This chapter reviews the business sector’s research and development (R&D) and innovation performance in Korea, drawing on extensive qualitative and quantitative analysis, including a benchmarking of the country’s technology specialisation in digital and green technologies. It highlights the challenges posed by the polarisation of business innovation performance across different sectors and between larger and smaller firms. Finally, it discusses the recent policy reforms taken to address these imbalances as well as the need for adjusting the policy mix for business innovation to ensure Korea’s business sector can seize the opportunities of the digital and green transitions.

OECD Reviews of Innovation Policy: Korea 2023

3. Business sector research and development and innovation in Korea

Abstract

Korea has built a very innovative and dynamic business sector, which has been the engine of economic growth and prosperity. However, the success of the Korean business sector has been overshadowed by acute discrepancies across firms and industries: 1) an innovation divide between large firms and small and medium-sized enterprises (SMEs); 2) the productivity gap between information and communication technology (ICT) and non-ICT industry; and 3) a disparity in innovation investments between manufacturing and services.

The chapter begins with a general diagnosis of business sector R&D and innovation in Korea that is followed by a series of policy recommendations.

First, the exceptionally high concentration in R&D spending on the few largest companies in Korea sheds light on the growing discrepancy between large companies and SMEs. A significant gap in R&D investment has resulted in an innovation divide between larger and smaller firms and a decline in the ability of SMEs to absorb new technologies and further their digitalisation. The strong commitment and support for SMEs by the government is encouraging, and there is evidence of a maturing start-up ecosystem, especially around Seoul. The government should sustain its support for SMEs and start-ups with more streamlined and impact-oriented programmes. In particular, the government could strengthen support for the global connectivity of SMEs and start-ups to help scale up and reach new markets.

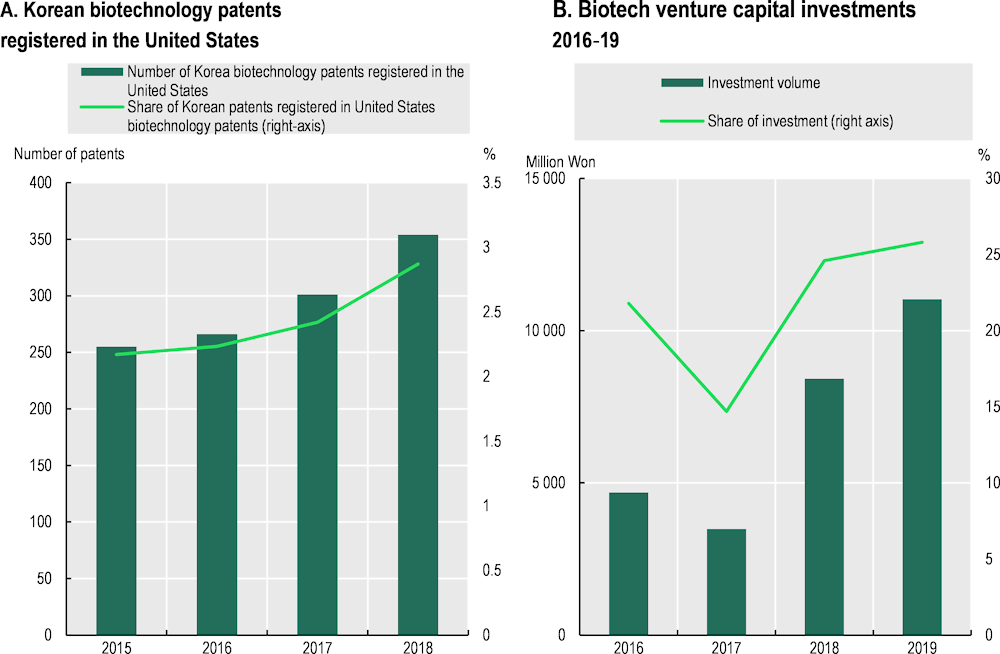

Second, the ICT industry in Korea has achieved remarkable growth and is now a global leader. However, there is also a widening discrepancy between ICT and non-ICT industry in various aspects ranging from R&D investment to productivity. In fact, the productivity of the non-ICT manufacturing industry is only half that of the ICT manufacturing sector. The government has long strived to support the diversification of its industrial landscape and reduce its reliance on the ICT industry. In this regard, the emergence of the biotech industry is impressive. The share of Korean biotechnology patents has increased significantly, and so has the number of biotech start-ups. The growth of the biotech industry is especially noteworthy in that the public R&D investment paved the way for its successful take-off. The government should continue to foster new and emerging technology-based firms and industries by promoting collaborative R&D and innovation activity across different firms and with academia.

Finally, the large discrepancy in productivity and investment between the manufacturing and the service industry persists despite active government support. Meanwhile, knowledge-based services, notably the software industry, offer the potential for higher value-added and balanced growth in the Korean economy. The government should enhance the role of services by developing a dedicated innovation strategy and addressing remaining regulatory barriers. In particular, the government should support the expansion of “servicification”, which represents the phenomenon whereby services are increasingly embedded in manufacturing products.

3.1. A general assessment of business innovation in Korea

This section describes Korean business research and development (R&D) and innovation performance and overall strengths based on different indicators. It highlights some of the critical imbalances in business sector innovation performance, notably the dominance of large manufacturing-based R&D, that prevent Korea from harnessing its full productivity potential through innovation in services and by smaller firms. Recognising the positive contributions of recent policies to address the imbalances in business innovation performance, the section advocates for well-designed policy support for emerging technologies to help Korea’s business sector seize the opportunities from the digital and green transitions, not only in manufacturing but also in services.

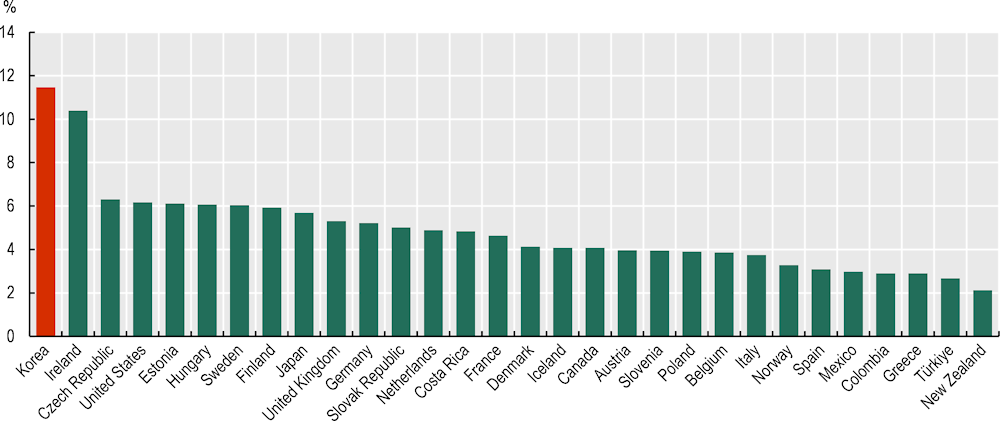

3.1.1. Korean business R&D has grown rapidly and leads globally

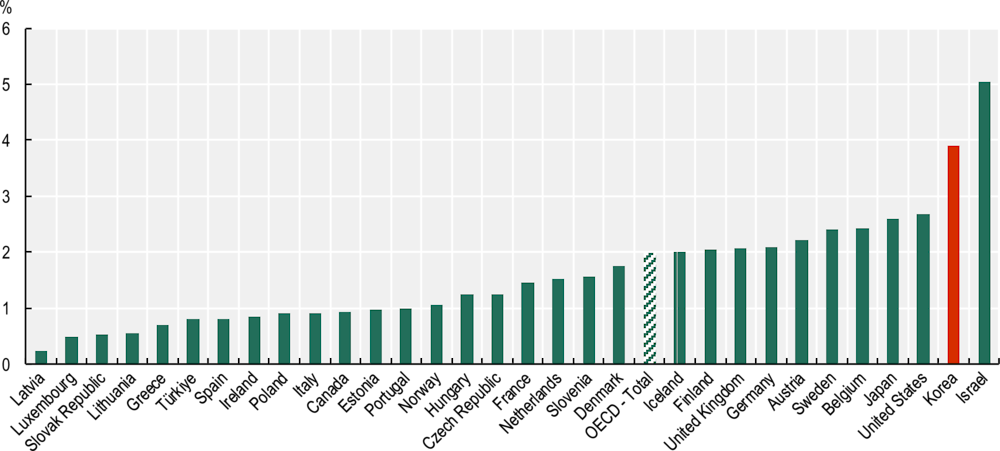

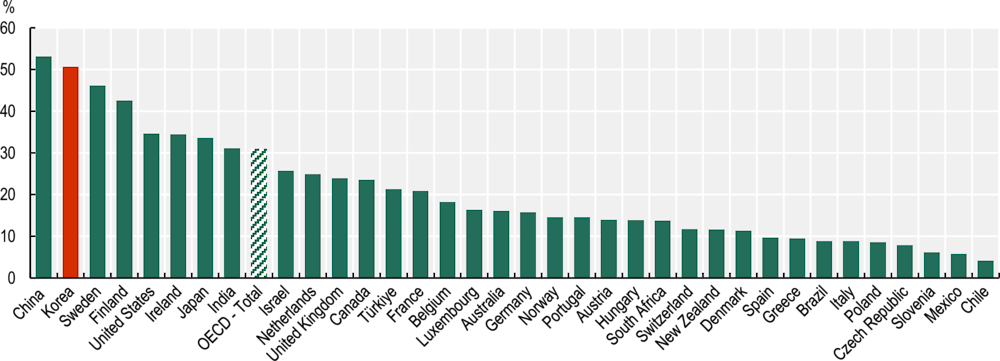

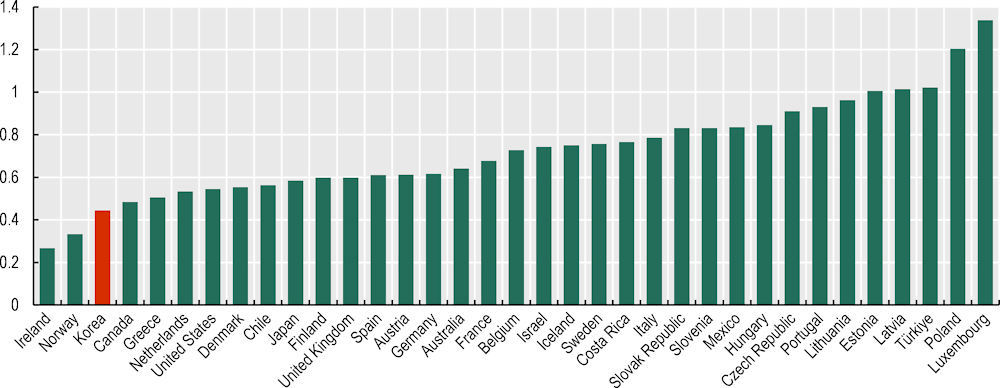

Business sector R&D in Korea more than doubled from KRW 32.8 trillion (Korean won) in 2010 to KRW 68.8 trillion in 2019 (OECD, 2021[1]). Moreover, business enterprise expenditures on R&D (BERD) amounted to 3.9% of gross domestic product (GDP) in Korea in 2021, which is more than double the OECD average and the second-highest business R&D intensity among all OECD countries, behind Israel (Figure 3.1) (OECD, 2023[2]). In terms of business R&D expenditure, 60 of the global top 2 500 firms are Korean, including Samsung Electronics and other chaebols. In 2020, Korea hosted the highest number of R&D players after the United States (779 firms), the People’s Republic of China (hereafter “China”) (597), Japan (293), Germany (124), the United Kingdom (105), Chinese Taipei (86) and France (66) (European Commission, 2022[3]).

Figure 3.1. Business enterprise expenditures on R&D as a percentage of GDP, OECD countries, 2021

Source: OECD (2023[4]), "Main Science and Technology Indicators", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en (accessed on 8 June 2023).

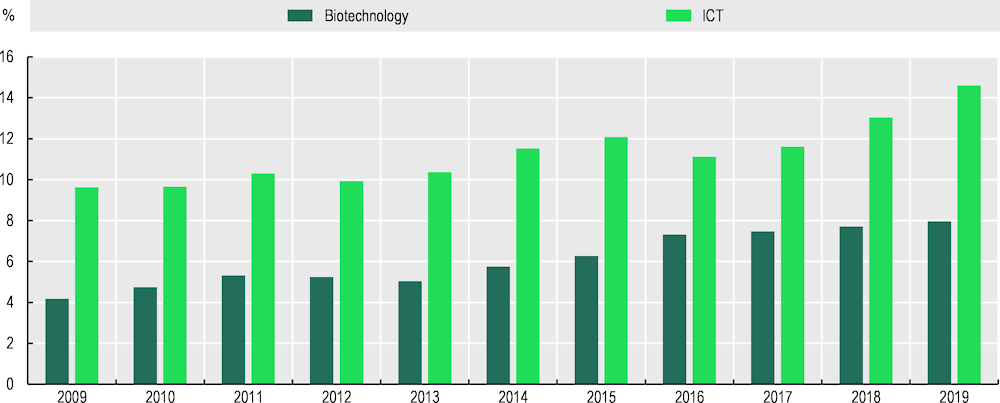

Outcomes of R&D activities can be measured through intellectual property (IP) production and, in particular, patents, which are mainly applied for by the business sector. The number of Korean patents filed under the PCT (Patent Cooperation Treaty) increased from 8 731 (5.6% of the world total) in 2009 to 17 333 (6.8% of the world total) in 2018 (OECD, 2023[2]). Moreover, Korea’s patent performance has improved not only in absolute but also in relative terms. The country’s patent share within the OECD has increased in high-tech industries, such as ICT and biotechnology (Figure 3.2). As of 2017, Korea had the second-highest number of ICT patent filings among all OECD countries, behind Japan, and the third-highest number of biotechnology patent filings, behind the United States and Japan. Korea’s patent filings per unit of GDP have been higher than in the United States and Japan in both high-tech sectors (Hemmert, 2020[4]).

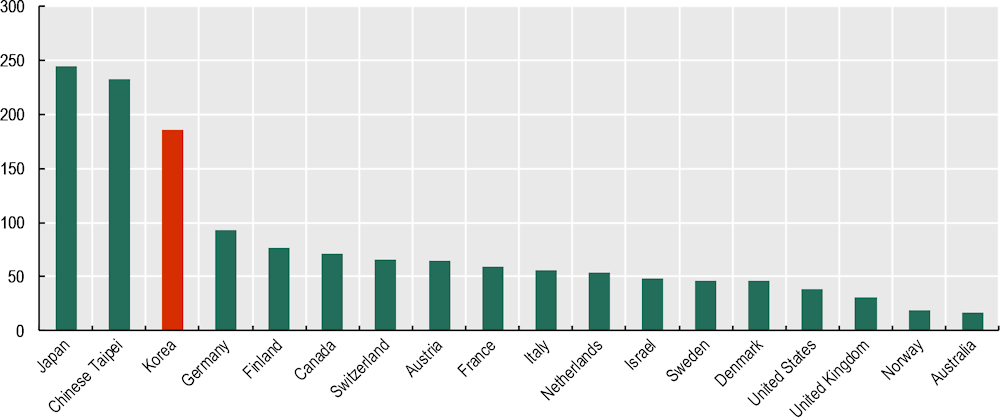

Individual Korean companies have also increased their IP positions in impressive ways. As of 2020, Samsung Electronics and LG Corporation have ranked second and third in the number of US utility patents among all companies worldwide (Harrity, 2021[5]). Moreover, strong R&D investment combined with high patent filing has advanced Korea over other economies in terms of patenting performance to R&D expenditure. Korea has placed third after Japan and Chinese Taipei (Figure 3.3).

Figure 3.2. Korea’s share in OECD ICT and biotech PCT patents, 2009-19

Note: Patent data are based on the inventor's residence and priority year.

Source: Authors’ calculations based on OECD STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, accessed on 9 June 2023).

Figure 3.3. Number of IP5 patents family per USD Billion of GERD, selection of economies, 2019

Note: Patent data are based on the inventor's residence and priority year. IP5 patent families refer to patents filed in at least two IP offices among five major patent offices in China, Europe, Japan, Korea and the United States.

Source: Authors’ calculations based on OECD, STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats (accessed on 9 June 2023) and (OECD, 2023[2]), "Main Science and Technology Indicators", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en (accessed on 8 June 2023).

3.1.2. Korea is advancing toward knowledge-intensive industry with increased global market share in high-tech products

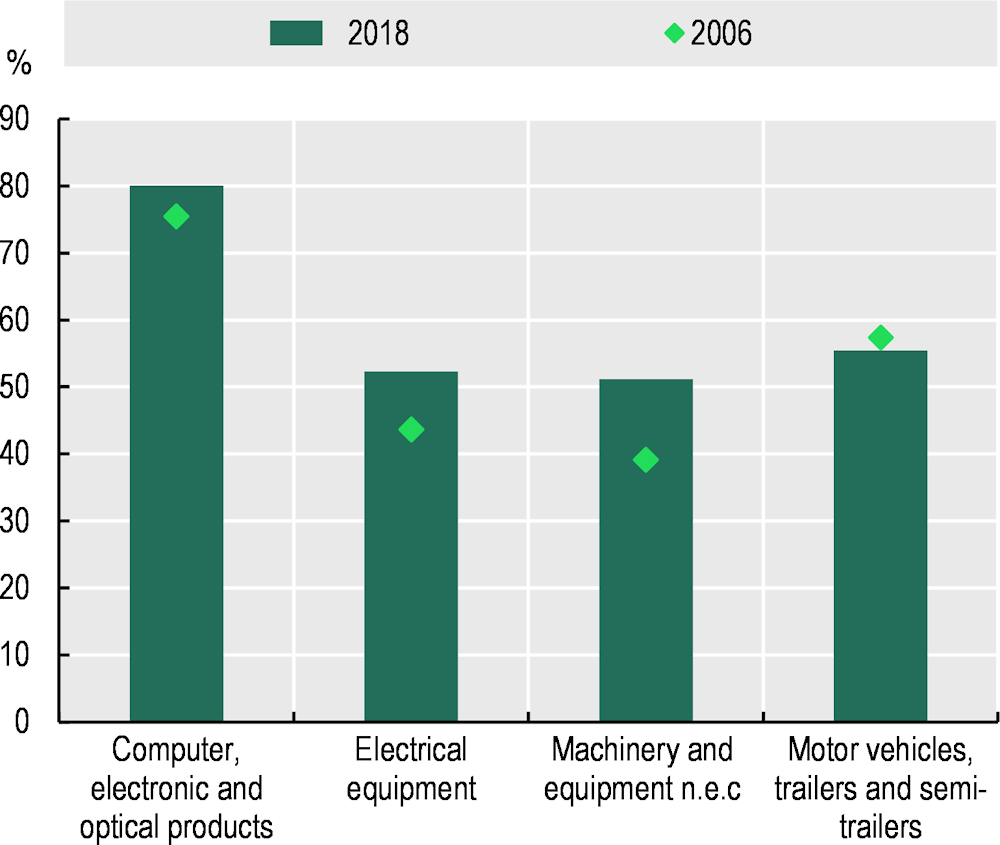

Innovation performance can be associated with the ratio of domestic value added to gross exports in high-tech industries. When Korea industrialised, companies in knowledge-intensive industries initially focused on downstream activities, such as the final assembly of electronic products and automobiles. As a result, the value added within Korea represented a relatively low share of industry output and exports. However, this ratio has significantly increased across major knowledge-intensive industries (Figure 3.4). As a result of the technological upgrading of Korean firms and foreign suppliers’ direct investment in Korea, value chains in knowledge-intensive manufacturing industries, which play a leading role in Korean exports, appear to have been localised to a high degree.

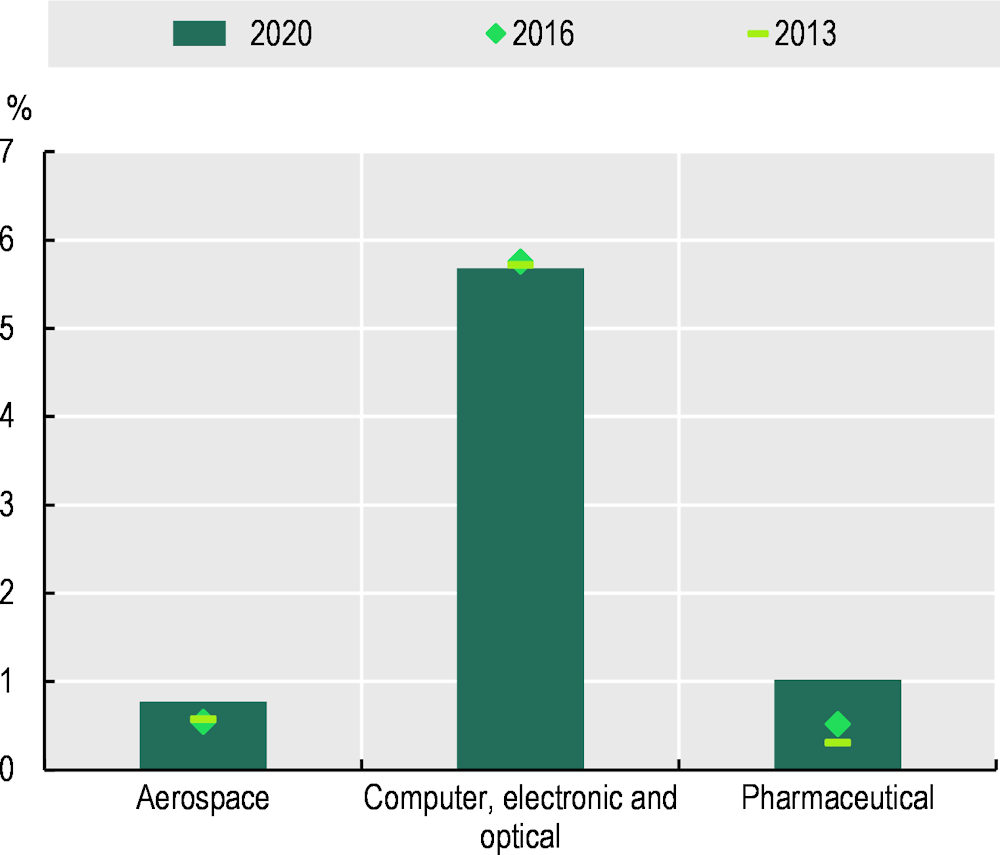

Business innovation performance can also be observed later in the innovation process through companies’ competitive performance, which can strongly reflect their innovation performance in high-tech industries (Figure 3.5). The world export market share of Korean companies in the computer, electronic and optical industry is above 5% and third-highest among all countries, behind China and the United States. Korean companies still have a small but growing share of the global export market in the pharmaceutical and aerospace industries.

Figure 3.4. Korea’s share of domestic value added embodied in foreign final demand, 2006 and 2018 for a selection of industrial sectors

Note: Computer, electronics and optical products correspond to Isic D26, Electrical equipment D27, Machinery and equipment n.e.c D28 and Motor vehicles, trailers and semi-trailers D29

Source: OECD (2023[6]), “Trade in value added”, OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en, (accessed on 9 June 2023).

Figure 3.5. World export market share of Korean firms in high-tech industries

Source: OECD (2023[7]), "Main Science and Technology Indicators", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en, August 2022.

3.1.3. Despite outstanding progress in business innovation, Korean firms’ innovation performance still has room for improvement

Overall, the Korean business sector’s innovation performance is strong and improving with impressive scale and speed when measured by IP production, export competitiveness in high-tech industries and domestic value added in knowledge-intensive industries. In particular, Korean firms’ performance is strong in the ICT sector in many measures. However, somewhat different pictures emerge when assessing the innovation performance activities of Korean firms from different angles.

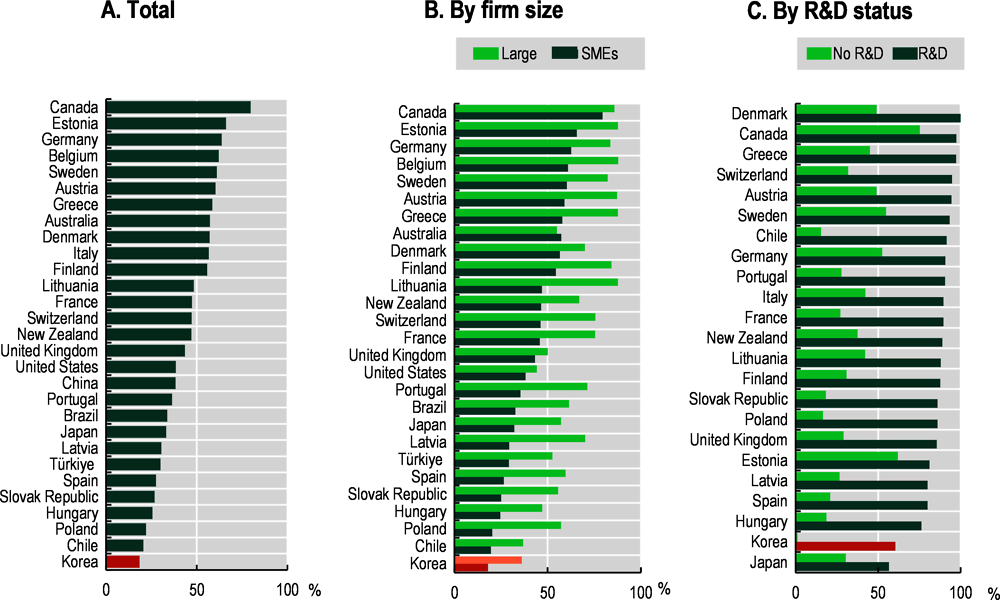

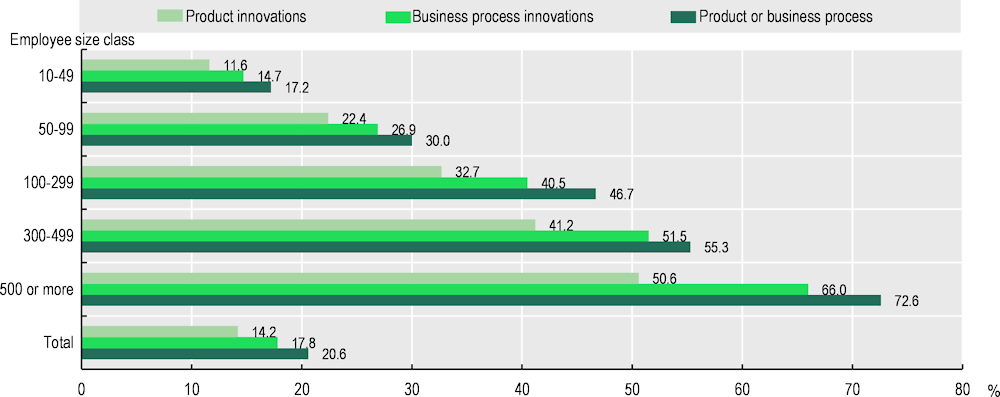

First, Korea's total ratio of innovating firms is the lowest among all OECD countries, and the low ratio of innovating firms consistently holds across firm size and R&D status (Figure 3.6). Furthermore, it is second-lowest in product innovation and the lowest in business process innovation (OECD, 2020[8]). Meanwhile, the most recent Korean Innovation Survey (KIS) on innovation activities by Korean manufacturing firms from 2017 to 2019 reveals several features of firm innovation activities in a more detailed manner. Overall, 14.2% of Korean manufacturing firms introduced a new product or service (product innovation); 17.8% innovated in processes, organisationally, or in marketing (business process innovation); and 20.6% innovated in at least one of the two categories (Figure 3.7). Adjusted values for Korea calculated for direct comparison with Community Innovation Survey (CIS) data are 23.8% for product innovation and 28.3% for business process innovation – thereby closer to, but still below, the EU average (STEPI, 2021[9]). Caution should be used when translating the results of the innovation surveys, however, due to cultural differences and different industrial landscapes across countries.

Figure 3.6. Innovative firms in Korea and selected countries, 2016-18

Note: Innovative firms are those reporting at least one product or business process innovation in the reference period (2016 18).

Source: OECD calculations, based on the 2021 OECD Survey of Business Innovation Statistics and the Eurostat’s Community Innovation Survey (CIS-2018), https://www.oecd.org/sti/inno-stats.htm, April 2022.

Figure 3.7. Share of innovating Korean manufacturing firms, 2017-19

Source: STEPI (2021[10]), Report on the Korean Innovation Survey 2020: Manufacturing Sector 2019, https://www.stepi.re.kr/kis/service/sub03_report.do.

Second, most Korean firms significantly rely on in-house R&D when innovating. Some 39.4% of Korean manufacturing firms conduct in-house R&D. In comparison, 5.6% engage in collaborative R&D, and 1.6% rely on out-contracted R&D. Among large firms with 500 or more employees, 94.3% conduct in-house R&D. In comparison, only 32.9% and 11.8% rely on collaborative and out-contracted R&D, respectively (STEPI, 2021[10]). The high ratio of in-house R&D in the Korean manufacturing industry is associated with a high level of vertical integration. In comparison, 12.2% of all manufacturing firms in the EU27 have contracted out R&D. Among medium-sized and large companies, the propensity to out-contract R&D exceeds 30% in many EU countries (Eurostat, 2021[11]). On top of R&D activities, Korean firms rely to a great extent on internal information sources when innovating. Among the surveyed manufacturing firms, 83.0% use company-internal sources of innovation. The second and third most frequent information sources are external private firms and universities and higher education institutions, which have been used by 27.7% and 19.7% of the firms, respectively. The statistics above imply that Korean business still has room for improvement regarding promoting open innovation, which espouses sourcing ideas from external and internal sources.

Third, most innovation activities by Korean firms are focused on R&D. Some 80.8% of their innovation expenses fall to in-house R&D, followed by 13.2% for in-house non-R&D expenses, 4.2% for collaborative R&D expenses and 1.3% for out-contracted R&D expenses. In contrast, the innovation expenses of innovating firms in most of Europe are less concentrated on R&D expenses in general and in-house R&D expenses in particular (Eurostat, 2021[11]).

Finally, Korean manufacturing firms mostly focus on incremental innovation. While 85.9% of the firms surveyed in the KIS 2020 worked on improving existing goods or services, only 39.8% targeted introducing new goods or services. This incremental innovation focus can be broadly observed across different enterprise size classes and industries (STEPI, 2021[10]). Meanwhile, it is worth noting that the Korean government is encouraging disruptive innovation and more innovative R&D across industry, as illustrated by the recently launched Alchemist Project that aims to develop technologies to transform industry.

3.1.4. Financial difficulties and a lack of qualified labour hinder Korean firms’ innovation

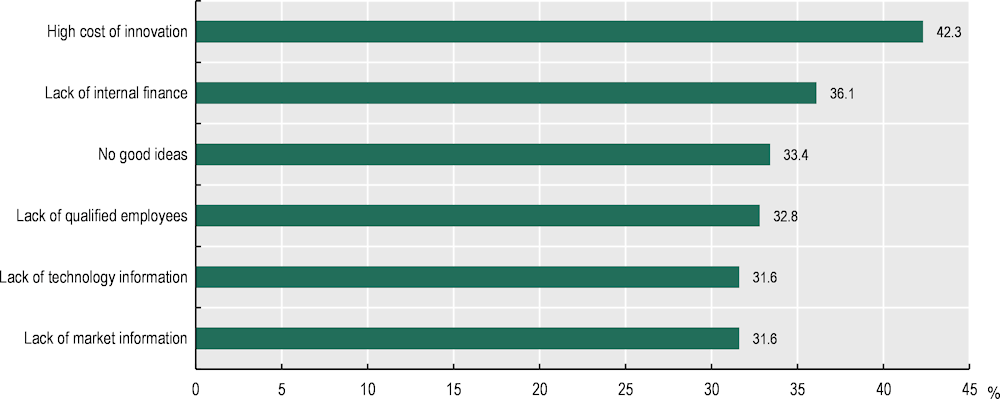

According to KIS 2020, the innovation barriers most frequently recognised as significant by Korean firms have been the high cost of innovation (42.3%), followed by a lack of internal finance (36.1%) and no good ideas (33.4%) (Figure 3.8). A lack of qualified employees and technology and market information also constitute important innovation barriers for Korean manufacturing firms. Overall, barriers related to financial difficulties and companies’ capabilities are most frequent. In contrast, market-related barriers (e.g. uncertainty about market demand) and necessity-related barriers (e.g. no need for additional innovation) are regarded not as hindering as financial difficulties and firms’ capabilities (STEPI, 2021[10]). Similar observations have been made for service firms, which play a lesser role in business innovation in Korea than manufacturing firms. The innovation barriers reported most frequently as significant by Korean service companies in the years 2015‑17 have been a lack of internal finance, difficulties with obtaining financial support from the government and the high cost of innovation (STEPI, 2019[12]). Service companies appear to rely to a relatively high degree on government support for innovation, as they have identified difficulties with obtaining such support as one of the most frequently significant innovation barriers.

Figure 3.8. Innovation barriers for Korean manufacturing firms, 2017-19

Source: (STEPI, 2021[10]), Report on the Korean Innovation Survey 2020: Manufacturing Sector 2019, https://www.stepi.re.kr/kis/service/sub03_report.do.

The finance- and capability-related innovation barriers in Korea are more important for smaller than for larger firms. However, they are highly relevant even for many large firms. While 46.0% of small firms with 10‑49 employees perceive the high cost of innovation as an important innovation barrier, the proportion of large firms with 500 or more employees that share this perception is 40.3%. The size-related difference is greater regarding the lack of internal finance, which is perceived by 38.9% of small firms and 15.8% of all large firms as a significant innovation barrier (STEPI, 2021[10]). In other words, while small Korean manufacturing firms often do not innovate due to high cost or lack of finance, large firms may have more internal financial resources but also do not innovate due to high cost. Overall, while most Korean firms feel a need to innovate, they are frequently hindered from doing so due to a lack of resources and capabilities, including finance, qualified staff, ideas and technology- and market-related information.

3.1.5. Internationalisation of business R&D and innovation is still relatively low

Business R&D in Korea is dominated largely by domestic companies. The R&D expenditures by foreign-owned companies in the manufacturing sector amounted to only 3.9% of all manufacturing sector R&D in 2018 (KISTEP, 2019[13]). In the meantime, the number of non-Korean companies with R&D activities in Korea increased from 60 in 1999 to 375 in 2014 (Hemmert, 2018[14]), indicating an increasing interest by foreign multinationals to conduct R&D in Korea.

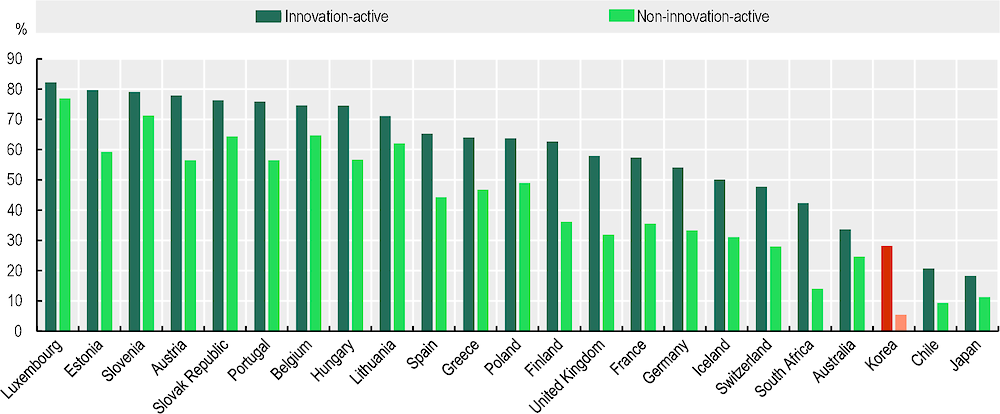

The degree of global integration of Korean business innovation is also relatively low among developed countries, yet increasing, partly due to the expansion of Korean conglomerates and policy initiatives such as the “Buy R&D” fund (KRW 100 billion), which supports technology adoption, the promotion of global mergers and acquisitions (M&As) and international joint R&D projects. Regarding inward global integration, R&D spending by foreign multinationals in Korea has rapidly increased from a very low base (Figure 3.9). Many foreign multinationals are active in upstream manufacturing industries, such as chemicals, high-tech materials and automotive parts and components (Hemmert, 2020[4]). Meanwhile, in terms of outward global R&D integration, some Korean conglomerates have established overseas R&D labs to support the customisation of their products or to acquire new technologies that are leveraged in their global new product development (Hemmert, 2018[14]). Recent OECD business innovation indicators also confirm the relatively weak global market integration of Korean businesses (OECD, 2020[8]). For example, Korean business shows low shares of firms operating in global markets regardless of whether they are innovative.

Figure 3.9. Firms operating in foreign markets in Korea and selected countries, by innovation-active status, 2016-18

Note: Innovative firms are those reporting at least one product or business process innovation in the reference period (2016 18).

Source: OECD based on the 2021 OECD Survey of Business Innovation Statistics and Eurostat (Eurostat, 2021[11]), Community Innovation Survey (CIS 2018), https://www.oecd.org/sti/inno-stats.htm, April 2022.

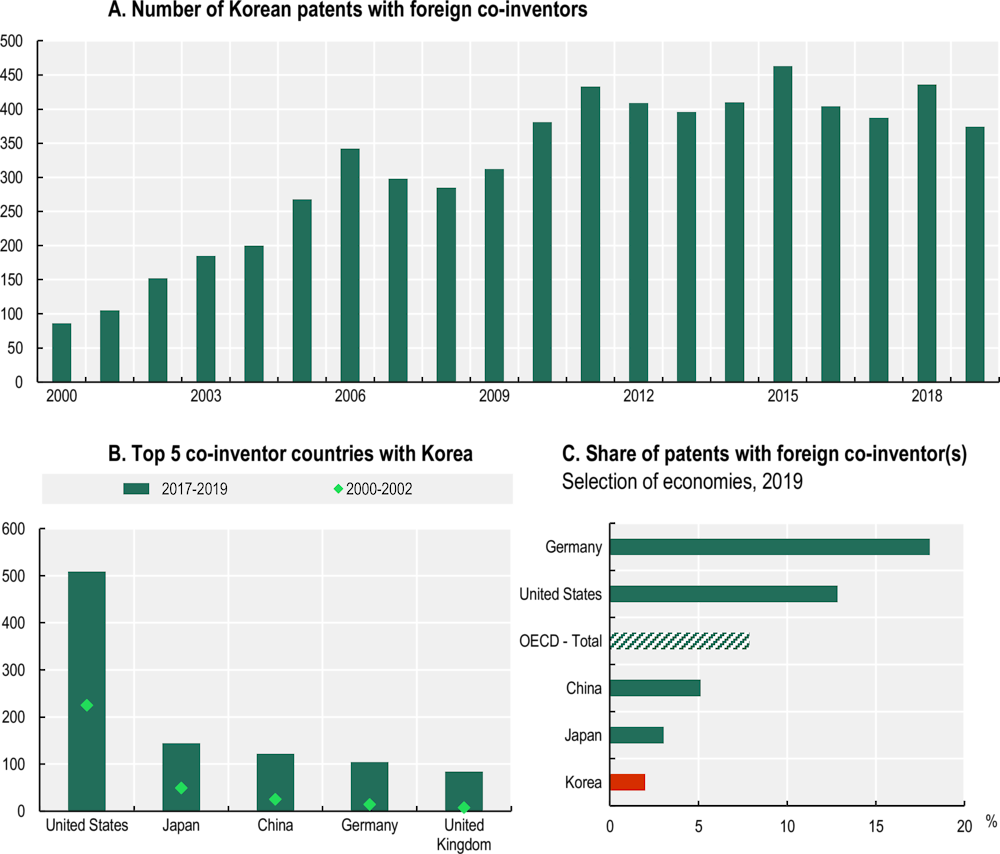

The degree of R&D globalisation can also be observed through co-patenting activities. The number of patents jointly published by Korean and foreign applicants greatly increased in the late 2000s and early 2010s (Figure 3.10 Panel A). Most Korean co-patenting has occurred with partners in the United States, followed by Japan, China, Germany, India and the Russian Federation (hereafter, “Russia”) (Figure 3.10, Panel B). Overall, while international co-patenting by Korean firms has increased since the turn of the millennium, the recent decrease suggests that the scale of the firms’ global R&D activities may have levelled off. Moreover, Figure 3.10 (Panel C) reveals that Korean international co‑operation in patenting with countries abroad is much behind the OECD average.

Figure 3.10. Korean co-patenting, 2000-17

Note: In the last few years, data may be partly due to time lags between the application and publication dates (generally taking one and a half years). Counting patents with multiple inventors/applicants: the indicators presented here are based on simple counts.

Source: OECD (2022[15]), STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, May 2022.

3.1.6. Korean technology is highly specialised in ICTs but less so in other emerging technologies

This section provides a snapshot of technology specialisation in the Korean business sector, emphasising selected technology fields instrumental to the digital and green transitions. Table 3.1 shows Korea’s revealed technology advantage (RTA1), measured as an index greater than 1, against the world average across the World Intellectual Property Organization classification of 35 technologies.2 Korea’s specialisation in ICT or semiconductors remains robust, while it has reinforced its specialisation in certain domains such as biotechnology. Although Korea’s technology specialisation remains concentrated in a few selected technology domains, its RTA has become more diversified as its economy has advanced, adding more complexity to its industrial landscape. Table 3.2 illustrates the RTA distribution of 35 technology domains across selected economies. In domains where Korea has high indices, including semiconductors and nanotechnology, Chinese Taipei and China demonstrate similar propensity. On the contrary, Germany and Japan appear to have greater RTA in mechanical areas, whereas Korea shows relatively low indices. While Korea has increased its specialisation in chemical, biotechnology and pharmaceutical technologies (Panel B), it is still below that of the United States and Germany.

Table 3.1. Technology specialisation (RTA), IP5 patent families in Korea, 2004-18

|

Field of technology |

2004-08 |

2009-13 |

2014-18 |

|---|---|---|---|

|

Electrical machinery, apparatus, energy |

1.2 |

1.2 |

1.2 |

|

Audio-visual technology |

1.8 |

1.7 |

1.7 |

|

Telecommunications |

2.1 |

1.6 |

1.2 |

|

Digital communication |

1.6 |

1.5 |

1.2 |

|

Basic communication processes |

1.5 |

1.2 |

1.2 |

|

Computer technology |

1.3 |

1.5 |

1.4 |

|

IT methods for management |

0.9 |

1.1 |

0.9 |

|

Semiconductors |

2.3 |

2.1 |

2.1 |

|

Optics |

1.5 |

1.2 |

1.2 |

|

Measurement |

0.5 |

0.7 |

0.7 |

|

Analysis of biological materials |

0.5 |

0.7 |

0.7 |

|

Control |

0.6 |

0.7 |

0.6 |

|

Medical technology |

0.3 |

0.5 |

0.6 |

|

Organic fine chemistry |

0.4 |

0.6 |

1.1 |

|

Biotechnology |

0.5 |

0.7 |

0.7 |

|

Pharmaceuticals |

0.3 |

0.5 |

0.6 |

|

Macromolecular chemistry, polymers |

0.6 |

0.8 |

1.1 |

|

Food chemistry |

0.4 |

0.5 |

0.8 |

|

Basic materials chemistry |

0.5 |

0.6 |

0.8 |

|

Materials, metallurgy |

0.6 |

0.8 |

0.9 |

|

Surface technology, coating |

0.7 |

1.0 |

0.9 |

|

Micro-structural and nano-technology |

1.9 |

1.7 |

0.8 |

|

Chemical engineering |

0.6 |

0.7 |

0.7 |

|

Environmental technology |

0.5 |

0.6 |

0.8 |

|

Handling |

0.4 |

0.4 |

0.4 |

|

Machine tools |

0.3 |

0.4 |

0.4 |

|

Engines, pumps, turbines |

0.4 |

0.4 |

0.6 |

|

Textile and paper machines |

0.6 |

0.4 |

0.3 |

|

Other special machines |

0.4 |

0.5 |

0.5 |

|

Thermal processes and apparatus |

1.3 |

0.9 |

1.0 |

|

Mechanical elements |

0.3 |

0.5 |

0.6 |

|

Transport |

0.4 |

0.7 |

0.8 |

|

Furniture, games |

0.8 |

0.7 |

0.8 |

|

Other consumer goods |

1.5 |

1.2 |

1.3 |

|

Civil engineering |

0.4 |

0.4 |

0.4 |

Note: IP5 patent families refer to patents filed in at least two IP offices among five major patent offices of China, Europe, Japan, Korea and the United States. These tables show red gradients as RTAs increase above 1.0 (RTA>1.0) and blue gradients as RTAs decrease below 1.0 (RTA<1.0)

Source: Authors’ calculations based on OECD (2022[15]), STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, May 2022.

Table 3.2. Technology specialisation (RTA), IP5 patent families in Korea and selected economies

|

Field of technology |

Korea |

Germany |

Japan |

United States |

China |

Chinese Taipei |

|---|---|---|---|---|---|---|

|

Electrical machinery, apparatus, energy |

1.2 |

1.1 |

1.3 |

0.7 |

1.0 |

1.2 |

|

Audio-visual technology |

1.7 |

0.4 |

1.2 |

0.6 |

1.7 |

1.9 |

|

Telecommunications |

1.2 |

0.5 |

1.1 |

0.9 |

1.4 |

1.3 |

|

Digital communication |

1.2 |

0.4 |

0.5 |

1.2 |

2.4 |

0.8 |

|

Basic communication processes |

1.2 |

0.6 |

1.0 |

1.0 |

0.9 |

1.9 |

|

Computer technology |

1.4 |

0.4 |

0.8 |

1.1 |

1.6 |

1.5 |

|

IT methods for management |

0.9 |

0.4 |

0.8 |

1.4 |

1.3 |

0.7 |

|

Semiconductors |

2.1 |

0.4 |

1.2 |

0.6 |

1.2 |

3.0 |

|

Optics |

1.2 |

0.4 |

1.7 |

0.5 |

1.5 |

1.7 |

|

Measurement |

0.7 |

1.4 |

1.0 |

1.0 |

0.8 |

0.8 |

|

Analysis of biological materials |

0.7 |

0.9 |

0.6 |

1.5 |

0.5 |

0.6 |

|

Control |

0.6 |

1.1 |

1.1 |

1.1 |

0.9 |

0.8 |

|

Medical technology |

0.6 |

0.9 |

0.7 |

1.6 |

0.5 |

0.6 |

|

Organic fine chemistry |

1.1 |

1.2 |

0.6 |

1.2 |

1.0 |

0.4 |

|

Biotechnology |

0.7 |

0.7 |

0.5 |

1.9 |

0.8 |

0.5 |

|

Pharmaceuticals |

0.6 |

0.5 |

0.4 |

2.0 |

0.8 |

0.6 |

|

Macromolecular chemistry, polymers |

1.1 |

0.9 |

1.5 |

0.8 |

0.6 |

0.5 |

|

Food chemistry |

0.8 |

0.6 |

0.7 |

1.2 |

0.6 |

0.4 |

|

Basic materials chemistry |

0.8 |

1.0 |

1.1 |

1.1 |

0.6 |

0.4 |

|

Materials, metallurgy |

0.9 |

1.1 |

1.4 |

0.8 |

0.8 |

0.4 |

|

Surface technology, coating |

0.9 |

1.0 |

1.4 |

0.9 |

0.7 |

0.8 |

|

Micro-structural and nano-technology |

0.8 |

1.4 |

0.6 |

1.0 |

1.1 |

2.1 |

|

Chemical engineering |

0.7 |

1.4 |

0.7 |

1.1 |

0.8 |

0.5 |

|

Environmental technology |

0.8 |

1.5 |

0.9 |

1.0 |

0.7 |

0.4 |

|

Handling |

0.4 |

1.5 |

1.1 |

0.8 |

0.6 |

0.5 |

|

Machine tools |

0.4 |

2.0 |

1.1 |

0.8 |

0.6 |

1.0 |

|

Engines, pumps, turbines |

0.6 |

1.6 |

1.0 |

1.3 |

0.3 |

0.3 |

|

Textile and paper machines |

0.3 |

1.0 |

2.0 |

0.6 |

0.4 |

0.4 |

|

Other special machines |

0.5 |

1.6 |

0.9 |

1.0 |

0.5 |

0.6 |

|

Thermal processes and apparatus |

1.0 |

1.2 |

1.1 |

0.7 |

0.8 |

0.6 |

|

Mechanical elements |

0.6 |

2.1 |

1.0 |

0.9 |

0.5 |

0.5 |

|

Transport |

0.8 |

1.8 |

1.1 |

1.0 |

0.4 |

0.3 |

|

Furniture, games |

0.8 |

1.2 |

0.7 |

0.9 |

1.0 |

1.2 |

|

Other consumer goods |

1.3 |

1.2 |

0.7 |

0.8 |

1.0 |

0.7 |

|

Civil engineering |

0.4 |

1.6 |

0.4 |

1.3 |

0.6 |

0.5 |

Note: IP5 patent families refer to patents filed in at least two IP offices among five major patent offices of China, Europe, Japan, Korea and the United States. These tables show red gradients as RTAs increase above 1.0 (RTA>1.0) and blue gradients as RTAs decrease below 1.0 (RTA<1.0)

Source: Authors’ calculations based on OECD (2022[15]), STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, May 2022.

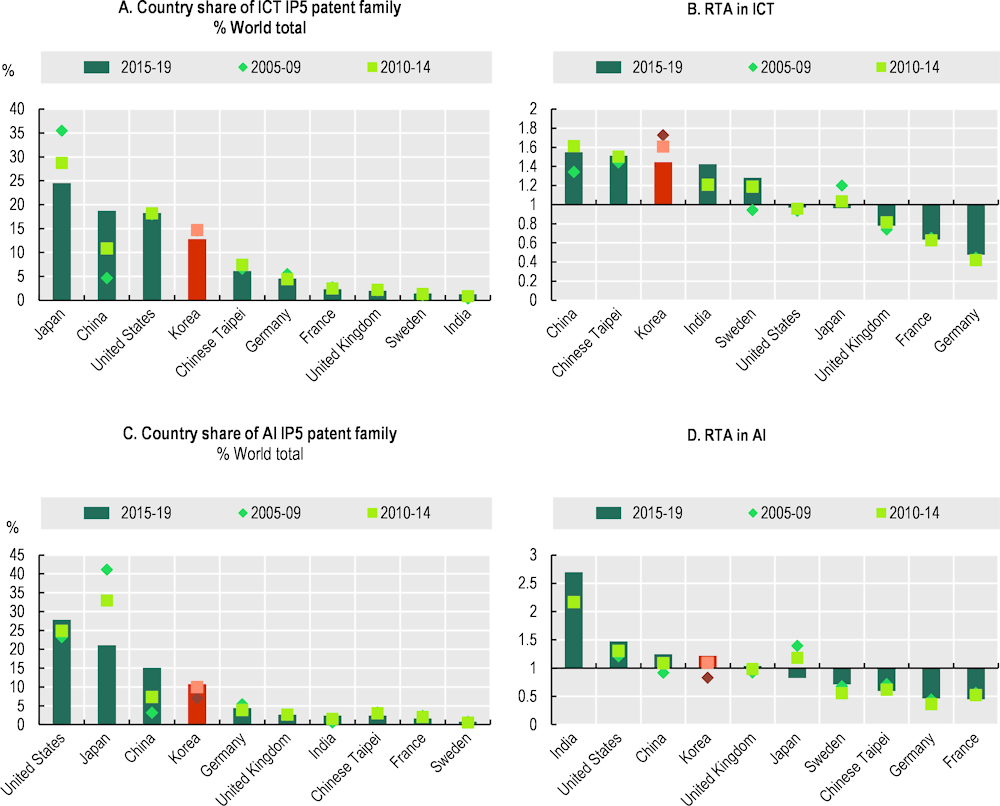

While Korea has accumulated patents in the fields of ICT and artificial intelligence (AI) and holds high shares compared to the world total (13.8% in ICT and 9.8% in AI) (Figure 3.11, Panel A), its specialisation differs in each field. For ICT, it shows greater value of RTA indices exceeding 1 after China and Chinese Taipei, whereas, for AI, Korea’s RTA is slightly above 1, indicating a little positive specialisation (Figure 3.11, Panel B). Thus, despite Korea’s relative strength in ICT in general, the country may do well to devote considerable efforts to specialise in AI, an emerging and enabling technology for Korea’s digital transformation. In AI, India, Israel, the United States and China have a higher RTA.

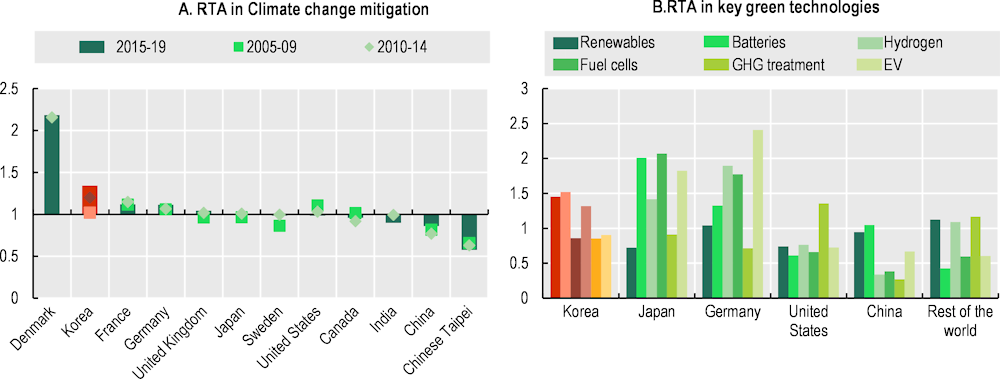

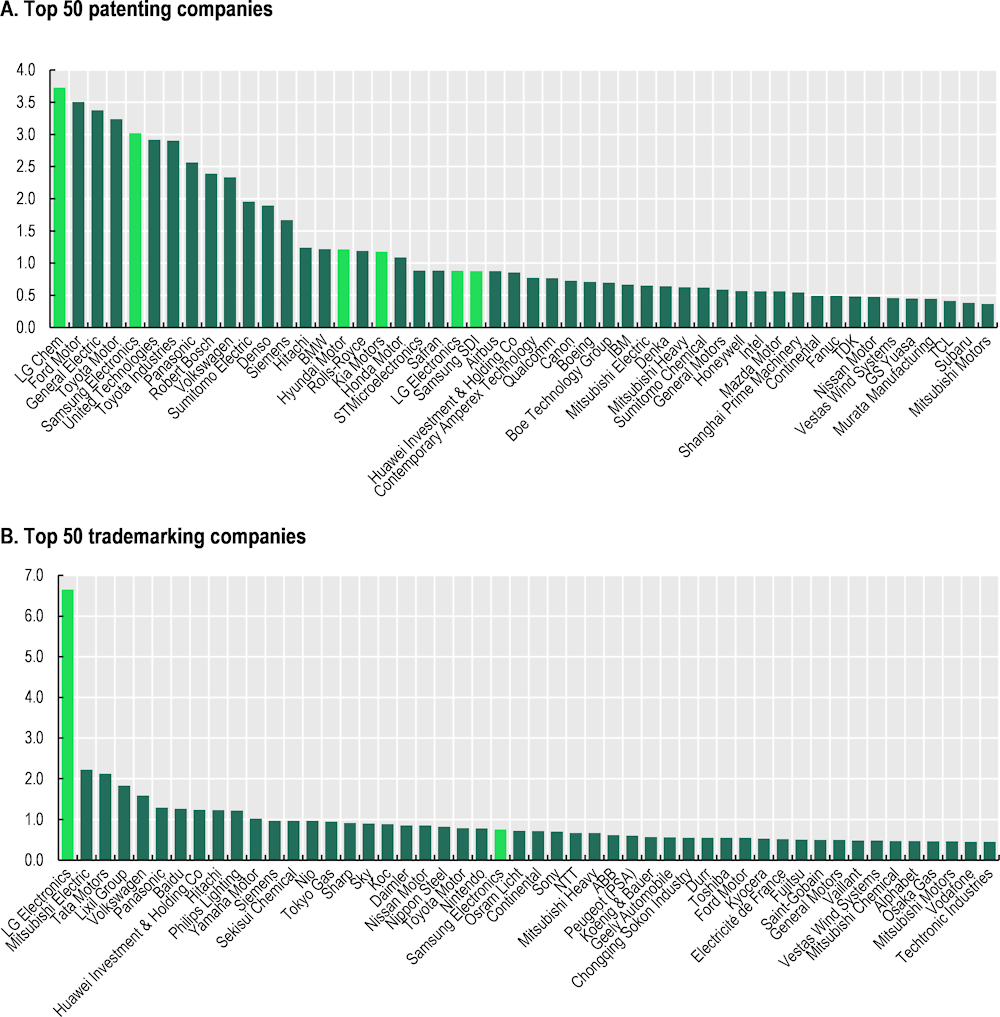

In contrast to its performance in ICTs, Korea’s specialisation in environmental technologies is below the world average, with an RTA below 1. However, in terms of climate change mitigation/adaptation technology, in particular among environmental technologies, Korea ranks second after Denmark (Figure 3.12, Panel A). Among the sub-categories in climate change mitigation or adaptation technologies, Korea has the highest RTA in renewables (Figure 3.12, Panel B) among comparable advanced economies. Korea’s RTA in batteries and fuel cells also exceeds 1, while hydrogen, treatment of greenhouse gas (GHG) and electric vehicles are below 1. Based on company-level data, Korean firms such as LG Chem and LG Electronics have emerged as global leaders in patenting and trademarks on climate change mitigation/adaptation technologies (Figure 3.13).

Figure 3.11. Country patent share and relative specialisation in ICT and AI patent families, for a selection of economies

Note: IP5 patent families refer to patents filed in at least two IP offices among five major patent offices of China, Europe, Japan, Korea and the United States.

Source: OECD, STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, June 2023

Figure 3.12. Technology specialisation (RTA) in climate change mitigation for a selection of economies

Note For Panel A: IP5 patent families refer to patents filed in at least two IP offices among five major patent offices of China, Europe, Japan, Korea and the United States.

Source: Authors’ calculations based on STI Micro-data Lab: Intellectual Property Database, http://oe.cd/ipstats, June 2023 and on OECD (2023), "Patents in environment-related technologies: Technology development by inventor country", OECD Environment Statistics (database), https://stats.oecd.org/Index.aspx?DataSetCode=PAT_DEV (accessed on 20 June 2023).

Figure 3.13. Top 50 patenting or trademarking companies in climate change mitigation and adaptation, 2016-18

Note: Bars in red are Korean firms. IP5 patent families and trademarks at the EUIPO, JPO and USPTO. Data relate to the share of the patents (respectively trademarks) related to climate change mitigation and adaptation owned by companies in total patents (respectively trademarks) in that domain owned by the top 2 000 corporate R&D sample in 2016-18.

Source: European Commission et al., (2021[16]), World Corporate Top R&D Investors: Paving the Way for Climate Neutrality, https://data.europa.eu/doi/10.2760/49552.

3.2. Public support for business R&D and innovation in Korea

The aforementioned developments and the strong rise of Korean business innovation in selected fields could not be possible without dedicated government support. This section shows that the Korean government’s efforts have significantly driven the rise of Korean business innovation while acknowledging a significant focus on supporting small and medium-sized enterprises (SMEs). Finally, this section describes how recent initiatives aim to alleviate some of the concerns about the partial fragmentation of government support.

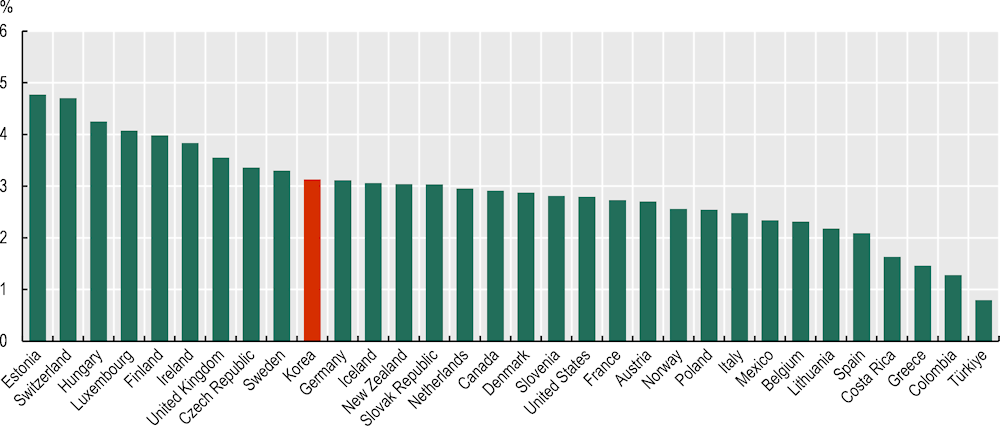

3.2.1. Government support to business R&D is among the highest in OECD countries, with a heavy focus on SMEs

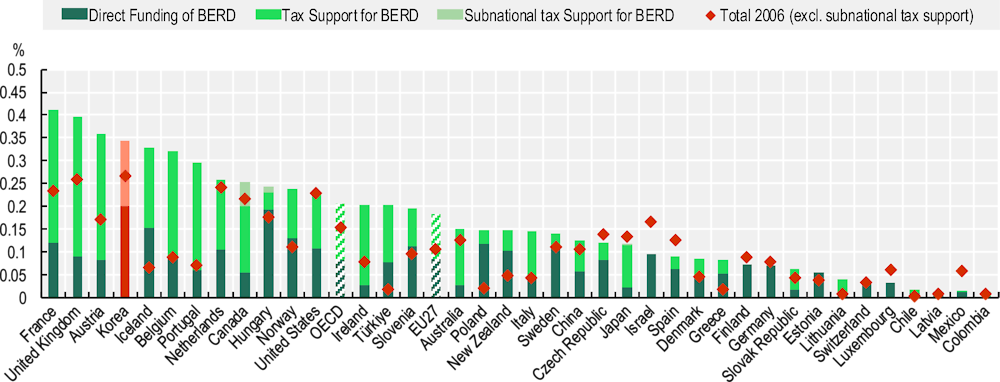

In 2020, Korea placed among the OECD countries that provide the largest level of total government support to business R&D as a percentage of GDP, at a rate of 0.29% of GDP (Figure 3.14) (OECD, 2022[17]). Most public support for business R&D is directed at SMEs. In 2019, the government financed 13.2% of all R&D conducted by SMEs. In contrast, the government financed only 1.8% of the R&D expenditures of large firms (MSIT and KISTEP, 2021[18]). Heavy focus on SMEs in public support for business R&D applies not only to direct funding but also to tax support. In line with the government's direct financing of business R&D, R&D tax breaks for SMEs are much more generous than for large firms. Specifically, tax credits for large firms are capped at 2% of R&D spending, while there is no ceiling for the R&D tax credits for SMEs. As a result, the implied tax subsidy rate for profit-making SMEs was 26% in 2020, in contrast to 2% for large firms (Box 3.1. R&D tax incentives in Korea). Nonetheless, due to the dominant role of large firms in R&D spending in Korea, the share of the total amount of R&D tax credits given to SMEs among all R&D tax credits was only 40% in 2018 (OECD, 2023[2]).

Korea is an outlier among major OECD countries in its strong focus on SMEs in R&D tax credits. With the exception of the United Kingdom, other large, developed countries provide more or less the same R&D tax incentives to large and small firms. Meanwhile, between 2007 and 2019, the importance of tax incentives increased in Korea in absolute terms, whereas the relative magnitude of tax compared to direct support remained fairly stable. As a result, R&D-related taxable income deductions for business firms amounted to KRW 2.81 trillion in 2018 (MOTOE and KIAT, 2020[19]).

Government support for SMEs in Korea encompasses a wide range of policy tools, including financing subsidies, notably business R&D; favourable access to public procurement; regulations differentiated by company size; and whole market segments reserved for SMEs. Although many of these policies may have some justification when seen in isolation, they add up to a system that supports the survival of low-productivity firms against a backdrop of regulatory complexity.

Figure 3.14. Direct government funding of business R&D and tax incentives for R&D in Korea and selected economies, 2020 (nearest year)

Note: Data on subnational tax support are only available for a group of economies.

Source: OECD (2022[17]), R&D Tax Incentives (database), http://oe.cd/rdtax, April 2022.

Box 3.1. R&D tax incentives in Korea

Design of R&D tax relief provisions

Korea provides R&D tax relief through a hybrid R&D credit and a volume-based investment credit for machinery, equipment, and buildings (see Table 3.3).

Key features include the following:

Under the hybrid R&D tax credit, R&D tax relief generally equals the larger of the volume-based or incremental tax off-set.

In case of insufficient tax liability, unused credits can be carried forward for ten years (previously five years) under the hybrid R&D tax credit and for five years under the R&D investment credit.

Table 3.3. Main design features of R&D tax incentives in Korea, 2021

|

|

|

R&D tax credit |

R&D investment credit |

|

|---|---|---|---|---|

|

Type of instrument |

Hybrid (volume or increment)* |

Volume-based |

||

|

Eligible expenditures |

Current |

Machinery and equipment, buildings |

||

|

Headline rates (%) |

Volume: 0-2 (Large firm) [0.5 R&D expense-sales ratio], 8-15 (HPE), 25 (SME) GIBT**: 20-30 (Large firm, HPE), 30-40 (SME) |

Increment: 25 (Large firm), 40 (HPE), 50 (SME)*** |

1 (Large firm), 3 (HPE), 7 (SME) |

|

|

Refund |

|

No |

||

|

Carry-over (years) |

10 (carry forward) |

5 (carry forward) |

||

|

Thresholds and ceilings |

Base amount |

R&D spending in the previous year |

n.a. |

|

|

Ceiling |

Tax credit capped at 2% of R&D spending (Large firms) |

No |

||

Note: R&D expense ratio=R&D/revenue; HPE: High Potential Enterprise (do not qualify as SME, respect rules about being part of a group and have sales below KRW 500 billion); *The R&D tax credit equals the greater of either: 1) the volume-based tax off-set, or the 2) incremental tax off-set; **Under the Growth Industry and Basic Technology scheme available to firms with R&D aimed at New Growth and Basic technologies (235 technologies in 12 areas, including future cars, next-generation electronic information devices, energy and environment), enhanced volume-based tax credit rates apply to SMEs (30~40; 15/10 for firms losing SME status, see compendium) and to large firms and HPEs (20~30); *** 40 for firms losing the SME status. Korea also offers an income-based tax incentive for outcomes of R&D activities. This incentive is beyond the scope of this chapter. For more details, see the OECD R&D Tax Incentive Compendium at https://www.oecd.org/sti/rd-tax-stats-compendium.pdf and “Eligibility of current and capital expenditure for R&D tax relief” at https://www.oecd.org/sti/rd-tax-stats-expenditure.pdf.

Source: OECD (2022[17]), R&D Tax Incentives (database), http://oe.cd/rdtax, December 2021.

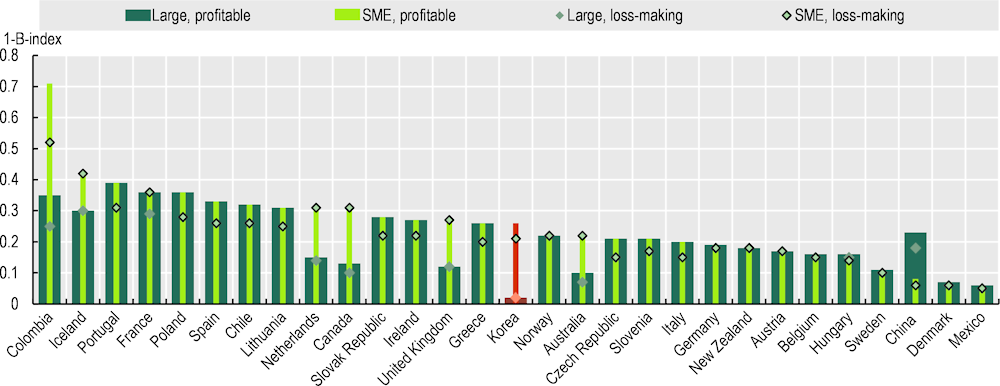

The generosity of R&D tax support in 2021

Differences in the design of R&D tax incentives drive significant variation in the expected generosity of tax relief per additional unit of R&D investment. For example, in 2022, the marginal tax subsidy rate for profit-making (loss-making) SMEs in Korea was estimated at 0.26 (0.21), above the OECD median of 0.20 (0.18) (Figure 3.15). On the other hand, the implied R&D tax subsidy rate for large firms equals 0.02 (0.02) in the profit (loss) case, well below the OECD median of 0.17 (0.15). These estimates focus on the hybrid R&D tax credit (not accounting for the enhanced tax credit rates applicable to a subset of firms under the Growth Industry and Basic Technology scheme) and the R&D investment credit.

Figure 3.15. Implied tax subsidy rates on R&D expenditures in Korea and selected economies, 2022

Note: Implied marginal tax subsidy rates, presented for different firm size and profitability scenarios, are calculated based on headline tax credit/allowance rates (see the methodology and country-specific notes), providing an upper bound value of the generosity of R&D tax support, not reflecting the effect of thresholds and ceilings that may limit the amount of qualifying R&D expenditure or value of tax relief.

Source: OECD (2022[17]), R&D Tax Incentives (database), http://oe.cd/rdtax (accessed on 12 June 2023).

3.2.2. Support for business R&D is in part fragmented, although recent policy initiatives are encouraging

Despite considerable and generous government support for business R&D in Korea, government support has long been under pressure to be more efficient and have more impact, as some problems, including fragmentation, have been identified. Institutionally, the three main actors of the R&D support policy for SMEs are the Ministry of Trade, Industry and Energy, the Ministry of SMEs and Start-ups, and the Ministry of Science and ICT. In 2019, these ministries administered 42.3%, 29.3% and 8.6% of the overall government budget for R&D support directed at SMEs, respectively (Ahn, Lee and Lee, 2021[20]). The ministries conduct a wide range of R&D support programmes that mostly focus on providing direct R&D subsidies or loans for SMEs (KISTEP, 2019[21]). Despite various R&D support portfolios from different ministries, R&D support policies in Korea have been assessed as highly fragmented. The government’s online portal for SME support policies lists over 400 separate programmes related to technology support (Ministry of SMEs and Start-ups, 2021[22]).

On top of fragmented support programmes, the following problems have also long been identified in terms of the R&D support programmes for SMEs in Korea: 1) subsidising R&D of SMEs that lack the research capabilities to use the funds effectively; 2) widespread multiple disbursements of R&D subsidies to the same firms; and 3) support of firms that lack managerial proficiency (Ahn, Lee and Lee, 2021[20]).

Meanwhile, recent policy initiatives which envision long-term support throughout technology development and commercialisation, link government support to private investment, emphasise collaborative R&D activities and reduce the administrative burden for participating firms (Ministry of SMEs and Start-ups, 2019[23]) are still in the early phase, to be monitored and assessed.

A different and new type of government support policy relates to public procurement to enhance innovation, which has been promoted in Korea through an amendment in the Public Procurement Law in 2020. Monitored by the Ministry of Economy and Finance, a target has been set that every public agency should spend at least 1% of its total procurement on innovative products (Lee, 2021[24]). Such products are certified by the Central Procurement Agency based on their technological excellence in order to enhance the quality of procured products and to support SMEs and venture firms. Suppliers of selected products also receive support for R&D related to developing these products (MOTIE, 2021[25]).

3.3. Imbalances in Korean business innovation

This section draws a more differentiated overview of Korean business innovation by showing that despite the strengths of the Korean business innovation system, several imbalances and concentration risks also exist. These imbalances persist with regard to firm size and type of industry, i.e. manufacturing and services, as well as ICT and non-ICT industries.

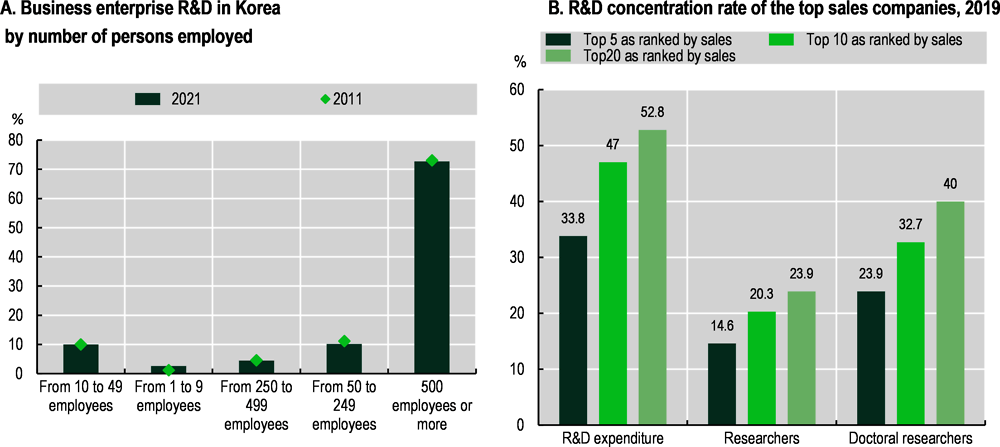

3.3.1. Strong concentration of R&D in large firms warrants cautious assessment of business innovation in Korea

In Korea, more than 70% of total R&D spending falls to large companies with 500 or more employees, compared with less than 14% spent by small enterprises with fewer than 50 employees (Figure 3.16, Panel A). This high concentration of business R&D spending on large firms is typical among developed countries. For example, the proportion of all business R&D expenditures falling to firms with 500 or more employees was 90.4% in Japan in 2019, 87.5% in Germany in 2017, 69.2% in the United Kingdom in 2018 and 64.8% in France in 2017 (OECD, 2021[26]). However, the exceptionally high concentration in business sector R&D spending on the largest companies is unusual among major industrialised countries like Korea. Some 33.8% of all business R&D spending fell to the five largest companies in 2019, up from 33.5% in 2014, and 47.0% to the ten largest companies, up from 44.1% in 2014 (Table 3.4) (MSIT and KISTEP, 2021[18]). Understandably, these companies also account for a large share of researchers in the business sector, such as 14.6% of the total researchers and 23.9% of doctoral researchers (Figure 3.16, Panel B).

Figure 3.16. Business R&D spending by firm size and top companies in Korea, 2019

Source: OECD (2023), "Research and Development Statistics: Business enterprise R-D expenditure by size class and by source of funds - ISIC Rev 4", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/7ce7448d-en (accessed on 11 June 2023).

Table 3.4. R&D concentration rate of top sales companies in Korea

In percentage

|

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|---|---|---|---|---|---|---|---|

|

R&D expenditure |

Top 5 |

33.5 |

37.2 |

37.7 |

40.4 |

36.8 |

33.8 |

|

Top 10 |

44.1 |

41.7 |

44.3 |

50.2 |

47.4 |

47.0 |

|

|

Top 20 |

51.6 |

49.3 |

51.6 |

54.0 |

53.7 |

52.8 |

|

|

Top 30 |

53.9 |

51.5 |

53.4 |

55.5 |

54.5 |

54.0 |

|

|

Top 50 |

58.9 |

57.3 |

56.3 |

58.0 |

58.4 |

56.6 |

|

|

Top 100 |

63.4 |

61.9 |

62.3 |

63.7 |

63.1 |

60.7 |

Source: MSIT and (KISTEP, 2019[13]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5

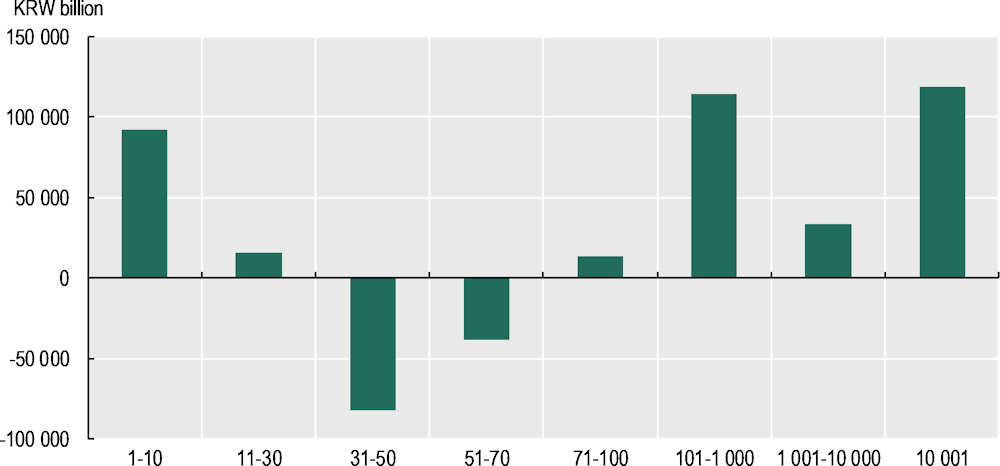

This significant concentration in business R&D necessitates caution, however, when examining the overall picture of Korean business innovation. Looking at the overall trend in business innovation could risk missing the actual underlying status of business innovation in Korea. For example, the expenditure of the top 30 sales companies has risen recently, whereas the R&D expenditure of companies ranking 31st through 70th in sales has decreased year on year (Figure 3.17). Furthermore, the dominance of the global information technology (IT) giant Samsung Electronics (Box 3.2), in terms of R&D spending, is so significant, accounting for around 20% of total business R&D in the country, that it inevitably could mislead the translation of aggregated statistics in business innovation.

Figure 3.17. Fluctuations of R&D expenditure among top Korean sales companies, 2019

Source: MSIT and (KISTEP, 2019[13]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5.

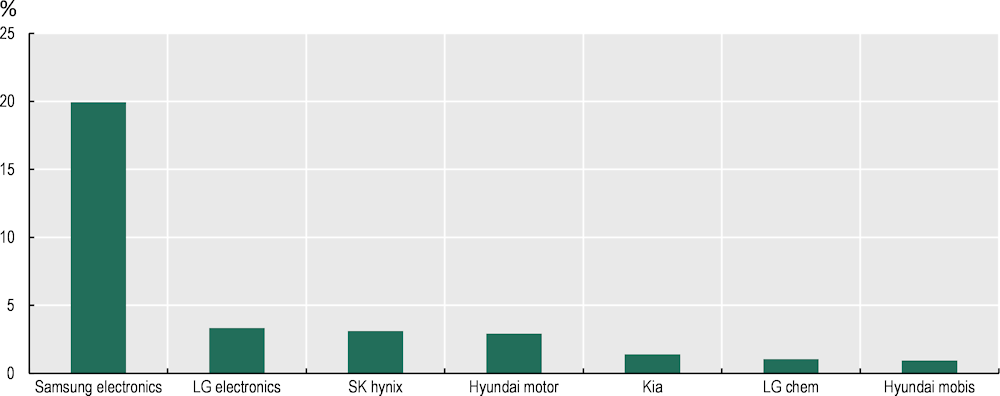

Box 3.2. The dominance of Samsung Electronics in Korean business innovation

In the Korean business R&D landscape, Samsung Electronics, a world ICT giant, is prominently leading in input (R&D expenditure), output, and commercialisation (patents and trademarks). It accounts for 2.3% of global R&D expenditures (after Alphabet), 3.6% in world IP5 family patenting (ranks top) and 1.2% in trademarking (seventh in the world) (European Commission et al., 2021[16]). From a domestic perspective, Samsung Electronics alone invested 19.9% of Korean business R&D expenditure in 2020 (Figure 3.18). As evidenced by Samsung’s intensive R&D investment, the electronic and electrical equipment sector is overwhelming others in Korea, which accounts for 19.1% of all domestic business R&D expenditure.

Figure 3.18. Firm shares in Business R&D expenditure in Korea, 2020

Source: European Commission (2022[3]), The 2021 EU Industrial R&D Investment Scoreboard, https://iri.jrc.ec.europa.eu/scoreboard/2021-eu-industrial-rd-investment-scoreboard; (OECD, 2022[27]), Research and Development Statistics (database), https://oe.cd/rds.

3.3.2. The innovation divide between larger and smaller firms is more acute in Korea than in other countries

Like R&D investment, there is also a large disparity in the ratio of innovating firms across enterprise size classes in Korea. Both for product innovations and business process innovations, the proportion of innovating firms with 500 or more employees is approximately five times that of innovating firms with 10‑49 employees (OECD, 2020[8]). These differences across enterprise class sizes are much more acute than in other developed countries. For example, in Germany, 23.4% of manufacturing firms with 10‑49 employees, 32.7% of firms with 50‑249 employees and 49.4% of firms with 250 or more employees have innovated ( (Eurostat, 2021[11])).

Despite the Korean government’s efforts to foster SMEs’ innovative capacity – notably by increasing government R&D investment in SMEs – the role of SMEs in Korea’s business innovation is relatively minor. This is partly due to large conglomerates conducting most of their R&D activities and innovation in-house. For example, expenditures for external R&D, including expenditures paid to member firms of the same conglomerate, amounted to only 6% of all R&D expenditures of Korean firms in 2019 (MSIT and KISTEP, 2021[18]). This relative amount of external R&D expenditures in Korea is much lower than in other major industrialised countries. For example, in the manufacturing sector, it was 23.7% in Germany in 2017, 17.2% in Japan in 2020, and 14.3% in the United States in 2018. However, it should be noted that there are some promising developments in the role of SMEs in Korea. In particular, manufacturing SMEs that have successfully innovated have often occupied market niches for technology-intensive products that have not received the attention of large conglomerates and have relied largely on global customers. As a result, some have established themselves as “hidden champions” (Box 3.3).

Box 3.3. Korea’s hidden champions

While innovation in the Korean manufacturing sector has been dominated by large conglomerates (chaebols), the innovation activities of a different type of companies have gained importance. These companies are much smaller and focus on a much narrower range of products than large conglomerates. Still, they hold a high or dominant global market share in their products. However, public awareness of these companies tends to be low. They may, therefore, be classified as “hidden champions”, as defined by Simon (2009[28]), who referred to them as companies that: 1) have high global market shares; 2) are not large; and 3) are not well-known to the general public.

Humax specialises in digital set-top boxes that connect TVs with external signals. It was founded by engineering graduates from Seoul National University and has focused on enhancing its technological capabilities and selling its products under its own brand based on in-house R&D (Kim, Sengupta and Kim, 2009[29]). The company has a strong global business presence and sells its products in almost all parts of the world (Humax, 2021[30]).

IDIS was founded by former students from the computer science department of the Korea Advanced Institute of Science & Technology (KAIST), a leading technical university, in a bid to create a global technology company. Based on its internally developed core technology, it has become a global pioneer and major competitor in digital camera surveillance systems (Lee, 2010, pp. 287-293[31]).

Suprema, founded by an engineering PhD from Seoul National University, has developed fingerprint recognition devices for security applications. It has focused on global markets from the outset, as the domestic demand for the company’s products has been initially small. The company has created technologically leading algorithms that can be applied to various types of product solutions (Cho, 2012[32]). It has regularly won international product competitions and has become a global market leader in access control biometric readers (Suprema, n.d.[33]).

Commonalities of these and other Korean hidden champions include an innovation focus based on in-house R&D, driven by their founders' deep technological expertise and a strong global business orientation. As a result, such firms are becoming more numerous.

Meanwhile, the Korean government has promoted the growth of SMEs into “hidden champions”. The Korean government’s most notable policy initiatives include implementing the World Class 300 Project, which aimed to promote 300 world-class enterprises by stimulating SMEs’ motivation and potential for growth with various support programmes, including financing, R&D and marketing, required to expand their global markets.

Source: Cho (2012[32]), The Growth Process and Key Success Factors of Technology-Intensive Ventures: The Case of Suprema Co., Humax (2021[30]), Humax Global Network, https://dearhumax.com/en/bbs/page.php?hid=Humaxintroduce3; Kim, Sengupta and Kim (2009[29]), “How Can Non-Chaebol Companies Thrive in the Chaebol Economy?”, https://doi.org/10.1080/12297119.2009.9707296; Lee (2010[31]), Small Giants: Korea’s Strong SMEs; Simon (2009[28]), Hidden Champions of the 21st Century: Success Strategies of Unknown World Market Leaders, https://doi.org/10.1007/978-0-387-98147-5; Suprema (n.d.[33]), Suprema, Who We Are, Proven Leader in Access Control, Time & Attendance and Biometric Solutions, https://www.supremainc.com/en/about/suprema.asp.

3.3.3. Korea’s ICT industry has achieved remarkable growth and leads globally

Korea’s ICT industry is outstanding in the Korean industrial landscape and against comparable advanced economies on the global stage. Korea ranked the highest in ICT value added (11.46%; see Figure 3.19) and third in the share of patents in ICT(18%; see Figure 3.20) among OECD countries (OECD, 2017[34]). Korea also ranked fourth in the utilisation of industrial robots (Figure 3.21). According to the Bank of Korea (2017), the real GDP of the Korean ICT industry accounted for 10.9% of whole GDP (Table 3.5). The real GDP growth rate of the ICT industry was 7.1% in 2017 compared to 2.6% for the non-ICT industry, and the contribution rate of the ICT industry to GDP growth amounted to 18.5% in 2017. For the previous five years (2012‑17), the real GDP growth rate of the ICT industry was 5.5% per year, exceeding the overall industrial growth rate of 3.0%. As such, the ICT industry continues to play a leading role in Korea’s economic growth.

Figure 3.19. Value added of the ICT sector in Korea and OECD countries, 2018

Source: OECD (2023), "STAN Industry ISIC Rev. 4", STAN: OECD Structural Analysis Statistics (database), https://doi.org/10.1787/data-00649-en (accessed on 10 June 2023).

Figure 3.20. Specialisation in ICT-related patents in Korea and selected economies, 2016-19

Source: OECD (2023), "STAN Industry ISIC Rev. 4", STAN: OECD Structural Analysis Statistics (database), https://doi.org/10.1787/data-00649-en (accessed on 10 June 2023).

Figure 3.21. Top-ten countries with the highest number of operational industrial robots, 2016-19

Source: OECD Going Digital Toolkit, based on the OECD STI Micro-data Lab, http://oe.cd/ipstats (accessed on 11 June 2023).

Table 3.5. Korea’s GDP growth rate and contribution of the ICT industry, 2011‑17

In percentage

|

Type |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|---|---|---|---|---|---|---|---|

|

ICT industry GDP growth rate (real) |

14.8 |

3.1 |

6.6 |

5.1 |

3.1 |

5.7 |

7.1 |

|

Non-ICT industry GDP growth rate (real) |

2.3 |

2.3 |

2.7 |

3.0 |

2.6 |

2.4 |

2.6 |

|

ICT industry as a percentage of GDP (real) |

9.6 |

9.7 |

10.0 |

10.2 |

10.2 |

10.5 |

10.9 |

|

ICT industry's contribution to GDP |

34.2 |

11.8 |

20.3 |

13.3 |

9.2 |

15.8 |

18.5 |

Source: Bank of Korea (2017).

Table 3.6. Korea’s top-ten manufacture exports, 2019‑20

In USD million

|

|

2019 |

2020 |

||

|---|---|---|---|---|

|

1 |

Semiconductors |

93 930 |

Semiconductors |

99 177 |

|

2 |

Automobiles |

43 036 |

Automobiles |

37 399 |

|

3 |

Petroleum products |

40 691 |

Petroleum products |

24 168 |

|

4 |

Automobile parts |

22 535 |

Marine offshore structures and parts |

19 749 |

|

5 |

Flat panel displays and sensors |

20 657 |

Synthetic resin |

19 202 |

|

6 |

Synthetic resin |

20 251 |

Automobile parts |

18 640 |

|

7 |

Marine offshore structures and parts |

20 159 |

Flat panel displays and sensors |

18 151 |

|

8 |

Steel plates |

18 606 |

Steel plates |

15 997 |

|

9 |

Wireless communication devices |

14 082 |

Computers |

13 426 |

|

10 |

Plastic products |

10 292 |

Wireless communication devices |

13 184 |

Source: Korean export customs data, https://www.index.go.kr/unity/potal/main/EachDtlPageDetail.do?idx_cd=2455.

The ICT industry has led to the trade surplus of Korean industry. In 2017, ICT exports amounted to USD 197.6 billion (US dollars), accounting for 34.4% of total exports (USD 573.7 billion). As a result, the trade surplus of the ICT industry was USD 95.5 billion, leading to the country's overall trade surplus (USD 95.22 billion; non-ICT industries suffered a USD 290 million deficit). The top-ten export items of all industries in 2020 (Table 3.6) included semiconductors, flat panel displays, computers and wireless communication devices. In particular, semiconductors ranked first, with USD 99.2 billion; computers ranked ninth, with USD 13.4 billion; and wireless telecom equipment ranked tenth, with USD 13.2 billion.

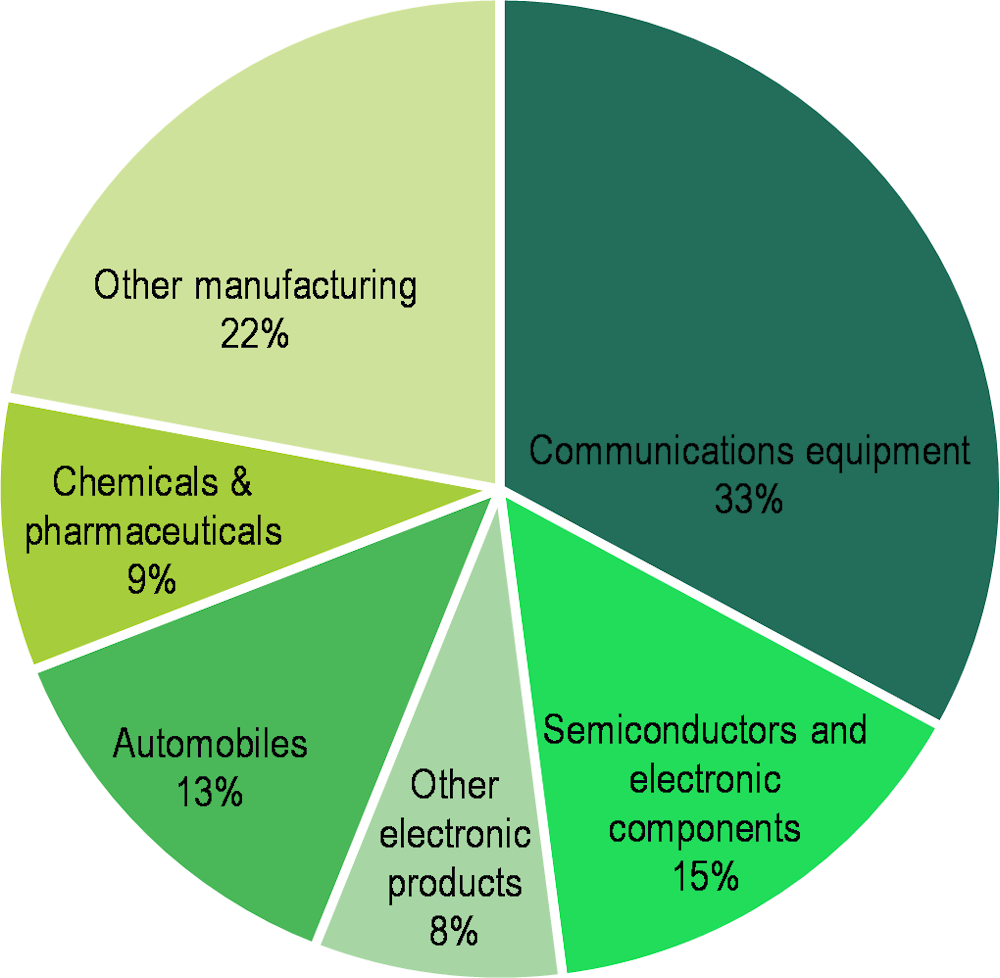

3.3.4. The widening discrepancy in R&D and productivity between Korea’s ICT and non-ICT industries is of concern

The remarkable growth and strength of Korea’s ICT industry reveal a widening discrepancy between ICT and non-ICT industries in various aspects. Business R&D concentration in Korea is outstanding not only across different firm sizes but across industries. In particular, business R&D concentration in the ICT industry is as conspicuous as the extent of business R&D concentration in large firms. In the manufacturing sector, no less than 56% of all R&D spending in 2019 fell to electronic components, computer, visual, sounding and communication equipment (broadly covering the IT and electronics industries), with 33% being spent by the communications equipment (mobile phone) industry alone (Figure 3.22). Other major R&D spenders are the semiconductor and electronic component industry (15%) and the automobile industry (13%). In contrast, the combined proportion of the chemical and pharmaceutical industries (9%) is modest, considering their generally high R&D intensity.

Figure 3.22. Manufacturing sector R&D in Korea by industry, 2019

Source: MSIT and KISTEP (2021[18]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5.

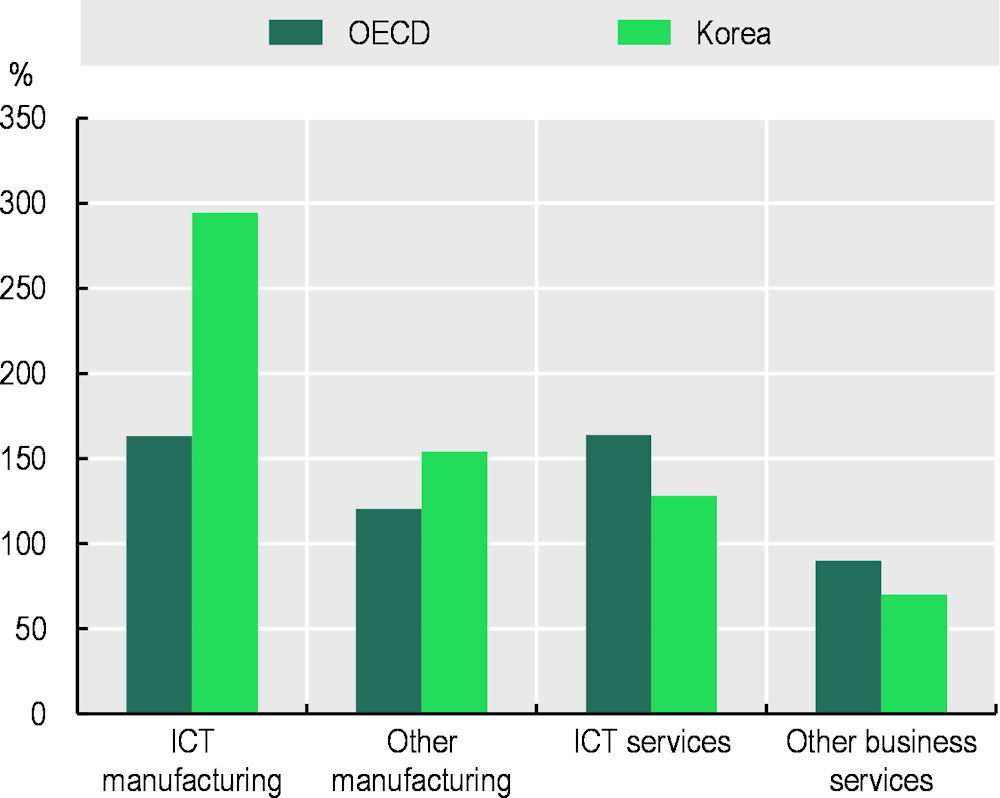

Figure 3.23. Sector productivity relative to total productivity in Korea and OECD, 2015

Note: “ICT manufacturing” includes the manufacture of computer, electronic and optical products. “ICT services” include publishing, telecommunication and IT services. “Other business services” excludes the housing sector.

Source: OECD (2020[35]), OECD Economic Survey: Korea 2020, https://doi.org/10.1787/2dde9480-en.

The disparity in innovation activity, including R&D investment across varying industries, could lead to increased disparity in productivity. In effect, the significant concentration on business R&D in the ICT industry mirrors the productivity gap between ICT and other industries. While the productivity of Korean ICT manufacturing business to total productivity (294%) is much higher than the OECD average (163%), the productivity of others remains at half of ICT manufacturing (154%) (Figure 3.23) (OECD, 2020[35]).

3.3.5. Stark discrepancies in R&D and productivity between manufacturing and services industries also exist

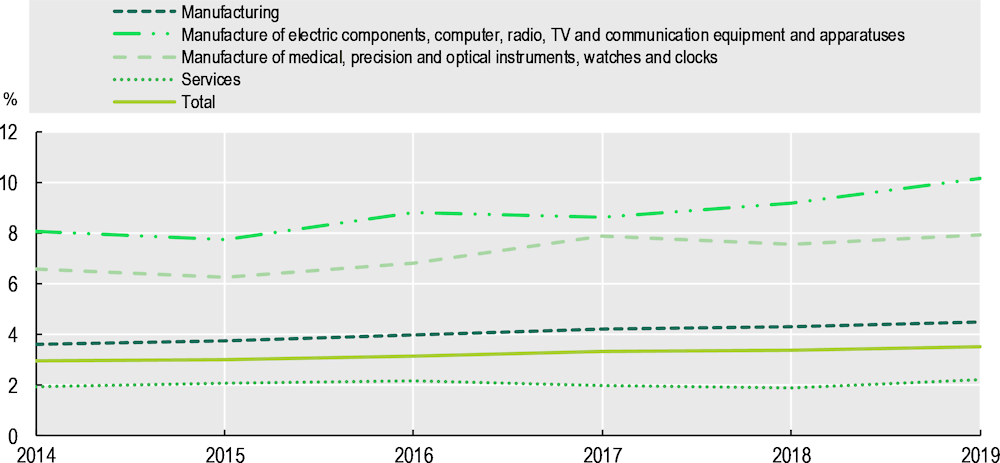

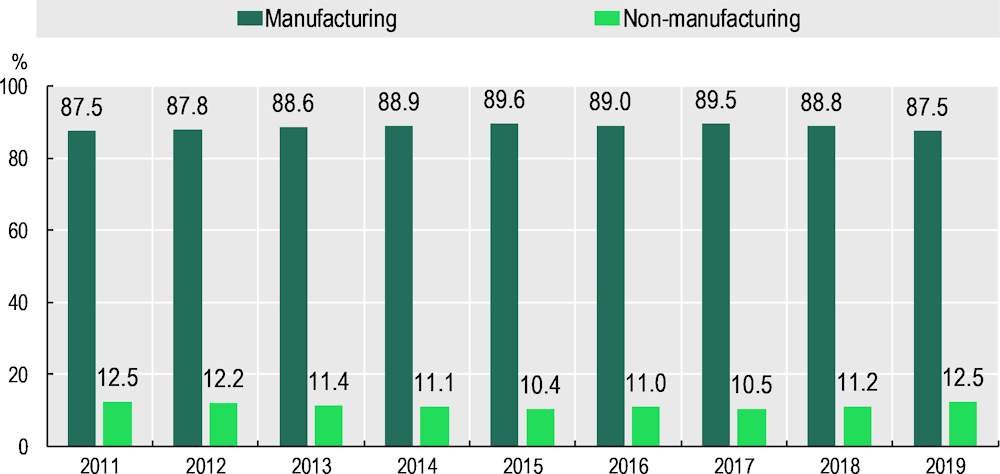

In Korea, almost 90% of all business R&D in Korea is spent on the manufacturing sector. The share of non-manufacturing R&D decreased from 12.5% in 2011 to 10.4% in 2015 before recovering to 12.5% again in 2019 (Figure 3.24). While the manufacturing sector generally plays an important role in business R&D across industrialised countries, the strong concentration of R&D on manufacturing firms in Korea stands out in international comparison. The average proportion of business R&D falling to manufacturing in the five largest developed economies (United States, Japan, Germany, United Kingdom and France) was 70.8% in 2016 (calculated from (OECD, 2023[2])).

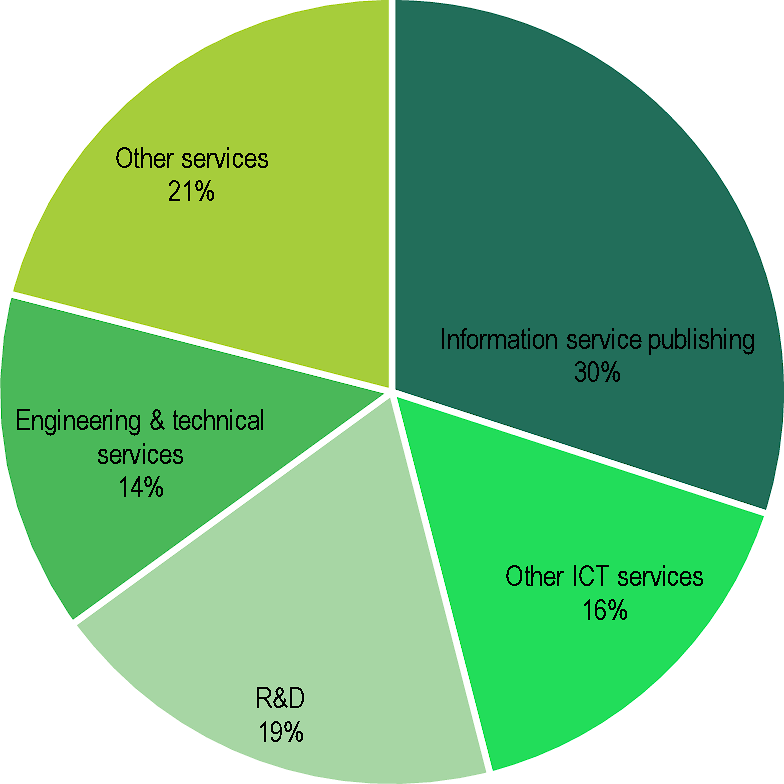

Furthermore, Korean manufacturing firms spend much more on R&D in relation to their revenue size than their counterparts in the service sector. In 2019, R&D intensity (the ratio between R&D expenditures and sales) was 4.49% in the manufacturing sector and 2.21% in the service sector (Figure 3.25) (MSIT and KISTEP, 2021[18]). Moreover, R&D intensity in manufacturing has risen over the last five years, from 3.63% to 4.49%, while the service sector has stagnated. In the service sector, the largest R&D spender is the “information service publishing” industry, which mainly consists of software companies (Figure 3.26). Most of the remaining R&D spending in services falls to other ICT services, including broadcasting, advertisement, R&D services, engineering and technical services. These service industries are thought to rely to a great extent on manufacturing business customers. In other words, substantial parts of service R&D appear to be linked to innovation in the manufacturing sector. The dominance of the manufacturing sector in business R&D in Korea thus may be even stronger than the overall sectoral composition of R&D spending suggests.

Figure 3.24. R&D expenditure rate to sales by major industries, Korea, 2014‑19

Source: MSIT and KISTEP (2021[18]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5.

Figure 3.25. Business enterprise R&D in Korea by sector, 2011-19

Source: MSIT and KISTEP (2019[13]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5.

Figure 3.26. Service sector R&D in Korea by industry, 2019

Source: MSIT and KISTEP (2021[18]), Survey of Research and Development in Korea, 2019, https://www.kistep.re.kr/reportDownload.es?rpt_no=RES0220210050&seq=res_0026P@5.

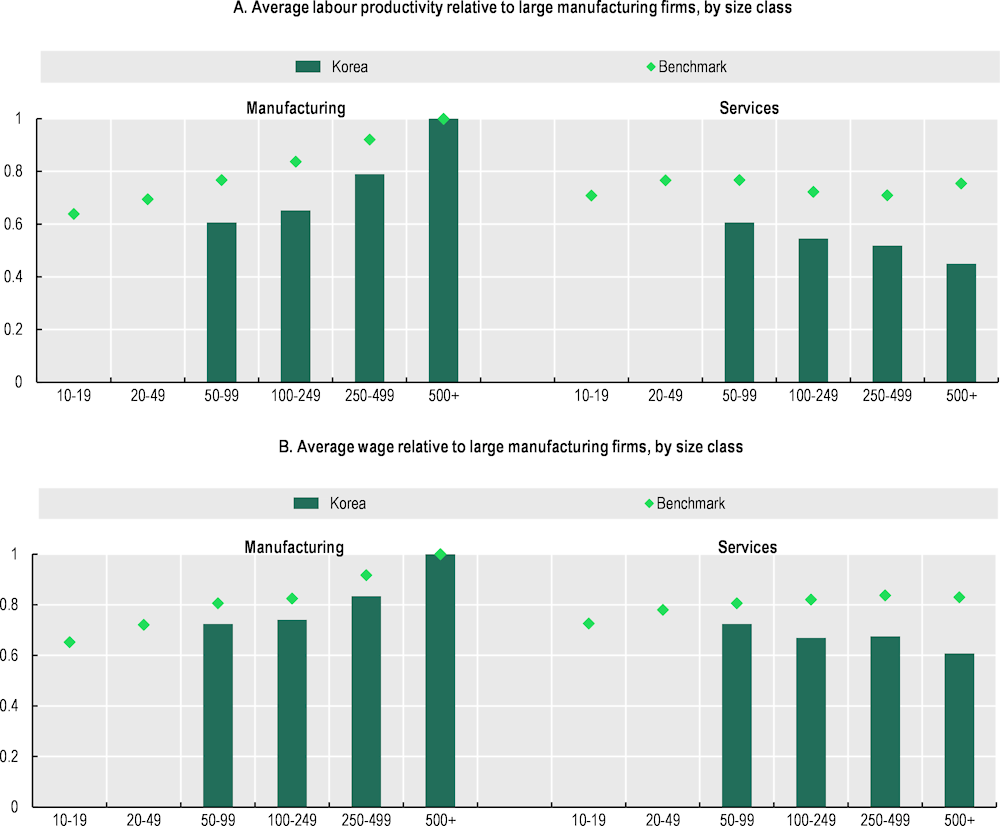

The gap between Korea’s manufacturing and service industries does not stop at R&D investment and spans various aspects of innovation. First, a wide productivity gap exists between Korea’s manufacturing and service industries (Figure 3.27). The sector productivity gap in Korea is among the highest in the OECD (OECD, 2023[6]). Meanwhile, a robust productivity-wage premium exists in OECD countries (Berlingieri, Calligaris and Criscuolo, 2018[36]). Higher wages are paid by more productive firms; thus, a close link can be observed between productivity and wages. Therefore, the productivity gap identified between Korea’s manufacturing and service sectors matches equally pervasive wage gaps. Adding the additional layer of imbalance between large and small firms on top of the sectoral productivity gap opposes large manufacturing firms to SMEs in the service sector. Combining the size and sectoral dimensions from the within-industry analysis and linking them to wages, it appears that productivity gains overwhelmingly accrue to large manufacturing firms. Productivity in small manufacturing and service firms of all sizes is low compared to large manufacturing firms, and the gap is larger in Korea than in other OECD countries on average (Figure 3.28, Panel A). Wage gaps largely reflect the productivity gaps (Figure 3.28, Panel B) (OECD, 2023[6]). Meanwhile, lack of productivity can also influence competitiveness and the Korean service industry’s advantage in terms of global integration. Korea ranked 7th among manufacturing hubs in global value chains and only 21st among services (OECD, 2021[37]).

3.3.6. The servicification of manufacturing can offer great potential but remains largely untapped

With the development of ICT technologies, services are increasingly embedded in manufacturing products as manufacturing firms increasingly rely on services, either as inputs, as production activities within a firm, or as outputs sold bundled with goods (Miroudot and Cadestin, 2017[38]). This phenomenon is known as “servicification” of the manufacturing industry. Korea has great potential for this servicification (OECD, 2020[35]). For instance, cell phone manufacturers can bundle their products with telecommunication services to allow users to install apps, generating additional service transactions. In this regard, Korea can benefit from the manufacturing sector itself to develop some value-added services. However, data show that Korea has not fully tapped into the potential of servicification. In effect, the contribution of domestic services to manufacturing exports is one of the lowest among OECD countries at 15%, while the OECD average is 28% (OECD, 2021[39]).

Figure 3.27. Labour productivity in services relative to manufacturing in Korea and OECD countries, 2015

Source: OECD (2021[37]), Inclusive Growth Review of Korea: Creating Opportunities for All, https://doi.org/10.1787/4f713390-en.

Figure 3.28. Average labour productivity and wages relative to large manufacturing firms in Korea, 2015

Source: OECD (2021[37]), Inclusive Growth Review of Korea: Creating Opportunities for All, https://doi.org/10.1787/4f713390-en.

3.4. Ongoing developments, achievements, and a way forward

This section discusses developments relevant to the Korean business innovation system and industry structure more generally, which is highly concentrated in the ICT and manufacturing industries. The section focuses on the emergence of biotechnology, which holds vast potential for Korea and constitutes a significant shift to emerging non-ICT technologies. In addition, it alludes to the importance of not neglecting high-value-added and knowledge-intensive services to counter the prevalent imbalance.

3.4.1. Korea relies the most highly on ICT industries among OECD countries, but new technology-based industries, such as biotechnology, are emerging

Korea has strived to diversify its industry landscape from ICT-centred manufacturing to knowledge- and high-tech-based industries with more diversity. Despite continued reliance on the ICT industry, the growing presence of the biotech industry in Korea provides a potential pathway for advancing toward a more diversified and knowledge-based economy. Korea envisioned promoting the biotech industry decades ago; its move started in the early 1980s with the Biotechnology Support Act (see Box 3.4), which provided the legal framework for governing support policies in the field of biotechnology.

Box 3.4. Korea’s Biotechnology Support Act

The purpose of Korea’s Biotechnology Support Act is to develop and support biotechnology more efficiently by laying the foundation for biotechnology research and to contribute to the sound progress of the national economy by facilitating the industrialisation of the technology.

The Minister of Science and ICT shall formulate the basic plan for biotechnology support (hereafter, the “basic plan”). The basic plan includes the following:

comprehensive plans and guidelines on fundamental studies of biotechnology and the promotion of studies for industrial application thereof

guidelines related to a comprehensive development plan and efficient utilisation of human resources necessary for research in biotechnology

plans and guidelines related to research in biotechnology and the international exchange of talents and technology.

The Council for Comprehensive Biotechnology Policy shall be formed under the authority of the Minister of Science and ICT for the management of affairs relating to the establishment of the basic plan and its execution and co‑ordination.

The Government of Korea shall promote co‑operative activities among academia, research institutes and industry for efficient research and technological development in biotechnology. The Government of Korea may take policy steps to provide assistance in matters falling under each of the following subparagraphs in order to vitalise the R&D of biotechnology and to facilitate the industrial application of the results thereof:

matters concerning assistance in the production of goods using new technology

matters concerning R&D aimed at facilitating the industrial application of the results of biotechnology research and the building of regional R&D bases

matters concerning assistance in start-ups and SMEs involved in biotechnology.

The Government of Korea shall endeavour to promote R&D by gathering information for biotechnological research and distributing it to related organisations.

The Government of Korea shall establish a system regarding safety and clinical tests for biotech products.

Source: Korea Legislation Research Institute and Korea Law Translation Center (2021[40]), Biotechnology Support Act, https://elaw.klri.re.kr/eng_service/lawView.do?hseq=60046&lang=ENG.

The growth of the Korean biotech industry has been impressive, with many Korean biotechnology firms now taking leading positions around the globe. Overall, the biotech industry has become one of Korea’s major industries. According to the latest data from the Ministry of Trade, Industry and Energy, Korean biotech industry production increased to KRW 1 749.23 billion in 2020, a significant jump, equivalent to 38.2% over the previous year, the greatest increase since the statistics were collected and announced (see Table 3.7, section A). Moreover, biotech industry exports rose 53.1% in 2020 (see Table 3.7, section B). This remarkable increase has been accompanied by a rapid increase in employment in the industry; in 2020, employment in biotech rose by 10% (Ministry of Trade, Energy and Industry, 2021[41]).

Table 3.7. Progress in Korea’s biotechnology industry, 2016‑20

Biotech industry production and domestic demand, 2016‑20, in KRW 100 million

|

A. Biotech industry production and domestic demand, 2016‑20, in KRW 100million |

|||||||

|---|---|---|---|---|---|---|---|

|

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

Average annual rate of change |

|

Production (Domestic sales + exports) |

Amount |

92 611 |

101 457 |

106 767 |

126 586 |

174 923 |

|

|

Rate of change |

8.9% |

9.6% |

4.5% |

19.3% |

38.2% |

17.2% |

|

|

Domestic demand (Domestic sales + imports) |

Amount |

60 898 |

65 466 |

70 966 |

81 836 |

98 189 |

|

|

Rate of change |

8.2% |

7.5% |

8.4% |

15.3% |

20.0% |

12.8% |

|

|

B. Biotech industry exports, 2016‑20, in KRW 100 million |

|||||||

|

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

Average annual rate of change |

|

Export |

Amount |

46 310 |

51 684 |

52 382 |

65 414 |

100 158 |

|

|

Rate of change |

8.0% |

11.6% |

1.4% |

24.9% |

53.1% |

21.3% |

|

Source: Ministry of Trade, Energy and Industry (2021[41]), Ministry of Trade, Energy and Industry Announcement of 2020 Bioindustry Survey Results, http://www.motie.go.kr/common/download.do?fid=bbs&bbs_cd_n=81&bbs_seq_n=165037&file_seq_n=1.

3.4.2. Public R&D investment in biotechnology has led to the rapid increase of Korean firms’ biotech patents and the creation of start-ups

Public R&D investment in biotechnology has played a critical role in creating Korea’s robust bio-industry ecosystem. Government R&D investment in biotechnology increased markedly from USD 1.2 billion in 2007 to USD 3.4 billion in 2016. Biotechnology investment in government R&D accounted for 15.7% of whole government R&D spending in 2016, rising to 19.2% in 2020. Moreover, the Korean government has chosen the biotech industry as one of three innovative growth engines (“Big 3”), along with system semiconductors and future vehicles. The government has prioritised its policy measures, including R&D, tax, and regulation reform, to drive the growth of the Big 3 industry. The government planned to invest USD 5.2 billion in 2022, a 42.7% increase from 2021. Government support for the biotech industry stretches the whole innovation cycle, from technology development, authorisation and production to market entrance. Sustaining the government’s strong support for R&D has yielded active patent applications and high-impact research performance (Figure 3.29). On top of academic and technological development, strong and continuing government investment has played a role in supporting entrepreneurs in creating and expanding biotechnology-related businesses, resulting in the rise of biotech venture capital investments as well (Figure 3.29). The number of biotech start-ups created in Korea was 140 in 2010, increasing to 440 in 2016. As a result, the Korean biotech industry has become competitive around the globe; Korea ranked second in terms of the production capacity of biomedicine in 2020 (Ministry of Trade, Energy and Industry, 2021[41]).

Figure 3.29. Development of Korea’s biotechnology industry

Source: Ministry of Science and ICT (2021[42]), Biotechnology 2020 in Korea, https://www.khidi.or.kr/board/view?pageNum=1&rowCnt=3&no1=&linkId=48855931&menuId=MENU02296.

Table 3.8. The number of SCI paper publications in Korea, 2013-17

|

|

2013 |

2014 |

2015 |

2016 |

2017 |

|---|---|---|---|---|---|

|

Number of publications |

52 827 |

55 791 |

58 832 |

60 471 |

61 163 |

|

Total number of publications worldwide |

1 572 889 |

1 622 978 |

1 670 162 |

1 733 431 |

1 790 016 |

|

Percentage of global publications |

3.36% |

3.44% |

3.52% |

3.49% |

3.42% |

|

World ranking |

12 |

12 |

12 |

12 |

12 |

Source: Ministry of Science and ICT (2021[42]), Biotechnology 2020 in Korea, https://www.khidi.or.kr/board/view?pageNum=1&rowCnt=3&no1=&linkId=48855931&menuId=MENU02296.

Meanwhile, the competitiveness of Korea’s biotech industry was particularly evident during Korea’s response to COVID‑19. Korea was one of the first countries to succeed in developing and exporting COVID‑19 diagnostic test kits shortly after the outbreak. The accumulated experience in developing diagnostic test kits and the prompt response by the government contributed to establishing a system for an early diagnosis of COVID‑19. Korean SMEs specialised in diagnosis and emergency screening had developed the capacity to develop diagnostic test kits for the swine flu and Middle East Respiratory Syndrome outbreaks in past decades. In the meantime, the Ministry of Food and Drug Safety approved the COVID‑19 diagnostic test kits by emergency use authorisation, which shortened the duration of the authorisation process by approximately 150 days. As a result, Korean biotech SMEs supplied 190 million COVID‑19 diagnostic test kits to 150 countries between April and August 2020. In addition, the Ministry of Food and Drug Safety approved 166 diagnostic reagent products, while the United States approved 16 products in the same period.

3.4.3. Korea’s biotech industry has huge potential, notably from the perspective of information technology-biotechnology convergence

The biotech industry in Korea has huge potential to grow into a top-notch industry in the world with a clear edge over competitors. The world’s number one ICT technology can provide enormous opportunities for the future growth of the biotech industry in Korea, given that biotechnology (BT) and IT are converged in technological development and the application of technology, notably in cases such as mobile medical devices. On top of its competitive ICT technology, Korea is ranked as number one in the electronic medical records penetration rate, which could be the foundation for data-driven medical service and research, resulting from one of the most efficient and strongest universal health insurance systems. Even though the Korean biotech industry has grown remarkably, it faces some challenges (see Box 3.5). In order to become a real powerhouse in the biotech industry on the global stage, Korea’s biotech business should make strong efforts to overcome these challenges.

Box 3.5. Challenges of the Korean biotech industry

Despite the outstanding growth of Korea’s biotech industry, many biotech firms have pointed out major challenges and hurdles they need to overcome to advance to become a global leader in the field. Several policy initiatives have been developed by the Korean government, including the Innovative Strategy on the Bio-health Industry (2019), which presents a strengths, weaknesses, opportunities and threats (SWOT) analysis. Across different aspects that comprise the competitiveness of the biotech industry, some challenges include: