The strong growth momentum in 2021 has stalled (Table 1). The war in Ukraine and supply-chain bottlenecks are having negative impacts on economic activity, adding to the already high inflation through higher energy and food prices. The post-pandemic recovery was mainly driven by domestic demand, reflecting a fiscal stimulus of about 10% of GDP in 2020-2021 that supported incomes and businesses, and allowed economic activity to surpass its pre-pandemic level in 2021. Before the war, economic growth was facing growing headwinds, such as rising energy prices, continued international supply chain bottlenecks and labour shortages. The war in Ukraine has further heightened uncertainty.

OECD Economic Surveys: Slovenia 2022

Executive summary

The economy is facing headwinds

Table 1. Strong growth is set to moderate

|

Y-o-y % changes |

2021 |

2022 |

2023 |

|---|---|---|---|

|

Gross domestic product |

8.1 |

4.6 |

2.5 |

|

Final domestic demand |

10.0 |

9.0 |

2.4 |

|

Net exports (contribution to GDP growth) |

-1.6 |

-3.7 |

0.2 |

|

Unemployment rate (% of labour force) |

4.8 |

3.9 |

3.7 |

|

Harmonised consumer price index |

2.0 |

7.6 |

6.0 |

|

Current account balance (% of GDP) |

3.3 |

-1.5 |

-1.1 |

Note: Data for 2022 and 2023 refer to projections.

Source: OECD Economic Outlook 111 database.

The labour market is strong and tightening. The government’s new short time work and furlough schemes contained the rise in unemployment during the pandemic. After the phasing out of the schemes, strong labour demand has allowed the unemployment rate to return to its pre-pandemic level. Employment reached a historic high in early 2022. Looking ahead, the tight labour market is expected to contribute to wage pressures in 2022 and 2023.

Inflation has increased to its highest level in 20 years. Initially, the rise in inflation reflected mostly international factors, such as higher energy prices, before domestic price pressures, in particular service prices, became important.

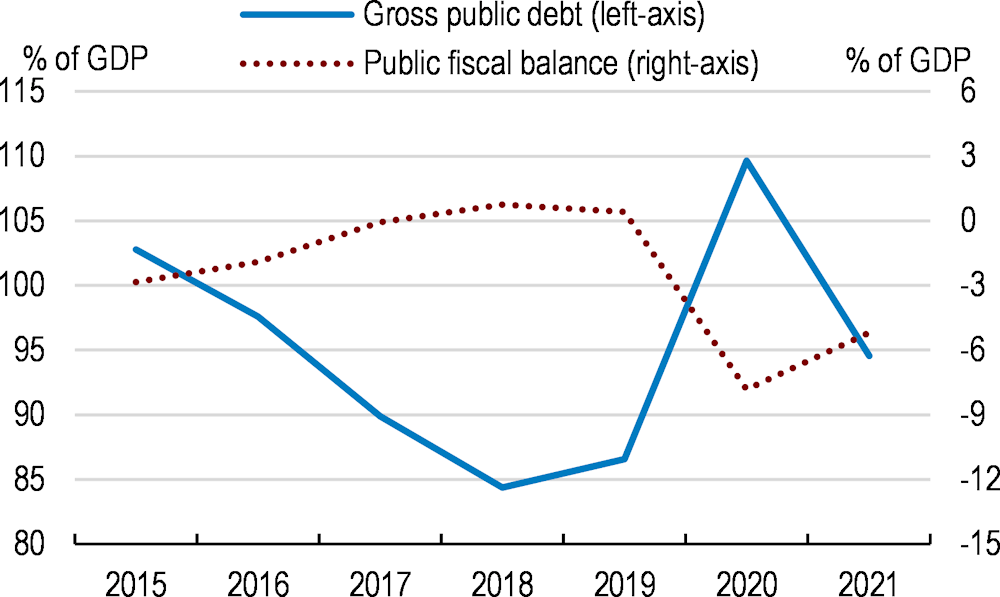

Fiscal policy has been supportive. As a result, public debt and the budget deficit remain high (Figure 1). The pro-cyclical fiscal stance added to demand pressures at a time when the ECB’s monetary policy fell short of containing inflation expectations in Slovenia, as reflected in the steeper yield curve. Fiscal consolidation of ½ % of GDP will be implemented in 2022. Looking forward, a faster fiscal consolidation is needed to reduce demand pressures. Additional support may be needed for households most vulnerable to high food and energy prices, financed by savings in other recurrent spending.

Figure 1. Fiscal policy has been expansionary

Note: National accounts definition of gross public debt.

Source: OECD Economic Outlook: Statistics and Projections database.

Structural reforms for stronger and more sustainable growth

Sustaining income convergence relative to richer OECD countries with an older and smaller workforce requires markedly improved productivity growth. This entails measures to raise investment in new technologies. Such efforts should be implemented alongside measures to improve the labour force participation of low-income and older workers, notably through longer working lives, and a more growth-friendly tax system.

Structural reforms are needed to prepare for the fiscal challenges associated with population ageing. The structural deficit on the public balance has widened with unfunded increases in pension benefits. This has contributed to one of the highest projected pension spending increases in the OECD. Population ageing is set to accelerate, requiring timely policy action.

Growth has become less CO2–intensive. Nonetheless, more concerted action is needed to achieve the ambitious net-zero target by 2050. Carbon pricing varies across sectors and activities, leading to varying abatement costs, and thus higher costs of achieving environmental targets. The public sector is not leading by example as fragmented budgetary and planning policies without consistent pricing of carbon mean that the cost of emission reductions varies across government programmes.

Labour taxes remain among the highest in the OECD, despite recent reforms. High labour taxation discourages labour force participation and reduces workers’ incentives to invest in skills. High taxes also erode wage gains for high-income workers and make it more difficult to attract and retain high-skilled workers. In contrast, property taxes are low and many exemptions reduce the consumption and income tax base.

Business dynamisms is held back by regulatory burdens and widespread state-ownership. The regulatory burden is similar to the OECD average, but in no area is the country as competitive as dynamic market economies. State-owned enterprises (SOEs) still account for a larger share of employment than elsewhere in the OECD in spite of recent privatisations. State ownership persists in inherently competitive sectors such as tourism. The presence of a holding company improved the governance of SOEs. However, assets of the largest SOEs have been moved back under direct state ownership between 2018 and 2020, reversing previous reform efforts. In addition, the perception of corruption remains high despite the recent strengthening of the anti-corruption framework.

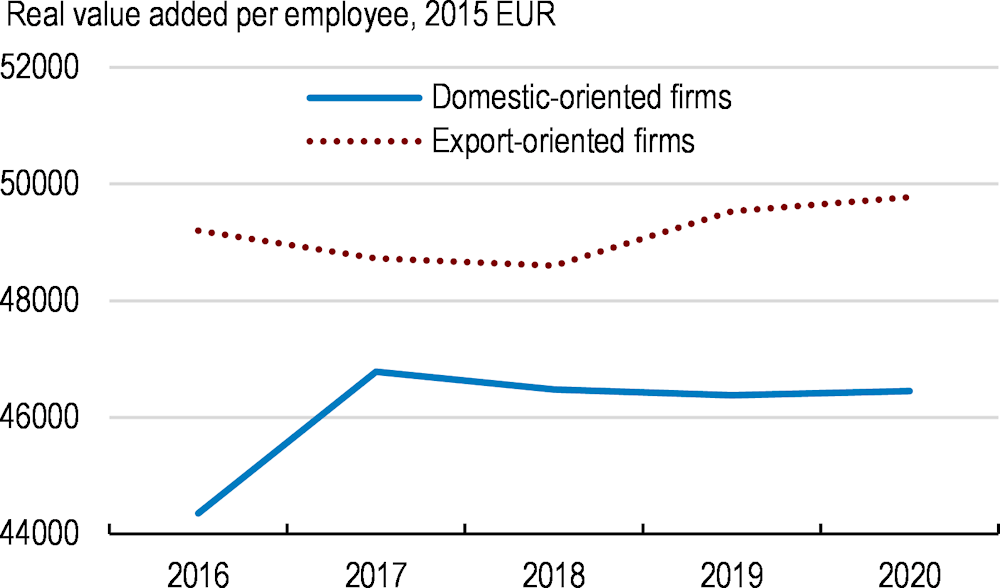

Productivity of the domestically-oriented SME sector is weak. This reflects weak product market competition. In contrast, firms that have integrated in international supply chains outperform in terms of productivity performance their domestically-oriented peers, reflecting international competition (Figure 2).

Figure 2. Domestically-oriented SMEs have lower productivity

Source: OECD calculations based on business survey data from the Statistical Office of Slovenia.

Supporting the digital transformation

The government wants to make Slovenia one of the five most digitalised EU countries. Achieving this requires addressing the relatively low digital competencies of the population and an insufficient rollout of broadband in rural areas. The establishment of the Government Office for Digital Transformation has improved coordination, but it lacks resources to monitor policy implementation.

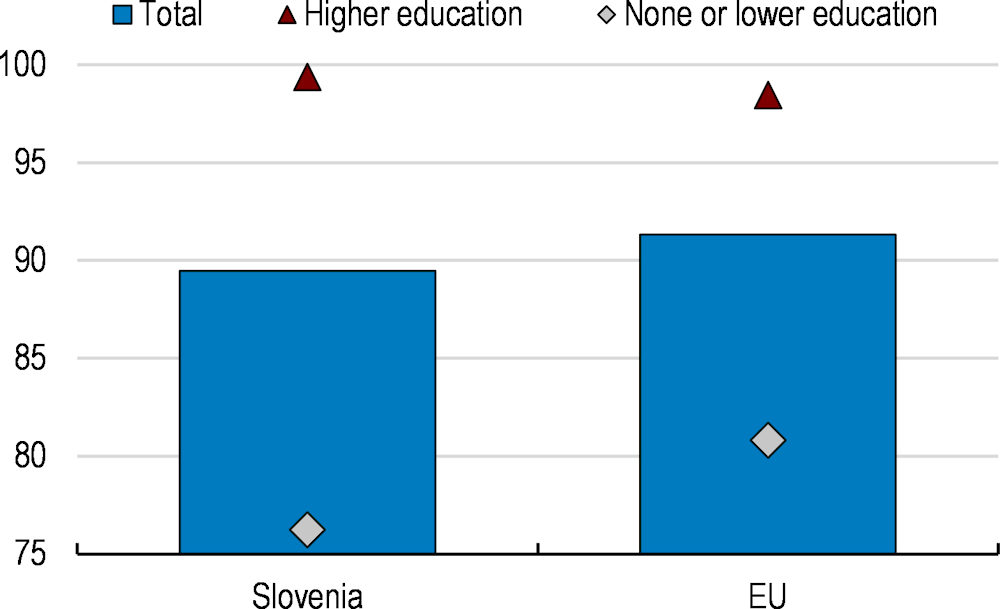

The government can drive digitalisation. However, the use of e-government services among the population is low. This reflects that not everyone is using the internet, especially people with lower education (Figure 3). Most digital public services are offered on an opt-in basis. This means that digital services coexist with traditional ways of delivering, which limits the incentive to use and provide digital solutions, while increasing costs of service provision.

Figure 3. Many Slovenians are still offline

Individuals using the Internet - last 3 month, %, 2021

Financing the digitalisation strategy is mostly through EU funds. This means that priorities are often set at the EU level. As the country develops national programs, a more coherent and strategic approach is needed, as well as greater efforts to identify market failures or other reasons for low digitalisation.

Connectivity in rural areas lags behind. Fast mobile broadband is broadly available. This reflects strong competition that led to lower prices. However, competition in the fixed broadband market is not sufficient to lower prices, leading to pockets of low connectivity in remote regions. The persistence of such pockets reflects that existing subsidies for providing fibre in many cases do not cover the additional costs.

Digitalisation is held back by underdeveloped capital markets. Traditional banks provide limited credit to new digital firms. In contrast with other countries, there are relatively few new Fintech providers and the involvement of venture capital and institutional investors remains limited.

Improving skills and mobility for the digital transformation

Promoting digitalisation requires improved labour allocation and enhanced skill formation. The centralised wage-setting process reduces the allocative efficiency of the labour market. More efficient labour reallocation will support digitalisation, and thus income convergence with richer OECD countries as labour resources in underperforming firms are freed up to the benefit of more digitalised and productive firms. In addition, VET graduates have weak ICT skills and the university system provides an insufficient number of ICT specialists.

Immigration of high-skilled talent can help address skill shortages. However, strict immigration rules and cumbersome procedures to obtain working permits discourage immigration of high-skilled workers from outside the European Union. International students that have finished their studies cannot easily stay in the country to continue working. Also, the Slovenian language policy at universities discourages international students and researchers from coming to the country.

Rigid labour contracts in the public sector are holding back the hiring of key ICT personal. The highest public salary is fixed at five times the minimum wage in the economy, making it difficult for the public sector to attract people with specialised knowledge such as IT professionals, slowing the government’s digitalisation efforts.

Digital skills and job mobility among older workers are low. This reflects seniority bonuses that increase with every year of work experience. Such bonuses lock older workers into their current job, thus reducing their incentives to invest in their digital skills as wages do not reflect productivity. The lock-ins also hamper efficient allocation of older workers to jobs with higher productivity.

Skills are poorly matched to labour market needs for digitalisation. Vocational training mainly delivers theoretical training with little work-based learning and relatively little emphasis on developing digital skills. The apprenticeship system is limited to traditional occupations such as carpenter and tool maker, where the provision of digital skills is sparse.

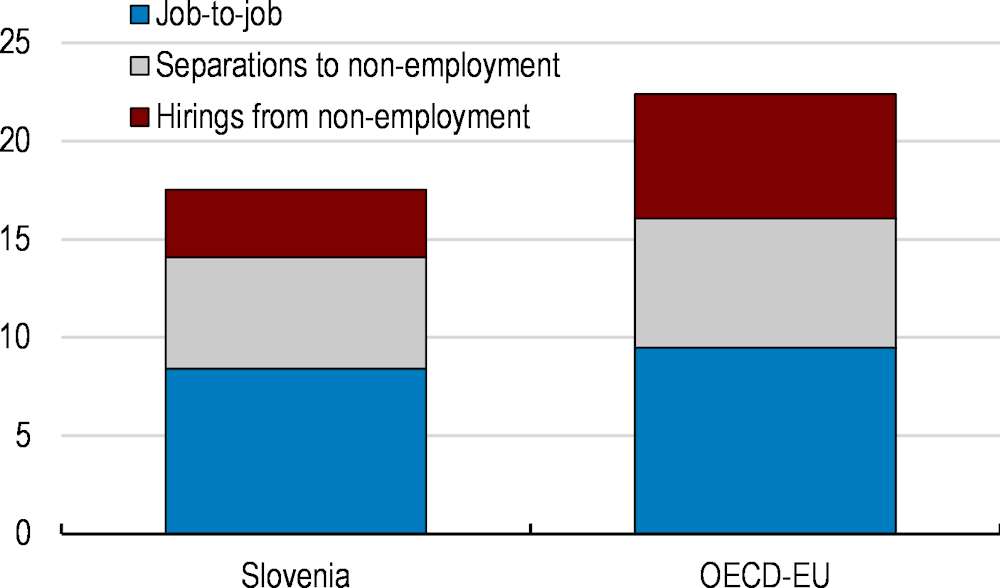

Co-ordinated wage bargaining hampers labour reallocation to more productive and digitalised firms. Raising potential growth in face of a smaller and older workforce will have to increasingly rely on improved labour mobility and skill formation (Figure 4). This requires stronger incentives for workers to invest in their digital skills and move to higher productivity jobs.

The high minimum wage reduces employment opportunities and transitions for low-skilled workers. The minimum wage to the median wage ratio is among the highest in the OECD. Minimum wage growth is important for improving incomes of the poorest. However, fast increases relative to other wages reduce job creation for low-skilled unemployed people. Improving skills and job prospects for low-skilled workers is important as they are most affected by job displacement due to automation.

Figure 4. Labour market transitions are low

Labour market transitions, % of average employment, 2019

Source: Causa, O., N. Luu and M. Abendschein (2021), "Labour market transitions across OECD countries: Stylised facts", OECD, https://doi.org/10.1787/62c85872-en.

|

Main Findings |

Key Recommendations |

|---|---|

|

Sustain the recovery and ensure fiscal sustainability |

|

|

The economy is running at full capacity with inflation above the ECB’s 2% target and accelerating. |

Implement fiscal consolidation to manage demand pressures. |

|

Population ageing is accelerating, boosting ageing-related spending pressures. |

Develop a medium-term fiscal consolidation plan to address the long-run challenges of ageing. Raise the minimum years of contributions required to retire, and use lifetime incomes to determine pension benefits. |

|

Accelerate structural reforms for stronger and more sustainable growth |

|

|

High labour taxes deter labour market participation and investment in skills. Many exemptions and allowances narrow the personal income tax base. |

Make the tax system more growth-friendly by further reducing labour taxes, and increasing consumption and property taxes. Broaden the personal income tax base by reducing allowances. |

|

Public wage increases are pro-cyclical. Some occupations in the public sector experience labour shortages (e.g. health and IT specialists). |

Establish a rules-based system for public wage increases subject to sound budget constraints, while allowing flexibility in public wage setting to address recruitment problems (such as in health and IT). |

|

The tax system imposes heterogeneous abatement costs across sectors and activities. |

Introduce and gradually align carbon taxes in residential, commercial and industrial sectors. |

|

Large parts of the population are exposed to small particles. |

Phase out fossil fuel-based boilers and complement the replacement subsidy for older wood-based boilers with regulatory requirements and financial sanctions. |

|

Competition in product markets is low. |

Continue privatisation efforts particularly in inherently competitive sectors such as tourism, and strengthen the corporate governance of State-Owned Enterprises. |

|

The anti-corruption framework needs further strengthening to be more effective. |

Continue efforts to fight corruption by strengthening the independence and bolstering the resources of the anti-corruption authority. |

|

Supporting the digital transformation of the economy |

|

|

The territorial connectivity divide between urban and rural areas persists. |

Align investment subsidies to reflect actual deployment costs, particularly in underserved areas. |

|

Support programmes for the digital transformation of businesses have a top-down design, starting with EU funding. |

Introduce input and output benchmarking in program management to evaluate effectiveness. |

|

The use of most digital public services for households is voluntary, duplicating existing services |

Move from opt-in (voluntary-based) to opt-out (compulsory-based) systems in e-government services. |

|

Capital markets remain underdeveloped. |

Promote digitalisation in the financial sector through evaluating the regulatory burden, and a closer alignment of FinTech regulations with other European countries. |

|

Improving skills and mobility for the digital transformation |

|

|

Apprenticeships are rarely available in technical programmes. |

Expand apprenticeships into technical programmes. |

|

Co-ordinated wage bargaining hampers labour reallocation and investment in skills. |

Encourage wage-setting at the firm level and determine framework conditions, such as seniority bonuses and minimum wages at the sectoral level. |