This overview chapter highlights key messages and summarizes relevant findings from each of the reports three substantive parts drawing on the full breadth of the OECD’s multidisciplinary expertise, and synthesises policy recommendations for accelerating resilient action on climate change.

Net Zero+

1. Net Zero+: Introduction and extended summary

Abstract

Addressing climate change has never been more urgent. The Intergovernmental Panel on Climate Change’s Sixth Assessment Report makes it clear that human-induced climate change is under way and accelerating, and that concerted action to rapidly reduce global emissions towards net zero, and to adapt to mounting climate impacts, is imperative.

Climate policies are not designed, nor carried out, in isolation, however. The unprecedented and disruptive events of recent years, including the COVID-19 pandemic and far-reaching implications of Russia’s war of aggression in Ukraine, demonstrate the challenge policy makers face today: how to increase momentum on long-term climate priorities while responding to urgent social and economic needs.

This is the focus of Net Zero+: Building climate and economic resilience in a changing world. Net Zero+ collates climate-relevant findings from across the OECD’s multidisciplinary expertise – for example on environment, economic and tax policy, financial and fiscal affairs, development, science and technology, and employment and social affairs – to provide cohesive recommendations for making the transition to net zero emissions resilient, and as well as building resilience to the impacts of climate change. As such, the project is a major step forward for the OECD’s whole-of-government approach to climate policy.

Figure 1.1. Net Zero+: Climate-relevant policy expertise from across the OECD

Sounding the alarm: Increased likelihood of crossing climate system tipping points

The urgency of the climate crisis is exemplified by the growing risk of crossing climate system tipping points. At certain levels of warming, these “points of no return” for elements of the global climate system would result in irreversible and potentially abrupt changes to our environment. These could occur in timeframes short enough to defy the ability and capacity of human societies to adapt, leading to widespread and catastrophic impacts.

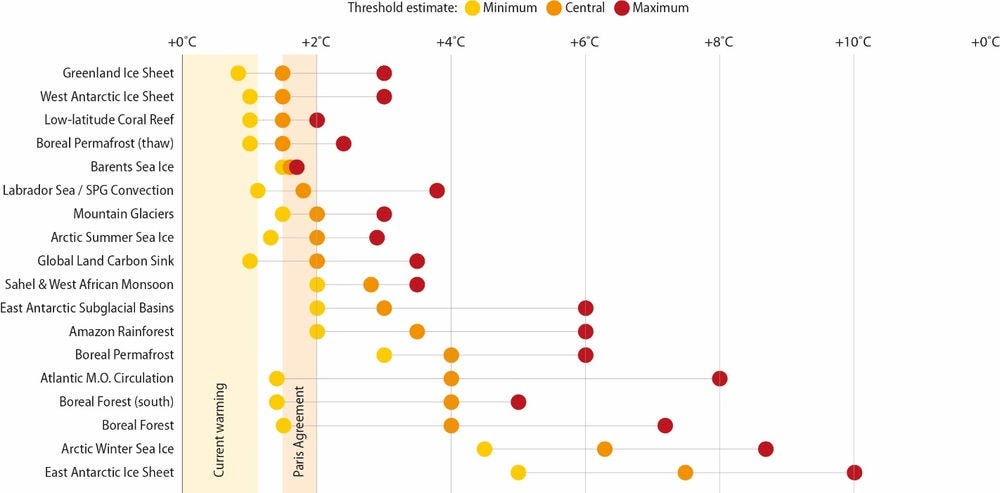

The latest science shows that climate system tipping points are likely to occur at lower levels of warming than previously thought. Already, at current levels of warming, some tipping points cannot be ruled out (Figure 1.2). This has stark implications for near-term policy making. Action on climate change needs to accelerate fast. It is not just about getting to net zero by a particular date; the shape of the pathway to get there matters hugely for lowering the risks of tipping points. Doing everything possible to limit temperature overshoot beyond 1.5°C is therefore essential to minimising tipping point risks.

Figure 1.2. Warming thresholds at which the crossing of climate system tipping points becomes likely

Despite recent progress on emissions reductions, the current pace of action is far too slow. A rapid acceleration is needed. At the same time, COVID-19 and the war in Ukraine have demonstrated the social and economic vulnerability of human systems and the threat that socio-economic disruptions can pose to climate policy resilience.

The systemic nature of climate risks and overlapping crises requires a systemic response

Recovery spending following the COVID-19 pandemic presented an opportunity to enhance climate policy efforts, but evidence shows that, in terms of the environment, it has not quite lived up to the promise of “building back better”. The OECD Green Recovery Database shows that only around one third of total COVID-19 recovery spending was environmentally friendly, and almost 15% of total recovery spending went towards environmentally harmful activities (OECD, 2022[2]). Efforts across countries to address the immediate social and economic consequences of the war in Ukraine offer a similarly mixed picture. Although a shift in government priorities towards energy security has significantly galvanised efforts to decarbonise the energy sector, short-term measures to secure energy supply and offer households untargeted relief from rising living costs – in the form of price support – risk encouraging and locking in longer-term fossil-fuel use, counteracting the net-zero transition.

In addition, the scale and speed of the net-zero transition itself will have profound economic implications on public finances, labour markets and income distribution. Meanwhile, the world grapples with other pressing mega-trends such as a rapidly changing labour market, aging societies, digital transformation of economies and of course environmental impacts related to climate change, biodiversity loss, degrading ocean health and others, and the potential for tipping points within these, all of which will come with their own challenges and opportunities. Designing climate policies with all these implications in mind is key to building economic resilience while also ensuring the resilience and durability of the net-zero transition.

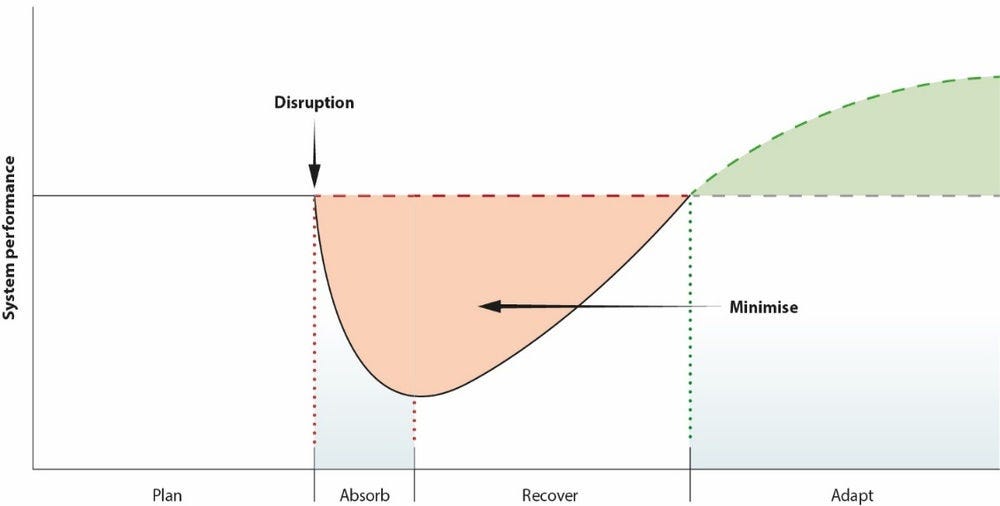

While climate impacts can be foreseen to some degree, the extent of overlap and interaction with other global changes is less clear. This calls for a “resilient by design” systems approach – seeking to be prepared for, and to respond to, multiple disruptions without knowing their exact nature. This requires foresight tools and techniques to help anticipate future shocks, building in buffers to absorb initial impacts and ensuring the availability of resources to invest in recovery efforts. It also requires acknowledgment that some changes may be irreversible and require permanent adaptation to new circumstances.

Figure 1.3. What is systemic resilience?

Despite recent progress, climate change is not yet sufficiently mainstreamed into core economic policy. Mitigation and adaptation remain largely compartmentalised from each other and are dealt with separately from other environmental challenges such as biodiversity. A systemic approach to resilience requires breaking down these silos, and identifying interactions and joint opportunities, for example across climate change mitigation, adaptation and tackling biodiversity loss.

Box 1.1. Policy recommendations: Responding to increasing climate risks amidst concurrent global crises

Act now to avoid potential catastrophic impacts from climate system tipping points (Chapter 2)

Take all possible measures to limit global warming to 1.5°C with limited or no overshoot.

Strengthen Nationally Determined Contributions (NDCs) before 2025, prioritising accelerated emissions reductions now.

Prepare for the possibility of climate system tipping points being triggered even if 1.5°C is achieved.

Enhance monitoring and early warning systems and modelling of likely impacts. Consistently review and evaluate implemented policies.

Make climate action resilient in the face of unpredictable and overlapping global disruptions (Chapter 3)

Ensure that spending for crisis relief and economic stimulus is aligned with, rather than acting in opposition to, climate goals.

Make climate strategies as “future-proofed” as possible (Chapter 4)

Focus policy making on system-wide alignment with climate goals rather than individual components or outcomes.

Look beyond short-term efficiency in order to better absorb future shocks and limit the need for emergency intervention.

Stress test net-zero strategies through tools such as strategic foresight.

Mitigation, no matter what: A resilient net-zero transition

A resilient net-zero transition necessitates a fair and globally co-ordinated response, with policy approaches tailored to differing national circumstances, and including financial and non-financial support to developing countries.

Governments first need to get the policy basics right. This means establishing clear long-term policy frameworks, setting overarching goals and interim targets that align with these, and ensuring regular monitoring and review of progress. It also means considering the full range of climate policy instruments and tailoring the policy mix to national circumstances, including phasing out fossil-fuel subsidies.

These policy basics can be supported by public governance tools such as employing “green budgeting” to better orient public expenditure towards the transition and using public procurement to drive demand for green products and services. A successful transition requires a genuinely “whole of government” approach, and institutions at the centre of government can play a key role in co-ordinating and aligning policies across departments. Subnational governments are equally important and are often the driving force behind implementing specific policy instruments on the ground.

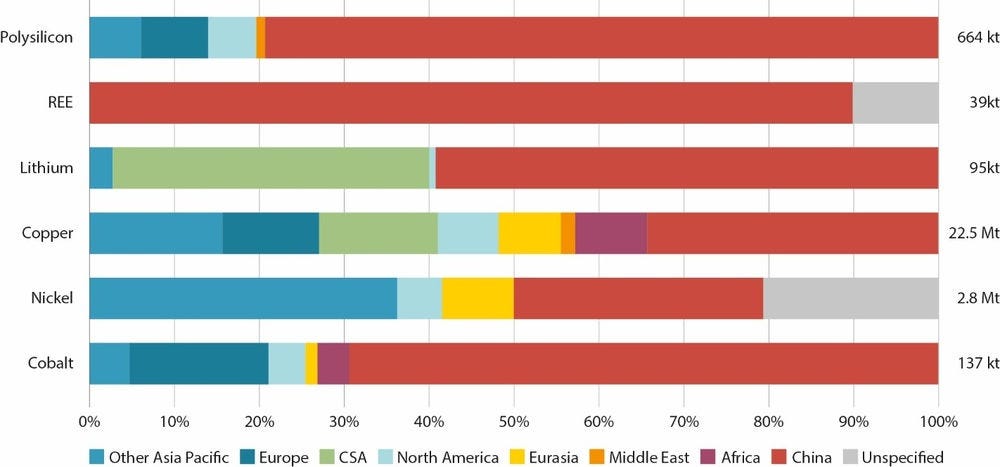

A resilient net-zero transition requires more than just increasing the scale and speed of policy action, but also an awareness of potential bottlenecks that could slow down or derail the transition, and the development of strategies to anticipate and overcome such challenges. Materials shortages, supply-chain vulnerabilities, skills gaps, lengthy permitting processes and rising costs of capital are just some areas where potential bottlenecks could slow down climate action. As just one example, the transition towards net-zero emissions needs a reliable supply of critical materials, which are currently highly concentrated geographically, not only in terms of their origin but also in processing and production (Figure 1.4) Governments therefore need to encourage increased diversity of supply chains, particularly considering lessons learned from the energy crisis induced by the war in Ukraine.

Figure 1.4. Regional shares of global production of selected critical materials, 2021

Public finance risks cannot be overlooked

The net-zero transition will cause significant shifts in economic activity and require substantial mobilisation of public resources. It is therefore imperative to consider the longer-term financial implications of different climate policy approaches. Recent crises have further underlined the importance of public finances to enable economic recovery and leverage private investment, but the large fiscal deficits incurred in the last few years cannot be sustained over coming decades.

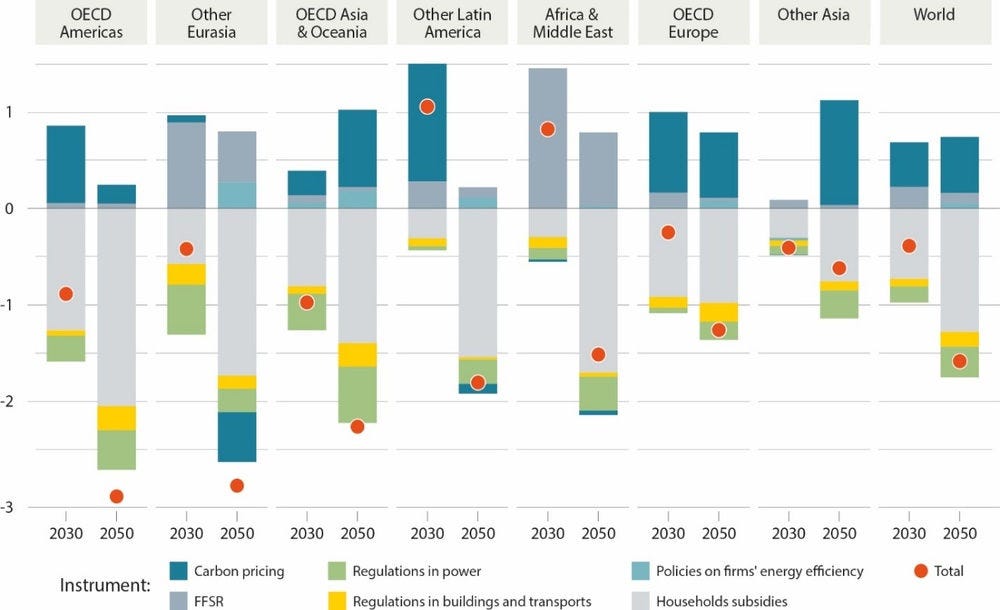

New OECD modelling of the public finance implications of a transition to net zero shows that the interaction between different climate policy mixes and domestic economic structures results in highly heterogeneous implications for public finances. While some policy measures increase public revenue over time, others decrease it. Overall, public revenues in the modelled scenario decrease by amounts equal to between 0.7 and 3.4% of GDP (Figure 1.5). This implies that governments will need to find alternative sources of revenue to make up for changes in the fiscal base due to the transition. For instance, if mitigation policy is designed to be growth-enhancing, new revenues could compensate for the erosion of tax bases. Differences due to varying policy tools, as well as across regions, underline the role of careful fiscal planning as part of climate policy design. The modelling also highlights the importance of taking interactions between policies, and their potential indirect effects on public revenues, into account.

Figure 1.5. Changes in net public revenues in a net-zero scenario range from -0.7% to -3.4% of baseline GDP in 2050, depending on the region

Note: Note: The black diamonds correspond to the full Net-Zero Ambition scenario, which implements the policy instruments altogether. It differs from the sum of the effects of individual policy instruments depicted in the bars due to interactions between the different policy instruments. FFFR=fossil fuel subsidy reform.

Source: OECD ENV-Linkages model.

Mission-driven innovation is essential

According to the International Energy Agency’s Net‐Zero Emissions by 2050 Scenario, half of the global reductions in energy-related CO2 emissions through 2050 will need to come from technologies that are not yet fully commercialised (IEA, 2021[5]). Yet recent trends indicate that innovation is not keeping pace. Low-carbon technology patents are declining while trademarks increase, implying that new innovations are slowing as more mature technologies come onto the market. Similarly, venture capital investments in climate-relevant technologies focus predominantly on early and late-stage technologies rather than seed money critical to supporting innovation efforts. Analysis shows that current policy portfolios put too much emphasis on deployment and not enough on research and development.

To reverse these trends, governments need to reorient policies towards research and development and take a mission-oriented approach to drive outcomes across the whole innovation chain, also considering the effects that core climate policies such as carbon pricing and standard setting can have on innovation.

A successful net-zero transition will be fair, equitable and publicly supported

Achieving net zero by 2050 requires important changes across society and the economy, predicated on the actions and attitudes of governments and citizens. Ensuring that the transition is effective, fair and equitable will maintain strong and widespread public support for ambitious action, a key prerequisite for resilient policies. For governments, this means implementing policies that make credible progress towards environmental objectives; ensuring trust in government itself; addressing and communicating the distributional effects of climate policies and of climate impacts; and assessing and acting on the labour market shifts induced by these policies.

The impacts of climate policies on people are widespread and complex, with implications for gender inequality, and intersecting with other megatrends including digitalisation and demographic change, as well as the impacts of climate change themselves. Climate policies have indirect as well as direct effects on household income. These can be similar in magnitude, but the indirect effects are often overlooked in distributional assessments. Regional heterogeneity is also an important consideration. In terms of labour market shifts, a better understanding of skills needs in the transition is essential, including identifying potential bottlenecks and designing reskilling programmes to avoid them. Reasonably flexible employment and social policies, based on careful analysis, will play a critical role in both facilitating the low-carbon transition and in maintaining strong public support for climate action.

Aligning finance and investment with net zero goals

Public finances alone will not be enough to meet transition needs. Aligning investment and financial markets and securing private sector buy-in is critical, but current commitments too often lack credibility. Environment, Social and Governance (ESG) investing could become a conduit for change but is held back by a lack of standardisation and evidence of greenwashing.

Businesses have a key role in scaling up climate ambition and implementing net-zero transitions, channelling policy commitments and related finance and investment into aligned activities across the real economy. The contribution of private-sector commitments to a resilient transition relies on commitments being implemented with environmental integrity, avoiding greenwashing and safeguarding against adverse impacts across other areas of business’ operations or responsibilities.

The need for a global response

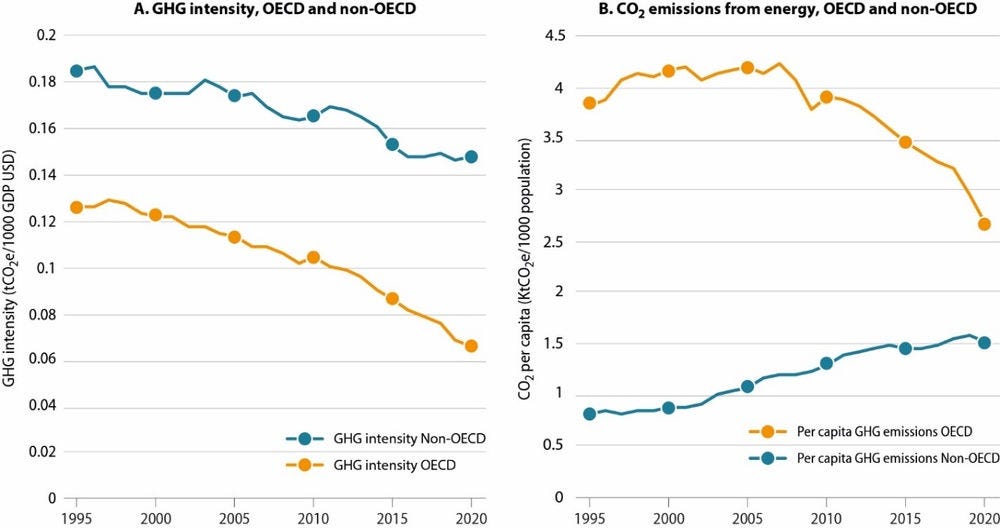

Given the global nature of climate change and highly interconnected economies, a resilient and durable transition to net-zero requires a global response. Developing countries – both the source of the majority of future emissions and most exposed to future impacts of climate change – will require international support to meet development needs while decarbonising their economies and building resilience to climate impacts, as captured in IPAC data (Figure 1.6). This implies international co-operation at several levels, which is of increasing importance in the current context of heightened international tensions.

Figure 1.6. Per-capita emissions have fallen in the OECD but are increasing in non-OECD countries

Note: The underlying GDP data used for this chart stems from (OECD, 2023[6]); the underlying CO2 emissions data stems from (IEA, 2022[7])..

Source: (IEA, 2022[6]).

The UNFCCC process remains central and delivered important agreements at the COP26 and COP27 climate conferences in 2021 and 2022, covering mitigation, adaptation, finance, and loss and damage. Beyond multilateralism, strategic partnerships to ensure necessary support to developing countries, including just transition partnerships, and to diversify clean energy supply chains, remain crucial. Development assistance can play an essential role here, but is currently not sufficiently aligned with climate objectives. Moreover, developing countries continue to face much higher capital costs for low-carbon technology investments. Overcoming this barrier is paramount to climate policy success. The OECD’s Inclusive Forum on Carbon Mitigation Approaches (IFCMA) can also play a key role to improve trust and transparency in countries’ policy approaches.

Box 1.2. Policy recommendations: Safeguarding the resilience of the net-zero transition

Get policy basics right

Consider the full range of policy tools, including price-based and non-priced-based instruments, including reforming fossil-fuel subsidies, tailoring climate policy mixes to regional, national and local circumstances.

Integrate climate policy making across all of government, making use of public governance tools such as “green budgeting” and including sub-national institutions and governments to foster implementation.

Identify and address potential bottlenecks to the net-zero transition (Chapter 5)

Address public finance implications (Chapter 6)

Employ careful fiscal planning to ensure the resilience of public finances in the net-zero transition, taking the direct and indirect effects of policy instruments into account.

Plan for the gradual introduction of new tax instruments designed to maintain fiscal resilience during the transition, such as distance-based vehicle charges.

Adopt a mission-oriented, outcome-based approach to drive the innovation cycle (Chapter 7)

Focus on targeted support measures for early-stage innovation and R&D.

Embed innovation policy within complementary climate policies including carbon pricing and technology support and standards and implement related education and skills development policies.

Ensure that the net-zero transition is publicly supported (Chapter 8)

Prioritise effective, accurate, clear, and easily accessible communication with the public about how policies work and what their distributional impacts will be.

Combat dis- and mis-information by agreeing on common data standards to monitor climate change.

Ensure that the net-zero transition is fair and equitable (Chapter 8)

Carefully assess direct and indirect distributional impacts of climate and consider multiple options for revenue recycling, tailoring these to local contexts and clearly communicating.

Support new employment patterns by ensuring reasonable labour market flexibility and mobility while simultaneously promoting job quality and protecting workers from unfair practices.

Identify skills needs and bottlenecks through long-term planning and prioritise up- or re-skilling workers to meet such needs through targeted support.

Align finance and private sector action with climate mitigation goals (Chapter 9)

Prioritise further research, improved data collection, and strengthened co-ordination to support better climate alignment of finance.

Harness market practices such as ESG investing to accelerate the mobilisation and reallocation of capital towards net zero-aligned investments and ensure that both FDI and investment treaty policies are aligned with climate objectives.

Recognise and address the barrier presented by rising costs of capital to low-carbon investments.

Leverage responsible business conduct tools and due diligence guidance to drive private sector-led climate action.

Leverage the interlinkages between climate action and development (Chapter 10)

Draw on all levers of development co-operation to develop a ‘global approach’ that aligns climate and development objectives.

Building systemic resilience to unavoidable climate impacts

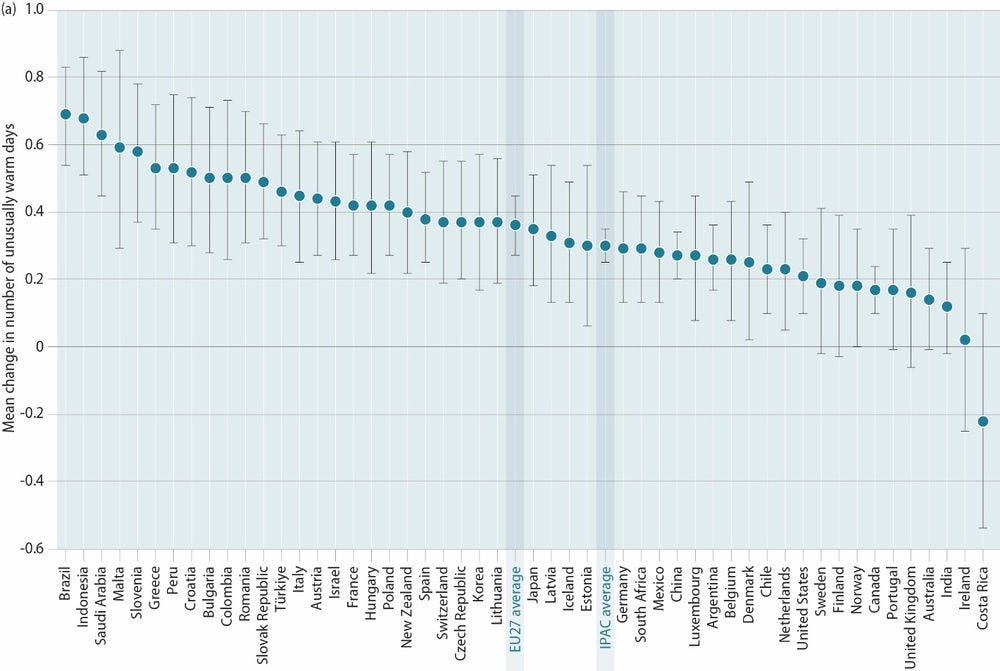

Some climate impacts are already “baked in”. In 2021 alone, the global direct costs of extreme climate‑related events were estimated at EUR 265 billion (Munich Re, 2022[7]), and IPAC data highlights observable changes (Figure 1.7).

Figure 1.7. Mean annual change in the number of unusually warm days over the period 1979-2021

Increased adaptation efforts will be necessary to limit losses and damages resulting from climate change impacts. Here too, a systemic approach is needed, shifting from responses to specific climate risks in favour of building overall resilience. This requires continuous and thorough assessment of hazard, exposure and vulnerability risks, taking regional circumstances into account. Adaptation efforts and overarching governance frameworks must be proactive and dynamic.

There are limits to adaptation, however. The threat of climate tipping points reinforces the urgent need for mitigation. Synergies between the two abound, and there is a clear need to overcome the division of climate policy between adaptation and mitigation. For example, efforts to restore forests or mangroves create an opportunity to increase ecosystems’ carbon storage capacity, while also contributing to the reduction of weather-related risks, such as landslides or coastal storm surges.

There are also important linkages between climate action and other environmental crises such as biodiversity loss. Marine and terrestrial ecosystems are natural carbon sinks, with an annual gross sequestration equivalent to about 60% of global anthropogenic emissions (IPBES, 2019[9]). Conserving, restoring and improving the management of forests, grasslands, wetlands and agricultural lands, could deliver an estimated 23.8 gigatonnes of cumulative CO2 emission reductions by 2030 (OECD, 2021[10]). Nature-based solutions offer one example of how such synergies can be harnessed to produce cost-effective win-win policy options, but implementation remains minimal due to a lack of awareness regarding their effectiveness, challenges in quantifying costs and benefits, and their omission from climate policy taxonomies and legal structures.

Aligning finance and investment with building resilience

Increased investment in adaptation will be critical for building resilience to the physical impacts of climate change. Finance flows must be aligned with climate-resilient development, and mobilised as additional resources for necessary adaptation measures. Estimated adaptation financing needs for developing countries alone stand at USD 140-300 billion per year by 2030 and USD 280-500 billion per year by 2050 (UNEP, 2021[11]). Progress is being made to fill this gap. Mitigation finance still represents the majority of climate finance provided and mobilised by developed countries (58% in 2020), but adaptation finance almost tripled between 2016 and 2020 (OECD, 2022[12]). However, tracking adaptation finance remains challenging due to a lack of common definitions. Existing estimates rely primarily on development assistance and other forms of international public finance.

The gap in adaptation investment cannot be filled by public funds alone. Thus, all finance flows and investments need to be aligned with resilience objectives to ensure they do not undermine adaptation efforts. The trillions of euros in investments made each year will only be re-directed if the enabling environment is strengthened. Governments play a key role in this through generating and sharing information on climate risks, communicating clear adaptation objectives, and applying economic and regulatory instruments. The strategic use of grant or concessional finance by multilateral development banks can be highly impactful but will require institutional reforms.

There is also growing interest in climate resilience issues within the financial sector itself, driven by the increasingly visible costs of climate-related extreme events and increasing financial opportunities offered by a changing climate. The insurance sector, in particular, has a unique role to play in building resilience to climate impacts, acting as both investor and provider of protection. Governments’ role includes mandating adequate climate risk monitoring in the insurance sector and reviewing regulation that impedes insurers’ ability to set risk-reflective premiums. With increasing global temperatures and mounting impacts, the global risk landscape is changing and incentives to invest in adaptation are rising. In order to harness this interest, investors themselves will need to demonstrate demand for adaptation-aligned investment opportunities and articulate frameworks and minimum standards for what information they require from investees. Several initiatives are under way, but challenges around the measurement of financial flows and collection of data persist.

Box 1.3. Policy recommendations: Building systemic resilience to climate impacts

Assess climate impacts and adaptation needs (Chapter 11)

Continue mainstreaming climate change adaptation throughout national policy processes. Establish comprehensive adaptation planning and careful monitoring and review of implemented policies.

Develop appropriate measurement tools. Make and regularly update hazard, exposure and vulnerability assessments.

Apply a systems approach (Chapter 12)

Conduct careful analysis to exploit synergies and minimise trade-offs between interlinked mitigation and adaptation policy objectives, and between climate and other environmental objectives.

Identify opportunities for, implement, and monitor nature-based solutions (NbS) to foster adaptation-mitigation synergies.

Take a systems-level view of climate resilience in key systems. For example, beyond providing incentives and education for farm-level adaptation, assess and act on vulnerabilities across the entire food system.

Financing adaptation in a world of rising risks (Chapter 13)

Scale up funding for the wide range of adaptation measures needed to respond to the impacts of climate change.

Support the alignment of financial flows with adaptation needs.

Consider the role of government in harnessing the double role of the insurance sector as both investor and insurance provider, for example through regulation of climate-risk assessment.

Box 1.4. Development and structure of the OECD Horizontal Project on Climate and Economic Resilience

OECD horizontal projects take full advantage of the OECD’s multidisciplinary expertise by engaging multiple committees to work on topics that cut across policy areas.

Guided by cross-OECD governance and co-ordination structures, in addition to an external high level Expert Advisory Panel1, and overseen by the OECD Environment Policy Committee, Net Zero+ is a key example of the OECD’s organisation-wide response to climate action in practice.

The Net Zero+ synthesis report brings together work carried out under the first phase of the OECD’s horizontal project on climate and economic resilience, launched by OECD Council in 2021.

The project’s first phase, carried out over (2021 and 2022) was structured around four modules.

Module 1: framing climate and economic resilience post-COVID-19.

Module 2: accelerating the transition to net-zero emissions and making it resilient.

Module 3: building systemic resilience to impacts of climate change.

Module 4: initial phase of the International Programme for Action on Climate (IPAC).2

The project’s second phase will take place over 2023-24. Phase 2 will continue to focus on climate and economic resilience, covering both resilience of the net-zero transition and building resilience to climate impacts. In addition, a new work area has begun with a focus on enabling transitions and supporting governments in identifying and removing barriers that prevent faster climate action. In parallel, the IPAC programme will continue to develop data and indicators for tracking progress. Overall, the work will embrace a number of cross-cutting themes including implications for gender equality, representing the perspectives of developing countries and focusing on capacity building of policy makers and government capabilities.

1. See list of panel members at https://www.oecd.org/climate-change/net-zero-resilience/

2. IPAC provides governments with comparable and comprehensive datasets, annual evaluation of action and best practices on progress towards the transition to net-zero emissions. While IPAC has delivered its own set of deliverables, IPAC data and indicators underpin the analysis in the wider project. See https://www.oecd.org/climate-action/ipac/

Reaching net zero in a rapidly changing world

Climate policy makers today face conflicting and competing needs for immediate and accelerated climate action at the same time as they must respond to social and economic crises, upended global markets and value/supply chains, geopolitical tensions, and a slow economic recovery. The Net Zero+ project and report speak to these tensions and offer a way through them.

Net Zero+ is about how we reach net zero in a rapidly changing world – it is about making sure climate policies are both ambitious and resilient in a world of overlapping disruptions. This means building resilience to the impacts of climate change itself, and designing policies that fully take socio-economic implications and considerations of fairness and equity into account.

The task is momentous and the stakes could not be higher – but through bold and deliberate policy making a resilient net-zero future is possible.

References

[4] IEA (2023), Energy Technology Perspectives 2023.

[6] IEA (2022), Greenhouse Gas Emissions from Energy.

[5] IEA (2021), Net Zero by 2050: A Roadmap for the Global Energy Sector, OECD Publishing, Paris, https://doi.org/10.1787/c8328405-en.

[9] IPBES (2019), Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services, https://doi.org/10.5281/zenodo.6417333.

[8] Maes, M. et al. (2022), “Monitoring exposure to climate-related hazards: Indicator methodology and key results”, OECD Environment Working Papers, No. 201, OECD Publishing, Paris, https://doi.org/10.1787/da074cb6-en.

[1] McKay, A. et al. (2022), “Exceeding 1.5°C global warming could trigger multiple climate tipping points”, Science, Vol. 377/6611, https://doi.org/10.1126/science.abn7950.

[7] Munich Re (2022), Hurricanes, cold waves, tornadoes: Weather disasters in USA dominate natural disaster losses in 2021, https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2022/natural-disaster-losses-2021.html.

[13] OECD (2023), “Labour Force Statistics: Population and vital statistics”, OECD Employment and Labour Market Statistics (database), https://doi.org/10.1787/data-00287-en (accessed on 3 February 2023).

[12] OECD (2022), Aggregate Trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020, Climate Finance and the USD 100 Billion Goal, OECD Publishing, Paris, https://doi.org/10.1787/d28f963c-en.

[2] OECD (2022), “Assessing environmental impact of measures in the OECD Green Recovery Database”, OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/3f7e2670-en.

[10] OECD (2021), “Biodiversity, natural capital and the economy: A policy guide for finance, economic and environment ministers”, OECD Environment Policy Papers, No. 26, OECD Publishing, Paris, https://doi.org/10.1787/1a1ae114-en.

[3] OECD (2020), A Systemic Resilience Approach to dealing with Covid-19 and future shocks, New Approaches to Economic Challenges, Paris, https://read.oecd-ilibrary.org/view/?ref=131_131917-kpfefrdfnx&title=A-Systemic-Resilience-Approach-to-dealing-with-Covid-19-and-future-shocks (accessed on 26 July 2022).

[11] UNEP (2021), Adaptation Gap Report 2021 The Gathering Storm - Adapting to Climate Change in a Post-pandemic World.