Naomitsu Yashiro

OECD

OECD Economic Surveys: Finland 2022

2. Rebooting the innovation ecosystems

Abstract

Finland is stepping up its efforts to reboot its innovation ecosystems, which weakened during the long economic stagnation that followed Nokia’s withdrawal from the mobile handset business. The government aims to increase Finland’s R&D spending to 4% of GDP by 2030 and will introduce legislation that commits to large and stable government R&D spending. However, rebooting Finland’s innovation system requires far more than revamping innovation support. Finland needs a clear mission-oriented innovation policy that directs applied research and innovation activities toward solving the most pressing socio-economic challenges. It will also need to strengthen innovation collaboration between the public and private sectors. In particular, concerted efforts toward a more diversified innovation ecosystem that is resilient to firm- and sector specific shocks are essential. To allow for more intensive innovation, the government must increase higher education study places and attract foreign skilled workers to meet the ever-growing demand for skilled workers. It should also help more Finnish firms capture foreign markets, enabling them to reap larger returns from their innovation.

Introduction

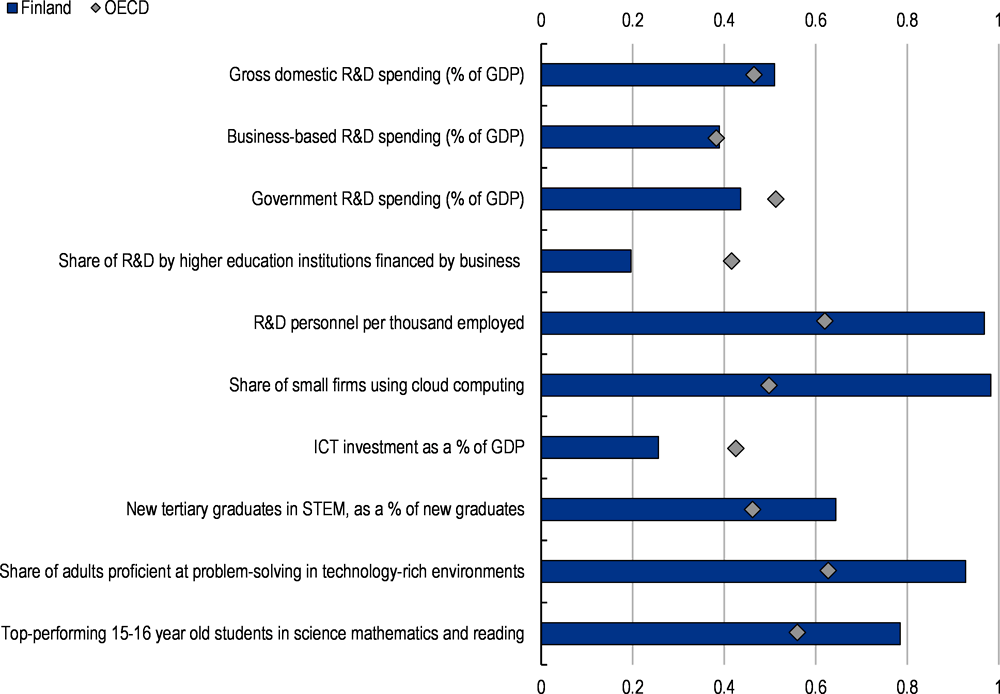

Finland is an innovative economy and outperforms many OECD countries on several dimensions of innovation activities and framework conditions (Figure 2.1). At 2.9% of GDP, its gross spending on research and development (R&D) exceeds the OECD average. The number of R&D personnel per thousand employees is among the highest in the OECD. The use of digital technologies is also widespread. For instance, 71% of Finnish firms with 10 to 49 employees use cloud computing services, as opposed to 38% in Germany or 26% in France. Finland boasts a highly skilled workforce, with high shares of adults with excellent problem-solving skills and tertiary education graduates in the fields of natural science and engineering. There are, however, areas where Finland is lagging, such as government R&D spending, innovation collaboration between businesses and higher education institutes, and investment in ICT capital.

Figure 2.1. Finland is an innovative economy

Finland’s innovation performance compared to OECD countries, 2021 or latest

Note: Indicators normalised to 0-1, 1 = top OECD country and 0 = bottom OECD country.

Source: OECD Going Digital Toolkit, https://goingdigital.oecd.org/.

An innovation ecosystem is a network of actors from the private sector, the government and research institutions who work together to develop new technologies, products or services that address shared specific goals (Box 2.1). Finland’s innovation ecosystems flourished in the 1990s and 2000s, on the back of strong public support for innovation, vigorous investment in tertiary education, and the development of export industries like electronics, forestry and metal (OECD, 2017[1]). However, they weakened during the long period of economic stagnation following the global financial crisis, as innovation support was withdrawn owing to fiscal consolidation needs and the competitiveness of the export sector, notably that of Nokia’s mobile handset business, waned.

Box 2.1. What is an innovation ecosystem?

An innovation ecosystem is a complex network of innovation actors contributing their human and financial resources and expertise to collaboration in research, development and commercialisation of new technologies that address shared priorities such as industrial competitiveness or climate change mitigation. These actors include business firms, higher education and research institutions, government agencies and innovation support organisations, as well as investors.

Innovation ecosystems can be geographically concentrated as clusters of interconnected firms and institutions in specific industries or research domains providing a related group of products or services. The key component of innovation ecosystems is innovation collaborations (Granstrand and Holgersson, 2020[2]), which are often coordinated and funded by government agencies. This contrasts with business ecosystems or (global) value chains, which foster innovation mainly through competition and are governed by the dominant firms that seek to appropriate the value of innovation by the participants (Jacobides, Knudsen and Augier, 2006[3]). The large externalities generated by innovation collaboration justify public support for innovation ecosystems.

The innovation ecosystems in Finland

Finland’s innovation ecosystems are often driven by large R&D-intensive firms like Nokia, Neste and Sandvik as well as the multitude of innovative start-ups, highly innovative universities like Aalto university, research institutes for applied research like the Technical Research Centre of Finland (VTT), public innovation funding agencies namely the Academy of Finland and Business Finland (Box 2.7), venture capital investors that include public investment funds like Tesi and Sitra, and Slush, the platform connecting start-ups and tech firms with investors (Chapter 1).

Policymakers in Finland have acknowledged the need for steady funding for innovation to deliver stronger productivity growth, which, in turn, is needed to sustain economic growth and the welfare state. The government has an objective to boost Finland’s gross domestic R&D spending to 4% of GDP by 2030. To meet this target, it recently reached a political agreement to increase overall public R&D spending to 1.33% of GDP (one-third of the 4% target) by 2030 and will introduce legislation that commits to increasing government R&D spending to 1.2% of GDP (90% of the overall public R&D spending). The government will also introduce a new R&D tax incentive, which is expected to broaden the scope of firms engaging in business-based R&D. However, boosting R&D and investment in complementary intangible capital such as data or organisational changes requires good access to highly qualified personnel. Policy reforms to reboot Finland’s innovation ecosystems thus need to go beyond revamping public innovation support. They need to alleviate Finland’s severe skills shortage, which is acting as an important bottleneck for more intensive innovation. They also should help Finnish firms reap higher returns on innovation so that more firms will invest in R&D despite the large upfront costs and high uncertainties. Against this background, this chapter highlights the following reform priorities:

Revamping innovation support in a way that maximises value for public money and helps Finland’s innovation ecosystems become more diverse and resilient;

Addressing the structural shortage of skilled workers through tertiary education and migration reforms;

Encouraging more Finnish firms to internationalise through exports or foreign direct investment.

Finland boasts favourable framework conditions for innovation, namely high technological capabilities and educational attainment, as well as business friendly regulatory settings and good access to credit (Chapter 1). Enhancing the innovation ecosystems by addressing bottlenecks is therefore crucial to boost Finland’s innovation performance and productivity growth.

The next section describes some important features of Finland’s innovation ecosystems and stresses the need for a more diversified one that is resilient to firm- or sector-specific shocks. Section 2.3 reviews the latest policy efforts to reboot Finland’s innovation ecosystems including the government’s R&D spending target and highlights policy reforms to enhance the effectiveness of revamped innovation support. Section 2.4 discusses the latest reforms in tertiary education and migration and their implications for the severe skill shortages. Section 2.5 explores the link between the internationalisation of Finnish firms and their propensity to innovate, showing that there is room to improve the current export and foreign direct investment promotion policies. Section 2.6 concludes.

Finland needs more diversified, resilient innovation ecosystems

Finland’s R&D spending declined in the 2010s

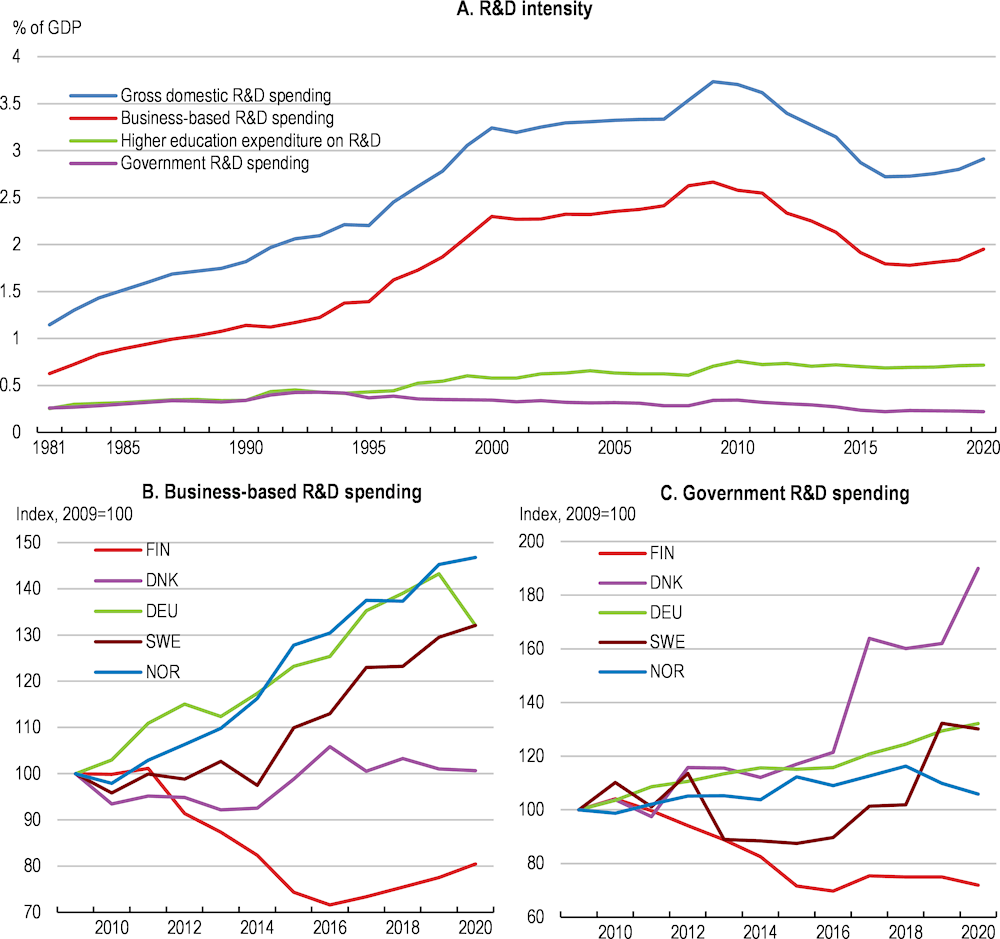

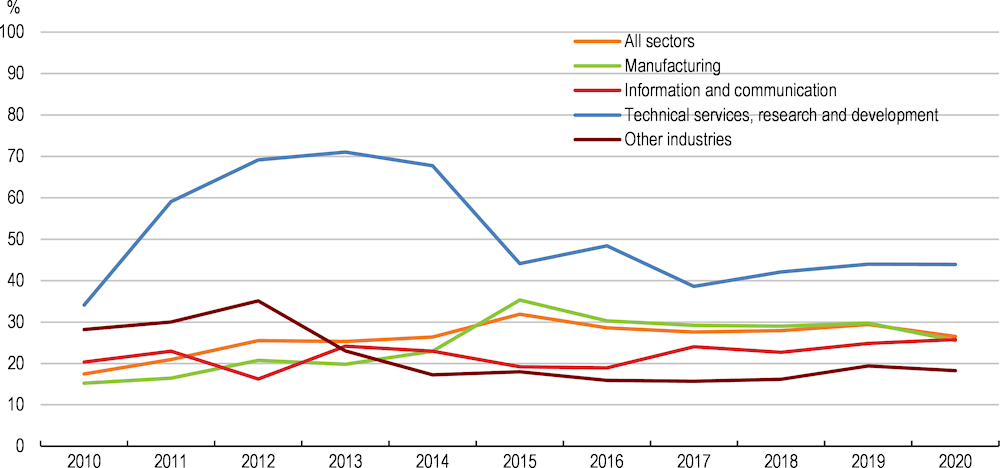

Finland’s R&D spending increased rapidly in the second half of the 1990s and throughout the 2000s, reaching 3.7% of GDP in 2009 (Figure 2.2, Panel A). Vigorous business-based R&D spending improved the productivity and export competitiveness of Finnish firms, which in turn boosted the demand for innovation (OECD, 2017[1]). This positive feedback loop was largely driven by the ICT sector, in particular Nokia, which represented 37% of Finland’s gross domestic R&D spending in 2008 (Ali-Yrkkö, 2010[4]). The extremely large role played by Nokia exposed Finland’s innovation ecosystems to firm- and sector specific risks, which materialised with the downfall of Nokia’s mobile phone business (Box 2.2). Finland’s R&D spending plunged to 2.6% of GDP by 2016, driven by an almost 30% fall in business-based R&D from its 2009 peak (Figure 2.2, Panel B). The large fall in business-based R&D contrasted with the increases among Finland’s competitors. However, the large decline of R&D spending in the electronics sector masked the increases in R&D spending in some knowledge-intensive sectors like pharmaceuticals (where R&D grew by 31% between 2009 and 2016) or information and communication (where R&D grew by 54%). Government R&D spending also declined from 2011 until 2016 (Figure 2.2, Panel C). In particular, public funding for innovation collaboration between firms, universities and research institutes was withdrawn quickly, weakening Finland’s innovation ecosystems (Section 2.3). While Finland’s R&D spending started to rise anew in 2016, business-based and government R&D spending remain at about 20% and 28%, respectively, below the 2009 levels (Figure 2.2, Panels B and C).

The main lesson from the 2000s is that Finland’s innovation ecosystems need to be driven by a more diverse set of firms, industries and technologies (Box 2.2). Diversification of the innovation base and portfolio is key to the resilience of Finland’s innovation ecosystems and can help Finland expand its comparative advantage beyond its traditional exporting industries.

Box 2.2. Nokia’s role in Finland’s innovation

Nokia was a dominant player in Finland’s innovation both quantitatively and qualitatively. At its peak in the mid-2000s, Nokia accounted for nearly half of Finland’s business-based R&D spending and 43% of patent applications filed to the European Patent Office (EPO). Nokia also employed a large share of Finland’s R&D workforce and led large networks of domestic suppliers comprising about 300 Tier 1 supplier firms. As the result of its rapid global expansion, Nokia eventually shifted a large part of its R&D activities abroad and offshored the production to large Asian electronics manufacturing services providers.

Nokia played an important role in technology diffusion from the global frontier to Finnish firms. It engaged in active R&D collaboration with universities and suppliers co-funded by Tekes (the National Agency for Technology and Innovation) on the latest technologies. Nokia also lobbied for an increase in university study places in the fields of electronics, telecommunications, and information technology. This contributed to the high share of STEM graduates seen today. Nokia recruited a large number of STEM graduates, offered them experience and later supported their spin-offs.

There are other examples of a handful of large firms playing a more than proportionate role in a country’s innovation. For instance, Philips accounted for a bit over 40% of the Netherlands’ patent applications to the EPO during 2000-06. However, Finland’s innovation was highly dependent on a single firm specialised in telecommunication, exposing it to large firm- and sector specific risks. Nokia’s weight in business-based R&D shrank to 17% after the takeover of its mobile handset activities by Microsoft in 2013. The downfall of Nokia’s mobile handset business led to knock-on effects that weakened Finland’s entire innovation. For instance, major software providers cut back on R&D spending and large telecommunications firms like Telia Sonera withdrew product development activities from Finland. Business funding for research collaboration between universities and research institutes like VTT (Technical Research Centre of Finland) shrank considerably. Nevertheless, many of Nokia’s former employees have founded new companies or joined them. Nokia’s Bridge Programme in 2011-14, the comprehensive plan for supporting the job transition of its employees, led to the creation of some 400 companies in Finland

Figure 2.2. Finland’s R&D spending has begun to increase but remains below earlier peaks

There is room to diversify the base of business-based R&D

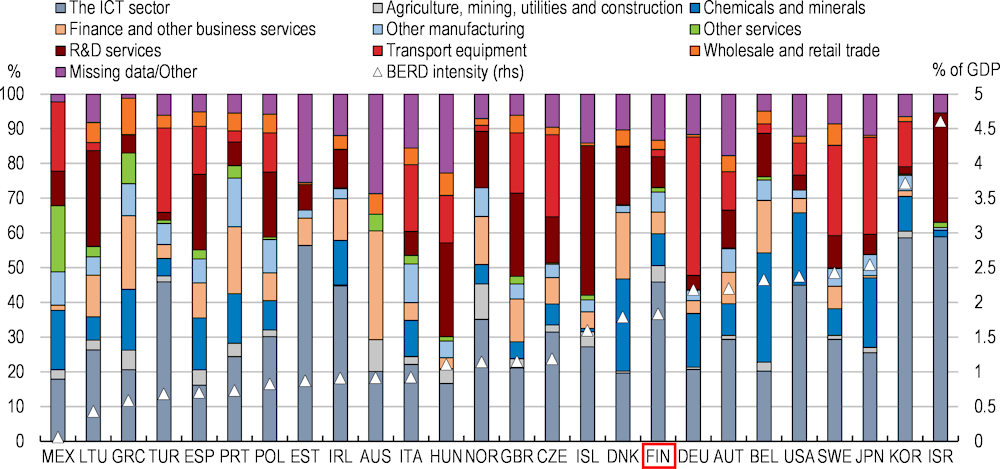

Finland’s business-based R&D is dominated by high-technology industries, namely the ICT sector (Figure 2.3). In 2019, ICT equipment manufacturing and information and communication services accounted for 40% of business-based R&D spending. The weights of other service industries, for instance wholesale and retail or transportation, are smaller than in other OECD countries. Higher R&D in those industries could unlock large productivity gains, especially if resources are reallocated toward innovative firms. The retail sector in the United States experienced fast productivity growth in the 1990s mainly due to the entry of more productive establishments that capitalised on the latest technologies like e-commerce and advanced inventory management and the exit of less productive establishments (Foster, Haltiwanger and Krizan, 2002[6]).

Figure 2.3. Business-based R&D is concentrated in the ICT sector

Industry composition of Business-based R&D (BERD) spending

Note: The ICT sector refers to ICT equipment, electrical equipment and machinery, and information and communication services.

Source: OECD Research and Development Statistics (database).

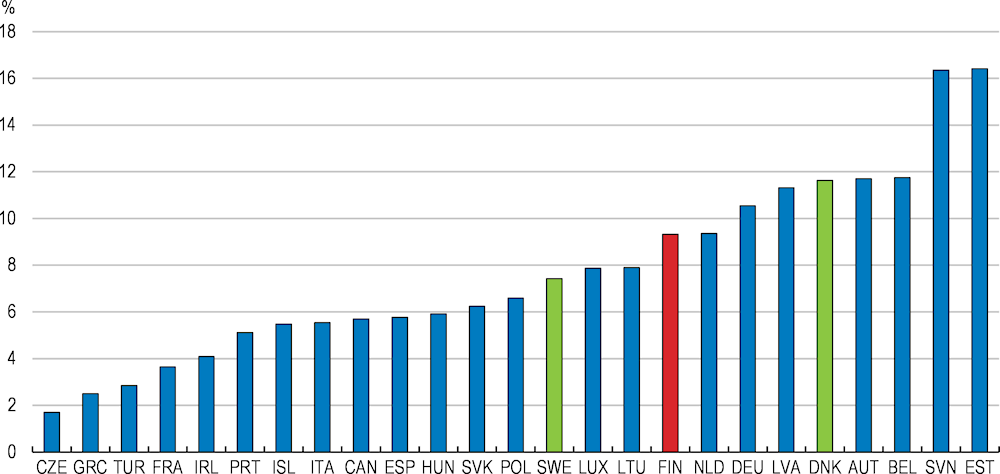

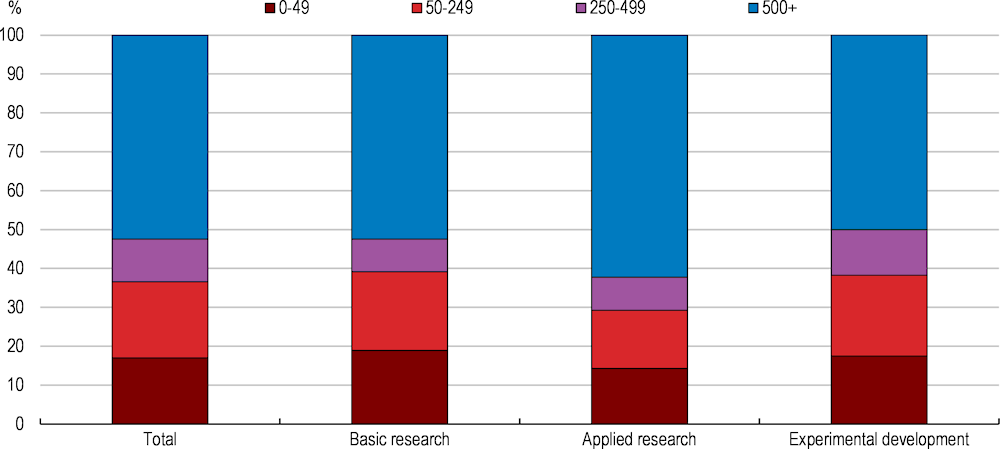

As in many OECD countries, SMEs are under-represented in innovation, especially in applied research. Business-based R&D in Finland is concentrated in large firms, although not as much as in Sweden or other technologically advanced economies (Figure 2.4). The large fixed costs and considerable uncertainties associated with R&D often deter firms with small production scales or small internal funds from investing. In 2020, more than 60% of business-based R&D spending in Finland was undertaken by firms with 250 or more employees, most of them being very large firms with more than 500 employees (Figure 2.5). The weights of large firms are particularly pronounced in applied research, a crucial phase in successful innovation that bridges basic research and experimental development toward the commercialisation of innovation. Broadening the base of business-based R&D spending by increasing the weight of SMEs would strengthen the resilience of Finland’s innovation ecosystems. Participation in applied research involves intensive collaboration with higher education and research institutions, which would enable SMEs to strengthen technological capabilities and acquire new knowledge in their relevant sectors.

Figure 2.4. Business-based R&D is driven by large firms as in many other OECD countries

The share of firms with more than 250 employees in business-based R&D, 2019

Figure 2.5. The weight of SMEs in business-based R&D is small, particularly in applied research

The composition of Finland's business-based R&D spending by firms’ size (number of employees), 2020

Note: Basic research is defined by Statistics Finland to be experimental or theoretical work undertaken primarily to acquire new knowledge of the underlying foundations of phenomena and observable facts, without any particular application or use in view. Applied research is an original investigation undertaken to acquire new knowledge. It is, however, directed primarily towards a specific, practical aim or objective. Experimental development is systematic work, drawing on knowledge gained from research and practical experience and producing additional knowledge, which is directed to producing new products or processes or to improving existing products or processes.

Source: Statistics Finland.

Innovation collaboration is common but can be strengthened further

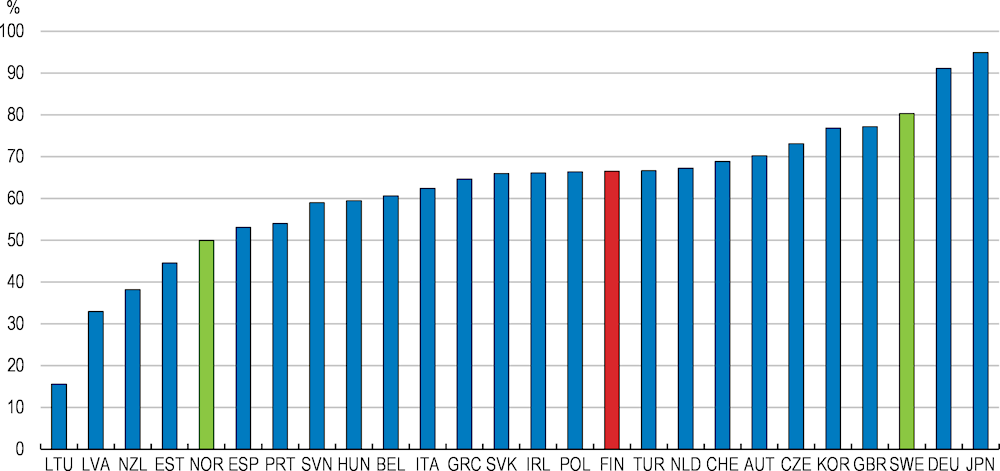

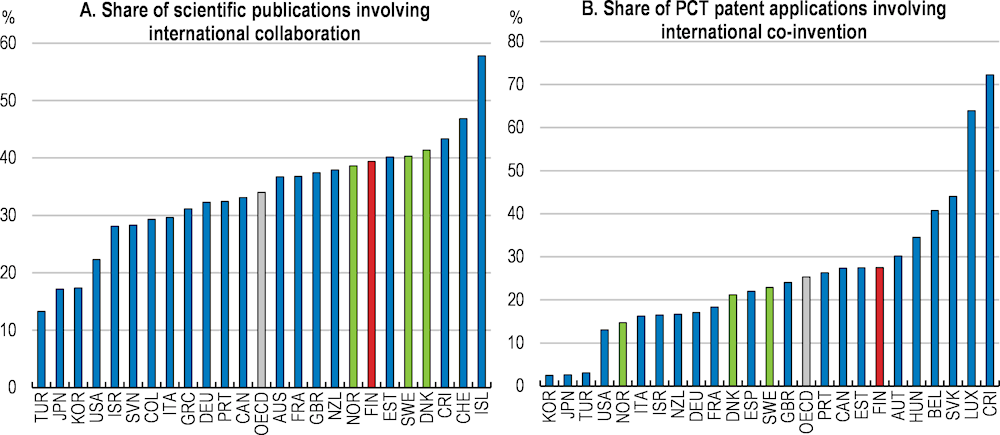

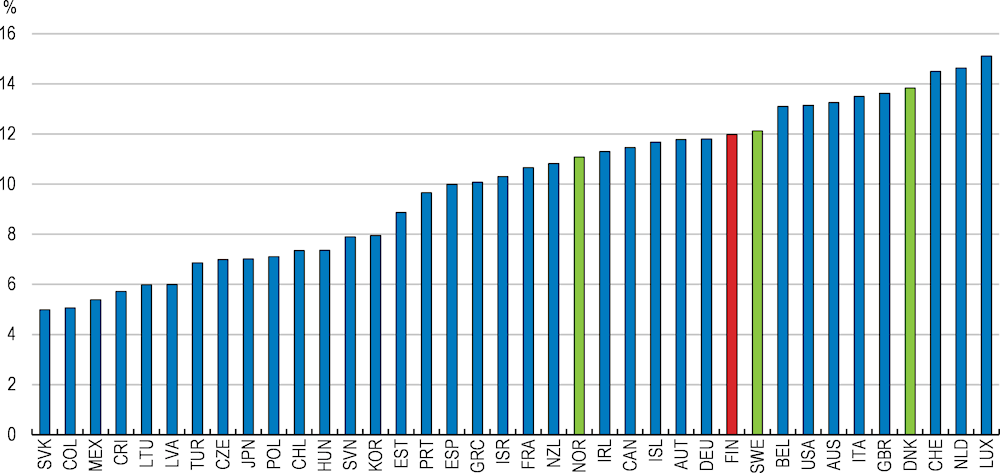

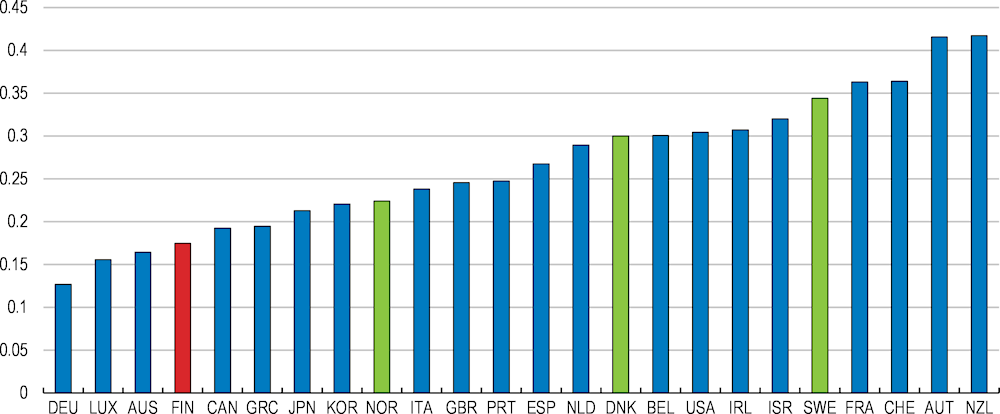

Innovation collaboration is an important channel through which advanced technologies and knowledge are transferred from research institutions or frontier firms to less technologically advanced firms. In particular, international collaboration provides opportunities for Finnish researchers and firms to absorb the latest technologies and scientific knowledge from the global frontier. Innovation collaboration seems rather common in Finland. For instance, Finland has a higher share of scientific publications involving international collaboration than many other OECD countries, albeit slightly lower than Sweden or Denmark (Figure 2.6, Panel A). The share of patents application involving international co-invention is also high, even compared to Scandinavian peers (Figure 2.6, Panel B). According to the European Commission’s Community Innovation Survey, 47% of surveyed Finnish firms undertaking some kinds of innovation collaborated with other firms, research institutions or foreign partners in 2018, a share that is higher than in most EU economies. However, Finland lags behind many other OECD countries in university-industry collaboration (Figure 2.7), which is an integral part of applied research. Indeed, the share of higher education R&D financed by business is highest among the economies with very strong innovation performance such as Korea, Germany and Switzerland.

Figure 2.6. Finland engages intensively in international innovation collaboration

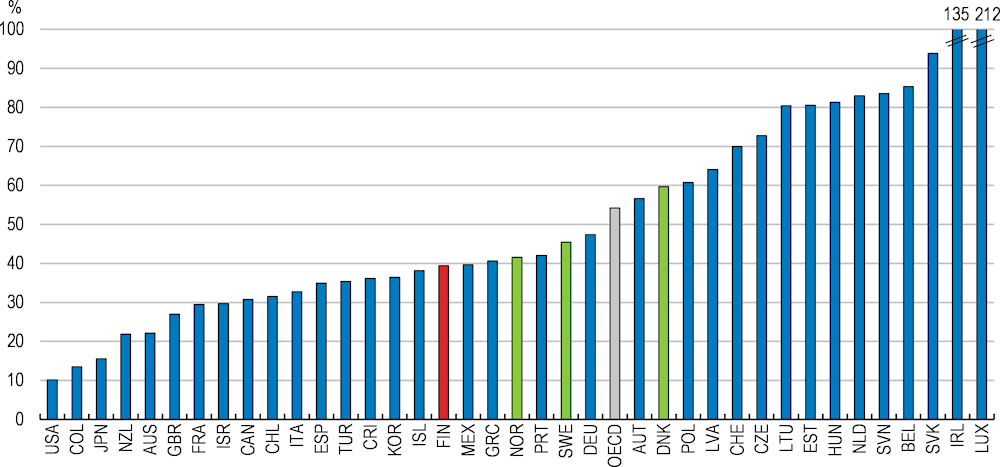

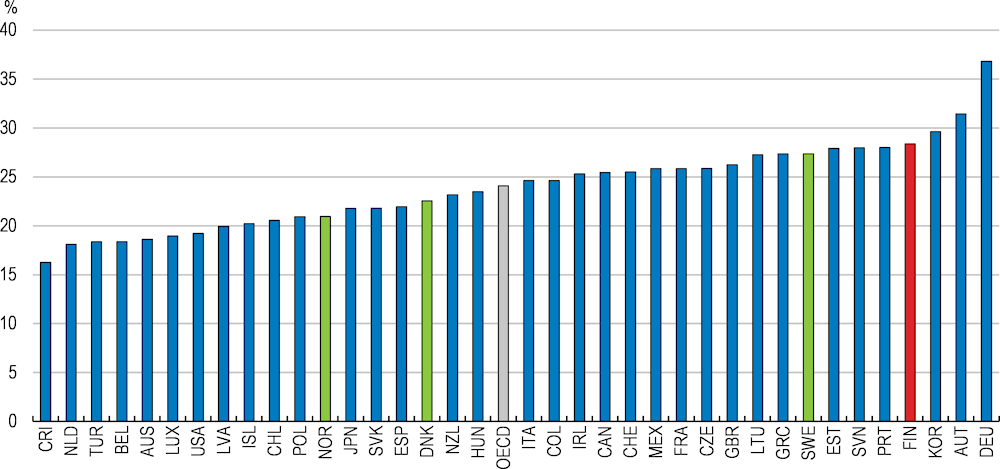

Figure 2.7. University-Industry R&D collaboration is low

Percentage of higher education expenditure on R&D financed by the business sector, 2020 or latest

Research quality is high

The high quality of research in Finland can be seen for instance in its relatively high share of scientific publications belonging to the world’s top 10% of most cited publications (Figure 2.8). The quality of research can be improved further by addressing the fragmented research base in higher education institutions. For instance, the need for small universities to provide a full set of degree programmes prevented them from building larger, more specialised internationally competitive research groups (OECD, 2017[1]). Steps were taken to strengthen research quality, for instance through consolidation. For example, three universities leading in the areas of Science and Technology, Art and Design, Business and Economics were merged into Aalto University in 2010, which ranks high internationally in research and innovation collaboration. The government also facilitated collaboration among groups of researchers, for instance through centres of excellence run by the Academy of Finland.

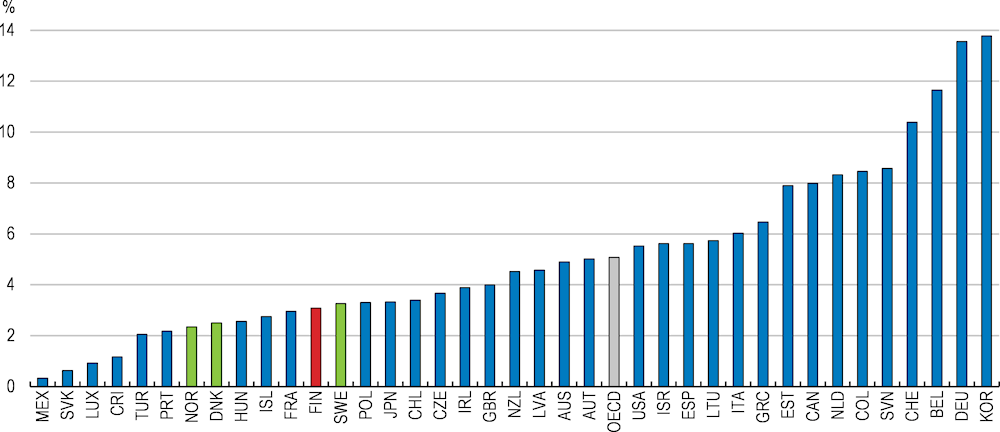

Business-based R&D in Finland has been resulting in patent applications with international significance, attesting to the high quality of Finland’s industrial innovation. The number of patent applications under the Patent Cooperation Treaty (PCT) relative to business-based R&D spending is among the highest across OECD countries (Figure 2.9). Nevertheless, innovation in Finland’s main industries has been more incremental in nature, where continuous refining of existing core technologies is reflected in new products (OECD, 2017[1]). According to Statistics Finland’s Innovation Survey, some 48% of surveyed Finnish firms introduced new products that improved upon the existing products in 2020, while 36% introduced products that were new to their markets (Statistics Finland, 2022[7]). Finland’s innovation ecosystems should better support radical innovation by promoting multidisciplinary innovation collaboration. Radical innovation can deliver strong productivity gains by opening up the possibilities of new technology adoption and new industrial applications.

Figure 2.8. The quality of scientific research is relatively high

The share of scientific publications belonging to the world's top 10% of most cited publications, 2020

Note: OECD calculations based on Scopus Custom Data, Elsevier, Version 5.2021, September 2021; and Scimago Journal Rankings.

Source: OECD Science, Technology and Innovation Scoreboard.

Figure 2.9. Business R&D is resulting in a high number of patent applications

Number of patent applications under the Patent Cooperation Treaty per USD one billion of business-based R&D spending, 2019

Note: Business-based R&D spending is converted to USD using PPPs and is in 2015 prices.

Source: OECD computation based on the OECD Main Science and Technology Indicators.

Finland needs more investment in intangible capital

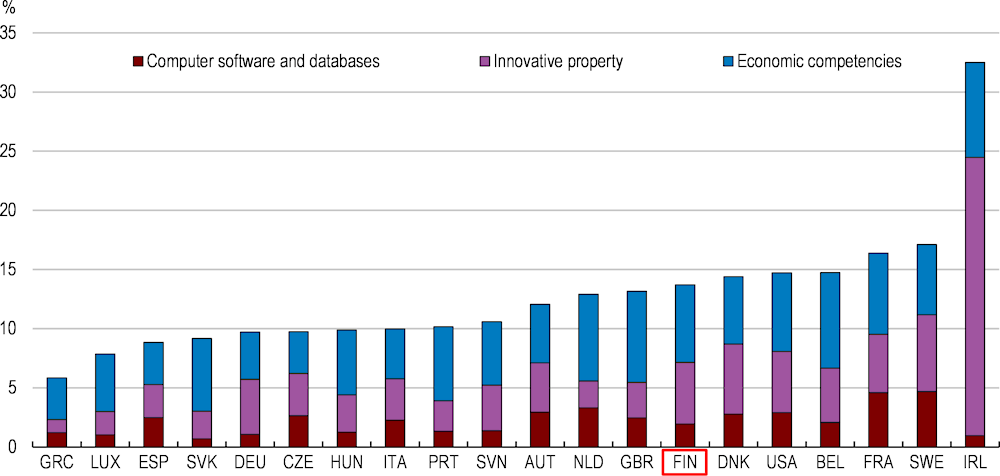

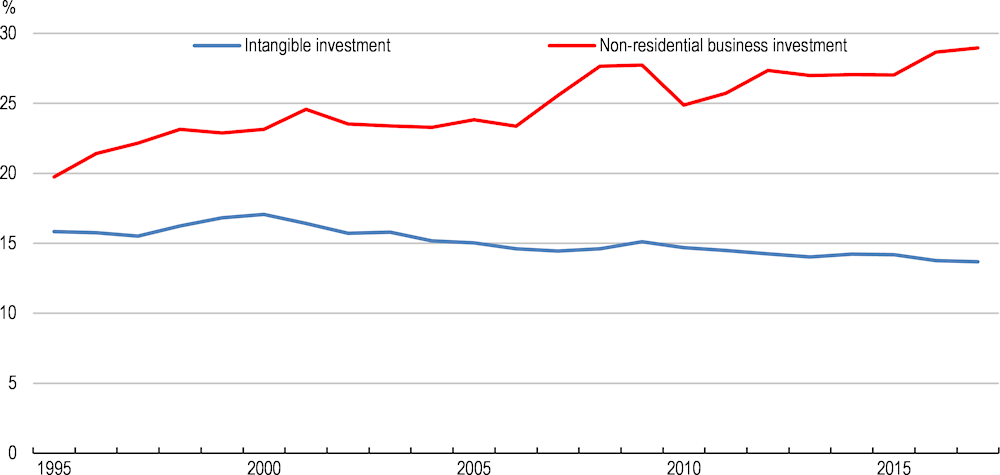

Innovation and productivity growth are increasingly driven by intangible capital, which includes not only R&D but also data and software, design and copyrights, as well as organisational structure and firm-specific skills (Box 2.3). Intangible capital plays a central role in successful commercialisation of new technologies, thereby translating innovation into productivity growth (Corrado and Hulten, 2010[8]). In many OECD countries, investment in intangible capital has increased faster than investment in physical capital and it significantly exceeds physical capital investment in some countries (Corrado et al., 2021[9]). Finland’s investment in intangible capital as a share of value added is relatively high compared with other OECD countries, albeit with some room to catch up to Scandinavian peers (Figure 2.10). However, it has been decreasing gradually since the early 2000s (Figure 2.11) and remained consistently lower than investment in physical capital.

Box 2.3. Intangible capital as a driver of innovation and productivity growth

Corrado and Hulten (2010[8]) classified intangible capital as the following expenditure on knowledge-based activities:

Computerised information: software and databases

Innovative property: R&D, patents, copyrights, designs, trademarks, etc.

Economic competencies: brand equity, firm-specific human capital, and organisational capital that generates competitive advantage and increases efficiency

Although these expenditures are usually treated as intermediate inputs in the System of National Accounts (except R&D, which has been capitalised in the 2008 System of National Accounts), they often contribute to production for more than a fiscal year, thereby meeting the accounting-convention definition of capital investment (OECD, 2013[10]).

Intangible capital plays an essential role in innovation. For instance, the automotive industry spends an increasingly large share of the cost of developing new vehicles on software, with high-end vehicles relying on millions of lines of computer code. Intangible capital is also an important source of productivity growth partly because several types of intangible capital can be duplicated at very low cost, generating large economies of scale. Corrado et al. (2016[11]) estimated that business investment in intangible capital accounted for 34% of annual average labour productivity growth in the United States and 20% in 14 advanced European economies during 2000-13. In Finland, it accounted for 25% of average labour productivity growth during the same period. Intangible capital continued to contribute positively to Finland’s labour productivity growth in the aftermath of the global financial crisis, even as overall productivity growth turned negative.

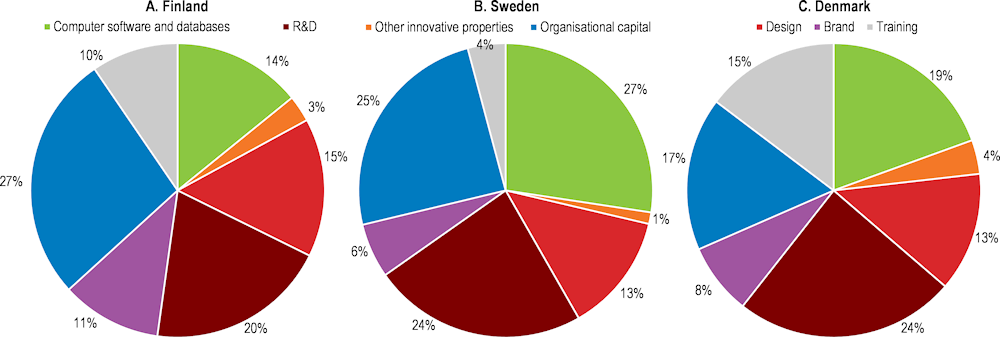

Stronger investment in intangible capital is essential for Finland’s strong innovation to result in significant productivity growth. It also helps Finland reap larger benefits from its vigorous adoption of digital technologies (see below). The extent of productivity gains firms enjoy from adopting digital tools is defined by their stock of intangible capital, such as valuable (big) data or sophisticated work organisation that is more conducive to the digitalisation of workflows (Brynjolfsson, Rock and Syverson, 2021[12]). However, Finland may not be making the most effective use of digital technologies due to insufficient investment in intangible capital that complements digital technologies. Indeed, there is room for more investment in software and datasets, which weights in Finland’s intangible investment are lower than in Sweden or Denmark (Figure 2.12). It has also been observed that diffusion of new technologies is held back by a shortfall in organisational capital like managerial skills, which holds back Finnish firms from translating their innovation into competitive new products (OECD, 2017[1]). Smaller firms, in general, lack the capabilities to reorganise work to reap the efficiency gains digital tools offer. The digitalisation of economic activities can then widen the productivity dispersion among Finnish firms, as only a handful of firms with a large stock of complementary intangible capital would enjoy large productivity gains (Corrado et al., 2021[9]). Therefore, Finland’s innovation ecosystems should foster stronger investment in intangible capital that helps more Finnish firms to capitalise on digital technologies.

Figure 2.10. Finland’s investment in intangible capital is relatively high

Investment in intangible capital as the share of gross value added, %, 2017

Figure 2.11. Finland’s investment in intangible capital has been declining

Investment in intangible capital as a share of gross industrial value added, %

Figure 2.12. Finland invested less in software and data than its peers

Composition of intangible capital investment, 2017

Low ICT investment holds back the gains from advanced digital adoption

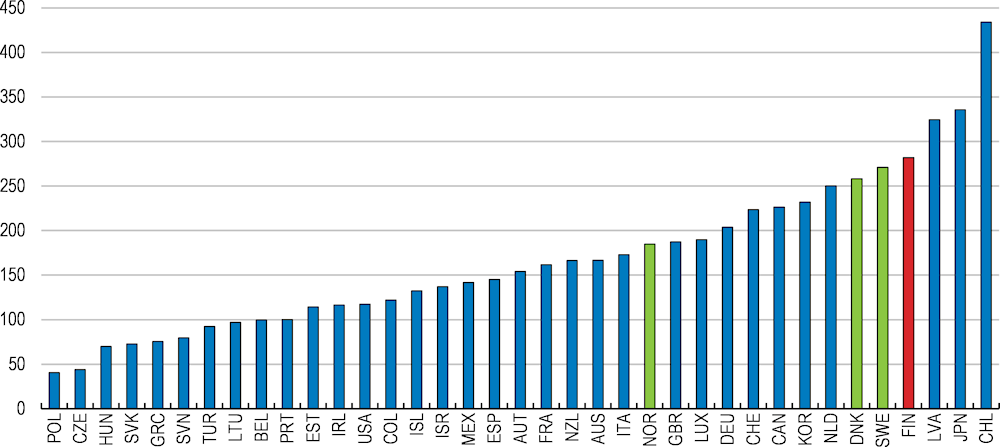

Investment in information and communication technologies (ICT) is crucial for seizing the opportunities for higher productivity growth presented by digital technologies (OECD, 2020[13]). Finland is considered the front runner in the adoption of digital technologies among EU countries (European Commission, 2022[14]). Indeed, a higher share of firms have adopted advanced digital technologies like Cloud Computing or Big Data Analysis in Finland than in many other OECD countries (Figure 2.13, Panel A). As in other OECD countries, the adoption of digital technologies is slower among smaller firms, but Finland outperforms the OECD average in the share of small firms adopting digital technologies (Figure 2.13, Panel B).

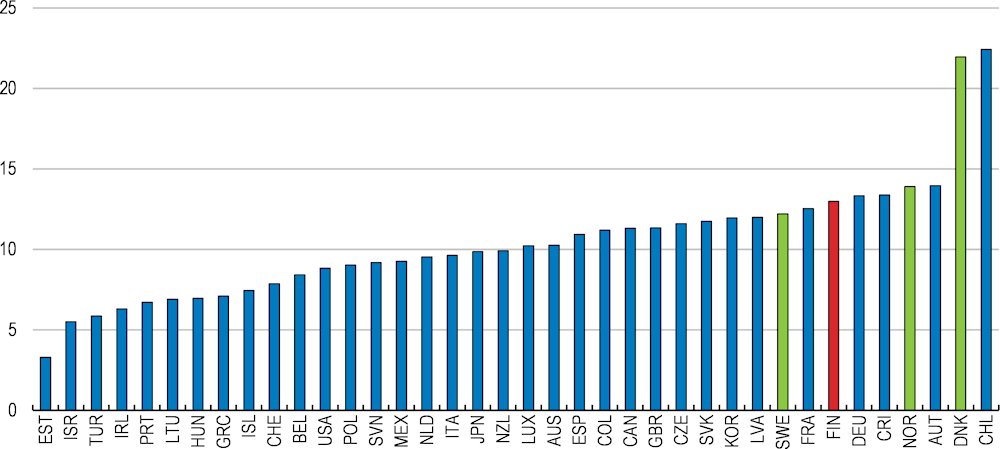

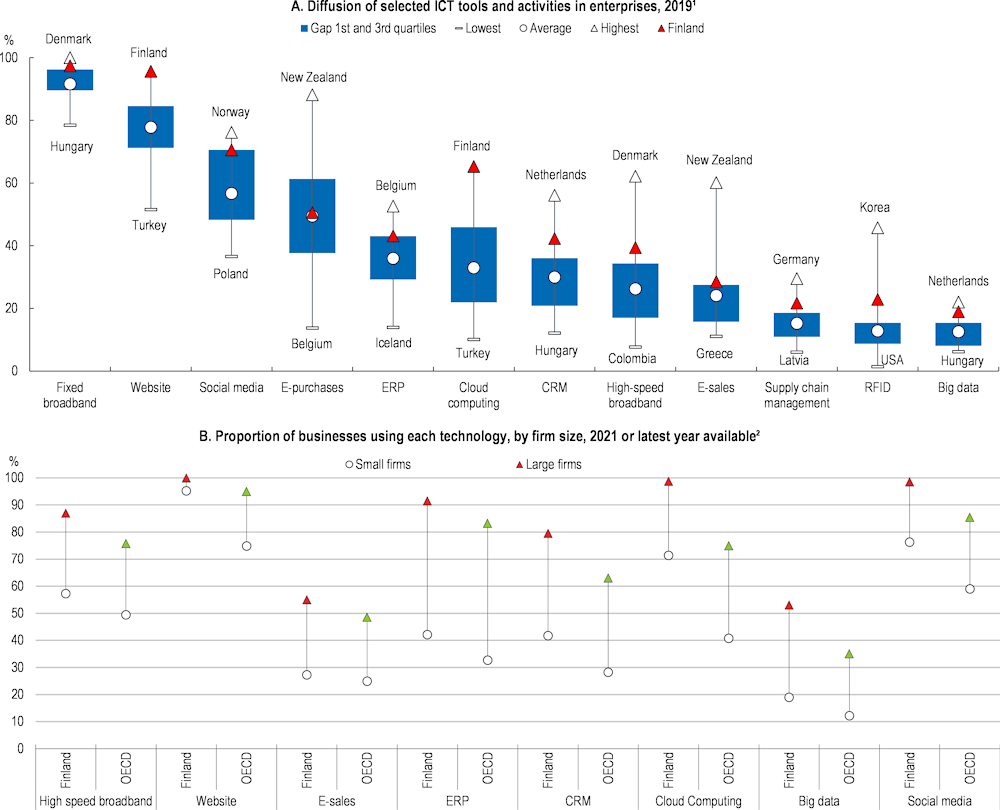

Despite the vigorous digital adoption, the average contribution from ICT capital deepening to labour productivity growth has been smaller in Finland than in many other OECD countries, particularly Sweden and Denmark (Figure 2.14). This owes to Finland’s slower deepening of ICT capital compared to many OECD countries (Figure 2.1), and the smaller weight of ICT capital in production for instance than in Sweden. There is thus substantial room for Finland to boost productivity through higher ICT investment and more intensive use of ICT capital in production.

Figure 2.13. Finland’s uptake of digital technologies is high even among small firms

1. CRM stands for customer relationship management. Enterprise resource planning (ERP) systems are software-based tools that can integrate the management of internal and external information flows, from material and human resources to finance, accounting and customer relations. Here, only sharing of information within the firm is considered. Cloud computing refers to ICT services used over the Internet as a set of computing resources to access software, computing power, storage capacity, etc. Supply chain management refers to the use of automated data exchange applications. Big data analysis refers to the use of techniques, technologies and software tools for analysing big data. This, in turn, relates to the huge amount of data generated from activities that are carried out electronically and from machine-to-machine communications. Social media refer to applications based on Internet technology or communication platforms for connecting, creating and exchanging content online with customers, suppliers or partners, or within the enterprise. Radio frequency identification (RFID) is a technology that enables contactless transmission of information via radio waves.

2. Small firms are defined as firms with 10 to 49 employees, whereas large firms are defined as those with more than 250 employees.

Source: Eurostat (2019), Digital Economy and Society Statistics (database) and OECD (2022), ICT Access and Usage by Businesses (database).

Figure 2.14. The contribution of ICT capital to labour productivity growth has been small

Average annual contribution of ICT capital deepening to labour productivity growth, 2010-2020, percentage points

Note: Data for Greece, Israel, Norway and Spain refer to the average over 2010-2019.

Source: The OECD Productivity Database.

Finland has a competitive edge in green innovation

Finnish firms have invested heavily in climate change mitigation and other environmental management technologies. For instance, 13% of patent applications concern environment-related technologies, a share that is higher than in many other OECD countries (Figure 2.15). In particular, Finland is leading in circular economy and bioeconomy innovation. Green innovation in Finland has been driven mainly by the business sector, motivated by environmental regulations and growing demand by customers for environment-friendly products. Finland has been a pioneer in implementing the EU environmental policies, which gave Finnish firms a first-mover advantage in the development of cleantech products (OECD, 2021[15]). As a result, Finland’s share in the global cleantech market, at over 1%, is twice as large as its contribution to global GDP. About 70% of firms in the cleantech industry are microenterprises and SMEs, illustrating the importance of entrepreneurship in this sector. Yet, their insufficient managerial skills are constraining the growth of these innovative firms and thereby the diffusion of novel technologies (European Commission, 2019[16]).

Figure 2.15. Finland is among the leading countries in green innovation

Patent applications on environment technologies, % of all patent applications, 2019

Making the most of the revamped innovation support

Innovation support was withdrawn quickly in the aftermath of the global financial crisis

Finland’s innovation ecosystems enjoyed broad-based policy support until 2010, underpinned by the government’s initiatives and a policy consensus that continuous investment in innovation was key to Finland’s long-run prosperity. Innovation collaboration between enterprises, universities and public research institutes was promoted through various funding schemes by Tekes (the National Technology Agency, currently Business Finland), which successfully strengthened the technological capabilities of Finnish firms and boosted business-based R&D spending (OECD, 2017[1]).

Public support for innovation waned during the long economic stagnation of the 2010s (see above) and underwent significant restructuring. Public funding for applied research was cut back, as the government reduced its R&D funding for Tekes by 24% in 2016. The government also consolidated the 20 public research institutes into 12 and cut their research funding by 37% during 2013-16. The Strategic Centres for Science, Technology and Innovation, aimed at establishing new types of public-private innovation partnerships similar to the Competence Centres in other OECD countries, were terminated abruptly in 2015 after issues of effectiveness and governance were raised (OECD, 2017[1]). The rapid withdrawal of public funding for applied research and innovation collaboration weakened Finland’s innovation ecosystems, especially by making it difficult for firms and universities to share the risks associated with the commercialisation of radical innovation.

The government’s stance towards innovation policy took a welcome turn in 2017 when it stressed the need to redress the decline in R&D spending to secure long-run innovation-based growth. Business Finland, a new organisation merging Tekes and the export promotion agency Finpro, was set up in 2018 to disburse innovation funding and promote trade, tourism and investment. The Research and Innovation Council (RIC), an effective platform that formed national strategic consensus and monitored Finland’s innovation ecosystems in the 1990s and 2000s (see below), was reconvened. It formulated at the time a vision that aims to turn Finland into the world’s most attractive and competent environment for experimentation and innovation by 2030 (Research and Innovation Council, 2017[17]). The government followed up in April 2020 with a National Roadmap for Research, Development and Innovation, which laid out policy priorities for achieving the government’s target on R&D spending (see below) as well as boosting business-based R&D and strengthening the innovation ecosystems (Box 2.4). On the back of renewed innovation support and the economy exiting the long stagnation, Finland’s business and government R&D spending grew in nominal terms by 19% and 9%, respectively, between 2016 and 2020 but their shares of GDP have not increased notably.

Box 2.4. Finland’s National Roadmap for Research, Development and Innovation

The National Roadmap for Research, Development and Innovation was put forth in April 2020 and updated in December 2021. It presents the strategy for attaining the R&D target and stresses the need to achieve a more diverse economic structure and stronger productivity growth. It highlights the need for more extensive innovation activities involving a wider range of industries and smaller firms and new models of public-private innovation partnership. The roadmap classifies policy measures across the following three pillars:

Competence

To increase the supply of qualified experts and R&D personnel, the government aims to lift the share of the 25-34 age group with tertiary educational attainment to 50% by 2030. It would also increase the number of foreign students threefold to 15 000 by 2030 and raise the share of foreign students graduated from Finnish universities who are employed in Finland to 75%. Adult education will be more aligned with industries’ need for research and innovation competence.

Public-private partnership

Responsible ministries and funding agencies, namely the Academy of Finland and Business Finland, and other stakeholders will develop a flexible public-private partnership for long-term research, development and innovation cooperation and its funding instruments. The use of EU funding and other international funding will be enhanced through better coordination within the government and new approaches developed jointly among universities, research institutes and firms.

Innovative public sector

The government will foster demand for innovation and leverage the latest technologies and innovation. It will increase innovative public procurement, make regulation more conducive to the commercialisation of innovation, and share public resources like data for innovation.

The government established an ambitious goal to boost R&D spending

The government has a target to increase gross domestic R&D spending to 4% of GDP by 2030. Finland has been setting national targets for R&D intensity since the 1970s and long had a good track record in achieving them (Deschryvere, Husso and Suominen, 2021[20]). The 4% target was first set in 2005 when Finland’s actual R&D spending reached 3.7% of GDP, buoyed by innovation in the ICT sector spearheaded by Nokia. However, this target was never reached and eventually dropped out of the government’s programme. It was reinstated in 2019 and promoted by the current government. R&D intensity targets are commonly found across OECD countries and some innovation-oriented non-OECD economies like China (OECD, 2021[21]). Finland’s target level of 4% is relatively high, a level shared only by Japan, Sweden and Iceland. Only Israel and Korea exceed this level of R&D spending. It will be challenging to achieve this target since it requires sustaining very large increases in R&D spending (Box 2.5). Moreover, such rapid expansion in R&D will not be feasible without addressing existing bottlenecks, notably severe skill shortages (see Section 2.4).

Box 2.5. How much of an increase in R&D spending is needed to meet the government’s 4% target?

This box provides a simple estimate of the growth rate in R&D spending needed to achieve the government’s R&D spending target. The main assumption is that Finland’s real GDP and inflation will follow the projection by the General Government Fiscal Plan for 2023-2026 (Ministry of Finance, 2022[22]) until 2026, and then the Bank of Finland’s central scenario between 2027 and 2030. This would bring nominal GDP to EUR 345 billion in 2030.

Gross domestic R&D spending equivalent to 4% of GDP would be EUR 13.8 billion. Given that the level of R&D spending was EUR 6.9 billion in 2020, it would require 7% annual growth in gross R&D spending to reach the target.

Similar computations imply that achieving the target for government R&D spending (1.2% of GDP by 2030) requires government R&D spending to grow by 6.4% (or around EUR 191 million) annually from 2020, on average. Government R&D spending decreased slightly in 2021 but increased by EUR 272 million in 2022. It is expected to decline by EUR 100 million in 2023. However, the government envisages an annual increase in its R&D spending by EUR 260 million between 2024 and 2026. Overall, these budget measures until 2026 roughly meet the cumulative increases needed to keep public R&D spending on track to achieve the 1.2% target.

In addition to these increases in public R&D spending, the government expects the introduction of the new R&D tax incentive (see below) to reduce fiscal revenue by about EUR 100 million every year from 2023.

Source: OECD computation based on the Ministry of Finance (2022[22]) and Bank of Finland (2021[23]).

In December 2021, Finland reached a political agreement to boost public sector’s R&D spending to 1.33% of GDP by 2030, which corresponds to a third of the overall R&D spending target of 4% of GDP. This agreement is motivated by the fact that historically public R&D has comprised one-third of Finland’s domestic gross R&D spending (for example, it was around 1% of GDP in 2020 while overall R&D amounted to 2.9%). Each additional euro in public R&D spending will need to be matched by two additional euros of business-based R&D. The government needs to commit to stable innovation support to induce such R&D spending by the business sector, given its history of swift and abrupt withdrawal of innovation support. Legislation (the R&D Finance Act) mandating the government to boost its R&D spending to 1.2% of GDP by 2030 is foreseen to enter into force in January 2023. The 1.2% target for government R&D spending is motivated by the fact that government R&D spending historically comprised 90% of the public sector R&D spending. The government will also introduce a long-term R&D funding plan that specifies the orientations of R&D policy and provides guidelines for the allocation of government R&D spending.

Two elements would define the effectiveness of the new framework for public R&D spending. First, the government should work closely with the private sector in achieving the R&D spending target. The government should not only monitor the development of business-based R&D but also work together with the private sector on designing policy measures to boost R&D spending by private enterprises, especially SMEs. This includes reflecting private-sector needs in the long-term orientation of government R&D funding. The R&D Finance Act foresees a monitoring role by the State Council, but it is unclear to what extent the private sector will be involved in its monitoring exercise. Second, while innovation support needs to be stable to provide a clear prospect of lasting innovation collaboration, it should not be rigid. The legislation should allow for some flexibility in annual government R&D spending, enabling future governments to accommodate fiscal revenue shocks or finance exceptionally large expenditures. This would make it easier for future governments to abide by the Act. The unused budget for R&D spending should be allowed to be carried over to avoid having to disburse all innovation support within a fiscal year, which risks compromising the quality of research projects and lowering the value for public money.

Innovation support must balance between basic research, which is driven by excellence and underpins Finland’s competitiveness as the innovation hub, and applied research, which is more targeted and oriented toward specific missions. While ensuring ample funding for basic research, Finland’s long-term R&D funding plan needs to set clear objectives and directions for research and innovation support to ensure that the large increase in government R&D spending strengthens Finland’s innovation ecosystems in the most cost-effective way. Finland’s innovation support is thinly spread across regions, measures and agencies, often lacking sufficient scale to reach a critical mass (OECD, 2017[1]). The government also does not target specific sectors or technologies in their efforts to reach the R&D intensity target. However, the limited size of policy resources and of the domestic market implies that Finland needs a more strategic innovation policy, like ones adopted by many OECD countries that orient public R&D spending toward specific missions to solve the most pressing societal challenges (Box 2.6). Such innovation policies involve picking the “problem” as opposed to picking the “winners”, while allowing innovation actors to propose the best technology solutions to address it (Larrue, 2021[24]). This trend in public R&D policy is likely to strengthen after the COVID-19 pandemic (Paunov and Planes-Satorra, 2021[25]).

Finland’s updated National Roadmap for Research, Development and Innovation mentions “a new challenge- and mission-based approach to implementing and funding research and innovation”, but the envisaged innovation strategy is unclear (Ministry of Economic Affairs and Employment; Ministry of Education and Culture, 2021[19]). There are also existing schemes like the Flagship Programmes by the Academy of Finland and the Growth Engines platforms by Business Finland, which are powerful policy instruments to mobilise a wide set of actors towards commonly developed strategic agendas. Although these initiatives do not fulfil all the design principles of the mission-oriented innovation policy, they have supported significant learning and cultural change in terms of governance and policy framework, upon which a fully-fledged and wider scope mission-oriented innovation policy could build. While the large coordination costs is a common drawback of mission-oriented policy (Box 2.6), OECD countries addressed this issue by enhancing the efficiency of the project governance through building trusts among the participants and adapting the governance system through learning.

Finland also needs stronger high-level coordination on innovation policy, given that its budget for innovation support is distributed across several ministries. It has had a highly effective coordination body that ensured systemically coherent research and innovation policies. The Research and Innovation Council (RIC) created in 1987 acted as an arena for debating innovation policy priorities from a holistic perspective and forming a national strategic consensus. While The RIC was an advisory body, it monitored the state of Finland’s innovation system and supported strong coordination and high-level decisions (Deschryvere, Husso and Suominen, 2021[20]; Arnold et al., 2022[26]). Unfortunately, the RIC was significantly downsized in 2016, and stripped of its secretariat and information gathering function. Although it has launched key innovation policy initiatives like the National Roadmap for Research, Development and Innovation, its functions are not as broad or independent as they used to be (Deschryvere, Husso and Suominen, 2021[20]). There is a case for restoring the RIC’s original capabilities, especially the strong coordination power. The rejuvenated RIC can be a suitable body for overall planning, implementing and monitoring mission-oriented innovation policies, given that mission-oriented innovation support should be subject to rigorous impact assessments and resulting reallocation of policy resources. The RIC can also help ensure that private sector needs are adequately taken into account in government R&D funding and support measures (see above).

Box 2.6. Mission-oriented innovation policies in OECD countries

What are mission-oriented innovation policies?

Mission-oriented innovation policies (MOIPs) are a coordinated package of policy and regulatory measures aimed at mobilising actors in science, technology and innovation to address well-defined societal challenges such as ageing or climate change within a defined timeframe. They emerged as governments across OECD economies needed to overcome limitations in traditional innovation policies, such as weak directionality, lack of holistic coordination and fragmentation of policy measures. MOIPs often involve a newly established coordination body at the level of each mission that determines and implements the direction of innovation activities toward the collectively developed objectives and a tailor-made bundle of instruments to meet these objectives. Public R&D spending plays a large role in MOIPs, as well as mission-oriented government procurement, such as green procurement that incorporates environmental requirements into their tenders or procurement of solutions to specific societal challenges.

Examples of mission-oriented innovation policies

Germany’s High Tech Strategy (HTS) 2025

The HTS 2025 adopted in 2018 is a comprehensive, inter-ministerial strategy that aims to raise Germany’s gross domestic R&D spending to 3.5% of GDP in 2025. It has set 12 mission areas to guide joint efforts of science, industry, and policy makers across ministries, which include healthcare, plastic pollution, reduction of greenhouse gas (GHG) emissions and artificial intelligence. For example, the GHG reduction mission aims to use research and innovation funding for new technologies that enable industry to contribute to the long-term carbon neutrality goal while securing Germany’s competitiveness as an industrial location. Challenges associated with the HTS include high coordination costs and the lack of common R&D funding resulting in fragmented funding across government agencies.

The Netherlands’ Top Sector Policy

The Top Sector Policy started in 2011 as an industrial policy for boosting the competitiveness of the Netherlands’ key sectors, such as agriculture, logistics, high-tech systems and materials, referred to as Top Sectors. Since 2018, it aims to achieve 25 missions in four societal challenges including energy transition, agriculture and healthcare. For each of these societal challenges, the public sector (led by the Ministry of Economic Affairs and involving authorities across various policy areas) and Top Sector partners (namely corporate enterprises) jointly draft and implement the Integral Knowledge and Innovation Agenda (IKIA), which specifies mission targets and the timeframe for achieving them. The IKIA is revised every four years. Challenges associated with the Top Sector Policy scheme include a large number of missions, an overly hierarchical governance system (currently being reformed) and the over-representation of incumbent actors experienced in collaborating with the government.

Source: Larrue (2021[24]), OECD (2020[27]).

The R&D intensity target is effective in signalling the political commitment to boosting innovation given that it is based on a straightforward indicator that is internationally comparable. Nevertheless, it fails to capture several important aspects of innovation, in particular investment in intangible capital, the quality of research, and the extent of knowledge spillovers. Furthermore, the R&D target does not capture R&D spending by innovative start-ups and other small firms with less than 10 employees. This is because these firms are not covered in Finland’s innovation survey nor in the innovation surveys of other EU countries, following the common sampling instruction by the European Commission (Deschryvere, Husso and Suominen, 2021[20]). The government should thus complement this target with other targets, for instance on research outcomes like the number of patent applications or the share of top scientific publications. This would allow more comprehensive monitoring of the progress toward the competitive innovation ecosystems envisaged in the Research and Innovation roadmap. Indeed, the National Roadmap for Research, Development and Innovation specifies eight indicators aside from R&D intensity to be monitored in the assessment of progress toward its policy goal, even though it does not assign any target levels for those indicators. The government should also consider collecting basic information on R&D expenditures by start-ups and micro enterprises, for instance by including the R&D spending in the list of information to be collected for its structural business and financial statement statistics, which surveys turnover and spending on inputs of all Finnish firms.

The new R&D tax credit should balance wide accessibility and efficiency

In addition to the large increase in government R&D spending that will revamp direct funding of business-based R&D, the government will also introduce a new R&D tax incentive. Both measures stimulate business-based R&D by subsidising the costs of R&D activities but differ importantly in their abilities to target some types of innovation and the scope of firms they can reach out to. For instance, the government can tailor direct support measures like R&D grants to guide innovation to specific societal challenges. However, only a limited number of firms with sufficient capacity to participate in these government-funded programmes would benefit from those grants. In contrast, R&D tax credits can be claimed by all eligible firms, but it is administratively difficult to target them to specific research themes. This trade-off between the extent to which the government can target the R&D support and the scope of firms it can reach out to implies that the government needs to deploy both direct support and tax credits to promote more diversified and competitive innovation ecosystems.

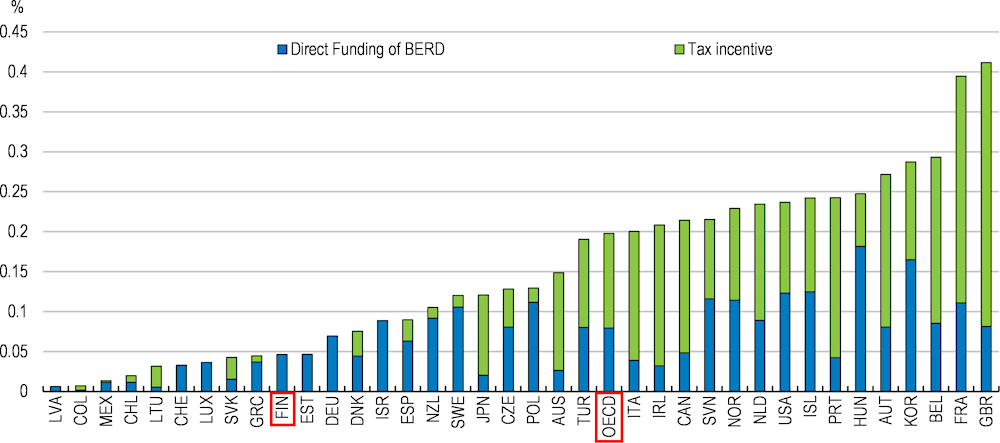

The government envisages introducing a tax allowance on 50% of the labour costs and expenditure on services purchased dedicated to R&D activities. Until recently, Finland was one of the few OECD economies that does not offer R&D tax incentives (Figure 2.16). While a temporary tax allowance introduced in 2013 allowed firms to deduct the wage expense of their R&D activities, it was removed at the end of 2014 following very low take-up (Kuusi et al., 2016[28]). In 2021, the government started offering a 50% deduction for the costs of R&D conducted jointly with higher education institutions or research institutes as a temporary measure until 2027. The deduction rate was boosted to 150% in 2022. Nevertheless, only firms with capacity to collaborate with higher education or research institutions benefit from this provision. The new tax incentive will cover more general R&D spending in line with the tax incentives offered by other OECD economies. It is expected to help broaden Finland’s R&D base by encouraging a larger mass of Finnish firms from a broader range of industries to innovate.

The new R&D tax incentive should be easily accessible to start-ups and other Finnish firms that would respond most to the scheme. A tax incentive in its purest form only covers firms that are profitable and pay taxes, thereby excluding firms that have not generated taxable profits. However, in many OECD countries, unused tax incentives can be carried forward. The period over which tax incentive claims can be carried forward varies widely across the OECD, ranging from three years in the Czech Republic to 20 years in the United States (OECD, 2021[29]). The government envisages allowing the new R&D tax incentive to be carried forward in line with corporate operational losses, which can be carried over for 10 consecutive years.

It is also common across OECD countries that R&D tax incentives are made refundable, transferring the excess credit that cannot be used to reduce tax liability in the form of a cash payment to the firms. Alternatively, the excess credit can be deducted from other corporate taxes or employer’s social security contributions. These features turning R&D tax incentives into de facto subsidies are particularly effective in providing cash flow to innovative firms in their early stage when they need to finance investment or product development. The R&D tax incentive can be also made “incremental,” covering the R&D spending exceeding a pre-defined baseline amount. Such baseline amount can for instance be 50% of the firm’s average R&D spending over the past three years, as in the United States. Some countries like Korea, Spain or Portugal offer hybrids of a volume-based R&D tax incentive topped by an incremental one. Koski and Fornaro (2022[30]) find that business-based R&D spending is larger in countries implementing either an incremental R&D tax incentive or a hybrid scheme. The government indeed envisages offering an incremental tax allowance on top of the 50% allowance mentioned above.

Figure 2.16. Finland was until recently one of the few OECD countries not offering R&D tax incentives

Direct government funding and tax support for business-based R&D, % of GDP, 2019

Across OECD countries, R&D tax incentives often target some firms and activities to induce larger R&D investment for a given tax expenditure (OECD, 2021[29]). For instance, the R&D tax incentives can target SMEs, given that the R&D investment by large firms is less responsive to tax incentives. An OECD empirical study based on firm-level data on R&D found that across 20 OECD countries, one euro of R&D tax credit induces 1.4 euros of R&D by firms with less than 50 employees whereas it induces only about 0.4 euros of R&D by firms with 250 or more employees (Appelt et al., 2020[31]). Instead of limiting the tax credits to smaller firms, many OECD countries set an upper bound on the amount of R&D spending that qualifies for R&D tax incentives. However, this was observed to result in pure income transfer to firms with R&D spending exceeding the upper bound. For instance, Finland’s temporary tax allowance in 2013-14 did not induce any additional R&D by firms with R&D spending larger than the upper bound of EUR 400 000 but allowed these firms to deduct EUR 400 000 from their corporate tax base (Takalo and Toivanen, 2017[32]).

The types of spending or activities eligible for the R&D tax incentives should be sufficiently broad for them to be relevant for many firms but need to be specified so they do not risk financing generic activities. In many OECD countries, R&D tax incentives often cover the labour costs of R&D personnel but the acquisition of capital assets to be used for R&D activities is less typically supported, as assets may be subsequently disposed of or used for other purposes (OECD, 2021[29]). Providing a clear definition of eligible activities would reduce uncertainties for firms embarking on innovation projects, especially those involving software development or other service-based activities that are on the boundaries between R&D and investment in intangible capital (OECD, 2021[33]). For instance, the United Kingdom offers detailed guidelines on the conditions under which software development qualify for the R&D tax allowance (HMRC, 2018[34]).

Direct R&D support should foster a strong public private partnership in innovation

As the government revamps direct R&D support, it should aim to build a strong public private partnership that links basic research with applied research and commercialisation of new technologies. This partnership should be driven by stronger interactions between research institutions and SMEs. The Academy of Finland and Business Finland promote industry-research collaboration through their support measures (Box 2.7). The two organisations should endeavour to attract innovative small firms into their innovation collaboration programmes. Innovation collaboration with universities and research institutions can be particularly beneficial for Midcap and small firms in developing novel environment-related technologies and commercialising them (OECD, 2021[15]). Small firms need a clear prospect of innovation outcomes to justify committing their time and scarce resources to these programmes. A fair governance system that reflects the concerns of SMEs as well as transparent communication of the project contents and burden sharing are key. It is also important to ensure that participation in those programmes does not penalise SMEs financially, for instance by preventing them from using the R&D tax incentive. For instance, the temporary tax allowance in 2013-14 (see above) was unavailable for firms receiving direct R&D support (OECD, 2017[1]).

The government should ensure the stability of support measures to encourage firms and research institutions to invest substantial resources in applied research and innovation collaboration. At the same time, both the Academy of Finland and Business Finland should streamline or consolidate support measures so that revamped innovation support will not be spread thinly across numerous potentially duplicative support measures. Furthermore, there has not been a notable synergy between their schemes. Deeper collaboration between the two organisations, such as launching co-funded projects is warranted, as this would bring grant recipients closer, facilitating the diffusion of knowledge and innovative ideas. At the same time, severe resource constraint has prevented the Academy of Finland from conducting rigorous impact assessments and reforms of its support measures (Arnold et al., 2022[26]). The government should ensure that sufficient resources are allocated to the Academy of Finland and Business Finland so that they can fulfil their essential functions.

While direct R&D support has been effective in inducing R&D investment in Finland, its contribution to the productivity of Finnish firms is less clear. For instance, Fornaro et al. (2020[35]) estimated that R&D support by Tekes (current Business Finland) boosted Finnish firms’ R&D spending per euro of sales by 30%. However, Koski and Parajanen (2015[36]) found that direct R&D support by Tekes has not resulted in significant labour productivity improvement of recipient firms, neither in the short run nor in the long run. These findings suggest some room for better targeting the R&D support like R&D grants or loans to firms with higher innovation capabilities and growth potential. Einiö et al. (2022[37]) show through a simulation that R&D support is most effective in boosting productivity when it can target firms with high innovation capabilities. In this case, R&D support promotes the reallocation of scarce resources (such as skilled workers) toward more innovative firms as it strengthens their competitiveness, displacing less innovative firms. Conversely, R&D support is less effective when it cannot exclude unproductive firms as it would delay their exit, hampering resource reallocation (Fornaro et al., 2020[35]).

Box 2.7. Direct R&D support in Finland

Most direct R&D support in Finland is disbursed by the Academy of Finland, which allocates grants to basic research, and Business Finland (formerly Tekes), which provides grants and subsidised loans to applied research.

The Academy of Finland

Over the period 2011-20, the Academy of Finland allocated on average about half of its budget to bottom-up research support, which includes research grants to projects proposed by academic researchers and various fellowship programmes. The other half of the budget was allocated to thematic funding, including the Strategic Research Council programmes aimed at establishing extensive multidisciplinary research consortia around four themes (Urban, Health, Work and Security), and the funding for Centres of Excellences and research infrastructure.

The Academy of Finland’s budget decreased in the early 2010s as public spending on innovation was cut back but increased after 2014, as funds for public research institutes like VTT were reallocated to the Academy of Finland to fulfil new responsibilities, such as the Strategic Research Council programmes. Nevertheless, the Academy of Finland is subject to significant resource constraints, which is contributing to low success rates in its bottom-up research grants. For instance, far less than 20% of applications for research grants and fellowship positions have been met with funding during 2011-20, which is very low by international comparison (Arnold et al., 2022[26]).

Business Finland

Business Finland offers loans for firms’ product development and piloting projects, covering 50 to 70% of project costs at a fixed interest rate (currently 1%) without collateral. Should a project fail to produce commercial revenue, a fraction of the loan will not be collected. Business Finland also offers grants to R&D projects covering up to 80% of costs. In 2021, it allocated 59% of its R&D support to grants, 21% to subsidised loans and 20% to its specific research programmes. The grants and loans are available to both large firms and SMEs. Roughly 70% of innovation support was directed to SMEs until 2020. SMEs also enjoy a 10% higher coverage of their project costs by R&D grants than midcap and large firms. Large firms are required to outsource at least 15% of project costs to SMEs or research institutions to receive subsidised loans. The weight of large firms in the R&D support increased to nearly half in 2020, as Business Finland launched the Challenge Competitions scheme (below).

Challenge Competitions scheme

In 2020 and 2021, Business Finland launched Challenge Competitions, which granted about EUR 180 million of R&D support to large leading firms (such as Nokia, Neste and Sandvik) to address major future challenges and increase their innovation investment in Finland. The scheme is expected to strengthen the innovation ecosystem, as 67% of this R&D support to leading firms was used to subcontract SMEs and research institutions (Business Finland, 2022[38]). In return for the R&D support, the leading firms have committed to boosting their R&D and other innovation investments by EUR 870 million, contributing to the government’s 4% R&D target.

Business Finland also funds other co-innovation efforts by groups of firms and research institutions collaborating on creating new international businesses or increasing the export competitiveness of Finnish firms.

Source: Academy of Finland homepage; Arnold et al. (2022[26]); Business Finland homepage.

Supporting investment in intangible capital

Intangible capital plays an integral role in translating innovation into productivity growth (see above). Yet, like R&D, investment in intangible capital is costly and time-consuming, as well as risky and requiring trial-and-error, which likely results in an under-investment (OECD, 2013[10]). Policies to reboot Finland’s innovation ecosystems should thus go beyond R&D to stimulate investment in a wide range of intangible capital. However, while public support to R&D is based primarily on the presumption that R&D generates large positive externalities that cannot be fully appropriated by the investor, this may not necessarily apply to intangible capital. For instance, some types of intangible capital like design or software are protected by intellectual property rights. Other types of intangible capital, like organisational structures, are highly firm-specific and cannot be replicated easily by competitors. Many forms of intangible capital are also often closely related to the commercialisation of innovation (Corrado and Hulten, 2010[8]), which brings investors more tangible financial returns than basic or applied research. These characteristics of intangible capital investment indicate that conventional policy support for R&D like tax credits may not be an appropriate tool for fostering intangible investment.

The experiences from OECD countries suggest that the schemes in line with the Centres of Excellence or Competence Centres are effective in supporting intangible investment. For example, Germany has 26 Mittelstand 4.0 Centres of Excellence that offer a wide range of services helping SMEs develop organisational changes to leverage digital technologies effectively. These services include demonstration factories and managerial consultations that help SMEs develop their own solutions to exploit digital technologies. The government could consider setting up a platform similar to the Strategic Centres for Science, Technology and Innovation (SHOKs) while addressing the shortcomings identified in the past evaluation exercise (see above).

Removing the skills bottleneck to unleash innovation

Skills shortages are more serious in Finland than elsewhere

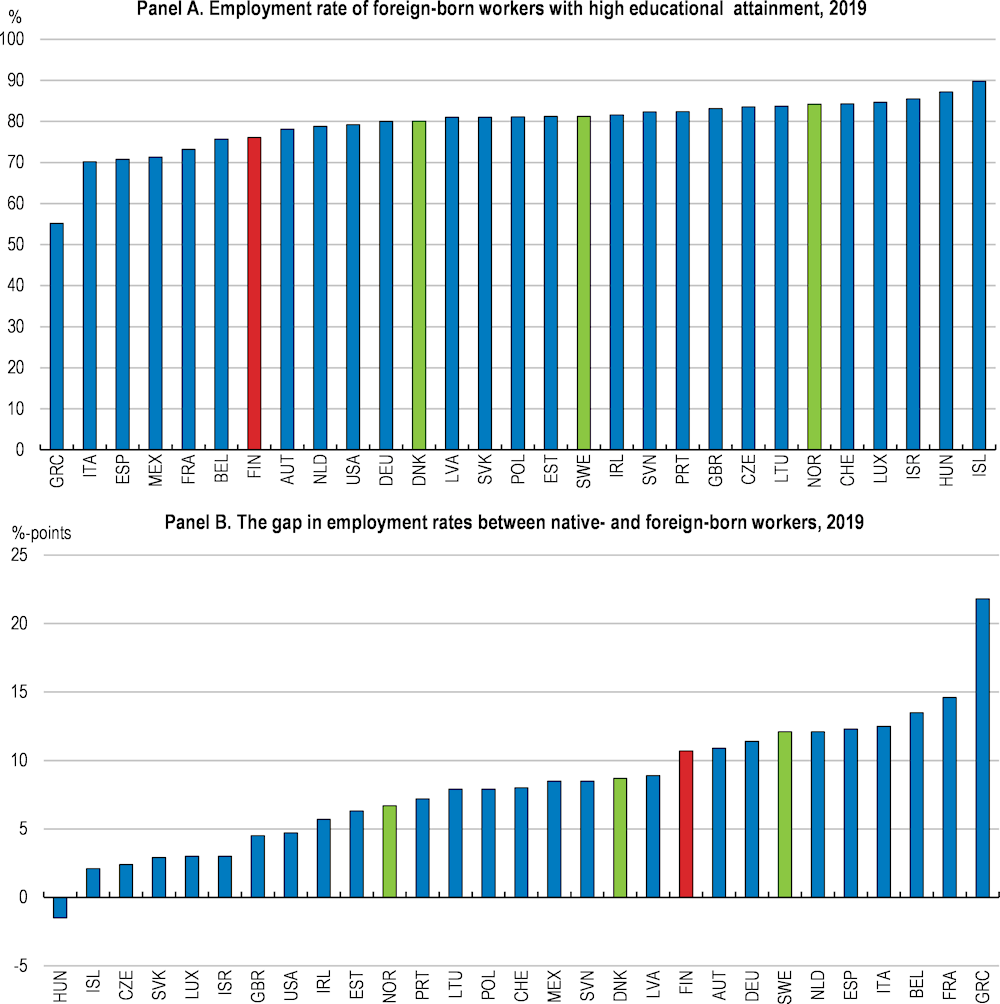

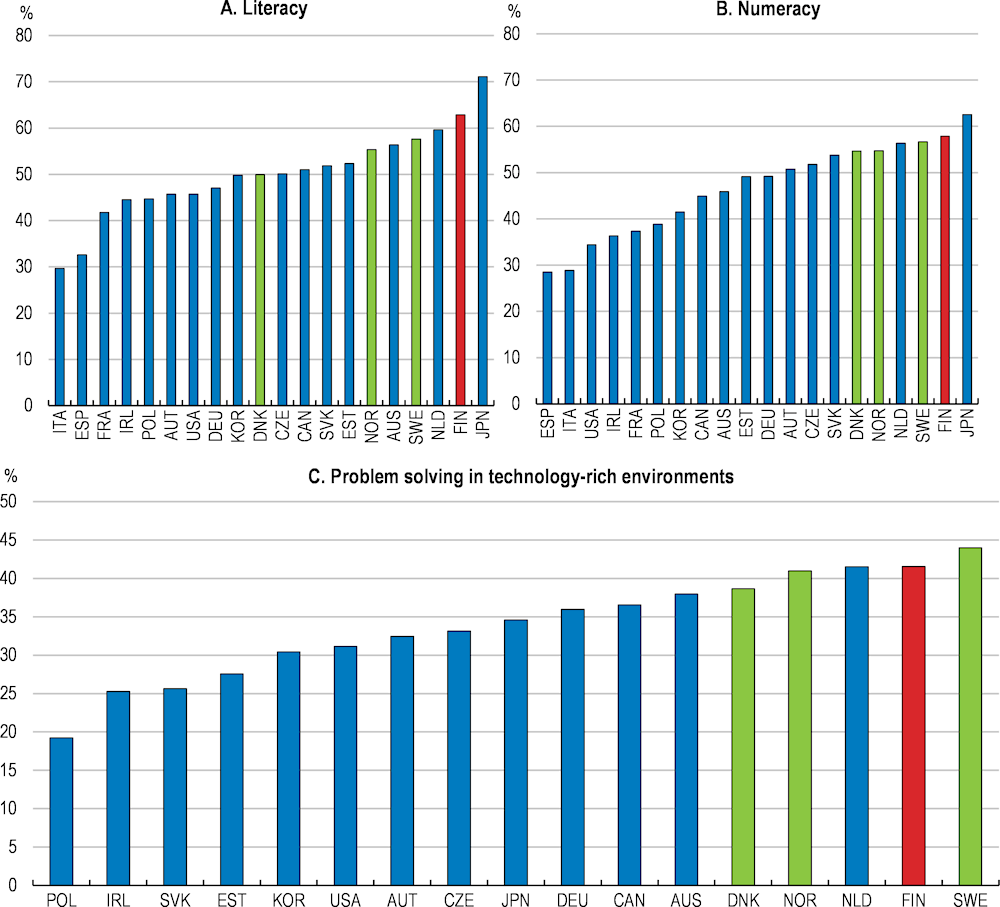

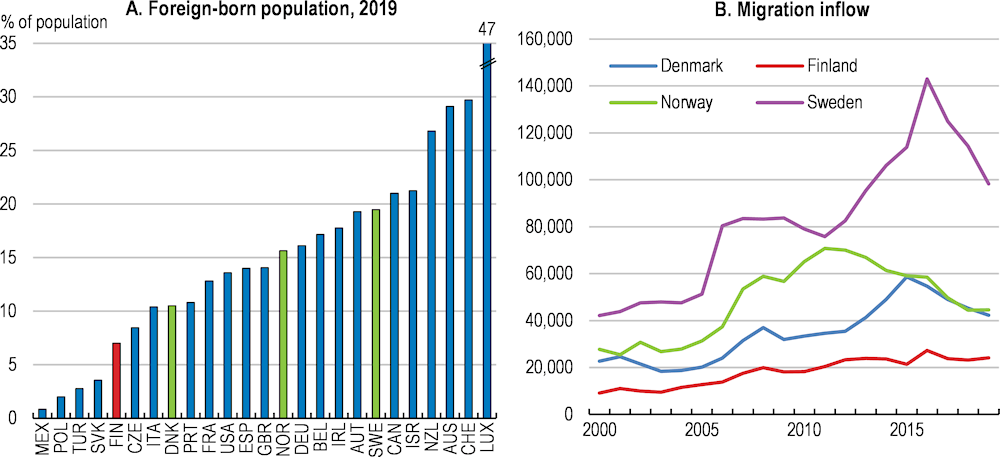

Finland boasts one of the most skilled workforces in the OECD economies. For instance, the shares of working-age adults excelling in literacy, numeracy and problem solving in technology-rich environments are all among the highest in the OECD countries (Figure 2.17). A relatively high share of graduates from tertiary education hold degrees in natural science, mathematics, ICT and engineering fields (Figure 2.18). Yet, Finland is suffering severe skills shortages. On the one hand, the fast pace of innovation and digitalisation is generating high demand for skilled workers (Hirvonen, Stenhammar and Tuhkuri, 2022[39]). For instance, the Finnish Federation of Technology Industries (Technology Finland) estimated that Finland’s high-tech industries will need to hire 130 000 experts over the next ten years, a 41% increase over their current employment (Technology Finland, 2021[40]). Finland’s public employment service also foresees persistent shortages of skilled workers required to exploit new technologies in various sectors including Medicare (in occupations like Medical Practitioners and various laboratory and equipment technicians as well as Nursing Professionals), ICT (Software and Application Developers, Application Programmers) and Construction (Civil Engineers). On the other hand, Finland’s skills supply is constrained by low tertiary educational attainment among young adults and a small inflow of skilled immigrants (see below). A massive increase in skills supply is needed just to prevent population ageing from reducing Finland’s skilled workforce and inevitably its growth potential: half of the required increases in experts foreseen by Technology Finland is due to the retirement of older skilled workers.

Figure 2.17. Finland’s workforce boasts high skills

Percentage of surveyed adults with high proficiency levels, 2012

Note: For literacy and numeracy, high proficiency corresponds to Level 3 and above. For problem solving in technology-rich environments, high proficiency corresponds to Level 2 and above. See the OECD Survey of Adult Skills for details.

Source: OECD Survey of Adult Skills.

Skills shortages are a more significant bottleneck for innovation in Finland than in other OECD economies for two reasons. First, the shortages of highly skilled workers in Finland are severe compared with many other OECD countries. For instance, more than nine out of ten jobs experiencing labour shortages in Finland were in high-skill occupations, such as managerial or professional occupations, which is the highest share across OECD countries where on average five out of ten jobs in shortage were in high-skill occupations (OECD, 2018[41]). Second, Finland’s good framework conditions for innovation including the business-friendly regulatory settings and good access to capital (see Chapter 1) make the skills shortages the most important bottleneck. The shortage of qualified personnel holds back innovative firms from expanding R&D and collaborating with research institutions. It also makes it difficult for innovative firms to scale up for instance through exports, thereby limiting the return to innovation (see Section 2.5).

Figure 2.18. Finland’s share of STEM graduates is high

The share of tertiary education graduates in fields of natural science, mathematics, ICT and engineering, 2019

Note: The share of tertiary education graduates in the following fields: Natural Science, Mathematics and Statistics; Information and Communication Technologies; and Engineering, Manufacturing and Construction.

Source: OECD, Education at a Glance database.

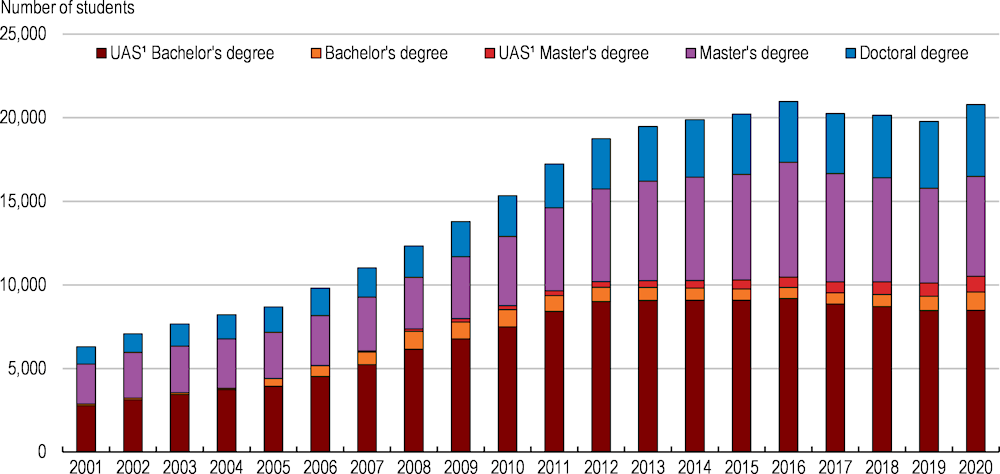

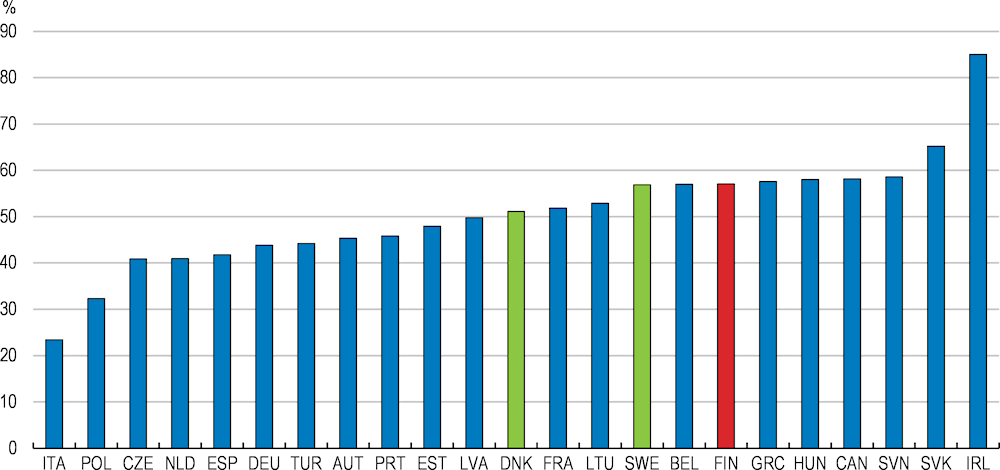

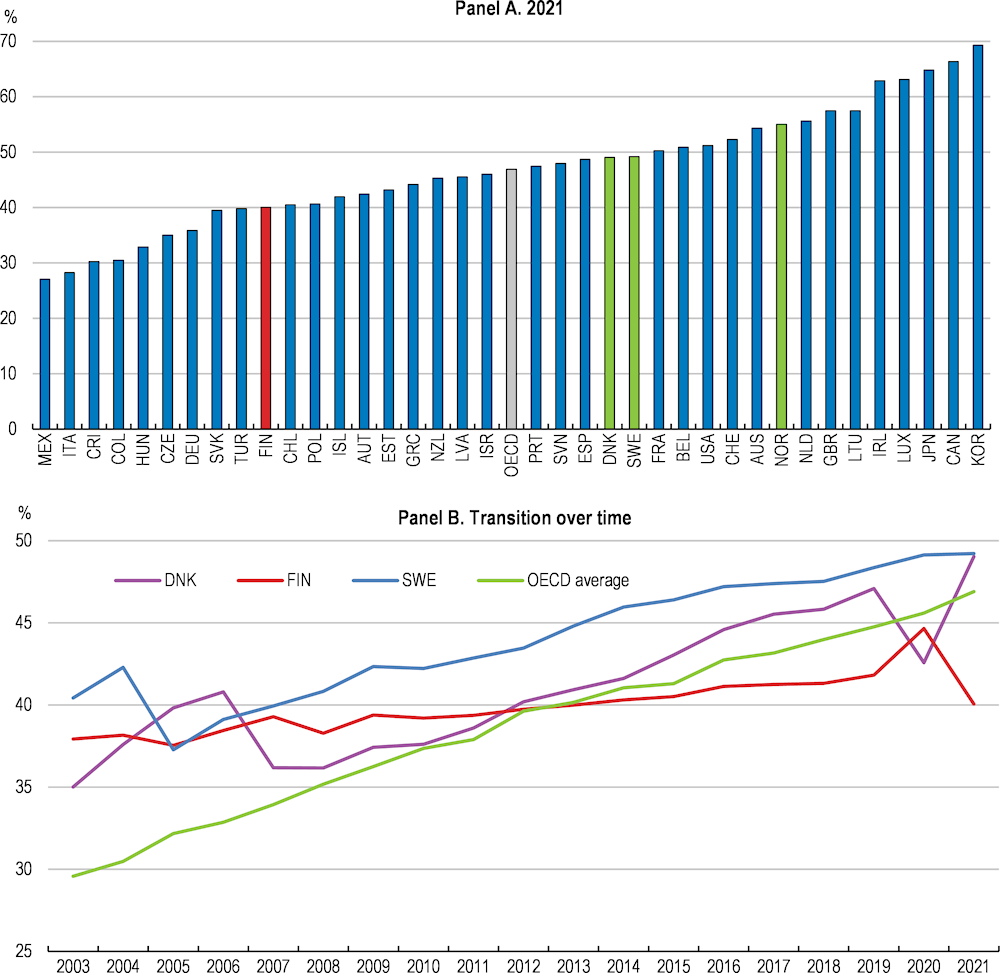

Low tertiary educational attainment among youth has been a long-standing issue

Young adults’ tertiary educational attainment is low in Finland compared with many other advanced OECD economies including Scandinavian peers (Figure 2.19, Panel A). The attainment rate improved little since the early 2000s, in contrast to many OECD countries including Sweden and Denmark (Figure 2.19, Panel B). This owes to severe shortages of study places in universities relative to demand, which results in high application rejection rates. During 2015-20, universities in Finland accepted only 30% of applicants while universities of applied sciences (UAS) accepted 33%, the lowest rates among the 14 OECD countries reporting admission rates (OECD, 2021[42]). The long study time at universities also contributes to low tertiary educational attainment among youth: university students most commonly take six years to complete their degrees while UAS students take five years (OECD, 2021[42]). The challenging transition from upper secondary education to tertiary education and long study time result in individuals graduating from tertiary education for the first time on the average age of 27.3, about two years older than the OECD average (25.4). Only 77.2% of the first-time graduates with bachelor’s degree are younger than 30, the share that is among the lowest in the 29 OECD countries with comparable statistics, constraining the supply of young, qualified workers.

The government has been tackling the shortfall in study places for many years. The Vision for Higher Education and Research in 2030, published in 2017, included a commitment to increase the share of higher education graduates to at least 50% of the 25-34 years-olds by 2030 (it was 44% in 2020). This would require increasing the number of graduates in that age group by 34 500 from 2019 to 2030 (OECD, 2021[42]). The current government’s policy priorities for higher education include ensuring that the number of available student places at universities and UAS meets the needs of society, taking into account regional employment needs (The government of Finland, 2019[43]). The government funded an additional 4 248 study places in 2020 and has committed to funding 5 954 additional study places during 2021-22. Nevertheless, these increases fall short of the pace needed to generate additional graduates needed to attain the 50% target (OECD, 2021[42]). The government has not yet provided a clear long-term plan laying out the number of study places to be increased and a commitment to greater funding to meet the target. A clear budgetary commitment is essential since the increases in study places will have to be funded mostly by the government, given that Finland does not charge tuition fees for tertiary education except for foreign students from outside the European Union.

Figure 2.19. Tertiary educational attainment among young adults is relatively low and has improved little

Percentage of 25-34 year-olds having completed tertiary education

Note: Panel A data refer to 2020 for Chile. The OECD average in panel B is calculated based on countries which data are available.

Source: OECD (2022), Education at a Glance 2022.

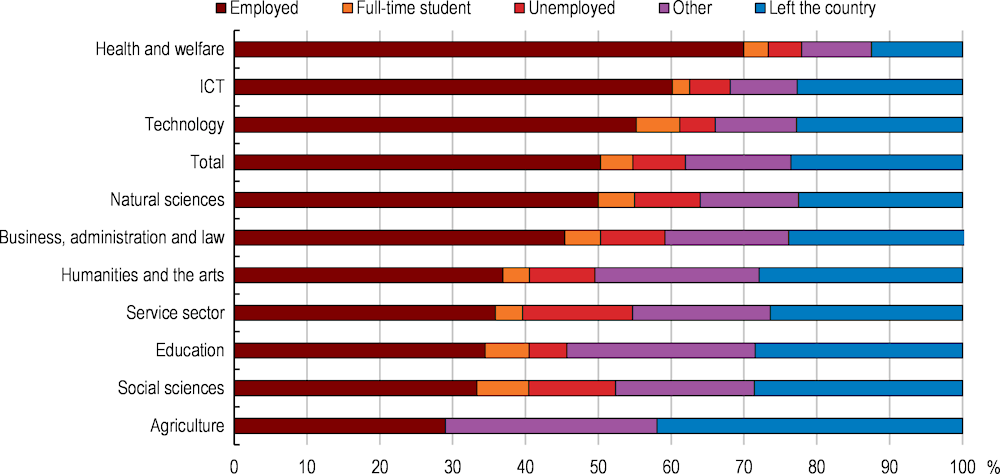

Allocation of study places should become more flexible and responsive to labour market demand

The government’s financial efforts to increase study places need to be matched by reforms to increase flexibility in the allocation of study places across study fields. In Finland, study places in UAS and universities are allocated by study field, as the result of consultation between the Ministry of Education and Culture and higher education institutions, informed by forecasts on labour market demand. In practice, additional study places are allocated across higher education institutions based on each institution’s willingness and capacity to accommodate additional students (OECD, 2021[42]). The allocation of study places is therefore highly rigid and may not reflect labour market demand well in the end. The highly supply-side driven allocation of study places contrasts with other countries charging tuition fees for tertiary education, where the allocation of study places is primarily driven by students’ demand.

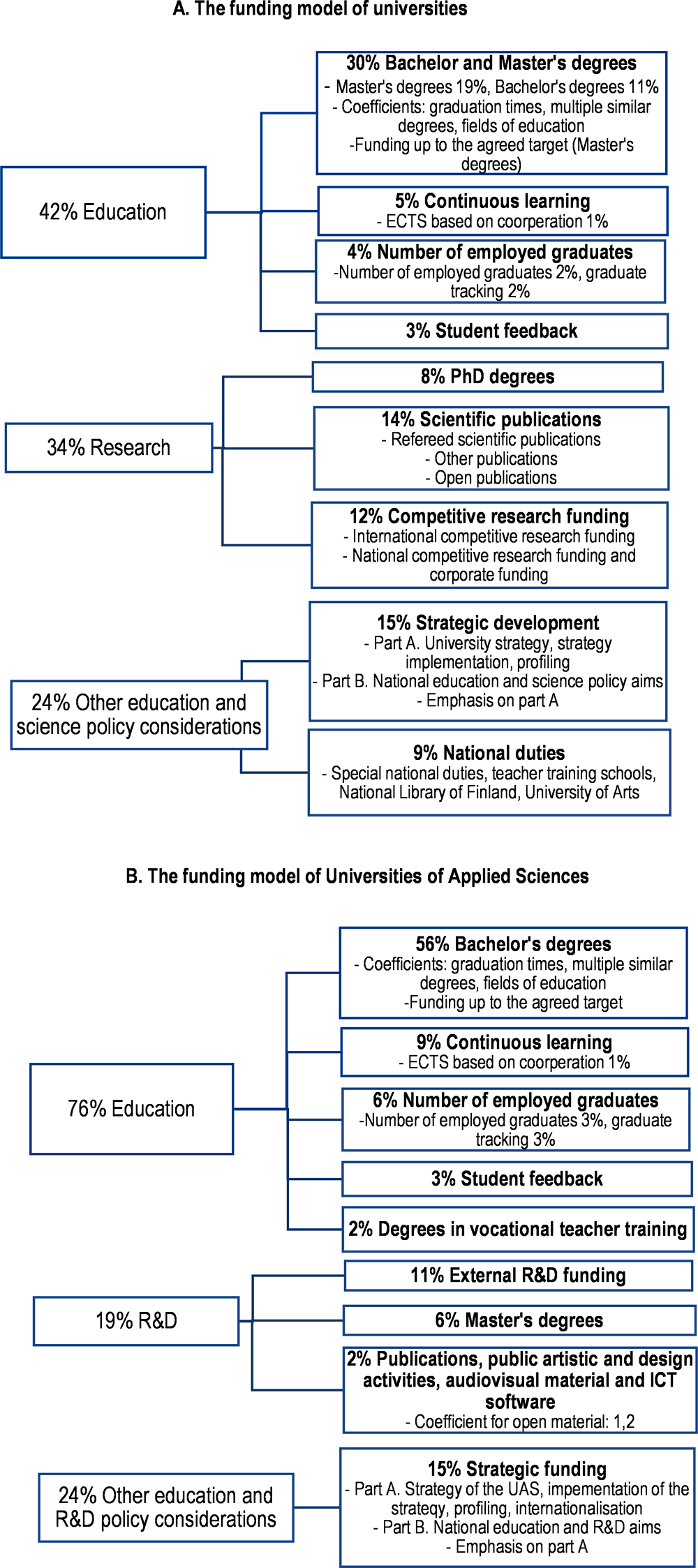

The funding models of universities and UAS, together with the strong autonomy of these institutions in managing their financial resources, limit the capacity of the government to direct higher education institutions to increase the enrolment of students in fields of study with strong labour market demand (OECD, 2021[42]). For instance, the weight of the provision of bachelor’s degree programmes in the funding for universities is only 11%, lower than the weight of scientific publications (14%) or competitive research funding (12%) (Figure 2.20, Panel A). This weight may be reduced, as universities will be receiving larger research funds as the government expands its R&D spending to meet the 4% R&D target (see above). Similar tend would apply to UAS, which weight of bachelor’s programmes is nevertheless much larger than that of universities (56%) (Figure 2.20, Panel B).

It is important to tighten the government’s control over higher education institutions’ bachelor’s degree programmes. The Ministry and higher education institutions agree on graduation numbers in each field of study during the budgetary cycle. However, these numbers are base assumptions for computing the budget disbursed to each higher education institution and is not statutory targets the institution is required to meet. The only statutory targets the government imposes to higher education institutions are the caps on the numbers of enrolment into study fields with weak labour market demand (OECD, 2021[42]), which do not involve significant financial penalties when institutions do not respect them. The government should introduce statutory targets on the minimum number of enrolment and graduates to be attained by each higher education institutions.

An increase in the number of study places should be flanked by additional academic and/or pastoral support for students to maintain the high quality of education and the levels of graduation rates. In 2019, 42% of students aged under 30 graduated from the tertiary education for the first time, a share that is about the OECD average. As many university students in Finland work part time during the long study period (see above), some of them may choose to leave universities without completing degrees to work full time, especially if faced with strong financial needs. In the academic year 2019/20, 6.2% of UAS students and 4.8% of university students discontinued their education, which would have led to a qualification. Without a formal degree, these individuals can face difficulties in upgrading their skills later in their careers and may have to return to universities as adult learners. Measures to prevent non-completion should be put in place and target students from disadvantaged socio-economic backgrounds, who face higher opportunity costs from spending five to six years of their prime working ages in tertiary study.

Figure 2.20. Undergraduate study has only a small weight in universities’ funding model

Source: Ministry of Education and Culture.

Further reforms in admission processes complement the study places reform

The government has complemented its efforts to increase the number of study places with reforms of admission processes in higher education institutions. For instance, UAS have adopted a common standardised test for assessing applicants’ aptitude in most study fields in 2019. However, universities have preferred to select applicants through 180 distinct entrance examinations each highly specific to the subject of study, adding significant burdens to applicants (OECD, 2021[42]). From 2020, admissions to just over a half of study places in higher education institutions have shifted to certificate-based admission, which is based on the grades of the matriculation examination at upper secondary schools and initial vocational qualifications from vocational institutes.

Applicants whose grades did not reach the required levels of certificate-based admissions still have to take entrance examinations to compete for the rest of the study places. However, the matriculation examination grades only become available shortly before mid-May, when the first entrance examinations for universities start. It is essential to secure more time between certificate-based admissions and entrance examinations to allow applicants sufficient preparation, even though universities are required after 2018 to ensure that their entrance examinations do not require lengthy preparation. Due to an overall increase in the number of study places, the number of places based on entrance examinations will increase even though its share in total study places will decline. This underscores the importance of a reasonable admission process to ensure a smooth transition from upper secondary schools to higher education institutions.

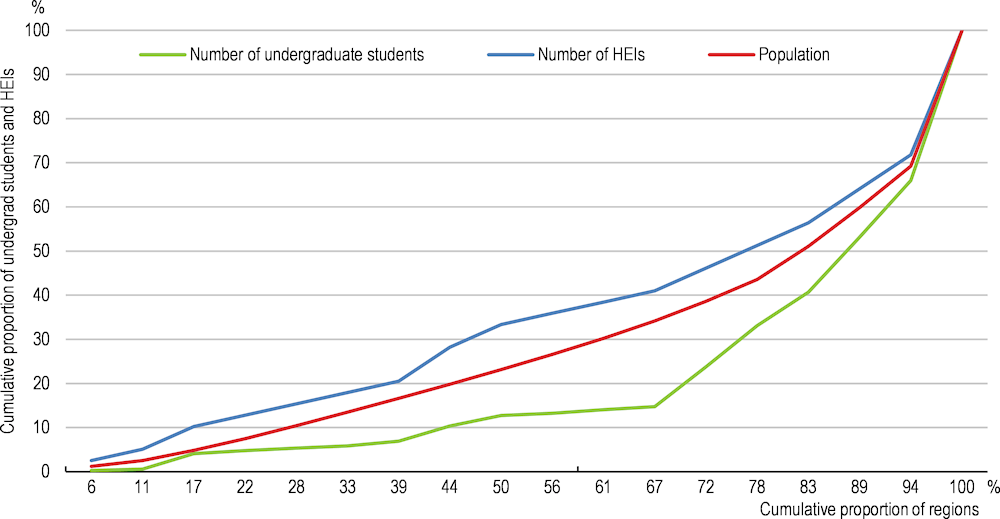

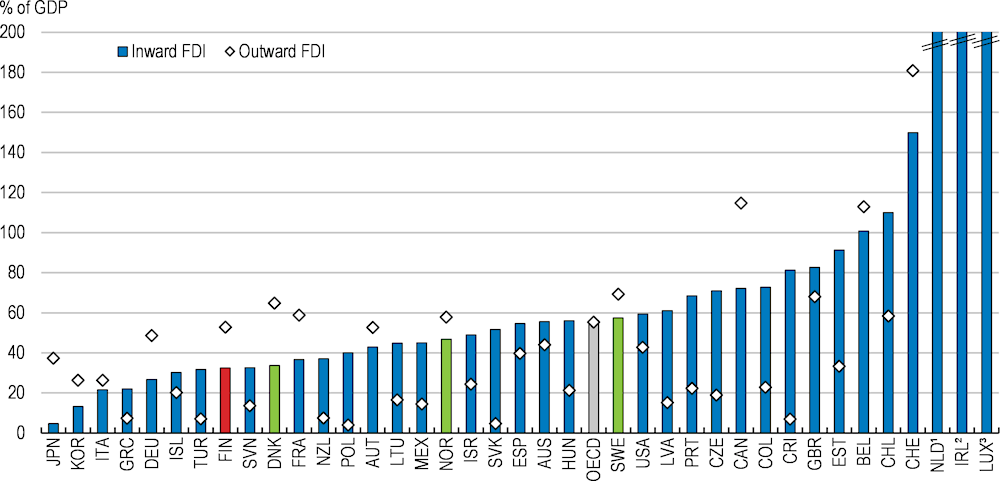

The regional allocation of additional study places should reflect real demand