Given the scale of investment needed to achieve carbon-neutrality, ensuring the fiscal feasibility of net-zero strategies will be important for making them resilient to future economic disruptions. This chapter presents the results of new modelling carried out by the OECD on the public finance resilience of net-zero emissions scenarios. It shows how these implications vary across regions and considers the need for alternative public revenue streams in order to account for tax-base erosion in the long-term.

Net Zero+

6. Public finance implications of the net-zero transition

Abstract

This chapter draws on contributions to the horizontal project carried out under the responsibility of the Environment Policy Committee and the Committee on Fiscal Affairs.

Achieving net-zero emissions will considerably alter economic structures, requiring vast investments in new technologies and implying a shift of activities across and within economic sectors. This in turn will entail substantial investment needs, with public resources expected to play a key role in driving the transition (IEA, 2021[1]). The disruptive events of the COVID-19 pandemic and Russia’s large-scale war of aggression in Ukraine highlight the importance of economic resilience when faced with shocks. Government responses to COVID-19 and the war in Ukraine have required substantial public spending, only part of which has been oriented towards green priorities, as highlighted in Chapter 3. It is clear that the large fiscal deficits incurred by recovery and energy-price support spending cannot be sustained in the long run.

It is imperative that climate policy design considers not only the ability to achieve the rapid emissions reductions needed to reach net zero, but the implications of different policy approaches for public finances over the longer term. Given the scale of investment needed to achieve carbon-neutrality, ensuring the fiscal feasibility of net-zero strategies will be important for making them resilient to future economic disruptions.

Achieving net-zero emissions will require a broad policy mix (D’Arcangelo et al., 2022[2]). This includes market-based policies such as carbon taxes, emissions trading schemes and subsidies to enhance the development and deployment of low-carbon technologies, as well as non-price-based instruments such as regulations and standards. These climate policy measures have different fiscal implications. Carbon prices, whether as a carbon tax or emissions trading scheme, generate government revenues. On the other hand, subsidies imply government spending or, if in the form of tax credits, foregone revenue. Removing or decreasing subsidies would thus result in reduced government expenditures or increasing tax revenues. Regulations and standards, while playing a potentially important role in steering the net-zero transition, have no direct fiscal implications.

In addition to direct fiscal implications, all climate policy measures have indirect fiscal effects as they shift economic structures and activities (phasing out of power generated from fossil fuels; increase in renewable energy sources; changes in demand for construction and transport services, etc.). These changes have indirect effects on public revenues and expenditures related to changes in economic activity in the corresponding sectors – for example, labour tax revenues – which can be both positive and negative for public finances.

In addition, many governments derive a substantial part of their tax revenues from excise duties on fossil fuels such as diesel for transport. A transition towards net-zero emissions will see consumption patterns shift away from fossil fuels in favour of low-carbon alternatives, leading to a loss in fiscal revenues from fuel excise duties, regardless of whether climate policies are price-based or otherwise. Such erosion of the tax base can have a considerable effect on public finances in the long run, warranting the more detailed analysis presented below.

This chapter reviews recent evidence on the public finance implications of the net-zero transition, taking into consideration differences across policy instruments and in regional contexts.

Public finance resilience in the net-zero transition across policy instruments and regions

For this report, new modelling was undertaken assess the fiscal implications of net-zero transitions. The modelling framework considered the impact on public finances of reaching net-zero emissions globally by mid-century (Box 6.1). A Net-Zero Ambition Scenario was compared to a baseline scenario reflecting countries’ current policies and those already legislated to be implemented in the future. The Net-Zero Ambition Scenario models a broad, regionally differentiated climate policy mix combining carbon pricing, removal of fossil fuel support, regulations in the power sector, and policies to stimulate investment in low carbon technologies by firms and households (e.g. building refurbishments and subsidies for electric vehicles). Regional differences are based on the structure of different economies, not least their energy sector composition, but do not necessarily reflect the preferences and political constraints specific to the corresponding region. In other words, instruments are assumed to be implemented such that regional targets are reached without excluding specific instruments in specific regions for political considerations.

Box 6.1. Modelling policy instruments in a global net-zero emissions scenario in ENV-Linkages

The ENV-Linkages model

The ENV-Linkages model is global recursive-dynamic computable general equilibrium model that describes economic activities in different sectors and regions and how they interact. It is based on the GTAP 10 database (van der Mensbrugghe, 2019[3]) and GTAP-Power satellite account (Chepeliev, 2020[4]). The model links economic activity to environmental pressures, including greenhouse gas emissions, air pollutants and materials. CO2 emissions from combustion of energy are directly linked to the use of different fuels using constant coefficients, while process CO2 emissions (for example in cement production) are linked to production levels in sectors where they are generated. The baseline scenario is carefully calibrated to offer a credible projection of economic activity by 2050 without ambitious climate action but including the impact of existing and stated policies. The baseline calibration includes technological progress through various productivity parameters (e.g. autonomous energy efficiency improvements and labour productivity improvements) as well as shifts in the structure of the economy towards the services sectors. Particular attention is given to the calibration of the energy sector, including power generation and energy demand, based on information from the IEA World Energy Outlook (IEA, 2022[5]).

The Net-Zero Ambition Scenario

The paper presents a Net-Zero Emissions Ambition Scenario which reflects the ambition to achieve net-zero CO2 emissions globally by mid-century, i.e. where carbon emissions do not exceed carbon sequestration. Specifically, all countries that have announced a commitment to achieve net-zero emissions by 2050 meet their target while all other countries achieve net-zero emissions by 2060. This Net-Zero Ambition Scenario is compared to a baseline scenario which reflects policies currently in place or legislated to be implemented. Both scenarios are presented with a 2050 time horizon. To achieve these emission reductions, ENV-Linkages has been tailored to model a broad policy package that combines various pricing and non-pricing policy instruments. Overall, the policy package targets all sources of CO2 emissions, including fossil fuel combustion as well as process and fugitive emissions.

Fiscal implications of the Net-Zero Ambition Scenario

Governments have a wide array of policy instruments they can use to achieve emission reductions. This paper focuses on six key policies to decarbonise the economy, which were chosen because (i) they reach all key sources of carbon emissions, and (ii) they contain some of the most widely used instruments available to governments. The instruments considered are:

Carbon pricing

Fossil fuel support removal

Regulations in the power sector to enforce a switch away from fossil fuels

Regulations to stimulate investments to decarbonise building and transport emissions

Policies to stimulate firms’ energy efficiency improvement

Subsidies to reduce and decarbonise energy consumption by households.

Each regional policy mix is determined by first calibrating regulations and subsidies based on available data on mitigation potential and investments based on information from the IEA’s Net Zero Emissions Scenario (2021[1]); then adding energy efficiency policies and fossil fuel support removal; and finally, adjusting the level of carbon pricing to match emission targets.

In addition to analysing the effects on carbon pricing revenues, the ENV-Linkages model can identify direct and indirect effects of changes in economic activity on net revenues from taxes and subsidies on: (a) production and consumption of fossil fuels, (ii) production, (iii) consumption, (iv) production factors such as labour and capital, (v) income including transfers to households and (vi) imports and exports.

The economic impact of reaching net zero

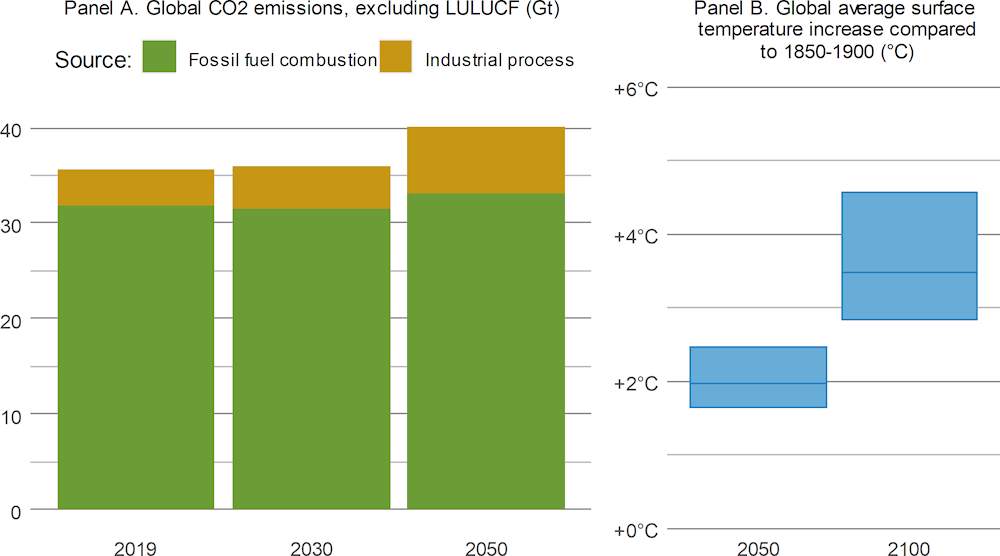

Under the baseline scenario, which reflects policies currently in place or legislated to be implemented, global CO2 emissions are projected to increase to 40 Gt in 2050, a 13% increase compared to 2019 levels. Such emissions increases would result in approximately 3.5°C of warming by the end of the century (Figure 6.1).

Global emissions in the baseline results calibrated here differ from some other commonly referred to scenarios, such as the IEA STEPS scenario, due to diverging macroeconomic assumptions such as on GDP growth trajectories, as well as diverging assumptions about the potential for energy efficiency improvements, particularly in industrial sectors. The reason for these diverging assumptions is partly a difference in policy assumptions (existing legislated policies versus those that have been announced) and results in a less optimistic outlook, appropriate for a conservative estimation of public finance risks. The baseline is nevertheless in line with the lower end of IPCC baselines. Global emissions in this baseline are considerably higher than some other commonly referred to scenarios, such as the IEA STEPS.

Figure 6.1. The baseline scenario projects a continued increase in CO2 emissions expected to exceed 2°C by 2050 and could lead to 2.8-4.6°C in 2100

Note: LULUCF stands for ‘Land use, land-use change and forestry’. Error bars in Panel B represent the 5th and 95th percentiles of the climate sensitivity in 2100.

Source: OECD ENV-Linkages model (Panel A) and MAGICC 7 based on OECD ENV-Linkages model emissions (Panel B).

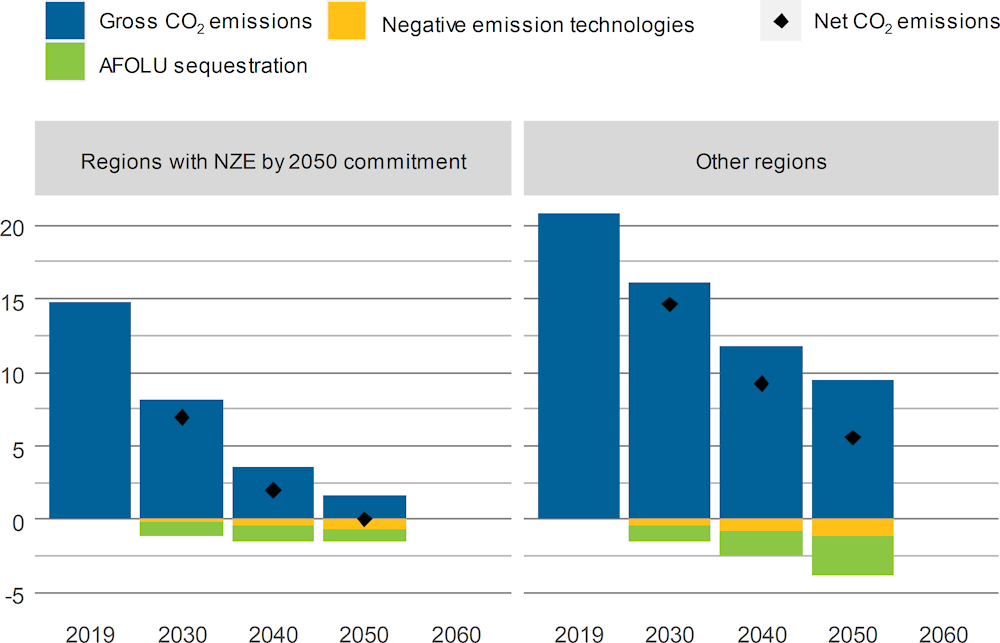

The Net-Zero Ambition Scenario, however, reduces global CO2 emissions by more than two-thirds compared to 2019 levels, to 11 Gt by 2050. A further 5 Gt is sequestered through afforestation and other land-use sequestrations, and negative emissions technologies in 2050 according to existing estimates. As such, net-global CO2 emissions reach 6 Gt in 2050, a trajectory to reach net-zero before 2060. Under this scenario global average temperatures would peak just above 1.5°C in the second half of the century.

Figure 6.2. Gross and net CO2 emissions steadily decline in the Net-Zero Ambition Scenario

Note: The modelling exercise only considers years up to 2050.

Source: OECD ENV-Linkages model and IMAGE dataset (Van Vuuren et al.2021).

Overall, the Net-Zero Ambition Scenario results in a strong shift away from fossil-fuel-intensive sectors, reducing the energy intensity of the global economy, with most emissions reductions resulting from the decarbonisation of the energy system. Under the model’s assumptions, this considerable restructuring of the global economy also results in a moderate slowdown of economic growth. Globally, GDP in 2050 is 5.6% lower than under the baseline scenario, with most of these reductions occurring after 2030. This corresponds to a 0.3 percentage point change in growth rate over the 2019-2050 period.

The results of the Net-Zero Ambition Scenario highlight the insufficient ambition of countries’ current Nationally Determined Contributions (NDCs) and legislated climate policies. They also underline the considerable inertia of the economic system with many emissions already tied up in long-lasting durable goods across economic sectors (which become stranded assets under the Net-Zero Ambition Scenario).

Macroeconomic impacts differ by region. This reflects a number of factors, including the regional gap between baseline emissions and sequestration potential; the policy mix employed by each country to reduce emissions; and countries’ overall economic structure. It is also assumed that investors are aware of policy signals and invest accordingly, implying a least-cost transition to net zero, where increased policy ambition leads to an immediate reaction among investors towards climate-friendly investments.

To avoid overly optimistic projections of the consequences of the net-zero transition, the Net-Zero Ambition Scenario assumes limited levels of negative-emissions technologies such as direct air capture and bioenergy with carbon capture and storage (BECCS). Energy efficiency breakthroughs in hard-to-abate sectors are also assumed to be limited. Likewise, the Net-Zero Ambition Scenario assumes limited behavioural changes beyond those due to by fiscal incentives and regulations. This results in higher macroeconomic costs compared to scenarios assuming more rapid development of these technologies. Nonetheless, a less optimistic scenario is better suited to the evaluation of potential downside risks for public finances. The Net-Zero Ambition Scenario allows for significant increases in investments, however these do not in themselves lead to a Keynesian boost to economic growth. Further analysis can be done to identify how specific policy instruments in the Net-Zero Ambition Scenario’s policy package can be designed to enhance growth and prevent the negative indirect effects on public revenues found in the current analysis.

These results should be interpreted in the context of benefits of climate policies on avoided climate damages and potential co-benefits such as reduced air pollution. As depicted in Chapter 2, these benefits are considerable given the increased possibility of climate system tipping points being triggered. In addition, projected higher economic costs after 2030 highlight the importance of accelerating technological innovation for a resilient and sustained transition. If this innovation is achieved along with the economic co benefits of climate action and avoided damages, GDP effects compared to baseline are likely to be far more positive, especially in the long run.

Government revenue effects of the net-zero transition across policy instruments and regions

Overall, public revenues and expenditures increase in the baseline scenario due to rising GDP. Net public revenues from climate-related taxation (i.e. carbon prices and fossil fuel production and consumption taxes (excise duties)) remain limited in both 2030 and 2050 as increases in carbon price revenue are balanced out by decreasing revenues from fossil fuel production and consumption taxation as energy efficiency gains erode the fiscal base.

Under the Net-Zero Ambition Scenario, global net public revenues decrease moderately in 2050, by -1.8% of baseline GDP. This reflects a trade-off between revenue-generating or expenditure-decreasing policy instruments such as carbon pricing and the removal of fossil fuel support, and the decrease in public revenues due to additional subsidies and tax-base erosion of other taxes, not least in energy-related taxation.

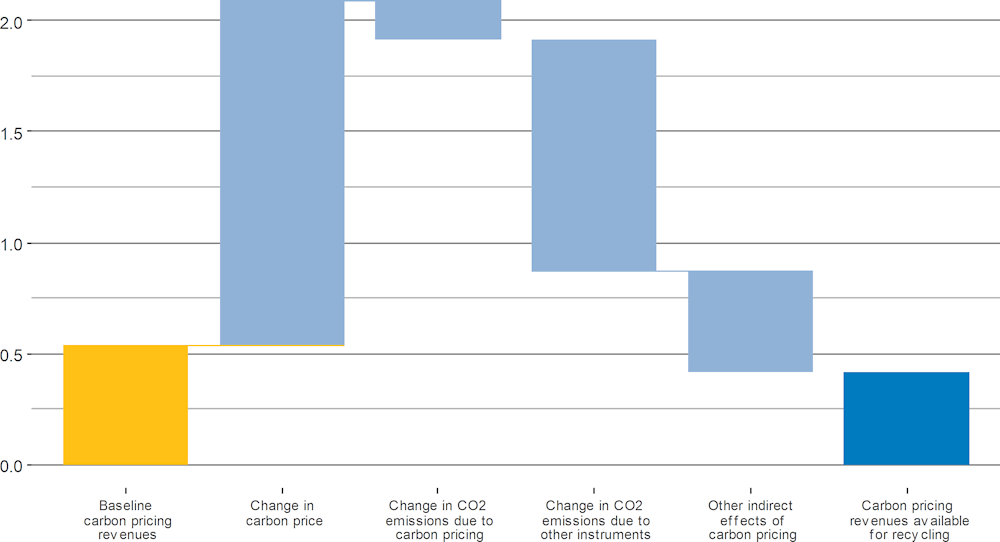

In the Net- Zero Ambition Scenario, the global average carbon price in 2050 increases from USD 22 per tonne of CO2 in the baseline scenario to USD 88 – with prices ranging from USD 0 to USD 714 depending on the region. Overall, although mitigation ambition erodes the fiscal base of carbon pricing over time as emissions decrease, the increase in carbon price levels and resulting revenues more than compensates for this, with revenues from carbon pricing increasing from 0.5% of baseline GDP in the baseline scenario to 0.9% of baseline GDP in the Net-Zero Ambition Scenario. This is the outcome of three main drivers illustrated in Figure 6.3: carbon prices increase significantly (second column) but at the same time CO2 emissions decrease compared to the baseline, both due to carbon pricing (third column) and other instruments (fourth column). However, only about half of the resulting revenues can be recycled to finance other policies, due in part to the indirect effects of carbon pricing on other tax bases (fifth column). This indicates that base-erosion in excise duties remains an important challenge despite the revenue generation potential of carbon pricing and fossil fuel subsidy reform.

Figure 6.3. Reduction in CO2 emissions and erosion of other tax bases partially offsets revenue increases from carbon pricing

Source: OECD ENV-Linkages model.

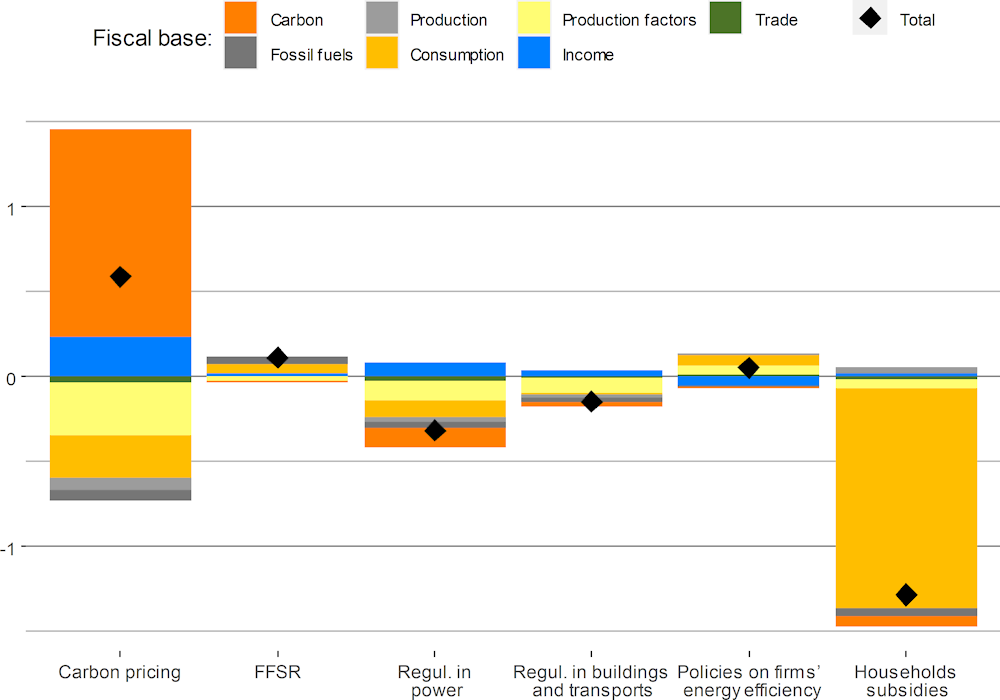

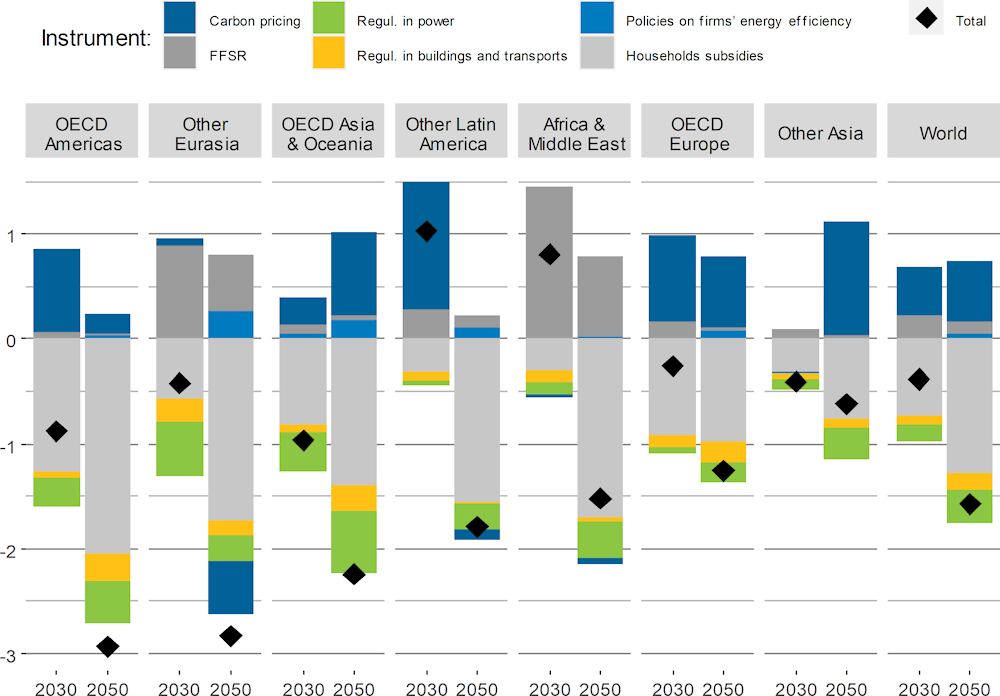

Among policy instruments considered, the largest effects on public finances are the direct effects of carbon pricing (net additional revenues) and household subsidies (net additional expenditure), and to a lesser extent, fossil fuel subsidies removal (net additional revenues), as shown in Figure 6.4. However, all instruments entail large indirect effects that reduce net public revenues (e.g. through changes to fossil fuel production and consumption and changes in the broader fiscal base due to economic restructuring).

Indirect effects generally result from a shift of economic activity towards sectors that are on average less heavily taxed, leading to a net decrease in tax revenue (Figure 6.4), particularly concerning revenues from income and production factor taxation. When the net tax rate is negative (which is the case, on average, at the global level), meaning countries earn less in income tax revenues than they expend in transfers to households, a reduction in income leads to an overall decrease in net income tax expenditures. As such, the decrease in income under the Net-Zero Ambition Scenario results in a decrease in transfer expenditure as transfers are linked to income levels, implying an overall gain in public revenues from income taxation for almost all policy instruments.

In addition to income taxation, relative changes between economic sectors also play a large role in determining revenues from production factors, depending on how countries choose to tax different sectors. In some regions, less heavily taxed (or more heavily subsidised) sectors benefit more from the net-zero transition, implying a decrease in public revenues from production factors. In other regions the opposite is true, and more heavily taxed (or less heavily subsidised) sectors benefit, implying public revenues from production factor taxation increase. At the global level and for almost all policy instruments, these changes in production result in a decrease in net revenues from production factors and production.

Figure 6.4. Most indirect effects of policy instruments lead to a decrease in net public revenues, while direct effects of carbon pricing and fossil fuel support removal represent additional revenues

Note: Each category corresponds to a scenario where only the policy instrument mentioned is implemented. FFSR stands for “fossil fuel subsidy removal”.

Source: OECD ENV-Linkages model.

Although the net global fiscal effects of reaching net-zero are limited, there are significant regional differences, with regional net public revenue changes in the Net-Zero Ambition Scenario ranging from - 0.7% to - 3.4% of baseline GDP, depending on the policy mix employed and the regional economic characteristics (Figure 6.5). These differences are driven in particular by differences in the effect of carbon pricing and fossil fuel subsidy removal on net revenues across regions.

Figure 6.5. Changes in net public revenues in the Net-Zero Ambition Scenario range from -0.7% to 3.4% of baseline GDP in 2050 depending on the region

Note: The black diamonds correspond to the full Net-Zero Ambition Scenario, which implements the policy instruments all together. It differs from the sum of the effects of individual policy instruments depicted in the bars due to interactions between the different policy instruments.

Source: OECD ENV-Linkages model.

Carbon pricing leads to a net increase in public revenues for almost all regions. In the group of non-OECD Latin American countries, these direct effects even result in an increase in total net public revenues by 2030 due to a large increase in carbon pricing revenues necessary to achieve the NDC target. More generally, the extent of the impact of carbon pricing depends on the importance of carbon pricing for meeting regional mitigation targets as well as the influence of other indirect effects. For regions with high sequestration potential, such as in the group of non-OECD Latin American countries, only minimal carbon price increases are needed between 2030 and 2050 to reach net zero. As a result, revenues generated through carbon pricing also remain minimal. GDP losses due to economic restructuring in order to meet net zero, as projected for the Other Eurasia region, also lead to minimal net public revenue gains from carbon pricing (and even a decrease by 2050) because other factors balance out the large revenue gains from carbon pricing, such as lower income taxation, fuel consumption taxes, and production.

The total net effect on regional public finances is a result of the trade-off between (it) these direct effects, mostly revenue-generating, (ii) the direct cost of financing households’ net-zero transition through subsidies, and (iii) the indirect effects of all instruments, mostly leading to a decrease in net public revenues as explained above. Countries that rely heavily on fossil fuel production (Other Eurasia, Africa & Middle East) are particularly at risk in the long run, as climate mitigation threatens both revenues from fossil fuel consumption taxes and trade taxes. The removal of fossil fuel support can provide revenue gains by 2030, somewhat lessening the fiscal deficit incurred in the long term and could even lead to a net increase in total public revenues for countries in Africa and Middle East where regulations in the power, transport and buildings sectors contribute negatively to net public revenues through indirect effects as previously discussed. As mentioned above, if policy measures are designed specifically to be growth enhancing, the outcome for public revenues would be more favourable than modelled here.

Considering the results presented, countries can benefit from improved awareness of the possible implications of their chosen policy mix on public finances. Past experiences show that public budgets are able to address such shifts in economic structure through creating new tax revenue streams (e.g. value added tax). Similarly, net-zero transition strategies should also consider fiscal strategy, for example introducing new tax bases to counter-balance the effects of base erosion.

In addition to managing the fiscal effects of restructuring across economic sectors and activities, addressing undesirable distributional outcomes will also be paramount to making sure that the transition is fair and equitable, an important prerequisite for a resilient transition. Factoring in the possible need for additional government expenditure (alongside climate-related expenditures) to protect low-income households is essential for sound fiscal policy going forward, in particular concerning recent shocks such as COVID-19 and the war in Ukraine. These distributional impacts are discussed in more detail in Chapter 8.

Overall, the modelling results show that the net-zero transition is feasible from an economic and fiscal standpoint. Governments have considerable leeway in carefully designing policies to match their economic and energy context while simultaneously considering other policy implications such as the effect of decarbonisation on public finances. Here the analysis highlights the importance of tailoring policy packages and support measures to national contexts, with fiscal effects differing substantially depending on economic structure and the climate policy mix employed.

The role of environmentally related taxes and carbon pricing for ensuring public finance resilience

Whereas the modelling analysis informing the previous section highlights the implications of net zero based on a stylised representation of aggregated sectors and regions, in practice many countries already have considerable experience with implementing carbon pricing policies. Drawing on the OECD’s Effective Carbon Rates work (OECD, 2021[6]; OECD, 2022[7]) and related analyses, this section considers how carbon pricing is implemented in practice, showing significant heterogeneity in countries’ effective carbon rate profiles. Considering carbon pricing practice and elasticities, the section highlights key implications for fiscal policy in the short- to medium-term. Finally, the section considers how these effects will play out in the long term, further highlighting the considerable risk of base-erosion in certain sectors as economies decarbonise, and policy measures to overcome this.

The principal interactions between tax policy and the transition to net-zero greenhouse gas emissions are twofold. First, progressive taxation is part of the policy toolkit to reduce greenhouse gas emissions and ensure a just transition. Second, as described in the modelling work above, the low-carbon transition induces the decline of carbon-intensive tax bases, creating a need for fiscal policy adaptation where revenues related to the consumption and production of fossil fuels (e.g. excise duties and royalties) are significant. Both dimensions are critical to maintain a stable, resilient transition towards net-zero emissions.

Taxes and similar instruments, e.g. fees or emissions trading systems, can encourage emissions reductions in various ways. They can be used to price carbon, and tax incentives can also be used to steer investment choices towards low- and zero-carbon choices. While the principal objective may be to create incentives to expedite the transition to net zero, as highlighted in the previous section, tax policy choices have budgetary impacts that should be considered when designing climate policy. In particular, policy makers need to anticipate the tax base erosion caused by declining carbon-based fuel use.

Carbon-intensive tax bases are set to erode and ultimately disappear as the transition to net zero progresses. This creates revenue challenges in fossil-fuel producing countries and in countries where taxes on carbon-based energy are a significant source of revenue. Some of these challenges may be relatively easy to address if preparations to shift to alternative tax bases start early, e.g. in the case of distance-based charges in transport instead of fuel taxes. But where alternative revenue sources are scarce, e.g. in countries heavily reliant on fossil-fuel extraction revenue, structural transformations need to be envisaged to ensure economic prosperity and fiscal capacity.

In addition to implications for public finances, climate-related tax policy can also play a key role in shaping the distributional impact of broad climate policy packages. There is a significant literature in this context on how the use of revenues from carbon pricing can shape distributional outcomes, helping support vulnerable households but also improving public support for climate policy. This is discussed in detail in Chapter 8.

Why price carbon, and how?

By increasing the price of carbon-intensive fuels, carbon prices provide incentives to reduce their use and encourage a shift to cleaner fuels. Unlike energy efficiency standards and other regulations, prices leave households and businesses a wide range of choices on how to cut emissions.1 This greater flexibility lowers the costs of cutting emissions, in particular where mitigation costs differ widely across emitters. Regulations tend to have a narrower focus and allow for a limited set of solutions, which in general drives up abatement costs. The compliance costs incurred with regulations are typically less visible than with carbon prices, but they too are real and abatement costs per tonne of CO2 tend to be higher.2 Pricing also creates ongoing mitigation incentives contrary to most regulations, where once the standard set by a regulation is met, there is no additional incentive to continue the abatement effort and innovate.

Carbon prices take three broad forms: carbon taxes and the price of permits in emissions trading systems on one hand,3 and fuel excise taxes on the other. The primary objective of carbon taxes and emissions trading systems is to reduce greenhouse gas emissions, but they also have important revenue implications, as described in the previous section.4 Excise taxes on energy use exist for a variety of reasons, including environmental ones, but their current structure remains heavily influenced by revenue-raising objectives and considerations related to political economy. The base for fuel excise taxes usually is the volume or weight of the fuel that they apply to. Since the carbon content of each fuel is proportional to such tax bases, fuel excise tax rates can be seen as a form of carbon pricing just like carbon taxes.

In addition to carbon prices, governments also subsidise or support fossil fuel production and consumption. This incentivises fossil fuel use, increasing emissions, and so has important implications for climate policy. In addition, fossil fuel subsidies also imply government expenditure and so have fiscal implications. As such, they play an important role in determining the overall implications of price-based climate policies on public budgets.

To the extent that carbon prices achieve their primary goal of reducing greenhouse gas emissions, the base to which they apply erodes (this is “base erosion that we want”). However, the use of carbon-based fuels is so widespread across most countries that, even with alternatives increasingly becoming available at declining costs, moving away from fossil fuels will take time. With a broad base and gradual erosion, the revenues that would be raised if carbon prices drive the low-carbon transition therefore are significant and can be expected to remain so over the next one to two decades, as shown in the modelling results above.

While fuel excise taxes can usefully be thought of as implying a carbon price, they are often not optimally designed from a carbon pricing perspective. Rates differ across fuels and users, often including generous exemptions to certain activities, meaning that excise taxes do not apply a uniform price across all emissions. Reforming excise taxes so that they reflect the carbon content of fuel and broaden their base (e.g. by getting rid of exemptions).5 could improve the environmental and climate performance of energy excise taxation (which includes fuel and electricity excise taxes). If ambitious in scope, such reforms could raise considerable revenues as they generally increase both the rates applied across fuels and expand the base to which these rates apply. This is part of what has also been termed “environmental fiscal reform” which aims to internalise external environmental costs.

The cost of carbon-based energy and other sources of greenhouse gas emissions is set to increase due to increasingly stringent policy efforts to transition to net-zero emissions. This raises concerns about differential impacts on different types of households, which may clash with equity objectives, for example when lower-income households are affected disproportionally. Here the revenue-raising potential of carbon pricing approaches may offer a key tool to help alleviate distributional concerns and maintain support for climate policies.

How have carbon prices evolved? Recent trends

The OECD tracks countries’ use of carbon taxes and emissions trading systems as well as their deployment of excise taxes on energy use.6 The sum of carbon taxes, tradeable emission permit prices and excise taxes on fuels is called the effective carbon rate (ECR). Accounting for forms of fossil fuel support that reduce pre-tax prices of fossil fuels produces the net effective carbon rate. Recent OECD data show that several countries have significantly increased their use of carbon pricing, primarily through emissions trading systems, with increasing coverage and price levels (OECD, 2022[7]).

In 2021, more than 40% of GHG emissions faced a positive net effective carbon rate, up from 32% in 2018. This increase is the result of the introduction or extension of explicit carbon pricing mechanisms in several countries, including Canada, China and Germany. Average carbon prices from emissions trading systems and carbon taxes more than doubled to reach EUR 4.3 per tonne of CO2e over the same period. This average hides very large and rising differences between countries. Not all countries focus on carbon pricing as part of their climate mitigation policies, but carbon prices increased in 47 of the 71 countries covered in the report in 2021.

Prices continued to rise in those countries that already implemented high net carbon prices in 2018. In these countries, changes were mostly driven by the rise of carbon taxes and permit prices in emissions trading systems. In contrast, increases in net carbon prices were generally less common in countries where prices were relatively low in 2018.

Net carbon prices often remain low outside of the transport and building sectors but inter-country heterogeneity is large. Where emissions from industry and electricity are priced, this is usually through emissions trading systems or carbon taxes. While many emissions remain unpriced, some emitters now face substantial carbon prices, especially in Europe. Nevertheless, the highest net effective carbon rates tend to result from relatively high fuel taxes (excise taxes) in the road sector.

Increasing effective carbon prices could raise substantial revenues while cutting emissions. Revenues from carbon pricing can play an important role during the net-zero transition where there will be substantial adjustment costs. Countries could raise an amount equivalent to approximately 2.2% of GDP on average if they were to introduce a carbon price floor of EUR 20 per tonne of CO2 – a mid-range estimate of carbon prices required by 2030 to drive the transition to net zero, but here too differences across countries are large, as is discussed below. These results align with those of the modelling exercise detailed previously, underscoring the revenue-raising potential of carbon pricing but also the large country differences as conditioned by the effect of the transition on different economic structures.

The effects of carbon prices on emissions and government revenues

Designing optimal carbon pricing policies requires understanding how businesses and consumers will respond to them in practice. A recent OECD paper carried out for the Net Zero+ project estimates the responsiveness of CO2 emissions from fossil fuel use to effective carbon rates (D’Arcangelo et al., 2022[8]). The estimated responsiveness levels enable simulations of the effects of changes in effective carbon rates both on emissions and on the revenues from carbon pricing.7

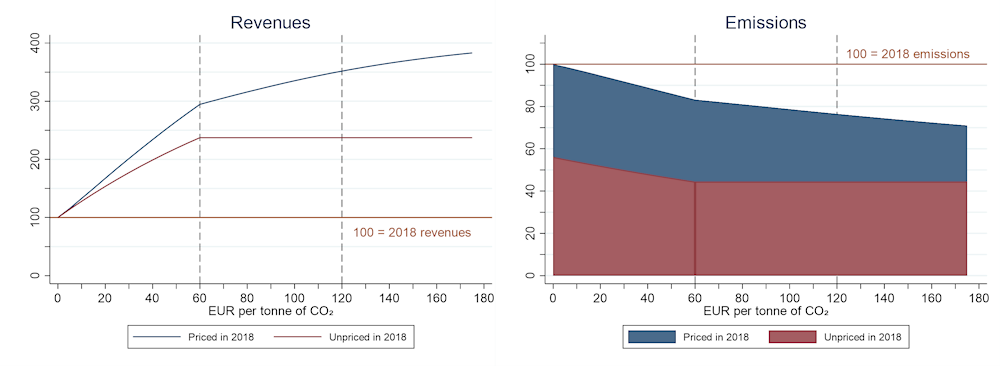

The simulated carbon price floors capture two options available to policy makers: increasing effective carbon rates for emissions already priced or broadening the emission base to which effective carbon rates apply. For emissions already priced, the policy scenarios consider price floors between EUR 0 and EUR 175 per tonne of CO2; for unpriced emissions the floors vary from EUR 0 to EU 60 per tonne of CO2.8

The simulations highlight the key importance of a broad policy mix for reaching net-zero emissions, with carbon pricing alone unlikely to be enough to meet net-zero objectives. This supports the Net-Zero Ambition Scenario modelling results presented in the previous section. Indeed, the simulations show that, given the moderate estimated responsiveness of emissions to carbon pricing, meeting net-zero targets would require a substantially higher price floor than those considered in the simulations. Combining the price floor of EUR 175 on already priced emissions and of EUR 60 on unpriced emissions is estimated to reduce total emissions from fossil fuel use by around 29% compared with the 2018 level (Figure 6.6, right panel). Sixty percent of this decline would come from emissions already priced in 2018.

Complementing carbon pricing with policies that increase the emission responsiveness to carbon pricing (e.g. related to green innovation) can also ease the substitution of clean energy sources for fossil fuels, thus reducing emission abatement costs (e.g. with new technologies) and making carbon pricing more effective. For instance, policy simulations show that an emission responsiveness twice as large as the baseline estimate combined with an effective carbon rate (ECR) floor of EUR 40 on priced and unpriced emissions would result in the same emissions reduction as baseline responsiveness estimates combined with an ECR floor of EUR 175 on priced emissions and EUR 60 on unpriced emissions.

Carbon-related government revenues (including fuel excise-tax related revenues) would increase almost four-fold compared with 2018 levels, with the base broadening price floor of EUR 60 increasing revenues by about 2.5 times. Across the range in the carbon pricing floors considered, more than half of the revenue increase would come from pricing previously unpriced emissions (Figure 6.6, left panel). The rate of the increase in revenues declines as the ECR floor rises, as higher ECRs progressively erode the emissions base. However, for the range of ECR floors considered this “base erosion effect” is always smaller than the “price increase effect” so total revenues continue rising with price floor levels. This aligns with the modelling results depicted previously, showing that carbon pricing can generate government revenues even while their revenue base (emissions) decrease in the long term.

Figure 6.6. Aggregate effects of an effective carbon rate floor on emissions and revenues

Note: Simulations of a global ECR floor by EUR 5 increments. The maximum ECR floor for emissions unpriced in 2018 is EUR 60 per tonne of CO2. Beyond EUR 60, the price floor on emissions already priced in 2018 keeps on rising until EUR 175, while that for unpriced emissions in 2018 remains at EUR 60. Semi-elasticities are allowed to differ by sector. An ECR floor of 0 corresponds to 2018 policies.

Source: OECD.

Carbon pricing effects on different sectors, fuels and countries

The effects of price floors on emissions and revenues differ across sectors, fuels and countries because of differences in current price levels and in the price-sensitivity of emissions. In sectors other than the road and off-road transport sector (where the base is broad to begin with), broadening the emissions base would result in substantial emission reductions.

Price increases triggered by the price floors are largest in the industry and electricity sectors since ECRs tend to be low for these sectors, particularly in high-emitting countries including China and the United States. Combined with the price-responsiveness observed in these sectors, this contributes to these two sectors also displaying the largest emissions reductions. Despite the large contraction of the emissions base, carbon-related revenues from these sectors would increase for all ranges of ECR floors considered.

The simulated increase in road sector carbon prices is markedly smaller than in industry and electricity as rates are generally already high, with an emission-weighted average of nearly EUR 90 per tonne of CO2 in the road sector against around EUR 3 in industry and electricity sectors. Already high effective carbon rates (ECRs) in the road sector imply that there would be almost no effects on emissions up to a EUR 40 price floor. As such, other measures beyond carbon pricing may be needed to incentivise substantial emissions reductions in transport.

The agriculture and fisheries sector is responsive to changing ECRs, and the analysis suggests that increasing ECRs in these activities would be effective in reducing CO2 emissions due to fossil fuel use. However, this must be considered in the context of reforming existing subsidies, both for fossil fuels and other support measures, which are considerable in these sectors. In addition, fuel use is not the largest emissions source in agriculture – greenhouse gas emissions there are mainly due to livestock emitting methane and agricultural soil treatment causing nitrous oxide emissions. Overall impact on total emission reduction and revenues would therefore likely be relatively small.

Simulations distinguishing between fuels underline the importance of pricing emissions from coal and other solid fossil fuels used to reduce global CO2 emissions. This is because of coal’s high responsiveness to carbon pricing and its low current price in most countries (including China and the United States, where a lot of coal is used in electricity generation and industry). In 2018, the average effective carbon rate of coal was just EUR 2.2 per tonne of CO2. Increasing prices on coal emissions would initially generate large government revenues at low price floor levels, but high price responsiveness means that higher prices would quickly erode the emission base. Revenues from coal emissions would decline from carbon price levels of around EUR 80. As phasing out coal is essential to the net-zero transition, this result further highlights the importance of fiscal planning for a resilient transition.

The effect of price floors differs across countries in part because low carbon price floors do not strongly affect countries with a high average current rate. Moreover, both the share of unpriced emissions in a country and the sectoral composition of emissions determine the country-level responsiveness of emissions and government revenues to carbon price floors. Overall, countries with the largest emission reductions and revenue gains are those in which the electricity and industry sectors are the predominant source of emissions and where current prices are relatively low. This might not necessarily mean large carbon-related revenue as a share of GDP, however. Countries in which fossil fuels account for a low share of total GHG emissions (and hence have a low intensity in GDP), for example because of a large agricultural sector, would not attain large carbon-related revenues as a percentage of GDP despite the steep increase in the average effective carbon rate. In these countries, the emission base to which ECR applies is small, relative the size of the economy, and hence they would raise less carbon-related revenues as a share of GDP than other countries. This further underlines the modelling results presented earlier in the chapter and again highlights the need to consider contextual factors when assessing the public finance implications of carbon pricing.

Beyond carbon pricing: the public finance implications of other policy instruments

Given that carbon pricing alone will not suffice to reach climate neutrality goals, governments seeking to accelerate a resilient transition need to deploy a suite of policies as part of a comprehensive decarbonisation strategy including tax incentives for clean technologies, standards and regulations, and complementary policies to facilitate the structural changes along the transition (D’Arcangelo et al., 2022[2]; Blanchard, Gollier and Tirole, 2022[9]).

Tax incentives can encourage specific consumption, production and investment choices by reducing the tax burden associated with these choices. Tax incentives can be channelled through the corporate or the personal income tax system, for example, to encourage the use and production of, or investment in low or zero-carbon technologies. They can be seen as a subsidy delivered through preferential tax treatment instead of through direct government outlays.

In the corporate income taxation context, tax incentives are frequently granted for specific types of investment and take different forms (Celani, Dressler and Wermelinger, 2022[10]). By providing a favourable deviation from a country’s general tax treatment, tax incentives reduce or postpone the tax liability of an investor, which can encourage investment under certain circumstances. Tax incentives can take the form of investment allowances and credits, accelerated depreciation, reduced tax rates, and tax exemptions, among others. Tax incentives are costly as they imply potentially considerable foregone government revenue, i.e. tax revenue that authorities do not collect because business receives preferential tax treatment on investments that it would have made in absence of the incentive (e.g. see modelling results on subsidies and their indirect effects discussed previously). There also are administrative costs, which can be considerable as determining eligibility and compliance is complex.

Tax incentives can complement or substitute carbon pricing as part of the needed broader policy mix. They can play a key role in supporting innovation and deploying new technology, but regulations and technology support are also needed to stimulate learning-by-doing to help overcome capital market imperfections, unlock network externalities and overcome path dependencies (for a more detailed discussion on innovation see Chapter 7). While a combination of instruments allows better alignment of climate change mitigation policies with the different policy concerns, political economy constraints can lead to deviations from ideal approaches – the imperative is to act in the way best suited for a country at a given moment in time.

A key example of tax incentives in practice is the recent United States’ Inflation Reduction Act (IRA), signed into law on 16 August 2022. The IRA relies on tax incentives to incentivise the uptake of clean technologies, both at the corporate and the personal tax level, and does not introduce new carbon pricing mechanisms (with the exception of a methane charge in oil and gas extraction). The Act contains two main spending areas: energy and climate (estimated cost of USD 386 billion from 2022-2031) and health care (USD 98 billion). On the revenue side, savings on health spending and new sources of revenue including a 15% minimum corporate income tax amount to USD 790 billion.9 Approximately two-thirds of the energy and climate spending will take the form of tax incentives, amounting to around 0.05% to 0.18% of GDP depending on the year, but analysis suggests the IRA is expected to be revenue positive overall, reducing the deficit by around 0.2% in 2031.10 Emissions reductions are expected to be significant, cutting CO2 emissions by 30% by 2050 compared to a no additional policy action scenario. The IRA is estimated to lead to a modest GDP increase of 0.1% in 2031, and a more significant increase of 0.6% in 2050 and 2.7% in 2100, illustrating the benefits of climate action – and the high costs of inaction.

Early analysis of the likely effects of the IRA shows that a climate policy mix not oriented around carbon pricing can still be effective at reducing emissions without unnecessarily burdening public finances. However, the risk of base-erosion also persists when emissions are reduced predominantly through tax incentives rather than pricing as demand shifts from fossil fuels to cleaner alternatives. In general, designing effective tax incentives is difficult as they risk distorting the allocation of resources in an economy by providing preferential treatment to certain groups. But when used to address market failures, as in the case of green incentives, they improve efficiency. While there is evidence that tax incentives can encourage investment (Maffini, Xing and Devereux, 2019[11]), not all incentives create additional investment, i.e. investment attracted exclusively by the incentive, and risk being at least partly redundant, i.e. are granted to investment that would have also taken place without the incentive, highlighting the importance to consider the “additionality” of considered tax incentives.11

The risk of base erosion along the net-zero transition and how to address it

Environment-related tax revenue is substantial across OECD countries and regions. The largest component of this comes from energy taxes (notably transport fuels and electricity), followed by transport taxes (mostly on road transport vehicles) (Table 6.1). There are large differences across OECD regions in how much revenue is raised from energy taxes, with European countries raising more revenue mostly because of higher road transport fuel tax rates. In general, however, revenues as a share of GDP have declined over the past two decades, a consequence of changes in the tax base (e.g. improving fuel economy), tax rates (not always increased in line with inflation), and the weight of transport sector in countries’ GDP.

Table 6.1. Environment-related tax revenue in the OECD, % of GDP

2000, 2010 and 2020

|

|

Energy |

Transport |

Pollution |

Resources |

|---|---|---|---|---|

|

2000 |

||||

|

OECD |

1.31 |

0.45 |

0.05 |

0.02 |

|

OECD America |

0.73 |

0.29 |

0.01 |

0.01 |

|

OECD Asia Oceania |

1.19 |

0.69 |

0.01 |

0.01 |

|

OECD Europe |

1.93 |

0.52 |

0.10 |

0.03 |

|

2010 |

||||

|

OECD |

1.16 |

0.42 |

0.05 |

0.02 |

|

OECD America |

0.47 |

0.25 |

0.01 |

0.01 |

|

OECD Asia Oceania |

1.22 |

0.57 |

0.01 |

0.01 |

|

OECD Europe |

1.84 |

0.54 |

0.10 |

0.02 |

|

2020 |

||||

|

OECD |

0.97 |

0.34 |

0.02 |

0.01 |

|

OECD America |

0.51 |

0.21 |

0.01 |

0.01 |

|

OECD Asia Oceania |

0.49 |

0.28 |

0.01 |

0 |

|

OECD Europe |

1.65 |

0.51 |

0.04 |

0.02 |

Source: OECD PINE database: https://www.compareyourcountry.org/environmental-taxes/en/3/185+186+2006+2007/default/2000

The data depicted in Table 6.1 suggest that, from a public finance point of view, the transition to net zero creates the need to address the erosion of the fossil fuel tax base, predominantly in the road transport sector, and more so in European countries than in other regions even though fuel tax and vehicle tax revenue is significant everywhere. As discussed above, carbon tax revenue can compensate part or even most of the declining fuel tax revenue in the medium term. The revenue potential could exceed 2% of global GDP with a carbon price floor of EUR 120/tCO2 (see previous section) and the UK Office for Budget Responsibility (OBR, 2021) estimates the revenues lost from base erosion at circa 1.6% of GDP in 2050, compared to revenues gained from carbon pricing (0.5-1.7% of GDP).

Over the longer term, however, as fossil fuel use declines, carbon tax revenue will also decline, and other options need to be considered. This involves assessing whether and when the declining revenue needs to be compensated, a matter informed by the scarcity of public revenue (as seen in the modelling results depicted previously) and the economic and political economy characteristics of alternative revenue-raising options. One option is to raise revenue not from transport energy but more directly from transport activity itself, e.g. through distance-based charges.

Base erosion in the transport sector: the need for distance-based charges

A key example of the base-erosion risks posed by climate policies lies in the transport sector. Governments have three options for dealing with declining revenues in the sector: choose not to replace the declining fuel tax revenue, look to tax bases outside of the transport sector, or consider tax policy reform within transport. This section discusses the latter option, specifically looking at the potential for distance-base charges as a mobility management and revenue-raising instrument.

In addition to climate policies, other trends including technological advancements and changes in transport use have the potential to erode fossil fuel tax bases in the transport sector. For instance, ongoing improvements in the fuel efficiency of traditional car technologies tend to reduce the demand for fuel. Furthermore, battery electric vehicles and plug-in hybrids are increasingly penetrating the car fleet, reducing the demand for fossil fuels. Systemic transformations in the transport sector may also impact tax revenues as consumer preferences shift away from private vehicles to public transportation or other shared modes of transport.

Fossil fuels are not the only tax base in road transport. Governments typically collect tax revenues from three tax bases: energy use, vehicle stock and road use. Taxes on vehicles reflect a variety of influences beyond the need to raise revenue. Geographic, industrial, social, energy, transport, urban and environmental policy considerations have all had an influence on the level and structure of taxation. Many taxes on vehicles were instituted in a time when cars were considered luxury items, but broadening car ownership has reduced the progressivity of those taxes. Taxes at the point of purchase and recurrent taxes are based on various characteristics, including polluting emissions, weight, engine power, number of axles, age, fuel efficiency, equipment, suspension, cylinder capacity, number of seats, type of fuel or electric propulsion.

The three tax bases in road transport interact and the technological trend towards fuel-efficient and electric vehicles will affect each of the bases differently. The evolution of tax bases in road transport remains uncertain: for example in relation to the speed at which fuel-efficiency increases and alternative technologies will penetrate the vehicle fleet. An OECD analysis for Slovenia (OECD/ITF, 2019[12]), where 14.6% of total tax revenue collected in 2016 came from excise duties and carbon taxes levied on diesel and gasoline used in road transport, developed scenarios for declining fuel tax revenues. The study aligned with the International Energy Agency’s 2°C Scenario for Europe, assuming that alternative fuel technologies account for 25% of passenger car purchases in 2030 and 62% in 2050 – compared to a 2% share in 2017. Under this assumption and with no policy responses, the tax revenue loss from reduced fossil fuel use in private cars would be substantial in the coming decades. Total tax revenues from fuel used in passenger cars in Slovenia in 2050 would be 56% lower than in 2017. The EU proposal for a ban on petrol and diesel vehicle sales by 2035 could exacerbate the impact on revenues. For trucks, the decline in fossil fuel use would likely be less important over the horizon considered because of slower take-up of alternative technologies.

As the fuel tax base erosion will be gradual, given the time it takes for new technologies to enter the fleet, a gradual reform of the tax system is possible but should start soon. Tax reform implementation takes time and requires preparation and discussion with stakeholders, especially when new types of taxes are considered, e.g. distance-based charges that could replace declining fuel tax revenue. To stabilise revenues from the sector, a new mix of taxing distances driven, vehicles and fuel or, more generally, transport energy will be needed.

In the short to medium term, increasing fuel or carbon taxes and regular adjustments of nominal rates to inflation can effectively continue to raise revenue. However, the politics around recent energy price increases, and previously the “yellow vest’ protest movement in France, highlight that such policies may be untenable from a political economy perspective without carefully designed distributional policies. As the fleet penetration of electric vehicles gathers momentum, the revenue potential from fuel taxes will be increasingly limited especially in the passenger car segment of the market. In some countries, fuel tax competition and distributional considerations will also constrain the scope for continued rate increases (Dechezleprêtre et al., 2022[13]).

Over the longer run, revenues can be sustained by gradually increasing fuel or carbon taxes that cover the external costs closely related with fossil fuel use in vehicles and by phasing-in distance-based charges for cars to reflect external costs closely related with driving. Such a tax system would gradually shift revenues to an alternative and likely more stable tax base, namely road use, while further reducing distortions. An efficient distance-based system for passenger cars would set as a base the number of kilometres driven (not annual vignettes). Distance-based charges could be complemented by congestion charges where necessary, keeping in mind that political support may require that the revenues from such local systems also accrue locally. Vehicle taxes may also be part of the tax reform package. An advantage of vehicle taxes is their relatively low administrative burden. However, if the idea would be to cover the shortfall in revenues from fuel excise over time, vehicle taxes would need to increase substantially over time and gradually cover alternative fuel vehicles too. In addition to the political feasibility and equity concerns over such a policy, their limited ability in managing external costs from driving reduces their appeal from a transport and broader mobility perspective.

Careful design and tailored communication are essential for the success of comprehensive tax reform in the road sector, given the involvement of numerous stakeholders. To gain support for tax reform it is necessary to develop a good understanding of the potential negative consequences (e.g. how changes in tax liability from reform distribute along income and spatial dimensions) and to design appropriate policy responses (including improving access to public transport, for example).

Chapter conclusions

The transition to net-zero emissions will have a substantial effect on countries’ public finances. Different policy approaches can increase or decrease public revenues in the net-zero transition, meaning that aggregate global effects mask stark country differences. Governments should carefully consider how their intended climate policy mix affects government revenues. Large revenue gains, as can generally be expected from a carbon pricing-centred mitigation policy approach, could create fiscal space, and this is potentially important given that public funds are scarce in many countries. Creating fiscal space improves economies’ resilience to risk in an era where exposure to catastrophic risk (e.g. from climate change, disease, cyberattacks or war) is rising. Revenues can also be recycled and may be integral to balancing out distributional concerns of carbon pricing and generating public support (Chapter 8).

Non-market-based policy instruments such as subsidies or tax incentives generally imply foregone government revenues, but the example of the Inflation Reduction Act (IRA) suggests they can be designed effectively in tandem with tax increases and expenditure savings to minimise the overall fiscal burden. Importantly, although tax incentives still result in a negative impact on public finances, the budgetary costs take the form of foregone revenue, which tends to be less salient than budgetary outlays or tax increases and can thus improve the political feasibility of tax incentives vis-à-vis other policies.

The indirect effects of climate policy instruments on public finances and their interactions with domestic economic structures mean that climate policy mixes need to be carefully designed for each context. Tax reforms that replace highly distortive taxes with less distortive climate-related taxes (i.e. environmental fiscal reform) may be possible in p The indirect effects of climate policy instruments on public finances and their interactions with domestic economic structures mean that climate policy mixes need to be carefully designed for each context. Tax reforms that replace highly distortive taxes with less distortive climate-related taxes (i.e. environmental fiscal reform) may be possible in principle, but tax policy approaches to climate change and the spending of any revenue that they generate will need to be carefully aligned with the spending needs associated with the transition to net zero, the distributional concerns this raises and the imperative of securing public support for it in principle, but tax policy approaches to climate change and the spending of any revenue that they generate will need to be carefully aligned with the spending needs associated with the transition to net zero, the distributional concerns this raises and the imperative of securing public support for it.

References

[9] Blanchard, O., C. Gollier and J. Tirole (2022), The Portfolio of Economic Policies Needed to Fight Climate Change, https://www.piie.com/sites/default/files/2022-11/wp22-18.pdf.

[10] Celani, A., L. Dressler and M. Wermelinger (2022), “Building an Investment Tax Incentives database: Methodology and initial findings for 36 developing countries”, OECD Working Papers on International Investment, No. 2022/01, OECD Publishing, Paris, https://doi.org/10.1787/62e075a9-en.

[4] Chepeliev, M. (2020), “GTAP- Power Database: Version 10”, Journal of Global Economic Analysis, Vol. 5/2, pp. 110-137, https://doi.org/10.21642/jgea.050203af.

[2] D’Arcangelo, F. et al. (2022), “A framework to decarbonise the economy”, OECD Economic Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/4e4d973d-en.

[8] D’Arcangelo, F. et al. (2022), “Estimating the CO2 emission and revenue effects of carbon pricing: new evidence from a large cross-country dataset”, Working Party No. 1 on Macroeconomic and Structural Policy Analysis, No. ECO/CPE/WP1(2022)7, OECD, Paris.

[13] Dechezleprêtre, A. et al. (2022), “Fighting climate change: International attitudes toward climate policies”, OECD Economics Department Working Papers, No. 1714, OECD Publishing, Paris, https://doi.org/10.1787/3406f29a-en.

[15] Flues, F. and K. van Dender (2020), “Carbon pricing design: Effectiveness, efficiency and feasibility: An investment perspective”, OECD Taxation Working Papers, No. 48, OECD Publishing, Paris, https://doi.org/10.1787/91ad6a1e-en.

[16] Flues, F. and K. van Dender (2017), “Permit allocation rules and investment incentives in emissions trading systems”, OECD Taxation Working Papers, No. 33, OECD Publishing, Paris, https://doi.org/10.1787/c3acf05e-en.

[5] IEA (2022), World Energy Outlook 2022.

[1] IEA (2021), World Energy Outlook 2021.

[11] Maffini, G., J. Xing and M. Devereux (2019), “The Impact of Investment Incentives: Evidence from UK Corporation Tax Returns”, American Economic Journal: Economic Policy, Vol. 11/3, pp. 361-389, https://doi.org/10.1257/pol.20170254.

[7] OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

[6] OECD (2021), Effective Carbon Rates 2021: Pricing Carbon Emissions through Taxes and Emissions Trading, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/0e8e24f5-en.

[14] OECD (2013), Effective Carbon Prices, OECD Publishing, Paris, https://doi.org/10.1787/9789264196964-en.

[12] OECD/ITF (2019), Tax Revenue Implications of Decarbonising Road Transport: Scenarios for Slovenia, OECD Publishing, Paris, https://doi.org/10.1787/87b39a2f-en.

[3] van der Mensbrugghe, D. (2019), The Environmental Impact and Sustainability Applied General Equilibrium (ENVISAGE) Model. Version 10.01, Center for Global Trade Analysis, Purdue University, https://mygeohub.org/groups/gtap/envisage-docs.

Notes

← 1. The same logic holds for carbon emissions which are not due to fuel use, such as industrial process emissions. Carbon pricing on those can encourage a switch to cleaner technology alternatives as well.

← 2. See, e.g. the abatement cost estimates in (OECD, 2013[14]), where it is worth noting that these estimates are derived in a static microeconomic framework that does not allow for learning effects, among others.

← 3. The similarities and differences between these approaches in terms of incentives created are discussed in (Flues and van Dender, 2020[15]), noting that specific policy design features drive performance, and that the differences between both forms of pricing tend to be smaller in practice than in the polar textbook cases.

← 4. For emissions trading systems, even with free allocations, the behavioural incentive to decrease emissions created at the margin remains. Investment incentives, however, can be weakened by free permit allocation depending on the allocation rule, see (Flues and van Dender, 2017[16]).

← 5. The recent EU Energy Tax Directive (ETD) revision proposal, for example, goes in that direction.

← 6. Carbon taxes here are meant as all taxes on greenhouse gases and not CO2 only.

← 7. Responsiveness was measured by the semi-elasticity of CO2 emissions to effective carbon rates, which measures by what percentage CO2 emissions vary when effective carbon rates increase by EUR 1 per tonne of CO2.

← 8. EUR 0 represents maintaining the status quo.

← 9. Estimated Budgetary Effects of H.R. 5376, the Inflation Reduction Act of 2022 (cbo.gov); What's In the Inflation Reduction Act? | Committee for a Responsible Federal Budget (crfb.org).

← 10. assessing-the-macroeconomic-consequences-of-the-inflation-reduction-act-of-2022.pdf (moodysanalytics.com)

← 11. The IMF, OECD, United Nations and World Bank (citation) summarise international evidence suggesting that tax incentives are often found to be redundant and that taxation is only one of many factors that determine investors’ decisions of where to invest – and not the most important factor in developing economies. Without well-functioning infrastructure, macroeconomic stability and a stable rule of law, tax incentives are unlikely to attract (additional) investment. The effectiveness of tax incentives, however, is sector- and incentive-specific and deserves careful monitoring and analysis.