This chapter describes the challenges in moving manufacturing to climate neutrality. It identifies manufacturing sectors subject to the biggest challenges and describes the transformations they require. Manufacturing activities are typically regionally concentrated and the transformations they need to undertake will therefore have implications for regional development. Five sectors – non-metallic minerals (notably cement), basic metals (notably steel), chemicals, oil refining and coke, as well as paper and pulp – stand out in terms of greenhouse gas (GHG) emissions and energy use. Key actions for reaching climate neutrality include reducing energy consumption and moving away from fossil energy use towards electrification. These industries often require high temperatures in their production processes, increasing energy needs and making electrification difficult. Circular economy practices help reach climate neutrality with less pressure on energy and material needs with co-benefits for other environmental outcomes and human health. The motor vehicle industry, which is also included in the analysis, generates few emissions and is not energy intensive but faces challenges from the move to electric, lighter and fewer vehicles the transition is likely to imply.

Regional Industrial Transitions to Climate Neutrality

1. Regional industrial transitions to climate neutrality: Identifying key sectors

Abstract

Introduction

This book is dedicated to the transition of manufacturing to climate neutrality and what this means for the regions at the subnational level, drawing on data from regions across Europe. The motivation is simple: some of the economic activities that are most difficult to make climate neutral are in manufacturing. And these manufacturing activities are typically regionally concentrated. Since the regions differ in their socio‑economic conditions, understanding the regional development implications will also help policy makers meet the needs of a just transition.

The transformations will have labour market implications. While most manufacturing sectors will continue to be needed in a climate neutral economy, thus having little impact on aggregate employment, certain sectors may shed employment in some regions. New activities will, by contrast, attract an increasing number of workers. For example, integrating circular economy solutions may result in increased employment (Material Economics, 2019[1]; OECD, 2020[2]). Risks of job loss may not coincide with the spatial distribution of job opportunities. Businesses and workers will need to transform occupations and skills. Impacts on regions will differ according to their socio-economic characteristics. The transformations climate neutrality requires, including access to new, fossil-fuel-free energy sources, zero-carbon transport and related infrastructure, may also shift comparative advantage across regions. Reducing emissions in manufacturing supply chains may also result in some relocation of activity. The labour market implications, therefore, require policy responses for a just transition.

Regional shocks to the industrial base typically widen to affect the production of goods and services in the same or adjacent regions to meet demand from workers in directly affected industries and their families. Loss of employment and value-added is also magnified over time through business clustering and emigration effects. Potential price responses, such as declining regional wages or real estate prices cannot equilibrate these shocks in practice because these price responses may aggravate decline or are too slow to attract activity. This may result in persistent regional crises. The impacts also travel along value chains. Such risks need to be understood and prevented and opportunities seized. Taking into account the move to climate neutrality in manufacturing is therefore central to regional development.

This chapter identifies manufacturing sectors which need to undergo particularly deep transformations and describes these transformations. The following section will describe what transitions to climate neutrality mean for manufacturing, followed by a description of employment implications. This will be followed by a selection of key sectors facing major challenges, the focus of this chapter that concludes with a description of the transformations in the key sectors and their place-based implications.

The second section of this chapter will identify the regions most vulnerable to these transformations. The third will explore infrastructure access conditions required by key manufacturing sectors. The fourth presents data analysis to help identify potential regional socio-economic vulnerabilities in most affected regions, laying the basis for policy action to support a just transition.

Challenges in moving manufacturing to climate neutrality

The manufacturing sector contributes substantially to GHG emissions. The steel and cement sectors alone each generate around 7% of CO2 emissions and the chemical sector a further 4%, in world economies included in the analysis by the International Energy Agency (IEA, 2020[3]). Heavy industries account for 45% of global GHG emissions (OECD, 2019[4]); (IEA, 2020[3]). In addition to steel, cement and chemicals, heavy industries include other metals, the processing of fossil fuels, for example in oil refining, as well as pulp and paper. These heavy industries account for most manufacturing emissions and will therefore also be referred to as emission-intensive industries below. All of these emissions from heavy industries have been growing significantly faster than overall GHG emissions.

Energy accounts for a relatively large share of production costs in several manufacturing industries. Variations in energy costs in the transition to climate neutrality may affect their competitive position, as manufacturing products are traded in global markets. Manufacturing also heavily depends on heavy-duty road transport for value chain management and market access which itself requires decarbonisation.

Most of the production in emission-intensive manufacturing sectors will need to continue in climate-neutral economies. In addition, outputs in these sectors are important for the infrastructure needs of the transition to climate neutrality, to achieve climate-neutral electricity generation, electrification of energy use, or the decarbonisation of transport and buildings for example (ETC, 2018[5]). However, moving to climate neutrality in these sectors requires technologies that do not exist at full scale in many cases (IEA, 2018[6]; Climate Action Tracker, 2020[7]; Bataille et al., 2018[8]). In these manufacturing sectors, emissions are therefore particularly hard to abate. Fossil fuels have been fundamental to production processes in these industries. In addition to energy-related emissions, process emissions are important in some and arise from chemical processes during the conversion of raw materials to intermediate or final products.

Some decarbonisation methods apply to most forms of manufacturing. These include: decarbonising all energy inputs, increasing energy efficiency and promoting material circularity (Johnson et al., 2021[9]). Two-thirds of industrial direct GHG emissions are from high-temperature process heat, either in the form of steam or hot water (20%) or from the direct firing of various types of furnaces (50%). Space heating contributes 9% (EC, 2018[10]).

Electrification of energy use will play an important role, especially for low to medium heat. Generating high‑temperature heat from electricity is challenging and costly. Biomass firing can be an alternative but is climate neutral only if sustainably sourced, limiting supply. Hydrogen produced with renewable electricity in electrolysis (“green hydrogen”) or synthetic methane produced from hydrogen can also be used for high heat beyond 1 000 degrees Celsius. These may be used in combination: for example, initial heating with electric heat pumps or some form of solar heating could be boosted with biogas, hydrogen or synthetic methane produced from hydrogen (Bataille et al., 2018[8]).

Electrification of energy needs risks raising electricity demand hugely and resulting in highly regionally concentrated electricity needs (Material Economics, 2019[1]). These electricity needs will need to be mostly met with renewable electricity. To limit economic and environmental costs from large-scale renewables expansion, as well as risks not reaching climate neutrality in the time , reducing energy demand is central to moving to climate neutrality by 2050 (Hickel et al., 2021[11]); (Johnson et al., 2021[9]). Achieving further energy savings in many cases requires the replacement of major parts of production processes, which is often best integrated with other transformations needed for the net-zero emissions target (EC, 2018[10]). The need to reduce energy demand and electrify energy end-use while decarbonising all electricity generation will also impact the types of goods manufacturing produces, such as electric heat pumps instead of natural gas boilers.

Long-lived quasi-fixed capital assets with high sunk cost prevail in emission-intensive sectors, with lifetimes of 30-40 years. Twenty-five years is a typical investment cycle for major refurbishments. New industrial facilities, therefore, need to be climate neutral starting now in some sectors, while refurbishments may need to be net-zero consistent starting in 2025. Investment needs to increase 50%, both to replace some existing capacity and to switch to more capital-intensive, low-CO2 production routes (Material Economics, 2019[1]).

Twenty-one percent of industrial emissions are process emissions (EC, 2018[10]). In some sectors they are major. Carbon capture, use and storage (CCUS) is essential for some process emission sources in manufacturing because they are difficult to avoid otherwise, as argued below. It may be desirable to limit CCUS to process emissions. Relying on it on a larger scale poses risks, as CCUS has not been deployed at scale yet and its large-scale deployment is subject to uncertainties. Relying on CCUS rather than reducing emissions upfront therefore raises the risk that climate neutrality is not reached. Most CCUS would need to be delivered through carbon capture and storage (CCS). There is limited scope for CO2 use (CCU) to support carbon removal. For CCU to result in permanent CO2 removal, materials produced with captured CO2 need to be fully controlled and closely linked to the emission source. CCU through direct air capture is highly energy intensive and costly. Due to limitations in the location of available, acceptable and commercially viable storage sites and their costs, CCS for industrial processes can be among the most expensive mitigation options (Sharmina et al., 2021[12]).

The contribution of the circular economy

Reducing demand for raw materials saves energy and other resources and avoids process emissions. This applies especially in the production of basic materials like steel, cement, plastics, paper and pulp which characterises emission-intensive industries. The circular economy is therefore particularly important for industrial transitions to climate neutrality. Without exploring circular economy potentials, switching production to climate-neutral processes alone would result in substantially higher costs and very large demand for clean energy, including for the production of hydrogen (Sun, Lettow and Neuhoff, 2021[13]). Circular economy approaches could reduce CO2 emissions from 4 major manufacturing sectors (plastics, steel, aluminium and cement) by 56% in developed economies by 2050 (Johnson et al., 2021[9]; Sharmina et al., 2021[12]; Material Economics, 2019[1]). They therefore also reduce the need for CCUS. These approaches include the following:

1. New business models to promote shared use, longer use, repair and reuse, can reduce the demand for industrial output and the materials it requires.

2. Materials recirculation can replace high-emitting raw materials with recycled materials including closed-loop systems, where waste from one process is an input to another.

3. Substitution from high-emitting or hard-to-abate materials to lower-emitting alternatives can achieve significant emissions cuts (EC, 2018[10]; OECD, 2018[14]).

Since the processing of goods and materials for reuse and recycling is likely to be close to where they are consumed, this is likely to also result in employment growth, including from relocation of activity from abroad. While this may also mean that overall emissions to high-income countries rise, at a global level, all other things being equal, emissions should fall.

The circular economy requires exchanging and reprocessing materials or shared-use assets among manufacturing plants or their customers. Reducing transaction costs among agents in the circular economy is therefore important, for example, to ensure the precise composition of materials is known. Digitalisation and industrial symbiosis can contribute as follows:

Digitalisation can support the circular economy, through improved tracking of product and materials composition. Major opportunities include marking technologies, low-cost sensors and real-time tracking to provide better information on materials composition as well as automation, for example in sorting (Material Economics, 2018[15]). Other opportunities are geolocation technologies to indicate asset locations or blockchain to store information (OECD, 2020[2]). Digital technologies also reduce transaction costs in innovative circular economy business models, such as in the provision of capital goods as a service (Barteková and Börkey, 2022[16]).

Industrial symbiosis, or closed-loop recycling, as it is sometimes called, involves the use of by‑products from one firm as inputs for another. Industrial symbiosis reduces intermediaries and is most common in industries that produce pure and homogeneous materials, such as the chemicals industry. Industrial symbiosis is more meaningful for industrial sites that are closely located to each other (EC, 2018[10]). Some of these relationships may develop organically or are the result of carefully planned industrial parks (OECD, 2019[17]). The partnership of industrial establishments across sectors, sharing infrastructures and their material inputs and outputs (including waste) can also optimise resource use.

Circular economy practices provide key environmental, health and economic benefits in addition to GHG emission reduction (Box 1.1).

Box 1.1. Key environmental, health and economic benefits of the circular economy

Materials extraction and processing, including biomass, fossil fuels, metals and non-metallic minerals account for around 70% of GHG emissions, as well as for substantial water, soil and air pollution and biodiversity loss. Most global environmental impacts of extraction and processing of these key materials are projected to at least double between 2017 and 2060 (OECD, 2019[18]).

Non-metallic minerals, such as sand, gravel and limestone mostly used in construction, and biomass account for the bulk of materials extraction. Although their extraction and processing pollute less per ton than metals, they have important lifecycle environmental impacts, which are magnified by their volume (Wilts et al., 2014[19]). For example, cement and concrete production generate high GHG emissions. It has a significant impact on energy demand, soil acidification and land use (OECD, 2019[18]).

More than 90% of global biodiversity loss and water stress come from resource extraction and processing (EC, 2019[20]), with biomass extraction playing an important role. As discussed below, biomass use is important, especially in the production of paper products but in some countries is also used to generate heat in other sectors. It will gain importance as fossil fuels are phased out. Substituting fossil fuels with sustainably sourced biomass can reduce GHG emissions but does not fully avoid adverse impacts on biodiversity. Plastics production and waste generation roughly doubled between 2000 and 2015, resulting in multiple environmental impacts, including high energy use, pollution from landfill and incineration, and ecosystems from uncontrolled disposals, such as marine litter (OECD, 2018[14]). Metals extraction and processing cause soil acidification, eutrophication of water flows and toxic effects on ecosystems.

In part, environmental degradation associated with material extraction and processing occurs in locations which are distant from the European Union (EU). However, some impacts arise locally, for example from the extraction of construction materials sourced locally. They can also materialise at the point of consumption or disposal. Wherever they arise they often generate adverse health effects on humans. Demand reduction and substitution of key chemicals, for example synthetic fertilisers or solvents and some plastics, could reduce pollution of water and land at the location of use, reduce risks from alterations in the nitrogen cycle (OECD, 2018[21]) as well as provide significant health benefits.

Economic benefits result from the security of resource supply and increase overall employment, especially in resource-importing countries. Security of resource supply improves as the circular economy can reduce material imports and diversify sourcing, especially when raw materials are distant and geographically concentrated.

Source: OECD (2019[18]), Global Material Resources Outlook to 2060: Economic Drivers and Environmental Consequences, https://dx.doi.org/10.1787/9789264307452-en; Wilts, H. et al. (2014[19]), “Policy mixes for resource efficiency”, POLFREE Policy Options for a Resource-Efficient Economy, University College London, London; EC (2019[20]), The European Green Deal, Communication from the Commission COM(2019) 640 final, European Commission; OECD (2018[14]), Improving Markets for Recycled Plastics: Trends, Prospects and Policy Responses, https://dx.doi.org/10.1787/9789264301016-en; OECD (2018[21]), Human Acceleration of the Nitrogen Cycle: Managing Risks and Uncertainty, https://dx.doi.org/10.1787/9789264307438-en.

Employment consequences

According to Cedefop’s European Green Deal (EGD) scenario (Cedefop, 2019[22]), by 2030, most manufacturing will see a redirection of employment toward cleaner production rather than a reduction at the 27 European Union countries (EU27) level, compared to a baseline with previous policies. However, there are some limitations to this analysis. It does not go all the way to climate neutrality, as targeted for 2050, potentially omitting the costliest transformations. It is a partial analysis where wider economic impacts driven by supply chain linkages, changes in consumption patterns and other factors are not systematically considered.

Industrial transitions to climate neutrality will also bring new and different jobs. Assessments of sector-specific transformations of occupations and skills demands in manufacturing are still rare. A broad range of skills, which are not unique to green jobs, will need to support the transition to climate neutrality. Seven out of ten top skills in “the green economy” are generic, while the remaining three are industry-specific. Skill requirements in new activities may be substantially different from those used in declining activities. The share of low-skilled jobs is high in highly polluting sectors, while environmentally friendly activities tend to have a high share of high-skilled jobs.

Table 1.1 shows sectoral manufacturing employment outcomes by 2040 consistent with the IEA Sustainable Development Scenario (SDS). These are closer to the full employment impact of climate neutrality. The SDS shows emission reductions which allow reaching the goals of the Paris Agreement, compared to a baseline that is consistent with policies around 2019. As they are simulated with a computable general equilibrium model, they include in principle supply chain linkages and other national and international market relationships. The processing of fossil fuels, the production of basic metals, chemicals, textiles, electronics, automobiles as well as paper and pulp may suffer employment losses, albeit mostly small ones. However, these are aggregate results for the EU as a whole as well as for other major economies. Secondary iron and steel production by contrast can benefit from circular economy advances.

Some net employment losses in Table 1.1 are likely to be smaller than would be consistent with reaching climate neutrality. The modelled SDS does not fully integrate the ambition to reach net-zero emissions in 2050. Moreover, the SDS assumes the use of CCUS for energy-related emissions in industry, prolonging the use of petroleum, natural gas and coal products for industrial heat and as raw materials as well as possibly employment in related sectors. The manufacturing of motor vehicles includes some diffusion of electric vehicles even in the baseline scenario because of their improving cost competitiveness, which limits the impact of electrification on employment attributed to climate action

The modelling assumes that countries achieve emission reductions in a co‑ordinated way. In practice, countries will move towards climate neutrality at different speeds without full co‑ordination. EU countries are likely to move ahead of others. Countries with more rapid transitions may not face bigger risks of employment or income losses economywide. Quicker emission reductions initially can, on the contrary, provide more protection against risks of stranded assets. But countries with more rapid transitions are likely to face stronger sectoral employment shifts (OECD, 2017[23]) and, therefore, also larger regional employment shifts. This could in particular generate sectoral employment losses over and above those in Table 1.1. This in particular concerns the manufacturing sectors discussed in this publication. In these sectors, transformation challenges are substantial, emission reductions may result in higher costs and products are mostly internationally tradeable. Policy actions, such as border carbon price adjustment or targeted subsidies, could offset employment losses but would need to be the larger, the bigger the impact of emission reductions on production costs is. Owing to the regional concentration of sectoral manufacturing activity, such policy action will need to be place-based.

Industrial transitions to climate neutrality will also bring new and different jobs. Assessments of sector-specific transformations of occupations and skills demands in manufacturing are still rare. A broad range of skills, which are not unique to green jobs, will need to support the transition to climate neutrality. Seven out of ten top skills in “the green economy” are generic, while the remaining three are industry-specific (Vasselina, Till Alexander and Saadia, 2020[24]). Skill requirements in new activities may be substantially different from those used in declining activities (Cecere and Mazzanti, 2017[25]). The share of low-skilled jobs is high in highly polluting sectors, while environmentally friendly activities tend to have a high share of high-skilled jobs.

Table 1.1. Employment changes from worldwide emission reductions consistent with the Paris Agreement, by sector, according to the OECD ENV-Linkages model

Deviation of sectoral employment from baseline in 2040, in percentages

|

Economic sectors |

OECD |

EU17 |

EU3+UK |

United States |

Japan |

|---|---|---|---|---|---|

|

Petroleum and coal products |

-21 |

-32 |

-34 |

-30 |

-27 |

|

Secondary zinc, lead, gold and silver production |

-6 |

-13 |

-7 |

-6 |

-9 |

|

Primary aluminium production |

-4 |

-5 |

-6 |

-6 |

-7 |

|

Secondary aluminium production |

-4 |

-5 |

-5 |

-6 |

-6 |

|

Primary copper production |

-4 |

-5 |

-5 |

-6 |

-6 |

|

Primary zinc, lead, gold and silver production |

-4 |

-4 |

-5 |

-6 |

-6 |

|

Secondary copper production |

-4 |

-4 |

-4 |

-5 |

-5 |

|

Textiles |

-4 |

-5 |

-4 |

-3 |

-4 |

|

Electronics |

-3 |

-1 |

-2 |

-5 |

-4 |

|

Chemicals, rubber, plastic products |

-3 |

-7 |

-7 |

-1 |

-1 |

|

Secondary iron and steel production |

3 |

8 |

-10 |

2 |

3 |

|

Non-metallic minerals |

-2 |

-1 |

-3 |

-1 |

-6 |

|

Motor vehicles |

-2 |

-2 |

-2 |

-1 |

-3 |

|

Paper and pulp production |

-2 |

-1 |

-2 |

-3 |

-4 |

|

Primary iron and steel production |

-1 |

4 |

-5 |

-1 |

0 |

Note: EU17 includes Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Ireland, Luxembourg, the Netherlands, Poland, Portugal, the Slovak Republic, Slovenia, Spain and Sweden. EU3+UK includes France, Germany, Italy and the United Kingdom.

Source: OECD calculations based on the ENV-Linkages model; OECD (2021[26]), OECD Regional Outlook 2021: Addressing COVID-19 and Moving to Net Zero Greenhouse Gas Emissions, https://doi.org/10.1787/17017efe-en; Bibas, R., J. Chateau and E. Lanzi (2021[27]), “Policy scenarios for a transition to a more resource efficient and circular economy”, https://doi.org/10.1787/c1f3c8d0-en.

There are two main types of skills for which green jobs differ from non-green jobs: i) engineering skills used in the design and production of technology; and ii) managerial skills (Vona et al., 2018[28]). Managerial workers, for example, will need to build resource efficiency into business and management practices, incorporate emission reduction scenarios in investment plans or establish carbon footprints in goods procurement. Since the climate transition will require linking activities closely that have so far been separate, such as intermittent electricity generation and use, the complexity of work in some sectors will require cross-, multi- and interdisciplinary skills. Jobs consistent with environmental objectives may be more intensive in non-routine analytical and cognitive skills (Consoli et al., 2016[29]). The gap in terms of skills between green and brown jobs for similar low-skilled occupations appears to be generally small, including in manufacturing (Vona et al., 2018[28]). However, the demand for low-skill occupations is likely to be smaller with the transition.

While carbon capture and storage (CCS) will be an emerging activity, the skill requirements in this industry are not new and can be met using a combination of skills used in the chemicals, oil and gas, process design and engineering construction industries. With some retraining, displaced pipe fitters and designers, leak test technicians and offshore barge operators in the oil and gas industry could be reemployed in CCS (UK Government, 2011[30]).

Key sectors and their transformations with place-based implications

The selection of key manufacturing sectors is based on the following criteria:

The contribution of sectors to total GHG emissions from manufacturing.

Transformation challenges from high energy use and low electrification of energy use.

The extent to which total emissions from each manufacturing sector are covered in the European Emissions Trading System (ETS).

A significant contribution to employment or employment risks.

GHG emissions are fundamental for the analysis of regional industrial transitions and their regional development implications. The analysis above also suggests that energy consumption and the degree of electrification are indicative of transformation challenges. EU ETS emissions data allow locating the emitting installations geographically.

ETS emissions data provide limited information on the sectoral origin of emissions. The analysis in this publication, therefore, attributes ETS emissions to Nomenclature of Economic Activities (NACE) sectors according to the main activity of businesses owning installations. To this end, ETS data are matched with international non-governmental Orbis business data. The attribution of ETS emissions to NACE sectors allows for estimating the coverage of emissions by ETS. As shown below, GHG emissions data for three- and four-digit NACE sectors allow pinpointing activities which are the most emission-intensive and which will need to undertake the deepest transformations.

The selected manufacturing sectors are the following: non-metallic mineral products (NACE 23), basic metals (NACE 24), coke and refined petroleum products (NACE 19), chemicals and chemical products (NACE 20), paper and paper products (NACE 17) and motor vehicles (NACE 29).

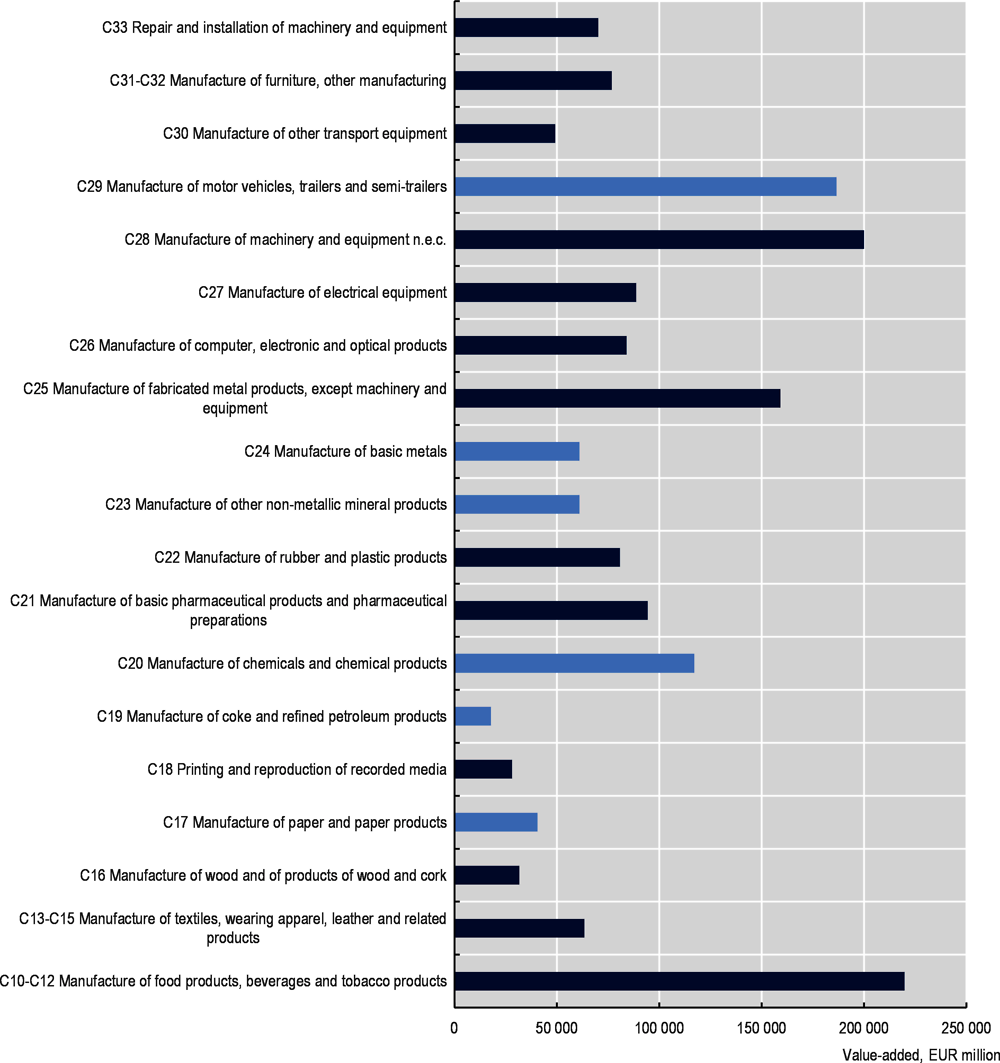

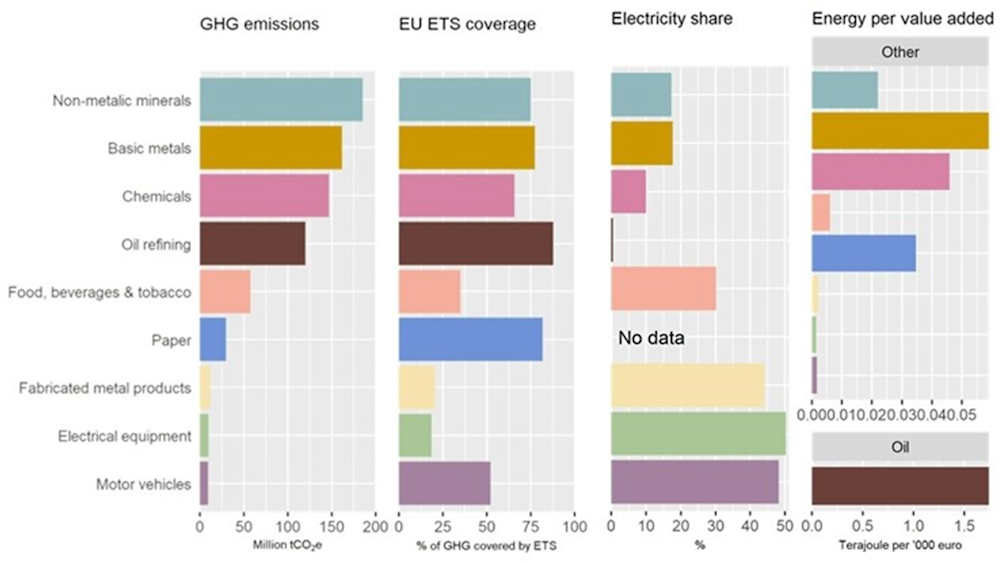

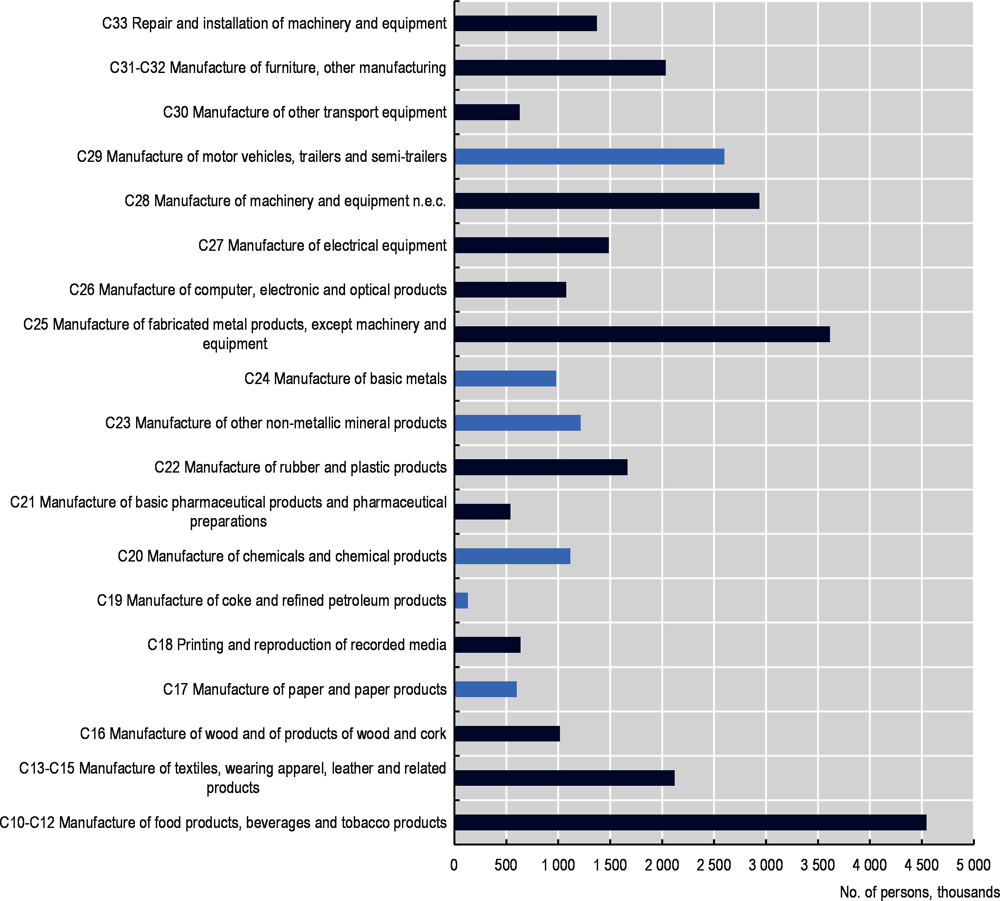

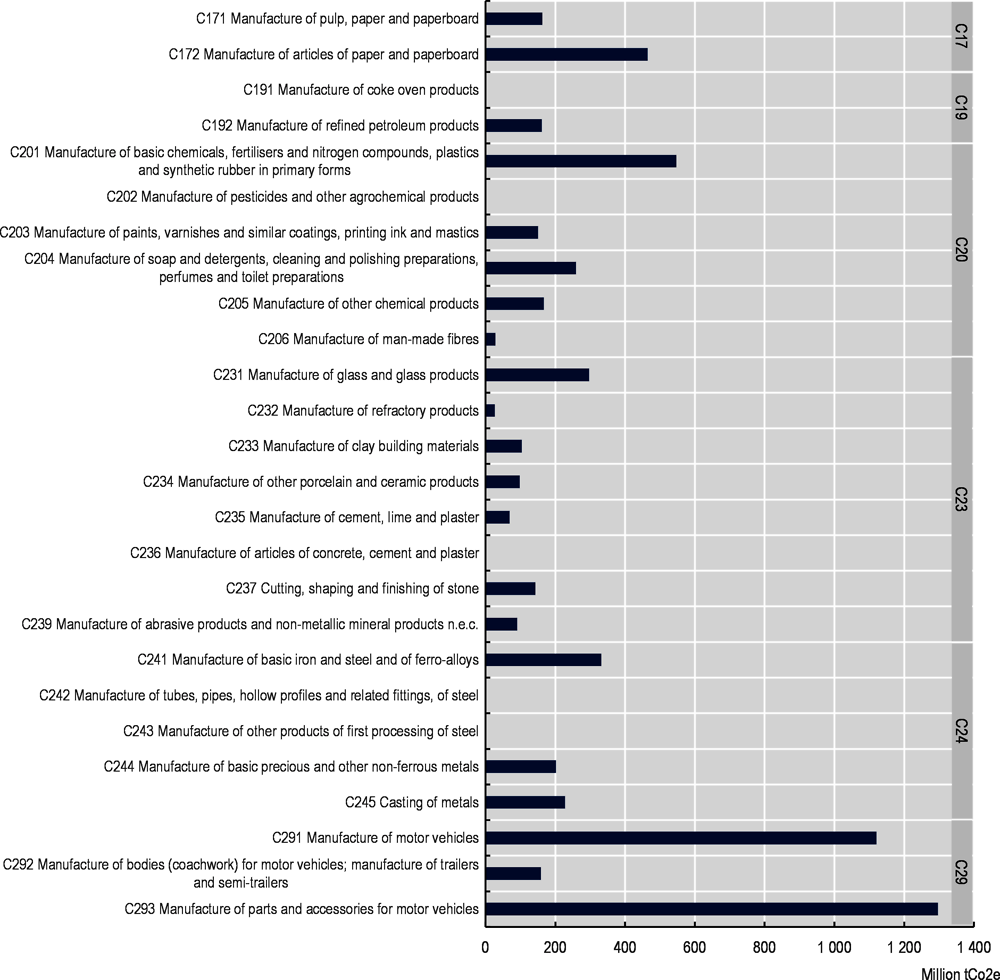

These six sectors also include most of the sectors with the highest GHG emissions in the EU (Figure 1.1). One exception is the manufacturing of food, beverages and tobacco products (NACE 10-12), where emissions are also high. However, ETS covers only a third of emissions, mostly in the food industry (NACE 10). Emissions in the manufacture of motor vehicles are by contrast relatively low. It also does not stand out in terms of the energy intensity of value-added or the share of electrified energy consumption. However, motor vehicle manufacturing employs the most people among the selected sectors. (Figure 1.2). The production of motor vehicles and chemicals also generates the most value-added (Figure 1.3). Employment is modest in the production of coke and oil refining. However, relative employment losses are likely to be the largest. The selected sectors account for more than 90% of manufacturing GHG emissions. The five selected sectors with high emissions also have the highest energy intensity of value-added and the lowest shares of electrified energy consumption.

With its production of basic materials, the emissions-intensive industry is particularly strongly integrated into the value chains of downstream industries. Addressing the transition to climate neutrality effectively and fairly in the regions where these activities take place is therefore important for activity in downstream sectors. For example, the steel industry employs only 6 million people worldwide but links indirectly to 42 million jobs. The chemical industry provides inputs to over 95% of all manufactured products (ICCA, 2012[31]). Downstream industries, which depend on a particularly large range of inputs from emissions-intensive industries, include the construction of buildings, the manufacturing of motor vehicles, civil engineering, computer electronics and optical as well as, to a lesser extent, electrical equipment (EC, 2018[10]). The prices of the basic materials produced by emissions-intensive industries may become significantly higher than today. Zero-carbon production routes may cost 20-30% more for steel, up to 60% for chemicals and 80% for cement. A more circular economy helps reduce raw materials and energy needs but also modifies value chains.

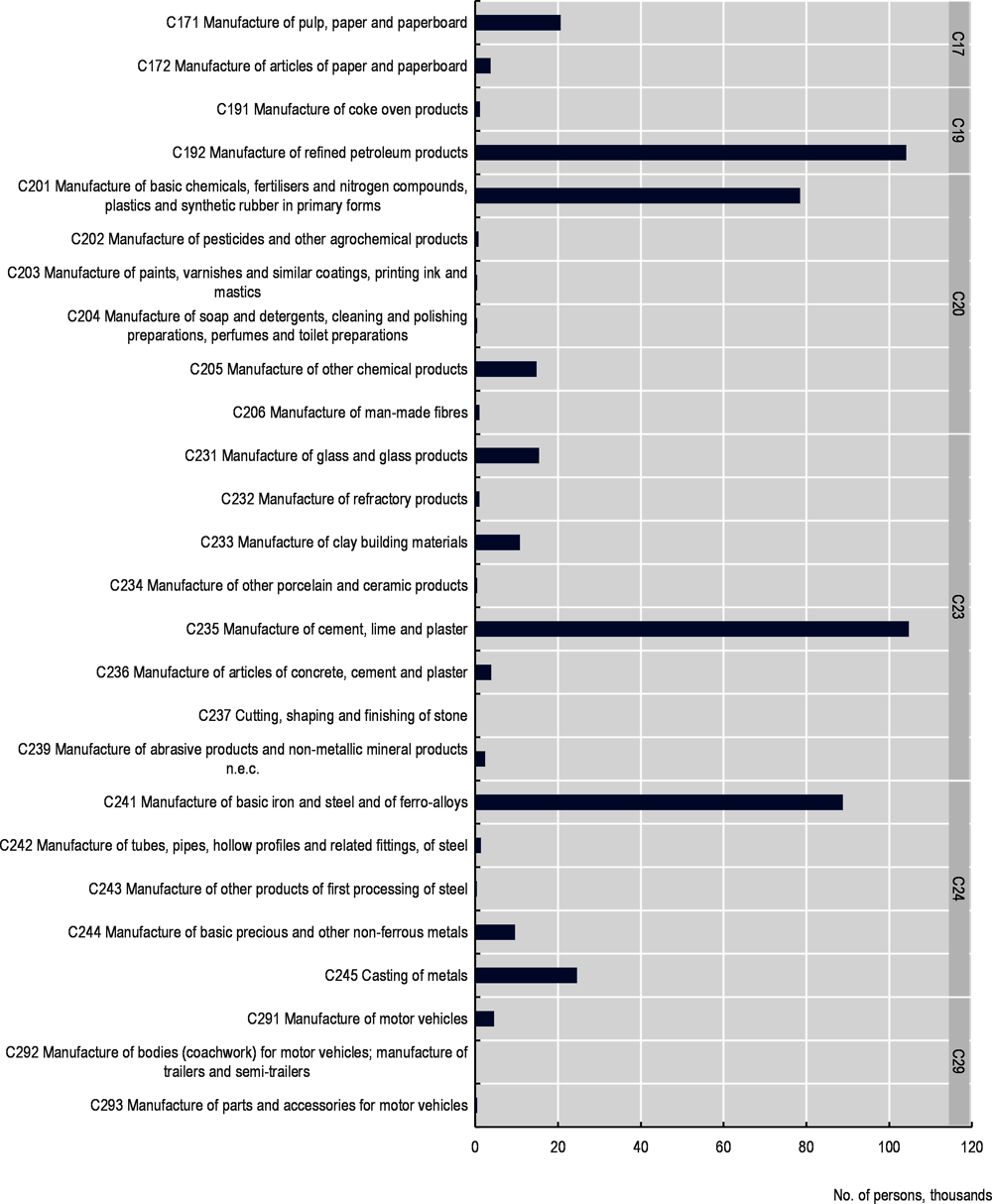

The attribution of ETS emissions to NACE sectors also allows an assessment of emissions in three- and four-digit NACE sectors, for which no emissions data are available. Emissions in the selected sectors are concentrated in some three-digit subsectors, in particular the production of paper and pulp, refined petroleum products, basic chemicals, cement, basic iron and steel (Figure 1.5). In the analysis of the following chapters, particular attention will be paid to these sectors. They are in some but not all cases the most employment-intensive (Figure 1.4).

Figure 1.1. Emissions, shares of GHG emissions covered by ETS and energy intensities in selected manufacturing sectors

Note: Data for 2019 or latest year available.

Source: Eurostat, matched ETS emissions and Orbis data.

Figure 1.2. Employment across two-digit NACE industries

Note: Selected sectors highlighted in fair blue.

Source: Eurostat. Selected sectors are highlighted in fair blue.

Figure 1.3. Value-added across two-digit NACE industries

Figure 1.4. Employment across three-digit NACE sectors

Figure 1.5. Emissions in three-digit NACE subsectors of key two-digit manufacturing sectors

Note: Emissions of installations attributed to business sector at the subsidiary level.

Source: Own calculations with EU ETS/ORBIS matched dataset (2019).

A large literature describes the transformations in production technologies to get these sectors to climate neutrality, summarised in detail in a forthcoming working paper (Fuentes and Noels, 2023[32]). Some high‑level characteristics of these transformations have place-based implications:

Refined oil production is likely to face the biggest relative employment loss among the chosen sectors because oil and coal product use will need to be phased out. Global demand for oil products will decrease significantly (IEA, 2021[33]) and more quickly so without reliance on CCS for energy‑related GHG emissions. According to Cedefop’s EGD scenario, direct employment in manufactured fuels in the EU27 will decrease by about 10% already by 2030 (Cedefop, 2021[34]).

Non-metallic minerals include several activities generating substantial emissions. Cement production stands out; others are glass and other building materials manufacturing. The former is the most likely to require CCS, as technologies to eliminate process emissions are least developed. More than half of emissions from cement production are process emissions (Cao et al., 2020[35]). Other emissions and energy demand reduction levers consistent with net-zero emissions, which need to be used in combination, are improving energy efficiency, switching to alternative fuels, reducing the clinker-to-cement ratio and using alternative binding materials (IEA, 2018[6]).

Chemicals production can do without CCS. This then reinforces the need to transform basic chemicals production processes more fundamentally and increases the demand for hydrogen. The three main supply-side decarbonisation levers are fuel and feedstock substitution, including biomass, and energy efficiency (Levi and Cullen, 2018[36]). Demand reduction, for example for single-use plastics, is important too. Especially in the near term, mitigation may be achieved through recycling and reuse and more sparing use of nitrogen fertilisers, though the production of plastics and other basic chemicals may still rise worldwide (IEA, 2021[33]). Reduced plastic varieties and additives can boost the value of recycled plastics. Innovative chemical and biochemical recycling can also contribute but requires high energy input.

Steel production can also do without CCS. This also reinforces the need to transform production processes more fundamentally and increases the demand for hydrogen. The combination of direct reduction and electric arc furnaces has the potential for full decarbonisation, using hydrogen and climate-neutral electricity sources (Wang et al., 2021[37]) (Bataille, 2020[38]). Aluminium smelters are also large electricity consumers (IEA, 2020[3]). Climate-neutral technologies need to reach significant market penetration in the next decade. In steel and aluminium production, secondary production from scrap generates much fewer emissions and is much less energy intensive (Liu and Müller, 2012[39]); (Liu, Bangs and Müller, 2013[40]) but depends on scrap availability. More scrap is available in high-income regions.

In paper and pulp, the biggest challenge may be rising competition for biomass from other sectors, such as transport (Material Economics, 2020[41]). In addition to biomass being the key raw material, 60% of the energy used in paper and pulp is from bioenergy. Raising the use of recycled paper, combined with renewable electricity use, is likely to be important, which may dissociate production sites from locations with biomass availability. However, combining biomass firing in paper and pulp production with CCS could contribute to net negative emissions, which high-income countries will need beyond 2050.

In vehicle manufacturing, the challenge is about producing electric vehicles. The transition to climate neutrality will also be facilitated by moving to less car use in high-income countries, notably in urban contexts, as well as to lighter vehicles, as the environmental footprint from the production of zero-emission vehicles is likely to be higher than that of conventional vehicles. A battery accounts for 10-30% of the total life cycle emissions of an electric vehicle (IEA, 2020[42]). The manufacture of an electric motor and related components requires 60-70% less labour than that of a diesel vehicle and 40% less than compared to a petrol car in Germany for example (Bauer et al., 2018[43]). Production operators and equipment technicians are expected to account for 75% of large battery factory workforces and these will require qualification upgrades in advanced manufacturing engineering. Ride-sharing can sharply reduce vehicles in urban contexts.

Most of these industries produce basic materials which are inputs in other manufacturing sectors. Freight transport is the foundation of the supply chain system. Freight transport is also challenging to decarbonise. Access to zero-carbon freight transport modes is therefore also important to move key manufacturing sectors to climate neutrality.

References

[44] Barková, E. and P. Börkey (forthcoming), Digitalisation and the circular economy, OECD Publishing, Paris.

[16] Barteková, E. and P. Börkey (2022), “Digitalisation for the transition to a resource efficient and circular economy”, OECD Environment Working Papers, No. 192, OECD Publishing, Paris, https://doi.org/10.1787/6f6d18e7-en.

[38] Bataille, C. (2020), “Low and zero emissions in the steel and cement industries: Barriers, technologies and policies”, OECD Green Growth Papers, No. 2020/02, OECD Publishing, Paris, https://doi.org/10.1787/5ccf8e33-en.

[8] Bataille, C. et al. (2018), “A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris Agreement”, Journal of Cleaner Production, Vol. 187, pp. 960-973, https://doi.org/10.1016/j.jclepro.2018.03.107.

[43] Bauer, W. et al. (2018), “Beschäftigung 2030 Auswirkungen von Elektromobilität und Digitalisierung auf die Qualität und Quantität der Beschäftigung bei Volkswagen”, Fraunhofer Institut.

[27] Bibas, R., J. Chateau and E. Lanzi (2021), “Policy scenarios for a transition to a more resource efficient and circular economy”, OECD Environment Working Papers, No. 169, OECD Publishing, Paris, https://doi.org/10.1787/c1f3c8d0-en.

[35] Cao, Z. et al. (2020), “The sponge effect and carbon emission mitigation potentials of the global cement cycle”, Nature Communications, Vol. 11, p. 3777, https://doi.org/10.1038/s41467-020-17583-w.

[25] Cecere, G. and M. Mazzanti (2017), “Green jobs and eco-innovations in European SMEs”, Resource and Energy Economics, Vol. 49, pp. 86-98, https://doi.org/10.1016/j.reseneeco.2017.03.003.

[34] Cedefop (2021), Digital, Greener and More Resilient: Insights from Cedefop’s European Skills Forecast, European Centre for the Development of Vocational Training, Luxembourg, http://data.europa.eu/doi/10.2801/154094.

[22] Cedefop (2019), Skills for Green Jobs: 2018 Update - European Synthesis Report, European Centre for the Development of Vocational Training, Luxembourg, http://data.europa.eu/doi/10.2801/750438.

[7] Climate Action Tracker (2020), Paris Agreement Compatible Sectoral Benchmarks: Elaborating the Decarbonisation Roadmap, https://climateactiontracker.org/data-portal (accessed on 19 December 2020).

[29] Consoli, D. et al. (2016), “Do green jobs differ from non-green jobs in terms of skills and human capital?”, Research Policy, Vol. 45/5, pp. 1046-1060, https://doi.org/10.1016/j.respol.2016.02.007.

[20] EC (2019), The European Green Deal, Communication from the Commission COM(2019) 640 final, European Commission.

[10] EC (2018), A Clean Planet for All: A European Long-term Strategic Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy, In-depth Analysis in Support of the Commission Communication COM(2018) 773, European Commission, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52018DC0773 (accessed on 2 March 2021).

[5] ETC (2018), Mission Possible: Reaching Net-Zero Carbon Emissions from Harder-to-abate Sectors by Mid-century, Energy Transitions Commission, https://www.energy-transitions.org/wp-content/uploads/2020/08/ETC_MissionPossible_FullReport.pdf (accessed on 19 December 2020).

[32] Fuentes, A. and J. Noels (2023), “Regional Industrial Transitions to Climate Neutrality: Identifying the sectors”, OECD Regional Development Policy Papers, OECD, Paris.

[11] Hickel, J. et al. (2021), “Urgent need for post-growth climate mitigation scenarios”, Nature Energy, Vol. 6/8, pp. 766-768, https://doi.org/10.1038/s41560-021-00884-9.

[31] ICCA (2012), The Global Chemical Industry’s Contributions to Sustainable Development and the Green Economy, International Council of Chemical Associations, Brussels.

[33] IEA (2021), Net Zero by 2050: A Roadmap for the Global Energy Sector, OECD Publishing, Paris, https://doi.org/10.1787/c8328405-en.

[3] IEA (2020), Energy Technology Perspectives 2020, OECD Publishing, Paris, https://doi.org/10.1787/d07136f0-en.

[42] IEA (2020), Global EV Outlook 2020: Entering the decade of electric drive?, OECD Publishing, Paris, https://doi.org/10.1787/d394399e-en.

[6] IEA (2018), Low-Carbon Transition in the Cement Industry, IEA Technology Roadmaps, International Energy Agency, Paris, https://doi.org/10.1787/9789264300248-en.

[9] Johnson, O. et al. (2021), “Toward climate-neutral heavy industry: An analysis of industry transition roadmaps”, Applied Sciences, Vol. 11/12, p. 5375, https://doi.org/10.3390/app11125375.

[36] Levi, P. and J. Cullen (2018), “Mapping global flows of chemicals: From fossil fuel feedstocks to chemical products”, Environmental Science and Technology, Vol. 52/4, pp. 1725-1734, https://doi.org/10.1021/acs.est.7b04573.

[40] Liu, G., C. Bangs and D. Müller (2013), “Stock dynamics and emission pathways of the global aluminium cycle”, Nature Climate Change, Vol. 3, pp. 338–342, https://doi.org/10.1038/nclimate1698.

[39] Liu, G. and D. Müller (2012), “Addressing sustainability in the aluminum industry: A critical review of life cycle assessments”, Journal of Cleaner Production, Vol. 35, pp. 108-117, https://doi.org/10.1016/j.jclepro.2012.05.030.

[41] Material Economics (2020), A Net-zero Transition for EU Industry: What Does It Mean for the Pulp & Paper Industry?, https://media.sitra.fi/2020/05/05104241/material-economicspulp-and-paper-in-a-net-zero-transition06-2020.pdf (accessed on 9 July 2021).

[1] Material Economics (2019), Industrial Transformation 2050 - Pathways to Net-Zero Emissions from EU Heavy Industry, University of Cambridge Institute for Sustainability Leadership (CISL), https://materialeconomics.com/publications/industrial-transformation-2050.

[15] Material Economics (2018), Retaining Value in the Swedish Materials System, Strategic Innovation Program RE:Source, https://circulareconomy.europa.eu/platform/en/main-language/swedish.

[26] OECD (2021), OECD Regional Outlook 2021: Addressing COVID-19 and Moving to Net Zero Greenhouse Gas Emissions, OECD Publishing, Paris, https://doi.org/10.1787/17017efe-en.

[2] OECD (2020), The Circular Economy in Cities and Regions: Synthesis Report, OECD Urban Studies, OECD Publishing, Paris, https://doi.org/10.1787/10ac6ae4-en.

[17] OECD (2019), Business Models for the Circular Economy: Opportunities and Challenges for Policy, OECD Publishing, Paris, https://doi.org/10.1787/g2g9dd62-en.

[18] OECD (2019), Global Material Resources Outlook to 2060: Economic Drivers and Environmental Consequences, OECD Publishing, Paris, https://doi.org/10.1787/9789264307452-en.

[4] OECD (2019), “Moving to sustainable industrial production”, in Accelerating Climate Action: Refocusing Policies through a Well-being Lens, OECD Publishing, Paris, https://doi.org/10.1787/75413ccd-en.

[21] OECD (2018), Human Acceleration of the Nitrogen Cycle: Managing Risks and Uncertainty, OECD Publishing, Paris, https://doi.org/10.1787/9789264307438-en.

[14] OECD (2018), Improving Markets for Recycled Plastics: Trends, Prospects and Policy Responses, OECD Publishing, Paris, https://doi.org/10.1787/9789264301016-en.

[23] OECD (2017), Investing in Climate, Investing in Growth, OECD Publishing, Paris, https://doi.org/10.1787/9789264273528-en.

[12] Sharmina, M. et al. (2021), “Decarbonising the critical sectors of aviation, shipping, road freight and industry to limit warming to 1.5-2°C”, Climate Policy, Vol. 21/4, pp. 455-474, https://doi.org/10.1080/14693062.2020.1831430.

[13] Sun, X., F. Lettow and K. Neuhoff (2021), “Climate neutrality requires coordinated measures for high quality recycling”, DIW Weekly Report, Vol. 6, https://doi.org/10.18723/diw_dwr:2021-26-1.

[30] UK Government (2011), Skills for a Green Economy: A Report on the Evidence, Departments for Business, Innovation and Skills, of Energy and Climate Change and for Environment, Food and Rural Affairs, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/32373/11-1315-skills-for-a-green-economy.pdf.

[24] Vasselina, R., L. Till Alexander and Z. Saadia (2020), Jobs of Tomorrow: Mapping Opportunity in the New Economy.

[28] Vona, F. et al. (2018), “Environmental regulation and green skills: An empirical exploration”, Journal of the Association of Environmental and Resource Economists, Vol. 5/4, pp. 713-753, https://doi.org/10.1086/698859.

[37] Wang, P. et al. (2021), “Efficiency stagnation in global steel production urges joint supply- and demand-side mitigation efforts”, Nature Communications, Vol. 12/1, pp. 1-11, https://doi.org/10.1038/s41467-021-22245-6.

[19] Wilts, H. et al. (2014), “Policy mixes for resource efficiency”, POLFREE Policy Options for a Resource-Efficient Economy, University College London, London.