balance of risks to the downside is the persistent depreciation of the domestic currency, the Myanmar kyat, which has lost nearly 34% of its value since February 2021.

China and India

In China, the pandemic remained largely under control in 2021, even as other countries in Emerging Asia struggled with record increases in cases. This notwithstanding, localised outbreaks led to the reinstatement of restrictions in parts of China, as the highly-contagious Omicron variant continued to spread. Economic momentum in the country has subsequently weakened. In particular, it has been burdened by sluggish private consumption and the ongoing turmoil in the property sector, which has resulted from the financial distress of Evergrande Group and several other property developers. A rising debt burden represents an additional vulnerability. On the upside, however, exports reached record highs in 2021, and they are anticipated to remain buoyant in the near term. Moreover, authorities still have the fiscal headroom to respond to economic headwinds. Real GDP growth is still projected to reach 5.1% in 2022 and 2023.

In India, the period from April to June 2021 saw a steep contraction in activity on the back of a severe COVID-19 wave. Then, after a steady fall in case counts in late 2021, caseloads rose to multi-month highs in early January 2022, fuelled by the Omicron variant. Overall, real GDP is projected to grow by 8.1% in 2022, and by 5.5% in 2023. Still, the evolution of the pandemic remains a significant downside risk to the outlook. The deterioration of the situation on the fiscal front is worrisome, with public debt now stabilising at the high level of 90% of GDP. In addition, the financial sector is constrained by non-performing assets, with the gross non-performing assets ratio standing at 6.9% in September 2021. On the upside, budget measures for the 2022 fiscal year, including higher infrastructure spending, could support the post-pandemic recovery.

Other key points regarding the economic outlook and assessment for Emerging Asia

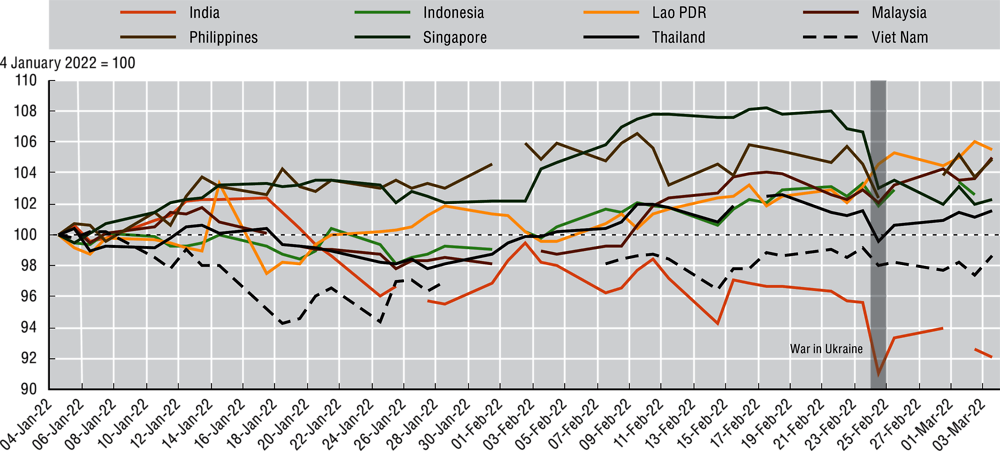

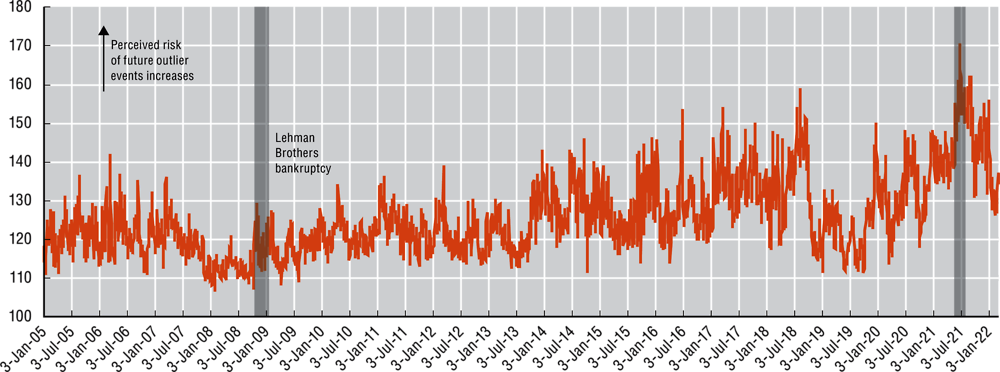

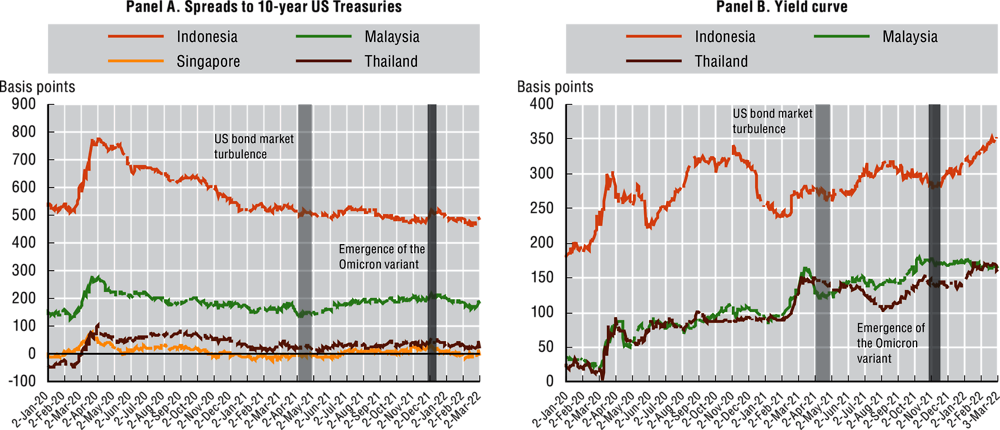

Developments on financial markets were broadly benign in 2021, but the war in Ukraine amplified stock market volatility in early 2022. After falling sharply in the first quarter of 2020, stock-market capitalisation recovered quickly, exceeding pre-pandemic levels in most countries in Emerging Asia. As for bond markets, the increase in nominal interest rates in the United States in the first quarter of 2021 was temporary, and its effects on Emerging Asian government-bond yields were limited. These favourable developments notwithstanding, the risk of a correction in global stock prices remains high. Indeed, the war in Ukraine may trigger higher financial market volatility. In addition, a rise in policy rates in the United States and other advanced economies could quickly lead to capital outflows from Emerging Asia.

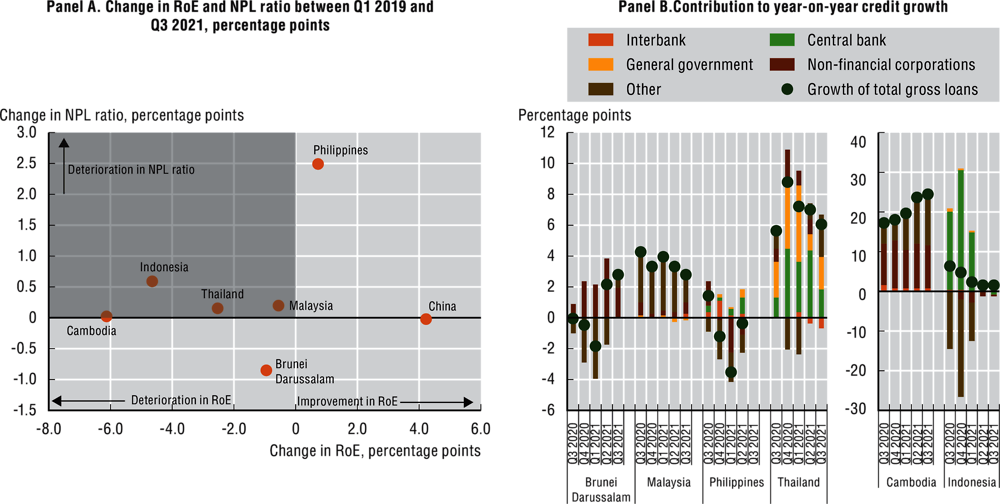

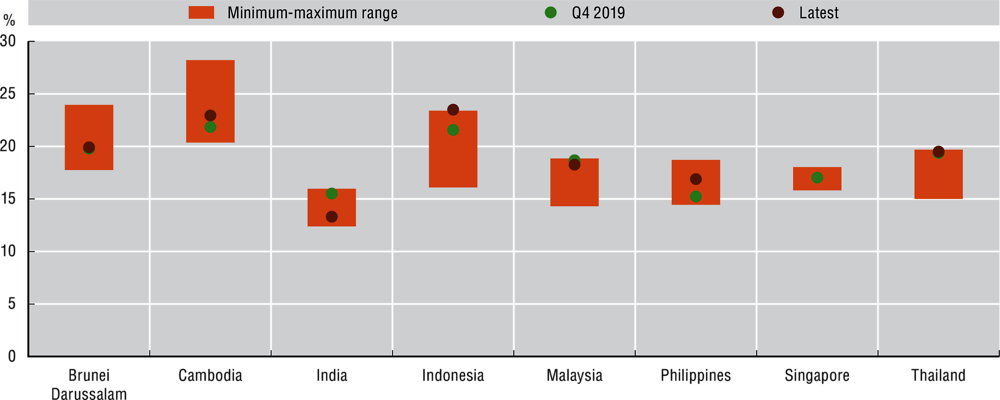

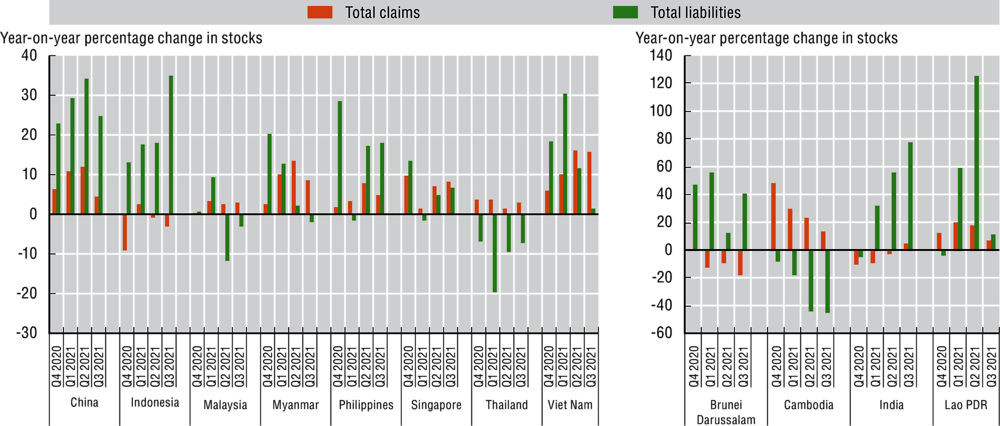

The pandemic affected banking sectors in Emerging Asia. Indeed, profitability levels in the banking sector deteriorated between the first quarter of 2019 and the second quarter of 2021 in several countries, although non-performing loan ratios remained mostly stable during the same period. In the first half of 2021, growth in bank lending turned negative in some countries, while deposit growth also fell back to more moderate levels. On a more upbeat note, however, stability in the banking sector remained relatively robust, with capital adequacy ratios above 15% in most countries.

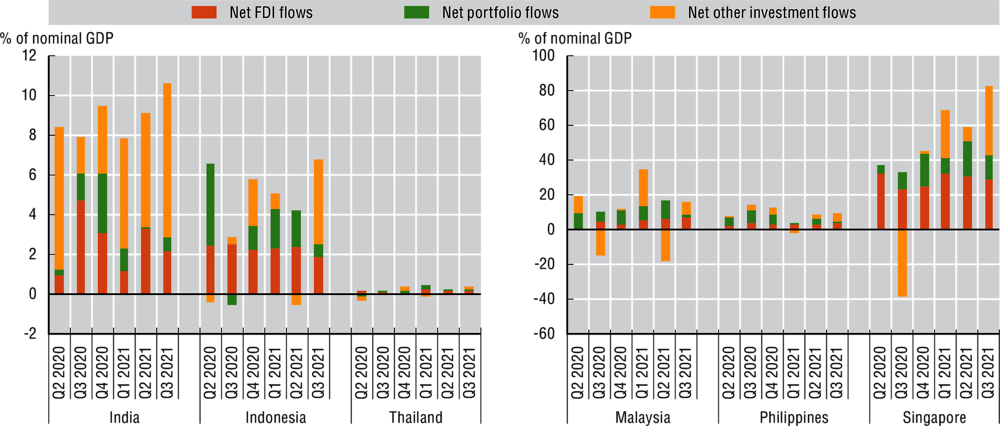

Another way in which recent economic turmoil has affected Emerging Asian economies is via the tightening of global credit conditions, resulting in a slowdown or even a temporary reversal of capital inflows into the region. According to balance of payments data, other investment flows have been more affected than foreign direct investment or portfolio flows since the beginning of the pandemic, mostly due to smaller inflows to the banking sector. With the stabilisation of global financial markets and easing liquidity pressures, from the fourth quarter of 2020 banks in some countries again started to rebuild their stocks of foreign assets.

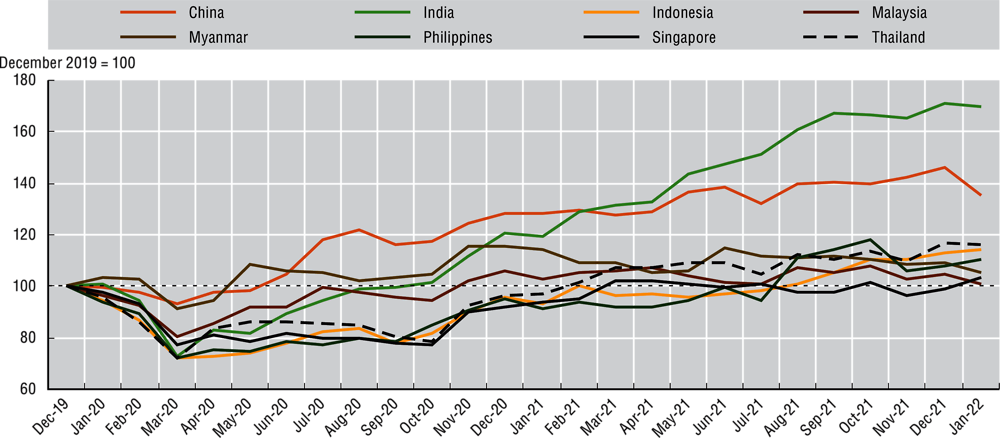

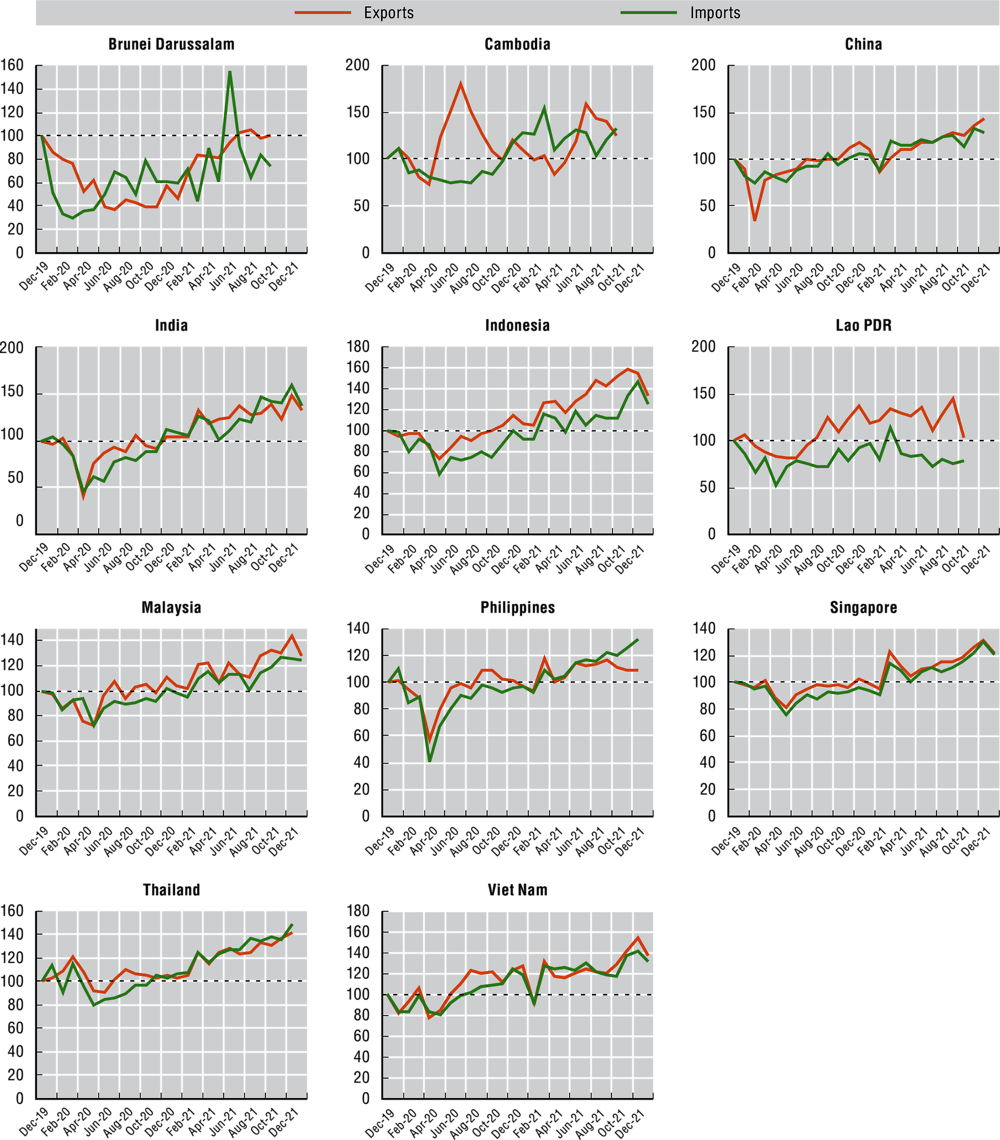

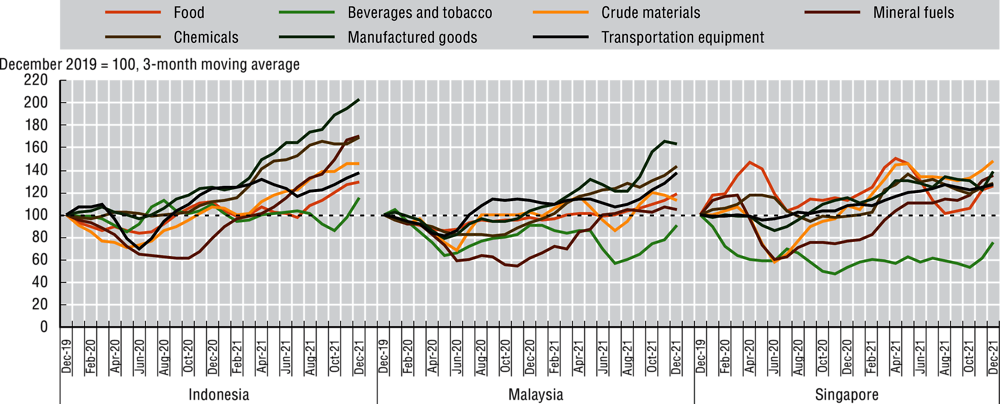

International trade continues to provide important support for economic growth in Emerging Asia. Indeed, robust global demand for goods has driven a strong trade performance in the region, in particular for manufactured goods, chemicals and transportation equipment. However, supply disruptions affecting key sectors such as semiconductors could weigh on growth in some countries. The underlying cause for these bottlenecks is a level of demand that has been running well ahead of supply, reflecting key structural shifts on the demand side. These demand pressures have been compounded by production disruptions due to localised outbreaks of COVID-19, and to labour shortages stemming from restrictions on the mobility of migrant workers. In light of the Omicron variant, and as case counts remain elevated across Asia’s production and shipping hubs, the risk of extended dislocations to the balance of supply and demand around the globe will remain high. The war in Ukraine also risks triggering further supply-chain bottlenecks.

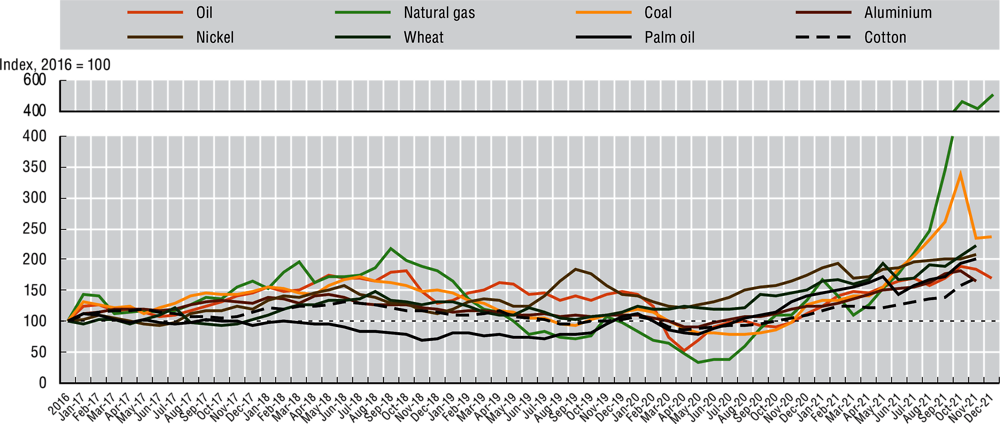

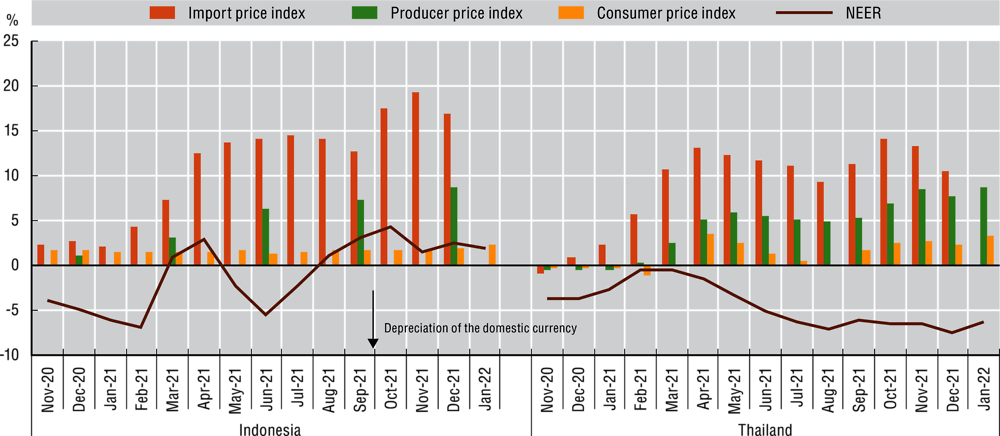

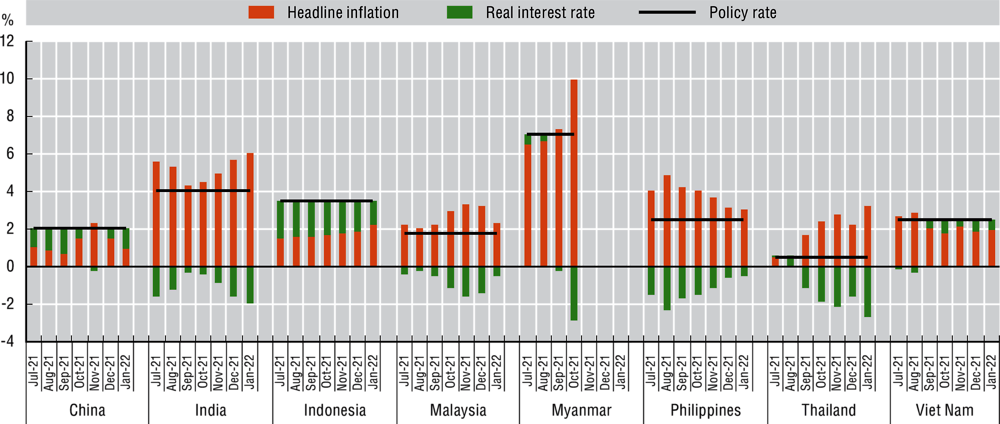

Headline inflation increased sharply in the second quarter of 2021, mostly reflecting rising commodity prices, but also the effects of a low comparison from a year earlier. Prices of natural gas, oil and coal have reached multi-year highs, while prices of agricultural commodities and metals have also surged. Several inflation-targeting countries in Emerging Asia have seen headline inflation exceed the upper limit of their tolerance bands. Another factor contributing to headline inflation in Emerging Asian economies is the pass-through from currency depreciation. Looking ahead, oil prices are projected to remain elevated amid rising demand, lower levels of inventories, and the war in Ukraine.

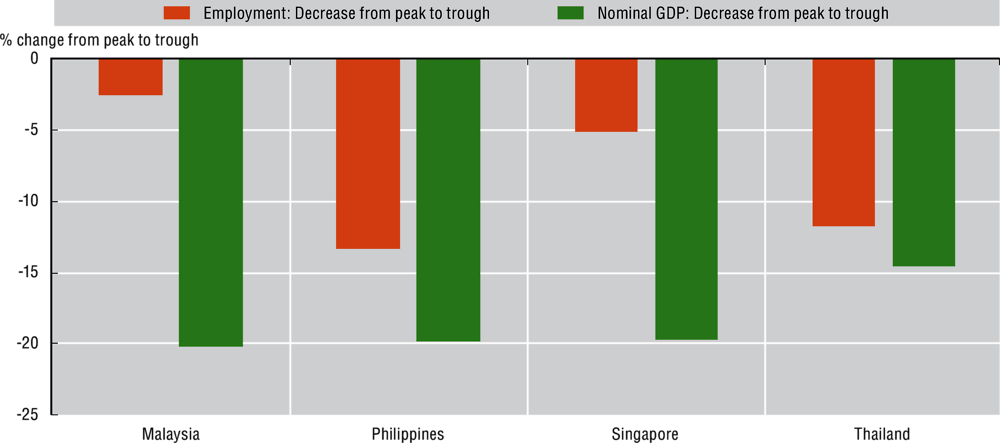

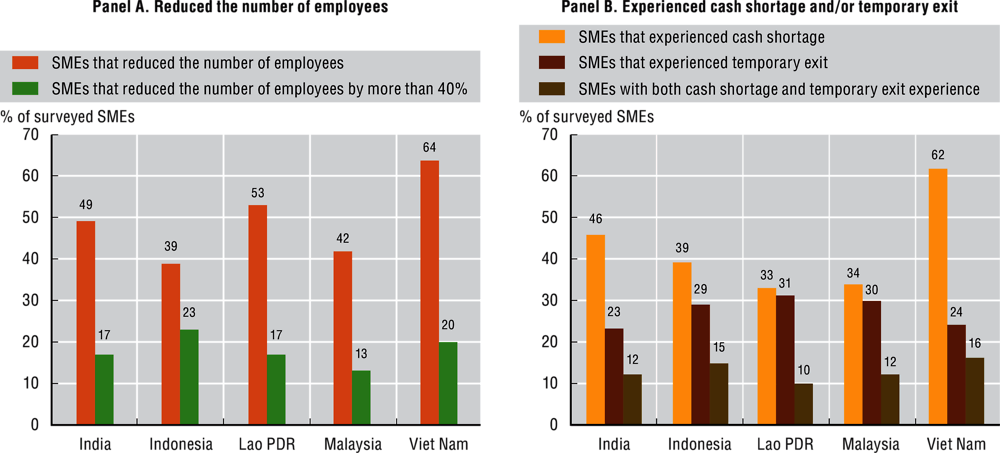

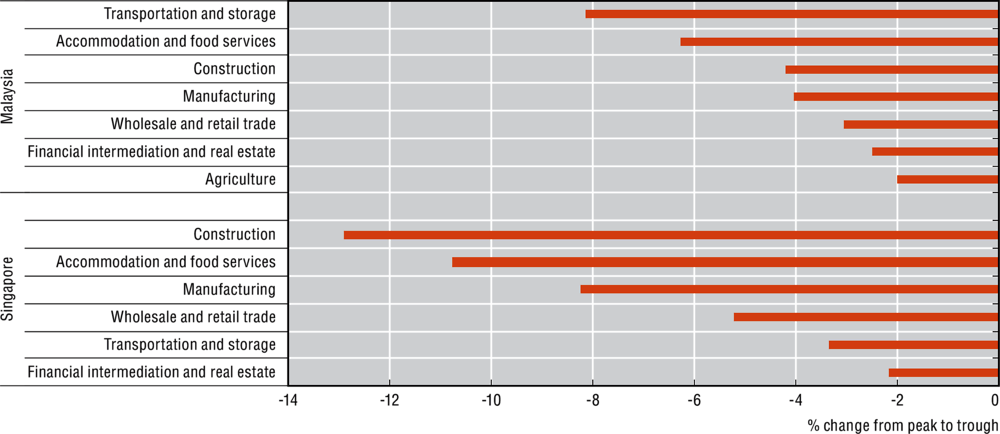

The pandemic has inflicted lasting damage on labour markets in Emerging Asia. This deterioration has been particularly acute in the Philippines and Viet Nam. Sectors of the economy that are especially cyclical, and indeed those that rely on face-to-face interactions, have endured the gravest job losses since the onset of the COVID-19 crisis. The widespread use of job-retention schemes has helped countries to contain the deterioration of labour markets, although this damage has still been substantial.

Monetary policy remains accommodative in most countries. Against the background of still-elevated numbers of COVID-19 cases from the Omicron variant, monetary policy makers are holding rates steady until economic prospects improve durably. In light of the aggressive easing of monetary policy that has taken place, real interest rates have fallen in many countries. Looking ahead, monetary policy is expected to remain accommodative as inflationary pressures are broadly under control. While central banks in Emerging Asia still have some cause to ease monetary policy themselves, however, they are wary of the potential knock-on effects of policy decisions by the US Federal Reserve, such as a tapering of asset purchases or the policy rate hike, which could put pressure on capital flows in the region.

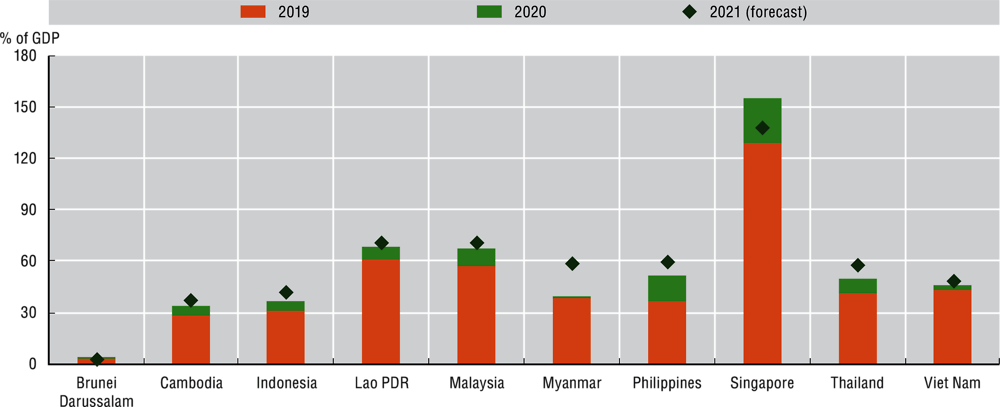

Following on from supportive measures in the first months of the pandemic, fiscal support continued into 2021 amid renewed COVID-19 outbreaks, with Malaysia, the Philippines, Singapore and Thailand rolling out additional fiscal stimulus throughout the year. Now, as economies recover, fiscal deficits are forecast to narrow marginally in 2022. Still, the debt-to-GDP ratios of most Emerging Asian countries are expected to continue rising in 2022, although at a much slower pace than in 2020. Although governments need to restore some fiscal flexibility, a strong complementarity between fiscal and monetary policies will remain essential. Calls from across society for measures to address longer-term challenges such as climate change will also lead to continued demands on government spending.

Given that the Omicron wave of the pandemic is likely to remain a significant factor in the first quarter of 2022, the effectiveness of healthcare responses and vaccination programmes will have a strong role to play in determining economic developments. Furthermore, coping with inflation risks is also crucial. The trend of headline inflation is pointing upwards in some Emerging Asian economies, clouding the outlook for economic growth and social stability. In addition, the brisk rebound in global demand in the second half of 2020 corroborated with persistent localised pandemic-related disruptions have affected several key industries, including the production of raw materials and semiconductors. These supply chain disruptions have the potential to reverberate through Emerging Asian economies and weigh on economic growth in the near term.

Political stability in Myanmar is important for the growth prospect of the country and the region.

Recent developments and near-term outlook

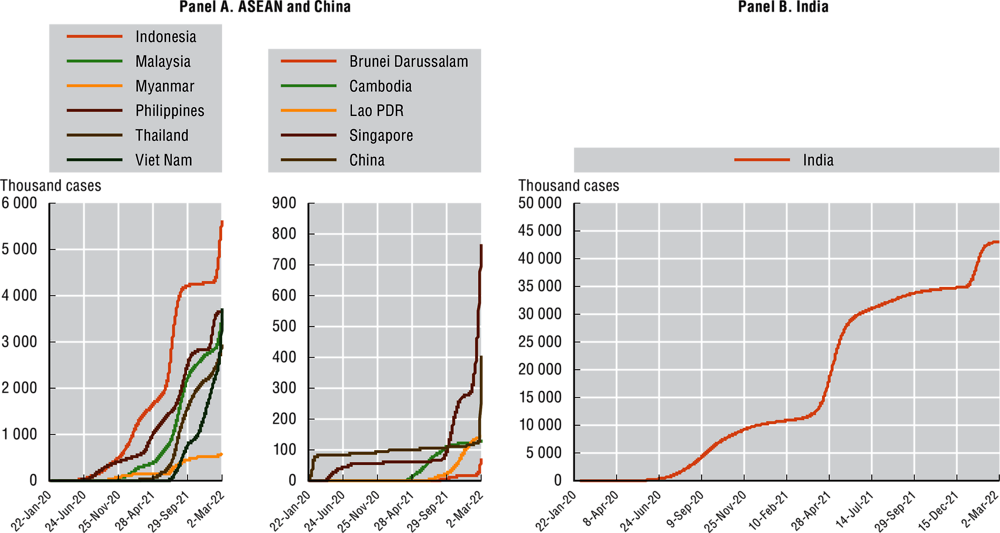

Emerging Asia’s headwinds in 2021 stem largely from the renewed lockdown measures that many countries imposed in order to manage the Delta variant. Infections rose considerably in 2021, putting renewed pressure on health systems. This was particularly the case in India, Indonesia, the Philippines, Malaysia, Singapore, Thailand and Viet Nam (Figure 1.2). Brunei Darussalam and the CLM countries (Cambodia, Lao PDR and Myanmar) managed to keep cases very low in 2020, but were confronted with sharp surges starting from the second quarter of 2021. Vaccination campaigns, which began in early 2021 in most Emerging Asian countries, promise an eventual decline in the severity of COVID-19 cases. Indeed, while the emergence of the highly contagious Omicron variant led to a sharp rise in infections in early 2022, particularly in India, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Viet Nam, hospitalisation and fatality rates were relatively more manageable than the rates recorded from late 2020 to early 2021.

Figure 1.2. Cumulative confirmed cases of COVID-19 in Emerging Asia, January 2020 to March 2022

Thousand cases

Renewed outbreaks of COVID-19 prompted authorities in several Emerging Asian countries to tighten restrictions, in particular during the third quarter of 2021. These included measures such as curfews, the partial closure of stores and factories in non-essential sectors, limits on travelling between provinces, and renewed calls to switch to remote working wherever possible. As vaccination coverage improves, however, there is an increasing shift in policy towards greater tolerance of COVID-19.

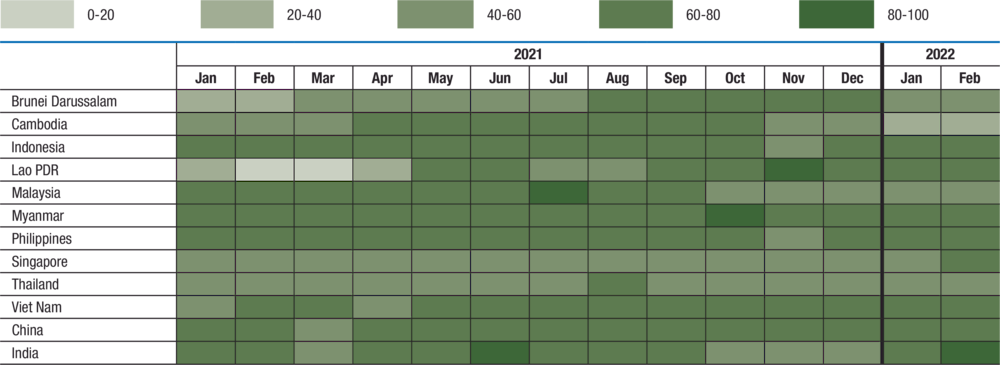

Even as more economies move to a policy of living with COVID-19 without major restrictions, the intensity of countries’ responses to the pandemic in recent months has varied considerably across Emerging Asia. Some economies have imposed tight restrictions in response to fresh outbreaks. Countries that have taken this approach include China, India, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore and Viet Nam. Meanwhile, other countries, namely Brunei Darussalam, Cambodia and Thailand, have implemented lighter mobility restrictions in response to outbreaks (Table 1.2). In India and Singapore, which have contended with sharp surges in cases fuelled by the Omicron variant, data for February 2022 point to a tightening of restrictions compared to the previous month. However, reassured by lower hospitalisation rates from Omicron, no country in Emerging Asia has returned to a full-scale lockdown.

Table 1.2. Stringency of COVID-19-related restrictions in Emerging Asian economies, January 2021 to February 2022

Stringency index on a scale of 0-100

Note: The data are as of 24 February 2022. Monthly values of the index represent the average of daily values for the respective month. An index between 0 and 20 denotes the lowest level of stringency. Meanwhile, an index between 80 and 100 corresponds to the highest level of stringency, which could include full-scale lockdowns.

Source: Authors’ elaboration based on Oxford COVID-19 Government Response Tracker.

Against a backdrop of new outbreaks of COVID-19, weaker-than-anticipated growth momentum has coincided with surprisingly high inflation over recent months, denting optimism for economic recovery in Emerging Asia. However, the contraction in economic activity in 2021 was far milder than in the first half of the previous year. After relatively broad-based declines in the first quarter, most economies rebounded strongly in the second quarter. Annual growth rates above 10% were recorded in the second quarter in Malaysia (16.1%), Singapore (15.8%), and the Philippines (12.0%). Nevertheless, strong base effects are at play in all of these countries, in that the comparison from 2020 reflects the turmoil of the early months of the pandemic. Growth figures for the third quarter of 2021 paint a more contrasted picture. The high stringency of COVID-19-related restrictions during the summer months caused several economies in Emerging Asia to plunge back into negative territory, while other countries experienced a deceleration in their annual growth rates (Table 1.3). The contraction in third-quarter output was most pronounced in Viet Nam (-6.0%) and Malaysia (-4.5%). Finally, most Emerging Asian countries posted solid growth rates in the three months to 31 December, ranging from 1.9% in Thailand to 7.7% in the Philippines.

Table 1.3. Quarterly real GDP growth in ASEAN, China and India, Q1 2020 to Q4 2021

Year-on-year percentage changes

|

|

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

|---|---|---|---|---|---|---|---|---|

|

ASEAN-5 |

||||||||

|

Indonesia |

3.0 |

-5.3 |

-3.5 |

-2.2 |

-0.7 |

7.1 |

3.5 |

5.0 |

|

Malaysia |

0.7 |

-17.2 |

-2.7 |

-3.5 |

-0.5 |

16.1 |

-4.5 |

3.6 |

|

Philippines |

-0.7 |

-16.7 |

-11.6 |

-8.3 |

-3.9 |

12.0 |

6.9 |

7.7 |

|

Thailand |

-2.2 |

-12.3 |

-6.4 |

-4.2 |

-2.4 |

7.7 |

-0.2 |

1.9 |

|

Viet Nam |

|

|

|

|

4.7 |

6.7 |

-6.0 |

5.2 |

|

Brunei Darussalam and Singapore |

||||||||

|

Brunei Darussalam |

2.3 |

3.5 |

0.4 |

-1.4 |

-0.8 |

-2.1 |

-2.2 |

|

|

Singapore |

1.2 |

-12.2 |

-4.6 |

-0.9 |

2.0 |

15.8 |

7.5 |

6.2 |

|

CLM countries |

||||||||

|

Myanmar |

-0.3 |

-2.8 |

-7.3 |

-8.5 |

-0.7 |

-0.7 |

|

|

|

China and India |

||||||||

|

China |

-6.9 |

3.1 |

4.8 |

6.4 |

18.3 |

7.9 |

4.9 |

4.0 |

|

India |

-23.8 |

-6.6 |

0.7 |

2.5 |

20.3 |

8.5 |

5.4 |

|

Note: Data as of 7 March 2022. Data for Q4 2021 were unavailable for Brunei Darussalam. Data for the period running from Q3 2021 to Q4 2021 were unavailable for Myanmar. Data for Q4 2021 were unavailable for India. Data for India and Myanmar relate to fiscal years ending in March. Quarterly data for Cambodia and Lao PDR were unavailable. The measurement method of real GDP growth for Viet Nam was changed as of Q1 2021.

Source: Authors’ calculations based on data from CEIC Data and national sources.

The most immediate threat to the near-term growth outlook in Emerging Asia remains the COVID-19 pandemic, with Omicron-fuelled case counts reaching record-high levels in several countries. The public health situation is nevertheless expected to improve gradually over the course of 2022 as vaccination rates increase, and as societies adapt to new protocols. However, there remains a downside scenario, in which vaccine-resistant virus mutations emerge, prolonging the crisis and requiring the implementation of new containment measures. Further risks to the recovery stem from longer-than-expected supply chain disruptions and higher-than-expected inflation. Furthermore, the war in Ukraine may also push up inflation.

In addition, authorities in Emerging Asia will need to cope with the lasting structural changes that the pandemic has brought about. There is broad consensus in the economic literature that the COVID-19 pandemic will, through the interplay of various transmission channels, have a lasting impact on economic factors such as potential output and economic resilience. Important structural economic changes that are expected to persist include the expansion of digital workplaces, e-commerce, and FinTech services. The increased use of digital financial services is expected to affect how and where economic agents consume, produce, and sell goods and services. For instance, Chinese consumers have increasingly turned to e-commerce and focused on neighbourhood shops and small-format stores, even as the pandemic outbreak subsided (Guthrie, Fosso-Wamba and Arnaud, 2021). In product markets, structural changes have also occurred that will affect potential output once the pandemic has subsided. These include changes in the overall composition of different sectors of the economy. The recovery in economic activity is expected to differ from sector to sector in the near term, altering the composition of overall economic activity. Recreational services are set to bear the brunt of the pandemic in the near term in Emerging Asia. According to the latest forecasts by the United Nations World Tourism Organization (UNWTO), international arrivals to the Asia-Pacific region are expected to return to pre-pandemic levels only in 2024 or later (UNWTO, 2022).

The highly contagious Omicron variant of COVID-19 emerged during a period of economic recovery in Emerging Asia, with stretched supply chains, elevated inflation, and rising inequality. However, high-frequency data indicate that Omicron has so far had a temporary and muted impact on regional economies. On the other hand, pressure on supply chains is likely to remain elevated in the first half of 2022. This will particularly be the case if China’s zero-COVID policy leads to additional disruptions around the country’s major production and shipping hubs in response to cases of Omicron in these areas. Moreover, such bottlenecks could have broader implications on production chains in other Emerging Asian countries. Indeed, a slowdown of the Chinese economy could also have a significant impact on its trading partners across Emerging Asia. The war in Ukraine could have implications for the region’s economies as a result of higher energy and food prices, and higher volatility on financial markets. Furthermore, trade and foreign direct investment may also be affected, albeit to a lower degree.

ASEAN-5

Indonesia

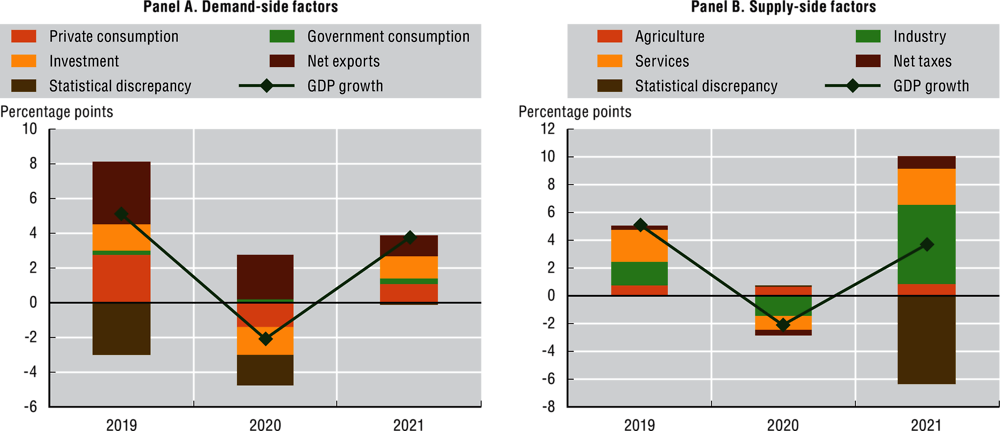

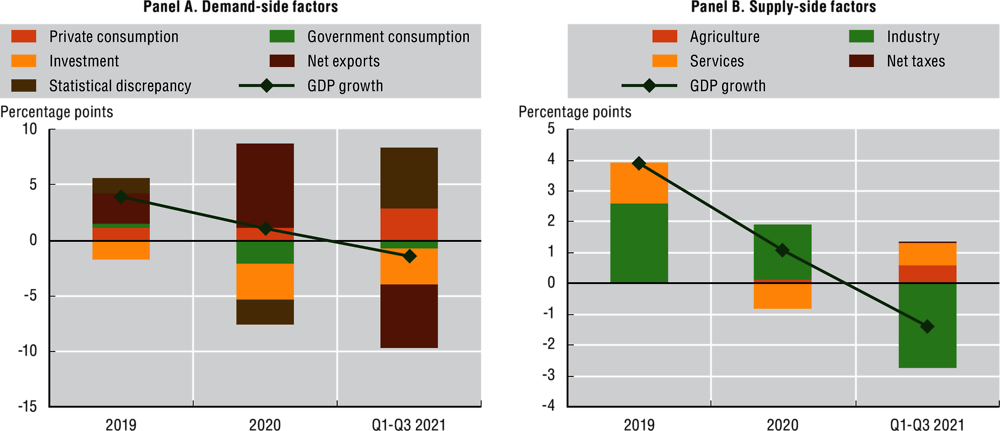

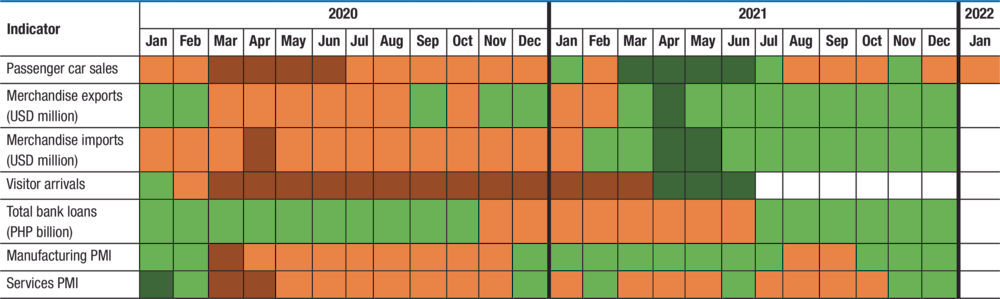

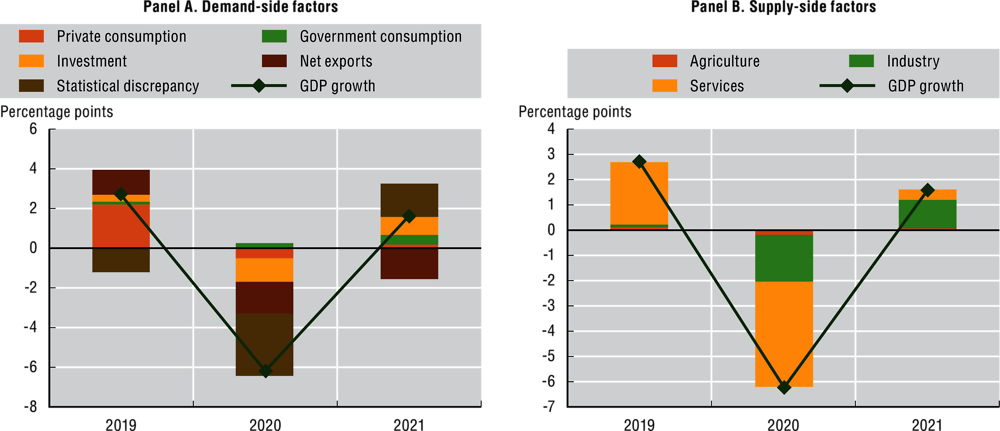

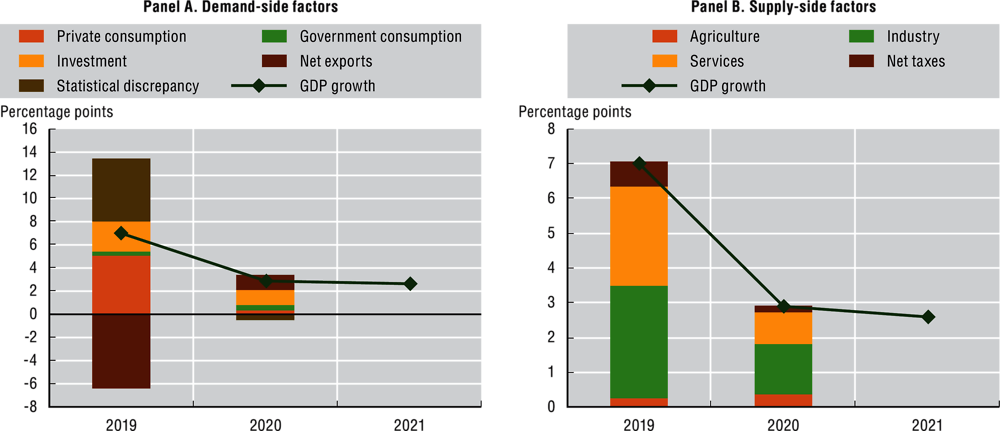

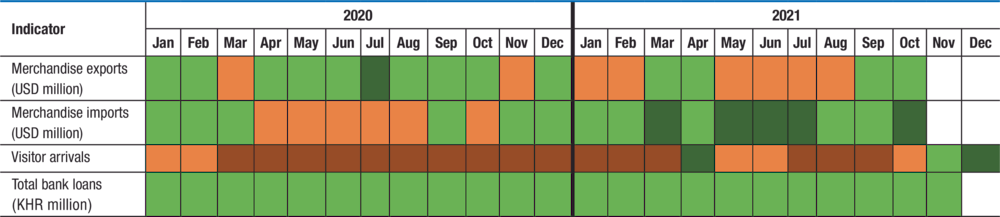

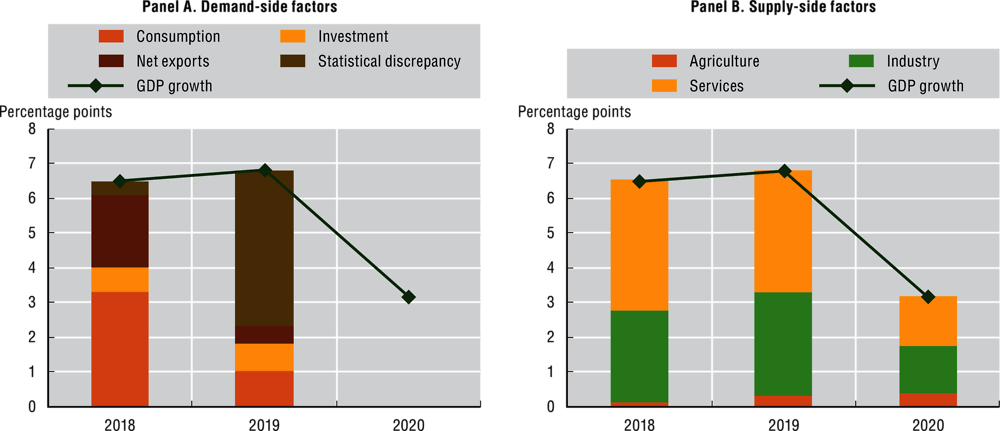

Economic activity in Indonesia moderated in the third quarter of 2021, after the government reintroduced restrictions to curb the transmission of the Delta variant. But as daily cases fell from their peak in mid-July 2021, the government announced a partial easing of restrictions in shopping malls, restaurants and places of worship in some parts of the country. In January 2022, the number of cases started to rise again due to the fast-spreading Omicron variant, and it remained high throughout February. However, restrictions on mobility have been lighter than for previous flare-ups of the pandemic. Real GDP increased by 7.1% in the second quarter of 2021, on strong base effects, marking Indonesia’s first spell of positive year-on-year growth since the first quarter of 2020. The emergency measures and travel restrictions put in place in July impacted growth in the third quarter of 2021, in which real GDP growth slowed to 3.5% in annual terms. Growth in real GDP reached 3.7% in 2021 on an annual basis. The recovery in 2021 was mostly driven by strong net exports and investment growth, although other demand-side components also provided support (Figure 1.3, Panel A). On the supply-side, growth recovered in all sectors, led by industry, while services also recovered in part, supported by the partial resumption of tourism-related activities (Figure 1.3, Panel B).

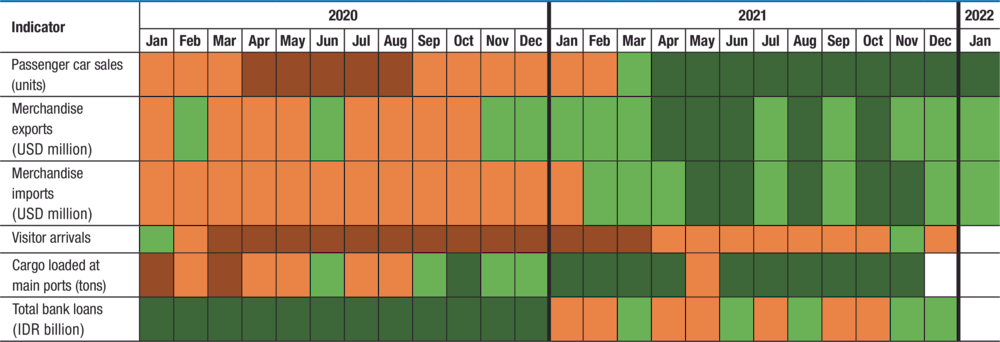

High-frequency indicators suggest that the expansion of economic activity has continued in recent months, despite slowing slightly in some areas (Table 1.4). Vehicle sales rebounded strongly in 2021, and remained robust in early 2022, mainly due to the effect of a low basis of comparison from a year earlier. Export activity was also solid throughout 2021. Overall, Indonesia’s cumulative trade surplus for the entire year was USD 35.3 billion, an increase of nearly 64% in annual terms. Meanwhile, merchandise exports increased by 41.9% compared to 2020, driven by the general upward trend in commodity prices since June 2020. The main export items in 2021 were iron and steel, oil and gas, and machinery and electrical equipment. Despite a slight rebound in November as international borders reopened for certain categories of tourists, tourism flows have remained subdued, and are still far below their pre-pandemic levels. In order to allow a resumption of tourism activity, authorities announced in October 2021 that restrictions on international travel to the island of Bali would be eased for nationals of 18 countries. However, the emergence of the Omicron variant has slowed the pace of foreign arrivals.

Figure 1.3. Contribution to GDP growth in Indonesia, 2019-21

Percentage

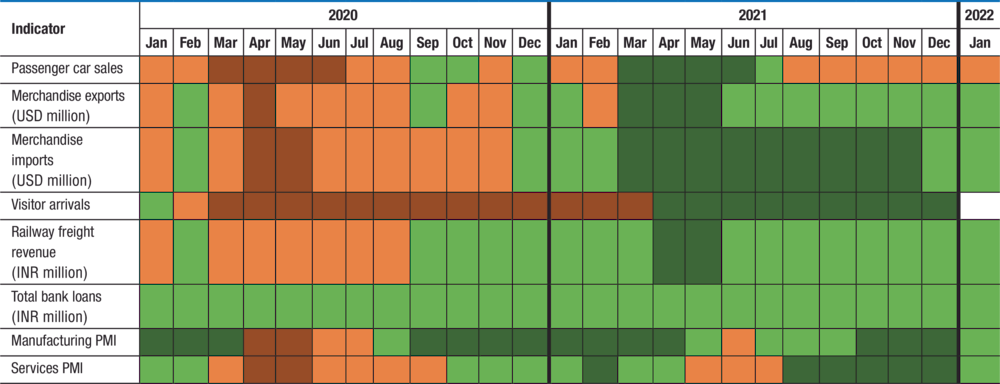

Table 1.4. Evolution of selected high-frequency indicators for Indonesia, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on visitor arrivals and total bank loans were unavailable for January 2022. Data on cargo loaded at main ports were unavailable for December 2021 to January 2022. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. USD stands for United States dollar and IDR stands for Indonesian rupiah.

Source: Authors’ elaboration based on data from CEIC and national sources.

Indonesia’s GDP is expected to grow at a rate of 5.2% in 2022, followed by an expansion of 5.1% in 2023. Indeed, economic activity is expected to gradually improve, provided that the impact of the Omicron variant on the healthcare system remains contained. A gradual improvement in household consumption, which accounts for nearly 60% of GDP, is expected to drive growth in 2022. Fiscal stimulus is expected to do the heavy lifting in supporting Indonesia’s suppressed domestic demand. Total spending in the 2022 budget was approved at around USD 190.4 billion, which is 0.6% higher than estimated spending in 2021. The 2022 budget is aimed at safeguarding welfare for the lower-income fringes of the Indonesian population, and to support the resilience of business sectors and small and medium-sized enterprises (Cabinet Secretariat of the Republic of Indonesia, 2021). On the downside, the room for monetary manoeuvre has narrowed. The resumption of activities in the tourism sector also remains subject to very high uncertainty, as Omicron-related cases are expected to remain at high levels in the first quarter of 2022.

Malaysia

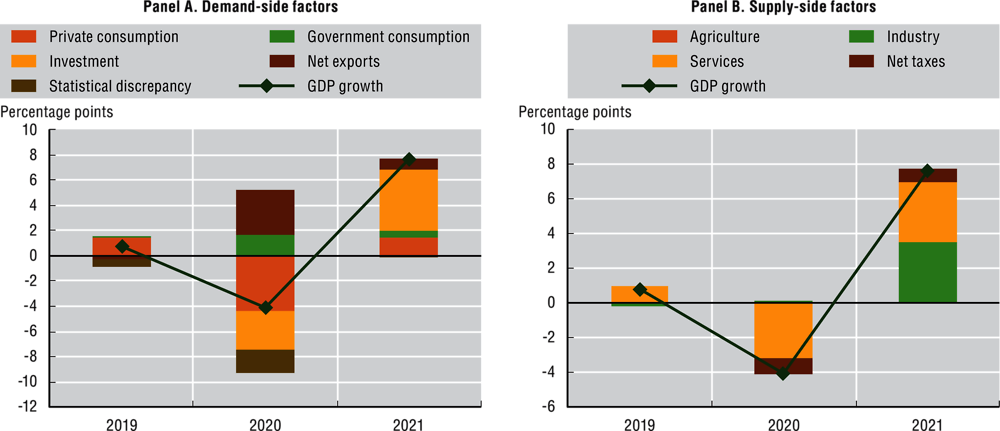

In Malaysia, a severe resurgence of COVID-19 cases peaked in August 2021. Authorities implemented new and very strict restrictions in geographical areas that host the core of the country’s economic activities, including certain districts of Kuala Lumpur and large parts of the state of Selangor. Manufacturing activity shrank considerably in the second quarter of the year, as firms were confronted with severe shortages of products and workers. In order to limit the economic impact of these measures, the government authorised the resumption of activity in certain economic sectors, such as electrical and electronic industries, aeronautics, and sectors related to food and health, as of mid-August. Output grew by 16.1% in the second quarter of 2021 in annual terms, following a 0.5% contraction in the prior quarter. In the third quarter of 2021, real GDP dropped again, by 4.5%, held back by a high degree of uncertainty and by containment measures in response to the pandemic. Overall, Malaysia’s real GDP rebounded by 3.1% in 2021. In 2021, the economy benefited from strong investment, although net exports made a slightly negative contribution, due to an intensification of supply-chain disruptions during the second and third quarters of the year (Figure 1.4, Panel A). On the supply side, industrial production contributed the most to economic growth in 2021 (Figure 1.4, Panel B). But despite this progress in 2021, the first cases involving the Omicron variant were reported in Malaysia in mid-December, and case counts reached record highs as of February 2022.

Figure 1.4. Contribution to GDP growth in Malaysia, 2019-21

Percentage

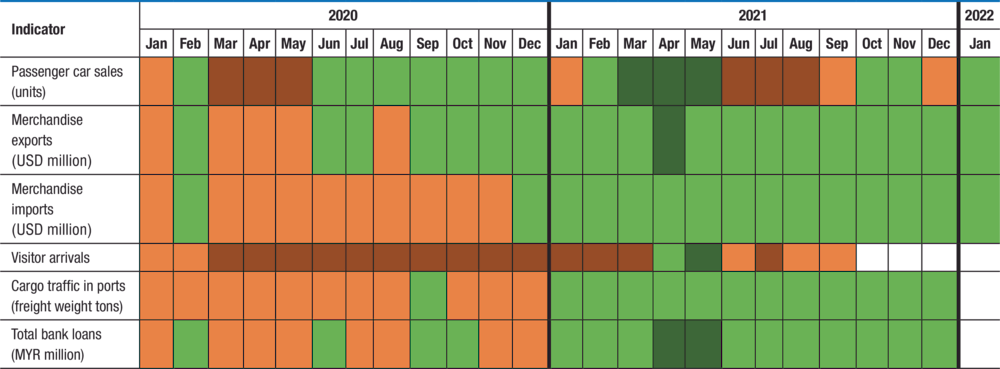

Over the past year, the continuous succession of periods of lockdown restrictions followed by a resumption of economic activity has resulted in a rather mixed picture from selected high-frequency indicators (Table 1.5). As most retail points were ordered to close, passenger car sales were particularly affected in 2021, falling by 6.8% from 2020. On the other hand, all components of foreign trade posted solid performances in 2021, and this continued into 2022. Total goods exports rose by 26% in annual terms in 2021, while imports progressed by 23.3%. The expansion in exports was driven mostly by petroleum products and the manufacturing of metals and electrical and electronic goods, while the rise in imports came mainly from products such as crude oil and chemical products. Cargo traffic in ports also increased, mirroring the rise in foreign trade. On the other hand, visitor arrivals remain at low levels. Plans by the Malaysian government to reopen international borders in November to fully vaccinated tourists from Singapore, followed by an extension to other countries as of early January 2022, have been revised in the context of the Omicron variant (Shukry, 2021).

Table 1.5. Evolution of selected high-frequency indicators for Malaysia, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on visitor arrivals for October 2021 to January 2022 were unavailable. Data on cargo traffic in ports and total bank loans were unavailable for January 2022. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. MYR stands for Malaysian ringgit.

Source: Authors’ elaboration based on data from CEIC and national sources.

In full-year terms, GDP growth in Malaysia is forecast to reach 6% in 2022, and 5.5% in 2023. Still, growth will largely depend on the country’s ability to contain the pandemic amid the emergence of the Omicron variant. While the resurgence of COVID-19 cases, and the potential re-imposition of nationwide containment measures, are expected to weigh on growth in 2022, several factors should mitigate their impact. These include continued government support for businesses in essential economic sectors, a higher degree of adaptability to remote work, and higher levels of automation and digitalisation. In addition, the 2022 budget unveiled on 29 October 2021 included a record spending package worth 332.5 billion Malaysian ringgit (MYR), or USD 80.1 billion. The allocation to the country’s COVID-19 Fund was set at MYR 23 billion (USD 5.5 billion), with the bulk of this outlay earmarked for cash payments and social assistance (Ministry of Finance of Indonesia, 2021). Meanwhile, the gradual implementation of spending plans outlined in Malaysia’s five-year plan for 2021-2025 will also support growth in the near term. Among other goals, the plan is expected to improve living standards, in particular for the lower-income fringes of the Malaysian population (Economic Planning Unit, 2021).

Philippines

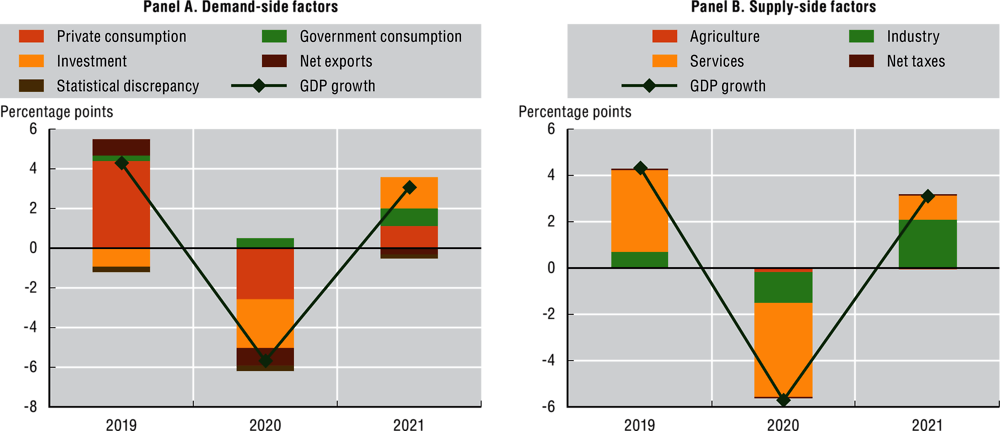

The economy of the Philippines remained under the grip of the pandemic in 2021. The number of new daily COVID-19 cases reached record levels in August and September, prompting authorities to reinstate lockdowns in the Metro Manila region, as well as in a number of other cities and provinces. The Omicron variant fuelled a record spike in the number of cases in mid-January 2022, although reports seem to point to lower pressure on hospitals compared to previous outbreaks. Following a contraction of 3.9% in the first quarter of 2021, real GDP posted year-on-year growth of 12% in the second quarter, ending five quarters of negative growth since the first three months of 2020. This double-digit growth in the second quarter of 2021 was mainly the result of a strong base effect, as GDP had contracted by 17.0% in the second quarter of 2020. In the third quarter of 2021, output growth in the Philippines registered 6.9% in annual terms. Moreover, the country’s real GDP inched 5.6% higher overall in 2021. Pent-up private consumption and considerable increases in investment drove the economic rebound in 2021, although supply-chain bottlenecks weighed on net exports (Figure 1.5, Panel A). On the supply side, the services sector made the largest contribution to growth (Figure 1.5, Panel B). Healthcare services expanded by 15% in annual terms, while information and communication services, which grew by 9.1%, also made a significant contribution to overall services growth in the Philippines.

Figure 1.5. Contribution to GDP growth in the Philippines, 2019-21

Percentage

Below, Table 1.6 illustrates the development of several high-frequency indicators in year-on-year terms. Domestic demand was weak in recent months. Sales of discretionary goods, such as passenger vehicles, fell by 20.7% in annual terms in January 2022, as mobility restrictions triggered by the Omicron variant suppressed domestic demand. Foreign trade was lacklustre, with the overall trade balance down by nearly 76% year-on-year in 2021. Moreover, manufacturing activity fell sharply in August and September 2021, as the rise in COVID-19 cases from the Delta-variant wave resulted in strict containment measures in the capital region and other parts of the Philippines. After several months of continuous expansion, the purchasing managers’ index (PMI) for manufacturing fell to 47.5 in August, and then to 46.7 in September, as many factories and businesses were forced to halt their activity. The latest data point to a recovery in manufacturing in the three months to 31 December 2021, with the PMI crossing above the threshold of 50-index points, at 53.8. The PMI for services also returned to expansionary territory in late 2021, with the latest reading for December standing at 53.3. In addition, remittances by overseas Filipino workers increased in 2021, supported by the economic recovery around the world. Cash remittances edged 13.5% higher year-on-year in May, on large base effects from the low figures from 2020, and continued to post solid growth in the second half of 2021 (Box 1.1).

Table 1.6. Evolution of selected high-frequency indicators for the Philippines, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on merchandise exports, merchandise imports, total bank loans, manufacturing PMI, and services PMI, were unavailable for January 2022. Data on visitor arrivals for July 2021 to January 2022 were also unavailable. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. For the PMI for manufacturing and services, the colour coding is: dark red indicates a PMI value below 30, light red indicates a PMI value between 31 and 49, light green indicates a PMI value between 50 and 55, and dark green indicates a PMI value above 55. PHP stands for Philippine peso.

Source: Authors’ elaboration, based on data from CEIC and national sources.

Box 1.1. Cash remittances by overseas Filipino workers rebounded strongly in 2021

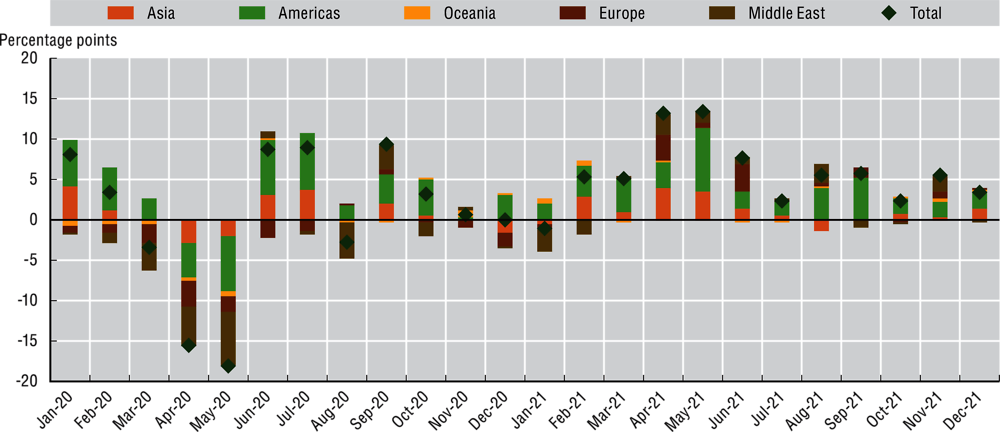

Cash remittances by overseas Filipino workers exceeded their pre-pandemic levels in the second half of 2021. In annual terms, total cash remittances in 2021 were 5.1% higher compared to 2020. The rebound was strongest in April (+13.2%) and May 2021 (+13.5%), with large base effects at play. The latest reading, for December, points to annual growth of around 3.5% (Figure 1.6). The largest contribution to the growth in remittances in December came from the Americas and Asian countries, while the Middle East made a negative contribution to the year-on-year growth figures.

According to data published by the Philippine central bank, personal remittances by overseas Filipino workers reached an all-time high of USD 34.9 billion for the full year of 2021. The sustained growth in personal remittances during 2021 was mainly due to remittances by land-based workers with work contracts of one year or more, which rose by 5.6% in annual terms. In parallel, remittances by sea- and land-based workers with work contracts of less than one year grew by 2.9%. In terms of host countries, cash remittances from the United States accounted for the largest share of overall remittances for the full-year 2021 (at 40.5%), followed by Singapore, Saudi Arabia, Japan, the United Kingdom, the United Arab Emirates, Canada, Chinese Taipei, Qatar and Korea (BSP, 2022). Nevertheless, the outlook for remittances remains subject to a high degree of uncertainty in the near term, as certain types of restrictions could be re-instated in workers’ host countries, depending on the evolution of the pandemic.

Figure 1.6. Contribution to growth in cash remittances by overseas Filipino workers by host area, January 2020 to December 2021

Note: Data as of 24 February 2022.

Source: Authors’ calculations based on data from CEIC and national sources.

The Philippines is expected to record solid economic growth of 7% in 2022, followed by an expansion of 6.1% in 2023. Public infrastructure spending is projected to contribute significantly to this growth. The 2022 National Expenditure Program amounts to around 5.1 trillion Philippine pesos (PHP), which is the equivalent of 22.8% of GDP. Infrastructure spending is expected to benefit from PHP 1.18 trillion of the total allocation, equivalent to 5.3% of GDP (Department of Budget and Management, 2021). The uptick in remittances by overseas Filipino workers is also expected to boost domestic spending. On the downside, however, the evolution of the situation on the health front remains subject to a very high degree of uncertainty. A new round of COVID-19-related restrictions amid the emergence of the Omicron variant, which were in place throughout most of December 2021 and January 2022, could reverse the recovery in the unemployment rate, which fell to 6.5% in November 2021 from a peak of 17.6% in the second quarter of 2020. Restrictions could also reverse the improvement in the poverty incidence rate, which fell to 16.7% in 2018, from 26.3% in 2009, amid rapid economic growth. In addition, inflation has also picked up, with headline inflation exceeding the upper limit of the tolerance band for most of the period from March to November 2021.

Thailand

In Thailand, COVID-19 cases increased sharply during the third quarter of 2021, before slowing down by the start of fall. The government reinstated a series of restrictions in Bangkok and some other provinces. In early January 2022, Thai authorities raised the country’s alert level amid rising case counts driven by the spread of the highly contagious Omicron variant. In the second quarter of 2021, Thailand’s economy posted positive year-on-year growth of 7.7% for the first time since the fourth quarter of 2019, though base effects cannot be ignored in light of 2020. The growth trend was reversed in the third quarter, when Thailand’s real GDP edged 0.2% lower. Overall, real GDP grew by 1.6% in 2021. Output growth for full-year 2021 was mainly driven by private investment, while private consumption and government consumption also made modest positive contributions (Figure 1.7, Panel A). In parallel, the balance of trade contributed negatively to growth in 2021, with supply-chain disruptions coinciding with a strong increase in domestic demand, which boosted imports. On the supply side, growth was largely supported by industrial production, while the contribution from the services sector was also positive (Figure 1.7, Panel B).

Figure 1.7. Contribution to GDP growth in Thailand, 2019-21

Percentage points

Note: The calculations are based on chain-linked volume measure series.

Source: Authors’ calculations based on data from CEIC and national sources.

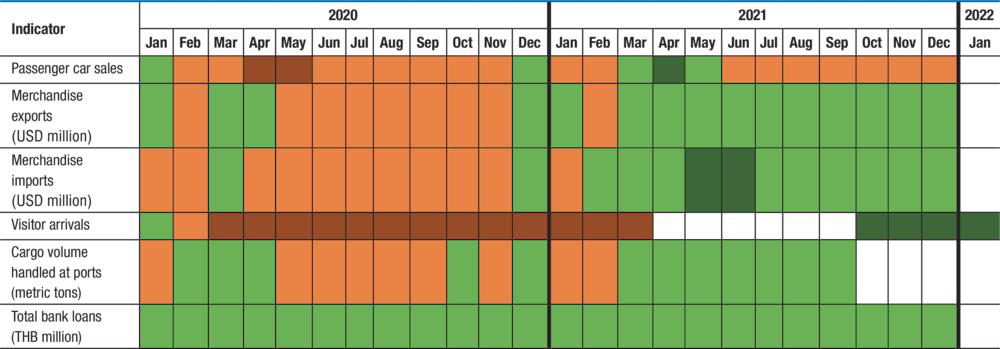

High-frequency indicators for Thailand paint a relatively mixed picture in 2021 (Table 1.7). Bottlenecks in global supply chains had a negative impact on the local automotive industry. Indeed, sales of passenger cars declined year-on-year each month between June and December, as restrictions to curb the spread of the pandemic dented sales of non-essential goods. Meanwhile, and despite a strong rebound that began in late-2021 and continued into January 2022, visitor arrivals to Thailand continue to remain at very low levels. Foreign trade activity was weak, with the growth in merchandise exports more than offset by the increase in imports. Total exports of goods in 2021 grew by 17.1% in annual terms, while imports of merchandise were 29.8% higher year-on-year.

Table 1.7. Evolution of selected high-frequency indicators for Thailand, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on passenger car sales, merchandise exports, merchandise imports, and total bank loans, were unavailable for January 2022. Moreover, data on visitor arrivals for April to September 2021 were unavailable. Data on the volume of cargo handled at ports from October 2021 to January 2022 were unavailable. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. Data on visitor arrivals were unavailable for the period from April to September 2021. THB stands for Thai baht.

Source: Authors’ elaboration based on data from CEIC and national sources.

Following a recovery in 2021, Thailand’s real GDP is expected to rise by 3.8% in 2022, and to expand by a further 4.4% in 2023. Although the new round of restrictions announced to curb the transmission of the Omicron variant was less strict than the measures that were implemented in early 2020, it nevertheless constituted a setback for economic activity in early 2022. Export growth is likely to be less dynamic if supply-side bottlenecks persist into 2022. On the upside, the continued fiscal support outlined in the 2021 budget, as well as the stimulus packages rolled out in January and July 2021, are likely to ease pandemic-related pressures on domestic demand in the near term. In addition, the quarantine-free reopening of borders to vaccinated visitors from 45 countries (TAT, 2021), which resumed in early 2022 after being temporarily halted due to the Omicron variant, will provide support to the critically important tourism sector.

Viet Nam

As for Viet Nam, it is one of a few economies in Asia that avoided a recession in 2020 due to a relatively successful containment of the pandemic, which allowed businesses to resume their normal operations. As of May 2021, however, Viet Nam began to experience its largest COVID-19 outbreak since the beginning of the health crisis, with new daily cases peaking at the beginning of September. Strict containment measures were implemented in Ho Chi Minh City, where many cases emerged. Restrictions included banning most travel in and out of the city, suspending most public transport, and requiring residents to remain at home except when purchasing essential goods or responding to exceptional circumstances. The first cases of community transmission of the Omicron variant in Viet Nam were reported in mid-January 2022, leading to another surge. This reached record highs as of late February. Real GDP increased by 5.2% in the final quarter of 2021, after declining by 6% in the three months to 30 September. Over the full year of 2021, the economy grew by 2.6% (Figure 1.8).

Figure 1.8. Contribution to GDP growth in Viet Nam, 2019-21

Percentage points

Note: Data on demand- and supply-side factors were unavailable for 2021.

Source: Authors’ calculation based on data from CEIC and national sources.

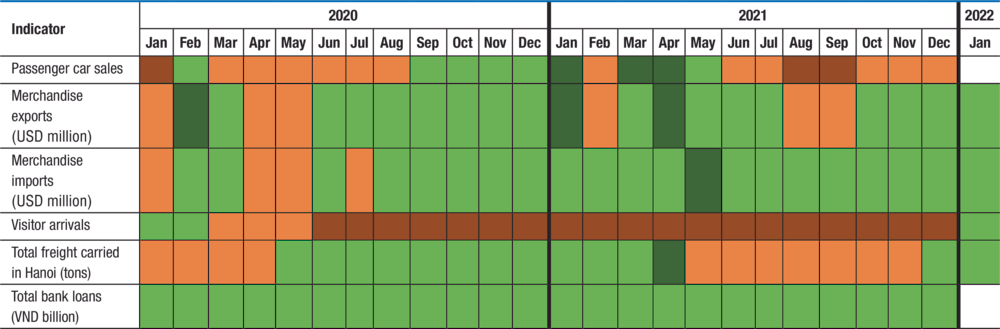

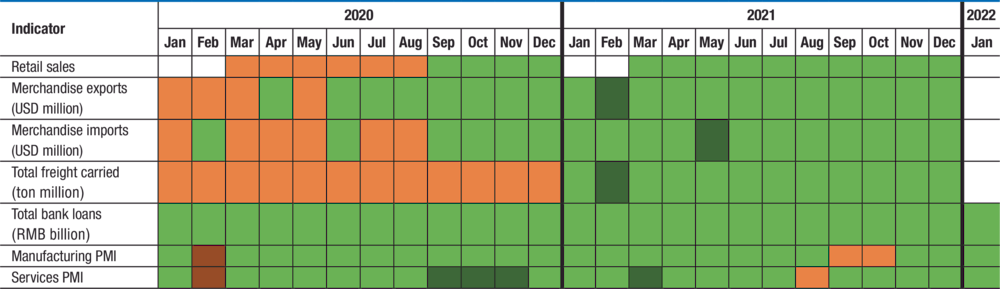

Several high-frequency indicators point to a rather mixed macroeconomic picture in recent months (Table 1.8). Viet Nam recorded a total trade surplus of USD 5.1 billion in 2021, contrasting with the USD 19.9 billion surplus that it achieved in 2020. Moreover, year-on-year growth of imports (+25.9%) more than outpaced growth in total exports of merchandise (+18.8%) in 2021, as businesses increased their imports of raw materials in order to resume production after the lifting of containment measures. These trends have continued into early 2022. Meanwhile, retail sales also dropped through most of 2021, with passenger car sales for the full year down by 5.7% in annual terms, as rising unemployment dented consumer sentiment. In addition, unemployment in Viet Nam soared to multi-year highs in the third quarter of 2021, reaching 3.98%. Furthermore, supply-side bottlenecks have made themselves felt in the decline in total freight carried in Hanoi, which was 10.3% lower in 2021 compared to 2020. Pandemic-related restrictions have also had implications for the tourism sector, with visitor arrivals still 99% below their pre-pandemic levels, despite a modest rebound in January 2022.

Table 1.8. Evolution of selected high-frequency indicators for Viet Nam, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on passenger car sales and total bank loans were unavailable for January 2022. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. Visitor arrival data are year-to-date. VND stands for Vietnamese dong.

Source: Authors’ elaboration based on data from CEIC and national sources.

Against this background, real GDP growth is forecast to reach 6.5% in 2022, and 6.9% in 2023. However, the growth outlook is highly uncertain, and it will be shaped both by the evolution of the pandemic, and by the need for further containment measures in response to the fast-spreading Omicron variant, which led to record-high case counts as of late February 2022. Another downside risk is that of further supply chain disruptions, which could jeopardise the recovery in both domestic consumption and foreign trade. A further escalation of the war in Ukraine could put upward pressure on prices for agricultural products, which in turn could jeopardise the recovery in domestic consumption. On the other hand, some strengths inherent to the Vietnamese economy constitute bright spots. The bulk of the country’s manufacturing output is destined for overseas markets, with goods exports equivalent to an average of 78% of GDP over the past five years. As a result, the country’s exports stand to benefit from the ongoing robust recovery in the United States and other major advanced economies.

Brunei Darussalam and Singapore

Brunei Darussalam

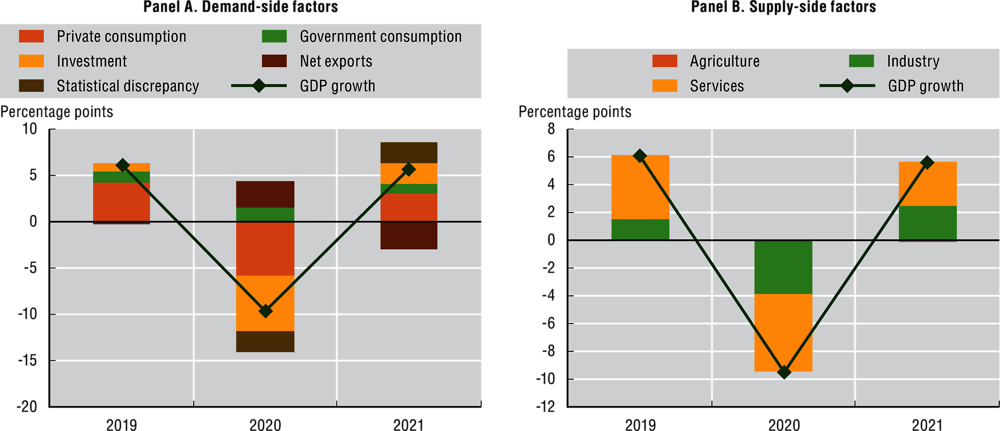

Economic activity in Brunei Darussalam recorded large swings over the first half of 2021. The country experienced a severe resurgence of the pandemic, which peaked around mid-October. In February 2022, meanwhile, the highly transmissible Omicron variant fuelled record-high numbers of cases after first being reported in the country in December. In 2021, the fallout from the resurgence of the pandemic was apparent in the second quarter, when GDP fell by 2.1%, and the third quarter, when it dropped by 2.2%. Overall, the contraction in the first three quarters of 2021 was largely driven by falling net exports (Figure 1.9, Panel A) and industrial production (Figure 1.9, Panel B). In addition, Brunei Darussalam’s cumulated trade balance during the first nine months of 2021 was 7.6% lower in annual terms compared to the same period in 2020. The rise in imports during this period (+71.2%) largely outpaced that of exports (+46.5%), driven by imports of goods to feed various construction projects in the petrochemicals industry. On the supply side, total industrial production during the first three quarters of 2021 dropped by 4.4% from the similar period the previous year. The items that fell most sharply in the industrial sector were construction activities (-8.3%), the manufacture of liquefied gas and methanol (-6.7%), and oil and gas mining (-3.8%). On the other hand, agricultural production soared by 46.8% in annual terms in the first three quarters of 2021, supported by authorities’ plans to develop livestock, poultry and fisheries.

Figure 1.9. Contribution to GDP growth in Brunei Darussalam, 2019-21

Percentage points

Real GDP growth in Brunei Darussalam is expected to come in at 3.5% in 2022. For 2023, an expansion in output of 3% is forecast. The near-term outlook for the beginning of 2022 is clouded by the rise in COVID-19 cases after the emergence of Omicron, and the restrictive measures that were put in place to curb its spread. The oil and gas industry is the main contributor to Brunei Darussalam’s growth, with a 48% share of the country’s GDP in 2020 (Petroleum Authority of Brunei Darussalam, 2021). Exports of refined fuels and foreign direct investment into refinery activities in the country are expected to be the main drivers of growth in 2022. Despite rising oil revenues, moreover, government expenditure will be constrained by the country’s large fiscal deficit. On the upside, the economy is set to benefit from government measures to intensify activities in the non-oil and gas sector, including in agriculture and services (Ministry of Finance and Economy, 2020).

Singapore

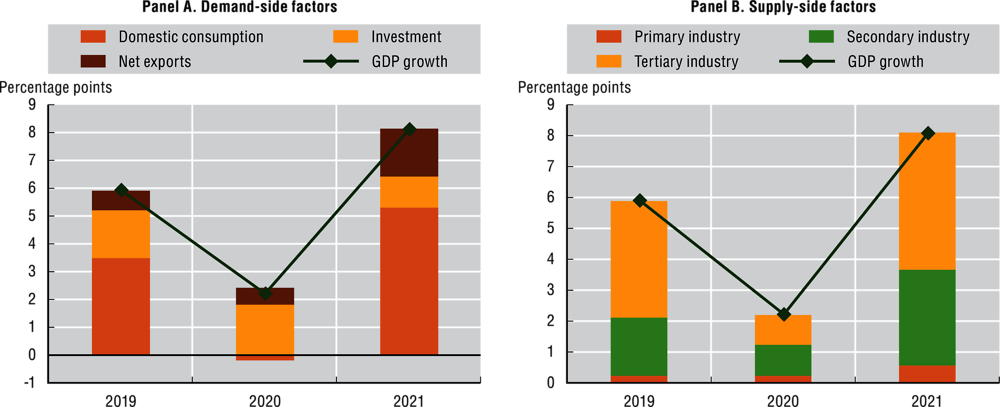

From July 2021, Singapore was confronted with rising COVID-19 caseloads, and the surge was particularly acute during the months of October and November. More recently, a rise in the number of Omicron cases, which began in early 2022 and reached record highs in February, prompted Singaporean authorities to halt the easing of restrictions. However, the management of cases is likely to become more streamlined as time goes by, as Singaporean authorities have signalled their intention to treat COVID-19 as an endemic disease. Although various restrictive measures were in place throughout most of the third quarter of 2021, their impact was rather contained, with real GDP coming in 7.5% higher year-on-year in that quarter. This followed growth of 15.8% in the second quarter of 2021, which partly reflected base effects, and growth of 2% in the first quarter. Overall in 2021, Singapore’s real GDP rebounded by a robust 7.6%. Output growth over the year was mainly driven by investment and domestic consumption, while net exports also posted a positive contribution to GDP growth (Figure 1.10, Panel A). On the supply side, industrial production provided the largest contribution to growth, reflecting sustained external demand for pharmaceutical products and precision engineering. The services sector also posted a solid performance (Figure 1.10, Panel B), driven by information and communication, and by financial services.

Figure 1.10. Contribution to GDP growth in Singapore, 2019-21

Percentage points

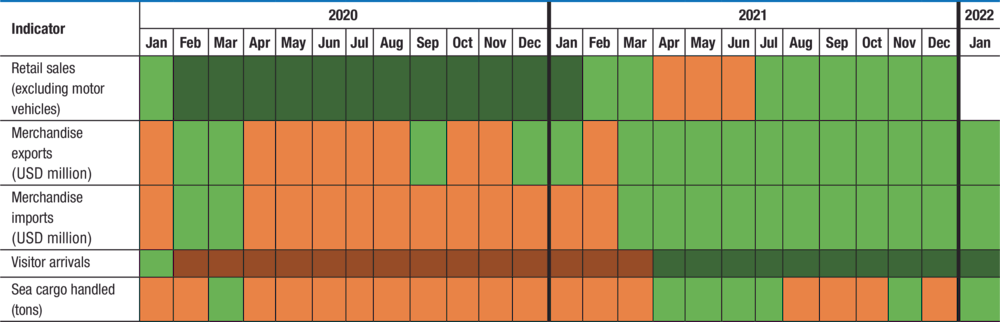

High-frequency indicators point to improvements on various fronts in late 2021, which continued into January 2022 (Table 1.9). Retail sales for full-year 2021 increased by 9.7% compared to 2020. Meanwhile, external demand has also remained strong in recent months. Singapore’s total trade surplus in 2021 was 9.7% higher than in the same period in 2020. Exports of chemical products, in particular, edged 20.3% higher year-on-year in 2021. Another sector that benefitted from strong external demand is the manufacturing of electronic products. In this sector, exports for the full year of 2021 grew by 16.3% compared to 2020. Furthermore, numbers of visitors arriving in the country have benefited in recent months from the launch of the “Vaccinated Travel Lane” framework, which allows fully vaccinated travellers from several countries to enter Singapore without quarantining. After a temporary retightening in December 2021 due to Omicron, Singaporean authorities announced their intention in early January 2022 to “restore quarantine-free travel with more countries and regions as allowed for by the public health assessment” (Park, 2022). On the other hand, the volume of sea cargo handled in Singapore fell each month in annual terms between August and October, before falling again in December. These declines reflected ongoing supply-chain bottlenecks in Southeast Asia. Port congestion rates increased in late 2021, with 53 vessels reported as waiting off the coast of Singapore, resulting in a backlog that was 22% above normal (Varley, 2021). The situation improved slightly in early 2022.

Table 1.9. Evolution of selected high-frequency indicators for Singapore, January 2020 to January 2022

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on retail sales were unavailable for January 2022. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%.

Source: Authors’ elaboration based on data from CEIC and national sources.

Following the sharpest economic recession in decades, and a strong rebound in 2021, Singapore’s economy is expected to edge 4% higher in 2022, on the back of a large fiscal expansion. The projection for 2023 is for the economy to grow by 3%. The government has stepped up its support for employment, unveiling subsidies of up to 25% of wages in the sectors that have been most affected by COVID-19 restrictions (Inland Revenue Authority, 2021). The financial sector has also demonstrated resilience during the crisis, and it is expected to benefit further from the launch of digital banking operations, after Singapore became the first country in Southeast Asia to issue digital banking licenses in 2020. The implementation of travel agreements that would allow tourists from a number of countries to visit Singapore under certain conditions is another upside factor for growth. Considering both the slower easing of remaining restrictions due to Omicron and the ongoing disruption to supply chains, the recovery path nevertheless remains highly uncertain, particularly in travel-related and consumer-facing sectors.

Cambodia, Lao PDR and Myanmar

Cambodia

Cambodia was confronted with a severe resurgence of COVID-19 in the second quarter of 2021, with new daily cases remaining in the high digits through October. As 2021 began, momentum was already weak, after a 3.1% decline in economic activity in 2020. Due to the rapid deterioration of the health situation, Cambodian authorities took a series of measures in the second quarter of 2021 in order to stop the spread of the pandemic. Following announcements including the closure of restaurants and tourist spots, a ban on gatherings, a night curfew, and a ban on movement between provinces, the capital Phnom Penh and several provinces ended up under lockdown measures. Some of these restrictions have since been relaxed, albeit in a very gradual manner. The emergence of Omicron led to a significant rise in cases, in particular from early February 2022 onwards.

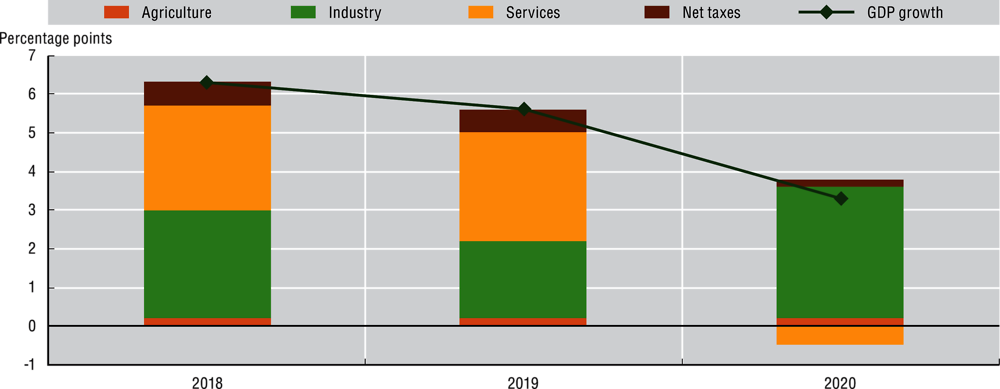

Figure 1.11. Contribution to GDP growth in Cambodia, 2018-20

Percentage points

Note: Data on demand- and supply-side factors were unavailable for 2020.

Source: Authors’ calculations based on data from CEIC and national sources.

In the second half of 2021, the rise in COVID-19 cases slowed Cambodia’s economic recovery, as depicted by selected high-frequency indicators (Table 1.10). Total merchandise exports in the first ten months of 2021 were down by 2.5% from the same period in 2020, while imports of merchandise grew by 49.7%. The drop in goods exports can be attributed in part to the decline in textile production, as textile factories were ordered to remain closed during the latest rounds of restrictions. The lockdown also caused disruptions in the haulage of inputs and finished products. On the other hand, agricultural exports have proven more resilient. According to Cambodia’s agriculture ministry, exports of fish and other agricultural products in the first ten months of 2021 increased by 37.8% from the same period the previous year. Visitor arrivals remained well below pre-pandemic levels, but showed some signs of recovery in November and December 2021, following the easing of restrictions on certain international arrivals. As part of the country’s gradual reopening, the government decided to open the borders to fully vaccinated tourists starting from mid-November 2021. This “Quarantine-Free Safe Tourism” programme is aimed at tourists with a minimum stay of five days (Ministry for Foreign Affairs and International Co-operation, 2021). Still, the outlook for tourism remains subject to a high degree of uncertainty, as the Omicron wave continues to unfold in Cambodia and several other countries in the region.

Table 1.10. Evolution of selected high-frequency indicators for Cambodia, January 2020 to December 2021

Year-on-year change (%)

Note: Data are as of 24 February 2022. Data on merchandise exports and merchandise imports for November to December 2021 period were unavailable. Moreover, data on total bank loans were unavailable for December 2021. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%. KHR stands for Cambodian riel.

Source: Authors’ elaboration based on data from CEIC and national sources.

Containment measures are expected to weigh on Cambodia’s economic growth, with real GDP expected to grow by 5.6% in 2022, before rising by 6.3% in 2023. As elsewhere, uncertainty surrounding the evolution of the pandemic and the need for further containment measures are major downside risks to the forecast. The health situation will continue to shape the outlook for private consumption, which accounts for around 70% of GDP. Domestic credit increased by 27.2% year-on-year in August 2021, following growth of 26.1% in July and 26.2% in June. Tourism, another important growth engine for Cambodia, remains subject to a high level of uncertainty amid the spread of Omicron, despite the country’s recent easing of restrictions on certain international arrivals. In addition, strong credit growth, and the concentration of domestic credit in the construction and real-estate sectors, will present risks for Cambodia’s financial stability. On the upside, the agricultural sector is anticipated to remain resilient, and exports of garments should benefit from the ongoing recovery in some of Cambodia’s most important trading partners such as the United States and the European Union.

Lao PDR

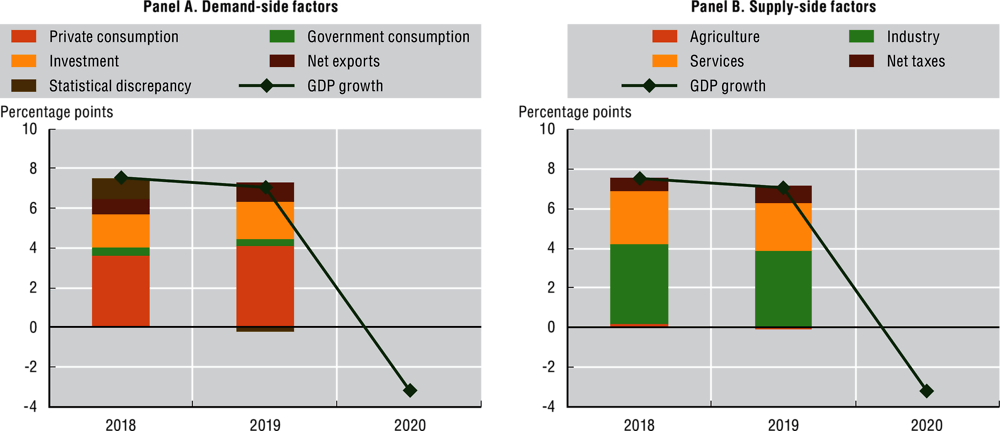

The economy of Lao PDR recorded growth of 3.3% in 2020, supported mainly by resilient industrial production (Figure 1.12). After a relatively contained outbreak of COVID-19 in 2020, the number of infections started to rise in April 2021, with a sharp rise in daily new cases in September and October 2021. In light of rising caseloads, the government of Lao PDR decided in April to place the capital, Vientiane, under lockdown, while other provinces, particularly ones that lie on the border with Thailand, banned people from entering or exiting. In the second half of 2021, as clusters of COVID-19 cases were identified in several factories, the government enacted a new round of strict restrictions on travel to and from Vientiane. In addition, all passenger transport services were suspended, while shops and markets selling non-essential items were ordered to close. The decline in the number of daily COVID-19 cases, which was visible throughout the month of December, was then brought to a halt as the first cases of Omicron were reported in the country in early January 2022. As of late-February, the situation seems to have stabilised, with the Omicron wave on a declining trajectory.

Figure 1.12. Contribution to GDP growth in Lao PDR, 2018-20

Percentage points

The real GDP of Lao PDR is forecast to expand by 4.6% in 2022, and by 4.9% in 2023. The Omicron wave of the COVID-19 pandemic, and the restrictions that have ensued, are expected to weigh on private consumption in the first quarter of 2022. Moreover, Lao PDR continues to post a lower vaccination rate than other countries in Emerging Asia. As a result, domestic risks related to the pandemic remain at a relatively high level. The slow recovery in tourism will also weigh on the services sector. In addition, repayment of the country’s external debt remains challenging, with around USD 422 million due by the end of 2021, and an average of USD 1.2 billion due each year between 2022 and 2025. As mentioned above, rolling over upcoming maturities on the Thai bond market may also prove challenging (Fitch Ratings, 2021a). On the upside, exports of goods are expected to be a bright spot in the economy. Indeed, increasing demand in neighbouring countries such as China, Thailand and Viet Nam is expected to boost exports of goods, including agricultural products, electricity, and mining products. The launch, in December 2021, of a high-speed railway between Vientiane and the town of Boten on the border with China could also boost flows of trade and tourism between the two countries (Kishimoto, 2021).

Myanmar

In 2021, Myanmar’s economy was battered by pandemic-related restrictions and political unrest. In addition to the political tensions that began in February 2021, Myanmar was also confronted with a sharp rise in COVID-19 cases as of June. As 2021 began, momentum was already weak, with economic growth moderating to 3.2% in 2020, down from 6.8% in 2019. Industrial production and services made an almost equal contribution to output growth in 2020 (Figure 1.13, Panel B). The garment industry bore the brunt of the pandemic in 2020, amid low consumer demand, order cancellations, and supply-chain disruptions. According to the Myanmar Garment Manufacturers’ Association, 50 out of around 700 member factories closed during the first wave of COVID-19 in 2020, with another 50 closed during the second wave (ILO, 2021a). The first cases of Omicron in Myanmar were reported in late December 2021, leading to another surge in the pandemic in early 2022. As of late February, the number of daily new cases had more than tripled compared to the beginning of the month, signalling a potentially severe wave that could further dent the economic recovery in the first half of 2022.

Figure 1.13. Contribution to GDP growth in Myanmar, 2018-20

Percentage points

Note: Data on demand-side factors for 2020 were unavailable. Data relate to the fiscal year ending in March.

Source: Authors’ calculations, based on data from CEIC and national sources.

Several high-frequency indicators show that a marked deterioration of economic activity began in February 2021 (Table 1.11). The latest available figures show that, over the first ten months of 2021, exports contracted by 12.5% and imports fell by 22.4% from the same period in 2020. Freight transport also declined sharply since February 2021. According to a report by the International Labour Organization (ILO), Myanmar lost around 1.2 million jobs (out of a total of 20 million) following the political turmoil in February. In addition, during the first half of 2021, the number of hours worked fell by 14%. Construction, garments, and tourism and hospitality have been among the most affected sectors, with employment falling by an estimated 35%, 31% and 25%, respectively (ILO, 2021b). Despite a slight rebound in the number of visitor arrivals in September and October 2021, meanwhile, the outlook for tourism remains clouded both by the evolution of the Omicron wave, and by political instability.

The GDP of Myanmar is expected to have contracted sharply in 2021, by 18.6%. Thereafter, the economy is projected to slightly decline by 0.3% in 2022, and then to grow by 3.3% in 2023. However, the downside risks to this outlook are considerable. The ongoing political uncertainty that began in February 2021 is likely to curb new investment in Myanmar, and indeed to spur some investors to pull out of existing projects. At a time when the economy has been hit hard by the pandemic, political uncertainty could also prevent Myanmar from receiving foreign aid. Lacklustre domestic demand amid heavy job losses represents another major downside risk to the outlook. In addition, the country may continue to contend with heavy depreciation pressures on its currency. The Central Bank of Myanmar had to intervene multiple times during 2021 in order to stabilise the Myanmar kyat exchange rate. As of October 2021, the kyat had lost nearly 50% of its value since the February 2021 coup (Kyaw and Karunungan, 2021), increasing the cost of imports and exacerbating the economy’s struggle with the dual challenges of the pandemic and political instability. Notwithstanding a stabilisation in recent months, the kyat’s value against the United States dollar was still nearly 34% lower in January 2022 than in January 2021.

Table 1.11. Evolution of selected high-frequency indicators for Myanmar, January 2020 to October 2021

Year-on-year change (%)

Note: Data as of 24 February 2022. The colour coding for each indicator should be interpreted as follows: dark red indicates a decline of more than 50%, light red indicates a decline equal to or below 50%, light green indicates an increase of less than or equal to 50%, and dark green indicates an increase of more than 50%.

Source: Authors’ elaboration based on data from CEIC and national sources.

China and India

China

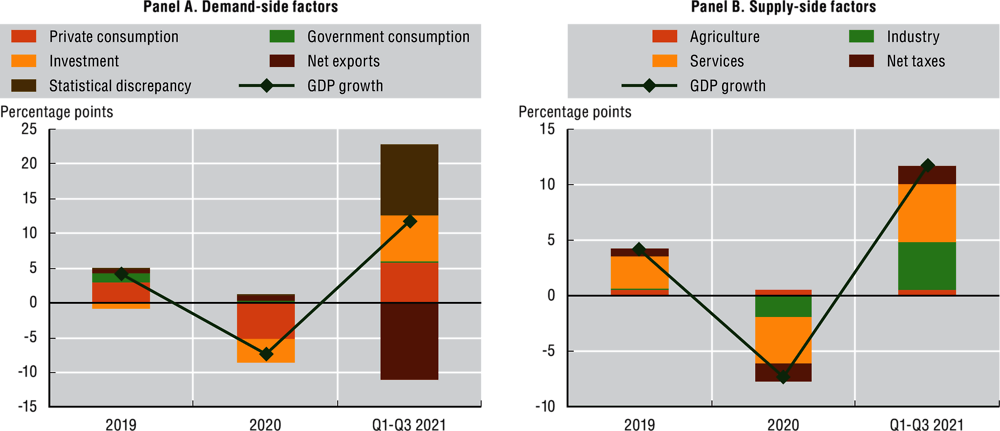

In China, new outbreaks of COVID-19 between September 2021 and February 2022 spurred parts of the country to place restrictions on movement. Some areas of Beijing have been sealed off, while regions in the northwest of China and the central province of Henan have imposed a range of restrictions, as the highly contagious Omicron variant has continued to spread. Real GDP growth in the three months to 31 December slowed to 4% year-on-year, the lowest since June 2020. Drags on growth in the fourth quarter stemmed mainly from contractions in real estate. In the third quarter of 2021, real GDP expanded by 4.9% year-on-year, following an expansion of 7.9% in the second quarter, and 18.3% in the first quarter. In 2021, China’s economy grew by 8.1% overall. Domestic consumption proved to be the main overall driver of growth in 2021 (Figure 1.14, Panel A). A recovery in the labour market, rising household incomes and improved consumer confidence supported this domestic consumption. Net exports have also been an engine of growth. Meanwhile public-sector spending provided support for private investment. On the supply side, the services sector acted as the main contributor to growth for full-year 2021 (Figure 1.14, Panel B), driven mainly by the financial sector.