This chapter describes the country’s performance across well-being dimensions and the SDGs and identifies the key constraints to development. First, it outlines the history and context of the Dominican Republic’s development and identifies a set of risks and trends that will impact its future development. Second, it presents performance across a range of well-being and SDG indicators. It then analyses the Dominican Republic across the five Ps of the 2030 Agenda: People, Prosperity, Partnerships, Peace and Institutions, and Planet.

Multi-dimensional Review of the Dominican Republic

2. Multi-dimensional constraints analysis in the Dominican Republic

Abstract

Introduction

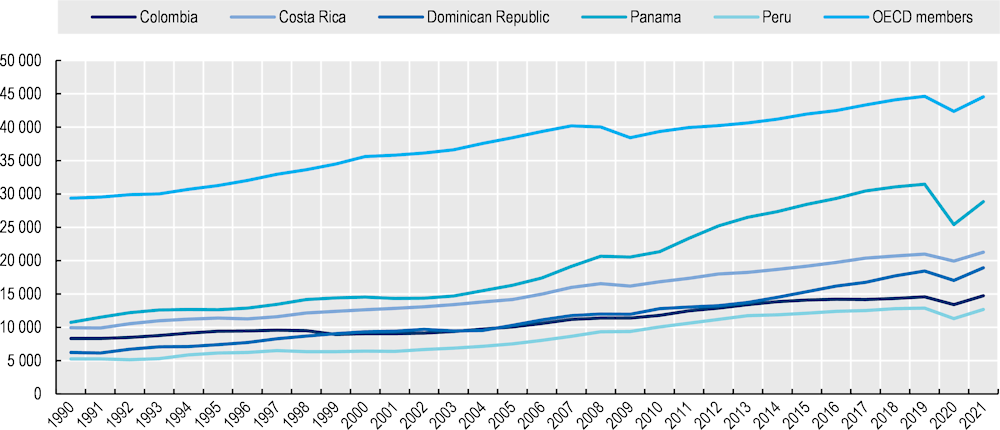

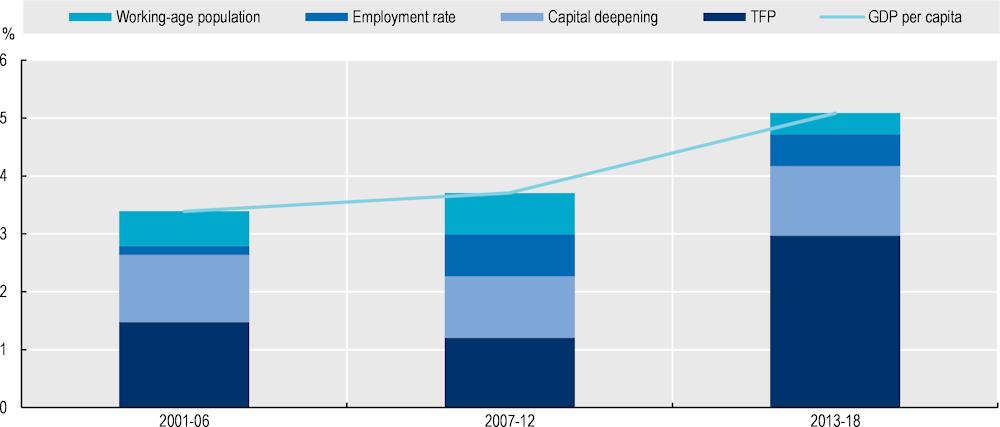

The recent history of the Dominican Republic is one of many socioeconomic achievements. The country has been one of the leading economies in the Latin American and Caribbean (LAC) region in terms of GDP growth, averaging a yearly rate of 5.1% between 1993 and 2021 (IMF, 2022[1]). This led the Dominican Republic to reach the upper middle-income status in 2011 (following the World Bank classification), only eight years after suffering the severe banking crisis of 2003. Likewise, poverty significantly declined, and well-being improved in that period, with progress also on areas like access to public services, life satisfaction, and employment rates. Life expectancy has also improved significantly, from 67.8 years in 1990 to 70.5 years in 2000, 72.7 years in 2010, and 74.2 years in 2020 (relative to 80.6 years on average for OECD countries in 2020) (World Bank, 2022[2]).

However, the impact of COVID-19 in the country revealed that the Dominican Republic was facing significant structural weaknesses already before the pandemic, and that previous progress had not been sufficiently inclusive and sustainable. The Dominican Republic is indeed a country undergoing “development in transition,” as defined in the Latin American Economic Outlook 2019 (OECD et al., 2019[3]). In this respect, before the pandemic the country was already facing various development traps in its transition towards greater levels of development. These were well reflected in the strategic priorities of the National Development Strategy (Estrategia Nacional de Desarrollo 2030, NDS 2030) which represents the common, long-term vision of development for the Dominican Republic. The multi-dimensional approach to development provided in this Multi-Dimensional Country Review (MDCR) of the Dominican Republic is needed to better understand the specific barriers to development facing the country, as well as their interactions and the best policy mixes to address them effectively.

This MDCR is being undertaken to support the country in its efforts to achieve greater levels of well-being for all and build a robust and inclusive recovery. This MDCR includes two main parts. The first one is this Initial Assessment, which builds on the 2030 Agenda for Sustainable Development and its Sustainable Development Goals (SDGs) to identify the main constraints to achieving inclusive sustainable development. In this respect, it identifies key constraints and the underlying development challenges that the Dominican Republic must address. The second part is an In-depth Analysis which focuses on specific policy areas, in particular: i) labour market formalisation; ii) financing for development; iii) digital transformation. In these three areas, the report examines main challenges and opportunities and provides policy recommendations to move from Analysis to Action. The analysis and recommendations are based on OECD expertise and experiences of other countries, as well as on dialogue with Dominican stakeholders, which took place in several bilateral meetings as well as in three thematic workshops held in Santo Domingo.

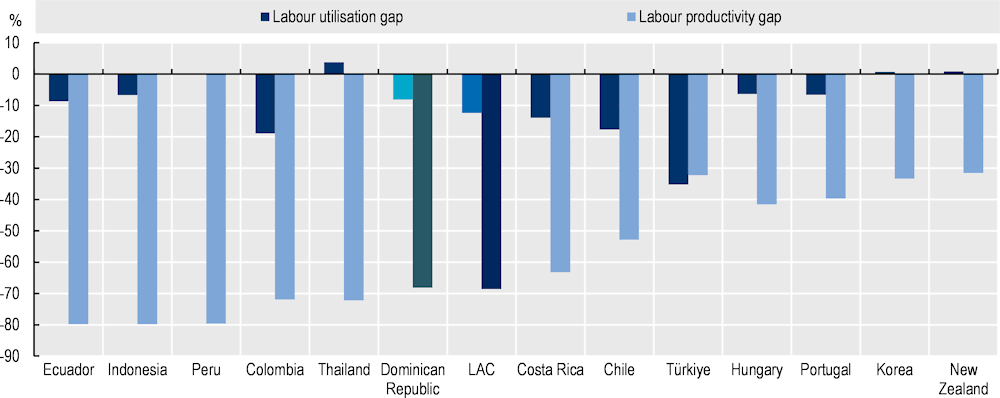

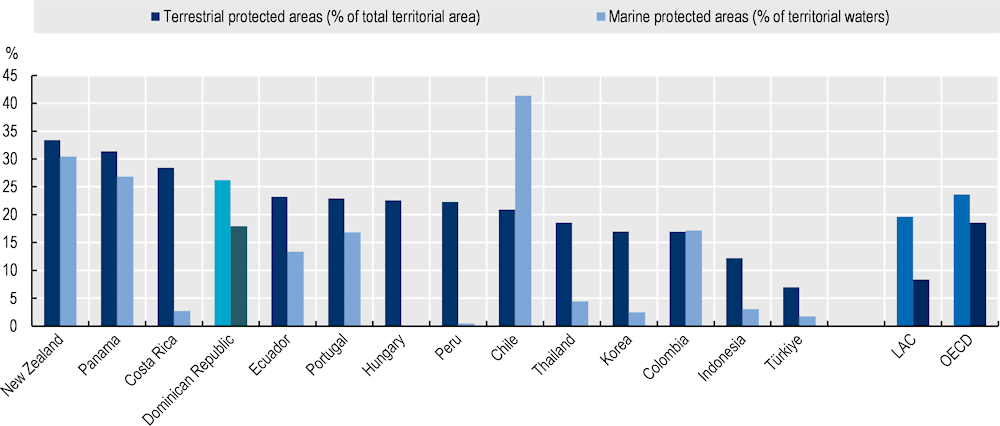

The Initial Assessment describes the Dominican Republic’s performance across well-being dimensions and the SDGs and identifies the key constraints to development. First, it outlines the history and context of the Dominican Republic’s development and identifies a set of risks and trends that will impact its future development. Second, it presents performance across a range of well-being and SDG indicators. It then analyses the Dominican Republic across the five Ps of the 2030 Agenda: People, Prosperity, Partnerships, Planet and Peace. Whenever relevant and subject to data availability, the Dominican Republic is compared with a set of benchmark economies in Latin America (Costa Rica, Chile, Colombia, Ecuador, Panama and Peru), in the OECD (Hungary, Korea, New Zealand, Portugal, Türkiye) and Asia (Indonesia and Thailand).

A brief history of the Dominican Republic’s development

The second half of the 20th century was filled with major events that marked the Dominican Republic’s development path. After three decades under Trujillo’s dictatorship, his death in 1961 gave way to a convoluted period that was marked by a coup d’etat in 1963, a civil war in 1965 and the subsequent occupation by the United States that lasted between April 1965 and September 1966. The Constitution approved in that year started a period known as the 4th Republic, which lasts until today and where new Constitutions have been approved in 1994, 2002, 2010 and 2015.

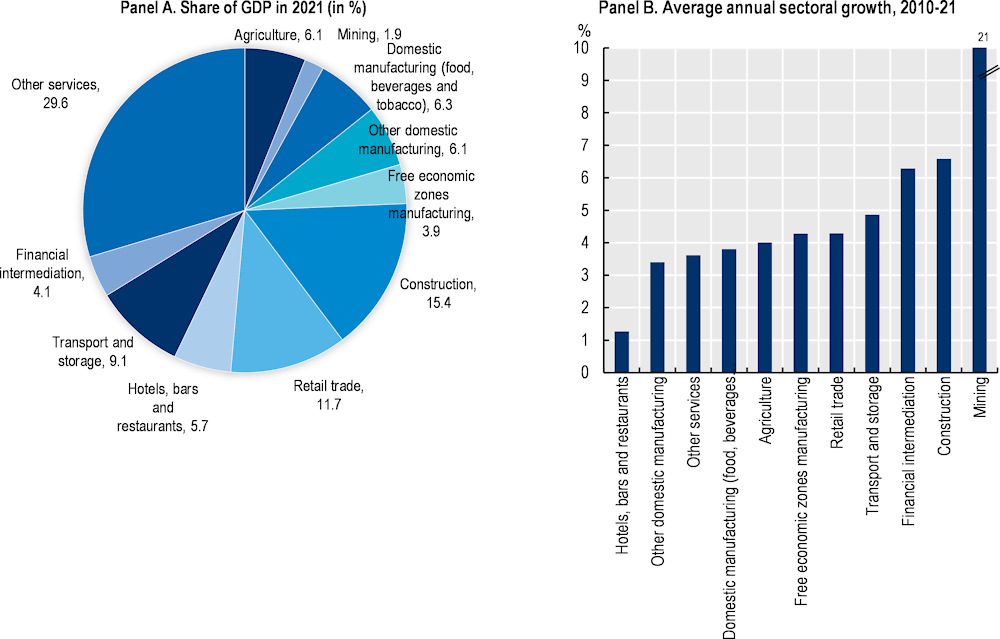

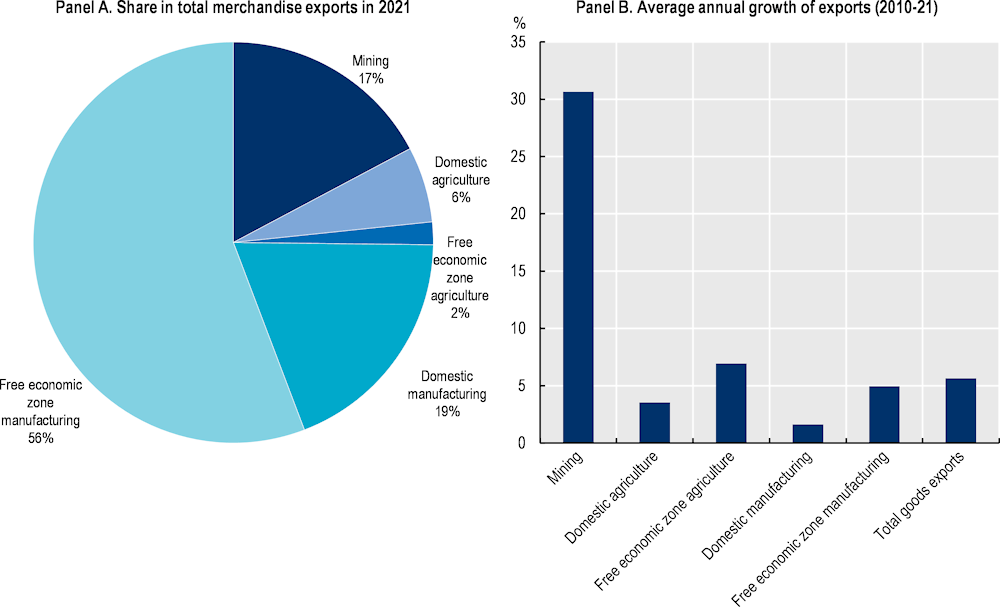

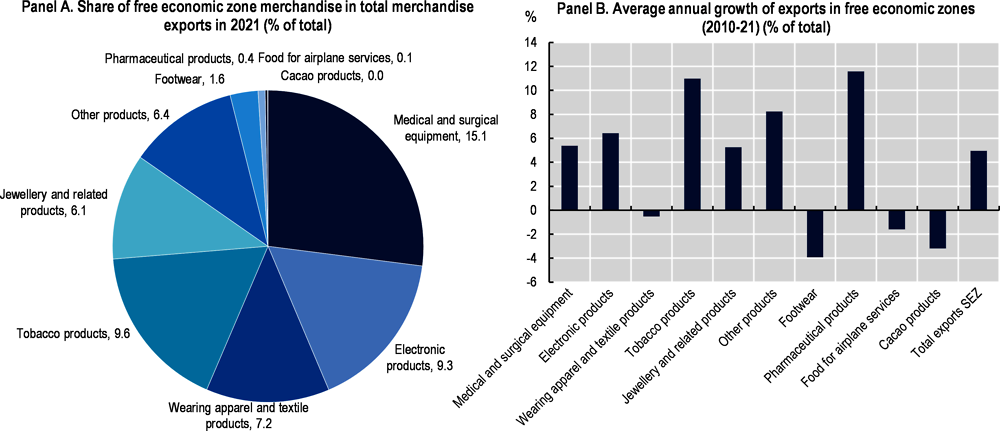

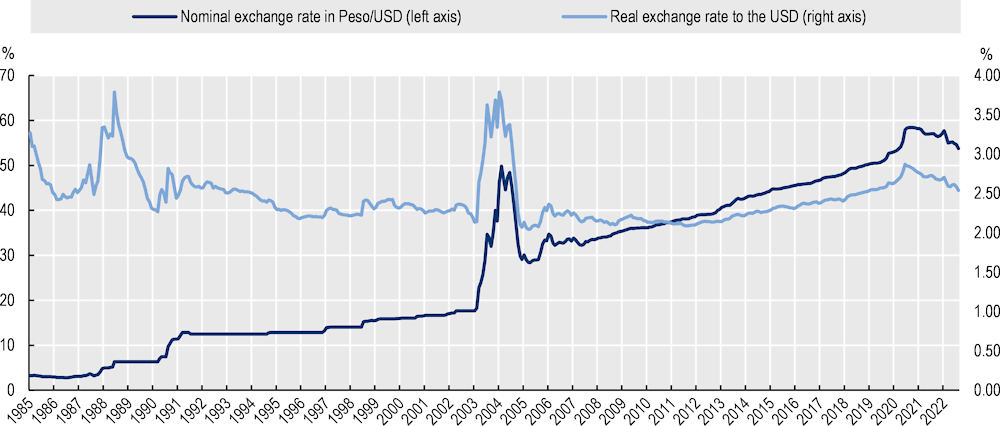

In economic terms, the 4th Republic started with a period of sustained growth, with an annual expansion of GDP of around 8% between 1966 and 1976. Economic development was mainly based in the production and exporting of primary commodities (Pozo et al., 2010[4]). Throughout this period, and similar to most economies in LAC, the government was supporting a policy of “import substitutions” to encourage the industrialisation of the country, which gained impetus in the late 1960s. This included measures related to trade, exchange rates and public investment. The first free-trade zone (FTZ) of the country was created in 1969.

The Dominican Republic was affected by the wave of economic crises that hit various LAC economies during the 1980s. These were mainly characterised by high levels of public debt and unsustainable fiscal deficits, in a context of tight international financial conditions and high volatility. This gave way to a series of structural reforms in the 1990s, much in line with the predominant doctrine of the Washington Consensus, oriented towards the liberalisation of certain markets, opening up to the global economy and the privatisation of SOEs, among others. The structure of production was transformed, with a transition from an economy mainly based on agriculture to one based on services, and with areas like telecommunications, financial services and tourism, together with exports from free-trade zones, becoming core engines of economic growth. This declining role of agriculture was one of the drivers of a process of urbanisation that started to gain strength: in 1993, 56% of the population lived in urban areas and ten years later 64.6% did (81% in 2018). Some rural areas became pockets of poverty.

The early 2000s were marked by the banking crisis of 2003, which had a strong impact on the country’s main macroeconomic and social indicators. The country signed a programme with the International Monetary Fund that supported the recovery in the subsequent years, linked to a package of structural reforms. The Conditional Cash Transfer programme “Programa Solidaridad’ was created in this period, in 2005, to support vulnerable populations and then was transformed into the programme “Progresando con Solidaridad in 2012. Since then, and until the impact of COVID-19, growth was strong and social progress was positive in many fronts, but with large gaps in different dimensions of well-being that the pandemic came to accentuate and that are the main subject of analysis of this Initial Assessment.

Looking ahead: Internal and external trends

In addition to the specific development challenges that are analysed in the following sections, there are a number of key trends with both immediate and long-term impact that cut across many dimensions of development and need to be considered in any future development strategy. This section briefly describes some of these key trends, namely population ageing, the rise of an urban middle-class, the digital transformation and climate change.

Population trends

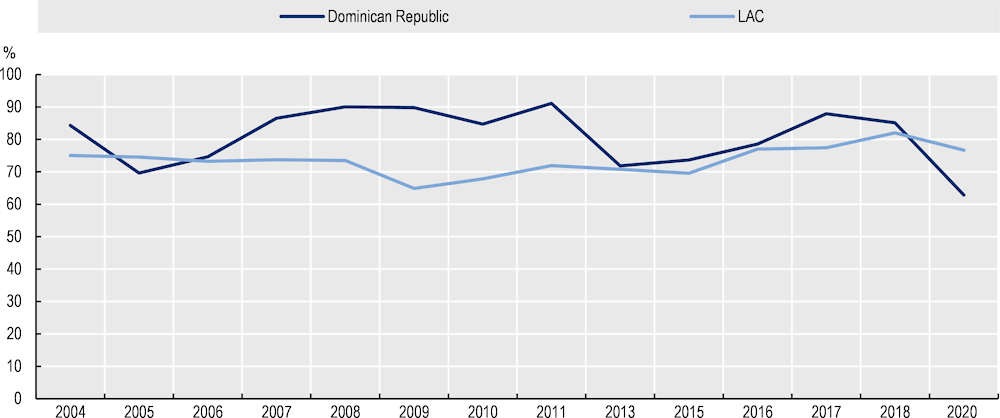

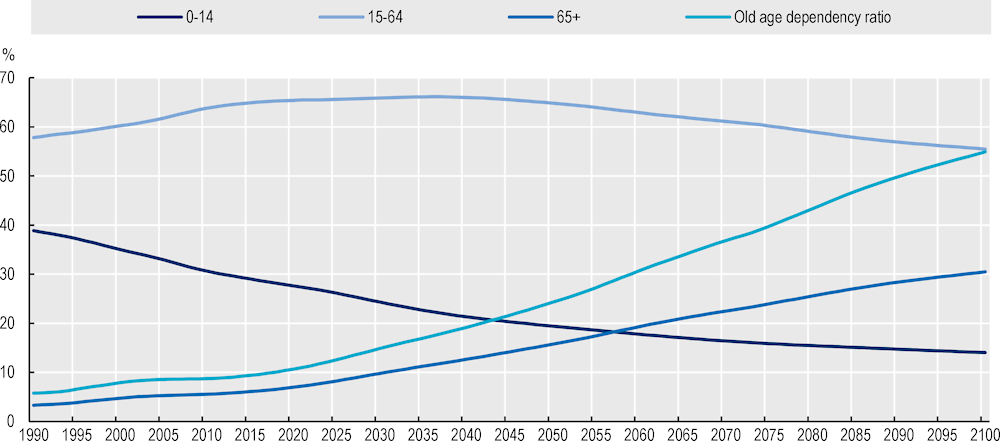

The Dominican Republic is experiencing a process of population ageing, which is usual in most countries as they advance towards greater levels of development. This process is also linked to global advancements related to healthcare improvements and better nutrition patterns, among others. The old-age dependency ratio will have jumped from a level of around 11 in 2022 to around 25 by 2050 (meaning that there will be one person aged 65+ per each four people in working age) and to around 50 by 2090 (Figure 2.1).

Figure 2.1. Demographic trends in the Dominican Republic, 1990-2100

Note: Estimates for 2022-2100 are from the medium fertility variant scenario. Old-age dependency ratio, is the ratio of older dependents –people older than 64– to the working-age population–those ages 15-64. Data are shown as the proportion of dependents per 100 working-age population.

Source: Authors’ elaboration based on (UNDESA, 2022[5]).

These demographic trends have relevant implications for public policy and well-being. Labour markets will have to adapt, as the working-age population will shrink in relative terms and hence improving productivity will become central. Careers will tend to be longer, with implications in terms of re-skilling and up-skilling, which will demand innovative responses from education and training systems. Likewise, social protection systems will have to adapt, with an evident need to develop a strong old-age pension system and to advance towards a sustainable and adaptable healthcare system.

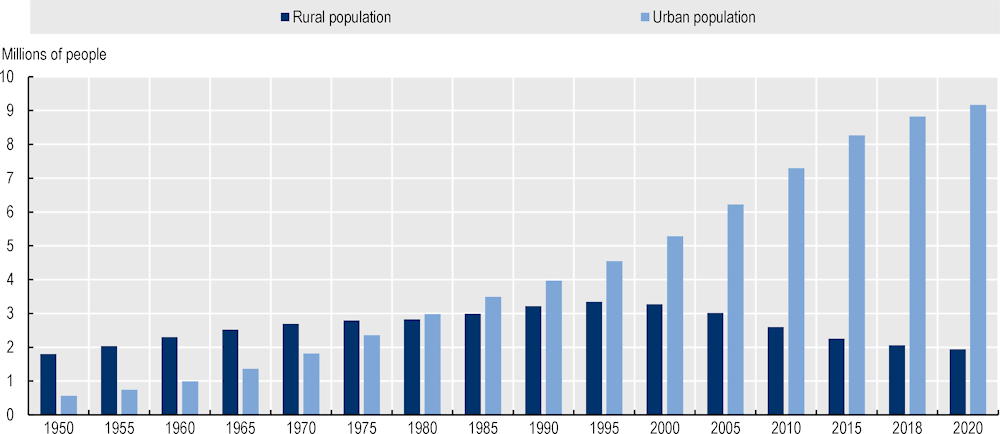

A growing urban middle-class

The Dominican Republic has been undergoing a process of rapid urbanisation. While in 1980 one in two Dominicans lived in urban areas, in 2020 around 84% of the population lived in cities, and by 2050 around 92% of the population will be settled in urban areas (Figure 2.2). This trend overlaps with the expansion of the middle-class, which in 2018 represented around one-third of the population, mostly living in urban areas. This middle-class is also expected to continue growing if current trends of economic expansion are sustained and the recovery from the COVID-19 pandemic is robust. The implications of these trends are numerous and will affect mainly the provision of good quality public services in cities. Public transport, health, education, water and electricity, among others, will have to be adapted to the rising demands of the middle-class but also to the increasing pressures of serving a large and densely concentrated population.

Figure 2.2. Evolution of the rural and urban population in the Dominican Republic from 1950 to 2020

The digital transformation entails risks and opportunities

Technological progress has accelerated globally, and major shifts are underway that are radically transforming economies and societies. The current period is one of transition towards a digital economy and society. Artificial intelligence, big data analytics, block chain technologies, the Internet of Things and the radical transformation of information and communication technologies are some prominent examples of this trend and make up for what many have labelled as the “the “next production revolution” (OECD et al., 2020[6]; OECD, 2017[7]).

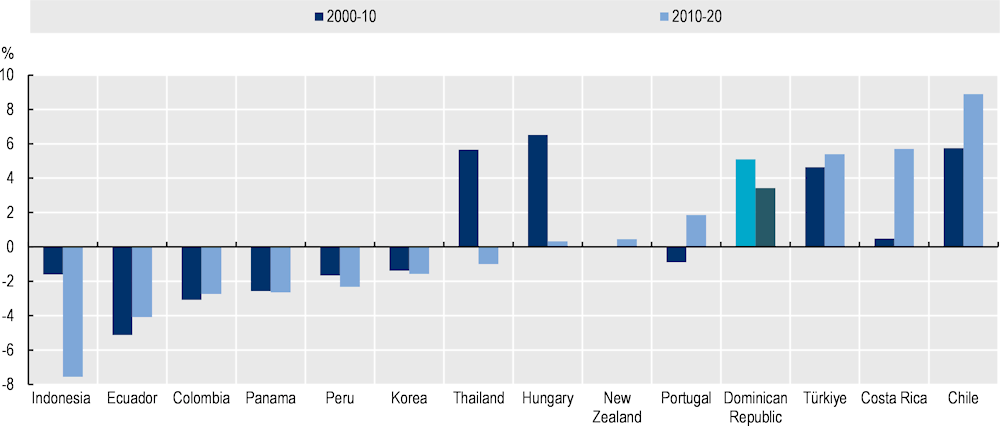

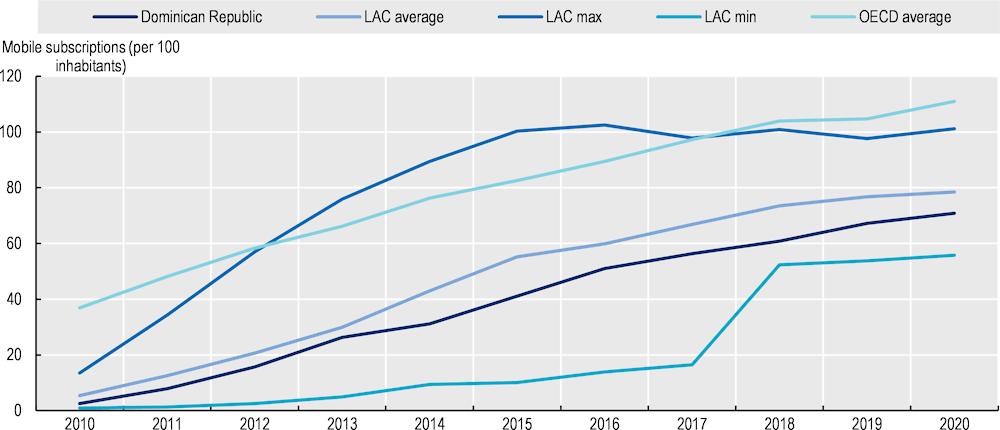

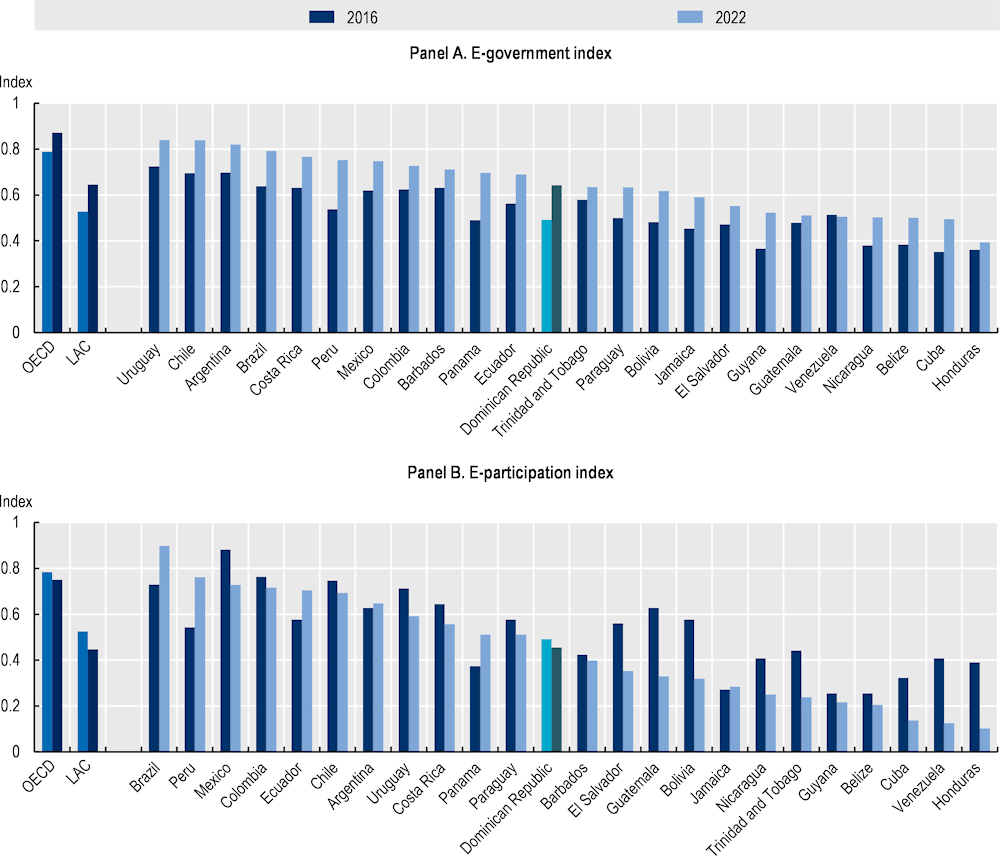

The digital transformation offers many opportunities for overcoming the main development traps in LAC countries and in the Dominican Republic. One of the key elements for this digital transformation to work for all is that access to quality internet connections is enhanced. In the Dominican Republic, 71% of citizens had a mobile broadband connection in 2020, slightly below LAC average but still well behind the OECD average (Figure 2.3).

Figure 2.3. Mobile broadband penetration

Active mobile-broadband subscriptions per 100 inhabitants

Note: LAC is a simple average of Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Mexico, Panama, Paraguay, Peru, and Uruguay. OECD is a simple average of all 38 member countries.

Source: Authors’ elaboration based on (ITU, 2021[8]).

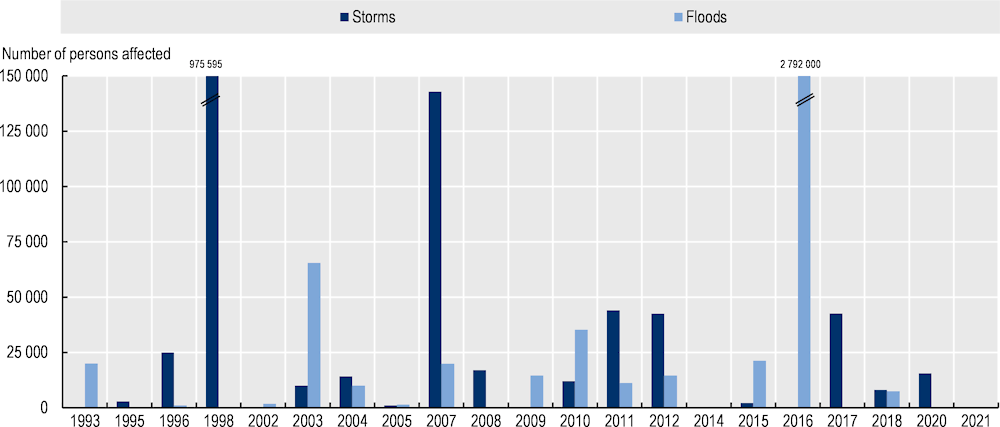

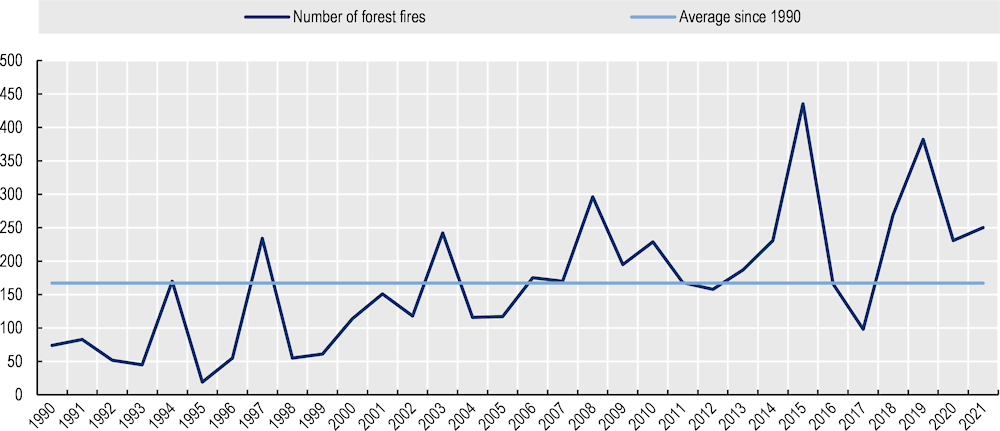

Climate change risks will become more pressing

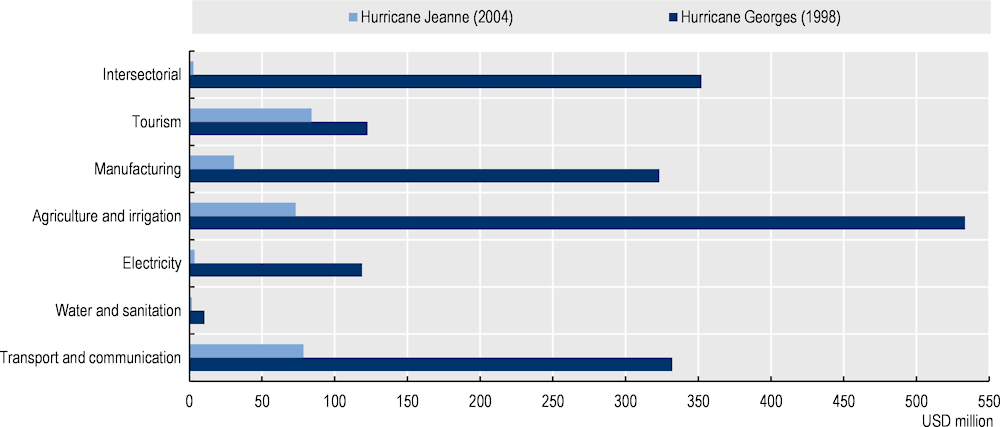

Climate change mitigation and adaptation are becoming increasingly important in the Dominican Republic and in the Caribbean, given the vulnerability of this area to climate risks (OECD et al., 2022[9]). Located in the centre of the Antillean Arc, the Dominican Republic shares the Caribbean island of Hispaniola with Haiti. Climate projections to 2050 predict an increase in average annual temperature of 1-2.5°C, a decrease in average annual precipitation by over 23% from 2010 levels and an increase in the number of consecutive “dry” days of 7.2% to 17.4%. It is most likely that the global average intensity of tropical storms will raise from 2% to 11% in 2100 (PLENITUD; Caribbean Community Climate Change Centre; Consejo Nacional para el Cambio Climático y Mecanismo de Desarrollo Limpio; Ministerio de Agricultura; UE, 2014[10]).

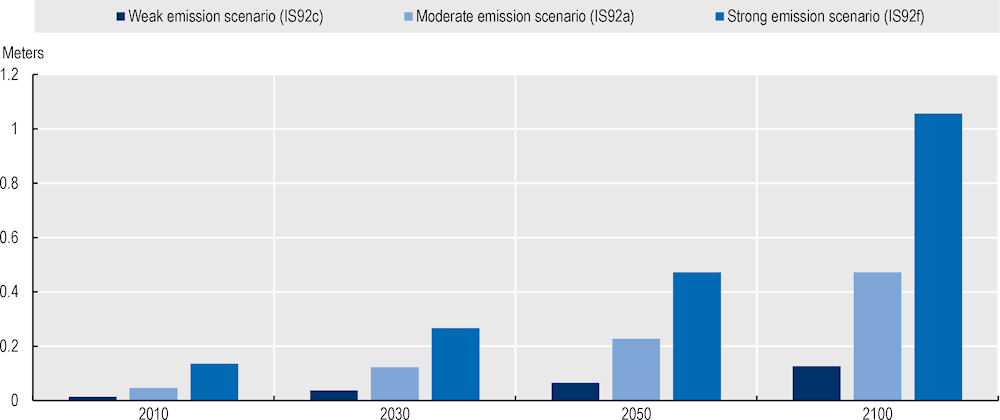

The economic costs of climate change in the Dominican Republic are estimated to reach 86% of GDP by 2100 (Burke, Hsiang and Miguel, 2015[11]). One of the effects of climate change is rising sea levels that create stress on coastal ecosystems. The sea-level projections estimate a 3 cm rise in sea level by 2030, a 6 cm by 2050 and a 12 cm by 2100 on a weak emission scenario. Alternatively, a strong emission scenario would involve a 26.73 cm rise in sea level by 2030, 47.27 cm by 2050 and 105.67 cm by 2100 (Figure 2.4).

Figure 2.4. Sea-level rise in the Dominican Republic, 2010-2100

Sea level projections based on three emission scenarios

Note: According to the first national communication, three emission scenarios are considered: one weak IS92c, one moderate IS92a and one strong IS92f. The base year is 1990.

Source: Authors’ elaboration based on (PLENITUD; Caribbean Community Climate Change Centre; Consejo Nacional para el Cambio Climático y Mecanismo de Desarrollo Limpio; Ministerio de Agricultura; UE, 2014[10]).

Well-being and Sustainable Development Goals (SDG) Analysis

How’s life in the Dominican Republic? Through the OECD well-being lens

The well-being of citizens can be comprehensively assessed with the OECD’s “How’s Life?” toolbox. Well-being encompasses people’s diverse experiences in all dimensions that matter to them, including households’ material conditions (e.g. income, jobs and housing), but also their broader quality of life (e.g. health, education, environment, life satisfaction). Recognising the importance of how people themselves evaluate their lives, the OECD Framework for Measuring Well-Being and Progress uses a mix of objective and subjective indicators (OECD, 2017[12]).

Using a well-being lens can help to identify trade-offs between different policy goals and reduce departmental silos. A growing number of countries in LAC and in the OECD and beyond are taking steps to embed well-being more deeply and systematically into policy processes (Durand and Exton, 2018[13]; OECD, 2021[14]). In LAC, countries like Bolivia, Colombia, Ecuador and Paraguay have drawn on well-being evidence to inform their National Development Strategies and performance frameworks. In the case of the Dominican Republic, increasing well-being is the superior objective around which the National Development Strategy 2030 (NDS 2030) Estrategia Nacional de Desarrollo 2010-2030: un viaje de transformación hacia un país mejor is built.

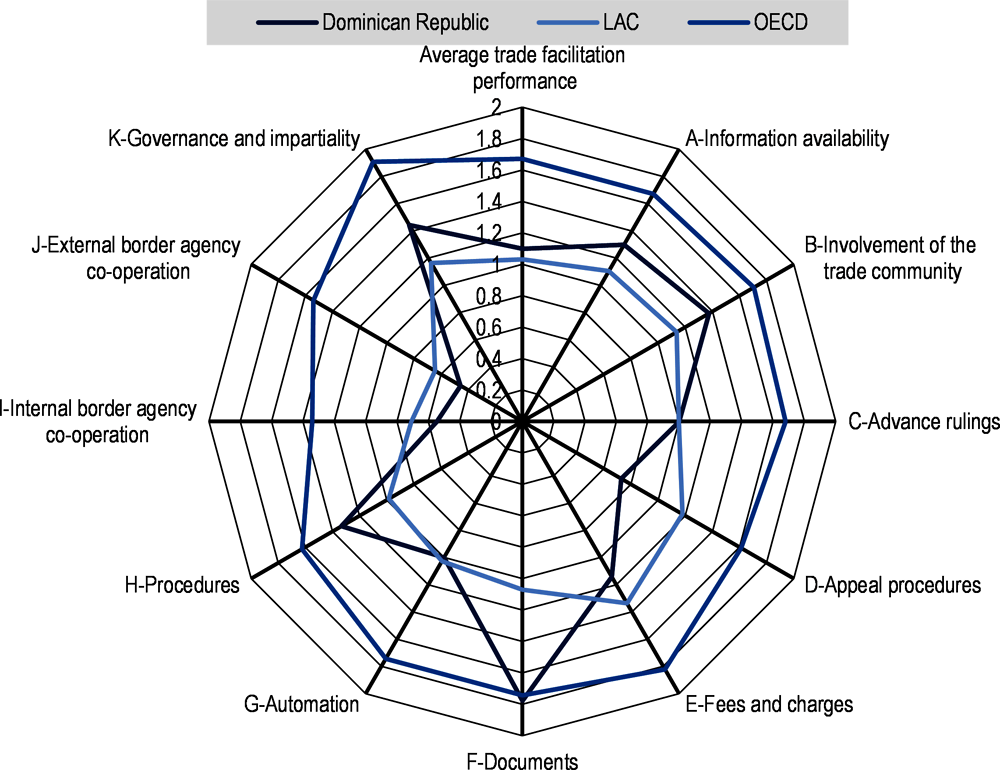

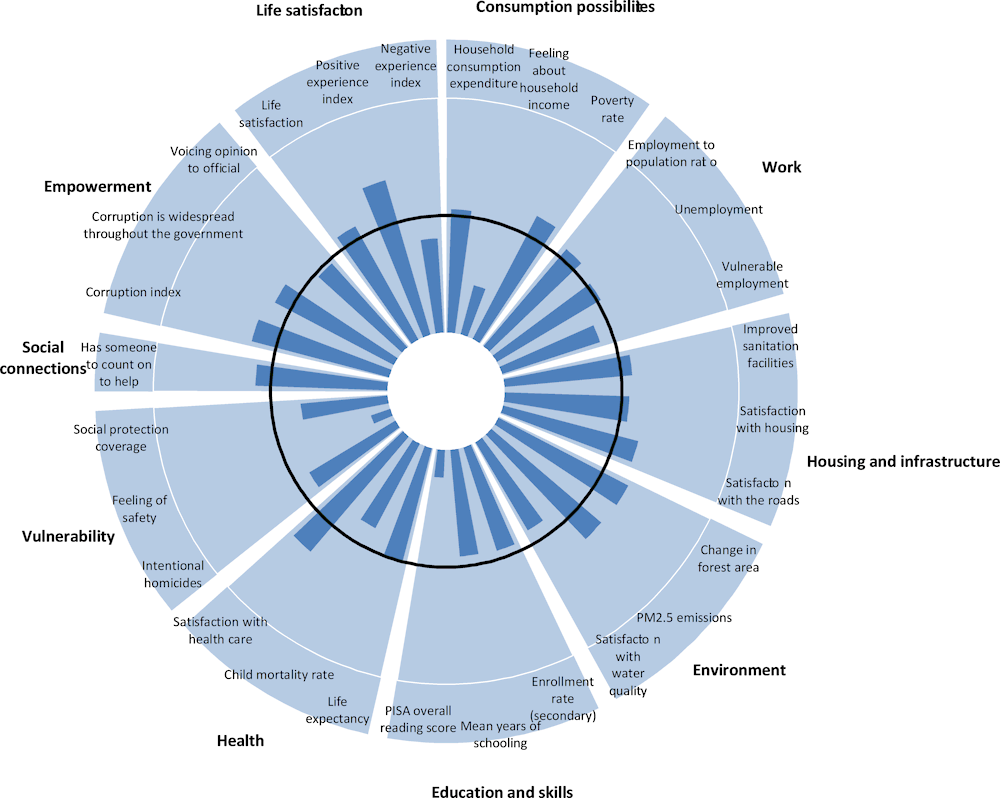

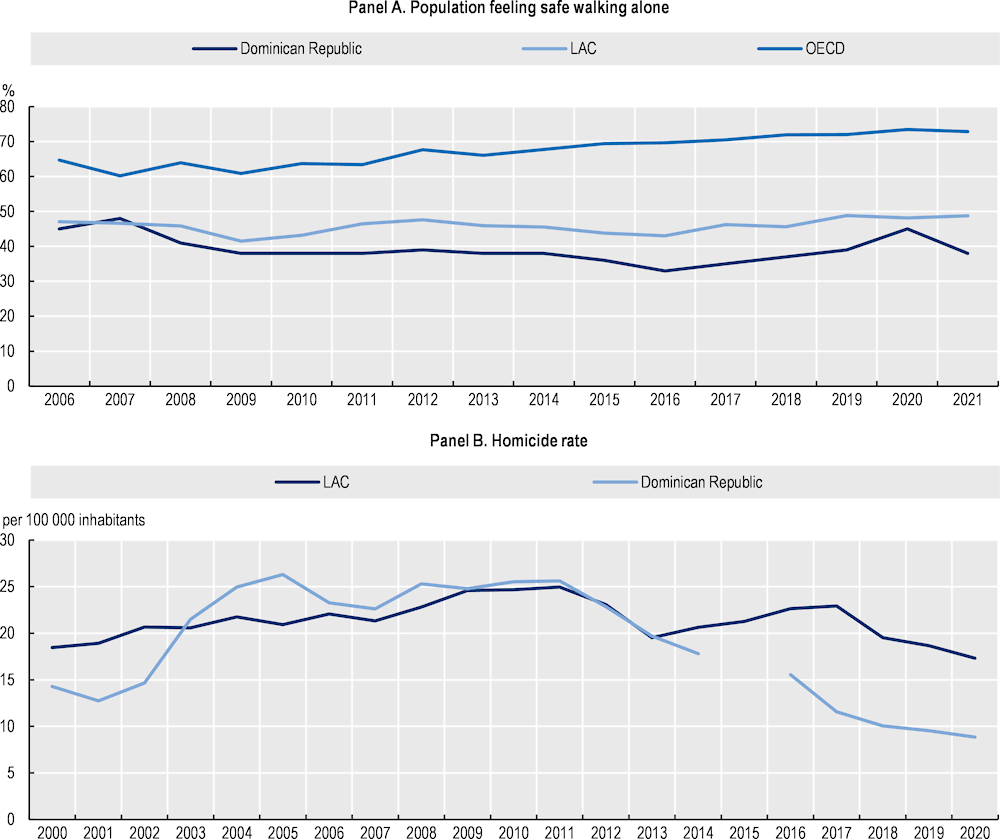

Compared to countries at a similar level of development, the Dominican Republic performs similar to them in many dimensions of well-being (Figure 2.5). Performance is stronger in areas like life satisfaction, for instance regarding satisfaction with healthcare, with roads and with housing. However, citizens feel less safe in the Dominican Republic than it would be expected by its level of development, and satisfaction with water quality is also below the expected value. Areas where the Dominican Republic underperforms are education, both in terms of quantity (enrolment rates and mean years of schooling) and quality, as shown by low PISA scores. Health, social protection and quality of jobs are other areas where the country performs below what would be expected for its level of development.

Figure 2.5. Current and expected well-being outcomes for the Dominican Republic: Worldwide comparison

Note: The observed values falling inside the black circle indicate areas where the Dominican Republic performs poorly in terms of what might be expected from a country with a similar level of GDP per capita. Expected well-being values (the black circle) are calculated using bivariate regressions of various well-being outcomes on GDP, using a cross-country dataset of around 150 countries with a population over a million. All indicators are normalised in terms of standard deviations across the panel.

Source: Authors’ elaboration based on (World Bank, 2022[2]; Gallup, 2022[15]; UNESCO, 2022[16]; Transparency International, 2019[17]; OECD, 2022[18]; ILO, 2022[19]).

Moving ahead on the SDGs

The SDGs consist of 17 goals and 169 targets with the ultimate objective of ending poverty, protecting the planet and ensuring prosperity and peace for all. They came into effect in January 2016 and provide guidelines for all countries up to 2030. The Dominican Republic has a solid commitment with the 2030 Agenda with a level of alignment of 91% between the SDGs and the national planning set in the National Development Strategy 2030, and the UN’s voluntary national reporting (Gobierno de la República Dominicana, 2021[20]).

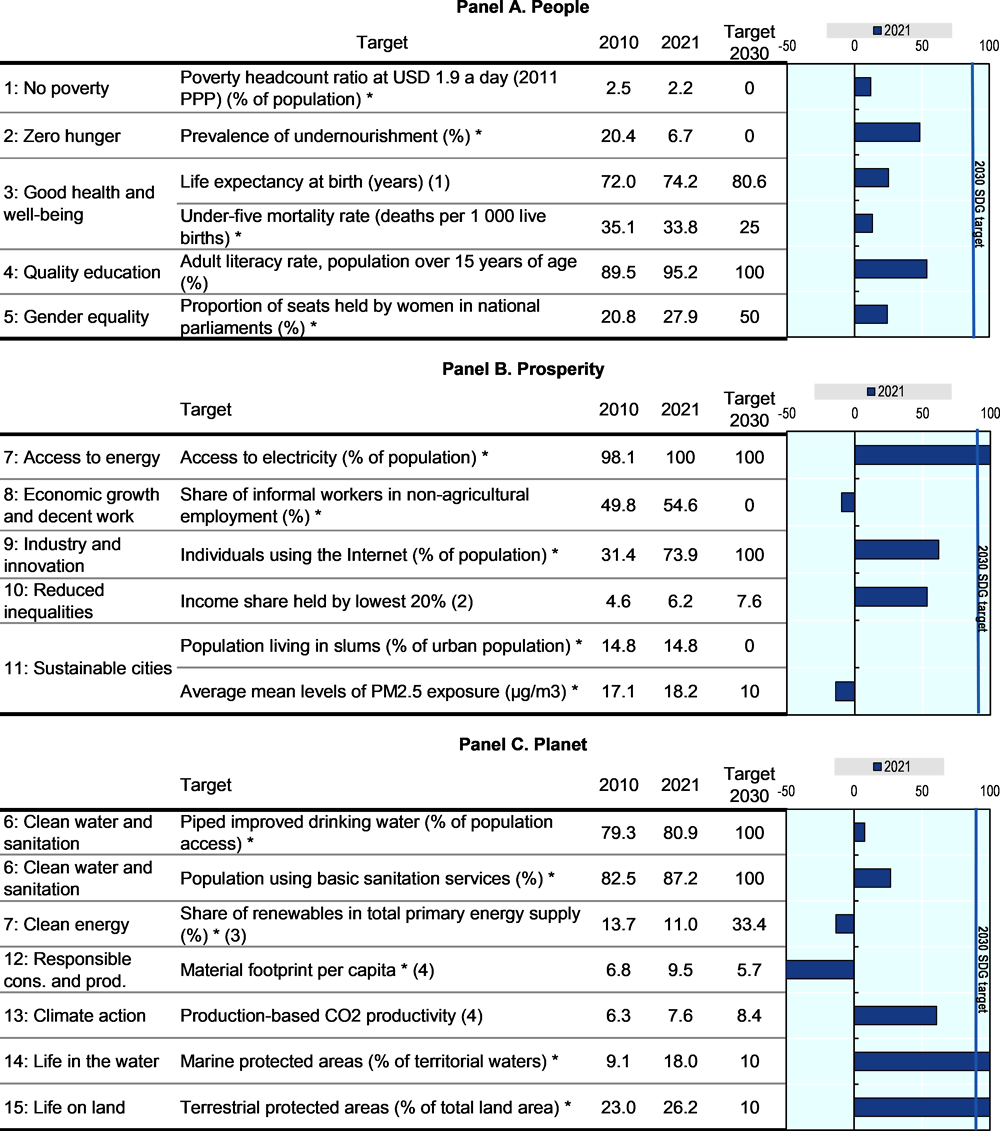

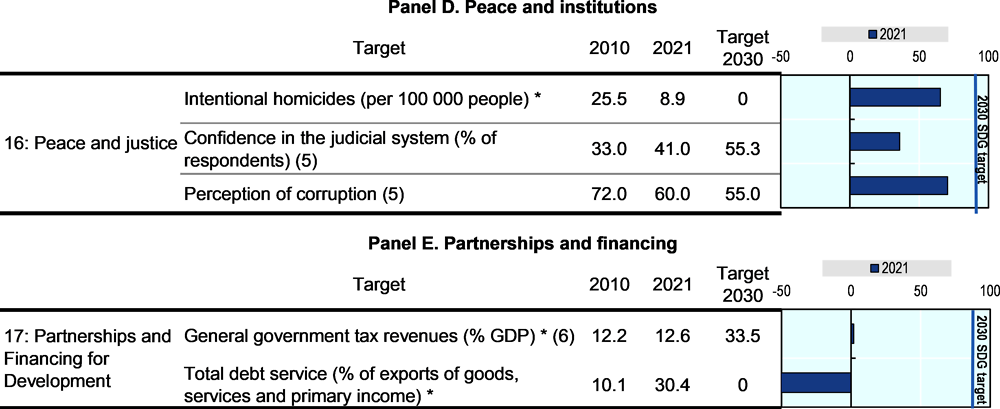

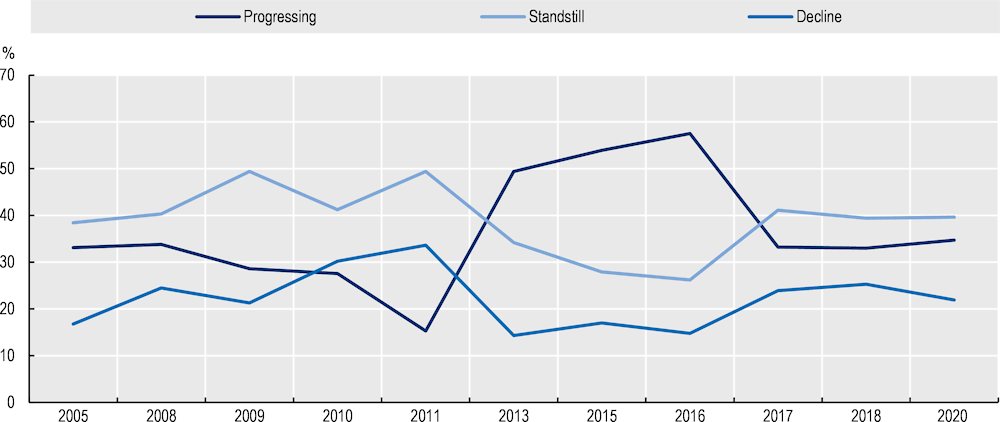

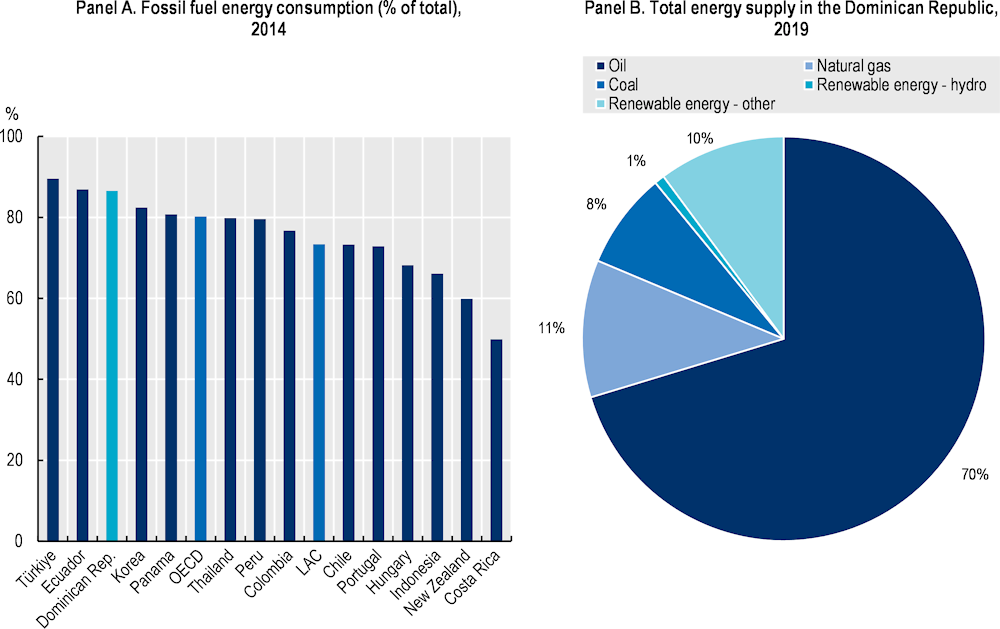

The Dominican Republic shows mixed results in its performance across the SDGs. Furthermore, progress towards SDGs has been severely affected by the impact of COVID-19 and the subsequent socioeconomic crisis, as well as by a complex global context in the aftermath of the pandemic (OECD et al., 2022[9]). To move forward, further progress is needed in various dimensions to advance towards more inclusive and sustainable development (Figure 2.6). Some of the greatest challenges ahead are gender equality, decent work, sustainable cities and clean energy.

Figure 2.6. Progress towards the Sustainable Development Goals (SDGs) in the Dominican Republic

Progress towards the 2030 targets by 2021 (relative to 2010 baseline)

Note: Progress is measured using data from 2021 or latest year available. Indicators marked with an asterisk (*) are official SDG’s indicators for monitoring progress. Targets are as set by the Sustainable development goals when available (with baseline 2010). For the following indicators 2030 target were set equal to: (1) 2020 OECD average; (2) 2019 OECD average; (3) 2020 OECD average; (4) OECD 2030 targets calculated based on (OECD, 2019[21]); (5) 2021 OECD average; (6) 2020 OECD average. Marine and terrestrial protected area baseline is 2016 instead of 2010. Production-based CO2 productivity is GDP per unit of energy-related CO2 emissions (2015 USD per kg).

Source: Authors’ elaboration based on (World Bank, 2022[2]; Gallup, 2022[15]; UNESCO, 2022[16]; IMF, 2022[1]; ILO, 2022[19]; ECLAC, 2022[22]; Inter-Parliamentary Union, 2021[23]; Gobierno de la República Dominicana, 2021[20]; OECD, 2022[24]; WHO/UNICEF, 2022[25]) (IEA/OECD, 2021[26]).

People – Towards better lives for all

Prior to the impact of the COVID-19 pandemic, the Dominican Republic enjoyed one of the strongest growth rates in Latin America and the Caribbean (LAC) over a period of 25 years. Yet economic growth was not sufficiently inclusive: around one in four Dominicans remain below the poverty line. The COVID‑19 pandemic had a negative impact on GDP in 2020, with a contraction of 6.7% (OECD et al., 2021[27]). Despite the country’s efforts to counter the effects of the crisis on most vulnerable groups, key social indicators were negatively affected. Poverty increased from 20.9% in 2019 to 23.4% in 2020 and up to 23.8% in 2021; while extreme poverty increased from 2.6% in 2019 to 3.5% in 2020, and decreased to 3.1% in 2021 (Ministerio de Economía, Planificación y Desarrollo, 2021[28]).

Even before the pandemic, the expansionary cycle had a limited impact on reducing poverty and inequality, in part because growth did not sufficiently translate into quality jobs. In fact, the sectors largely driving economic growth showed falling labour shares. Low-skilled workers became increasingly concentrated in low-quality jobs and in sectors that showed low productivity growth, while labour informality remained high and persistent. Additionally, the gap widened between productivity and earnings.

This section examines the evolution of key social indicators that reflect efforts undertaken and challenges faced by the Dominican Republic in a bid to transform economic progress into inclusive and sustainable development. The first sub-section summarises the main achievements in relation to tackling poverty and inequality over past decades and identifies ongoing challenges. The second examines the level of social spending and the effects of taxes and transfers on income distribution and poverty alleviation. The third analyses the country’s labour markets. The fourth, fifth and sixth sub-sections identify the main constraints that hinder expanding and improving education, health and social protection services.

Growth has not been sufficiently inclusive

The strong economic growth evident in most of the past 20 years in the Dominican Republic (before the COVID-19 pandemic, and with the main exception of the 2003 crisis) did not render the expected poverty reduction. Although economic expansion enhanced the living standards of citizens, including of those at the lower end of the income distribution, it did not result in significant poverty reduction. Over the 15 years following the domestic crisis of 2003, the rate of poverty declined only modestly. In 2019, more than 2 million people, representing one-fourth of the population, lived below the national poverty line. This level began to clearly decrease only after 2013, but poverty has been picking up in recent years, largely owing to the impact of the pandemic. In parallel, income inequalities are significant in the Dominican Republic: people in the top 20% of the income distribution hold more than ten times the share of income held by the bottom 20% (OECD, 2022[29]).

Poverty and inequality declined in the last two decades but remain important

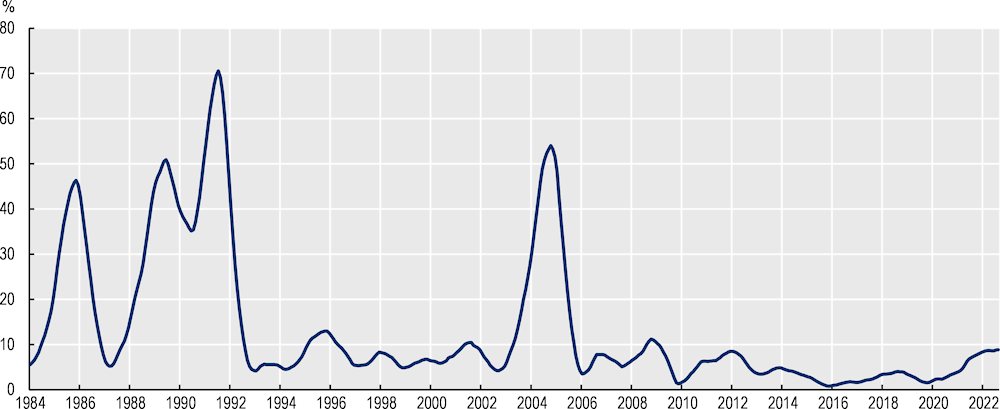

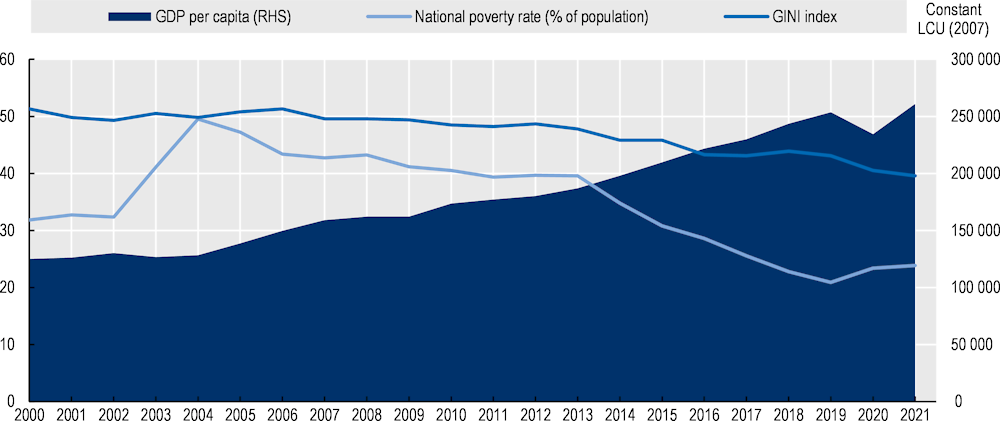

The domestic crisis of 2003 had negative long-term and durable effects on poverty, inequality and well-being in the Dominican Republic. In the aftermath of the banking crisis, the economy recovered rapidly while poverty decreased at a significantly slower pace. During the early 2000s, approximately one-third of the population lived below the national monetary poverty line (Figure 2.7); the domestic financial crisis of 2003 escalated the poverty rate to almost 50%. Ten years later (by 2013), poverty had fallen by 10 percentage points to 39.6% of the population – still well above the earlier figure. The extreme poverty rate followed a similar path, having doubled from 7.9% in 2000 to 15.4% in 2004, after which it gradually decreased to 9.3% in 2013. Although positive, this poverty reduction was modest in contrast to the strong growth experienced by the Dominican economy during this period (Carneiro and Sirtaine, 2017[30]).

The banking crisis also had long-lasting social effects, in part due to the lack of suitable fiscal stabilisers and counter-cyclical policies. In times of economic shocks, especially when monetary policy is constrained, automatic fiscal stabilisers and fiscal measures become particularly effective to reduce the long-term effects of a crisis (OECD, 2018[31]). This requires a fiscal policy framework that creates sufficient fiscal space during upturns to support a stimulating fiscal policy response during downturns, including rapidly scaling up income support and active labour market programmes as needed – and mechanisms to scale them down quickly as conditions return to normal.

The impact of economic growth on poverty reduction gained momentum after 2013. Poverty fell sharply in 2014 to 34.8% and to 30.8% in 2015 (on par with levels prior to the 2003 crisis). By 2019, it hit a record low of 20.9%. It should be noted, however, that the National Labour Force Survey methodology was changed in 2016; as such, estimates from 2016 to 2021 are not perfectly comparable with previous figures (Figure 2.7).

Figure 2.7. Fast growth in income per capita versus slower decline of poverty and inequality

Note: Since 2016, the surveying methodology of the National Labour Force Survey changes to become the National Continuous Labour Force Survey, so poverty data may not be perfectly comparable before and after 2015. Estimates for GDP per capita from WEO April 2022, start after 2019, base year is 2007.

Source: Authors’ elaboration based on (Ministerio de Economía, Planificación y Desarrollo, 2022[32]; IMF, 2022[1]).

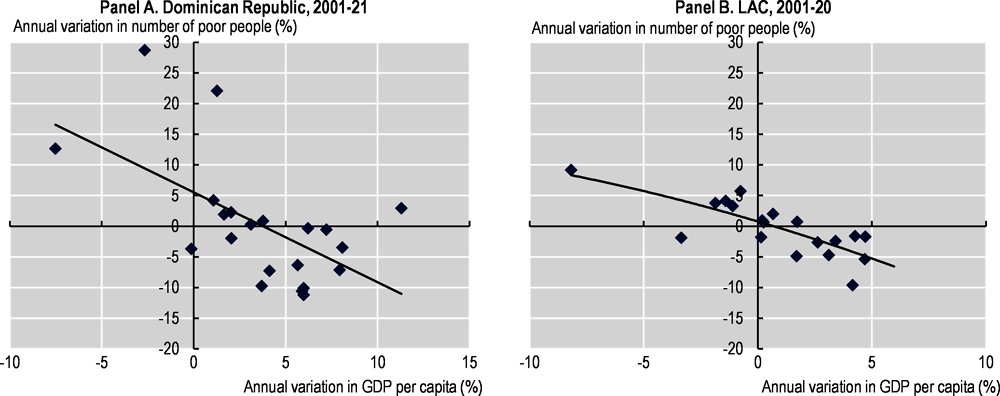

In comparison to LAC, poverty in the Dominican Republic has been more sensitive to economic contraction than to growth, particularly between 2004-13. From 2000 to 2004, while the GDP per capita increased by 0.7%, more than 1.5 million people fell into poverty (poverty increased at a compound rate of 13.2%). During the subsequent period (2004-13), when GDP per capita increased at a compound annual growth rate of 4.3%, poverty declined by only 1.4% per year. On a positive note, this relationship has changed since 2014: while GDP per-capita growth increased to an average of 5.3% per year (2014-18), poverty declined, on average, at a higher rate of 9.2% annually (Figure 2.8).

At the aggregate LAC level, comparing the annual rate of change in the number of people living in poverty and the annual rate of change in per-capita GDP, poverty in LAC over the past 15 years has correlated closely with the business cycle (Figure 2.8). Between 2002 and 2008, when the region experienced vigorous growth of per-capita GDP of 3.2% per year, the number of poor people fell at a compound annual rate of 3.7%. Between 2014 and 2016, as GDP per capita contracted by 1.3% annually, the proportion of poor people increased by 4.8%.

Figure 2.8. Links between growth and poverty reduction are weaker in the Dominican Republic than in LAC

Variation in poverty and in per-capita GDP

Note: Poverty data for Dominican Republic is from National poverty lines, and data for LAC is from (ECLAC, 2022[33]) based on data from Household Surveys Database (BADEHOG). For the GDP per capita data is from WEO April 2022, base year is 2007, and estimates start after 2019.

Source: Authors’ elaboration based on (ECLAC, 2022[22]) (Ministerio de Economía, Planificación y Desarrollo, 2022[32]) (World Bank, 2022[2]) (IMF, 2022[1]).

Addressing child and old-age poverty is one of the biggest challenges in terms of poverty reduction in the Dominican Republic. At present, children (0-14 years old) represent 27% of total population. Relative poverty among children in 2020 was 36.5%, when defining poverty as the share of the population in each age group whose average per-capita income is below the poverty and extreme poverty line. Against the level of 42.6% in 2000, this is a small reduction. Adult poverty varies by age group, ranging from 23% for those between 25-34 years down to 8.1% for the age group 55-64 and 8% for the elderly (65 years or more) (ECLAC, 2022[34]). If the poverty line is taken as half the median household income of the total population, the rate of poverty is about 15% for youths (18-25) and adults (26-65); it climbs to 22% among children and 28% for the elderly – almost double the adult average (OECD, 2022[35]). Notably, while children and elderly make up around one-third of the population of the Dominican Republic, they account for about half of the poor population. Considering different approaches to analyse the poverty situation among age groups confirms that children and the elderly people are particularly vulnerable – largely reflecting that they are not participating in labour market and have little or no perceived income. Clearly, these age groups could benefit most from social protection systems, public services and targeted programmes.

Income inequality also remained high during the almost 20 years of strong growth in the Dominican Republic, with upward economic mobility remaining relatively low. Overall, inequality fell, with the Gini index declining from 0.513 in 2000 to 0.396 in 2021 (a higher decline than the LAC average). Nevertheless, limited upward economic mobility means the disparities have become even more marked. Over the period 2004 to 2014, less than 7% of the population in the Dominican Republic moved up in the income ranks, in sharp contrast to 41% in the LAC region (Baez et al., 2014[36]).The middle class, composed of individuals living in households with a daily per-capita income between USD 13-70 (PPP 2011), remained relatively stagnant at around 26% of the population between 2006 and 2013. However, after 2014 and as poverty reduction accelerated, the middle class reached 42.4% of the population in 2019, before falling back to 37.1% in 2020 as the effects of COVID‑19 continued to undermine progress (World Bank, 2022[37]).

Almost half (46.9%) of Dominicans were part of the vulnerable middle class in 2020 (World Bank, 2022[37]), defined as individuals living in households with a daily per-capita income between USD 5.5 -13 (PPP 2011). Some of these are at risk of falling into poverty owing to substantial vulnerabilities such as low labour income, insufficient skills, informal employment and poor access to quality public services (Ferreira et al., 2013[38]).

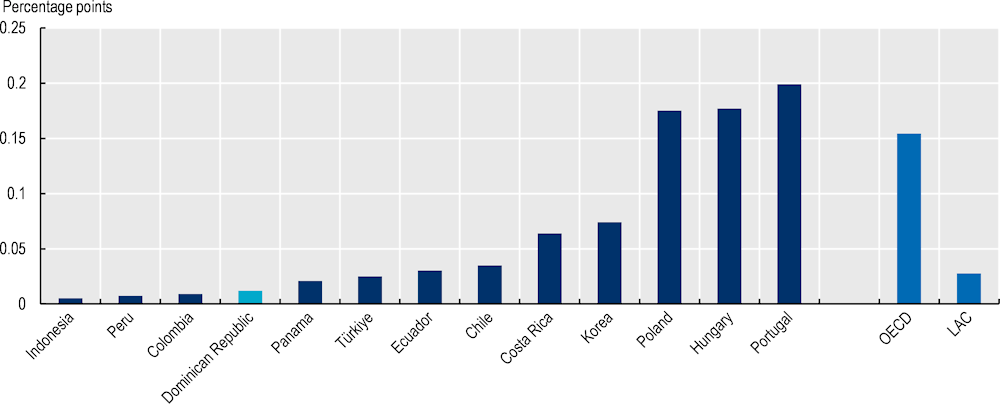

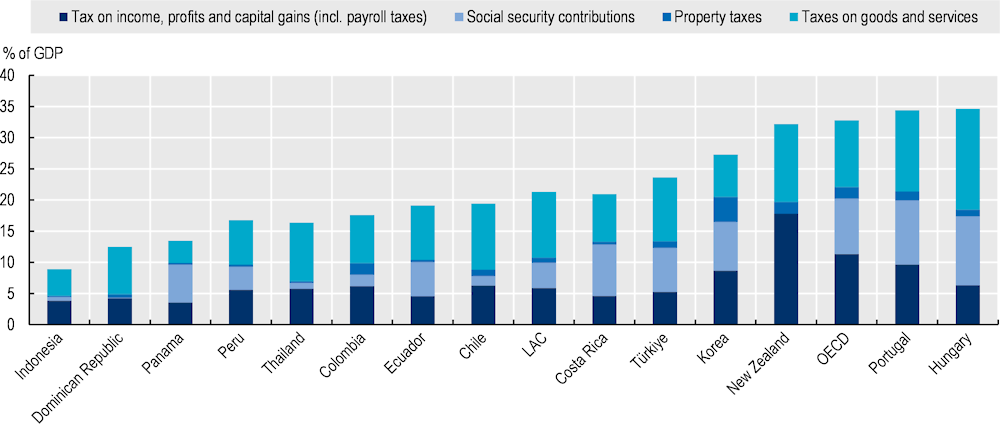

Taxes and transfers have little power to reduce inequality and poverty

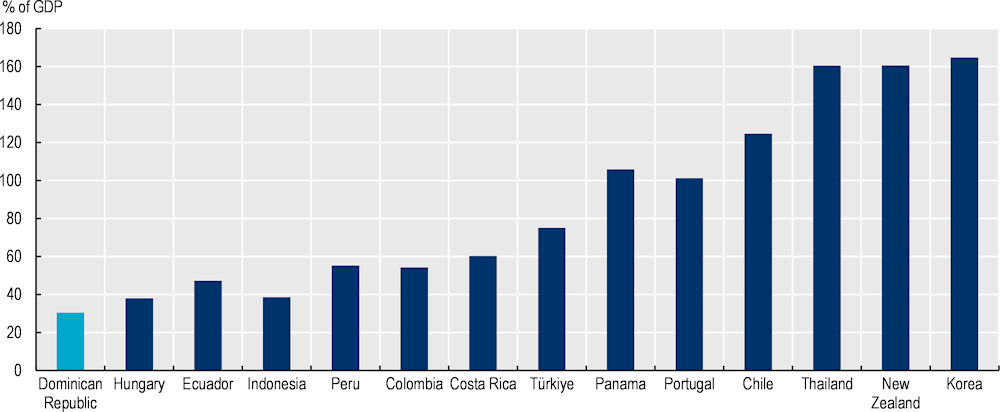

Taxes and transfers play only a modest role in shaping income distribution in the Dominican Republic. Direct and indirect taxes and transfers reduce the Gini index by less than 2 percentage points (Figure 2.9). Similarly, the poverty reduction incidence of direct transfers is modest. Households in the poorest decile receive transfers and indirect subsidies worth 10% of their market income, which is relatively low compared to most countries in LAC, OECD and benchmark economies (Aristy-Escuder et al., 2016[39]).

Figure 2.9. Taxes and transfers play a modest role in shaping income distribution in the Dominican Republic

Note: Data displayed is the difference between income market Gini and disposable income (after taxes and transfers) Gini. The year of the data varies among countries from 2011 to 2021.

Source: Authors’ elaboration based on (Commitment to Equity Institute Data Centre, 2022[40]; OECD, 2022[41]).

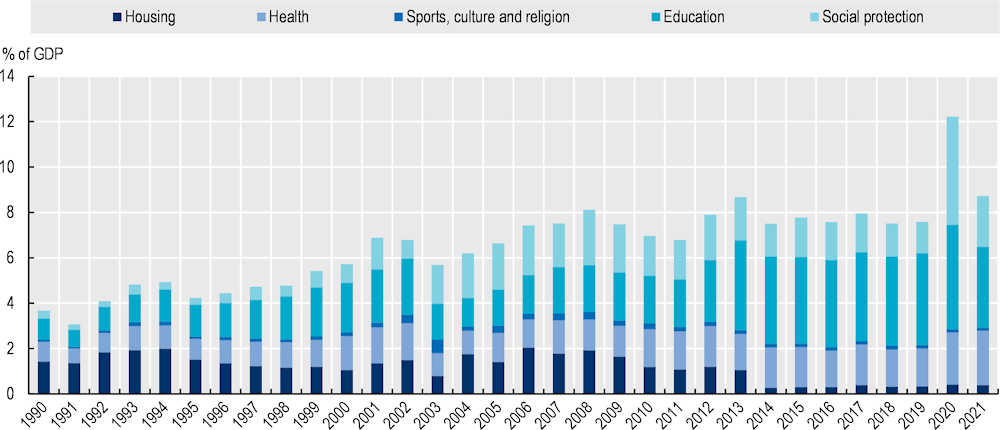

Transfers have played a slightly progressive role, with the modest impact being partially related to low social spending in the Dominican Republic, which is considerably lower than the averages in LAC, OECD and benchmark economies. It should be noted that, in the context of the COVID-19 pandemic, the government has made extraordinary efforts to protect the most vulnerable populations (see Chapter 3 for more details). Although social spending has been gradually increasing in the last three decades, it has expanded at a very slow pace (Figure 2.10). In the 1990s, growth in social spending was mainly driven by education, health and social protection, while spending in housing remained constant with the largest share of expenditure. During the early 2000s, only social protection expenditure continued to expand, as the new conditional cash transfer was introduced. Spending composition changed significantly in 2013 with the Pacto Nacional Para La Reforma Educativa (National Pact for Educational Reform), which established a minimum annual education spending of 4% of GDP.

In 2020, due to the COVID-19 pandemic, expenditure on health and social protection increased significantly, from 1.7% in 2019 to 2.3% for health, and from 1.4% to 4.8% for social protection. Expenditure on health was maintained at 2.4% of GDP in 2021, but social protection expenditure dropped again to 2.2%. This drop can be explained by the fact that, although net expenditure increased from 2020 to 2021, GDP grew more than social expenditure in 2021 (Figure 2.10).

The Dominican government responded to the COVID-19 crisis with increases in the transfers of existing social programmes and the creation of new emergency measures. Regarding labour force, the Employee Solidarity Assistance Fund (FASE) was created to provide income support to formal sector workers at high risk of losing their jobs. Later, the Independent Worker Assistance Program (PA’ TI) was created to provide financial help to self-employed workers (WTTO, 2022[42]). To assist vulnerable households, the government created the Stay at Home Program (QEC), which targeted structurally poor or vulnerable households with Quality of Life Index (QLI) of 1, 2 and 3. These emergency programmes drove the increase in social spending from 7.6% of GDP in 2019 to 12.2% in 2020 and to 8.7% in 2021 (Figure 2.10).

Figure 2.10. Social spending in the Dominican Republic has increased particularly in the context of the COVID-19 pandemic

Source: Authors’ elaboration based on (Ministerio de Hacienda: Dirección General de Presupuesto, 2022[43]; IMF, 2022[1]).

Growth did not translate into sufficient – and better – jobs

The coexistence of strong growth and modest social inclusion can be partly attributed to labour market falling short in channelling the benefits of growth to the population, which in turn contributed to making the effect of the 2003 crisis more durable. Labour force participation remained low, particularly for the poor, and unreactive even as economic activity recovered. At the same time, while strong growth was accompanied by an increase in labour productivity, wages remained stagnant. Additionally, the sectors largely driving economic growth experienced falling labour shares, possibly due to “biased” technical change that increased productivity while lowering demand for labour (World Bank, 2017[44]). Low-skilled workers became increasingly concentrated in low-quality jobs and in sectors that showed low productivity growth, while labour informality remained high and persistent.

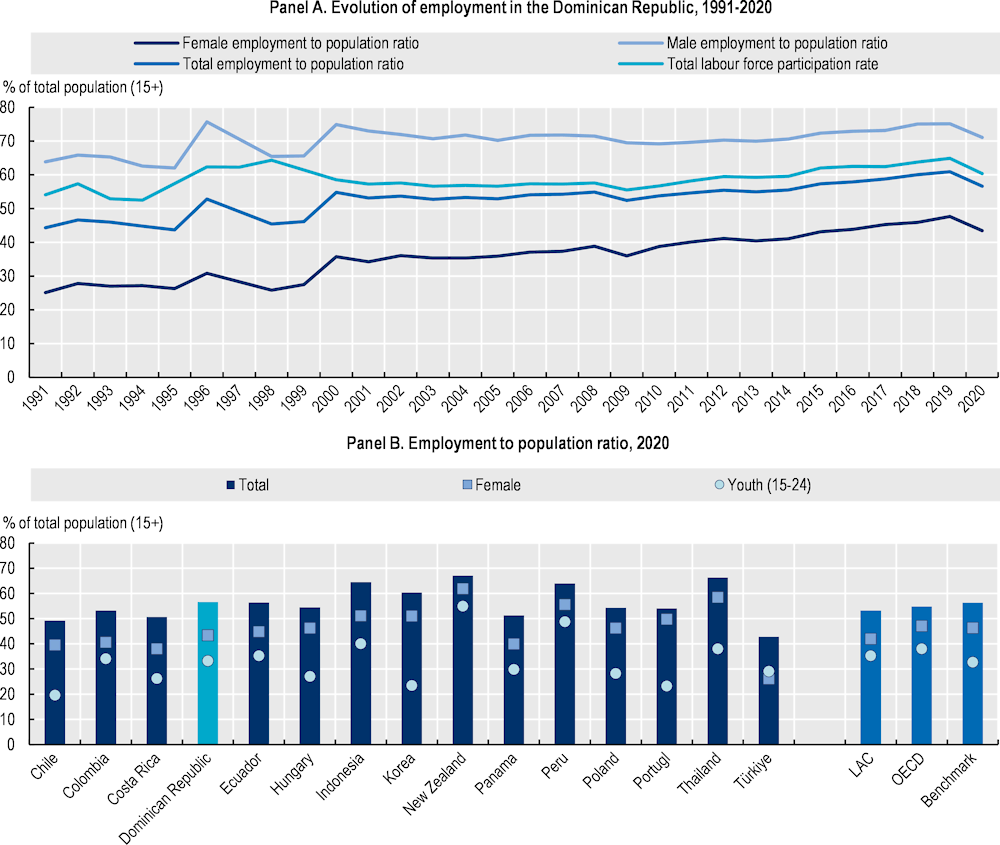

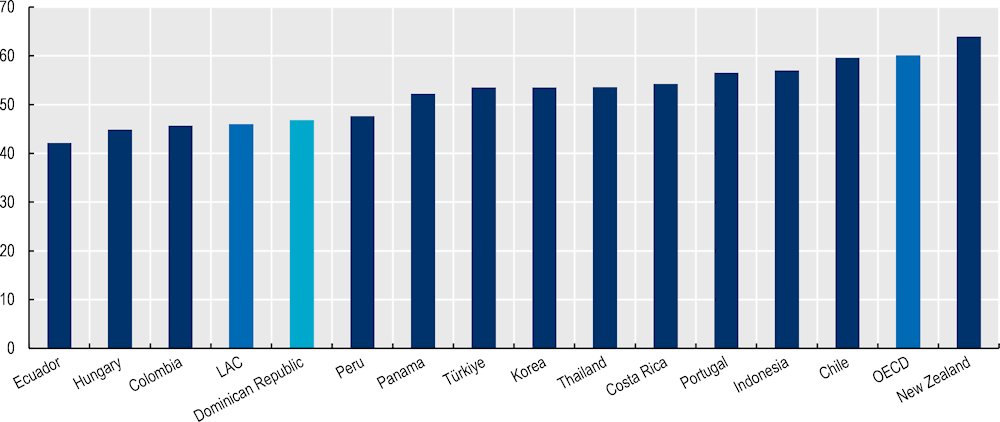

Labour force participation is persistently low in the Dominican Republic

While labour force participation in the Dominican Republic has been expanding, still less than two-thirds of adults participate in the labour market. Overall, labour participation remained relatively stable during the past decades, at a lower level than in most LAC, OECD and benchmark economies. In 2019, participation reached 60.9% of the Dominican population (15+) active in the labour market, whether working or looking for work (Figure 2.11). Subsequently, it decreased to 56.7% in 2020. Total employment levels have been on par with the averages for LAC, OECD and benchmark economies since 2018, while female employment remains below OECD and benchmark averages, and youth employment is lower than LAC and OECD averages (World Bank, 2022[2]).

Figure 2.11. Economic growth has only modestly translated into more jobs in the Dominican Republic

Note: The values for benchmark countries are a simple average.

Source: Authors’ elaboration based on (World Bank, 2022[2]).

The low employment to population rate in the Dominican Republic is mainly explained by low female and youth participation. In 2020, only 43% of women aged 15+ were employed. This is partly the result of a high level of discriminatory social institutions and norms (OECD, 2022[45]). Similarly, at 33%, youth labour force participation is low; only one in five young Dominicans has a formal job. If lower participation was a result of high levels of school enrolments or training, then it could be a driver of better employment opportunities in the future. Unfortunately, only a small part of the low participation rate reflects enrolments in education and training. One in five Dominicans aged 15 to 24 are not in employment or in education. It is important to highlight that female and youth participation in employment were particularly hit by the COVID‑19 pandemic, with participation decreasing by 5 percentage points compared to 2019.

Besides low participation rates, the Dominican labour market is characterised by a large share of own-account workers. In 2018, almost 1.5 million own-account workers represented 37% of the employed population. Usually, own-account workers hold poor quality jobs with 96% making no contributions to the social security system (Central Bank of the Dominican Republic, 2017[46]).

Economic growth did not lead to sizeable job creation

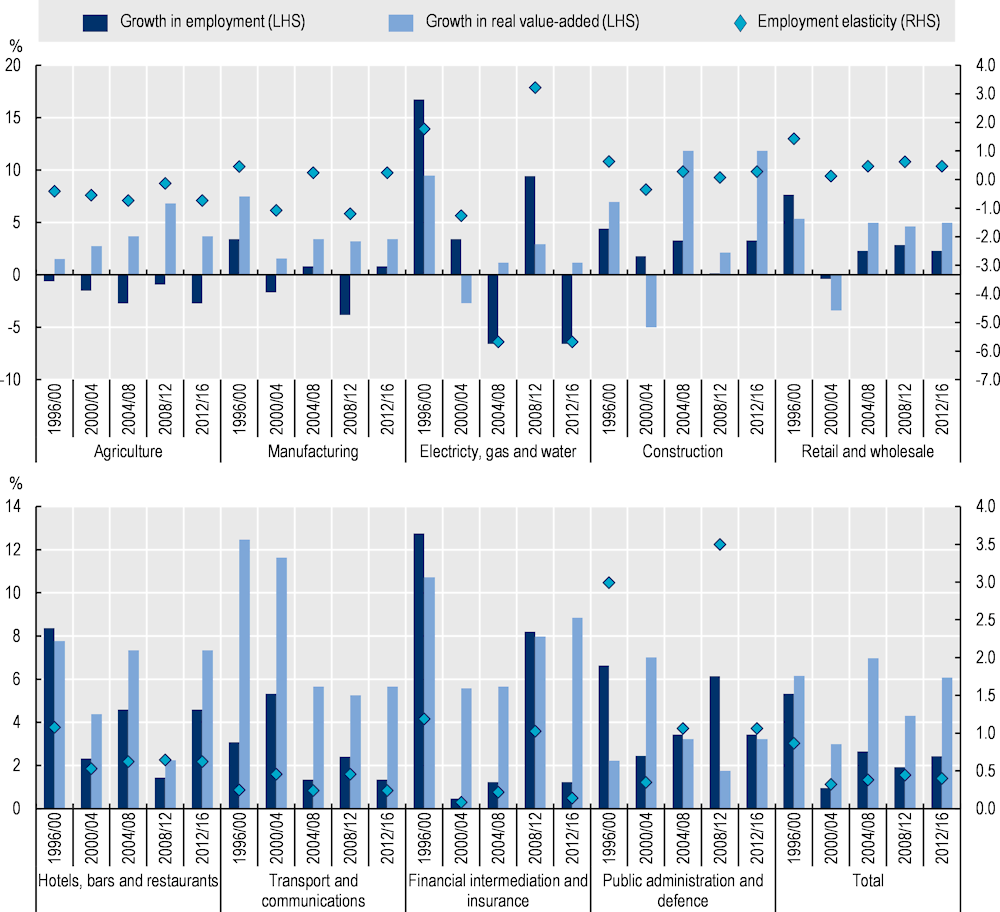

Behind the robust but only modestly pro-poor growth process, there is low creation of jobs and relatively low elasticity of employment to growth. While the aggregate elasticity of employment to growth from 2000‑16 was 0.39, estimates have changed during different periods of growth (Figure 2.12), varying from 0.32 during 2000‑04, when GDP grew at 2.9% annually, to 0.40 during 2012-16, when GDP grew at 5.6% annually.

Employment elasticity represents a convenient way to summarise the employment intensity of growth or the sensitivity of employment to output growth. It is a measure of the percentage change in employment associated with a 1 percentage-point change in economic growth. As such, it can indicate the ability of an economy to generate employment opportunities for its population – as a percentage of its growth process – and can be used to track sectoral potential for generating employment (Islam and Nazara, 2000[47]) A positive employment elasticity of growth indicates that increased output is associated with increased employment. An elasticity lower than 1 indicates that output is growing more quickly than employment, signifying both increases in productivity and in employment.

Figure 2.12. Elasticity of employment to growth is relatively low in most sectors driving growth in the Dominican Republic

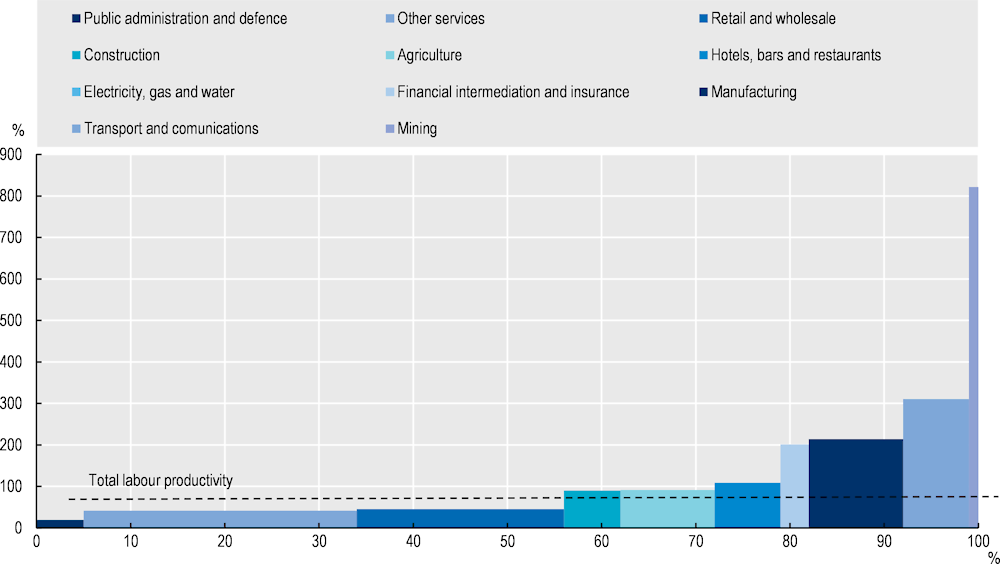

The buoyant sectors of the economy in the Dominican Republic have shown poor job-generation capacity. From 2008 to 2016, productivity gains in most of these sectors have been achieved while elasticity of job creation to economic growth has fallen or remained steady overall. Figure 2.12 shows growth in real gross value-added, employment and employment elasticity of growth across the sectors with the largest employment shares in the economy. Elasticity varies considerably across sectors ranging from construction to retail and wholesale, which experienced the most job-friendly growth. In contrast, electricity, gas and water sectors show workforce reductions during two of the five periods analysed. The services sectors (including hotels, bars and restaurants; retail and wholesale; and transport and communications) have generally been employment-intensive during the past decade. Yet, they show falling elasticity as fast employment growth was accompanied by steady productivity growth. Figure 2.13 shows the distribution of productivity and employment levels across economic sectors in the Dominican Republic.

Figure 2.13. Productivity and the distribution of labour in Dominican Republic, 2016

Relative value-added as a percentage of workers and employment by economic sectors (y axis: 100 = total labour productivity and x-axis: % of employment)

Most new jobs created in the last decade are in the low productivity services sector. There are significant productivity gains to be realised through labour reallocations from less to more productive sectors as well as by endowing workers with better skills. In the Dominican Republic, as in many LAC countries, jobs are moving out of agriculture and manufacture into the services sector. While productivity increased in both sectors and employment fell by 11% in agriculture and 15% in manufacture between 2008-16, rescinding more than 120 000 jobs. In parallel, almost 70% of all new jobs were created in retail, wholesale and other services while sectors that drove strong growth – e.g. construction, transport and communication, hotels, bars and restaurants – created only 18% of new jobs. Retail and wholesale and other services employed the largest shares of the population while having the lowest productivity levels; although labour productivity in both sectors increased, it was still very low (below 50%) compared to overall labour productivity.

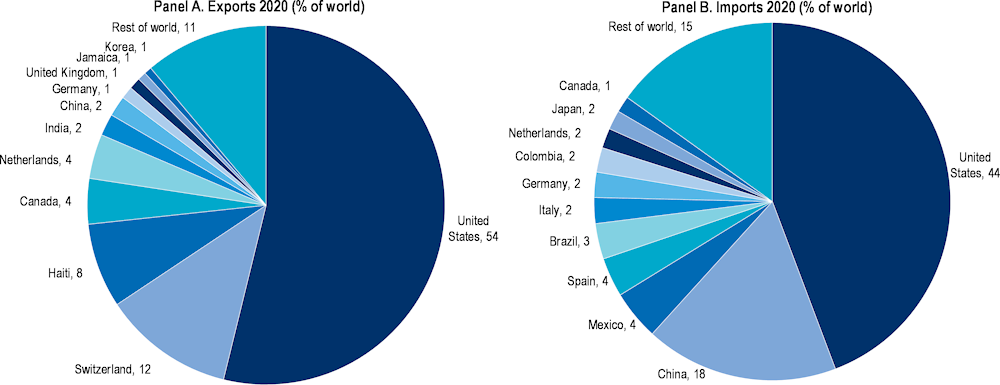

Box 2.1. Migration in the Dominican Republic

International migration – both emigration and immigration – are a significant feature in the Dominican Republic, offering substantial potential for development. Emigration has been consistently growing since 1990, from approximately 458 000 people to 1.6 million in 2020, with around 1.1 million emigrants (68.8% of total) living in the United States. Emigrants have been a particularly resourceful boon to the Dominican economy. In 1980, they remitted USD 183 million – a figure that remained relatively stable until 1990. In 1992, the amount remitted almost doubled to USD 347 million; by 2000, remittances were estimated to be nearly USD 2 billion. In 2019, they surpassed USD 7 billion, equivalent to 8.6% of GDP (World Bank, 2022[2]); just two years later (2021), personal remittances of USD 10.7 billion accounted for 11.3% of GDP (UN Migration, 2022[48]). In comparison, foreign direct investment (FDI) inflows were at 3.4% of GDP in 2018, while official development assistance was at 0.2% of GNI in 2017 (World Bank, 2019[49]). Remittances are thus an important financial flow.

The Dominican Republic also has a growing number of immigrants, with a sharp increase evident between 2010 and 2015 after the earthquake in Haiti. In 2017, there were over 500 000 estimated immigrants, primarily from Haiti (336 000, 67%) (World Bank, 2018[50]).Immigration has continued increasing, reaching more than 600 000 in 2020 (UN Migration, 2022[48]). The Dominican Republic is among several developing countries dealing with increasing immigration and integration challenges, with mixed results.

The role of migration is acknowledged in national development planning in the Dominican Republic, through the National Migration Council and the National Migration Institute. However, migration’s development potential is not fully reflected in its policy framework. A study by the OECD Development Centre, based on empirical data collected in the Dominican Republic in 2014 and 2015, shed light on the complex relationship between migration and sectoral policies (OECD/CIECAS, 2017[51]) It found that the various dimensions of migration – emigration, remittances, return migration and immigration – have both positive and negative effects on key sectors of the Dominican economy. Similarly, sectoral policies have indirect and sometimes unexpected impacts on migration and its role in development. Understanding these impacts is critical for developing coherent policies. For example, the analysis found that vocational training programmes may encourage citizens to emigrate – especially women and urban residents – by making them employable abroad. It also found that formal titles to land can help develop land markets while allowing households to use land as collateral, without fear of losing the land when they emigrate. In fact, having an official land title is positively linked to a household having an emigrant. Public policies also affect remittances. Households with a bank account were more likely to receive remittances. Yet almost two-thirds of households sampled in the OECD study were found to be unbanked and only a few had participated in a financial training programme in the past five years.

The 2017 OECD study shows that many sectoral policy makers do not yet sufficiently take migration into account in their areas of influence and some policies seem to be inadvertently contributing to emigration. Migration needs to be considered in the design, implementation, monitoring and evaluation of relevant sectoral development policies. In turn, a more coherent policy framework across ministries and at different levels of government would help to optimise migration.

Another study by the OECD Development Centre focuses specifically on immigration and three dimensions of its economic contribution to the Dominican Republic: labour markets, economic growth and public finance (OECD/ILO, 2018[52]). It found that immigrants have higher labour force participation and employment rates than the native-born population and tend to replace native-born workers, particularly those with low skills. The study also found that immigrants contribute to economic growth: given the sectoral distribution of workers and their productivity, immigrants are estimated to contribute between 3.8% and 5.3% of the value added in the Dominican Republic, compared to their share in the population at 4.2%. In 2007 (the latest year for which data were available), immigrants made a positive and larger net fiscal contribution than the native-born population, reflecting that they paid more in indirect taxes and benefited less from public expenditures on social security, social assistance and education. The limited impact of immigration on the economy means that the Dominican Republic is not fully leveraging its potential for development. A lack of integration can cause problems with social cohesion in the Dominican Republic and hamper the way immigrants contribute to development. Priorities should therefore be given to policies that invest in migrant integration.

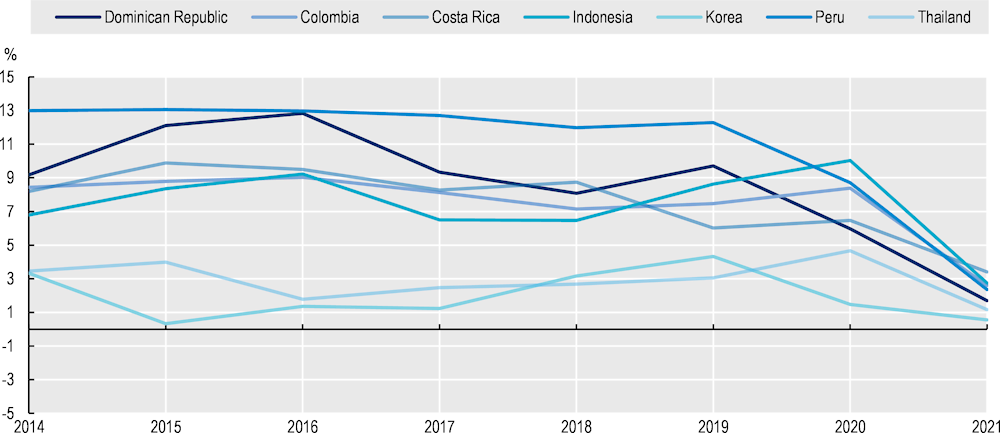

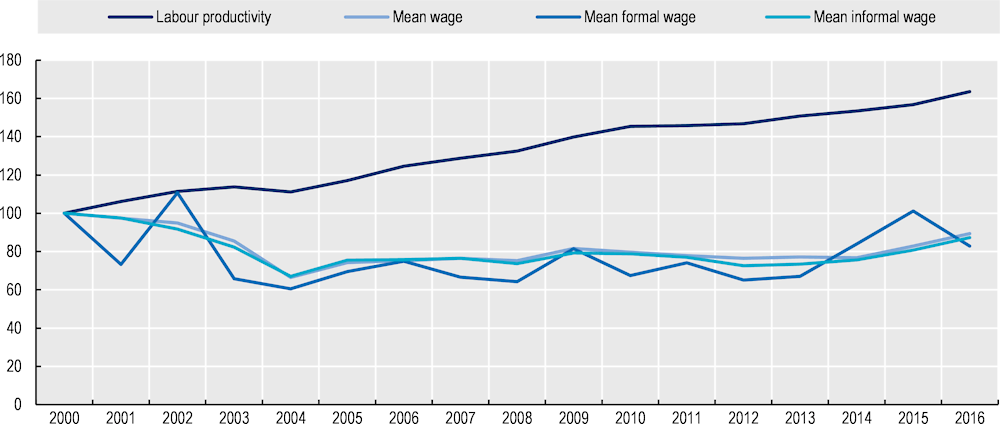

Productivity and wages have decoupled

Aggregate labour productivity growth in the Dominican Republic decoupled from real average compensation growth in a period of analysis spanning 2000-16. The robust – but only modestly inclusive – growth was largely fuelled by fast-growing labour productivity. Aggregate labour productivity grew by 68% from 1996 to 2016 but presumably only part of the benefits of these productivity gains were translated to workers. Overall, increasing productivity did not appear to raise real wages for the average worker, as illustrated by three measures of real labour compensation: average national wage, average formal national wage and average national informal wage (Figure 2.14).

Figure 2.14. Labour productivity growth decoupling from growth in wages in the Dominican Republic, 2000-16

Index 2000 =100

Note: Labour productivity is the annual value-added per hour worked.

Source: Authors’ elaboration based on (Central Bank of the Dominican Republic, 2017[46]).

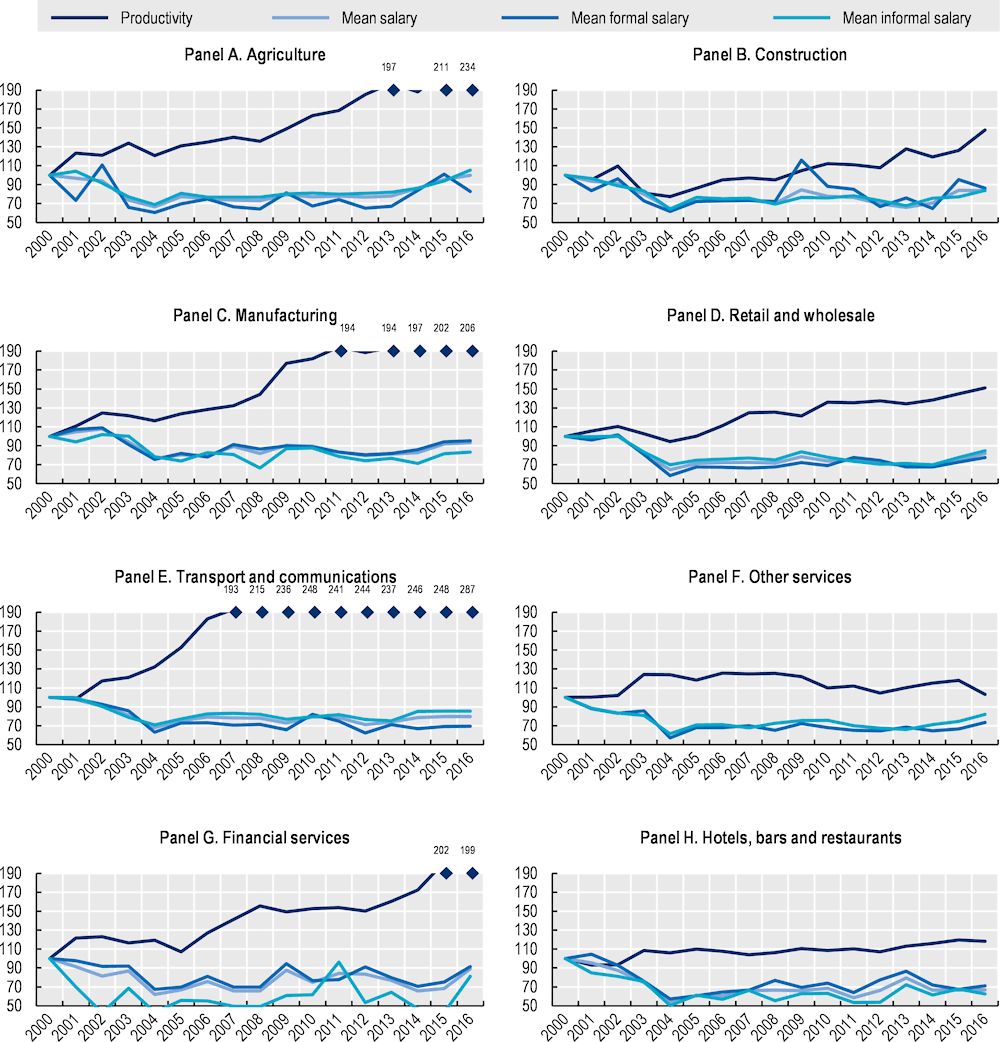

At the sector level, productivity and wages followed the aggregate trend. It should be noted that sectoral categories aggregate medium and small enterprises (MSMEs) as well as large business that have different levels of productivity and wages. Labour productivity growth in all sectors decoupled from real average compensation growth. In agriculture, manufacturing, transport and communications, as well as in financial services, productivity and wages followed very different paths compared to the other sectors (Figure 2.15). In fact, productivity rapidly spiked while wages decreased, suggesting that firms failed to compensate workers for gains in productivity. In contrast, productivity grew at a slower pace in construction, retail and wholesale, hotels, bars and restaurants, and other services. Both patterns suggest that a role exists for public policies to ensure productivity gains are better shared in some industries while not eroding competitiveness in others.

The sectoral analysis also reveals that labour productivity grew less in sectors with higher job creation capacity, concentration of informality and unskilled workers. Employment in construction, retail and wholesale, hotels, bars and restaurants, and other services accounted for 64% of the labour force of the Dominican Republic. Labour productivity growth in most of these sectors was less dynamic than in the rest of the economy. In fact, in the hotel, bars and restaurant sector, productivity gains account for less than 20% in 16 years. This confirms that poor and vulnerable workers were relatively more clustered in low-skilled, lower productivity economic activities (World Bank, 2017[44]).

Figure 2.15. Labour productivity growth decoupling from wage growth at sector level, 2000‑16

Index 2000 =100

Note: Labour productivity is the annual value-added per hour worked. The diamonds are values that outstand the scale of the graph and correspond to the productivity series.

Source: Authors’ elaboration based on (Central Bank of the Dominican Republic, 2017[46]).

Labour market institutions can be strengthened in the Dominican Republic

Many Dominican workers have few alternative employment options and low bargaining power. With less than 10% of the workers unionised, collective bargaining and trade union coverage is low (OECD/ILO, 2018[52]). Moreover, informal and self-employed workers have almost no scope to organise and bargain collectively. Strong power imbalances that favour employers over workers tend to put downward pressure on labour demand and wages; effective policies can help restore the balance and improve both equity and efficiency (OECD, 2018[31]).

Collective bargaining and social dialogue can complement government efforts to make labour markets more inclusive. They can also be useful institutions to help companies respond to demographic and technological changes by allowing them to adjust wages, working time and work organisation as well as adapt tasks to new needs in a more flexible and pragmatic manner than through labour regulation (while remaining fair). In some OECD countries, social partners play a significant role in providing active support to workers who have lost their jobs and in anticipating skills needs (OECD, 2018[31]).

At present, the system of minimum wage in the Dominican Republic is complex, with several wage levels depending on different criteria. The National Salary Committee (Comité Nacional de Salarios, CNS), which is part of the Ministry of Labour, is in charge of fixing the minimum wages through meetings organised with employers and employees of the sector concerned (Chapter 3). This complex minimum wage system offers flexibility to tailor the evolution of the minimum wage to the conditions in each sector. However, more complex minimum wage matrices are more difficult to communicate, enforce and monitor, and require higher institutional capacity on the part of the state. In fact, they require that members of a minimum wage board understand the characteristics of all the sectors, firms and regions. Thus, systems that are overly complex, as is the case in the Dominican Republic, tend to lose their effectiveness (World Bank, 2017[44]).

While the minimum wage sets a floor informed by technical criteria, it should be distinguished from collective bargaining, which can be used to set wages above an existing floor. In the long run, strengthening collective bargaining at the firm or sector level would make the current complex matrix unnecessary. As working conditions would be negotiated between workers and firms and/or sectors, salaries would better reflect productivity changes, thus guaranteeing that both workers and firms profit from them.

A large share of jobs are still informal

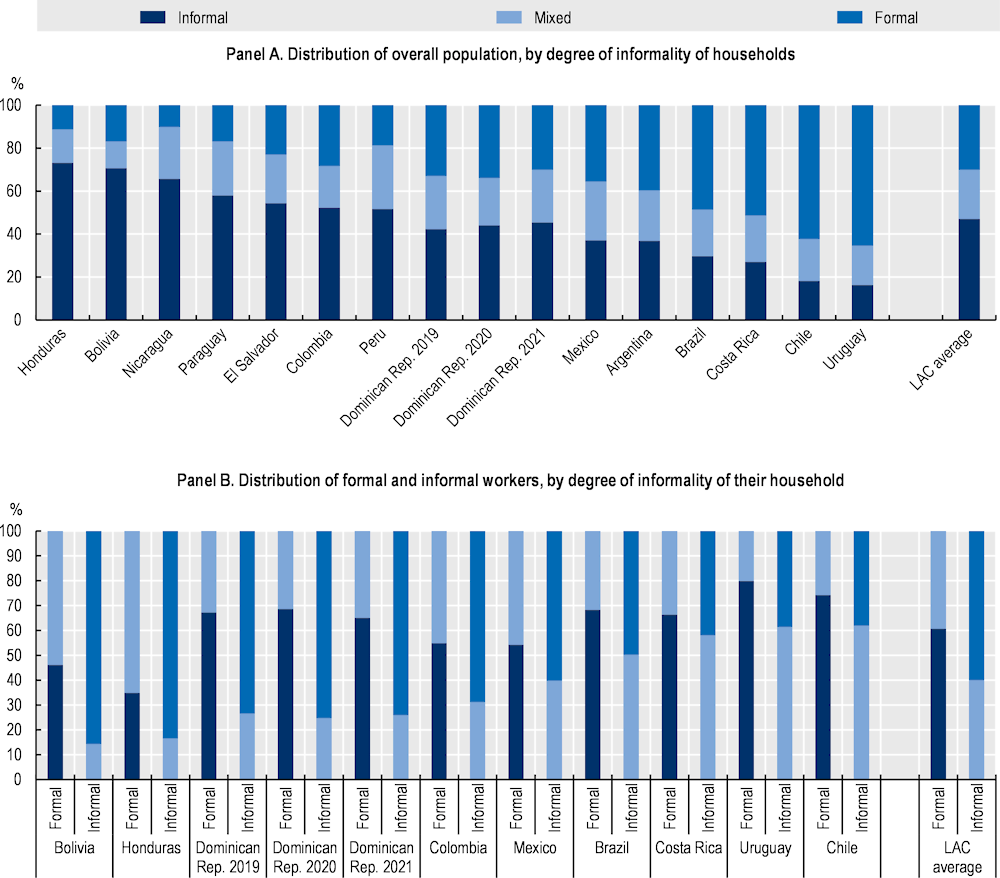

Labour informality has remained almost stagnant at around half of the country’s jobs for the past two decades. Informal work, by definition, leaves workers without the right to a pension, health insurance and the general entitlements of the formal sectors (this report uses this definition). In 2021, the informal employment rate reached 59% (up from 55.3% in 2019) and 45.4% of the population lived in households where all workers were employed in informal jobs (Figure 2.16).

Informality is one of the main obstacles to making the labour market in the Dominican Republic more inclusive. The incidence of informality is much higher for workers from poor and vulnerable households, youth, and the less educated, perpetuating the vicious cycle of inequality and low productivity (see Chapter 3 for more details).

Moreover, inequalities in the labour market start early. Young workers from poor or vulnerable families are more likely to hold informal jobs than those from the middle class. In turn, youth from these households leave school earlier than their peers in better-off households. At age 15, nine of ten youth living in poor households are in school; at age 30, seven of ten are informal workers or inactive. In vulnerable households, six of ten young people are informally employed or inactive. Remarkable differences are observed among consolidated, middle-class households: at age 15, nine of ten youth are in school; at age 30, seven of ten have formal jobs. This suggests that a certain degree of labour market segmentation exists in Dominican Republic, making the transition from school to work a particularly relevant stage in young people’s careers and futures (OECD/CAF/ECLAC, 2018[53]) (Chapter 3).

Figure 2.16. Informality in the Dominican Republic is high and affects the most vulnerable households

Note: Estimates for selected LAC countries correspond to 2018 or the closest available year. The LAC average is the unweighted average of the 14 LAC countries studied. To ensure microdata comparability and availability, estimates for the Dominican Republic use the ENCFT data for the third quarter of 2019, 2020 and 2021.

Source: Authors’ elaboration based on (OECD, forthcoming[54]), using the Key Indicators of Informality based on Individuals and their Household (KIIbIH) database.

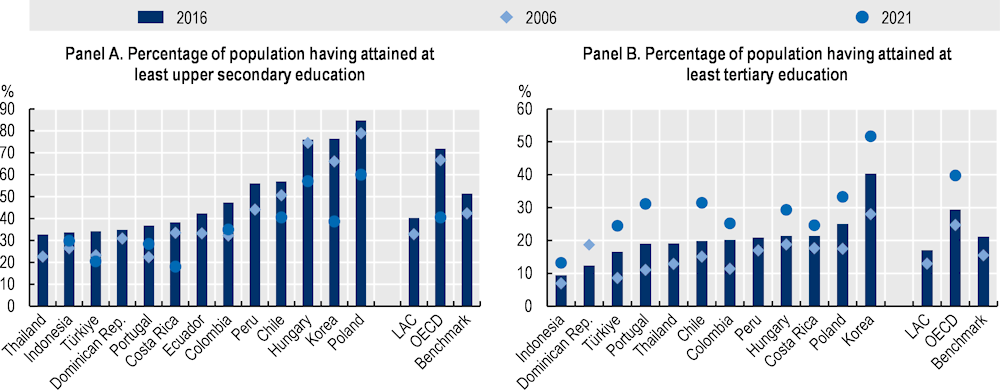

Education outcomes have improved mostly in terms of access, but quality remains a challenge

Despite progress, educational attainment in the Dominican Republic is low in international comparison (Figure 2.17). Although coverage has expanded over the last decade – especially in pre-primary and secondary education – the country lags behind benchmark economies. Only 34% of the population aged 25-64 had completed secondary education in 2016, in contrast with the OECD average of 71% (OECD, 2018[55]). Moreover, only 12% of this population had attained a higher education degree. In 2016 (the latest internationally comparable data available), the mean years of schooling of the population 25 years and older in the Dominican Republic was 9, compared to 9.8 years for benchmark economies in 20201 (UNESCO, 2022[16]). The gross graduation ratio from first degree programmes in tertiary education remained low at 31.4% in 2017.

Figure 2.17. Educational attainment in the Dominican Republic remains low despite some improvements

Note: For tertiary education in 2006, values for Costa Rica and Chile are from 2007, from 2008 for Poland, and from 2009 for Hungary and Korea; for 2016, values are from 2015 for Dominican Republic, Chile, Peru, and Korea. For upper secondary education in 2006, values are from 2007 for Dominican Republic, Costa Rica, Ecuador and Chile, 2008 for Poland, 2009 for Hungary and Korea, and 2010 for Panama. For upper secondary education in 2016, values are from 2015 for Dominican Republic, Chile, Korea and Peru. Data not available for Panama after 2010. The values in 2021 are from 2020 for Chile.

Source: Authors’ elaboration based on (OECD, 2022[18]; UNESCO, 2022[16]).

Learning outcomes in the Dominican Republic remain insufficient and the gap with respect to LAC, OECD and benchmark economies is large and has persisted across time, directly impacting the well-being of the population. Moreover, the COVID‑19 pandemic caused prolonged school closures. Over the period March 2020 to May 2021, schools in the Dominican Republic remained closed for 33 weeks, higher than the LAC average of 26 weeks (OECD et al., 2021[27]). This has negative consequences for children and adolescents such as falling enrolment rates, learning loss, increasing risk of malnutrition, increasing risk of domestic violence and affectations on mental health (Azevedo et al., 2020[56]; Busso and Camacho, 2021[57]). As closures continued during 2020, the Dominican Republic managed to implement distance learning solutions such as: digital content for teachers, parents and students that was published through the website of the Ministry of Education; distribution of physical learning material; use of social media, radio and television to disseminate educational content; and delivery of electronic devices (IDB, 2020[58]). To move forward, the country must increase efforts to collect data to diagnose the content lost in the learning process and quantify these losses. This is fundamental to design appropriate interventions that target these losses globally and identify the most-affected students. Also, strategies should be developed to locate and try to reintegrate students who dropped out (Näslund-Hadley and Ortiz, 2022[59]). Evidence shows that the survival rate2 to the last grade of primary education sharply decreased from 85.2% in 2019 to 56.2% in 2020 (UNESCO, 2022[16]).

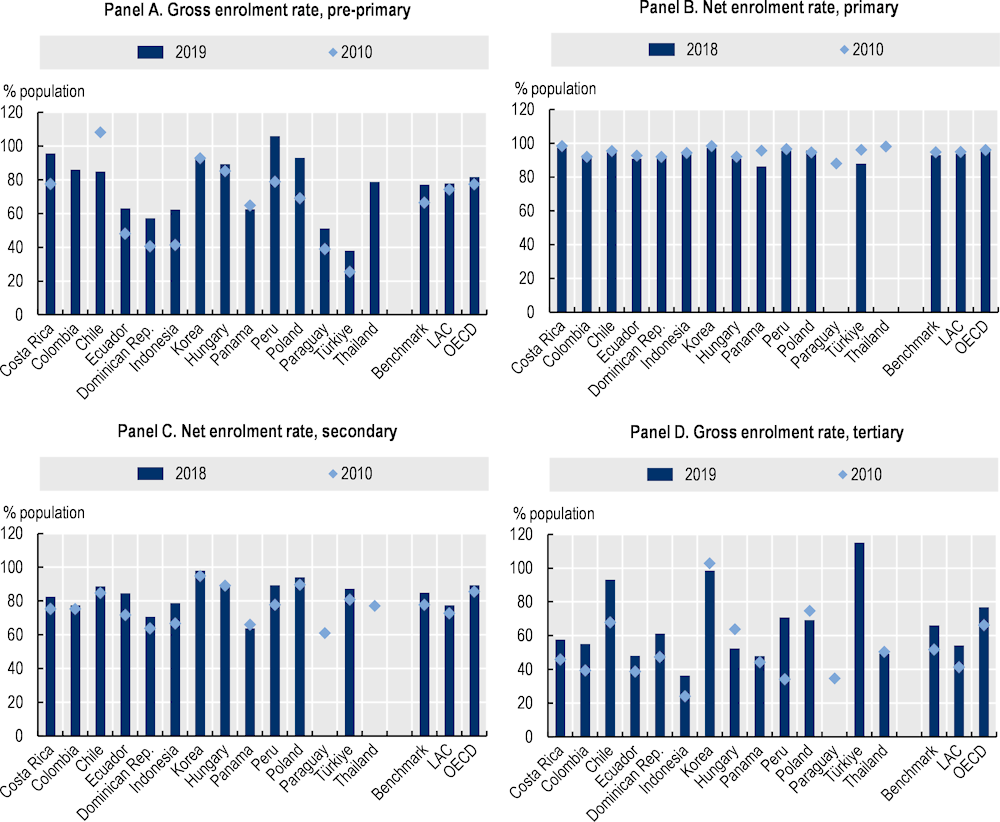

School enrolment and student retention are low for some levels of education

Education in the Dominican Republic is compulsory and free from pre-school to secondary school. The system is structured into three main blocks. Initial education covers all pre-primary education, yet only pre-school (age 5) is compulsory. Primary education consists of a 6-year cycle (corresponding to Level 1 of the International Standard Classification of Education [ISCED]). Secondary education also consists of a 6‑year cycle (corresponding to ISCED Levels 2 and 3).

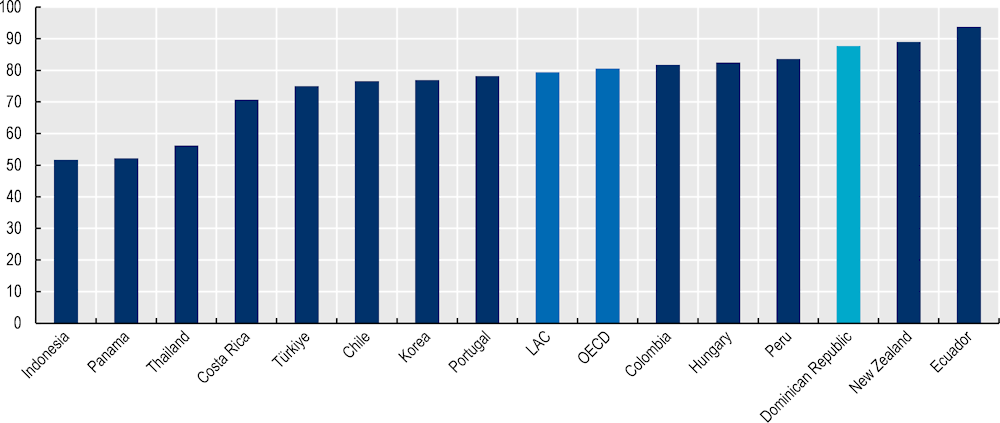

In terms of coverage, despite improvements in the past decade, enrolment rates across all education levels remain below LAC, OECD and benchmark economies. Similar to other LAC economies, while almost all primary age students attend school, the Dominican Republic exhibits low enrolment rates for pre-primary (57%), secondary (71%) and tertiary (61%) education (Figure 2.18).

Most of the recent progress has been made in pre-primary education, although coverage is still low. Since 2014, pre-primary education has been free when provided in public schools, which led to a relatively high pre-school enrolment rate. The gross enrolment rate in initial education was 47.9% in 2015, up from 35.1% in 2007, sharply below rates of over 93% in primary education (World Bank, 2022[2]). International evidence has shown that quality preschool and early child development programmes can have a significant impact on future school performance and, ultimately, on earnings, with the highest impact on children from low-income families (World Bank, 2018[50]). In terms of enrolment, secondary and tertiary education also remain key challenges for education progress. Since 2014, enrolment rates in secondary education increased by 7 percentage points up to 70.6%. In line with other countries in the region, the Dominican Republic shows a rapid increase in access to tertiary education; although the enrolment rate of 61.2% surpasses the LAC average, it remains low compared to OECD and benchmark economies.

Figure 2.18. Enrolment rates remain low for some levels of education in the Dominican Republic

Note: Certain values are from different years, as follows. For pre-primary enrolment, 2010 data for Korea are from 2013; 2019 data are from 2020 for Colombia and Paraguay, and from 2018 for Indonesia. For primary enrolment in 2010, data are from 2011 for Costa Rica and from 2009 for Türkiye; for 2018, data are from 2017 for Chile, Korea, Hungary, Panama, Poland and Türkiye while older values for Paraguay (2012) and Thailand (2009) were not included. For secondary enrolment in 2010, data are from 2011 for Costa Rica; values for 2018 are from 2017 for Chile, Korea, Hungary and Panama. For tertiary enrolment in 2010, values are from 2011 for Costa Rica, from 2008 for Ecuador and from 2006 for Peru; values for 2019 are from 2016 for Panama and Thailand, from 2017 for Peru, and from 2018 for Indonesia. Gross enrolment rates were used when net enrolment data was not available.

Source: Authors’ elaboration based on (World Bank, 2022[2]).

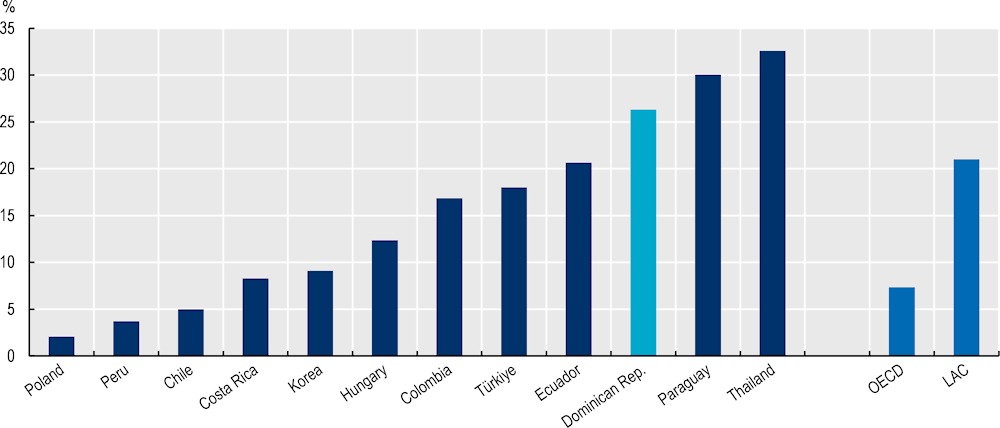

Although enrolment rates have improved in the Dominican Republic, few students graduate from secondary education, which undermines strong skills acquisition. For the basic education programme, of every 100 students who begin school in first grade, only 75 complete fourth grade, 63 complete sixth grade, and 52 complete the programme on time (World Bank, 2018[50]). Dropping out of school before completing secondary education truncates the path towards higher education, exacerbates inequalities and reduces the skill base of the labour force. More than 10% of lower secondary school students drop out of school every year and drop-out rates have increased since 2009. The rate of repetition in lower secondary had been decreasing – from 8.2% in 2015 to 2.9% in 2019 – but significantly increased again to 9.4% in 2020. In that year, more than 25% of secondary students were out of the school system before completing their studies (Figure 2.19), a trend that has remained unchanged for the past ten years and that places the country above most benchmark economies. This rate increased sharply to 32% in 2021 (UNESCO, 2022[16]), evidencing some of the negative effects the COVID‑19 pandemic has on school attendance.

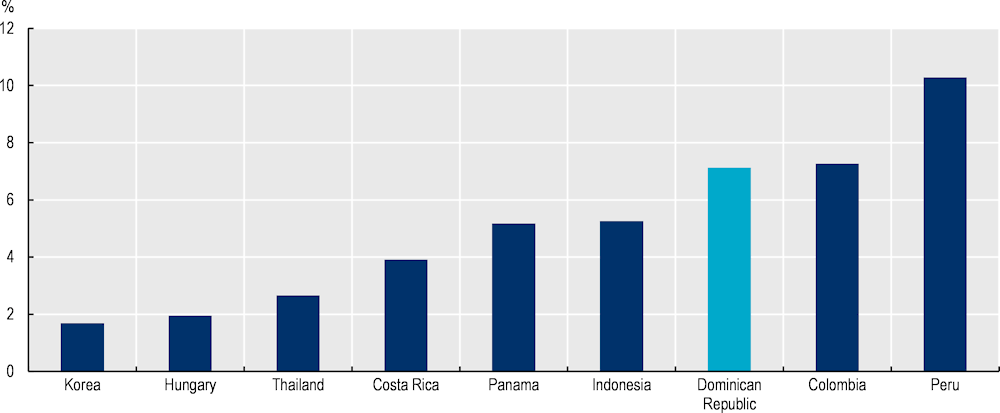

Figure 2.19. Out-of-school upper secondary school age youth, 2020

Note: Data corresponds to 2020 or latest year available. OECD (2018) and LAC (2019) are simple averages. Number of youth of official upper secondary school age who are not enrolled in upper secondary school expressed as a percentage of the population of official upper secondary school age.

Source: Authors’ elaboration based on (UNESCO, 2022[16]).

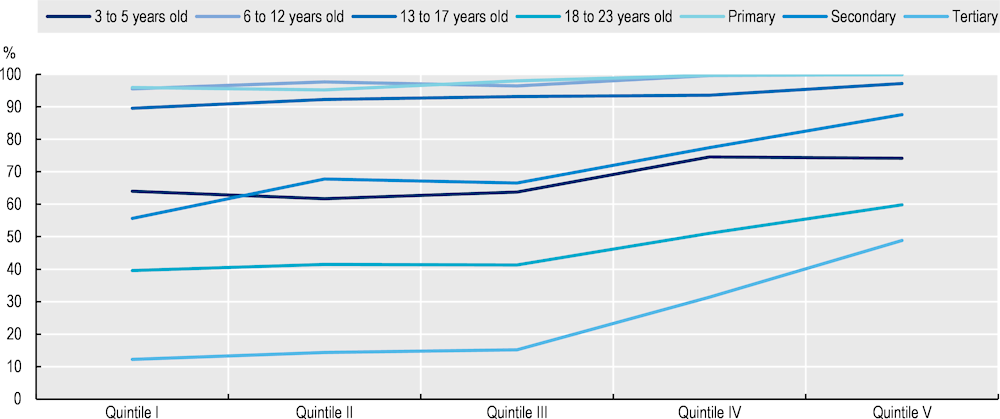

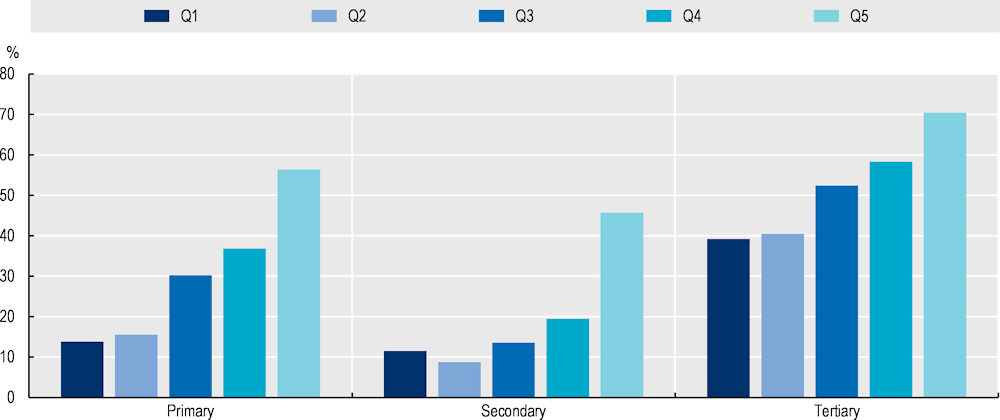

Education and skills can play a major role in tackling inequality

For all levels of education and age groups, education enrolment in the Dominican Republic is higher for students in higher income households than for those from lower income households (Figure 2.20). Differences are particularly wide for pre-primary and tertiary education. In 2016, 74% of children aged 3‑5 years in households from the top income quintile were attending an educational institution, compared to 64% of children in the lowest quintile. The smallest difference is in primary school (ages 6-12), with only 4 percentage points difference between the top and bottom income quintiles and net enrolment rates being very high (100%) for the top quintile. A large net enrolment gap exists for secondary education between adolescents from the lowest quintile (56%) and the highest quintile (88%). This evidences that students from the lowest income quintile are more susceptible to lag behind, drop out or remain out of school when they reach secondary education. Consequently, the gap widens at tertiary education at which point only 12% of youth from the lower income quintile enrol compared to 49% from the top quintile. The enrolment rate for the age group 18-23 is much higher than that for tertiary education, meaning youth in this age group are enrolled at secondary or non-tertiary education. The enrolment gap at this age group is 20 percentage points, being 40% for students in the lowest quintile versus 60% in the top quintile. In parallel, enrolment rates are higher among children living in cities than in rural areas. The low coverage and significant differences in pre-primary, secondary and tertiary education enrolment prevent the country from advancing towards equal education opportunities for all children, in particular for low-income households.

Figure 2.20. Enrolment by income quintiles and ages, 2016

Wide territorial disparities are evident in terms of educational coverage and attainment. On average, citizens of the Santo Domingo Capital District attain 8.9 years of education; in contrast, people living in Baoruco, Elías Piña and Pedernales attain five years of education or less. Except for primary education, the urban/rural coverage gap has persisted over a long time. Gaps are especially large in pre-primary and tertiary education, although they have been progressively narrowed. For example, in San Pedro de Macorís, more than 56% of children of age 5 or younger attend school, while only 19% do so in Pedernales. Likewise, more than 71% of the tertiary education population in Santo Domingo Capital District is enrolled in the education system compared to only 31% in El Seibo.

Access to education in the Dominican Republic is mainly equal across gender. Differences in enrolment rates between females and males are visible only at upper secondary and tertiary education. In 2019, the gender parity index (GPI) in pre-primary, primary and lower secondary education was 1.0, revealing enrolment parity. At upper secondary and tertiary education, however, enrolment of females was higher reflected in GPIs of 1.2 and 1.4,3 respectively (World Bank, 2022[61]).

Low education quality is a major obstacle for inclusiveness

The Dominican Republic faces great challenges to improve learning outcomes in both primary and secondary schooling. Recent expansion in education spending (4% of GDP annually) will take some years to produce better outcomes. The increase in access in the past two decades has not been accompanied by parallel improvements in quality, which impedes students from advancing to higher stages of education.

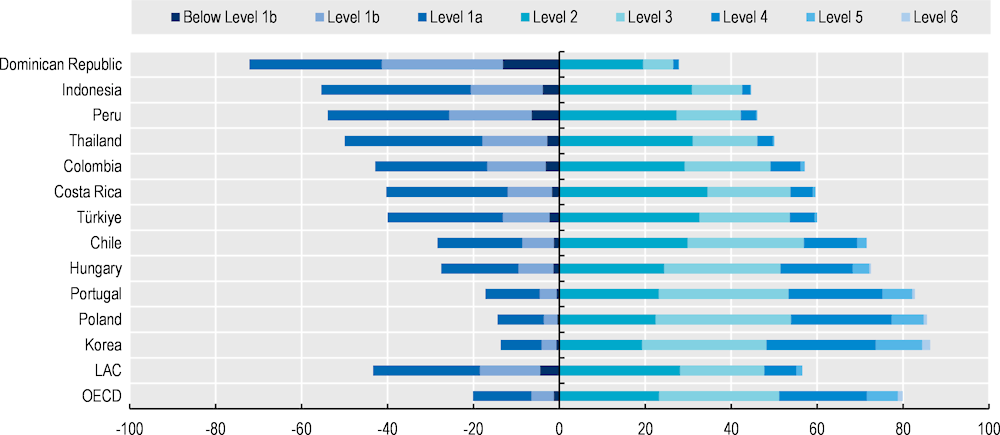

The overall quality of the education system is insufficient. Among more than 70 countries participating in the OECD’s Programme for International Student Assessment (PISA) in 2018, the Dominican Republic was the lowest performer in mathematics and science, and the second-lowest performer in reading (after the Philippines) (OECD, 2019[62]). As much as 75% of young Dominican students enrolled in high school did not acquire basic-level proficiency in all three subjects (i.e. performed below Level 2, the baseline level of skills needed to fully participate in society). In particular, 79.1% of students performed below Level 2 in the reading test, a much poorer result than the average of 53.3% for LAC countries participating in the PISA test and significantly below the 22.6% average in OECD countries (Figure 2.21). This presents a major challenge for countries transitioning into knowledge-based economies in which citizens need to innovate, adapt and leverage advanced skills. In terms of pertinence for the Dominican Republic, the matching between skills demand and supply is still poor.

Figure 2.21. Student proficiency in reading in PISA 2018

Note: Countries and economies are ranked in descending order of the percentage of students at Levels 2, 3, 4, 5 and 6. LAC is simple average (Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Mexico, Peru, Trinidad and Tobago and Uruguay).

Source: Authors’ elaboration based on (OECD, 2019[62]).

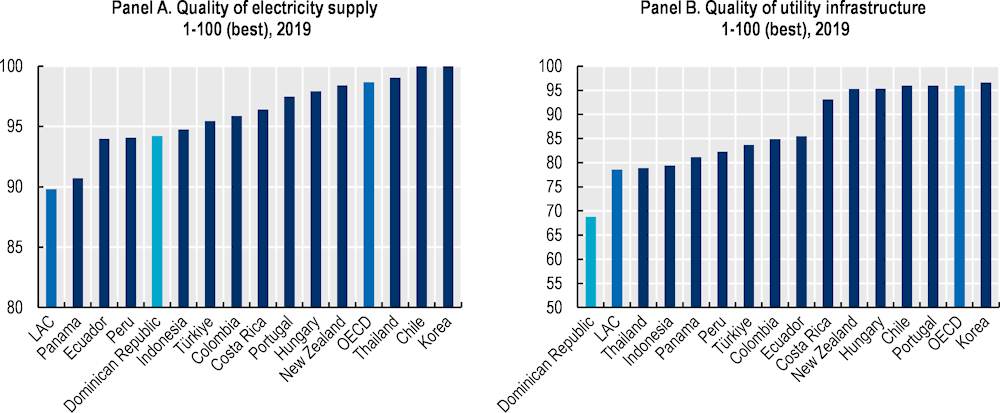

Electricity, water and sanitation services are insufficient

The Dominican Republic has advanced in providing households with electricity, water and sanitation services, yet these systems face numerous challenges. Electricity access has improved the most, now covering 100% of those living in urban and rural areas. Provision of the electrical service, however, remains caught in a vicious cycle of regular blackouts, high operating costs, large losses, and low bill collection rates, while a system of direct and indirect subsidies that add an excessive fiscal burden to the government budget. As a result, many consumers have opted to pay high costs to ensure alternative self-generated electricity (World Bank, 2014[63]).

These inefficiencies were addressed in the Pacto Nacional para la Reforma del Sector Eléctrico en la República Dominicana (2021-2030) signed in February 2021. The pact aims to build an efficient, competitive and sustainable electric system, including a responsible environmental vision. Some of the goals are to reduce energy losses to 15% in six years, increase the standards and supervision of the quality of the service and the measuring appliances, and gradually decrease subsidies to reach a maximum rate of 12% in 2023. The high inflation post-COVID-19 context forced the government to pause future increases in electricity rates and start conversations to revaluate the goals of the pact (Presidencia de la República Dominicana, 2021[64]).

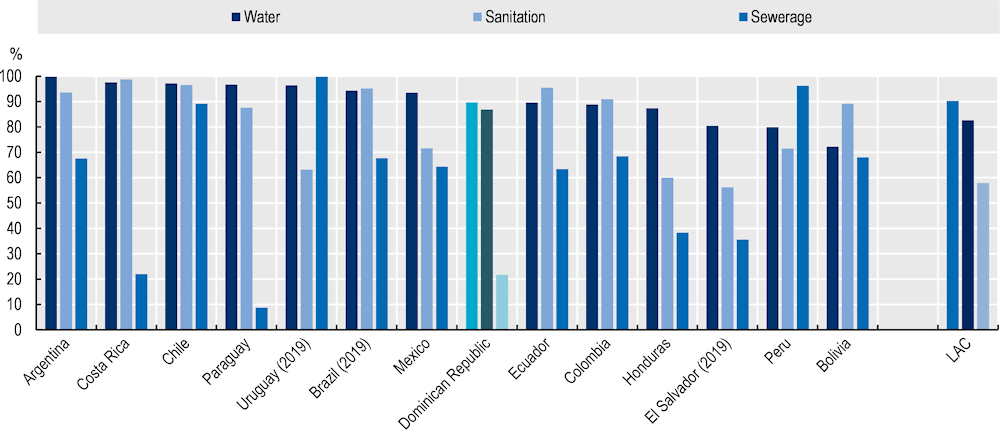

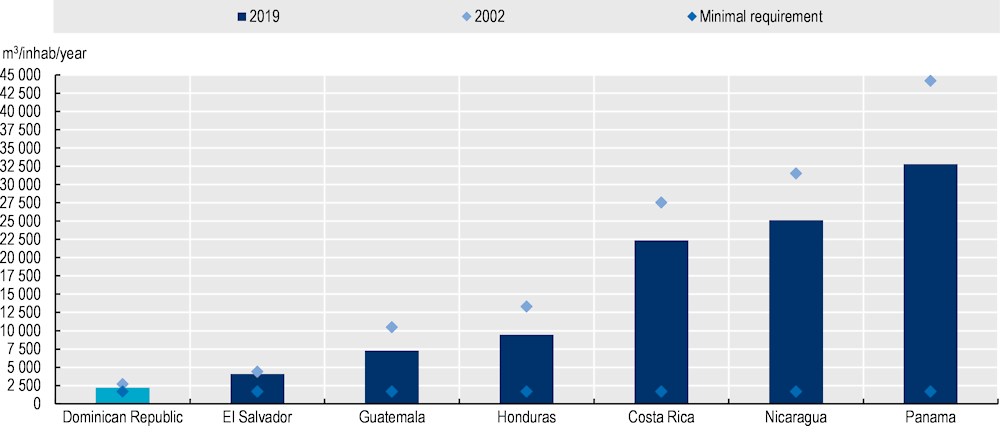

In terms of water and sanitation, significant advances have been made in the last 20 years but access is still not universal. At national level, on average 90% of the population has access to safe water and 87% to sanitation facilities. Conversely, sewerage coverage still lags, with only 22% of the population having access – far below the LAC average of 58% (Figure 2.22). For the rural population, the shares drop to 76% for safe water, 66% for sanitation and 3% for sewerage. The country shows a high mortality rate attributed to unsafe water, unsafe sanitation and lack of hygiene with 2.2 deaths per 100 000 inhabitants in 2016, well above average rates for LAC (1.8 deaths), OECD average (0.4 deaths) and all benchmark economies except those in Southeast Asia (World Bank, 2022[2]).

Figure 2.22. Water, sanitation and sewerage access, 2020

Note: LAC is a simple average of Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Mexico, Paraguay, Peru and Uruguay.

Source: Authors’ elaboration based on (CEDLAS/World Bank, 2022[60]).

Inequalities persist beyond rural and urban zones, present also in sub-national regions of the Dominican Republic. Access to water and sanitation and electricity infrastructure is unequal across territories. The largest disparities can be observed in water and sanitation services, partially because they lag in terms of coverage. A difference of 50 percentage points is evident across sub-national regions between the highest and lowest coverage of both water and sanitation infrastructure.

Access to good quality health remains unequal

While the impacts of COVID-19 showed some of the weaknesses of the health system in the Dominican Republic, it also served as an opportunity to identify areas for improvement. For instance, measures were adopted in 2020 to include 2 million citizens into the subsidised regime of the National Health Service (SENASA), among which were those whose jobs had been suspended in the context of the pandemic and who were initially protected by temporary programmes. This involved moving from a coverage of around 7.9 million people in December 2019 (76% of the population) to 9.65 million in December 2020 (92%) and 9.9 million in July 2021 (93%) (CISS, 2022[65]).

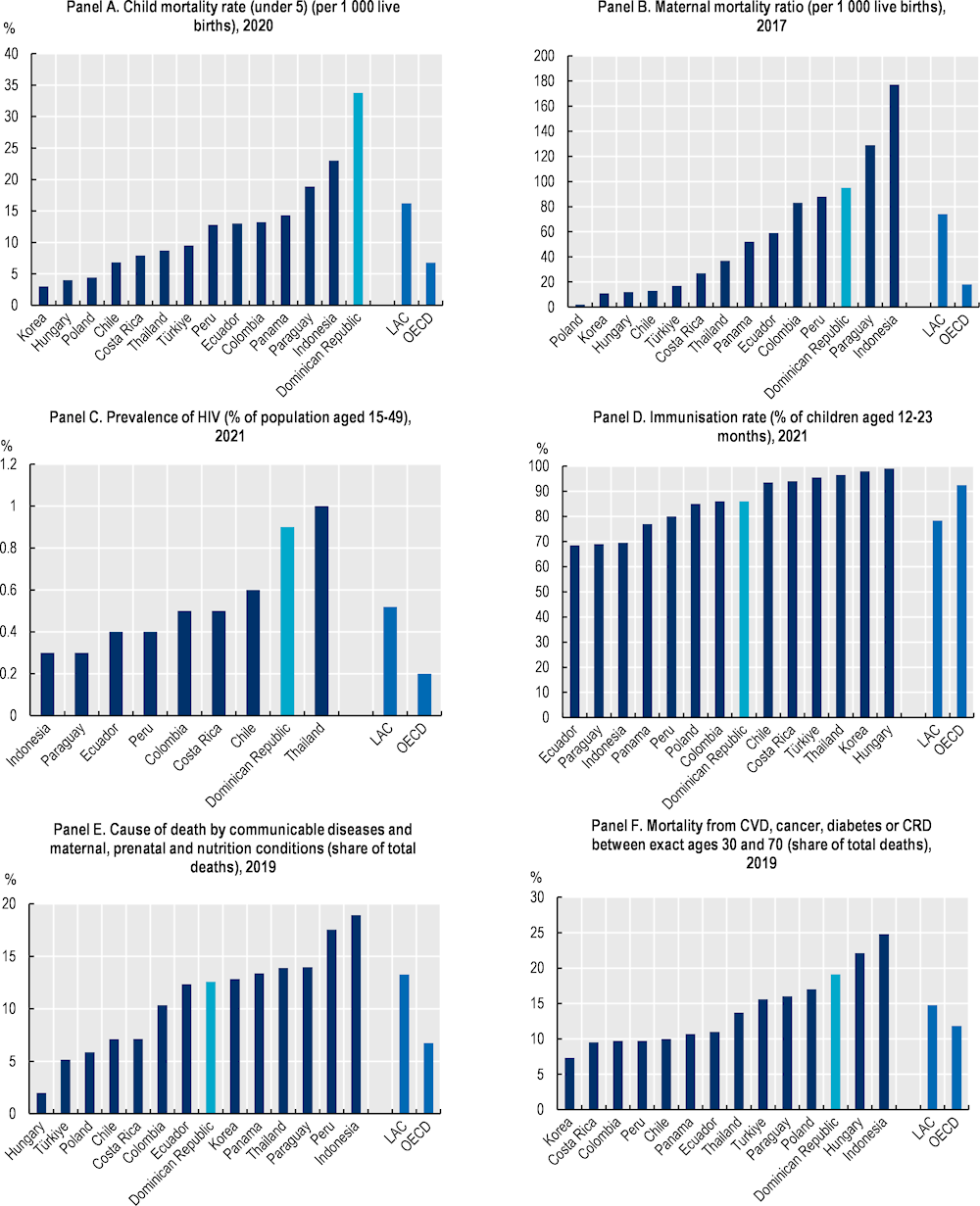

The quality of care and health outcomes of the Dominican Republic are low. The country faces a double burden of high maternal, neonatal and child mortality rates, and an increasing share of non-communicable diseases, including cardiovascular disease (CVD), cancer, diabetes and chronic renal diseases (CRD) (Figure 2.23). Poor improvements in outcome indicators leave the country well behind the averages for LAC and benchmark economies. Special attention should be placed on under-five mortality rate (35% per 1 000 live births), which more than doubles the LAC average (16%) and triples that of all benchmark economies (11%).

Figure 2.23. The quality of care and health outcomes of the Dominican Republic is insufficient

Notes: The immunisation rate is the average of the immunisation rate of measles and of diphtheria, pertussis and tetanus (DPT). Values of the prevalence of human immunodeficiency virus (HIV) for the OECD do not include Belgium, Canada, Finland, Iceland, Israel, Korea, Rep., Latvia, Poland, Sweden, Switzerland, Türkiye, United Kingdom and United States.

Source: Authors’ elaboration based on (World Bank, 2022[2]).

Large gaps persist between coverage and the quality of services provided across health systems in the Dominican Republic. Analysing the extent to which health services translate into improved health outcomes is one common way to assess the quality of the health service. Trends in maternal and child mortality, as well as in premature deaths (deaths under age 75 that could potentially be avoided, given effective and timely healthcare) serve as indicators for a combination of access and quality of health services. Almost 13% of total deaths in the Dominican Republic are attributed to communicable diseases – double the OECD average (7%). Likewise, 19.1% of deaths among people aged 30 to 70 are attributed to CVD, cancer, diabetes or CRD, which is significantly higher than averages for LAC (14.8%) and OECD (11.8%).

The poor quality of public services is reflected in the large share of the population using private facilities, especially among the higher income quintiles (World Bank, 2018[50]). Almost 66% of Dominicans used public facilities for outpatient consultations in 2015, while only 50% used the inpatient services. These shares are significantly lower than in other upper middle-income LAC countries such as Costa Rica (80%) and Panama (70%) (World Bank, 2018[50]).

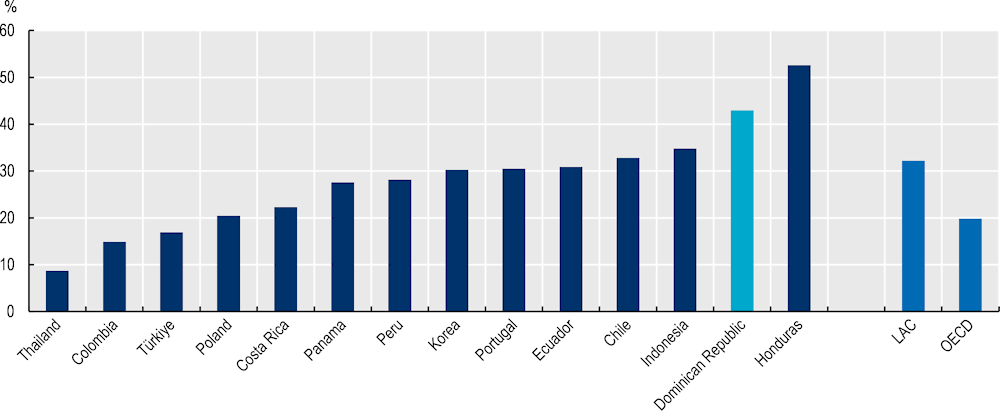

Despite recent efforts, the Dominican Republic falls short on achieving universal health coverage. In the past decade, the country has especially advanced in terms of population coverage and access to basic health services (e.g. immunisation, family planning, prenatal care, skilled attendance at birth, and improved water and sanitation). Yet population coverage remains insufficient, public spending on health is low and out-of-pocket payments are high (Figure 2.24). As a result, citizens – especially those in the poorest quintiles – find it difficult to receive needed health services without facing financial hardship (World Bank, 2015[66]).

Figure 2.24. Individuals assume a relatively large share of total health expenditures in the Dominican Republic

Out-of-pocket expenditure (% of current health expenditure), 2019

Note: The LAC average is a simple average of 33 countries for which data is available. The OECD average is a simple average for 38 member countries.

Source: Authors’ elaboration based on (World Bank, 2022[2]).

Individuals in the Dominican Republic assume a relatively large share of total health expenditures. In 2019, they paid 43% of health expenditures out of their own pockets, more than double the 20% recommended by the World Health Organization and also higher than the averages for LAC (32.2%) and OECD countries (19.8%) (Figure 2.24). Moreover, health expenditures have been increasing and accounted for 14% of the poverty gap in 2016. In 2018, 8.2% of the Dominican population was spending more than 10% of household consumption or income on out-of-pocket health care expenditure. Lower out-of-pocket expenditure on health reduces the risks of catastrophic or impoverishing health spending while higher public spending is associated with higher financial protection (WHO, 2016[67]; WHO, 2017[68]). This indicator reflects the extent to which public health systems offer protection to citizens. High out-of-pocket payments are of great concern as they may force low-income households to cut back in relevant areas such as food and education or fall into deeper poverty levels when faced with large exogenous health shocks (WHO, 2017[68]).

The social protection system is fragmented, limiting the efficiency of service delivery

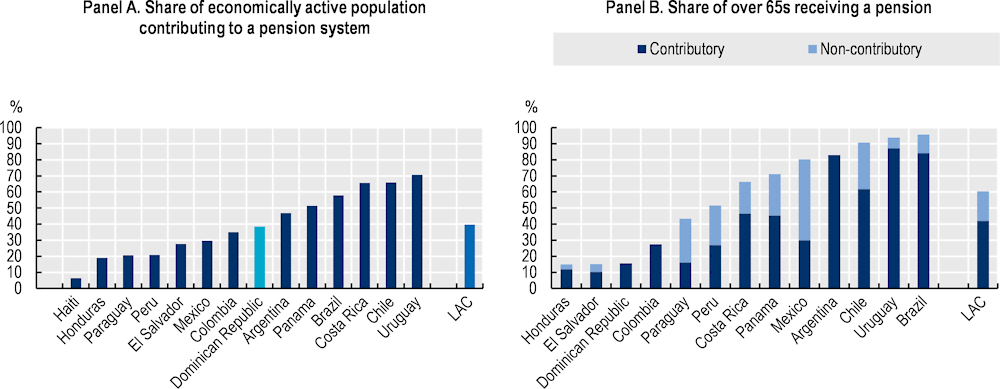

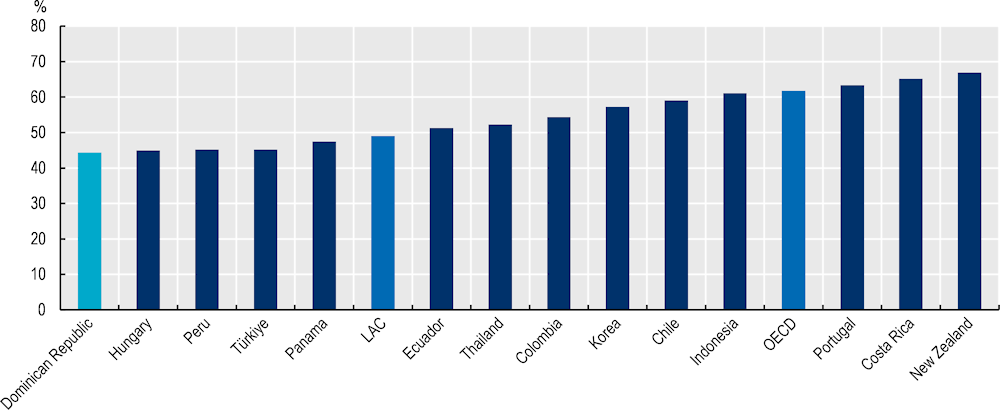

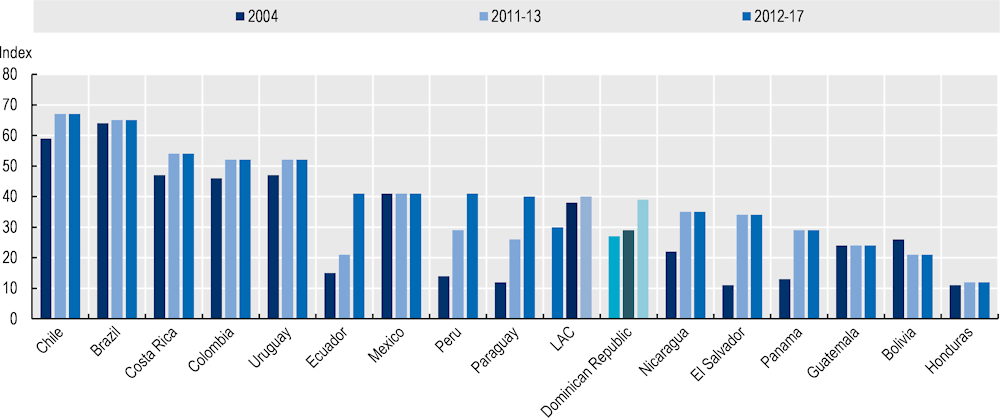

Despite recent improvements, social protection coverage is low in the Dominican Republic compared to the rest of LAC. In 2016, only 38.5% of the economically active population contributed to a pension system (Figure 2.25) Low coverage is strongly related to the high prevalence of labour informality, which affects more than half of Dominican workers (Chapter 3).

In terms of pensions in the Dominican Republic, two systems co-exist – the old defined benefit system and a new defined contribution system – both with very low coverage. Overall, the pension system is a contributory scheme. Since the pension reform of 2001, it is based on individual capitalisation accounts. All workers, both public and private, and their employers must contribute to their respective capitalisation accounts and must pay an insurance premium for disability and survivor coverage. In parallel, the old defined benefit scheme still offers old-age insurance coverage to a closed group of affiliates aged 45 or older at the time that the law went into effect. This group encompasses both public employees and a limited segment of formal workers in the private sector (OECD/IDB/The World Bank, 2014[69]). Public-sector workers who opted not to join the individual account system remain in the old social insurance system for public-sector workers.

New labour-market participants must enter into the mandatory scheme of the new Dominican Pension System, including those affiliated to the previous schemes who were 45 years old or younger when the reform went into effect. Workers contribute 2.87% while employers contribute 7.1% of base wages for old age, disability and survivors’ insurance. Of this amount, 8 percentage points are allocated to individual capitalisation accounts. Disability and survivor insurance premiums are established by law up to a maximum of 1% of the contributory wages. In turn, administrative fees are established by law up to a maximum of 0.5% of wages, although the pension fund management companies also charge up to 30% of the returns on investments above a certain threshold. A charge of 0.07% applies to finance the Superintendent of Pensions’ operating costs and a contribution of 0.4% goes to the Social Solidarity Fund. Benefits can be drawn as programmed retirement or annuities indexed to the consumer price (OECD/IDB/The World Bank, 2014[69]).The retirement age for both women and men is 60 years old.

Concurrently, the old pay-as-you-go social system for private-sector workers was closed to new entrants in 2003 and is being phased out. It still covers two groups: private-sector workers who were aged 45 or older in 2003 and chose to remain in this system; and private-sector pensioners who began receiving their pensions before June 2003.

Subsidies to individual accounts for self-employed, informal and other vulnerable workers have not yet been implemented. The 2001 social security law introduced a social assistance for old-age and disability, as well as a survivor pension; so far, however, this scheme has not been fulfilled. As a result, coverage remains low and old-age poverty high.

Figure 2.25. Pension coverage is low in the Dominican Republic

2016 or latest year available

Notes: Panel B shows the ratio of the total number of pension beneficiaries (contributory or non-contributory) over the total population of individuals aged 65 and over. Contributory beneficiaries include those receiving old age, disability, and widows’ pensions. Data for Brazil, Chile and Panama is from 2015; from 2012 for Haiti.