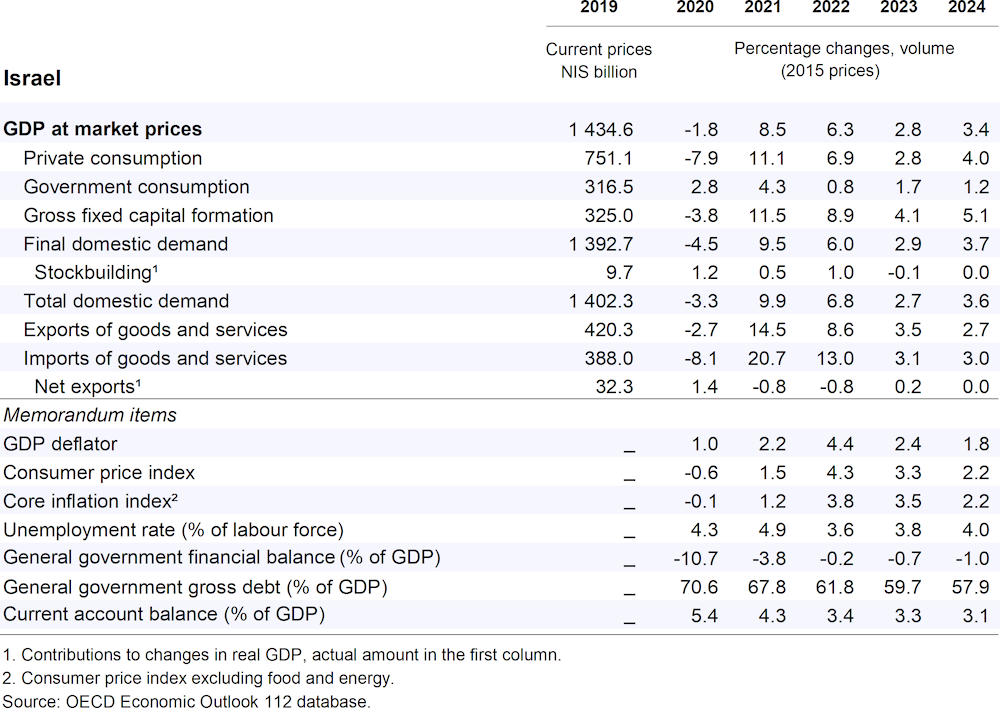

GDP growth is projected to moderate from a strong 6.3% in 2022 to 2.8% in 2023 and 3.4% in 2024. The global slowdown is set to weaken demand from Israel’s trading partners. Elevated inflation will slow disposable income and private consumption. Increasing interest rates and lower stock market valuations will weigh on investment. Growth is projected to pick up towards its potential rate in 2024 as inflation abates. Risks are skewed to the downside, and particularly related to a continuation of Russia’s war of aggression against Ukraine.

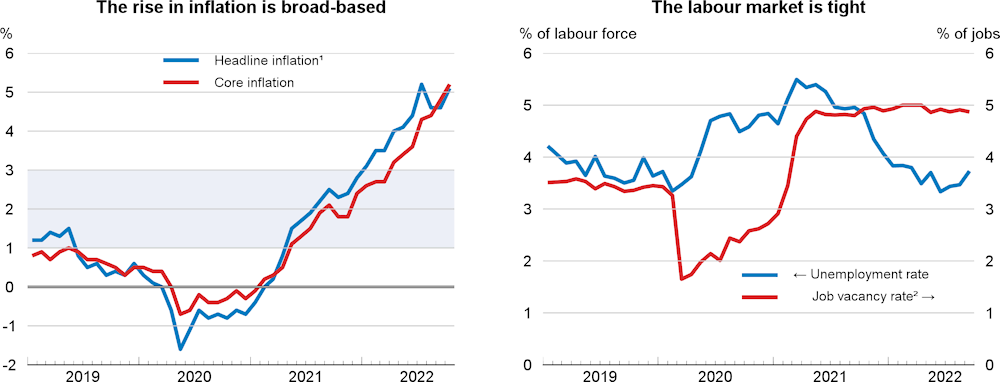

The gradual tightening of monetary policy should continue in order to bring inflation back into the target range. Fiscal policy should avoid adding to inflationary pressures while allowing for temporary and targeted support to households and firms most affected by rising costs. Recent reforms to reduce tariff and non-tariff import barriers are welcome and should continue. The expansion of renewable energy should be promoted by removing administrative barriers and investing in storage and transmission capacity.