Tobacco use is the second leading risk factor for early death and disability worldwide, claiming more than 8 million lives every year, out of which about 1.2 million are the result of non-smokers exposure to second-hand smoke (WHO, 2023[1]). The negative effects of smoking spread out beyond individual and population health affecting the economy as well. Worldwide in 2019, the prevalence of daily smoking was 29.6% for men and 5.3% for women, representing 21.1% and 33.8% reductions, respectively, since 2007 (WHO, 2021[2])

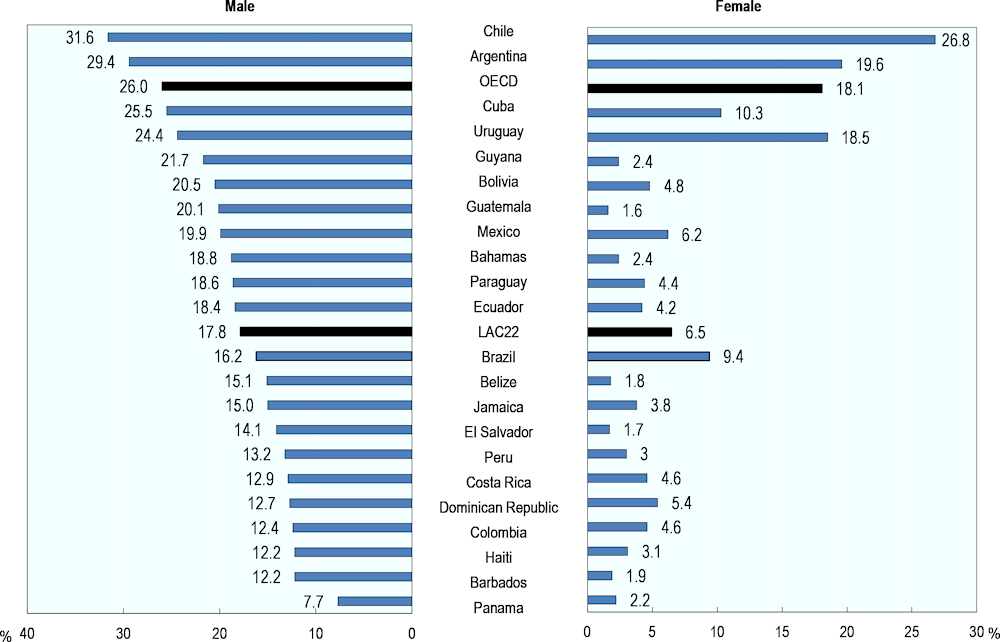

The proportion of daily tobacco smokers varies greatly across countries but close to one in five men aged 15 and above in the LAC22 smokes daily, a rate lower than the OECD average of more than in four men of the same age group (Figure 4.17). Rates are particularly high in Chile and Argentina, where around three out of every ten men smoke, being the only two countries in the region with a rate higher than that of the OECD. The lowest rate amongst men is observed in Panama, being the only country below 10%. Rates are lower amongst women with 6.5% smoking daily, slightly more than a third of the OECD average of 18%. Chile is at the top with over one women of every four smoking, followed closely by Argentina and Uruguay. The lowest rates for women are found in Guatemala, El Salvador, Belize and Barbados, all below 2%. Guatemalan women smoke 12 times less than men do.

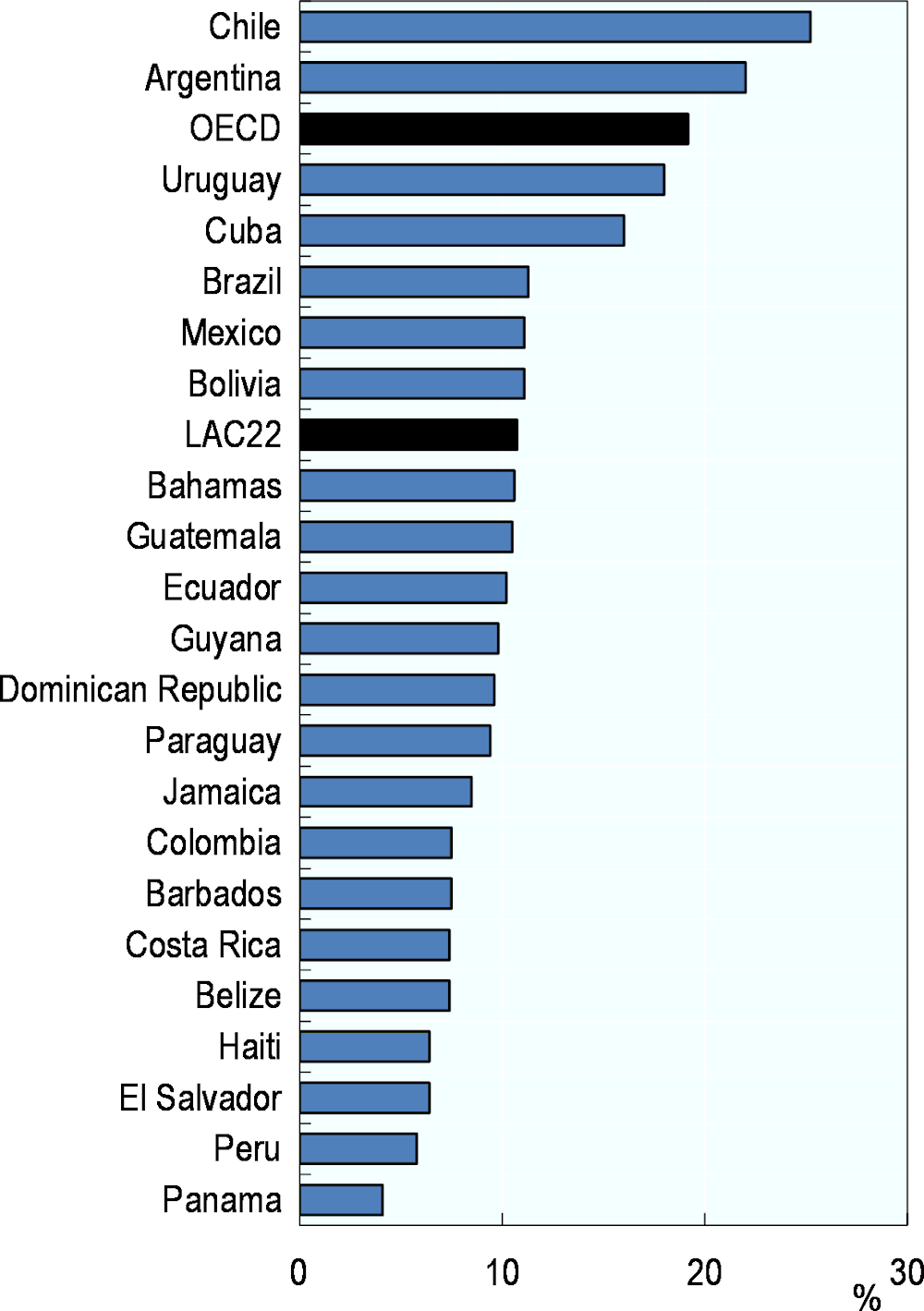

Tobacco use in LAC is expected to be around half of that in the OECD by 2025, with total prevalence for LAC22 at 10.7% and at 19.2% for the OECD. Chile and Argentina are the only countries in the region to show estimated trends of tobacco use above the OECD average. Countries like Panama, Peru, El Salvador and Haiti all show estimated trends for tobacco use below 7% (Figure 4.18).

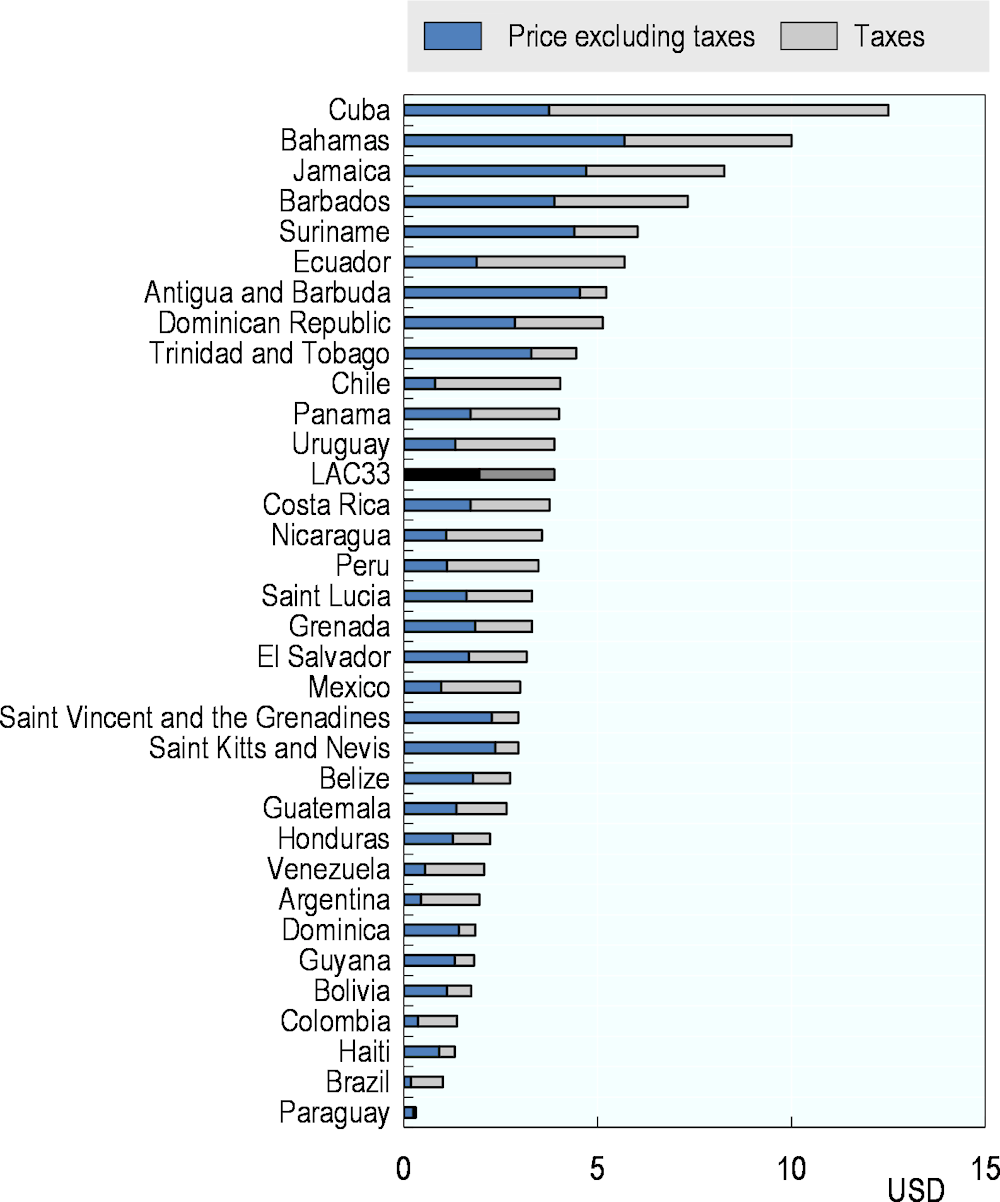

Increasing tobacco prices through higher taxes is one of the most effective interventions to reduce tobacco use, by discouraging youth from beginning cigarette smoking and encouraging smokers to quit. A recent review of studies conducted in LAC countries found that tax increases effectively reduce cigarette use and can also be expected to increase cigarette tax revenue (Guindon, Paraje and Chaloupka, 2018[3]), which can be used in complementary interventions. The average taxation in LAC is 50% for a pack of 20 cigarettes (Figure 4.19). The countries with the highest taxation on tobacco are Brazil, Chile and Argentina with more than 75%, but these are not the countries with the highest prices. The most expensive tobacco can be found in Cuba with a price of USD 12.50, while the cheapest one is observed in Paraguay with a price of USD 0.31.

LAC countries can strengthen its regulations to reduce tobacco use by fully implementing the WHO Framework Convention on Tobacco Control. For this, WHO’s strategy MPOWER can be followed to Monitor tobacco use and prevention policies; Protect people from tobacco use; Offer help to quit tobacco use; Warn about the dangers of tobacco; Enforce bans on tobacco advertising, promotion and sponsorship; and Raise taxes on tobacco (WHO, 2022[4]).