This chapter provides an overview of the rationale and objectives of the Guide. It provides background on the origins of this work and explains how it supports implementation of the Recommendation on FDI Qualities and complements the FDI Qualities Policy Toolkit. It makes the case for strengthening the role of development co-operation to enhance the impact of foreign direct investment on sustainable development. It then lays out how this Guide could help further strengthen the positive impact of FDI in developing countries.

FDI Qualities Guide for Development Co-operation

1. Rationale and objectives

Abstract

1.1. What is the FDI Qualities Guide for Development Co-operation?

Foreign Direct Investment (FDI) can play a crucial role in making progress toward the Sustainable Development Goals (SDGs). From the viewpoint of the host country, it can, for example, enhance growth and innovation, create quality jobs and develop human capital, including for women, and raise living standards and environmental sustainability. By linking domestic firms to multinational enterprises (MNEs), it serves as a conduit for domestic firms to access international markets and integrate in global value chains (GVCs).

Realising the potential benefits from FDI, however, is not a given: among countries receiving FDI, some have benefited more than others and, within countries, some segments of the population have been left behind. Efforts to mobilise investment should be aligned with concerns on qualities and impacts of investment, including progress toward the SDGs. To realise the potential benefits from investment, policies and institutional arrangements play a critical role.

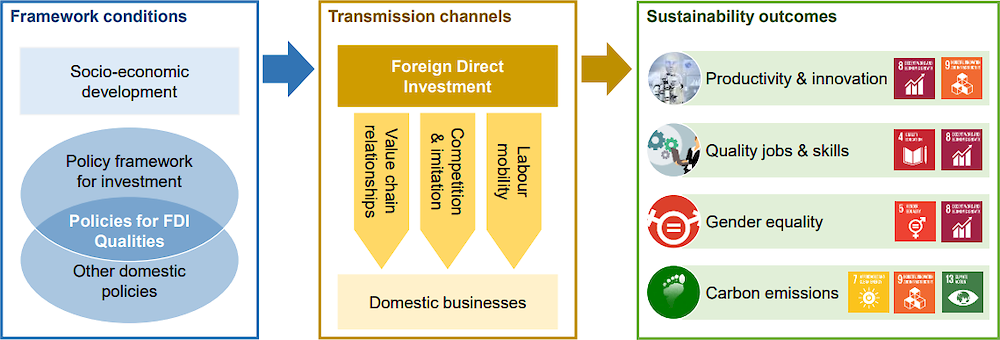

The FDI Qualities Policy Toolkit (the Policy Toolkit) (OECD, 2022[1]), from which the substance of the Recommendation on FDI Qualities for Sustainable Development (the Recommendation) (OECD, 2022[2]) was drawn, and which supports its implementation, provides advice on how governments can enhance the contribution of FDI to meeting the SDGs. The Policy Toolkit complements the Policy Framework for Investment (PFI) (OECD, 2015[3]), a substantive tool to help governments improve their investment climate. The Policy Toolkit builds on the PFI to provide more specific directions on policy and institutional reforms to enhance the impact of FDI on sustainable development. The Policy Toolkit combines investment and related policies of the PFI with more specific policies in each of the following areas: productivity and innovation; job quality and skills; gender equality; and decarbonisation (Figure 1.1).

Figure 1.1. Conceptual Framework: FDI Qualities Policy Toolkit

The Recommendation and the Policy Toolkit, like the PFI, have strong links with development co-operation and an embedded objective to foster partnerships with the donor community. The PFI has been recognised as an important tool for development co-operation programmes and policy dialogue with partner countries to foster investment and private sector development.1 The work on FDI Qualities has been partly developed to reinforce engagement from the development co-operation community on investment and foster greater use of the PFI for development co-operation by integrating a specific focus on the SDGs.

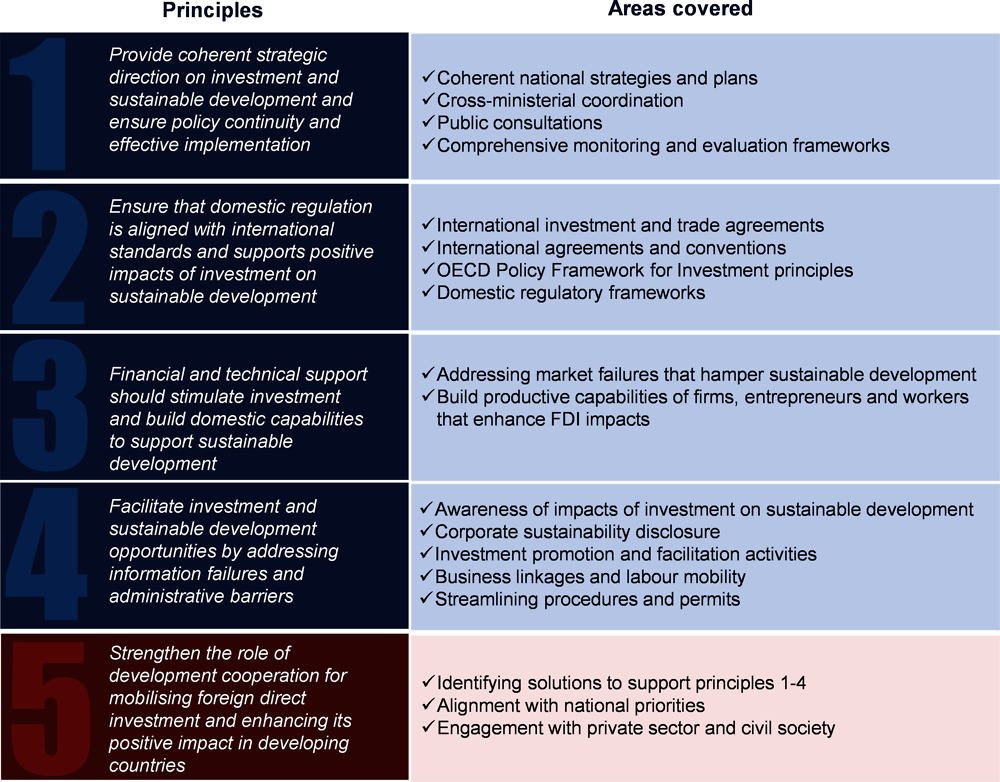

The FDI Qualities Guide for Development Co-operation (the Guide) supports the implementation of the Recommendation adopted by the OECD Council at Ministerial Level on 10 June 2022, and complements the Policy Toolkit, which was developed by the Investment Committee (IC) and launched in June 2022, by supporting its objective to reinforce collaboration between governments and the development co-operation community on investment and sustainable development. The Recommendation includes five policy principles drawn from the substance of the Policy Toolkit and provide overarching guidance to Members and non-Members having adhered to it (the Adherents). The first four principles are addressed to governments. They constitute the backbone of the Recommendation, which tailors the principles to specific area of sustainable development (productivity and innovation, job quality and skills, gender equality; and decarbonisation). The fifth principle targets both governments and development co-operation actors. Practical details for its implementation are provided separately through this Guide. This Guide provides practical guidance aligned with the Policy Toolkit and the PFI to donors and development co-operation partners to tailor and co-ordinate their private sector development programmes. It also provides a common framework to foster collaboration between governments and the development co-operation community and align efforts on investment and sustainable development. Such collaboration is essential to ensure a successful implementation of the policy principles set in the Recommendation in developing countries.

Figure 1.2. Key policy principles of the Recommendation on FDI Qualities

1.2. Why should the development co-operation community and governments collaborate on this agenda?

FDI is one of the main external sources of financing available to developing countries for achieving the SDGs. In 2018, FDI represented 30% of total international capital flows to developing countries, before remittances (26%), other investment (19%), Official Development Finance (15%), and portfolio investment (10%) (OECD, 2020[4]). FDI reflects long-term investment decisions of firms seeking to bolster existing – or to establish new – productive capacity in international markets (OECD, 2016[5]; 2020[6]). As such, FDI is often considered as one of the most “development-friendly” private resources (Box 1.1). The Addis Ababa Action Agenda (AAAA), which provides a global framework for financing the 2030 Agenda, recognises that FDI flows and the knowledge spill-overs from FDI, enabled through appropriate public policies, are key for achieving the SDGs.

Box 1.1. What is foreign direct investment and why does it matter for development?

Foreign direct investment (FDI) is a category of cross-border investment in which an investor resident in one economy establishes a lasting interest in and a significant degree of influence over an enterprise resident in another economy. Ownership of 10% or more of the voting power in an enterprise in one economy by an investor in another economy is evidence of such a relationship.

FDI may consist either in creating an entirely new enterprise (so-called “greenfield” investment) or, more typically, changing the ownership of existing enterprises (via mergers and acquisitions). Other types of financial transactions between related enterprises, like reinvesting the earnings of the FDI enterprise or other capital transfers, are also defined as foreign direct investment. In that sense, FDI differs from other forms of investment such as portfolio investment – which designates ownership of a stock, bond, or other financial asset, typically with the expectation that it will earn a return, grow in value over time, or both.

FDI is a key element in international economic integration because it creates stable and long-lasting links between economies. FDI is also an important channel for the transfer of technology between countries, promotes international trade through access to foreign markets, and can be an important vehicle for economic development. FDI can be crucial in helping countries make progress towards achieving the SDGs. For example, foreign firms often have a technological advantage over domestic firms and might invest in high value-added activities, which improves productivity outcomes at the economy-wide level. Foreign firms’ operations also have spill-over effects on domestic businesses arising from their value chain relationships with domestic firms; market interactions through competition and imitation effects; and labour mobility of workers between foreign and domestic firms. Conducive policies and institutions can help realise the sustainable development potential of FDI and maximise its impact on the SDGs.

Source: OECD (2022[1]), FDI Qualities Policy Toolkit, https://doi.org/10.1787/7ba74100-en.

Development co-operation is often essential to attract FDI in developing countries. While FDI is crucial to build productive capacities and support economic and social transformation in developing countries, countries where the needs are the greatest sometimes struggle to attract FDI. For example, in 2020, FDI flows to LDCs accounted for only 2% of total FDI flows (UNCTAD, 2021[7]). This can be partially explained by a combination of barriers to investment and actual or perceived risks making it more difficult for the private sector to invest (OECD/UNCDF, 2020[8]). Development co-operation can help lower these barriers, for example by offering access to de-‑risking instruments such as blended finance, including loans or guarantees offered at concessional or competitive terms to unlock private finance. Donors also play an important role in supporting governments’ efforts to enhance the attractiveness of developing countries as investment destinations. Donors frequently provide support, for example for investment climate reforms and/or development of physical infrastructure. A 2016 study by the International Growth Centre identified that a 10% increase in aid to infrastructure would increase FDI by about 4.7 percentage points (IGC, 2016[9]).

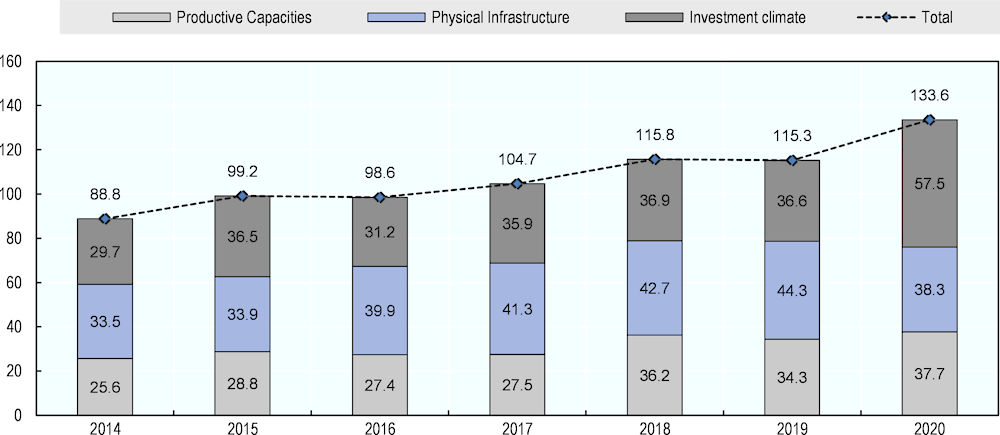

In recent years, increased pressures on public finance and efforts to narrow the SDG financing gap have placed FDI and mobilisation of private sector resource mobilisation at the centre of development co-operation efforts. Donors, including DAC members, have developed various initiatives, tools and methods to increase private sector participation in development outcomes (OECD, 2021[10]). While precise figures on donors’ support to FDI are unavailable, data on official development finance2 (ODF) for private sector development (PSD) can provide an approximation of donors’ efforts to improve the contribution of private investment to sustainable development, which has steadily increased in the last decade (average growth of 7% year between 2014 and 2020). Total DAC contributions to PSD amounted to USD 756 billion in disbursements over 2014-20, representing 43% of total official development finance (Figure 1.3).

Figure 1.3. Official development finance (ODF) to PSD has steadily grown over the period 2014‑20

Source: Authors’ calculations based on Creditor Reporting System OECD/CRS database (2021) https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

The focus has generally remained quantitative (e.g. number of jobs created, volume of exports) with limited attention to the qualities and impact of private sector resources mobilised (e.g. quality of jobs, domestic value‑added). As shown by the FDI Qualities Indicators, these qualities are essential to move from resource mobilisation to SDG impact. Unlike public finance, private sector resources do not inherently serve public objectives, and alignment with the SDGs is neither systematic nor automatic (OECD, 2019[11]). For example, depending on the sector, the type of relations between lead and subsidiary firms, or the business model, the impact of FDI job creation, knowledge and technology transfers, or decarbonisation may vary. Furthermore, not all effects of FDI are positive: while FDI has the potential to create jobs, reduce poverty and improve well-being, it can also create or exacerbate risks and vulnerabilities, especially in the absence of a sound governance framework.

FDI mobilisation needs to be accompanied with SDG-alignment efforts to ensure that the ultimate impact of mobilised FDI is positive and maximised. The 2019 OECD Global Outlook on Financing for Sustainable Development (OECD, 2018[12]) stressed that in a context of limited fiscal space, ensuring that resources are channelled in a way that enables and maximises the positive contribution of FDI to sustainable development is more important than ever before to support a sustainable recovery (OECD, Forthcoming[13]). FDI-related development co-operation interventions rarely integrate such objectives, or adopt a deliberate and structured approach to enhancing the sustainability footprint of FDI. As a result, development co-operation activities related to investment and sustainable development tend to be fragmented, with risks of duplication, loss of opportunities and misalignment with specific country needs.

Enhancing FDI impacts requires systematic, comprehensive and coordinated efforts to create adequate conditions and incentives to influence investment decisions and business behaviour and to drive sustainability outcomes. Therefore, ensuring alignment between development co-operation actions, specific country needs, and government priorities is particularly essential to ensure meaningful and effective support. This Guide provides a framework to identify specific areas where development co-operation can have an added value to enhance the impact of FDI, and identify development co-operation options for mobilising and leveraging FDI for the SDGs. It is structured as an extension of the Policy Toolkit, and can provide a common framework for enhanced collaboration between governments, private actors and the development co-operation community to make the most of donor resources and align priorities, policy objectives and practices with the SDGs.

1.3. How to use this Guide?

This Guide is addressed to the development co-operation community, as well as developing countries willing to engage with donors and development co-operation actors to enhance the impact of FDI on sustainable development. The Guide can help Adherents as donors to more explicitly and systematically consider the qualities of FDI in overall strategies as well as the design, implementation and monitoring of FDI-related assistance. Developing countries can also use the Guide to inform their engagement with donors, and ensure the consistency and coherence of FDI-related donor efforts in partner countries. By providing a common framework for international development actors and local authorities in developing countries, the Guide can support effective collaboration on sustainable investment, which is key to further the implementation of the Recommendation on FDI Qualities. The Guide is designed to support the implementation of the fifth principle of the Recommendation on FDI qualities, focusing on development co-operation:

V. RECOMMENDS that Adherents strengthen the role of development co-operation for mobilising foreign direct investment and enhancing its positive impact in developing countries. To this effect, Adherents should promote and foster co-operation across and between the broader donor community and partner countries to:

Identify ways that financial and technical assistance, such as blended finance, can support the implementation of the above four principles to enhance the impact of foreign direct investment on sustainable development.

Promote alignment of donors’ assistance with national priorities related to sustainable investment in accordance with relevant international standards, including through the mapping of such assistance, and the identification of potential support gaps or opportunities to replicate or scale‑up existing assistance.

Increase engagement with the private sector, trade unions and civil society, and promote effective multi-stakeholder partnerships aimed at enhancing the impacts of investment on sustainable development, including increased opportunities for women and youth in particular in relation to equal treatment and skills.

Chapter 2 of this Guide provides an overview of development co-operation options that can support efforts to enhance the impact of FDI on the SDGs. It aims to allow the identification of development co-operation options aligned with the Policy Toolkit and the PFI, supporting implementation of the four core principles of the Recommendation on FDI Qualities by implementing principle five focused on development co-operation. It also aims to provide a common language to support enhanced collaboration between partner countries and the development co-operation community. The identification and classification of various financial and technical assistance solutions relies on a comprehensive review of FDI-related development co-operation, some of which were provided by DAC members.

Chapter 2 is structured around four types of development co-operation assistance which can directly support the implementation of the policy principles of the Recommendation on FDI Qualities: i) development co-operation assistance to promote policy coherence on investment and sustainable development; ii) development co-operation assistance to promote alignment of domestic and international policy and legal frameworks with regard to investment and sustainable development objectives; iii) prioritisation of sustainable development objectives when providing financial and technical support to stimulate investment; and iv) development co-operation assistance to facilitate investment and sustainable development opportunities by addressing information failures and administrative barriers. The chapter provides detailed description of what these areas entail, why they matter and what development co-operation support can look like in practice for each category. Throughout Chapter 2, good practice examples are used to illustrate different ways in which development co-operation partners can engage in the promotion of sustainable investment.

Chapter 3 provides guidance to help prioritise, develop and implement development co-operation assistance tailored to specific country contexts. While Chapter 2 lays out options through which development co-operation assistance can support sustainable investment, Chapter 3 aims to support decision-making in the process of developing and implementing relevant assistance on investment and sustainable development. Chapter 3 is structured around six key areas of particular importance in this process:

1. Assessing and understanding the impact of FDI on sustainable development

2. Ensuring alignment with national priorities

3. Ensuring coordination and coherence among the development co-operation community

4. Identifying opportunities, trade-offs and managing the risks of development co-operation assistance for sustainable investment

5. Engaging with businesses, trade unions and civil society

6. Enhancing impact measurement and accountability in development co-operation projects

For each of these key areas, Chapter 3 provides a list of guiding questions to support governments and development co-operation actors in the review, development and implementation of development co-operation interventions aiming to mobilise and leverage FDI for the SDGs. It can be used to inform development co-operation strategies, programmes and projects, and can support collaboration between various actors in a specific country context. Chapter 3 includes guidance that can be used to map different operating channels of donors to enhance the qualities of FDI in a specific country context. Such a mapping can support alignment and coordination of efforts by multiple partners and stakeholders and help identify gaps and opportunities to replicate or scale up relevant interventions.

The three Annexes are important components of this Guide:

Annex A provides guiding questions that could be used by the development co-operation community and partner countries to review, develop, implement and monitor strategies and projects with a specific objective to enhance the impact of FDI on sustainable development.

Annex B takes the form of a case study on Jordan to provide an illustration of how this Guide could be used in practice. While this example does not intend to provide a comprehensive review of Jordan, it illustrates how the two chapters and guiding questions can be operationalised in a specific country context, and could facilitate the implementation of this Guide.

Annex C provides a non-exhaustive list of projects reviewed in the context of this Guide and can serve as a repository of good practice for donors, other development co-operation partners, as well as governments willing to leverage development co-operation to enhance the impact of FDI on sustainable development.

References

[9] IGC (2016), “Aid Financed Infrastruture promotes Foreign Direct Investment”, https://www.theigc.org/blog/aid-financed-infrastructure-promotes-foreign-direct-investments/.

[1] OECD (2022), FDI Qualities Policy Toolkit, OECD Publishing, Paris, https://doi.org/10.1787/7ba74100-en.

[2] OECD (2022), Recommendation of the Council on Foreign Direct Investment Qualities for Sustainable Development, https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0476.

[10] OECD (2021), Private sector engagement in development co-operation, OECD Publishing, https://www.oecd.org/dac/private-sector-engagement-in-development-co-operation.htm.

[4] OECD (2020), Global Outlook on Financing for Sustainable Development 2021: A New Way to Invest for People and Planet, OECD Publishing, Paris,, https://doi.org/10.1787/e3c30a9a-en.

[6] OECD (2020), Investment and sustainable development: Between risk of collapse and opportunity to build back better, https://www.oecd.org/investment/Between-risk-of-collapse-and-opportunity-to-build-back-better.pdf.

[11] OECD (2019), FDI Qualities Indicators: Measuring the sustainable development impacts of investment, https://www.oecd.org/investment/FDI-Qualities-Indicators-Measuring-Sustainable-Development-Impacts.pdf.

[12] OECD (2018), Global Outlook on Financing for Sustainable Development 2019: Time to Face the Challenge, OECD Publishing, Paris, https://doi.org/10.1787/9789264307995-en.

[5] OECD (2016), Development Co-operation Report 2016: The Sustainable Development Goals as Business Opportunities, OECD Publishing, Paris, https://doi.org/10.1787/dcr-2016-en.

[3] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

[13] OECD (Forthcoming), Global Outlook on Financing for Sustainable Development 2023: No sustainability without equity, OECD Publishing, Paris.

[8] OECD/UNCDF (2020), Blended Finance in the Least Developed Countries 2020: Supporting a Resilient COVID-19 Recovery, OECD Publishing, Paris, https://doi.org/10.1787/57620d04-en.

[7] UNCTAD (2021), “Foreign direct investment: Inward and outward flows and stock, annual”, https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740.