This chapter gives a brief overview of the recent achievement in the field of public finances in Peru. It then presents some key characteristics of Peru’s public financial management framework and discusses the areas with the greatest potential for improving public financial management in Peru.

Public Financial Management in Peru

1. Main characteristics and cross-cutting challenges for public financial management in Peru

Abstract

1.1. Introduction

The public financial management system that has been developed in Peru since the 1990s has successfully ensured the public sector’s fiscal sustainability. Its good results are reflected in international recognition, as shown by the invitation in 2022 to begin the accession process to the OECD. This means that Peru’s practices are now analysed in light of OECD best practices.

These achievements result from institutional transformations, particularly improvements in public financial management processes. This review analyses the main public financial management systems in Peru today and proposes recommendations for aligning Peru’s practices with OECD best practices.

The four areas analysed are:

1. budget practices and governance

2. treasury and cash management systems

3. fiscal management of human resources

4. public investment programming, budgeting and management

The recommendations presented in this report represent a significant change and should thus be implemented gradually. To this end, it is essential to create the necessary conditions, particularly in terms of the capacities of all actors, before taking on new responsibilities. This study also recognises that any changes must preserve the achievements in terms of fiscal stability, controlling deficit and current public spending. The recommendations could lead to changes in existing control mechanisms but should in no way lead to the removal of controls without first creating the necessary conditions for this to be done without jeopardising financial stability.

1.2. Peru has been successful in terms of growth and control of public finances

1.2.1. Economic growth has been higher than the regional average

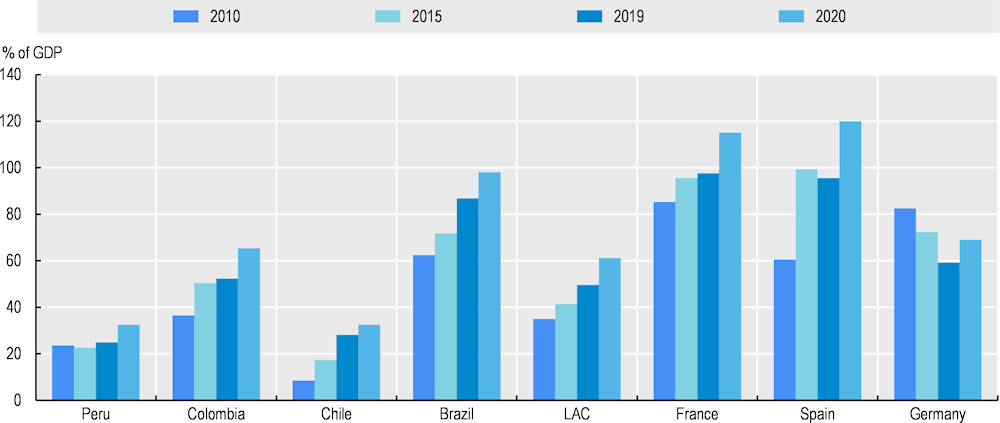

The success of the Peruvian economy is the result of a combination of good domestic policies and a favourable external context. Economic growth has been stable over the last decades. Between 2002 and 2019, the Peruvian economy had an annual growth rate of 5.1%, higher than the average of 3.5% for Latin America and other countries in the region, such as Chile (3.7%), Colombia (4.0%) and Mexico (2.1%) (Figure 1.1). The increase in per capita income1 allowed Peru to reach upper middle-income country status in 2008. Projections for 2027 highlight the good dynamism of the Peruvian economy, with a forecast growth rate of 3%, higher than the Latin American average of 2.4% and that of OECD countries (IMF, 2022[1]).

Figure 1.1. GDP growth rate in Peru and selected countries, 2014-21

Source: OECD stat.

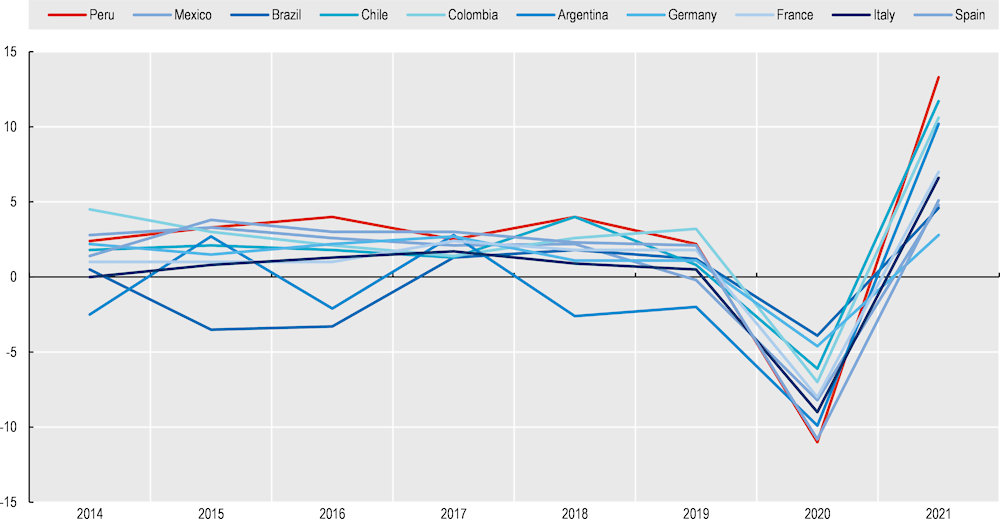

1.2.2. Peru’s fiscal deficit and public debt levels have been better than those of the region

At the domestic level, macroeconomic stability in terms of control of the fiscal deficit and public debt is noteworthy. These promising results allowed, for example, the adoption of measures to manage the crisis generated by the COVID pandemic. Despite having one of the highest mortality rates2 in 2020, Peru designed transitional programmes that allowed it to stimulate the economy and mitigate the effects of the measures adopted to curb the spread of the COVID-19 virus. The Peruvian economy achieved a growth rate of 13.3% in 2021, which is largely due to these measures.

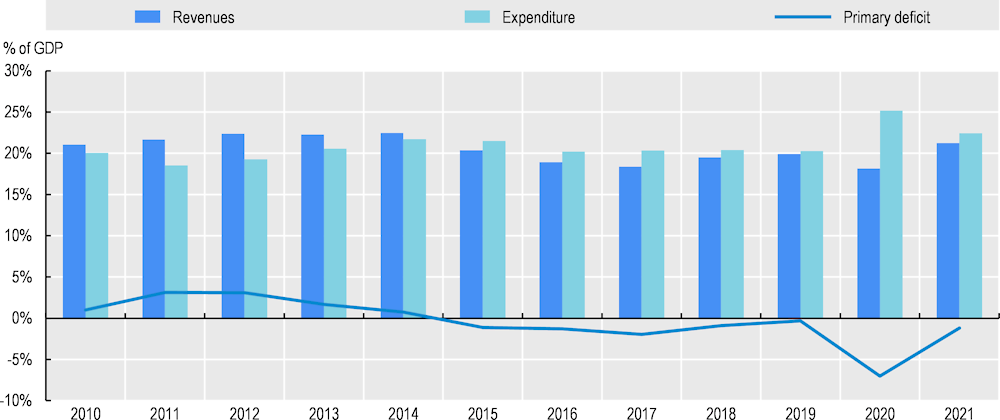

Peru’s public indebtedness in recent years has remained below the regional average. Its public debt levels over the period 2010-19 remained relatively constant, ranging between 18% and 22% of gross domestic product (GDP), while the average for the Latin America and Caribbean region was 42% in the same period (Figure 1.2). In the same period, the fiscal deficit remained at an average of -0.7% of GDP, lower than the average fiscal deficit of -2.2% in Latin America and -1.8% across the OECD. This value increased by more than 7 percentage points (from 1.6% to 8.9%) due to measures implemented in 2020 to respond to the COVID-19 pandemic (Figure 1.3). In 2021, the fiscal deficit returned to -2.6% of GDP, thanks to higher natural resource prices,3 higher tax revenues, tax debt collection and the gradual withdrawal of the fiscal stimulus measures adopted in 2020 (IMF, 2022[2]).

Figure 1.2. Public debt in Peru and selected countries

Figure 1.3. Peru’s general government revenue, expenditure and deficit, 2010-21

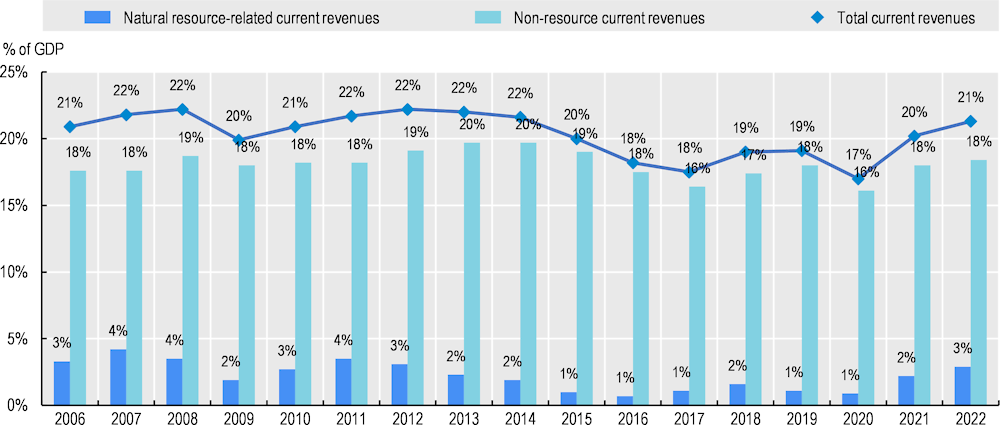

1.2.3. Economic growth is highly dependent on the price of raw materials

Externally, the good performance of natural resource commodity prices allowed international trade to play a key role in Peru’s positive economic performance. Between 2004 and 2013, world mineral and food prices rose sharply, generating strong export revenues. Historically, Peru’s export basket is composed of mining products, such as gold, copper, tin, oil and natural gas, representing on average about 66% of total exports (Central Reserve Bank of Peru, 2020[4]). This feature is one of Peru’s greatest challenges today. Most of the volatility of fiscal revenues is associated with the international context, and in particular, export prices (Figure 1.4).

Figure 1.4. Peru’s general government current revenues, 2006-22

1.3. Main characteristics of Peru’s public financial management system

Public financial management reforms in Peru since the 1990s have been successful in achieving fiscal stability in the public sector, thanks to clear fiscal rules and very strict control by the Ministry of Economy and Finances (MEF). However, some of the public financial management practices today complicate operational management and, thus, service delivery. In particular, some elements hamper the entities’ management capacity:

The budget voted by Congress (opening institutional budget) represents a spending floor that is significantly modified (increased) during execution. This does not allow entities to efficiently programme their activities, procurement or staff recruitment processes. Moreover, it generates a continuous budget discussion process that mobilises important human resources in both the MEF and the entities throughout the year.

The budget system is micro-focused, based on inputs and execution levels rather than expenditure ceilings, results and quality. In particular, expenditures are linked to specific funding sources, which does not allow for the fungibility of public funds. This creates difficulties in estimating revenues, calculating baselines and thus allocating public resources according to government priorities.

Building management capacities in the entities (ministries and subnational governments) is difficult due to high staff turnover.

The response to the various challenges has been to centralise responsibilities in the MEF, with an emphasis on obtaining information and controlling the budget at the micro, input level (investment projects, human resources payroll, etc.).

Thus, today, the MEF centralises several functions that are the responsibilities of sectoral ministries or subnational governments in OECD countries. However, this input-oriented supervision may actually further reinforce the challenges (by making predictability and management more difficult for the public sector) without fully controlling the quantity or quality of public spending.

This leads to a short-term approach to public financial management in Peru that lacks credibility, with a planning horizon of less than a year, and which responds to the priorities established or modified by the heads of the entities. The budget becomes a reactive instrument, “estimating” expenditures and “registering” the modifications proposed by the entities instead of being the central instrument for planning and “authorising” expenditures by the MEF.

This OECD study of public financial management in light of best practices in OECD countries proposes identifying and fixing the problems at their root, so that such strict supervision at the input level by the MEF is not necessary, and so that each entity is in a position to credibly plan its expenditures during the fiscal year, and as a consequence perform effective and efficient operational management.

1.4. Areas with the greatest potential for improvement for public financial management in Peru

The substantive chapters of this report identify challenges in the different four different areas under review: public budget, treasury management, fiscal management of human resources and public investment. This section presents a summary of each of these areas.

1.4.1. Moving from a micro approach based on inputs and quantities to a more aggregated approach based on results and quality

Peru’s current public financial management system is based on a micro to aggregate approach. Programming and formulation are characterised by a very granular focus on inputs, leaving overall amounts or results in the background.

Expenditure is linked to funding sources

The most challenging element of public sector budgeting and financial management in Peru is the link between expenditures and sources of financing. The budget not only provides estimates of revenues from different sources of financing but also allocates expenditures according to these sources of financing (see Chapter 2, Section 2.2.3, 2.5.3, 2.7.2, 2.7.3; Chapter 3, Section 3.2.2). Several complications arise from this relationship, the most important of which are as follows:

It generates a high level of rigidity, as it requires a budget amendment to transfer expenditure from one source to another if there is, for example, an error in revenue estimation per source.

It generates complications in the management of the treasury and accounts (see Chapter 3, Section 3.2.2, 3.2.3) since it is not sufficient to estimate the overall evolution of income for each type of source. Still, it is necessary to have a very precise estimate of each type of resource for each entity.

The principle of the fungibility of money, which is essential for forecasting, execution and profitability, is violated.

There may be incentives for entities to underestimate or overestimate different sources of revenue because the way differences are treated between the amount of revenue estimated in the budget and the revenue actually collected varies according to the source of funding.

Projection of human resources expenditure based on micro data

At the budget programming stage, the General Directorate of Public Budget calculates the financial needs for civil servants’ remuneration at the central and regional levels based on estimates provided by the General Directorate of Fiscal Management of Human Resources. To make these estimates, the directorate aggregates the staffing needs of each entity, both at the national and regional levels, based on previous years’ expenditures as well as current employee records. For this purpose, the General Directorate of Fiscal Management of Human Resources uses a database called the Computer Application for the Centralised Registration of Payroll and Human Resources Data of the Public Sector (AIRHSP) (See Chapter 4, Section 4.9.3). Staff costs are formulated at the micro level (per employee) rather than as a high-level aggregation of human resources costs by entity. This generates several difficulties, including:

It does not give entities the flexibility to structure their staff costs according to their needs. To meet new staffing needs, entities must therefore request an increase in their payroll, which leads to an increase in total human resources expenditure.

It reduces the ability to make medium- and long-term human resource projections of personnel costs since, by the law of large numbers, it is possible to make medium- and long-term projections of the overall mass of a country’s human resources. It is, however, not possible to predict the evolution of each individual who makes up this overall wage bill.

Investment based on annual gap diagnosis and not on a medium-term development vision

The Invierte.pe investment system has brought about improvements in terms of identifying needs, generating indicators, defining prioritisation criteria and selecting projects. However, as the gap diagnosis exercise is an annual process, it risks being carried out in a mechanical and routine manner. This short‑term practice, identifying current rather than future gaps, may represent an inefficient use of the public resources invested. Moreover, not linking strategic planning to the annual execution of investment projects limits its long- or medium-term vision (see Chapter 5, Section 5.3.3, 5.4.2). It is also characteristic of an approach based on a micro vision (the individual investment), not a global one of the trajectory for public investment.

The main indicator is the level of budget execution, not the objectives achieved

Today, the main indicator that is monitored daily is the level of budget execution by each of the budget units and areas. The best budget execution is on expenditure on human resources, while subnational governments have the lowest level of budget execution. There is no rigorous monitoring of the objectives achieved.

However, as mentioned in the next section, the budget allocated to each budget unit at the beginning of the year is modified (increased) throughout the year. In particular, subnational governments’ opening budget doubles or triples during the budget year, and the executed levels are systematically higher than the opening budgets. Therefore, one of the major causes of the low level of execution is the lack of predictability of allocated resources (see next section).

A level of budget execution systematically well below the allocated budget should also raise the question of whether the allocated budget really corresponds to a need and targets priority expenditures.

1.4.2. Improve predictability and appropriate allocation of resources

The micro approach mentioned above and the difficulties it creates for resource estimation, coupled with the MEF’s characteristic prudence in revenue estimation, results in frequent budget changes that affect the proper allocation of resources and generate several negative incentives (see Chapter 2, Section 2.5.5, 2.6).

Difficult and unreliable resource estimation

The dependence of public revenues on commodity prices, which are highly volatile and beyond the country’s control, makes resource estimation difficult, particularly for subnational governments. However, beyond this external factor, two internal factors affect adequate resource estimation:

1. Responsibility for revenue calculation is diluted, as many units are responsible for calculating revenues.

2. Moreover, as there is a link between expenditures and funding sources (revenues), the calculation has to be so detailed that it adds a lot of complexity and reduces reliability. This forces the estimates to be made at a very micro level, per budget unit and per funding source, which reduces the quality of the estimates (due to the law of large numbers).

In addition, linking spending authorisations to each budget unit’s level of directly collected revenue makes estimating these levels a political process. The reform to be implemented from fiscal year 2023 to consider the national government’s budget units’ directly collected revenue as ordinary revenue is a step in the right direction. The impact of this reform will need to be analysed a few years after its implementation. However, as long as expenditures are linked to funding sources, there is a risk that incentives to make honest revenue estimates will be insufficient (see Chapter 2, Section 2.2.3).

Frequent and important changes to the budget

Budget modifications are more significant and more frequent in Peru than in OECD countries. The budget discussed and approved by Congress, called the “opening institutional budget”, is considered to be a spending floor. All actors (the MEF, sectoral ministries, public entities, subnational governments, etc.) know and expect this opening budget to be modified (increased) during the year. There are several sources of budget modifications: important and systematic errors in the estimation of revenue, which lead to an effective collection higher than the estimates used in the voted budget, as indicated in the preceding paragraphs; late incorporation of the carry-forward budget; late incorporation of resources from canon and royalties; and transfers of items, among others (see Chapter 2, Section 2.6).

Frequent budget modifications generate a large gap between the opening institutional budget and the modified institutional budget, do not allow for an inclusive debate, or to take decisions that reflect the government’s priorities. Similarly, they make it difficult to have an overall view of expenditure, to discuss and decide to which institution and for what purpose resources are allocated, and can therefore generate equity problems since the modified (and executed) budget may not take into account the balances discussed in the initial budget formulation. This reduces the usefulness of the budget as an instrument for prioritising spending strategically, as it ends up being treated as a spending floor rather than as an honest and credible picture of what is to be spent (see Chapter 2, Section 2.6).

Lack of budgetary instrument to commit resources over several years

Most infrastructure investments are made over several years. The lack of a budgetary instrument to commit funds over several years creates uncertainty for both the contracting authority and the contractor. In addition, infrastructure planners have difficulties developing a project portfolio without medium-term visibility on the availability of budgetary resources.

While multiannual investment programming has enabled great advances in identifying needs and how these can inform the investment process, some limitations hinder its ultimate objective. Because it is not binding, programming ended up being an unlimited exercise in identifying needs and projects, and its capacity to effectively programme investment is limited. Indeed, Invierte.pe indicates an order of priority for prioritising projects, but projects already authorised and being implemented must be included again due to the lack of a budgetary instrument to commit funds over several years (within a budget system that remains annual). This leads to confusion between the prioritisation and implementation stages, jeopardising the strategic prioritisation of investment (see Chapter 5, Section 5.4.4).

There is a lack of credible and timely data, in particular for subnational governments

In the budget process, whether for treasury management, human resource management or public investment, subnational entities must provide accurate and truthful information and data. For example, the assessment of current and future infrastructure needs is done through comprehensive data collection to provide the executing agency with information for long-term planning. However, in Peru, some actors state that the data and information with which these indicators are constructed have gaps, as they are not constructed jointly between sectors. Nor is there a true sectoral diagnosis, and programming is based on a current diagnosis of the service to be provided (see Chapter 5, Section 5.3.3).

In terms of human resources at the subnational level, entities find it difficult to produce robust data on policy performance and service delivery, which undermines forward-looking planning and policy prioritisation. These factors result in an environment where effective controls and safeguards are very weak, which can create opportunities for corrupt employment practices and weaken the public administration’s capacity (see Chapter 4, Section 4.5.2).

Peru still lacks systems for the systematic collection of relevant data and for ensuring that responsibility for carrying out analysis, dissemination and learning from such data is clearly identified (see Chapter 4, Section 4.6.3 and Chapter 5, Section 5.6.2).

1.4.3. Moving from input monitoring systems to effective expenditure execution control systems

The MEF centralizes several oversight functions that in OECD countries are usually the responsibility of line ministries, sub-national governments or comptroller institutions with accredited capacities. However, this oversight is mainly focused on quantities and inputs, and there is a need for efficient instruments to monitor expenditure levels or the quality of spending.

This is reflected for example in the investment budget, which is voted at an unusually micro and detailed level, as it indicates each investment project (some with amounts of less than 5,000 soles, or 1200 euros). However, not all projects initially prioritized in the Multiannual Investment Programming and in the draft budget submitted to Congress remain in the initial approved investment budget. Not all projects that are in the initial approved investment budget are implemented. And many projects that are implemented were neither in the initial approved budget nor in the Multiannual Investment Programming. This means that, de facto, the detail of the budget law does not help to control either the quantity or the quality of investment spending.

This is also reflected in human resources spending, where the MEF centralizes the supervision of every public sector employee, but where, nevertheless, entities continue to hire staff outside the payroll, and there are still staff on the payroll who do not meet the required criteria.

The trend in OECD countries is to reduce oversight on inputs, and to establish more efficient control instruments on overall spending amounts and quality requirements. Many countries reform their budgets to vote at more aggregated levels (ministries, mission or programme), setting strict expenditure ceilings and strict accountability and quality control mechanisms.

1.4.4. Develop a culture of long- and medium-term planning

Detailed analysis of the four sectors under review shows that Peru has limited strategic planning capacity, which could be strengthened. Credible expenditure ceilings and predictable resources for subnational governments are essential to enable medium- and long-term planning.

Credible expenditure ceilings are essential for planning

Needs are, by nature, potentially infinite, but the resources available to governments are limited. There are, however, ways of achieving objectives, depending on the amount of money available. It is, therefore, essential to know what resources are available to be able to plan strategically and optimise the use of the finite resources.

In Peru, the “expenditure ceiling” that the MEF communicates to the different entities at the beginning of the budget formulation process is seen by all as the minimum amount that will be allocated to them, and all entities submit budget requests higher than these “expenditure ceilings” and actually obtain a higher amount. Therefore, these “expenditure ceilings” are perceived by the entities as minimum allocations and do not allow entities to effectively prioritise their demands for new policies (see Chapter 2, Section 2.3.2).

In addition, the opening institutional budget voted by Congress does not represent a ceiling on expenditures since all entities know and expect this budget to be modified (increased). This further reduces the predictability of the resources that will be available during the year (see Chapter 2, Section 2.6)

This practice helps to limit fiscal risk, as it provides the MEF with complete information on the directly collected revenue of the various public entities. However, it reduces the quality and efficiency of public spending due to the underestimates that can occur.

This is particularly problematic for public investment programming and budgeting. For example, until 2021, the multiannual investment programming did not have budget ceilings, which led to estimates of needs being made on demands without considering the capacity to finance these needs. This has been identified as one of the most notorious shortcomings of the investment system. In 2022, the incorporation of budget ceilings was piloted, which should be evaluated after two to three years of implementation (see Chapter 5, Section 5.3.4).

As for the staff expenditure ceiling, in practice, it is also a spending floor or baseline calculation rather than a maximum amount of expenditure, as each entity develops its own staffing needs, which may exceed the previously allocated ceiling. However, this is an area where budget execution deviates the least (see Chapter 4, Section 4.7, 4.8).

For subnational governments, this requires improving the predictability of their resources

The lack of credible expenditure ceilings is also relevant for sub-national governments. In this case,the challenge comes from the difficulty of estimating the resources that subnational governments will have, and the late determination of these resources in the fiscal year. Ninety per cent of subnational government revenues in Peru are transfers received from the national government. However, the final value of these transfers is only known when the national government budget is voted on 30 November. Therefore, the formulation process of sub-national government budgets is intrinsically conditioned to the formulation process of the national government budget. On 30 November, when the final amount of transfers is known, subnational governments can adjust their budgets with the final figure.

Develop a long-term vision for infrastructure and human resources

Peru does not have a medium- or long-term vision for infrastructure or human resources, and existing planning mechanisms have not been sufficient to achieve this objective. Peru should develop centralised strategic planning guidelines that reflect and reaffirm the linkages and articulation between sectors or entities.

In terms of public investment, there is no long-term infrastructure vision at the sectoral or inter-sectoral level to establish a clear path of priorities based on an estimation of the available resources and a rigorous assessment of current and future infrastructure needs. The annual process of diagnosing gaps and defining indicators in the Invierte.pe system represents wear and tear for civil servants, as well as an inefficient use of the public resources invested. The gap closure exercise tends to be used mechanically and routinely. On the other hand, it does not respond to medium-term criteria or objectives but to present needs. It may not even represent a solution to cross-sectoral problems in the country (see Chapter 5, Section 5.3.3, 5.6.1). The greatest challenge in Peru’s investment system is to generate strategies with a long‑term perspective, prioritising investment projects with technical sense and social responsibility.

The objective of prospective workforce planning is to recruit and build the necessary skills in the medium and long term. In Peru, limited capacities in human resource management and public budgeting weaken such forward planning. There is also a lack of strategic workforce planning. Given the complexity of the employment system, administrative processes take up most of the human resources units’ time, which issue to the General Directorate of Fiscal Management of Human Resources a large number of requests for advice and clarifications on the legality of employment and/or salary concepts. This has two consequences. First, the directorate loses its capacity to plan and analyse the situation and the needs to be met. Second, it has an impact on financial planning. Finally, human resources budget requirements are based on immediate needs without considering the workforce’s needs and future evolution (see Chapter 4, Section 4.3.1, 4.8).

Develop sectoral infrastructure plans

Peru does not have a tradition of long-term strategic planning at the sectoral level that identifies current and future needs and available resources in each sector. The sectoral planning mechanisms or initiatives that are developed within the SINAPLAN framework are not linked to each other and are not linked to multiannual investment programming. In this particular case, the link between gap closure and a more general long-term vision of the country is limited, and the strategic capacity of the investment system restricted (see Chapter 5, Section 5.6.1, 5.2.2).

1.4.5. Investing in enabling factors and capacities

Difficulty in attracting and retaining qualified staff

The public administration in Peru is characterised by high staff turnover. This high turnover has a negative impact on the capacity of the Peruvian public administration to develop new services or improve existing ones. It also hinders building a professional civil service and strengthening knowledge and skills through experience building or training. High levels of turnover are observed among civil servants in charge of implementing the system, for example in Invierte.pe and in many human resources units. High staff turnover occurs especially at subnational levels, thus losing the knowledge acquired in different areas (see Chapters 2, Section 2.7.4; Chapter 4, Section 4.4.3, 4.4.1; and Chapter 5, Section 5.2.3). This reduces the benefits of the MEF’s and sectoral ministries’ efforts to provide training.

Fragmentation of the system leads to increased staffing and co-ordination needs

Peru’s budget system is fragmented. This means that multiple entities perform similar functions independently without constant communication or co-ordination between them. A fragmented system can result in the displacement of planning to day-to-day budgetary processes, as well as duplication of efforts in physical and human resources.

To illustrate how fragmented the system is, in Peru there are more than 500 public employment rules, no standardised job positions, more than 400 salary criteria, no standardised recruitment criteria and limited staff planning. The combination of these factors makes the administration of the system in the entities and the financial control from the Directorate General for Fiscal Management of Human Resources difficult. This hampers the formulation and budget execution of public service’s wagebill and medium- and long‑term projections of personnel costs. While the Peruvian civil service has taken considerable steps towards a public service system more consistent with the design of the Administrative System of Human Resources Management, the regime remains highly complex (see Chapter 4, Section 4.3.1).

Two examples illustrate the need to deploy staff due to the fragmentation of the system: the entities’ resource estimates and budget modifications. The budget units, including regional and local governments, estimate their revenues for the following year in January and February. However, the allocation of expenditures according to funding sources complicates this process. As a very precise estimate of directly collected revenue is required, staff must be deployed to take responsibility for establishing these estimates, as well as to negotiate them with the General Directorate of Public Budget (see Chapter 2, Section 2.6.1). On the other hand, budget modifications must be reviewed and authorised by the MEF, which requires the mobilisation of an entire team (Thematic Budget Directorate). This generates a high cost and absorbs human resources that could be dedicated to more strategic issues related, for example, to the quality of spending, its efficiency, etc. (see Chapter 2, Section 2.6.1).

Duplication of operating systems

Within the framework of the development of integrated financial administration systems, Peru has modernised its systems and developed the technical and material infrastructure for this process. For example, the SIAF has been in continuous movement, the investment system has been integrated with other state systems, and the General Directorate of Fiscal Management of Human Resources has been interoperating with information systems such as RENIEC, MINSA and SERVIR. Similarly, in 2018, the integration of the systems for multiannual programming and investment management, public budget, debt, accounting, treasury, procurement, and the fiscal management of human resources was provided for.

Despite these advances, greater and more effective systems integration should be pursued. In Peru, there are currently certain difficulties in terms of interoperability: the SIAF does not integrate information from the Central Registry of Payrolls and Data of Human Resources of the Public Sector, or from the Investment Bank, or from Invierte.pe, nor does it allow obtaining information on debt and treasury in real time; the multi-annual programming of investments and the gap approach are not articulated with other systems; the General Directorate of Fiscal Management of Human Resources uses several computer applications that are not all interoperable; the treasury and debt systems are not integrated and are not on line (see Chapter 2, Section 2.9.1; Chapter 3, Section 3.2.3; Chapter 4, Section 4.9.4; and Chapter 5, Section 5.2.2).

1.5. Conclusion

This study Public Financial Management in Peru: An OECD Peer Review presents a detailed analysis of current practices in Peru in four essential areas of public management in the light of best practices in OECD countries.

This study shows that Peru has made important reforms in recent years, and has been successful in ensuring the fiscal sustainability of the public sector. However, some of the central features of the system today create challenges that reduce the ability of the public sector to plan and prioritize its actions, and thus reduce the quality and quantity of goods and services for citizens and fail to fully exploit development opportunities for the country.

This study proposes concrete recommendations to improve public financial management in Peru in order to support sustainable growth, economic development with social inclusion, and poverty reduction. Some of the recommendations can be implemented immediately, others would require further analysis to identify concrete actions to be taken, build consensus on the need for change and the direction to take. All require political support and a group of public servants in the MEF to design and implement this agenda. This implies effort, accepting to step out of one's comfort zone, patience and long-term commitment.

References

[6] CAF (2021), Perú: La implementación de una política fiscal eficiente en un contexto post-COVID con notarias dificultades en la estructura social y pública.

[4] Central Reserve Bank of Peru (2020), REPORTE DE INFLACIÓN: Panorama actual y proyecciones macroeconómicas 2020-2022, https://www.bcrp.gob.pe/docs/Publicaciones/Reporte-Inflacion/2020/diciembre/reporte-de-inflacion-diciembre-2020.pdf.

[2] IMF (2022), Peru: Staff Concluding Statement of the 2022 Article IV Mission, International Monetary Fund, Washington, DC, https://www.imf.org/es/News/Articles/2022/03/07/mcs030722-peru-staff-concluding-statement-of-the-2022-article-iv-mission.

[1] IMF (2022), World Economic Outlook: War Sets Back the Global Recovery, International Monetary Fund, Washington, DC.

[3] IMF (2021), Global Debt Database, International Monetary Fund, Washington, DC, https://www.imf.org/external/datamapper/datasets/GDD.

[5] MEF (2022), Multiannual Macroeconomic Framework 2023-2026, Ministry of Economy and Finances, Lima, https://www.mef.gob.pe/es/?option=com_content&language=es-ES&Itemid=100869&lang=es-ES&view=article&id=3731.

Notes

← 1. From USD 6 653 in 2002 to USD 12 854 in 2019. Data measured at purchasing power parities (constant 2011 international prices). See: https://datos.bancomundial.org/indicator/NY.GDP.PCAP.PP.KD?locations=PE.

← 2. With 263 deaths per 1 000 people, followed by Bulgaria (254 per 1 000 people), the Russian Federation (245), Mexico (240) and Ecuador (229) (CAF, 2021[6]).

← 3. The IMF index includes price changes in aluminum, cobalt, copper, iron ore, lead, molybdenum, nickel, tin, uranium and zinc (IMF, 2022[2]).