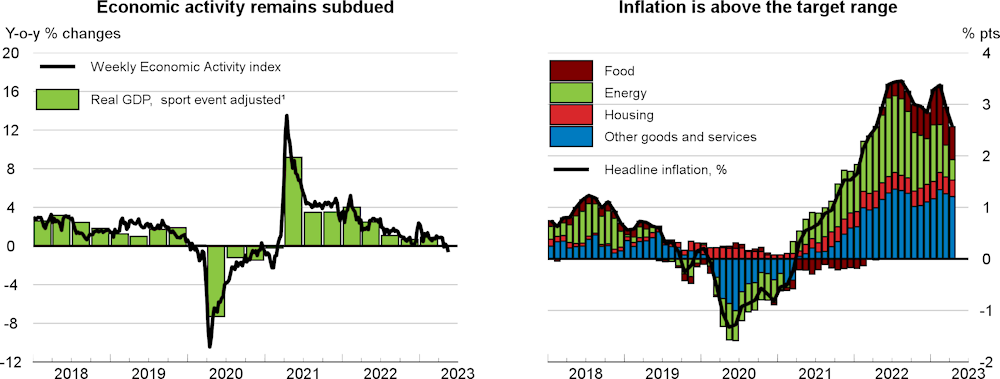

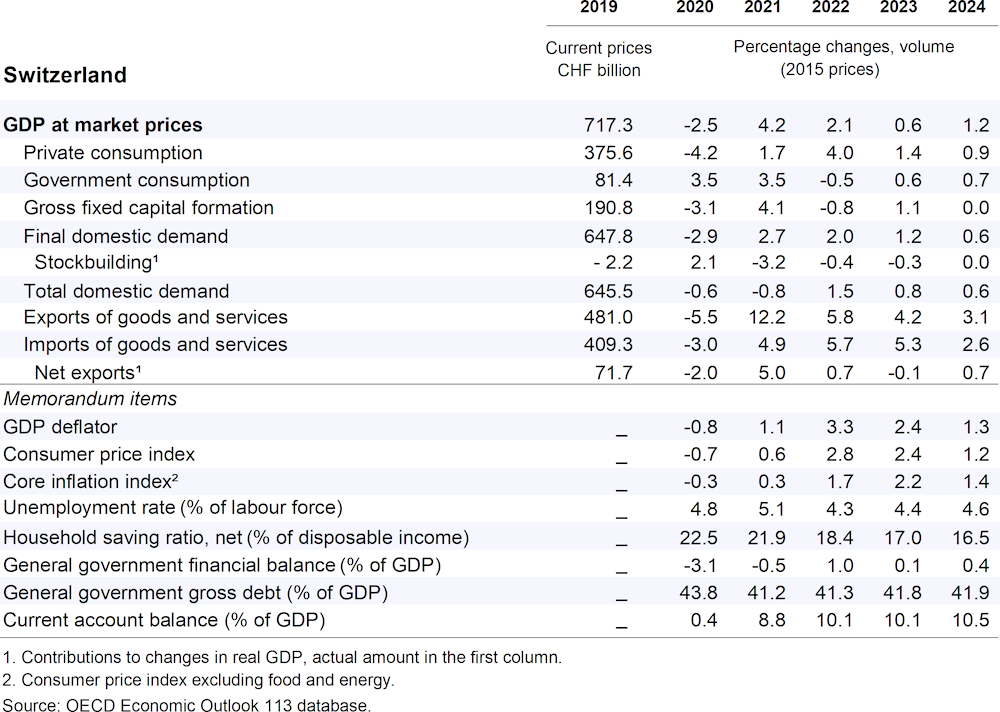

The economy is projected to grow by 0.6% in 2023 and 1.2% in 2024. Tighter financial conditions, subdued economic sentiment and heightened inflation will moderate household consumption and private investment. Geopolitical tensions and elevated uncertainty will reduce trade. Headline inflation will remain above the Swiss National Bank’s target range of 0-2% in 2023, before moderating towards the end of that year. Financial market stress, house price corrections and a further weakening of foreign demand are key downside risks to activity.

Monetary policy will need to be tightened further to ensure that inflation returns to the target range, and risks to financial stability will need to be closely monitored. Continued fiscal surpluses are appropriate, but targeted measures to assist the most vulnerable households should be maintained. Structural policies are needed to increase labour market integration among under-represented groups, and to raise energy efficiency to help ensure energy security and improve environmental sustainability.