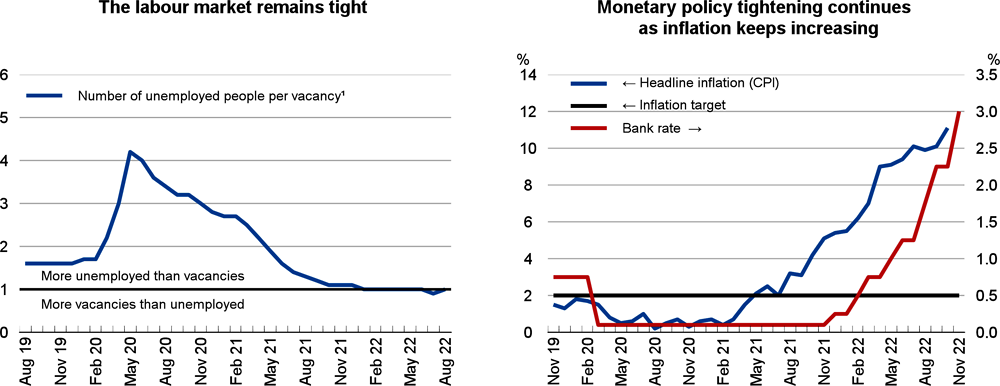

The Bank of England has responded to rising inflation with monetary tightening, raising the policy rate from 0.1% in December 2021 to 3% by November 2022. It has also continued with quantitative tightening by no longer reinvesting the proceeds of gilt redemptions in new gilt purchases and gradually reducing its holdings of sterling corporate bonds until the end of 2023. From November 2022, the Bank of England started to sell government bonds to gradually reduce the GBP 838 billion stock that was built up since the global financial crisis. Monetary policy tightening is expected to continue, with the bank rate reaching 4.5% by Q2 2023 and remaining at that level throughout the projection period.

The government has introduced several support measures to help households and businesses to cope with rising energy prices. To protect households and businesses from high energy prices, the government introduced the Energy Price Guarantee and the Energy Bill Relief Scheme, which both are effective from October 2022 until end-March 2023. Households will benefit from the Energy Price Guarantee, which caps the cost per unit, with the government covering the difference to the market price. This new scheme, expected to cost about GBP 25 billion, will reduce the annual cost of electricity and gas for an average household with typical energy expenditure to around GBP 2 500 a year. On average usage, a household will save GBP 1 000 a year. Over the same period, gas and electricity prices will also be capped for businesses, charities and the public sector under the Energy Bill Relief Scheme, estimated to cost GBP 18 billion. This six-month long support for households and businesses together is estimated to cost about GBP 43 billion (1.9% of 2022 GDP). The government announced that for the fiscal year 2023/24, the cap of the Energy Price Guarantee will be raised to GBP 3 000 per year for the energy consumption of a typical household (worth about GBP 13 billion) and that the most vulnerable households will be aided with additional support to mitigate the rising cost of living. These measures for households and businesses come on top of support packages announced earlier in the year (worth GBP 37 billion) to help households, including a GBP 11.7 billion Energy Bills Support Scheme worth up to GBP 400 each for around 28 million households, as well as a GBP 150 disability cost-of-living payment and a GBP 650 cost-of-living payment for households on means-tested benefits. Moreover, the government reversed the 1.25 percentage points increase in national insurance contributions previously planned to take effect from November 2022. While

most of the support package is debt financed, from April 2023, an increase in the corporate income tax rate from 19% to 25% and a decrease of the income threshold for taxation at the additional rate of 45% for higher earners from GBP 150 000 to GBP 125 140 will support the public finances. In 2023, the fiscal stance is expected to be slightly expansionary before tightening by 1.5 percentage points of potential GDP in 2024.