This chapter analyses the role of labour market institutions in the Netherlands and in Amsterdam. It focuses on institutions with responsibilities for the integration of the long-term unemployed and the economically inactive on three levels. First, this chapter provides an overview on the role of the national government and the national public employment service in developing policies and providing benefits and employment services. Next, the responsibilities and organisation of municipalities and their provision of employment services and (re)integration measures are discussed. The final section provides an overview of the regional cooperation between municipalities and other labour market stakeholders such as employer and employee organisations.

Policy Options for Labour Market Challenges in Amsterdam and Other Dutch Cities

4. Labour market institutions in the Netherlands and Amsterdam

Abstract

In Brief

In the Netherlands, the responsibility for publicly financed employment services is divided between two levels of government, national and local. Although in some parts of the Netherlands, regional collaborations of employment services have gained additional importance. The national public employment service, Uitvoeringsinstituut Werknemersverzekeringen (“Institute for Employee Insurances”; UWV), is responsible for recipients of insurance-based unemployment and incapacity benefits. Municipalities are tasked to provide means-tested social assistance benefits and are responsible for activating and supporting social assistance recipients who are not eligible for UWV support. Over the past years, the responsibilities of different stakeholders evolved and local governments received a more proactive role and start to work through regional collaborations with other municipalities.

After the global financial crisis of 2008, the Dutch labour market has gone through several major reforms to increase labour market participation. To stimulate job creation, the national government implemented several policies to create greater labour market flexibility. At the same time, social policies were reformed to lower the public finance burden and increase labour market coordination across different levels of government. The goal of these reforms was to make the Dutch economy more competitive and to keep state budgets in balance. In recent years, the reforms were evaluated and adjusted. A commission for work – the so-called “Borstlap commission” – was installed to advise the government about labour market policies to review the reforms and consider what is required in a changing labour market.

UWV is tasked to administer unemployment insurance, match unemployment insurance or disability benefit recipients to suitable vacancies, provide services to employers, assess requests for work permissions and provide information on the labour market. Workers who lose their job or whose job is threatened can apply for help and information. The public employment service offers three main services to jobseekers that are all focused on reintegration in the labour market: digital services, personal services and guidance in training and education.

Municipalities are tasked to administer social welfare benefits and provide employment services and other labour market integration support measures. The majority of clients registered with the municipalities are long-term unemployed or economically inactive. The national government provides municipalities with autonomy (within national boundaries) over the labour market services and measures provided locally to best match the municipalities’ residents and local labour market needs. With the responsibility across areas of the social domain and labour market integration, municipalities aim to link benefits with participation in the labour market. Funding for the implementation of active labour market policies at the local level comes from the Municipalities Fund. The allocation of the Municipalities Fund across municipalities follows statistical criteria such as the size of the local population and the share of social welfare recipients, adjusted for the local fiscal capacity.

The formula that underlies the central government’s grant allocation to municipalities to fund social welfare benefits strongly incentivises (larger) municipalities to decrease the number of people who depend on social welfare. Municipalities receive bundled funding through a grant from the central government to finance social welfare payments for those eligible within the municipal boundaries. The allocation of the grant follows an objective allocation model based on household, municipality and neighbourhood level characteristics but not past expenditure to predict social welfare needs for large municipalities of more than 40 000 residents. These large municipalities can retain the money that is unspent but need to finance social welfare expenditure through other funding sources if spending exceeds the allocated amount. The efficiency of the incentives built into the social welfare budget allocation crucially depend on sufficient funding for these measures.

Collaboration at a regional level between municipalities and other stakeholders aims to facilitate labour market participation. Municipalities, national ministries, educational institutes and the social partners cooperate on the level of the 35 labour market regions. The labour market regions provide a framework wherein regional initiatives of labour market integration are designed. One of such initiatives is the regional mobility team, which can provide services to workers that are at risk of unemployment to help them transition to new jobs, including through additional training that allows them to switch occupation or even sector.

Introduction

The Dutch government system combines a centralised government with large autonomy at the local level for some policy areas. This includes labour market policies, where municipalities have many responsibilities and a large degree of autonomy. However, the Dutch national government has the power – although seldom used – to intervene in the functioning and polices of municipalities and other subnational governments, in particular through financing (OECD, 2014[1]).

In the Netherlands, employment support services are divided over two levels of government: national and local. A national agency, Uitvoeringsinstituut Werknemersverzekeringen (“Institute for Employee Insurances”; UWV), supports recipients of insurance-based unemployment and incapacity benefits. Unemployment insurance is based on the number of years worked and limited to a maximum of two years (see Box 4.3). Municipalities are tasked to provide means-tested or social assistance (or “welfare”) benefits and provide support for social assistance recipients who are not or no longer eligible for UWV support through employment services and labour market measures such as sheltered jobs or employment subsidies. In the Netherlands, workers who for various reasons do not have a job for a longer period are often described as having a “distance to the labour market”. Employer and employee representative organisations, i.e. the “social partners”, are involved in collective agreements that stipulate unemployment and pension rights, and certain sickness disability income guarantees. Employer and employee organisations as well as independent experts are brought together in the Sociaal Economische Raad (“Social Economic Council”, SER). The SER is the main advisory body on social and economic policies for the Dutch government and parliament.

The responsibilities of different stakeholders have been evolving and local governments have been given a more proactive role in employment and skills policies. For instance, skills training was traditionally only the task of firms with support of sectoral bodies, and sometimes regionally coordinated in cooperation with educational institutions. Municipalities have become more involved in using adult learning services to overcome the friction of firm and sector specific training for workers that require to move across sectors, for example by supporting skills initiatives (SEO & ROA, 2022[2]). Similarly, local and national programmes are increasingly used to provide public services to people that are still in work, but potentially at risk of job-loss. The immediate transition to new employment rather than time in unemployment is beneficial to both workers and the national government that provides income support to the unemployed. Overall, the local and national government have become more active in providing employment services to the working population and those in risk of unemployment (see Table 4.1).

Table 4.1. The collaboration across stakeholders and levels of government for people in work is broadening

The responsibility of public employment services across employment stages.

|

From past |

To present |

|||||

|---|---|---|---|---|---|---|

|

Local |

Sectoral |

National |

Local |

Sectoral |

National |

|

|

In work |

• |

• |

• |

• |

||

|

Risk of unemployment |

• |

• |

• |

• |

||

|

Unemployed |

• |

• |

• |

• |

||

|

Social benefit recipient |

• |

• |

||||

Note: A simplified representation of responsibilities and initiatives across the stages of employment. Exceptions for individual cases or situations may exists, for instance people with a long-term illness can still be covered by national provisions.

Source: OECD elaboration.

Collaboration at a regional level across all stakeholders aims to facilitate a more effective (re)integration in the labour market. Municipalities play a crucial role in labour market integration, but their size often limits them to increase regional employment and help unemployed workers finding a job (Edzes and Dijk, 2015. Therefore, it is important for municipalities to participate in regional cooperation. Regional collaboration of municipalities, social partners representing employers and employees and the UWV work together in labour market regions. Labour market regions provide a framework wherein regional initiatives for labour market integration are designed. One of such initiatives is the regional mobility team which was introduced during the COVID-19 crisis. Regional mobility teams provide services to workers that are at risk of unemployment to help them transition to new employment, potentially through additional trainings that allows them to switch occupation or even sector.

The remainder of this chapter provides an overview of the role of labour market institutions in the Netherlands. It has the following structure: the first section describes national policies to increase labour market participation as well as the role of the national public employment service UWV. The second section covers in more detail the tasks of municipalities and describes their funding and expenditures. The third section provides an overview of the regional cooperation between municipalities and other stakeholders such as UWV, employers and employee organisations, and educational institutions.

The national government sets out the framework for the labour market integration of unemployed and economically inactive

The Dutch national government is responsible for general labour market policies. National laws on unemployment benefits, social assistance and labour participation provide the frameworks under which the national public employment service and municipalities implement these policies. Municipalities have a large degree of autonomy but are bound by national legislation.

After the global financial crisis of 2008, the Dutch labour market has gone through several major reforms to increase labour force participation. The goal of these reforms was to make the Dutch economy more competitive and to keep state budgets in check (Buiskool et al., 2016[4]; OECD, 2015[5]). The “Act on Work and Security” of 2015 created more flexibility on the labour market by simplifying the labour regulation on job dismissals and made it easier for individuals to work as a self-employed entrepreneur. The “Act Labour market in Balance” in 2020 withdrew some of these changes and made it easier for employers to create permanent contracts. The “Participation Act” of 2015 (see Box 4.1) aimed to decrease complexity around social security and increase labour force participation. Moreover, the pension system was reformed by increasing the pension age from 65 in 2015 to 66 in 2018 and thereafter changing it annually to match the average increase in life expectancy. An increase of life expectancy by one year currently increases the pension age by eight months.

In response to the financial crisis, labour market acts have been undergoing reforms with the aim to increase labour force participation and address worker rights. Next to the ambition to create the right labour market conditions that can spur economic growth, there were concerns about the relatively large number of incapacity benefit recipients (EUR 0.8 million in 2021) and the vulnerable position of self-employed workers (CBS, 2022[6]). The number of self-employed has grown from EUR 0.9 million in 2013 to EUR 1.1 million in 2021 while their labour rights (incapacity benefits, pension accrual) are poorly organised (OECD, 2019[7]). A committee for work was installed (the so-called “Borstlap commission”) to advise the government about labour market policies in light of these developments and in light with a changing labour market (see Box 4.2) (OECD, 2019[7]).

Box 4.1. The Participation Act aims to increase labour participation

The Participatiewet (“Participation Act”) aims to increase labour participation by creating opportunities for individuals who need special assistance in finding a job. The law came into effect in 2015 and serves as a minimum income guarantee for those furthest away from the labour market. The idea behind this law is that everyone should participate in society, preferably through a regular job. The participation act replaced the “Work and Social Assistance Act” (WWB), the “Sheltered Employment Act” (WSW) and partly replaced the “Young Disabled Persons Act” (Wajong).a

The Participation Act is intended to decrease complexity and guarantees everyone’s right to access to a job. Everyone with a distance to the labour market now has the same rights and obligations, whereas previously there were multiple regulations for specific groups. This reduced complexity in combination with financial support is expected to make it easier for employers to hire workers with a disability. As part of the Participation act, a “Jobs agreement” with employers aims to create 100 000 extra jobs for people with a distance to the labour market by 2026. Government employers aim to create 25 000 extra jobs in that period.

Municipalities became responsible for enabling participation and those who need special assistance to find work. The Participation Act meant an important step in the decentralisation process. Municipalities received more responsibility for their expenditures, the financial means for the implementation of the Participation Act are budgeted to local governments. Municipalities have several tools to guide people towards work. If people do not succeed in finding an (adapted) job, they might qualify for a social assistance benefit.

Note: a. Wet Werk en Bijstand (WWB), Wet Sociale Werkvoorziening (WSW), Wet Arbeidsongeschiktheidsvoorziening jonggehandicapten (Wajong).

Source: OECD (2015[5]) Reintegrating welfare benefit recipients through entrepreneurship in the Netherlands. Rapid Policy Assessments of Inclusive Entrepreneurship Policies and Programmes, http://www.oecd.org/employment/leed/inclusive-entrepreneurship.htm. SCP (2019[8]) Eindevaluatie van de Participatiewet.

The introduction of the “Participation Act” has hardly led to an increase in job opportunities. In 2019, the Sociaal en Cultureel Planbureau (“Netherlands Institute for Social Research”, SCP), a government agency which conducts research into the social aspects of government policy, published an evaluation of the Participation Act (SCP, 2019[8]). The main conclusion of this evaluation is that the effect of the law is limited. This applies both for the largest group of social assistance claimants as for the group of people who lost their right to sheltered employment. The employment chances of young disabled people increased slightly, but their income position deteriorated because of the increase of temporary contracts.

Box 4.2. Commission on the Regulation of Work (“Borstlap Commission”)

In November 2018, the Dutch government initiated the formation of an Independent Commission on the Regulation of Work to prepare advice on how to better align the labour market institutions to the needs of a changing labour market. In January 2020, the commission, chaired by Hans Borstlap and therefore referred to as “Borstlap Commission”, published its report, titled “What kind of country do we want to work in?”. The report puts forward a broad framework on the criteria that improve resilience in a changing labour market. It includes an assessment of current labour market regulation and whether institutional settings are aligned with these criteria, and where not, makes recommendations for new solutions.

The commission’s assessment framework for the functioning of the labour market has four criteria: adaptability, clarity, resilience, and reciprocity, which are briefly described here:

Adaptability: Workers need to become more adaptable to respond to labour markets that are changing because of technological advancement, economic cycles and other long-term developments such as the digital and green transitions. This adaptability of workers is preferably organised by their employer and within a durable labour contract.

Clarity: The report concludes that the current fiscal system incentivises self-employment and other non-standard contracts over regular employment contracts. This is driven by regulations that make several labour insurances compulsory for standard employment contracts but not for self-employment individuals. Differences in secondary benefits such as pension arrangements or number of free days emerged between people employed directly and through employment agencies while doing the same jobs The legal framework should therefore define the type of contract by defining the work carried out within it rather than by differing fiscal treatment.

Resilience: Resilience implies that workers are better prepared for changes on the labour market, increasing their ability to transition from job-to-job in order to prevent long-term unemployment. Continuous development of skills and knowledge can facilitate such transitions. Moreover, workers who face health limitations should be able to transition into less physically demanding occupations if needed.

Reciprocity: All workers are expected to contribute to the system of employment insurance and insurance against unemployment due to illness. These are public facilities that are provided to enable (re)integration in the labour market and job-to-job transition. In the current system, the self-employed contribute less to these public facilities than employed workers, whereas they do have rights to access them when needed.

Source: Commissie Regulering van Werk (2020, “In wat voor land willen wij werken? Naar een nieuw ontwerp voor de regulering van werk”.

Since the report published by the “Borstlap Commission”, a number of labour market reforms were introduced. Some of the recommendations of the commission build on already ongoing reforms or recent changes. The national government that took office in January 2022 included several recommendations in their coalition agreement as reform plans (Government of the Netherlands, 2021[10]). The plans mainly focus on promoting internal adaptability and discouraging external flexibility. Important areas of the coalition agreement include:

1. The employment costs of employers (in cases of continuous payment or dismissal) will be reduced while it will be easier to change the number of hours or other characteristics of existing permanent contracts

2. Tax credits given to self-employed will be reduced and the differentiation between self-employed and regular employment will be modernised and based on the arrangement of the work in practice, no longer based on the type of contract

3. The government also aims to facilitate self-development and learning among all workers by creating a personal development budget, which supports (adult) education

4. Learning and re-skilling should also be a more prominent instrument in employment activation while differences in obligation to pay for employment insurance in case of illness, disability and age between employees with a contract and the self-employment will be reduced.

Organisation of public employment services at the national level

The Dutch national public employment service UWV is tasked to implement and administer insurance-based benefits, match recently unemployed jobseekers to suitable vacancies and provide (publicly available) information on the labour market. UWV is organised as an autonomous administrative authority under responsibility of the Ministry of Social Affairs and Employment (Ministerie van Sociale Zaken en Werkgelegenheid).1 The organisation had over 15 000 employees in 2021. UWV has offices throughout the Netherlands and works together with municipalities in regional labour market areas (UWV, 2021[11]).

UWV provides a key service in the Dutch labour market by facilitating knowledge exchanges and matching jobseekers and employers. The main mission of the UWV is to increase labour participation and to promote work. The organisation has formulated core tasks in four areas (UWV, 2022[12]):

1. Employment: UWV helps clients to remain employed or find employment. This is done in close cooperation with municipalities

2. Assessment of incapacity for work: UWV evaluates illness and incapacity for work according to predefined criteria

3. Benefits: UWV administers employment insurance-based benefits – covering both unemployment and incapacity benefits

4. Data management: UWV provides the government with information and analysis about the labour market and benefit recipients.

Workers who lost their job or who are at risk of unemployment can contact UWV. In comparison to other public employment services across the OECD, UWV has been among those leading the transition towards digital services (OECD, 2015[13]). For example, all required forms to apply for unemployment benefits can be filled out online. UWV offers three main services that are all focused on reintegration into the labour market: digital services, personal services and the use of personal learning paths which consist of guidance in taking on training and education. The type of service used depends on the characteristics of each client and the type of benefit a person is entitled to. The different benefits schemes are further explained in Box 4.3.

UWV is financed through insurance premiums and grants by the Ministry of Social Affairs and Employment. UWV distributes about EUR 20 billion to around 1.2 million benefit recipients annually. After the financial crisis of 2008, the budget of UWV was reduced. The execution costs per benefit recipient decreased from EUR 1 800 in 2007 to EUR 1 300 in 2016. However, with the introduction of new services, changes in laws and the effects of the COVID-19 crisis, the execution costs per benefit recipient rose to EUR 1 825 in 2021 (UWV, 2021[11]).

UWV has had different approaches to serve jobseekers. Starting from 2012, UWV put strong emphasis on providing digital services to jobseekers. The reason for this were budget cuts and the resulting need for higher efficiency in serving jobseekers. Only groups in need of additional help such as youth and elderly unemployed received extra (in person) guidance in specific programmes. However, after an evaluation of these services in 2015 (Hek et al., 2015[14]), service provision partly shifted back to more in-person guidance (De Beleidsonderzoekers, 2021[15]). A recent evaluation found a positive effect of personal services, support in the form of a conversation and complementary services increases the job finding rate by about two percent (SEO, 2021[16]). Furthermore, the use of personal services led to a higher level of customer satisfaction. The UWV services have a positive effect on the knowledge, attitude and behaviour in looking for a job. These positive effects are larger for jobseekers with a smaller distance to the labour market (SEO, 2020[17]).

Box 4.3. Employment insurance benefit system

The Dutch social security system is regulated in several social security insurance laws. These employee insurances protect employees from loss of income if they become unemployed, ill or incapable to work. All employed workers are obliged to pay into these insurances, which are usually automatically paid through the employer.

In the Netherlands, workers who lose their jobs and meet the eligibility criteria are entitled to unemployment benefits under the Unemployment Insurance Act. Unemployment insurance (Werkloosheidsuitkering, WW) guarantees 75% of the last received pay for the first two months of unemployment and 70% thereafter. The duration of unemployment benefits is at least three months but is extended depending on the number of years worked before the unemployment spell begins. The maximum duration of benefit receipt is 24 months.a In principle, every unemployment benefit recipient is obliged to look for a job. After six months of unemployment, the range of jobs jobseekers are required to consider is expanded to include lower income jobs. In cases where it is not possible to look for work or when recipients start their own company or are within a year of their retirement, the job application obligation is dropped. If a recipient does not or does no longer meet the conditions to receive unemployment benefits, they may qualify for social assistance benefits, although this is only the case for a small proportion. A special regulation exists for unemployed who are 60 years old or older and long-term unemployed (IOW).b The entitlement and amount depend on the individual and household’s financial situation, but a minimum income is guaranteed.

Specific laws regulate the benefits of individuals who cannot work for a temporary period due to illness or disability. These individuals receive a benefit according to the former act (WAO) or the new “Labour Capacity Act” (WIA), which contains the “Full Invalidity Benefit Regulations” (IVA) and “Return to Work (Partially Disabled) Regulations” (WGA). For young people there is the “Disability Assistance Act for Handicapped Young Persons” (Wajong).c

The Wajong act is meant for young people with a disability that prevents them from having a (full-time) job. After the introduction of the Participation Act, young workers with a Wajong benefit were invited to re-evaluate their capability to work. At the same time, Wajong insurance recipients who have the capacity to work but who do not have a job were invited for a conversation to see if they could be guided towards a job. UWV received extra budget for this operation. From 2018 onwards, everyone with a Wajong benefit and a capability to work is monitored and regularly invited for a conversation to ensure durable work.

Note: a. In some collective labour agreements it is possible to extent this period to 38 months.

a. Wet inkomensvoorziening oudere werklozen (Act income provision older unemployed) (IOW)

b. Wet werk en inkomen naar arbeidsvermogen (WIA), Inkomensvoorziening Volledig Arbeidsongeschikten (IVA), Werkhervatting Gedeeltelijk Arbeidsgeschikten (WGA), Wet Arbeidsongeschiktheidsvoorziening jonggehandicapten (Wajong).

Source: De Beleidsonderzoekers (2021[15]) “Perspectief op bestaanszekerheid en arbeidsparticipatie”. OECD (2020[18]) “The OECD tax-benefit model for the Netherlands: Description of policy rules for 2020”.

UWV uses statistical profiling tools to segment jobseekers upon registration with UWV, with jobseekers with larger distance to the labour market receiving personal counselling earlier in the unemployment spell. Unemployment benefit recipients must fill out an online statistical profiling tool (werkverkenner) upon registration with the UWV (Desiere, Langenbucher and Struyven, 2019[19]). This tool gives an indication of the distance from the labour market of the jobseeker. More attention is dedicated to jobseekers with a larger distance to the labour market than to those who are likely to find a job on their own. They are invited earlier for a face-to-face conversation in which an agreement about help from UWV is made.

UWV provides jobseekers with tools and information to support their reintegrate in the labour market. On the digital service platform, jobseekers can look up relevant information around their benefits, can search for vacancies and receive personalised recommendations for suitable vacancies. UWV advisors complement the online services through workshops, personal conversations and tests to activate and help jobseekers (De Beleidsonderzoekers, 2021[15]).

Unemployment benefit recipients have the responsibility to look for a job. UWV advisors try to enforce agreements with jobseekers on job search by actively providing them with information about their rights and obligations. This is particularly important when it comes to the “best effort obligation” of recipients in looking and applying for jobs. Recipients of unemployed benefits should send at least four job applications in every four weeks period. The assigned UWV advisor can also inform, monitor and correct in the job seeking process and impose a sanction when needed (SEO, 2020[17]). Compared to other countries, the Netherlands scores around the average on the OECD index of strictness of activation requirements for jobseekers, 3.09 on a range from 1 (least strict) to 5 (most strict) (OECD, 2022[20]). Verlaat et al. (2021[21]) find that sanctions that were implemented because of a lack of job application activity have limited effects.

UWV offers a range of labour market services to target specific groups in the labour market. With the introduction of the “Participation Act” in 2015 (see Box 4.1), the UWV had to adjust a number of its services. Since 2015, the UWV is responsible for a suitable work programme (passend werkaanbod). This programme is focused on jobseekers who are unemployed for over six months and aims to increase labour force participation. The goal of the programme is to offer long-term unemployed workers at least two suitable vacancies. The candidate then has to apply for these jobs and accept the job if a job offer is made. If a job offer is turned down by the long-term unemployed jobseeker, a reduction in unemployment benefits serves as a sanction. In the period between 2015 and 2019, the goal of 5 000 offers to long-term unemployed candidates per year was reached. The number of unemployed that were actually hired varies between 2 500 and about 3 800 per year. There were almost no sanctions needed (De Beleidsonderzoekers, 2021[15]).

In 2015, the conditions for suitable work were adjusted. After six months of unemployment insurance benefit receipt, every job is regarded as suitable. This means that recipients can no longer reject jobs based on the type of work or the distance to their home. To make jobseekers aware of the changed rules and help them adjusting, UWV holds face-to-face meetings in the seventh month of unemployment. During this conversation the jobseeker and the UWV make an agreement about the job-seeking process and about two vacancies that the jobseeker will apply for. From 2018 onwards, UWV advisors started to guide jobseekers towards jobs outside their direct preferences at an earlier point of unemployment spells. An evaluation of this innovation showed that jobseekers indeed took a broader perspective in the type of jobs that they applied for when receiving additional job market guidance early on during their unemployment spell. An evaluation showed that in particular workers with transversal skills could be integrated into the labour market more quickly (De Beleidsonderzoekers, 2021[15]).

Municipalities implement policies and guide the labour market integration of the economically inactive

Labour market policies in the Netherlands have been decentralised since 2000. There were two reasons for the decentralisation of labour market policies. First, local governments are closer to the residents in their local areas and, hence, are likely to better anticipate and respond to their labour market needs. Secondly, decentralisation was also driven by the aim to increase efficiency and reduce social welfare cost. The introduction of the Work and Social Assistance Act (2004) increased the responsibilities of the municipalities and had a positive effect on cost efficiency (Broersma, Edzes and van Dijk, 2013[22]). The Participation Act (see Box 4.1) gave municipalities even more social welfare responsibilities (Edzes and Dijk, 2015[3]).

As part of the decentralisation process, municipalities have become central in implementing social policies. While the Participation Act of 2015 (see Box 4.1) made municipalities responsible for local labour market policies, the decentralisation of the “Youth Act” (Jeugdwet) and the “Social Support Act” (Wet maatschappelijke ondersteuning, WMO) gave additional social policy responsibilities to municipalities. The increase in responsibilities generally, not only in the domain of social and employment, motivated some amalgamations and mergers between municipalities. The number of municipalities decreased form 537 in 2000 to 344 in 2022.

The increasing responsibilities of municipalities result in specialised local labour market services. While the national government provides funding for several services, municipalities have the task to implement them. This means that they have considerable administrations, a substantial budget and need to hire specialised workers or work with contractors. Larger municipalities such as Amsterdam can create specialised departments that deal with the integration of specific groups like youth, the elderly or migrants. The remainder of this subsection first gives an overview of the internal organisation of municipalities and the employment support they provide, as well as the role of the Association of Dutch Municipalities. The second part focuses on the labour market funding and expenditure of municipalities.

Employment support services provided by municipalities

Municipalities in the Netherlands are tasked to provide focused employment support to the long-term unemployed and the economically inactive who depend on social welfare. Municipalities offer both labour market integration support and income support. Income support is conditional on active job search or active participation in labour market integration programmes that are offered by the municipalities. Exemptions of this obligation can be given in case of chronic illness or for single parents with young children. For specific cases, mostly related to individuals’ physical, medical or psychological limitations to work, the municipalities provide services in collaboration with UWV which is providing the independent medical assessment on the ability to work.

In the Netherlands, residents in a household with little or no income and capital can apply for social assistance benefits at their municipality. This is only possible for applicants who meet certain criteria and do not or no longer receive other (unemployment) benefits. Residents can apply online for social assistance benefits. Some cities, such as Amsterdam, also provide publicly available computers which can be used to apply for welfare benefits. The municipality checks eligibility and informs applicants of the outcome. In 2022, single social assistance recipients receive EUR 1 037, while a couple receives EUR 1 482. These net monthly amounts differ dependent on age, family composition and living situation and do not include a holiday bonus which is paid out in May. Indexation of this amount occurs semi-annually and is based on the increase of the net minimum wage. The city of Amsterdam, like many other Dutch municipalities, also offers additional services to low-income groups. For instance, this includes a “City Pass” which can be used to get discounts on public transport, school costs and cultural activities (City of Amsterdam, n.d.[23]).

With responsibility across the social domain and labour market integration, municipalities aim to link benefits with participation in the labour market. The social assistance benefits administered by municipalities are the last safety net for income support. It is available for citizens who do not qualify for unemployment insurance benefits or those who have exhausted them, if they meet the means-test. Municipalities consider the needs and possibilities of their clients and accordingly adjust the support clients receive and their mutual obligations, which depend on clients’ capabilities, motivation to work, and expected results of job search.

Residents that cannot find a job themselves receive job search support and guidance from the municipality. It is the responsibility of the municipality to support residents without income towards work, regardless of whether they qualify for welfare benefits. Support services include career advice, counselling, matching services, labour market training, support for self-employment, work placements (e.g. through voluntary work) or other meaningful activities. However, people who are long-term unemployment often face multiple barriers that prevent them from integrating into the labour market. Such barriers range from poor physical or mental health, insufficient knowledge of the Dutch language, the inability to navigate online platforms, debt or other financial difficulties. While municipalities are incentivised to bring people back to the labour market, a broader package of support may be required for unemployed with more complex barriers to the labour market. Municipalities therefore often provide services such as language training and help in dealing with personal finances. In Amsterdam, most of these forms of support are organised through neighbourhood teams in one of the seven districts of the city. A neighbourhood team consists of several professionals that provide advice about care, finances, safety and other support measures free of charge. Residents can make an appointment after which a support plan is developed.

Experimental evidence suggests that personalised counselling is an effective tool to integrate social welfare benefits recipients into the labour market. In the period from 2017 to 2019, six municipalities in the Netherlands conducted randomised controlled trials to find out which strategies work best to integrate social assistance recipients into the labour market.2 The randomised controlled trials included the following interventions: increased personalised counselling, exemption from sanctions on additional earnings (that would normally result in a lower benefit) and exemption from reintegration obligations such as the requirement to apply for jobs regularly. The results of the impact evaluation show no negative effects on the transition into employment when additional earnings are exempt from a reduction of the benefit or when job-search obligations are lifted. On the other hand, the results provide some evidence that intensive and personalised support may lead to higher outflow to (part-time) work (Edzes et al., 2021[24]). Statistical uncertainty of the effects of other interventions suggest that further and larger studies can be useful to gain further insights on labour market instrument effectiveness across places and target groups.

Since 2021, the integration of people with a migration background into the labour market, and society more broadly, is the responsibility of municipalities. In 2021, the Netherlands received over 250 000 immigrants (CBS, 2022[25]). National institutions regulate the legal conditions for migrants to stay in the country. People who are granted the right to stay through an asylum procedure and require income and housing support are allocated across municipalities in the Netherlands. In 2021, the civic integration system was changed. Like in the Participation Act, municipalities now play the central role in integrating migrants, which is useful since immigrants with a residence permit are often on social assistance from the municipality. The aim of this shift of responsibility to the local level is to accelerate the integration process for newcomers who are obliged to complete the civic integration programme. This programme aims to facilitate participation in Dutch society by familiarising newcomers with Dutch culture and language.

Local labour market information systems are the basis of municipal labour market policies

Accurate and timely labour market information constitutes the basis for local policymaking. Several surveys such as the arbeidsvraagpanel (“Labour demand panel”) and the UWV employer survey provide national wide information. The arbeidsvraagpanel is a survey that is carried out every two years by the Netherlands Institute for Social Research. A representative sample of companies is asked to answer questions about various topics such as recruitment, retaining and the training of staff. However, the data is only publicly available after more than two years following the survey. The UWV employer survey is comparable to parts of the arbeidsvraagpanel. In 2020 and 2022, UWV conducted a survey on recruitment and skills among 10 000 companies in the Netherlands, with a response rate of around 30%. The survey focuses on problems in recruiting and retaining staff, skills requirements and skills developments within occupations.

One of the challenges faced by local policymakers is that data collected on the country level is not always representative on smaller geographical levels. Even if surveys are designed to accurately represent sub-national regions, slicing data by, for example, occupations, economic sectors or population groups can lead to unreliably small sample sizes. Similarly, local policies can be informed by past experiences of other regions but the transferability into a different labour market context requires great care. It partly falls on local governments to ensure that policies on the sub-national level still have the necessary knowledge and evidence base to carry out local labour market policies. Although it is not a formal responsibility of the municipality, it is essential to continuously improve local labour market information systems through the creation of local databases using administrative data, disaggregated survey data where possible and the evaluation of past local policies. Municipalities can use the data that is collected and provided by UWV to monitor and improve their policies.

The labour market information systems in Dutch municipalities are advanced especially in some of the larger municipalities. Some of the larger municipalities such as the city of Amsterdam have their own statistics and research departments, but many smaller municipalities lack the resources for the creation of local labour market indicators. The partnership between the Centraal Bureau voor de Statistiek (CBS, Statistics Netherlands) and municipalities has intensified in recent years within so-called CBS Urban/Rural Data Centres. CBS Urban Data Centres are collaborations between the Centraal Bureau voor de Statistiek (CBS, Statistics Netherlands) and municipalities. CBS Rural Data Centres exist in less densely populated areas in the Netherlands. Within the cooperation, CBS supports municipalities in analysing survey and national register data about employment for use on the local level and to link it to administrative data sources. Such cooperation can therefore create new local labour market indicators and expand the evidence base to inform local labour market policies.

The growing responsibility of municipalities in designing and implementing local labour market policies requires a systematic cataloguing and evaluation of labour market instruments. As municipal responsibilities related to labour market increased and targeted support initiatives are required, there is a need to create a service menu for both municipality staff and residents to understand all the available services that a municipality provides. Currently, providing such a menu is not a formal responsibility of municipalities, leading to variation in the information provision on labour market policies and policy evaluation across municipalities. For instance, the municipality of Amsterdam started to catalogue policy instruments for labour market interventions more systematically within its Instrumentenwaaier (catalogue of policy instruments). The Instrumentenwaaier lists labour market services across different themes, such as training, job coaching and education. It also spells out eligibility requirements and contact information of different labour market instruments. To add a quality component to the catalogue, the recently founded “Commission of effectiveness of labour market instruments” gives an ex-ante assessment of policy instruments the municipality plans to implement based on secondary literature. These initiatives remain in their early stages and could be gradually expanded in line with best-practice examples from other OECD countries. For instance, the German TrEffeR (“Treatment Effects and Prediction”) tool addresses the need to measure the effectiveness of active labour market policies more systematically. TrEffeR is described in more detail in Box 4.4.

Box 4.4. The German TrEffeR system

In 2008, the German PES and the German PES-affiliated Institute of Employment Research introduced the TrEffeR (“Treatment Effects and Prediction”) tool to evaluate labour market programs. The tool compares employment outcomes of participants in labour market programs with similar non-participants. Participants and non-participants are made comparable by selecting non-participants based on similarities in socio-economic characteristics. These characteristics include information on the local labour market area, the unemployment status, age and gender.

Labour market programs can be evaluated by provider, local area and type of intervention. It is further possible to evaluate the effectiveness of interventions by different target groups such that future programs can be designed targeting specific sub-groups of the unemployed.

One of TrEffeR’s advantages is that it is relatively cost-efficient. Once the IT infrastructure is set up and administrative employment biography data is available, the cost for maintenance are small. The process of selecting suitable non-participants is semi-automated and requires only limited input from experts who update the tool twice a year. Evaluations based on TrEffeR’s quasi-experimental methods are therefore an alternative to fully fleshed randomised controlled trials that are more demanding to implement at scale.

Source: Schewe (2017[26]), TrEffeR (Treatment Effects and Prediction), European Commission document available at https://ec.europa.eu/social/BlobServlet?docId=18219&langId=en.

Different jobseeker registration systems hamper the communication between municipalities, the UWV and other organisations. A suite of different IT systems are used to register jobseekers. The UWV uses SONAR, some municipalities use RAAK and the labour unions PARAGIN. The fact that these systems are not linked makes the exchange of information challenging and potentially inefficient. There is currently no structured exchange on policy instruments between UWV and municipalities despite overlapping client groups. Better cooperation and information sharing might help to increase labour market participation. For example, the City of Amsterdam does not have the tools to assess their clients’ ICT skills but unions can make those assessments. A closer cooperation could be beneficial to jobseekers but would require a more efficient exchange of information.

Funding and expenditure of municipalities

The degree of spending autonomy that subnational governments in OECD countries have, depends on their financial self-reliance, the financial transfer system and the borrowing autonomy. The discretion subnational governments have over how they spend funds available to them depends on three main sources of funding: First, locally raised revenue, or financial self-reliance, which in turn depends on subnational government’s fiscal autonomy. Second, the financial transfer system which determines the conditionality of central government transfers. Third, the subnational government’s borrowing autonomy, i.e. the extent to which higher levels of government constrain lower tiers of government to borrow from capital markets or to take on loans from banks (Ladner, Keuffer and Bastianen, 2021[27]).

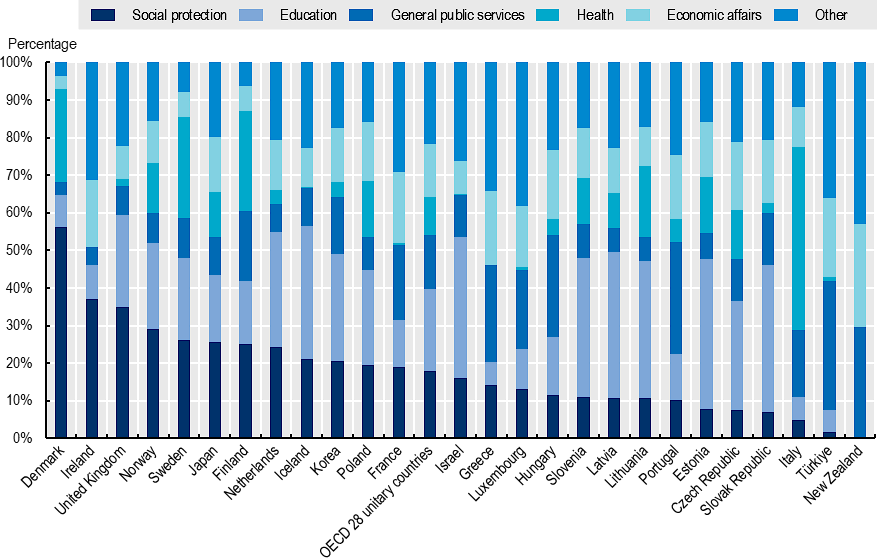

Municipalities in the Netherlands have a moderate to high degree of spending autonomy compared to subnational governments in other OECD countries. Like subnational governments in other OECD countries with a comparable unitary government structure, municipalities in the Netherlands are funded through a mix of central government grants and locally raised revenue (Ladner, Keuffer and Bastianen, 2021[27]). Around 73% of municipal funding came from central government grants in 2019, thus constituting the bulk of local revenue. The remaining 27% came from locally raised revenues, such as local taxes, surcharges and parking fees (CBS, 2020[28]). In recent years, central government grants have become increasingly unconditional. Around 60% of all central government transfers to municipalities are now unconditional, compared to 40 to 50% of total transfers in the early 2000s. In theory, municipalities in the Netherlands also have a high degree of borrowing autonomy that allows them to borrow without seeking authorisation from the central government. However, the strict legal requirement that municipalities’ budgets must be balanced de facto limits the borrowing autonomy to the funding of capital expenditure (Ladner, Keuffer and Bastianen, 2021[27]). Figure 4.1 shows that local governments in the Netherlands mostly use their available funds to spend on social protection and education. The former includes social welfare expenditure.

Figure 4.1. Dutch municipalities mostly spend on social protection and education

Note: OECD countries with a unitary government structure only. Sorted by the share of expenditure on social protection.

Source: OECD statistics, Subnational governments in OECD countries: 5. SNG expenditures and investment by function.

To finance social assistance benefits, wage cost subsidies and labour market integration activities, municipalities receive two separate grants from the central government. Since the Participation Act was adopted in 2015, municipalities receive bundled funding through a specific grant (Bundeling Uitkeringen Inkomensvoorzieningen Gemeenten, BUIG) that covers multiple social welfare regulations. Municipalities use the funds from BUIG to finance social welfare payments to those eligible within the municipal boundaries. BUIG is also meant to cover wage cost subsidies and expenditure on institutionalised and homeless persons. The allocation of the BUIG, the so-called macro budget, is described in more detail in Box 4.5. Funding for the implementation of labour market activation policies that target the economically inactive comes from the unconditional Municipalities Fund.

Box 4.5. The allocation of the social welfare budget and the budget for wage cost subsidies across Dutch municipalities

Both the budget allocated to municipalities for spending on social welfare and the budget component for wage cost subsidies come from the BUIG (Bundeling Uitkeringen Inkomensvoorzieningen Gemeenten), a central government grant that forms the so-called macro budget. In 2021, the total macro budget for social welfare assistance and wage cost subsidies was EUR 6 385 million. This budget is split between Dutch municipalities through a model that distinguishes both budget components and differs by population size of municipalities.

Social welfare budget

The formula to determine the share of the social welfare budget component each municipality receives depends on the population size:

>40 000 residents: For large municipalities, an objective allocation model is used to determine their budget share. The basis for the calculation of the objectively determined municipal social welfare budget is a non-linear model that uses indicators at the household, municipality and neighbourhood level to predict social welfare needs. Only indicators that are not (directly) affected by municipal policy are included in the model such that any surplus or deficit on the local budget is due to municipal policies. The distribution model consists of a volume component and a price component. The volume component estimates the probability of each household in the municipality to receive social welfare and the price component calculates the amount the household would be entitled to. The volume and price component are then multiplied to get a prediction for the amount of social welfare a household would receive. The total budget share the municipality receives is then determined by the sum of all households’ predicted social welfare needs.

<15 000 residents: For small municipalities, the budget size is determined entirely historically, on the basis of the realized municipal social welfare expenditure in the previous year, taking into account changes in the number of households and changes in the total size of the macro budget between the previous and current budget year.

15 000 to 40 000 residents: For medium-sized municipalities, a weighted mix of the objective allocation model and historical expenditure determines the share of the macro budget these municipalities receive. The share determined by the objective allocation model increases linearly with the local population size.

Budget for wage cost subsidies

The split of the part of the available macro budget for wage cost subsidies is based on the expenditure share in wage cost subsidies (realisations) of the year preceding the year for which the budget is determined.

Source: Government of the Netherlands (2022[29]), Beschrijving verdeelsystematiek bijstandsbudget en budget loonkostensubsidies.

The formula that underlies the central government’s allocation of BUIG to municipalities strongly incentivises larger municipalities to decrease the number of people who depend on social welfare. Depending on the number of people residing within municipal borders, municipalities receive a budget for social welfare either based on a budget allocation model or based on historical expenditure on social welfare. The model uses a formula that does not include past welfare expenditure for municipalities with more than 40 000 residents and only partly includes historical expenditure for municipalities with a headcount of between 15 000 and 40 000. The budget of municipalities with fewer than 15 000 residents is based entirely on historical expenditure on social welfare as described in Box 4.5. Municipalities can retain the money that is unspent, for instance because residents found employment and no longer need the support. This provides a financial incentive to municipalities to provide effective services, although it may also lead to some prioritisation of services to those individuals that are expected to be most effective.

Despite its incentivising effect on larger municipalities to activate the economically inactive into the labour market, the current system may in theory lead to a path dependency in financial means available for labour market activation instruments. If municipalities manage to spend less on social welfare than their allocated budget, they may spend the surplus at their discretion. On the other hand, municipalities that spend more on social welfare than their allocated budget have to use funds from other spending areas to avoid running a deficit. This could, in theory, lead to a downward spiral if municipalities fund excess social welfare spending through revenue from discretionary grants that would have otherwise been channelled towards labour market activation measures. Conversely, municipalities that run a surplus on social welfare could invest excess funds into additional labour market activation measures that, if successful, could lead to an even higher surplus in the next budget allocation cycle. The Dutch central government can continue to monitor time trends in municipalities’ social welfare spending closely. Should a clear pattern of repeated surplus and deficit emerge, the government could consider adjusting their allocation model of the BUIG grant for large municipalities to be partly based on social welfare expenditure in previous years. This would maintain the incentive for municipalities to integrate social welfare recipients into the labour market while ensuring that necessary financial means to fund activation measures are not declining over time.

The so-called “safety net” ensures that municipalities in a large social welfare deficit do not have to cut spending on other items beyond a certain level. The Dutch central governments provides an insurance against large social welfare deficits. Municipalities that run a deficit up to 7.5% of total social welfare expenditure are required to use discretionary funds to cover the deficit. A deficit of 7.5% to 12.5% of total expenditure on social welfare is compensated at 50% by the central government and any deficit of more than 12.5% receives a 100% compensation3. To avoid moral hazard, the safety net scheme is not intended to compensate for structural shortfalls in municipalities’ macro budget. It is intended to absorb disproportionate financial risks arising from imperfections in the allocation model and from unexpected setbacks municipalities may suffer.

Funding for labour market activation policies comes from the Municipalities Fund. Since 2015, funding for new tasks related to the regular integration into work (i.e. integration except sheltered employment) are funded by a general grant component of the Municipalities Fund. The grant is distributed across municipalities based on two principles: The cost orientation and the local fiscal capacity. The cost orientation refers to an allocation based on more than 60 objective criteria such as the size of the local population, the share of social welfare recipients or the share of senior residents. The budget municipalities receive from the Municipalities Fund is then corrected by an equalisation system that accounts for differences in the local potential to generate income (the fiscal capacity). The most important correction factor is the local property tax capacity, which is independent of the actual property tax rate set by a municipality. Requesting additional funds from the Municipalities Funds due to an extended period of large financial deficits is possible but leads to an “Article 12 status”, which refers to article 12 of the Financial Relationship Act, under which municipalities are put into a state of guardianship. Article 12 status requires municipalities to comply with a set of central government conditions (Council of Europe, 2021[30]).

The Dutch government will need to monitor and evaluate frequently if the funding from the Municipalities Fund is sufficient for municipalities to carry out their new tasks related to activation policies. The effectiveness of the incentive system built into the allocation of BUIG critically hinges on municipalities’ ability and financial endowment to integrate social welfare recipients into the labour market. It is therefore important to assess regularly if available funding is sufficient for municipalities to finance appropriate policy instruments that support the activation of the economically inactive. Such assessments can be done in dialogue with VNG (see Box 4.6). In addition, evaluating cross-municipal variation in the spending on labour market integration measures per local welfare recipient and the share of welfare recipients who are successfully guided into employment in a given year can provide some evidence on the nature of the link between these variables. If such assessments conclude that the Municipalities Fund is insufficient to cover municipal responsibilities that are meant to be covered by the fund, a policy option would be to increase municipal taxing autonomy as proposed by the Ministry of Interior and Kingdom Relations (Ministerie van Binnenlandse Zaken en Koninkrijksrelaties), the Ministry of Finance (Ministerie van Financiën) and the VNG (Council of Europe, 2021[30]). This could strengthen financial autonomy of municipalities and could lead to a more adequate local capacity to respond to local needs in domains laid out in the Participation Act.

Sheltered employment (Beschut werk) is covered by the integration grant component of the Municipalities Fund. The amount of funding municipalities receive from the integration grant to fund sheltered employment is based on pre-2015 shares of inflows into sheltered workshops. The national government determines how many sheltered workplaces every municipality should create if there is a need for them. For instance, the number of sheltered workplaces was set to 454 in Amsterdam in 2021 (Ministry of Social Affairs and Employment, 2020[31]). The number increased to 505 in 2022 (Ministry of Social Affairs and Employment, 2021[32]).

Box 4.6. Association of Dutch Municipalities in the Netherlands

The Vereniging van Nederlandse Gemeenten (“Association of Dutch Municipalities”, VNG) represents the interests of municipalities towards the central government.

VNG represents all municipalities and aims to support and improve the quality of local governments. Central in this aim is the exchange of knowledge and experiences around the implementation of all policies in the responsibility of Dutch municipalities. VNG is funded through contribution of its member municipalities and through subsidies.

VNG facilitates local cooperation between local governments and plays an important role in the cooperation between the national and local level as it tries to advocate the interests of the municipalities at the national government and in a number of other platforms such as the Council of European Municipalities and Regions.

VNG organises events like conferences, webinars and summer schools to provide information and facilitate the exchange of information between municipalities. VNG also publishes factsheets and position papers in which the interests of municipalities are laid out. For instance, during the coalition negotiations to form a new national government in 2021, VNG and UWV published a joint letter in which they called for increased accessibility to labour market services and proposed measures to increase labour market participation

Source: VNG and UWV (2021[33]) “7 bouwstenen voor arbeidsmarktondersteuning”, https://vng.nl/nieuws/vng-en-uwv-7-bouwstenen-voor-arbeidsmarktondersteuning

Regional cooperation aims to increase labour market integration

Regional cooperation between municipalities, UWV and other stakeholders aims to facilitate job creation and labour market integration. While municipalities fulfil a crucial role in the labour market, they are often too small to influence regional employment (Edzes and Dijk, 2015[3]). Therefore, it is important for municipalities to cooperate regionally. National policies can have different impacts on regions depending on their economic situation and structure (van Dijk and de Grip, 1998[34]). The regional cooperation in labour market regions provides a framework within which regional initiatives of labour market integration are developed and implemented. The twelve provinces that form an administrative layer between the national government and the municipalities do not play a role in labour market policies.

The Netherlands is divided into 35 labour market regions in which municipalities, the public employment service (UWV) and other stakeholders coordinate their services to employers and jobseekers.4 The 35 labour market regions form a separate geographical level, in between the 344 municipalities and 12 provinces. Labour market regions are groups of municipalities, roughly approximating commuting zones. The labour market regions differ from the 40 COROP (NUTS 3) regions that are often used for regional statistical analysis. This means that there are some notable size differences between labour market regions. In the Netherlands, it is common to commute daily into adjacent municipalities. In 2015, only about 4 out of 10 workers lived and worked in the same municipality, while the average distance to work was about 22 kilometres (CBS, 2017[35]). Labour market regions were formed to serve employers and were created based on existing cooperation within the regional business community. UWV provides labour market information at the level of the regional labour market. Statistics and insights on the number of vacancies and jobseekers and the tightness in specific sectors are regularly published for each labour market region. Examples of regional cooperation are the “regional work companies” and the “employer service centres” discussed in more detail below. In addition, regional mobility teams provide services to workers that are at risk of unemployment and help them transition to new employment, potentially through additional training that allows them to switch occupation or even sector.

“Regional work companies” support the co-ordination of labour market policies across a region

The labour market region is used as a platform to reach agreements about job creation. Every labour market region has a so-called “regional work company” (regionaal werkbedrijf). On this administrative platform, municipalities, the UWV, employer organisations and employee organisations aim to reach agreements about the regional labour market and create equal opportunities within the region. This is done to support the national goal to raise labour force participation. Regional work companies are financed by its stakeholders, while municipalities often take on the largest share of the costs. The incentive for cooperation on the level of the regional labour market is the commitment to the “jobs agreement” (see Box 4.1). Labour market labour markets regions have some freedom to choose their own form of cooperation, goals and priorities (Programmaraad, 2015[36]).

“Learn-work offices” (leerwerkloketten) in the regional labour markets advice residents about (re)schooling and education within the vison of life-long learning. Municipalities, UWV and educational institutions cooperate and fund learn-work offices. Learn-work offices help and advice workers, jobseekers, students and employers in all issues around Life-Long Learning (see chapter 5). Learn-work offices provide career advice, assess competences and support students in writing a resume. Learn-work offices exist in every labour market region but their activities differ.

“Employers service centres” help employers in hiring workers with a distance to the labour market

Each of the 35 labour market regions has an “employer service centre” (werkgeversservicepunt) in which employers can receive advice on the implementation of the Jobs agreement and the participation act. In this centre, UWV, municipalities and social work companies (companies that create jobs for workers with a mental, physical or psychological disability) work together to provide information, advice and expertise to companies. Other partners such as educational institutions are sometimes involved, too. Employer service centres provide companies with information about selecting and hiring candidates who have a low attachment to the labour market free of charge. Employers can also ask for extra advice on employing persons with a disability. Employer service centres also offer advice on specific services that can be provided by partners such as the UWV. For instance, job coaches provide employees with a personal training programme and support in their workplace. Another service is the wage cost subsidy (loonkostensubsidie), which is administered by the employer service centres. Employers who hire a person with a disability whose productivity falls short of earning the minimum wage receive the difference between the wage value and the minimum wage of that worker. While national and local employment services cooperate through the employer service centres, the separation of responsibilities and involvement of several actors still implies inefficient competition in some areas such reach-out to employers and sourcing of vacancies.

Regional mobility teams aim to facilitate job switches to avoid unemployment

In response to the economic challenges of the 2008 Global Financial Crisis, UWV created Regional Mobility Centres (RMCs). RMCs were implemented to address two problems. First, public employment services typically only provide support to jobseekers that are unemployed, not to those at risk of unemployment. Second, job-to-job transitions may require training or additional education, but private sector solutions are often sector-oriented, making transitions across sectors difficult. The centres enabled the UWV, in co-operation with public and private partners, to offer support to employees and guide them towards a new job, potentially in other sectors. The centres contacted employers to identify their needs and provided information to employees about options of work-to-work transitions across sectors and training opportunities. The RMCs functioned as a spider in the web of regional stakeholders. They disseminated information to both employers and employees and provided financial incentives in the form of training bonuses to facilitate job-to-job transitions. At the time, the government aimed to integrate these temporary centres in the future structure of the public employment service (EMCC, 2021[37]).

Although there were some signs of positive employment effects, the overall effectiveness of the RMCs was questioned because their impact was not evaluated and UWV did not track clients who used the centres’ services. In theory, employees of all companies in a region were eligible to use the regional mobility centre. In practise, mainly small and medium-sized enterprises and companies most effected by the global financial crisis (e.g. companies in the construction and transport sector), made use of this service. While the RMCs of the UWV were closed following the economic recovery, the idea of mobility centres was not abandoned. In some regions, regional mobility centres continued functioning, albeit sometimes in a different form. New mobility centres were sometimes set up on an ad-hoc basis in case of specific disruptive events to local labour market (EMCC, 2021[37]).

In 2020, to soften the expected negative employment effect of the COVID-19 crisis, the government announced the introduction of Regional Mobility Teams (RMT) in all 35 regional labour market areas. The RMTs were part of a larger government programme to support labour market integration in the wake of the Covid-19 crisis (Ministry of Social Affairs and Employment, 2022[38]). These new RMTs are a cooperation between municipalities, UWV, educational institutions and employers and employee organisation. The national government provides funding but the teams are established by the stakeholders in the region. During the COVID-19 crisis, the Dutch government issued a large support scheme ("Noodmaatregel Overbrugging Werkgelegenheid", Temporary emergency employment bridging measure) in which employers were compensated for the cost of retaining workers who were not able to work due to social distancing regulations (see chapter 2). Initial expectations were that unemployment would increase when compensation would end. To help mitigate the effect of scaling back the compensation scheme, regional mobility teams were established. The scope of these teams is wider than that of the RMCs. All workers in need of support, including youth, self-employed and people in need of special assistance could receive intensive individual support i) to find a job after unemployment; ii) for job-to-job transitions; or iii) to find suitable education. The aim of the teams is to avoid a transition into unemployment and facilitate job-to-job transitions.

Since the regional mobility teams consist of local stakeholders such as employer organisations, unions and municipalities, and their services are supplementing existing activities, there are substantial differences in the organisation of the RMTs across regions. The largest municipality often has a leading and coordinating role and one of its aldermen is part of the administrative team. This means that the activities are influenced by the willingness of the largest municipality to take action and their relationship with surrounding municipalities. The level of engagement across municipalities within the same labour market region can also vary. In Amsterdam, for instance, the stakeholder composition of the RMT is wider than in other regions because of its strong cooperation with the Employers Service Centre. The Employers Service Centre focusses on the needs of employers and, hence, the Amsterdam RMT aims to cater both the needs of jobseekers and employers. Amsterdam’s RMT started as a cooperation between UWV and the municipality and now also includes three labour unions. In the labour market region of Amsterdam, trade unions are strongly involved, but employer associations are less well represented.

An update on the progress of the teams in February 2022 revealed that the teams are operational in all regions but that the use of the teams is lower than expected. The reason for this is the prolonged compensation schemes and the tight labour market. While numbers of participants are not yet available, it is expected that regional mobility teams reach their goal of helping resident change their jobs. Especially self-employed entrepreneurs and jobseekers without the right to benefits profit from the help of the regional mobility teams. These groups are often overlooked by regular service points. The central government is working towards a biweekly monitor with statistics to gain insights on the elements of the regional mobility teams that work best (Ministry of Social Affairs and Employment, 2022[39]).

Regional Mobility Teams may become a permanent feature in Dutch regional labour markets. The current national government emphasises the importance of job-to-job transitions in the coalition agreement. To stimulate job-to-job transitions, several tools for enrolment in schooling and further education are available. While the coalition agreement supports policies for job-to-job transition, the services may be provided in a different way. In an update on labour market policies in October 2022, ministers announced their intention to combine regional labour market cooperation like the RMT, employers service centres and learn-work offices into one regional cooperation. This will create one unit which jobseekers, employees and employers can use in case of need for labour market services (Ministry of Social Affairs and Employment, 2022[40]).

Amsterdam has extended the service of their Regional Mobility Team in a Regional Work Centre that services its labour market region. This Regional Work Centre is a continuation of an existing network and connects all stakeholders in the regional labour market, which includes Schiphol Amsterdam Airport. The centre is available for employers, employees, (self-employed) entrepreneurs, jobseekers and everyone without a job looking for work. The centre works together with the employer service point and aims to match demand and supply for labour by connecting, advising and supporting jobseekers and employers. Whereas the other regional mobility teams have a strong focus on employees and jobseekers, the Amsterdam Regional Work Centre also pays attention to the labour demand side. This link between the demand and supply side of the labour market is vital for faster labour market matching.

References

[22] Broersma, L., A. Edzes and J. van Dijk (2013), “Have Dutch municipalities becomes more efficient in managing the cost of social assistance dependency?”, Journal of Regional Science, Vol. 53/2, pp. 274-291, https://doi.org/10.1111/J.1467-9787.2012.00762.X.

[4] Buiskool, B. et al. (2016), “The Social and Employment Situation in the Netherlands and Outlook on the Dutch EU Presidency 2016”.

[25] CBS (2022), How many people immigrate to the Netherlands?, https://www.cbs.nl/en-gb/dossier/migration-and-integration/how-many-people-immigrate-to-the-netherlands- (accessed on 22 August 2022).

[6] CBS (2022), Sociale zekerheid; kerncijfers, uitkeringen naar uitkeringssoort, https://www.cbs.nl/nl-nl/cijfers/detail/37789ksz (accessed on 7 September 2022).

[28] CBS (2020), Local government depends heavily on central government funding, https://www.cbs.nl/en-gb/news/2020/41/local-government-depends-heavily-on-central-government-funding (accessed on 17 August 2022).

[35] CBS (2017), Bijna 4 op de 10 werkt en woont in dezelfde gemeente, https://www.cbs.nl/nl-nl/nieuws/2017/32/bijna-4-op-de-10-werkt-en-woont-in-dezelfde-gemeente (accessed on 22 August 2022).

[23] City of Amsterdam (n.d.), Applying for social assistance benefit - City of Amsterdam, https://www.amsterdam.nl/en/work-income/apply-for-benefit/#h359ef37f-f7ee-403a-9652-c96f65728004 (accessed on 18 August 2022).

[9] Commissie Regulering van Werk (2020), In wat voor land willen wij werken? Naar een nieuw ontwerp voor de regulering van werk, https://www.rijksoverheid.nl/documenten/rapporten/2020/01/23/rapport-in-wat-voor-land-willen-wij-werken.

[30] Council of Europe (2021), Monitoring of the application of the European Charter of Local Self-Government in the Netherlands, Committee on the Honouring of Obligations and Commitments by Member States of the European Charter of Local Self-Government (Monitoring Committee).

[15] De Beleidsonderzoekers (2021), Perspectief op bestaanszekerheid en arbeidsparticipatie, http://www.beleidsonderzoekers.nl.

[19] Desiere, S., K. Langenbucher and L. Struyven (2019), “Statistical profiling in public employment services: An international comparison”, OECD Social, Employment and Migration Working Papers, No. 224, OECD Publishing, Paris, https://doi.org/10.1787/b5e5f16e-en.