The Dominican Republic has made strides on many socioeconomic fronts over the years. The country has been one of the leading economies in Latin America and the Caribbean in terms of GDP growth, yet progress on the different dimensions of well-being has been more modest. In particular, socioeconomic and territorial disparities are still important, and public institutions remain insufficiently solid. For the Dominican Republic to embark on a more prosperous development path, three critical dimensions must be tackled. First, providing quality jobs for all, with particular emphasis on boosting formalisation and productive transformation. Second, mobilising more public and private finance for development, with more progressive and effective taxation systems, more efficient public expenditure and deeper capital markets. Third, accelerating digital transformation to boost productivity, enhance inclusion and support job creation. This Overview summarises the main messages of the Multi‑dimensional Review of the Dominican Republic.

Multi-dimensional Review of the Dominican Republic

1. Overview

Abstract

Economic growth in the Dominican Republic has been remarkable, but progress in the different dimensions of well-being remains insufficient. This Multi-dimensional Review offers an Initial Assessment of the main challenges and opportunities for more inclusive and sustainable development, and provides an In-Depth Analysis of three areas found to be particularly relevant for the country’s future: jobs, financing for development and digital transformation. In each of these areas, the report presents policy recommendations.

Economic growth has been strong but progress in terms of well-being remains insufficient

The recent history of the Dominican Republic is one of many socioeconomic achievements. The country has been one of the leading economies in the Latin American and Caribbean (LAC) region in terms of GDP growth, averaging a yearly rate of 5.1% between 1993 and 2021 (IMF, 2022[1]). This led the Dominican Republic to reach upper middle-income status in 2011, only eight years after the severe banking crisis of 2003-04. However, the impact of COVID-19 revealed significant structural weaknesses, and ample room for more inclusive and sustainable development (OECD et al., 2021[2]).

Economic growth has been mainly driven by a services-based, dual economy

Efforts to maintain macroeconomic stability have been an essential ingredient of economic growth, and of the relative resilience shown by the country to the impact of the COVID-19 crisis. Before the pandemic, structural reforms that helped increase foreign direct investment (FDI) flows – particularly in manufacturing in special economic zones (SEZs), mining and tourism –, coupled with favourable global conditions were the main drivers of growth. Remittances, mainly from Dominicans in the United States, also played a role, amounting to as much as 7.6% of GDP in 2018 (World Bank, 2018[3]). These factors continue to be the main engines of growth in the aftermath of the pandemic: while GDP contracted by 6.7% in 2020, the country saw a strong rebound in 2021, with GDP growing by 12.3% (IMF, 2022[1]).

Labour productivity has improved, particularly since 2010. Yet, it still represents around 65% less than in the OECD average, similar to the LAC average. This is partly the result of low labour participation rates among women, at only 43.4% (71% for men) in 2020 (World Bank, 2022[4]).

The fastest growing economic sectors between 2010 and 2018 were mining, construction and services, in particular tourism and financial intermediation. The economic structure is dominated by the services sector, which accounts for 60% of GDP, represents about half of yearly economic growth, and employs 74% of the total workforce (Central Bank of the Dominican Republic, 2022[5]). Among services, tourism is key, but took a particularly heavy toll as a result of the COVID-19 pandemic. Merchandise exports are dominated by manufacturing in SEZs, amounting to 56% of total merchandise exports in 2021. The mining sector has been receiving large inflows of FDI, in particular in gold and silver mining, and has increased exports significantly, accounting for 17% of merchandise exports in 2021 (Central Bank of the Dominican Republic, 2022[5]).

The economic structure is characterised by its duality between domestic firms and firms in SEZs, which have undergone a structural shift towards medium and high-skilled manufacturing since the 2000s. While the more traditional textile and wearing apparel industries were labour intensive and employed many low-skilled female workers, the emerging industries (pharmaceutical, medical and surgical equipment, electronic products) are less labour intensive and require higher levels of skills. In 2021, medical and surgical equipment, electronic products and manufactured tobacco products accounted for 27%, 17%, and 17% of total merchandise exports from SEZs, respectively. Meanwhile, exports from firms outside SEZs are dominated by products that are resource-based or of low technology content, including agricultural and food products as well as mining. Due to the higher technology intensity of emerging industries in SEZs, and broad tariff and tax exemptions, linkages with domestic firms outside of SEZs are relatively low (OECD/UNCTAD/ECLAC, 2020[6]).

Social conditions have made slower progress than economic performance, and have deteriorated in the context of the pandemic

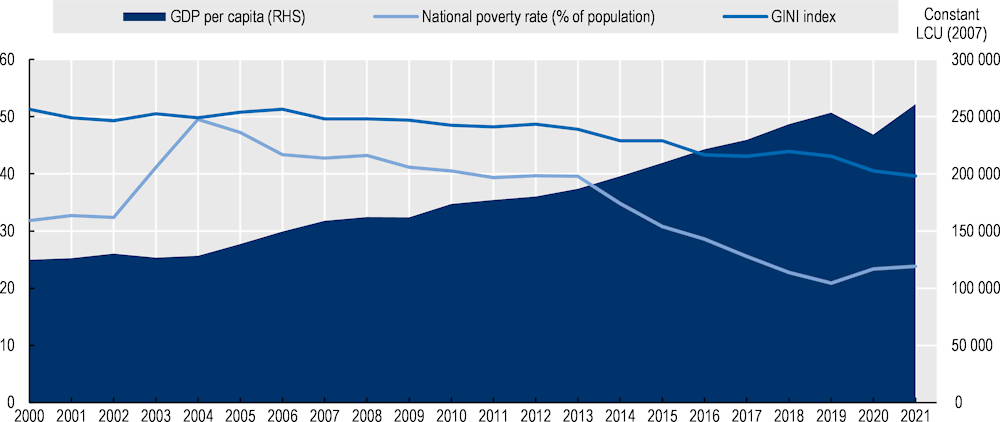

Strong and sustained economic growth has not translated into equally solid reduction in poverty and inequality, which have been aggravated by the pandemic. Poverty increased from 20.9% in 2019 to 23.4% in 2020 and up to 23.8% in 2021. Extreme poverty increased from 2.6% in 2019 to 3.5% in 2020, and slightly decreased to 3.1% in 2021. In previous years, poverty had recorded a steady but slow decline, from almost 50% in 2004 – largely because of the crisis – to 39.6% in 2013, accelerating thereafter (Figure 1.1). Inequality also fell between 2000 and 2021, with the Gini index declining from 0.513 to 0.396. This drop was higher than the average for LAC countries.

Figure 1.1. Evolution of GDP per capita, poverty rate and GINI index in the Dominican Republic

Note: Since 2016, the surveying methodology of the National Labour Force Survey changed to become the National Continuous Labour Force Survey, so poverty data may not be perfectly comparable before and after 2015. Estimates for GDP per capita begin after 2019.

Source: Authors’ elaboration based on (Ministerio de Economía, Planificación & Desarrollo; Unidad Asesora de Análisis Económico y Social, 2022[7]); (IMF, 2022[1]).

In 2020, almost half (46.9%) of Dominicans were part of the vulnerable middle class. These are individuals living in households with a daily per capita income between USD 5.5 -13 (PPP 2011) (World Bank, 2022[4]). Some of these are at risk of falling into poverty owing to substantial vulnerabilities, and the COVID‑19-related crisis impacted them particularly.

Taxes and transfers play a modest role in shaping the income distribution, as they only reduce the Gini index by less than 2 percentage points (Commitment to Equity Institute Data Centre, 2022[8]). Nevertheless, the capacity of the state to protect the most vulnerable has improved in the last decades and social protection tools have been strengthened, particularly as a response to the pandemic. The Dominican government increased transfers in existing social programmes and put in place new emergency packages. The Employee Solidarity Assistance Fund (FASE) was created to assist formal sector workers at high risk of losing their jobs with income support. Later, the Independent Worker Assistance Program (PA’ TI) sought to assist self-employed workers with financial help. The government also put in place the Stay at Home Program (Quédate en Casa), which targeted structurally poor or vulnerable households. These emergency programmes drove largely the increase in total social spending from 7.6% of GDP in 2019 to 12.2% in 2020 and 8.7% in 2021 (Ministerio de Hacienda, 2022[9]).

Environmental risks add to vulnerability to climate-related disasters

The Dominican Republic faces growing environmental pressures. Between 2000 and 2019, it was one of the 50 most vulnerable countries to extreme weather events globally (GermanWatch, 2021[10]). Due to its geographical location, the Dominican Republic is particularly affected by hurricanes, storms and floods. The vulnerability of housing constructions and the lack of urban and territorial planning increase physical and property damage, and can also affect economic activities like agriculture and tourism.

The current development model entails certain environmental risks. Marine resources are threatened by coastal development and overfishing. Mass tourism can also be a major threat for environmental protection. While the impact of COVID-19 reduced the flow of tourists, this had increased by 35% between 2007 and 2017, and figures for 2022 show a full recovery of this sector. Deforestation has been controlled in the last decades, and indeed the country has managed to increase forest area substantially, though pressures from agriculture and fires must be managed. Forest area increased by 5.1% between 2000 and 2010 and by 3.4% between 2010 and 2020 in the Dominican Republic, compared to -5.7% and -3% for South America for the same period. In 2020, the country’s total forest cover was estimated at 44.4% of total land area (FAO, 2022[11]). The current development model also puts pressure on the water resource, which is close to the stress level in the Dominican Republic, contrary to other neighbouring countries in Central America. The efficiency rate of irrigation in agriculture is lower than 25%, due to the common practice of irrigation by flooding (Sánchez, 2016[12]). Mining has been growing in the country, with various environmental impacts, water use and contamination being among them.

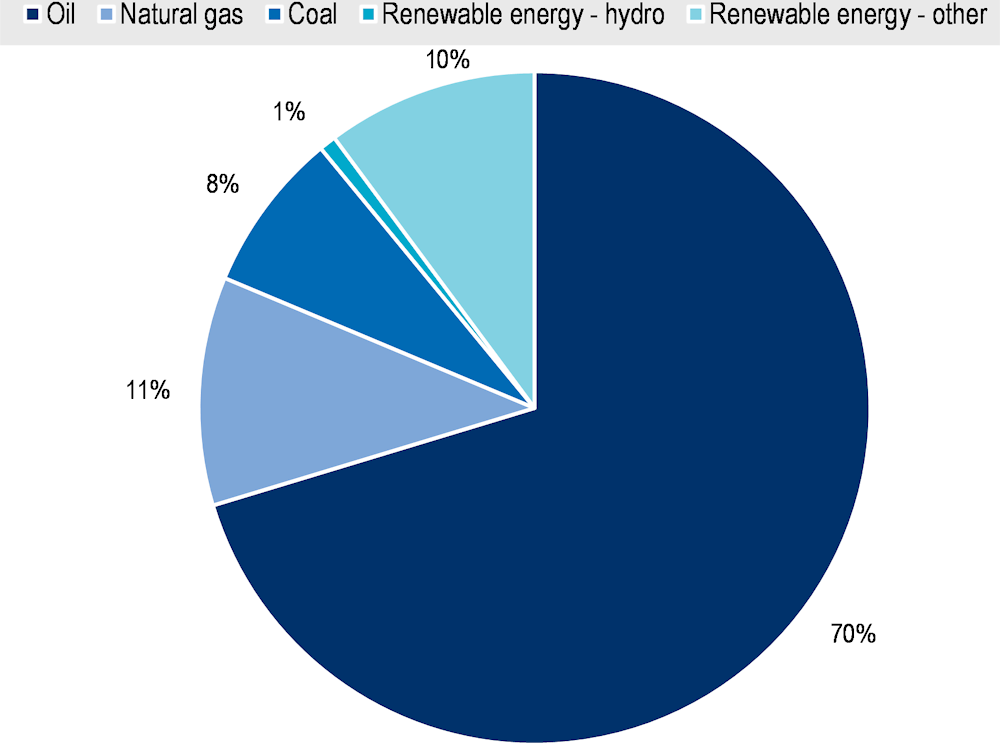

The Dominican economy remains largely dependent on fossil fuels. These represented 89% of total energy supply in 2019, while renewable energies accounted for the remaining 11% (Figure 1.2) (IEA/OECD, 2021[13]). The country has committed to reducing its emissions by 27% with respect to a business-as-usual scenario by 2030. It also set the target to reduce its per capita greenhouse gas (GHG) emissions by 25% by 2030 compared to 2010 levels (MEPyD, 2014[14]). Investing in renewable sources of energy can help in reducing the dependency on imports of fossil fuels as well as their impact on the environment. The Dominican Republic has abundant solar and wind resources and should pursue its efforts in developing renewable sources of energy (OECD et al., 2022[15]).

Figure 1.2. Total energy supply in the Dominican Republic, by source of energy (2019)

Strengthening trust in institutions is key to renewing the social contract and building consensus on ambitious reforms

Despite strong economic growth, trust in public institutions has been relatively low and volatile. Confidence in national government was particularly low in 2011 (41%), 2015 (45%) and 2019 (41%), but reached higher levels more recently, with 63% and 57% of the population having confidence in the government in 2020 and 2021, respectively. Current levels of confidence remain above the LAC (38%) and the OECD (47%) averages (Gallup, 2022[16]). Other indicators point to an erosion of citizens’ trust in institutions, though again with a recovery particularly since the impact of the pandemic. For instance, support for democracy fell from a maximum of 73% in 2008 to 60% in 2013, 54% in 2017, and a minimum of 44% in 2018 (Latinobarometro, 2021[17]). In 2020, support for democracy grew slightly to reach a level of 50%, presumably because part of the population perceived and appreciated efforts put in place by the government to counter the effects of the pandemic. Perception of progress in the country has also deteriorated. After a low point in 2011, more than half of the population believed that the country was progressing in the period between 2013 and 2016. However, there has been a fall in recent years, and in 2020, only 35% of the population believed that the country was progressing (Latinobarometro, 2021[17]).

There are multiple factors potentially driving these divides between citizens and public institutions in the country. On the one hand, social demands have increased, due to the expansion of the middle class, a younger and increasingly urbanised population, or the greater access to digital technologies and hence to information. On the other hand, while there have been undeniable efforts to strengthen the institutional framework, public institutions still face significant challenges. This can be related both to the lack of institutional capacities, but also to the fact that institutions are often deviated from serving the public interest, either through corruption or through policy capture to serve particular interests. Despite some significant improvements, in 2021 60% of the population still believed that corruption was widespread in the government, and 59.8% of Dominicans thought the country was governed for and by the powerful (Figure 1.3).

Figure 1.3. Share of the population believing that the country is governed for and by the powerful

Three priority areas to achieve greater well-being for all Dominicans

As a result of the Initial Assessment conducted in this Multi-dimensional Review, and following dialogues held with various Dominican stakeholders, three areas were identified as critical policy domains where ambitious reforms are needed in the country to advance towards greater well-being for all. First, jobs remain a fundamental part of citizens’ well-being, yet in the Dominican Republic many workers are employed informally, without adequate working conditions and with poor access to social protection. It is therefore imperative to create more formal job opportunities. Second, an ambitious development agenda will inevitably demand vast financial resources, but the country faces the rigidities of low fiscal space and a complex global scenario. It is essential for the country to advance towards a more robust, inclusive and sustainable “financing for development” model. Third, the challenges facing the Dominican Republic are taking place in a rapidly changing world, which also opens new opportunities. The digital transformation appears as a critical megatrend which the country must embrace to transform its development model.

Towards more formal jobs in the Dominican Republic

Informality is one of the critical and most persistent challenges in the Dominican Republic. Informal labour erodes tax collection, undermines productivity growth and leaves workers vulnerable to shocks due to lack of social protection. It also perpetuates low productivity levels, unsophisticated economic structures, and low levels of skills across workers. All of these factors are not only consequences of informality: they are also key contributors to it. This is why labour informality is a complex and multi-dimensional phenomenon that is both a driver and a result of low development levels.

The Dominican Republic’s labour market has shown high levels of informality for decades, consistently above 50%. In 2021, the informal employment rate reached 59%, slightly above the 2019 rate of 55.3%, mainly as a result of the pandemic. This is slightly above the average level observed in LAC, at 56.5% (OECD, forthcoming[18]). The Dominican Republic must continue its efforts to place formalisation at the centre of its development strategy for several reasons. First, formalisation is key to expanding the breadth of the social protection system and reaching the most vulnerable groups. Second, barriers to the formalisation of companies should be reduced, which can have a positive effect on productivity growth, tax collection and increased trade opportunities, hence leading to the creation of more formal job opportunities. Third, investing in skills development and production transformation are key policy areas for greater formalisation through gains in productivity as well as better prospects for employability.

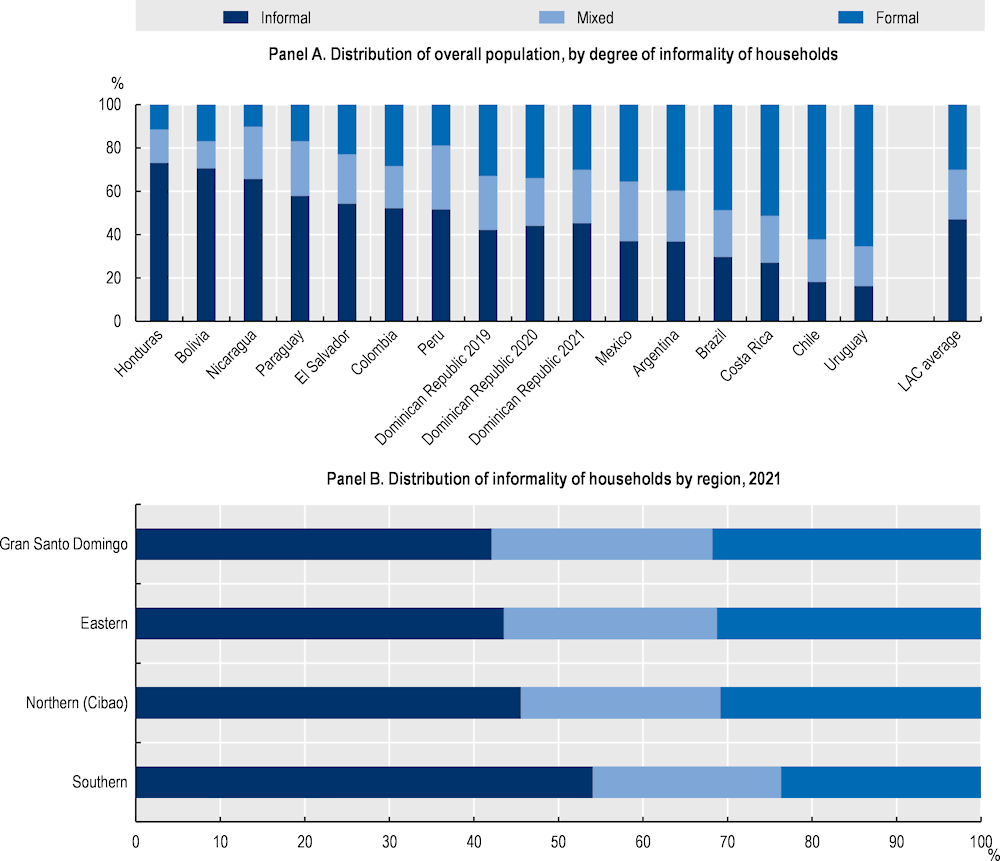

Informality leaves many workers and their households without adequate social protection

In 2021, 45.4% of Dominicans lived in households where all workers were employed in informal jobs. This was more than a three-percentage-point increase from 2019 (Figure 1.4, Panel A). Analysing the incidence of informality from the perspective of the household provides a more accurate picture of its impact on vulnerability, as usually social protection associated with formality extends from the formal worker to the rest of the household members. Conversely, households where all family members are informal are particularly vulnerable as they remain completely outside the scope of the social protection system.

Most low-income and rural households in the Dominican Republic depend only on informal employment. In 2021, 64.6% of people in the poorest income quintile lived in a household that depended only on informal employment, compared with 26.4% of those in the wealthiest income quintile. Households in rural areas also have significantly higher levels of informality. As much as 56.6% of the population in rural areas lived in a completely informal household in 2021. There are also considerable differences in informal household composition between regions: 54.1% of the total population in the Southern region lives in a completely informal household, compared with 42.1% of the population in Gran Santo Domingo. The highest proportion of mixed households (with both formal and informal workers) is found in the Eastern region (25.2%) and in Gran Santo Domingo (26.2%) (Figure 1.4, Panel B).

Figure 1.4. Composition of households according to their degree of informality, in total and by region

Note: Estimates for selected LAC countries are derived from data for 2018 or the closest available year. The LAC average is the unweighted average of selected LAC countries.

Source: Authors’ calculations based on (OECD, forthcoming[18]), using the KIIbIH database. In order to ensure microdata comparability and availability, the Dominican Republic’s 2019, 2020 and 2021 estimates use the ENCFT for the third quarter.

The COVID‑19 crisis has underscored the importance of reinforcing social protection in the Dominican Republic. As most informal workers fall outside the coverage of traditional contributory social security mechanisms, they are more dependent on other public social assistance, non-contributory programmes, usually cash transfers, solidarity pensions and in-kind transfers. Among others, strengthening the interoperability of registries and adopting a household lens can improve the targeting of social programmes (Basto‑Aguirre, Nieto‑Parra and Vázquez Zamora, 2020[19]; OECD, forthcoming[18]).

Structural factors impede the formalisation of firms and the creation of formal jobs

Beyond mitigating the social consequences that informality causes, a strategy for formalisation must address the barriers and disincentives companies face to operate formally. In fact, firm formalisation often precedes labour formalisation. However, formalisation remains unattractive or unaffordable for many Dominican firms, especially the smaller ones. While some highly productive sectors can afford the costs of formality, other less productive sectors or firms are unable or unwilling to afford the transition to formality. In the Dominican Republic, 91% of small enterprises’ employees and 22.8% of medium-sized enterprises’ employees are informally employed. In contrast, only 3.7% of employees in large enterprises are informally employed (BCRD, 2022[20]; OECD, 2021[21]).

There are several factors creating barriers or disincentives to formalisation. The tax and administrative burden associated with the formal status can be high for some micro, small or medium-sized enterprises (MSMEs). The Dominican government has made efforts to streamline these procedures, which has helped to reduce disincentives to firm formalisation. The country has also implemented simplified tax regimes for small taxpayers, but tax rates are not differentiated for MSMEs or newly formalised enterprises. Minimum wage regulations have many sectoral and size-related variants, which lead to complexity in their application and makes it challenging to comply with the law, also pushing some firms to operate informally. Finally, some of the country's non-wage labour costs could also constitute a barrier to formalisation, particularly for small employers. While most non-wage labour costs are relatively stable over time, those in case of dismissal increase drastically after the first year, potentially exerting a disincentive for employers to hire formally.

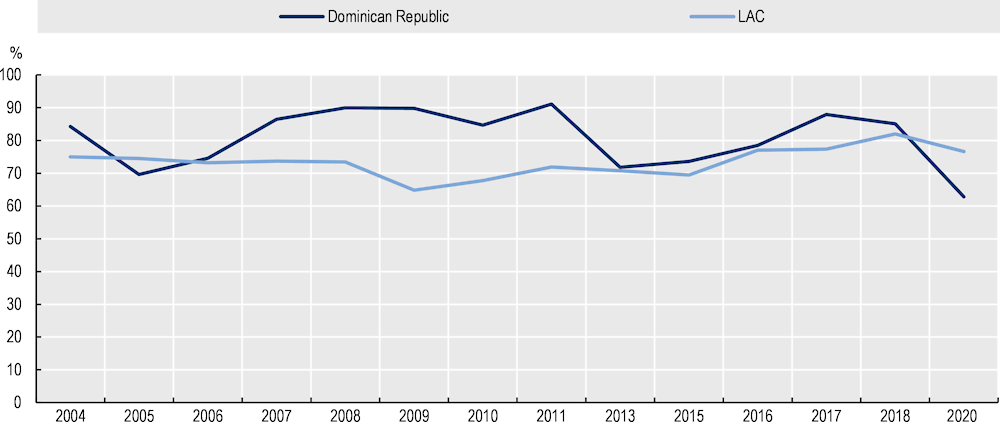

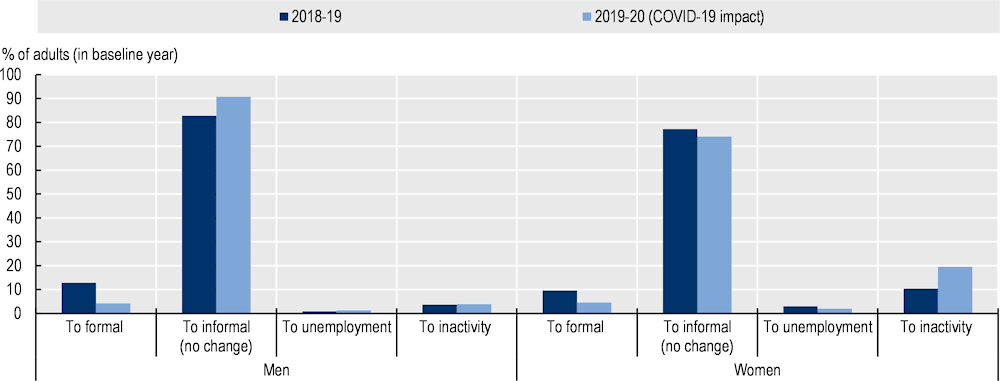

Barriers to formalisation are also reflected in a segmented labour market, where transitions between informality and formality are relatively scarce, particularly for women. Only 12.8% of male informal workers transitioned to formal employment between 2018 and 2019, and only 9.6% of informal female workers. Around 80% of workers remained in their informal status. Between 2019 and 2020, during the COVID‑19 pandemic, transitions from informal to formal employment dropped significantly, to 4.2% among men and 4.5% among women (Figure 1.5).

Figure 1.5. Yearly transition rates from informality (aged 30-55), by gender

Skills development and the transformation of the production structure are crucial to increasing labour productivity and promoting formal employment

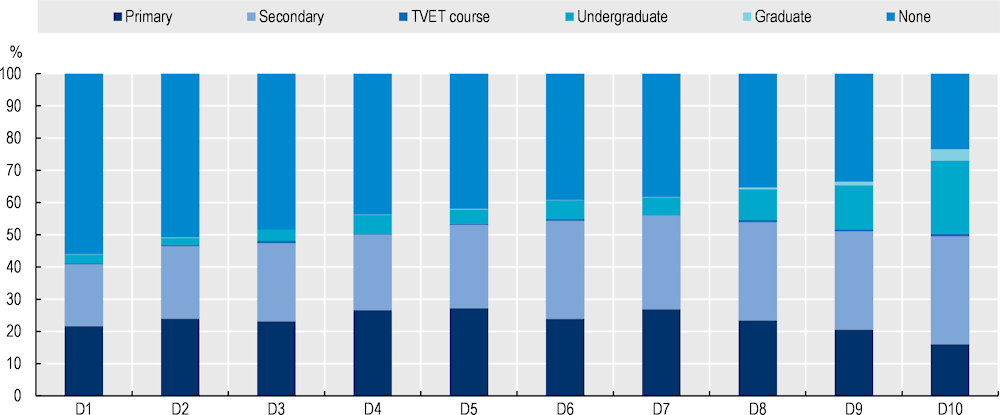

Skills development is a critical determinant for a worker's competitiveness in the labour market and, in turn, for the productivity of companies and the production sector in general. These are fundamental dimensions to boost formalisation. However, the level of skills across Dominican workers is limited, to a large extent due to low educational attainment levels, especially among vulnerable people (Figure 1.6). As much as 79% of 15-year-old Dominican students fail to reach level 2 proficiency in reading, mathematics and science in the Programme for International Student Assessment (PISA) test. Level 2 is described as the minimum level of proficiency that all children should acquire by the end of secondary education. This challenge is also recognised by firms: 29.1% of manufacturing companies in the Dominican Republic identify an inadequately educated workforce as a major constraint (World Bank, 2016[22]). Better skills not only make it more likely for a worker to access a formal job, they also lead to other externalities such as innovation, entrepreneurship and productive transformation in the aggregate, hence favouring the creation of more formal job opportunities.

Figure 1.6. Educational attainment by level of education and income decile

Technical and vocational education and training (TVET) can be critical in increasing formalisation levels. TVET supply in the Dominican Republic is fragmented and would benefit from more co-ordination and strategic guidance to better respond to current and future demands for skills. In particular, strengthening the coverage and quality of secondary and post-secondary TVET is key to building skills in the workforce. The ongoing effort to create a National Qualifications Framework is, for instance, a significant step forward in aligning TVET education with general secondary and tertiary education. Moreover, it can facilitate the identification of professional qualifications demanded in the national production system.

A better match between the demand and supply of skills is critical to favour employability and job formalisation. Currently, the Dominican Republic has scarce information on these fronts. Investing in better resources and methods to analyse the supply and demand of skills can contribute to implementing more effective education and training policies. Likewise, facilitating the transition from education to work not only reduces a burden on companies but also supports young people in getting started on their career paths.

Box 1.1. Policy recommendations to create more formal jobs

Policy objective 1: Consolidate a robust and sustainable social protection system to protect informal workers and their household members

1. Strengthen social protection systems and build on the lessons learned during the COVID‑19 pandemic

Improve interoperability across different existing registries, integrating all social protection information systems and strengthening the role of SIUBEN in order to reach vulnerable, informal populations, and exploiting the potential of digital technologies.

Enhance the conditionality associated with social protection to make it a catalyst for better educational, economic and social inclusion.

Adopt the household lens in order to better understand household composition, and thus better identify the right mix of interventions for each type of household.

2. Make social protection contributions more flexible in order to include informal workers

Progress towards a system that allows more flexibility for workers to contribute to the social protection system, particularly for those who face difficulties in making regular contributions. This is especially relevant for own-account workers (e.g. a flat rate for their contributions).

3. Progress towards a universal and more sustainable social protection system

In the short to medium term, efforts should be made to extend coverage to categories of the population not covered by social protection and across all regions of the Dominican Republic.

In the longer term, move towards a universal social protection system. Technical and political discussion is required to assess the convenience of developing a system where coverage depends less on individuals’ employment status, and where general taxes, instead of workers’ contributions, gain relevance as a source of financing.

Policy objective 2: Rethink the current institutional and policy framework to remove or alleviate existing barriers to formalisation

1. Provide favourable conditions for formalisation, particularly among MSMEs

Encourage formalisation of MSMEs by providing them with special support and tax benefits, for instance by providing tax exemptions during the first years of operation for newly created firms.

Continue efforts to simplify the taxation and regulatory administration of businesses, streamline bureaucratic procedures during formalisation and encourage more businesses to formalise. The Formalízate programme should be strengthened and expanded.

Promote innovative mechanisms to foster the growth of MSMEs, such as business acceleration programmes, smart funds, and support in maintaining fiscal commitments.

Expand the types of investment funding available (beyond loans) with an emphasis on independent workers.

2. Address main institutional barriers to the formalisation of workers and consider a reform of the Labour Code

Rethink the minimum-wage-setting process to strike a better balance between a more simplified system that favours its application by employers and a sufficient number of minimum wages that accounts for differences across sectors and firms.

Begin a technical discussion on the impact of severance payment on informality, in order to balance protection of the employee against flexibility in the labour market.

Appoint a team that works to align the conditions and stakeholders required for the effective implementation of the new National Employment Plan.

Frame the discussions around a new National Employment Plan within a broader tripartite debate at the national level, including the possibility of reforming the current Labour Code.

Introduce a regulatory framework for digital platforms, whether within a new Labour Code or independently.

3. Strengthen policies to boost the creation of formal jobs in the economy

Align employment generation policies with industrial and production policies, strengthening connections between special economic zones and the local economy.

Create sector-specific strategies to promote formalisation in sectors where informality is high.

Policy objective 3: Invest more effectively in the workforce, focusing particularly on skills and youth, to increase labour productivity and improve employability in the formal sector

Strengthen connections between the education and training system and the demand for skills in the economy to facilitate the transition to formality

Strengthen technical and vocational education and training, by investing in better and more modern infrastructure, teacher training and tools for identifying labour market needs.

Harmonise the fragmented TVET system.

Ensure the continuity of efforts to implement the National Qualifications Framework, as this will be key in facilitating the identification of professional qualifications demanded by employers.

Encourage partnerships between the private and educational sectors, expanding programmes that combine classroom teaching with practical training and other active labour market services, and strengthening transition programmes from school to the workplace for young people.

Create formal entrepreneurship programmes in the last year of high school to increase the possibility of starting a formal work activity upon leaving school.

Put in place regular skills supply and demand data collection systems. Involving the productive sector and exploiting the benefits of digital transformation are key to building such information.

Policy objective 4: Develop a broad, holistic strategy for formalisation

Embark on a broad-based discussion on a holistic strategy for formalisation in order to integrate formalisation efforts across different policy areas and levels of government.

Financing for development in the Dominican Republic: Towards a more inclusive, resilient and sustainable model

The Dominican Republic needs vast amounts of financial resources to underpin the post-COVID-19 recovery and overcome pending structural challenges. Traditionally low fiscal space has been further tightened by the impact of the pandemic and by a very complex global scenario.

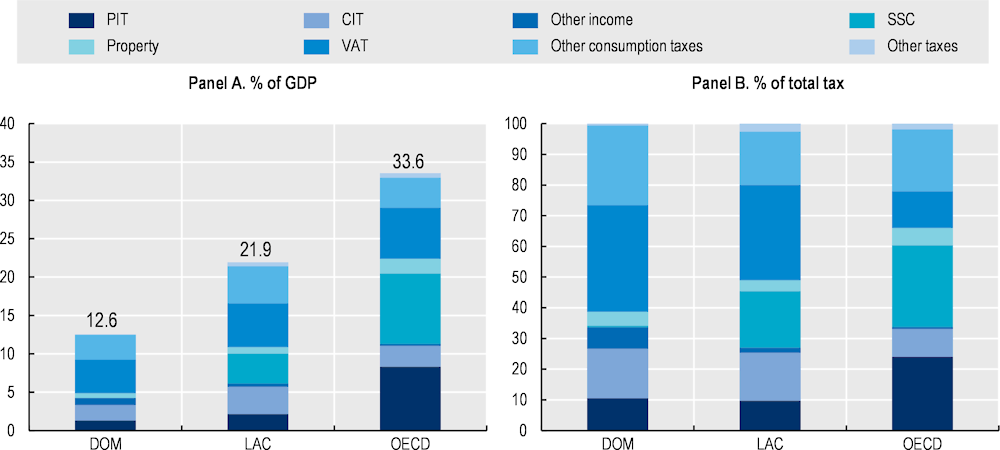

Increasing fiscal space and ensuring sufficient resources to finance a sustainable development path will require additional tax revenues in the Dominican Republic. Tax revenues are low and represented 12.6% of GDP in 2020. This is significantly below the LAC and OECD averages of 21.9% and 33.6% respectively (OECD et al., 2022[23]; OECD, 2022[24]). A variety of policy options can lead to greater tax revenues. Identifying these and finding the right balance of measures will be crucial for success and for maintaining the taxation system as a catalyst for equity and economic growth.

Rethinking the tax mix can improve revenues and strengthen the redistributive capacity of the tax system

The Dominican Republic’s tax structure presents potential areas for readjustment that can help to increase revenues, expand the tax base and build a more efficient and equitable tax system (Figure 1.7). Indirect taxes represent almost two-thirds (60.7%) of total tax revenues, representing 7.6% of GDP in 2020. Notwithstanding this, the efficiency of value-added tax (VAT) (ITBIS) remains limited. In fact, tax revenues from VAT represent 4.4% of GDP in the Dominican Republic, below the LAC average of 5.7%. Significant scope exists to improve VAT efficiency and increase its revenue-raising capacity. Low efficiency in VAT collection is mainly caused by tax non-compliance, tax exemptions and weaknesses in tax administration.

Figure 1.7. Tax structure in the Dominican Republic, LAC and OECD member countries, 2020

Direct taxes also have the potential to contribute more to total revenues and, by their progressive nature, they can support a more equitable tax system. The two main sources of direct revenues are corporate income taxes (CIT) and personal income taxes (PIT). Tax revenues from CIT accounted for 2.1% of GDP in 2020, making it the second-largest source of tax revenues after ITBIS. However, this level is lower than the averages for LAC (3.6% of GDP) and the OECD (2.8% of GDP) (OECD et al., 2022[23]; OECD, 2022[24]). The corporate tax rate in the Dominican Republic is near the LAC average, yet CIT efficiency levels are low. This is mainly explained by the proliferation of tax incentives – mostly those used to attract investment in Free Trade Zones (FTZs) – and high tax evasion, which need to be carefully assessed in order to improve revenues from CIT.

Revenues from PIT in the Dominican Republic are relatively low by international standards, as they represented 1.3% of GDP in 2020, well below the averages in LAC (2.2) and the OECD (8.3%) (OECD et al., 2022[23]; OECD, 2022[24]). Several factors limit PIT revenues in the Dominican Republic. These include a small tax base, a high concentration of income earners at low income levels, high levels of informality and tax evasion, and the existence of generous exemptions, deductions or tax credits. There are several options to increase the PIT tax base. For instance, it would be useful to explore the reduction of the minimum taxable level of personal income. Similarly, a policy option is to reduce the cost of being formal, providing the correct incentives to become formally employed or rationalising tax exemptions, deductions or credits. Utilising new technologies (e.g. large-scale automated data) to cross-check PIT with information from online vendors could also help reduce tax evasion.

Immovable property and inheritance tax revenues have potential for expansion with low distortionary effects and high redistributive impact. Yet, tax revenues from these taxes are relatively low in the Dominican Republic. Real estate taxes only accounted for 0.06% of GDP in 2020 (0.4% of GDP in the LAC average and 1% of GDP in the OECD average) (OECD et al., 2022[23]). Several factors undermine tax revenue from immovable property, including low level of property registration, high threshold exemptions, and the lack of a unified, updated and easy-to-access property registry. Correct and up-to-date information and new digital tools can unleash the potential of immovable property taxes.

To further mobilise resources for development, new taxes can be explored in areas like the digital economy or the green transition (OECD et al., 2022[15]). The Dominican Republic already obtains revenues from fuel taxes and several initiatives have already slowly started to create a framework of environmental taxes. Nevertheless, some options remain unexplored, such as carbon taxes which are a simple and cost-effective way to limit climate change, increase tax revenues and limit health damage from local pollution. Other taxes (such as creating a tax for vehicles that are more than ten years old) offer a new opportunity to raise tax revenues and promote green growth. Similarly, the tax system must adapt to the changes and challenges brought on by the digitalisation of the economy. For instance, a proposal currently under discussion is to extend the 18% VAT (ITBIS), or the 10% Selective Consumption Tax, to digital platforms. Estimates suggest that the potential of VAT revenue derived from taxes on digital services could have represented 0.4% of the Dominican Republic’s GDP in 2018, 0.5% in 2019 and 0.6% in 2020 (Jiménez and Podestá, 2021[25]). These efforts are essential not only for diversifying tax sources, but also for guaranteeing fair competition between these international platforms and local companies that provide these services.

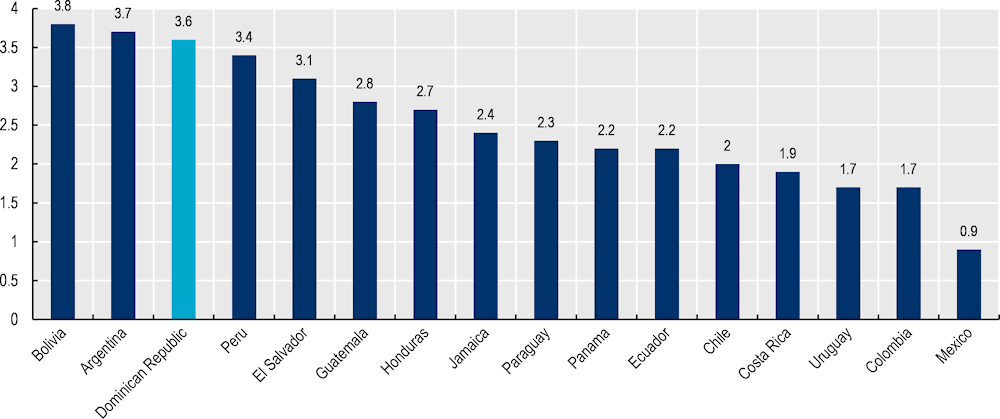

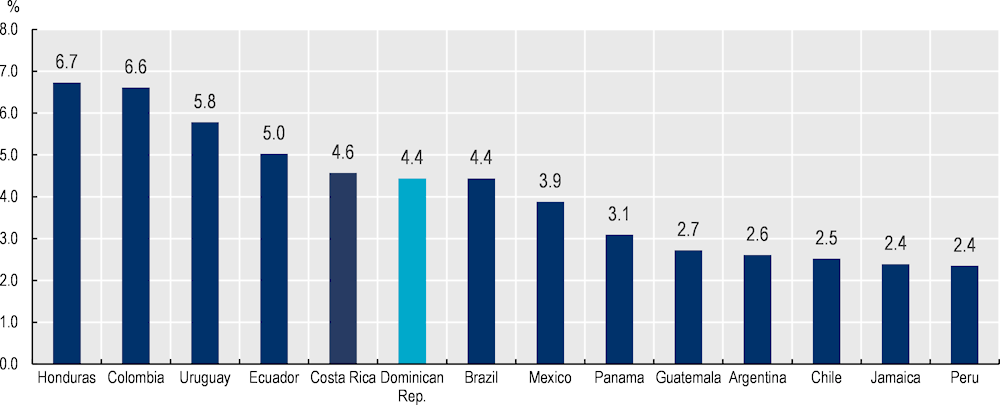

Rationalising tax exemptions and fighting tax evasion are critical to improving tax collection

Rationalising tax expenditures can create fiscal space and improve the overall impact of the tax system in terms of equity and efficiency. Tax expenditures are typically used by governments to achieve different economic, social and equity objectives by providing specific conditions to incentivise behavioural change. In 2021, tax expenditures accounted for 4.44% of GDP, one of the highest levels in the LAC region (Figure 1.8). As much as 70.1% of tax expenditures came from indirect taxes in 2021, with the majority of them related to the ITBIS (54.4% of total) and taxes on hydrocarbons (7.4%). Tax expenditures from the ITBIS represented 2.41% of GDP, and all tax expenditures from indirect taxes accounted for 3.12% of GDP, while those resulting from direct taxes represented 1.32% of GDP, divided between 0.76% of GDP from income taxes and 0.56% from wealth and property tax (Ministerio de Hacienda, 2020[26]).

Tax expenditures are not always well designed, and they can be regressive and provide greater benefits to those who need them less or are not always conducive to job creation or economic growth. A reform or elimination of outdated or poorly targeted tax expenditures that do not achieve the associated policy objectives can be a source of more tax revenues. Tax expenditures need periodical assessments to continuously evaluate their effects on growth, labour, inequality and efficiency. Similarly, avoiding arbitrariness in the criteria for admitting firms into FTZs and other special tax regimes by setting up clear qualification conditions can be an effective manner to ensure their efficiency.

Figure 1.8. Tax expenditures across LAC countries as a percentage of GDP

Source: Authors’ calculations based on national sources; (Redonda, Haldenwang and Aliu, 2021[27]) and (Peláez-Longinotti, 2019[28]).

Fighting tax non-compliance can be a source of greater tax revenues, while making the tax system more equitable and fairer. Tax non-compliance in the Dominican Republic ranks among the highest in LAC, with an estimated level of 61.8% (4.2% of GDP) for CIT, 57.07% (1.68% of GDP) for PIT and 43.5% (3.6% of GDP) for VAT in 2017. Indeed, VAT evasion in the Dominican Republic is well above the LAC average of 30.1% (Ministerio de Hacienda, 2018[29]; Gómez Sabaini and Morán, 2020[30]) (Figure 1.9). Improving VAT efficiency to reduce non-compliance would require the use of digital tools (for instance expanding the use of electronic invoicing [e‑CF]), exploring alternative and innovative policies (such as personalised VAT), and modernising and adapting to the challenges of the digital economy. Information campaigns and efforts to raise awareness and tax morale, alongside the simplification of the tax system, can also be effective short-term measures in fighting tax non-compliance.

On the international front, it is critical to address both the challenges arising from the digitalisation of the economy and from non-compliance across multinationals. Sometimes businesses artificially shift profits to low- or no-tax locations where they have little or no economic activity, or they erode tax bases through deductible payments such as interests or royalties. This international challenge is addressed by the OECD/G20 Inclusive Framework on BEPS. Continuing to comply with the agreements and actions of this Framework will be fundamental to tackle tax avoidance in the Dominican Republic.

Figure 1.9. Estimated tax loss from non-compliance on value-added tax, 2017 or latest available year (percentage of GDP)

Public spending must be made more efficient, as part of a comprehensive fiscal pact

Reduced levels of fiscal space underscore the need to spend more efficiently, striking a balance between short-term challenges and long-term development. Inefficiencies in public spending in the Dominican Republic are relatively large and are estimated at 3.8% of GDP, slightly below the LAC average of 4.4% of GDP (World Bank, 2019[31]). Inefficiencies are primarily caused by leakages in transfers and procurement waste. Enhancing efficiency will require improved targeting of social programmes alongside the strengthening of the institutional framework for public spending. This includes multi-year budgetary frameworks that promote greater transparency and consider the phase of the business cycle (for instance with a fiscal rule) and protect capital investment and key social spending. Similarly, ex ante evaluations can help guide budget allocations to increase efficiency, improve the design of future policies and increase transparency by providing more accountability to citizens.

The challenges to raise additional revenues and spend in a more efficient manner underscore the need for a comprehensive fiscal pact in the Dominican Republic, as foreseen in the National Development Strategy 2030. The role of fiscal policy for the post-COVID‑19 recovery must be holistic, making use of all fiscal policy tools and co‑ordinating measures. In this respect, and while there are several political economy implications in advancing a fiscal pact, this should also be seen as an opportunity to build an inclusive and sustainable development path. Bundling the various fiscal reforms into a comprehensive package can help to build fiscal legitimacy, as well as reduce political constraints, facilitating political support and addressing distributional issues by making the system more progressive (OECD et al., 2021[2]).

Deepening and strengthening the financial system would help to channel private resources towards development

Developing domestic debt markets can be growth-enhancing and promote socio-economic development. Long-term financing through bond issuances and other related securities allow to raise investment capital for infrastructure, housing or equipment, to smooth consumption, and to cope with climate and health emergencies, thus supporting long-term economic, social and environmental progress. The COVID‑19 pandemic increased the need to provide financing through bond issuances and the Dominican Republic also increased its market access at the lowest rate on record, issuing a mix of foreign and domestic bonds. High international liquidity (and in particular capital flows towards sovereign bonds) in emerging markets during the pandemic contributed to these positive outcomes. As a result, consolidated public sector debt reached 70.3% of GDP in 2020, almost 20 percentage points higher than in 2019 (53.2%) (IMF, 2022[32]). As much as 56.4% was external debt (Ministerio de Hacienda, 2021[33]). Public debt was reduced to 62.1% of GDP in 2021 and the ratio should continue to trend downward, to an estimated 59.2% in 2022 (IMF, 2022[32]). Non-financial public sector debt, according to national data, was at 40.4% of GDP in 2019, increased to 56.6% in 2020, and decreased again to 50.4% in 2021 and to 46.5% by October 2022 (Ministerio de Hacienda, 2022[34]).

The market of local currency bonds is being developed, but additional efforts are needed. Co‑ordination between the Central Bank and the Treasury is critical to avoid debt fragmentation, unnecessary competition, yield curve distortions and additional issuance costs (OECD, 2012[35]). In recent years, both institutions have made efforts to meet regularly to strengthen the co‑ordination of public debt issuances in the local market.

The local private bond market in the Dominican Republic also remains underdeveloped. Since 2013, the total amount of private debt issued as a percentage of GDP has fluctuated between 0.7% and 0.2%, while in LAC countries it has ranged from 25% to 50% of GDP (Abraham, Cortina and Schmukler, 2020[36]). This could be partly due to the fact that large local companies prefer to issue international notes or to access credit facilities or loans in international markets in foreign currencies. Similarly, pension funds continue to invest a large portion of their portfolios in public sector bonds, reducing the liquidity in the private bond market. On a positive note, new players are coming into the local private bond market. The Dominican Republic public authorities have also been active as new laws have been passed to improve minority investor protection and market functioning, and laid the foundations for further innovations in the domestic market, such as green and social bond issuances.

The banking system in the Dominican Republic has proven to be resilient, though there is room for improvement in its contribution to financing development. Banking depth has been improving, but it still remains below LAC and the OECD. In 2019, the banking-credit-to-GDP ratio stood at 28.9% of GDP, below the 50% of GDP in LAC and the 80% in the OECD average (World Bank, 2022[4]). The banking system remains concentrated, and real interest rates and spreads are relatively high. The ten largest entities by assets held controlled 90.2% of deposits by the end of 2020, 3.3 percentage points higher than in 2012. Among a sample of 19 LAC economies, the Dominican Republic presented the fourth-most concentrated financial system (Tambunlertchai et al., 2021[37]). In the case of real lending interest rates faced by the private sector, they remained high, at close to 10%, between 2010 and 2019 (Banco Central de la República Dominicana, 2022[38]). High real interest rates are key barriers to accessing banking finance in the formal sector of the Dominican Republic’s economy.

Box 1.2. Policy recommendations for a more inclusive, resilient and sustainable “financing for development”

Policy objective 1: Strengthen tax revenues by restructuring the tax mix

1. Rebalance the tax structure to increase the share of direct taxes and the level of progressivity

Launch a technical and political discussion on the feasibility of decreasing the minimum taxable personal income, so that high-income deciles are effectively included.

Explore the potential of personalised VAT (ITBIS) as a way of increasing overall revenues from these taxes, while compensating low-income taxpayers to reduce the regressive nature of VAT.

2. Enhance the revenue potential of other taxes

Strengthen property registries in order to boost revenues from property taxes by: 1) moving towards a unified and simplified property registry with an up-to-date land and property registration in central cadastres; and 2) reducing information asymmetries in immovable property, closing the gap between the appraised value and the market value.

Explore the potential of new taxes adapted to the emerging economy, such as digital and green taxes, which serve the dual purpose of raising revenues while creating the incentives for a greener and more digitalised development model.

Policy objective 2: Rationalise tax exemptions to raise revenue capacity and improve the overall impact of the tax system in terms of equity, efficiency and simplicity

1. Rethink tax exemptions on main sources of revenue

Rethink VAT (ITBIS) exemptions in order to improve efficiency and reduce its regressive impact – for example, exemptions applied to financial services or to the imports of low-value goods, or exemptions on certain non-essential goods and services such as those related to tourism or certain cultural products. Measures aimed at reducing VAT exemptions should be accompanied by clear measures to directly compensate lower-income groups.

Evaluate PIT deductions, like exemptions for educational expenditure, which can be regressive.

2. Evaluate the overall impact of special economic regimes and consider a gradual phasing out of those where the costs – in terms of forgone tax revenues – outweigh the benefits

Rethink tax incentives associated with special economic regimes through periodical assessments of their distributional and efficiency implications.

Include an analysis in tax expenditure reports of how these incentives contribute to key development objectives like economic growth, job creation or support to low-income groups.

Limit the potential arbitrariness associated with special economic regimes by, for example, strengthening the criteria for admitting companies; rethinking their governance to balance the distribution of power; including all tax expenditures in the tax code; or giving the Ministry of Finance the main responsibility for granting these incentives.

Policy objective 3: Fight tax non-compliance

1. Use digital tools to fight evasion and to leverage existing international agreements

Expand the use of the electronic invoice (e-CF) and advance towards making it compulsory, and work to strengthen the implementation of the destination principle.

As a member of the OECD/G20 Inclusive Framework on BEPS, continue to advance in the implementation of the two-pillar solution in order to address the challenges of digitalisation.

2. Use digital tools to increase tax compliance through the simplification of the tax system or a better taxation of digital trade

Launch information campaigns, increase efforts to raise awareness, and use nudges, all of which can have an impact on lowering tax non-compliance.

Adopt recommendations from the OECD/World Bank VAT Digital Toolkit for Latin America and the Caribbean, aimed at addressing the VAT challenges of digital trade.

Use new technologies to cross-check information (for example, large-scale automated data and cross-checking of PIT against information from online vendors), to reduce tax evasion.

Policy objective 4: Improve the quality and efficiency of public expenditure

Improve the targeting of social programmes, strengthen the interoperability of existing registries, and make use of household level analysis and of innovative ways of reaching informal workers.

Accompany new policies with ex ante evaluations led by the central budget authority. Ex ante evaluations can help guide budget allocations in order to increase efficiency, improve the design of future policies, and increase transparency by providing more accountability to citizens.

Strengthen solid fiscal frameworks. Instituting a multi-year budgetary framework that includes a fiscal rule can promote greater transparency and protect capital investment as well as key social spending at different stages of the economic cycle or against internal or external shocks.

Policy objective 5: Implement a fiscal pact to support the recovery and build a more inclusive and sustainable financing model in the Dominican Republic

Build a holistic and well co-ordinated fiscal strategy for the recovery, backed by a broad consensus, and advance towards the objective established in the National Development Strategy 2030 of increasing tax revenues to 21.5% of GDP by 2025 and 24% of GDP by 2030.

Policy objective 6: Strengthen the banking system to channel financial resources to productive activities and increase financial inclusion

Seek further reductions of real lending interest rates to promote investment and long-term growth, through increased competition among banks and other financial institutions, including by promoting Fintech or digital banks.

Advance in an ambitious National Strategy for Financial Inclusion.

Policy objective 7: Deepen and further develop the public and private debt market in the country

Elaborate a new Medium-Term Debt Strategy (MTDS) with new guidelines which reflect the new environment after the COVID-19 shock and the lessons learned from the previous MTDS (2016‑2020) to enhance risk management and planning capabilities of the Debt Management Office.

Continue strengthening the co-ordination between the Treasury, the Central Bank, and other regulatory bodies like the Superintendencia de Valores in the local market to lower lending interest rates, promote long-term bond liquidity and continue diversifying in the investor base.

Advance in efforts to develop a local-currency risk-free bond yield curve, and develop the private debt market, promoting the diversification of the investor base through appropriate changes in pension fund and mutual portfolio regulations and tax incentives for individuals.

A digital transformation for all

The digital transformation represents a profound and impactful global trend that could bring enormous opportunities for inclusive and sustainable development in the Dominican Republic. Indeed, digital innovation has the potential to improve productivity, foster inclusiveness, help tackle climate change, transform public institutions and increase the overall well-being of citizens. However, if not accompanied by an adequate policy mix, the digital transformation can also deepen existing inequalities and create new gaps, generating digital divides that could be a source of exclusion (OECD et al., 2020[39]).

Embracing the digital transformation and making it work for all in the Dominican Republic will require strong policy ambition. In 2021, Decree 71-21 created the Gabinete de Transformación Digital (Digital Transformation Cabinet) and the National Dialogue on Digital Transformation (Dialogo de las reformas 2021: Transformacion Digital) was initiated (Consejo Económico y Social, 2021[40]). These two milestones provide good evidence of the political commitment to enable a digital transformation in the country, which resulted in the approval in 2022 of a Digital Agenda 2030.

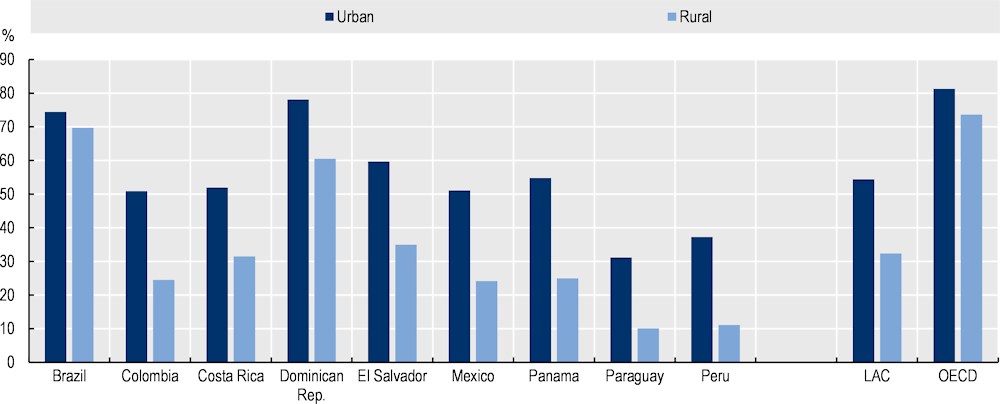

Making the digital transformation work for households and schools

More people are connected to the Internet than ever in the Dominican Republic, yet providing access and connectivity to all is a pending challenge. The country made improvements in terms of fixed broadband connections from 2014 (5.9 connections per 100 inhabitants) to 2020 (9.5 connections per 100 inhabitants), but it is still below the averages for LAC (14.2 connections per 100 inhabitants) and OECD member countries (33.6 connections per 100 inhabitants) (ITU, 2021[41]). Around 32% of households had access to a fixed broadband connection to the Internet in 2018, below the LAC (42%) and world (55%) averages, despite significant improvements between 2014 and 2018 (ONTIC, 2020[42]).

Active mobile broadband subscriptions per 100 inhabitants have also increased notably, from 31.2 subscriptions in 2014 to 70.9 subscriptions in 2020. This is slightly below the LAC average (72.1 subscriptions) and below the average for OECD member countries (110.9 subscriptions) (ITU, 2021[41]). The prevalence of mobile phones in society suggests that building a strong mobile broadband network can be an effective method of ensuring Internet access for all. This is the case in the Dominican Republic, where 80% of mobile broadband Internet access is through cellular devices (INDOTEL, 2021[43]). This is similar to the trend across LAC, where active mobile broadband subscriptions in 2018 were more than five times higher than fixed broadband subscriptions (OECD et al., 2020[39]).

The expansion of fixed and mobile broadband in the Dominican Republic has led to a significant increase in the overall number of Internet users. As of 2020, the Dominican Republic had one of the highest rates of Internet users in LAC. Since 2010, the percentage of Internet users has more than doubled, from 31.4% to 76.9%, being around ten percentage points below the OECD average (ITU, 2021[41]).

While the Dominican Republic has experienced a rapid expansion of connectivity, disparities in access and usage across territories, socio-economic status, age and gender persist, and these may have been exacerbated during the pandemic. Territorial disparities represent one of the major inequalities. In fact, the share of households with access to Internet ranges from 44.4% in highly populated and developed provinces such as the Distrito Nacional or 34.4% in La Altagracia, to the low levels of connectivity in smaller, less developed provinces, such as Elías Piña (5.4%) or Independencia (4.9%). There is a difference of 45.8 percentage points between the region with the highest and the lowest share of households with Internet connectivity. Nine out of the 32 provinces in the Dominican Republic do not reach the 10% threshold of households with Internet (INDOTEL, 2021[44]). Territorial disparities in the Dominican Republic are similar to those in other LAC countries, and larger than in the OECD (Figure 1.10).

Figure 1.10. Share of Internet users in the Dominican Republic, selected LAC countries and the OECD

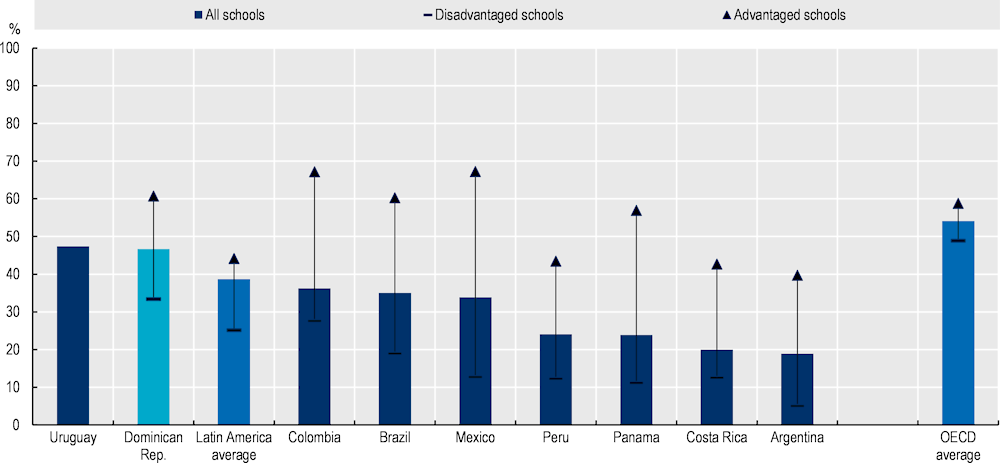

The Dominican Republic has seen an increase in access to ICT in schools in recent years. In fact, the number of students per computer has declined since 2015. In 2018, there was one computer available per 1.4 students, and almost one computer with an Internet connection per 2 students. This places the Dominican Republic in a slightly better position than the LAC average, but worse off than the OECD average, which in 2018 had approximately one Internet-connected computer for every student (OECD et al., 2020[39]). However, notable gaps still exist across different socio-economic groups in terms of access to ICT both at school and at home. As an illustration, on average 47% of schools were equipped with effective online learning support platforms, one of the highest levels across LAC countries. This level was 61% in advantaged schools and only 33% in disadvantaged schools (i.e. a 28-percentage-point difference) (Figure 1.11).

Figure 1.11. Availability of effective online learning support platforms, by schools’ socio-economic status, 2018

The digital transformation of the economy and jobs

The digital transformation can be a catalyst for productivity growth, triggering innovation and productive diversification. Harnessing the opportunities this presents depends on how economies, productive sectors, institutions and societies position themselves to absorb and adapt to digital technologies. These new technologies change the way companies produce goods and services, innovate, and interact with other companies, workers, consumers and governments. Digitalisation opens the door for superior data storage capacities and increased processing capabilities, while artificial intelligence enables companies to automate increasingly complex tasks (OECD et al., 2020[39]).

Having a strong innovation system is critical to making the most of the digital transformation and promoting productivity growth, yet the Dominican Republic underperforms in this area. Research and development (R&D) investment is low: the country reported R&D investment of 0.01% of GDP in 2015, lower than the LAC (0.7%) and OECD (2.34%) averages in 2018. Greater efforts in R&D and innovation could boost productivity as well as the quality of production (OECD/UNCTAD/ECLAC, 2020[6]). A high-performing logistics system is another critical dimension of building a stronger digital ecosystem that is conducive to productivity growth. The Dominican Republic’s score on the Logistics Performance Index has decreased in recent years and is currently below the LAC average (CAF, 2020[45]).

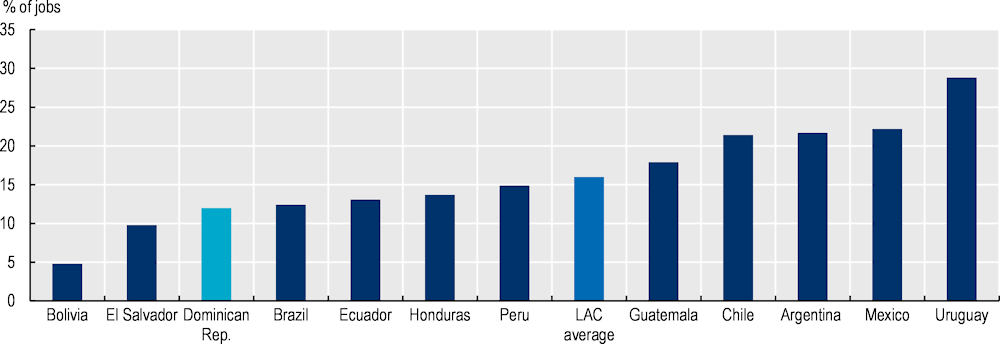

The impact of new forms of employment on the Dominican Republic is uncertain but, based on its current economic structure, 12% of jobs are at high risk of automation (Figure 1.12). This is slightly below the impact on LAC countries overall, where 16% of jobs, on average, are at high risk of automation and another 16% of occupations may change substantially due to the digital transformation. The economic structure of the Dominican Republic can explain the limited impact of the digital transformation on jobs. With a large share of employment concentrated in low-skilled services and sectors like retail and construction, which are not easily automatable, job destruction may be less prevalent. However, this may also indicate low levels of sophistication in the productive structure, with a low penetration of ICT and an inability to shift the production structure towards higher-value-added sectors.

Figure 1.12. Percentage of jobs at high risk of automation

Source: Authors’ elaboration based on (OECD et al., 2020[39])and (Weller, Gontero and Campbell, 2019[46]).

Two policy areas stand out as particularly relevant to making the digital transformation a catalyst for better jobs. The first is skills: workers need a mix of skills, including strong cognitive and socio-emotional skills, as well as high-level ICT skills in technology-related occupations. The Dominican Republic ranks 106th in the world in terms of ICT skills (Network Readinness Index, 2020[47]). The second policy area is lifelong learning: these systems can enhance the accessibility and quality of education and provide training and learning opportunities throughout all stages of life, increasing workers’ chances of acquiring the required skills to adapt to a rapidly changing labour market.

A strategic vision for the digital transformation

The digital transformation affects and creates opportunities in almost every dimension of public policy. Thus, embracing the digital transformation calls for policies and practices that address digital issues in a holistic and coherent manner. In this context, the success in moving towards a digital economy and society relies greatly on the capacity to develop a clear, ambitious and cross-cutting digital agenda (DA) that is also linked to a country’s broader and longer-term development strategy (OECD et al., 2020[39]).

In 2021, the Dominican Republic established the Gabinete de Transformación Digital (Digital Transformation Cabinet) to oversee the Digital Agenda (DA) 2030, which was approved in 2022. There are several criteria that are relevant for the success of a DA, many of which are reflected in the Digital Agenda 2030 (OECD et al., 2020[39]). Clear responsibility and adequate implementation powers are crucial. A high-level body leading the strategy can be particularly helpful in co‑ordinating a swift digital transformation. In addition, effective co‑ordination among government bodies, beyond ICT-related ministries, is also essential for the implementation of a coherent DA, and must be complemented by a comprehensive data governance framework in order to ensure proper data management throughout the DA’s life cycle. Similarly, as the digital transformation is promoted by multiple stakeholders, including businesses, individuals and other non-government stakeholders, it is important to ensure an open multi-stakeholder dialogue, which can help identify obstacles, exchange best practices and create opportunities for public–private partnerships. An effective oversight framework is important for monitoring the implementation of and evaluating the DA. It is also important that the DA is well aligned with national development plans (NDPs) (OECD et al., 2020[39]).

Box 1.3. Policy recommendations to embrace the digital transformation and make it a driver of greater well-being for all

Policy objective 1: Increase connectivity throughout the Dominican Republic to ensure a successful and inclusive digital transformation

1. Design policies that continue to increase broadband Internet connections in the Dominican Republic and close the gap with LAC and the OECD

Invest in communication networks, creating the conditions to attract private investment and to foster public–private partnerships.

Expand the deployment of 4G networks across the country.

2. Reduce gaps in access, particularly in rural areas and across low-income populations

Expand connectivity in rural areas by making full use of existing technologies.

Expand connectivity through enhanced public networks, particularly in remote areas.

Subsidise access to the Internet for low-income populations, making use of existing sources of information to better identify and target vulnerable households.

3. Improve affordability and availability of digital devices and services

Continue to distribute digital devices to students, particularly those from less advantaged socio-economic backgrounds, accompanied by training for both teachers and students.

Create conditions for affordable access to digital devices and services.

Policy objective 2: Enhance digital skills and the use of digital tools in the education system and in the transition to the new world of work

1. Develop digital skills among students and teachers as well as across the adult population

Mainstream digital skills and tools across the education system, starting from early childhood. Develop specific programmes to train the adult population in digital skills.

Develop an ambitious programme of training for current and future teachers in digital skills, including innovative pedagogical methods that are adapted to the needs of the digital society.

2. Reinforce the availability of digital tools within the education system

Bridge the gap in ICT across schools in different socio-economic backgrounds, including access to online educational resources and platforms and digital devices for teaching and learning.

Develop a national map that identifies the needs of schools in terms of connectivity, ICT and digital endowments in order to develop targeted actions in the most disadvantaged areas.

3. Strengthen linkages between the education system and the emerging digital economy

Strengthen the digital component within vocational education and training, as well as in higher education, with specific degrees related to emerging professional profiles in the digital economy.

Develop mechanisms to identify the demand for skills and, in particular, the emerging needs of the digital economy.

Policy objective 3: Create a digital ecosystem to boost the development of the digital economy

1. Enable the use of digital tools and services by MSMEs and favour the emergence of a digital industry

Put in place specific public programmes to support MSMEs in the adoption of digital technologies and their use to better connect with larger companies and global value chains.

Develop specific instruments and incentives for the development of the digital industry in the Dominican Republic.

2. Develop a holistic digital ecosystem in order to facilitate the digital transformation of production processes by all companies in order to promote productivity growth

Develop a strategic plan to enhance the digital ecosystem as a catalyst for greater productivity, acknowledging that this must include key complementary investment in R&D; infrastructure and logistics; and skills and human capital, including organisational and managerial capabilities.

Policy objective 4: Adopt a strategic, well co-ordinated vision of the digital transformation

1. Ensure a coherent and holistic approach to the digital transformation, as presented in the Digital Agenda 2030, that is well connected with the broader National Development Strategy 2030

Assign clear responsibilities and adequate implementation powers to a high-level body leading the Digital Agenda 2030 (e.g. to the Gabinete de Transformación Digital).

Ensure effective co-ordination among government bodies (beyond ICT-related ministries); a comprehensive data governance framework; open multi-stakeholder dialogue; and an effective oversight framework.

2. Strengthen statistical digital capacities

Enhance the use of digital technologies to improve the collection and use of statistical data and to strengthen their potential to inform public policies (e.g. use of big data).

Develop mechanisms to regularly produce digital indicators that allow monitoring of progress in the Digital Agenda 2030 and a better understanding of emerging challenges and opportunities as the digital transformation continues to advance.

References

[36] Abraham, F., J. Cortina and S. Schmukler (2020), “Growth of Global Corporate Debt: Main Facts and Policy Challenges”, Policy Research Working Paper, No. 9394, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/34480.

[38] Banco Central de la República Dominicana (2022), Riesgo-País (EMBI) y Calificación Deuda Dominicana, https://cdn.bancentral.gov.do/documents/entorno-internacional/documents/EMBI.pdf?v=1668696709696.

[19] Basto‑Aguirre, N., S. Nieto‑Parra and J. Vázquez Zamora (2020), Informality in Latin America in the post COVID-19 era: towards a more formal “new normal”?, http://www.lacea.org/vox/?q=blog/informality_latam_postcovid19.

[20] BCRD (2022), Encuesta Nacional Continua de Fuerza de Trabajo (ENCFT) [Continuous National Labour Force Survey], Banco Central de la Republica Dominicana, Santo Domingo, https://www.bancentral.gov.do/a/d/2541-encuesta-continua-encft.

[45] CAF (2020), El estado de la digitalización de América Latina frente a la pandemia del COVID-19, Corporación Andina de Fomento, Caracas, https://scioteca.caf.com/bitstream/handle/123456789/1540/El_estado_de_la_digitalizacion_de_America_Latina_frente_a_la_pandemia_del_COVID-19.pdf.

[5] Central Bank of the Dominican Republic (2022), Estadísticas, Banco Central de la República Dominicana, Santo Domingo, https://www.bancentral.gov.do/a/d/2533.

[8] Commitment to Equity Institute Data Centre (2022), CEQ Standard Indicators, Tulane University, https://tulane.app.box.com/s/w5frpk5lum6jimodad2wp0dz5fdupp7h/file/959930285240.

[40] Consejo Económico y Social (2021), Dialogo de las Reformas 2021: Transformación Digital, https://www.ces.org.do/index.php/transformaciondigital.

[11] FAO (2022), “Global Forest Resources Assessments (website)”, http://www.fao.org/forest-resources-assessment/en/.

[16] Gallup (2022), Gallup World Poll, https://ga.gallup.com/.

[10] GermanWatch (2021), Global Climate Risk Index 2021. Who suffers most from extreme weather events? Weather-related loss events in 2019 and 2000-2019, http://www.germanwatch.org/sites/default/files/Global%20Climate%20Risk%20Index%202021_2.pdf.

[30] Gómez Sabaini, J. and D. Morán (2020), Estrategias para abordar la evasión tributaria en América Latina y el Caribe: avances en su medición y panorama de las medidas recientes para reducir su magnitud, https://www.cepal.org/es/publicaciones/46301-estrategias-abordar-la-evasion-tributaria-america-latina-caribe-avances-su.

[13] IEA/OECD (2021), IEA World Energy Statistics and Balances (database), http://www.oecd-ilibrary.org/energy/data/iea-world-energy-statistics-and-balances_enestats-data-en.

[32] IMF (2022), Dominican Republic: 2022 Article IV Consultation-Press Release; and Staff Report, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/CR/Issues/2022/07/08/Dominican-Republic-2022-Article-IV-Consultation-Press-Release-and-Staff-Report-520543 (accessed on 2 December 2022).

[1] IMF (2022), World Economic Outlook Database, https://www.imf.org/en/Publications/WEO/weo-database/2022/April.

[43] INDOTEL (2021), Desempeño de las Telecomunicaciones, Instituto Dominicano de las Telecomunicaciones, https://transparencia.indotel.gob.do/media/216292/informe-de-desempe%C3%B1o-de-las-telecomunicaciones-enero-septiembre-2021.pdf.

[44] INDOTEL (2021), Portal de Transparencia, Indicadores Estadísticos por Provincias y Municipios, Instituto Dominicano de las Telecomunicaciones, https://transparencia.indotel.gob.do/publicaciones-oficiales/estad%C3%ADsticas-telecomunicaciones/indicadores-estadisticos-por-provincias-y-municipios/.

[41] ITU (2021), World Telecommunication/ICT Indicators Database 2021 (database), International Communication Union/Geneva, https://www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx.

[25] Jiménez, J. and A. Podestá (2021), “Tributación indirecta sobre la economía digital y su potencial recaudatorio en América Latina. Emparejando la cancha en tiempos de crisis”, Documentos de trabajo, Dirección General de Ingreso (DGI), Centro Interamericano de Administraciones Tributarias - CIAT, https://biblioteca.ciat.org/opac/book/5754.

[17] Latinobarometro (2021), Latinobarometro (database), http://www.latinobarometro.org/latContents.jsp.

[14] MEPyD (2014), Ley 1-12 Estrategia Nacional de Desarrollo 2030, Ministerio de Economía, Planificación y Desarrollo, Santo Domingo.

[7] Ministerio de Economía, Planificación & Desarrollo; Unidad Asesora de Análisis Económico y Social (2022), Boletín de estadísticas oficiales de pobreza monetaria en la República Dominicana 2021, https://mepyd.gob.do/publicaciones/boletin-pobreza-monetaria-a7-no9.

[34] Ministerio de Hacienda (2022), Estadísticas Dirección General de Crédito Público, https://www.creditopublico.gob.do/inicio/estadisticas.

[9] Ministerio de Hacienda (2022), Informe de Ejecución Presupuestaria del Gobierno Central.

[33] Ministerio de Hacienda (2021), Proyecto de Ley Presupuesto República Dominicana (Tomo 1), Gobierno Central, https://www.hacienda.gob.do/wp-content/uploads/2020/10/Proyecto-de-Ley-PGE-2021-Tomo-I.pdf.

[26] Ministerio de Hacienda (2020), Gasto Tributario en República Dominicana: Estimación para el Presupuesto General del Estado del año 2021, Ministerio de Hacienda, Santo Domingo, https://www.hacienda.gob.do/wp-content/uploads/2021/01/2020-10-16-Estimacion-del-Gasto-Tributario-2021.pdf.

[29] Ministerio de Hacienda (2018), Estimación del Incumplimiento Tributario en República Dominicana, https://dgii.gov.do/publicacionesOficiales/estudios/Documents/2018/Incumplimiento-Tributario-en-RD.pdf.

[47] Network Readinness Index (2020), The network readiness index 2020: Accelerating digital transformation in a post-COVID global economy, Portulans Institute, Washington, DC, https://networkreadinessindex.org/wp-content/uploads/2020/11/NRI-2020-V8_28-11-2020.

[24] OECD (2022), Revenue Statistics 2022: The Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/8a691b03-en.

[21] OECD (2021), Key Indicators of Informality based on Individuals and their Household (KIIbIH) database, OECD Development Centre, https://www.oecd.org/dev/Key-Indicators-Informality-Individuals-Household-KIIbIH.htm.

[35] OECD (2012), Capital Markets in the Dominican Republic: Tapping the Potential for Development, Development Centre Studies, OECD Publishing, Paris, https://doi.org/10.1787/9789264177628-en.

[18] OECD (forthcoming), Labour Informality and Households’ Vulnerabilities in Latin America [Provisional Title], OECD Development Centre, OECD Publishing, Paris.

[15] OECD et al. (2022), Latin American Economic Outlook 2022: Towards a Green and Just Transition, OECD Publishing, Paris, https://doi.org/10.1787/3d5554fc-en.

[23] OECD et al. (2022), Revenue Statistics in Latin America and the Caribbean 2022, OECD Publishing, Paris, https://doi.org/10.1787/58a2dc35-en-es.

[2] OECD et al. (2021), Latin American Economic Outlook 2021: Working Together for a Better Recovery, OECD Publishing, Paris, https://doi.org/10.1787/5fedabe5-en.

[39] OECD et al. (2020), Latin American Economic Outlook 2020: Digital Transformation for Building Back Better, OECD Publishing, Paris, https://doi.org/10.1787/e6e864fb-en.

[6] OECD/UNCTAD/ECLAC (2020), Production Transformation Policy Review of the Dominican Republic: Preserving Growth, Achieving Resilience, OECD Development Pathways, OECD Publishing, Paris, https://doi.org/10.1787/1201cfea-en.

[42] ONTIC (2020), Evaluación del Desarrollo de las Tecnologías de la Información y la Comunicación en la República Dominicana, Observatorio Nacional de las Tecnologías de la Información y la Comunicación, https://www.ontic.org.do/media/1125/onticrd_e.

[28] Peláez-Longinotti, F. (2019), Los Gastos Tributarios en los Países Miembros del CIAT [Tax Expenditure in CIAT Member Countries], https://www.ciat.org/Biblioteca/DocumentosdeTrabajo/2019/DT_06_2019_pelaez.pdf.

[27] Redonda, A., C. Haldenwang and F. Aliu (2021), The Global Tax Expenditure Database, GTED, https://gted.net/2021/05/the-global-tax-expenditures-database-companion-paper/.

[12] Sánchez, G. (2016), Contraste de la disponibilidad y demanda de agua por provincia, situación actual y retos futuros, BanReservas, Santo Domingo.

[37] Tambunlertchai, S. et al. (2021), Can Fintech Foster Competition in the Banking System in Latin America and the Caribbean?, International Monetary Fund, Washington, DC, https://www.imf.org/-/media/Files/Publ.

[46] Weller, J., S. Gontero and S. Campbell (2019), Cambio tecnológico y empleo: Una perspectiva latinoamericana. Riesgos de la sustitución tecnológica del trabajo humano y desafíos de la generación de nuevos puestos de trabajo, ECLAC, https://www.cepal.org/es/publicaciones/44637-cambio-tecnologico-empleo-perspectiva-latinoamericana-riesgos-la-sustitucion.

[4] World Bank (2022), World Development Indicators [database], https://databank.worldbank.org/source/world-development-indicators#.

[31] World Bank (2019), Fiscal Policy and Redistribution in the Dominican Republic, https://documents.worldbank.org/en/publication/documents-reports/documentdetail/827851478242582427/fiscal-policy-and-redistribution-in-the-dominican-republic-an-analysis-based-on-the-commitment-to-equity-methodology-for-2013.

[3] World Bank (2018), Dominican Republic - Systematic Country Diagnostic, World Bank Group, Washington, DC, http://documents.worldbank.org/curated/en/980401531255724239/pdf/Dominican-Repuiblic-SCD-final-07022018.pdf (accessed on 21 September 2022).

[22] World Bank (2016), World Bank Enterprise Surveys (database), http://www.enterprisesurveys.org.