This chapter describes the Swiss agricultural innovation system (AIS). It identifies the actors in agricultural innovation and their roles, describes the main trends in public investments in agricultural research and development (R&D), discusses the impact of agricultural policies on AIS, and describes initiatives to foster agri-food innovation. It also depicts institutional co‑ordination between regional innovation systems (RIS) and the Federal Office for Agriculture’s (FOAG) advisory services at the canton level.

Enhancing Innovation in Rural Regions of Switzerland

4. The agricultural innovation system in Switzerland

Abstract

Switzerland is a small open economy with a high gross domestic product (GDP) per capita and relatively low inflation and unemployment. Framework conditions for research and innovation (R&I) in Switzerland are remarkably good, including a strong and stable macroeconomy and institutional framework, high quality of life, significant equality, reliable legal framework, sophisticated financial system and generally favourable taxation, among others. Innovation also benefits from a strong human resource base with a well-educated labour force, high investment in R&D, a strong science base, outstanding innovation performance of the economy and good positioning in international networks. Switzerland is a federal country with a federal innovation policy. There are national programmes and initiatives but no centralised innovation policy (OECD, 2021[1]).

The following sections of this chapter outline the actors and funding in the Swiss agricultural innovation system (AIS), agricultural policies in Switzerland, and specific Swiss initiatives that foster agri-food innovation and institutional co-ordination between the RIS, FOAG and cantonal offices.

Scene-setting for the Swiss AIS

Agriculture plays a relatively minor and declining role in the Swiss economy. In 2017, it contributed to only 0.7% of GDP and 2.6% of total employment (World Bank, 2021[2]). However, the sector is perceived as an important element in maintaining food security, an economic pillar in decentralised settlement and mountainous regions, and as a provider of environmental benefits and maintenance of cultural landscapes, all of which are highly valued by Swiss society.

Agricultural policies in Switzerland seek to find a balanced solution for addressing a variety of commercial, social and environmental objectives. The result is a system of market protection in combination with a set of payments to farmers that provides income support as well as incentives for certain types of farming practices.

Farmers are highly supported by agricultural policies such as broad market price support measures and direct payments. This protection allows maintaining land and agricultural activities for non-productive uses. It also slows structural adjustment and can negatively affect innovation and sustainable productivity. As farmers receive large subsidies, these can create disincentives for innovation and sustainable productivity growth. As these subsidies decrease, there is more room for innovation services that support farmers, the agri-food chain and related services industries.

Business development, innovation, and competitiveness of the farm sector and the food industry are hindered by trade policies that raise the prices for imported inputs and shield producers from competition. Although the level of agricultural support in Switzerland, as measured by the Producer Support Estimate (PSE), has declined gradually, it is still one of the highest among OECD countries. Support to farmers (as a percentage of gross farm receipts) declined from close to 80% of gross farm receipts in the late 1980s to slightly less than 50% in 2020 (OECD, 2021[3]).

The Swiss AIS is sophisticated and advanced. It is comprised of national institutions (FOAG, Secretariat for Education, Research and Innovation [SERI], the Swiss Innovation Agency Innosuisse, the Swiss National Science Foundation [SNSF], the Swiss Confederation's centre of excellence for agricultural research Agroscope, etc.) that provide the general (agricultural) innovation framework and fund and/or carry out agricultural R&D. The Swiss AIS is also composed of cantonal agricultural offices that implement agricultural policy (direct payments and support for structural improvements) and execute advisory services and other agricultural matters. The role of the private sector and the public-private initiatives (e.g. AGRIDEA, Star’Terre) has been crucial for the sector.

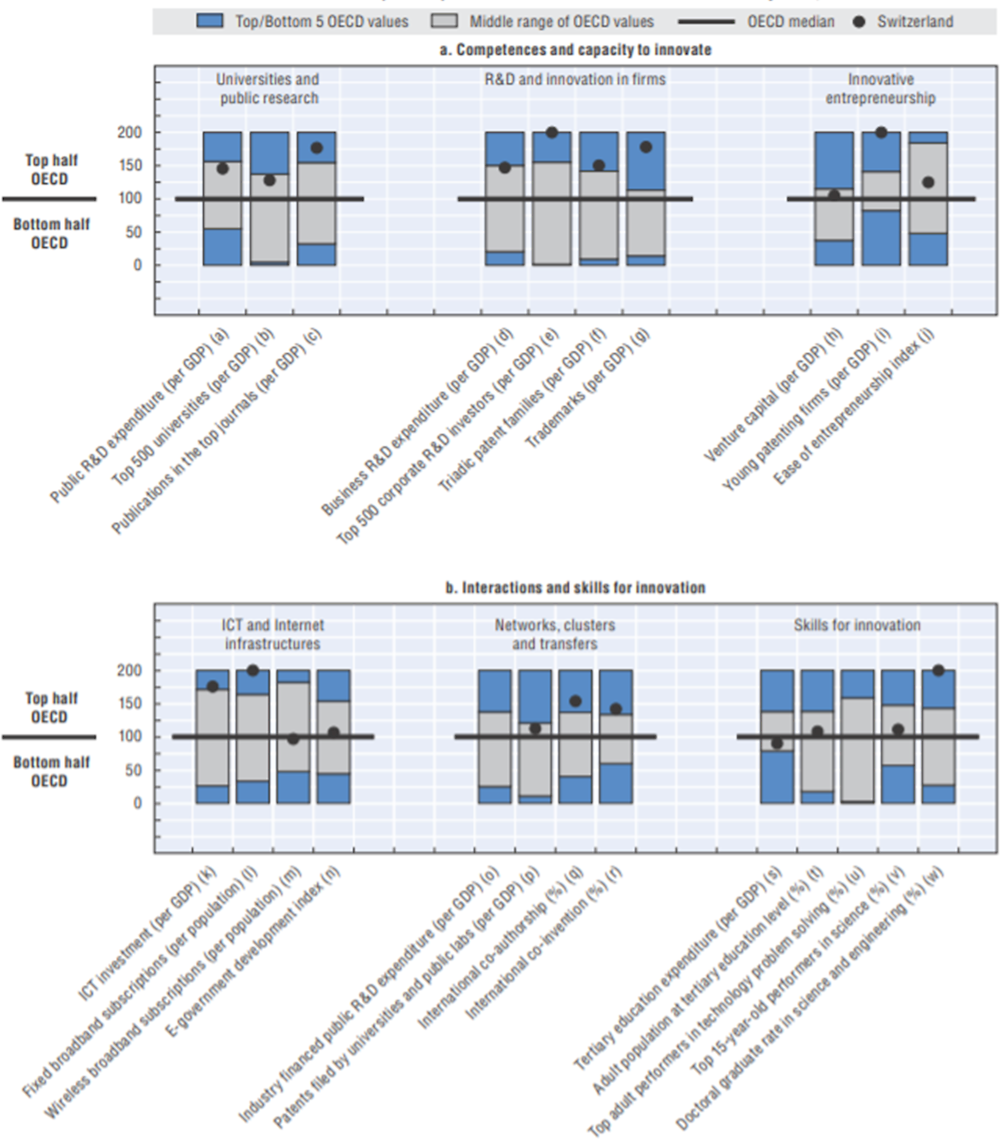

General investment in research is relevant and high in the Swiss innovation system (OECD, 2014[4]). Both the public and the private sector invest heavily in research, and research intensity is above the OECD median. Public expenditure on R&D makes up a significant share of the government budget, accounting for 3.37% of GDP in 2017 (World Bank, 2021[5]). As a share of GDP, public expenditure on R&D is higher than the OECD median, placing Switzerland in the top half of OECD performers (3.5% of GDP in 2019). Higher education expenditure on R&D is among the highest in the OECD area (Figure 4.1).

An important part of the public expenditure on R&D goes to research at Swiss universities and research centres such as the Swiss Federal Institutes of Technology (ETH Zurich and EPFL), which include research institutes like the Paul Scherrer Institute (PSI), the Swiss Institute for Materials Science and Technology (EMPA) and the Universities of Basel, Bern, Geneva, Svizzera Italiana (USI) and Zurich, among others. These universities and research institutes are well placed in global rankings of world-class universities and publications. They received, in 2019, about a 61% of total R&D funding from the public sector (Table 4.1).

Figure 4.1. Science and innovation in Switzerland

Source: OECD (2016[6]), OECD Science, Technology and Innovation Outlook 2016, https://dx.doi.org/10.1787/sti_in_outlook-2016-en.

Table 4.1. Public Budget Outlays on Research and Development by purpose, 2019

|

Item |

Current Million CHF |

Percentage |

|---|---|---|

|

Research financed by the General University Funds (FGU) |

4 319.8 |

61.43 |

|

Other civil research1 |

1 862.6 |

26.49 |

|

Political and social systems, organisation and processes |

198.4 |

2.82 |

|

Exploration and exploitation of space |

183.5 |

2.61 |

|

Industrial production and technology |

169.8 |

2.41 |

|

Agriculture |

155.4 |

2.21 |

|

Energy |

42.9 |

0.61 |

|

Defence |

25.8 |

0.37 |

|

Environment |

23.1 |

0.33 |

|

Health |

16.9 |

0.24 |

|

Education |

12.6 |

0.18 |

|

Transport, telecommunications and other infrastructure |

9.5 |

0.14 |

|

Exploration and exploitation of the terrestrial environment |

8.9 |

0.13 |

|

Culture, leisure activities, ideology and media |

2.7 |

0.04 |

|

Total public budgetary allocations in R&D |

7 032.0 |

100.00 |

Note:

1. Non-distributable research.

Source: FSO (2021[7]), Federal Statistics Office, https://www.bfs.admin.ch/bfs/en/home.html.

Nevertheless, some limitations faced by the innovation framework include the lack of competition in some sectors of the economy that sometimes reduces the incentives to innovate. Barriers to entrepreneurship are still high: these include difficulties in financing new innovative businesses. Moreover, there is no well-defined national innovation policy framework (see Chapter 3 for more details).

Actors and funding of the Swiss AIS

Agricultural innovation is the process whereby individuals or organisations bring new or existing products, processes or ways of the organisation into use for the first time in a specific context in order to increase effectiveness, competitiveness, resilience to shocks or environmental sustainability. They thereby contribute to food security and nutrition, economic development and sustainable natural resource management (OECD, 2019[8]). The Swiss AIS is fully integrated into the general innovation policy and institutional framework. The economy-wide framework for science, technology and innovation provides the underlying incentive structure in all sectors of the economy (see Chapter 3 for more details).

AIS involve a wide range of actors who enable, guide, fund, perform and facilitate innovation. The key players include policy makers, researchers, teachers, advisors, farmers, private companies and consumers. AIS around the world are increasingly driven by economy-wide process and organisational innovations, developments in information and communication technology (ICT) and the bioeconomy.

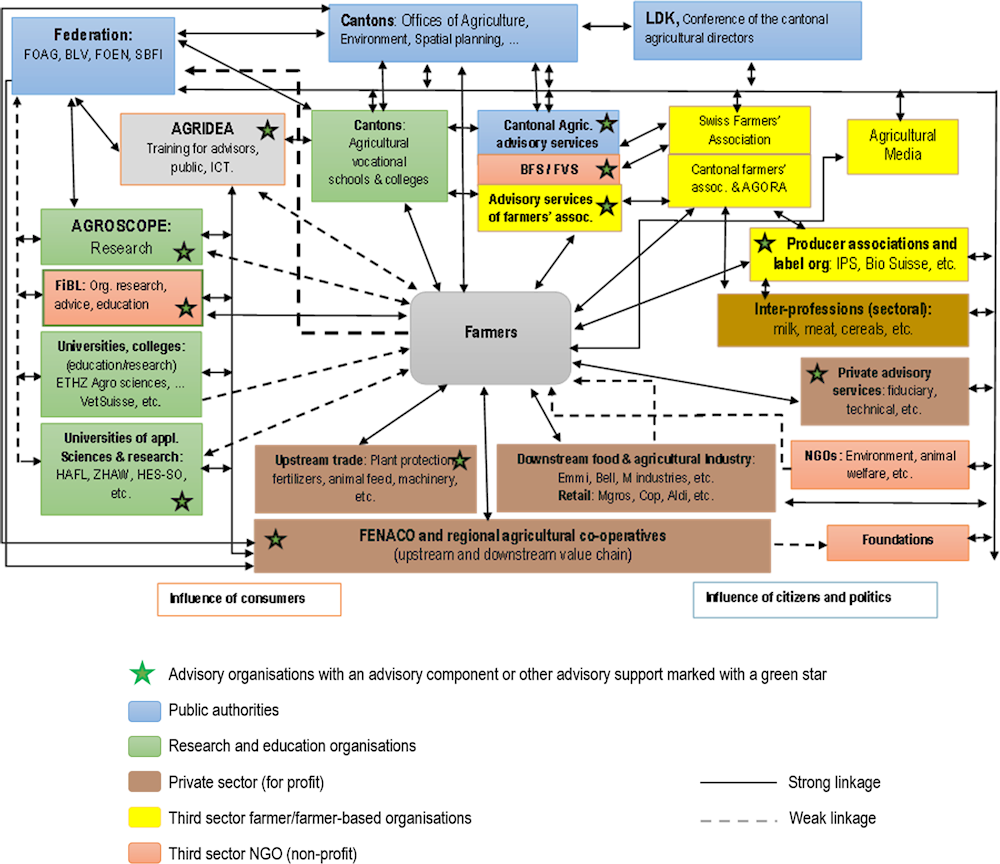

The Swiss AIS is highly sophisticated and advanced and is comprised of national institutions that provide the general agricultural innovation framework and fund and/or carry out agricultural R&D. The Swiss AIS is also comprised of cantonal agricultural offices that provide advisory services and also implement agricultural policy. Table 4.1 shows a diagram depicting its main institutions.

Figure 4.2. The Swiss AIS

Note: This figure is attributed to AGRIDEA (2021[9]). Abbreviations used in this graphic are original and refer to German names. They include BLV, which is FSVO (Federal Food Safety and Veterinary Office) and SBFI which is SERI.

Source: AGRIDEA (2021[9])), AKIS and Advisory Services in Switzerland, Swiss Association for the Development of Agriculture and Rural Areas.

Actors in the AIS

R&D institutes

The government plays a role in the governance and funding of the AIS, by setting, implementing and monitoring policy, as well as evaluating programmes, policies, knowledge and R&D organisations.

Knowledge generators include universities, research institutes, government bodies and companies. Most public research takes place in universities and they are the main actors in public research. There are more than 50 accredited university colleges, universities or other organisers of higher education, with at least 1 university and/or university college in every canton (Swiss Universities, 2021[10]). Apart from universities, some research institutes and private and public actors offer knowledge to the food and agriculture sectors.

Research is carried out by universities, applied science universities and vocational schools and colleges, while knowledge transfer and advisory services are carried out by cantons and certain private institutions. Key public institutions involved in innovation in agriculture and the food and nutrition sector at the national level are:

The Federal Office for Agriculture (FOAG).

The Federal Food Safety and Veterinary Office (FSVO).

The Federal Office for the Environment (FOEN).

The Federal Department of Economic Affairs, Education and Research (EAER):

The State Secretariat for Education, Research and Innovation (SERI).

The State Secretariat for Economic Affairs (SECO).

The Swiss Innovation Agency (Innosuisse).

26 cantons agricultural offices.

The Swiss National Science Foundation (SNSF), an independent agency.

Main education and research institutions in the agri-food sector are the Swiss Federal Research Institute for the Agri-food Sector (Agroscope), the Swiss Federal Institute of Technology (ETH Zurich), the Research Institute of Organic Agriculture (FiBL), the School of Agricultural, Forest, and Food Science (HAFL), the Vetsuisse (University of Zurich) and Zurich University of Applied Sciences (ZHAW), among many other universities. Agroscope is directly under the auspices of FOAG (AGRIDEA, 2021[9]). The cantons are responsible for the universities (including VetSuisse) and the universities of applied sciences (HAFL, ZHAW, University of Applied Sciences and Arts of Western Switzerland [HES-SO], etc.). These universities undertake both education and research in the areas of agriculture, forestry, food and environmental science (AGRIDEA, 2021[9]).

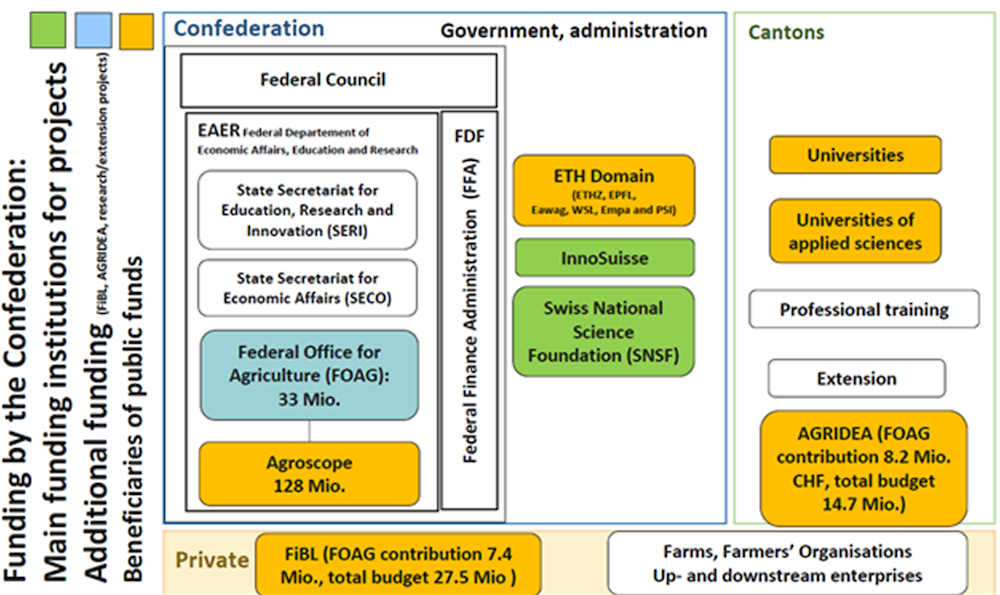

Agricultural research and education are funded by the federal government and by the cantons. The federal government finances the agricultural research institute Agroscope, a major research centre, and in part the FiBL. However, the FiBL is privately operated and receives private funding as well. The ETH Zurich agro sciences faculty is funded by the federal government. The cantons finance the agricultural schools as well as agricultural education and extension centres and higher agricultural training courses (AGRIDEA, 2021[9]). Box 4.1 describes the main public institutions of the AIS.

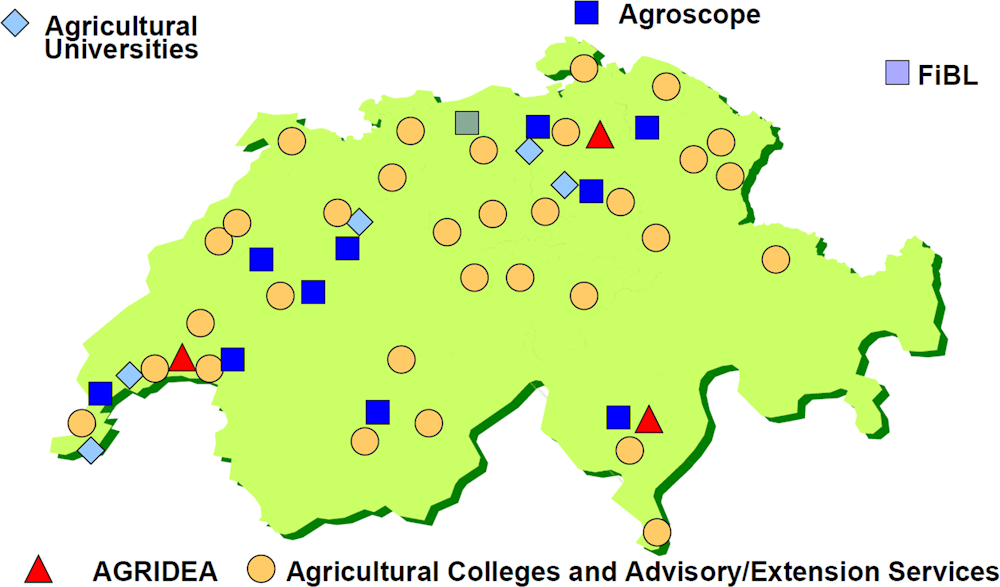

Public AIS institutions are located and spread out across the country (Figure 4.3). For instance, there are 5 agricultural universities, 11 Agroscope centres, 1 organic agricultural research centre (FiBL), 3 AGRIDEA centres and more than 30 agricultural colleges and advisory/extension services that provide agricultural technical assistance.

Figure 4.3. Public AIS institutions in Switzerland

Box 4.1. Brief description of main AIS institutions

The Federal Office for Agriculture (FOAG) is the Swiss Confederation’s competency centre for all things relating to the agricultural sector. The FOAG is a part of the Federal Department of Economic Affairs, Education and Research (EAER) and has under its authority Agroscope, which is the Swiss centre of excellence for agricultural research. The department, on the basis of the Agricultural Act, promotes and designs agricultural policy instruments and implements them together with cantonal authorities and farmers’ associations (FOAG, 2021[12]).

The Federal Food Safety and Veterinary Office (FSVO) promotes the health and well-being of humans and animals through enforcing measures of food safety and healthy eating for humans, and animal health and welfare for animals. The department is supported by the Federal Food Chain Unit in implementing legislation in the areas related to plant health, food and feed, and animal diseases and welfare. The FSVO is organised into specialist divisions that work closely with other parties in their respective disciplines. This includes, for example, the Swiss Veterinary Service in addition to a number of committees to incorporate expert knowledge into policy design and development (FSVO, 2021[13]).

The Federal Office for the Environment (FOEN) is responsible for the sustainable use of natural resources such as land and water domestically, as well as for international environmental policy. It is also responsible for the protection against natural disasters, safeguarding the environment and human health, and preserving biodiversity and landscape quality. This is meant to tackle the main changes facing the environment through designing policies related to climate protection, biodiversity conservation and sustainable resource management. The FOEN also creates a space for dialogue between the different cantons as well as other types of stakeholders and actors on a variety of topics related to the environment (FOEN, 2021[14]).

The State Secretariat for Economic Affairs (SECO) is the Swiss federal government’s centre of expertise in key matters related to economic policy. The centre aims to ensure sustainable economic growth, improve employment and fair working conditions, and provide a stable environment for regulatory, economic and foreign trade policy. SECO is responsible for a number of directorates such as the Labour Directorate, Economic Policy Directorate, Foreign Economic Affairs Directorate, Promotion Activities Directorate and the Organisation, Law and Accreditation Directorate. Through its directorates’ operations, the agency helps design legislations related to export and location promotion. The secretariat also addresses issues related to economic policy, foreign trade and economic co‑operation, involvement in international organisations and tourism promotion (SECO, 2021[15]).

Agroscope, under the auspices of the FOAG, is the Swiss centre of excellence for agricultural research. The centre works to promote sustainable agriculture and growth of the food sector, while preserving the environment and its resources, thereby contributing to an improved overall quality of life. As such, Agroscope is responsible for R&D along the entire value chain of the agro-food sector including agriculture, nutrition and the environment. It also provides guidance for policy-making authorities and encourages knowledge exchange and technology transfer with different actors in the field (Agroscope, 2021[16]).

The Swiss Federal Institutes of Technology (ETH Zurich) is a university of science and technology that is dedicated to the study of a varied range of disciplines, which allows knowledge to be shared and combined in original and future-oriented ways. It consists of 16 departments covering a broad academic spectrum with various strategic initiatives, competency centres and networks that encourage interdisciplinary co-operation. The university is built upon Swiss values of freedom, individual responsibility, entrepreneurial spirit and open-mindedness, which has granted it a leading rank amongst scientific educational institutions globally (ETH Zurich, 2021[17]).

The Research Institute of Organic Agriculture (FiBL) involves non-governmental public institutions or non-profit organisations functioning as foundations or associations in various European countries. They are legal independent entities that group themselves under the partnership of the FiBL Group. The common goal of these entities is the continuous development of organic agriculture and the creation of added value along the chain of the food system through research, knowledge transfer, advisory services, hands-on projects and public relations expertise. The group works in partnership with the actors and stakeholders in the field on projects related to food security and nutrition, preserving natural resources and promoting organic farming and a sustainable agro-food system. The FiBL Group currently comprises FiBL Switzerland (founded in 1973), FiBL Germany (2001), FiBL Austria (2004), ÖMKi (Hungarian Research Institute of Organic Agriculture) (2011), FiBL France (2017) and FiBL Europe (2017) (FIBL, 2021[18]).

The School of Agricultural, Forest, and Food Science (HAFL) is an institution that teaches and researches in disciplines related to agricultural, forestry and food sciences. It uses a holistic, multifaceted and innovative scientific research approach to develop solutions to address current and future challenges in a number of areas pertaining to its five divisions (agriculture, forest science, food science and management, MSc programmes, and transdisciplinary subjects) and it does so through two main areas of operations teaching as well as research, consulting and continuing education (BFH, 2021[19]).

AGRIDEA is the Swiss agricultural extension centre, mainly providing support for cantonal extension services and any organisation working in agriculture. It acts as a competency centre for the production, exchange and distribution of research knowledge and expertise. AGRIDEA provides a network for various kinds of small or big actors in the agricultural sector and rural areas. The centre has three locations in Cadenazzo, Lausanne and Lindau that are committed to delivering cutting-edge solutions and research publications related to efficient and sustainable agriculture and vigorous rural development. As such, AGRIDEA plays a central role in the Swiss agricultural knowledge system (AKIS), which connects science and farming and creates new synergies that open a number of opportunities in the agro-food industry (AGRIDEA, 2021[20]).

Established in 2013, the State Secretariat for Education, Research and Innovation (SERI) is part of the federal department of EAER. It is responsible for building bridges between these different sub‑disciplines knowing that they are interdependent and all connected to the overall well-being and prosperity of Swiss society. The department is leading collaboration on national and international matters related to education, research and innovation (ERI), and is responsible for co-ordination efforts of the canton authorities, private sector actors, academic institutions as well as other types of organisations. SERI has an annual total budget of CHF 4.5 billion for the year 2021, which is distributed amongst its 8 divisions that specialise in different areas of ERI design and implementation. This means that SERI is responsible for the design and implementation of innovation policy at the federal level, through its application of the Research and Innovation Promotion Act. It also provides funding for projects that are put forward by the SNSF (see below), while overseeing the conduct of Innosuisse. Between 2017 and 2020, SERI allocated CHF 2.5 billion towards projects put forward by the European Framework Programmes for Research and Innovation and CHF 625 million towards projects put forward by Innosuisse (SERI, 2021[21]).

The Swiss National Science Foundation (SNSF) is the leading Swiss institution for promoting science and research and was established in 1952 to provide financial aid to research projects and initiatives and to support upcoming scientists in a variety of academic disciplines. In 2020, the SNSF had a budget of CHF 937 million, which was awarded entirely to new proposals adding to over 6 000 projects employing 20 000 researchers (SNSF, 2021[22]). The foundation is at the forefront of research collaboration and is leading many initiatives in conjunction with higher education institutions, all while conducting an evaluation of third-party-led research projects. The SNSF is committed to maintaining the reputable level of quality of Swiss research by operating under high standards of excellence and accountability. To continue to do so, the foundation is proud to be operating autonomously as a private entity that values fairness, impartiality and equal access to opportunity (SNSF, 2021[22]).

Innosuisse is the Swiss Innovation Agency responsible for promoting R&I in areas of science that would benefit the Swiss economy and society at large. The agency employs a special outlook on the importance of combining knowledge and R&D and promotes collaboration between private market entities and academic institutions to maintain a sustainable innovative state of the economy that nurtures start-ups. However, Innosuisse provides support for projects in accordance with the subsidiarity principle, that is it only supports projects if there is a possible risk of lost market potential and implementation of innovation without funding. Therefore, the yearly budget varies considerably depending on the number of project proposals approved by the agency. For example, during the first 6 months of 2020, 208 out of 359 projects received were approved, thus amounting to a total budget of CHF 63 million, for the first half of 2020. In addition to its regular funding activities, the agency also launched 2 new funding initiatives in 2021 and, during the first 6 months of the year, 72 projects under the impulse innovation programme were approved, totalling CHF 33.1 million (Innosuise, 2021[23]). Innosuisse also benefits from close collaboration with both SNSF and SERI at the national level, in addition to international exchanges through its membership of the European network of leading national innovation agencies (TAFTIE) (Innosuise, 2021[23]).

Vocational training

Vocational training is a common responsibility of the Swiss Confederation that sets the legal framework and the cantons that offer the training courses, e.g. in agricultural colleges. These colleges provide vocational education and training to people aged between 16 and 20 years old, professional education and training to people aged 20 and older and to farmers with an advanced federal diploma. Moreover, the professional organisations define the content of the vocational training, for example its objectives, requirements and topics, among others. The professional organisations responsible for vocational training in the field of agriculture have recently started a reform process. This process will consider and take into account emerging concerns and issues such as the role of digitisation, entrepreneurial issues and innovation skills, resource management, biodiversity, etc.

Advisory services

Knowledge intermediaries are those sharing and spreading knowledge between actors. Cantons (the public sector) have traditionally provided advisory services in the Swiss AIS. Agricultural offices of the 26 cantons are responsible for agricultural advisory services, as well as for the cantonal veterinarians and food control authorities. The offices provide extension services such as information and documentation for farmers, training courses, advice/extension in public and private interest, and project support. Since 2008, the cantons’ public agricultural advisory services have been financed exclusively by the cantons. Some cantons like Bern, Geneva, Jura, Neuchâtel, Vaud and Zurich, grant (full or partial) advisory mandates to the cantonal farmers’ associations, which then operate the cantonal advisory services. Moreover, the cantonal agricultural advisory services are independent. They do not depend on the FOAG (AGRIDEA, 2021[9]).

Private sector and non-profit organisations also provide extension services. AGRIDEA, for example, is a non-profit association. The services of the three AGRIDEA advisory centres are financed by a mandate from the FOAG, membership fees and private funds from the sale of products. AGRIDEA provides services to cantons (training courses, publications, information technology [IT] solutions and other services), while for farmers it mainly provides publications and IT solutions (AGRIDEA, 2021[9]).

Private sector actors include several firms and consultants with varying competencies and knowledge areas. Some companies provide advice to farmers, e.g. on plant production and risk management. Companies selling stable equipment provide the main advice on silos and provide service and advice on robot milking equipment. A number of research centres at universities aim to have close relationships with businesses to diffuse knowledge and innovation. Some of these are directly related to the agricultural and food sectors. Private or farmer-based advisory services such as agricultural fiduciary services play an important role in the areas of accounting, business and tax advice. The Swiss Farmers’ Association runs a private consultancy centre (Agriexpert) on topics such as fiduciary services, legal issues, farm transfers, etc.

As mentioned above, advisory services are provided at the canton level by the agricultural offices and are generally well perceived. Nevertheless, in general, AIS actors may need to improve their co‑ordination and collaboration mechanisms, particularly to improve the link between basic research, applied research, advisory services and technology adoption by the farmer. Knowledge exchange and transfer between research and agricultural sector in advisory services need to remain up to date. There are many factors that influence this exchange and transfer of practical experience toward advisors and researchers in the field of agriculture. In recent times, there is increased ease of exchange and access to knowledge and information sharing due to the effects of digitalisation and the central role played by the Internet. This facilitates the emergence of new opportunities, which fit the changing information needs and expectations regarding access to AIS topics. At the same time, the novelty of some aspects of digitalisation in application poses a challenge for agricultural research (AGRIDEA, 2021[20]).

AGRIDEA mainly provides services to cantons but also has direct contacts with farmers. The areas of consultancy that are most in demand are business and farm management, diversification and risk mitigation, agro-environmental measures and financing concerns. These advisory services are financed through national and cantonal public government funds and private contributions such as membership fees and cost-recovery from farmers.

Agricultural extension lies within the individual jurisdiction of the 26 cantons. As such, it is in many cases small in structure; therefore, cantons that have exceptionally small agricultural sectors seek co-operation with their neighbouring cantons. However, on the national level, cantons participate in a common forum for the exchange and protection of interests (AGRIDEA, 2021[20]).

Some of the most used forms of communication concerning advisory services include telephone, face-to-face meetings on or off the farm, virtual communication channels and group assistance outside the farm. Advisory services are dominated by individual advice followed by group advice. These services are provided by a group of highly qualified individuals – 80% of whom have over 3 years of professional experience in the field. Additionally, there is a relatively high level of collaboration in the sector between public authorities, farmer-based or professional groups, and academic or research institutions. Agricultural extension services continue to thrive under public support in areas of nutrient production and pesticide use, conservation of biodiversity, and value creation within the sector (AGRIDEA, 2021[20]).

Farmers and farmer organisations

Farms structure in Switzerland continues to consolidate. The number of farm holdings has decreased by around 30% from 2000 to 2020 (Table 4.2). In 2020, there were 49 363 agricultural holdings, which is a decline of 1.3% compared to 2019 (FSO, 2021[7]). Size holdings greater than 10 hectares represent 72% of total holdings. In 2020, around 15% of total farms are using organic production systems. The average farm size in Switzerland was 21 hectares in 2020 and the country has witnessed a structural change as farm size has increased constantly since 1990, when the average was around 11 hectares. There are around 150 000 employees in the agri-food subsector in the country (FSO, 2021[7]).

Table 4.2. Farm holdings by size, 2000 and 2020

|

Farm size |

2000 |

Percentage |

2020 |

Percentage |

|---|---|---|---|---|

|

Less than 1 hectare |

3 609 |

5.1 |

2 064 |

4.2 |

|

From 1 to 3 hectares |

4 762 |

6.8 |

3 139 |

6.4 |

|

From 3 to 5 hectares |

5 393 |

7.6 |

2 408 |

4.9 |

|

From 5 to 10 hectares |

13 149 |

18.6 |

6 284 |

12.7 |

|

From 10 to 20 hectares |

24 984 |

35.4 |

14 005 |

28.4 |

|

From 20 to 30 hectares |

11 674 |

16.6 |

10 287 |

20.8 |

|

From 30 to 50 hectares |

5 759 |

8.2 |

8 114 |

16.4 |

|

50 hectares and more |

1 207 |

1.7 |

3 062 |

6.2 |

|

Total |

70 537 |

100.0 |

49 363 |

100.0 |

Source: FSO (2021[7]), Federal Statistics Office, https://www.bfs.admin.ch/bfs/en/home.html.

Farmers are organised in different chambers by sub-sector. The Swiss Farmers’ Union is the umbrella organisation of Swiss agriculture. It is made up of representatives from 25 cantonal professional organisations and various trade associations.

Farmers are the main users of knowledge and innovation generated in the AIS. The agricultural structure is characterised by small- and medium-sized enterprises (SMEs), which can affect their innovative capacity. Traditionally, farmers participate in field experimentation but, even when farmers’ involvement in innovation generation projects is highly regarded, adoption of innovation in some agricultural sub-sectors is relatively lower than the national average (AGRIDEA, 2021[9]).

The farmers’ organisations under the Swiss Farmers’ Union play a key role in the AIS. Among other things, they are also responsible for designing vocational training for farmers. The Vocational Training Organisation (OdA AgriAliForm) groups ten organisations from the agricultural and equestrian sectors which are involved in vocational education and training (AGRIDEA, 2021[9]).

Agroindustry

Upstream and downstream value-added partners play a key role for agricultural enterprises. Upstream are the suppliers of plant protection products, fertilisers, animal feed, machinery, equipment and services that provide the inputs necessary for agriculture. Upstream suppliers are important intermediaries of innovation on farms. Downstream is the whole agri-food industry as a consumer of agricultural products. Domestically, a significant market position in the upstream and downstream value chains is held by the FENACO agricultural co-operative association and its affiliated regional agricultural co-operatives. The agricultural co-operatives are run by farmers. FENACO is an important supplier to the farms and the food industry with high market shares (AGRIDEA, 2021[9]).

National label certification associations such as Bio Suisse or IP-Suisse also are farmer-based and have cantonal sections. Also important are the sectoral associations (Interprofession milk, Proviande, Swissgranum, Swisspatat, etc.), which involve the players along the entire value chain, from production to processing and marketing, and play a major role in industry standards, market issues, representation of interests and sales promotion, among other things.

Business development, innovation and competitiveness of the farm sector and the food industry are hindered by trade policies that raise the prices for imported inputs and may shield producers from the competition (OECD, 2014[4]). Successful participation in such value chains requires unencumbered access to the best inputs at the lowest prices as well as regulations and technical standards that facilitate the exchange of semi-processed and finished products with partner countries.

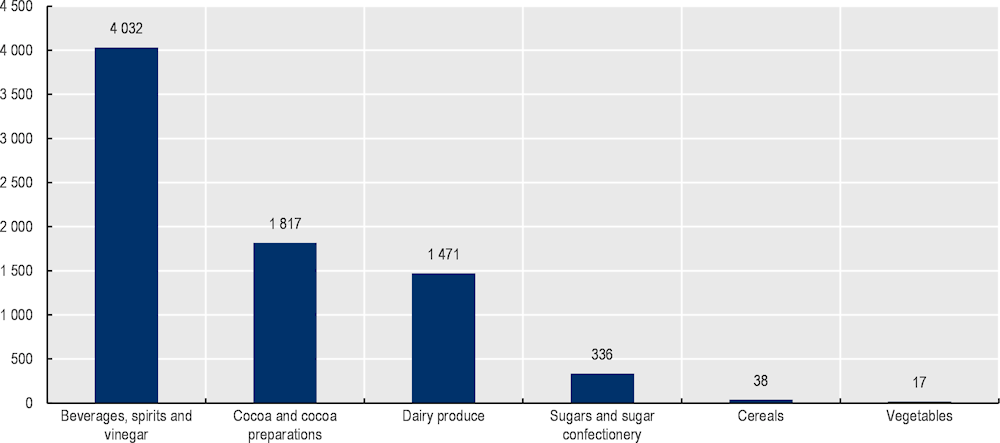

The Swiss food and beverage industry overall has a relatively strong position in comparison to the main competitors. However, this situation is mainly driven by particular sub-sectors such as cocoa and chocolate manufacturing or beverages (e.g. mineral water): these subsectors count for more than 70% of total agri-food exports. Over recent years, as is evident in 2019 (Figure 4.4), Switzerland’s leading export category under the agro-food sector has been headed by beverages at USD 4.03 billion, cocoa and cocoa-related products at USD 1.8 billion and dairy products at USD 1.47 billion (UN-COMTRADE, 2021[24]).

Figure 4.4. Swiss main agri-food exports, 2019

On the other hand, some of the less competitive sub-sectors in Switzerland are meat and dairy, which rely mainly on domestic primary agriculture for their inputs, although some dairy producers successfully serve high-value niche markets. These industries as well as the weak animal feed sector have to pay relatively high prices for their material inputs. Additionally, these less competitive sectors have experienced relatively low labour productivity growth and are relatively labour intensive.

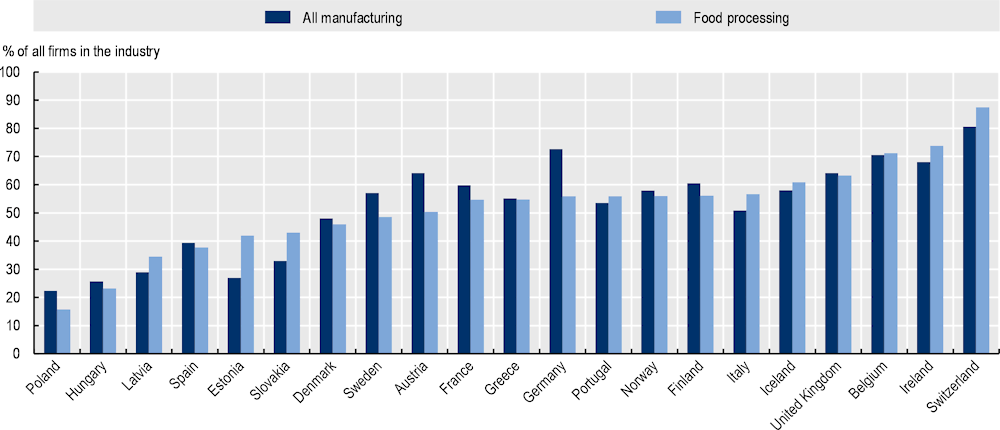

Lastly, according to the Eurostat innovation survey (2017[25]), food processing firms in Switzerland tend to be more innovative than all-manufacturing firms. Around 87.5% of food processing firms reported having introduced some innovation in 2012-14 compared to 80.6% of all-manufacturing firms (Figure 4.5). The share of innovative firms among food processing firms is higher in Switzerland than in other countries in the EU. In international comparison, the gap between food processing and all-manufacturing firms in Switzerland is significant without being too wide.

Figure 4.5. Share of innovative firms in selected countries, 2014

Source: Eurostat (2017[25]), Community Innovation Survey, http://ec.europa.eu/eurostat/data/database.

Networks

The AIS has several thematic networks at the national and cantonal levels, which play a major role in the exchange of knowledge, experience, networking and solving current problems. The networks mainly bring together experts, researchers, decision-makers, multipliers and also farmers. AGRIDEA alone, for example, is involved in over 150 thematic networks every year.

Agricultural media play an important role in the transfer of knowledge between the AIS actors and farmers. This media report on new products, practical application of innovations, examples, key research results and important technical or agricultural policy topics. The most important ones are BauernZeitung (farmer-owned), Schweizer Bauer (private), and Agri (farmer-owned, French-speaking Switzerland). Other publications include agricultural research (Agroscope), cantonal farmers’ association newspapers, newsletters, etc. (AGRIDEA, 2021[9]).

Funding of the AIS

The public sector continues to be the main source of funding in the AIS of Switzerland, with the SNSF as the leading contributor (CHF 938 million total budget in 2020 for all subsectors of the economy) to research performed in public or private organisations (SNSF, 2021[22]). Based on observed allocations, government budget expenditures on R&D for agriculture are typically more variable than total R&D expenditure over time, reflecting changes in government priorities from year to year. However, private funding in agriculture is also relevant, with total business expenditures on R&D (BERD) in Switzerland amounting to around 2.5% of GDP in 2016 (OECD, 2019[8]). Nonetheless, agriculture R&D represents only 2.2% of total R&D public outlays (FSO, 2021[7]).

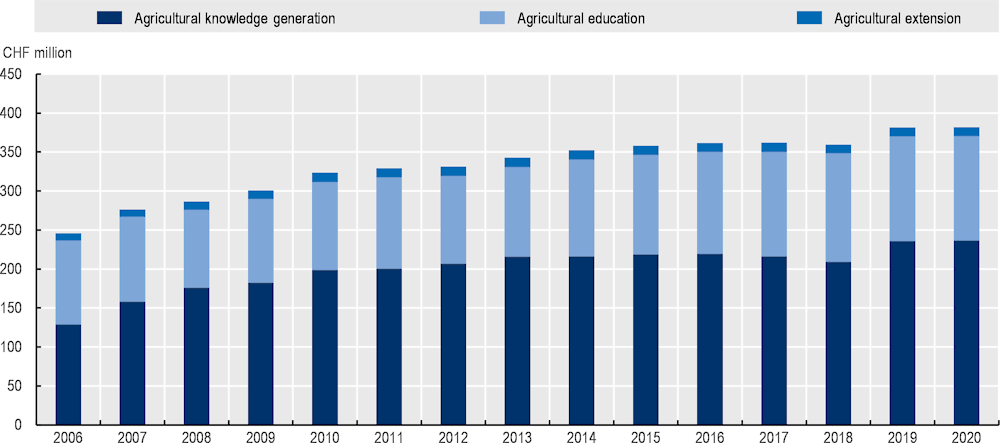

Since 2006, there has been a gradual increase in spending on the development of AIS, with agricultural knowledge generation receiving most of the funding, from close to CHF 250 million in 2006 to around CHF 375 million in 2020. These changes also depict the difference in the distribution of the funds. While agricultural knowledge generation still receives the highest percentage, funding for agricultural education has also grown compared to previous years (Figure 4.6).

Figure 4.6. Evolution and composition of the AIS public budget, 2006-20

Source: OECD (n.d.[26]), “Producer and Consumer Support Estimates”, http://dx.doi.org/10.1787/agr-pcse-data-en.

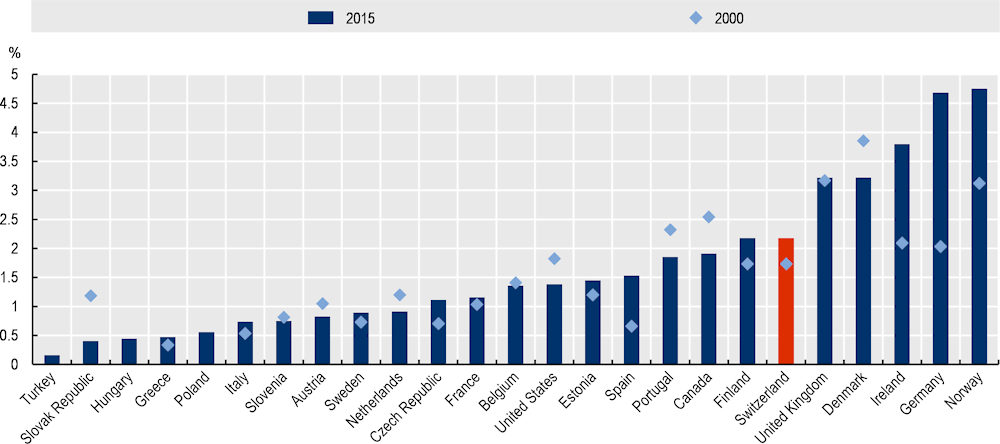

When looking at trends in research intensity within R&D in the agricultural sector, it is evident that Switzerland ranks amongst the mid- to high-performing countries of the OECD (Figure 4.7). Swiss government expenditure on agricultural R&D grew from 1.7% to around 2.2% share of total expenditure on R&D between 2000 and 2015 respectively.

Figure 4.7. Agricultural R&D intensity in selected countries, 2000 and 2015

Note: 2002 instead of 2000 for Estonia. Public expenditure on R&D is government budget appropriations or outlays for R&D comes from OECD R&D statistics, and value-added from OECD GDP statistics.

Source: OECD (2017[27]), OECD Research and Development Statistics, https://stats.oecd.org/ (Accessed 1 September, 2022).

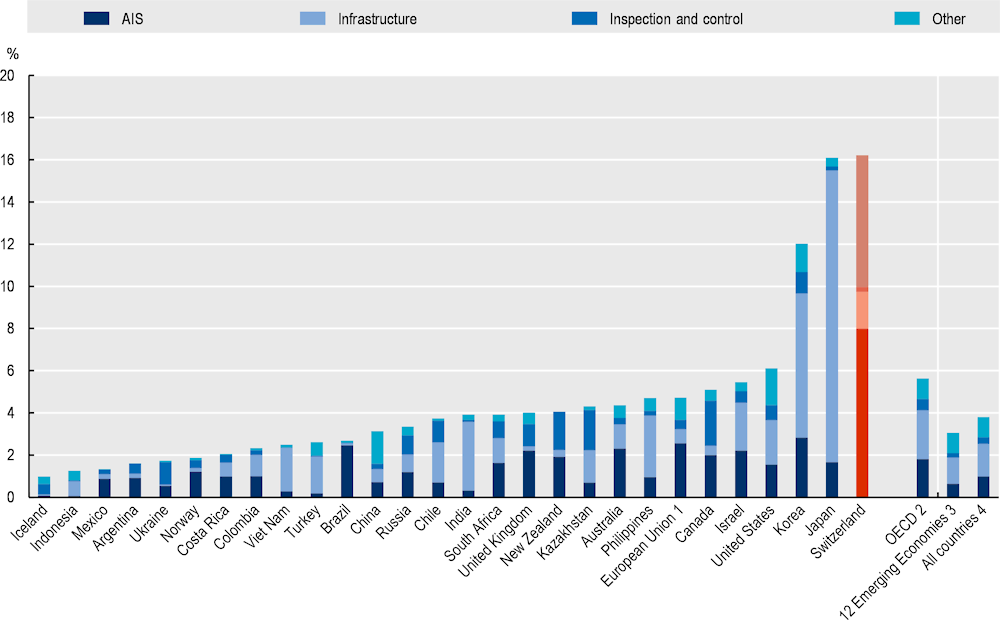

Almost half of the General Services Support Estimate (GSSE) expenditure finances the AIS. AIS, infrastructure expenditure, and inspection and control, among other support services, have one of the highest shares in agricultural value-added and composition in Switzerland (Figure 4.8). While Japan and Korea have a higher share of infrastructure support services, Switzerland ranks the highest in AIS support services provided. Between 2018 and 2020, the country had a 16% share of the support services in agricultural value-added.

Figure 4.8. General Services Support Estimate, share in agricultural value-added and composition, 2018-20

Note: “AIS” refers to the agricultural knowledge and innovation system. “Other” includes the marketing and promotion, cost of public stockholding and miscellaneous categories of the GSSE. Countries are ranked according to the share of total GSSE in agricultural value-added.

Due to missing value-added data, the 2018-20 average GSSE is related to agricultural value-added data for 2017-19 except for Japan and the United States (2016-18) and for Canada and New Zealand (2015-17).

1. EU28 for 2018-19, EU27 plus UK for 2020.

2. The OECD total does not include the non-OECD EU member states. Latvia and Lithuania are included only for 2018-20. Costa Rica became the 38th member of the OECD in May 2021. In the data aggregates used in this report, however, it is included as one of the 12 emerging economies.

3. The 12 emerging economies include Argentina, Brazil, China, Costa Rica, India, Indonesia, Kazakhstan, the Philippines, the Russian Federation, South Africa, Ukraine and Viet Nam.

4. The “All countries” total includes all OECD countries, non-OECD EU member states and emerging economies.

Source: OECD (2021[3]), Agricultural Policy Monitoring and Evaluation 2021: Addressing the Challenges Facing Food Systems, https://dx.doi.org/10.1787/2d810e01-en; OECD (n.d.[26]), “Producer and Consumer Support Estimates”, http://dx.doi.org/10.1787/agr-pcse-data-en.

The main public institutions that provide funding to the AIS are the Federal Council through Innosuisse, the SNSF and FOAG, while the main beneficiaries are the universities and institutional research centres like Agroscope (Figure 4.9).

Figure 4.9. Main public institutions and funding of the AIS for 2019, in CHF Million

International co-operation in food and agricultural R&D

International co-operation in agricultural R&D offers universal benefits. While this is generally true given the public good nature of many innovations in agriculture, it is particularly the case where global challenges are being confronted (e.g. climate change) and when initial investments are exceptionally high. The benefits of international co-operation for national systems stem from the specialisation it allows and from international spill-overs. In countries with limited research capacity, scarce resources could then be used to better take into account local specificities.

Switzerland has a long tradition of international co-operation in agricultural R&D. A number of forms of international co-operation are specifically prevalent in the Swiss AIS and are often financed or operated through the main current research funding organisations.

For example, the European Union (EU) Framework Programme for Research and Innovation was first established to encourage cross-border collaboration on research amongst countries in the EU in addition to within them, individually. It currently acts as a tool to create opportunities for R&I in a number of areas. Switzerland has been an active participant in this framework, though it is considered a non-associated third country for the submission of project proposals in programmes and initiatives. As such, project participants based in Switzerland can apply to participate in collaborative projects, which will not be funded by the European Commission but by the Swiss SERI. This means that there are a number of limitations that apply to Swiss participants as they cannot be responsible for co-ordination of projects despite taking a lead in it, for example. However, with a total budget of EUR 95.5 billion, the framework is sure to attract a lot of promising project proposals from participants in member countries and Switzerland can learn by association from collaborating on such projects with them (SERI, 2021[21]).

Agricultural policies in Switzerland

Although agriculture plays a relatively minor and declining role in the Swiss economy, the sector is perceived as an important element in maintaining food security and increasingly as a provider of positive externalities such as environmental benefits and animal welfare, which are highly valued by Swiss society. Hence, agricultural policies and related support to agriculture are an important part of the Swiss political landscape (OECD, 2015[28]). Agricultural policies in Switzerland seek to find a balanced solution for addressing a variety of commercial, social and environmental objectives. The result is a system of market protection in combination with an elaborate set of payments to farmers that provides income support as well as incentives for certain types of farming practices (OECD, 2015[28]).

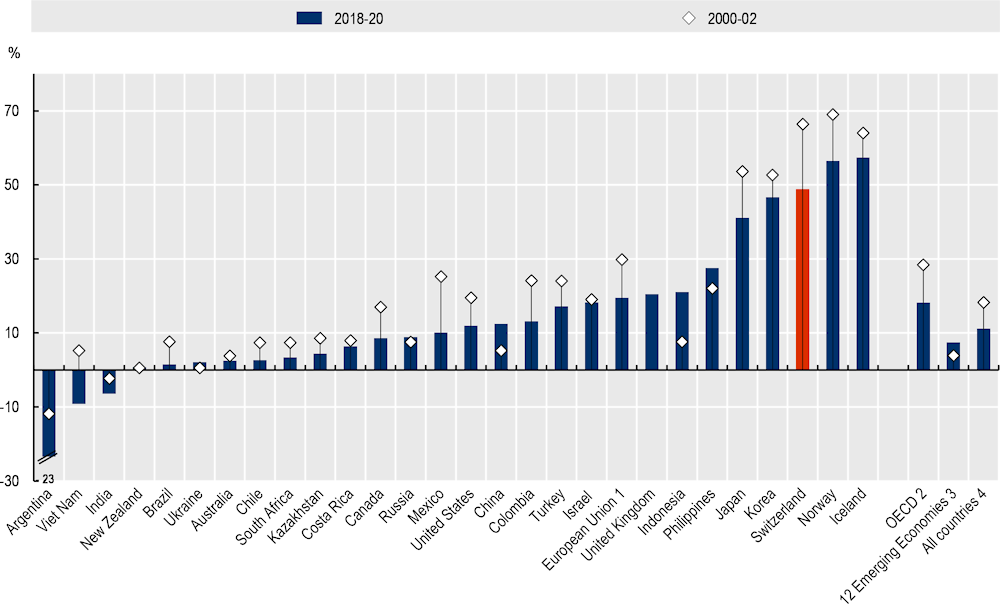

The level of agricultural support in Switzerland, as measured by the Producer Support Estimate (PSE) as a share of gross farm receipts, has declined gradually but is still one of the highest amongst OECD countries. Figure 4.10 shows that Switzerland is one of the top three countries that support the most its agriculture, just after Iceland and Norway, but way above the OECD average. Support to producers remains high: around 50% on average in 2018-20, almost 3 times the OECD average (OECD, 2021[3])

Figure 4.10. Producer Support Estimate by country, 2000-02 and 2018-20

Note: Countries are ranked according to the 2018-20 levels.

1. EU15 for 2000-02, EU28 for 2018-19 and EU27 plus UK for 2020.

2. The OECD total does not include the non-OECD EU member states. Latvia and Lithuania are included only for 2018-20. Costa Rica became the 38th member of the OECD in May 2021. In the data aggregates used in this report, however, it is included as one of the 12 emerging economies.

3. The 12 emerging economies include Argentina, Brazil, China, Costa Rica, India, Indonesia, Kazakhstan, the Philippines, the Russian Federation, South Africa, Ukraine and Viet Nam.

4. The “All countries” total includes all OECD countries, non-OECD EU member states and emerging economies.

Source: OECD (2021[3]), Agricultural Policy Monitoring and Evaluation 2021: Addressing the Challenges Facing Food Systems, https://dx.doi.org/10.1787/2d810e01-en; OECD (n.d.[26]), “Producer and Consumer Support Estimates”, http://dx.doi.org/10.1787/agr-pcse-data-en.

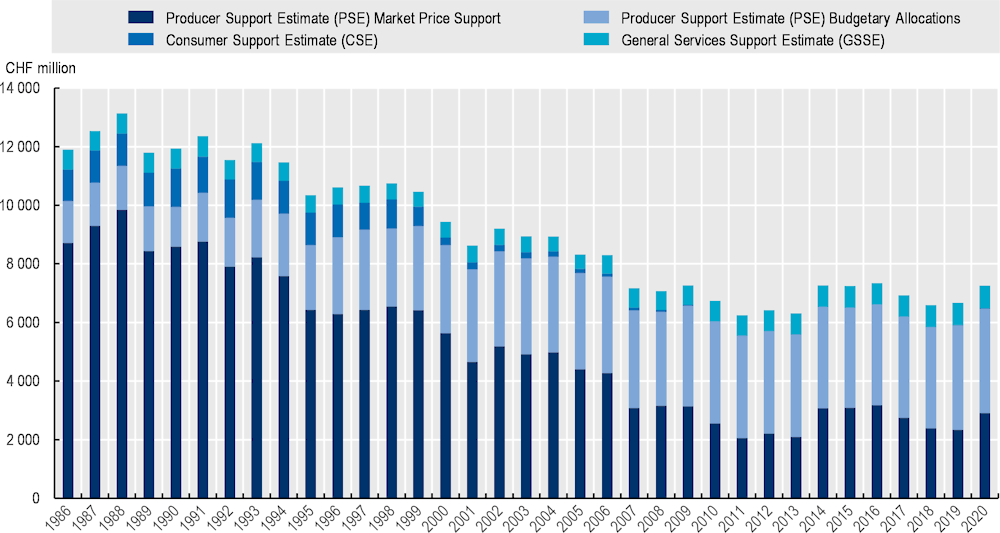

There have been some important changes in the structure of support, as direct payments partly replaced market price support (MPS). MPS, mainly due to tariff rate quotas (TRQs) with high out-of-quota tariffs, remains the main component of support. Over the past 30 years, MPS fell from 80% to around 50% of total producer support. Nonetheless, average domestic prices were on average 46% above world prices in 2018-20 (OECD, 2021[3]). Potentially most production- and trade-distorting support (mainly MPS) also declined from around 80% to less than 50% of producer support between 1986 and 2020, while payments considered less distorting grew (Figure 4.11).

The country provides direct payments to farms (almost all subject to environmental cross-compliance). These increased over time: while they represented around 20% of support to farmers in the 1980s, their share rose to almost 50% in recent years. Most are general area payments to all agricultural land, payments to maintain farming in less favoured conditions and payments to farmers who voluntarily apply stricter farming practices related to environmental and animal welfare. Expenditures for general services (GSSE) are high in Switzerland. GSSE relative to agricultural value-added rose from 11% in 2000-02 to 16% in 2018-20 and is among the highest of countries covered by this report. Total support for agriculture as a share of GDP fell from 2% in 2000-02 to 1% in 2018-20 (OECD, 2021[3]).

Figure 4.11. Switzerland: Level and Total Support Estimate (TSE) composition by support categories, 1986-2020

Source: OECD (2021[3]), Agricultural Policy Monitoring and Evaluation 2021: Addressing the Challenges Facing Food Systems, https://dx.doi.org/10.1787/2d810e01-en; OECD (n.d.[26]), “Producer and Consumer Support Estimates”, http://dx.doi.org/10.1787/agr-pcse-data-en.

Agricultural policies’ performance can be improved by making the distinction between policies that address market failures (the provision of positive externalities and public goods as well as the avoidance of negative externalities) and those that address income problems. Current policies combine both aspects and seek to address market failures by a combination of cross-compliance conditionalities and differential payment rates to stimulate certain farming practices. Direct payments have reached such a high level relative to what farmers earn by selling their products on the market that price and market signals appear to play only a secondary role in guiding their decisions. This hampers structural adjustment in the farm sector and, more generally, limits the development of an innovative and competitive food-producing sector that contributes to food security objectives and continues to produce high-quality products (OECD, 2015[28]).

The competitiveness of the Swiss food and beverage industry is almost entirely driven by sub-branches that source most of their raw material inputs abroad or where inputs are non-agricultural (chocolate, coffee and beverages like mineral water). As previously seen, chocolate together with beverages accounts for 70% of the exports of the Swiss agro-food industry. While meat and dairy processing continue to be less competitive and rely on agricultural public support (OECD, 2015[28]; UN-COMTRADE, 2021[24]).

Specific Swiss initiatives that foster agri-food innovation

Knowledge diffusion and adoption are some of the most difficult challenges in R&D and the knowledge and innovation system. Policy incentives for the adoption of innovation include a wide range of regulatory and financial approaches, including business investment support and support for public-private co‑operation arrangements and participation in networks. In primary agriculture, training, extension and advisory services can facilitate the transfer and successful adoption of innovation (OECD, 2014[4]).

In the case of Switzerland, given the relatively large number of small-scale farmers, extension and advisory services become essential. Advisory services are crucial in facilitating farmers’ access to technology and knowledge, in farmers’ effective participation in innovation networks and in the ability to formulate their specific demands – in particular, to support the diffusion of innovation in small-scale farms and agro-firms.

R&D projects

Switzerland has an important number of initiatives on R&D, for instance, the platform Projets de recherche, évaluations et études externes provides access to research and evaluation projects and external studies which are supported by the FOAG. Projects range from the field of plant protection initiatives to sustainability, water, healthcare, etc. The platform provides both shorter summaries of the projects as well as longer detailed versions. This is meant to share knowledge and provide ideas for future projects that can build upon the blueprints of the existing projects on this database. Users can search for projects by category (field), type, project status and period. The projects listed here represent only a small fraction of all R&D projects; moreover, most projects carried out by Agroscope, FiBL etc. do not receive direct funding from the FOAG.

Steady investment in R&D projects is required to improve agriculture’s sustainability. At the canton level, there are many initiatives like the one in the canton of Vaud, for example (which accounts for 10% of the Swiss agricultural surface), which offers a supportive environment for innovation in the agro-food sector and encourages collaboration between researchers, entrepreneurs, and cantonal and federal entities (Vaud, 2020[29]).

Furthermore, for example, in the area of Swiss agricultural R&D, certain players are leading the way for the future of innovation in this field. One of them is the Communauté d’Études pour l’Aménagement du Territoire (CEAT), which is a pioneering research institution that works on projects dealing with territorial planning. Another player is Agroscope, which is making incredible headway in identifying future challenges in the Swiss agricultural and food processing sector and their respective smart farming solutions. Lastly, the Geodetic Engineering Laboratory (Topo) is producing research findings that revolve around geodesy, monitoring and cartography, sensors and satellite positioning for agricultural growth purposes (Vaud, 2020[29]). These are only a few examples of the innovation projects and initiatives carried out in the agro-food sector.

Agri-food Innovation hubs

For agricultural innovation, it is important to have a holistic approach to achieve sustainable agriculture. The country has many important hub initiatives. For instance, Swiss Food Research is a network that helps the generation and cultivation of ideas that promote the growth of innovation in the agro-food ecosystem. The Innosuisse innovation network is made up of over 160 businesses, start-ups, universities and research institutions all contributing to the growth of the Swiss agro-food industry. The network and its members operate under the guidance of the 17 goals for sustainable development proposed by the United Nations (UN). The canton of Zurich is home to many thriving projects that experiment with drones and imaging, agricultural robots, soilless agriculture and other forms of smart agriculture (Swiss Food Research, 2021[30]).

Another effort is the NTN IB Swiss Food Ecosystems – Funding Next Generation’s Food Ecosystem. The NTN Innovation Boosters are 12 initiatives supported by Innosuisse that intend to cultivate innovation through developing ideas and testing their implementation. The initiatives are built upon principles of knowledge exchange and transfer between all actors and stakeholders that are involved in the value chain of a sector. This includes educational and research institutions, private actors and public government entities that collaborate on 600 projects that have a collective allocation of CHF 21.3 million (Swiss Agro Food, 2021[31]).

Of the 12 NTN initiatives, the Swiss Food Ecosystem aims to provide cutting-edge solutions to current and future food and agricultural issues that require collaboration and a holistic approach to innovation. The initiative provides financial and administrative support to the promising ideas proposed and the support is provided through Suisse Agro Food Leading house. Many of the projects undertaken by the initiative focus on smart nutrition solutions, bioeconomy efficiency solutions and sustainable packaging solutions (Swiss Agro Food, 2021[31]).

The Swiss Food & Nutrition Valley is an innovation ecosystem that involves institutions based mostly in the canton of Vaud as well as the canton itself, but there are other cantons involved. It is a national initiative that is reinforcing and promoting innovation in food and agriculture both within Switzerland and internationally. It tackles challenges stemming from food security concerns, agricultural support and nutritional value by providing sustainable solutions for the future of food through the utilisation of advancements in science and technology. Switzerland has a high density of scientific research institutions and start-ups working in agro-food and robotics innovation, making it a cultivating environment for research in this sector to thrive and continue to benefit the world’s food concerns. This initiative brings together different actors and stakeholders with the aim of contributing to advances in five areas: precision nutrition, sustainable proteins, food systems 4.0, the future of farming and sustainable packaging (Swiss Food & Nutrition Valley, 2021[32]).

Precision nutrition is a scientific approach to explaining the relationship between the body’s genetic makeup and the food it consumes to explain trends in health and nutrition. Sustainable proteins refer to the process of producing proteins from alternative plant-based sources, but also to making meat production more sustainable. Food systems 4.0 is the process of digitalisation of food production that is implemented along the entirety of the food supply chain. This is also tied to the future of farming, which focuses on new ways of growing food using all sorts of sophisticated technologies to grow food sustainably and efficiently. Lastly, sustainable packaging is the process by which packaging is made to be more eco-friendly, having a minimal impact and a low carbon footprint to contribute to sustainable waste management (Swiss Food & Nutrition Valley, 2021[32]).

Agropole involves mostly the canton of Vaud and is a physical space (campus) that acts as an ecosystem for different types of innovators in the agro-food sector to work and collaborate. This stimulates innovation through knowledge exchanges between academics, farmers, manufacturers, retailers, investors and so on. Furthermore, this bridges the gaps in communication between actors on the food value and supply chain and thus, accelerate the rate at which sustainable innovative solutions are implemented in agriculture. As an accelerator, Agropole has helped bring many new sustainable solutions to the market in order to benefit the environment, economy and society to the point where it is now expanding its campus by constructing additional buildings to continue to grow its collaborative space (Agropole, 2021[33]).

The canton of Fribourg’s Agri & Co Challenge is an initiative that aims to attract promising project proposals – of which it currently funds 16 prize winners for 2018 collectively amounting to CHF 500 000 in total funding. This initiative has been a great propelling force towards increased collaboration on innovative projects, value chain creation and overall sustainable economic development. During its last period of selection in 2018, the initiative received 154 project proposals from 53 countries through its Relocation Program or Remote Collaboration Program. The Relocation Program allows the winners to operate at the St.-Aubin Innovation Space for 2 years under a CHF 30 000 grant in addition to administrative support. The Remote Collaboration Program, on the other hand, allows winners who are not interested in relocating their operation to still have access to Swiss markets and develop long-term partnerships with local actors (Agri&Co Challenge, 2021[34]).

Star’Terre is an inter-canton (Fribourg, Geneva and Vaud) platform that supports local projects aiming to solve food consumption issues in the Geneva region through agro-food innovative solutions. The platform supports farmers, entrepreneurs and other stakeholders in their efforts to innovate, share knowledge and create sustainable food production. It offers a base of knowledge systems that are meant to provide ease of access to information, a vast network of actors with diversified skillsets and resources, a hub that solves problems and answers questions, complementary dedicated administrative support and guidance, in addition to visibility to interested outside parties through a distinct platform (Star'Terre, 2021[35]).

Star’Terre is working to increase synergies between agriculture and innovation entrepreneurship, given that both are dependent on total commitment to daily business conduct while being subjected to changes in the market environment. The industries must constantly reinvent themselves to remain adapted to success factors while making sure that every stage of the value chain is operating as efficiently and as sustainably as possible. Many of these agro-entrepreneurial initiatives rely on funding from federal and regional entities, such as L’ordonnance sur la promotion de la qualité et de la durabilité dans le secteur agroalimentaire (OQuaDu), Projets de développement régional (PDR), AgrIQnet, and regiosuisse (Star'Terre, 2021[35]).

Innovativi Puure, in the canton of Zurich, works on making the agricultural sector adaptable to the types of changes that affect it by increasing its viability. It aims to motivate different actors in this sector to keep reinvesting in development and sustainability through employing process and specialisation expertise. This co-operative and goal-oriented initiative views innovation as a logical business process of renewal and remaining up to date. It offers services such as Puure info, Puure plan, Puure coaching, Puure project and Puure price to support farmers in operating sustainably and implementing change and innovative solutions. These services are meant to provide educational platforms and resources, guide through the process of a business plan creation, coach through the stages of project conception, help realise a project through financing and consulting, and ensure its sustainable success over the long run once it is up and running (Innovativi Puure, 2021[36]).

Another agricultural innovation initiative is the Konzept zur Förderung von Innovationen in der Landwirtschaft in the canton of Lucerne. This is a project lasting about 9 months and aims to promote innovation use in agricultural development. The project perpetuates a culture of evaluation of the business, agricultural and political factors that strengthen innovation within agriculture. It employs intensive research and subject experts to assess whether a proposed initiative fits the standards of the New Regional Policy (NRP) and is thus eligible for funding (regiosuisse, 2021[37]). Agricultural hubs are key for technology adoption and technology transfer, an example of these hubs is depicted in Box 4.2.

Box 4.2. Agri-Food innovation hubs: Incubators and accelerators

H-Farm: Linking innovation, entrepreneurship and education from a young age, Italy

Established in 2005, H-Farm is located in Sile River Natural Park in an area known as Ca’ Tron, one of the largest single agricultural estates in Italy, bordering Venice, in Italy’s northeast region. The multi-purpose facility operates as an incubator, business consultancy and education service provider for entrepreneurs looking to start new businesses and accelerate pre-existing ones. The philosophy of the founders of the hub is to place education at the heart of operations. It offers entrepreneurs a physical location in a rural region, housing, entertainment and educational services to support entrepreneurship and consists of a boarding school focused on the farming industry, a boarding school in Treviso with virtual classes (in virtual reality) for students 3 to 16 years old, various other programmes for young students and courses for entrepreneurs in a variety of industries.

Cultivator, Regina, Saskatchewan, Canada

Cultivator is a credit union lead accelerator focused on supporting companies working in the agri-tech space. While the location of the accelerator is technically within the metropolitan area of Regina, the hub is built for bringing talent to work on issues related to the agricultural sector and self-identifies as a hub for rural development in the Canadian Prairies. The programme started in 2019. The accelerator was built to create an innovation hub that provided the programming, resources, mentorship, funding and space founders to accelerate the growth of local tech start-ups. The initiative was founded by Conexus Credit Union (Conexus) and supports founders by providing coaching, mentorship, product development, customer discovery, investor readiness, space, perks and hiring support.

Source: H-Farm (2021[38]), About Us, https://www.h-farm.com/en/corporate/about; Cultivator (2022[39]), Homepage, https://www.cultivator.ca/ (accessed on 1 September, 2022).

Intellectual property rights (IPRs) for biological innovations

IPRs, knowledge networks and knowledge markets are of growing importance in fostering innovation. Reinforcing linkages across participants in the AIS (researchers, educators, extension services, farmers, industry, non-governmental organisations, consumers and others) can help match the supply of research to demand, facilitate technology transfer and increase the impact of public and private investments. Partnerships can also facilitate multi-disciplinary approaches that can generate innovative solutions to some problems.

The characteristics of different types of IPRs used to protect biological innovations are shown in Table 4.3. Following EU regulations, patents cannot be issued for new plant varieties or new breeds in relation to conventional biological processes. However, they can be granted if the invention is not specific to a specific sort of plant or specific breed. The Swiss Federal Institute of Intellectual Property issues patents in their modern forms in line with the patent regulation. It works alongside governmental agencies, trade groups and businesses to administer Swiss indications of source (tells consumers the geographic origin of a product, where it was produced or processed) both within Switzerland and internationally.

Plant variety protection is similar to an issued patent. These rights declare that the party that has created a new plant variety has reserved all rights to it. The FOAG issues these rights under Article 7 of the Agriculture Act and there is a requirement that the plant should be new, distinguishable, uniform and stable. The protection means that no other actor-exempt breeders can use the specific plant or identical plant variations in any form.

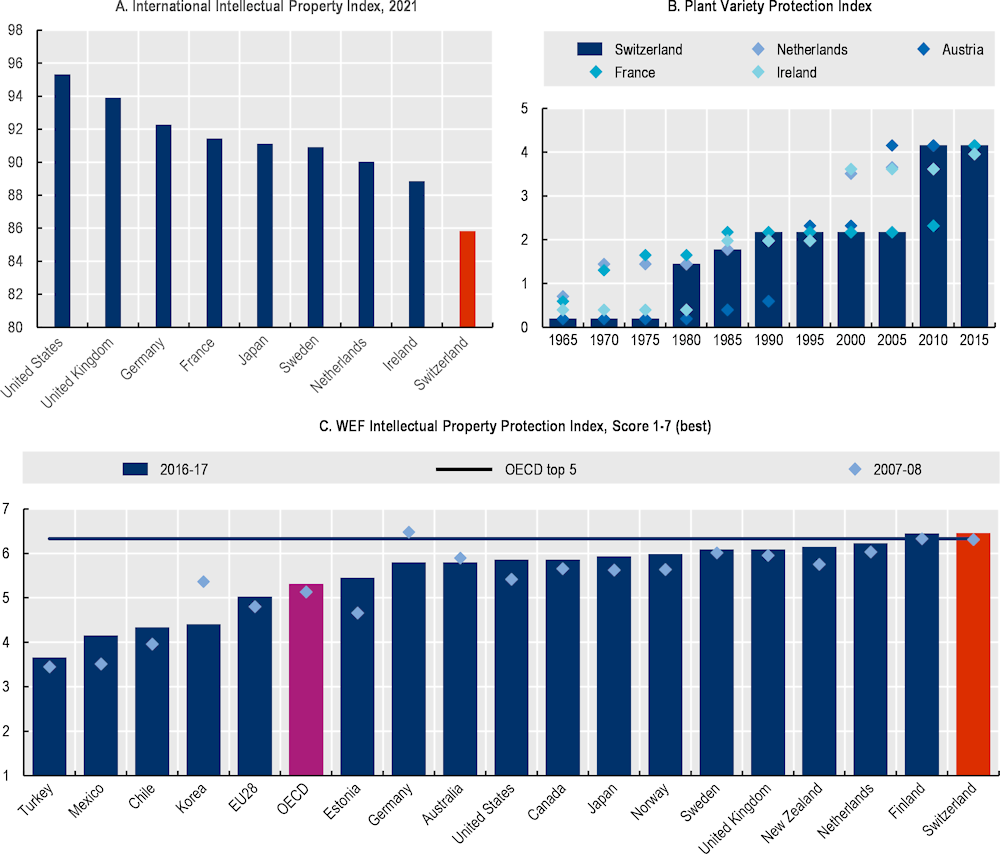

Figure 4.12 showcases the intellectual property (IP) protection metrics of Switzerland compared to other OECD members. Panel A indicates that Switzerland stands at 85.8% on the international IP index in 2021 and is lower in terms of percentage compared to some other countries that are leading in the level of IP submissions. These indices examine the environment that IP is governed within different countries. Panel B looks specifically at plant variety protection within Switzerland in five-year intervals between 1965 and 2015, which indicates a significant increase in the last decade. Lastly, Panel C portrays that Switzerland, alongside Finland, is a leading country in the World Economic Forum (WEF) Intellectual Property Protection Index measures.

Figure 4.12. Intellectual property protection

Note: OECD top 5 refers to the average of the scores for the top 5 performers among OECD countries (Finland, Luxembourg, the Netherlands, New Zealand and Switzerland). Indices for EU28 and OECD are the simple average of member-country indices.

Source: Statista (Statista, 2021[40]); Campi, M. and A. Nuvolari (2020[41]), “Intellectual property rights and agricultural development: Evidence from a worldwide index of IPRs in agriculture (1961-2018)”, https://www.econstor.eu/handle/10419/228145/; World Economic Forum (2017[42]), The Global Competitiveness Report 2016-2017: Full Data Edition, https://www3.weforum.org/docs/GCR2016-2017/05FullReport/TheGlobalCompetitivenessReport2016-2017_FINAL.pdf.

Publications outcomes

Publications and citations are indicative of the progress that research on innovation has reached. Overall progress to create and adopt relevant innovations can be usefully monitored, including using proxy measures, such as the number of patents or bibliographic citations (OECD, 2014[4]). It should be noted, however, that although the number of patents is an informative proxy, it is not a comprehensive indicator of the outcomes of the innovation system, as not all innovations are patented and not all patents are used. Other IPR systems exist for plant varieties rather than patents and are frequently used for food processing innovations. In addition, numbers must be complemented with indicators of patent quality (Table 4.3).

Table 4.3. Agriculture and food publications or R&D outcomes (accumulated 1996-2020)

|

Country |

Agro publications % of the country’s total |

Agro citations % of the country’s total |

Agro publications % of the world total |

Agro citations % of the world total |

|---|---|---|---|---|

|

United States |

6.0 |

6.6 |

17.9 |

24.5 |

|

United Kingdom |

5.7 |

7.8 |

5.0 |

7.7 |

|

Germany |

5.9 |

7.2 |

4.5 |

5.7 |

|

Japan |

5.5 |

6.2 |

3.7 |

3.3 |

|

Canada |

8.0 |

9.1 |

3.5 |

4.6 |

|

France |

6.5 |

8.5 |

3.4 |

4.6 |

|

Italy |

6.2 |

6.2 |

2.8 |

2.6 |

|

Netherlands |

6.4 |

7.4 |

1.6 |

2.5 |

|

Spain |

9.3 |

11.7 |

3.3 |

3.7 |

|

Sweden |

7.3 |

8.3 |

1.2 |

1.7 |

|

Switzerland |

6.2 |

7.0 |

1.1 |

1.8 |

Source: SJR (2021[43]), International Science Ranking, http://www.scimagojr.com (accessed on 1 September, 2022).

Institutional co-ordination: RIS, the FOAG and cantonal offices

Improved co-ordination between the local level and regional and national governments and across sectors and institutions within the government enable a stronger, opportune response, better utilisation of resources and more accurate targeting of resources to address the greatest need. Promoting collaboration in areas of innovation and policy making related to agricultural and rural development is key to the successful and sustainable role they play in economic well-being (Cervantes-Godoy, forthcoming[44]). Policy integration not only reduces redundancy and conflict but also maximises efficiency and creates collective synergies. However, establishing effective integration is quite tricky (OECD, 2012[45]).

The New Regional Policy (NRP) was created in 2008 as the answer to the development needs of cantons with mountainous regions, rural regions and the border regions of Switzerland. The NRP also aims to support the creation and maintenance of workplaces in these regions by reducing the disparities between the different regions (HES-SO Valais Wallis, 2021[46]). The introduction of RIS within the framework of the NRP established the RIS organisations as a central link between the federal government and the cantons in the operational implementation of an innovation-based regional policy. By 2021, Switzerland had six RIS covering significant parts of the country. The RIS are inter-cantonal economic areas and focus on demand and need-driven innovation services, specifically targeting SMEs (see Chapter 2 for more details).

In summary, the RIS is an intricate, multi-dimensional innovation system that promotes networking and facilitates access to the various skills available on regional, cantonal and national levels. This includes skills and knowledge of academic institutions, private companies, trade associations and other stakeholders. The Swiss Confederation co-finances six RIS initiatives: RIS Basel-Jura (BL, BS, JU), RIS Mittelland (BE), RIS Eastern Switzerland (AI, AR, GL, GR, SH, SG, TG, Zurich mountain area), RIS Southern Switzerland (TI, GR), RIS Western Switzerland (BE, FR, VD, VS, NE, GE, JU) and RIS Central Switzerland (LU, NW, OW, SZ, UR, ZG). Every RIS has a different governance mechanism unique to the characteristics of cantons and regions.

In the field of agricultural policy, the agricultural offices of the cantons are in charge of implementing the federal agricultural policy, particularly the programmes related to direct payments to farmers. However, these offices also are in charge of co-financing rural infrastructure projects and providing extension services. Additionally, many cantons have set up their own agricultural innovation programmes or initiatives.

In the field of regional policy, the RIS works collaboratively with different partners to design and implement a wide array of programmes and solutions related to training and research, sharing information and raising awareness, conducting comprehensive preliminary analysis, building networks, transferring technology, protecting IP, supporting incubators, coaching, in addition to financing innovative project proposals. However, when it comes to agriculture and food, the RIS and FOAG, together with the agricultural offices at the cantonal level, have limited interaction. Most farmers do not know of the RIS programmes. The New Regional Policy (NRP) RIS operates under a budget of CHF 40 million non-repayable funds per year and 50 million grants.

Fostering co-ordination amongst different ministries results in the arrival of effective policy solutions. Consequently, this will lead to ease of conduct between different levels of government (municipal, cantonal and federal). Policy co-ordination apparatuses that involve all government levels are fundamental to resolving discrepancies between sectoral priorities and the objectives of policies. Additionally, they must assess foreign and domestic policies, and how actors from different sectors and institutions can apply them (OECD, 2021[3]).

Some best practices of institutional inter-governmental co-ordination suggest that high-level political backing is important to enhance co-ordination. This suggestion has been raised previously in Chapter 3 of this report where an example from the United States is provided. Hereby, simple mechanisms often work best while overlapping functions and blurred accountability make co-ordination difficult (OECD, 2017[27]). Flexible and adaptive co-ordination mechanisms, which sometimes are informal, may work better than rigid and prescriptive ones, as they have a better chance to be sustained and become self-reinforcing even as leaders change. In the case of Switzerland, for example, the supreme responsibility for the co-ordination of Switzerland’s policy making generally lies with the Federal Council. This applies to different policy areas but the example found is related to sustainable development strategy, where the Federal Office for Spatial Development (ARE) heads the Interdepartmental Sustainable Development Committee (ISDC). This committee serves as a platform for knowledge sharing and a forum to cultivate interdepartmental co‑operation, thereby working to align objectives and address policy conflicts at the national level (OECD, 2022[46]). Routine reporting procedures, combined with a careful assessment and monitoring of obstacles and measures to resolve them, are essential links in the accountability chain.

A platform for knowledge exchange and access to information would best be established as a website. This website can have two main tabs, one outlining institutional offers and services that farmers can access, the other geared towards knowledge sharing and peer learning for researchers, academics and the like. This online platform can be incorporated as a part of a new structure of supply chain known as “net chains” (a combination of networks and chains). Net chains serve as a web or network of connections that focus on consumers (in this case farmers) as well as other stakeholders who are interested in different forms of information exchange. Such a platform would also help outline the knowledge base and analytical tools that are made available to farmers, policy makers and other stakeholders to monitor progress, evaluate agricultural and innovation policies, and guide decisions making processes. The government plays a critical role in data collection, which permits the creation and implementation of efficient, evidence-based policy. This would be taking into consideration the results of monitoring and evaluation of said policies and making relevant information readily accessible to any concerned party (farmers, investors, etc.) on a shared network (online platform).

Generally, excellence in agro-food research and innovation attracts investment from investors looking to promote and benefit from this type of research collaboration. Government efforts to promote investment at different stages of innovation typically require the provision of data and information necessary to incentivise investors in their decision to invest. This can be made easily available on an online platform for knowledge sharing. Well-educated farmers using this platform will also become more aware of the types of resources, training and advisory services available to them. Given the variety of stakeholders that will stand to benefit from the platform, funding for it can be raised through government contribution and/or private investment. In the Netherlands, for example, the government promotes private investment through the provision of tax incentives, which further strengthens public-private partnerships.

References

[34] Agri&Co Challenge (2021), Homepage, http://agricochallenge.org/?lang=fr (accessed on 1 September 2022).

[20] AGRIDEA (2021), AGRIDEA - Swiss Association for the Development of Agriculture and Rural Areas.

[9] AGRIDEA (2021), AKIS and Advisory Services in Switzerland, Swiss Association for the Development of Agriculture and Rural Areas.

[33] Agropole (2021), Homepage, https://www.agropole.com/ (accessed on 1 September 2022).

[16] Agroscope (2021), Homepage, https://www.agroscope.admin.ch/agroscope/en/home.html (accessed on 1 September 2022).

[19] BFH (2021), School of Agricultural, Forest, and Food Science (HAFL), Bern University of Applied Sciences.

[41] Campi, M. and A. Nuvolari (2020), “Intellectual property rights and agricultural development: Evidence from a worldwide index of IPRs in agriculture (1961-2018)”, LEM Working Paper Series, No. 2020/06, https://www.econstor.eu/handle/10419/228145/.

[44] Cervantes-Godoy, D. (forthcoming), “Aligning agricultural and rural development policies in the context of structural change”.

[39] Cultivator (2022), Homepage, https://www.cultivator.ca/ (accessed on 1 September 2022).

[17] ETH Zurich (2021), Homepage, Eidgenössische Technische Hochschule Zürich (Swiss Federal Institutes of Technology), https://ethz.ch/en.html.

[25] Eurostat (2017), Community Innovation Survey, http://ec.europa.eu/eurostat/data/database.

[18] FIBL (2021), Research Institute of Organic Agriculture FiBL, https://www.fibl.org/en/ (accessed on 1 September 2022).

[11] FOAG (2021), ERI-Project OECD Information Request, Federal Office for Agriculture.

[12] FOAG (2021), Federal Office for Agriculture.

[14] FOEN (2021), Federal Office for the Environment.

[7] FSO (2021), Federal Statistics Office, https://www.bfs.admin.ch/bfs/en/home.html.

[13] FSVO (2021), Federal Food Safety and Veterinary Office.

[38] H-Farm (2021), About Us, https://www.h-farm.com/en/corporate/about.

[23] Innosuise (2021), Innosuise - Swiss Innovation Agency, https://www.innosuisse.ch/inno/en/home.html (accessed on 2021 September 1).

[36] Innovativi Puure (2021), Was match Innovativi Puure?.

[46] OECD (2022), Policy Coherence for Sustainable Development Toolkit, Policy Coordination, OECD, Paris, https://www.oecd.org/governance/pcsd/toolkit/goodpractices/Policy%20Coordination.pdf.