This chapter examines national renewable energy targets of MENA economies in light of the COVID-19 crisis and their overall impact on the energy sector. It argues that the postponement of renewable energy projects, due to the prioritisation of immediate economic recovery, is counterproductive given the severe effects of climate change and the potential of an ambitious renewable energy strategy for job creation in the MENA region.

Navigating beyond COVID-19

6. Energy and climate action

Abstract

Key takeaways

In recent years, the ambition level of national renewable energy targets of some MENA economies have steadily been increasing to reach more than 50% in total generation of electricity. The MENA region has also joined the global energy transition move, going beyond efficiency and renewables to include new technologies like green hydrogen, as is the case in Morocco, and electrification with renewable power such as electric vehicles.

Fluctuations in regional oil prices due to COVID-19 have an impact on the attractiveness of green energy solutions in the MENA countries. In the initial period of the COVID-19 crisis, the impact of falling oil prices on the development of renewable energies was double-edged: while falling hydrocarbon revenues may have pushed oil exporters in the MENA region to diversify their energy investments, the same fall in price may have had the opposite effect on importing countries if the short-term cost of renewable energies and energy efficiency solutions becomes less attractive.

Financial and priority constraints in the face of COVID-19 halted or ended some ongoing renewable energy projects in the region. Despite the MENA region being ambitious in terms of energy transition, the pandemic exacerbated the region’s difficulties in getting renewable projects off the ground. Nevertheless, postponement of renewable energy projects due to the prioritisation of immediate economic recovery is counterproductive given the potential of an ambitious renewable energy strategy in terms of jobs is high.

Oil market volatility due to the pandemic has highlighted the need to move towards renewable energy resources that can provide a stable and resilient source of energy for the MENA region. The need for public-private partnerships in the climate and energy sectors is therefore greater than ever. COVID-19 has exacerbated the challenges facing the region's energy infrastructure, with volatile growth and macroeconomic conditions, supply disruptions and the need to change operations to align with social policies and social safety nets. In this context, PPPs can help MENA countries to mobilise private sector financing needed to build resilience in energy infrastructure systems.

The economic downturn caused by COVID-19, while slowing degradation for a time, has not fully prevented biodiversity loss. As biodiversity loss can be a driver of infectious diseases, the pandemic has proven the need for regional coordination for biodiversity. Increasing the comprehensiveness and alignment of national policies before tackling regional programmes is a first step. Enhancing coordination at local and national levels will be essential to avoid overlapping or conflicting policy objectives, which will help streamline regional efforts in the long-term.

Moving towards energy efficiency solutions in the MENA region1 has become increasingly important for long-term economic growth and environmental wellbeing. The MENA economies have become more active in developing national energy efficiency strategies over the last decade, with most renewable energy targets and strategies spanning until 2030. Renewable energy targets have been set in the MENA countries, with some economies foreseeing ambitious targets of 50% renewable capacity, in line with some European countries (Table 6.1).

Table 6.1. Selected MENA installed renewable capacity and targets

|

Country |

Installed renewable capacity |

Current renewable electricity capacity (2020) |

Target renewable capacity |

|

Morocco |

2 728 MW |

33% |

52% by 2030 |

|

Algeria |

536 MW |

3% |

27% by 2030 |

|

Tunisia |

324 MW |

6% |

30% by 2030 |

|

Egypt |

3 660 MW |

10% |

42% by 2035 |

|

Jordan |

2 400 MW |

21% |

31% |

|

Lebanon |

350 MW |

2000 MW |

30% by 2030 |

|

Mauritania |

350 MW |

21 |

41% by 2030 |

Notes: Morocco : although the official target remains 52%, sources report that teh countries will soon raise its renewable energy target to more than 64% by 2030 (Le Matin Maroc, 2021[1]) ; Jordan : data on current renewable capacity and targets was sourced from the National Energy Strategy 2020-2030.

Source: (IRENA, 2020[2]) https://www.irena.org/mena; (Ministry of Energy and Mineral Resources of Jordan, 2020[3]) https://www.memr.gov.jo/EBV4.0/Root_Storage/AR/EB_Info_Page/Strategy2020.pdf

Several MENA countries have also taken action to strengthen climate mitigation efforts, covering areas listed under the Plan Bleu’s State of the Environment and Development in the Mediterranean (UNEP/MAP and Plan Bleu, 2020[4]). The actions of selected MENA countries shown in Table 6.2 are generally on par with neighboring UfM countries such as Israel and Türkiye (UfM, 2020[5]).

Table 6.2. Selected MENA climate adaption actions (2020)

|

Climate change issues to adapt to |

Adaptation actions |

|

|

Lebanon |

|

|

|

Morocco |

|

|

|

Palestinian Authority |

|

|

|

Tunisia |

|

|

Transition to green and cirular economy

Further fluctuations in regional oil prices due to COVID-19 have lessened the attractiveness of green energy solutions in the MENA countries

At the beginning of the pandemic, the economic shock in the MENA region was magnified by the collapse of oil commodity markets and capital flight from emerging markets. With the sudden drop in oil prices in March 2020, due to a decrease in global demand and coordination problems, the price of crude oil in the region experienced enormous fluctuations, adding to difficulties in planning of trade and economic recovery packages (Dabrowski and Dominguez-Jimenez, 2021[7]).

Fluctuating oil prices in the region play a large role in the attractiveness of renewable energy investments for MENA countries, as well as the broad MENA region as a whole, but in very different ways. MENA countries are mostly oil importing countries, whereas the broad MENA region includes GCC economies that are high oil exporting countries. Decreasing oil prices may encourage oil exporters to invest in sustainable and reliable energy solutions. For oil importing countries this makes transitions to green energy less attractive for governments and investors (IEA, 2020[8]). Major oil exporting countries in the region like Saudi Arabia, the UAE and Kuwait are already implementing substantial economic diversification plans to move away from hydrocarbons as an energy source due to the increasing volatility of the oil market (Hussein, 2020[9]). However, due to lower levels of FDI and tourism from oil exporters, there is a negative impact of decreasing oil prices also on oil importers, creating an opportunity for accelerated diversification and transition during recovery, making green stimulus from governments paramount (World Bank, 2021) (Bianchi, 2020[10]).

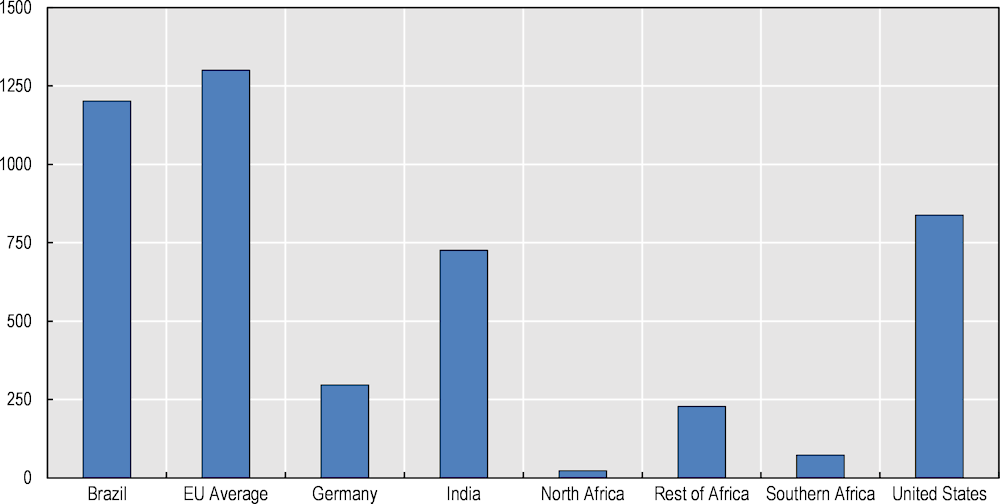

Despite the high potential of renewable energy for electricity generation, the share of renewables in the electricity capacity of the Southern Mediterranean countries of the UfM remains low compared to global trends, and also varies greatly within the region. It is estimated that the share of renewable energy in final energy consumption accounts for 0.1% in Algeria, between 5 and 5.5% in Egypt and Jordan, and between 10 and 12% in Morocco and Tunisia (Figure 6.1) (OECD, 2021[11]).

Figure 6.1. Renewable energy consumption

Note: Renewable energy consumption is the share of renewable energy in total final energy consumption. This indicator includes energy consumption from all renewable resources: hydro, solid biofuels, wind, solar, liquid biofuels, biogas, geothermal, marine and waste.

Financial and priority constraints in the face of COVID-19 halted or ended some ongoing renewable energy projects in the region

As noted in the UfM SEMed Private Renewable Energy Framework, the MENA region has seen some promising changes in moving towards renewables, such as the establishment of the Moroccan Khalladi Wind Farm in 2015 and the Egyptian Global Energy solar farm in 2020 (UfM, 2021[13]). Algeria and Egypt’s solar plants have seen significant development in recent years, with Egypt having the largest solar farm in the world with further developments planned and Algeria launching a call for investors for a mega project in the solar sector.

There have been promising developments for the greater MENA region with respect to wind energy in particular, increasing from 286 MW in 2015 to 915 MW in 2020, with Jordan alone presenting an increase of 397 MW from 2015 to 2020 (IRENA, 2021[14]). According to IRENA’s Renewable Energy Capacity Statistics 2021, Morocco is ranks just behind Spain and the United States when it comes to total installed capacity of concentrated solar power (CSP) at 530 MW. The region is also excelling with regards to total installed capacity of solar photovoltaic. According to the same report, Jordan and Israel rank the second and third highest in the Middle East region at 1359 MW and 1190 MW capacity respectively and Egypt ranking second in African region at 1673 MW capacity (IRENA, 2021[14]). However, OECD analysis finds that in recent years, the region continues to face difficulties in getting renewable projects off the ground, a problem which is exacerbated by the pandemic. Existing challenges to infrastructural projects included long and complex contractual processes, unstable political and economic landscapes, commercial bank deleveraging and tightened bank prudential regulations (OECD, 2014[15]). Ongoing planned renewable energy projects in the broad MENA region during the COVID-19 period reached a cost of USD 82.4 billion, only USD 4.1 billion worth of which are currently at an advanced stage of design or implementation. The other approximate USD 78.3 billion worth of planned projects have been decelerated, many of which are projected to fall through or heavily change in scope (Global Data, 2021[16]).

In the broad MENA region, large-scale infrastructure projects have already fallen through due to COVID-19, as was the case with the abolishment of the Kuwaiti Al-Dabdaba solar plant project which was anticipated to replace 15% of electrical energy needs in the oil sector. The heavy fluctuation and uncertainty of oil prices in the region, a principal source of GDP, and financial markets, are a key factor in these failures. Some MENA countries have also followed trend, with COVID-19 negatively affecting ongoing energy-efficiency infrastructure projects.

Algeria has approximately USD 42.1 billion planned renewables projects in progress – the region’s biggest pipeline - but around USD 41.9 billion of those projects have not yet been implemented or come to light (Global Data, 2021[16]).

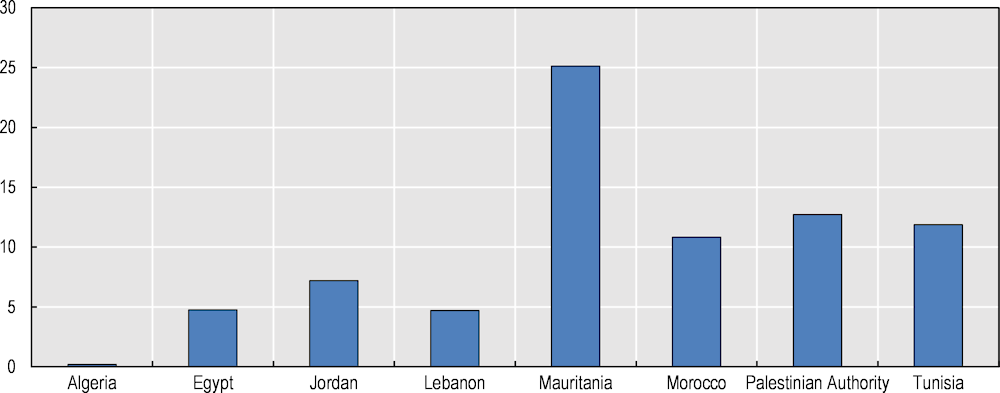

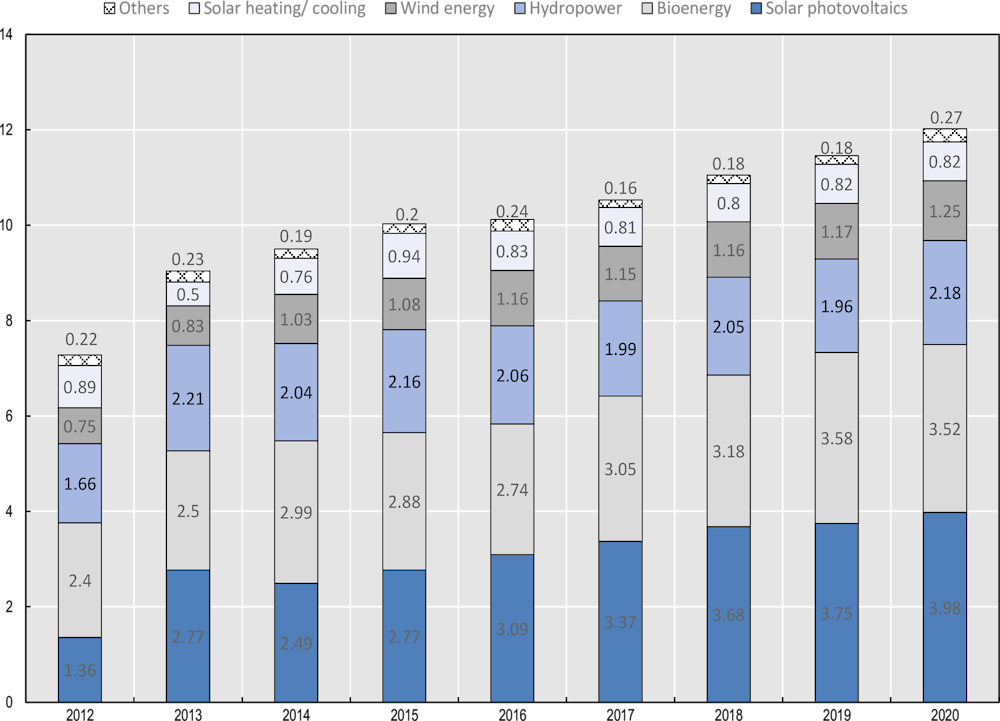

The cost of postponing renewable energy related projects due to the prioritisation of immediate economic recovery is counterproductive to long-term economic growth. Countries of the broad MENA region already lag behind European and worldwide counterparts in terms of jobs in the renewables sectors, with a total of only 23 000 people working in renewable energy, notably in North Africa. Nevertheless, the potential of an ambitious renewable energy strategy in terms of jobs is high. In 2020, the renewable energy sector directly and indirectly accounted for approximately 12 million jobs worldwide (IRENA, 2021[17]). In 2021, the ILO reported that solar photovoltaics and bioenergy continued to dominate global renewable energy employment growth, accounting for a total of approximately 4 million and 3.5 million jobs respectively (ILO, 2021[18]).

Figure 6.2. Global renewable energy worldwide employment by technology, 2012-20

Note: Bioenergy: includes liquid bofuels, solid biomass and biogas; Hydropower: direct jobs only; Others: include geothermal energy, concentrated solar power, heat pumps (ground based), municipal and industrial waste, and ocean energy.

Figure 6.3. Renewable energy employment, selected countries and regions, 2020

In MENA the total amount of employees in the renewables sector remains low, but is increasing. In Jordan, for instance, there have been promising develoments: IRENA and ILO estimate that the economy provides more than 6 000 jobs in energy efficiency (lighting and buildings), for a combined 11 300 jobs solely in Jordan. However, women held only about 5% of the jobs (8% in solar and only 1% in wind) (RCREEE and GWS, 2010[20]). The country employed approximately 5 000 people in renewable energy in 2020, comprising more than 2 000 in photovoltaics, nearly 2 000 in wind power and 1 000 in solar thermal, in comparison to approximately 600 jobs in 2013, principally in solar water heaters (IRENA, 2021[17]).

The need for effective public private partnerships for infrastructure in climate and energy related sectors has been exacerbated by growing energy supply and resource needs caused by the pandemic.

Climate change impacts infrastructure sectors in several domains including the water, transport, energy, ICT, urban development and solid waste sectors. Damages caused by climate hazards due to inappropriate planning and design, poor construction, maintenance or mismanagement, specifically where considerations of climate change have not been considered can have devastating and costly effects, particularly for developing countries (Global Center on Adaptation, 2021[21]). With increased demand for energy supplies and weak or outdated infrastructure that is susceptible to increasingly extreme weather patterns, chronic stresses and acute shocks to infrastructure impact the MENA region especially harshly.

COVID-19 exacerbated the challenges facing MENA infrastructure with growth and macroeconomic volatility, declines in demand, supply disruptions, added health and safety regulations and the need for a change in operations and government policy or sector decisions to implement stimulus or social safety nets. New PPPs can help UfM countries in need to mobilise private sector finance required to enhance the resilience of infrastructure systems to the impacts of climate change (World Bank, 2021[22]).

PPPs in energy solutions and climate action can have an amplified impact for developing countries, especially MENA countries that are plagued with underlying effects of poor water, environment, climate and energy management. For example, investment to reduce air pollution by transitioning towards renewable energy, sanitation and waste management infrastructure generates savings in healthcare expenditure. Meanwhile, improved drainage and climate-resilient road infrastructure have proven to generate savings in maintenance costs, while reducing disruptions in infrastructure service (Bassi, Pallaske and Guzzetti, 2020[23]).

COVID-19 has also compelled countries to revise existing PPP agreements and their functioning, and this affects energy PPP in the same way as other PPP agreements. The pandemic highlighted the need for increasing coordination and cooperation for PPP and implementing more fluid forms of partnerships given the extreme complexity, uncertainty and high projected costs of preparing for and responding to the impacts of the pandemic and climate change (Harvard Zofnass Program, 2020[24]). Enforced communication among partners has to remain key to mitigate information asymmetry challenges for governments due to COVID-19.

Policy considerations

Key progressive aspects are still missing from policy landscapes in MENA countries, hindering investor support and confidence. Given that energy demand will continue to grow at exponential rates, while private sector interest in the sector is not increasing correspondingly (EIB, 2016[25]), addressing these policy deficiencies will be crucial for promoting the renewable energy sector to foreign and domestic investors. To aid the UfMs approach on encouraging a Mediterranean agenda for energy and climate action linked to the global agenda, as noted by the SEMed Private Renewable Energy Framework (UfM, 2021[13])and supporting reports on climate financing, this OECD report suggests that MENA countries support reinforce and adapt climate related policies in the following ways:

Support a systematic and comprehensive assessment of potential climate impacts on energy systems. There is no one-size-fits-all solution to enhance the resilience of North African energy systems, because of the wide range of patterns and magnitude of potential climate impacts in the region. Instead, tailored policy measures based on systematic assessments of climate risks and impacts will help North African countries increase the resilience of their energy systems. The assessment should be based on scientific methodologies and established guidelines. Governments can provide technical support by commissioning research and making quality data and information available. Governments can also develop, support and implement capacity-building activities for the assessment. In addition to the support for the science-policy nexus covered by the UfM Climate Action Plan (UfM, 2019), this report suggests that furthering opportunities for research on green recovery tools in the wake of the pandemic can be a strong tool to improve evaluations and encourage the inclusion of youth and research institutions in climate action policymaking. Not only will expanding such opportunities allow for further detailed assessments on how COVID-19 affected the implementation of the action plan, for example, in relation to nationally determined contribution implementation or mapping of interconnected supply chains to ensure stable movement of goods and services in the future.

Avoid postponement of climate-related projects due to the prioritisation of immediate economic recovery. This is counterproductive to long-term climate efforts. Moreover, energy related infrastructure projects are a good way to boost economic recovery, employment and improve future economic growth. MENA countries should expand efforts to promote climate and energy solution sectors as strong investment opportunities, in line with the UfM report on Tracking and Enhancing International Private Climate Finance in the SEMed Region (UfM, 2019[26])and drawing on experience and evidence included in the UfM report on Climate Finance Flows in the SEMed Region (Borde and Righi, 2020[27]). These economies should focus on green recovery efforts that take such investments and projects at the centre of economic stimulus packages, in principle, avoiding postponement of renewable energy related projects while providing solutions for economic recovery.

Enhance public private partnerships opportunities in renewable energy and update PPP frameworks to include climate specific incentives. PPPs offer a unique opportunity to make the MENA region an active player for renewable solutions to increasing energy needs. However, PPP infrastructure in the region remains weak, hindering opportunities to attract investors. Complementing UfM’s recommendations on PPP in the water sector (UfM, 2019[28]), which point to enhancing cross-institutional interaction and capacity development, this report calls for MENA countries to focus on improving stakeholder engagement and communication, integrating key tools and capacities on climate resilience into PPP, and embedding resilience into existing frameworks of PPP. A set of OECD tools, including the OECD Principles for Public Governance of Public-Private Partnerships (OECD, 2012[29]), the Public-Private Partnerships Reference Guide (OECD and World Bank, 2017[30]) and the OECD policy considerations on climate resilient infrastructure (OECD, n.d.[31]) provide useful guidance on building resilient PPP frameworks.

As prioritising climate action in the MENA region’s economic recovery can prove challenging, small scale private action at the local levels can help bridge the gap. Despite some heterogeneous actions such as plastic pollution, there are relatively few government strategies on climate change in the region compared to European Mediterranean countries. The region has to cope with its political limitations that result from a lack of social cohesion and instability. Put simply, when priorities are focused on ensuring electricity supply and distribution, spotlighting climate action can be challenging. Private actions at the local and municipal levels in urban setting, such as urban mobility shift from car to bike sharing initiatives in cities (as discussed in chapter 5), can often be the first step towards more structured government responses.

Protect biodiversity and natural resources

Despite less coastal traffic due to COVID-19, rising sea levels and coastal erosion are on track to devastate major MENA cities while biodiversity loss remains on the rise

While 40% of the world’s population live in coastal areas, the share of total population living in the vicinity of the coast in the Maghreb is even higher, ranging from 65% in Morocco to 85% in Tunisia (Maul & Duedall, 2019). As the region’s 7 500 km of coasts are home to every countries’ capitals as well as major cities, growing urban density is increasing the portion of the population that could be affected by coastal erosion.

Coastal infrastructure plays a large role in the region’s global trade through ports and shipping transits, providing efficient trade routes between the African and European continents. Moreover, intact beaches and coasts directly affect livelihoods and major industries in the region, have important indirect effects on economic revenues for the tourism reliant countries and remain important determinants for how much hotels can charge and the willingness of tourists to return (Heger and Vashold, 2021[32]).

Coasts are disproportionately vital to Maghreb economies, so coastal erosion is a major concern. Global average coastline recession is about 0.07 meters per year (m/yr). However, Tunisia has a rate of coastline recession 10 times higher, reaching approximately 0.70 m/yr. Morocco’s situation is also increasingly worrisome as the Atlantic coast is currently receding at a rate of 0.12 m/yr and its Mediterranean coast at 0.14 m/yr, twice the global average (Luijendijk et al., 2018[33]). Although coastal traffic in MENA countries has decreased due to a lack of tourism, movement protocols and businesses closures during the pandemic, there have been no reports of a slowdown in the rate of coastal erosion in the Maghreb region.

COVID-19 has not staved off biodiversity loss, which continues to rise at dangerous rates in the MENA countries

The ecosystem degradation is driven by factors typically amplified in the broad MENA region. Land and sea-use change (particularly agricultural expansion), climate change, direct exploitation of wild species, invasive alien species, and pollution are all linked and shaped by indirect drivers, such as demographic and social changes like rapid urbanisation (as described in chapter 5) and lack of adequate climate and conservation related policies (as discussed in chapter 4). Unfortunately, biodiversity loss is a key driver of emerging infectious diseases, and poses a variety of other growing risks to businesses, society and the global economy (OECD, 2020[34]).

Although sources of coastal erosion are manifold, human-induced factors including coastal subsidence, coastal protections, tourism infrastructure or land reclamation heavily impact coastline changes. With coastal traffic severely decreased due to the pandemic, increased biodiversity and vegetation regrowth has the ability to contrast further erosion. For example, posidonia fields, vegetation native to the Mediterranean Sea, reduces the energy of waves and currents, stabilising the seabed and securing sediment which can protect against coastal erosion (Jeffries and Campogianni, 2021[35]). However, around 70% of habitat loss of Posidonia oceanica is projected by 2050 with a potential for functional extinction by 2100, with no signs of slowdown with the pandemic.

Policy considerations

Promote regional coordination for sustainable biodiversity and conservation efforts. The UfM Regional Analysis on Nationally Determined Contributions underlines the need for identifying relevant synergies among UfM member countries in the South and East of the Mediterranean (UfM, 2020[5]). The report stresses the dependence of the region’s protected area management on connectivity and interconnected areas that state-levels cannot reach alone. Complementing the principles laid out in the UfM analysis, this OECD report recommends increasing the comprehensiveness and alignment of national policies before tackling regional programmes. Coherence among national strategies and plans for environmental well-being should be ensured to streamline efforts, as adherence to multilateral mechanisms and agreements on environment is lacking. Horizontal and vertical institutional coordination on a local and national level is key for policy alignment in the nexus between land-use, biodiversity, climate, water and food and can help avoid overlapping or contradictory policy objectives, which will help streamline regional efforts in the long-run. The OECD’s recent guidance on sustainable land use by aligning biodiversity, climate and food policies (OECD, 2020[36]) can be a useful tool in achieving these objectives.

Reduce Pollution

COVID-19 recovery in MENA countries should prioritise quickly implementable projects for greening the economy, and pollution mitigation programmes offer a good starting point

As noted in chapter 5, the broad MENA region faces serious pollution challenges, with the highest air pollution levels after South Asia, making climate change a growing long-term concern. While the impact of COVID-19 on water and air pollution has been discussed in Chapters 4 and 5 of the report, projects and guidelines to implement pollution mitigation programmes can be further elaborated upon. Quickly implementable infrastructure projects provide potential for fast and strong economic recovery by opening employment opportunities for many people (Hallegatte and Hammer, 2020[37]). Infrastructure projects in pollution abatement sectors such as fuel switching, energy efficiency and end-of-pipe projects are shovel ready and can spearhead a rapid but sustainable economic recovery, making them COVID-19 relevant. Pollution mitigation projects, especially for a region harshly impacted by deteriorating air quality as industries start to pick up in the wake of the pandemic, offer a chance to integrate green solutions into economic recovery from COVID-19 impacts.

There are strong pollution mitigation projects in MENA countries that offer solid opportunities to scale up private action in the fight against climate change.

In Lebanon, the Lebanese Environmental Pollution Abatement Project (LEPAP) offered to firms in heavy polluting industries credit at near 0% interest rates for a period of 7 years. LEPAP has provided this concessional funding to fuel switching, energy efficiency and end-of-pipe projects (Ministry of Economy of Lebanon, 2021[38]).

In Jordan, the Green Growth National Action Plan 2021-2025, approved in 2020, promotes green growth, climate change action and sustainable development through sectoral planning in the agriculture, energy, tourism, transport, waste and management sectors. The Plan aims to reduce fuel use and import dependence to ensure sustainable economic growth while decreasing unemployment and poverty (Ministry of Environment of Jordan, 2020[39]).

In Egypt, the Environmental Pollution Abatement Project (EPAP) project helped industry improve performance and comply with environmental regulations. Eligible industries in Greater Cairo and Alexandria could borrow funds for fuel switching, energy efficiency, and end-of-pipe technologies at near zero interest rates. The project’s second phase ended in 2016, allowing for initial replicability for neighboring countries. Phase 3 implementation is ongoing until 2022 (Ministry of Environment of Egypt, 2017[40]). The Air and Climate Pollution Reduction Project, funded by the World Bank, aims to reduce pollution from the transport sector and the solid waste management sector, which are the two largest contributors to emissions in the Greater Cairo area (World Bank, 2020[41]).

Policy considerations

Pollution reduction efforts continue to be hindered by inefficient policies and incentives that do not properly reward low carbon output goals. Encouraging citizens, particularly at the household level, to use energy efficient solutions will be an effective way to grow national awareness and support for the use of small-scale action to prevent climate change.

Align cross-sectoral policies to lower carbon output. Efforts to stimulate economic recovery in the wake of COVID-19 offer an opportunity to align incentivising factors for energy efficiency and implement new climate mandates across several sectors. Such policies are typically found in mandates for energy efficiency targets, energy efficiency standards for firms, fuel efficiency standards for vehicles, fuel switching, end-of-pipe technologies and pricing pollution/carbon, and removing harmful subsidies that contribute to pollution and carbon use. For the broad MENA region in particular, local level requirements in the form of energy efficiency standards for buildings, and minimum performance standards for appliances, such as air conditioners and refrigerators, hold high promise. Using the UfM SEMed Private Renewable Energy Framework as a guideline, MENA countries may consider following the suggestions laid out by the OECD on aligning policies for low carbon economies (OECD, 2015[42]).

References

[23] Bassi, A., G. Pallaske and M. Guzzetti (2020), Post-COVID19 Recovery: Harnessing the Power of Investment in Sustainable Infrastructure, https://www.orfonline.org/research/post-covid19-recovery/.

[10] Bianchi, M. (2020), Prospects for Energy Transition in the Mediterranean after COVID-19, https://www.iai.it/sites/default/files/iaip2018.pdf.

[27] Borde, A. and T. Righi (2020), Climate Finance Flows in the SEMed Region in 2018, https://ufmsecretariat.org/wp-content/uploads/2021/01/Climate-Finance-Flows-in-SEMed-Region-2018.pdf.

[7] Dabrowski, M. and M. Dominguez-Jimenez (2021), The socio-economic consequences of COVID-19 in the Middle East and North Africa, https://www.bruegel.org/2021/06/the-socio-economic-consequences-of-covid-19-in-the-middle-east-and-north-africa/.

[25] EIB (2016), What’s Holding back the Private Sector in MENA? Lessons learned from the enterprise survey., https://www.eib.org/attachments/efs/econ_mena_enterprise_survey_en.pdf.

[6] Energy and Climate Intelligence Unit (2021), Net Zero Scorecard, https://eciu.net/netzerotracker.

[21] Global Center on Adaptation (2021), Climate-Resilient Infrastructure Officer Handbook: Knowledge Module on Public-Private Partnerships for Climate-Resilient Infrastructure, https://gca.org/reports/climate-resilient-infrastructure-officer-handbook/.

[16] Global Data (2021), Middle East renewables surge as energy transition accelerates, https://power.nridigital.com/future_power_technology_sep21/middle_east_renewables.

[37] Hallegatte, S. and S. Hammer (2020), Thinking ahead: For a sustainable recovery from COVID-19 (Coronavirus), https://blogs.worldbank.org/climatechange/thinking-ahead-sustainable-recovery-covid-19-coronavirus?deliveryName=DM65761.

[24] Harvard Zofnass Program (2020), A Lesson from COVID-19: Re-envisioning Public Private Partnerships, https://research.gsd.harvard.edu/zofnass/menu/events/forthcoming/re-envisioning-public-private-partnerships/.

[32] Heger, M. and L. Vashold (2021), Disappearing coasts in the Maghreb: Coastal Erosion and its Costs, https://thedocs.worldbank.org/en/doc/8320c30ab5eee11e7ec39f7f9496b936-0280012021/original/Note-Cost-of-Coastal-Erosion-En.pdf.

[9] Hussein, B. (2020), Energy sector diversification: Meeting demographic challenges in the MENA region, https://www.atlanticcouncil.org/in-depth-research-reports/report/energy-sector-diversification-meeting-demographic-challenges-in-the-mena-region/.

[8] IEA (2020), The Oil and Gas Industry in Energy Transitions, https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions.

[18] ILO (2021), Renewable energy jobs have reached 12 million globally, https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_823759/lang--en/index.htm.

[14] IRENA (2021), Renewable Capacity Statistics, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Apr/IRENA_RE_Capacity_Statistics_2021.pdf.

[17] IRENA (2021), Renewable Energy and Jobs, https://en.econostrum.info/attachment/2221736/.

[2] IRENA (2020), MENA Country Specific Renewables Readiness Assessments, https://www.irena.org/mena.

[19] IRENA (2020), Renewable Energy Employment by Country, https://www.irena.org/Statistics/View-Data-by-Topic/Benefits/Renewable-Energy-Employment-by-Country.

[35] Jeffries, E. and S. Campogianni (2021), The Climate Change Effect in the Mediterranean: Six stories from an overheating sea, https://www.wwf.fr/sites/default/files/doc-2021-06/20210607_Rapport_The-Climate-Change-Effect-In-The-Mediterranean-Six-stories-from-an-overheating-sea_WWF-min.pdf.

[1] Le Matin Maroc (2021), Énergies renouvelables dans le mix électrique : Le Maroc relève à 64,3% ses ambitions pour 2030, https://lematin.ma/journal/2021/energies-renouvelables-mix-electrique-maroc-releve-643-ambitions-2030/366328.html.

[33] Luijendijk, A. et al. (2018), “The State of the World’s Beaches”, Scientific Reports, https://doi.org/10.1038/s41598-018-24630-6.

[38] Ministry of Economy of Lebanon (2021), Lebanon Environmental Pollution Abatement Project, https://lepap.moe.gov.lb/?q=content/about-us.

[3] Ministry of Energy and Mineral Resources of Jordan (2020), National Energy Sector Strategy 2020-2030, https://www.memr.gov.jo/AR/Pages/%D8%A7%D8%B3%D8%AA%D8%B1%D8%A7%D8%AA%D9%8A%D8%AC%D9%8A%D8%A9_%D9%82%D8%B7%D8%A7%D8%B9_%D8%A7%D9%84%D8%B7%D8%A7%D9%82%D8%A9.

[40] Ministry of Environment of Egypt (2017), Egypt Pollution Abatement Project III, https://www.eeaa.gov.eg/portals/0/eeaaReports/N-EPAP/EPAP%20III/EPAP%20III%20Arabic%20updated.pdf.

[39] Ministry of Environment of Jordan (2020), Green Growth National Action Plan 2021-2025, https://www.edama.jo/wp-content/uploads/2021/08/Green-Growth-National-Action-Plan-2021-2025.pdf.

[11] OECD (2021), Regional Integration in the Union for the Mediterranean: Progress Report, https://www.oecd.org/science/regional-integration-in-the-union-for-the-mediterranean-325884b3-en.htm.

[34] OECD (2020), Biodiversity and the economic response to COVID-19: Ensuring a green and resilient recovery, https://www.oecd.org/coronavirus/policy-responses/biodiversity-and-the-economic-response-to-covid-19-ensuring-a-green-and-resilient-recovery-d98b5a09/.

[36] OECD (2020), Towards Sustainable Land Use: Aligning Biodiversity, Climate and Food Policies, OECD Publishing, Paris, https://doi.org/10.1787/3809b6a1-en.

[42] OECD (2015), Aligning Policies for Low Carbon Economies, https://www.oecd.org/environment/Aligning-Policies-for-a-Low-carbon-Economy.pdf.

[15] OECD (2014), Public-Private Partnerships in the Middle East and North Africa, https://www.oecd.org/mena/competitiveness/PPP%20Handbook_EN_with_covers.pdf.

[29] OECD (2012), Recommendation of the Council on Principles for Public Governance of Public-Private Partnerships, https://www.oecd.org/gov/budgeting/oecd-principles-for-public-governance-of-public-private-partnerships.htm.

[31] OECD (n.d.), OECD Environment Policy Papers, OECD Publishing, Paris, https://doi.org/10.1787/23097841.

[30] OECD and World Bank (2017), Public-Private Partnerships Reference Guide - Version 3, https://www.oecd.org/gov/world-bank-public-private-partnerships-reference-guide-version-3.htm.

[20] RCREEE and GWS (2010), Country Report Jordan, https://rcreee.org/content/country-report-jordan.

[13] UfM (2021), SEMed Private Renewable Energy Framework “SPREF”, https://ufmsecretariat.org/wp-content/uploads/2021/07/Leaflet_CA_03_APRIL2021-08_digital.pdf.

[5] UfM (2020), Regional Analysis on Nationally Determined Contributions (NDCs) - 2nd Phase, https://ufmsecretariat.org/wp-content/uploads/2021/01/Enhancement-of-NDCs-in-the-SEMed-Region_WEB.pdf.

[28] UfM (2019), Public-Private Partnerships and the Financial Sustainability of the Mediterranean Water Sector, https://ufmsecretariat.org/wp-content/uploads/2021/06/UfM-Water-Investment-Report.pdf.

[26] UfM (2019), Tracking and enhancing international private climate finance in the Southern-Mediterranean Region, https://ufmsecretariat.org/wp-content/uploads/2019/09/Private-Climate-Finance-Tracking-and-enhancing-international-private-climate-finance-in-the-Southern-Mediterranean-Region.pdf.

[4] UNEP/MAP and Plan Bleu (2020), State of the Environment and Development in the Mediterranean, https://planbleu.org/wp-content/uploads/2021/04/SoED_full-report.pdf.

[22] World Bank (2021), COVID-19 and Public-Private Partnerships Practice Note, https://library.pppknowledgelab.org/documents/6027.

[41] World Bank (2020), New Project to Support the Improvement of Air Quality and the Fight Against Climate Change in Greater Cairo, https://www.worldbank.org/en/news/press-release/2020/09/30/new-project-to-support-the-improvement-of-air-quality-and-the-fight-against-climate-change-in-greater-cairo.

[12] World Bank (2018), World Development Indicators, https://data.worldbank.org/indicator/EG.FEC.RNEW.ZS.

Note

← 1. In this chapter, MENA region or MENA countries refer to the group of countries that are members of the Union for the Mediterranean. These countries are: Algeria, Egypt, Jordan, Lebanon, Mauritania, Morocco, Palestinian Authority and Tunisia. Where the term “broad MENA region” is used, it refers to the group of MENA countries that include UfM and non UfM members.