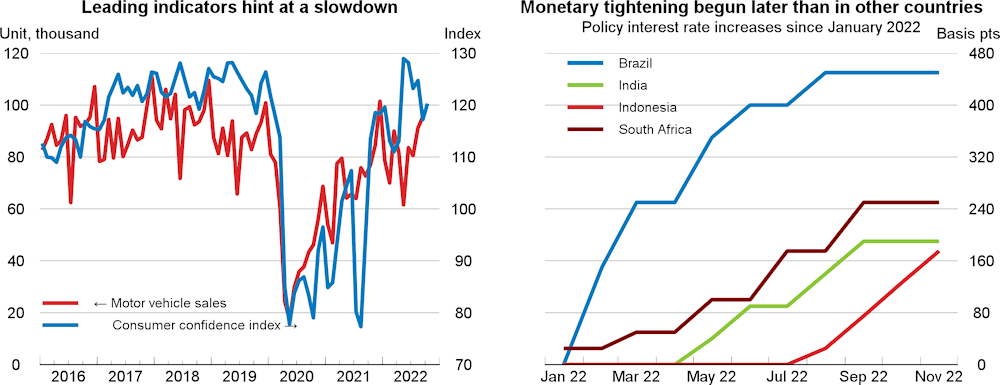

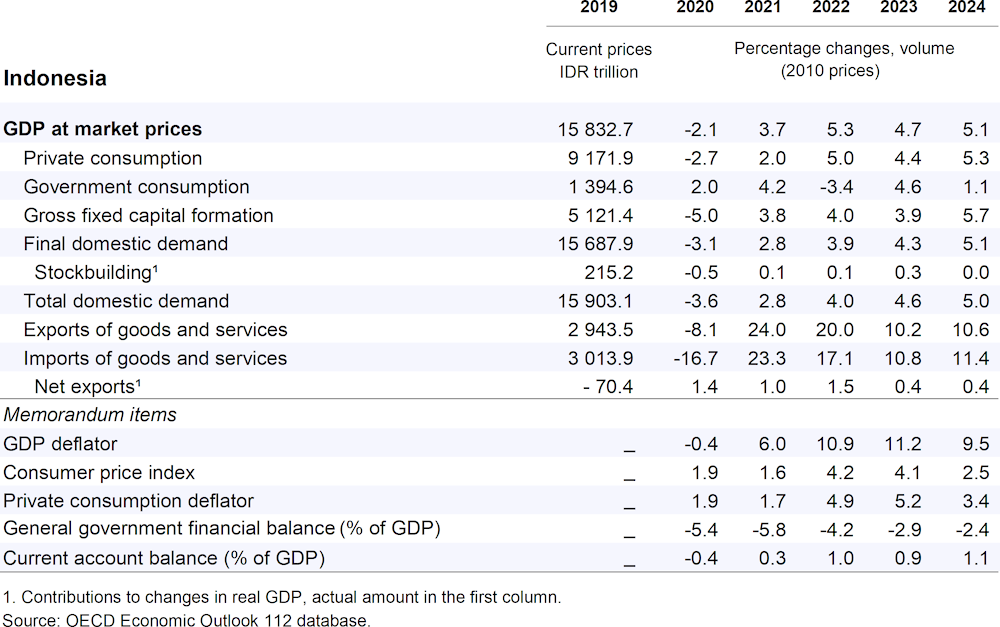

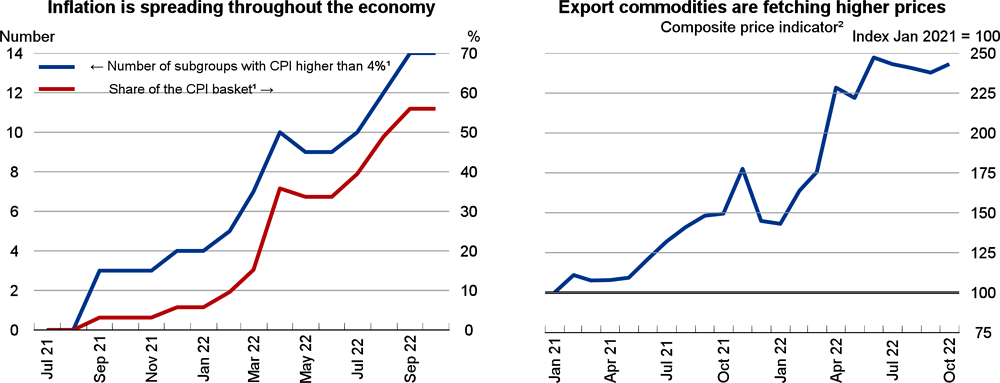

Favourable commodity prices and still buoyant capital inflows are helping Indonesia to resist strong global headwinds. However, domestic demand and private consumption growth is being held back by high headline inflation. With foreign investors recognizing the progress made towards macroeconomic stability and enhanced structural reforms, and expanding their reach in Indonesia, GDP growth is projected to average around 5% in 2022 and 2023 and strengthen slightly in 2024. Persistent tensions on energy, fertiliser and food markets and social unrest ahead of the February 2024 presidential elections are the main downside risks.

Fiscal and monetary policies should remain tight, while support for vulnerable households should be maintained. In the medium run, the overarching imperative remains to spur productivity growth through appropriate human capital policies, the removal of obstacles to business activity and the restructuring of state-owned enterprises (SOEs). It is also important to reinforce the independence and professionalism of the Indonesia Investment Authority, the recently-established sovereign wealth fund. On the upside, the impact on potential output of reforms enacted in recent years to liberalise labour markets may turn out to be larger than expected.