Following Finland’s application in May 2022 to join NATO, Russia terminated gas and electricity exports to Finland. While most gas was imported from Russia, gas only represents 5% of total energy consumption and plans are advanced for sourcing most of it elsewhere, in LNG form. Nevertheless, replacing gas in industrial uses is proving more difficult. The new nuclear power plant will supply 14% of Finland’s electricity when it reaches normal production this winter, more than compensating for lost Russian electricity imports.

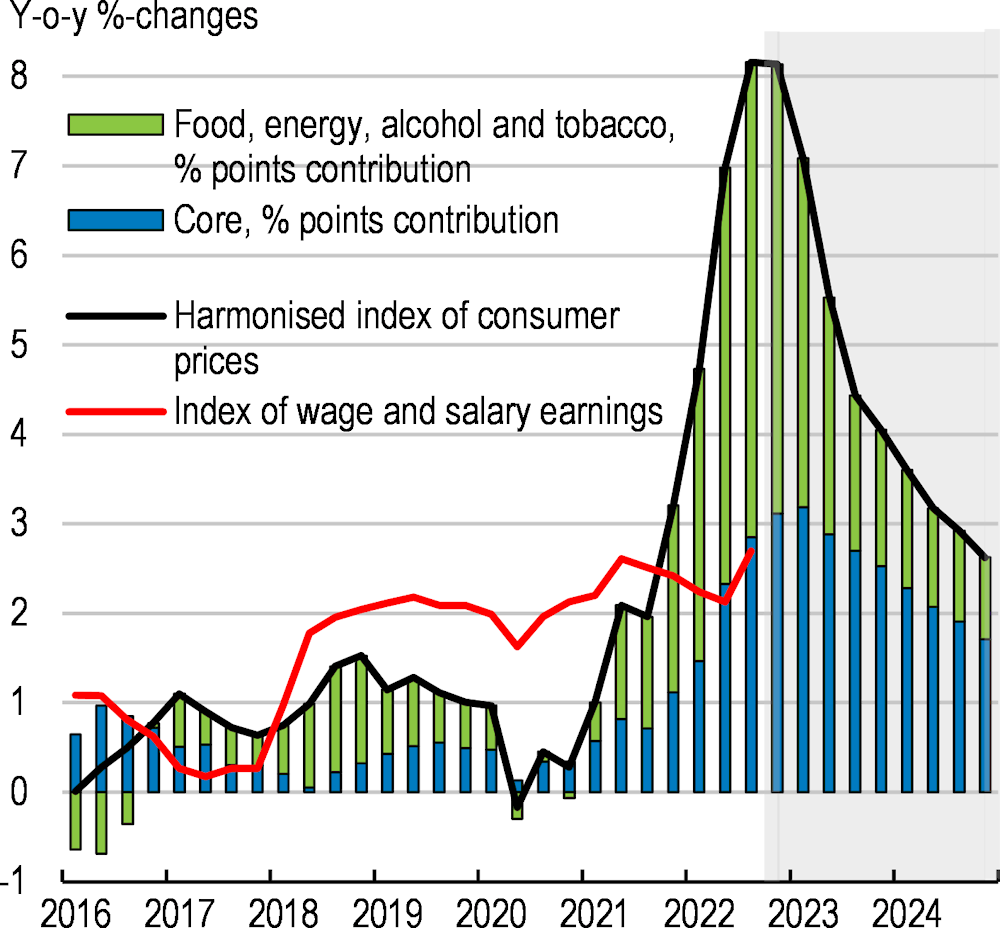

Russia’s war of aggression against Ukraine accentuated increases in energy prices that began in late 2021, pushing up inflation to 8.2% by the third quarter both directly and indirectly as higher energy and food prices fed into core inflation (Figure 1). Wage increases have lagged far behind inflation, reducing household real disposable income and portending future weakness in private consumption expenditure.

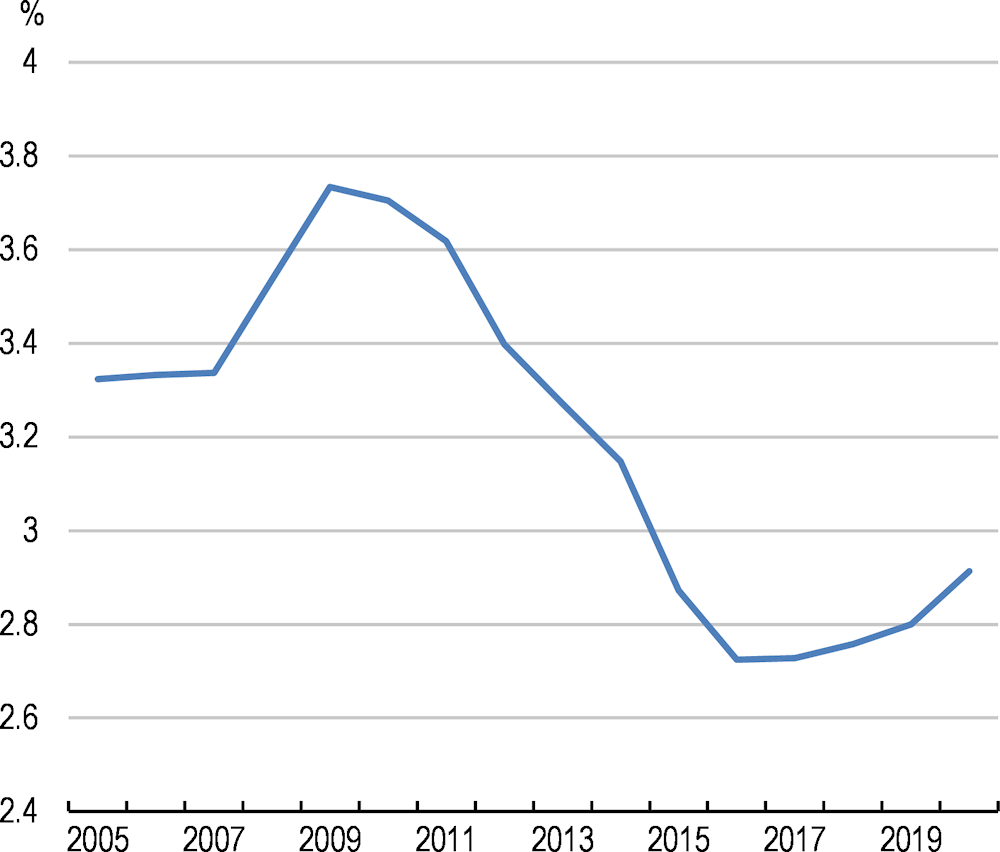

Finland enjoyed a strong labour market recovery from the COVID-19 shock until the second quarter of 2022. The employment and unemployment rates regained pre-pandemic levels by mid-2021 and early 2022, respectively, and have now posted their best performances since 1987 and 2008, respectively. Labour market tightness has increased markedly and the job vacancy rate is now higher for any given unemployment rate than in the past. Given the fast recovery and rapid increase in employment, part of the mismatch may be temporary, reflecting rigidities in filling jobs. Nevertheless, shortages in non-cyclical professions, such as healthcare and long-term care, are the most pronounced and are likely to persist. Reducing such mismatches requires training of workers and/or relaxation of skill requirements in jobs as well as stronger incentives for workers, unions and firms to compromise to improve match acceptance rates.

To rein in inflation, the European Central Bank has begun tightening monetary policy and is expected to continue doing so through 2023. Fiscal policy in Finland became expansionary in 2022 largely owing to expenditures related to Russia’s war in Ukraine and will be again in 2023 but will be neutral in 2024.

The economy will stall in 2023 but growth will recover to 1.1% in 2024. Consumption will weaken in response to falling real wages but subsequently recover as wages rise. Export growth will decline with export markets, which are being hit by the reduction in gas supplies from Russia, but will pick up as alternative energy sources are found. Business investment will remain weak through 2023 owing to the economic downturn and more uncertain economic outlook caused by Russia’s war in Ukraine but strengthen in 2024 as the global outlook improves. The unemployment rate should peak at around 8% and only fall slightly by end-2024. Inflation will fall to 3.1% in 2024, when the energy shock will have passed.

The downturn would be deeper if Russia were soon to cut off gas supplies to more EU countries, thereby preventing the rebuilding of gas stocks during summer 2023. Another downside risk is that tightening global financial conditions could affect the housing market and consumption and investment more than foreseen.