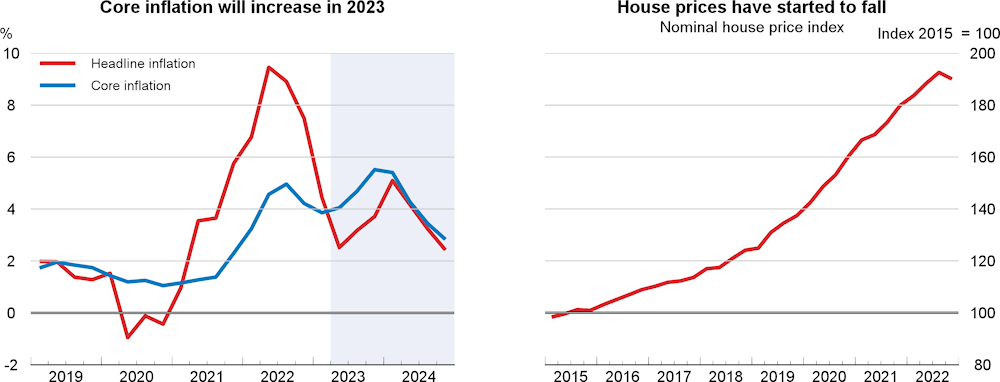

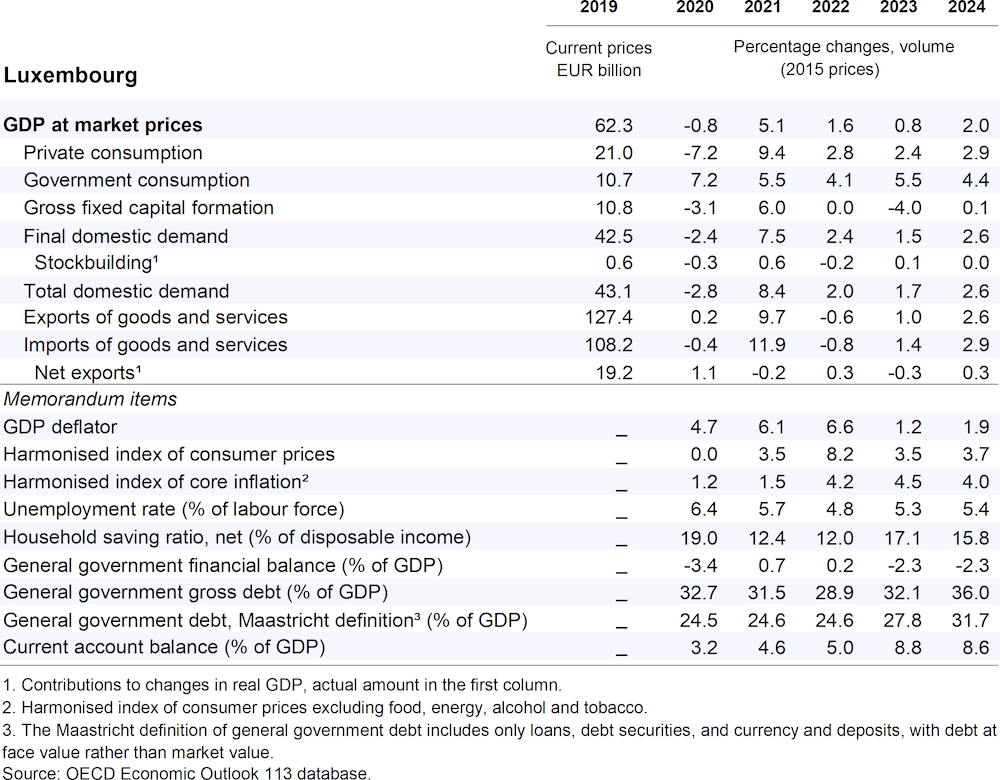

GDP growth is projected to slow to 0.8% in 2023 from 1.6% in 2022 before picking up to 2% in 2024. Measured activity in the key financial and insurance services sector is weakening, and tightening financial conditions are slowing private investment. Domestic consumption will sustain activity in 2023 and 2024, and a partial recovery in net exports and investment will boost growth in 2024. Risks are tilted to the downside, as the looming housing market correction might have a larger-than-expected impact on private consumption. Measured activity is highly sensitive to financial market prices and developments.

While some mild fiscal expansion might be warranted to sustain consumption in the short term, energy-related support should be phased out and the fiscal stance tightened as the economy recovers. Looking ahead, reforming the pension system to ensure long-term fiscal sustainability should be a priority. A reform of the wage indexation system to restrict indexation to non-energy price inflation should also be considered. Family policies to bring the working time of women more in line with that of men should be strengthened.