A changing climate is threatening livelihoods and economic activity in Greece and the world. Transitioning to a green economy – mitigating the causes of climate change and adapting to its effects, while sustaining activity and improving well-being – is among the greatest policy challenges of the coming decades. In Greece, legacies of high emission intensity, limited fiscal space and scarce private financing amplify the challenge. Greening Greece’s energy system is at the core of this transition. This entails swiftly developing its large potential for renewable energies and adapting energy consuming sectors. A well-chosen mix of policies – including carbon pricing, public infrastructure investments, and gradually tightening regulations on minimum energy efficiency standards, while providing financial support and protecting vulnerable households – would minimise the costs of this transition. Developing insurance coverage can better protect households and firms from damages resulting from a warming climate, while limiting fiscal exposure. Engaging all stakeholders and supporting those affected by the transition will help build the consensus for implementing these policies into the long term.

OECD Economic Surveys: Greece 2023

2. Transitioning to a green economy

Abstract

Climate change is making the transition to a green economy imperative

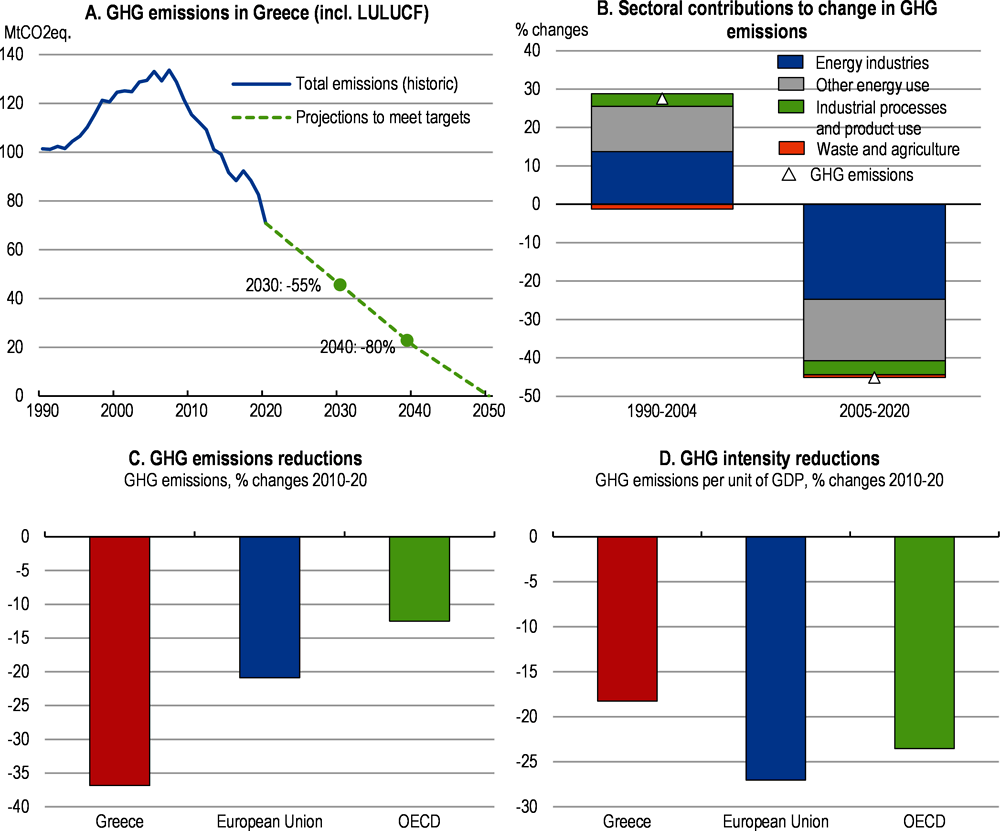

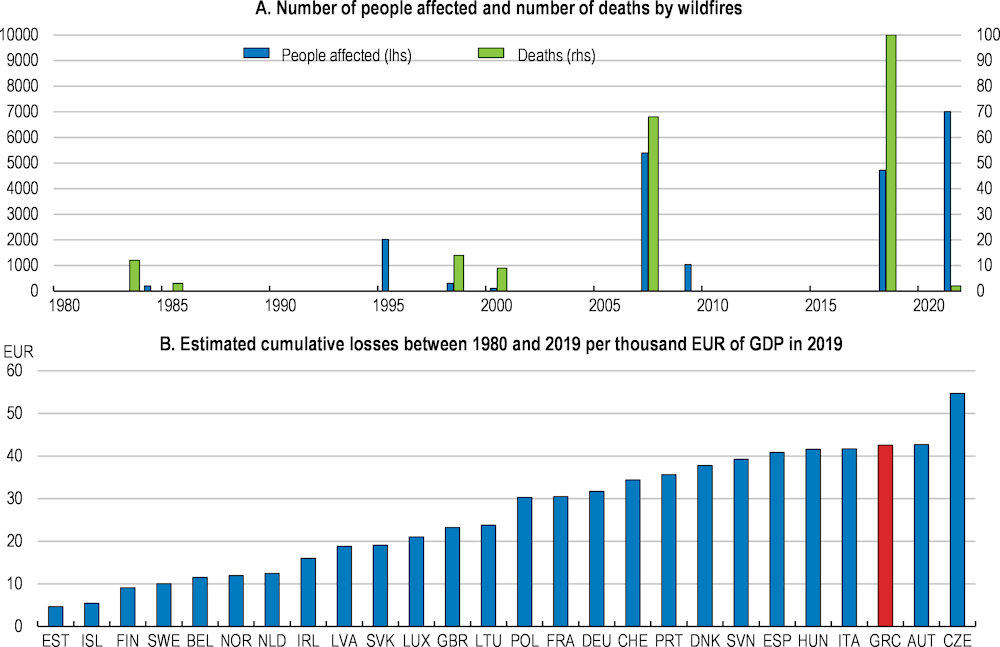

The climate in Greece is changing. Higher average temperatures and more extreme weather events are harming well-being, challenging the economy and threatening livelihoods. Disruptions are likely to grow as climate change accelerates, even if adaptive measures can reduce some of the damages. Over recent years Greece has cut its greenhouse gas emissions (GHG) faster than most OECD countries. By 2050, it has committed to reach net-zero GHG emissions in line with the Paris Agreement, and it has adopted ambitious intermediate targets to get there in time. Greece recognises the need for immediate policy action to help people and businesses to become more resilient to a changing climate, as the priorities of its Recovery and Resilience Plan and the creation of the Ministry for Climate Crisis and Civil Protection demonstrate.

Transforming the economy to mitigate and adapt to climate change will ultimately improve people’s lives and firms’ productivity. With 70% of emissions generated by fossil fuels, shifting to a green energy system is at the core of this transition, and promises wider benefits. Energy prices increased substantially since the recovery from COVID-19 and the war in Ukraine (discussed in Chapter 1). High energy bills weigh on production costs for firms’ and households’ purchasing power. Replacing fossil fuels with renewable sources will reduce dependency on oil and gas imports. Many buildings in Greece are not energy efficient and energy poverty is widespread. Renovations will improve housing quality and lower energy bills. Reliance on cars is high, as are air pollution, accidents and road congestion. Shifting to net zero emissions from transport will entail greener and less polluted cities and improved access to transport modes other than cars.

Notwithstanding the long-term benefits, transforming the economy brings inherent costs, especially in the short run. Businesses in sectors ranging from transport to tourism are likely to experience higher costs and will need to invest and restructure their operations. Capital bound up with fossil fuels needs to be replaced and new infrastructure needs to be built. Some products, especially those intensive in carbon, will become more expensive because of carbon pricing policies. Financing capacity has been curbed by the decade-long economic crisis, and the transition will absorb scarce fiscal space and private finance, especially once the exceptional NextGenerationEU facility concludes in 2026. Mobilising capital while cutting emissions and adapting to a changing climate, all at the lowest cost to households, firms and the public sector, are key challenges for Greece for the coming decades. Sustaining a broad consensus for the comprehensive and long-ranging changes involved in transitioning to a green economy will be essential to achieve this. Legacies of low levels of public trust and inconsistent government implementation capacity challenge these goals.

This chapter identifies a mix of policies to help Greece transition cost-effectively to a green economy, by mitigating its contribution to climate change and adapting to a changing climate in a socially and politically acceptable way. The analysis and recommendations are informed by new research conducted by the OECD and the International Transport Forum, assessing different policy options for Greece to cut emissions, and their macroeconomic and distributional consequences. The chapter first focuses on the central role of the green energy transition to meet Greece’s GHG emission goals and discusses key cross-sectoral policies as well as macroeconomic and fiscal implications. It then discusses how policies specific to key sectors can support this transition, then on policies to support households and businesses to reduce vulnerabilities by adapting to a hotter and more volatile climate. The final section discusses how these long-term policy programmes for mitigating and adapting to climate change can be implemented by building a consensus and supporting firms and workers through the green transition.

Towards net-zero via the green energy transition

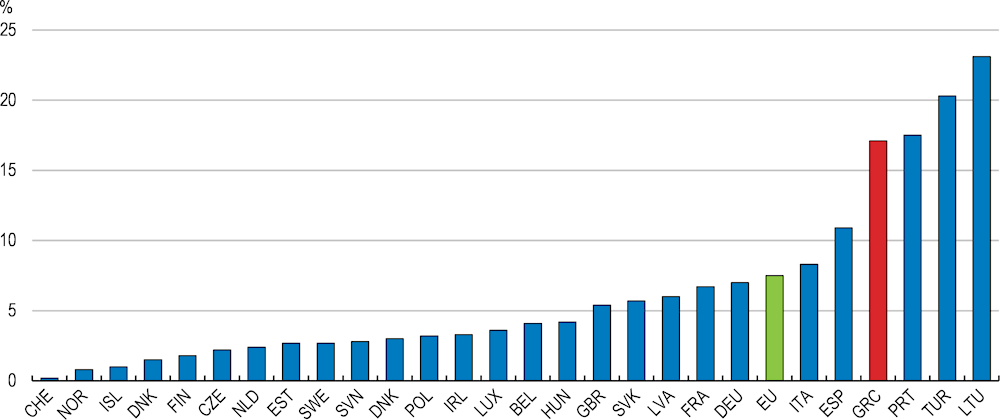

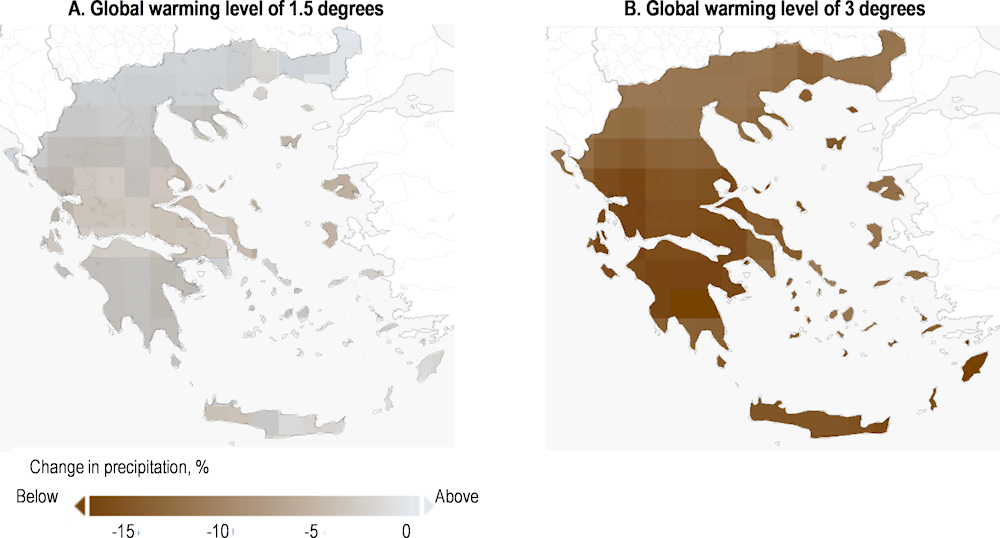

Greece has achieved large reductions in greenhouse gas (GHG) emissions since their peak in 2005 (Figure 2.1, Panel A). This reduction was largely associated with the nearly thirty percent contraction in Greece’s GDP during the economic crises of the 2010s, which compressed energy demand, while a shift in energy sources away from coal and oil towards natural gas and renewable energy reduced emission intensity (Figure 2.1, Panel B). This is reflected in the fact that total emissions declined faster than the OECD and the EU (Figure 2.1, Panel C), while the decline in emissions per unit of GDP was slower (Figure 2.1, Panel D). In 2020, Greece’s economy remained more emission-intensive than the OECD average (Figure 2.2, Panel A), reflecting a combination of low energy use per unit of GDP (Figure 2.2, Panel B) but high emissions per unit of energy produced (Figure 2.2, Panel D), also because power and heat generation uses more fossil fuels than in most other OECD countries (Figure 2.2, Panel C).

Figure 2.1. Greece needs to sustain its recent pace of GHG emission reductions to reach net zero

Note: Panel A: GHG emissions include land use, land-use change and forestry (LULUCF). Preliminary data for 2019. The reduction for 2030 and 2040 are relative to the 1990 GHG emission level. Panel B: GHG emissions exclude LULUCF.

Source: OECD (2022), Environment: Air and climate (database); and European Environment Agency (2021), EU Emissions Trading System (ETS) data viewer.

Greece has adopted ambitious plans to reduce GHG emissions over recent years (Box 2.1). In 2022 it raised the targets in its National Energy and Climate Plan and in its Climate Law is now committed to cutting GHG emissions by 55% by 2030 and 80% by 2040 compared to 1990 levels, in line with recent EU-level targets. Achieving these targets while sustaining growth in economic activity will require Greece decoupling GHG emissions from economic activity faster than achieved thus far.

Box 2.1. Greece’s main policy plans and goals for the green economy transition

The main policy goals and measures relating to the green economy transition are set out in the National Energy and Climate Plan, the National Climate Law, and the Recovery and Resilience Plan “Greece 2.0”, which dedicates 37.5 % of grants and loans to green objectives. Overall, EUR 6.2 billion (3% of 2021 GDP) are budgeted for the green transition, which are expected to mobilise a total of EUR 11.6 billion (6% of 2021 GDP) (Table 2.1). Focusing on adaptation, the National Strategy for Adaptation to Climate Change provides guidelines and indicative actions, which will support identifying policy priorities and devising action plans at the regional and local level through Regional Plans for Adaptation to Climate Change, which are currently being finalised.

Table 2.1. Policy targets and measures for achieving the green economy transition

|

National Energy and Climate Plan (2019) |

National Climate Law (2022) |

Greece 2.0 (2021) |

|

|

Total greenhouse gas emissions |

By 2030 reduction of 43% compared to 1990 level |

By 2026, introduction of 5-year sectoral carbon budgets By 2030 reduction of 55% compared to 1990 level By 2040 reduction of 80% compared to 1990 level By 2050 reach net-zero |

|

|

Energy industry |

After 2028, ban of lignite for power generation; close lignite plants currently in operation by 2023 By 2030, at least 35% of final energy consumption from renewable sources By 2030, connecting to mainland or upgrading power grid for remaining 29 unconnected islands |

After 2028, ban of solid fossil fuels for electricity generation, which can be brought forward until 2025 From 2023, requirement for most new and large buildings generate electricity on-site from renewable sources |

Investments for electricity storage (EUR 0.5 bn), interconnection of islands (EUR 0.2 bn), and upgrading electricity network (EUR 0.1 bn) Reform account for Renewable Energy Sources (EUR 0.2 bn), licensing procedures and spatial planning for renewable energy sources |

|

Buildings |

In 2030, limit final energy consumption to 16.5 Mtoe Upgrade energy efficiency of 60 000 dwellings on average annually Renovate 3% of floor area of central public administration buildings annually |

From 2025, sale and installation of heating oil burners is prohibited From 2030, sale of heating oil is allowed only when it is mixed at least 30% with renewable fuels |

Investment subsidies for energy saving actions, including renovations, for households (EUR 1.25 bn), businesses (EUR 0.5 bn) and public sector (EUR 0.2 bn) Create framework for tackling energy poverty |

|

Transport |

By 2030, 30% of registrations for new vehicle are zero-emissions |

From 2030, only new passenger and light commercial vehicles with zero emissions can be sold From 2024, one fourth of business cars have to be electric or plug in hybrid emission below 50 CO2/km From 2026, in Athens and Thessaloniki, new taxis and one third of new rental cars have to be electric |

Subsidies for charging stations and electrification of public transport (EUR 0.2 bn); framework for charging stations R&D investment to cut emissions on carbon capture and passenger shipping (EUR 0.3 bn) |

|

Adaptation |

Investment to upgrade water management infrastructure (EUR 0.2 bn), flood protection (EUR 0.1 bn), and civil protection (EUR 0.4 bn) |

Note: The table shows selected policy targets and measures.

Source: National Energy and Climate Plan; law 4936/2022 “National Climate Law - Transition to Climate Neutrality and Adaptation to Climate Change”; Recovery and Resilience Plan Greece 2.0.

Figure 2.2. Greening energy use is crucial for decoupling emissions from economic activity

1. Greenhouse gas (GHG) excl. LULUCF emissions intensity per unit of GDP, kg/USD, 2015 PPP

Source: OECD (2022), OECD Environment Statistics (database); and OECD (2022), OECD Economic Outlook (database).

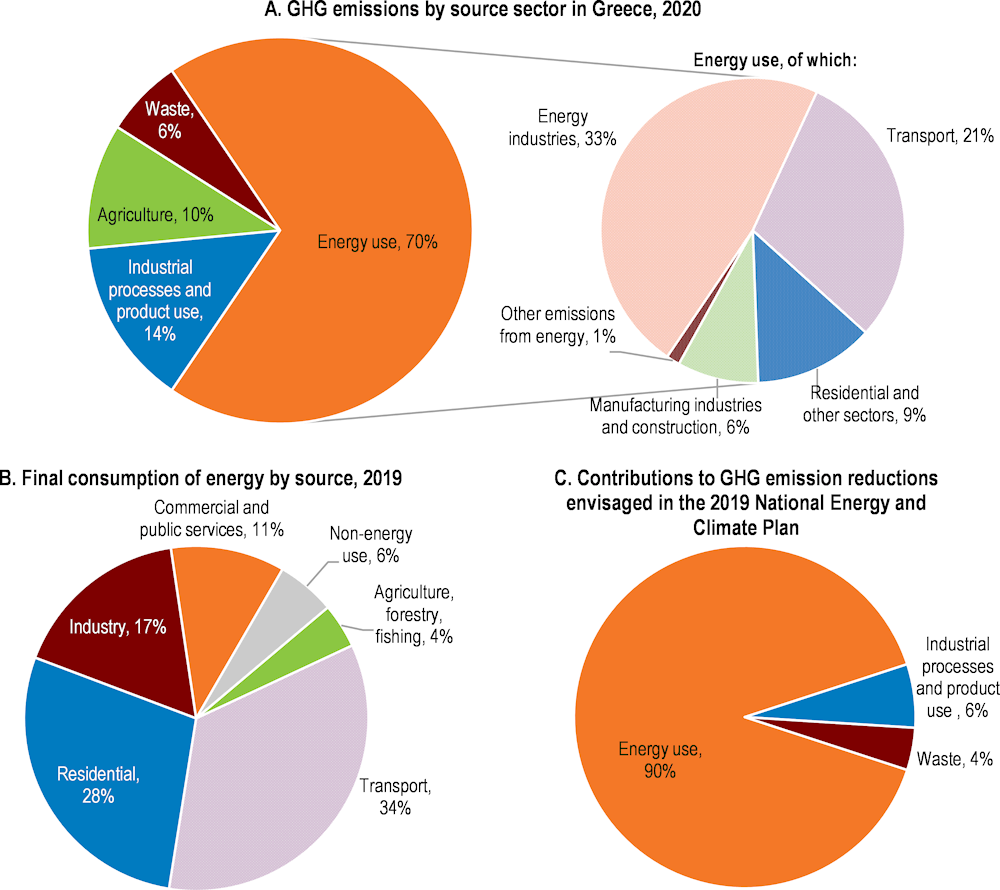

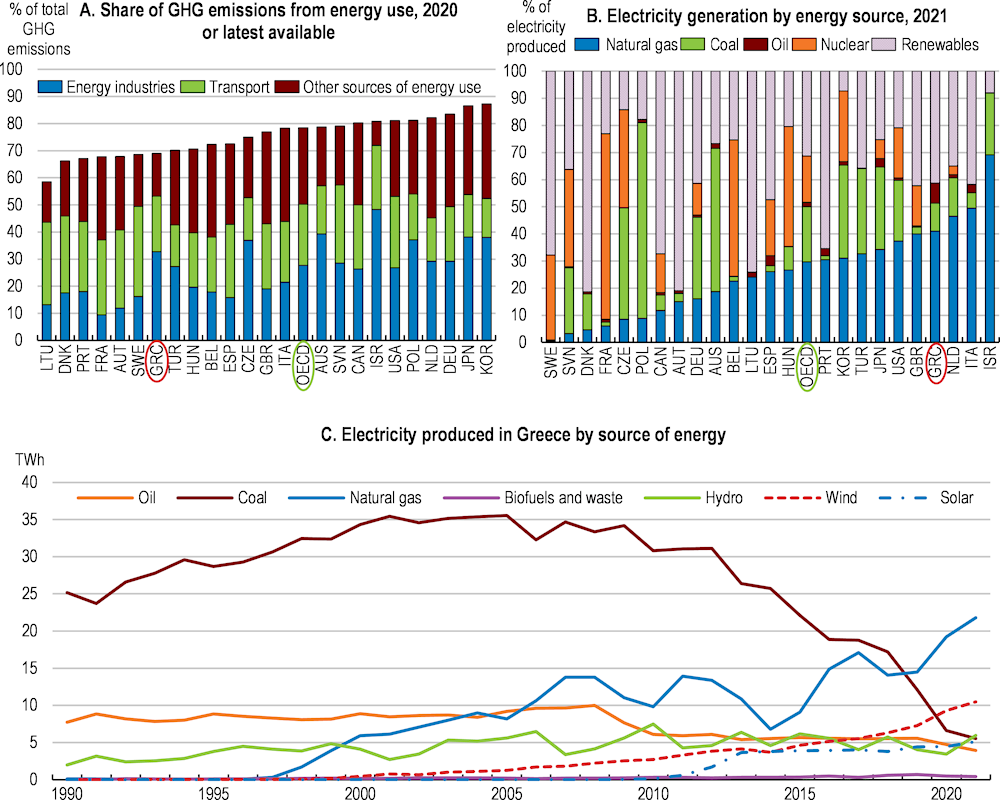

This Section provides an overview of the policy mix likely to be required to meet Greece’s emission reduction goals, focusing on the green energy transition – the shift from fossil fuels to renewable sources. It first presents how reducing the 70% of total emissions that arise from energy use (Figure 2.3, Panel A) can contribute to Greece’s mitigation targets. It then discusses key policies to cut emissions from energy use across sectors to achieve the transition at lowest costs, with sector-specific policies then discussed. It concludes by discussing macroeconomic implications for growth, investment needs and the fiscal impact of transforming the energy system.

Achieving the green energy transition is key for reaching emission targets

Greece aims to transition to a green energy system to meet its GHG emission targets for 2030. Greece’s National Energy and Climate Plan Energy envisages about 90% of emission reductions until 2030 coming from energy use (Figure 2.3, Panel C). The plan is currently under revision to account for its new intermediate emission targets. Sizeable increases in energy use from renewable sources will likely be required to meet these targets, given the large share of GHG emissions from energy use (Figure 2.3, Panel A). OECD modelling (OECD, 2022[1]) suggests that reaching a share for renewable sources of 70% of primary energy consumption would allow Greece to meet its 2030 GHG emissions target, while reaching a lower share from renewable sources would require achieving more sizeable reductions from emissions not related to energy use.

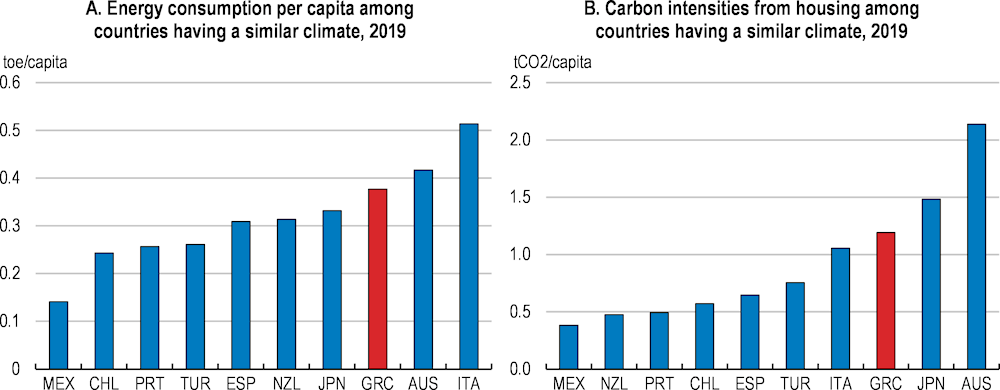

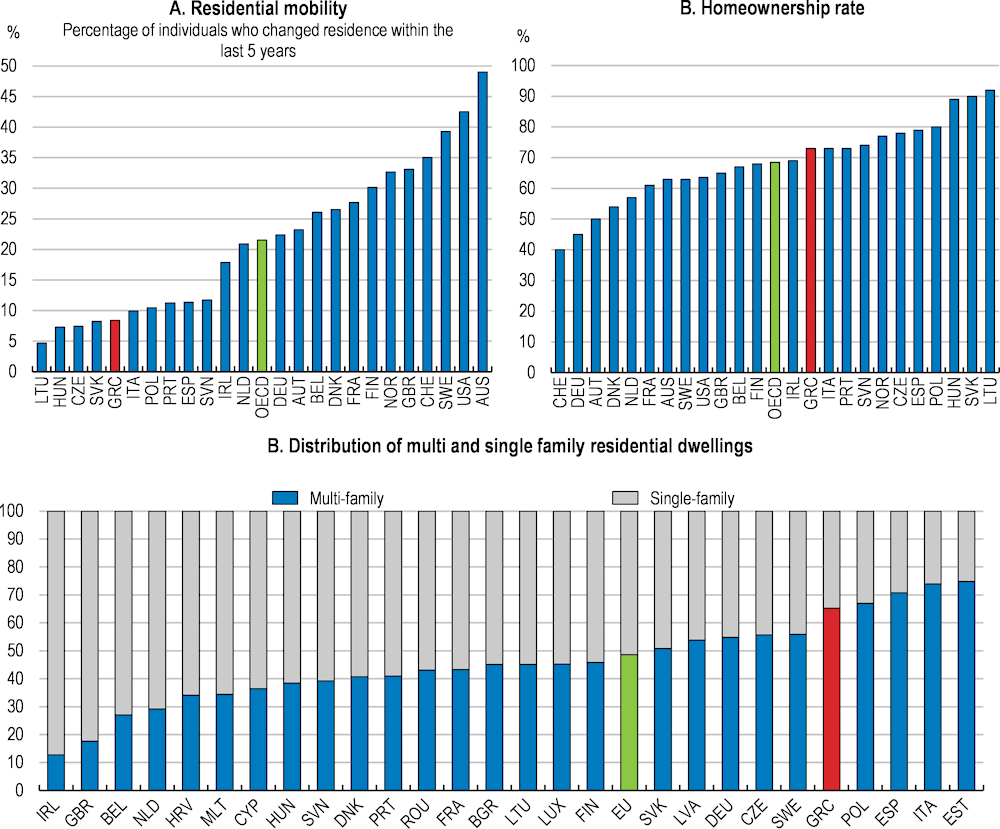

Upscaling power generation from renewable sources will be key to achieving the green energy transition. In addition, to expand the role of renewable sources, energy use in energy consuming sectors needs to adapt. Most energy is consumed for housing and transport, discussed below, which together account for almost two thirds of final energy use (Figure 2.3, Panel B). Adapting energy use in these sectors to achieve Greece’s policy goals for 2030 will be challenging. For transport, given Greece’s high car dependency, this entails either replacing its large fossil-fuelled car fleet with more expensive low- or zero-emission vehicles, or shifting transport off the road. For buildings, the latest available data indicate that 70% of final energy consumption come from the direct use of fossil fuels, mostly for heating (MoEE, 2018[2]). Swiftly upgrading Greece’s building stock through renovations, improving energy efficiency and replacing machinery will be crucial to reduce reliance on fossil fuels.

Figure 2.3. Transforming the energy system will achieve the largest emission cuts

Note: Panel B: Agriculture includes other non-specified energy use.

Source: OECD (2022), Air and Climate, Environment Statistics (database); IEA (2022), IEA World Energy Statistics and Balances (database).

In the longer-term, shifting to low-emission energy sources will not be enough to be reach net zero. Just under one-third of GHG emissions are unrelated to energy use and arise from chemical reactions in industrial processes and product use, agriculture, and waste (Figure 2.3, Panel A). Half of these emissions arise from industrial processes, for example when producing cement or steel, and are mostly covered by the EU Emission Trading Scheme (ETS) (MoEE, 2020[3]). International cooperation and gradually rising prices under the EU-ETS can encourage reductions in these sectors, for example by accelerating the diffusion of technologies to produce cement and steel with less energy, improve recycling of materials, and boost research into new technologies, such as carbon capture and hydrogen (OECD, 2019[4]).

Emissions from agriculture, for example from livestock, contribute 10% of Greece’s total GHG emissions. Substantial emission reductions can be achieved by providing financial incentives to adopt already available measures to either absorb more emissions in agricultural soils or reduce emissions from agricultural production (Wreford, Ignaciuk and Gruère, 2017[5]; OECD, 2019[6]). Measures include, for example, adopting improved cropland and grazing land management to capture more CO2, changing the feed composition for cattle so less methane is emitted during digestion, or using less fertilisers by better predicting crops’ fertiliser needs to reduce nitrous oxide emissions (Henderson et al., 2021[7]).

Emissions from waste management, with most waste going to landfills in Greece, account for 6% of emissions. Physical waste management and low rates of recycling are long-standing issues in Greece. The European Court of Justice fined Greece EUR 127 million in 2021 for the slow improvement in plastics management, and further fines are likely without raising the share of plastics that are collected and recycled. Measures to encourage recycling and reduce landfill include enforcing landfill fees, which were enabled by a 2021 law, or promoting pay-as-you-throw pricing of waste collection (OECD, 2020[8]). Requiring plastic products contain minimum amounts of recycled material would raise demand for plastics to recycle and improve the sectors’ economics (Valaskas, Demian and Stavrak, 2022[9]; OECD, 2022[10]).

Policies for reducing emissions from energy use across sectors at lowest cost

A policy mix, combining both sector-specific and cross-cutting measures, can achieve a successful and cost-effective transition to net-zero greenhouse gas (GHG) emissions. Table 2.2 outlines selected policy instruments and how they can contribute to lowering abatement costs.

Pricing emissions from energy use while protecting vulnerable groups is central to identify and exploit the lowest-cost opportunities to cut emissions across sectors (D’Arcangelo et al., 2022[11]; Pisany-Ferry, 2021[12]). How costly it is to cut emissions differs between emission sources, abatement measures, and is likely to change over time as new technologies become available. Putting an equal price on GHG emissions for all sectors, businesses and households in Greece will help to make the most of opportunities to reduce emissions. By contrast, uncertainty and decentralised information about the costs of reducing emissions imply that relying mostly on more directive approaches, such as regulations, may raise total abatement costs by missing already available opportunities for low-cost emission reductions. For example, lower effective emission prices for housing than for transport may encourage fewer low-cost energy saving renovations, for which Greece has large potential (discussed below), and may in turn require larger reductions from other sectors to meet intermediate mitigation targets – for example from transport, where emission costs are already high but where cuts are difficult to achieve due to Greece’s high reliance on cars (discussed below). Meanwhile, raising carbon prices can be politically challenging. Box 2.2 discusses how assessing public opinion allows support to be tracked and measures to be adapted.

Table 2.2. Comparing mitigation policy instruments along several cost dimensions

|

Policy instrument |

Cost-effectiveness |

Administrative and fiscal costs |

Distributional and social concerns |

Political acceptability |

|---|---|---|---|---|

|

(a) Emission pricing and incentive-based instruments |

||||

|

Emission pricing, e.g. GHG tax or fuel excise taxes |

High cost-effectiveness. Encourages innovation to reduce future abatement costs, but does not address all market failures. |

Low to moderate administrative costs. Increased revenue. |

Moderate concerns. Regressive effects can be flanked with compensational policies. May lead to leakage. |

Low acceptability. Can be improved through recycling revenues. |

|

Subsidies, e.g. feed-in-tariffs |

Medium to high cost- effectiveness. Risk of ‘picking winners’. |

High administrative costs. Increased expenditure. |

Low concerns. |

High acceptability. |

|

(b) Standards and regulations |

||||

|

Performance standards, e.g. zero-emission vehicles |

Low cost-effectiveness in short-term. Can reduce future abatement costs by spurring innovation. |

Low administrative costs. Fiscal impact neutral. |

Low concerns. |

Moderate-high (effects on prices are hidden). Associated investments to meet standards can reduce acceptability. |

|

Information requirements, e.g. energy efficiency of electrical equipment |

Low to moderate cost-effectiveness. Can help to guide or `nudge’ consumption behaviour towards low emission alternatives. |

Low administrative costs. Fiscal impact neutral. |

Minimal concerns. |

High acceptability. |

|

(c) Complementary policies |

||||

|

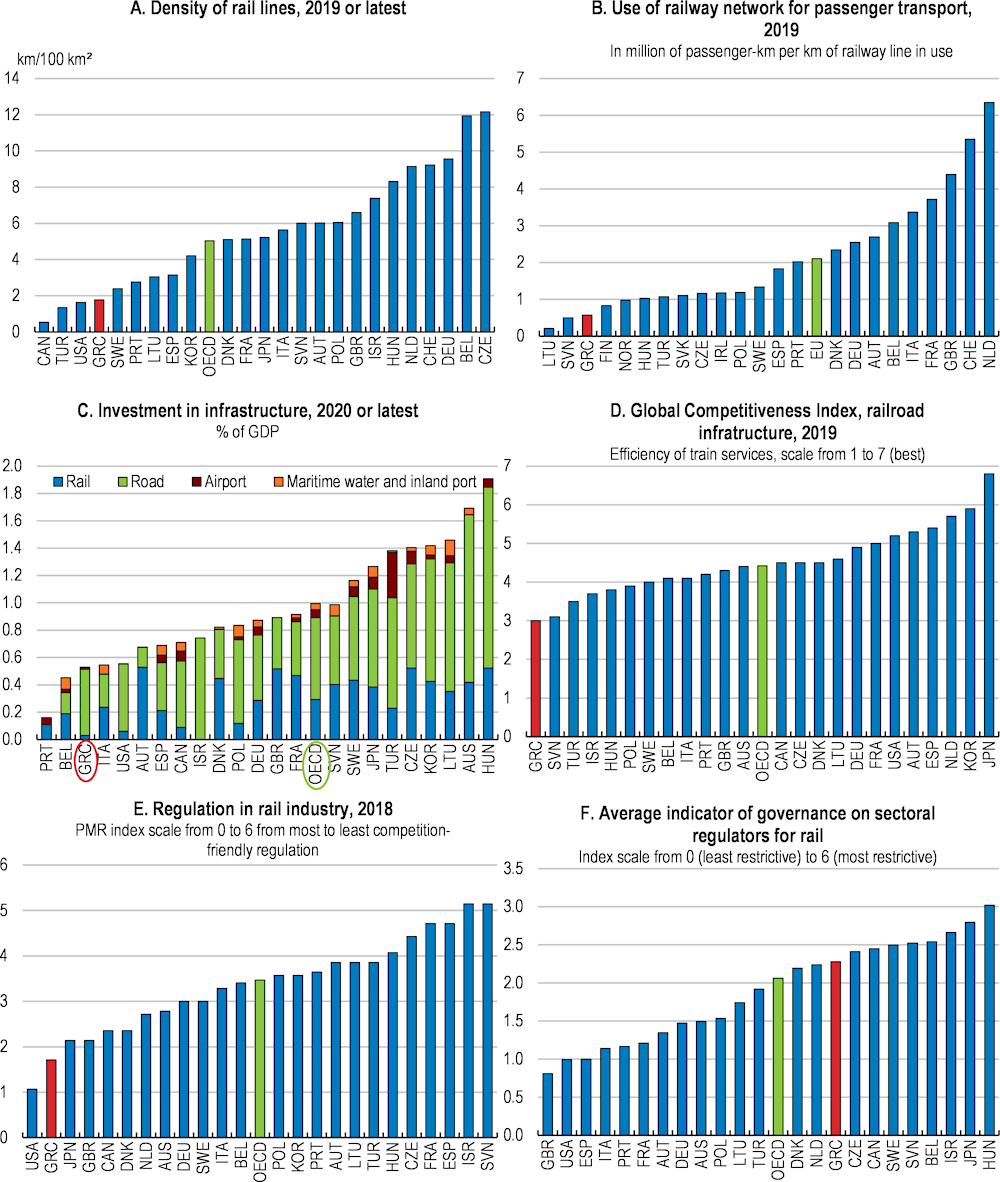

Public infrastructure investments, e.g. in railway or electricity network |

Reduces overall abatement costs by addressing public good and coordination problem market failures. |

Moderate administrative costs. Increased expenditures. |

Low concerns. |

Mixed acceptability. |

|

Financial support policies, e.g. subsidised loans for renovations or vehicle purchase subsidies |

Reduces overall abatement costs by addressing financial frictions and coordination failures. |

Moderate administrative costs. Increased expenditures, more for grants than for loans. |

Regressive, as favouring those who can afford activities. |

High acceptability. |

Source: Adapted from D’Arcangelo et al. (2022[11]).

Pricing emissions alone is likely to be insufficient to achieve net zero emissions (D’Arcangelo et al., 2022[13]; D’Arcangelo et al., 2022[11]; High-level Commission on Carbon Prices, 2017[14]). Combining carbon pricing with a mix of complementary, sector-specific instruments – including a mix of regulation, financial support, public investment, and institutional reforms measures – is crucial to make it cheaper to shift away from fossil fuels for several reasons. Reducing emissions is challenged by multiple market failures requiring different instruments, for example credit constraints preventing households from financing cost-saving renovations or coordination failures limiting the adoption of green technologies, such as the lack of charging points for electric vehicles in Greece. In addition, policy instruments can be more effective if combined with one another, while incoherence between instruments can weaken their effectiveness. For example, encouraging renovations by imposing energy efficiency standards that buildings must meet in the future, while providing financial support to address credit constraints, is more effective if carbon pricing strengthens price signals for energy savings. Complementary measures would also shore up competitiveness by lowering energy bills and improving the transport system (European Investment Bank, 2021[15]), counteracting some of the adverse effects from raising costs of emission-intensive inputs.

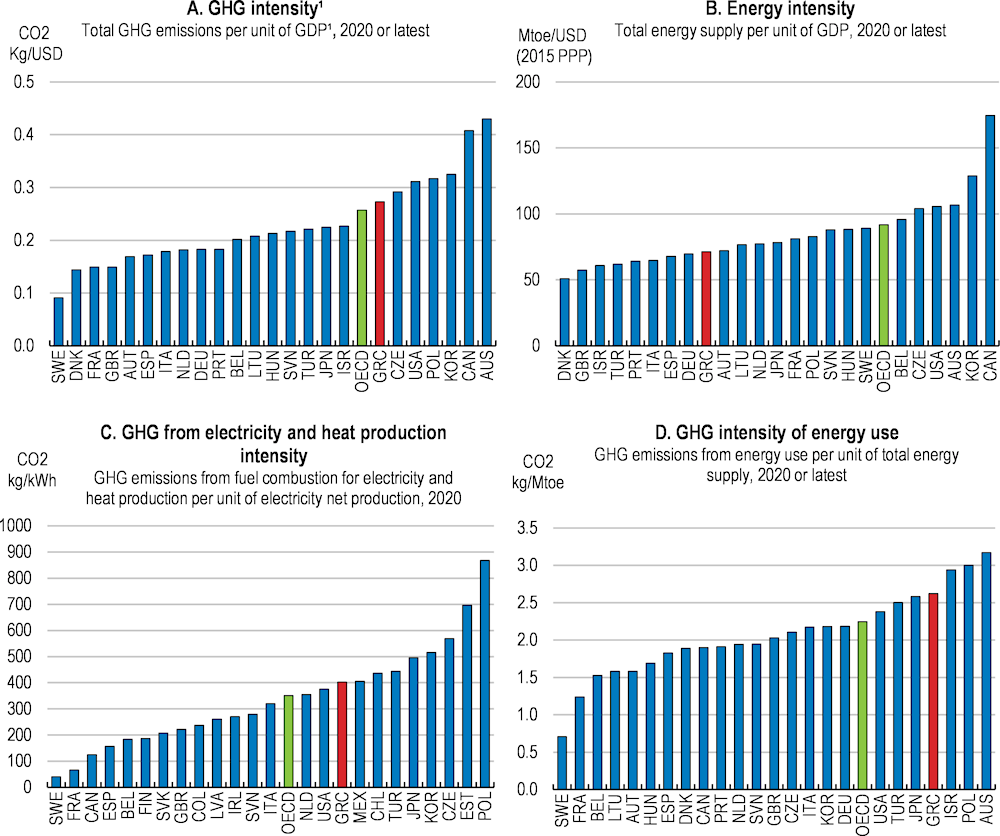

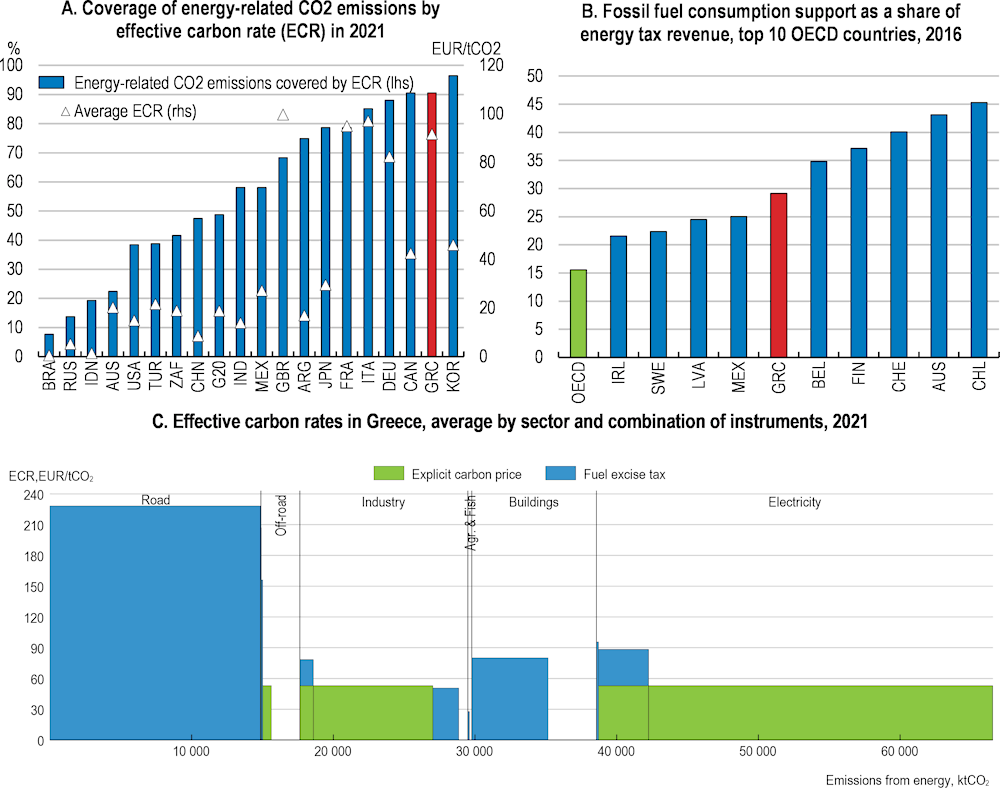

Harmonising carbon prices to better encourage low-cost emission cuts across sectors

Aligning the price of GHG emissions across fuels and uses by adjusting tax rates and subsidies would provide more consistent price signals. Most energy-related CO2 emissions in Greece are already priced either explicitly, through the EU Emissions Trading Scheme (ETS), or through fuel excise taxes, and average CO2 prices are high in international comparison (Figure 2.4, Panel A). However, there are large differences in the cost of CO2 emissions across users. For example, CO2 emitted by road transport is four- to twenty-fold as expensive as CO2 emitted from other uses. Among road transport fuels, CO2 emissions from gasoline are twice as expensive as from diesel (OECD, forthcoming[16]). These price differences across emissions reflect the fact that high carbon prices are largely driven by fuel excise taxes, especially from transport (Figure 2.4, Panel C), whereby fuel taxes are typically imposed for objectives other than cutting CO2 emissions, such as raising revenues and addressing non-climate related negative external effects. Greece’s high tax exemptions and subsidies for fuels, for example for remote areas and islands not yet connected to the mainland electricity grid to even energy costs with the mainland, additionally weaken price signals (Figure 2.4, Panel B). Gradually aligning effective carbon prices in the medium-term – to assure that at least a common, minimum price applies – to all sources of GHG emissions would encourage more low-cost emission cuts. The expansion of electricity connections to islands and remote areas provides an opportunity to cut subsidies for these areas. Developing a detailed list of subsidies and taxes, including expenditures for tax exemptions, on fossil fuels as a part of ‘green budgeting’ expenditure tagging would make it easier to identify policy distortions (OECD, 2020[8]; European Commission, 2020[17]).

Projected pathways to reach net zero by the International Energy Agency suggest increasing carbon prices in the future. Greece’s current effective carbon prices are below the level expected to be necessary from 2030 onwards to be on track for net-zero (IEA, 2021[18]; OECD, 2021[19]) (Table 2.3). About 57% of energy-related emissions in Greece are covered by the EU-ETS. Introducing a price floor across fuels and users for the remaining emissions in the medium-term, after the current surge in energy prices, by aligning and gradually raising fuel excise taxes on emissions that are priced below the minimum, would provide more consistent price signals and raise overall effective carbon prices. Empirical work carried out for this Survey, leveraging cross-country experiences of emission reductions associated with carbon pricing, suggests that introducing a carbon price floor at 120 EUR/tCO2 by itself could decrease CO2 emissions by 16% relative to 2021 emissions, and bring up to EUR 1.8 billion (1% of 2021 GDP) additional annual revenues (Table 2.3). While the effectiveness of higher emission prices can be impaired by emission-intensive firms shifting production to countries with lower or no carbon prices, past experience points to only small emission leakage effects resulting from pricing emissions (Pizer and Aldy, 2015[20]; Borghesi, Franco and Marin, 2020[21]; Sato and Dechezleprêtre, 2015[22]; Naegele and Zaklan, 2019[23]). Providing rebates, which are gradually phased out, to emission-intensive and exporting firms affected by higher carbon prices could be considered to address concerns about competitiveness and leakage.

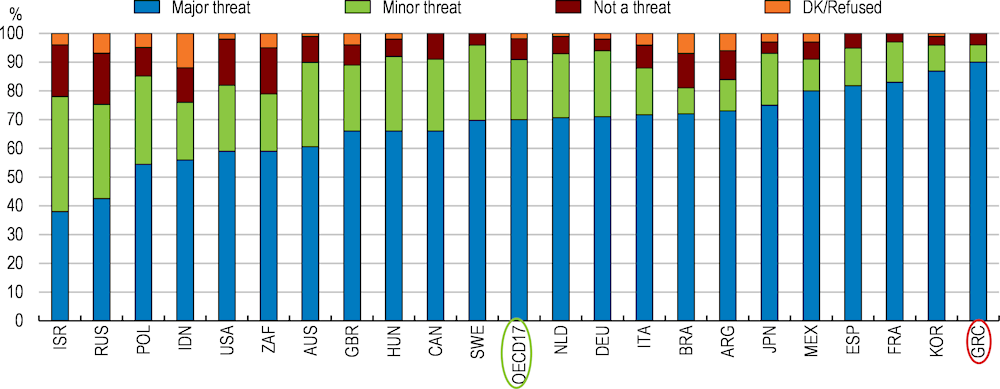

Box 2.2. Understanding public acceptability of mitigation policies across countries

Public attitudes towards measures to reduce greenhouse gas (GHG) emissions can be a challenge for implementing policies. Understanding peoples’ attitudes about policy tools can help to strengthen support by addressing concerns and potential misconceptions. Ongoing OECD work conducts comparable and nationally representative surveys covering 40 000 respondents across 20 countries to assess how people think about climate policies and which factors shape policy support (Dechezleprêtre et al., Forthcoming[24]).

Beliefs about effectiveness, equity and own costs of climate policies shape policy support

The survey finds broad awareness about climate change: in each country at least three quarters of respondents agree that tackling climate change is important. However, this awareness not always translates into support for climate policies. Whether a policy enjoys strong support is found to hinge on three beliefs: a policy enjoys stronger support if (a) it is perceived to be effective at cutting GHG emissions, and lower support if it is perceived to (b) increase inequality or (c) impose personal costs. These beliefs are much stronger predictors than socioeconomic and lifestyle factors, which are linked more weakly and with more mixed patterns to how a person thinks about climate policies. For example, while more educated and left-leaning respondents show generally stronger support for climate policies, higher income is related to stronger policy support only in 9 out of 20 countries, and young people are not generally found to show stronger support for climate policies than older people.

Addressing concerns and informing about policies can raise policy support

Designing policies to address peoples’ concerns about fairness and their personal costs and informing people about how policy measures work can raise support. A sub-sample of respondents were shown videos on impacts of climate change in their country as well as on particular climate policies; in particular a carbon tax with cash transfers, a ban on combustion-engine cars, and a green infrastructure programme. Seeing videos on policies significantly increased support for these policies, while videos on the impact of climate change had no significant impact. Survey results also indicate that reducing personal costs can raise support. For example, support for a ban of combustion-engine cars in city centres was higher if people had better access to public transport. Support for carbon taxes was higher when revenues are earmarked to support low-income groups or fund green infrastructure projects, reflecting how policies perceived to be fair and contribute to cutting emissions enjoy stronger support.

Figure 2.4. Revising fossil fuel taxes and subsidies to introduce a minimum carbon price floor would make emission pricing more effective

Note: Panel C: Figures shows coverage and height of effective carbon pricing of CO2 emissions from energy use in Greece in 2021. The width of the bars shows how much of emissions in the respective sector are priced. The height of the bars indicates the effective carbon price. Effective carbon prices do not account for subsidies for fossil fuels, such as heating allowances.

Source: OECD Centre for Tax Policy and Administration; OECD Environmental Performance Reviews: Greece 2020.

Table 2.3. A higher minimum carbon price floor can reduce emissions while raising revenues

Simulation results for Greece from introducing a minimum price floor for CO2 emissions from energy use

|

Effective carbon price floor (EUR/tCO2) |

Year carbon price will be consistent with net-zero |

Reduction in CO2 emission from energy use in 2021 |

Additional revenues in EUR billions |

|---|---|---|---|

|

60 |

n.a. |

-2% |

0.40 |

|

120 |

2030 |

-16% |

1.84 |

|

220 |

2050 |

-37% |

3.09 |

Note: Results refer to annual long-run effects of introducing a minimum price floor for effective carbon prices and removing free allowances and fossil fuel subsidies. Effective carbon prices already above the price floor at left unaffected.

Source: (IEA, 2021[18]; OECD, 2021[19]).

Protecting vulnerable households while encouraging energy savings

Unwinding Greece’s energy subsidies and tax expenditures, and instead providing direct support to vulnerable households, would encourage emission reductions and improve equity. Greece supports energy consumption of low-income households mainly by subsidising electricity tariffs and by providing an allowance conditional on heating with fossil fuels. To address the recent surge in energy prices, Greece expanded existing measures and provided several additional subsidies, mostly horizontal subsidies making energy based on fossil fuels cheaper (Table 1.1). Replacing price subsidies with direct income transfers not linked to how much or which type of fuel is being used would better encourage energy savings and switching to cleaner fuel types. For example, converting the subsidy households receive through social tariffs into a direct income transfer means that they could afford their existing energy consumption, while energy savings would bring larger gains in disposable income. Only about one-third of guaranteed minimum income recipients in 2018 received social electricity tariffs (Marini et al., 2019[25]). Targeted income transfers can ensure support reaches the most vulnerable households.

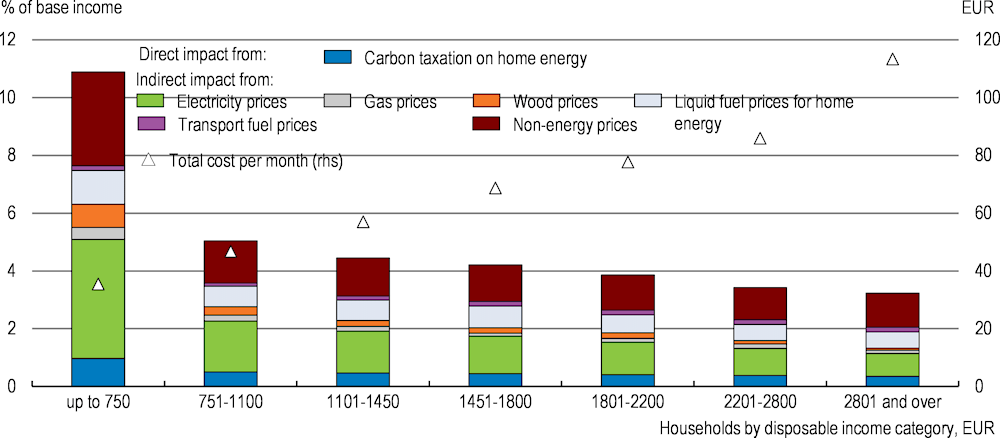

Redistributing revenues from higher carbon pricing would protect lower-income households from rising living costs. OECD work (Blake, Bulman and Joumard, forthcoming[26]) suggests that harmonising and raising prices for energy-related CO2 emissions to at least EUR 120 per tonne would raise monthly household expenses by EUR 68 on average (Box 2.3). Vulnerable households would be disproportionately affected as they spend a larger share of their budget on energy. For example, while costs for the 20% households with the highest incomes would increase by about 3%, poor households would have to pay about 11% more to maintain consumption. Additional revenues from implementing a minimum carbon price would initially be more than enough to offset higher living costs of lower-income households through income transfers. Over time, both adverse income effects and additional revenues would diminish as consumption becomes less emission-intensive.

Box 2.3. Income transfers can offset regressive effects from carbon pricing

Introducing a minimum carbon price floor can raise the price of fossil fuels and reduce households’ real incomes. Impacts are likely to differ across income groups with share of income spent on emission-intensive goods and services. New empirical research carried out for this survey assessing how households are impacted across income groups can help design appropriate compensatory policies.

Relative to other EU countries, Greek households are particularly vulnerable to an increase in energy prices due to the still high share of coal used for electricity generation (24% in 2019, against a 15% average in European OECD countries). Lack of proper insulation in many buildings additionally raises costs for heating and cooling and contributes to relatively high levels of energy poverty.

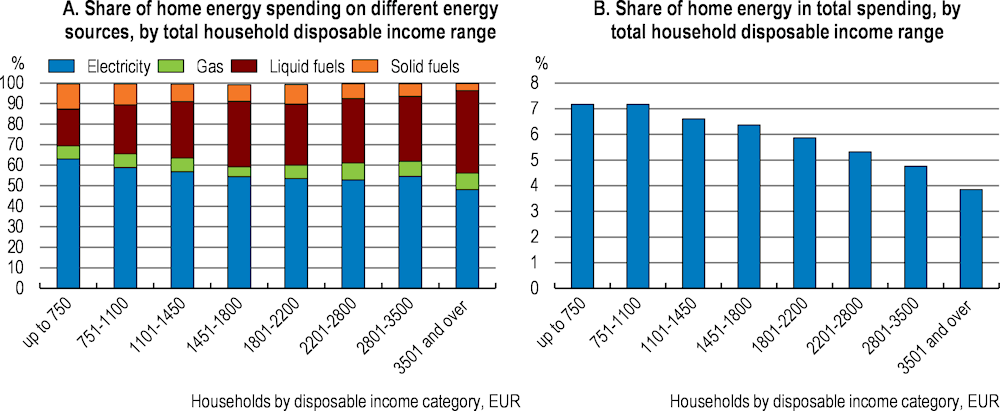

Carbon pricing will reduce households’ purchasing power through a direct and an indirect effect. The direct effect raises prices of fuels they directly consume whose emission price is below the price floor. Low-income households are more exposed as they spend a higher share of their income spent on home energy: households earning less than EUR 1 100 per month (30% of households) spend on average 7% of their expenditures home energy while this share amounts to less than 4% for households earning more than EUR 3 501 (Figure 2.5).

Figure 2.5. Lower income households spend a larger share of their income on home energy, especially electricity

The indirect effect of carbon pricing stems from raising the costs for fuels used as inputs, most notably for electricity production. Using information on the carbon embodied in final demand, calculated from input-output tables, allows assessing how carbon pricing can affect final prices, which is crucial to assess the regressive impact of carbon pricing (Blake, Bulman and Joumard, forthcoming[26]). This is because electricity generally accounts for a larger share in lower-income households’ energy mix, who rely less on central heating – only 27% of households with incomes below than EUR 1101 per month compared to 40% for the whole population – and more on electric heating (Figure 2.5).

On average, a minimum carbon price floor of at least EUR 120 per tonne CO2 in Greece, leaving higher prices unaffected, would imply that households need to pay EUR 68 more per month to maintain consumption. By far the largest effect, 68% of the total impact on purchasing power, would be indirect, from using fossil fuels as inputs (Figure 2.6).

Figure 2.6. Higher carbon prices would reduce lower income households’ real incomes the most

Note: Graph show the estimated direct and indirect impact of a EUR 120 carbon tax price floor on household income. Estimates are based on 2018 spending patterns. Changes in consumption patterns resulting from price changes are not taken into account but are likely to occur. Complementary policies that decrease the carbon content of consumption and are likely to dampen regressive effects.

Source: Calculation based on data from the Greece Household Budget Survey 2018; IEA (2021), Energy prices (database); and OECD data on carbon embodied in trade from Environment Statistics (database).

Poorer households would have to increase their spending by a larger percentage (Figure 2.6). This regressive impact largely stems from electricity consumption. Besides differential effects across income groups, rural households would be more affected compared to urban households, although the difference would be much smaller than between income groups. The cost of rural households’ current consumption baskets would rise by only 2% more than the cost of an urban household. Their living costs would increase by 4.8% of their income, compared with a 3.9% increase for urban households, reflecting rural households’ slightly higher share of income spent on energy.

To cushion the loss in purchasing power related to a minimum carbon price floor for the low-income households and offset the regressive impact, the government could provide a means-tested subsidy. The overall cost would amount to EUR 1.4 billion (0.7% of GDP in 2021), which would be less than the additional revenues gained from a minimum carbon price floor.

Growth, investment and fiscal implications of the green energy transition

Gradually abandoning the use of fossil fuels for other energy sources constitutes an economic challenge (Pisany-Ferry, 2021[12]; OECD, 2021[27]). Production costs continue to depend on energy prices from fossil fuels, which are likely to rise with higher emission prices. Shifting away from fossil fuels entails faster depreciation of capital and of workers investing in the skills required to shift to new activities. These costs could be reduced through productivity gains generated by the energy transition, for example from reduced energy needs or a more effective transport system. Importantly, considering the potentially catastrophic damage of climate change, contributing to the global shift to net-zero emissions remains the best way to limit the overall cost, sustain livelihoods and support activity into the long-term of a changed climate.

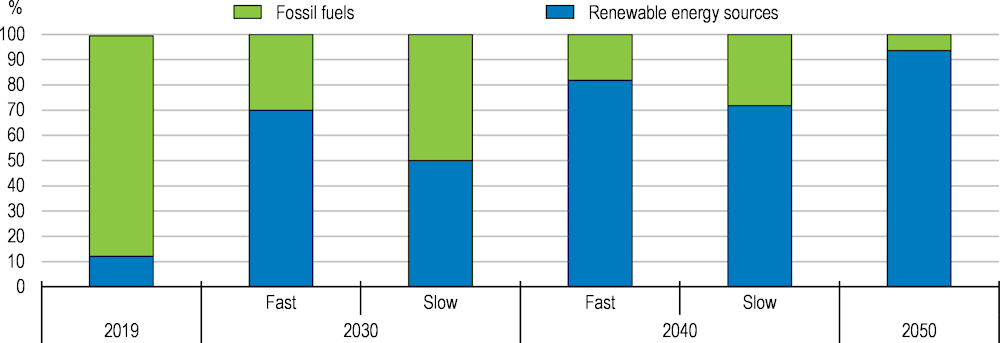

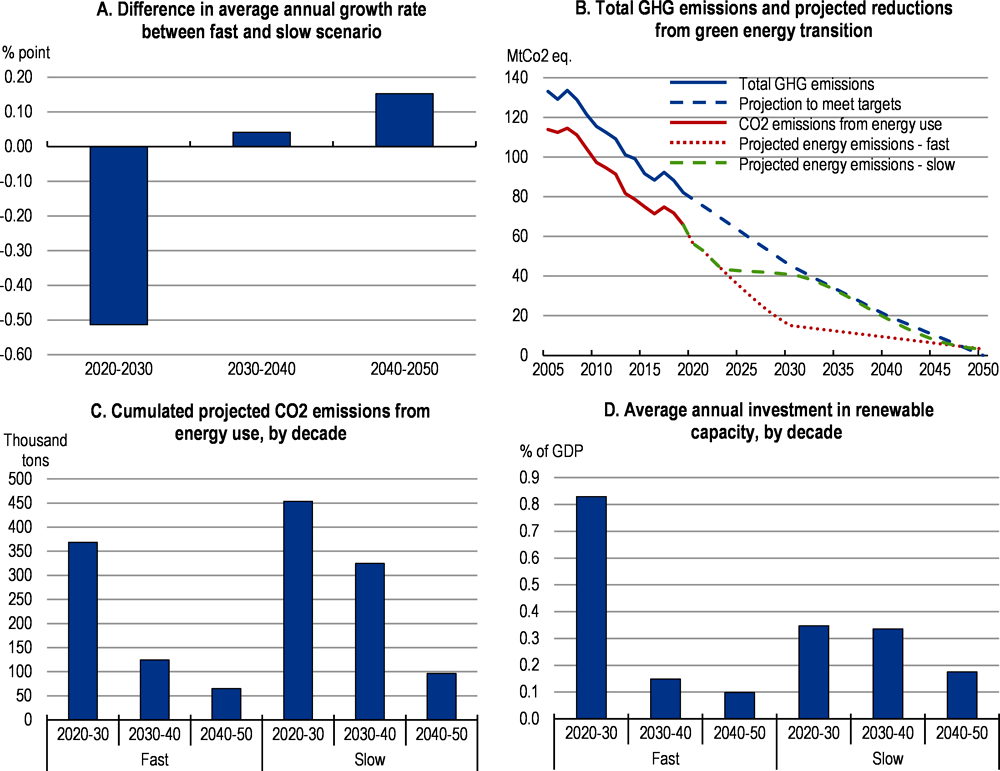

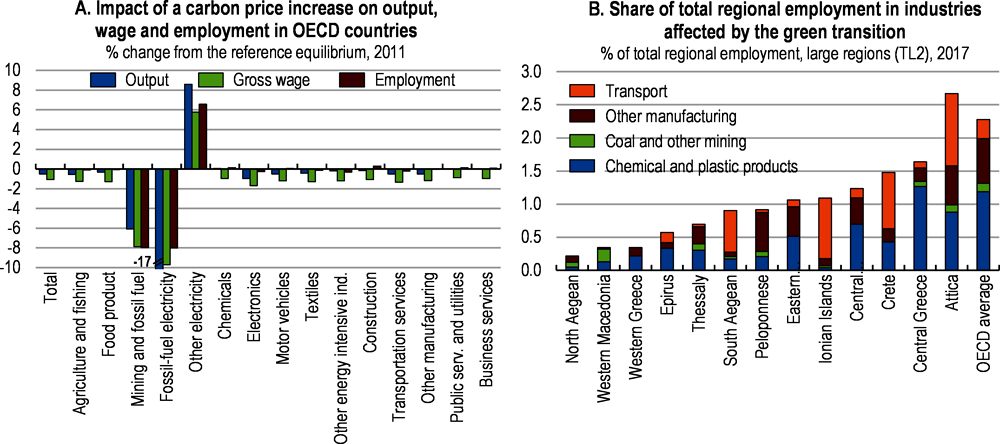

The loss of output from the green energy transition for Greece is likely to be modest overall, and can be offset by the continued policy reforms and investments to raise Greece’s productivity and employment rates discussed in Chapter 1. Scenarios illustrate the potential investment needs and change in output engendered by the shift to net zero emission energy system. These scenarios extend the OECD global long-term model by incorporating abatement cost estimates from the Network for Greening the Financial System and the OECD’s ENV-Linkages Computable General Equilibrium model (OECD, 2022[1]) (described in Box 2.4). They suggest that average annual output would be 0.3% slower between 2023 and 2050 under the scenario of a front-loaded energy transition, and 0.2% slower in the case of a slower transition, both compared to a scenario that abstracts from the shift to low- and zero-emission energy sources. Regarding the path of the transition to net zero emissions, achieving a fast transition in line with Greece’s ambitious targets – as compared to a more gradual transition – would entail a larger slowing in economic growth in the current decade and a smaller slowing in growth in the following decades (Figure 2.8, Panel A). Importantly, a more gradual transition to net zero emission energy would require larger cuts in emissions generated by other sectors for Greece to meet its intermediate emission reduction targets. Figure 2.8, Panel B illustrates this by showing that, from 2030, the level of energy emissions under the ‘slow’ transition scenario would be near the level of total projected GHG emissions consistent with overall emission reduction targets, while under the ‘fast’ scenario energy emissions are well below total projected emissions. Further, a slower transition implies that Greece would accumulate higher total emissions before reaching net zero emissions, equivalent to about three times current annual emissions (Figure 2.8, Panel C). If replicated globally, higher cumulative emissions entail larger increases in average temperatures, and a higher risk of reaching climatic tipping points with more disastrous consequences.

Achieving the green energy transition goals requires significant, but feasible, front-loaded investments. Chapter 1 discusses how to mobilise private and public investment which can support the green energy transition in a fiscally sustainable way. For a fast transition, estimates suggest the needed additional investments to develop renewable generation capacity correspond to about 0.8% of GDP per year over the current decade (Figure 2.8, Panel D). Investment needs in subsequent decades would be substantially smaller. Additional investments will be needed to upgrade the electricity network, provide storage, and adapt energy use to renewable sources, for example to replace internal combustion engine cars and renovate houses. Research conducted for this survey by the International Transport Forum and the OECD suggests adopting ambitious scenarios for greening transport would require additional infrastructure investments of 0.2% of GDP per year on average until 2050. The ‘Greece 2.0’ Recovery and Resilience Plan allocates EUR 1.0 billion (0.5% of 2021 GDP) to direct investments in the electricity network and capacity from renewable sources until 2026, in addition to the EUR 2.27 billion (1.2% of 2021 GDP) scheme to encourage investments in capacity from renewable sources. In addition, some of the revenues from 25 million EU-ETS allowances, worth EUR 2.0 billion at 80 EUR/tonne CO2 (1% of 2021 GDP), will be used for investments to connect islands to the mainland electricity grid, and for storage and capacity from renewable energy sources.

Box 2.4. Modelling the macroeconomic implications of transitioning to a green energy system

The OECD regularly prepares long-term scenarios about economies’ long-term prospects for activity, investment and employment in light of their structural policies and demographic developments. New empirical research extends the OECD global long-term model to account for the macroeconomic implications of measures to reduce greenhouse gas emissions from energy use (OECD, 2022[1]). The model abstracts from direct effects of climate change, such as damages from extreme weather events, the scale of which remains highly uncertain.

The green energy transition entails shifting energy use away from fossil fuels towards low- or zero-emission energy sources, notably renewable energies. The focus on energy use reflects their contribution of 73% of global greenhouse gas emissions (Lenaerts, Tagliapietra and Wolff, 2021[28]). For a particular country, the model produces trajectories for a host of macroeconomic variables for a given evolution of the primary energy mix. The link between the green energy transition and potential output is mediated by an abatement cost curve. This cost curve expresses how much annual GDP growth is reduced as a function of emissions reduction in that year relative to a business-as-usual path. It is based on reduced-form estimates of average carbon mitigation costs in two Integrated Assessment Models (MESSAGEix-GLOBIOM 1.1 and REMIND-MAgPIE 2.1-4.2, using the Network for Greening the Financial System scenarios) and one Computable General Equilibrium model (ENV-Linkages). It captures the trade-off between rising costs from cutting more emissions in a given year – as the lowest-cost means of reducing emissions are exhausted and additional reductions are more costly – and falling costs in the future – as technological advances make low-emission alternatives less costly. Among others, the model produces results on potential output, investment needed to build capacity for energy generation, and CO2 emissions. The development of these long-term scenarios is ongoing. Future work will enrich how different policy choices affect abatement costs.

Two scenarios, shown in Figure 2.7, Panel A, are considered to assess the macroeconomic implications of the green energy transition for Greece:

“Fast”: the energy mix evolves to meet intermediate targets by cutting emissions from energy use. Renewable sources generate 70% of energy needs by 2030 and reach a share compatible with net-zero greenhouse gas emissions in 2050.

“Slow”: the energy mix evolves slowly at first, with 50% of energy generated by renewable sources by 2030, but speeds up thereafter and reaches a share compatible with net-zero greenhouse gas emissions in 2050.

Figure 2.7. Scenarios for greening the energy mix

The assumed evolution of primary energy sources under different transition scenarios

Figure 2.8. A faster green energy transition would shift growth to future decades and contribute to reducing the damages from climate change

Source: Simulations based on the OECD’s Global Long-Term Model and Eurostat population projection scenarios (OECD, 2022[1]) and OECD (2022), Environment: Air and climate (database).

Containing the fiscal impact of the green transition

Transitioning to a green economy entails fiscal costs. Most importantly, the transition requires additional investments, including for renewable energy production, building renovations, and in low-emission transport modes. These investments will, at least partly, be financed by the public sector directly or through grants and loans. In addition, the green transition will affect government revenues. While rising carbon prices under the EU-ETS or raising fuel excise taxes to at least a minimum carbon price floor will bring additional revenues in the short- to medium-term, these revenues will ultimately shrink as the economy becomes less emission intensive.

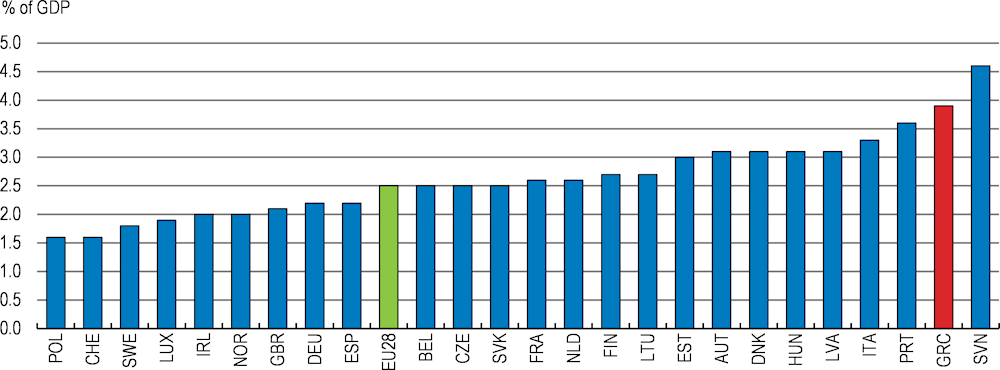

Revenues from taxing road transport, mostly from fuel excise taxes, are substantial in Greece, at about 4% of GDP (Figure 2.9). Analysis based on the ITF transport model suggests that tax revenues related to road transport over 2020 to 2050 would be up to 20% lower in a scenario for transformative change of the transport system (Box 2.6). Disruptions to the labour market as jobs shift from carbon-intensive work to new opportunities in the green economy can temporarily reduce employment, decrease revenues from income tax and social security contributions, and raise spending on unemployment benefits. Tax expenditures to support green investments can help achieve emission reduction goals but reduce public income.

This Survey proposes measures to help contain fiscal costs. Measures would contribute in several ways, as detailed in Table 2.4. First, they would bring additional revenues, for example from introducing a minimum carbon price floor or, in the long-term, shifting towards distance-based charges in road transport discussed in Box 2.5. Second, they would reduce public expenditures, for example by boosting energy-efficiency improving renovations to halve energy consumption from buildings (MoEE, 2018[2]), or cost-effective training and hiring subsidies (Brown and Koettl, 2015[29]). Third, they would help to make public spending more effective by combining subsidised loans with gradually tightening regulations to leverage more private financing.

Table 2.4. Selected measures to help limit fiscal costs of the green economy transition

|

Section |

Policy area |

Description of proposed measures |

Contribution to limiting fiscal costs |

|---|---|---|---|

|

2.2.2 |

Carbon pricing |

Harmonised and rising fuel excise taxes to at least a minimum price floor for carbon emissions. |

Additional revenues, which will decline as fossil fuels are used less intensively. |

|

2.2.2 |

Energy support measures |

Replacement of energy price subsidies with targeted income transfers. |

No fiscal impact. |

|

2.3.2 |

Transport |

Increased investments in public transport; replacement of purchase grants for low emission vehicles with subsidised loans; adjustment of vehicle taxes and restrictions of use in cities for fossil fuel cars. Increased reliance on road usage pricing. |

Reduced need for financial support for fleet renewal to meet intermediate emission targets; leveraging more private financing through loans and regulations. Additional revenues from vehicle taxes and increased road usage pricing. |

|

2.3.3 |

Building renovations |

Tightening regulations on minimum energy efficiency standards for more existing buildings; expansion of financial support measures prioritising subsidised loans over grants. |

Lower spending needs on energy support measures in longer-term; leveraging more private financing through loans and regulations. |

|

2.4.2 |

Adaption |

Regulations broadening insurance coverage against damages from extreme weather events. |

Reduced contingent liabilities of public sector by leveraging more private financing. |

|

2.5.2 |

Labour market |

Expansion of active labour market policies, including training and hiring subsidies. |

Higher revenues and lower expenditures through shorter unemployment spells and higher employment level. |

Box 2.5. Raising revenues from road transport in a green transport system

Taxes from road transport, for example from fuel excise taxes, are an important revenue source for governments, especially in Greece (Figure 2.9). Road transport taxes also support efficiency objectives, as a means to charge for road use, and to apply a cost to congestion, pollution and noise.

Changing the transport system to achieve net-zero emissions from transport implies that, under current tax and charging schemes, revenues from road transport would decline substantially as internal combustion engine vehicles give way to low- and zero-emission vehicles and fossil fuels are used less. New empirical analysis from the OECD and the International Transport Forum (ITF), described in Box 2.6, suggests revenues from road transport – in particular fuel excise duties, registration and circulation taxes, and tolls – would be one-fifth lower until 2050 in a scenario of transformative change.

Figure 2.9. Taxes from road transport are a significant source of governmental income

Total tax and charge revenues for road, rail and inland navigation transport, 2016

Source: European Commission (2019), Directorate-General for Mobility and Transport, Transport taxes and charges in Europe: an overview study of economic internalisation measures applied in Europe, https://data.europa.eu/doi/10.2832/416737.

A stable tax base for a transport system less reliant on conventional cars could be achieved by shifting from fuel-based to distance-based charges reflecting the costs related to the distance driven. The ITF model suggests that Greece could sustain tax revenues while transforming the transport system by charging about EUR 0.003 per kilometre in 2025, rising gradually to EUR 0.021 in 2050. The revenue so gained would correspond to EUR 86 per adult and year on average, and would equal the decrease in revenue from road-related taxes compared to the baseline scenario.

Source: (OECD/ITF, 2019[30]).

Policy mixes to achieve the green energy transition in key sectors

This Section discusses sector-specific policy mixes aiming at reducing the costs of shifting to low-emission alternatives for energy use in key sectors, complementing cross-cutting policies discussed above. It focuses in turn on electricity generation, buildings, and transport, which contribute the bulk of emissions from energy use.

Shifting electricity production to renewable sources

Upscaling electricity production from renewable sources will be essential to enable low-cost and low-emission energy as alternative to fossil fuels. Energy use produces 70% of Greece’s GHG emissions. Using more renewable sources in the energy industry, for example to replace lignite for power generation, would allow cuts of up to half of those emissions; the other half of emissions can be cut by adapting other sectors to use electricity produced from renewable sources (Figure 2.10, Panel A). This will require expanding electricity generation from renewable sources, and producing more electricity overall (DESFA, 2022[31]).

Greece’s reliance on fossil fuels for electricity production remains high (Figure 2.10, Panel B). Recent years have seen coal being replaced mostly with natural gas (Figure 2.10, Panel C), as carbon pricing made coal less competitive to natural gas. Replacing coal with gas has slowed however as a result of rising natural gas prices and uncertain supply following Russia’s invasion of Ukraine, with closures of several coal plants postponed (Greece’s reliance on Russian energy imports is discussed in Chapter 1). Replacing coal with gas can deliver more limited emission reductions while generation from renewable sources is being expanded, as natural gas produces about one-third less CO2 emissions than coal to generate an equivalent amount of electricity (OECD, 2022[1]). In the long run, retrofitting gas generation plants with carbon capture or to run on hydrogen can further reduce emissions from natural gas, although costs can be high (IEA, 2021[18]). Greece does not envisage developing nuclear power generation. It will ban solid fossil fuels, such as lignite, for electricity production by 2028.

Figure 2.10. Greening electricity generation can make significant inroads into Greece’s emissions

Note: Panel A: Other sources of energy use covers manufacturing industries and construction, residential and other sectors, and fugitive emissions from fuels. Panel B: Renewables include biofuels and waste, hydro, wind, solar, geothermal and other energies.

Source: OECD (2022), Environment Statistics (database); and IEA (2021), Electricity Information (database).

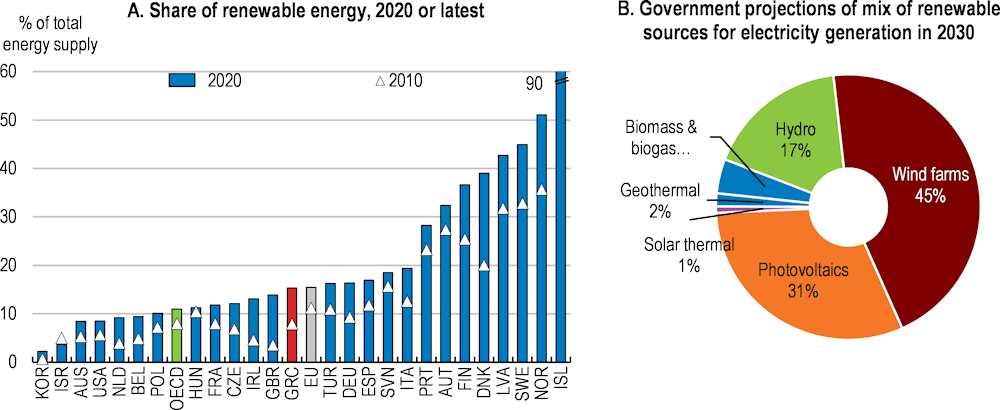

Boosting the role of renewable sources in the electricity system

Greece has ambitious aims to exploit its large potential for renewable energy, including from solar and wind (OECD, 2020[8]). Its share of electricity generated from renewable sources grew faster than the EU average in recent years, driven by generous feed-in-premiums, but still lags most other OECD countries (Figure 2.11, Panel A). Greece plans to substantially raise the share of renewable sources for final energy consumption, relying mostly on solar and wind (Figure 2.11, Panel B). Reaching a 70% share of renewable sources of primary energy consumption would allow meeting its GHG emission target in 2030 by focusing on cutting emissions from energy use. This would require the share to expand about four times faster than during the previous decade. For example, providing the increased share through wind power alone to meet projected demand for 2030 would correspond to installing more than 310 large wind turbines (based on 10MW capacity and operating at their full capacity on average 35% of the time) each year (DESFA, 2022[31]).

Greece is encouraging and simplifying investments to scale up renewable capacity. A EUR 2.27 billion (1.2% of 2021 GDP) scheme provides financial incentives to develop capacity via a contract-for-difference premium, guaranteeing a stable price – established through competitive auctions – to electricity suppliers from renewable sources (European Commission, 2021[32]). New legislation, requiring most buildings larger than 500m2 to install solar panels covering at least 30% of the building covered area will further add capacity from renewable sources. Planned reforms of licensing procedures and special spatial plans for renewable sources are intended to speed up procedures to implement investments.

Figure 2.11. Greece plans to rapidly expand electricity generated from renewable sources

Source: OECD (2022), Green Growth Indicators, Environment Statistics (database); and Ministry of the Environment and Energy (2019), National Energy and Climate Plan.

Greece is expanding its electricity network to allow it to better exploit its renewable energies. Limited network capacity is emerging as a major constraint for scaling up electricity production from renewable sources. Investments in the transmission and distribution network will allow connecting more capacity from renewable sources to its electricity grid (IPTO, 2021[33]). In addition, the Greece 2.0 Resilience and Recovery Plan provides for ongoing investments to connect islands to the mainland electricity grid. This will allow exploiting more fully the large potential for renewable energy sources on islands (OECD, 2020[8]). Meanwhile, prices for electricity network costs are lower compared to other EU countries (ACER, 2021[34]). Assuring that prices for network usage provide sufficient funds for maintaining and expanding the network may further support upscaling electricity production from renewable sources.

Assuring reliable energy from renewable sources

Further investments in Greece’s electricity system will be needed to ensure supply is reliable as more energy will come from renewable sources. Uncertainty about when the wind blows or the sun shines makes it difficult to predict electricity production from renewable sources, while periods of peak electricity demand do not generally align with peak supply. More balancing capacity from sources that can be switched on and off at short notice, and better limiting non-essential electricity consumption when production is low, can help to align energy supply and demand (OECD/NEA, 2012[35]; NEA, 2019[36]). Making buildings more energy efficient, as discussed below, will complement these efforts.

Greece is planning to boost capacity for energy supply when production from renewable sources is low. Greece 2.0 includes grants for installing storage capacity of up to 1400 MW. A previously planned Strategic Reserve Mechanism for 2023 has been abolished, as the postponed closure of several coal-fuelled generators means they can provide balancing capacity for longer. For the future, when currently high electricity prices may have decreased, Greece is considering proposing a capacity remuneration scheme to encourage private investors to provide balancing capacity (European Commission, 2021[37]).

Better integrating Greece’s electricity network with neighbouring countries will add additional capacity by enlarging the pool of potential energy supply. Greece made important progress in connecting its wholesale electricity market with neighbouring countries by implementing the EU target model in November 2020 (Ioannidis et al., 2021[38]), and is taking several steps to improve capacity for cross-border trade (IPTO, 2021[33]; European Commission, 2021[37]).

Making electricity consumption more responsive to supply conditions, for example by programming energy-intensive tasks for times when supply is plentiful relative to demand, would reduce system stress and the need for balancing capacity (IEA, 2021[18]). This can be achieved through disseminating smart meters, which inform consumers about their electricity consumption in real-time, combined with dynamic pricing, which provides financial incentives to shift electricity demand to periods when supply is more plentiful. Measures in Greece 2.0 will promote the roll-out of smart meters, while the share of consumers with dynamic pricing contracts, which reflect current production costs more closely, is low (European Commission, 2022[39]). Promoting time-differentiated tariffs while informing customers about the risks and benefits, replacing price subsidies with income transfers (ACER/CEER, 2021[40]), and simplifying electricity bills by removing items not related to energy costs (IEA, 2017[41]), could encourage uptake of dynamic contracts.

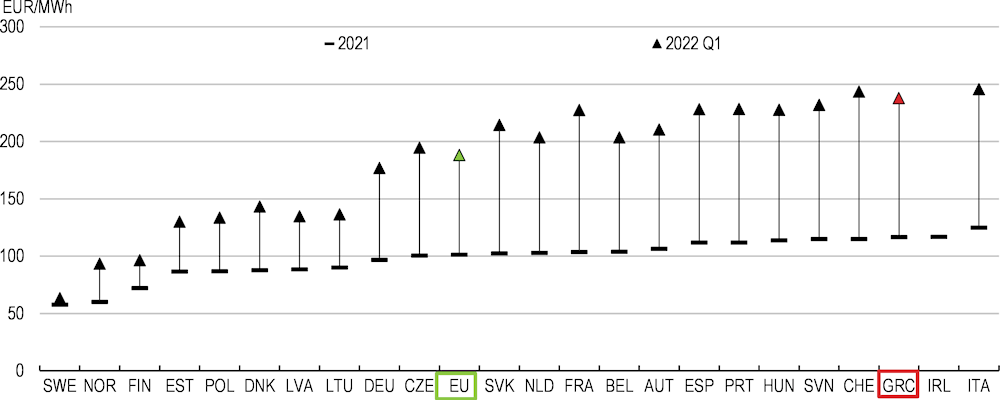

Providing affordable electricity through a more competitive market

Wholesale electricity prices have generally been higher in Greece than in other OECD countries (Figure 2.12), and were among the highest in Europe during the 2021-2022 price surge (ACER, 2021[34]), mainly due to the high dependence of electricity production on natural gas. While a successful transition likely would ultimately reduce energy costs (IEA, 2021[18]), several factors may temporarily contribute to rising electricity prices as renewable sources become more important for Greece’s energy mix. Fossil fuels will become more expensive as their prices incorporate the environmental costs of carbon emissions, while investments in exploration and production reduce. Replacing retiring fossil fuel plants with renewables requires substantial investments, whose costs will likely be passed on to customers (IEA, 2021[18]). While new installations of renewables are increasingly competitive with fossil fuels, they entail growing systemic costs, for example for providing storage, as their share of overall electricity supply increases (IEA/NEA, 2020[42]). In addition, wholesale prices are largely based on variable production costs. As more energy comes from renewable sources, prices could vary substantially depending on whether there is enough supply from renewable sources to satisfy demand, or whether dispatchable sources need to be switched on. Lowering electricity prices, also by improving competition in electricity markets and reducing systemic costs through flexible demand and providing balancing capacity as discussed above, will be key to limit costs and support businesses’ competitiveness.

Figure 2.12. Wholesale electricity prices in Greece are among the highest in Europe

Wholesale prices for electricity, annual average of day-ahead electricity prices (EUR/MWh)

Note: 2022 Q1 covers the period from 1st January 2022 to 13th March 2022.

Source: Union of the Electricity Industry – Eurelectric (2021), Power Barometer (powerbarometer.eurelectric.org).

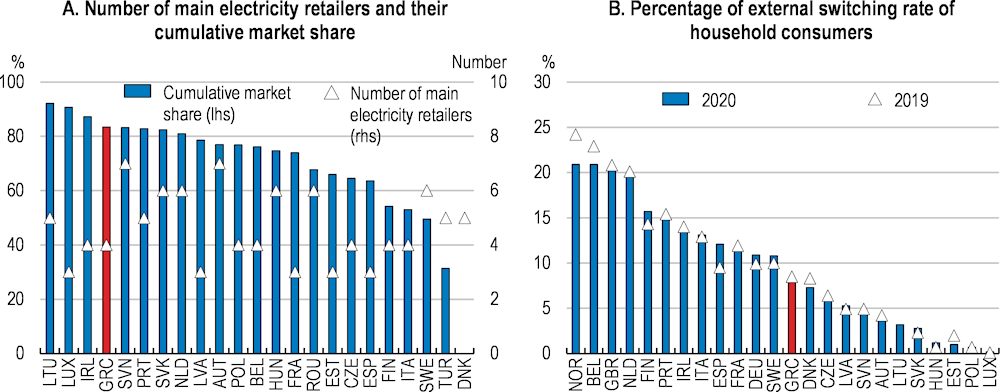

More competitive wholesale and retail markets could make electricity more affordable. Retail prices are generally lower in countries with less concentrated electricity markets (European Commission, 2022[39]). While Greece considerably improved competition in both wholesale and retail markets in recent years (IEA, 2017[41]; European Commission, 2021[37]), market concentration in the retail market remains high (Figure 2.13, Panel A), and customers change suppliers – which raises competitive pressure by enabling customers to shift to more competitive suppliers – less often than in other countries (Figure 2.13, Panel B). Promoting price comparison tools, for example with data-driven information campaigns aimed at winning new users (ACER/CEER, 2021[43]), would promote competition and contribute to reducing electricity bills. The introduction of a framework to encourage demand responses in wholesale electricity markets in 2022, allowing all domestic and non-domestic consumers to provide balancing capacity for example by trading reductions in their electricity consumption to third parties, is welcome. When considering a future capacity remuneration scheme, assuring that no restrictive requirements, for example minimum bid sizes, prevent capacity providers – those reducing consumption or generating electricity – from participating would further support competition in wholesale electricity markets (ACER/CEER, 2021[40]; Vitale and Terrero, 2022[44]).

Figure 2.13. Greece could further improve competition in its electricity retail market

Note: Panel A: retailers considered as "main" if they sell at least 5% of the total national electricity consumption.

Source: Eurostat; ACER/CEER (2021), Annual Report On The Results Of Monitoring The Internal Retail Markets And Consumer Protection In 2020.

Research shows that, across OECD countries, more independent and well-governed regulators are associated with more pro-competitive decision-making, better firm performance and higher investments in network industries (Sutherland et al., 2011[45]; Koop and Hanretty, 2018[46]; Demmou and Franco, 2020[47]). Best practice principles (OECD, 2014[48]), complementing the OECD Council Recommendation on Regulatory Policy and Governance, suggest that further safeguards for the independence of Greece’s Regulatory Authority for Energy could involve selecting heads and board members by an independent panel, instead of by the government, and restricting government guidance on its work programme (Vitale and Terrero, 2022[44]).

Shifting transport to net zero emission fuels

Greater reductions in the transport sector’s greenhouse gas (GHG) emissions would put Greece more firmly on a path towards net zero. Transport is the second largest source of total GHG emissions in Greece; one fifth of energy-related GHG emissions emanate directly from transport, for example when burning fuel to run an internal combustion engine car (Figure 2.3, Panel A). Transport is the single sector with the largest energy needs and accounts for 38% of final energy consumption (Figure 2.3, Panel B).

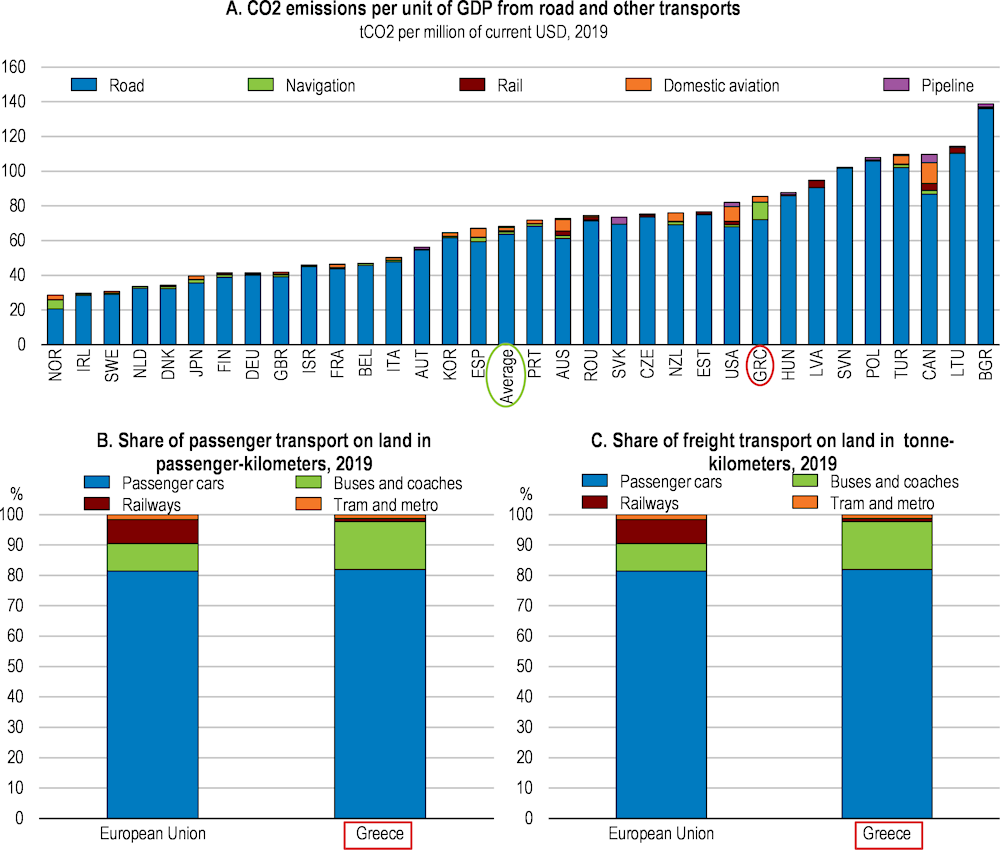

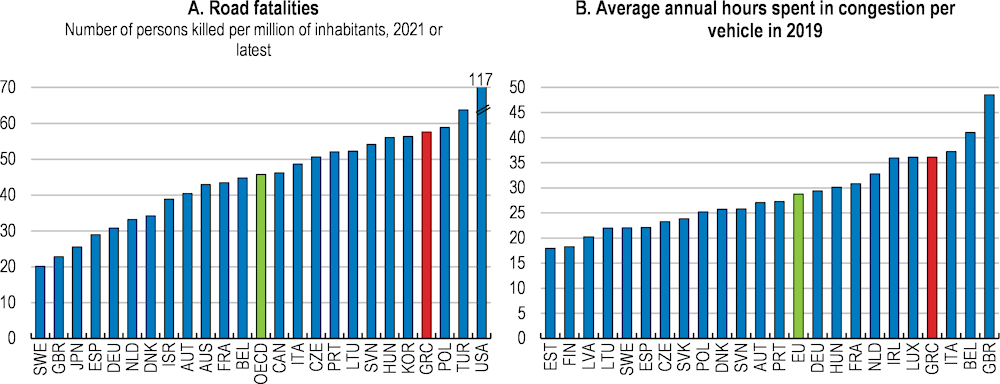

Large emission reductions by 2030 could be achieved from land transport. For some forms of transport – notably aviation, shipping, and heavy trucks – commercial low-emission technologies are still to be developed (IEA, 2021[18]). For land transport, low-emission solutions such as electric vehicles, rail, and metro, are more readily available. Most emissions from transport in Greece, 85%, arise from road transport (Figure 2.14, Panel A), as Greece relies intensively on road transport for both passengers and freight (Figure 2.14, Panel B and C). Simulations conducted for this Survey, described in Box 2.6, suggest that adopting a high-ambition policy path focusing on reducing emissions from road transport and shifting transport off the road, for example onto rail, could achieve large emission cuts by 2030, and up to 74% by 2050 if including comprehensive measures such as land use and urban planning (Table 2.5). These policies also hold the potential to raise firms’ productivity, for example by improving linkages between ports and rail to lower freight costs. Technological advances will reduce future abatement costs for still hard-to-decarbonise transport modes, including for ferries which account for 12% of emissions from passenger transport. Box 2.7 discusses challenges for Greece’s large shipping services sector to reduce emissions from ocean freight shipping.

Box 2.6. Simulating policy pathways with the International Transport Forum model

Scenarios for the global development of transport until 2050 have been developed by the International Transport Forum (ITF) in the ITF Transport Outlook 2021 (ITF, 2021[49]). The global model covers detailed transport modes for passenger and freight transport within cities, between cities and between countries. Characteristics such as speed and costs of available transport modes, demand for trips and which modes are being used to optimally satisfy mobility needs, are estimated sequentially at the detailed geographical level. A set of assumptions about regional policy pathways and technological developments, indicating different levels of ambition to reduce greenhouse gas (GHG) emissions from transport, are reflected in several scenarios: ‘Recover’ reflects mostly existing policy commitments, limited support for technological developments and a return to travel norms before the Covid-19 pandemic, whereas ‘Reshape+’ reflects more ambitious policies to transform the transport system and seize opportunities from the pandemic to change travel behaviours, such as expanding teleconferencing. While ‘Reshape+’ is consistent with transport’s contribution to limit global warming to 1.5 degrees, ambitions under ‘Recover’ are insufficient to bring transport’s contribution to net zero.

New empirical analysis developed by the OECD and the ITF for this survey explored by how much different policy pathways could reduce emissions for Greece in 2030 and 2050 and associated costs. The scenarios considered high ambition policies for particular policy areas for land transport, based on Greece’s regional specification of `Reshape+’, while remaining policies and technological developments followed the `Recover’ scenario. Scenarios and results are described in Table 2.5 below.

Table 2.5. More ambitious policies focusing on land transport could achieve large emission cuts

|

Reduction in annual GHG emissions from transport, relative to 2019, % |

Additional average network infrastructure costs until 2050, % of GDP |

Average annual foregone tax revenues until 2050, % of GDP |

||||

|---|---|---|---|---|---|---|

|

Policy scenario |

High ambition policy areas |

2030 |

2050 |

|||

|

1 |

Private transport |

Diffusion of zero-emission vehicles and low-emission fuels; longer range and lower costs of electric cars |

13% |

57% |

0.0% |

0.2% |

|

2 |

Public transport |

Increase in rail use to close gap in intensity of use of existing railway network to EU average with improvement in service quality, frequency and speed; improved linkages between railway and ports; improvement in network density and frequency of metro and bus; improved integration between different public transport modes and ticketing; prioritisation of public transport in traffic |

13% |

47% |

0.2% |

0.2% |

|

3 |

Public transport and transport efficiency |

Scenario 2 plus increase in mixed use neighbourhoods around public transport hubs and limiting urban sprawl with land use and urban planning; improved shared transport; increased teleconferencing; deprioritisation of private car transport |

19% |

51% |

0.2% |

0.1% |

|

4 |

Transformative change |

Scenarios 1 plus 3 |

29% |

74% |

0.2% |

0.4% |

Note: Simulations for Greece based on ITF Transport Outlook 2021 (ITF, 2021[49]). GHG emissions from domestic and international passenger and freight transport. Emissions from international transport not emitted in Greece and from sea transport not landing in Greek harbours have been excluded. Infrastructure costs include additional construction and maintenance costs for urban and non-urban road, metro, bus and rail networks compared to the baseline scenario; costs for purchasing vehicles are not included. Costs and foregone revenues from taxes on fuels, car registration and circulation, and tolls under current tax system, are calculated relative to baseline scenario Recover and expressed as percentage of cumulated simulated GDP over 2020 to 2050.

Source: OECD and ITF calculations for Greece based on (ITF, 2021[49]).

Figure 2.14. Road transport can make a large contribution to reducing Greece’s GHG emissions

Note: Panel A: Emissions from international transport and navigation excluded. Pipeline refers to long-distance transport of liquids or gas through a system of pipes. Average shown for countries included in the figure.

Source: OECD transport database; EC (2021), Statistical Pocketbook for Transport 2021.

Cutting emissions in road transport

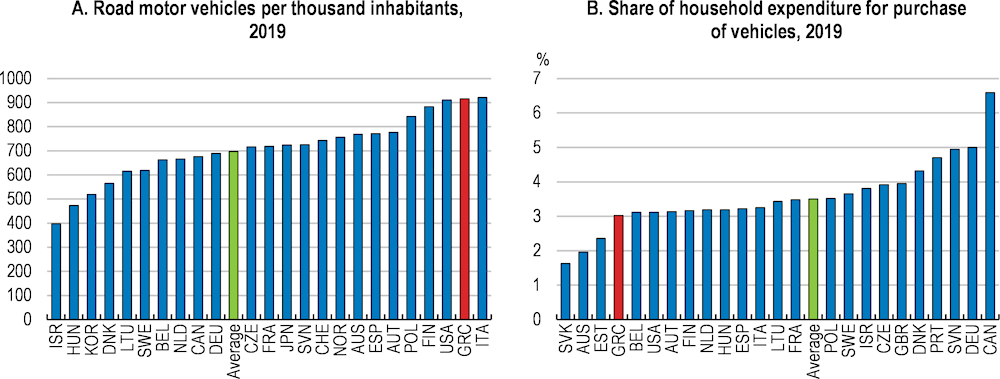

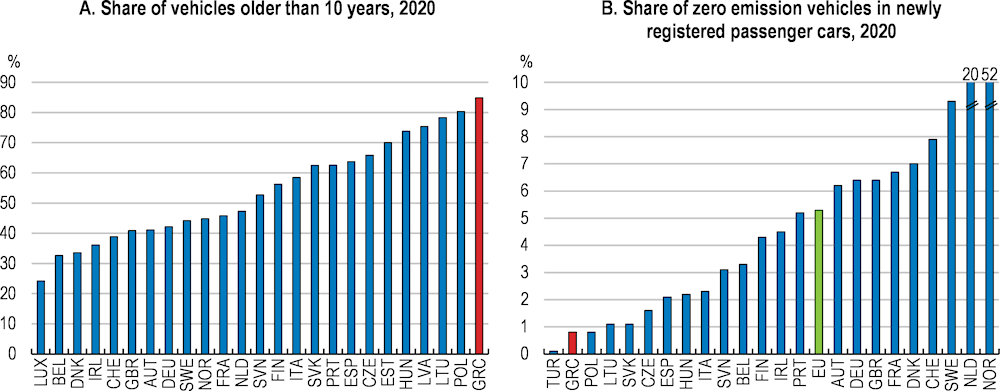

Greece faces financial headwinds to green its vehicle fleet. The fleet renews only slowly, likely reflecting limited financial resources of households and businesses to purchase cars. Greeks use motor vehicles for transport more than most other OECD countries (Figure 2.15, Panel A) but spend among the lowest share of their income on buying cars (Figure 2.15, Panel B). Buying used cars is common, with second-hand cars making up almost half of all passenger car and more than half of all van registrations in 2020-22 (ELSTAT, 2022[50]). As a result, Greece has one of the oldest car fleets among OECD countries (Figure 2.16, Panel A). Financial constraints and high costs for electric vehicles may delay the switching of many households and businesses to zero-emissions cars. Although price gaps between electric and combustion engine cars may disappear within the next few years (Lutsey and Nicholas, 2019[51]), used combustion engine cars are likely to remain substantially cheaper beyond 2030.

Figure 2.15. Greece is especially reliant on motor vehicles but spends few resources on purchasing them

Ambitious policies will be needed to overcome these headwinds. Greece lags other countries in adopting zero-emission vehicles. Both the share of zero-emission vehicles for the existing fleet (Figure 2.16, Panel B) and for new registrations is among the lowest in the OECD and EU (IMF, 2021[52]). Greece plans to raise the share of zero-emission cars among new registrations from 0.8% in 2020 to 30% in 2030. Replacing older and more emission-intensive cars with newer internal combustion engines would bring some modest emission reductions. Starting in 2024 and 2026, restrictions to registering new business vehicles, taxis or rental cars will promote zero- and low emission vehicles (see Table 2.1). From 2030, for new cars, only zero-emission passenger and light commercial vehicles can be sold. Achieving this will depend on sufficient zero-emission cars being produced, which may be challenging given global supply constraints. Slow fleet renewal implies these measures may make limited inroads into overall emissions reductions from vehicles. For example, based on registrations for passenger cars in 2019, these plans imply replacing vehicles with zero-emission cars corresponding to 0.7% to 2.5% of the current vehicle stock each year, thus taking several decades to replace all internal combustion engine cars (European Commission, 2021[53]). Measures to ban the import of used, very high-emission cars are welcome. Making purchasing zero-emission vehicles more attractive compared to internal combustion engine cars, as discussed below, would accelerate the adoption of zero-emission vehicles. OECD and ITF modelling suggests that adopting a high-ambition policy scenario focusing on the fast diffusion of zero-emission vehicles would yield GHG emissions reductions from transport of 13% in 2030 and 57% in 2050 (Table 2.5).

Developing a dense network of charging points would make electric vehicles more attractive. Most charging for electric cars is done at home or at work. However, having easy access to charging points elsewhere is crucial for their practicality. Greece has one of the least dense networks for public charging stations among OECD countries (IMF, 2021[52]). Measures included in Greece 2.0, such as a framework and financial support for installations, plan to add more than 8 000 charging points. This corresponds to achieving one charging point every 13 kilometres along Greece’s road network. Leveraging more private capital, and concentrating public support on areas where charging points are not financially viable, could further bolster the network’s density. Greece’s recent Climate Law requires municipalities to prepare and implement Charging Point Plans together with private investors. Regulation could make the installation of publicly accessible charging points obligatory for petrol stations or other focal points (IEA, 2021[54]). Germany, for example, planned to negotiate voluntary commitments by petrol station owners to equip 75% of all existing petrol stations by 2026 with charging points, and to mandate this if the goal is missed (Bundesregierung, 2020[55]).

Figure 2.16. Greece’s vehicle fleet is old and fleet renewal towards greener vehicles is slow

Source: European Automobile Manufacturers’ Association (ACEA, 2022), Vehicles in Use - Europe 2022; European Commission and European Alternative Fuel Observatory (EAFO).

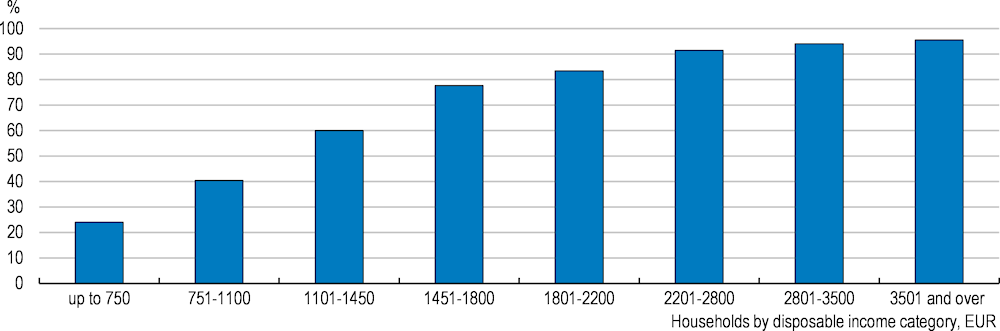

Targeted financial support to buy cleaner vehicles could accelerate take-up. Greece is offering generous purchase grants of up to EUR 8000 in addition to vehicle or business tax reductions or exemptions, including for registration taxes (ACEA, 2021[56]). An additional EUR 1000 is offered for scrapping an old conventional vehicle. Making zero-emission cars cheaper to buy helps to kick-start the market but is a fiscally costly way to promote wider adoption. For example, providing purchase subsidies to replace one-third of the vehicle stock, at the same average cost per vehicle as Greece’s programme operating in mid-2020 (Electrive, 2019[57]), would require EUR 12 billion (6.5% of 2021 GDP) of grants. Furthermore, the households that buy electric cars and benefit from these subsidies largely have high incomes. In the United States, for example, 90% of tax credits for electric vehicles went to the 20% highest income households (Borenstein and Davis, 2016[58]). Subsidising stations with zero-emission cars available for renting could provide better access for low-income households, who are less likely to own a car (Figure 2.17) (Nicholas and Bernard, 2021[59]). Subsidising loans rather than grants for purchasing zero emission vehicles, as done in Scotland, addresses financial constraints by overcoming high upfront costs of electric cars and mobilises more private funding (ICCT, 2020[60]).

Figure 2.17. Poorer households are less likely to own a car

Percentage of households with car ownership across household income groups, 2018

Box 2.7. International coordination will be crucial to cutting emissions from shipping

Maritime transport is core to global trade flows, and for producers and consumers of essential goods from food to energy supplies. 90% of global merchandise is moved via ships. Greece plays a key role for maritime transport. Greek ship-owners own about one-fifth of the global shipping capacity. Ships owned by Greeks are of strategic importance for the European Union’s oil and natural gas and other essential goods and staples’ imports. 32% of oil tankers and 22% of liquefied natural gas carriers globally are Greek-owned. In turn, maritime transport is also important for Greece’s economy, to which it contributes about 3% of value added, while shipping services contribute about 20% of total export receipts.

Maritime transport accounted for 2.5% of global emissions from energy in 2020, making it important for the global economy to become greenhouse gas emission neutral by mid-century. Most of maritime transport is by bulk carriers and tankers operating across oceans, which require fuels with high energy density. Batteries are still far less energy dense than conventional fuels, while alternative fuel types, such as hydrogen and ammonia, are not yet commercially available in the needed volumes at ports across the globe (IEA, 2021[18]).

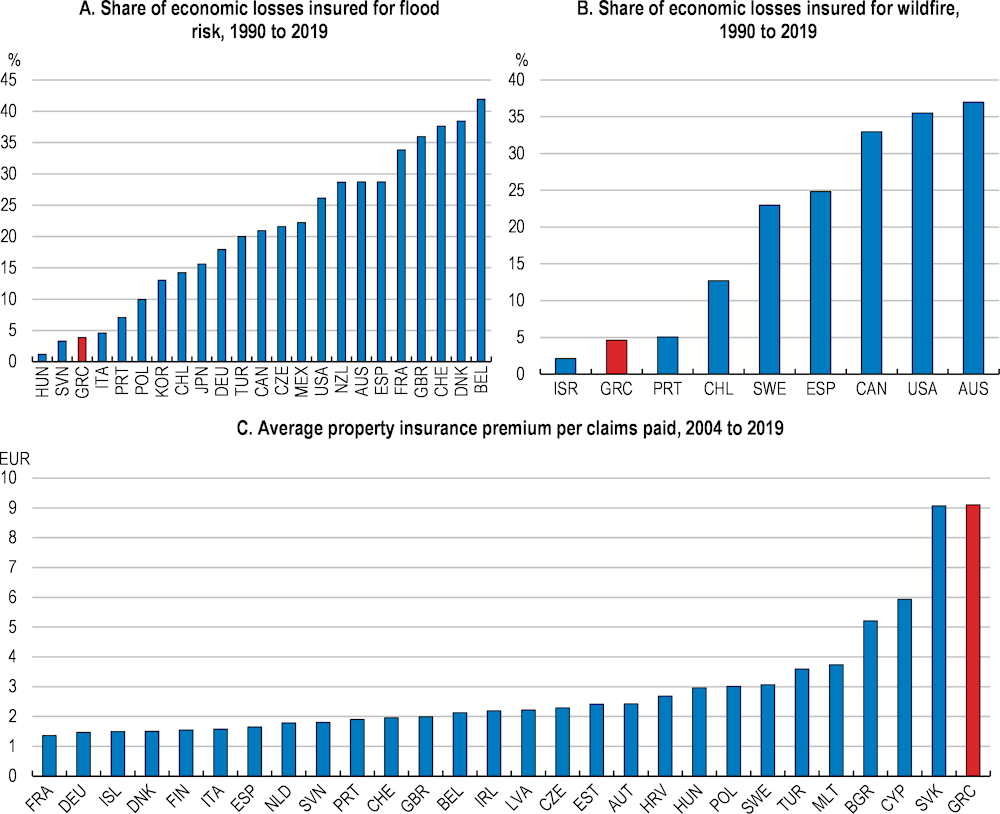

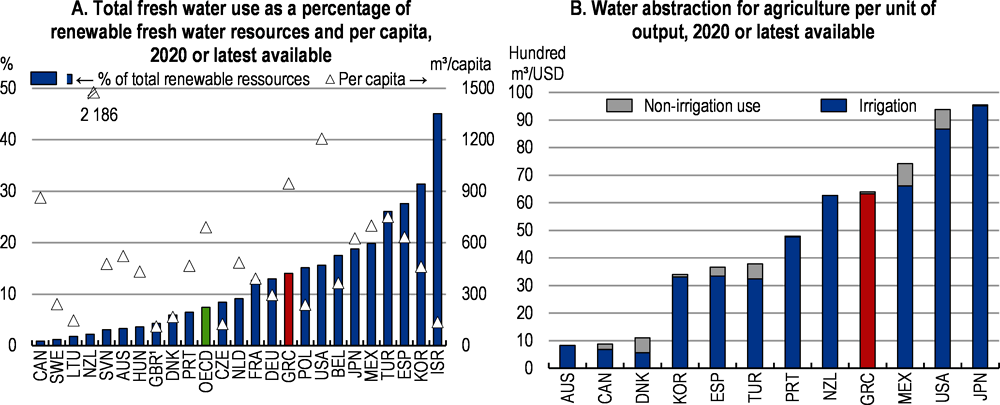

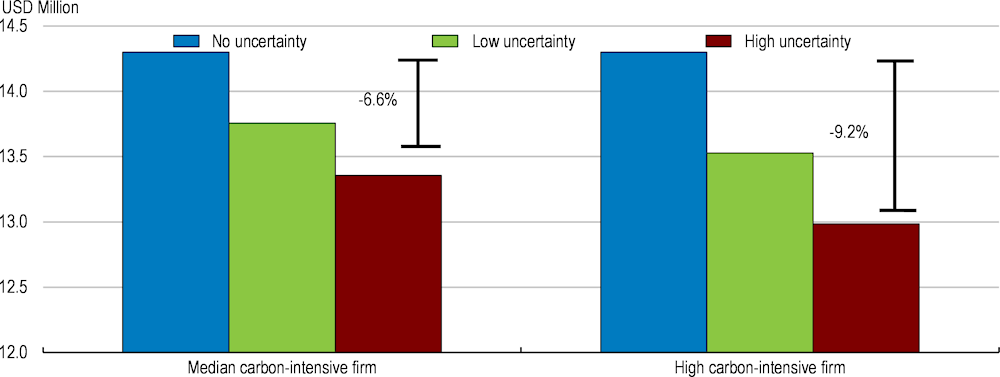

In the short term, including shipping in carbon pricing schemes such as the European Union’s Emission Trading Scheme can encourage commercial ship operators to reduce emissions and support innovation. For example, slow steaming (i.e., reducing vessel speed to use less fuel per trip (Degiuli et al., 2021[61])), is already available, but currently high freight rates and shortages of ships pressure commercial ship operators to minimise journey times. Until technologies and fuels allowing for larger emission cuts become commercially viable, pricing emissions from shipping may lead to higher trade costs with little effect on emissions.