This chapter provides an overview of the tax reforms adopted by the OECD/G20 Inclusive Framework jurisdictions during 2022, who responded to the OECD’s annual tax policy reform questionnaire. It describes the reforms that were announced and implemented in 2022, examining trends in each category of tax, including personal income taxes and social security contributions, corporate income taxes and other corporate taxes, taxes on goods and services (including value added taxes, sales taxes, and excise duties), environmentally related taxes and property taxes.

Tax Policy Reforms 2023

3. Tax policy reforms

Abstract

3.1. Personal income tax and social security contributions

Reforms to personal income tax (PIT) and Social Security Contributions (SSC) were driven by equity and affordability concerns in 2022. Jurisdictions commented that tax reforms affecting PIT and SSC payments were predominantly focused on supporting households and businesses in coping with elevated inflation levels. In some cases, jurisdictions targeted support measures at lower-income households with the aim of maintaining tax progressivity, lowering their fiscal costs, and limiting additional inflationary pressures. Support measures for the self-employed and unincorporated businesses were more common in 2022 than in previous years, and – in a change to PIT and SSC policy trends – a number of jurisdictions targeted measures towards specific industries. Given elevated inflation levels throughout the year, the indexation of PIT and SSC systems was particularly important.1 Increases in the generosity of support measures also raised governments’ revenue needs.

Jurisdictions mainly implemented PIT base narrowing measures and increased top PIT rates on labour income and taxes on capital income. Many jurisdictions implemented PIT base narrowing measures to lower the tax burden on labour income and support households in dealing with the increase in living costs, through more generous PIT allowances and increases in earned income and child tax credits while a number of jurisdictions also implemented PIT base narrowing measures to lower the tax burden on the self-employment and unincorporated businesses to encourage greater investment and employment. A small group of jurisdictions also narrowed the PIT base for employees operating in certain sectors with the aim of increasing investment and employment in industries deemed to be of strategic importance. Top PIT rates and capital income taxes were increased in several jurisdictions to raise revenue and support the progressivity of taxes on personal income. Reforms to SSCs were comparatively more mixed, as some jurisdictions emphasised the need to promote the sustainable financing of social security systems while others implemented support measures through the SSC system.

Jurisdictions made more PIT and SSC reforms in 2022 than in previous years. Compared to 2021, the number of reported reforms to these tax bases nearly doubled. In line with trends noted over the past eight years (when the Tax Policy Reforms report was first published), jurisdictions continued to narrow their PIT bases. More jurisdictions also reported raising top PIT rates and taxes on capital income compared to previous years.

3.1.1. PIT and SSCs continue to be a major source of tax revenue

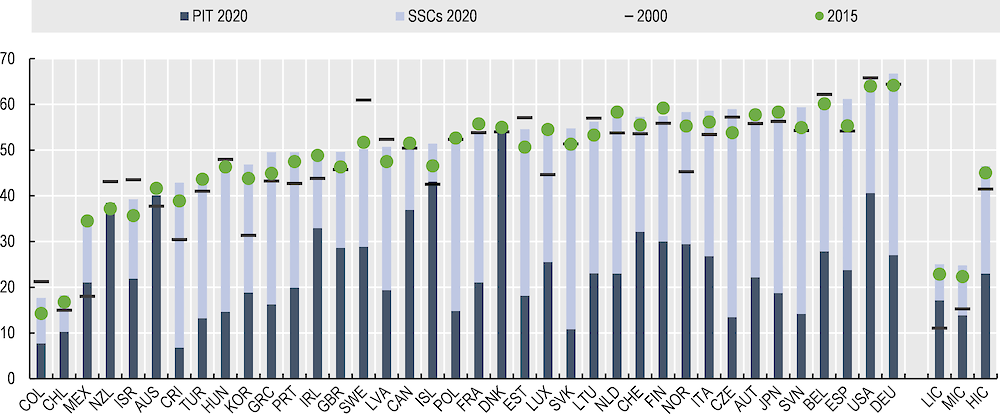

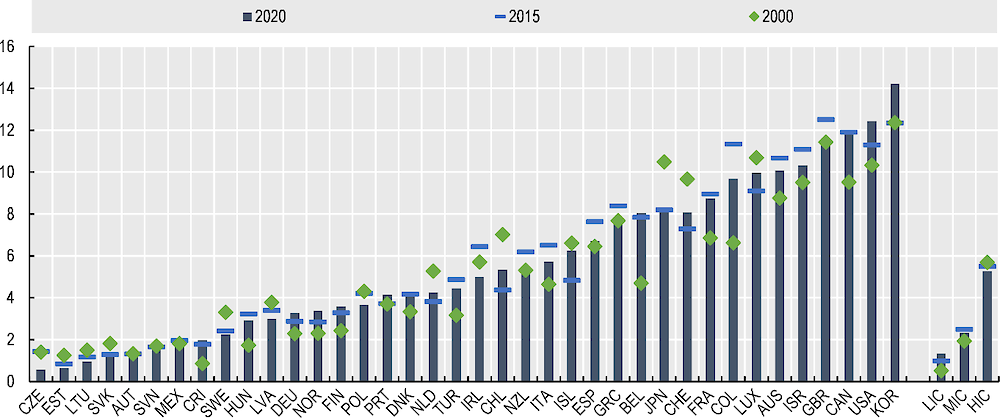

PIT and SSCs form significant sources of tax revenues in most OECD and high-income countries, while their share of overall tax revenue is smaller in low- and middle-income countries. In 2020, PIT and SSCs accounted for around half of total tax revenues, with PIT making up 24% and SSCs accounting for 28% of total tax revenue on average across OECD countries. In contrast, PIT accounted for, on average, 17% and 14% in low-income and middle-income countries (LICs and MICs), respectively, while SSCs make up 8% and 11% of total tax revenue.

The share of PIT within total tax revenue declined in the majority of OECD countries and across LICs, MICs and HICs in recent years. Cross-country differences in the contribution of PIT to total tax revenues remain large (Figure 3.1). The share of PIT in total tax revenue declined in 28 OECD countries between 2015 and 2020, as well as across LICs, MICs and HICs, on average. This fall was preceded by a 15-year period of increasing PIT shares in overall tax revenues in the majority of OECD countries. Differences in PIT’s share of total tax revenue remained large over the observed period. For instance, among OECD countries, the PIT share in total tax revenue was larger than 40% in Denmark Iceland, the United States and Australia while it accounted for less than 10% in Costa Rica and Colombia in 2020. As Figure 3.1 shows, these outliers are largely the result of certain countries relying more heavily on either PIT or SSCs, rather than having more equal contributions of the two taxes.

Figure 3.1. Revenues from personal income tax and social security contributions

Note: Personal income tax revenues refer to tax category 1100 under the OECD classification of taxes, and social security contributions to tax category 2000. Tax revenues are the sum of taxes collected by all levels of government. See Revenue Statistics Interpretative Guide for more detail. The low- (LIC), middle- (MIC), and high-income country (HIC) averages are representative of the 116 jurisdictions that provide tax revenue data to the OECD.

Source: OECD Global Revenue Statistics Database.

The share of SSCs in total tax revenues in HICs is more than twice as large as in LICs and MICs, and this share has increased across the majority of countries. The SSC share in total tax revenue increased in the majority of OECD countries as well as in LICs, MICs and HICs during the past two decades, and in contrast to PIT, also grew steadily in recent years. The growth in the SSC share between 2000 and 2020 was slightly higher in LICs, though the differences between SSC shares in LICs (8%) and MICs (11%) compared to HICs (24%) remained large. Within OECD countries, the SSC share in total tax revenue is larger than 20% in 28 out of 38 countries and as high as 40% in the Czech Republic, Japan, Slovenia, and the Slovak Republic. Eastern European countries rely more heavily on SSCs compared to other OECD countries, while SSCs play a less significant role in Latin American countries.

3.1.2. Elevated inflation levels in 2022 had a significant impact on the tax burden on income from labour

Inflation had important consequences for the labour tax burden in 2022 due to the effects of fiscal drag. Nominal wage growth did not keep pace with price increases in OECD countries on average in 2022, meaning workers’ incomes fell in real terms. Despite the majority of OECD countries indexing their tax and transfer systems, whether through automatic or discretionary mechanisms, the increase in nominal incomes pushed labour taxpayers into higher PIT brackets in a number of countries, increasing average tax rates and compounding citizens’ loss of purchasing power. The OECD (2023[1]) shows, for example, that the average tax wedge increased in 23 OECD countries pushing the OECD average for single workers without children earning the average wage up slightly (+0.04 p.p.). In some countries, the rise in the average tax wedge was due to nominal increases in wages which were not matched by the upward adjustments of income tax thresholds due to inflation. In other countries the value of allowances and credits fell relatively more than earnings, while SSCs drove labour tax increases in a third group of countries. The average tax wedge declined in 11 countries, either driven by increases in tax exemptions, deductions, and tax credits or by lower SSCs, and remained constant in four countries. The largest increase in the average tax wedge was reported in the United States (2.2.p.p.), due to the withdrawal of COVID-19 related support measures while the largest decline was reported in Türkiye (-2.66 p.p.), due to the introduction of a minimum wage tax exemption.

3.1.3. A number of jurisdictions sought to raise tax revenues and promote progressivity by reducing the tax burden on lower-income earners and increasing top PIT rates

Four HICs and one MIC implemented or announced top PIT rate increases. Jurisdictions increased top PIT rates in an attempt to raise additional government revenue and to enhance the progressivity of their tax systems, which marks a continuation of top PIT rate increases implemented in the past year. With effect in 2023, Slovenia raised its top PIT tax rate by 5 p.p. to 50%, which reversed the top PIT rate decrease implemented in January 2021. In Norway, the top PIT rate was raised by 0.1 p.p. to 17.5%2 with effect from January 2023. To increase progressivity, Indonesia introduced an additional tax bracket to its four-bracket income tax schedule, raising the top rate from 30% to 35% in 2022. Singapore announced the addition of two tax brackets to its PIT schedule, raising the top PIT rates from 22% to 24% for income above SGD 1 million (USD 0.7 million) (for income above SGD 500 000, (USD 363 582) a rate of 23% will apply). Japan proposed the introduction of an effective minimum tax of 22.5% on individuals earning more than YEN 330 million (USD 2.6 million) to take effect in 2025.3 Five high-income countries implemented non-top PIT rate cuts to lower the tax burden on low- and middle-income households and to encourage consumption. Norway and Portugal lowered tax rates applied to low-and middle-income households, with Norway reducing the rates levied on the first and second tax band by 0.1 p.p. and Portugal lowering its rate applied to the second income tax bracket by 2 p.p. to 21% in January 2023. To boost economic growth, Poland reduced the tax rate applied to the first income tax bracket from 17% to 12%, and as a result abolished the middle-class relief,4 while the Netherlands lowered the tax rate applied to the first tax bracket of box 1 income (employment, homeownership) by 0.11 p.p. to 36.93% with effect from 2023.5 Ireland extended the application of reduced universal social charge rates for individuals earning less than EUR 60 000 (USD 63 180) and who have a full medical card. Mauritius added a second income tax bracket to a three-bracket income tax schedule, lowering the tax burden for middle-income households.

The Czech Republic, the Netherlands and Norway increased non-top PIT rates to raise tax revenue. In Norway, tax rates applied to the third- and fourth-income tax bracket were raised by 0.1 p.p. The Netherlands abolished the option to average income over the last three years to calculate PIT liability from the 2023 tax year to simplify the tax system and announced that income from business ownership (box 2 tax), which is currently taxed at a flat rate of 26.9%, will be subject to a two-bracket progressive tax schedule with a top rate of 31% applying to income above EUR 67 000 (USD 70 550) from 2024 onwards. The Czech Republic increased the value of flat rate payments, which qualifying self-employed individuals may choose instead of paying PIT, SSCs and health insurance contributions in 2023.

Table 3.1. Changes to personal income tax rates

|

|

Rate increase |

Rate decrease |

||

|---|---|---|---|---|

|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

Top PIT rate |

CAN3, NZL |

IDN, JPN1,2, NOR, SGP2, SVN, |

CAN3 |

|

|

Non-top PIT rate |

CZE, NOR, NLD |

CAN3 |

CAN3, MUS, NLD, NOR, POL, PRT |

|

Note: 1 denotes a new tax, 2 denotes reform announcement, 3 denotes that tax reform was implemented at the sub-central level (rate increases in the Province of Newfoundland and Labrador and rate decreases in the Province of New Brunswick).

Source: OECD Annual Tax Policy Reform Questionnaire.

3.1.4. Reforms narrowing PIT bases continued in 2022

The trend of jurisdictions narrowing PIT bases continued in 2022. Of the reforms undertaken by jurisdictions who altered their PIT bases in 2022, 63 were base narrowing and 11 were base broadening. The majority of PIT base narrowing reforms aimed at supporting low- and middle-income earners, particularly families with children, and self-employed individuals and unincorporated businesses in coping with significant increases in their costs of living. Some PIT narrowing measures provided investment and employment incentives to boost sluggish economic growth; these were often targeted at sectors deemed to be innovative or of strategic importance, sectors especially affected by inflation, or to the self-employed and unincorporated businesses. PIT relief measures were also used in response to housing affordability issues.

Table 3.2. Changes to personal income tax bases

|

|

Base broadening |

Base narrowing |

||

|---|---|---|---|---|

|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

Personal allowances, credits, tax brackets |

ITA, NOR, GBR2, URY1,2 |

COL, KOR, NLD, NOR |

BRA, CZE, FIN, IRL, ITA, LTU, NOR, SWE, ZAF |

ALB4, CAN4,5, DEU, ESP, EST, FIN, IRL, KOR, LTU, LVA,4 NLD, NAM, NOR, POL4, SVN, TTO |

|

Self-employed and unincorporated business |

|

CZE, NLD, SVN |

AUT, DEU, POL, MEX, TUR |

ARG, ITA, KOR, ROU |

|

Employment |

BEL, SWE |

|

AUS, AUT, BEL, DEU, NLD, NOR |

CAN, ESP, HUN4, ITA, JPN, MUS, POL, PRT, ROU, SVN, SWE4, TUN, ZAF, USA |

|

Provisions targeted at low-income earners, EITCs and other in-work benefits |

|

|

CAN, FIN, ITA, SWE1, USA |

DNK, IRL, LUX |

|

Children and other dependents |

|

|

BEL, BGR1, FIN1, ITA, |

AUT4, ARG, AUT, BGR, CAN4, CHE4, CZE4, DEU, ESP, FRA, HRV, IRL, KOR, LUX, MUS, POL4, PRT |

|

Elderly & disabled |

|

|

EST, LVA, POL, SWE |

AUT, CAN, DEU, FIN, KOR, MLT4, SWE, USA |

|

Miscellaneous expenses, deductions, and credits |

|

BEL, CAN, CHL ESP4, NOR4 |

|

BRB, CAN, DEU, IRL1, NZL, SWE, CZE, USA |

Note: 1 denotes a temporary tax measure, 2 denotes a new tax, 3 denotes reform announcement, 4 denotes reforms introduced in 2022, but covered is last year’s TPR edition, 5 denotes that tax reform was implemented at the sub-central level

Source: OECD Annual Tax Policy Reform Questionnaire.

Most jurisdictions increased the generosity of general PIT allowances and credits and adjusted tax thresholds for inflation

Several jurisdictions increased the generosity of their PIT relief measures. To support citizens with the impact of rising price levels and to increase the progressivity of their tax systems, jurisdictions increased the generosity of their tax allowances and credits. Inflation also risked raising the tax burden in progressive tax systems through its impact on nominal wages. OECD countries regularly adjust their PIT system for inflation, either through automatic indexation mechanisms or on a discretionary basis, which was of particular importance in the context of rising inflation and falling real wages in 2022 (OECD, 2023[1]).

Several jurisdictions raised basic allowances in response to elevated inflation levels. Basic allowance increases in some jurisdictions were notably larger than inflation, lowering the tax burden for low- and middle-income earners. Norway, Lithuania, and Slovenia increased their basic allowances by 25%, 36%, and 11% respectively between 2022 and 2023.6 Germany raised its basic allowance by 4% retroactively with effect from January 2022 and legislated further increases of 5% in 2023 and 6% in 2024.7 Germany also increased its standard tax allowance by 20% to EUR 1 200 (USD 1 265), retroactively, for 2022 and legislated a further EUR 30 (USD 32) increase for 2023. In Estonia, the basic allowance was raised by approximately 31% to EUR 7 848 (USD 8 265) and is phased out to zero for income between EUR 14 400 (USD 15 165) and EUR 25 200 (USD 26 535). Spain also modified the phase-out in its basic allowance and increased the maximum income threshold at which the basic allowance becomes zero by around 17% to EUR 19 747 (USD 20 800). Trinidad and Tobago increased its personal allowance by 7% to TDD 90 000 (USD 13 300).

Ireland, the Netherlands, and Namibia increased their basic tax credits. The Netherlands increased the maximum employment tax credits by 18% and extended the basic tax credit from box 1 (broadly, earned income) to box 2 and 3 income (broadly capital income). Ireland increased its personal tax credit by 4% while Namibia implemented a nearly fourfold increase in its tax credit to NAD 150 000 (USD 8 470)) in 2023.

Given the high levels of inflation, jurisdictions adjusted their tax thresholds to avoid bracket creep, either through one-off adjustments or through automatic indexation mechanisms. Half of all OECD countries index their PIT schedule automatically for inflation while OECD 20 countries adjust for inflation on a discretionary basis, which commonly allows governments to determine the timing of the adjustment (for detail, see the Special Feature in the Taxing Wages 2023 publication). Some countries responded to elevated inflation levels by implementing in-year adjustments or introducing an automatic inflation mechanism. With effect from January 2023, Austria introduced an automatic inflation adjustment mechanism which increases income bands automatically in line with inflation, with the exception of the top income bracket. Germany increased all income tax band thresholds, except for the highest income tax bracket, by 7.2%, and also increased the exemption limit for the solidarity surcharge by 3% for the 2023 tax year. Ireland increased the standard rate band for single earners by 9% and for joint filers with one income by 7% while also increasing the rate band ceiling for the second tax bracket of the Universal Basic Charge to adjust for increases in the hourly minimum wage rate.8 Korea adjusted the first and second of its seven income tax brackets upwards by KRW 2 million (USD 1 550) to KRW 14 million (USD 10 900) and to KRW 50 million (USD 39 000), respectively.

Several jurisdictions introduced temporary PIT measures to help households cope with elevated inflation levels, and significant increases in energy prices in particular

Some high-income countries used temporary PIT measures as part of policy packages to support households with increases in living costs. Australia introduced a one-off cost of living offset of AUD 420 (USD 442) for taxable incomes less than AUS 126 000 (USD 132 680), in addition to the temporary low- and middle-income tax offset. Austria introduced a one-time inflation tax credit of EUR 500 (USD 526) for employees, which was uniformly reduced to zero for current income between EUR 18 200 (USD 19 160) and EUR 24 500 (USD 25 790) and a temporary PIT-relief measure that allows employers to pay their employees an inflation bonus of up to EUR 3 000 (USD 3 160), which is exempt from PIT and SSCs. Germany provided one-off allowance of EUR 300 (USD 316) for all workers, self-employed individuals, owners of unincorporated businesses and pensioners for the 2022 tax year.

Several jurisdictions introduced measures to lower energy and fuel costs, mostly by providing more generous tax treatment of commuting costs. Luxembourg introduced a temporary “Energy Tax Credit” for employees, the self-employed and pensioners between July 2022 and March 2023.9 Germany increased the commuter allowance by 9% to EUR 0.38 (USD 0.40) per kilometre travelled in excess of 20 kilometres for the 2022 tax year, while Sweden raised the standard amount that may be deducted for commuting expenses by 35% to SEK 25 (USD 2.47) per 10 kilometres. Austria temporarily increased the distance-dependent tax credit for commuters from EUR 2 to EUR 8 (USD 2.11 to USD 8.42) and also raised the lump-sum deduction for commuters by 50%, between May 2022 to June 2023.10 France permanently increased the expenses per kilometre travelled that employees could deduct on business trips for PIT purposes by 10% from February 2022. Finland provided a temporary tax credit for people facing electricity expenses of more than EUR 2 000 (USD 2 105) over a four-month period in 2022 and introduced a temporary increase in the deduction of commuting expenses for the tax years 2022 and 2023.

Jurisdictions continued to introduce PIT measures to support lower income households with caring costs in 2022

Several jurisdictions increased the generosity of PIT measures aimed at supporting families with children. Increases were introduced in nine high-income countries. Germany increased the basic allowance per child by 2% retrospectively from January 2022 and announced 5% rises for 2023 and 4% in 2024. Germany also increased child benefits for up to three children in 2023, Luxembourg raised its allowance for extraordinary expenses for children not living in the household by 10%, and Slovenia increased its tax allowance for dependent family members by 7.5% with effect in 2023. Portugal increased the deduction for families with more than one child under the age of six by EUR 300 (USD 315) per child while Israel granted an additional tax credit of ILS 2 676 (USD 800) per child aged between 6 and 12 to help families cope with increased living costs. Croatia increased the personal allowance for dependent family members by 60% with effect in December 2022 while Bulgaria temporarily increased the deduction for minor children by 33% for the tax years 2022 and 2023. France increased the maximum threshold of the 50% tax credit applied to the childcare expenses of children aged six or below by 52% to EUR 3 500 (USD 3 685).

Jurisdictions also introduced PIT measures targeted at education and training expenses of dependent children. Germany increased the deductible training expenses per child by 30% to EUR 1 200 (USD 1 260) in 2023. Mauritius more than doubled the deductions for non-sponsored full-time undergraduate or postgraduate education to MUR 500 000 (USD 10 995) in June 2022 while Argentina introduced an educational allowance for dependent children under the age of 24 which is capped at 40% of the annual basic allowance, with effect in December 2022.

Several jurisdictions introduced support measures with a particular focus on single parents and mothers. Luxembourg increased the maximum tax credit by 67% to EUR 2 505 (USD 2 640) for single parents earning below EUR 60 000 (USD 63 180),11 while Germany increased the single parent allowance by 6% to EUR 4 260 (USD 4 490) for 2023 onwards. Spain increased the eligibility for the maternity tax credit to all women with children under the age of three, who receive unemployment benefits at the time of birth or who are registered with other social security authorities.

A few OECD countries provided support for the elderly through their PIT regime

Six OECD countries implemented PIT measures to support the elderly, some of which promoted labour market participation among older workers. The United States introduced several reforms to incentivise retirement saving. Reforms included changes to several tax favoured retirement savings plans (e.g., Individual Retirement Accounts (IRA), employer retirement plans (such as 401(k) plans), ABLE accounts, SIMPLE), including raising the age for mandatory distributions, increasing and indexing the limits individuals can make in catch-up contributions after reaching the age threshold, and allowing the withdrawal of funds for emergency expenses under certain conditions. The United States also converted the non-refundable tax credit for contributions to certain retirement plans into a federal matching contribution scheme that must be deposited in the taxpayer’s IRA account. To incentivise increased participation in the workforce, Finland and Sweden increased the tax deductions on earned income for people over 60 and 65, respectively. To support households with the costs of caring for elderly relatives, Ireland increased the Home Carer Tax Credit12 by 6% while Canada introduced tax credits to promote multigenerational living as well as renovations to make homes more functional for seniors.

Tax reforms for the self-employed were mostly aimed at promoting investment and boosting economic activity in specific sectors

Argentina, Italy, and Romania lowered the tax burden of self-employed individuals and unincorporated businesses to boost economic activity. Italy increased the maximum revenue threshold for the 15% substitute flat tax regime available to entrepreneurs and the self-employed by 31% to EUR 85 000 (USD 89 510) while also introducing an incremental flat tax for the tax year 2023, which effectively increases the application of the flat tax regime and lowers the tax burden on the self-employed.13 Argentina more than doubled its annual deduction for the self-employed, new professionals and entrepreneurs,14 while Romania lowered the tax rate on micro enterprises from 3% to 1% in 2022.

Several jurisdictions introduced PIT reforms to encourage investment, attract skilled professionals and encourage greater employment, particularly among young workers

Some jurisdictions introduced PIT relief measures to foster investment and innovation, often in sectors of strategic importance. Spain increased the tax credit on investments in new companies from 30% to 50% and almost doubled the investment value cap to EUR 100 000 (USD 105 310) from EUR 60 000 (USD 63 180) in 2022. Slovenia introduced a tax deduction of 40% of the costs of investments in sectors associated with the digital and green transition. Tunisia doubled the ceiling for deductions on R&D expenses in the area of the green, blue, and circular economy to TDN 400 000 (USD 131 210) and introduced an additional 50% deduction on R&D expenses of the same value for unincorporated businesses. Mauritius introduced an angel investor allowance of 50% of invested capital provided a minimum investment of MUR 100 000 (USD 2 200).

Canada, Italy, and Spain implemented PIT measures to attract skilled workers and promote innovation and productivity. Spain extended the scope of workers eligible to be taxed under the tax-favourable inpatriate regime in 202315 and more than tripled the exemption threshold for stock options of employees in start-up companies to EUR 50 000 (USD 52 650). Italy lowered its substitute tax from 10% to 5% levied on premiums related to productivity and quality (such as bonuses or profit-sharing programmes) of up to EUR 80 000 (USD 84 240) per year, with the aim of promoting productivity and tax compliance. Canada introduced a deduction of up to CAD 4 000 (USD 3 070) for certain travel and relocation expenses of workers employed in the construction industry.

Jurisdictions also introduced favourable tax provisions to support young workers in their labour market participation. To address challenges of persistently high youth employment, South Africa increased the value of employment tax incentives by 50% with effect from March 2022.16 Portugal increased the partial income exemptions available to employees under the age of 26 during the first five years of employment. Similarly, Slovenia introduced an allowance of EUR 1 300 (USD 1 370) for employment income received by individuals under the age of 29 and Romania introduced an additional personal deduction of 15% of the minimum gross salary for individuals under the age of 26 earning below set income thresholds.17

A limited number of high-income countries increased the generosity of Earned Income Tax Credits to support employment. Both Denmark and Ireland increased their maximum earned income tax credit by 4%, while Luxembourg adjusted the phase-in and phase-out bands of the tax credit applied to the social minimum wage upwards by 20%.18 Korea increased their maximum earned income tax credit by 10% and expanded the eligibility of workers by raising the property possession threshold by 20% to KRW 240 million (USD 187 000).

PIT provisions were also used to promote housing affordability and environmental sustainability in some jurisdictions

Canada and Ireland introduced PIT measures to increase the affordability of housing. Ireland implemented PIT relief measures which aim at increasing people’s buying power, including the introduction of a EUR 500 (USD 525) tax credit for renters of specific properties,19 available between 2022 and 2025, and prolonged the enhanced Help to Buy scheme until the end of 2024, which grants first-time buyers a refund of their PIT payments and deposit interest retention tax up to EUR 30 000 (31 590). Similarly, Canada doubled its First-Time Home Buyers’ Tax Credit to CAD 10 000 (USD 7 680). Canada also introduced a tax-free “first home savings account” that provides prospective first-time buyers the opportunity to make contributions up to CAD 40 000 (USD 30 730) which are tax deductible from the PIT; withdrawals from this account, including investment income, will not be taxed if the withdrawal is made for the purpose of buying a first home.

Some jurisdictions introduced PIT measures to promote environmental sustainability. The United States introduced the Inflation Reduction Act in August 2022, which presented a major climate and tax reform package, aimed at promoting the green transition while also fostering economic development and social cohesion (box 1). With effect from January 2023, Sweden will increase its “green deduction” for the installation of certain green technologies (solar cell systems) to promote the green transition and reduce reliance on fossil fuels. Temporary exemptions for the taxation of in-kind benefits arising from charging an electric vehicle at the workplace have also been proposed, while the Czech Republic increased the taxable benefits for the private use of low-emission company cars.20 To promote the production of renewable energy, Germany introduced a tax exemption on earnings derived from photovoltaic systems subject to certain conditions. Similarly, Portugal exempted income of up to EUR 1 000 (USD 1 055) generated from the production of renewable energy from PIT.

Box 3.1. The Inflation Reduction Act

In August 2022 the United States Congress passed the Inflation and Reduction Act (IRA), a major climate and tax bill. The principal tax changes introduced are listed below:

Lowering consumer energy costs

The existing credit for energy efficiency home improvements (e.g., for heat pumps, rooftop solar and water heaters) increased from 10% to 30% and extended until 2032.

A consumer tax credit of up to USD 4 000 for lower/middle income individuals to buy second hand clean vehicles.

An extension of the existing USD 7 500 tax credit to buy qualified new clean vehicles. Eligibility is partly based on local-content requirements that consider the country of production and assembly of the vehicle and battery components.

Improving energy security and domestic manufacturing

Production tax credits to accelerate U.S. manufacturing of solar panels, wind turbines, batteries, and critical minerals processing, estimated to cost USD 30 billion.

A USD 10 billion allocated investment tax credit to build clean technology manufacturing facilities (e.g., those producing electric vehicles, wind turbines and solar panels).

Decarbonising the economy

Expanded clean energy tax credits for wind, solar, nuclear, clean hydrogen, clean fuels, and carbon capture (includes production tax credits and the extension of the investment tax credit).

Tax credits for clean fuels, such as a new low-carbon transportation fuel production credit, and clean commercial vehicles.

Tax credits to reduce emissions from industrial manufacturing processes.

Agriculture and rural communities

Tax credits to support the domestic production of biofuels and to encourage the building of the infrastructure needed for sustainable aviation fuel and other biofuels.

Taxation

The introduction of a 15% minimum corporate tax that applies to corporations that, for three taxable years, have average annual adjusted financial statement income greater than USD 1 billion. The Joint Committee on Taxation estimates that about 150 taxpayers annually will be subject to the proposed book minimum tax (Congress of the United States, 2022[2]). This provision is estimated to raise USD 222 billion in revenue over the next 10 years.

Investing USD 80 billion in the Internal Revenue Service to improve tax enforcement and compliance.

1% tax on share buybacks by corporations.

Source: OECD (2022[3]).

3.1.5. A few jurisdictions introduced measures that broadened PIT bases

Some jurisdictions restricted the generosity of general PIT relief measures to raise tax revenues and strengthen progressivity. Colombia reduced the general income tax exemption almost fourfold from approximately COP 122 million (USD 23 040) to COP 33 million (USD 6 320), while Norway lowered the tax bracket thresholds for the third-, fourth- and fifth-income tax brackets. Norway also implemented base narrowing reforms, reducing the maximum pension deduction by 2% to NOK 32 825 (USD 3 410), aimed at directing tax relief measures towards those on lower incomes. Belgium abolished the federal tax credit for second and subsequent homes. Slovenia reduced the income threshold for the lower flat rate income tax for the self-employed, effective from 2023.

The Netherlands made a number of reforms to existing PIT measures to broaden the tax base. The government announced that it will phase-out the combined tax credit in January 2025 to encourage greater labour force participation of second earners.21 Furthermore, plans were put in place to accelerate the lowering of the self-employed tax deduction from EUR 6 310 (USD 6 645) in 2023 to EUR 900 (USD 950) in 2027 (Government of the Netherlands, 2022[4]). From 2023 onwards, Managing Directors of start-ups in the Netherlands will no longer be able to set their taxable wage at the minimum wage, and there will also be a phasing out of the PIT exemption for the profits earned by unincorporated businesses that are used to contribute towards saving accounts.22 In addition, tougher criteria were introduced for expatriates with sought after skills to qualify for a 30% tax free allowance up to EUR 216 000 (USD 240 000).

3.1.6. Changes to the taxation of capital income increased in 2022 compared to 2021, but remained relatively limited

Of the jurisdictions that introduced changes to personal capital income taxation in 2022, most increased rates or narrowed the capital income tax base. To raise tax revenues and align the treatment of capital and labour income, several jurisdictions raised the tax burden on capital income, both through rate increases and base broadening measures, continuing a trend observed in previous years. Some of the capital base broadening measures aimed to promote housing affordability by limiting the preferential tax treatment of mostly non-main residential properties. Other jurisdictions introduced base narrowing measures, granting tax relief measures directly to prospective property owners. In contrast, some jurisdictions lowered the tax burden on capital income to encourage household savings and promote the progressivity of the capital income tax system.

Four jurisdictions increased rates on capital income to raise revenues and better align the tax treatment of labour and capital income. From 2023, dividends received by resident taxpayers in Colombia will be subject to the progressive PIT schedule, while the tax rate on dividends received by non-residents will increase from 10% to 20%. Colombia also increased its capital gains tax rate from 10% to 15% and lowered the exemption threshold. To promote the progressivity of the tax system, the Netherlands legislated a 1 p.p. increase in the tax rate of savings and investment income (box 3) per year between 2023 and 2025, which will raise the tax to 32% in 2023. Norway implemented a further increase of the adjustment factor applied to dividend income,23 further reducing the difference in marginal tax rates between shareholder income and wages and lowering income shifting incentives. Spain increased the tax rate by 1 p.p. to 27% that will apply to savings income between EUR 200 000 (USD 211 000) and EUR 300 000 (USD 316 000) and will introduce a new 28% rate on savings income above EUR 300 000 (USD 316 000), in order to raise additional tax revenue. Romania increased the tax rate on dividends paid between domestic entities and non-residents from 5% to 8%.

Slovenia decreased tax rates on capital income to encourage savings. Slovenia decreased the tax rate applied to interest income, dividends, and capital gains from 27.5% to 25%, with effect from 2023. Additionally, the minimum holding period beyond which capital gains are tax exempt was lowered from 20 to 15 years.

Table 3.3. Changes to tax rates on personal capital income

|

|

Rate increase |

Rate decrease |

||

|---|---|---|---|---|

|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

Dividend or interest income/equity or bond investment |

BRA, NOR |

ESP, COL, NLD, NOR, ROU |

SVN |

|

|

Capital gains |

ESP, COL, NLD |

SVN |

||

Source: OECD Annual Tax Policy Reform Questionnaire.

Several jurisdictions implemented capital income tax base broadening measures to promote equity, raise revenue, and limit the preferential tax treatment of housing to dampen housing demand in face of housing supply shortages. Norway legislated a reduction in the tax deduction applied to savings within the Young People’s Housing Savings scheme from 20% to 10% of the deposited housing amount for 2023 onwards, to raise tax revenue and decrease the preferential tax treatment of housing as a savings vehicle. Canada passed a law that ensures that profits arising from the sale of “flipped” properties are taxed as business income from 2023 onwards.24 Chile limited several tax benefits, including, among others, tax exemptions for rental income, restricting them to individuals’ first and second homes.25 Chile also introduced a capital gains tax of 10% on shares of publicly traded companies, mutual funds, and investment funds (previously tax exempt under certain conditions). Tunisia removed or limited the application of several capital gains tax exemptions, abolishing the general capital gains tax exemption of up to TND 10 000 (USD 3 580), amending the capital gains tax schedule to account for the share holding period, and limiting exemptions on the transfer of certain types of real estate.

Some jurisdictions introduced capital income base narrowing measures in an attempt to encourage savings of private households and investment, and to promote progressivity of their tax systems. Germany increased its saving allowance by 25% (to EUR 1 000 (USD 1 055) for individual filers and EUR 2 000 (USD 2 110) for joint filers), while Japan proposed an increase in the contribution limit to the Nippon Individual Savings Account (NISA), and a rise in the exemption limits on capital gains and dividends derived from the NISA with effect from 2024. To encourage greater investment in start-ups and young businesses, Japan introduced an exemption for gains on stock transfers when gains are reinvested in financing the establishment of a business. The Netherlands increased the tax exemption threshold applied to saving and investment income by approximately 13% in 2023 (part of which was in excess of the standard annual indexation of the threshold) to increase the progressivity of the tax schedule. In 2023, Peru will extend a law enacted in 2015 which exempts capital gains from shares traded on the Lima Stock Exchange (LSE) from taxation until December 2023, under certain conditions.

Table 3.4. Changes to personal capital income tax bases

|

Base broadening |

Base narrowing |

||||

|---|---|---|---|---|---|

|

2021 |

2022 or later |

2021 |

2022 or later |

||

|

Dividend or interest income/equity or bond investment |

BRG, BEL |

JPN, SVN |

|||

|

Capital gains |

NZL, HUN, NGA |

AUT1,2, CHL, TUN |

MLT |

CAN, JPN, NZL PER, SVN |

|

|

Rental income |

CHL, CAN |

||||

|

Tax treatment of pensions and savings account |

GBR |

NOR |

DEU, JPN, NLD |

||

Source: OECD Annual Tax Policy Reform Questionnaire.

3.1.7. There was a marked increase in the number of SSC reforms introduced by jurisdictions in comparison to previous years

Jurisdictions introduced a mix of reforms raising and reducing SSC contributions. Increases in SSC contribution rates and base broadening measures were mostly introduced to improve the financial sustainability of SSC systems. Permanent and temporary rate decreases and base narrowing measures sought to support households with cost-of-living increases and promote employment in certain sectors, including agriculture, food processing and health care.

Jurisdictions raised SSC rates to improve the financial sustainability of social security systems, while rate decreases

Several jurisdictions increased their SSC rates, largely to promote the sustainable financing of their social security systems. Germany continued to increase contributions to the statutory unemployment insurance (by 0.2 p.p. to 1.3%) and the supplementary contribution to statutory health insurance (by 0.15 p.p. to 0.8%) for 2023, which are split equally between employers and employees. Similarly, Japan raised employer and employee SSCs towards unemployment insurance from 0.3% to 0.4%. Mexico raised employer SSCs, as part of gradual increases set out between 2023 and 2030. From 2023 onwards, Mexico will also levy a progressive compulsory social quota to promote more equitable financing of its pension scheme. In line with increases in the minimum wage, Latvia increased its minimum SSC payments for employees in 2023 and 2024. To discourage the excessive use of short-term employment contracts, Belgium introduced a special SSC for workers on temporary agency work contracts, with contributions increasing with the number of consecutive days worked.

Six jurisdictions reduced their SSC rates, either on a permanent or temporary basis, to support employment and encourage consumption. Austria reduced employer contributions to the “Family Burden Equalisation Fund” by 0.2 p.p. to 3.7% in 2023 in order to encourage employment.26 As part of its “Purchasing Power Act” measures, France extended the reduction in employer SSCs paid on overtime in companies who employ between 20 and 250 employees and reduced the health insurance contributions for self-employed individuals earning close to minimum wage, while Italy also supported households with rising cost of living expenses by introducing a temporary reduction in employee SSC rates in 2022. Switzerland removed the solidarity contributions of 1%, which had been introduced in 2011 to support the unemployment insurance scheme. Romania reduced SSC contributions and introduced exemptions for health care contributions for workers in the agricultural and food industry. Argentina extended the reduction of employer SSCs for health care service providers until December 2023 and introduced a “Bridge to Employment” programme, which provides a 100% reduction of employer SSCs for new hires in certain social, educational and employment programmes. Tunisia reduced the employee SSC rate from 1% to 0.5% for the tax years 2023 to 2025.

Table 3.5. Changes to social security contribution rates

|

|

Rate increase |

Rate decrease |

||

|---|---|---|---|---|

|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

Employers SSCs |

DEU, JPN, LVAt, MEX |

AUT, FRA, TUN |

||

|

Employees SSCs |

BEL, DEU, JPN, MEX |

ARG, ITAt, ROU |

||

|

Self-employed |

FRA |

|||

|

Payroll taxes |

||||

Note: “t” denotes a temporary reform.

Source: OECD Annual Tax Policy Reform Questionnaire.

Jurisdictions introduced fewer reforms affecting SSC bases compared to previous years

The Slovak Republic and Spain introduced base broadening measure to promote the sustainable financing of their social security systems in an equitable manner. The Slovak Republic legislated several base broadening measures starting from 2023, including the introduction of a minimum social healthcare contribution for all workers and the automatic enrolment into the second pillar of the pension system. Spain introduced a progressive social security contribution system for self-employed individuals, which aims to increase contributions from high earners while reducing contributions from lower earners and align the self-employed SSC system more closely to that of employees.

Several jurisdictions introduced base narrowing measures to support employment in specific sectors such as agriculture and food processing, or to promote social security coverage. The United States introduced several SSC base narrowing measures applying to different social security schemes, which aim at incentivising employers to offer social security plans to employees and thereby increasing social security coverage. To address labour supply shortages, the Slovak Republic introduced an employer and employee SSC allowance for seasonal workers employed in the agricultural, food processing and tourism sectors. Similarly, Sweden increased the reduction of SSCs for professionals working in R&D, with the aim of improving recruiting and retaining employees in growing companies. Sweden also extended the tax-exempt status of certain benefits-in-kind offered by employers for their employees, such as free parking. Israel abolished the foreign worker levy of 20% (15% for certain sectors) that was payable by employers.

Table 3.6. Changes to social security contribution and payroll tax bases

|

Base broadening |

Base narrowing |

|||

|---|---|---|---|---|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

|

Employers SSCs |

BGR |

BGR, ROU |

ARG, AUS |

SVK, SWE, USA |

|

Employees SSCs |

BGR |

BGR, LVA, SVK |

URYt |

ISR, NOR, SVK, SWE |

|

Self-employed |

BGR, ESP |

|||

|

Payroll taxes |

||||

Note: “t” denotes a temporary tax reform.

Source: OECD Annual Tax Policy Reform Questionnaire.

3.2. Corporate income taxes and other corporate taxes

The downward trend in statutory corporate income tax (CIT) rates is moderating. After two decades of continued decline and convergence of CIT rates across jurisdictions, rates are historically low. Hence, jurisdictions are favouring measures that narrow the tax base rather than rate decreases. Tax base changes continued to be more common than rate changes in 2022, in line with trends noted over the past eight years (when the Tax Policy Reforms report was first published), and these rate changes were minimal.

Raising revenues and incentivising investment were among the most cited rationale for adopting CIT reforms among jurisdictions that responded to the Tax Policy Reforms questionnaire. These motivations echoed governments’ efforts to stimulate the economy, curb fiscal deficits, and restore fiscal buffers after expenditure surges during the COVID-19 pandemic.

Many jurisdictions have continued to increase the generosity of their corporate tax incentives to support investment and innovation. Tax incentives to encourage greater investment in innovative technologies and research and developments were common in 2022, as they have been over the last decade. In high-income countries, tax incentives were also frequently used to cushion the effect of elevated energy prices on businesses, especially SMEs. Many European countries reported having adopted energy-related tax rate cuts and tax incentives. Schemes inherited from COVID-19 related programs were often extended to provide relief to companies facing rising energy costs and high inflation more generally.

An increasing number of jurisdictions used tax incentives to support investment in more environmentally friendly technologies and reductions in carbon emissions. The United States’ Inflation Reduction Act was the most significant example.

Corporate tax reforms were also used by several jurisdictions to address high profits in certain sectors. Many jurisdictions introduced windfall taxes, levies or other measures on companies that generated extraordinary profits due to the economic consequences of Russia’s large-scale aggression against Ukraine, particularly in the energy sector.

Efforts to protect CIT bases against corporate tax avoidance have continued with the adoption of measures in line with the OECD/G20 Base Erosion and Profit Shifting (BEPS) project. After the agreement to a Two-Pillar Solution in 2021, many jurisdictions took steps to commence implementation of the global minimum tax under Pillar Two, while negotiations on Pillar One are ongoing. Progress also continued on the implementation of BEPS minimum standards (actions 5, 6, 13 and 14).

3.2.1. CIT revenue trends vary across jurisdictions

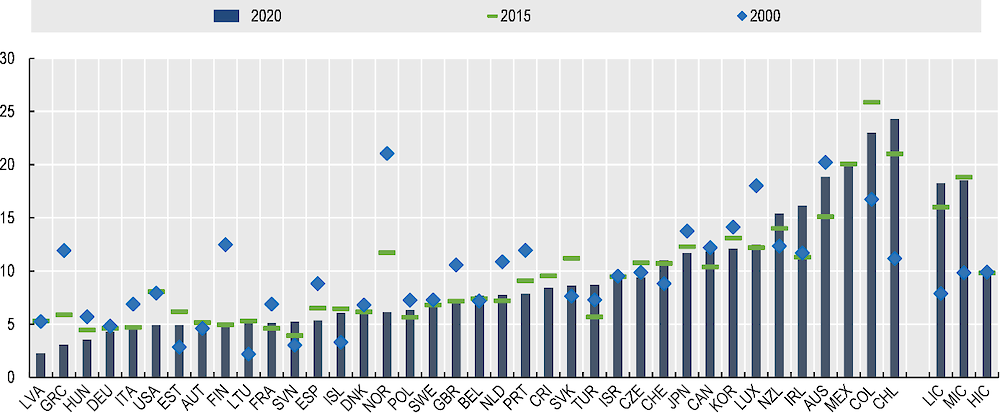

Data from the OECD’s Corporate Tax Statistics database show that there was a slight increase in both the average of CIT revenues as a share of total tax revenues and as a share of GDP between 2000 and 2020 across the 114 jurisdictions for which data are available. Average corporate tax revenues as a share of total tax revenues increased from 12.6% in 2000 to 15.1% in 2020, and average CIT revenues as a percentage of GDP increased from 2.6% in 2000 to 3.0% in 2020. The averages mask considerable differences across jurisdictions, which differ considerably in the portion of total tax revenues raised by the CIT.

The ratios of CIT to GDP and CIT revenues as a share of total tax revenues continue to vary substantially across Inclusive Framework jurisdictions. Among OECD countries, CIT ranged from 2.3% of total taxation in Latvia, to 24.3% of total tax revenues in Chile (Figure 3.2). Multiple factors can explain differences in revenues from CIT including statutory CIT rates, the breadth of the CIT base, the degree to which firms are incorporated, the phase in the economic cycle and the degree of cyclicality of the corporate tax system, as well as countries’ reliance on other taxes. These factors may have also contributed to the large differences in revenues between 2000 and 2020 observed in several countries including Finland, Mexico, and Norway. Figure 3.2 also shows that CIT tends to represent a larger share of revenue in countries with significant natural resources and in low- and middle-income countries (LICs and MICs). In the case of LICs and MICs, total tax revenues are generally lower as a percentage of GDP and personal income tax revenues tend to play a smaller role than the CIT.

Figure 3.2. Corporate income tax revenues

Note: Corporate income tax revenues refer to tax category 1200 under the OECD classification of taxes. Tax revenues are the sum of taxes collected by all levels of government. See Revenue Statistics Interpretative Guide for more detail. The low- (LIC), middle- (MIC), and high-income country (HIC) averages are representative of the 116 jurisdictions that provide tax revenue data to the OECD.

Source: OECD Global Revenue Statistics Database.

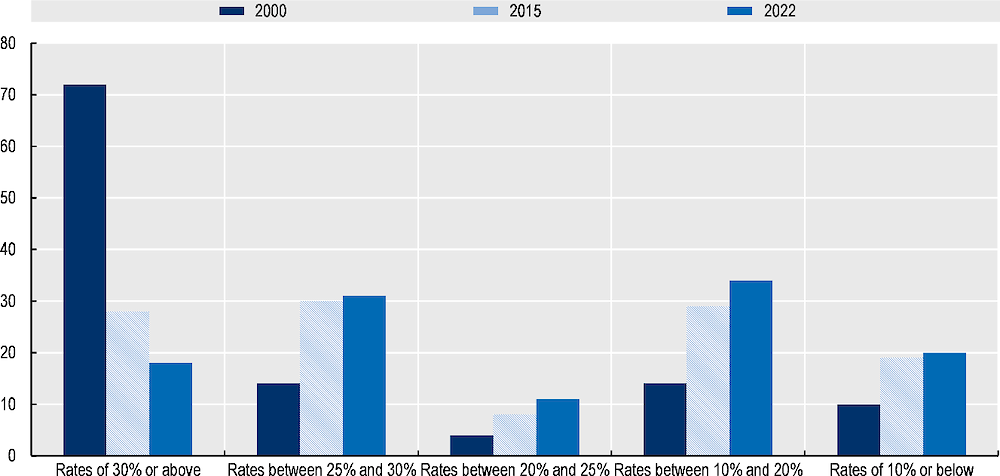

3.2.2. CIT rates have stabilised after decades of decline

Standard corporate income tax rates

The decline in CIT rates appeared to stabilise in 2022, following a steady decline over the past decades (Figure 3.3). For the first time since 2015 (the first year of the Tax Policy Reforms report), more CIT rate increases than decreases were announced or legislated by jurisdictions. A number of jurisdictions also implemented new corporate taxes or levies in 2022, notably on windfall profits (see Box 3.2). Despite this, tax rates are now at historic lows in many jurisdictions (OECD, 2022[5]). Across all 114 jurisdictions in the OECD Corporate Tax Statistics Database, the combined CIT rate (central and sub-central government) declined from 28.0% in 2000 to 20.0% in 2022.

Figure 3.3. Distribution of combined statutory CIT rates

Note: Data were available for 114 OECD/G20 Inclusive Framework jurisdictions in 2022.

Source: OECD Corporate Tax Statistics Database.

Three jurisdictions announced or introduced rate cuts in 2022. South Africa announced that it will decrease the statutory CIT rate from 28% to 27% from April 2023, Korea lowered the tax rate it applies to each of its corporate income tax brackets by 1 percentage point, and France began a two-year process to remove a sub-national production tax (Contribution sur la Valeur Ajoutée des Entreprises).

Four jurisdictions increased their CIT rates in 2022 or announced rises for 2023. The Netherlands increased its lowest CIT rate from 15% to 19% from the beginning of 2023, while broadening the tax base for its top tax rate by almost halving its threshold to EUR 200 000 (USD 210 550). Many jurisdictions announced to introduce domestic minimum taxes in preparation for the implementation of the GloBE Rules under Pillar Two of the Two-Pillar Solution in many jurisdictions from 2024 (see Box 3.3).27 In Belgium, a temporary reinforced minimum tax is to apply from 2023, anticipating the global minimum tax until its adoption. Colombia enacted a number of changes to reform its corporate tax base, including the removal of several exemptions, the imposition of surcharges for certain taxpayers, an increase in the tax rate on dividend income (from 7.5% to 10% for domestic firms and from 10% to 20% for foreign companies), and the establishment of a 15% minimum tax for resident firms. This minimum tax applies when the effective tax rate paid by a firm is lower than 15%, including when a below 15% rate is a result of tax incentives. The United Arab Emirates announced an historic change to their tax system, with the introduction of a generalised Corporate Income Tax from mid-2023 at a rate of 9%.28

Table 3.7. Changes in corporate income tax rates

Note: Jurisdictions in brackets are those that have announced reforms but are yet to implement them.

Excise taxes on stock repurchases introduced by the United States and announced by Canada are taxes levied upon the market value of stocks and are therefore categorised as taxes on financial and capital transactions under the OECD revenue statistics interpretative guide. Taxes on financial and capital transactions (category 4400) are a sub-category of property taxes (category 4000) and are therefore discussed in Section 3.5. They refer to taxes on the issue, transfer, purchase, and sale of nonfinancial and financial assets (including foreign exchange or securities), taxes on cheques and other forms of payment, and taxes levied on specific legal transactions such as the validation of contracts and the sale of immovable property.

1. This also includes the removal of the sub-national tax “contribution sur la valeur ajoutée des entreprises” over two years, applied to companies with profits above EUR 500 000.

2. Temporary rate decrease during the COVID-19 pandemic.

3. The CIT rate decrease in Canada, announced in 2021, applies to zero-emission technology manufacturing profits. The CIT rate decrease will reduce the general corporate income tax rate and small business income tax rate on eligible profits to 7.5% (from 15%) and to 4.5% (from 9%), respectively, for taxation years beginning after 2021 and before 2029.

Source: OECD Annual Tax Policy Reform Questionnaire.

CIT rates for Small and Medium-Sized Enterprises

Colombia and Spain both lowered CIT rates for SMEs.29 As part of efforts to encourage investment, Spain reduced the CIT rate applicable to SMEs (i.e., firms with net turnover of less than EUR 1 million) from 25% to 23%. The rate for start-up companies was also lowered from 25% to 15%.30 To encourage formalisation, Colombia reduced most rates in its presumptive tax regime, applicable to businesses with revenue below UVT 100 000 (USD 893 000). The lowest rate in the regime was reduced from 2.0% to 1.6% and the top rate was cut from 14.5% to 8.3%, while the base of the regime was expanded to additional sectors, including education, human health and social assistance services, and recycling.

Other business taxes

A significant number of jurisdictions introduced windfall taxes, levies or other measures on companies generating extraordinary profits during the period. In many cases, these profits were linked to Russia’s large-scale aggression against Ukraine. Windfall taxes, levies or other measures were generally imposed on companies operating in the electricity and fossil fuel sectors, as well as the financial and pharmaceutical sectors in some jurisdictions (see Box 3.2).

A few jurisdictions introduced or increased taxes on the financial sector in 2022. Taxes on the financial sector are generally collected on top of ordinary corporate taxes and can be applied to different tax bases. They gained attention in the aftermath of the global financial crisis and were the subject of increased policy interest during the COVID-19 pandemic and as energy prices remained elevated in 2022, as policy makers sought ways to raise revenue. Canada introduced a permanent 1.5 p.p. increase on banking and life insurance groups with income above CAD 100 million (USD 77.8 million). As a result, the federal CIT rate for these institutions will increase from 15% to 16.5% from April 2022. Colombia increased the existing surtax on financial institutions by 2 p.p. until 2027, raising their effective CIT rate to 40%, and broadened the base of the surtax to include insurers and stockbrokers. Kenya introduced a 15% tax rate on gains from financial derivatives earned by non-resident persons.

Box 3.2. Windfall taxes and solidarity levies

Some businesses experienced large increases in profits in late 2021 and throughout 2022, particularly those operating in the energy sector (Forbes, 2022[6]). A number of European countries, alongside a few Latin American countries, that responded to the OECD’s annual Tax Policy Reform questionnaire introduced temporary windfall profit taxes, solidarity levies or other measures in response, highlighting the need to raise revenues for additional fiscal expenditures and limit inequalities (to maintain social cohesion), particularly as many jurisdictions concurrently introduced costly fiscal support measures to cushion the impact of elevated prices on households and businesses (OECD, 2023[7]).

Under Council Regulation 2022/1854, the EU, for example, agreed upon common emergency measures to reduce electricity demand and to collect and redistribute the energy sector's surplus revenues to final customers. A mandatory temporary solidarity contribution was applied to the extraordinary and unexpected profits of businesses active in the extraction of crude petroleum, natural gas, coal, and refinery sectors. The solidarity contribution was calculated on the taxable profits, as determined under national tax rules in the fiscal year starting in 2022 and/or in 2023, which were more than 20% above the average yearly taxable profits for the period 2018-2021. This solidarity contribution applied in addition to regular taxes and levies, and EU countries agreed to use the proceeds from the solidarity contribution to provide financial support to households and companies to mitigate the effects of high retail electricity prices. Member States can keep national measures that are equivalent to the solidarity levy provided they are compatible with the objectives of the Regulation and generate at least comparable proceeds. Moreover, market revenues for electricity generators using inframarginal technologies were capped at EUR180/MWh, with surplus revenues at the disposal of EU countries to support and protect electricity consumers.

Windfall (or excess) profit taxes seek to tax the portion of profits received in excess of a risk-adjusted normal return, i.e., economic rents with returns above the opportunity cost of the investment (Vernon and Baunsgaard, 2022[8]). Temporary windfall profit taxes seek to tax unanticipated increases in corporate earnings, though differ in their duration being temporary rather than permanent. Thus, where long standing excess profit taxes are in place, temporary excess profit taxes are not required.

Theoretically, taxing a pure economic rent, whether under an excess or windfall profits tax, should have no detrimental effect on investment, or other production choices, if it is well designed. However, there are number of conceptual, administrative, and practical challenges in designing and introducing an effective windfall profit tax. Such taxes, especially if poorly designed, can fail to target economic rents and may negatively impact investment and certainty.

Base considerations:

How should the base be calculated? What is deemed a reasonable change?

What should the reference period be? This applies for both the normal return and the length of time that the temporary tax or levy applies.

Should specific sectors be targeted? For example, should the measures be restricted only to the energy sector? Sector-specific demarcation can be challenging for tax administrations and for businesses.

How should allowances for investment be designed? Policymakers need to consider the impact of windfall profit taxes or solidarity levies on tax certainty and investment incentives.

How will these taxes and levies interact with the existing CIT?

Can neutrality of company form be ensured? Otherwise, businesses may have an incentive to change legal structure, from being incorporated to unincorporated, or vice-versa.

Which geographic locations fall under the tax or levy? Companies may have base erosion and profit shifting incentives to determine the valuation of assets and location of profits earned differently.

Rate considerations:

Should the rate be sector-specific or neutral across sectors?

How much higher should the rate be than the CIT rate? The higher the rate the greater the incentive for profit shifting.

Table 3.8. Design of windfall profit taxes, solidarity levies and other measures

|

Country |

Tax base |

Rate |

Sectors |

Duration |

|---|---|---|---|---|

|

Surplus market revenues above price cap |

||||

|

Austria* |

Above price cap of EUR 180 (USD 200) per megawatt hour (MWh) |

90% |

Electricity |

1 Dec ‘22 – 31 Dec ‘23 |

|

Czech Republic |

90% |

Electricity producers |

1 Dec ‘22 – 31 Dec ‘23 |

|

|

Germany |

90% |

Energy producers |

1 Dec ‘22 – 31 Dec ‘23 |

|

|

Slovenia |

100% |

Energy producers |

1 Dec ‘22 – 31 Dec ‘23 |

|

|

Sweden |

Above price cap of EUR 194 per MWh (SEK 1 957; USD 194) |

90% |

Electricity producers |

1 Mar ‘23 – 30 Jun ‘23 |

|

France |

Above price cap (varies depending on technology employed) |

90% |

Energy producers |

1 Jul ‘22 – 31 Dec ‘23 |

|

Netherlands |

Revenues from prices exceeding EUR 0.50 per m3 (USD 0.56) |

65% |

Natural gas |

2023 – 2024 |

|

Slovak Republic |

Revenues from prices exceeding EUR 50 to EUR 250 range per MWh (USD 56 to USD 278) |

90% |

Energy producers |

1 Dec ‘22 – 31 Dec ‘24 |

|

Solidarity levies on surplus profits |

||||

|

Austria |

Taxable profits that exceed 120% of the average profits made between 2018 and 2021 |

40% |

Fossil fuels |

1 Jul ‘22 – 31 Dec ‘23 |

|

Bulgaria |

33% |

Fossil fuels |

2022 – 2023 |

|

|

Croatia |

33% |

All sectors |

2022 |

|

|

Czech Republic |

60% |

Energy companies; Financial institutions |

2023 – 2025 |

|

|

France |

33% |

Fossil fuels |

2022 |

|

|

Germany |

33% |

Fossil fuels |

2022 – 2023 |

|

|

Italy |

50% |

Fossil fuels; Energy producers |

2022 |

|

|

Lithuania |

33% |

Fossil fuels |

2023 |

|

|

Netherlands |

33% |

Fossil fuels |

2022 |

|

|

Romania |

60% |

Fossil fuels |

2022 – 2023 |

|

|

Slovenia |

80% |

Fossil fuels |

2022 – 2023 |

|

|

Greece |

Surcharge on profits generated between Oct ’21 and Jun ‘22 |

90% |

Electricity producers |

1 Oct ‘21 – 30 Jun ‘22 |

|

United Kingdom |

Surcharge on profits (in addition to ring fence corporation tax and the supplementary corporation tax charge) |

25% (35% from 1 Jan ’23) |

Fossil fuels |

26 May ’22 – 31 Mar ‘28 |

|

Taxable income |

||||

|

Argentina |

All taxable income |

25% or 15% |

All sectors |

2022 – 2023 |

|

Colombia |

Taxable income exceeding COP 1.14 billion (USD 267 900) |

3% |

Financial institutions |

2023 – 2027 |

|

|

Taxable income exceeding COP 1.9 billion (USD 446 500) |

Progressive (max 15%) |

Hydroelectrical companies |

2023 – 2026 |

|

|

Taxable income exceeding COP 4.6 billion (USD 1.1 million) |

5% |

Fossil fuel extraction |

Permanent, from 2023 |

|

Other |

||||

|

Belgium |

Set price per tonne of crude oil or cubic metre of product released for consumption |

EUR 6.90 per tonne of crude oil/EUR 7.80 per cubic metre of product released for consumption |

Fossil fuels |

2022 – 2023 |

|

Brazil |

Exports |

9.20% |

Oil exports |

1 Mar ‘23 – 30 Jun ‘23 |

|

Colombia |

Gross payments |

1% or 5.4% |

Fossil fuels; exports |

Not specified |

|

Hungary |

Varies by sector |

0-95% (rate varies by sector) |

Energy companies; Fossil fuels; Financial institutions; Pharmaceuticals, Retail; Telecommunications |

2022 – 2023 |

|

Italy |

Positive spread between balance of output transactions and input transactions calculated for VAT purposes in various time periods |

35% |

Energy companies |

One-off contribution |

|

Romania |

Monthly selling price of electricity/ Difference between the average transaction cost on the day before the transaction and the acquisition cost in case of exported energy |

98%/100% |

Energy companies |

1 Sep ’22 – 31 Mar ‘23 |

|

Spain |

Net amount of turnover/net interest income |

1.2% or 4.8% |

Energy companies; Financial institutions |

2023-2024 |

Note: The table is based upon country responses to the OECD’s annual tax policy reform questionnaire, supplemented with information from the IBFD and is up to date as of end-March 2023. Some countries covered in this report may therefore have introduced solidarity levies or windfall taxes that are not covered in this table. ARS 130.6; COL 4 256.2; HUF 372.596 = EUR 1. In Austria, a revenue cap of 140 EUR/MWh applies for electricity in general. Only if investments in the energy change can be proven, this value rises to up to EUR 180. Companies that can prove investments in the transition to renewable energy resources between 31 December 2021 and 1 January 2024, may deduct 50% of the respective investment costs (with a maximum of 17.5%) from the amount of the crisis contribution. The cap for the tax credit of 17.5% from the amount of the crisis contribution applies only for fossil fuel companies. For electricity, the maximum tax credit is EUR 36 per MWh. The price cap of EUR 180 per MWh cannot be exceeded. In Italy, the energy profits levy has 80% investment allowance for decarbonisation expenditure. In the United Kingdom, investment allowances under the energy profits levy, capital allowance eligibility, and decarbonization expenditure will allow for total tax relief of GBP 109.25 to be obtained for every GBP 100 spent on such costs.

Source: OECD annual Tax Policy Reform questionnaire; IBFD (2023[9]); European Parliament (2023[10]); OECD (2022[11]); (2023[7]); Hebous, Prihardini and Vernon (2022[12]); Vernon and Baunsgaard (2022[8]).

Intellectual property regimes

None of the jurisdictions that responded to the tax policy reforms questionnaire reported altering the tax rates that they apply to intellectual property (IP) regimes in 2022. As has been the trend for a number of years, jurisdictions favoured modifying IP regime bases as described below (González Cabral, Appelt and Hanappi, forthcoming[13]). Nine IP regimes were reviewed in 2022 (OECD, 2023[14]) as part of the BEPS Action 5 peer review process, four of which were found to be non-harmful or non-harmful in their amended version (Cabo Verde, Hong Kong, Jamaica, North Macedonia), one was deemed potentially harmful (Albania), two were in the process of being amended (Armenia), and two were abolished (Honduras, Pakistan).

3.2.3. Many jurisdictions have continued to increase the generosity of corporate tax incentives

CIT base narrowing measures outnumbered base broadening measures in 2022, continuing a trend observed since the first edition of the Tax Policy Reforms publication (in 2015). Jurisdictions commonly cited stimulating investment, innovation, and environmental sustainability as the reasons for increasing the generosity of CIT incentives (Table 3.9). These measures contribute to reducing effective corporate tax rates further.31

Table 3.9. Changes to corporate tax bases

|

Base broadening |

Base narrowing |

|||

|---|---|---|---|---|

|

2021 |

2022 or later |

2021 |

2022 or later |

|

|

Capital allowances and general incentives |

NGA |

BEL, BEN, COL, MKD, NLD |

CAN1, GBR, MUS, POL |

AGO, CAN1,2, CZE, DEU, DNK, FIN, GBR, ITA, KEN, MUS, TTO, USA |

|

Environmentally related tax incentives |

CAN1,2, IRL, MYS |

AGO, CAN1,2, CZE, PRT, USA |

||

|

R&D tax incentives and patent box regimes |

AUS, ESP, FIN, ISL, ITA, JPN, MUS, NLD, NZL, POL, SWE |

CAN1, FIN, GBR, JPN, KOR, PRT, TUN |

||

|

SME-related tax base changes |

GBR |

CAN1, DEU2, JPN |

AGO, BEN, CAN1,2, DEU3, MUS, POL, PRT, URY, TTO |

|

|

Other business tax incentives |

NZL |

CHL, KEN, NOR, USA |

AGO, CAN1, IRL, ITA, KEN, LVA, (NZL), POL, TTO, UKR |

|

|

Loss carryforward and carryback provisions |

PRT, ZAF |

FRA, HUN |

KOR |

|

|

Notional interest deductions |

BEL |

ITA |

||

Notes: Jurisdictions in brackets have only announced reforms. For countries with federal and provincial levels of government, 1 denotes where this measure was enacted at the provincial level and 2 at the federal level. 3. Applies to unincorporated businesses and the self-employed. New Zealand has announced an exemption of Fringe Benefit Tax (FBT) for employers subsidising public transport for their employees.

Source: OECD Annual Tax Policy Reform Questionnaire.

Capital allowances and general incentives

Many jurisdictions sought to encourage investment through increased generosity of capital allowances in 2022, often via the introduction of temporary measures or extension of previous pandemic-related relief. Germany, for example, extended its accelerated depreciation allowance for movable assets up to the end of 2022, while Denmark announced that it would maintain the increased cap on investment deductions that it adopted during the pandemic. Czech Republic also extended its COVID-19-related accelerated depreciation for selected assets,32 and the UK increased the maximum capital allowance that can be claimed in a year, making a temporary pandemic-related measure permanent.33 Finland extended the temporary accelerated depreciation of fixed assets to cover 2024 and 2025. Italy implemented a number of temporary tax credits to support companies facing increased energy prices.34

Middle-income countries also used tax incentives with the aim of encouraging investment and boosting economic growth. Trinidad and Tobago announced a tax credit for companies investing in new machinery, production lines and equipment, with a cap of USD 50 000, as well as a tax credit for electronic payment providers. Mauritius granted an eight-year tax holiday to companies registered as Freeport operators or developers starting operations after 1 July 2022, while Kenya increased deductions available to tax-exempt, charitable organisations and to telecommunication operators. Angola introduced several incentives for companies, including a wide array of enhancing tax allowances, temporary reductions of the CIT rate for private investments ranging from 20% to 80% for two to eight years (depending on where the project is located), and accelerated depreciation schemes.35 A reduced 15% CIT rate was also introduced for companies operating in free zones, with a possibility to decrease the rate further if certain conditions are fulfilled.

Several jurisdictions reduced or abolished preferential regimes and general incentives. To prepare for the introduction of the global minimum tax, Belgium introduced a “temporary reinforced minimum tax” in 2023, which temporarily broadened the CIT base. For the year 2023, the income “basket”36 for CIT deductions has been reduced from EUR 1 million (USD 1.1 million) plus 70% of taxable income in excess of EUR 1 million, to EUR 1 million plus 40% of taxable income in excess of EUR 1 million. When the EU Minimum Tax Directive (see Box 3.3) comes into effect in 2024, the former 70% basket will be restored. Benin removed a tax exemption for new companies that have a turnover of over XOF 1 billion (USD 1.6 million) as well as for subsidiaries of non-resident companies. Chile repealed its tax credit for investment in fixed assets for larger companies.37 As part of its 2022 tax reform, Colombia increased the stringency of or removed a number of CIT incentives to broaden its tax base. Notably, reduced CIT rates available to companies operating in the country’s free trade zones will be limited to income from exports of goods and services from 2024, while exemptions, deductions, and credits were restricted.

Research and development and innovation tax incentives

A number of jurisdictions increased support for research and development (R&D) and innovation through new tax measures, increased generosity of incentives, and the extension of their validity. Finland, Portugal, and Tunisia expanded deductions available for R&D expenditure or intellectual property rights. Finland introduced a new R&D expenditure deduction, while Tunisia doubled the ceiling applicable for such deductions to TND 400 000 (USD 143 370). Portugal introduced a waiver of withholding tax on income derived from intellectual property related to contents protected by copyrights. The UK announced it will increase its R&D tax credit expenditure rate from 13% to 20% from April 2023 to encourage greater investment. In Canada, several provinces also extended the generosity or the duration of their tax credits for R&D (British Columbia, Quebec, and Saskatchewan). Japan announced substantial extensions of tax benefits for innovation and R&D, modifying the R&D tax credit rate to between 20% and 30% depending on the level of expenditure (compared to a single 25% rate before) and expanding the scope of incentives to promote innovation, start-ups, joint research and mergers and acquisitions.

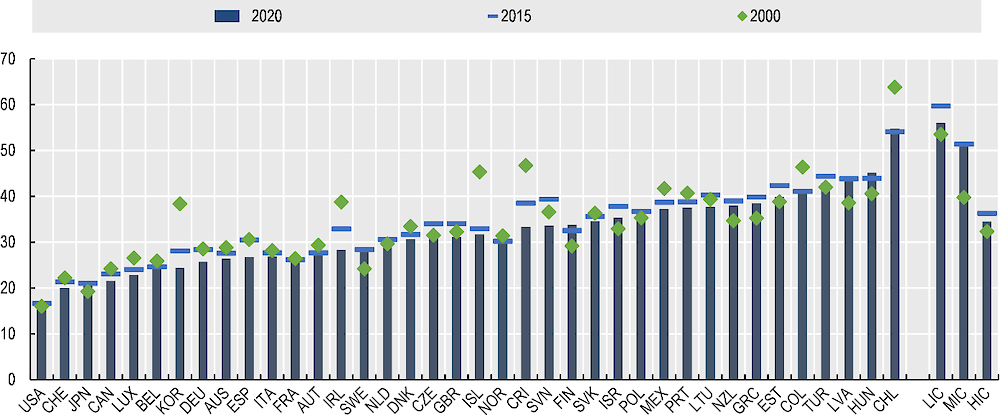

These changes to R&D and innovation tax incentives are a continuation of an ongoing trend of governments using tax policy to incentivise business investment in these activities. The number of OECD countries offering tax relief for R&D expenditures increased from 20 OECD countries in 2000 to 33 of 38 OECD countries in 2022 (OECD, 2022[5]). The average implied marginal R&D tax subsidy has markedly increased across OECD countries since 2000, reflecting the introduction of new R&D tax incentives and the increasing generosity of existing R&D tax relief provisions over time. Implied subsidies are typically larger on average for SMEs due to targeted preferential tax treatment towards these smaller businesses, but there are notable differences in the implied subsidy rates on R&D expenditures for large, profitable firms across countries and years. In 2022, R&D tax incentives for marginal investments were particularly generous for large, profitable firms in France and Portugal, while profitable SMEs received the most favourable support in Colombia, Iceland and Portugal (OECD (2022[5]; n.d.[15])).

SME-related tax base changes

Many jurisdictions have taken steps to expand support to SMEs and young firms, and to foster collaboration amongst different-sized firms. To support small businesses with the economic consequences of the COVID-19 pandemic and Russia’s large-scale aggression against Ukraine, Germany made changes to provisions available to unincorporated companies and the self-employed. COVID bonuses of up to EUR 4 500 (paid in 2021 and 2022, USD 4 740) and inflation premiums of up to EUR 3 000 (in 2023, USD 3 260) were tax exempt, while tax loss deductions were increased to EUR 10 million (EUR 20 million for joint assessments, USD 10.5 million and USD 21.1 million) for 2022 and 2023. Poland announced that it would remove minimum CIT payments for SMEs permanently, after suspending them temporarily in 2022 and 2023, to increase tax certainty. In Canada, British Columbia increased its tax credits schemes, and Saskatchewan temporarily extended its CIT rate reduction, for SMEs and start-ups in order to promote investment by and in small firms, while Portugal extended the scope of the reduced 17% CIT rate for SMEs to small-medium capitalisation companies with the aim of supporting small firms and boosting economic growth. The UK reduced the generosity of its R&D SME scheme, however, by lowering deduction and credit rates from April 2023, due to efficiency concerns.