The Assessment and Recommendations present the main findings of the OECD Environmental Performance Review of Portugal. They identify 26 recommendations to help the country make further progress towards its environmental objectives and international commitments. The OECD Working Party on Environmental Performance discussed and approved the Assessment and Recommendations at its meeting on 6 December 2022.

OECD Environmental Performance Reviews: Portugal 2023

Assessment and recommendations

Abstract

1. Towards sustainable development

Addressing key environmental challenges

Portugal has made progress on decoupling

Portugal has a small, service-based economy that grew steadily between 2013 and 2019.1 The country was among the OECD economies most strongly hit by the pandemic but has been recovering fast since mid-2021 (Figure 1). However, growth is expected to slow in 2023 (OECD, 2022a). While Portugal has few direct trade links with these countries, Russia’s war against Ukraine is driving up energy and food prices, increasing uncertainty and weighing on activity.

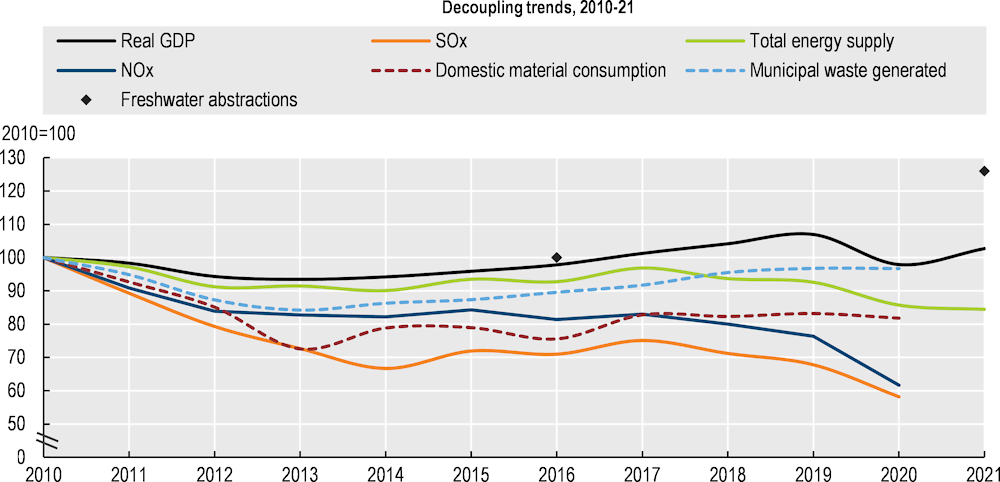

Over 2013-19, Portugal managed to decouple energy consumption, greenhouse gases (GHGs) and air pollutant emissions from economic growth (Figure 1). However, material consumption, municipal waste generation and freshwater abstractions have grown at the same rate or faster than gross domestic product (GDP). Portugal has improved the regulatory framework for environmental services. It has made progress in wastewater treatment and expanded protected areas. However, agriculture, infrastructure development, invasive species, natural processes (such as erosion), as well as climate change and related wildfire risk, are exerting major pressures on biodiversity.

Figure 1. Portugal managed to decouple some environmental pressures from economic growth

Note: Freshwater abstractions: 2016=100, excluding abstractions for electricity cooling; 2021: estimate based on the 2022-27 management plans of the 8 continental river basins.

Source: APA (2022), provisional version of the third RBMPs 2022-27; IEA (2022), IEA World Energy Statistics and Balances (database);

OECD (2022), OECD Economic Outlook (database); OECD (2022), Environment Statistics (database).

The energy mix has shifted from oil and coal to natural gas and renewables

Portugal’s energy intensities per capita and per GDP are below the OECD Europe averages, reflecting its service-oriented economy. The 2008 financial crisis was followed by a significant drop in energy consumption in all sectors. With economic recovery, energy demand in the transport sector increased over 2013-19. However, this increase was offset by lower demand in industry thanks to improved efficiency and a structural shift to less energy-intensive activities. Portugal met its 2020 target under the 2018 EU Directive on Energy Efficiency. This good result was amplified by the decrease in energy demand due to the restrictions linked to the COVID-19 pandemic.

Over the past decade, the energy mix has shifted from oil and coal to natural gas and renewables. Portugal can be commended for closing its last two coal power plants in 2021, two years ahead of schedule. Fossil fuels continue to make the bulk of energy supply, but the share of renewable energy (mostly biomass, wind and hydro) is higher than in most European countries. Annual variations in hydropower generation affect domestic energy production and energy dependency. In terms of fossil fuels, the country relies entirely on imports. However, imports from the Russian Federation represent a relatively small share of its supply (IEA, 2021).

With 34% of renewable energy in gross final energy consumption in 2020, Portugal achieved its binding target of 31% set by the EU Renewable Energy Directive (Eurostat, 2022a), partly due to reduced energy consumption linked to the pandemic (APA, 2021). The country was close to achieving its 2020 sub-targets for electricity (58.0% vs. 60.0%) and transport (9.7% vs. 10.0%); it met the sub-target for heating and cooling (41.5% vs. 41.0%) (Eurostat, 2022a). Portugal has made progress towards Sustainable Development Goal (SDG) 7, ensuring clean energy but affordability remains an issue (Chapter 2).

Air quality has improved, and efforts must be continued

Emissions of major air pollutants have decreased thanks to the shift in the electricity mix, the implementation of desulphurisation systems in large energy plants and stricter vehicle emissions standards (APA, 2022). Portugal achieved its 2020 targets set by the EU Directive on the reduction of national emissions of certain atmospheric pollutants. It missed the target for ammonia (NH3), whose emissions have grown with the number of poultry. Portugal needs to clarify how it will ensure compliance with its 2030 targets in the national air pollution programme (due in 2022). The application of best available techniques and the publication of the national advisory code of good agricultural practice to control NH3 emissions is expected to support progress in this area.

People are less exposed to air pollution in Portugal than in other OECD countries. However, air quality remains a concern with regard to concentrations of nitrogen dioxide (NO2) and particulate matter in urban areas and tropospheric ozone in rural areas. Annual NO2 limit value has been persistently exceeded in Lisbon, Porto and Braga, mostly due to diesel vehicle traffic. In 2020, with restrictions on mobility, no exceedances were recorded.

Portugal has missed most of its 2020 waste targets

Portugal’s material productivity2 is well below the OECD-Europe average. It improved until 2013 but has remained broadly constant since then (Figure 1). Non-metallic minerals (mostly construction materials) make the bulk of the materials mix. Since 2013, municipal waste generation has grown at a faster rate than the economy. In 2020, Portugal generated more municipal waste per capita than the European average. It was also among the countries with the highest landfilling rates. Circular material use rate is almost six times lower than the EU average (2.2% vs. 12.8% in the European Union in 2020) (Eurostat, 2021). The country improved its regulatory framework for waste management, including a benchmarking system for municipalities. It also increased investment in treatment facilities (Section 1.2). However, the country has missed most of its 2020 objectives. Ensuring sustainable consumption and production patterns (SDG 12), is a significant challenge.

The National Waste Management Plan for 2030, under discussion, aims to prevent waste generation; promote efficient use of resources; and reduce environmental impacts through integrated and sustainable waste management. The Strategic Plan for Municipal Waste for 2030, under discussion, aims to improve waste prevention and increase preparation for reuse, recycling and other forms of recovery of municipal waste to reduce consumption of primary raw materials. It seeks to ensure compliance with the EU Waste Framework Directive (under revision), which will set more ambitious targets for 2030. Recovering the costs of waste management service is a prerequisite for financing the sector and changing behaviour (Section 1.2).

Progress towards biodiversity targets has been insufficient

Major challenges remain to protect, restore and promote sustainable use of marine and terrestrial ecosystems (SDGs 14 and 15). Over the past decade, the status of habitats and species has deteriorated. Agriculture, infrastructure development, invasive species, natural processes (such as erosion), climate change and wildfires are exerting major pressures on biodiversity (EEA, 2021; ICNF, 2020). About 30% of fish and birds and 20% of mammals and reptiles are threatened (OECD, 2022b).

In 2020, protected areas covered 25% of Portugal’s territory and 8.9% of marine areas under its jurisdiction (Tribunal de Contas, 2022). The country thus met the 2020 Aichi target of protecting at least 17% of land area but missed the target of protecting 10% of coastal and marine areas. In 2021, Portugal created Europe’s largest marine protected area, a significant step towards the goal of protecting at least 30% of EU sea area by 2030.

Management plans have been developed only for a few Sites of Community Importance in the Natura 2000 network (ICNF, 2020). The European Commission has opened an infringement procedure against Portugal for failure to adopt management plans and conservation measures (EC, 2021a). Mainstreaming biodiversity in agriculture, forestry, fisheries, urban and spatial planning sectors is a major challenge (ICNF, 2020). The National Biodiversity Strategy and Action Plan will be updated in 2023 in line with the EU Biodiversity Strategy 2030 and post-2020 Global Biodiversity Framework.

Agriculture puts significant pressures on water bodies

Portugal has relatively low water stress at the national level (OECD, 2022b). However, seasonal and spatial distribution of freshwater resources and use varies widely. Water scarcity is of serious concern in the Sado and Mira (in the Alentejo region) and the Algarve River basins.

Agriculture is the largest user of freshwater. Agricultural abstractions have increased by about 25% since the mid-2010s, particularly in the southern regions. Irrigated areas increased by the same order of magnitude, reflecting modernisation investments in orchards, vineyards and olive groves (INE, 2021). However, investments focusing on irrigation efficiency, without policies regulating water demand, can increase water consumption or accelerate groundwater depletion (Grafton et al., 2018). Beyond the third River Basin Management Plans, the new National Strategic Plan for Water Supply and Wastewater and Rainwater Management (PENSAARP 2030, to be adopted in 2022) aims at, among other goals, improving water-use efficiency, especially in water-scarce areas.

In 2021, less than half of surface water bodies and two-thirds of groundwater bodies achieved good global (ecological and chemical) status. The most significant pressures on these bodies are diffuse agricultural sources (EC, 2019a). They are followed by other diffuse sources, point sources of pollution and alterations to the natural flow and morphology of water bodies. Compliance rates with the EU Drinking Water Directive requirements are high. Most bathing waters are of excellent quality.

In 2018, 92% of urban wastewater (load generated) was treated according to the requirements of the EU Urban Waste Water Treatment Directive (EC/EEA ETC/ICM, 2021). The country was close to complying in terms of collection (article 3) but not for treatment levels; 93% of wastewater collected underwent secondary treatment3 (article 4) and 76% more stringent treatment4 (article 5). The number of small agglomerations with inadequate wastewater treatment has been drastically reduced (APA, 2021). Portugal has made progress towards SDG 6, increasing access to clean water and sanitation. However, challenges remain in using water efficiently and achieving good status of water bodies.

Enhancing policy coherence for sustainable development

Strengthening horizontal co‑ordination and evidence-based integration tools

The Portugal 2030 Strategy, adopted in 2020, is the reference framework for public policies in the next decade. It promotes reforms and investment in institutional resilience, the business environment, the green and digital transition, skills and competences (EC, 2021b). The strategy also focuses on reducing social and territorial inequalities. It seeks to ensure coherence of measures financed through the Multiannual Financial Framework 2021-27, the Recovery and Resilience Facility, and other EU and national funds.

Environmental issues are increasingly integrated into sectoral plans as often required by the European Union. For example, the National Energy and Climate Plan 2021-2030 (NECP 2030) seeks to ensure coherence between climate and energy policies (Government of Portugal, 2019). Climate transition and sustainability are priorities of the 2021 Plan to Reactivate Tourism and Build the Future. Several institutional mechanisms, such as the inter-ministerial Commission of the Recovery and Resilience Plan (RRP), chaired by the prime minister, support horizontal co-operation. However, they are not necessarily sufficient to ensure policy coherence. In particular, the balance between environmental and economic objectives is not always clear in the agriculture, transport and tourism sectors.

Strategic environmental assessment (SEA) has been increasingly used in land-use plans, less frequently in sectoral plans (APA, 2021). SEAs are generally developed in line with good practices and national guidance. However, the lack of alternatives considered often hinders the identification of more sustainable development options. Cost-benefit analysis is seldom used.

The environmental impact of recovery measures should be tracked

Responding to the COVID-19 crisis, Portugal provided substantial support to workers and businesses amounting to 2.1% of GDP in 2020 and 3.3% in 2021 (INE, 2022). The government started to phase out pandemic-related support measures in 2022, with a view to containing an inflating fiscal deficit. The outlook remains uncertain due to the geopolitical context and the new measures to address rising prices announced in 2022 (Chapter 2).

Portugal submitted its RRP to boost its economy with Next Generation EU funds over 2021-26. Its 83 investments and 32 reforms are to be supported by grants and loans representing about 8% of 2020 GDP. Portugal devoted 38% of its RRP budget to the climate objectives.5 This is above the EU requirements (37%) but below the average of 40% of the 22 RRPs endorsed by the end of 2021. The climate part of Portugal’s RRP rightly focuses on improving energy efficiency to reduce GHG emissions, dependence on fossil fuels and energy poverty. Sustainable mobility is promoted notably through the extension of the metro networks in Lisbon and Porto but also by the acquisition of clean buses and their charging stations. The RRP also includes investments to decarbonise industrial processes and boost the use and production of hydrogen, prevent and fight rural fires, improve water-use efficiency and promote a sustainable bioeconomy.

The RRP was well-received by most stakeholders, but it was criticised for its contradictions (Heilmann et al., 2021). These include aiming to reduce emissions from transportation while expanding the road network and considering tourism as a key growth sector; planning the construction of new dams in water‑scarce areas, and providing for a limited number of measures to enhance biodiversity (EC, 2021b). The actual share of green measures will only be measurable once the plan is implemented. Portugal is committed to full environmental impact assessments of RRP investments to ensure compliance with the “do no significant harm” principle of the Regulation establishing the Recovery and Resilience Facility (EU 2021/241).

Upgrading environmental infrastructure requires better pricing of services

Public expenditure on environmental protection (current expenditure and investment) decreased until 2016 and has increased since then. It reached 0.7% of GDP in 2020, below the EU average of 0.9% (Eurostat, 2022b). Waste management is the largest expenditure item, driving the recent increase in public investment and spending on environmental protection. However, this trend is not reflected in the performance of the service provision (Section 1.1). Portugal has made little progress in passing on the waste management tax to households through waste charges as recommended in the 2011 Environmental Performance Review. Recovering the costs of waste management service is a prerequisite for financing the sector. However, in 2020, three-quarters of municipalities did not fully recover the costs of waste service provision through tariffs charged to consumers (ERSAR, 2022). Waste charges are included in the water bill and usually linked to water consumption. Indexing of waste charges to amounts of waste collected is essential to encourage behavioural changes. However, this will only become mandatory from the end of 2025.

Public spending on biodiversity has increased since 2016 but accounted for only 0.1% of GDP in 2020, 25% less than in 2010.

Portugal has completed the main infrastructure for wastewater management, but investment needs remain significant: about EUR 5.5 billion for water supply, wastewater and rainwater management by 2030, half of which for rehabilitation of existing assets (MAAC, 2022). Despite an apparent good cost-recovery of wastewater services, there is scope to improve the ability of municipalities to assess these costs and to increase tariffs, particularly where they provide the service directly (ERSAR, 2022). Recovering the costs of water services will also require better reflecting environmental and resource costs in water charges. Although they vary with water scarcity, rates are reduced for irrigation. The ease of licensing new water abstractions in water-stressed areas, the limited capacity to monitor and fine illegal abstractions and low water abstraction charges for non-potable uses have kept levels of water reuse low (about 1%) (Martins et al., 2021).

Part of the public expenditure on environmental protection is incurred by the Environmental Fund. It was created in 2017 from the merger of previous funds to improve efficiency. The Fund’s income has increased sevenfold between 2017 and 2021 thanks to increased revenue from auctioning allowances under the EU Emissions Trading System (ETS). However, a small part of its expenditure directly supports environmental protection. Most of the spending is on fare reductions to promote public transport and reverse the decline in demand resulting from the pandemic, and to subsidise the national electricity system. Non-governmental organisations have been criticising the Fund for its lack of transparency, inconsistency with national priorities and low spending on nature restoration (ANP/WWF, 2022; ZERO, 2022). Some have proposed an active role for the National Council for Environment and Sustainable Development in advising on the policy to allocate the financial resources of the Environmental Fund and in evaluating its performance. As an intermediate beneficiary, the Fund also implements some RRP investments.

Effective use of EU funds is key to boost green investment

Over the past decade, subdued public investment has been part of Portugal’s fiscal consolidation strategy (OECD, 2021a). At around 2% of GDP, public investment was among the lowest in the OECD in 2019 and 2020. The cohesion policy has become the main source of financing accounting for 60% of total public investment over 2014-20. With the Next Generation EU funds, Portugal will have to manage significantly higher amounts over 2021-27. This is an opportunity to address environmental issues but also a challenge in terms of designing, approving and implementing programmes.

Overall, Portugal had a higher absorption rate of structural funds than the EU average for 2014-20. This was also true for funds allocated to environmental protection and resource efficiency, climate change adaptation and risk prevention but not for low-carbon economy. Under the Operational Programme for Sustainability and Efficient Use of Resources, projects on improving energy efficiency, developing clean urban transport infrastructure and railways have been delayed partly due to the complexity of projects. Portugal needs to develop administrative capacities to accelerate processes and streamline the public procurement system while ensuring transparency and accountability to prevent risks of fraud (OECD, 2021a). Ensuring coherence between the RRP and operational programmes of the cohesion policy will be a key factor of success. Portugal has created a structure to co‑ordinate related funds under the Minister of the Presidency.6

Over half of the Rural Development Programme (RDP) 2014-22 budget7 has been allocated to farmers for adopting environment-friendly land management practices (EC, 2022a). Despite increased areas under contract to preserve biodiversity, improve water and soil management, the impact of the agri-environmental measures could not be assessed due to lack of appropriate indicators (Tribunal de Contas, 2021). Support for the Natura 2000 network has been insufficient to cover the needs identified (EC, 2019b). Despite the large amounts of money allocated to water-use efficiency, the evidence of savings is weak (Atthis Consulting, IESE, 2019). As in other EU countries, Portugal supports water-intensive crops in water‑stressed areas through voluntary coupled support and market measures under Pillar 1 of the common agricultural policy (CAP) (ECA, 2021). The new CAP 2023-27 is an opportunity to better mainstream environmental objectives in the agricultural policy.

The green tax reform should be pursued

In 2014, Portugal introduced a green tax reform as recommended in the 2011 Environmental Performance Review. As part of a broader fiscal consolidation effort under the EU economic adjustment programme, Law No. 82-D/2014 introduced a carbon tax in sectors outside the EU ETS. It also increased the CO2 component of the vehicle registration tax, revised the taxation of water and waste management, granted property tax breaks for forest management and introduced a tax on lightweight plastic bags.

Revenue from environmentally related taxes rose from 2.3% of GDP in 2014 to 2.5% of GDP in 2019, above the OECD Europe average of 2.3%. The increase in consumption and tax rates on diesel explains this increase until the COVID-19 crisis reduced the purchase and use of cars. Most receipts come from taxes on energy products and motor vehicles. Taxes on pollution and resources raise little revenue.

The tax on single-use lightweight plastic bags has significantly reduced their use. However, the carbon tax and the taxes on water and waste management have not provided sufficient incentives to curb energy and water use and divert waste from landfills. The property tax exemption for forest management plans has unclear effects. The Ministry of Finance and Ministry of Environment and Climate Action are evaluating the impact of the green tax reform. They should build on this assessment to pursue reform. A renewed reform could have a positive impact on growth and jobs by 2030 with a slightly progressive effect on real incomes depending on revenue recycling options (Mottershead et al., 2021).

The tax system is complex and many preferential tax treatments blur the price signals. As do other OECD countries, Portugal supports consumption of fossil fuels through tax expenditure; oil and gas attract the bulk of government support. The largest amounts include reduced tax rates for diesel fuel used by agricultural equipment and, since 2017, partial refund of diesel taxes to freight companies; tax exemptions on energy products used for electricity production, and on co-generation or by industrial installations under the ETS or an energy-efficiency agreement. Overall, this tax relief represented 0.3% of GDP in 2020 and 2021. Since 2014, forgone revenue from tax relief has increased with consumption and taxes on diesel and natural gas. In 2018, Portugal started to gradually phase out some fuel and carbon tax exemptions, which helped to phase out coal power in 2021. However, the 2022 plan to address rising prices sends different signals (Chapter 2).

Portugal is among the few EU countries to have performed a comprehensive stocktake of fossil fuel subsidies in its National Energy and Climate Plan 2021-2030 (EC, 2020a). The 2021 Climate Law provides for their phase-out by 2030. With support from the International Monetary Fund and the European Commission, the country is setting up a unit to regularly monitor and assess tax benefits and streamline the tax system (EC, 2022b). The government could consider mandating this unit to track progress in removing environmentally harmful subsidies.

Vehicle taxation and road pricing could promote decarbonisation and improve air quality

Combined with a fuel tax differential in favour of diesel and EU vehicle performance standards, vehicle taxation has resulted in lower average CO2 emissions from new passenger cars. However, the share of diesel vehicles has steadily increased to almost 60% of passenger cars in 2020, one of the highest shares in the European Union, with adverse effects on local air pollution. Since the mid-2010s, new car registrations have shifted to petrol and, in recent years, to electric vehicles (EVs) and plug-in hybrid electric vehicles. However, with the increase in the number of cars and distance travelled, and the ageing of the fleet due to imports of used vehicles, GHG emissions from road transport increased over 2013-19 (Chapter 2). Closing the tax gap between diesel and petrol, removing the preferential circulation tax treatment for older vehicles and introducing a NOx component in vehicle taxes, as was recently done by Ireland (OECD, 2021b), would help to rejuvenate the fleet and steer towards cleaner vehicles.

While fuel taxes are effective to reduce carbon emissions, distance-based charges depending on vehicle emissions and the place of driving are the best option to address local air pollution (van Dender, 2019). The shift to taxes based on road use would also help offset the loss of revenue from fuel taxes as EVs become widespread. Portugal has an electronic toll system operating on the motorway network for all vehicle categories. Toll prices vary according to the distance travelled, the height and the number of axles of the vehicles but not their emissions. Since 2011, Lisbon has introduced a low emission zone banning the most polluting vehicles from the city centre during working hours. This has not reduced NOx and PM2.5 concentrations significantly, suggesting the need for stricter standards and stronger enforcement (Santos, Gómez-Losada and Pires, 2019).

Recommendations on sustainable development

Addressing key environmental challenges

Continue efforts to ensure sustainable financing of water services and infrastructure including by improving municipalities’ cost accounting capacity and updating tariffs, particularly where they provide the service directly.

Raise water abstraction charges for agriculture, strengthen capacity to monitor abstractions, enforce water licensing regulations and limit new abstraction permits in over-allocated basins.

Accelerate the passing on of municipal waste management costs to households through dedicated identifiable charges uncoupled from the water bill, as part of wider awareness-raising campaigns to move up the waste hierarchy; develop separate collection of waste.

Increase allocations to protected areas management under the new common agricultural policy 2023-27 and assess the environmental impact of measures implemented.

Enhancing policy coherence for sustainable development

Continue to improve SEA practices through appropriate consideration of alternatives and increased use of cost-benefit analysis.

Carry on efforts to ensure the transparent and effective implementation of programmes financed with EU funds prioritising investments with the highest social return. Carefully assess the environmental impacts of RRP investments.

Ensure that the expenditure of the Environmental Fund is aligned with Portugal's environmental and climate objectives, strengthen its links with the managing authorities of EU funds and monitor its performance.

Complete the evaluation of the green tax reform with a view to applying the polluter pays principle more consistently and supporting a green and inclusive recovery; as part of the inventory of tax benefits, identify potentially environmentally damaging supports and phase out those not justified on economic, environmental or social grounds.

Gradually close the tax gap between diesel and petrol, remove the preferential circulation tax treatment for older vehicles and consider introducing a NOx component in vehicle taxes to rejuvenate the fleet and steer towards cleaner vehicles.

Vary toll prices with vehicle emissions; further develop low emission zones with strict standards in cities exceeding air quality limits and ensure their effective enforcement.

2. Carbon neutrality

Mitigating GHG emissions

2030 climate targets are within reach but carbon neutrality by 2050 calls for sustained and comprehensive action

Portugal is a small GHG emitter, accounting for less than 2% of EU emissions in 2020. Two-thirds of its emissions come from energy use, especially in transport and energy production. Portugal’s economy is slightly less energy intensive than the OECD Europe average due to the high share of services. The carbon intensity of its energy mix is also lower thanks to renewable energy. Emissions of methane (from agriculture and waste) and fluorinated gas (hydrofluorocarbons from refrigeration and air conditioning equipment) make the country's economy more GHG emission intensive than the OECD Europe average.

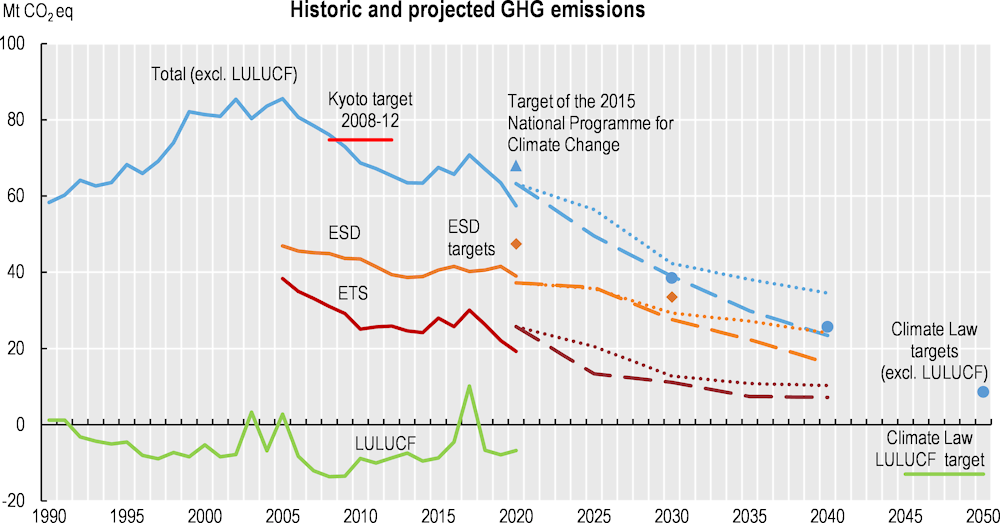

Considering the impacts of the COVID-19 crisis, total GHG emissions (excluding land use, land-use change and forestry, LULUCF) have been reduced by one-third over 2005-20. Portugal is in the top third of European OECD countries in terms of emission reductions over this period. The country reached the 2020 economy-wide objective of the 2015 National Programme for Climate Change (-18% to -23% from 2005 levels) (Figure 2). In the early 2010s, emissions declined due to the reduction in energy demand following the 2008 crisis and increasing renewable electricity generation. With the economic recovery, emissions rebounded in 2014-17, particularly in the transport sector. However, they have since fallen, driven by a strong shift away from coal-fired power generation. LULUCF has been a net sink over the last decades, except in years of extreme forest fires.

In 2019, Portugal approved a Roadmap for Carbon Neutrality by 2050 (RNC 2050). As required by the European Union, it adopted the National Energy and Climate Plan 2021-2030 (NECP 2030)8 in 2020, setting the main priorities for the coming decade. Portugal can be commended for its active role in the approval of the European Climate Law under its Presidency of the Council of the European Union in 2021, and for enshrining carbon neutrality in national law, in line with EU objectives. Portugal’s 2021 Framework Climate Law set the target of reducing total emissions by at least 55% from 2005 levels by 2030 and by 90% by 2050, and to increase removals from LULUCF to 13 MtCO2 by 2050.

Portugal is on track to meet its 2030 targets as set out in the NECP. National projections indicate that additional policies will be needed to meet the more ambitious Climate Law targets for 2030 and 2050 (Figure 2). The 2023 NECP revision should clarify and elaborate the measures envisaged to achieve the targets.

So far, most of the emission abatement has taken place in energy production. Although the country seems on track to reach its 2030 target for non-ETS emissions (from road transport, buildings, agriculture, small industrial installations and waste), the NECP provides limited details on the policies to be implemented. The impact of existing and planned measures is not quantified, and their financing remains unclear. The country will need to tap the decarbonisation potential of all sectors.

Figure 2. Portugal seems on track to meet its 2030 climate targets

Note: LULUCF: land use, land-use change and forestry. Dotted lines refer to projections of the National Energy and Climate Plan with existing measures. Dashed lines refer to projections with additional measures. ESD 2020 target: under the EU Effort Sharing legislation; 2030 target: European Commission's proposal for the revision of the Effort Sharing Regulation COM(2021) 555 final. ETS: emissions under the EU Emissions Trading System.

Source: APA (2022), National Inventory Report 2022, April; EEA (2021), Greenhouse Gas Projections Data Viewer – December; Eurostat (2022), Greenhouse gas emissions in ESD sectors.

Climate policy governance has improved

The Ministry of Environment and Climate Action (MAAC) defines and supervises environmental policies, including energy and climate, forestry and nature conservation, urban planning and mobility. It is in charge of monitoring and implementation of climate policies with the Portuguese Environment Agency. In 2015, the government instituted the Commission for Climate Action, a positive step towards improving inter-ministerial co-ordination. The Commission is headed by the MAAC and includes representatives of other ministries. It oversaw the development of the RNC, the NECP 2030, the 2015 National Climate Change Adaptation Strategy (ENAAC) and the 2019 Action Program for Climate Change (P-3AC).

Public consultation on climate action has progressed, notably through the Participa portal but could be strengthened. Climate mitigation and adaptation strategies were discussed with experts and stakeholders. Meetings across the country to present the NECP 2030 and the RNC were followed by a public consultation. However, the time span for comments on the NECP 2030 (less than one month) was relatively short (three months for the RNC). Giving advance notice of upcoming consultations and specifying time frames would encourage more active participation.

In line with international good practices, the 2021 Climate Framework Law requires five-year climate budgets, sectoral mitigation plans, municipal climate action plans and an annual government progress report to Parliament. It sets out green budgeting principles requiring the government to specify the resources allocated to climate policy in the state budget. The Law also creates an independent body, the Council for Climate Action, to assess climate action and provide recommendations. It plans a web portal to inform the public. Although promising, the Law remains to be implemented through specific regulations.

Portugal needs to maintain clear carbon price signals while addressing energy poverty

Pricing instruments are key levers in Portugal’s strategy to mitigate carbon emissions. However, like in all countries, carbon prices vary across sectors and fuels. Effective carbon rates9 consist of fuel excise taxes and to a smaller extent of permit prices from the EU ETS and of carbon taxes. In 2021, Portugal priced about 74% of its GHG emissions, of which 28% were above EUR 60 per tonne of CO2, the midpoint benchmark for carbon costs in 2020. Emissions priced at this level originated primarily from the road transport sector. The majority of unpriced emissions were non-CO2 emissions. With an average effective carbon price of EUR 74 per tonne of CO2, in 2021, Portugal ranked in the middle of other OECD European countries (OECD, 2022c).

The government has to strike a balance between maintaining a clear price signal on fossil fuel use and supporting households’ purchasing power, particularly in times of energy price surge. Budget surveys show that low- and middle-income households, which spend a larger share of their incomes on energy, carry a heavier burden for higher energy prices, either driven by climate policies or the international conjuncture. Like in many countries, the Portuguese government’s response has so far mainly consisted in price support, which weakens the incentive to save energy. Social energy tariffs seek to protect vulnerable consumers, guaranteeing access to this essential service at affordable prices and under conditions of greater tariff stability. Their automatic payment has increased the number of beneficiaries by more than eight times between 2015 and 2021, to reach about 800 000 households, allowing for better coverage of the economically and socially vulnerable population. These tariffs have helped the poorest, but they could better address non-income dimensions of energy poverty by considering the energy performance of housing in the eligibility criteria (MAAC, 2021). Beneficiaries of the social electricity tariff who own their home are also eligible for the energy efficiency voucher programme (Vale Eficiência, see below on energy efficiency).

While the 2022 Budget Law confirmed the phasing out of energy and carbon tax exemptions initiated in 2018 (Chapter 1), the government suspended the carbon tax increase at the end of 2021. In September 2022, the plan to address rising prices (Famílias Primeiro) involved EUR 2.4 billion in addition to the EUR 1.6 billion already spent throughout the year to mitigate the impacts of inflation (Government of Portugal, 2022a). Overall, EUR 1.5 billion (0.7% of 2021 GDP) was spent in the form of untargeted fuel tax reliefs. Although energy price control and tax cuts are quick and simple to implement, Portugal should shift to targeted income support measures to protect vulnerable populations while encouraging energy savings and fuel switching (OECD, 2022d). Means-tested subsidies uncorrelated to energy consumption and aid for building renovation should be prioritised in the forthcoming national strategy to combat energy poverty.

Aligning investments and skills to decarbonisation will be major challenges

About EUR 1 billion additional annual investment is needed until 2030 and EUR 4 billion over 2030-40 to achieve carbon neutrality by 2050. Sustainable transport and buildings will attract most of it in the next decade although the NECP 2030 does not estimate the costs of specific measures. EU funds, including the Resilience and Recovery Facility, and to a lower extent EU ETS auction revenue, are expected to be the main sources of financing, together with domestic environmental taxation. Beyond 2030, Portugal will need to increase national financing while environmental tax revenue is expected to decrease. The mobilisation of the private sector will be all the more important in the long term, when financing is uncertain.

As Portugal’s GDP has a relatively small carbon intensity, the direct negative impact of decarbonisation on activity and the labour force is expected to be mild at the aggregate level. However, local impacts on industries should be anticipated. Skill shortages are high in Portugal, especially in key sectors such as construction, energy and transport (EC, 2022b). Moreover, take-up for on-the-job training is particularly low, which can create rigidities in the labour market and hinder the transition of the workforce to carbon-neutral activities. New skills will be required and need to be integrated into initial and on-the-job trainings to avoid increased shortages on the labour market and to provide the means for the country’s transition.

Renewable energy has developed, but there remains potential to tap

Most electricity is produced from renewable sources, the fruit of a strategy in place over the past two decades. It began with tapping hydropower and progressed to development of wind power through feed-in-tariffs. For decades, biomass has also made up the main renewable energy source in residential and industries, in particular through cogeneration in the pulp and paper industry. More recently, Portugal has been encouraging solar energy with the setting of dedicated auctions to access the grid, and feed-in-tariffs for small installations.

Portugal needs to accelerate the development of renewable energy and diversify energy sources to comply with the EU Renewable Energy Directive and reduce its import dependency. Further diversifying of energy sources will be key for a sustainable and stable energy system, all the more when the energy supply is threatened by international tensions. A large part of its electricity production comes from hydropower, which varies greatly from year to year, potentially adding a supply-side risk to the energy system. The country plans an increase in pumped storage hydropower to support development of intermittent sources such as wind or solar but also a stable capacity of non-pumped hydro. As climate change intensifies, Portugal should clarify how its new energy mix will adapt to increased water stress.

Structural changes have been initiated to integrate new renewable sources into the energy system, notably through electrification of the economy. Portugal plans to increase the share of cross-border interconnections to achieve 15% of total capacity in 2030 (national target in NECP 2030 and EU target). The development of hydrogen by electrolysis and of carbon storage are expected to help decarbonise sectors that are hard to electrify (air and maritime transport). Portugal launched a National Hydrogen Strategy to deploy 2.0-2.5 GW of electrolysis capacity and reform regulation. Investments have been initiated for a first project of 1 GW of renewable-based hydrogen in the industrial area of Sines.

Introducing technological-neutral auctions would help Portugal further diversify its renewable energy sources and to discriminate the most cost-efficient projects. A clear auction agenda needs to unfold to provide certainty to investors. This would support the country’s ambitions to develop solar photovoltaic, onshore wind (which so far only relies on the repowering of existing turbines) and sustainable biomass use.

Projects for renewable energy have been subject to intense debate regarding their environmental impact (e.g. destruction of ecosystems, coastal erosion). Factoring in non-climate environmental criteria (biodiversity, coastal shore preservation, fight against deforestation, etc.) upstream of auctions would facilitate the processes and encourage the most environmentally friendly projects.

Energy efficiency efforts must be stepped up, notably in the building sector

Portugal has committed to reduce final energy consumption by 35% in 2030. The NECP 2030 presents a large array of new policies and measures for all sectors (EC, 2020b). However, energy policies over the last decade have tended to focus more on energy supply than on demand management and progress on energy efficiency has been modest (CNADS, 2022). Putting energy efficiency first would help to meet the climate objectives and to cushion the adverse impacts on firms and households of strained energy markets.

The building stock is in poor condition, putting a large part of households in energy poverty. About 20% of the population are unable to keep their homes adequately warm in winter and 36% suffer from the heat at home during the summer. The poor insulation of buildings can exacerbate health issues related to heatwaves as they become more frequent and intensify.

The government needs to sharpen its action for energy efficiency in buildings to absorb the existing funds in the short term and then mainstream efficiency works. Portugal has implemented various policies, including building regulations and support to the retrofitting of old dwellings co-financed by EU funds. The design of existing instruments fails to attract liquidities and suffers from a very low take-up. The accumulation of plans makes the overall policy difficult to read, and the dispersion of actors hinders progress. Developing organisations providing local social and technical supports and putting actors (workers, banks, local administration) together can facilitate the process for households. Moreover, some instruments are not fit for purpose. For example, the energy efficiency voucher programme covers a small share of the renovation costs and only supports low-income owners. This results in low uptake and small coverage of households living in buildings with poor energy performance.

The government can accelerate action with large retrofitting and renovation plans, including a mix of regulation, grants and loans, adapted to specific needs. It should also target rented housing (tenants make up 17% of households), for instance considering specific energy efficiency requirements in rented dwellings. Calls for project should also promote synergies between energy efficiency, climate and the environment, more particularly with renewable energy use or self-production. Assessing the skill needs and adapting the supply of professional training accordingly can be a decisive factor to avoid bottlenecks on the labour market.

GHG emissions from the transport sector grew regularly until the pandemic

Fuel and vehicle taxation did not reverse the growth in GHG emissions from road transport over 2013-19 (Chapter 1). In addition to vehicle tax exemption, the government is encouraging the procurement of low‑carbon vehicles through subsidies and investment in charging infrastructure. In 2021, the share of EVs10 in new car registrations was slightly above the EU average (20% vs. 18%). The number of charging stations has almost quadrupled in ten years, but their density per square kilometre remains less than half the EU average. The deployment of charging infrastructure across the country, including in remote areas where dependence to private vehicles is hard to solve, will be key.

Portugal’s railway network density is below that of the EU average as is the modal share of passenger rail transport (Government of Portugal, 2022b). Investment in rail infrastructure has increased in recent years. However, in 2020 it was less than half its 2010 level and remained well below road investment. A shift in investment from road to rail will be needed to reduce the sector’s GHG emissions by 40% by 2030 from 2005 levels. Large projects, mainly EU-funded, will enhance access to public transport. Meanwhile, the high-speed train between Lisbon and Porto will simplify travel through the country. Dedicated support to local governments in the institutionalisation of bus lines, with low-carbon vehicles, can address other areas in the short term.

Land and road management are also key to reduce car dependency. As cities build cycling lanes and promote active mobility, roads should also be adapted to reduced car use. Reduced parking zones, including for residents, can increase the space and the safety of these mobility modes. Such strategies call for increased co-operation between the different municipalities within the same agglomeration to ensure lanes’ continuity and the organisation of multimodal hubs.

Agriculture is not on track to meet climate goals

Agriculture’s contribution to Portugal’s decarbonisation strategy is modest but risks being undermined if trends are not reversed. To reduce emissions by 55% in 2030, emissions from agriculture will have to fall by 11%. The NECP 2030 plans that most emission abatement will come from more efficient fertiliser use and enteric fermentation and that, in parallel, pastures become net carbon sinks.

The sector is not on track. Since 2013, GHG emissions have been increasing, driven by livestock emissions. Production is particularly emission intensive by international standards. Thorough reforms are challenging and private financial resources are scarce. A large number of small farms have little income and capacity to invest. This situation is worsened by the consequences of climate change (drought, land desertification, reduced yields, etc.) and the induced uncertainty.

Over 2014-20, Portugal devoted a higher share of agricultural rural development support to climate and environment compared to the EU average. However, few actions support the mitigation of agriculture emissions and target livestock. In addition, the country has among the highest share of coupled supports (i.e. proportionate to production or the number of animal heads), targeting mainly ruminants and incentivising livestock-intensive farming. The proportion of land used for climate purpose (e.g. carbon sequestration) is low and the budget dedicated to land restoration is below the average on the continent. According to national data, the share of organic farming in agriculture land has more than doubled since 2020, reaching almost 18% in 2022. It is a positive development to enhance soils’ carbon content. However, further efforts are needed to reach the EU target of 25% by 2030. The Portuguese target (19% in 2027) and planned funding for organic farming (EUR 391 million) in its CAP strategic plan 2023-27 seem unambitious.

Portugal needs to step up action and unfold an integrated food strategy, making climate action a pillar of the agriculture system. Subsidies from the EU common agricultural policy largely consist of direct payments, with minimum environmental standard criteria and sectoral supports. A larger share should be used to promote sustainable practices. Specific payments for sustainable land management and environmental service provision, including agriculture sinks, should be scaled up and mainstreamed. Tighter regulation on input use, animal feed or animal density would complete such payments effectively. Portugal needs to promote further an extensive agriculture sector, particularly for livestock, that would reduce the number of animals, their impact on ecosystems, and methane emissions. Such a comprehensive approach would be even more effective and profitable for farmers if embedded in a larger food strategy promoting sustainable food consumption, made with the co‑operation of all components of the food chain. The clauses on the reduction of food waste and promotion of healthy diets in the 2021 Climate Law (article 56) could reduce the environmental footprint of agriculture. They call for concerted efforts to build a detailed and broad strategy with stakeholders belonging to all parts of the supply chain.

Portugal also needs to clarify its strategy for the development of renewable energy from agriculture (sustainable biofuels, cogeneration or biogas) to improve farmers’ livelihoods and decrease GHG emissions. Such a strategy should ensure the environmental sustainability of projects. In addition, it should accelerate development of a market for sustainable biogas, notably through adapted legislation and grid connections. Dialogue with stakeholders will be key.

Adapting to the impacts of climate change

Portugal has stepped up action on adaptation

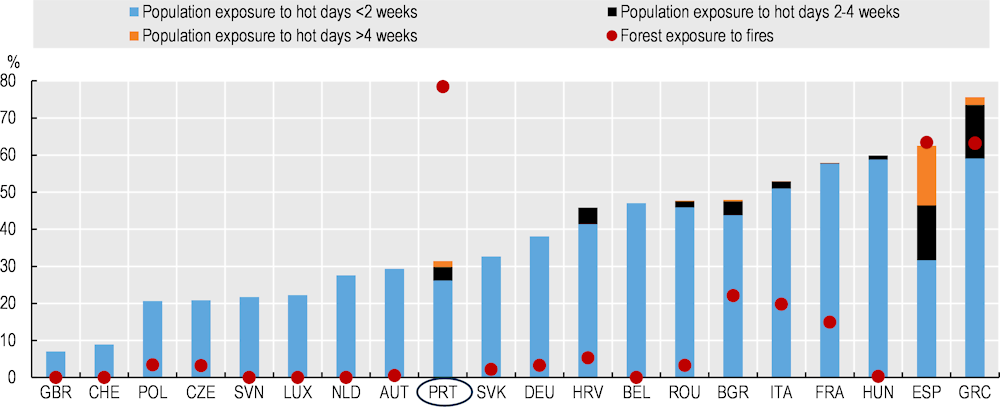

Portugal’s territory faces multiple threats related to climate change. Coastal areas, where most of the population and economic activity reside, are threatened by coastal erosion. Rainfall and extreme heat days are becoming more frequent and intense (Figure 3), causing material destruction and health issues. In addition, droughts undermine agricultural yields and hydropower production. Portugal is regularly affected by wildfires in the summer and autumn; an increasing part of its population is suffering from the unprecedented impacts of these fires.

Figure 3. Portugal is particularly exposed to increasing temperatures and forest fire danger

Percentage of population exposed to hot summer days and percentage of tree-covered area exposed to fire danger in selected European countries (2017-21 average)

Note: OECD and IEA calculations allow estimating population exposure to hot summer days where the maximum daily temperature exceeds 35°C using daily temperature data from the Copernicus Climate Data Store (ERA5 reanalysis). The Global Human Settlement Layer population grids allow for the estimation of the residential population target years 1975, 1990, 2000 and 2015 at a 250 m spatial resolution. Further linear interpolation between target years is done to develop annual indicators.

OECD calculations allow estimating forest exposure to very high or extreme wildfire danger based on the Fire Weather Index (a meteorological data-based index that accounts for temperature, relative humidity, wind speed and precipitation levels). This dimensionless index rates the potential fire line intensity given the meteorological conditions in a reference fuel type and level terrain. The Copernicus gridded Land Cover maps at 300 m spatial resolution allow for the identification of tree-covered areas.

Source: Maes et al. (2022), Monitoring exposure to climate-related hazards: Indicator methodology and key results.

The government stepped up its policy tools to address these challenges, defining institutions in charge of supervising actions, measures to be implemented and a clear budget. The 2015 National Adaptation Strategy establishes the governance and responsibilities, and the 2019 Action Programme for Adaptation to Climate Change sets the measures to be implemented. A large part of EU funds, including from the Recovery and Resilience Plan, is dedicated to investments for adaptation. A broad range of stakeholders take up action in the public and private sectors. The most affected sectors (agriculture, tourism) have developed specific plans. Municipalities are legally required to have their own strategy, possibly within the framework of inter-municipality. Portugal has also commendably sharpened its action for risk prevention, particularly for the management of wildfires.

The information system supporting policy action for adaptation risks lagging behind, notably due to a lack of stable funding in the long term. The adaptation programme set ambitious targets that are to be monitored annually, although the corresponding indicators have not yet been updated. The government has started the National Roadmap for Adaptation 2100 project to update climate projections and assess the physical and economic impacts of climate change in priority sectors. The project also aims to estimate the costs for adaptation and inaction. It is expected to be completed in 2023.

The clear definition of roles and responsibilities for adaptation action will be key. Promoting co‑ordination between sectors and stakeholders, including local governments, can prevent conflicting interest (e.g. for resource management) and ensure the dissemination of information and data. The Climate Law establishes the government as responsible for co‑ordinating climate action. In the case of coastal management, responsibility is shared between dozens of entities, local governments and administration (Oliveira, Moura and Boski, 2020). This hinders decision and action, and can even create conflicts. Finally, insurance coverage of vulnerable assets and activities is particularly low regarding climate risks, and public funds are often used as last recourse compensation. Having insurance take on more of the risk would encourage private actors to enhance their investment in the adaptation to climate change.

Sustainable land use in rural areas is a key challenge for climate change mitigation and adaptation

Forests are at the crossroad of mitigation and adaptation efforts in Portugal’s climate strategy. The country plans to increase its carbon sink potential by 50% by 2030 and double it by 2050, without strong net expansion. Forest fuel will also be a central renewable energy source, able to compensate for other variable renewable energy sources. On the other hand, forest fires intensified by climate change represent a major adaptation challenge. Forest and rural land management practices should then focus on enhancing the land’s productivity and mitigate fire intensities, notably through fuel management and the development of more resilient landscapes.

The structure of forest ownership is a major barrier to government action. Only 3% of forest land is owned by the Portuguese state or other public administration, compared to 40% at the EU level (APA, 2020). Most forest lands are privately owned and small owners are numerous, particularly in the North. As a result, investment in land management is rarely profitable and large-scale action, with possible economies of scale, is difficult. The number of owner associations aiming to enhance land profitability through active land management has been growing. However, only 27% of forests were covered by a long-term forest management plan in 2016 (as compared to 96% in Europe). On top of this, more than half of rural properties do not have a cadastral delimitation and an estimated 20% of forest land has unknown owners.

Rural land is being abandoned in Portugal due to the ageing of the population and migration to cities. This has led to the increase of unmanaged rural land, including a large share of forests, with concentrated fuel loads that are prone to catch and spread fires. This raises a general environmental and social risk but also undermines Portugal’s capacity to store carbon and reach carbon neutrality.

The government needs to build an integrated and structural strategy enhancing management of forests and rural land. As a first step, Portugal needs to accelerate its development of the cadastre of rural land, by using all available information, including from owner associations, and establishing strong incentives for land registration. Payment for ecosystem services should also be mainstreamed and used as a basis for rural policies.

In parallel, the government should promote active land management by making it profitable, for landowners and communities. Subsidies and payments for environmental services can bring monetary value to services like carbon sequestration in lands, biodiversity protection or water retention in soils. Sustainable management of forestry resources by the energy sector and the industry could also be enhanced. The government can support investments but also potentially operating costs. Measures like the dissemination of information and training for sustainable land management in rural areas should be broadly implemented and streamlined.

Recommendations on carbon neutrality

Improving the governance of climate policy

Swiftly implement the Framework Climate Law. Clarify the measures envisaged to achieve the 2030 goals, quantify their mitigation impact and specify how they will be financed.

Enhance public participation in climate policies by informing the public in advance of upcoming consultations and allowing sufficient time.

Aligning the economy with climate ambitions

Align economic incentives to climate targets. Set clear milestones to phase out all fossil fuel subsidies by 2030, as committed in the Climate Law. Continue to protect vulnerable groups by shifting from energy price control to targeted income support measures uncorrelated to energy consumption, and by increasing investment in decarbonising buildings.

Anticipate the labour market needs for green jobs, notably to address an increasing demand for energy renovation, by developing skills and facilitating immigration for workers with requisite skill sets.

Support private investment for climate by providing long-term visibility to investors on future regulations and carbon prices, developing tailored sector-specific tools (e.g. auctions or third‑party payment organisations in sectors where liquidity is strained).

Develop renewable energy sources on a cost-efficient basis

Increase the use of auctions for renewable energy projects, with a technology-neutral approach. Consider requiring environmental indicators in public tenders to rule out projects with strong detrimental impact on natural capital.

Encourage private renewable energy producers to sell their production on the grid by reducing the administrative and price barriers.

Assess and monitor climate impacts on security of supply, including the volatility of hydro generation, as part of the annual security of supply monitoring report for the national electricity system.

Step up action for energy efficiency in buildings

Accelerate and mainstream retrofitting works with a package of measures adapted to all households’ configurations and specific instruments for households unable to contribute to the work such as direct grants or tax cuts. Facilitate access to existing supports, including with information, technical support and a dedicated platform putting actors together.

Encourage deep retrofits by correlating supports to the energy consumption cut generated, adding premiums for packages of works, more efficient than dispersed measures.

Reduce emissions from vehicles and car dependency

Continue supporting the purchase of low-carbon vehicles and phase out supports to older vehicles. Accelerate the deployment of charging stations for electric vehicles across the country, supporting their installation in remote areas as planned.

Reduce private car use. Shift investment from new road building to improving the rail network. Integrate the reduction of private car dependency as a requirement for land and road management in municipal climate plans. Facilitate the access to services and activities by active mobility and public transport in cities.

Accelerate action for reducing GHG emissions from agriculture production

Increase use of monetary incentives to enhance GHG emission mitigation and sequestration in agriculture. Consider introducing taxes based on the number and type of animals, and on fertiliser use. Mainstream payments for ecosystem services under the new common agricultural policy. Divert public support from emission-intensive activities in the agriculture sector (e.g. energy tax break or support coupled to animal heads).

Develop a national food strategy encouraging sustainable diets through education campaigns and developing alternatives to meat-intensive diets in public catering, with the co‑operation of local stakeholders. Make the fight against food waste a key pillar in this strategy.

Sharpen the country’s adaptation strategy

Improve the information system related to climate change adaptation policies to track their implementation and impacts on risks and exposure. Ensure stable funding to track the progress of the adaptation strategy on a yearly basis; assess the impact of policies on climate change risk.

Enhance the value of rural lands for the mitigation and the adaptation to climate change. Accelerate development of the land cadastre in rural lands. Encourage the sustainable creation of value from rural land by extending payments for ecosystem services to all rural land, including non-agricultural lands, and setting the rule of a sustainable management of forestry resources by the energy sector and the industry.

References

ANP/WWF (2022), “Fundo ambiental investe em todos os setores menos na conservação da natureza e biodiversidade [Environmental Fund invests in all sectors except in nature and biodiversity conservation]”, 16 March, Associação Natureza Portugal/World Wide Fund for Nature, www.natureza-portugal.org/conteudos2/noticias/?uNewsID=6196841.

APA (2022), Portuguese Informative Inventory Report 1990-2020, Submitted under the NEC Directive (EU) 2016/2284 and the UNECE Convention on Long-range Transboundary Air Pollution, Portuguese Environmental Agency, Amadora, https://cdr.eionet.europa.eu/pt/eu/nec_revised/iir/envyk8r3a/IIR2022_15april.pdf.

APA (2021), State of the Environment Report 2020/21, Portuguese Environmental Agency, Amadora, https://sniambgeoviewer.apambiente.pt/GeoDocs/geoportaldocs/rea/REA2020/REA2020.pdf.

APA (2020), National Forestry Accounting Plan 2021-2025, Portuguese Environmental Agency, Amadora, https://apambiente.pt/sites/default/files/_Clima/Mitiga%C3%A7%C3%A3o/Plano%20Contabilidade%20Florestal%20Nacional%202021-2025/National%20Forestry%20Accounting%20Plan_Revised%20version%20january%202020.pdf.

Atthis Consulting, IESE (2019), Sumário Executivo da Avaliação de 2019 ao Programa de Desenvolvimento Rural do Continente 2014-2020 (PDR2020) [Executive Summary of the 2019 Evaluation of the Rural Development Programme for the Mainland 2014-2020 (PDR2020)], Atthis Consulting, IESE, www.pdr-2020.pt/Centro-de-informacao/Relatorio-de-Avaliacao.

CNADS (2022), Parecer sobre a Eficiência Energética nos Edifícios, com Enfoque nos Edifícios Residenciais [Opinion on Energy Efficiency in Buildings, with Focus on Residential Buildings], National Council for Environment and Sustainable Development, www.cnads.pt/images/documentos/2022_eficenergedificios-19maio.pdf.

EC (2022a), Factsheet on 2014-2022 Rural Development Programme for Mainland, Portugal, European Commission, Brussels.

EC (2022b), 2022 Country Report – Portugal, Commission staff working document SWD(2022) 623 final, European Commission, Brussels, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52022SC0623.

EC (2021a), December Infringements Package: Key decisions, 2 December, European Commission, Brussels, https://ec.europa.eu/commission/presscorner/detail/EN/INF_21_6201.

EC (2021b), Analysis of the recovery and resilience plan of Portugal, Commission staff working document SWD(2021) 146 final, European Commission, Brussels, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021SC0146.

EC (2020a), An EU-wide assessment of National Energy and Climate Plans, COM(2020) 564 final, European Commission, Brussels, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0564&from=EN.

EC (2020b), Assessment of the final national energy and climate plan of Portugal, Commission staff working document SWD(2020) 921 final, European Commission, Brussels, https://energy.ec.europa.eu/system/files/2021-01/staff_working_document_assessment_necp_portugal_en_0.pdf.

EC (2019a), Second River Basin Management Plans-Member State: Portugal, SWD(2019) 56 final, European Commission, Brussels, https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=SWD:2019:0056:FIN:EN:PDF.

EC (2019b), The EU Environmental Implementation Review 2019, Country Report - Portugal, European Commission, Brussels, https://ec.europa.eu/environment/eir/pdf/report_pt_en.pdf.

EC/EEA ETC/ICM (2021), Overview: Urban Waste Water Production and its Treatment – Portugal, WISE Freshwater Information System for Europe, webpage, https://water.europa.eu/freshwater/countries/uwwt/portugal (accessed on 10 May 2022).

ECA (2021), “Sustainable water use in agriculture: CAP funds more likely to promote greater rather than more efficient water use”, Special Report, No 20, European Court of Auditors, Luxembourg, www.eca.europa.eu/Lists/ECADocuments/SR21_20/SR_CAP-and-water_EN.pdf.

EEA (2021), Conservation Status of Habitat Types and Species : datasets from Article 17, Habitats Directive 92/43/ECC reporting, 2020 dataset, www.eea.europa.eu/data-and-maps/data/article-17-database-habitats-directive-92-43-eec-2 (accessed on 10 May 2022).

ERSAR (2022), Relatório Anual dos Serviços de Águas e Resíduos em Portugal 2021, Vol.1 Caracterização do setor de águas e resíduos [Annual Report on Water and Waste Services in Portugal 2021, Vol.1 Characterisation of the water and waste sector], Portuguese Water and Waste Services Regulation Authority, www.ersar.pt/_layouts/mpp/file-download.aspx?fileId=1884905.

Eurostat (2022a), Shares 2020 (Renewables), Energy Data (database), https://ec.europa.eu/eurostat/web/energy/data/shares (accessed on 22 March 2022).

Eurostat (2022b), Government Expenditure on Environmental Protection, webpage, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Government_expenditure_on_environmental_protection (accessed on 19 July 2022).

Eurostat (2021), Circular Economy – Material Flows, webpage, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Circular_economy_-_material_flows (accessed on 10 May 2022).

Government of Portugal (2022a), Familias Primeiro [Families First], 6 September, www.portugal.gov.pt/download-ficheiros/ficheiro.aspx?v=%3d%3dBQAAAB%2bLCAAAAAAABAAzNDY0MwUAlev7QgUAAAA%3d.

Government of Portugal (2022b), Thematic Programme for Climate Action and Sustainability (Version submitted on 4 June 2022), https://portugal2030.pt/consulta-publica-do-programa-para-a-acao-climatica-e-sustentabilidade/.

Government of Portugal (2019), National Energy and Climate Plan 2021-2030, https://energy.ec.europa.eu/system/files/2020-06/pt_final_necp_main_en_0.pdf.

Grafton, R. et al. (2018), “The paradox of irrigation efficiency”,Science, Vol. 361/6404, pp. 748-750, http://dx.doi.org/10.1126/science.aat9314.

Heilmann, F. et al. (2021), Green Recovery Tracker - Country Reports - Portugal, Wuppertal Institute and E3G, www.greenrecoverytracker.org/country-reports/portugal.

ICNF (2020), Sixth National Report for the Convention on Biological Diversity - Portugal, The Clearing-House Mechanism of the Convention on Biological Diversity, https://chm.cbd.int/database/record?documentID=253132.

IEA (2021), Portugal 2021 Energy Policy Review, International Energy Agency, Paris, http://dx.doi.org/10.1787/3b485e25-en.

INE (2022), Main aggregates of General Government - 2021, Statistics Portugal, Lisbon, www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_destaques&DESTAQUESdest_boui=531597709&DESTAQUESmodo=2.

INE (2021), Agriculture Census – 2019, Statistics Portugal, Lisbon, www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_publicacoes&PUBLICACOESpub_boui=437178558&PUBLICACOESmodo=2.

MAAC (2022), Projeto de Resolução do Conselho de Ministros que aprova o Plano Estratégico para o Abastecimento de Água e Gestão de Águas Residuais e Pluviais 2030 (PENSAARP 2030) [Draft Resolution of the Council of Ministers approving the Strategic Plan for Water Supply and Wastewater and Rainwater Management 2030 (PENSAARP 2030)], Ministry of Environment and Climate Action, https://participa.pt/pt/consulta/projeto-de-resolucao-do-conselho-de-ministros-que-aprova-o-pensaarp-2030.

MAAC (2021), Estratégia Nacional de Longo Prazo para o Combate à Pobreza Energética 2021-2050 [National Long-Term Strategy to Combat Energy Poverty 2021-2050], Ministry of Environment and Climate Action, https://participa.pt/pt/consulta/estrategia-nacional-de-longo-prazo-para-o-combate-a-pobreza-energetica-2021-2050.

Martins, J. et al. (2021), A água e os rios no futuro, contributos do CNA para decisões estratégicas no sector da água [Water and rivers in the future, CNA contributions to strategic decisions in the water sector], National Water Council, Lisbon, https://conselhonacionaldaagua.weebly.com/uploads/1/3/8/6/13869103/a_agua_e_os_rios_no_futuro-pag_a_pag.pdf.

Mottershead, D. et al. (2021), Green Taxation and Other Economic Instruments: Internalising Environmental Costs to Make the Polluter Pay, European Commission, Luxembourg, http://dx.doi.org/10.2779/326501.

OECD (2022a), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris, http://dx.doi.org/10.1787/f6da2159-en.

OECD (2022b), Environment at a Glance Indicators, OECD Publishing, Paris, www.oecd.org/environment/environment-at-a-glance/.

OECD (2022c), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, http://dx.doi.org/10.1787/e9778969-en.

OECD (2022d), “Why governments should target support amidst high energy prices”, OECD Policy Responses on the Impacts of the War in Ukraine, OECD Publishing, Paris, www.oecd.org/ukraine-hub/policy-responses/why-governments-should-target-support-amidst-high-energy-prices-40f44f78/#figure-d1e267.

OECD (2021a), OECD Economic Surveys: Portugal 2021, OECD Publishing, Paris, http://dx.doi.org/10.1787/13b842d6-en.

OECD (2021b), OECD Environmental Performance Reviews: Ireland 2021, OECD Environmental Performance Reviews, OECD Publishing, Paris, http://dx.doi.org/10.1787/9ef10b4f-en.

Oliveira, S., D. Moura and T. Boski (2020), “The evolution of the European framework for coastal management, linked to the new environmental challenges. The Portuguese case”, Journal of Integrated Coastal Zone Management / Revista de Gestão Costeira Integrada, Vol. 20/1, pp. 27-48, http://dx.doi.org/10.5894/rgci-n213.

Santos, F., Á. Gómez-Losada and J. Pires (2019), “Impact of the implementation of Lisbon low emission zone on air quality”, Journal of Hazardous Materials, Vol. 365, pp. 632-641, http://dx.doi.org/10.1016/j.jhazmat.2018.11.061.

Tribunal de Contas (2022), Auditoria às Áreas Protegidas [Audit of Protected Areas], Tribunal de Contas, Lisbon, www.tcontas.pt/pt-pt/MenuSecundario/Noticias/Pages/n20220811-1.aspx.

Tribunal de Contas (2021), Auditoria às Medidas Agroambientais (PDR 2020) [Audit of Agro-environmental Measures (PDR 2020)], Tribunal de Contas, Lisbon, www.tcontas.pt/pt-pt/ProdutosTC/Relatorios/RelatoriosAuditoria/Documents/2021/rel008-2021-2s.pdf.

van Dender, K. (2019), “Taxing vehicles, fuels, and road use: Opportunities for improving transport tax practice”, OECD Taxation Working Papers, No. 44, OECD Publishing, Paris, http://dx.doi.org/10.1787/e7f1d771-en.

ZERO (2022), “Zero continua a defender o acompanhamento do fundo ambiental, melhor fiscalidade automóvel e economia circular no orçamento para 2022 [Zero continues to advocate monitoring of the Environmental Fund, better car taxation and circular economy in the 2022 budget]”, 11 May, https://zero.ong/zero-continua-a-defender-o-acompanhamento-do-fundo-ambiental-melhor-fiscalidade-automovel-e-economia-circular-no-orcamento-para-2022/.

Annex 1. Actions taken to implement selected recommendations from the 2011 OECD Environmental Performance Review of Portugal

|

Recommendations |

Actions taken |

|

|---|---|---|

|

Chapter 1. Towards sustainable development |

||

|

Analyse how environmentally related taxes could contribute to fiscal consolidation, whilst offsetting reductions in more distortionary taxes on labour and corporate activity. Continue to broaden the use of environmentally related taxes by introducing other such taxes (e.g. on air pollutants and pesticides), and by linking a component of fuel taxes to the carbon content of fuels. |

In 2014, Portugal introduced a green tax reform as part of a broader fiscal consolidation effort under the EU economic adjustment programme. Law No. 82-D/2014 introduced a carbon tax in sectors outside the EU ETS. It also increased the CO2 component of the vehicle registration tax, revised the taxation of water and waste management, granted property tax breaks for forest management and introduced a tax on single-use lightweight plastic bags. Revenues from environmentally related taxes increased from 2.3% to 2.5% of GDP between 2014 and 2019, and then fell to 2.4% in 2020 with the decline in car purchase and use due to the COVID-19 pandemic. In 2022, the Ministry of Finance and Ministry of Environment and Climate Action were evaluating the impact of the green tax reform. |

|

|

Review the current array of tax exemptions and discounts, with a view to phasing out those that are costly and environmentally harmful; ensure that the water and waste management taxes are passed on to final users; provide targeted support for those households adversely affected by energy, water and waste prices. Speed up the introduction of household waste collection charges to provide incentives for better waste management. |

Portugal is among the few EU countries to have performed a comprehensive stocktake of fossil fuel subsidies in its National Energy and Climate Plan 2021-30 (NECP 2030). The 2021 Climate Law provides for their phase-out by 2030. The country is setting up a unit to regularly monitor and assess tax benefits and streamline the tax system. ERSAR, the regulatory authority for water and waste services, has established a benchmarking system for waste and water management utilities. It has issued recommendations and established guidelines to harmonise municipalities’ practices and ensure the principles of universality, quality, affordability and sustainability of public service obligations. Service provision and tariffs for retail service are a municipal responsibility. The 2017 decree-law 147 provides for social water tariffs for families in economic deprivation. Municipalities are free to adhere to this tariff, which must be financed explicitly from municipal budgets. To ensure affordability of water and waste services, some municipalities have targeted monthly support, others have social tariffs and others have both mechanisms. In 2022, ERSAR issued a new recommendation on water tariffs. Despite an apparent good cost recovery of wastewater services, there is scope to improve the ability of municipalities to assess these costs and to increase tariffs, particularly where they provide the service directly. Recovering the costs of water services also requires better reflecting environmental and resource costs in water charges. Water abstraction fees (components of the water resource tax) vary with water scarcity, but rates are reduced for irrigation. This does not encourage efficient water use and the reuse of treated wastewater for non-potable uses. In 2020, three-quarters of municipalities did not fully recover the costs of waste service provision through tariffs charged to consumers. Waste charges are included in the water bill and usually linked to water consumption. Only as from the end of 2025 will waste charges be mandatorily indexed to the amounts of waste collected. |

|

|

Progressively decouple environmental expenditure from EU funding, including through private investment and well-designed user charges for environmental services. |

Public expenditure on environmental protection (current expenditure and investment) decreased until 2016 and has since increased. It reached 0.7% of GDP in 2020, below the EU average of 0.9%. The cohesion policy has become the main source of financing accounting for 60% of total public investment over 2014-20. |

|

|

Develop and implement a comprehensive framework for promoting eco-innovation and employment in eco-industries, including increased public support for R&D, improved co-operation among competent authorities and with universities, the private sector and financial institutions, and investment in higher education and training; and green the jobs in the strategic sectors of the economy. |

Portugal has low government spending on R&D in environmental and energy fields and limited patenting activity. The country encourages R&D generally through generous tax credits for businesses. It has been a pioneer in developing cutting-edge technologies for large-scale projects of renewable energy, co-funded with EU and private funds. There is no strategy guiding energy research, development and demonstration. |

|

|

Continue to simplify and streamline environmental requirements and reduce associated administrative costs of compliance, particularly for small and medium-sized enterprises; assess the staffing arrangements needed to support an efficient, effective and transparent environmental regulatory system at all levels of government; develop a strategy, with supporting instruments, to address serious non-compliance with environmental requirements. |