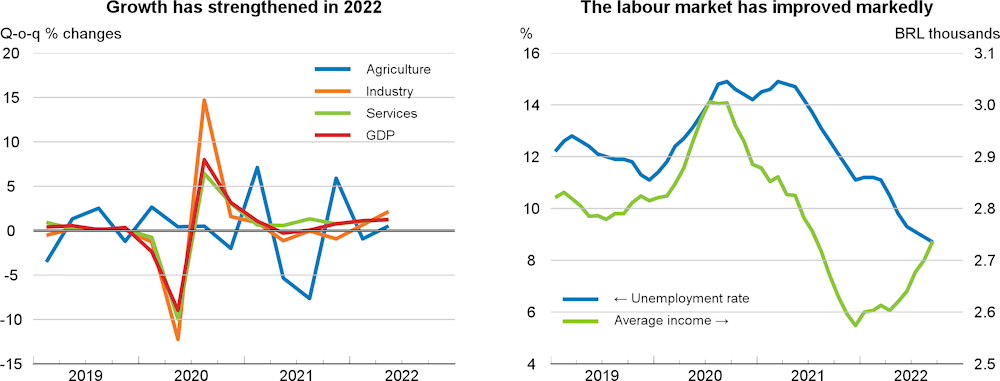

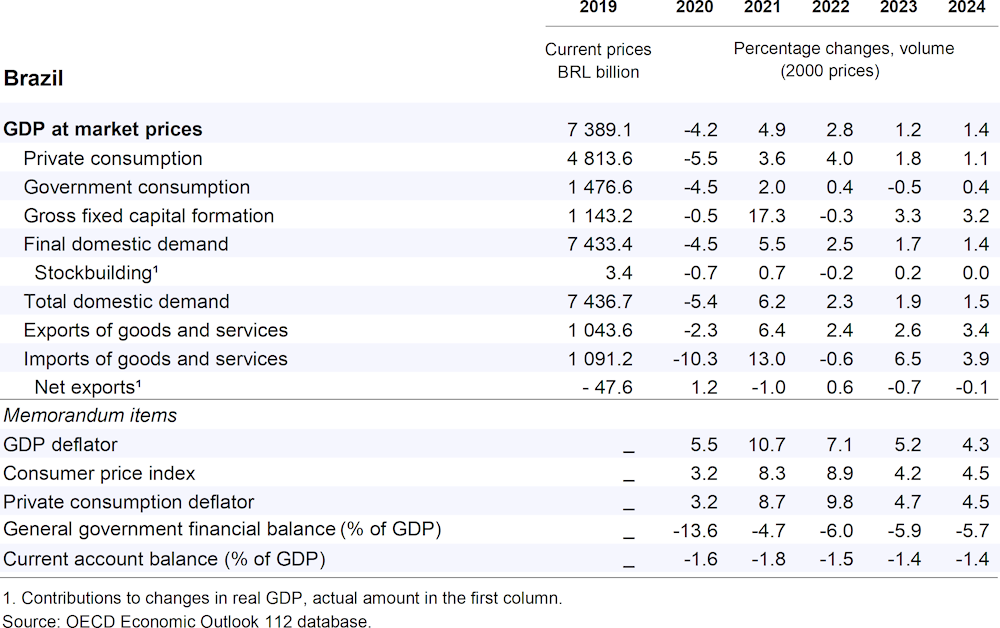

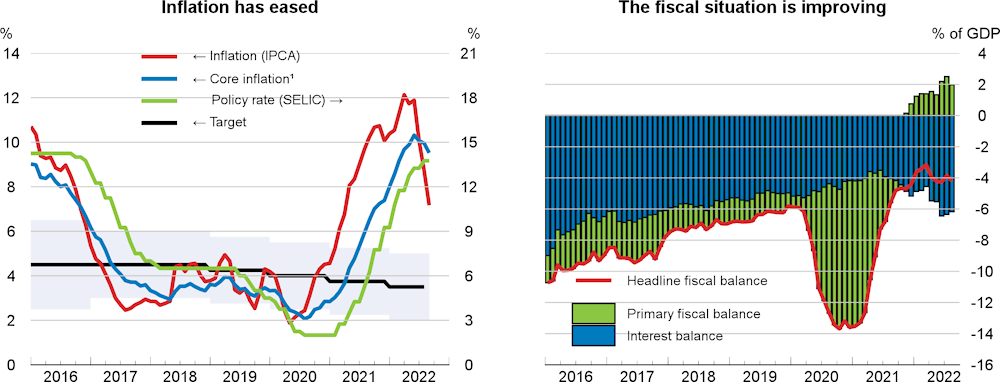

GDP is projected to grow by 2.8% in 2022, 1.2% in 2023, and 1.4% in 2024. Household consumption, private investment and exports will remain the main drivers of growth, although quarterly export growth is projected to slow in 2023. Household spending is buoyed by higher social transfers and vigorous employment growth but will also ease next year. Private investment will continue to rise on the back of improving business confidence. Despite higher global interest rates, the exchange rate has appreciated slightly this year, attenuating inflationary pressures. Inflation is projected to decline over the projection period as the effects of higher energy and food prices fade.

Monetary policy is expected to remain restrictive, with the current policy rate of 13.75% unchanged until mid‑2023. Policy interest rates can be lowered once inflationary pressures recede further. Fiscal policy has been expansionary and has contributed to inflationary pressures by raising demand. A comprehensive consolidation strategy is needed to reduce the deficit and restore the credibility of the fiscal framework. Reducing budget rigidities and limiting mandatory government spending would improve spending efficiency. Better managing public infrastructure investment, reforming social transfers, and stronger sustainability incentives for the agricultural sector could boost potential growth while improving public finances. Further developing the energy mix would reinforce resilience to climate shocks.