This Pillar articulates a vision for long-term systemic change and economy-wide decarbonisation, shaping a least cost pathway to net-zero to enable the achievement of sustainable development outcomes, whilst also addressing biodiversity loss and environmental degradation. Pillar 3 provides guidance on “how” fossil fuel developing economies can seize the transformational opportunities associated with the low-carbon transition, by pursuing green industrialisation, valuing natural capital and building low-carbon value chains with more value-added produced locally. Pillar 3 outlines strategies to accelerate decarbonisation of the power, transport, building sectors, leading to no-regrets and delivering benefits for citizens’ well-being. The Pillar also offers guidance on pricing negative externalities of carbon intensive technologies and modes of production through carbon pricing and inefficient fossil fuel subsidy reform as key steps to deliver least cost decarbonisation plans, as well as reforming fiscal systems to maximise revenue generation, while ensuring equitable distributive outcomes.

Equitable Framework and Finance for Extractive-based Countries in Transition (EFFECT)

Pillar 3. Systemic change and economy-wide decarbonisation

Abstract

3.1. Laying down the global foundations for systemic change: Resetting the relationship between importer and producer fossil fuel-based and mineral-rich developing economies

The uneven global response to the COVID-19 pandemic and ongoing climate, environment and biodiversity crises have highlighted the enormous inequality in access to finance, resources and opportunities which separates advanced economies from the rest of the world. Meanwhile, Russia’s invasion of Ukraine is having a profound impact on energy prices and food security, especially in developing countries. Despite having contributed least to climate change and suffering the worst effects from its physical impacts, developing countries have largely been excluded from accessing the climate finance they need to set their economies on a path to sustainable prosperity, while the overwhelming concentration of coronavirus vaccine deployment in high-income countries is indicative of widening inequalities between North and South when it comes to access to healthcare and basic social protection.

These facts have highlighted the limitations of the 20th century social contract, a trade-off between economic growth and productivity on the one hand, and environmental and social protection and labour rights on the other, which has defined the post-Second World War period in the Global North. While citizens in high-income countries have undoubtedly gained from improved workers’ rights and social protection, vast swathes of the rest of the world have been excluded from these safeguards. The interconnected nature of the pandemic and climate and environmental crises have highlighted the 20th century social contract’s inability to respect planetary boundaries, biodiversity and the sustainable use of natural resources (Frey et al., 2021[1]).

In parallel, the divide between the rich and the poor, both nationally and internationally, has grown rapidly, with direct implications for the climate crisis. Today, the emissions of the world’s richest 1% are 30 times higher than per capita levels consistent with a 1.5°C increase in global temperatures (Frey et al., 2021[1]), and per capita emissions in advanced economies dwarf those in developing countries. Emissions from high-income countries therefore exacerbate the worst physical impacts of climate change including pollution, rising temperatures, land degradation and extreme weather events in countries which are most vulnerable, in turn raising the cost of adaptation measures and contributing to poverty.

International finance and global debt architecture compound challenges for developing countries who face greater obstacles than their advanced economy peers in accessing affordable debt and capital. The cost of borrowing for a country in sub-Saharan Africa with a lower than investment grade rating, for instance, will be seven times higher than for an advanced economy, while perceptions of political, regulatory and payment risk mean developing countries have a far worse track record in attracting private capital in low-carbon investments than high-income countries. Meanwhile, the pandemic has led to burgeoning debt levels for many developing countries, with debt service repayments accounting for huge proportions of government revenue. Between 2019 and 2025, debt service payments on external debt will amount to 20% or more of revenues in 18 developing countries (Jensen, 2021[2]).

Box 3.1. The Great Financing Divide

The Inter-agency Task Force on Financing for Development’s Financing for Sustainable Development Report identifies the Great Financing Divide as a defining feature of the difference between advanced and developing economies in responding to the COVID-19 pandemic. Advanced economies during the pandemic were able to borrow huge amounts of money at low interest rates with long maturities, enabling them to invest in recovery and safeguarding the livelihoods of citizens and businesses. In contrast, the capacity of developing countries to respond to the pandemic was severely curtailed by a lack of access to long-term affordable debt, in spite of the fact that economic slowdowns and debt proportions as a percentage of fiscal revenue were far more pronounced in advanced economies.

Key issues for developing countries include the role credit ratings agencies play in assessing debtor risk of default. Almost all of the 61 sovereign ratings downgrades during the COVID-19 pandemic were developing countries, despite advanced economies performing worse in terms of economic slowdowns. Yet, developing countries found it harder to access long-term debt, and have had to borrow at higher rates and with shorter maturities than advanced economies, resulting in more burdensome service payment schedules, which account for a far higher proportion of fiscal revenue than in advanced economies. This has resulted in almost 60% of LDCs and LICs being at risk of debt distress or in debt distress in 2022, up from 30% in 2015. A key issue is the lack of transparency in credit rating agency methodologies, which penalise developing countries based on perceived risks.

Not only does this mean that many developing countries struggle to mobilise the necessary financial resources to invest in low-carbon transition plans, but also that over decades, public investment in essential public services and infrastructure, as well as institutional and capacity strengthening, has gradually been eroded undermining the relationship between the citizens and the state. Even before the COVID-19 pandemic, many developing countries were experiencing low productivity challenges, high vulnerability and inadequate social protection coverage. In many developing countries, an economic model premised on ready access to cheap fossil fuels affords few benefits for most of the population. Today, 785 million people around the world lack access to electricity, while 2.6 billion lack access to clean cooking solutions (IEA, 2021[4]). Meanwhile, several amplifying factors make developing countries particularly vulnerable, including pre-existing limited fiscal space, a growing burden of unsustainable debt, high levels of poverty and inequality, and more fragile health and sanitation systems, as well as widespread economic informality. At the same time, the pandemic has pushed a further 100 million people into energy poverty, while rampant inflation threatens to exclude investments in developing countries on the margins of risk acceptability from accessing finance (SE4All, 2020[5]).

Any discussion on the low-carbon transition in developing countries must recognise these realities, as well as the unequal global system that has contributed to them. A systemic rethink of the economic model is required to break the assumed link between economic growth and societal progress which has led to a resource-intensive development model characterised by inefficiency, waste and overconsumption in advanced economies and unsustainable production in developing countries.

For developing countries who have contributed least to historic emissions and whose per capita emissions are meagre compared to those of their advanced economy peers, the low-carbon transition is a development issue, entailing the simultaneous achievement of environmental, social and economic objectives as reflected in the SDGs, as well as decarbonisation. For governments to articulate compelling arguments encouraging citizens to accept the short-term costs of the transition, meaningful progress on economic, social and environmental development indicators needs to be prioritised, while balancing decarbonisation targets against their historic contributions to climate change and the realities of persistent widespread exclusion from access to affordable energy at a domestic level, as well as debt and finance at an international level.

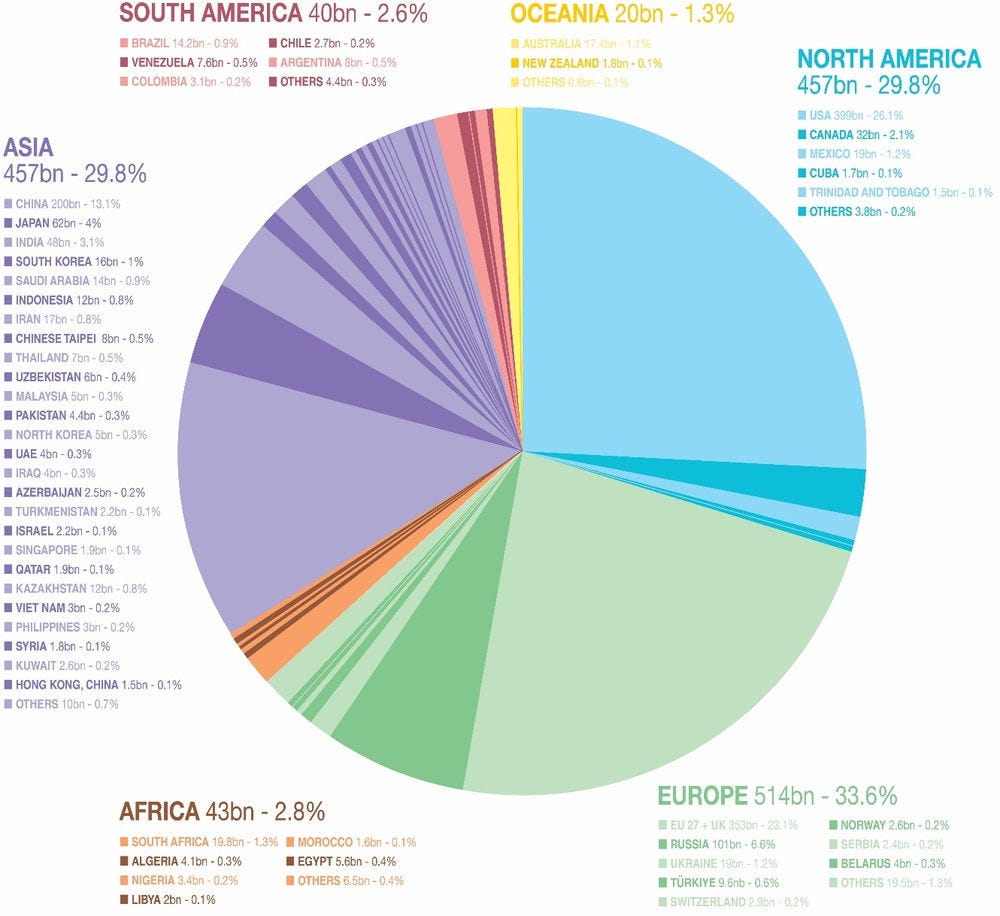

Figure 3.1. Regional contributions to cumulative global CO2 emissions (1751-2017)

Source: Adapted from Energy for Growth Hub and the Africa Center, 2021.

Enabling a just low-carbon transition in developing countries will require shifting away from a system that perpetuates existing power dynamics and consumption patterns and the reshaping of the resource-driven global governance system. Moving away from GDP and investor credit metrics as the dominant indicators of societal progress will be key to this process. A more holistic set of indicators, incorporating human well-being and natural capital measurement, can facilitate more equitable and affordable access to international finance and debt for developing countries (SYSTEMIQ, The Club of Rome, and the Open Society European Policy Institute, 2022[6]). Global governance systems should shift from a resource-driven system of competition for and cheap access to natural resources to a system based on collaboration, mutual trust and shared benefits to preserve and regenerate natural resources and work for the well-being of people. This will require advanced economies to drastically reduce materials consumption, which at current levels is unsustainable, investing instead in circular and regenerative business models that incentivise land regeneration, as well as re-use and recycling of materials. Circular economy principles can reduce demand for scarce natural resources, while also avoiding the risk that the energy transition’s thirst for critical minerals and scarce resources, often under stress, exacerbates environmental and social injustice, resulting in an unequal sharing of the costs and benefits of mining between advanced and developing economies (Kalt and Tunn, 2022[7]).

In parallel, profound systems change in international relationships are needed to build transformative win-win partnerships (SYSTEMIQ, The Club of Rome, and the Open Society European Policy Institute, 2022[6]). Such partnerships should account for a fair share of the resources to be used to support local and regional development. This means, for example, building green mineral value chains in the countries and regions where those resources are located. Transformative partnerships between producing and importing countries should also address the major stresses to deliver human needs (i.e. water and land use), when considering the potential for generating revenue from new exports, such as green hydrogen.

Global efforts to diversify and increase resilience of critical minerals, hydrogen and renewable power supply chains offers extensive opportunities for long-lasting and mutually beneficial collaboration between developing producers and advanced economies, including through technical assistance on governance, legal and regulatory frameworks, and mitigating social and environmental risks, as well as financial support for geological mapping and technology transfer to facilitate the development of green value chains in new countries.

A global just transition should also consider the impact of climate policy making in advanced economies across borders. For instance, the EU’s Carbon Border Adjustment Mechanism (CBAM) could impose a carbon price on certain imported goods such as iron and steel, cement, fertilisers, electricity and aluminium. Meanwhile, the EU’s Green Deal and European Industrial Strategy emphasise partnerships with mineral rich economies to improve the supply of critical minerals for the transition. To avoid any unintended consequences on developing countries, importer governments will have to step up and accept the responsibility of supporting exporter governments to keep pace with change and decarbonise sectors, subject to CBAM. Without accompanying transition support, mechanisms such as CBAM could render entire industries and sectors in developing countries uncompetitive for export, with dire consequences for jobs, economic growth and poverty.

Just energy transition partnerships can help importing countries meet energy security, while providing long-term revenue certainty to underpin a transition to renewable energy generation and the growth of low-carbon industries in producing countries. This will allow them to avoid high-carbon lock-in, and enable the progressive phase-down/out of fossil sources as renewables are phased in, while also offering off-takers certainty to facilitate renewables development and provide incentives for importer countries to invest in risk mitigation and subordinate finance instruments to de-risk renewables development.

Advanced economies should:

Fulfil and exceed the annual commitment to provide developing economies with USD 100 billion in climate finance under the Paris Agreement, raising the proportion of blended finance through highly concessional loans, grants, subordinate finance, risk mitigation tools and guarantees to unlock private capital in clean investments. These efforts must recognise that USD 100 billion alone will be insufficient to meet global climate objectives and facilitate a transition which progresses at the required pace across the world. The primary goal should be to stimulate increased flows of private climate finance to developing economies.

Move first and fastest to phase-down/out domestic production of fossil fuels and prioritise energy imports from developing country producers, guided by long-term, mutually beneficial partnerships to support the low-carbon transition, through the achievement of all SDGs, including energy access and security, and consistent with an equitable global phase-down/out of fossil fuel production and Paris-aligned emissions reduction pathways (Calverley and Anderson, 2022[8]).

Importer and producer developing economies together should:

Promote the concept of a new global deal for development to underpin the low-carbon transition, based on recognition of the interplay between environmental and social justice, achievement of all SDGs, and the need to ensure developing countries possess the means to invest in effective public services, social protection, sustainable infrastructure, energy access, healthcare and education, particularly in fossil fuel producer regions and communities. Equalising access to affordable finance and debt will be critical to achieving this goal and is a necessary condition for building public acceptance for low-carbon transition policies across the world.

Establish transformative low-carbon win-win partnerships, as well as public-private partnerships for the deployment of low-carbon technology, progressive fossil fuel phase-down/out and renewables phase-in and capacity building.

Explore opportunities for partnerships between IOCs and NOCs, as outlined throughout Pillar 1, which could be based on recognition of the shared responsibility for curbing flaring and venting in producing countries (see Pillar 1, Section 1.2.3). Partnerships could be established to build capacity on measurement, verification and reporting of CO2 and methane emissions, to facilitate the flow of technical and financial support for the deployment of the best available technologies for emissions abatement, and to jointly investigate the potential for a domestic natural gas market in order to monetise any associated gas, if gas is (also) used domestically.

3.1.1. Reshaping the relationship between the state and its citizens: A necessary condition to build broad societal support for the low-carbon transition

The climate crisis and the pandemic highlight the necessity of reshaping the social and environmental contract between the state and its citizens, recognising the intrinsic links between human welfare and ecosystems. This is true everywhere, but especially in developing countries, as the welfare of the poor depends on their access to, and the quantity and quality of terrestrial and marine ecosystems, as well as of other forms of biodiversity. Developing countries are also most vulnerable to the physical impacts of climate change and biodiversity loss, such as the degradation of critical ecosystem services, sea level rise, drought, wildfires, floods and loss of life. Focusing just on economic growth, and greening later, would be much more costly than following a path now to transform to a greener, more resilient and inclusive economy, as this would entail sharper subsequent corrective measures, higher risk of irreversible environmental damage, high-carbon lock-in and stranded assets, exacerbated by adverse distributional impacts. Deploying nature-based solutions, delivering benefits to the environment and communities, as well as setting the right incentives for the preservation and sustainable use of natural resources, will be key to shaping more sustainable patterns of production and consumption. This includes building a shared understanding within society of the goals to be achieved, the steps to be undertaken, and the resources to be deployed to realise such a large-scale and profound transformation, and to obtain broad societal support to navigate through the transition.

France’s Gilets Jaune (Yellow Jacket) movement demonstrates the risks of public opposition to low-carbon policies and its potential to derail progress of the transition if burdens and costs are perceived to fall primarily on poorer citizens. For all countries, distributing the costs and benefits of the low-carbon transition equitably, and ensuring that those most exposed (including women, migrants, informal workers, ethnic, racial and religious minorities, and Indigenous communities) are not disproportionately affected by negative impacts is a necessary condition for building public acceptance of systemic decarbonisation, and overcoming political economy obstacles to correcting misaligned incentives and internalising negative externalities of fossil fuels production and use.

Structuring effective mechanisms for procedural (affected groups included in decision making), distributional (equitable sharing of costs and benefits) and restorative (compensation for environmental and health impacts) justice is key to this process and can play an important role in ensuring citizens shape a low-carbon trajectory that enjoys wide stakeholder buy-in.

Developing countries may face additional challenges in building support for low-carbon transition strategies and policies because of persistent under-investment in public services, infrastructure, healthcare and education, and the associated need for institutional and individual capacity strengthening. This, in many cases, has undermined trust in governments, with citizens less willing to bear short-term transition costs against long-term benefits for household bills and livelihoods. Where natural resource rents are owned and distributed by the state, fossil fuel producer governments are likely to face greater resistance if a record of state capture, corruption and impunity has further deteriorated the relationship between the state and its citizens.

Articulating a compelling vision that places equitable income distribution, promotion of human capital, poverty alleviation, strong public integrity policies, and environmental and social justice through inclusive decision making at the heart of the relationship between the state and its citizens, can help governments build support for low-carbon transition strategies and policies, alongside decarbonisation plans. Open and inclusive policy making, in which governments broaden the sphere of action in which citizens can influence policy choices, will help to build consensus and strengthen government understanding of citizen needs and concerns, while facilitating public acceptance and support for policy reform. Governments can also leverage digital solutions to facilitate open and inclusive dialogue with citizens, as well as multiple platforms to effectively communicate the benefits of low-carbon transition policies and what they are doing to mitigate impact on citizens who will be negatively affected.

Governments should consider prioritising the following actions:

Incorporate equity and justice issues into national development and decarbonisation frameworks, recognising the interlinkages between environmental and social justice, as well as the importance of valuing biodiversity, nature and ecosystems as core components of a sustainable, inclusive and prosperous society. Governments need to integrate this vision into development and decarbonisation frameworks, clearly articulating how the costs of transition policies on poorer households will be mitigated, and building a compelling vision as to what the benefits will be, when they can be realised and what the necessary steps are to achieve them. Moving away from an economy based on cheap access to fossil fuels should lead to a more equitable distribution of income, better access to services and sustainable infrastructure, as well as health and environmental benefits.

Prioritise strong and engaged intermediary structures, including political parties, unions, associations, community and civil society groups, providing avenues and mechanisms for them to meaningfully participate in the vision and policy design process, in line with recommendations relating to planning for a just transition included in Pillar 2.

Invest in educational and information-sharing tools and campaigns which build awareness of the risks of climate change and a continued reliance on fossil fuels, as well as outlining a vision for transformation, including how citizens can be involved.

3.1.2. Using scenario analysis to assess and manage transition risks

Traditional forecasting methods, which rely primarily on identifying trends from historic data, offer little when it comes to identifying and planning for transition risks. Instead, governments should aim to raise their capacity to integrate new techniques, such as scenario analysis, stress testing and horizon scanning, to identify risks and develop strategies to successfully manage them.

Ultimately, navigating the complexity of risks and uncertainties presented by the low-carbon transition, and taking advantage of opportunities, will entail more sophisticated, holistic and flexible policy making. This must enable governments to anticipate and adapt to changing circumstances, and should reflect national socio-economic conditions and development plans.

Scenarios may need to be revisited following unexpected geopolitical developments. For example, Russia’s invasion of Ukraine has spurred volatility in global commodity markets, causing prices for fossil fuels to rise rapidly. Future scenarios for fossil fuel production and demand will need to account for this volatility, while also addressing the weaponisation of energy exports, renewed energy security concerns and rising domestic energy nationalism which undermines international energy and trade cooperation.

Governments should consider prioritising the following actions:

Use global fossil fuel supply and demand scenarios as a common basis for the discussion of national development plans and the role of fossil fuels within them.

Consider the interaction between fossil fuel production, revenues and demand under different climate/energy transition scenarios, factoring in the costs of domestic consumption and debt servicing, and the effects of lower prices on export revenues and tax income. This will support better understanding of carbon linkages (i.e. how carbon risks would flow from the fossil fuel sector to the wider economy).

Consider the implications for the profitability and fiscal stability of the government (where significant sums of public and private finance are invested in the sector), the companies (including NOCs), as well as the sectors and economies that are most exposed to market risks (e.g. devalued or stranded assets).

Develop plans that are robust enough to address the lowest case scenario for fossil fuel investments, market prices and demand.

Consider that established fossil fuel revenues could be used to support the implementation of a green transformation strategy at home while production is exported – instead of following the traditional “fossil fuel-led” development pathways, with emphasis on the linkages between the fossil fuel sector and fossil fuel-based value chains, which would increase risks. In any case, this option is unlikely to be available to new producers, given the timeframe to market and anticipated speed of decline in oil and gas demand and prices under a 1.5°C pathway.

Actions requiring international support in contexts where government capacity is low:

When assessing the opportunity to explore for and develop hydrocarbon reserves, consider the type of oil or gas and its likely export markets, the scale of the resource, and the cost of development and production against best estimates of commercially viable production under the 1.5°C scenario, with due regard given to assumptions related to the choice and deployment of carbon abatement technologies.

Assess the resilience of current plans in the sector to gradual or more disruptive change in international and domestic energy and industrial markets, in particular in the “lowest case” scenario, where revenues are lower than expected and projects are delayed or do not reach a final investment decision.

Build capacity to undertake non-traditional forecasting techniques (which go beyond identification of trends from historic data), risk management such as stress testing and scenario analysis, as well as effective institutional co-ordination processes to facilitate government-wide collaboration on risk management. This will help governments begin to plan for unanticipated events, identify them earlier and minimise negative impacts. Important techniques include scenario development and deep dive analyses, assessing how transition risks will play out in different sectors and communities (Collins, Florin and Sachs, 2021[9]).

Consider incorporating horizon-scanning techniques into planning apparatus. Horizon planning can be used to identify weak signals of coming changes, based on which governments can plan and develop mitigation strategies (Collins, Florin and Sachs, 2021[9]).

Using scenario analysis to assess and manage risks of continuous reliance on fossil fuels

Multi-decade scenario analysis can help simulate risks of continuous reliance on fossil fuels and their impacts on national plans for revenue management and spending, energy and industrial policy. This analysis can also plot the interaction of production, exports and/or domestic consumption, infrastructure development, revenues, associated emissions and well-being indicators under different transition pathways.

This will help inform decision making regarding the fossil fuel sector, in the light of economic and social trade-offs associated with different development pathways as well as alternative options for revenue-generation, access to energy, sustainable infrastructure and sustainable economic growth.

The impact of risks associated with continued reliance on fossil fuels will vary depending on a country’s stage of fossil fuel production, the type and scale of resources, their production cost and low-carbon nature, as well as the planned allocation of production to export and/or domestic markets. These factors should be considered in macroeconomic scenario analyses conducted by central banks, regulators and ministries of finance, in line with the Network for Greening the Financial System.

Box 3.2. Scenarios for fossil fuel production and demand

Future scenarios for fossil fuel production and demand are highly dependent on assumptions about technology development and deployment, and future global climate policy. They also depend heavily on assumptions about the deployment of CC(U)S, carbon removal strategies, and on the competitiveness of “green” hydrogen produced by the electrolysis of water, versus “blue” hydrogen, produced by steam methane reforming of natural gas. Patterns of demand will also be affected by the impacts of climate change itself, which will be more severe and disruptive the less successful efforts are at meeting the Paris Agreement objectives.

Scenarios can be based on climate models or on energy systems models. The first type of model is used to study the climate effects of GHG emissions, whereas the second type considers the energy sector reforms necessary to reach climate targets. Scenarios can also incorporate climate effects and energy supply and demand across different economic sectors.

According to the IPCC’s Sixth Assessment Report, limiting global warming to 1.5°C will require global CO2 emissions to decline by about 48% by 2030 and 80% by 2040, compared to 2019 levels. To limit global warming to below 2°C, CO2 emissions need to decline by about 27% by 2030 and 52% by 2040, compared to 2019 levels. In modelled pathways that limit warming to 1.5°C, the global use of coal, oil and gas in 2050 is projected to decline with median values of about 95%, 60% and 45%, respectively, compared to 2019.

According to UNEP’s 2020 Production Gap Report, global coal, oil and gas production would need to decline annually by 11%, 4% and 3%, respectively, between 2020 and 2030, to be consistent with a 1.5°C pathway. The same report finds that countries are instead planning and projecting an average annual increase of 2%, that would by 2030 generate more than double the emissions consistent with the 1.5°C limit.

The Energy Transitions Commission finds that reaching net zero by 2050 will require electrification of 65-70% of final energy demand, versus 19% today. It will also require an expansion of the role of clean hydrogen to 15-20% of final energy demand, hydrogen-based fuels (ammonia, synthetic fuels), biomass as bioenergy or bio-feedstock for the chemical industry, and natural gas combined with CCS.

The IRENA Transforming Energy Scenario would cut fossil fuel-use by about 75% by 2050. This scenario sees emissions fall at a compound rate of 3.8% per year, to 70% less than today’s level by 2050. The largest consumption declines would take place in coal, reducing by 41% by 2030 and 87% by 2050, and oil by 31% by 2030 and 70% by 2050. Natural gas demand would increase by 3% by 2030, but would decline 41% by 2050. Under this scenario, the share of renewable energy in electricity generation would increase to 65% by 2030 and the share of renewable energy in the global energy mix would increase from 19% in 2019 to 79% by 2050.

The IEA’s Net Zero Roadmap finds that the share of fossil fuels in the global energy supply would need to be reduced from around four-fifths currently to one-fifth by 2050. Coal demand would need to be reduced by 90%, gas demand by half and oil demand by 75% by 2050. By then, electricity will account for around half of total energy consumption, with solar providing 20% of global energy demand. Due to energy efficiency improvements, global energy demand will under this projection be around 8% smaller in 2050 than it is today, although the size of the world economy will double. Clean energy investment will need to triple by 2030, to around USD 5 trillion per year up from around USD 1.4 trillion today.

The rapid drop in oil and natural gas demand in the net-zero scenario means that no fossil fuel exploration and no new oil and natural gas fields are required beyond those that have already been approved for development in 2021. Fossil fuels would still be used for non-energy purposes in sectors where the complete elimination of emissions is particularly challenging (mostly oil to fuel aviation in particular), and in the electricity and industrial sectors requiring USD 650 billion investment in CC(U)S. A small amount of unabated coal and natural gas are used in industry and in the production of energy, resulting in around 1.7 Gt CO2 emissions in 2050, which would be offset by Bio-Energy with Carbon Capture and Storage (BECCS) and Direct Air Carbon Capture and Storage (DACCS). Investment in fossil fuel-based CC(U)S could be avoided if additional investment were mobilised for extra wind, solar and electrolyser capacity, for electricity-based routes in heavy industry, and for expanded electricity networks and storage to support this higher level of deployment, with an additional cumulative investment to reach net-zero emissions in 2050, which would be USD 15 trillion higher than in the Net Zero Emissions by 2050 Scenario.

The IEA’s (2021) report on financing the clean energy transition in emerging and developing economies finds that annual clean energy investment in these economies must increase from less than USD 150 billion in 2020 to over USD 1 trillion annually by 2030 to reach net-zero emissions by 2050. These countries, which are home to two-thirds of the world population, will represent 90% of future emissions growth. However, they only receive 20% of the funding for low-carbon technologies and other green investment.

Meanwhile, the IEA’s Africa Energy Outlook 2022 notes that Africa’s industrialisation will rely in part on expanding its use of natural gas. The report states that 5 000 billion cubic metres of natural gas have been discovered in Africa, but have not yet been approved for development. This resource could provide 90 billion cubic metres of gas per year by 2030, sufficient to drive development of the continent’s fertiliser, steel and cement industries, as well as water desalination. Cumulative CO2 emissions from utilisation of this gas over a 30-year period would amount to 10 Gt, raising the continent’s share of global emissions to just 3.5%. However, the report also notes the importance of Africa leveraging its gas to primarily meet domestic needs, rather than for export, while in parallel preparing for a gradual decline in revenues from fossil fuels.

What can governments do to build capacity to develop scenarios on future fossil fuel production and demand?

Set up a team or identify a technical agency dedicated to modelling and scenario building.

Support the continuity and growth of internal capabilities by regularly updating scenarios and engaging with external stakeholders to ensure quality assurance

Build partnerships with external institutions to enhance capacity and co-develop energy models and scenarios

Disclose assumptions and data used and engage with a broad range of stakeholders, including civil society, to foster well-informed national policy dialogue.

When outsourcing scenario development, ensure that absorptive capacity exists within government to aid understanding and use of scenario results.

What can the fossil fuel industry do to support governments in developing scenarios on future fossil fuels production and demand?

Share fossil fuel production and demand scenarios at project level wherever possible

Fully disclose scenario data and modelling methodologies and help governments understand the underlying data and assumptions as well as the implications for fossil fuel production.

Explain how long-term strategies are tested against different carbon-constrained scenarios.

Explain that in order to remain sustainable and competitive, a leaner and more efficient oil and gas industry is required. This will include shortening investment cycles, developing low-carbon and low‑cost resources, minimising product losses including methane leakage, and increasing recycling and re-use of inputs such as water, as well as infrastructure repurposing, wherever technically and economically feasible.

Help governments improve understanding around the deployment of significant higher levels of artificial intelligence and automation, and remote operation and management.

Publicly disclose how company decarbonisation and sustainability plans will impact specific projects in producer countries. Fossil fuel companies – both private and state-owned – should disclose production, energy transition and responsible exit plans for their projects. They should also engage with stakeholders on the social and economic impacts that project continuation, wind down or transfer would have on host governments and communities (e.g. impacts on payments to government and local employment, timelines and decommissioning plans).

What can development finance institutions do to support governments in developing scenarios on future fossil fuel production and demand?

Provide training and capacity-building support to government technical agencies to develop scenario analysis and the capacity of ministries to understand and use scenario results.

Build partnerships to co-develop energy models and scenarios.

Provide funding to access proprietary tools for scenario development.

3.1.3. Integrating national development and decarbonisation plans

Low-carbon development integrating climate change with development objectives is a process of structural transformation that requires the elaboration of a long-term vision developed through a multi-stakeholder governance process and a coherent strategy, underpinned by a combination of consistent policy direction and careful sequencing of complementary and mutually reinforcing measures to enable an efficient and cost-effective shift to a low-emission and climate resilient economy. Long-term integrated development planning, incorporating interconnected energy, climate, environmental, macro-economic fiscal, labour, skills, industrial, infrastructure and transport policies, will be key for fossil fuel producer developing and emerging economies to align short and mid-term policy choices with long-term objectives, increase policy coherence and support implementation. Setting a long-term direction underpinned by wide stakeholder buy-in will also require articulating the benefits of low-carbon development models, which can outlast election cycles and changes in government administrations. Mainstreaming low-carbon and climate resilience development strategies into national development planning should also integrate effective Measurement, Reporting and Verification (MRV) mechanisms to regularly take stock of progress, and be sufficiently flexible to adapt to changing circumstances and the emergence of new technologies and evolving climate conditions.

This will entail taking co-ordinated and harmonised actions horizontally across multiple departments and vertically across levels of government (national, regional and local, with meaningful stakeholder engagement), all pulling in the same direction, as opposed to an array of isolated policy measures often implemented in an inconsistent manner and leading to suboptimal or even contradictory outcomes.

Just transition plans, Nationally Determined Contributions (NDCs), and national development and economy-wide decarbonisation plans should be integrated into a coherent national development and decarbonisation programme that clearly articulates how social, environmental and economic objectives will be achieved, alongside delivery of the least-cost pathway to decarbonisation. Moreover, the process of building a national development framework, coherent with the NDCs, provides an important way to build public acceptability for the low-carbon transition, if steps are taken to integrate citizens’ voices into the policy making process and the framework is delivered from the bottom up. Developing countries can also integrate conditional components into their NDCs. These are emissions reduction and avoidance initiatives and investments that are achievable contingent on the receipt of international finance, technology and capacity transfer. This is an important mechanism to hold advanced economies to account regarding shared responsibility for decarbonisation, and to clearly delineate the limits of what can be accomplished based on domestic resources alone and what will require international support. Fossil fuel producer developing countries should capitalise on efforts to diversify oil and gas supply to insist on technology and skills transfer and finance to deploy emissions abatement technologies on oil and gas production, processing and transport. This represents a key factor in maintaining market access, as well as longer-term partnerships to support deployment of renewables generation and investment in infrastructure for transmission, distribution and transport, which will be key to sustaining a longer-term move away from a dependence on fossil fuel revenue.

Achieving overall policy coherence between decarbonisation strategies and overarching development plans requires close collaboration and alignment between institutions mandated to lead on each process. In many countries, the environment ministry leads on the NDC, while the finance, economy or planning ministry is normally responsible for overall economic planning and prioritisation of development programmes through the national budgeting process, as well as being the designated recipient of international development assistance and climate finance. Imbalances in administrative capacity, established lines of communication with other government departments and levels of influence between these institutions can make it challenging to integrate NDC initiatives into the national development planning process, particularly where projects are funded through national budget allocations and compete with other spending imperatives.

Shared leadership roles on NDC development, for example, between environment and finance ministries, and clear legal mandates over which entities are responsible for which components of NDC development can help to: 1) better integrate NDC development with the broader economic planning process; 2) ensure initiatives in the NDC are adequately resourced, while aligning NDC and economic planning cycles, and 3) ensure similar stakeholders are consulted across both processes to improve policy coherence.

Clearly defined sectoral goals, based on SMART (Specific, Measurable, Agreed-upon, Realistic and Timebound) design principles bracketing targets and initiatives by sector and GHG type can support implementation, clarifying requirements for agencies responsible for oversight (Bird, Monkhouse and Booth, 2017[18]).

Table 3.1. Suggested interim measurement indicators to track decarbonisation progress by sector

|

Sector |

Milestones |

Potential indicators |

|---|---|---|

|

Energy |

Transition to low-carbon (abated gas) and renewables generation sources, and replacement of fossil fuels with low-carbon or zero-carbon synthetic fuels; progressive roll out of energy access. |

|

|

Manufacturing and industry |

Energy and material intensity of manufacturing to decrease, with production processes, especially in hard-to-abate sectors. |

|

|

Transportation |

Domestic vehicles use should be more efficient and progressively substituted by non-carbon transport modes. Aeroplanes, trucks and ships to become less carbon intensive. |

|

|

Residential use and buildings |

Efficient (new or retrofitted) buildings are necessary to keep energy demand low |

|

|

Agriculture, forestry and land use |

Agriculture should become sustainable while satisfying increasing food demand |

|

Source: Adapted from (D’Arcangelo et al., 2022[19]).

Governments should consider prioritising the following actions:

Consider how to align NDC and national development planning processes, integrating planning cycles with NDC actions, and interim and long-term targets into budget allocation cycles. This process is key to aligning decarbonisation, social, economic and environmental development objectives, and balancing climate change goals.

Consider how to optimise sequencing of reforms, based on national circumstances and political economy considerations. For example, policies which lead to increased costs for certain segments of the population can be spread over time to avoid creating obstacles, while they can also risk derailing simpler, less contentious reforms which may be more straightforward to introduce.

Establish interim and long-range decarbonisation measurement indicators based on extensive industry and cross-government consultation to ensure they are ambitious yet achievable, as well as consistent with a just and least-cost decarbonisation pathway and complementary to overall development objectives. Basing these targets on SMART design principles will facilitate oversight from implementing agencies (Bird, Monkhouse and Booth, 2017[18]).

Consider how to align and harmonise authorship and ownership of NDC and national development planning, particularly in contexts where the former is led by the environment ministry and the latter is led by the finance or economy ministry, which may carry more weight in cross-governmental administration and engagement processes. Joint ownership between the environment and finance or economy ministry can ensure both institutions pull in the same direction in integrating decarbonisation and development goals. An inter-governmental co-operation agency or commission with a strong mandate can help to facilitate this process, ensuring policy making adheres to high-level climate and development goals.

Clearly delineate which NDC targets are achievable with domestic resources only, and which are conditional and can be achieved upon receipt of technology and skills transfer and financing from international partners. Clearly defined and costed activities, which are accompanied by a clear rationale as to how they will contribute to further emissions reduction beyond what is considered unconditional in the NDC, will facilitate access to international support, and can support discussions with importer governments and development finance institutions to make this support a reality.

Actions requiring international support in contexts where government capacity is low:

Invest in robust MRV systems and build cross-sectorial capacity to monitor, follow-up and report on progress against emissions reduction targets as an important requirement for attracting climate finance and guarding against greenwashing, and to enable timely changes to policy direction when measures are not working or prove to be counterproductive to overall achievement of least-cost transition outcomes.

3.1.4. Mobilising transition finance

The IEA Net Zero report states that “for many developing countries, the pathway to net zero without international assistance is not clear. Technical and financial support is needed to ensure deployment of key technologies and infrastructure. Without greater international co‐operation, global CO2 emissions will not fall to net zero by 2050” (IEA, 2021[20]).

In developing countries, uptake of green finance has been significantly slower than in advanced economies. Less than 20% of USD 1 trillion of green bonds issued globally are from developing countries. Between them, Latin America and Africa combined make up less than 3% of global green bond issuance. For the world to achieve the objectives of the Paris Agreement, international support is needed to enable access to finance for countries with high emissions, including their NOCs and heavy industries. However, high emitters frequently do not qualify for green finance, as they do not meet the required benchmarks or criteria for GHG. The slow uptake of green finance in emerging economies raises the question of whether it is fair to impose the same benchmarks and criteria used in advanced economies on developing economies that are already struggling to provide basic services to their populations. Furthermore, under current criteria, countries that score low on environmental, social and governance (ESG) performance standards, but make genuine efforts to improve would not be able to access green finance.

Box 3.3. What is transition finance?

Transition finance has recently been gaining traction as a complementary approach to existing green finance instruments that, in the area of climate change mitigation, tend to focus on providing and mobilising finance for economic activities and projects that are already low- or zero-carbon. To date, transition finance is a nascent and evolving space and as such does not currently have a commonly agreed definition. However, a 2021 OECD review of related approaches and instruments found that existing approaches tend to view transition finance as being intended to decarbonise economic activities or entities that are currently 1) emissions-intensive, 2) may not yet have a zero-emission alternative economically available or credible in all contexts, 3) but are important for socio-economic development.

In this context, transition finance is considered a promising avenue for mainstreaming climate transition considerations in finance and across corporates, especially when supporting energy-intensive and hard-to-abate sectors to decarbonise. Transition finance-related instruments and approaches have, however, been criticised by financial market participants and civil society for creating greenwashing risks and showing a lack of environmental integrity. This is further compounded by the heterogeneity of existing transition finance approaches, which can be difficult to compare across jurisdictions and markets. One of the key risks is creating carbon-intensive lock-in through investments into emissions-intensive assets or infrastructures with a long lifetime. Even if those investments are aimed at efficiency improvements and emission reductions, absolute emissions of the targeted assets and infrastructures may remain too high to be consistent with the temperature goal of the Paris Agreement. A key challenge in transition finance is to balance these risks when ensuring environmental integrity and preventing emission lock-in, while remaining inclusive of sectors and geographies in need of finance for their climate transition.

The OECD Guidance on Transition Finance applies to corporates and posits that to prevent greenwashing and support cross-border co-ordination in the transition finance space, transition finance transactions should be based on credible corporate climate transition plans. This can ensure that there is an entity-wide strategy behind the related financial instrument, including mechanisms to prevent carbon-intensive lock-in for assets and infrastructures at risk. The guidance therefore proposes that transition finance should be understood as “finance deployed or raised by corporates to implement their net-zero transition, in line with the temperature goal of the Paris Agreement and based on credible corporate climate transition plans”. It sets out ten key elements of credible corporate climate transition plans, such as target-setting and reporting on progress, and proposes modifications for small- and medium-sized enterprises as well as certain corporates operating in emerging markets and developing economies, in order to allow for inclusiveness. While the guidance focuses on non-financial corporates, many of its elements can also apply to other entities, including, for example, national and municipal administrations.

Source: Authors based on (OECD, 2022[21]); (Tandon, 2021[22]).

Transition finance complements green finance

Compared to green finance, transition finance often refers to finance that targets progress on climate and environmental parameters, rather than only satisfying certain climate and environmental thresholds or criteria (see Box 3.3 for further background on transition finance). Whereas green budgeting and reporting, green financial instruments and green taxonomies, as well as other green finance-related tools, can be used in a static manner by stakeholders to inform their investment decisions, transition finance aims to be more forward looking and dynamic (Box 3.4 clarifies the difference between green, sustainability-linked and transition financial instruments such as bonds). Transition finance does not necessarily require countries or companies to have achieved certain performance standards today to be eligible for financing, but instead provides finance for countries and companies that set themselves on an ambitious and verifiable path of transition, including performance milestones and targets to be met over a certain period, measured by pre-defined and verifiable KPIs and metrics. For example, under some existing transition finance approaches, equity investments in existing natural gas projects could be linked to progress towards eliminating emissions from natural gas production for hydrogen or from existing natural gas-fired power plants by applying CC(U)S to the flue gases from natural gas-powered plants or to the design of transition ready and future-proof infrastructure (see also Pillar 2, Section 2.3). Without transition finance, emerging and developing economies with energy-intensive and hard-to-abate sectors could be excluded from the financing that they need to transform their energy systems and, more broadly, their economies, while advanced economies continue to decarbonise.

An important challenge for transition finance in emerging and developing economies is to balance environmental credibility with inclusiveness, by creating credible criteria and mechanisms whereby this financing is allocated, including mechanisms for monitoring, verification and reporting of progress on climate and environmental parameters, and to prevent carbon-intensive lock-in.

Box 3.4. Bond instruments to support the climate transition: Green, sustainability-linked and transition bonds

Interest in green and transition finance continues to grow, as an increasing number of companies, financial institutions, and jurisdictions across the world adopt net-zero targets. In this context, fixed-income instruments are gaining traction in green finance more generally, but especially in the transition finance space. To date, most transition finance-related instruments are sustainability-linked bonds and loans, although a new denomination of transition bonds is also starting to emerge. Green bonds are also often included in the transition finance discussion, despite their narrower focus on low- and zero-emission projects, as they are a key building block in an issuer’s overall climate transition. For example, ICMA’s Climate Transition Finance Handbook takes the view that a “transition” denomination should communicate an issuer’s strategy to align with the Paris Agreement goals. This means that a “transition bond” could be either a green, sustainability, sustainability-linked or a transition bond, if it contributes to the issuer’s climate transition strategy.

Green bonds

Green bonds are generally use-of-proceeds instruments whereby the funds raised are used to finance or refinance projects or assets that are deemed eligible through a project categorisation or taxonomy. Funds raised through green bonds are committed to projects that contribute to climate or environmental objectives, such as investment in renewable energy or zero-emission transport. The most prominent standard for green bond issuances, both by private and sovereign issuers, is the International Capital Market Association (ICMA) Green Bond Principles, which are voluntary process guidelines to “promote integrity in the development of the green bond market” by providing clarity on the approach to issuance, transparency and disclosure.

Sustainability-linked bonds

Sustainability-linked bonds are performance-based instruments that allow companies to raise finance for general purposes, while setting out sustainability performance targets that need to be achieved by the issuer. The bond’s finance terms, such as the coupon, are linked to these targets and vary depending on whether the issuer achieved the predetermined target. Targets can generally cover several sustainability-related dimensions, including climate, environmental and social elements, though nearly 60% of issuances in Q1 2022 specifically targeted GHG or carbon emission reductions. For this reason and because sustainability-linked bonds are accessible to issuers from all sectors and geographies, they are considered as a promising financial instrument for transition finance.

Transition bonds

Transition bonds are a very recent market segment, with to date less than 20 issuances explicitly labelled as such and mostly issued by non-financial corporates in Asia, using the ICMA Climate Transition Finance Handbook. The Climate Bonds Initiative (CBI) is currently undertaking work on a dedicated transition label, which would define transition bonds as use-of-proceeds instruments, used to finance specific economic activities and projects that are compliant with CBI’s criteria, in a manner similar to green bonds.

Source: Authors based on (OECD, 2022[21]); (Tandon, 2021[22]); (ICMA, 2020[23]); (ICMA, 2021[24]); (CBI, 2022[25]); (CBI, 2022[25]).

Governments should consider prioritising the following actions:

Establish frameworks that ensure verifiable progress towards commitments under NDCs.

Adopt regulatory requirements for corporate disclosure on environmental risks in line with the Taskforce on Climate-Related Financial Disclosures (TCFD). Monitor progress of the International Sustainability Standards Board (ISSB)’s work on sustainability disclosures, which builds on recommendations of the TCFD, to enhance provision of information on sustainability-related risks and opportunities necessary for investors to assess enterprise value (IFRS, 2022[26]).

Actions requiring international support in contexts where government capacity is low:

Foster standardisation of transition finance guidelines, standards and definitions, on how to measure sustainability performance, including relevant KPIs, as well as mechanisms to guard against risk of greenwashing, to provide investors with the necessary information to assess the credibility of transition plans and monitor implementation.

Consider issuance of domestic currency transition bonds to build a liquid sovereign transition bond market for domestic investors. This will be contingent on development of guidance and standards for sovereign transition bonds, which enable investors to assess the credibility of transition plans, progress against them and guard against greenwashing.

Criteria for issuing sovereign transition bonds could include 1) the allocation of responsibility for verification and reporting of transition bond proceeds, 2) establishing criteria for verification and reporting on bonds; and 3) ring fencing of sovereign transition bonds proceeds from the general budget.

Establish a local corporate transition bond index.

What can financiers do?

Local commercial and investment banks can seek out protocols for transition bond issuance and develop internal processes to identify eligible projects, including by seeking clients with credible climate transition plans. OECD guidance on transition finance can help identify relevant corporates with credible transition strategies.

Banks can provide more efficient foreign exchange hedging to mitigate the risk of currency volatility for foreign investors venturing into local markets.

Local investors (including pension funds) can demonstrate a stronger interest in transition bonds, and in providing new green retail products.

Index providers can create local corporate transition bond indexes when appropriate.

What can government and financiers do together?

Bond issuers (sovereign and corporate) can contribute to long-term market creation by 1) incorporating long-term risks to their economies and business models, 2) building system resiliency, and 3) cultivating a new set of investors and building credibility by establishing a history of issuance for transition bonds.

Provide training on the process and benefits of issuing transition bonds.

What can development finance institutions do?

Provide guarantees tied to transition bonds. Possibilities include a basket of bonds in which development finance institutions take the first-loss (equity) tranche.

3.2. Economic diversification

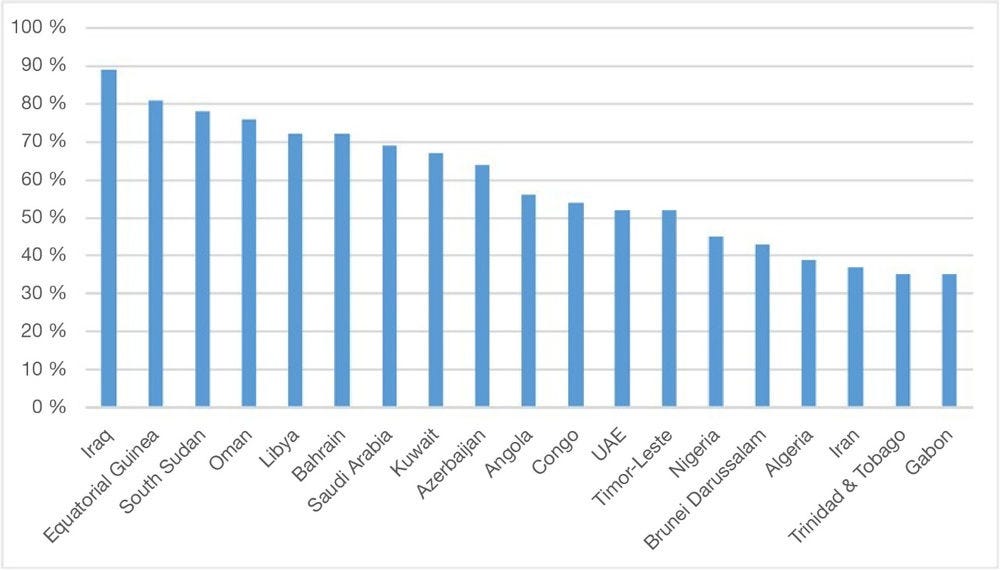

With some countries expected to see a 51% drop in government oil and gas revenues, as a result of the shift to a low-carbon world over the next two decades, economic diversification, including through economy-wide decarbonisation, is an imperative for fossil fuel-producer emerging and developing countries, to set their economies on a pathway to sustainable growth. This is particularly the case for countries that are dependent on oil and gas for 60% or more of their fiscal revenue, and in some cases above 90% (Coffin, Dalman and Grant, 2021[27]). Economic diversification, in addition to increasing resilience to external shocks through reducing dependence on few sectors or commodities, can help to decouple government spending from price fluctuations, create quality jobs and broaden the tax base, as well as reduce pollution and environmental degradation by moving away from fossil fuel-intensive industries. This strategy can also contribute to strengthening the contract between the state and its citizens, given the positive correlation between broader taxation, citizens holding government to account, improved public spending, and more inclusive and improved policy making. Fossil fuel revenue can provide an important avenue for governments to fund strategic and targeted investments to set the foundations for economic diversification and to stimulate productivity and competitiveness in the private sector. For example, Ghana’s One District, One Factory scheme uses oil revenue to build a factory in each of the country’s 260 districts to promote export competitiveness, while Saudi Arabia’s Public Investment Fund has allocated USD 1.1 billion to support SME development.

Fossil fuel producer emerging and developing economies should adopt strategies to build diversified, value-added economies, characterised by increased productivity of non-fossil fuel private sector firms and diversified export revenue. Ultimately, no single sector or industry will be able to replace revenue from fossil fuels, and the process of diversifying and transforming the economy will be a lengthy and uncertain endeavour, requiring long-term vision, with few guarantees of success.

Governments can play a role in correcting market failures and misaligned incentives to investment, production and consumption that are environmentally harmful and exacerbate fossil fuel path dependency, while at the same time clearing the way for the uptake of cleaner substitutes (see Pillar 3, Section 3.3). However, this can be challenging given the established and widespread availability of cheap carbon-intensive products and infrastructure which benefit dominant, incumbent industries and in which large volumes of capital have been invested. Addressing this imbalance requires raising the competitiveness of new sectors.

Through improved public-private co-ordination, involving public-private dialogue processes and programmes to create and identify opportunities for private sector investment, governments can set an enabling environment through which they can manage the transition away from fossil fuel dependence and scale up low-carbon technologies. This process requires a long-term but flexible vision, as well as an institutional structure enabling the identification of opportunities that align with national development objectives and circumstances upon which government and industry can build together. Rather than trying to pick winning sectors from the outset, governments can pursue a flexible portfolio of potential options emerging from public-private dialogue and identify the most appropriate enabling measures. Effective feedback loops and constant, proactive engagement with industry and business is vital to incorporating lessons learned into adaptive and integrated policy making, with government participation in industry networks and associations feeding back into government plans. A core function of government’s role is to ensure experimental programmes take place to test what technologies work in the local context and how they should be adapted, and that resulting lessons are fed back into government policy making and support for businesses (Alternburg and Assmann, 2017[28]).

Box 3.5. Key transition management elements for developing countries to overcome fossil fuel dependence and phase-in low-carbon technological substitutes

1. Plan proactively as an initial step, including the development of a long-term vision and a clear roadmap with interim goals and steps.

2. Communicate early and clearly with investors and the private sector about the intended vision and roadmap to achieve policy objectives. Involve stakeholders, including manufacturers, business associations and standardisation bodies, as early as possible in the process to identify innovations and opportunities that are best suited to the national context.

3. Carefully select a portfolio of options to provide with government support, ensuring that the selection is reviewed by independent experts to avoid capture by lobby and interest groups.

4. Pursue a sequential approach to providing support to greener technologies, tightening restrictions, applying charges and removing preferential treatment for fossil fuel-intensive businesses.

5. Explicitly include policy learning in the process of phasing in low-carbon technologies, ensuring that policy making builds on lessons learned, and feedback mechanisms are in place to end public support if it is shown not to be working.

6. Leverage multiple available policy options, including mandates, market pull policies, research and development, skills and capacity development, and standards and certification, based on analysis of local context and engagement with consumers and the private sector.

7. Invest in quality control and assessment mechanisms, including technology testing, to build confidence among consumers in new low-carbon technologies.

Source: (Alternburg and Assmann, 2017[28]).

For the most part, countries with limited but high potential domestic technology manufacturing capabilities will be late-comers to the market, and will be catching up with established manufacturers. One way to build domestic manufacturing skills, expertise and know-how would be for governments to support firms to invest in assembly, with future potential for manufacturing in specific low- and medium- tech green products (e.g. solar heaters, solar water pumps, solar driers, drip irrigation systems, rainwater harvesting technologies or LPG, LNG or ethanol cooking stoves), or to promote manufacturing of components for renewables technology or batteries for domestic deployment and exports (e.g. blades for wind turbines, or PV modules, and mirrors). This strategy has notably been employed by China, a late-comer to solar photovoltaic components manufacturing, but now the dominant player, as well as Chinese Taipei in the electronics sector. India’s National Mission on Transformative Mobility and Battery Storage, which aims to develop gigascale manufacturing in five years, also employs this strategy, initially focusing on battery module and battery pack assembly, and at a later stage progressing to battery cell manufacturing as the firms’ capacity improves (Kumar and Shrimali, 2020[29]).

However, pursuing a bottom up or catch-up strategy still requires good choices as to which products are likely to be successful. Governments need to undertake a baseline assessment and build credible and reliable statistics on existing industry capacity, raw materials, energy availability and financing, size of local enterprises, level of participation in value chains, supplier landscape and institutional capacity for skills and small and medium-sized enterprise development to inform strategic planning, required skills upgrading and technical training activities, as well as potential government incentive schemes and support measures. Industry demand analysis is also key to building economies of scale necessary to drive costs down and take advantage of potential export opportunities.

Regional co-ordination has strong potential to create market demand at scale, and avoid overlap between countries in terms of manufacturing capability and co-ordinating roadmap development to foster technology transfer and collaboration on financing. Additionally, joint ventures or strategic partnerships with advanced economies can support technology transfer and financing.

Figure 3.2. Fiscal dependence on oil and gas revenues by country (2015-18 average revenues as a percentage of total government revenues)

Source: (Coffin, Dalman and Grant, 2021[27]), Beyond Petrostates: The burning need to cut oil dependence in the energy transition, Carbon Tracker Initiative, https://carbontracker.org/reports/petrostates-energy-transition-report/.

Many fossil fuel producers are well placed to respond to growth in demand of green products, fuels and services given established energy and trade infrastructure, such as ports, pipelines and storage facilities, a skilled workforce familiar with producing, converting and handling energy fuels and products, and existing energy trading relationships (IRENA, 2022[30]).

In parallel, fossil fuel producer governments should pursue horizontal or non-sector-specific, broad-based policies which aim to build a thriving SME sector as an engine for quality job creation – especially in contexts with rapidly growing young populations who will need jobs – and to drive innovation and competition, with a view to integrating firms into regional and/or global value chains (GVCs). Participation in such value chains represents a central challenge for developing countries, many of whom are distant from manufacturing hubs, and face high transport costs. This is particularly the case for countries in Latin America and sub-Saharan Africa. Participating in higher value-added segments of the value chain, which create skilled jobs and higher income, rather than, for example product assembly, can be difficult to achieve in the face of international competition. Broad-based measures to improve the business environment, including streamlining business registration processes and revising bankruptcy rules, alongside policies to attract foreign direct investment in promising sectors, such as establishment of special economic zones, ideally linked to resource corridors offering improved shared infrastructure for multiple sectors, can help to enhance the quality and efficiency of SMEs, ultimately enabling them to compete with international peers.

Facilitating access to finance for SMEs is one of the most transformative changes governments can introduce. If finance is deployed strategically and targeted towards a company’s development needs, it can enable a firm to invest in the skills, business intelligence, design capacity, processes and equipment it needs to innovate, upgrade its products and build efficiency, to better compete on price and quality with international peers. Access to finance is a central impediment to upgrading firm productivity in developing countries, where the banking sector is often undercapitalised and few financial products are available for SMEs. In fossil fuel-producer countries, fossil fuel revenue flows directly from NOCs to governments without passing through the banking sector, leading to a situation in which the country is income rich, but banks are cash poor. In these circumstances, governments can try to address this balance by targeting SME financing programmes through the local banking sector, or through other financial intermediaries, such as a Strategic Investment Fund (SIF) to raise firm productivity and competitiveness.

Some fossil fuel producers have adopted vertical diversification strategies focused on industries linked to fossil fuels further down the value chain, such as chemicals and plastics manufacturing. Saudi Arabia’s Vision 2030, for instance, aims to expand the country’s existing petrochemicals industry. For a few fossil fuel producers, particularly those with low-cost production and competitive existing downstream industries, this can be an effective way to diversify revenue and monetise existing reserves. However, for the overwhelming majority of fossil fuel producer emerging and developing countries, which lack a comparative advantage and trade relationships in these downstream sectors, and without enabling infrastructure in place, the downside risks of vertical diversification will be too high, particularly given the high cost of abatement when cross-border carbon pricing mechanisms, such as the EU’s CBAM, kick in in the middle of the current decade. These countries are better off adopting broad-based measures to stimulate the competitiveness of non-fossil fuel sectors.

Box 3.6. IEA’s support for producer economies under the Clean Energy Transitions Programme (CETP)

Through its Clean Energy Transitions Programme (CETP), the IEA is working with producer economies to leverage their existing capacities and competitive advantages in traditional energy forms towards clean and low-carbon energy technologies. The aim is to help countries chart a low-carbon pathway for their own growing energy demand, while also exploring export opportunities for emerging low-carbon energy sectors, such as hydrogen.

This is a broad-ranging programme that cuts across the work streams of the IEA. It includes supporting renewable and clean energy deployment through policy reform; navigating the pathways available to countries seeking to implement national hydrogen strategies; and bolstering economic resilience through the promotion of local value chains. The programme functions through high-level dialogue; tailored support for national policy development; and thematic workshops and training. The programme has successfully put on the international agenda the unique challenges faced by this unique subset of countries, hosting with Oman a “Ministerial Dialogue on Clean Energy Transitions and Economic Resilience in the MENA region” in September 2021, while the IEA Executive Director published a joint opinion article with the Deputy Prime Minister of Iraq on the importance of climate action in producers.

The energy transitions in the producer economies programme supports the IEA’s ongoing work by feeding lessons learned and data collected from producer economies back into IEA analysis and publications, such as the World Energy Outlook, Energy Technology Perspectives and Renewables Market Report.

Governments should consider prioritising the following actions:

Consider strategies for economic diversification at the earliest possible opportunity, especially for communities in fossil fuel producer regions, recognising that a broad-based approach which incorporates horizontal, or non-sector specific policies, alongside targeted green industrial policy, will maximise chances of success in a highly competitive and constantly evolving global market place. Governments should recognise that economic diversification is a long-term process, requiring constant adjustments to policy making to ensure overall value for money, and to support projects which bear fruit, while abandoning those that are less successful.

Promote strong SMEs which can innovate, take risks and grow, as this is key to accessing regional and/or GVCs, creating quality jobs and broadening the tax base.

Facilitate access to finance for SMEs, as this is key to help them make the necessary investments in strategy, human resources, processes, equipment and research and development, to become competitive in the international marketplace, and move into higher-value segments of the value chain. Fossil fuel producer governments can look to channel finance to SMEs through financial intermediaries in contexts where the domestic banking sector is under capitalised. Financing should be targeted to the development needs of SMEs, and based on clear strategies to grow and export.

Provide missing inputs and services. Education, human capital, and access to quality and affordable services and infrastructure, including transport, trade-related infrastructure, broadband and reliable electricity are key to setting the foundations for non-fossil fuel private sector growth and encouraging foreign direct investment.

Address non-tariff barriers, such as land permitting, access to electricity and intellectual property rules, as this can incentivise investment, both domestic and international, to boost productivity and participate in regional and/or GVCs.

Prioritise measures which promote upskilling, technology transfer and development of local SMEs through strong linkages between international and domestic firms.

Assess how export revenue from fossil fuels can be deployed to support economic diversification policies and incentives through the long term. Deploying emissions abatement technologies, in line with Pillar 1, will be crucial to maintain market access for fossil fuel exports through the medium term, but revenues should be deployed to support investments in sustainable, low-carbon infrastructure, particularly transport, broadband and energy, as well as to reinforce diversification strategies.

Carefully assess the potential benefits, risks, costs and trade-offs of pursuing a dual-track approach to diversification which incorporates investments in downstream industries related to fossil fuels, for example, abated gas utilisation or chemicals manufacturing. Governments should only consider vertical diversification strategies on the basis of existing competitive advantage and rationale for investment (e.g. existence of proven reserves, enabling infrastructure and a market).