This chapter provides an overview of the regional labour market of Amsterdam in comparison with regional labour markets of the other large Dutch cities, Rotterdam, The Hague and Utrecht, and with those of selected European cities. Long-term labour market trends and the recovery from the COVID-19 pandemic are highlighted through data on unemployment and labour force participation. The chapter then assesses the tightness of the regional labour markets of the four largest Dutch cities across occupations and sectors. Finally, the chapter analyses labour market outcomes by educational attainment, for different age groups, by gender and by migration background.

Policy Options for Labour Market Challenges in Amsterdam and Other Dutch Cities

2. Comparing Amsterdam’s labour market nationally and internationally

Abstract

In Brief

The four largest cities in the Netherlands, Amsterdam, Rotterdam, The Hague and Utrecht (referred to as the “G4”), are experiencing a tight labour market. The high demand and low supply of labour presents a challenge to successfully implement policies that support inclusive regional labour markets.

The four cities represent an important share of the Dutch labour market. The municipality of Amsterdam constitutes 5% of the total Dutch labour force. The combined provinces (Noord Holland, Zuid Holland, Utrecht province) of the four cities make up 40% of the total Dutch labour force.

The labour markets in each of the four cities are concentrated in services. Business services are important job providers in all four cities, but Amsterdam also has a large hospitality and tourism services sector. The region around the city of Rotterdam still has an important manufacturing sector and a large logistics sector due to the presence of the Port of Rotterdam, Europe’s largest seaport.

The improvement in unemployment and participation rates since 2010 is continuing following the COVID-19 pandemic. Participation rates increased from a range of 68% to 73% in 2010 to a range of 71% to 76% across the G4 in 2021. The COVID-19 pandemic brought a brief reversal to steadily decreasing unemployment rates in 2020. However, by 2021, unemployment rates were around the lowest levels of the decade, ranging between 4% and 5% across the four cities.

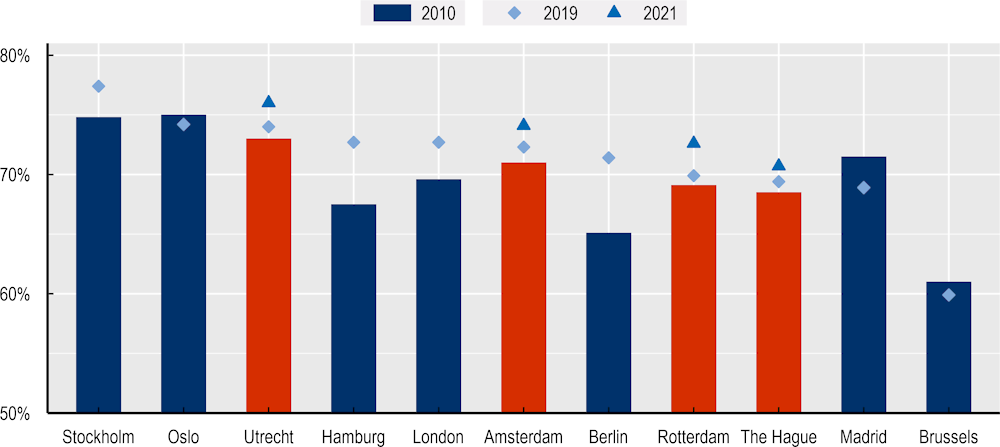

Figure 2.1. Participation rates are increasing, but differences across cities remain

Note: For Dutch cities the labour force participation rates are at the level of TL3 regions, for the population aged 15-75. For other cities, the data correspond to the TL2 regions that compose the respective metropolitan area and covers the population aged 15-74.

Source: OECD calculations based on Eurostat Table lfst_r_lfp2actrt (Economic activity rates by sex, age and NUTS 2 regions, %) and CBS table 83523NED (Arbeidsdeelname; provincie).

A tight labour market challenges firms to hire the right people and fill all jobs. The ratio of vacancies to the short-term unemployed across most sectors is currently at the highest level since 2018. In the second quarter of 2022, 30 of the 35 labour market regions in the Netherlands reported more than four job vacancies for every short-term unemployed. Amsterdam and Utrecht experienced an even larger shortage of workers with vacancy-to-jobseeker ratios reaching 7.2 and 8.5. About one in two vacancies was hard to fill according to employers in 2021. Employers cite the lack of applicants as the most important reason to fail filling open vacancies.

Not all workers benefit equally from the tight labour market. People with lower education levels, young people and those with a non-Western migration background have structurally higher rates of unemployment and experience stronger negative effects from economic shocks such as the COVID-19 pandemic. The unemployment rate of people with low levels of education varies between 7% and 13% across the G4 in 2021. The youth unemployment rate is double that of other groups, exceeding 10% in all four cities. The unemployment rate of people with a non-Western migration background improved substantially in the years prior to the pandemic but has been rising again to around 8% in 2021. In contrast, gender differences in the unemployment rates are limited, but participation rates of women are 10 percentage points below those of men in all four cities.

While the current labour market can be characterised as very tight, the analysis of the COVID-19 pandemic years, 2020-2021, indicate that the labour market situation can reverse rapidly. The experience shows that future economic upheaval is likely to affect groups differently. Especially the young, low educated and people with a migration background who already have higher unemployment rates in a growing economy may bear the brunt of changing economic circumstances.

Introduction

The four largest cities of the Netherlands – Amsterdam, Rotterdam, Utrecht, and The Hague, referred to as the G4 – are concentrated towards the west of the country, also known as the Randstad, and lie within one hour travel from each other. Collectively, they represent a major share of the whole Dutch labour market.

Important differences in the four cities’ economic structure and demographics exist. Amsterdam, the largest Dutch city, relies heavily on national and international business services. The port of Rotterdam, the largest seaport of Europe across a range of metrics, supports manufacturing and logistics in Rotterdam’s economy. The Hague is the centre of the national government and seat of several international organisations. More centrally located, Utrecht has the fastest growing and most highly educated population of the G4. It also serves as a logistics and services hub to the rest of the country.

The four largest cities in the Netherlands have in common that they are currently experiencing a tight labour market. The high demand and low supply of labour presents a challenge to the successful implementation of regional labour market policies that are both inclusive and resilient to ongoing and future demographic and economic transitions.

This chapter starts with an overview of the size and trends of the regional labour markets of the four largest cities of the Netherlands and compares these to selected European cities. This overview is followed by an analysis of labour market tightness following the COVID-19 pandemic across sectors and occupations. The chapter finishes with additional analyses on how local population-level characteristics such as age and migration background may explain some of the differences in labour market outcomes across the four cities.

The local and regional labour markets in the Netherlands’ four largest cities

Cities play an important role in the performance of national labour markets. The labour force of the Netherlands in 2019 amounted to 9.2 million workers. The three provinces of the four cities, Noord-Holland, Zuid-Holland and Utrecht province, have a combined labour force of 4.2 million workers, representing over 45% of the total Dutch labour force. This report focuses on the four largest cities in the Netherlands, Amsterdam (in the province of Noord Holland), Rotterdam and The Hague (both in Zuid Holland) and Utrecht (in the province of Utrecht) and their statistical and administrative regions.

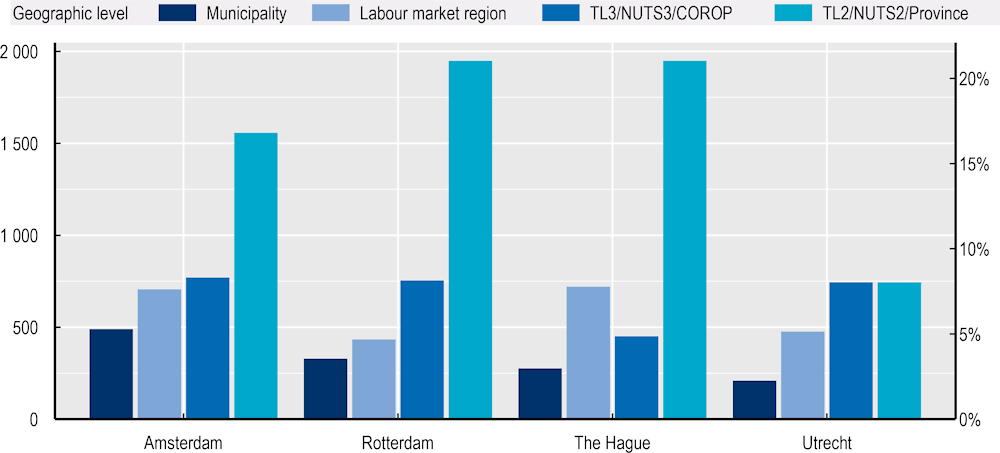

The municipality of Amsterdam has the largest labour force among the big four cities, amounting to close to 0.5 million workers and representing more than 5% of the total Dutch labour force in December 2019 (Figure 2.2). The municipalities of the G4 cities represent large fractions of their respective labour market and NUTS3 regions. The municipality of Amsterdam represents about 30% of the labour force in the province of Noord-Holland, as does the combination of Rotterdam and The Hague in the province of Zuid-Holland and the municipality of Utrecht in the province of Utrecht. The labour market regions of Amsterdam and The Hague host close to 0.7 million workers, while there are 0.4 and 0.5 million workers in the labour market regions of Rotterdam and Utrecht respectively. Box 2.1 provides details on the regional terminology of this report. Figure 2.4 illustrates these in maps that identify provinces, regions, labour market regions and municipalities.

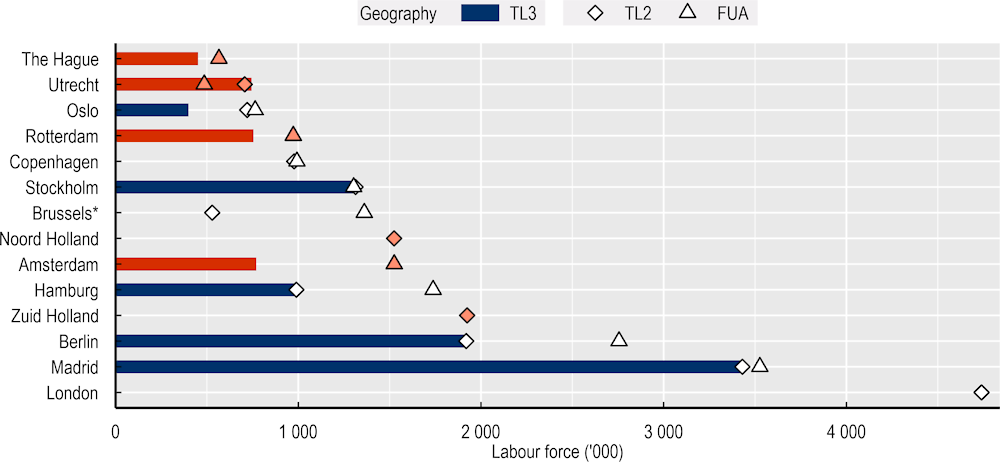

In this report, the four Dutch cities are compared to a selection of cities in other European countries. International comparisons include major cities in the neighbouring countries, Germany and Belgium, as well as the capitals of Norway (Oslo), Sweden (Stockholm), Denmark (Copenhagen), Spain (Madrid) and the United Kingdom (London). Each of these cities belong to TL2 and TL3 geographies, which are generally closely centred around the relevant city. The OECD also provides statistics at the level of functional urban areas (FUAs), which are geographies based on commuting patterns. FUA provide a more internationally harmonised city geography (OECD, 2012[1]; OECD, 2021[2]).

Figure 2.2. The labour force of the G4 cities represents large shares of their respective labour market regions and small (NUTS) regions

Notes: The TL2/NUTS2 region of Amsterdam is Noord Holland, of Rotterdam and The Hague is Zuid Holland and for Utrecht is Utrecht province.

Source: OECD calculations based on CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

Figure 2.3. Dutch cities compared to selected European regions and cities

Note: TL3 data on Amsterdam, Rotterdam, The Hague and Utrecht from CBS, refer to people aged 15-74 years; other data form OECD regions and cities database refers to people 15-64 years old. TL: Territorial Level. FUA: Functional Urban Areas. * Brussels FUA labour force data is for 2016.

Source: OECD calculations based on OECD regions and cities database and CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

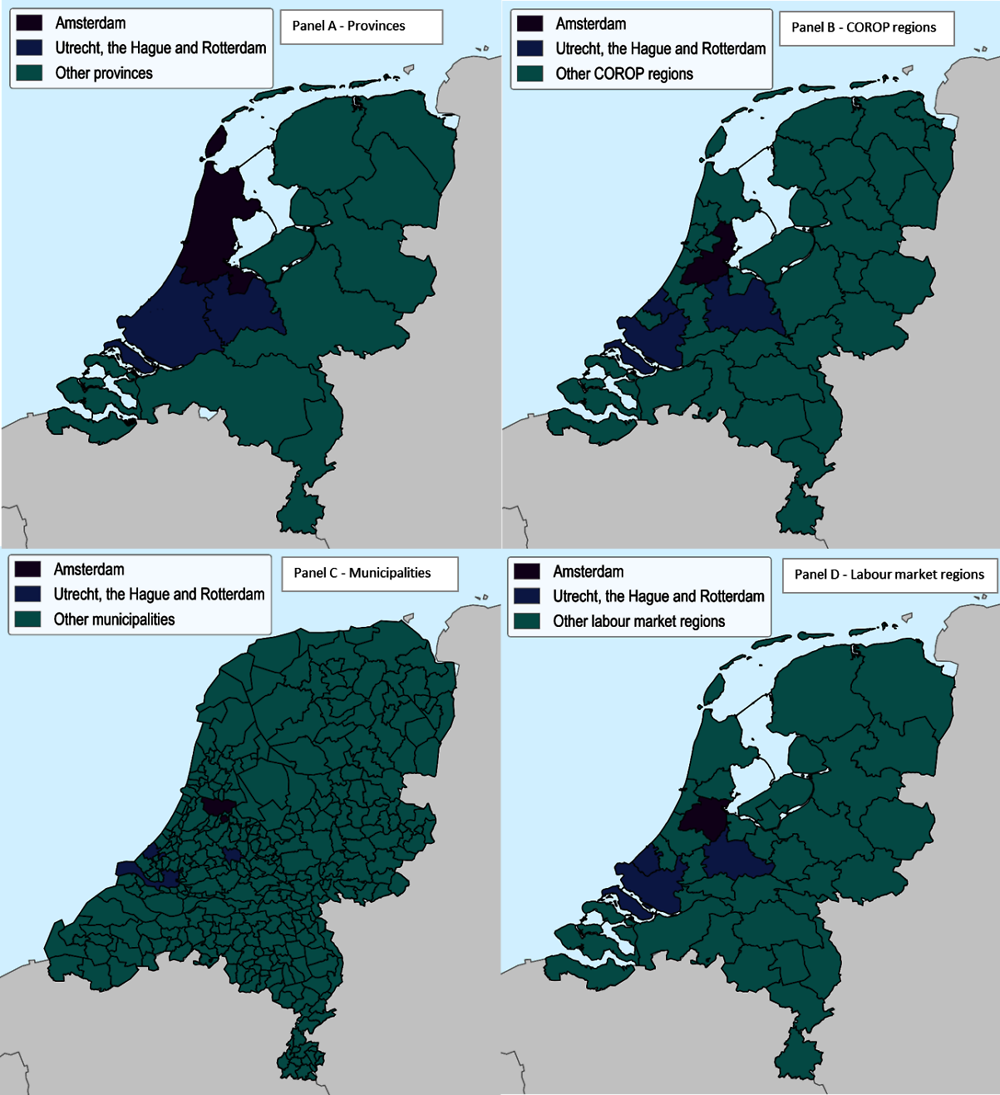

Box 2.1. Regional terminology

This report combines labour market data and analysis at various regional levels. The four biggest cities in the Netherlands, Amsterdam, Rotterdam, The Hague and Utrecht, are located in the west and the centre of the country. The national statistics office, CBS (Centraal Bureau voor de Statistiek), and the national agency for public employment services, UWV (Uitvoeringsinstituut Werknemersverzekeringen), provide labour market data across various administrative levels and regional groupings. The Netherlands has 12 provinces, which signify Eurostat NUTS2 regions. These are equivalent to OECD TL2 regions. The provinces nest 40 small regions, Eurostat NUTS3 regions, which are equivalent to OECD TL3 regions, and CBS COROP (Coördinatiecommissie Regionaal Onderzoeksprogramma) regions. In addition, regional cooperation is arranged in municipal groups. For the labour market, municipal cooperation is implemented in 35 labour market regions. The labour market regions are arranged independently from NUTS2 and NUTS3 regions. Table 2.1 provides a brief overview of the regional levels and associated names. It also provides the corresponding maps.

Table 2.1. Overview of regional terminology

|

Netherlands |

Amsterdam |

Rotterdam |

The Hague |

Utrecht |

|

|---|---|---|---|---|---|

|

Municipality |

345 |

Amsterdam |

Rotterdam |

The Hague (in Dutch, Den Haag, or ‘s-Gravenhage) |

Utrecht (Municipality |

|

Labour market region |

35 |

Groot Amsterdam |

Rijnmond |

Haaglanden |

Midden-Utrecht |

|

Consists of |

8 municipalities |

16 municipalities |

5 municipalities |

15 municipalities |

|

|

COROP region (NUTS3/TL3) |

40 |

Groot-Amsterdam |

Groot-Rijnmond |

Agglomeratie ‘s-Gravenhage |

Utrecht (COROP) |

|

Consists of |

15 municipalities |

24 municipalities |

6 municipalities |

23 municipalities |

|

|

Metropole region |

3a |

Amsterdam |

Rotterdam Den Haag |

- |

|

|

Consists of |

32 municipalities |

23 municipalities |

- |

||

|

Province (NUTS2/TL2) |

12 |

Noord Holland |

Zuid Holland |

Utrecht (Province) |

|

Note: a. The third metropole region is Eindhoven.

Source: OECD elaborations

The size of the labour market of the four Dutch cities, even when referring to their respective NUTS3 region, is small in international comparison. While all cities except The Hague (TL3) are larger than Oslo or Brussels, they are smaller than Copenhagen, Stockholm, Hamburg. The size of the labour force in the TL3 regions of Berlin and Madrid respectively is more than two and three times as large as the labour force in Amsterdam and Rotterdam. The provinces of Noord Holland and Zuid Holland (representing TL2 regions) are more comparable to the TL2 regions of those that contain the cities of Berlin in Germany and Stockholm in Sweden. The functional urban areas are defined independently of the TL2 and TL3 regions, and therefore, the associated labour force can be larger or smaller than the labour force in the corresponding territorial levels. The functional urban area of Amsterdam is as large as the Noord Holland province and comparable to that of Brussels. The labour force of the FUA of The Hague is larger than its TL3 region, while for Utrecht it is smaller. The FUA of Rotterdam is also larger than its TL3 region and comparable with that of Copenhagen.

Figure 2.4. Illustration of different regions in the Netherlands

Source: OECD illustration.

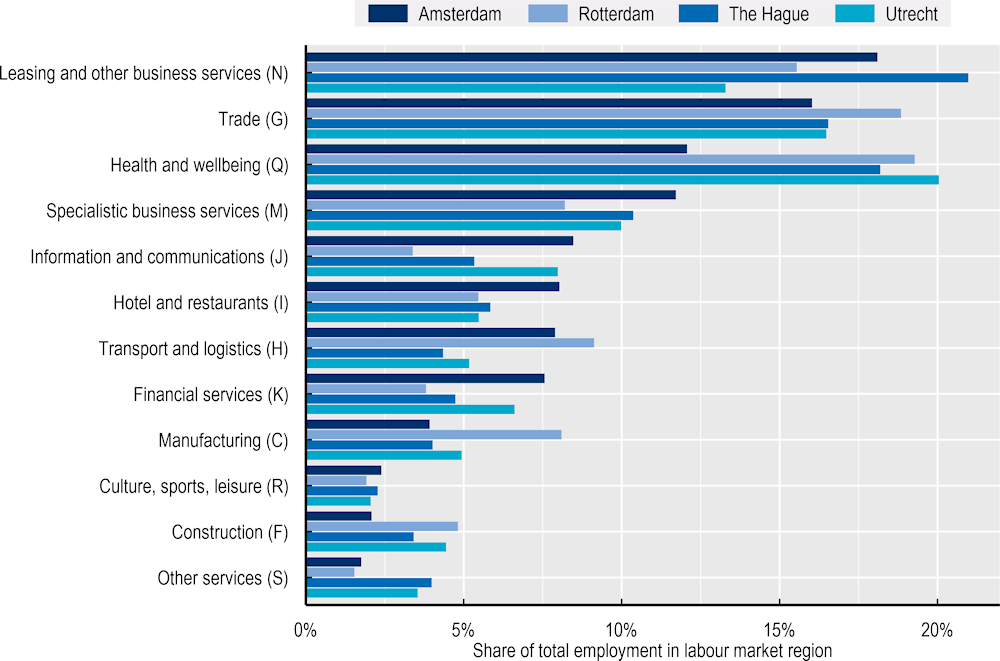

The service sectors dominate the labour market across the Netherlands four largest cities, while each have their specialisation. Leasing and other business services, trade (wholesale and retail) and health and well-being each constitute 15% to 20% of total employment in the labour market regions of the four cities (Figure 2.5). Within services, the cities have different specialisation patterns. Health and wellbeing services make up more than five percentage points more employment in Rotterdam, The Hague and Utrecht than in Amsterdam. The employment share of specialist business services, which includes professional, scientific and technical activities, management consulting, and architecture and engineering services makes up a larger employment share in Amsterdam relative to the other cities, although the difference compared to Utrecht and The Hague is small. Amsterdam has a larger share of employment in information and communication activities and in hotel and restaurants. Hotel and restaurants reflect both the importance of business services, the international airport Schiphol and the tourism activities in the city of Amsterdam. The city of Rotterdam stands out with the largest shares in trade, transport and logistics and manufacturing. Each of these activities can be linked to the international seaport of Rotterdam, which remains the largest port of Europe.

Figure 2.5. The G4 cities have service-oriented labour markets

Note: Agriculture, forestry, fisheries (A), resource extraction (B), Energy (D), Water and waste management (E), Real estate services (L), Public administration and government (O), Education (P) excluded.

Source: OECD calculations based on CBS table 83582NED (Banen van werknemers; SBI2008, regio).

The labour markets before and after COVID-19

The positive long-term trends on regional labour markets were only briefly interrupted by the COVID-19 pandemic, but structural differences remain. Across the G4, labour force participation rates were rising, and unemployment rates were decreasing prior to 2019, approaching the levels of Oslo and Stockholm. The COVID-19 pandemic brought only a brief interruption to these long-term trends, potentially aided by extensive policy support for a large share of the working population in response to the health crisis, such as labour costs compensations for firms, and grants for own account workers (Jongen and Koning, 2020[3]; Adema et al., 2021[4]).

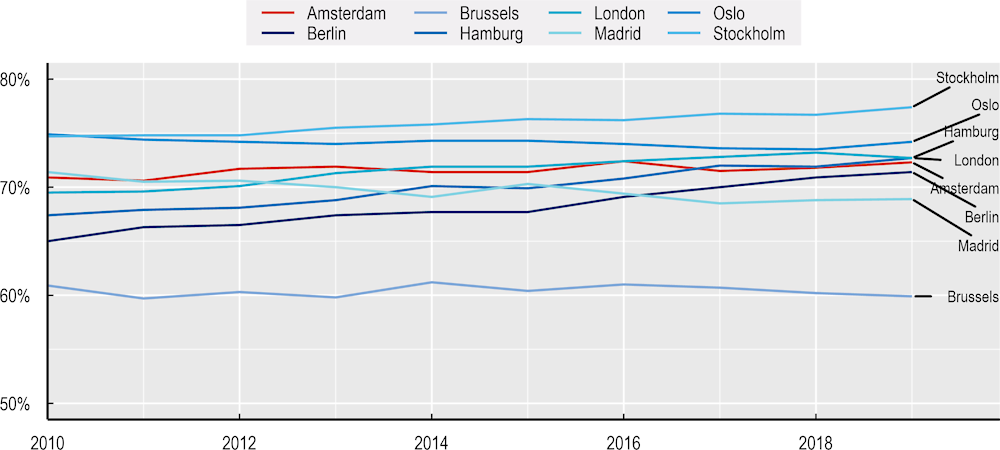

The labour force participation rate has improved gradually since 2010 across European cities. In Amsterdam, the labour force participation rated increased from 70.9% in 2010 to 72.3% in 2019 (Figure 2.6). In comparison, the labour force participation rate in Hamburg increased from 67.4% to 72.7%, and in London from 69.5% to 72.7% over the same period. All cities lag Stockholm, where the participation increased from 74.7% to 77.4%. Brussels, with a labour force participation rate of 59.9% in 2019 and no visible upward trend in earlier years remains far behind the other cities.

Figure 2.6. The labour force participation rate gradually improved in Amsterdam during the decade preceding the COVID-19 pandemic

Note: Amsterdam refers to the TL3 region of Groot Amsterdam, population aged 15-75 years. For other cities, the data correspond to the TL2 regions that compose the respective metropolitan area, population aged 15-74 years.

Source: OECD calculations based on Eurostat table lfst_r_lfp2actrt (Economic activity rates by sex, age and NUTS 2 regions, %) and CBS table 83523NED (Arbeidsdeelname; provincie).

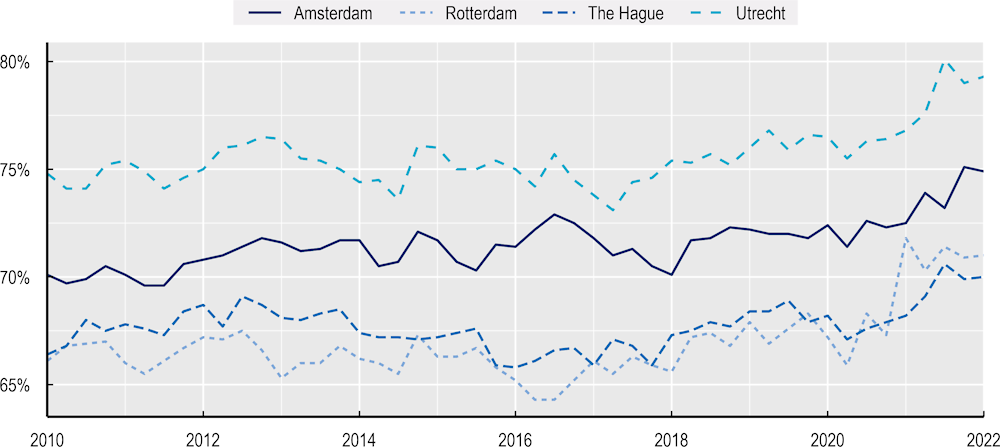

Figure 2.7. The labour force participation rate is increasing in all G4 cities, but with substantial structural differences in levels

Note: Gross participation rate for the municipalities of the four cities only. CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: OECD calculations based on CBS table 83523NED (Arbeidsdeelname; provincie)

Although increasing, the labour force participation rates of the working-age population in the big four Dutch cities differ structurally by almost 10 percentage points between. The municipalities of The Hague and Rotterdam reported participation rates that went above 70% in 2021 for the first time since at least 2010. At the same time, Utrecht showed a participation rate of 79.3% in 2022Q1, while Amsterdam’s stood at 74.9% (Figure 2.7). For the entire period, structural differences between the cities are noticeable, with the latest numbers ranging between 70% in The Hague and 79% Utrecht. The participation rates in each city remained largely constant between 2009 and 2019. Since the second half of 2020, all four cities have seen an increase in their participations rates.1

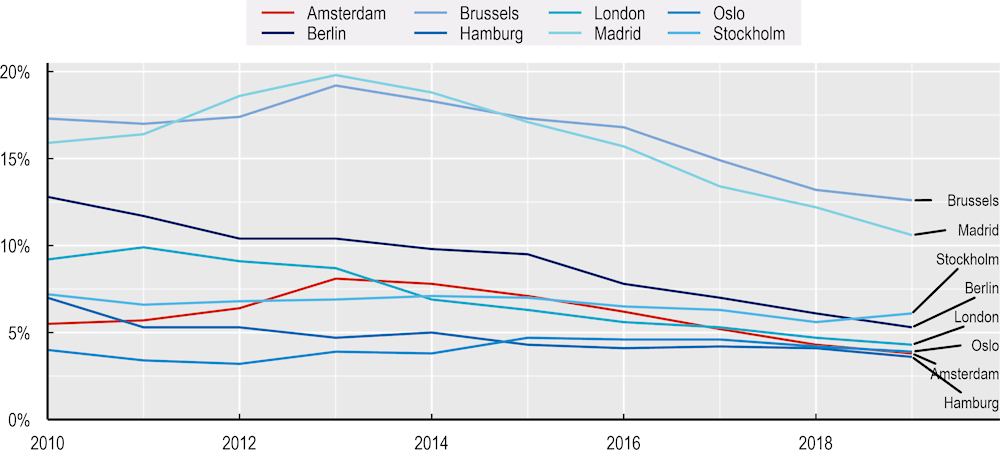

Unemployment rates in European cities, including in Amsterdam, have steadily decreased since 2013. Places with relatively low unemployment rates, such as Hamburg and Oslo kept the unemployment rate below 5% (Figure 2.8). At the same time, places with relatively high unemployment rates, such as Brussels and Madrid, have experienced major reductions in unemployment. Amsterdam, together with London and Berlin, experienced a convergence of unemployment rates towards the cities with the lowest numbers.

Figure 2.8. Unemployment was relatively low in Amsterdam in international comparison before the COVID-19 pandemic

Note: Amsterdam refers to the TL3 region of Groot Amsterdam. For other cities, the data correspond to the TL2 regions that compose the respective metropolitan area.

Source: OECD calculations based on Eurostat table lfst_r_lfu3rt (Unemployment rates by sex, age, educational attainment level and NUTS 2 regions, %) and CBS table 85230NED (Arbeidsdeelname; provincie).

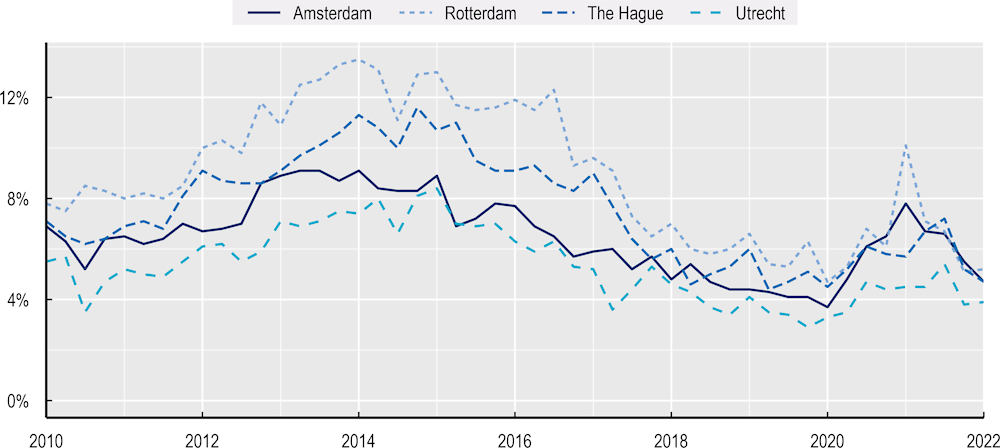

Unemployment rates in the four largest Dutch cities dropped to their lowest since 2010. In Amsterdam specifically, the unemployment rate peaked at 9.1% in 2013Q2 and then dropped to 3.7% in 2020Q1 (Figure 2.9). The COVID-19 pandemic brought a reversal. The unemployment rate in Amsterdam rose to 6.5% in 2020Q4. The last numbers indicate that unemployment is falling again. Since 2010, the unemployment rate in Amsterdam tended to be structurally below the rates in Rotterdam and The Hague, but slightly above that of Utrecht. Nevertheless, in 2019, the unemployment rate in each of the four Dutch cities is as low as that of the European cities with the lowest rates presented in Figure 2.8.

Figure 2.9. The unemployment rate in Dutch large cities continues to improve since 2014

Note: Unemployment rate for the municipalities of the four cities only. CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: OECD calculations based on CBS table 83523NED (Arbeidsdeelname; provincie).

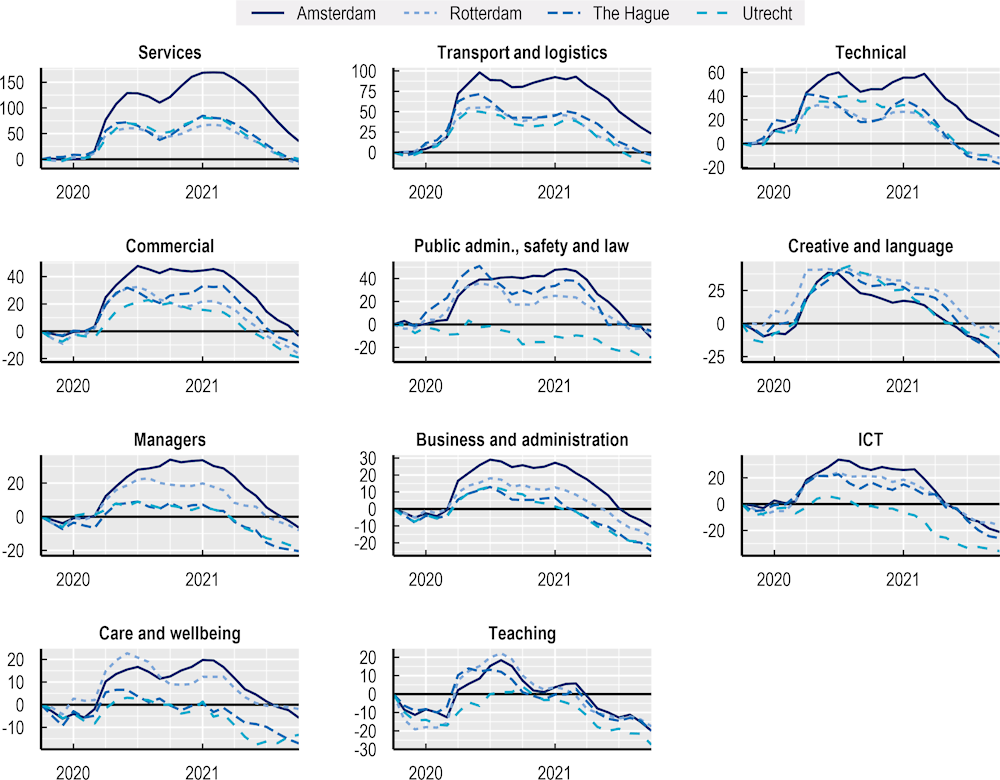

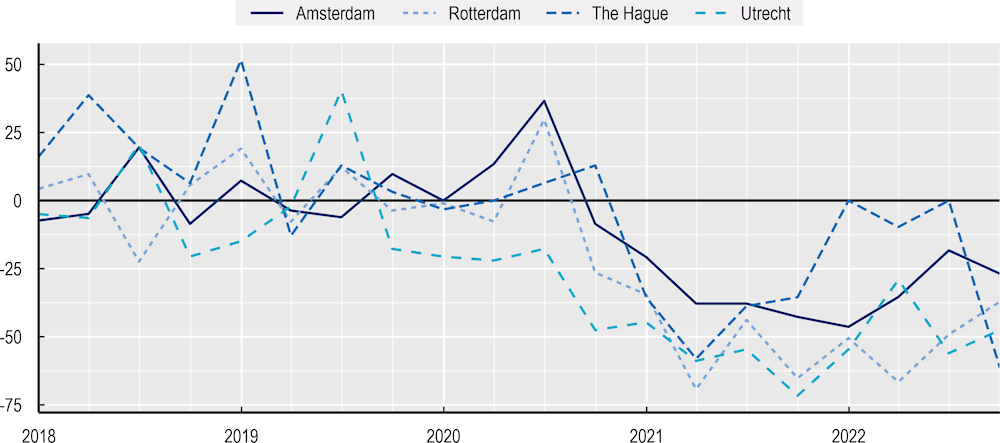

Workers in Amsterdam experienced larger shocks in unemployment during the COVID-19 pandemic across several occupations relative to workers in the other G4 (Figure 2.10). In Amsterdam, workers in business and administration, management, general services and transport and logistics saw larger percentage increases in unemployment compared to the other cities. This larger relative shock also affected the time it took for the number of unemployment claimants to fall back to pre-pandemic levels. Not all occupations were affected to the same extend. General services occupations and transport and logistics saw a doubling of unemployment claimants relative to the fall of 2019, while pedagogic and ICT occupations saw relatively minor increases, and the quickest reversal. The latest numbers indicate that the number of unemployment claimants across most cities and occupations lies below the level of the COVID-19 pandemic.

While the COVID-19 pandemic caused an increase in unemployment across most OECD regions and cities, the effects were felt most strongly in cities (OECD, 2020[5]). Cities experience stronger employment effects because they typically have a higher concentration of employment in the non-tradable services sector. Jobs in sectors such as hospitality and recreation often do not lend themselves to remote and online working. Moreover, larger cities tended to be more affected than smaller ones. This pattern is also visible in Figure 2.10, where the rise in unemployment in Amsterdam is larger in the most affected occupations relative to the other cities. The rise in unemployment coincided with a decrease in vacancies in cities, especially in occupations that require face-to-face interaction. Across 18 OECD countries with available data, online job postings decreased by an average of 35% on any given day between 1 February and 1 May 2020. “Public services” (i.e. services in education, health care and social work, or public administration and defence sectors), and business services, followed by trade and transportation, and the accommodation and food industries made the largest contributions to these declines (OECD, 2020[6]; OECD, 2020[5]). Evidence from US cities also indicates that online job postings contracted more than other types of vacancy postings. Moreover, the recovery was slower in metropolitan areas that are larger, have a more educated workforce, and have a more diversified industrial structure (Tsvetkova, Grabner and Vermeulen, 2020[7]).

Figure 2.10. The COVID-19 crisis hit all G4 cities hard, but recovery is broadly shared

Note: Number of unemployment claimants in the respective labour market regions. See definition on labour market regions in Box 2.1.

Source: OECD calculations based on data of UWV, see https://www.werk.nl/arbeidsmarktinformatie/datasets.

The national policy response to the COVID-19 pandemic likely aided the limited rise in unemployment. The Dutch government introduced an emergency scheme based on short-time work programmes where employers who reduced workers’ hours were compensated for hours not worked, while employees received their regular wages. Employers claiming the “Emergency Instrument for bridging employment” (Noodmaatregel Overbrugging Werkgelegenheid, NOW), could get up to 90% of their wage costs re-imbursed if they suffered a revenue decline of at least 20% relative to a comparable period in 2019. In 2020, NOW distributed EUR 15.8 million to companies. At its peak, it reached 150 000 businesses (Jongen and Koning, 2020[3]). The NOW mostly benefitted employees on a regular contract. For own-account workers, another instrument was created that considered an individual’s income and family situation. In 2020, this instrument allocated EUR 2 million to individuals. Analysis of CPB data indicates that among OECD countries, The Netherlands was relatively generous with their support to workers and other instruments to avoid lay-offs (Adema et al., 2021[4]). Modelling results suggest that without the complete package of employment and income support, the unemployment rate in 2020 would have been 0.7 to 2.2 percentage points higher (Verstegen, van der Wal and Deijl, 2021[8]).

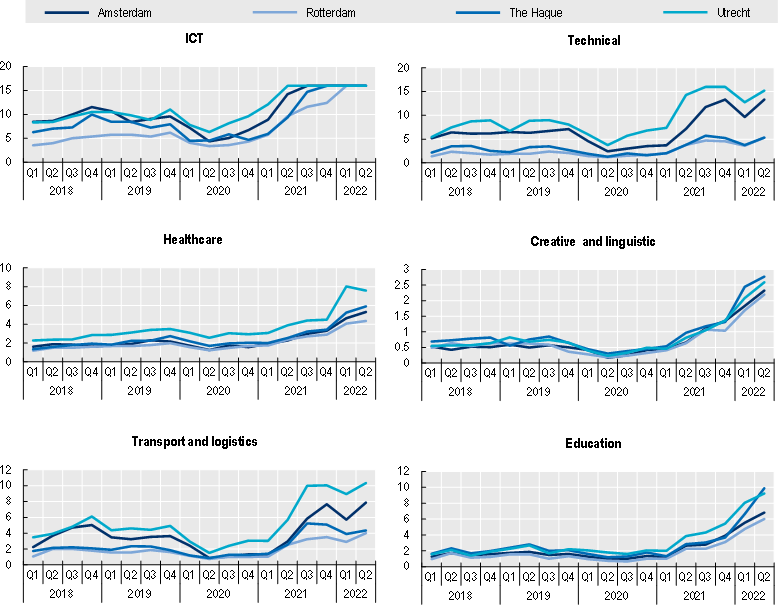

The labour market is tight across the Netherlands’ four largest cities

The labour market is tight across the big four cities and across sectors. The Dutch public employment office, UWV, publishes a labour market tension indicator that sets the number of vacancies against the number of jobseekers who receive unemployment benefits for less than six months. In 2022Q2, 30 of the 35 labour market regions in the Netherlands reported more than four job vacancies for every short-term unemployed. Amsterdam and Utrecht experienced an even larger shortage of workers with vacancy-to-jobseeker ratios reaching 7.2 and 8.5. By contrast, the labour markets of the other G4 cities, Rotterdam and The Hague, have vacancy-to-jobseeker ratios closer to the national average (4.4 and 5.2 respectively) (UWV, 2022[9]). Figure 2.11 shows that since the second half of 2020, the number of vacancies relative to unemployed workers has steadily increased across all sectors.

Figure 2.11. The labour market has tightened rapidly since 2020Q2 across cities and occupations

Note: The tension indicator is based on the number of vacancies per sector divided by the number of people who receive unemployment benefits for less than six months. The number of vacancies is weighted to ensure labour market representativeness of vacancies. Sectoral difference in hiring practices, turnover rates and length of contracts across sectors can result in structural differences in the tension indicator.

Source: UWV, see https://www.werk.nl/arbeidsmarktinformatie/datasets.

Vacancies in occupations such as transport and logistics, ICT and other technical occupations show high values in their tightness indicator. Differences in hiring practices, turnover rates of employees and differences in the length of contracts across sectors can result in structural differences in the tension indicator between sectors. Despite such differences, short-term trends across sectors are similar and all sectors report their highest vacancy-to-jobseeker ratio in the most recent quarters. Nevertheless, differences in sector-specific labour market tightness emerge between cities. For instance, the tightness indicator for technical occupations in Amsterdam and Utrecht is more than twice as high as it is in The Hague and Rotterdam.

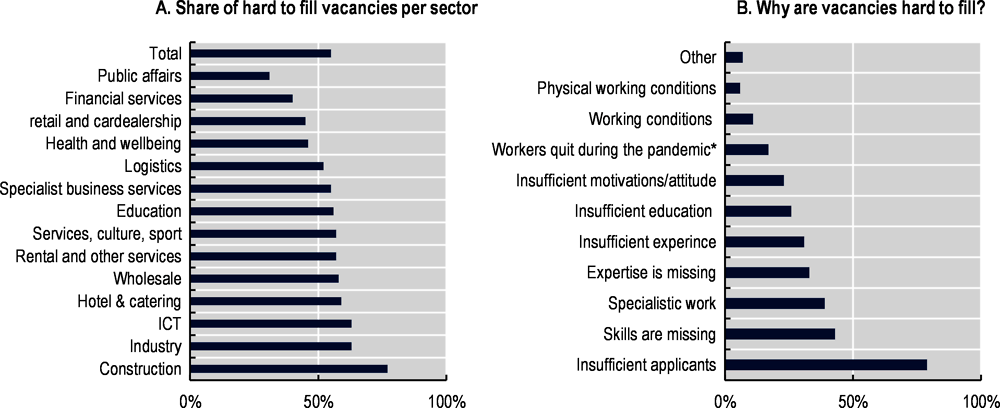

Employers struggle to fill vacancies across a range of sectors. More than half of all vacancies are hard to fill according to Dutch employers responding to a survey in 2021 (Figure 2.12). Almost eight out of ten employers in the construction sectors find it hard to fill vacancies. Similarly, more than six out of ten employers in the Industry and ICT sectors state that it is hard to find suitable workers. Employers in public affairs and financial services feel the least pressure relative to the average, but more than three out of 10 employers still find it hard to fill vacancies. In response, UWV suggests that employers could look for alternative solutions to address labour shortages, such as considering refugee with the right to remain (“statusholders”, see Chapter 5), recruit in a larger labour pool by considering applicants in different regions or with different professional backgrounds and the rearrangement of work tasks among current employees (UWV, 2022[10]).

Figure 2.12. More than half the vacancies are hard to fill in the Netherlands, mostly due to a lack of suitable applicants

Note: Survey across 3061 establishments, conducted between September and November 2021. Sectoral shares are reweighted to be representative of the underlying population. * full reason: workers moved to other sectors due to the pandemic.

Source: UWV. Moeilijk vervulbare vacatures en behoud van personeel, 3 February 2022.

The main reason for the inability to fill vacancies is the lack of applicants, followed by a lack of suitable skills of applicants. Almost four out of five employers cite a lack of applicants as a reason that makes vacancies hard to fill. This reason is cited almost twice as often as the next most cited reasons, which is the lack of skills and required expertise. The COVID-19 pandemic is sometimes suggested to have caused employees to rethink their career paths (Garcia and Paterson, 2022[11]). However, in the Netherlands, less than one in five employers indicate that the pandemic has caused suitable workers to look for jobs in other sectors.

COVID-19-related state support for business may be contributing to the tightness in the labour market. A historic low rate of bankruptcies since the pandemic suggest that the state aid provided by many OECD governments, including the Netherlands, has kept otherwise unviable business active (OECD, 2021[12]). As Box 2.2 documents, default rates in the TL3 regions of the G4 cities were at least 25% lower during the COVID-19 pandemic than in previous years. Consequently, workers employed by firms that otherwise would have had defaulted are now not available for hiring to more successful firms with growing need for more staff.

Box 2.2. Are too many workers locked-in unviable businesses?

Most governments of OECD member states provided financial support to businesses during the COVID-19 pandemic, which has led to historic low bankruptcy rates (OECD, 2021[12]), including in the Netherlands (Fareed and Overvest, 2021[13]). In the NUTS3 regions of the Netherlands’ four largest cities, quarterly business failures dropped in the third and fourth quarter of 2020. The number of defaults in all cities except Amsterdam were more than 50% lower in some quarters relative to the quarterly average of 2019 (Figure 2.13). In Amsterdam, bankruptcy rates were 46% lower in the last quarter of 2021, relative to 2019. In the first quarter of 2022, all cities are still below the average quarterly number of defaults in 2019, although some increase is visible for The Hague, Utrecht and Amsterdam.

Figure 2.13. Business failures lie far below pre-pandemic trends

Notes: Relative default rates of firms and other organisations. The rates exclude firms without employees.

Source: OECD calculations based on CBS table 82522NED (Uitgesproken faillissementen; regio).

As default rates return to pre-2020 levels, employees that are employed in non-viable businesses can move to businesses in sectors and occupations in which there is high demand for workers. However, this effect may be limited in practice. In the Netherlands, most firms that received emergency support were financially healthy prior to the pandemic, but firms that were in a less healthy situation were relatively more likely to request support (Altares, 2021[14]; Adema et al., 2021[4]). This is in line with evidence from other OECD countries that finds that credit guarantees aided the smaller, financially weaker firms or less productive firms disproportionally in Italy, Portugal and the US (Core and De Marco, 2020[15]; Kozeniauskas, Moreira and Santos, 2020[16]; Cororaton and Rosen, 2020[17]; Granja et al., 2020[18]). In this sense, the business support policies were effective. Once the emergency measures are phased out, it can be expected that defaults will rise again (Rajan, 2020[19]). However, the employment effect may be limited because the additional defaults may occur in relatively small firms.

Sources:

Adema et al. (2021[4]) Economische analyse steunpakket 2020, CPB. Altares (2021[14]) “Bij deze ondernemers komt de NOW-steun terecht”.

Core and De Marco (2020[15]) Public Guarantees for Small Businesses in Italy during COVID-19, https://doi.org/10.2139/ssrn.3604114.

Cororaton and Rosen (2020[17]) Public Firm Borrowers of the US Paycheck Protection Program https://doi.org/10.2139/ssrn.3590913.

Fareed and Overvest (2021[13]) Business dynamics during the COVID pandemic, CPB.

FT (2021[21]) Keeping zombie companies alive is the right call, https://www.ft.com/content/ac2828ad-7930-43ef-a227-1cbd8ff8c018.

Granja et al. (2020[18]) Did the Paycheck Protection Program Hit the Target?, https://doi.org/10.3386/w27095.

Hodbod et al. (2020[20]) Avoiding zombification after the COVID-19 consumption game-changer, https://voxeu.org/article/avoiding-zombification-after-covid-19-consumption-game-changer.

Kozeniauskas, Moreira and Santos (2020[16]) Covid-19 and Firms: Productivity and Government Policies, CEPR.

OECD (2021[12]) SME and entrepreneurship performance in times of COVID-19, https://doi.org/10.1787/6039c015-en.

Rajan (2020[19]), State support for Covid-hit companies has to change, https://www.ft.com/content/baeb54fa-8902-4ac9-a4a1-fdf48cf13a8e.

Differences in demographics and education levels across the labour markets of the Netherlands’ four largest cities

A tight labour market overall does not imply that all workers benefit equally, but it can offer the opportunity to policy makers to address structural differences. People of different socio-economic characteristics such as age and migration background may benefit to a different extent from a high demand for labour. However, a tight labour market can be an opportunity for regional policy makers to address such structural differences in the performance of different groups on the labour markets.

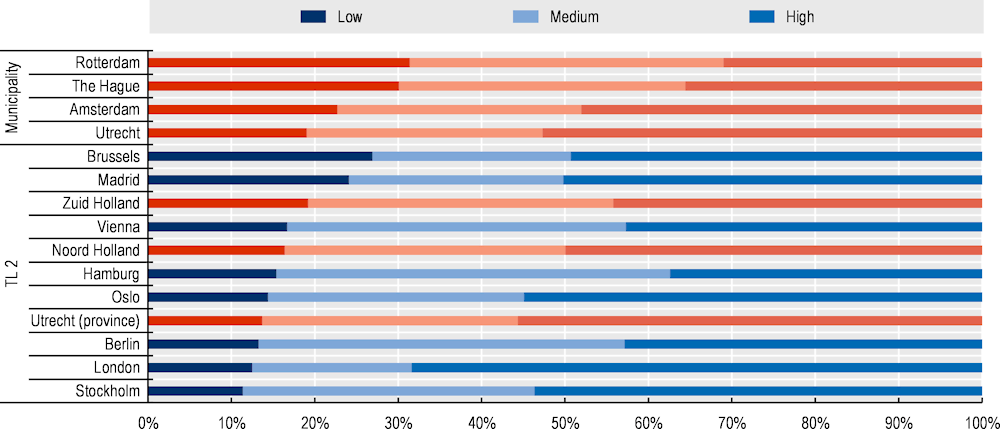

Educational attainment and labour market outcomes

Around one in two workers is highly educated in the provinces of Noord Holland, Zuid Holland, and Utrecht. Relative to other selected comparison cities in Europe, this is close to the median (Figure 2.14). In London, almost 70% of the working-age population is highly educated, compared to 50% in Oslo, Stockholm and Madrid. In Vienna and Berlin, more than 40% of workers are highly educated. In Hamburg, the share is just below 40%. The highly educated are not more concentrated in the city municipalities relative to the provinces (TL2 regions). The municipalities of Utrecht and Amsterdam have the highest share of highly educated workers among the G4, but these percentages are close to 50%, similar to the level observed for Noord Holland and Utrecht province.

Figure 2.14. Almost half of the working-age population in Noord-Holland and Amsterdam are highly educated

Note: TL2 regions of respective cities, Noord-Holland for Amsterdam, Zuid-Holland for The Hague and Rotterdam, and the province of Utrecht for the city of Utrecht. Population aged 25-64. Municipality level data, population aged 15-75.

Source: OECD calculations based on Eurostat table edat_lfse_04, and CBS table 85051NED (Opleidingsniveau wijken en buurten, 2020).

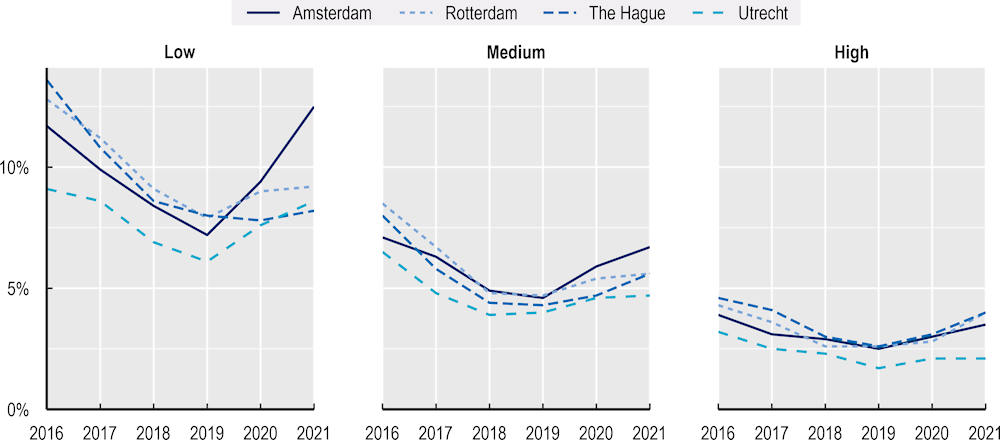

The level of education of workers is an important predictor of their ability to find jobs and their vulnerability to employment shocks. The unemployment rate among the low educated, defined as those with unfinished secondary education or basic level vocational training, is higher compared to those with at least advanced high school diplomas or at least advanced vocational degrees (Figure 2.15). Moreover, lower levels of education make workers more vulnerable to economic shocks, as can be seen by the faster increase in unemployment following the start of the COVID-19 pandemic in 2019. Amsterdam has seen the largest uptick in the unemployment among those with the lowest levels of education, increasing to 12.5% in 2021. Utrecht generally has the lowest unemployment rate of all four cities across education categories.

Figure 2.15. The lower educated were more vulnerable to the COVID-19 shock on unemployment

Notes: Low education corresponds to education up to ISCED level 2, medium education up to ISCED level 4, and high education to ISCED level 5 or higher. CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

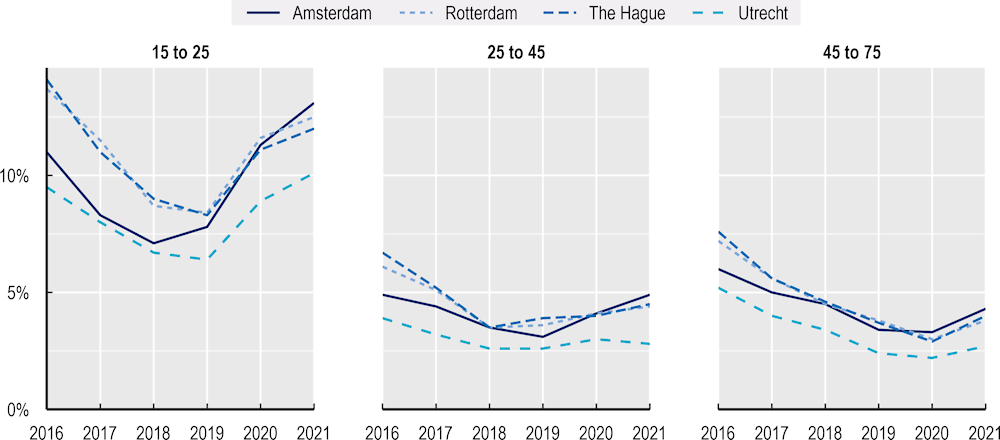

Youth unemployment and inactivity

Youth unemployment is more than double the rate of older workers. Although youth unemployment decreased substantially in all four large Dutch cities prior to the pandemic, it has increased since 2019. For instance, in Amsterdam, the rate increased from 7.1% in 2019 to 13.7% in 2021. While the other age groups, those aged 25 to 45 and 45 to 75, also saw some increase in unemployment since 2021, the effects are relatively minor and unemployment rates across all cities remain below 5%. While reflecting the general vulnerability of young workers in the labour market, the different experience of youth relative to the other age groups may also reflect the difference in coverage of COVID-19 support measures across types of workers. In the Netherlands, employees with a permanent contract had access to a more generous employment and income support scheme relative to workers in more flexible and non-permanent contracts, potentially benefitting older workers more (Schulenberg, 2022[22]). Nevertheless, relative to other OECD countries, employment among youth in the Netherlands has recovered faster. Whereas the OECD average employment rates of youth increased 0.1 percentage points between 2019Q1 and 2021Q2, in the Netherlands the increase was 2.3 percentage points over the same period (OECD, 2022[23]).

Figure 2.16. Youth unemployment is more than double the rate of older age groups

Notes: CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

Youth inactivity in employment or education can provide a more comprehensive indicator for their performance on the job market of today and in the near future. The youth unemployment rate tends to be above that of the total labour force as young people are entering the job market and may switch occupations. Youth are also more likely to switch in and out of education and training. Therefore, the percentage of young people that are neither in employment nor in education and training provides a better indication of how many youth are at risk of failing on the job market. Moreover, young people who leave school early without a degree tend to be more vulnerable to a changing labour market due to sudden economic upheaval, such as the COVID-19 pandemic, or long-term transitions, such as the increasing automation at production (Carcillo et al., 2015[24]).

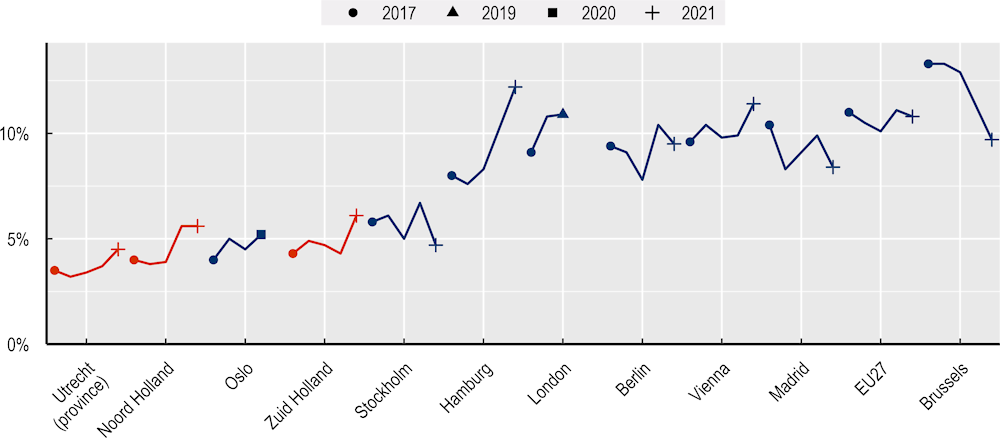

The regions of the Netherlands’ four largest cities have low rates of youth who are not in employment, education or training (NEET) compared with other European regions (Figure 2.17). Like the regions around Oslo and Stockholm, Noord Holland, Zuid Holland and Utrecht reported NEET rates that were below 5% in 2017. Over recent years, including the years of the pandemic, NEET rates in the three Dutch provinces have increased, but still compare favourably to other European regions. Other European regions, such as Hamburg, Berlin and Brussels tend to display notably higher rates of inactivity among their youth population. In Brussels, NEET rates have declined substantially over the years of the pandemic. Such decline may be due to young people re-engaging with education during times of periods when finding work is difficult (OECD, 2022[23]).

Figure 2.17. In the Netherlands, rates of youth who are not in employment, education or training (NEET) are low in European comparison

Note: NUTS2 regions of corresponding cities, except London, which is at NUTS1 level.

Source: Eurostat table edat_lfse_22 (Young people neither in employment nor in education and training by sex and NUTS 2 regions, NEET rates).

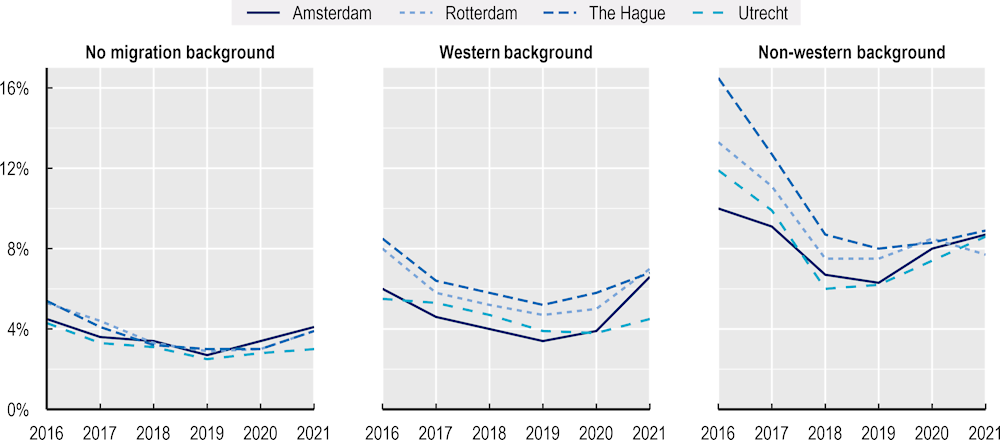

Migration background and labour market outcomes

Unemployment rates are higher among people with a non-Western migration background, defined by the person’s or parental country of birth, across all Dutch cities. In 2016, the unemployment rate of people with a non-Western migration background was three times as high in The Hague and twice as high in Amsterdam, compared to people without a migration background. By 2021, these rates had converged across all four cities, but remain about twice as high, at around 8%. A worker has a non-Western background if the person, or at least one of their parents, is born in a country in Asia (excluding Japan and Indonesia), Africa, Latin America or Türkiye. People with a Western migration background are those who are born, or have at least one parent who is born, in Europe, North America, Oceania, Japan or Indonesia (Box 5.3 provides a further explanation on the distinction between Western and non-Western migrants in official Dutch statistics). The unemployment rate of people with a Western migration background falls between those with a non-Western migration background and those with no migration background in all four large Dutch cities.

Figure 2.18. The unemployment rate of people with a migration background is twice that of people without a migration background

Notes: Migration background is defined by at least one of the parents’ country of birth. For no migration background both parents were born in the Netherlands. Western includes countries in the rest of Europe (excluding Türkiye), North America, Oceania, and Indonesia and Japan. Non-Western includes countries in Africa, Latin-America, Asia (excluding Indonesia and Japan) and Türkiye. CBS indicates that 2021 is a break in the series due to a change in survey methodology.

Source: CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

The difference in labour market outcomes between people with a non-Western migration background and other groups is structural and shared across the country. Labour force participation rates of people with a non-Western migration background have been around 10 percentage points lower compared to people without a migration background since 2003, with little narrowing of this gap during periods of economic growth (CPB and SCP, 2020[25]). In the Netherlands, people with a migration background from Türkye, Morocco, Suriname and the Caribbean constitute the largest group among the so-called migrants with a non-Western background. Among these groups, the participation rate of men aged between 30 to 40 years from Morocco is at 70%, while it is around 80% those among men aged between 30 and 40 years who have a migration background from Türkye, Suriname or the Caribbean. This compares with over 90% for men aged 30 to 40 years without a migration background. For women in the same age category, participation rates are 49% for people with a migration background from Morocco, 56% for Türkye and around 70% for Suriname and the Caribbean. These numbers compare to 86% for women in the same age group without a migration background (CPB and SCP, 2020[25]).2

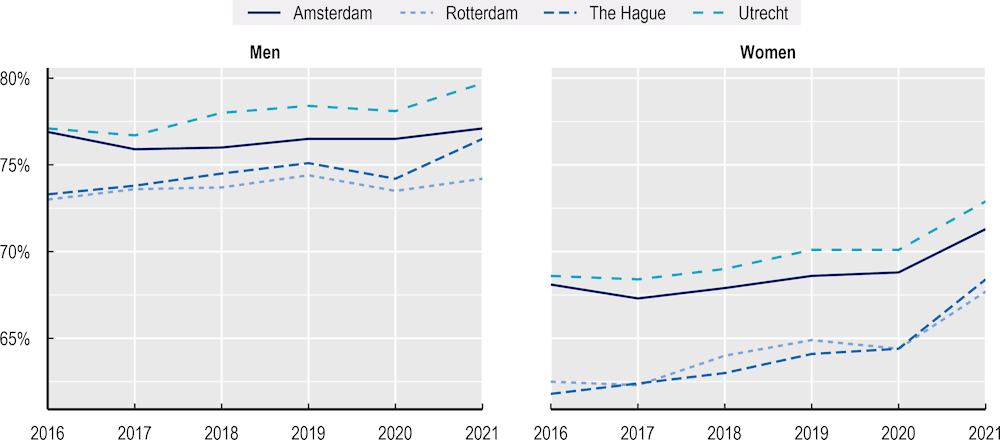

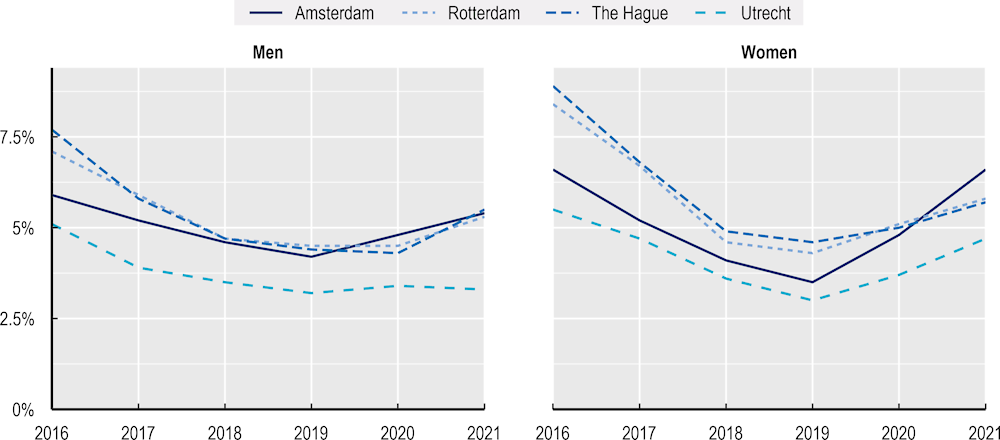

Gender differences in participation rates

Women show lower participation rates compared to men, but the difference in unemployment rates is minor. Figure 2.19 show a structural difference in the participation rates between men and women across the four cities. The differences ranged from 5.8 percentages points in Amsterdam to 8.1 percentage points in The Hague in 2021. The participation rate of women improved over the years 2016 to 2020, with the difference between men and women decreasing by more than 1 percentages point on average across the four cities. Although the unemployment rate is higher for women relative to men across the four cities, the difference is small compared with the differences observed by age and education level (Figure 2.20). The unemployment rate of women increased faster during the COVID-19 pandemic. In Amsterdam, the unemployment rate of women increased from 3.5% to 6.6%, while that of men increased from 4.2% to 5.4%.

Figure 2.19. Women show structurally lower participation rates than men, but the gap is narrowing

Note: CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

Figure 2.20. Unemployment rates of women were strongly affected by the COVID-19 pandemic

Note: CBS indicates that 2021Q1 is a break in the series due to a change in survey methodology.

Source: CBS table 85230NED (Arbeidsdeelname; regionale indeling 2021).

References

[4] Adema, Y. et al. (2021), “Economische analyse steunpakket 2020”, CPB Notitie, CPB.

[14] Altares (2021), Bij deze ondernemers komt de NOW-steun terecht.

[24] Carcillo, S. et al. (2015), “NEET Youth in the Aftermath of the Crisis: Challenges and Policies”, OECD Social, Employment and Migration Working Papers, No. 164, OECD Publishing, Paris, https://doi.org/10.1787/5js6363503f6-en.

[15] Core, F. and F. De Marco (2020), “Public Guarantees for Small Businesses in Italy during COVID-19”, SSRN, https://doi.org/10.2139/ssrn.3604114.

[17] Cororaton, A. and S. Rosen (2020), “Public Firm Borrowers of the US Paycheck Protection Program”, SSRN Electronic Journal, https://doi.org/10.2139/ssrn.3590913.

[25] CPB and SCP (2020), Kansrijk integratiebeleid op de arbeidsmarkt, Centraal Planbureau and Social and Cultural Planbureau, https://www.cpb.nl/sites/default/files/omnidownload/Kansrijk_integratiebeleid_op_de_arbeidsmarkt2.pdf (accessed on 21 October 2022).

[13] Fareed, F. and B. Overvest (2021), “Business dynamics during the COVID pandemic”, CPB COVID-19 publication, CPB.

[21] FT (2021), Keeping zombie companies alive is the right call, Financial Times, Kate Allen, https://www.ft.com/content/ac2828ad-7930-43ef-a227-1cbd8ff8c018 (accessed on 4 February 2021).

[11] Garcia, C. and A. Paterson (2022), The great resignation: The reaction in places., OECD Cogito, https://oecdcogito.blog/2022/06/14/the-great-resignation-the-reaction-in-places/ (accessed on 10 November 2022).

[18] Granja, J. et al. (2020), Did the Paycheck Protection Program Hit the Target?, National Bureau of Economic Research, Cambridge, MA, https://doi.org/10.3386/w27095.

[20] Hodbod, A. et al. (2020), Avoiding zombification after the COVID-19 consumption game-changer, VoxEU, https://voxeu.org/article/avoiding-zombification-after-covid-19-consumption-game-changer (accessed on 22 December 2020).

[3] Jongen, E. and P. Koning (2020), “Lessen voor de NOW”, CPB coronapublicatie, Centraal Planbureau.

[16] Kozeniauskas, N., P. Moreira and C. Santos (2020), Covid-19 and Firms: Productivity and Government Policies, Centre for Economic Policy Research, London, http://www.cepr.org.

[23] OECD (2022), OECD Employment Outlook 2022: Building Back More Inclusive Labour Markets, OECD Publishing, Paris, https://doi.org/10.1787/1bb305a6-en.

[2] OECD (2021), “Metropolitan areas (Edition 2021)”, OECD Regional Statistics (database), https://doi.org/10.1787/71243603-en (accessed on 20 October 2022).

[12] OECD (2021), “SME and entrepreneurship performance in times of COVID-19”, in OECD SME and Entrepreneurship Outlook 2021, OECD Publishing, Paris, https://doi.org/10.1787/6039c015-en.

[5] OECD (2020), Job Creation and Local Economic Development 2020: Rebuilding Better, OECD Publishing, Paris, https://doi.org/10.1787/b02b2f39-en.

[6] OECD (2020), OECD Employment Outlook 2020: Worker Security and the COVID-19 Crisis, OECD Publishing, Paris, https://doi.org/10.1787/1686c758-en.

[1] OECD (2012), Redefining “Urban”: A New Way to Measure Metropolitan Areas, OECD Publishing, Paris, https://doi.org/10.1787/9789264174108-en.

[19] Rajan, R. (2020), “State support for Covid-hit companies has to change”, Financial Times, https://www.ft.com/content/baeb54fa-8902-4ac9-a4a1-fdf48cf13a8e (accessed on 21 December 2020).

[22] Schulenberg, R. (2022), “Ontwikkeling van het arbeidsinkomen tijdens corona”, CPB coronapublicatie, CPB.

[7] Tsvetkova, A., S. Grabner and W. Vermeulen (2020), “Labour demand weakening during the COVID-19 pandemic in US cities: Stylised facts and factors related to regional resilience”, OECD Local Economic and Employment Development (LEED) Papers, No. 2020/06, OECD Publishing, Paris, https://doi.org/10.1787/700d91ba-en.

[9] UWV (2022), Dashboard Spanningsindicator, https://www.werk.nl/arbeidsmarktinformatie/dashboards/spanningsindicator (accessed on 5 December 2022).

[10] UWV (2022), Personeelstekorten aanpakken Oplossingen voor werkgevers.

[8] Verstegen, L., E. van der Wal and C. Deijl (2021), “Macro-economische effecten van coronasteunbeleid in 2020”, CPB Achtergronddocument, CPB.

Notes

← 1. Geographically, municipalities are not very large in the Netherlands. Therefore, a substantial share of the population works in a different municipality from their residency which can affect the observed participation rates. For instance, differences in labour force participation across cities can also be affected by the attractiveness of the city municipalities relative to neighbouring municipalities for people that are active in the labour market.

← 2. All figures from CPB and SCP (2020[25]) and for 2017.