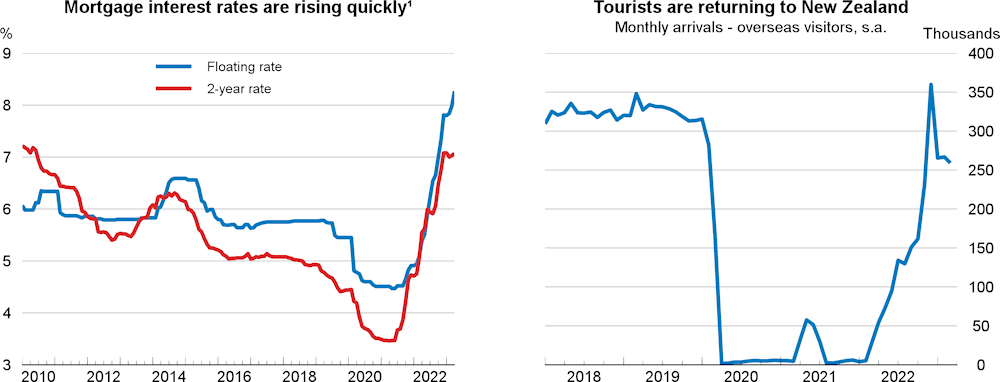

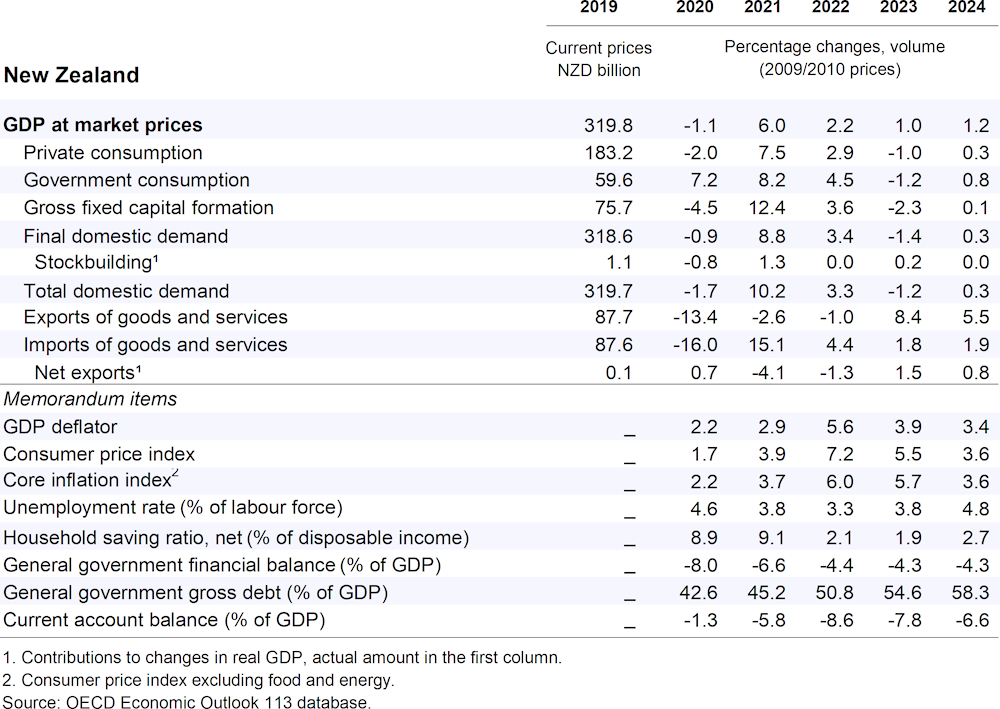

Real GDP growth is projected to ease to 1% in 2023 and 1.2% in 2024. Private consumption is set to weaken due to lower employment growth and rising mortgage-servicing costs. Higher interest rates and declining house prices will weigh on investment. Unemployment is expected to increase throughout the projection period, on the back of weaker activity growth. The slowdown in demand, increasing spare capacity and stabilising energy prices should gradually reduce inflation through 2023-24.

Inflation remains well above the central bank’s target range and, together with still elevated medium-term inflation expectations and rapid wage growth, requires monetary policy to remain restrictive. Public debt has risen substantially in recent years and fiscal consolidation should continue to ensure that the government is on track to meet its 2026 operating surplus target. This will also help reduce inflationary pressures. Reforms that strengthen ICT skills supply are essential for sustainably boosting productivity and growth.